4c2212163a0389ccbc607e030c13b95c.ppt

- Количество слайдов: 34

Vertical Spreads A Denver Trading Group Options Interest Council presentation by Ken Sheppard

Vertical Spreads A Denver Trading Group Options Interest Council presentation by Ken Sheppard

Review of Option Concepts • Leverage • Protection • Getting paid for that protection © Gryffindor Global Investments LLC

Review of Option Concepts • Leverage • Protection • Getting paid for that protection © Gryffindor Global Investments LLC

Key Trade Offs • Potential risk • Probability of profit • Potential profit © Gryffindor Global Investments LLC

Key Trade Offs • Potential risk • Probability of profit • Potential profit © Gryffindor Global Investments LLC

The Battle • Time erosion vs. favorable move in stock price • Fewer days to expiration – Cheaper – Smaller loss – Higher probability • More days to expiration – More time for a favorable move – Less price erosion – More sensitive to changes in IV © Gryffindor Global Investments LLC

The Battle • Time erosion vs. favorable move in stock price • Fewer days to expiration – Cheaper – Smaller loss – Higher probability • More days to expiration – More time for a favorable move – Less price erosion – More sensitive to changes in IV © Gryffindor Global Investments LLC

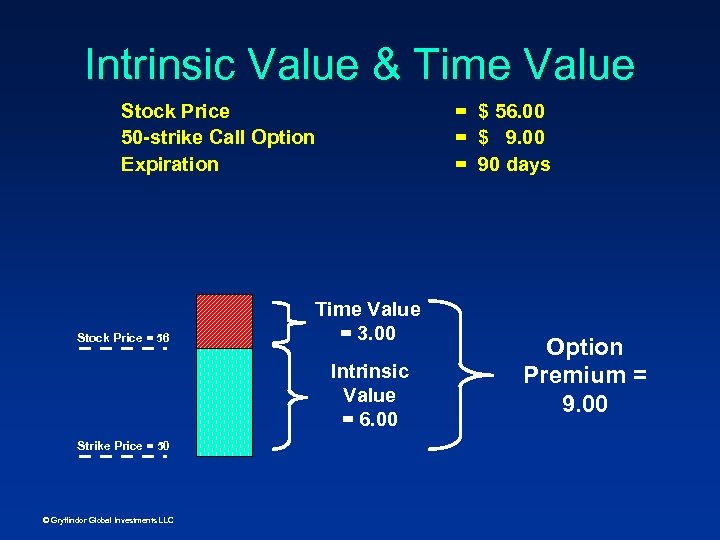

Intrinsic Value & Time Value Stock Price 50 -strike Call Option Expiration Stock Price = 56 = $ 56. 00 = $ 9. 00 = 90 days Time Value = 3. 00 Intrinsic Value = 6. 00 Strike Price = 50 © Gryffindor Global Investments LLC Option Premium = 9. 00

Intrinsic Value & Time Value Stock Price 50 -strike Call Option Expiration Stock Price = 56 = $ 56. 00 = $ 9. 00 = 90 days Time Value = 3. 00 Intrinsic Value = 6. 00 Strike Price = 50 © Gryffindor Global Investments LLC Option Premium = 9. 00

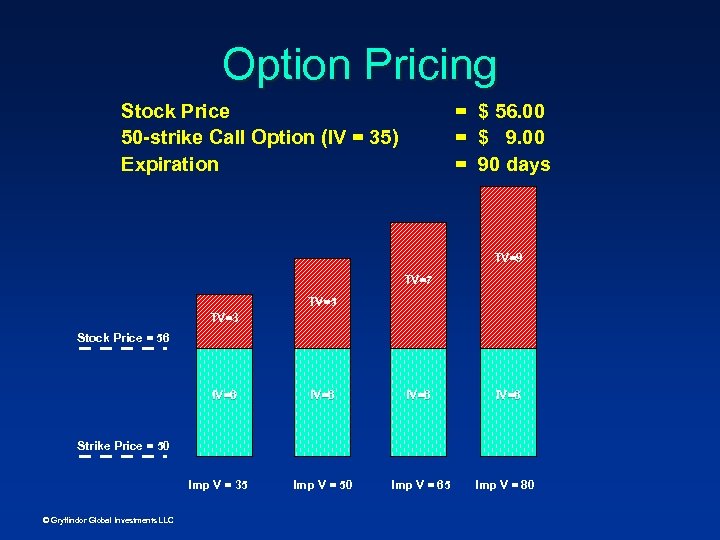

Option Pricing Stock Price 50 -strike Call Option (IV = 35) Expiration = $ 56. 00 = $ 9. 00 = 90 days TV=9 TV=7 TV=5 TV=3 Stock Price = 56 IV=6 Imp V = 50 Imp V = 65 Imp V = 80 Strike Price = 50 Imp V = 35 © Gryffindor Global Investments LLC

Option Pricing Stock Price 50 -strike Call Option (IV = 35) Expiration = $ 56. 00 = $ 9. 00 = 90 days TV=9 TV=7 TV=5 TV=3 Stock Price = 56 IV=6 Imp V = 50 Imp V = 65 Imp V = 80 Strike Price = 50 Imp V = 35 © Gryffindor Global Investments LLC

