00fc4890d5e67a339b0c63916c066ed7.ppt

- Количество слайдов: 64

VERIFICATION AND ELIGIBILITY Carrying out Verifications in Practice Maeve Hamilton – EU Fund Management Division

Overview of Session How to. . . • Put together a verification methodology • Record the verification • Verify the eligibility of expenditure • Verify simplified costs • Deal with personnel and overhead costs • Prevent double financing • Comply with State Aid and Public Procurement rules • Help ensure successful verification activity

Developing a verification methodology. Where to start? • Know the regulations. . • EC Guidance. . • Talk to national authorities. . • Talk to other relevant bodies/peers. . • Review your Operational Programme. . • Talk to any Intermediate Bodies / Delivery Partners. . . • Buy in or source expertise. .

Developing a Verification Methodology • Other factors to be considered: Ø Overall Programme Value? Ø How many operations estimated? Ø How many claims will be received? Ø How are the operations to be delivered? Ø What types of organisations are involved in delivery? Ø What are the historic risks/lessons learned? Ø Geographical spread? Ø Special expertise needed (e. g. major works, financial Instruments, procurement etc. )? Ø Verification resources needed/available?

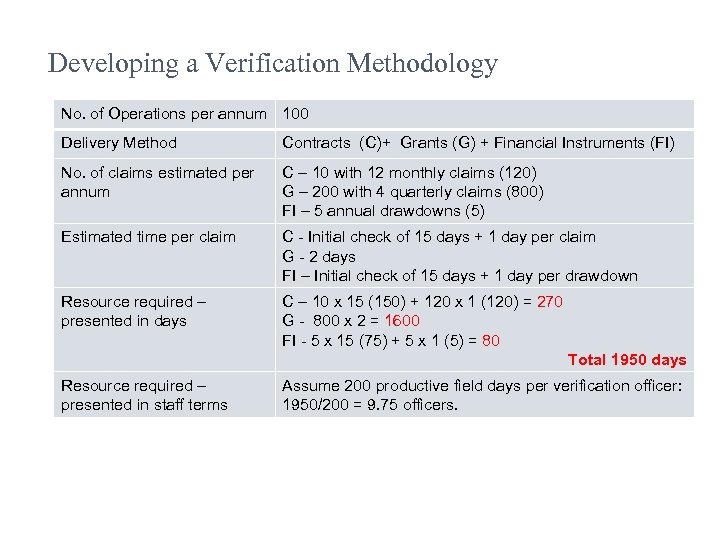

Developing a Verification Methodology No. of Operations per annum 100 Delivery Method Contracts (C)+ Grants (G) + Financial Instruments (FI) No. of claims estimated per annum C – 10 with 12 monthly claims (120) G – 200 with 4 quarterly claims (800) FI – 5 annual drawdowns (5) Estimated time per claim C - Initial check of 15 days + 1 day per claim G - 2 days FI – Initial check of 15 days + 1 day per drawdown Resource required – presented in days C – 10 x 15 (150) + 120 x 1 (120) = 270 G - 800 x 2 = 1600 FI - 5 x 15 (75) + 5 x 1 (5) = 80 Total 1950 days Resource required – presented in staff terms Assume 200 productive field days per verification officer: 1950/200 = 9. 75 officers.

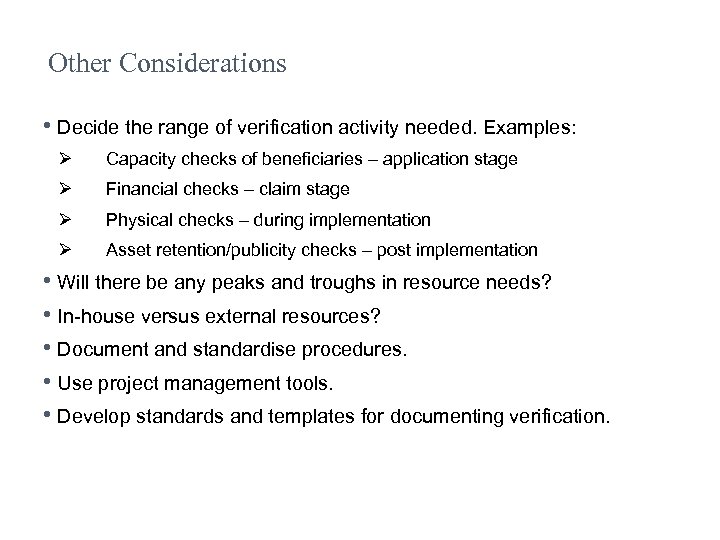

Other Considerations • Decide the range of verification activity needed. Examples: Ø Capacity checks of beneficiaries – application stage Ø Financial checks – claim stage Ø Physical checks – during implementation Ø Asset retention/publicity checks – post implementation • Will there be any peaks and troughs in resource needs? • In-house versus external resources? • Document and standardise procedures. • Use project management tools. • Develop standards and templates for documenting verification.

