b62ec412876e2f1602fd3f838fb10736.ppt

- Количество слайдов: 47

Vertical and Conglomerate Mergers Chapter 17: Vertical and Conglomerate Mergers 1

Vertical and Conglomerate Mergers Chapter 17: Vertical and Conglomerate Mergers 1

Introduction • General Electric and Honeywell proposed to merge in 2000 – GE supplies jet engines for commercial aircraft – Honeywell produced various electrical and other control systems for jet aircraft • Deal was approved in the US • But was blocked by the EU Competition Directorate – this was a merger of complementary firms – it is “like” a vertical merger – so can potentially remove inefficiencies in pricing • benefiting the merged firms and consumers – so why block the merger? Chapter 17: Vertical and Conglomerate Mergers 2

Introduction • General Electric and Honeywell proposed to merge in 2000 – GE supplies jet engines for commercial aircraft – Honeywell produced various electrical and other control systems for jet aircraft • Deal was approved in the US • But was blocked by the EU Competition Directorate – this was a merger of complementary firms – it is “like” a vertical merger – so can potentially remove inefficiencies in pricing • benefiting the merged firms and consumers – so why block the merger? Chapter 17: Vertical and Conglomerate Mergers 2

Introduction 2 • Vertical mergers can be detrimental – if they facilitate market foreclosure by the merged firms • refuse to supply non-merged rivals • But they can also be beneficial – if they remove market inefficiencies • Regulators need to look for the balance these two forces in considering any proposed merger Chapter 17: Vertical and Conglomerate Mergers 3

Introduction 2 • Vertical mergers can be detrimental – if they facilitate market foreclosure by the merged firms • refuse to supply non-merged rivals • But they can also be beneficial – if they remove market inefficiencies • Regulators need to look for the balance these two forces in considering any proposed merger Chapter 17: Vertical and Conglomerate Mergers 3

Complementary Mergers • Consider first a merger between firms that supply complementary products • A simple example: – – – final production requires two inputs in fixed proportions one unit of each input is needed to make one unit of output input producers are monopolists final product producer is a monopolist demand for the final product is P = 140 - Q marginal costs of upstream producers and final producer (other than for the two inputs) normalized to zero. • What is the effect of merger between the two upstream producers? Chapter 17: Vertical and Conglomerate Mergers 4

Complementary Mergers • Consider first a merger between firms that supply complementary products • A simple example: – – – final production requires two inputs in fixed proportions one unit of each input is needed to make one unit of output input producers are monopolists final product producer is a monopolist demand for the final product is P = 140 - Q marginal costs of upstream producers and final producer (other than for the two inputs) normalized to zero. • What is the effect of merger between the two upstream producers? Chapter 17: Vertical and Conglomerate Mergers 4

Complementary mergers 2 Supplier 1 Supplier 2 price v 1 Final Producer price P Consumers Chapter 17: Vertical and Conglomerate Mergers 5

Complementary mergers 2 Supplier 1 Supplier 2 price v 1 Final Producer price P Consumers Chapter 17: Vertical and Conglomerate Mergers 5

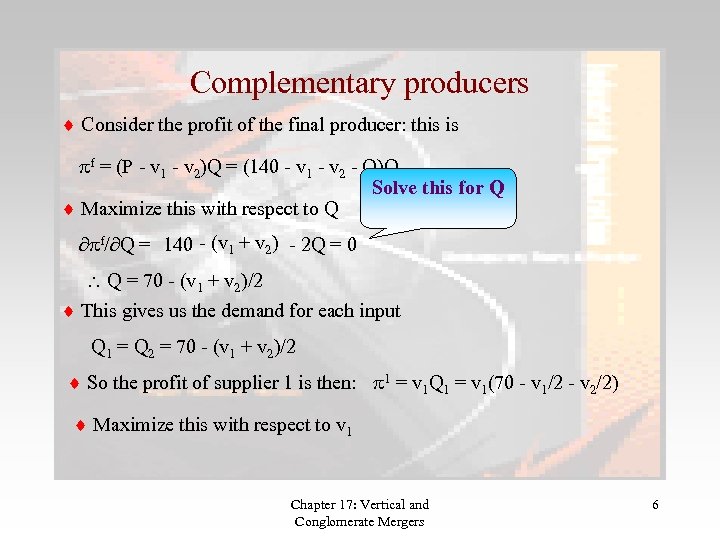

Complementary producers Consider the profit of the final producer: this is pf = (P - v 1 - v 2)Q = (140 - v 1 - v 2 - Q)Q Solve this for Q Maximize this with respect to Q pf/ Q = 140 - (v 1 + v 2) - 2 Q = 0 Q = 70 - (v 1 + v 2)/2 This gives us the demand for each input Q 1 = Q 2 = 70 - (v 1 + v 2)/2 So the profit of supplier 1 is then: p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Maximize this with respect to v 1 Chapter 17: Vertical and Conglomerate Mergers 6

Complementary producers Consider the profit of the final producer: this is pf = (P - v 1 - v 2)Q = (140 - v 1 - v 2 - Q)Q Solve this for Q Maximize this with respect to Q pf/ Q = 140 - (v 1 + v 2) - 2 Q = 0 Q = 70 - (v 1 + v 2)/2 This gives us the demand for each input Q 1 = Q 2 = 70 - (v 1 + v 2)/2 So the profit of supplier 1 is then: p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Maximize this with respect to v 1 Chapter 17: Vertical and Conglomerate Mergers 6

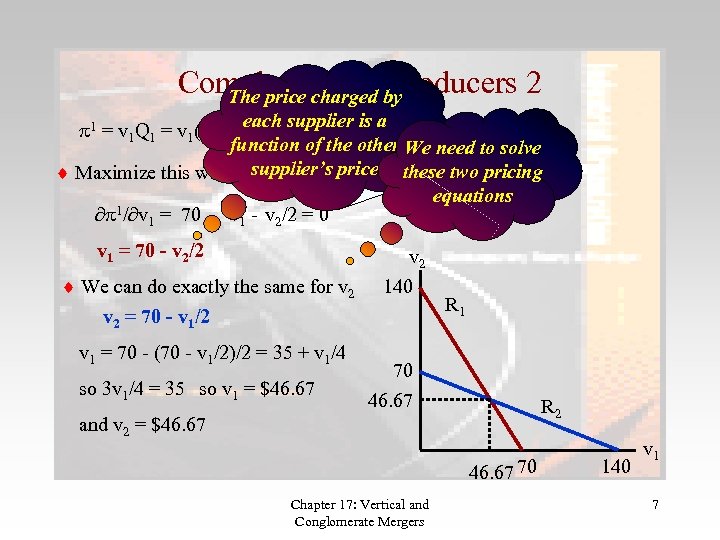

Complementaryby producers 2 The price charged each supplier is a p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Solve this for v function of the other We need to solve 1 supplier’s Maximize this with respect to v 1 price these two pricing equations 1/ v = 70 - v /2 = 0 p 1 1 2 v 1 = 70 - v 2/2 v 2 We can do exactly the same for v 2 = 70 - v 1/2 v 1 = 70 - (70 - v 1/2)/2 = 35 + v 1/4 so 3 v 1/4 = 35 so v 1 = $46. 67 140 R 1 70 46. 67 R 2 and v 2 = $46. 67 70 Chapter 17: Vertical and Conglomerate Mergers 140 v 1 7

Complementaryby producers 2 The price charged each supplier is a p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Solve this for v function of the other We need to solve 1 supplier’s Maximize this with respect to v 1 price these two pricing equations 1/ v = 70 - v /2 = 0 p 1 1 2 v 1 = 70 - v 2/2 v 2 We can do exactly the same for v 2 = 70 - v 1/2 v 1 = 70 - (70 - v 1/2)/2 = 35 + v 1/4 so 3 v 1/4 = 35 so v 1 = $46. 67 140 R 1 70 46. 67 R 2 and v 2 = $46. 67 70 Chapter 17: Vertical and Conglomerate Mergers 140 v 1 7

