656dfcafb31c9d29e03392ded6908bec.ppt

- Количество слайдов: 12

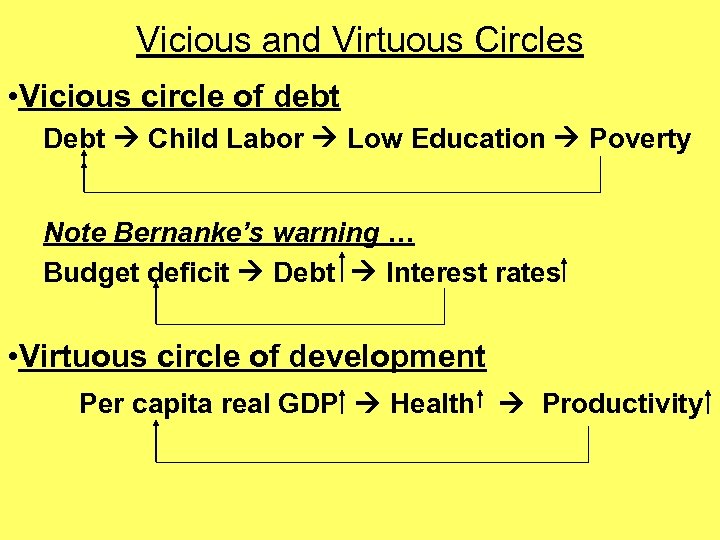

Vicious and Virtuous Circles • Vicious circle of debt Debt Child Labor Low Education Poverty Note Bernanke’s warning … Budget deficit Debt Interest rates • Virtuous circle of development Per capita real GDP Health Productivity

Vicious and Virtuous Circles • Vicious circle of debt Debt Child Labor Low Education Poverty Note Bernanke’s warning … Budget deficit Debt Interest rates • Virtuous circle of development Per capita real GDP Health Productivity

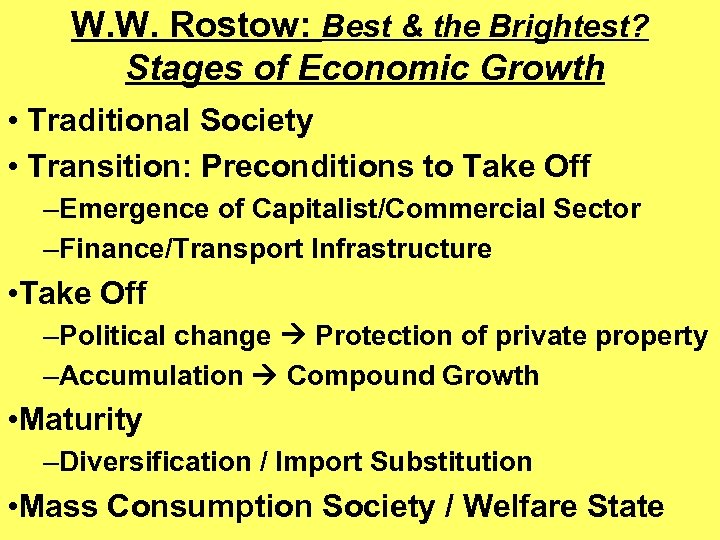

W. W. Rostow: Best & the Brightest? Stages of Economic Growth • Traditional Society • Transition: Preconditions to Take Off –Emergence of Capitalist/Commercial Sector –Finance/Transport Infrastructure • Take Off –Political change Protection of private property –Accumulation Compound Growth • Maturity –Diversification / Import Substitution • Mass Consumption Society / Welfare State

W. W. Rostow: Best & the Brightest? Stages of Economic Growth • Traditional Society • Transition: Preconditions to Take Off –Emergence of Capitalist/Commercial Sector –Finance/Transport Infrastructure • Take Off –Political change Protection of private property –Accumulation Compound Growth • Maturity –Diversification / Import Substitution • Mass Consumption Society / Welfare State