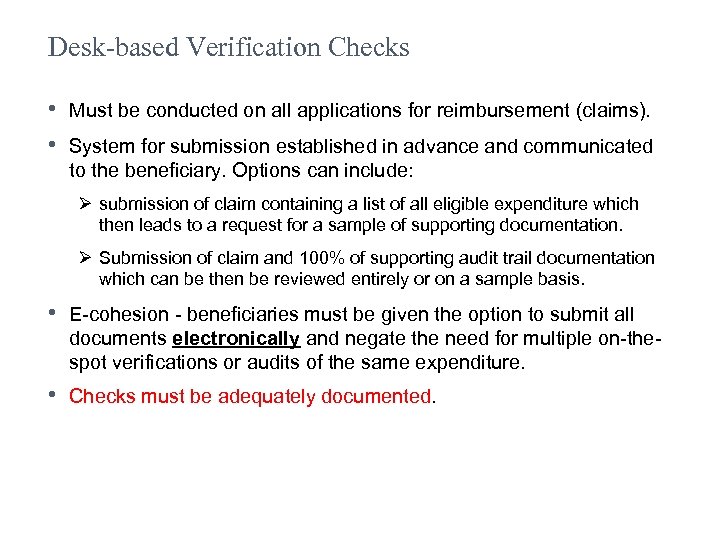

Desk-based Verification Checks • Must be conducted on all applications for reimbursement (claims). • System for submission established in advance and communicated to the beneficiary. Options can include: Ø submission of claim containing a list of all eligible expenditure which then leads to a request for a sample of supporting documentation. Ø Submission of claim and 100% of supporting audit trail documentation which can be then be reviewed entirely or on a sample basis. • E-cohesion - beneficiaries must be given the option to submit all documents electronically and negate the need for multiple on-thespot verifications or audits of the same expenditure. • Checks must be adequately documented.

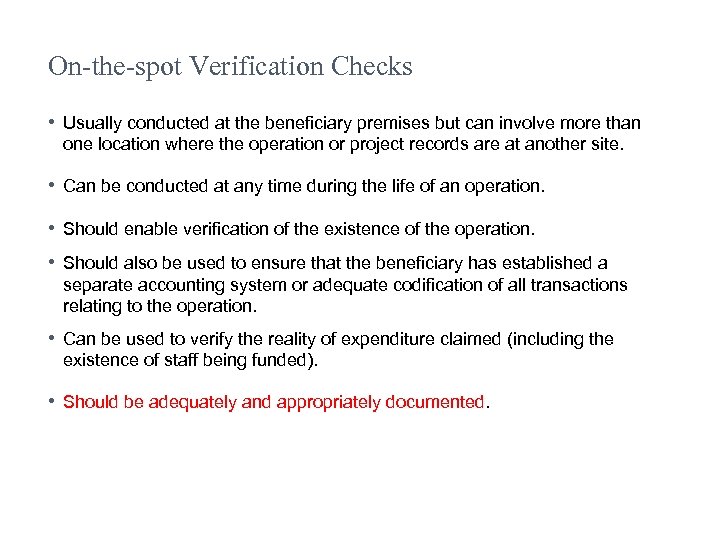

On-the-spot Verification Checks • Usually conducted at the beneficiary premises but can involve more than one location where the operation or project records are at another site. • Can be conducted at any time during the life of an operation. • Should enable verification of the existence of the operation. • Should also be used to ensure that the beneficiary has established a separate accounting system or adequate codification of all transactions relating to the operation. • Can be used to verify the reality of expenditure claimed (including the existence of staff being funded). • Should be adequately and appropriately documented.