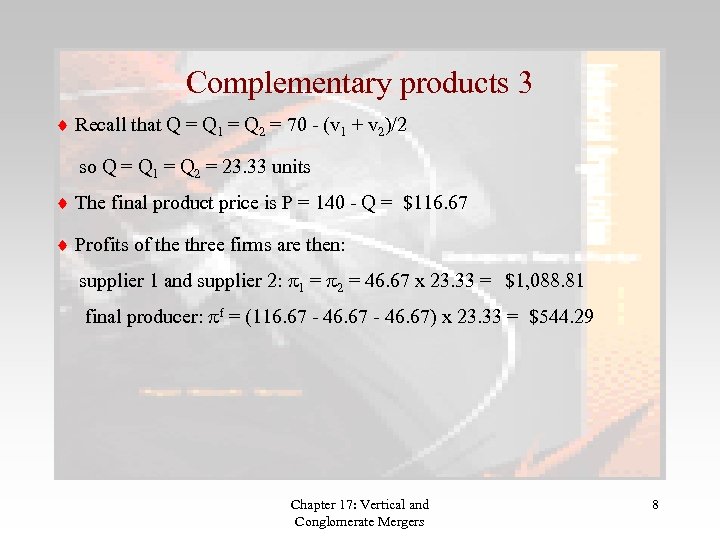

Complementary products 3 Recall that Q = Q 1 = Q 2 = 70 - (v 1 + v 2)/2 so Q = Q 1 = Q 2 = 23. 33 units The final product price is P = 140 - Q = $116. 67 Profits of the three firms are then: supplier 1 and supplier 2: p 1 = p 2 = 46. 67 x 23. 33 = $1, 088. 81 final producer: pf = (116. 67 - 46. 67) x 23. 33 = $544. 29 Chapter 17: Vertical and Conglomerate Mergers 8

Complementary products 3 Recall that Q = Q 1 = Q 2 = 70 - (v 1 + v 2)/2 so Q = Q 1 = Q 2 = 23. 33 units The final product price is P = 140 - Q = $116. 67 Profits of the three firms are then: supplier 1 and supplier 2: p 1 = p 2 = 46. 67 x 23. 33 = $1, 088. 81 final producer: pf = (116. 67 - 46. 67) x 23. 33 = $544. 29 Chapter 17: Vertical and Conglomerate Mergers 8

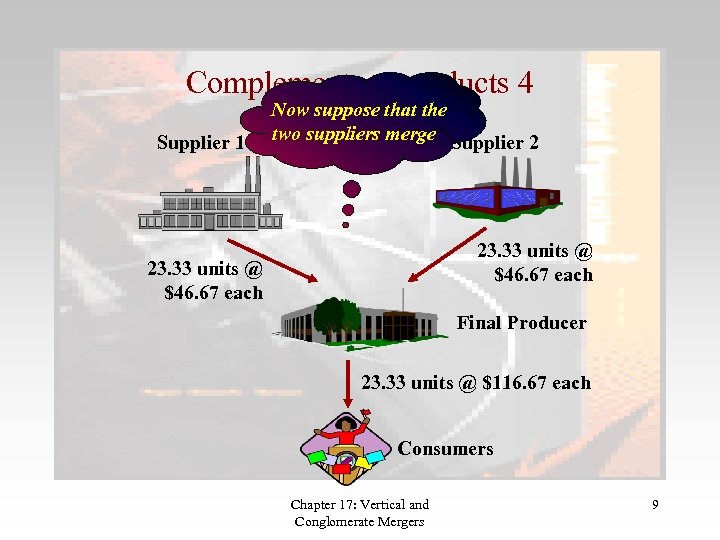

Complementary products 4 Supplier 1 Now suppose that the two suppliers merge Supplier 2 23. 33 units @ $46. 67 each Final Producer 23. 33 units @ $116. 67 each Consumers Chapter 17: Vertical and Conglomerate Mergers 9

Complementary products 4 Supplier 1 Now suppose that the two suppliers merge Supplier 2 23. 33 units @ $46. 67 each Final Producer 23. 33 units @ $116. 67 each Consumers Chapter 17: Vertical and Conglomerate Mergers 9

Complementary mergers 5 Supplier 1 Supplier 2 price v The merger allows the two firms to coordinate their prices Final Producer price P Consumers Chapter 17: Vertical and Conglomerate Mergers 10

Complementary mergers 5 Supplier 1 Supplier 2 price v The merger allows the two firms to coordinate their prices Final Producer price P Consumers Chapter 17: Vertical and Conglomerate Mergers 10

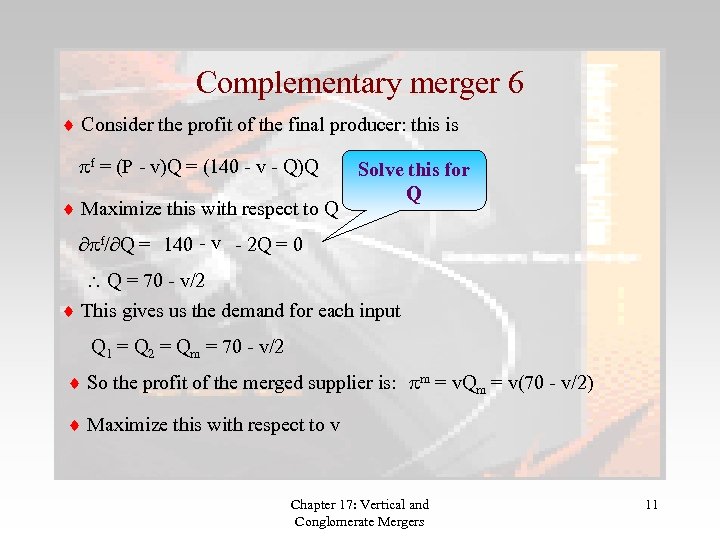

Complementary merger 6 Consider the profit of the final producer: this is pf = (P - v)Q = (140 - v - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - v - 2 Q = 0 Q = 70 - v/2 This gives us the demand for each input Q 1 = Q 2 = Qm = 70 - v/2 So the profit of the merged supplier is: pm = v. Qm = v(70 - v/2) Maximize this with respect to v Chapter 17: Vertical and Conglomerate Mergers 11

Complementary merger 6 Consider the profit of the final producer: this is pf = (P - v)Q = (140 - v - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - v - 2 Q = 0 Q = 70 - v/2 This gives us the demand for each input Q 1 = Q 2 = Qm = 70 - v/2 So the profit of the merged supplier is: pm = v. Qm = v(70 - v/2) Maximize this with respect to v Chapter 17: Vertical and Conglomerate Mergers 11

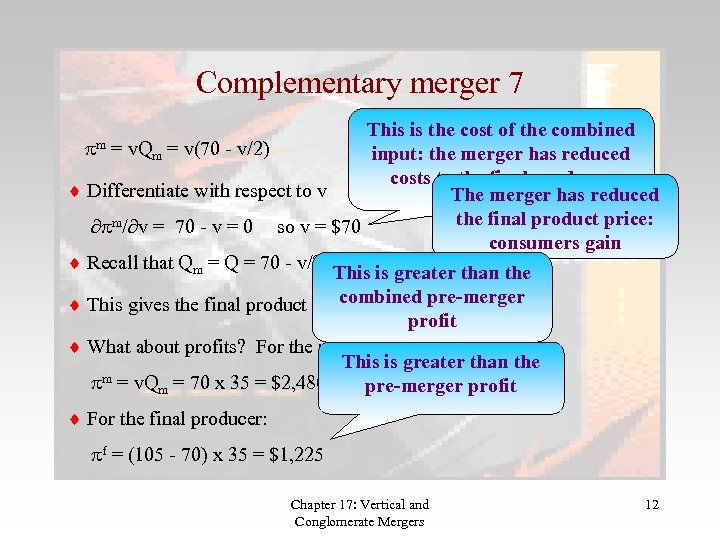

Complementary merger 7 This is the cost of the combined pm = v. Qm = v(70 - v/2) input: the merger has reduced costs to the final producer Differentiate with respect to v The merger has reduced the final product price: pm/ v = 70 - v = 0 so v = $70 consumers gain Recall that Qm = Q = 70 - v/2 so Qm = Q = 35 units This is greater than the combined Q = $105 This gives the final product price P = 140 -pre-merger profit What about profits? For the merged upstream firm: This is greater than the m = v. Q = 70 x 35 = $2, 480 p pre-merger profit m For the final producer: pf = (105 - 70) x 35 = $1, 225 Chapter 17: Vertical and Conglomerate Mergers 12