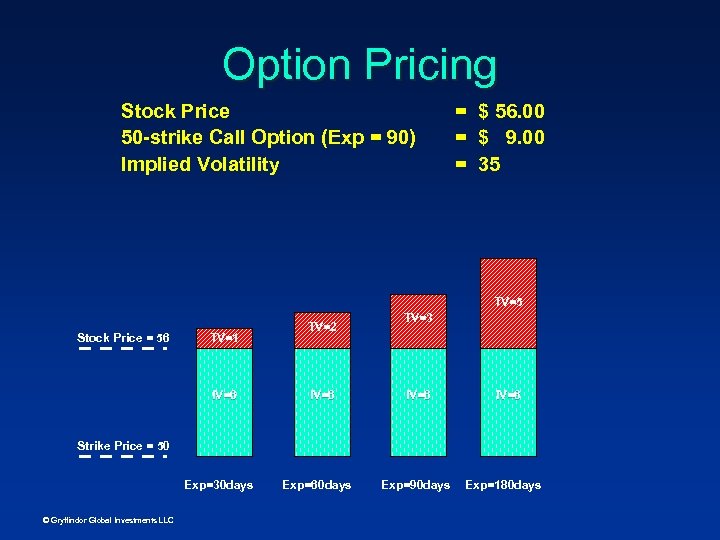

Option Pricing Stock Price 50 -strike Call Option (Exp = 90) Implied Volatility = $ 56. 00 = $ 9. 00 = 35 TV=5 Stock Price = 56 TV=1 IV=6 TV=2 IV=6 TV=3 IV=6 Strike Price = 50 Exp=30 days © Gryffindor Global Investments LLC Exp=60 days Exp=90 days Exp=180 days

Option Pricing Stock Price 50 -strike Call Option (Exp = 90) Implied Volatility = $ 56. 00 = $ 9. 00 = 35 TV=5 Stock Price = 56 TV=1 IV=6 TV=2 IV=6 TV=3 IV=6 Strike Price = 50 Exp=30 days © Gryffindor Global Investments LLC Exp=60 days Exp=90 days Exp=180 days

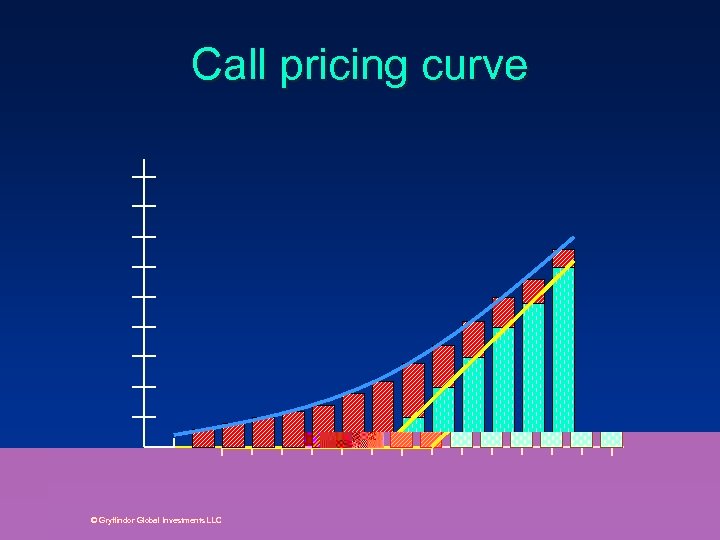

Call pricing curve © Gryffindor Global Investments LLC

Call pricing curve © Gryffindor Global Investments LLC

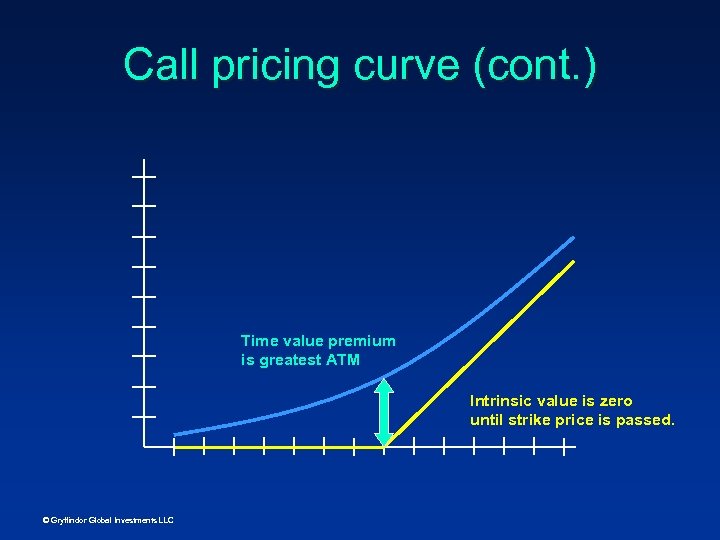

Call pricing curve (cont. ) Time value premium is greatest ATM Intrinsic value is zero until strike price is passed. © Gryffindor Global Investments LLC

Call pricing curve (cont. ) Time value premium is greatest ATM Intrinsic value is zero until strike price is passed. © Gryffindor Global Investments LLC

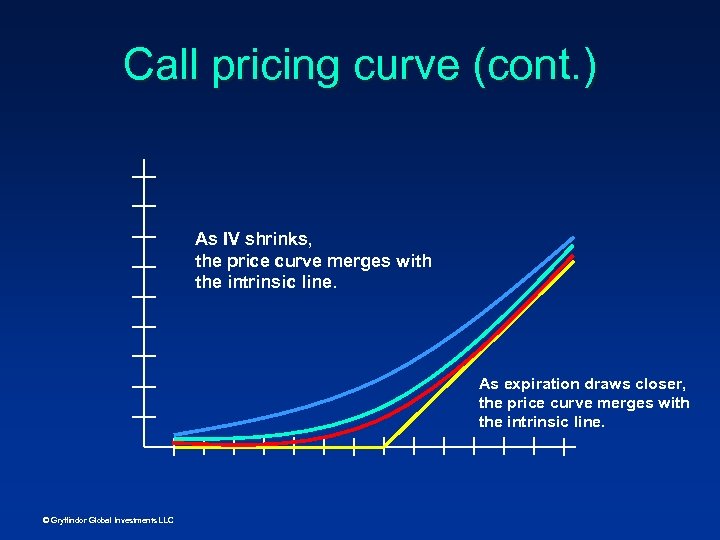

Call pricing curve (cont. ) As IV shrinks, the price curve merges with the intrinsic line. As expiration draws closer, the price curve merges with the intrinsic line. © Gryffindor Global Investments LLC