Desk Check versus On-the Spot • Validation of costs, audit trail documents and payments. • Additionality – cost is real & a direct consequence of the operation. • Expenditure contributes to the achievement of the defined outputs. • Expenditure incurred & paid within the eligible period and approved budget limits. • Expenditure not claimed before or against another project. • Expenditure meets all relevant eligibility and compliance rules. • Expenditure claimed at the correct financing rate Much of the above can be checked through desk verification

Desk Check versus On-the Spot • Outputs. • Existence of assets, assets registers and retention policies. • Procurement documentation. • Materials/publications for training or events. • Existence of staff where labour costs claimed. • Publicity. • Adherence to State Aid rules, sustainable development, environmental and equality requirements. • Arrangements to ensure that the audit trail will be maintained. • Expenditure accounting / codification arrangements. Much of the above will need to be verified on-the-spot

Verification - Timing • At application stage - capacity of the applicant. • Pre-payment – administrative/desk checks on all claims received. • On-the-spot – normally following prior notice. • Rule of thumb as soon as practical to enable early corrective action. • Use Common sense: Ø No expenditure – no point in a financial inspection. Ø Foundations being excavated - no point in a visit by a quantity surveyor. Ø One-off event or if issues suspected then an unannounced visit may be needed. • Post implementation verification for: Ø Retention/durability of operation issues Ø Revenue generation monitoring. Ø Validation of longer-term targets/outputs/objectives.

Verification - Frequency and Nature • Frequency and coverage determined taking account of the level of funding and risk. • Large scale projects or those being implemented over a longer period should generally receive more than one on-the-spot check. • The nature will depend on the project and can take many forms: Ø Checking goods received against purchase order records Ø Getting a technical inspection carried out on a capital project Ø Attending a Project Board Meeting to discuss project progress Ø Conducting a desk review of project audit trail documents Ø Reviewing a project report or post project evaluation Ø Attending a one-off event Ø Checking the existence of an asset or personnel

Documenting Verification Activity

What needs to be recorded? • Risk assessment and sample • The request for audit trail information • The checks conducted • Date and name of person undertaking check • Countersignature (if appropriate) • Summary of findings • Details of follow-up action required • Details of any irregularities identified / error rate • Amount cleared for payment • The supporting audit trail information received or copies of relevant documents/evidence reviewed on site. • Pictures of assets and publicity material

Recording the verification • Record the main findings in a written report. • Use checklists to record the specific checks conducted. • Prepare and issue report ideally within two weeks. • Set out required actions. • Set reasonable timescales for completion. • Seek a written response to the report. • Record follow-up action. • Formally sign-off once completed. • Enter all findings and follow-up on database. • Highlight significant issues to management. • Review risk assessment in light of findings. Name of your presentation

Verifying Eligibility of Expenditure

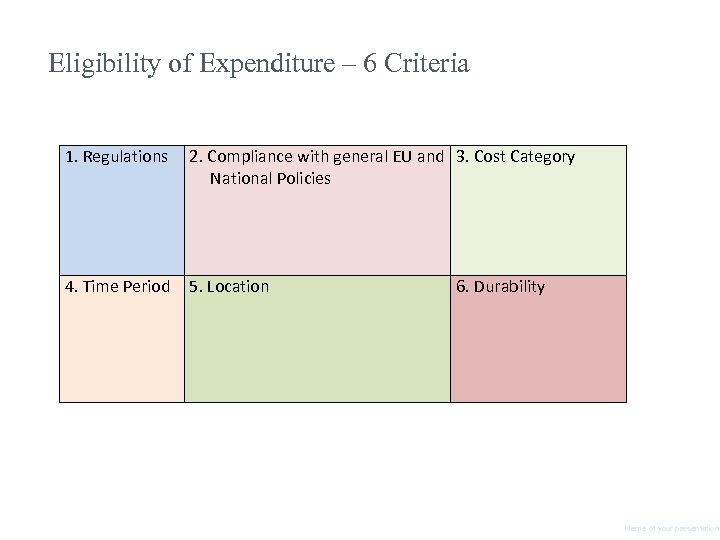

Eligibility of Expenditure – 6 Criteria 1. Regulations 2. Compliance with general EU and 3. Cost Category National Policies 4. Time Period 5. Location 6. Durability Name of your presentation