Complementary merger 7 This is the cost of the combined pm = v. Qm = v(70 - v/2) input: the merger has reduced costs to the final producer Differentiate with respect to v The merger has reduced the final product price: pm/ v = 70 - v = 0 so v = $70 consumers gain Recall that Qm = Q = 70 - v/2 so Qm = Q = 35 units This is greater than the combined Q = $105 This gives the final product price P = 140 -pre-merger profit What about profits? For the merged upstream firm: This is greater than the m = v. Q = 70 x 35 = $2, 480 p pre-merger profit m For the final producer: pf = (105 - 70) x 35 = $1, 225 Chapter 17: Vertical and Conglomerate Mergers 12

Complementary mergers 8 • A merger of complementary producers has – increased profits of the merged firms – increased profit of the final producer – reduced the price charged to consumers Everybody gains from this merger: a Pareto improvement! Why? • This merger corrects a market failure – prior to the merger the upstream suppliers do not take full account of their interdependence – reduction in price by one of them reduces downstream costs, increases downstream output and benefits the other upstream firm – but this is an externality and so is ignored • Merger internalizes the externality Chapter 17: Vertical and Conglomerate Mergers 13

Complementary mergers 8 • A merger of complementary producers has – increased profits of the merged firms – increased profit of the final producer – reduced the price charged to consumers Everybody gains from this merger: a Pareto improvement! Why? • This merger corrects a market failure – prior to the merger the upstream suppliers do not take full account of their interdependence – reduction in price by one of them reduces downstream costs, increases downstream output and benefits the other upstream firm – but this is an externality and so is ignored • Merger internalizes the externality Chapter 17: Vertical and Conglomerate Mergers 13

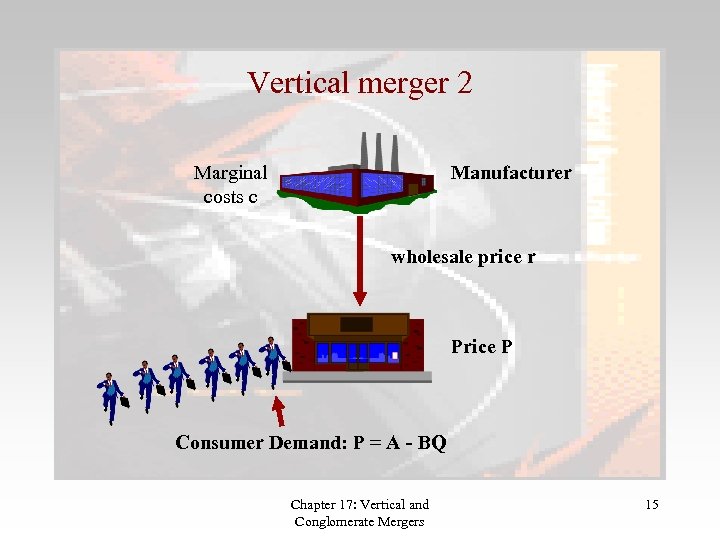

Vertical Mergers • The same result arises when we consider vertical mergers: mergers of upstream and downstream firms • If the merging firms have market power – lack of co-ordination in their independent decisions – double marginalization – merger can lead to a general improvement • Illustrate with a simple model – one upstream and one downstream monopolist • manufacturer and retailer – – upstream firm has marginal costs c sells product to the retailer at price r per unit retailer has no other costs: one unit of input gives one unit of output retail demand is P = A – BQ Chapter 17: Vertical and Conglomerate Mergers 14

Vertical Mergers • The same result arises when we consider vertical mergers: mergers of upstream and downstream firms • If the merging firms have market power – lack of co-ordination in their independent decisions – double marginalization – merger can lead to a general improvement • Illustrate with a simple model – one upstream and one downstream monopolist • manufacturer and retailer – – upstream firm has marginal costs c sells product to the retailer at price r per unit retailer has no other costs: one unit of input gives one unit of output retail demand is P = A – BQ Chapter 17: Vertical and Conglomerate Mergers 14

Vertical merger 2 Marginal costs c Manufacturer wholesale price r Price P Consumer Demand: P = A - BQ Chapter 17: Vertical and Conglomerate Mergers 15

Vertical merger 2 Marginal costs c Manufacturer wholesale price r Price P Consumer Demand: P = A - BQ Chapter 17: Vertical and Conglomerate Mergers 15

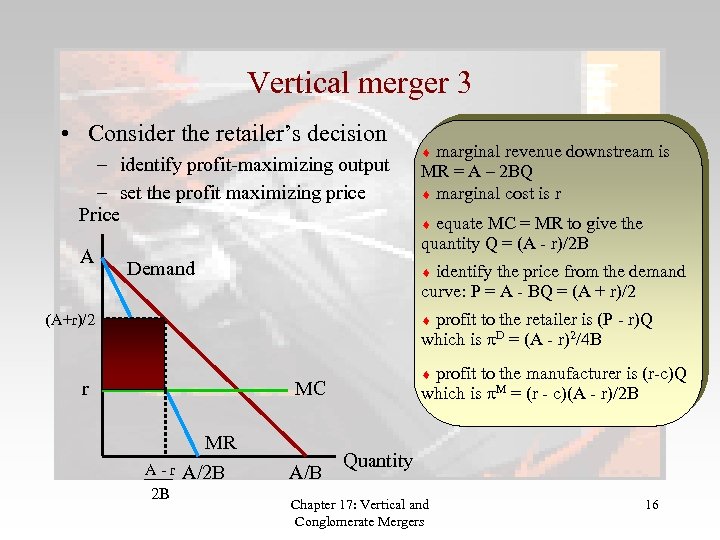

Vertical merger 3 • Consider the retailer’s decision – identify profit-maximizing output – set the profit maximizing price Price A Demand marginal revenue downstream is MR = A – 2 BQ marginal cost is r equate MC = MR to give the quantity Q = (A - r)/2 B identify the price from the demand curve: P = A - BQ = (A + r)/2 profit to the retailer is (P - r)Q which is p. D = (A - r)2/4 B (A+r)/2 r profit to the manufacturer is (r-c)Q which is p. M = (r - c)(A - r)/2 B MC A-r 2 B MR A/2 B A/B Quantity Chapter 17: Vertical and Conglomerate Mergers 16

Vertical merger 3 • Consider the retailer’s decision – identify profit-maximizing output – set the profit maximizing price Price A Demand marginal revenue downstream is MR = A – 2 BQ marginal cost is r equate MC = MR to give the quantity Q = (A - r)/2 B identify the price from the demand curve: P = A - BQ = (A + r)/2 profit to the retailer is (P - r)Q which is p. D = (A - r)2/4 B (A+r)/2 r profit to the manufacturer is (r-c)Q which is p. M = (r - c)(A - r)/2 B MC A-r 2 B MR A/2 B A/B Quantity Chapter 17: Vertical and Conglomerate Mergers 16

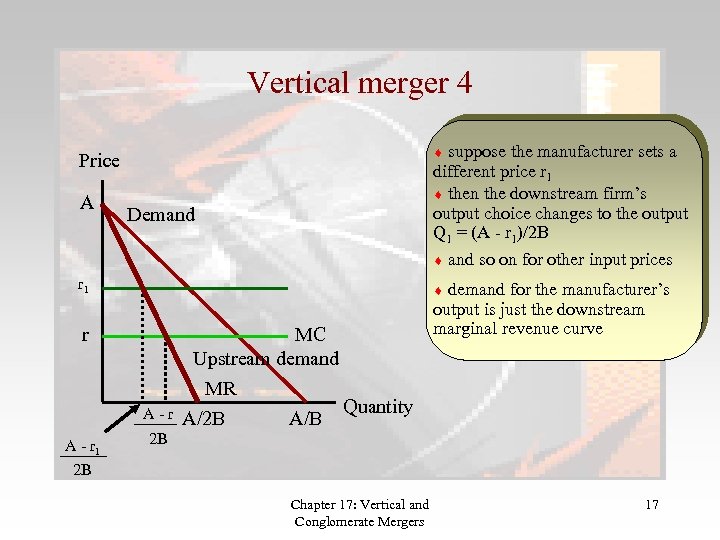

Vertical merger 4 suppose the manufacturer sets a different price r 1 then the downstream firm’s output choice changes to the output Q 1 = (A - r 1)/2 B Price A Demand r 1 demand r A-r A - r 1 2 B so on for other input prices MC Upstream demand MR Quantity A/2 B A/B for the manufacturer’s output is just the downstream marginal revenue curve 2 B Chapter 17: Vertical and Conglomerate Mergers 17