Call pricing curve (cont. ) As IV shrinks, the price curve merges with the intrinsic line. As expiration draws closer, the price curve merges with the intrinsic line. © Gryffindor Global Investments LLC

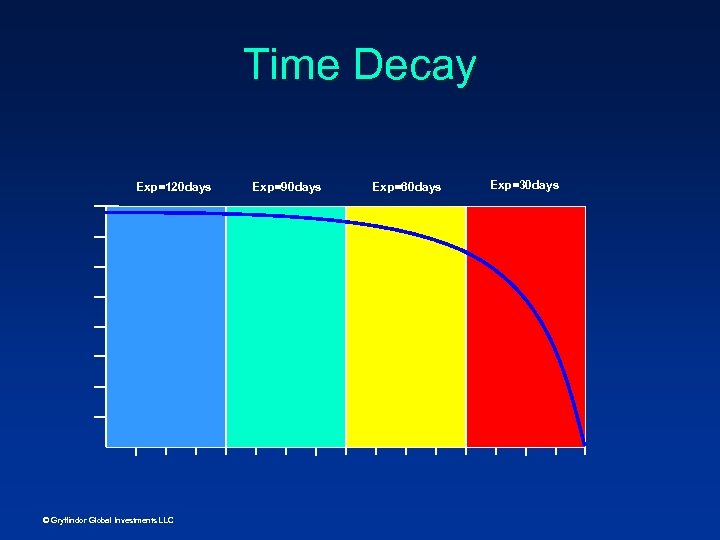

Time Decay Exp=120 days © Gryffindor Global Investments LLC Exp=90 days Exp=60 days Exp=30 days

Time Decay Exp=120 days © Gryffindor Global Investments LLC Exp=90 days Exp=60 days Exp=30 days

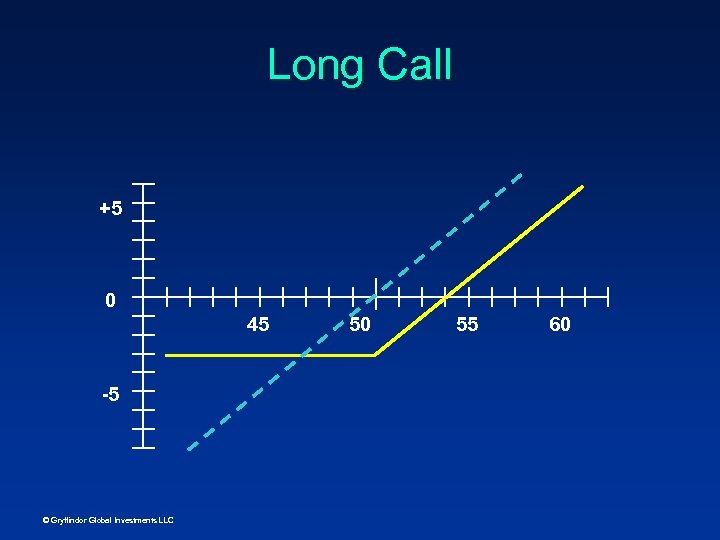

Long Call +5 0 45 -5 © Gryffindor Global Investments LLC 50 55 60

Long Call +5 0 45 -5 © Gryffindor Global Investments LLC 50 55 60

Profitability • Foremost: – Favorable movement by the underlying • Secondarily: – An increase in implied volatility © Gryffindor Global Investments LLC

Profitability • Foremost: – Favorable movement by the underlying • Secondarily: – An increase in implied volatility © Gryffindor Global Investments LLC

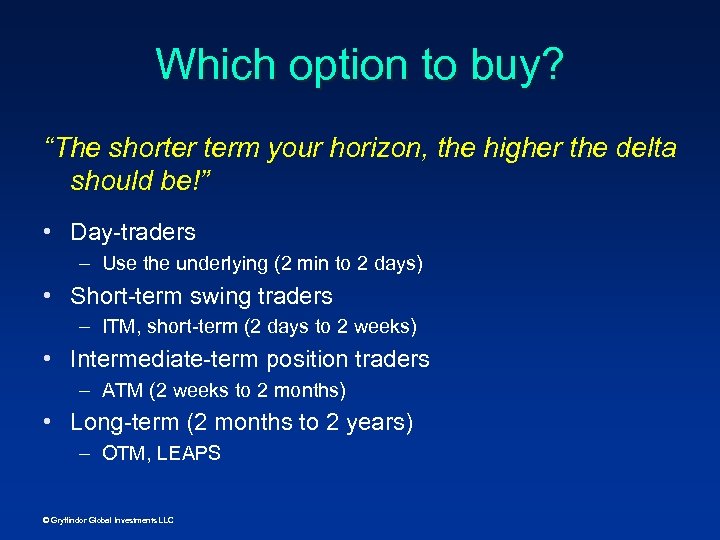

Which option to buy? “The shorter term your horizon, the higher the delta should be!” • Day-traders – Use the underlying (2 min to 2 days) • Short-term swing traders – ITM, short-term (2 days to 2 weeks) • Intermediate-term position traders – ATM (2 weeks to 2 months) • Long-term (2 months to 2 years) – OTM, LEAPS © Gryffindor Global Investments LLC