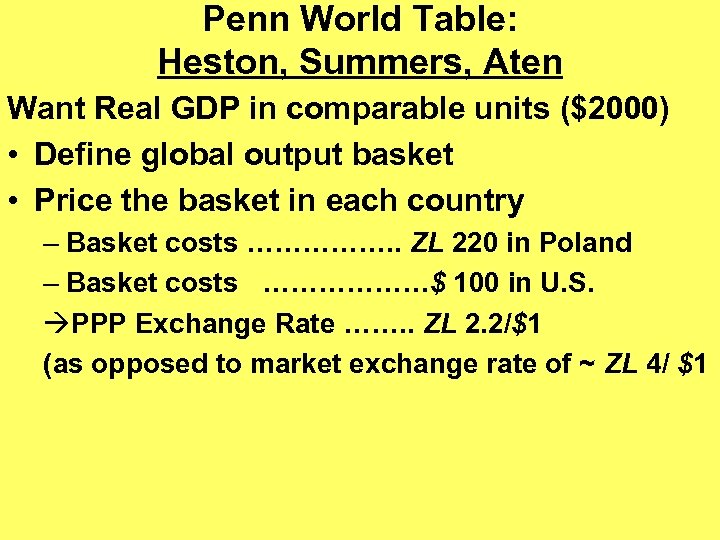

Penn World Table: Heston, Summers, Aten Want Real GDP in comparable units ($2000) • Define global output basket • Price the basket in each country – Basket costs ……………. . ZL 220 in Poland – Basket costs ………………$ 100 in U. S. PPP Exchange Rate ……. . ZL 2. 2/$1 (as opposed to market exchange rate of ~ ZL 4/ $1

Penn World Table: Heston, Summers, Aten Want Real GDP in comparable units ($2000) • Define global output basket • Price the basket in each country – Basket costs ……………. . ZL 220 in Poland – Basket costs ………………$ 100 in U. S. PPP Exchange Rate ……. . ZL 2. 2/$1 (as opposed to market exchange rate of ~ ZL 4/ $1

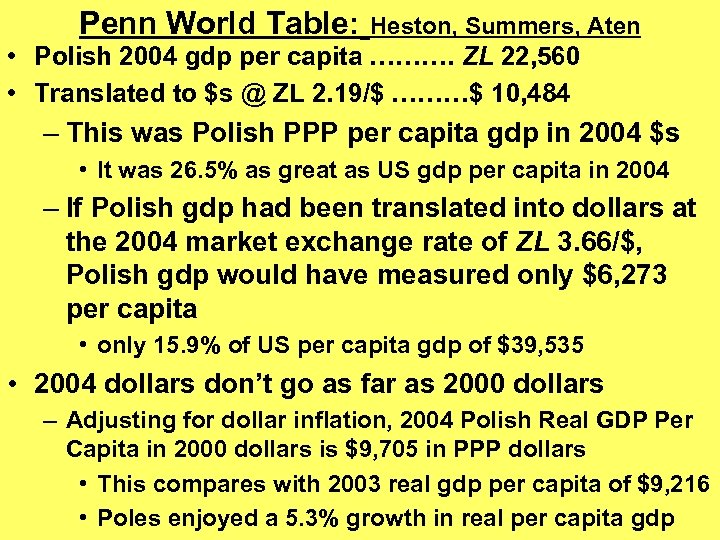

Penn World Table: Heston, Summers, Aten • Polish 2004 gdp per capita ………. ZL 22, 560 • Translated to $s @ ZL 2. 19/$ ………$ 10, 484 – This was Polish PPP per capita gdp in 2004 $s • It was 26. 5% as great as US gdp per capita in 2004 – If Polish gdp had been translated into dollars at the 2004 market exchange rate of ZL 3. 66/$, Polish gdp would have measured only $6, 273 per capita • only 15. 9% of US per capita gdp of $39, 535 • 2004 dollars don’t go as far as 2000 dollars – Adjusting for dollar inflation, 2004 Polish Real GDP Per Capita in 2000 dollars is $9, 705 in PPP dollars • This compares with 2003 real gdp per capita of $9, 216 • Poles enjoyed a 5. 3% growth in real per capita gdp