Vertical merger 4 suppose the manufacturer sets a different price r 1 then the downstream firm’s output choice changes to the output Q 1 = (A - r 1)/2 B Price A Demand r 1 demand r A-r A - r 1 2 B so on for other input prices MC Upstream demand MR Quantity A/2 B A/B for the manufacturer’s output is just the downstream marginal revenue curve 2 B Chapter 17: Vertical and Conglomerate Mergers 17

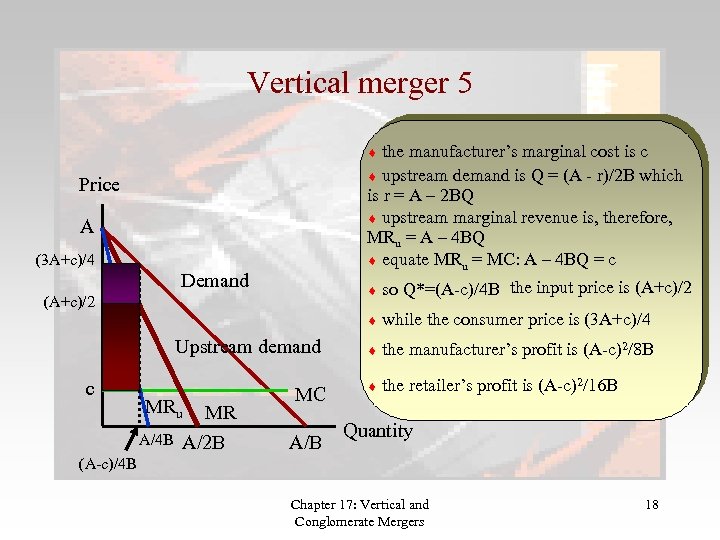

Vertical merger 5 the manufacturer’s marginal cost is c upstream demand is Q = (A - r)/2 B which is r = A – 2 BQ upstream marginal revenue is, therefore, MRu = A – 4 BQ equate MRu = MC: A – 4 BQ = c Price A (3 A+c)/4 Demand so (A+c)/2 while Upstream demand c Q*=(A-c)/4 B the input price is (A+c)/2 MRu A/4 B MR A/2 B MC A/B the consumer price is (3 A+c)/4 the manufacturer’s profit is (A-c)2/8 B the retailer’s profit is (A-c)2/16 B Quantity (A-c)/4 B Chapter 17: Vertical and Conglomerate Mergers 18

Vertical merger 5 the manufacturer’s marginal cost is c upstream demand is Q = (A - r)/2 B which is r = A – 2 BQ upstream marginal revenue is, therefore, MRu = A – 4 BQ equate MRu = MC: A – 4 BQ = c Price A (3 A+c)/4 Demand so (A+c)/2 while Upstream demand c Q*=(A-c)/4 B the input price is (A+c)/2 MRu A/4 B MR A/2 B MC A/B the consumer price is (3 A+c)/4 the manufacturer’s profit is (A-c)2/8 B the retailer’s profit is (A-c)2/16 B Quantity (A-c)/4 B Chapter 17: Vertical and Conglomerate Mergers 18

Vertical merger 6 • Now suppose that the retailer and manufacturer merge – – manufacturer takes over the retail outlet retailer is now a downstream division of an integrated firm the integrated firm aims to maximize total profit Suppose the upstream division sets an internal (transfer) price of r for its product – Suppose that consumer demand is P = P(Q) The internal transfer – Total profit is: price nets out of the • upstream division: (r - c)Q • downstream division: (P(Q) - r)Q • aggregate profit: (P(Q) - c)Q profit calculations • Back to the example Chapter 17: Vertical and Conglomerate Mergers 19

Vertical merger 6 • Now suppose that the retailer and manufacturer merge – – manufacturer takes over the retail outlet retailer is now a downstream division of an integrated firm the integrated firm aims to maximize total profit Suppose the upstream division sets an internal (transfer) price of r for its product – Suppose that consumer demand is P = P(Q) The internal transfer – Total profit is: price nets out of the • upstream division: (r - c)Q • downstream division: (P(Q) - r)Q • aggregate profit: (P(Q) - c)Q profit calculations • Back to the example Chapter 17: Vertical and Conglomerate Mergers 19

Vertical merger 7 This merger has the benefited the two merger has integrated demand is P(Q) = A - BQ This marginal revenue is MR = A – 2 BQ firmsbenefited consumers Price marginal cost is c so the profit-maximizing output requires that A – 2 BQ = c so Q* = (A – c)/2 B so the retail price is P = (A + c)/2 A Demand (A+c)/2 aggregate (A – c)2/4 B c MR (A-c)/4 B profit of the integrated firm is MC A/B Quantity Chapter 17: Vertical and Conglomerate Mergers 20

Vertical merger 7 This merger has the benefited the two merger has integrated demand is P(Q) = A - BQ This marginal revenue is MR = A – 2 BQ firmsbenefited consumers Price marginal cost is c so the profit-maximizing output requires that A – 2 BQ = c so Q* = (A – c)/2 B so the retail price is P = (A + c)/2 A Demand (A+c)/2 aggregate (A – c)2/4 B c MR (A-c)/4 B profit of the integrated firm is MC A/B Quantity Chapter 17: Vertical and Conglomerate Mergers 20

Vertical merger 8 • Integration increases profits and consumer surplus • Why? – the firms have some degree of market power – so they price above marginal cost – so integration corrects a market failure: double marginalization • What if manufacture were competitive? – retailer plays off manufacturers against each other – so obtains input at marginal cost – gets the integrated profit without integration • Why worry about vertical integration? – two possible reasons • price discrimination • vertical foreclosure Chapter 17: Vertical and Conglomerate Mergers 21

Vertical merger 8 • Integration increases profits and consumer surplus • Why? – the firms have some degree of market power – so they price above marginal cost – so integration corrects a market failure: double marginalization • What if manufacture were competitive? – retailer plays off manufacturers against each other – so obtains input at marginal cost – gets the integrated profit without integration • Why worry about vertical integration? – two possible reasons • price discrimination • vertical foreclosure Chapter 17: Vertical and Conglomerate Mergers 21

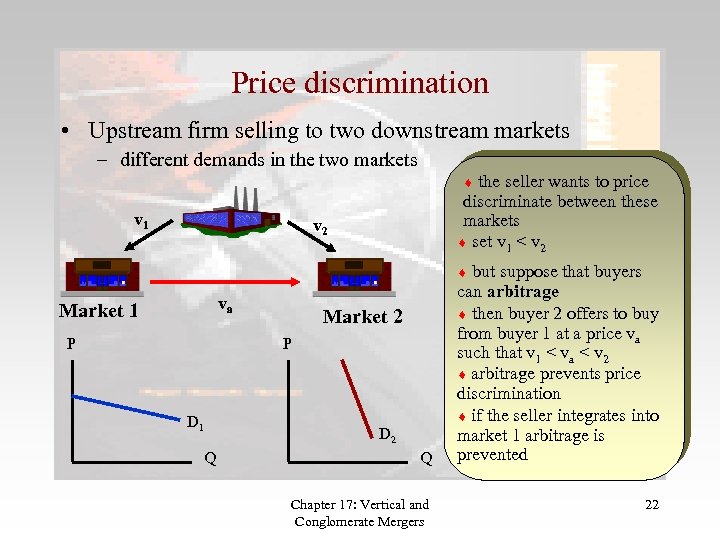

Price discrimination • Upstream firm selling to two downstream markets – different demands in the two markets v 1 the seller wants to price discriminate between these markets set v 1 < v 2 but va Market 1 P Market 2 P D 1 D 2 Q Q Chapter 17: Vertical and Conglomerate Mergers suppose that buyers can arbitrage then buyer 2 offers to buy from buyer 1 at a price va such that v 1 < va < v 2 arbitrage prevents price discrimination if the seller integrates into market 1 arbitrage is prevented 22