Which option to buy? “The shorter term your horizon, the higher the delta should be!” • Day-traders – Use the underlying (2 min to 2 days) • Short-term swing traders – ITM, short-term (2 days to 2 weeks) • Intermediate-term position traders – ATM (2 weeks to 2 months) • Long-term (2 months to 2 years) – OTM, LEAPS © Gryffindor Global Investments LLC

The frustration problem • Bid-ask spread • Implied volatility changes • Risk management © Gryffindor Global Investments LLC

The frustration problem • Bid-ask spread • Implied volatility changes • Risk management © Gryffindor Global Investments LLC

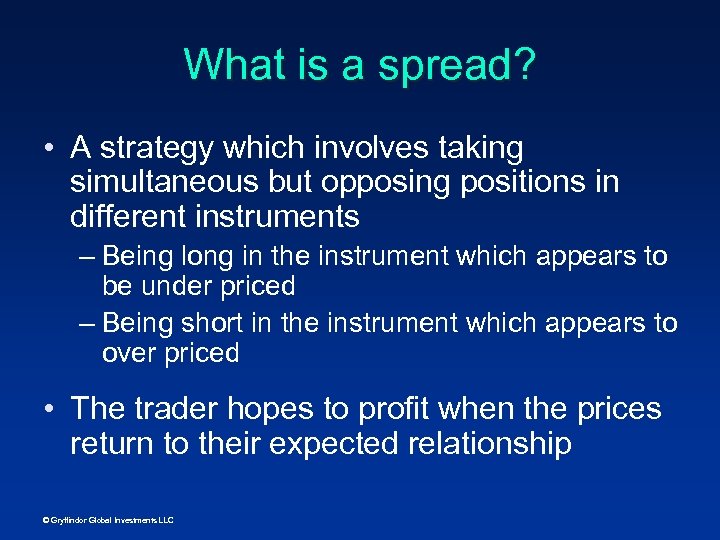

What is a spread? • A strategy which involves taking simultaneous but opposing positions in different instruments – Being long in the instrument which appears to be under priced – Being short in the instrument which appears to over priced • The trader hopes to profit when the prices return to their expected relationship © Gryffindor Global Investments LLC

What is a spread? • A strategy which involves taking simultaneous but opposing positions in different instruments – Being long in the instrument which appears to be under priced – Being short in the instrument which appears to over priced • The trader hopes to profit when the prices return to their expected relationship © Gryffindor Global Investments LLC

Why spread? • Reduces the effect of short-term ‘bad luck’ • Reduces short-term risk - Natenberg p 133 © Gryffindor Global Investments LLC

Why spread? • Reduces the effect of short-term ‘bad luck’ • Reduces short-term risk - Natenberg p 133 © Gryffindor Global Investments LLC

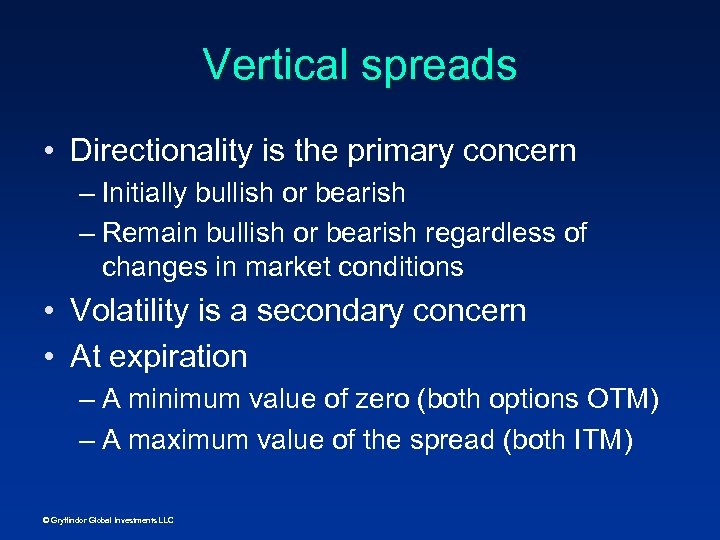

Vertical spreads • Directionality is the primary concern – Initially bullish or bearish – Remain bullish or bearish regardless of changes in market conditions • Volatility is a secondary concern • At expiration – A minimum value of zero (both options OTM) – A maximum value of the spread (both ITM) © Gryffindor Global Investments LLC

Vertical spreads • Directionality is the primary concern – Initially bullish or bearish – Remain bullish or bearish regardless of changes in market conditions • Volatility is a secondary concern • At expiration – A minimum value of zero (both options OTM) – A maximum value of the spread (both ITM) © Gryffindor Global Investments LLC

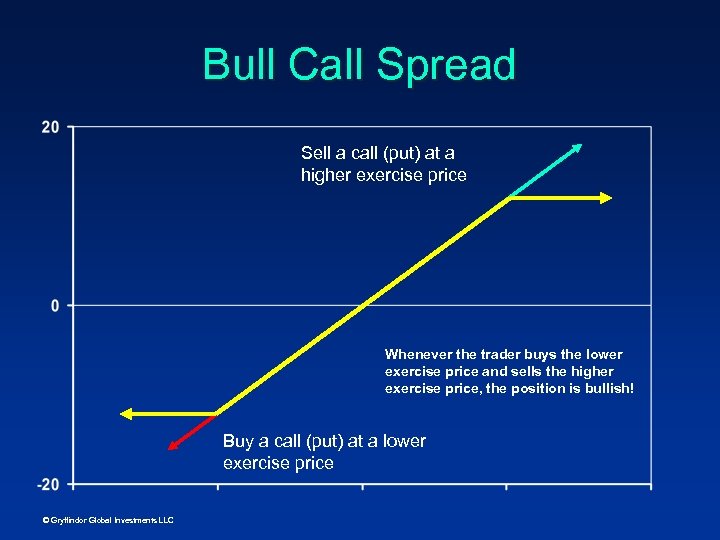

Bull Call Spread Sell a call (put) at a higher exercise price Whenever the trader buys the lower exercise price and sells the higher exercise price, the position is bullish! Buy a call (put) at a lower exercise price © Gryffindor Global Investments LLC