Penn World Table: Heston, Summers, Aten • Polish 2004 gdp per capita ………. ZL 22, 560 • Translated to $s @ ZL 2. 19/$ ………$ 10, 484 – This was Polish PPP per capita gdp in 2004 $s • It was 26. 5% as great as US gdp per capita in 2004 – If Polish gdp had been translated into dollars at the 2004 market exchange rate of ZL 3. 66/$, Polish gdp would have measured only $6, 273 per capita • only 15. 9% of US per capita gdp of $39, 535 • 2004 dollars don’t go as far as 2000 dollars – Adjusting for dollar inflation, 2004 Polish Real GDP Per Capita in 2000 dollars is $9, 705 in PPP dollars • This compares with 2003 real gdp per capita of $9, 216 • Poles enjoyed a 5. 3% growth in real per capita gdp

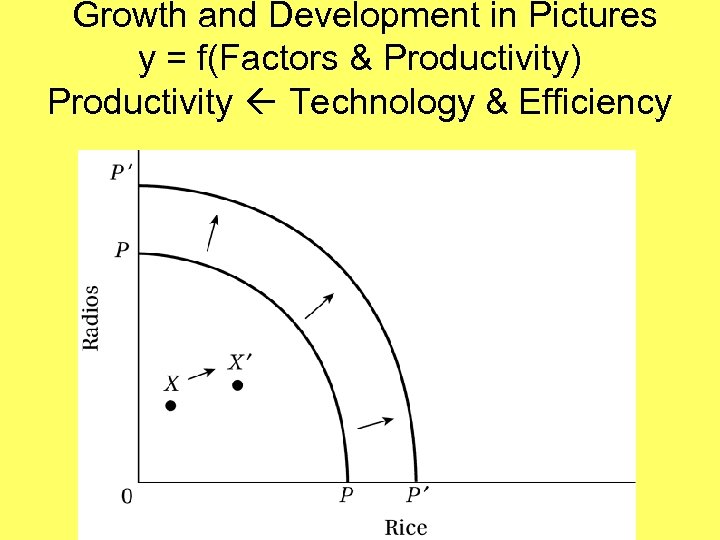

Growth and Development in Pictures y = f(Factors & Productivity) Productivity Technology & Efficiency

Growth and Development in Pictures y = f(Factors & Productivity) Productivity Technology & Efficiency

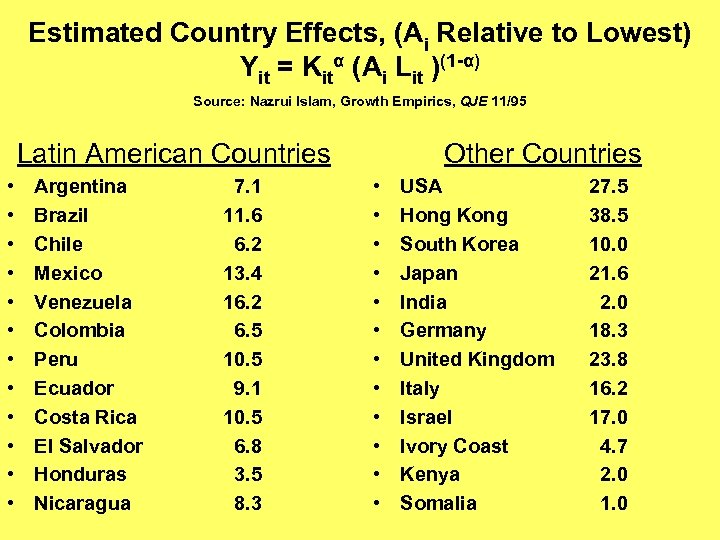

Estimated Country Effects, (Ai Relative to Lowest) Yit = Kitα (Ai Lit )(1 -α) Source: Nazrui Islam, Growth Empirics, QJE 11/95 Latin American Countries • • • Argentina Brazil Chile Mexico Venezuela Colombia Peru Ecuador Costa Rica El Salvador Honduras Nicaragua 7. 1 11. 6 6. 2 13. 4 16. 2 6. 5 10. 5 9. 1 10. 5 6. 8 3. 5 8. 3 Other Countries • • • USA Hong Kong South Korea Japan India Germany United Kingdom Italy Israel Ivory Coast Kenya Somalia 27. 5 38. 5 10. 0 21. 6 2. 0 18. 3 23. 8 16. 2 17. 0 4. 7 2. 0 1. 0