Price discrimination • Upstream firm selling to two downstream markets – different demands in the two markets v 1 the seller wants to price discriminate between these markets set v 1 < v 2 but va Market 1 P Market 2 P D 1 D 2 Q Q Chapter 17: Vertical and Conglomerate Mergers suppose that buyers can arbitrage then buyer 2 offers to buy from buyer 1 at a price va such that v 1 < va < v 2 arbitrage prevents price discrimination if the seller integrates into market 1 arbitrage is prevented 22

Vertical foreclosure • Vertically integrated firm refuses to supply other firms – so integration can eliminate competitors suppose that the seller is supplying three firms with an essential input the seller integrates with one buyer if the seller refuses to supply the other buyers they are driven out of business is this a sensible thing to do? Chapter 17: Vertical and Conglomerate Mergers 23

Vertical foreclosure • Vertically integrated firm refuses to supply other firms – so integration can eliminate competitors suppose that the seller is supplying three firms with an essential input the seller integrates with one buyer if the seller refuses to supply the other buyers they are driven out of business is this a sensible thing to do? Chapter 17: Vertical and Conglomerate Mergers 23

Vertical foreclosure 2 • Vertical foreclosure may reduce competition – offsets benefits of removing double marginalization • But for this to work – foreclosure has to be a credible strategy for the merged firms – foreclosure must be subgame perfect • Consider two models of foreclosure – Salinger (1988) with Cournot competition – Ordover, Saloner and Salop (1990) with price competition Chapter 17: Vertical and Conglomerate Mergers 24

Vertical foreclosure 2 • Vertical foreclosure may reduce competition – offsets benefits of removing double marginalization • But for this to work – foreclosure has to be a credible strategy for the merged firms – foreclosure must be subgame perfect • Consider two models of foreclosure – Salinger (1988) with Cournot competition – Ordover, Saloner and Salop (1990) with price competition Chapter 17: Vertical and Conglomerate Mergers 24

Vertical foreclosure 3 The integrated firm will Suppose that there are some integrated firms and some independent upstream and downstream producersnot source on the independent market Profit of an integrated firm is: The integrated firm will p. I = (PD - c. U - c. D)q. Di not sell on the independent market Profit of an independent upstream firm is: p. U = (PU - c. U)q. Un Profit of an independent downstream firm is: p. D = (PD - PU - c. D)q. Dn Chapter 17: Vertical and Conglomerate Mergers 25

Vertical foreclosure 3 The integrated firm will Suppose that there are some integrated firms and some independent upstream and downstream producersnot source on the independent market Profit of an integrated firm is: The integrated firm will p. I = (PD - c. U - c. D)q. Di not sell on the independent market Profit of an independent upstream firm is: p. U = (PU - c. U)q. Un Profit of an independent downstream firm is: p. D = (PD - PU - c. D)q. Dn Chapter 17: Vertical and Conglomerate Mergers 25

Vertical foreclosure 4 For the independent upstream firms to survive requires PU - c. U > 0 The downstream unit of an integrated firm obtains input at cost c. U Buying from an independent firm costs PU > c. U so the downstream divisions will not source externally Now suppose that an upstream division of an integrated firm is selling to independent downstream firms it earns PU -But on eachtrue: sold c. U this is unit so Profit from Profit downstream division: this leaves the downstream diverting output from Divert one unit to its from the external market price unchanged: itselling. PD -selling on this unit diverted earns c. U - c. D internallyexternally increases profits PD - PU - c. D > 0 for independent downstream firms to survive PD - c. U - c. D > PU - c. U requires: PD - PU - c. D > 0 so the upstream divisions will not sell externally Chapter 17: Vertical and Conglomerate Mergers 26

Vertical foreclosure 4 For the independent upstream firms to survive requires PU - c. U > 0 The downstream unit of an integrated firm obtains input at cost c. U Buying from an independent firm costs PU > c. U so the downstream divisions will not source externally Now suppose that an upstream division of an integrated firm is selling to independent downstream firms it earns PU -But on eachtrue: sold c. U this is unit so Profit from Profit downstream division: this leaves the downstream diverting output from Divert one unit to its from the external market price unchanged: itselling. PD -selling on this unit diverted earns c. U - c. D internallyexternally increases profits PD - PU - c. D > 0 for independent downstream firms to survive PD - c. U - c. D > PU - c. U requires: PD - PU - c. D > 0 so the upstream divisions will not sell externally Chapter 17: Vertical and Conglomerate Mergers 26

Vertical foreclosure 5 • Foreclosure happens – but is not necessarily harmful to consumers • reduces number of buyers in the upstream market • increases prices charged by independent sellers to non-integrated downstream firms • but integrated downstream divisions obtain inputs at cost • puts pressure on non-integrated downstream firms – provided there are “enough” independent upstream firms the anticompetitive effects of foreclosure will be offset by the cost advantages of vertical integration • There also strategic effects that might prevent foreclosure – to avoid non-integrated firms from integrating Chapter 17: Vertical and Conglomerate Mergers 27

Vertical foreclosure 5 • Foreclosure happens – but is not necessarily harmful to consumers • reduces number of buyers in the upstream market • increases prices charged by independent sellers to non-integrated downstream firms • but integrated downstream divisions obtain inputs at cost • puts pressure on non-integrated downstream firms – provided there are “enough” independent upstream firms the anticompetitive effects of foreclosure will be offset by the cost advantages of vertical integration • There also strategic effects that might prevent foreclosure – to avoid non-integrated firms from integrating Chapter 17: Vertical and Conglomerate Mergers 27

Vertical foreclosure 6 • The strategic aspects are considered in Ordover, Saloner and Salop (OSS) – suppose that there are two downstream and two upstream firms • downstream firms make differentiated products • upstream firms make homogeneous products – both sets of firms compete in prices – suppose that U 1 merges with D 1 • • suppose also that they credibly refuse to supply D 2 then U 2 is a monopoly supplier to D 2 U 2 and D 2 set prices reflecting double marginalization so they may well choose to merge also – but U 1 and D 1 can foresee this and so may choose not to merge Chapter 17: Vertical and Conglomerate Mergers 28

Vertical foreclosure 6 • The strategic aspects are considered in Ordover, Saloner and Salop (OSS) – suppose that there are two downstream and two upstream firms • downstream firms make differentiated products • upstream firms make homogeneous products – both sets of firms compete in prices – suppose that U 1 merges with D 1 • • suppose also that they credibly refuse to supply D 2 then U 2 is a monopoly supplier to D 2 U 2 and D 2 set prices reflecting double marginalization so they may well choose to merge also – but U 1 and D 1 can foresee this and so may choose not to merge Chapter 17: Vertical and Conglomerate Mergers 28

Vertical foreclosure 7 • The OSS analysis thus far requires that there is no other source of the input supply – if there is such a source this will constrain U 2’s price • may make merger of U 2 and D 2 less likely • Also, U 1 D 1 may try to undermine the merger another way – offer to supply D 2 undercutting U 2 – find a price such that U 2 and D 2 have no incentive to merge – so complete foreclosure is avoided • Note that there is a timing problem with this analysis – U 1 and D 1 decide whether or not to merge • if they do not the market continues as is • if they do they seek to undermine a merger of U 2 and D 2 – but if U 1 and D 1 don’t merge U 2 and D 2 have a strong incentive to merge Chapter 17: Vertical and Conglomerate Mergers 29