Bull Call Spread Sell a call (put) at a higher exercise price Whenever the trader buys the lower exercise price and sells the higher exercise price, the position is bullish! Buy a call (put) at a lower exercise price © Gryffindor Global Investments LLC

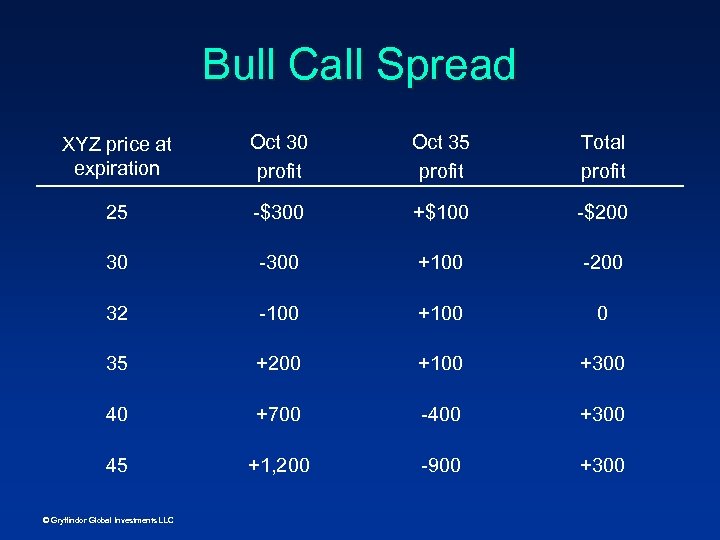

Bull Call Spread XYZ price at expiration Oct 30 profit Oct 35 profit Total profit 25 -$300 +$100 -$200 30 -300 +100 -200 32 -100 +100 0 35 +200 +100 +300 40 +700 -400 +300 45 +1, 200 -900 +300 © Gryffindor Global Investments LLC

Bull Call Spread XYZ price at expiration Oct 30 profit Oct 35 profit Total profit 25 -$300 +$100 -$200 30 -300 +100 -200 32 -100 +100 0 35 +200 +100 +300 40 +700 -400 +300 45 +1, 200 -900 +300 © Gryffindor Global Investments LLC

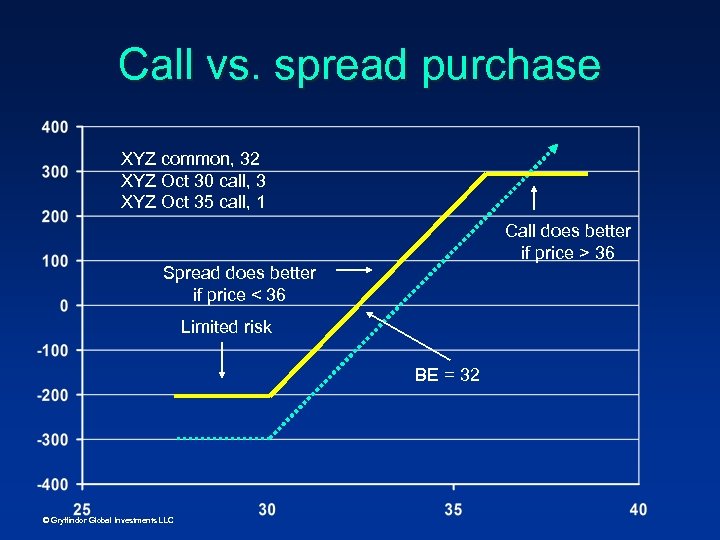

Call vs. spread purchase XYZ common, 32 XYZ Oct 30 call, 3 XYZ Oct 35 call, 1 Call does better if price > 36 Spread does better if price < 36 Limited risk BE = 32 © Gryffindor Global Investments LLC

Call vs. spread purchase XYZ common, 32 XYZ Oct 30 call, 3 XYZ Oct 35 call, 1 Call does better if price > 36 Spread does better if price < 36 Limited risk BE = 32 © Gryffindor Global Investments LLC

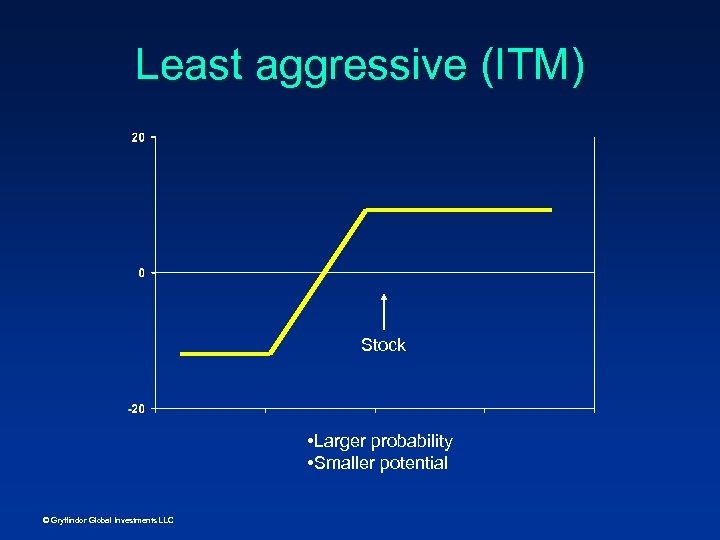

Least aggressive (ITM) Stock • Larger probability • Smaller potential © Gryffindor Global Investments LLC