Estimated Country Effects, (Ai Relative to Lowest) Yit = Kitα (Ai Lit )(1 -α) Source: Nazrui Islam, Growth Empirics, QJE 11/95 Latin American Countries • • • Argentina Brazil Chile Mexico Venezuela Colombia Peru Ecuador Costa Rica El Salvador Honduras Nicaragua 7. 1 11. 6 6. 2 13. 4 16. 2 6. 5 10. 5 9. 1 10. 5 6. 8 3. 5 8. 3 Other Countries • • • USA Hong Kong South Korea Japan India Germany United Kingdom Italy Israel Ivory Coast Kenya Somalia 27. 5 38. 5 10. 0 21. 6 2. 0 18. 3 23. 8 16. 2 17. 0 4. 7 2. 0 1. 0

Adam Smith’s Glorious Vision Accumulation + Division of Labor = Cumulative Progress

Adam Smith’s Glorious Vision Accumulation + Division of Labor = Cumulative Progress

Adam Smith • Accumulation: – “capitals are increased by parsimony and diminished by prodigality and misconduct. ” • Division of labor: – “… natural propensity among men to truck, barter, and exchange one thing for another. ”

Adam Smith • Accumulation: – “capitals are increased by parsimony and diminished by prodigality and misconduct. ” • Division of labor: – “… natural propensity among men to truck, barter, and exchange one thing for another. ”

Adam Smith: • The division of labor is limited by the extent of the market. • Free Trade Extended Market

Adam Smith: • The division of labor is limited by the extent of the market. • Free Trade Extended Market

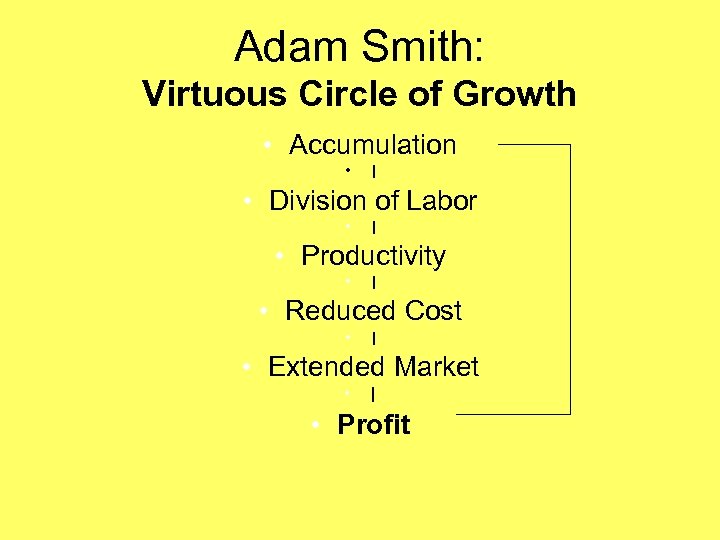

Adam Smith: Virtuous Circle of Growth • Accumulation • | • Division of Labor • | • Productivity • | • Reduced Cost • | • Extended Market • | • Profit

Adam Smith: Virtuous Circle of Growth • Accumulation • | • Division of Labor • | • Productivity • | • Reduced Cost • | • Extended Market • | • Profit

