ab3f9679f47d48b1af024428e9358874.ppt

- Количество слайдов: 28

Vertical Branding OTC BB: VBDG

Safe Harbor Statements VBDG. OB Forward-looking statements: Certain statements in this presentation may contain forward-looking information within the meaning of Rule 175 under the Securities Act of 1933 and Rule 3 b-6 under the Securities Exchange Act of 1934, and are subject to the Safe Harbor created by those rules. Other than statements of historical fact, any statements included in this presentation, including without limitation statements regarding potential future plans and objectives of the company, are forward-looking statements that involve risks and uncertainties that could cause actual results or events to differ materially from those anticipated in such statements. Some of these risks, uncertainties and other factors are described in the Company’s periodic filings with the Securities and Exchange Commission (available at www. sec. gov), such as the company’s most recent Form 10 -KSB filing and registration statement on Form S -1. Forward-looking statements reflect present intentions and available information only, and many facts, circumstances or events could arise in the future that might prevent the achievement of any objectives, or the implementation of any strategically significant plan(s), outlined herein, or that might cause the company to reconsider such objectives or plans. The company undertakes no obligation to publicly update or revise any statements in this presentation whether as a result of new information, future events or otherwise. Non-GAAP financial measures: This presentation contains references to adjusted EBITDA, a non-GAAP financial measure, which management believes provides better insights into Company performance than GAAP metrics. Please consult the Company’s SEC filings and press releases for reconciliations of EBITDA with GAAP measures.

Who We Are VBDG. OB v Vertical Branding is a consumer products company selling high quality household, beauty and personal care products at affordable prices. v The Company sells directly to consumers through television, Internet and print advertising as well as wholesale to many of the country’s largest retailers and drugstore chains, catalogs, home shopping channels and international distributors. v The Company’s hottest-selling products and brands currently include My Place, Steam Buddy, Hercules Hook, Zorbeez, EZ-Fold. Z Step Stool and Star. Maker Cosmetics.

What you’re about to hear… VBDG. OB What is Unique & Compelling about Vertical Branding All About Our Products Our Marketing & Sales Approach Financial Information Management

What is Unique & Compelling about VBI VBDG. OB l Our Track Record – demonstrated ability to develop and/or identify quality, high margin yet inexpensive products that appeal to a core demographic and high success rate bringing those products to market; l Our Products - New product introductions through a robust product pipeline, as well as line extensions on existing and future products, fuel growth while recurring sales from an ever-expanding product portfolio provides a stable base of revenues; l Our Advertising Strategy - Multi-media (TV, Internet, Print, Radio), ROI-based transactional advertising strategy that creates brand awareness and promotes retail sell-through while simultaneously generating revenues through direct response sales; l Continually Testing - Metric-driven testing of new products and marketing campaigns avoids large capital expenditure prior to market validation; l Strong year over year revenue growth; l Experienced, high caliber management.

It’s all about the Products… VBDG. OB Current Products Product Pipeline Product Development and Selection

Current Product Overview VBDG. OB Vertical Branding’s products make life easier and/or more affordable My Place. TM Steam Buddy. TM by answering unique consumer needs in innovative ways

VBI Product Pipeline VBDG. OB Vertical Branding’s v Develop our own proprietary products and brands track record of success makes us v License products from third parties attractive to inventors v Dozens of potential new product opportunities reviewed every month submitted by inventors, vendors, manufacturers, trade shows, etc. and license holders as a potential home for their products

Expertise in Product Development & Selection VBDG. OB v Unique, top-quality, compelling value proposition v Affordable price points ($9. 99 - $29. 99) v Resonate with core demographic (women 28 – 55) v Potential to sell >50 million households v Each product gets rigorous in-house evaluation (financial, operational, quality assurance & legal)

Our Marketing and Sales Approach VBDG. OB v Creating and testing the campaign Transaction al Marketing v v v Transactional Marketing Retail Sales Deepening relationship with retailers as “category captain” and reliable source of popular products Media generates revenues on the “front end” while creating v Catalog and Home Shopping Sales Brand v International Distribution used to Awareness drive Retail v Future trends and focus Sales

Creating & Testing the Campaign VBDG. OB Transaction v Television commercials, Internet marketing, and print advertising is created and tested al Marketing allows continual v v Limited amount of media is purchased during testing phase Results are then analyzed, gauging response and profitability prior to national media rollout testing and refinement of the marketing message and the value proposition