Least aggressive (ITM) Stock • Larger probability • Smaller potential © Gryffindor Global Investments LLC

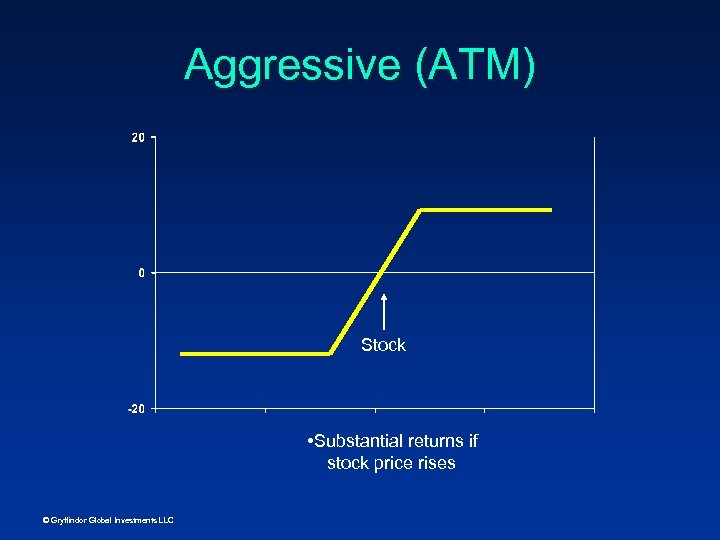

Aggressive (ATM) Stock • Substantial returns if stock price rises © Gryffindor Global Investments LLC

Aggressive (ATM) Stock • Substantial returns if stock price rises © Gryffindor Global Investments LLC

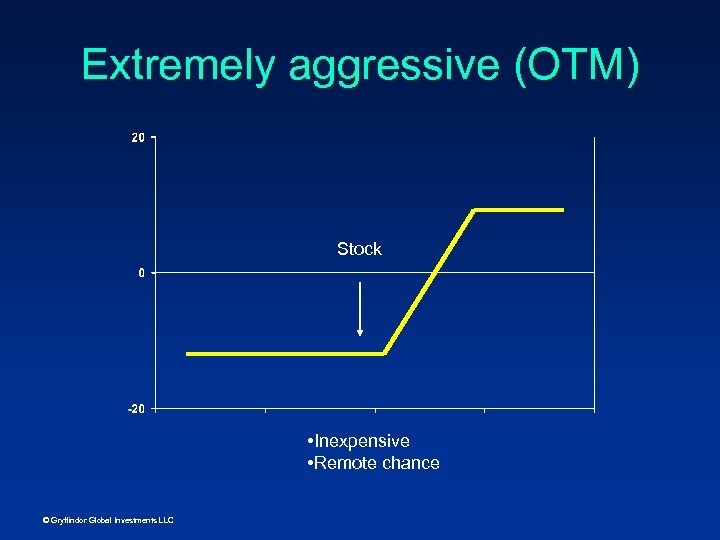

Extremely aggressive (OTM) Stock • Inexpensive • Remote chance © Gryffindor Global Investments LLC

Extremely aggressive (OTM) Stock • Inexpensive • Remote chance © Gryffindor Global Investments LLC

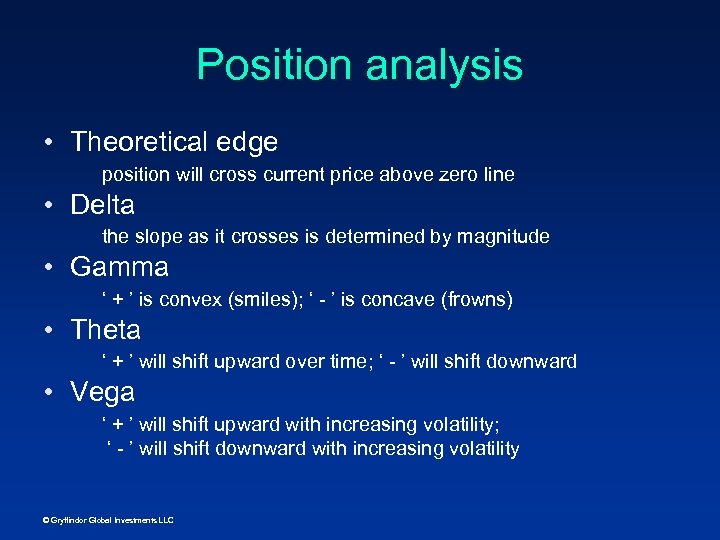

Position analysis • Theoretical edge position will cross current price above zero line • Delta the slope as it crosses is determined by magnitude • Gamma ‘ + ’ is convex (smiles); ‘ - ’ is concave (frowns) • Theta ‘ + ’ will shift upward over time; ‘ - ’ will shift downward • Vega ‘ + ’ will shift upward with increasing volatility; ‘ - ’ will shift downward with increasing volatility © Gryffindor Global Investments LLC

Position analysis • Theoretical edge position will cross current price above zero line • Delta the slope as it crosses is determined by magnitude • Gamma ‘ + ’ is convex (smiles); ‘ - ’ is concave (frowns) • Theta ‘ + ’ will shift upward over time; ‘ - ’ will shift downward • Vega ‘ + ’ will shift upward with increasing volatility; ‘ - ’ will shift downward with increasing volatility © Gryffindor Global Investments LLC

How volatility affects bull spreads • Stock price: 25 • Time to expiration: 3 months • Position: – bco at 25 – sco at 30 • What happens to the price of the spread is implied volatility increases? © Gryffindor Global Investments LLC