Vertical foreclosure 7 • The OSS analysis thus far requires that there is no other source of the input supply – if there is such a source this will constrain U 2’s price • may make merger of U 2 and D 2 less likely • Also, U 1 D 1 may try to undermine the merger another way – offer to supply D 2 undercutting U 2 – find a price such that U 2 and D 2 have no incentive to merge – so complete foreclosure is avoided • Note that there is a timing problem with this analysis – U 1 and D 1 decide whether or not to merge • if they do not the market continues as is • if they do they seek to undermine a merger of U 2 and D 2 – but if U 1 and D 1 don’t merge U 2 and D 2 have a strong incentive to merge Chapter 17: Vertical and Conglomerate Mergers 29

Vertical Merger and Oligopoly • The implication is that we should consider a simultaneous model – fear of vertical merger by one pair of firms might induce vertical merger by other firms – this might lead to a prisoners’ dilemma game • vertical merger harms firms • benefits consumers • and is a Nash equilibrium for the merging firms • Consider a (reasonably) simple model – two upstream and two downstream Cournot firms – downstream demand is P = A – BQ – upstream firms’ marginal costs are c. U and downstream firms’ marginal costs (excluding the upstream input) are c. D Chapter 17: Vertical and Conglomerate Mergers 30

Vertical Merger and Oligopoly • The implication is that we should consider a simultaneous model – fear of vertical merger by one pair of firms might induce vertical merger by other firms – this might lead to a prisoners’ dilemma game • vertical merger harms firms • benefits consumers • and is a Nash equilibrium for the merging firms • Consider a (reasonably) simple model – two upstream and two downstream Cournot firms – downstream demand is P = A – BQ – upstream firms’ marginal costs are c. U and downstream firms’ marginal costs (excluding the upstream input) are c. D Chapter 17: Vertical and Conglomerate Mergers 30

Vertical merger and oligopoly 2 • Competition in three stages – stage 1: • upstream and downstream firms choose simultaneously whether or not to merge – U 1 merges with D 1 and/or U 2 with D 2 – stage 2: • non-merged upstream firms compete in quantities • merged upstream firms supply their downstream divisions at marginal cost c. U – stage 3: • downstream firms compete in quantities • Three cases: – no vertical merger; one vertical merger; two vertical mergers Chapter 17: Vertical and Conglomerate Mergers 31

Vertical merger and oligopoly 2 • Competition in three stages – stage 1: • upstream and downstream firms choose simultaneously whether or not to merge – U 1 merges with D 1 and/or U 2 with D 2 – stage 2: • non-merged upstream firms compete in quantities • merged upstream firms supply their downstream divisions at marginal cost c. U – stage 3: • downstream firms compete in quantities • Three cases: – no vertical merger; one vertical merger; two vertical mergers Chapter 17: Vertical and Conglomerate Mergers 31

Vertical merger and oligopoly 3 • Case 1: no vertical merger – competition in the upstream market generates an intermediate product price PU – so downstream marginal cost is PU + c. D – Cournot equilibrium output of each downstream firm is • q 1 D = q 2 D = (A – PU – c. D)/3 B – Cournot equilibrium profit of each downstream firm is • p 1 D = p 2 D = (A – PU – c. D)2/9 B Chapter 17: Vertical and Conglomerate Mergers 32

Vertical merger and oligopoly 3 • Case 1: no vertical merger – competition in the upstream market generates an intermediate product price PU – so downstream marginal cost is PU + c. D – Cournot equilibrium output of each downstream firm is • q 1 D = q 2 D = (A – PU – c. D)/3 B – Cournot equilibrium profit of each downstream firm is • p 1 D = p 2 D = (A – PU – c. D)2/9 B Chapter 17: Vertical and Conglomerate Mergers 32

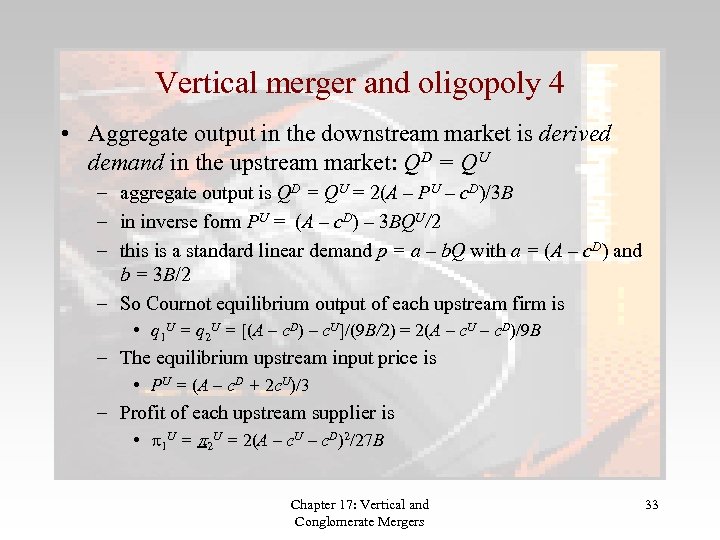

Vertical merger and oligopoly 4 • Aggregate output in the downstream market is derived demand in the upstream market: QD = QU – aggregate output is QD = QU = 2(A – PU – c. D)/3 B – in inverse form PU = (A – c. D) – 3 BQU/2 – this is a standard linear demand p = a – b. Q with a = (A – c. D) and b = 3 B/2 – So Cournot equilibrium output of each upstream firm is • q 1 U = q 2 U = [(A – c. D) – c. U]/(9 B/2) = 2(A – c. U – c. D)/9 B – The equilibrium upstream input price is • PU = (A – c. D + 2 c. U)/3 – Profit of each upstream supplier is • p 1 U = p 2 U = 2(A – c. U – c. D)2/27 B Chapter 17: Vertical and Conglomerate Mergers 33

Vertical merger and oligopoly 4 • Aggregate output in the downstream market is derived demand in the upstream market: QD = QU – aggregate output is QD = QU = 2(A – PU – c. D)/3 B – in inverse form PU = (A – c. D) – 3 BQU/2 – this is a standard linear demand p = a – b. Q with a = (A – c. D) and b = 3 B/2 – So Cournot equilibrium output of each upstream firm is • q 1 U = q 2 U = [(A – c. D) – c. U]/(9 B/2) = 2(A – c. U – c. D)/9 B – The equilibrium upstream input price is • PU = (A – c. D + 2 c. U)/3 – Profit of each upstream supplier is • p 1 U = p 2 U = 2(A – c. U – c. D)2/27 B Chapter 17: Vertical and Conglomerate Mergers 33

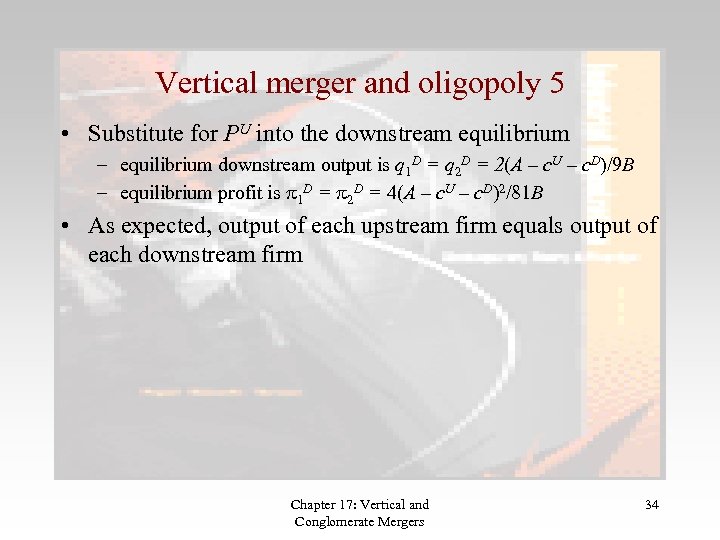

Vertical merger and oligopoly 5 • Substitute for PU into the downstream equilibrium – equilibrium downstream output is q 1 D = q 2 D = 2(A – c. U – c. D)/9 B – equilibrium profit is p 1 D = p 2 D = 4(A – c. U – c. D)2/81 B • As expected, output of each upstream firm equals output of each downstream firm Chapter 17: Vertical and Conglomerate Mergers 34