Transactional Marketing Highlights VBDG. OB v Simultaneously generates revenues and builds brands “Brand” advertisers v Transactional media net costs are a fraction of conventional brand/image advertising now engaged in direct v Immediate, lasting return on marketing investment Response is measurable Creation of a direct, lasting customer relationship Gives management sound basis for marketing tactics v Enables metrics-based marketing and management marketing on TV and online: P&G GM Ford Ti. Vo Kodak Discover

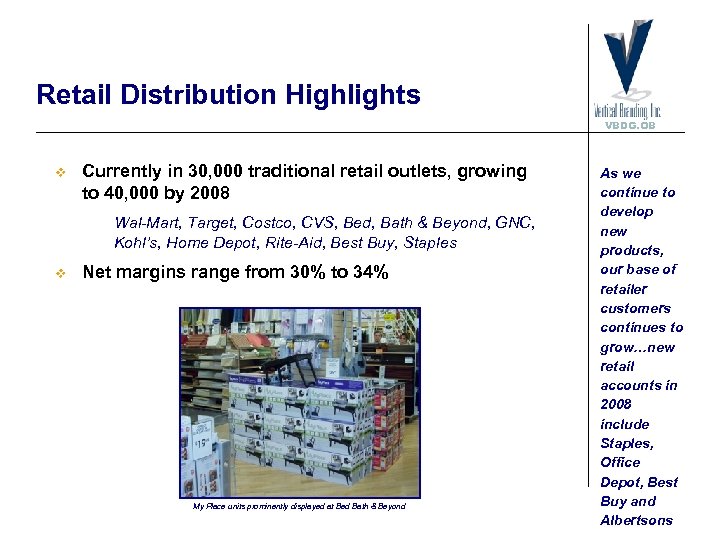

Retail Distribution Highlights VBDG. OB v Currently in 30, 000 traditional retail outlets, growing to 40, 000 by 2008 Wal-Mart, Target, Costco, CVS, Bed, Bath & Beyond, GNC, Kohl’s, Home Depot, Rite-Aid, Best Buy, Staples v Net margins range from 30% to 34% My Place units prominently displayed at Bed Bath & Beyond As we continue to develop new products, our base of retailer customers continues to grow…new retail accounts in 2008 include Staples, Office Depot, Best Buy and Albertsons

Transactional/Retail Synergies VBDG. OB v Retail channel leverages prior investments in transactional and continuity marketing v Retailers grant more and better display space for products that generate additional customer traffic v Unit sales at retail are 3 x - 5 x better for products with strong transactional marketing track records

Deepening Relationship with Retailers VBDG. OB v The acceptance of our products and our responsiveness has led to deepening relationships with many of our retail customers v We have been named “Category Captain” by several major retail chains which gives us an opportunity to greatly expand our distribution to those stores with both our own products and third party products v New product opportunities have arisen directly from retail buyers The EZFold. Z Step Stool was brought to Vertical Branding by a Wal-Mart buyer due to the retail success of Hercules Hook and other products

Category Captain – VBI Partners with its Own Retailer Customers VBDG. OB v Currently in 30, 000 traditional retail outlets, growing to 40, 000 in 2008 As category captain, VBI controls hightraffic “As Seen on TV” end-cap shelf sections for v Net margins: 30% to 34% -- v Retail chains are bringing VBI new product opportunities leading New products gain entrée with new retailers (e. g. , Po. P data and v My. Place made VBI category captain with Staples) retailers, gains direct new product ideas, selects and merchandises its own products and other manufacturer

Other Wholesale Channels VBDG. OB Vertical Catalog Home Shopping Channels International Distribution Branding’s media exposure creates tremendous appeal among transactional marketers… having multiple distribution channels helps fuel our growth

VBDG. OB Financial Information

Financial Highlights VBDG. OB v FY 2007 revenues up 57% year over year, to $36. 3 million v FY ‘ 07 adjusted EBITDA swung to $1. 8 million from FY ’ 06 equivalently calculated loss of $(1. 2 million) Since acquiring retail v v Annual revenue run rate per employee: approx. $1. 25 million Revenue guidance for 2008: $47 million to $50 million, 29% to 38% Y-o-Y growth division in August 2006, revenues, margins and profitability have shown dramatic, sustained improvement