How volatility affects bull spreads • Stock price: 25 • Time to expiration: 3 months • Position: – bco at 25 – sco at 30 • What happens to the price of the spread is implied volatility increases? © Gryffindor Global Investments LLC

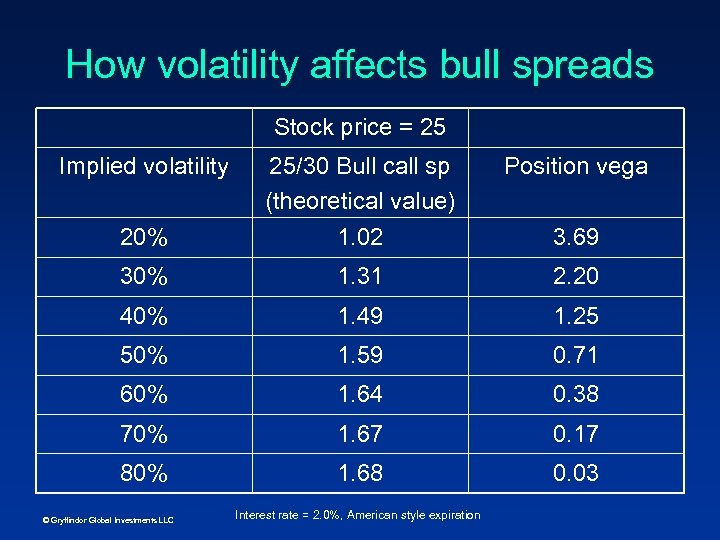

How volatility affects bull spreads Stock price = 25 Implied volatility Position vega 20% 25/30 Bull call sp (theoretical value) 1. 02 30% 1. 31 2. 20 40% 1. 49 1. 25 50% 1. 59 0. 71 60% 1. 64 0. 38 70% 1. 67 0. 17 80% 1. 68 0. 03 © Gryffindor Global Investments LLC Interest rate = 2. 0%, American style expiration 3. 69

How volatility affects bull spreads Stock price = 25 Implied volatility Position vega 20% 25/30 Bull call sp (theoretical value) 1. 02 30% 1. 31 2. 20 40% 1. 49 1. 25 50% 1. 59 0. 71 60% 1. 64 0. 38 70% 1. 67 0. 17 80% 1. 68 0. 03 © Gryffindor Global Investments LLC Interest rate = 2. 0%, American style expiration 3. 69

How volatility affects bull spreads • If implied volatility is too low – Focus on purchasing the ATM option (the option whose delta is closest to 50) • If implied volatility is too high – Focus on selling the ATM option (the option whose delta is closest to 50) © Gryffindor Global Investments LLC

How volatility affects bull spreads • If implied volatility is too low – Focus on purchasing the ATM option (the option whose delta is closest to 50) • If implied volatility is too high – Focus on selling the ATM option (the option whose delta is closest to 50) © Gryffindor Global Investments LLC

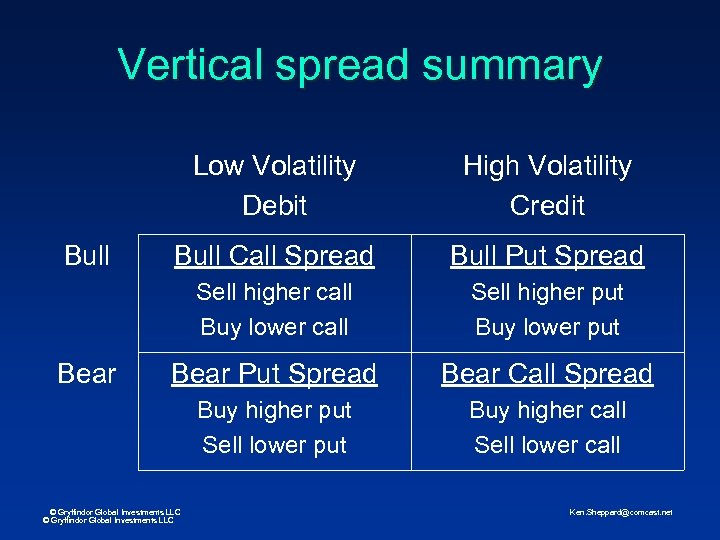

Vertical spread summary Low Volatility Debit Bull Put Spread Sell higher put Buy lower put Bear Put Spread Bear Call Spread Buy higher put Sell lower put Bear Bull Call Spread Sell higher call Buy lower call Bull High Volatility Credit Buy higher call Sell lower call © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Vertical spread summary Low Volatility Debit Bull Put Spread Sell higher put Buy lower put Bear Put Spread Bear Call Spread Buy higher put Sell lower put Bear Bull Call Spread Sell higher call Buy lower call Bull High Volatility Credit Buy higher call Sell lower call © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