Vertical merger and oligopoly 5 • Substitute for PU into the downstream equilibrium – equilibrium downstream output is q 1 D = q 2 D = 2(A – c. U – c. D)/9 B – equilibrium profit is p 1 D = p 2 D = 4(A – c. U – c. D)2/81 B • As expected, output of each upstream firm equals output of each downstream firm Chapter 17: Vertical and Conglomerate Mergers 34

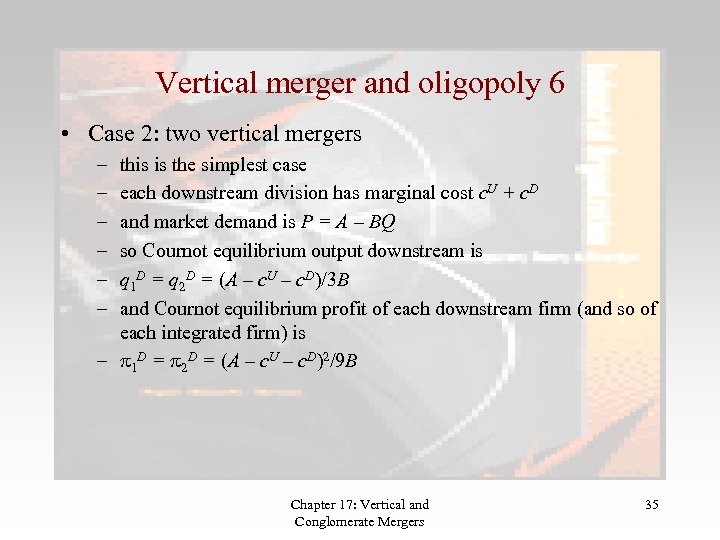

Vertical merger and oligopoly 6 • Case 2: two vertical mergers – – – this is the simplest case each downstream division has marginal cost c. U + c. D and market demand is P = A – BQ so Cournot equilibrium output downstream is q 1 D = q 2 D = (A – c. U – c. D)/3 B and Cournot equilibrium profit of each downstream firm (and so of each integrated firm) is – p 1 D = p 2 D = (A – c. U – c. D)2/9 B Chapter 17: Vertical and Conglomerate Mergers 35

Vertical merger and oligopoly 6 • Case 2: two vertical mergers – – – this is the simplest case each downstream division has marginal cost c. U + c. D and market demand is P = A – BQ so Cournot equilibrium output downstream is q 1 D = q 2 D = (A – c. U – c. D)/3 B and Cournot equilibrium profit of each downstream firm (and so of each integrated firm) is – p 1 D = p 2 D = (A – c. U – c. D)2/9 B Chapter 17: Vertical and Conglomerate Mergers 35

Vertical merger and oligopoly 7 • Case 3: One vertical merger – suppose that U 1 and D 1 merge – from the Salinger analysis the merged firm • will not supply the non-merged downstream firm • will not buy from the non-merged upstream firm – suppose that U 2 sets price PU for its intermediate product • • • downstream firm 2 has marginal cost PU + c. D downstream firm 1 has marginal cost c. U + c. D downstream demand is P = A – BQ so equilibrium Cournot outputs are q 1 D = (A – 2 c. U – c. D + PU)/3 B q 2 D = (A – 2 PU – c. D + c. U)/3 B Chapter 17: Vertical and Conglomerate Mergers 36

Vertical merger and oligopoly 7 • Case 3: One vertical merger – suppose that U 1 and D 1 merge – from the Salinger analysis the merged firm • will not supply the non-merged downstream firm • will not buy from the non-merged upstream firm – suppose that U 2 sets price PU for its intermediate product • • • downstream firm 2 has marginal cost PU + c. D downstream firm 1 has marginal cost c. U + c. D downstream demand is P = A – BQ so equilibrium Cournot outputs are q 1 D = (A – 2 c. U – c. D + PU)/3 B q 2 D = (A – 2 PU – c. D + c. U)/3 B Chapter 17: Vertical and Conglomerate Mergers 36

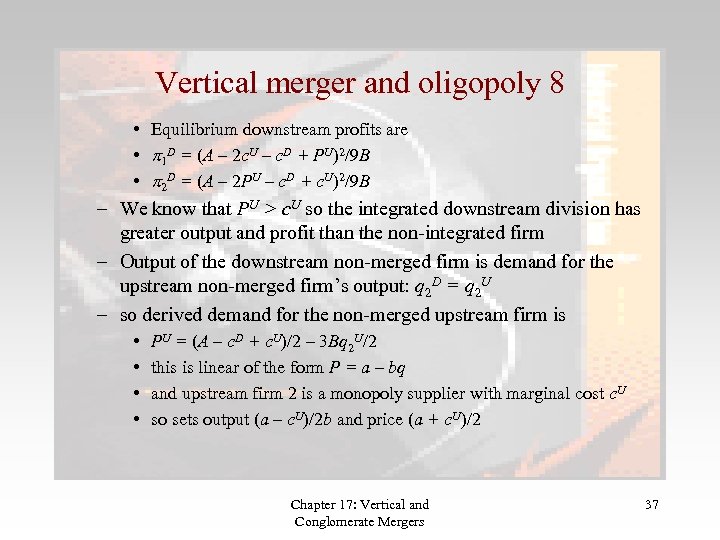

Vertical merger and oligopoly 8 • Equilibrium downstream profits are • p 1 D = (A – 2 c. U – c. D + PU)2/9 B • p 2 D = (A – 2 PU – c. D + c. U)2/9 B – We know that PU > c. U so the integrated downstream division has greater output and profit than the non-integrated firm – Output of the downstream non-merged firm is demand for the upstream non-merged firm’s output: q 2 D = q 2 U – so derived demand for the non-merged upstream firm is • • PU = (A – c. D + c. U)/2 – 3 Bq 2 U/2 this is linear of the form P = a – bq and upstream firm 2 is a monopoly supplier with marginal cost c. U so sets output (a – c. U)/2 b and price (a + c. U)/2 Chapter 17: Vertical and Conglomerate Mergers 37

Vertical merger and oligopoly 8 • Equilibrium downstream profits are • p 1 D = (A – 2 c. U – c. D + PU)2/9 B • p 2 D = (A – 2 PU – c. D + c. U)2/9 B – We know that PU > c. U so the integrated downstream division has greater output and profit than the non-integrated firm – Output of the downstream non-merged firm is demand for the upstream non-merged firm’s output: q 2 D = q 2 U – so derived demand for the non-merged upstream firm is • • PU = (A – c. D + c. U)/2 – 3 Bq 2 U/2 this is linear of the form P = a – bq and upstream firm 2 is a monopoly supplier with marginal cost c. U so sets output (a – c. U)/2 b and price (a + c. U)/2 Chapter 17: Vertical and Conglomerate Mergers 37

Vertical merger and oligopoly 9 – this gives the equilibrium upstream non-merged output: • q 2 U = (A – c. U – c. D)/6 B – and price • PU = (A + 3 c. U – c. D)/4 – profit of the non-merged upstream firm is • p 2 D = (A – c. U – c. D)2/24 B – using the equilibrium non-merged input price PU we then have • q 1 D = 5(A – c. U – c. D)/12 B • q 2 D = (A – c. U – c. D)/6 B – equilibrium downstream profits are • p 1 D = 25(A – c. U – c. D )2/144 B • p 2 D = (A – c. U – c. D )2/36 B – The merged division is larger and more profitable than the nonmerged firm Chapter 17: Vertical and Conglomerate Mergers 38

Vertical merger and oligopoly 9 – this gives the equilibrium upstream non-merged output: • q 2 U = (A – c. U – c. D)/6 B – and price • PU = (A + 3 c. U – c. D)/4 – profit of the non-merged upstream firm is • p 2 D = (A – c. U – c. D)2/24 B – using the equilibrium non-merged input price PU we then have • q 1 D = 5(A – c. U – c. D)/12 B • q 2 D = (A – c. U – c. D)/6 B – equilibrium downstream profits are • p 1 D = 25(A – c. U – c. D )2/144 B • p 2 D = (A – c. U – c. D )2/36 B – The merged division is larger and more profitable than the nonmerged firm Chapter 17: Vertical and Conglomerate Mergers 38