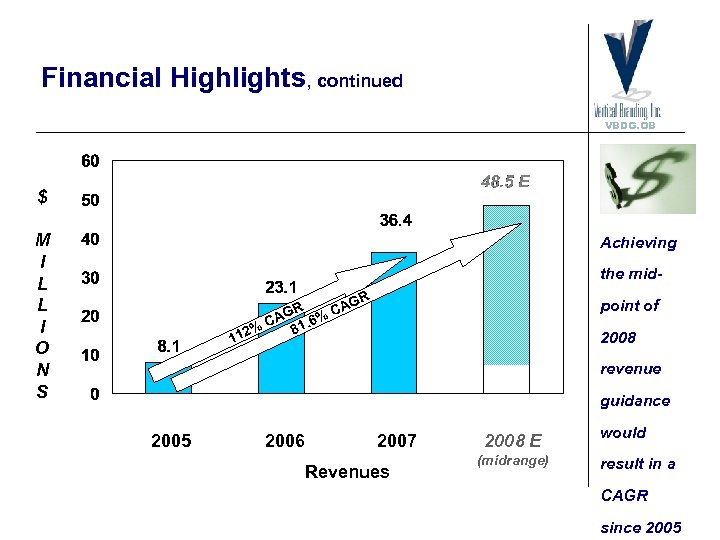

Financial Highlights, continued VBDG. OB $ M I L L I O N S Achieving the mid- 1 G GR % CA A 6 % C 81. 2 1 R point of 2008 revenue guidance 2005 2006 2007 Revenues 2008 E (midrange) would result in a CAGR since 2005

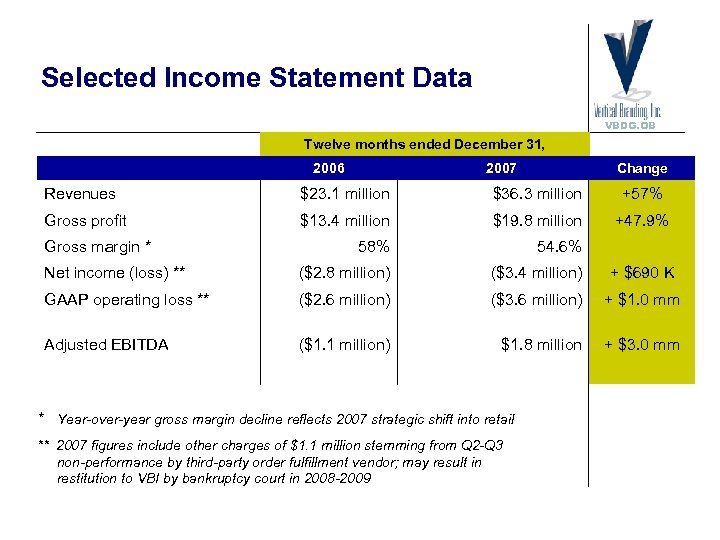

Selected Income Statement Data VBDG. OB Twelve months ended December 31, 2006 2007 Change Revenues $23. 1 million $36. 3 million +57% Gross profit $13. 4 million $19. 8 million +47. 9% 58% 54. 6% Net income (loss) ** ($2. 8 million) ($3. 4 million) + $690 K GAAP operating loss ** ($2. 6 million) ($3. 6 million) + $1. 0 mm Adjusted EBITDA ($1. 1 million) $1. 8 million + $3. 0 mm Gross margin * * Year-over-year gross margin decline reflects 2007 strategic shift into retail ** 2007 figures include other charges of $1. 1 million stemming from Q 2 -Q 3 non-performance by third-party order fulfillment vendor; may result in restitution to VBI by bankruptcy court in 2008 -2009