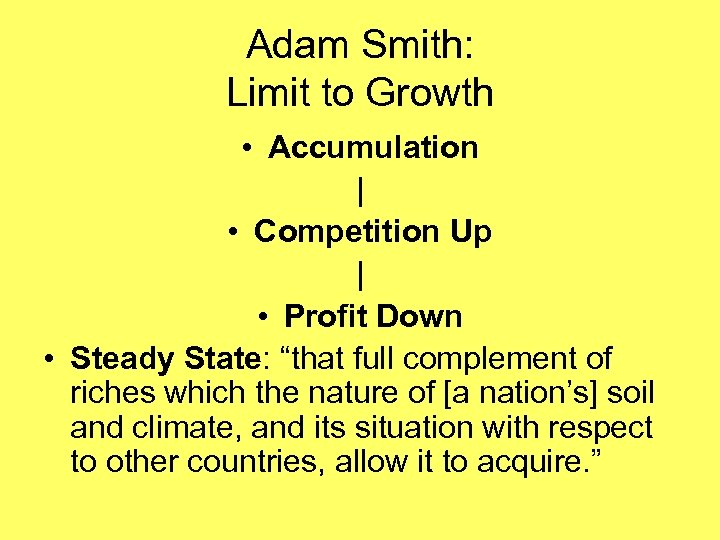

Adam Smith: Limit to Growth • Accumulation | • Competition Up | • Profit Down • Steady State: “that full complement of riches which the nature of [a nation’s] soil and climate, and its situation with respect to other countries, allow it to acquire. ”

Adam Smith: Limit to Growth • Accumulation | • Competition Up | • Profit Down • Steady State: “that full complement of riches which the nature of [a nation’s] soil and climate, and its situation with respect to other countries, allow it to acquire. ”

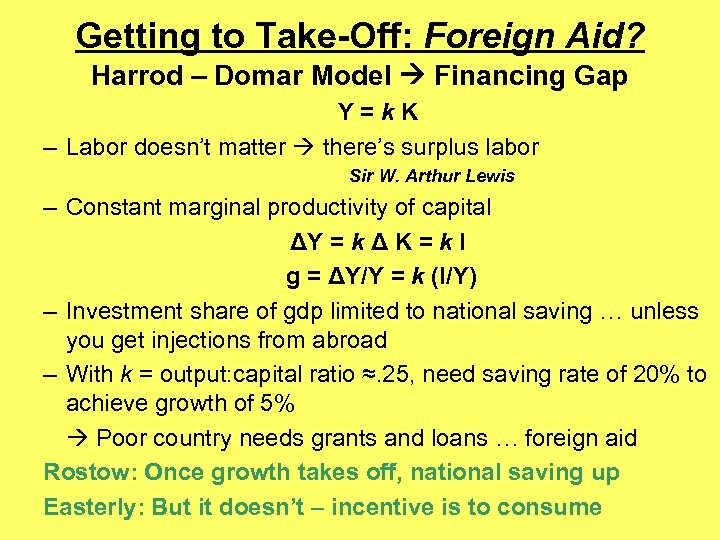

Getting to Take-Off: Foreign Aid? Harrod – Domar Model Financing Gap Y=k. K – Labor doesn’t matter there’s surplus labor Sir W. Arthur Lewis – Constant marginal productivity of capital ΔY = k Δ K = k I g = ΔY/Y = k (I/Y) – Investment share of gdp limited to national saving … unless you get injections from abroad – With k = output: capital ratio ≈. 25, need saving rate of 20% to achieve growth of 5% Poor country needs grants and loans … foreign aid Rostow: Once growth takes off, national saving up Easterly: But it doesn’t – incentive is to consume

Getting to Take-Off: Foreign Aid? Harrod – Domar Model Financing Gap Y=k. K – Labor doesn’t matter there’s surplus labor Sir W. Arthur Lewis – Constant marginal productivity of capital ΔY = k Δ K = k I g = ΔY/Y = k (I/Y) – Investment share of gdp limited to national saving … unless you get injections from abroad – With k = output: capital ratio ≈. 25, need saving rate of 20% to achieve growth of 5% Poor country needs grants and loans … foreign aid Rostow: Once growth takes off, national saving up Easterly: But it doesn’t – incentive is to consume