Vertical merger and oligopoly 10 • We can now solve the first stage game – calculate aggregate profits of an upstream and downstream firm or an integrated firm • merger will be suggested if it increases aggregate profit – – note that all profits have the term (A – c. U – c. D)/B in common so we can give this term any value so assume that A = 100, B = 1 and c. U = c. D = 23 this gives the pay-off matrix: Chapter 17: Vertical and Conglomerate Mergers 39

Vertical merger and oligopoly 10 • We can now solve the first stage game – calculate aggregate profits of an upstream and downstream firm or an integrated firm • merger will be suggested if it increases aggregate profit – – note that all profits have the term (A – c. U – c. D)/B in common so we can give this term any value so assume that A = 100, B = 1 and c. U = c. D = 23 this gives the pay-off matrix: Chapter 17: Vertical and Conglomerate Mergers 39

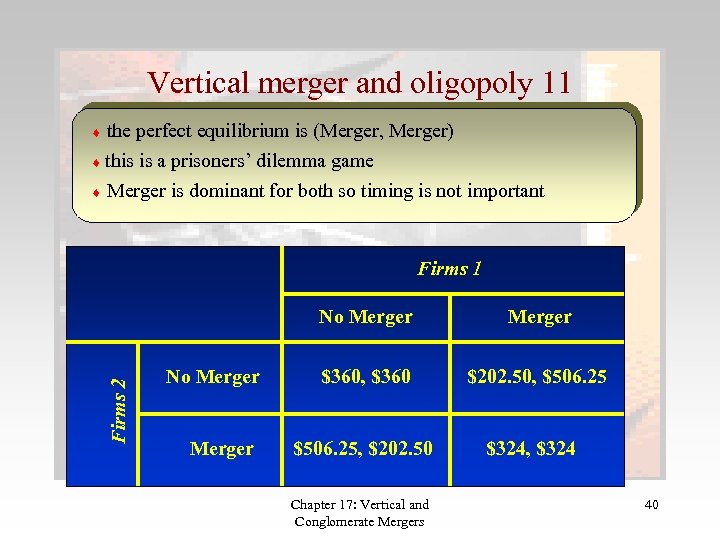

Vertical merger and oligopoly 11 the perfect equilibrium is (Merger, Merger) this is a prisoners’ dilemma game Merger is dominant for both so timing is not important Firms 1 Firms 2 No Merger $360, $360 $202. 50, $506. 25, $202. 50 Chapter 17: Vertical and Conglomerate Mergers $324, $324 40

Vertical merger and oligopoly 11 the perfect equilibrium is (Merger, Merger) this is a prisoners’ dilemma game Merger is dominant for both so timing is not important Firms 1 Firms 2 No Merger $360, $360 $202. 50, $506. 25, $202. 50 Chapter 17: Vertical and Conglomerate Mergers $324, $324 40

Vertical merger - reappraisal • Vertical merger has three effects in this model – removes double marginalization – reduces cost for a downstream integrated firm and makes downstream market more competitive – reduces competitive pressures in the upstream market • In the model the first two effects dominate – so consumers benefit from lower prices even with only one vertical merger – but in equilibrium the firms lose from vertical merger Chapter 17: Vertical and Conglomerate Mergers 41

Vertical merger - reappraisal • Vertical merger has three effects in this model – removes double marginalization – reduces cost for a downstream integrated firm and makes downstream market more competitive – reduces competitive pressures in the upstream market • In the model the first two effects dominate – so consumers benefit from lower prices even with only one vertical merger – but in equilibrium the firms lose from vertical merger Chapter 17: Vertical and Conglomerate Mergers 41

Vertical merger – reappraisal 2 • Recall the proposed GE-Honeywell merger – if this is the only merger then the merged firm gains and the nonmerged firms lose • appears to be this that guided the EU Competition Directorate • but consumers benefit even in this scenario • and rivals have a clear strategic response: merge – so the EU must have believed that merger by rivals was not possible • ever! – and that if the integrated GE-Honeywell gains a monopoly position price will rise • but it is easy to check in the example that price would not rise • So the decision remains questionable Chapter 17: Vertical and Conglomerate Mergers 42

Vertical merger – reappraisal 2 • Recall the proposed GE-Honeywell merger – if this is the only merger then the merged firm gains and the nonmerged firms lose • appears to be this that guided the EU Competition Directorate • but consumers benefit even in this scenario • and rivals have a clear strategic response: merge – so the EU must have believed that merger by rivals was not possible • ever! – and that if the integrated GE-Honeywell gains a monopoly position price will rise • but it is easy to check in the example that price would not rise • So the decision remains questionable Chapter 17: Vertical and Conglomerate Mergers 42

Conglomerate Mergers • Bring under common control firms whose products are neither substitutes nor complements – results in a diversified firm – period from 1960 s to early 1980 s is when many were forms • Is there a convincing rationale for this type of merger? – if not then probably an accident of history – gradually corrected by downsizing and focus on “core competence” • Possible rationales: Chapter 17: Vertical and Conglomerate Mergers 43

Conglomerate Mergers • Bring under common control firms whose products are neither substitutes nor complements – results in a diversified firm – period from 1960 s to early 1980 s is when many were forms • Is there a convincing rationale for this type of merger? – if not then probably an accident of history – gradually corrected by downsizing and focus on “core competence” • Possible rationales: Chapter 17: Vertical and Conglomerate Mergers 43

Conglomerate mergers 2 • Economies of scope – but these generally derive from use of common inputs – so merged firms should be related in some respect • similar markets • similar technologies – data do not support this hypothesis Chapter 17: Vertical and Conglomerate Mergers 44

Conglomerate mergers 2 • Economies of scope – but these generally derive from use of common inputs – so merged firms should be related in some respect • similar markets • similar technologies – data do not support this hypothesis Chapter 17: Vertical and Conglomerate Mergers 44

Conglomerate mergers 3 • Economize on transactions costs – take a specialized machine can produce two goods A and B • markets for A and B are concentrated • if machine is used to produce only A there is spare capacity – then owner may wish also to produce B – conglomeration – the owner could also lease use of the machine to a specialized B producer to avoid conglomeration • but this has problems – negotiating and bargaining over the lease • conglomeration avoids these problems – particularly important when the asset is knowledge intensive – so this motive is reasonable • but the assets are common to all the conglomerates products • not supported by the data Chapter 17: Vertical and Conglomerate Mergers 45

Conglomerate mergers 3 • Economize on transactions costs – take a specialized machine can produce two goods A and B • markets for A and B are concentrated • if machine is used to produce only A there is spare capacity – then owner may wish also to produce B – conglomeration – the owner could also lease use of the machine to a specialized B producer to avoid conglomeration • but this has problems – negotiating and bargaining over the lease • conglomeration avoids these problems – particularly important when the asset is knowledge intensive – so this motive is reasonable • but the assets are common to all the conglomerates products • not supported by the data Chapter 17: Vertical and Conglomerate Mergers 45

Conglomerate mergers 4 • Managerial motives – conglomeration suits interests of management but not shareholder • division of ownership and control of large public corporations • monitoring of management is far from perfect • so management can pursue its own agenda to some extent – suppose management compensation based on company growth • easier to grow by acquisition than internally • horizontal merger may be blocked by regulators • so grow by conglomeration – conglomeration to reduce management risk • diversified firm has diversified risk • this diversifies the risk that management faces • Seems to be supported by the evidence Chapter 17: Vertical and Conglomerate Mergers 46

Conglomerate mergers 4 • Managerial motives – conglomeration suits interests of management but not shareholder • division of ownership and control of large public corporations • monitoring of management is far from perfect • so management can pursue its own agenda to some extent – suppose management compensation based on company growth • easier to grow by acquisition than internally • horizontal merger may be blocked by regulators • so grow by conglomeration – conglomeration to reduce management risk • diversified firm has diversified risk • this diversifies the risk that management faces • Seems to be supported by the evidence Chapter 17: Vertical and Conglomerate Mergers 46

Chapter 17: Vertical and Conglomerate Mergers 47

Chapter 17: Vertical and Conglomerate Mergers 47