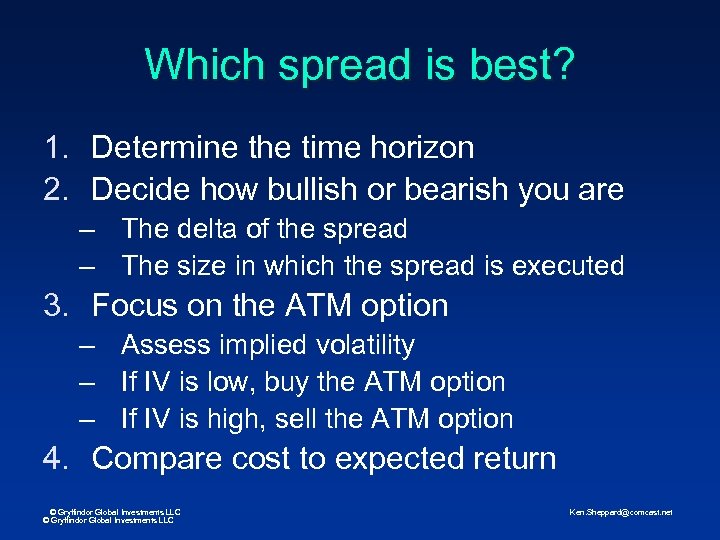

Which spread is best? 1. Determine the time horizon 2. Decide how bullish or bearish you are – The delta of the spread – The size in which the spread is executed 3. Focus on the ATM option – Assess implied volatility – If IV is low, buy the ATM option – If IV is high, sell the ATM option 4. Compare cost to expected return © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Which spread is best? 1. Determine the time horizon 2. Decide how bullish or bearish you are – The delta of the spread – The size in which the spread is executed 3. Focus on the ATM option – Assess implied volatility – If IV is low, buy the ATM option – If IV is high, sell the ATM option 4. Compare cost to expected return © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

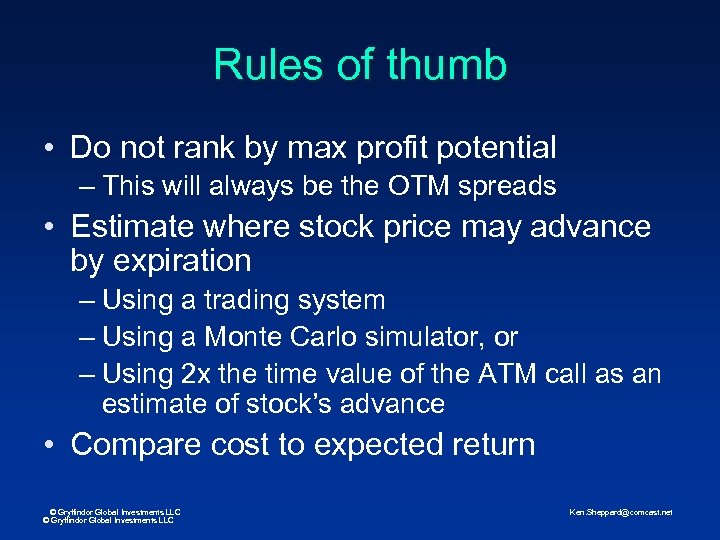

Rules of thumb • Do not rank by max profit potential – This will always be the OTM spreads • Estimate where stock price may advance by expiration – Using a trading system – Using a Monte Carlo simulator, or – Using 2 x the time value of the ATM call as an estimate of stock’s advance • Compare cost to expected return © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Rules of thumb • Do not rank by max profit potential – This will always be the OTM spreads • Estimate where stock price may advance by expiration – Using a trading system – Using a Monte Carlo simulator, or – Using 2 x the time value of the ATM call as an estimate of stock’s advance • Compare cost to expected return © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

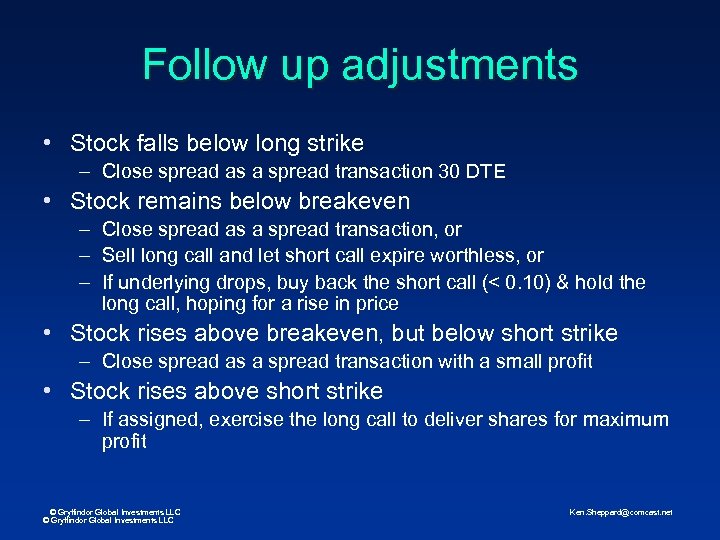

Follow up adjustments • Stock falls below long strike – Close spread as a spread transaction 30 DTE • Stock remains below breakeven – Close spread as a spread transaction, or – Sell long call and let short call expire worthless, or – If underlying drops, buy back the short call (< 0. 10) & hold the long call, hoping for a rise in price • Stock rises above breakeven, but below short strike – Close spread as a spread transaction with a small profit • Stock rises above short strike – If assigned, exercise the long call to deliver shares for maximum profit © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Follow up adjustments • Stock falls below long strike – Close spread as a spread transaction 30 DTE • Stock remains below breakeven – Close spread as a spread transaction, or – Sell long call and let short call expire worthless, or – If underlying drops, buy back the short call (< 0. 10) & hold the long call, hoping for a rise in price • Stock rises above breakeven, but below short strike – Close spread as a spread transaction with a small profit • Stock rises above short strike – If assigned, exercise the long call to deliver shares for maximum profit © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Stops • • • Stock stops Exit at 40% or 50% loss If spread doubles, sell half for a free trade Then, implement tight trailing stop Finally, sell remainder at 80% of spread Exit debit spreads before 30 DTE © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Stops • • • Stock stops Exit at 40% or 50% loss If spread doubles, sell half for a free trade Then, implement tight trailing stop Finally, sell remainder at 80% of spread Exit debit spreads before 30 DTE © Gryffindor Global Investments LLC Ken. Sheppard@comcast. net

Option Concepts • Leverage • Protection • Pay for protection © Gryffindor Global Investments LLC

Option Concepts • Leverage • Protection • Pay for protection © Gryffindor Global Investments LLC