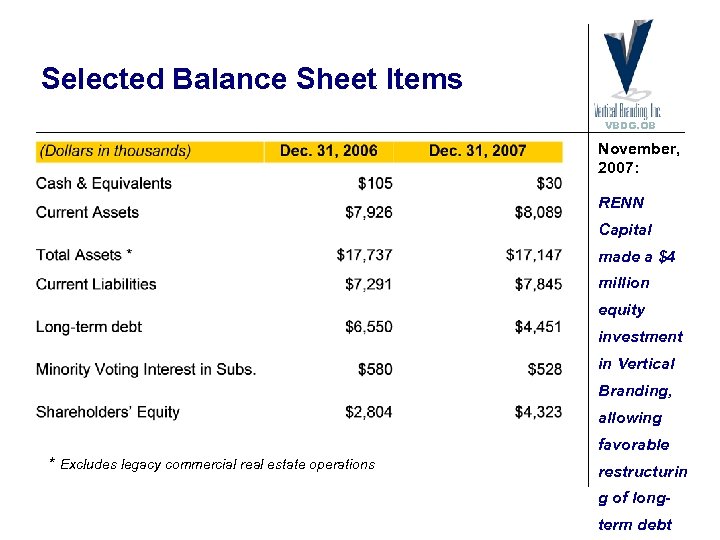

Selected Balance Sheet Items VBDG. OB November, 2007: RENN Capital made a $4 million equity investment in Vertical Branding, allowing favorable * Excludes legacy commercial real estate operations restructurin g of longterm debt

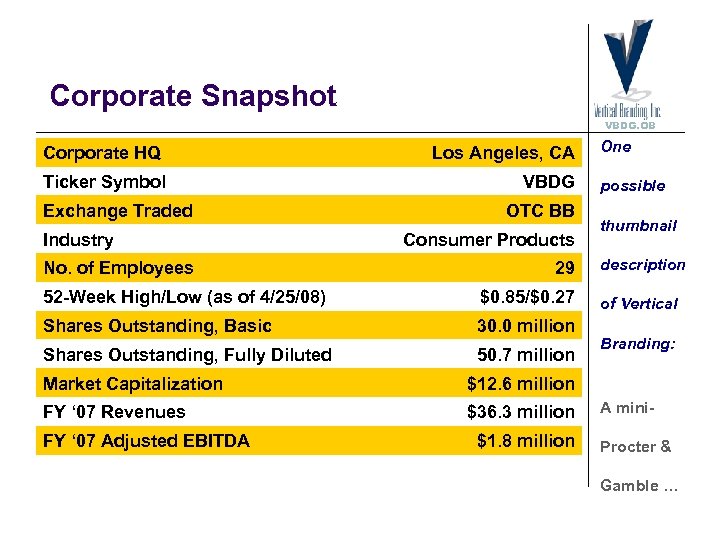

Corporate Snapshot VBDG. OB Corporate HQ Los Angeles, CA Ticker Symbol VBDG Exchange Traded Industry No. of Employees OTC BB Consumer Products 29 52 -Week High/Low (as of 4/25/08) $0. 85/$0. 27 Shares Outstanding, Basic 30. 0 million Shares Outstanding, Fully Diluted 50. 7 million Market Capitalization $36. 3 million possible thumbnail description of Vertical Branding: $12. 6 million FY ‘ 07 Revenues One FY ‘ 07 Adjusted EBITDA $1. 8 million A mini. Procter & Gamble …

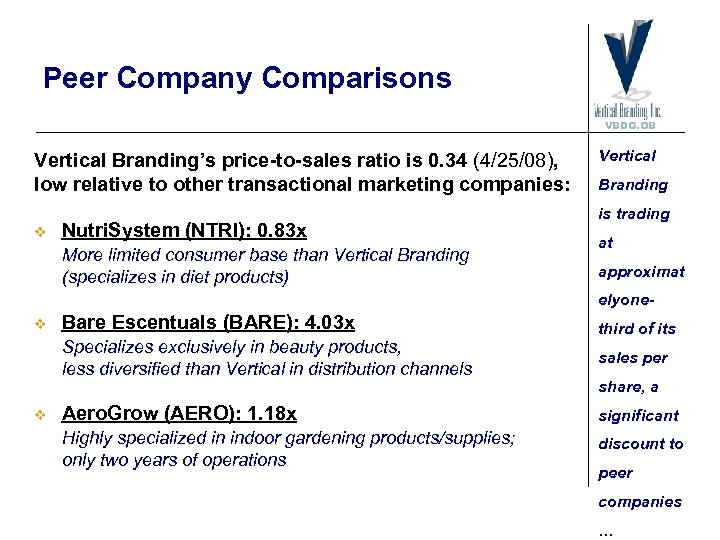

Peer Company Comparisons VBDG. OB Vertical Branding’s price-to-sales ratio is 0. 34 (4/25/08), low relative to other transactional marketing companies: v Nutri. System (NTRI): 0. 83 x More limited consumer base than Vertical Branding (specializes in diet products) Vertical Branding is trading at approximat elyone- v Bare Escentuals (BARE): 4. 03 x Specializes exclusively in beauty products, less diversified than Vertical in distribution channels v third of its sales per share, a Aero. Grow (AERO): 1. 18 x significant Highly specialized in indoor gardening products/supplies; only two years of operations discount to peer companies …

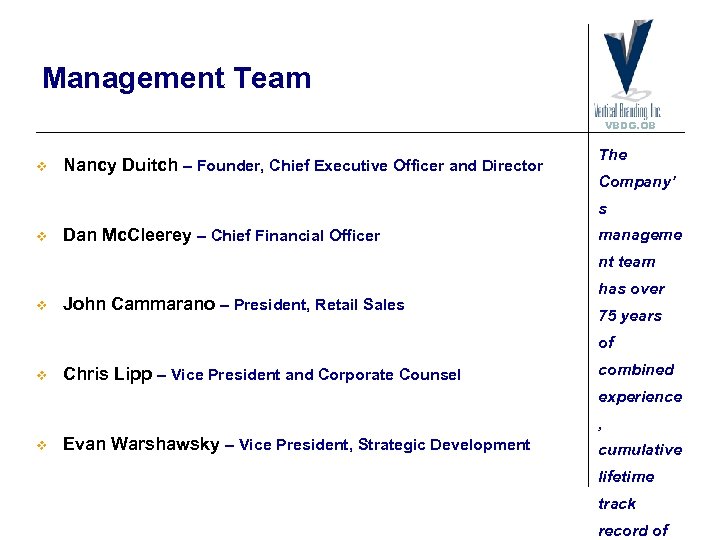

Management Team VBDG. OB v Nancy Duitch – Founder, Chief Executive Officer and Director The Company’ s v Dan Mc. Cleerey – Chief Financial Officer manageme nt team v John Cammarano – President, Retail Sales has over 75 years of v Chris Lipp – Vice President and Corporate Counsel combined experience , v Evan Warshawsky – Vice President, Strategic Development cumulative lifetime track record of

Investment Highlights VBDG. OB v Strong track record of successfully selecting popular products and mass-marketing them through multiple sales channels Vertical Branding has a rare combination v Transactional marketing strategy “road-tests” products, builds brands, optimizes retail channel sellthrough v Margins and profitability trends improving v Scalable business model leverages profits from successful mature products to support robust new product pipeline of track record, sustainable and scalable business model and deep managemen t expertise

VBDG. OB Vertical Branding OTC BB: VBDG

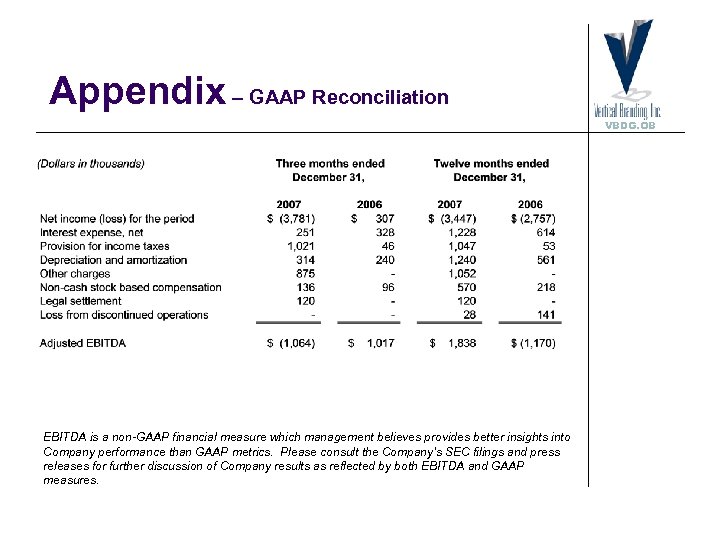

Appendix – GAAP Reconciliation VBDG. OB EBITDA is a non-GAAP financial measure which management believes provides better insights into Company performance than GAAP metrics. Please consult the Company’s SEC filings and press releases for further discussion of Company results as reflected by both EBITDA and GAAP measures.

ab3f9679f47d48b1af024428e9358874.ppt