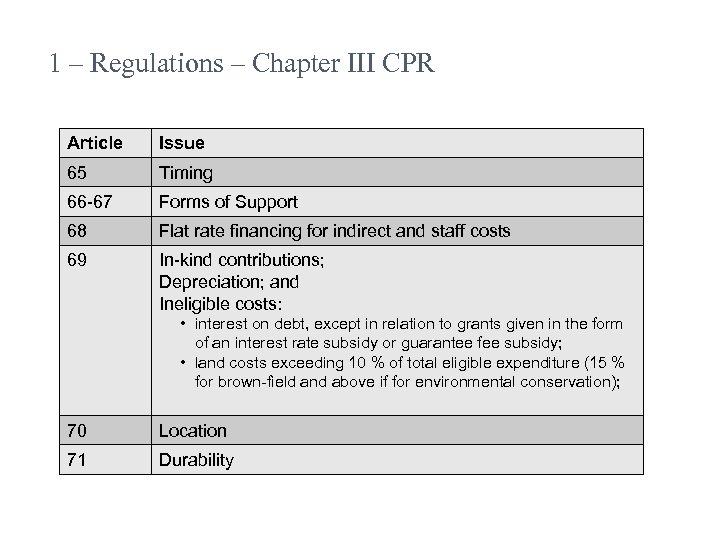

1 – Regulations – Chapter III CPR Article Issue 65 Timing 66 -67 Forms of Support 68 Flat rate financing for indirect and staff costs 69 In-kind contributions; Depreciation; and Ineligible costs: • interest on debt, except in relation to grants given in the form of an interest rate subsidy or guarantee fee subsidy; • land costs exceeding 10 % of total eligible expenditure (15 % for brown-field and above if for environmental conservation); 70 Location 71 Durability

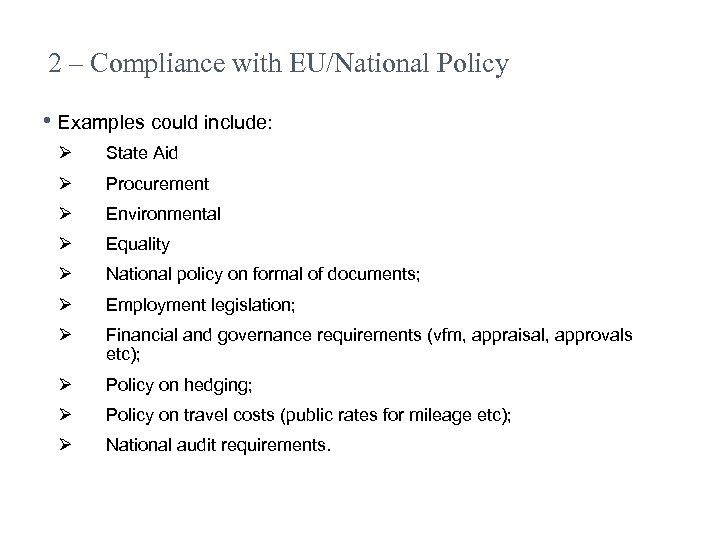

2 – Compliance with EU/National Policy • Examples could include: Ø State Aid Ø Procurement Ø Environmental Ø Equality Ø National policy on formal of documents; Ø Employment legislation; Ø Financial and governance requirements (vfm, appraisal, approvals etc); Ø Policy on hedging; Ø Policy on travel costs (public rates for mileage etc); Ø National audit requirements.

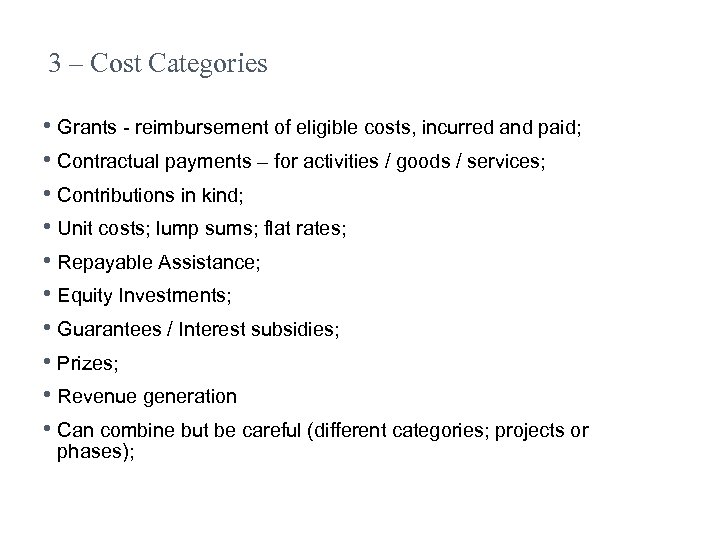

3 – Cost Categories • Grants - reimbursement of eligible costs, incurred and paid; • Contractual payments – for activities / goods / services; • Contributions in kind; • Unit costs; lump sums; flat rates; • Repayable Assistance; • Equity Investments; • Guarantees / Interest subsidies; • Prizes; • Revenue generation • Can combine but be careful (different categories; projects or phases);

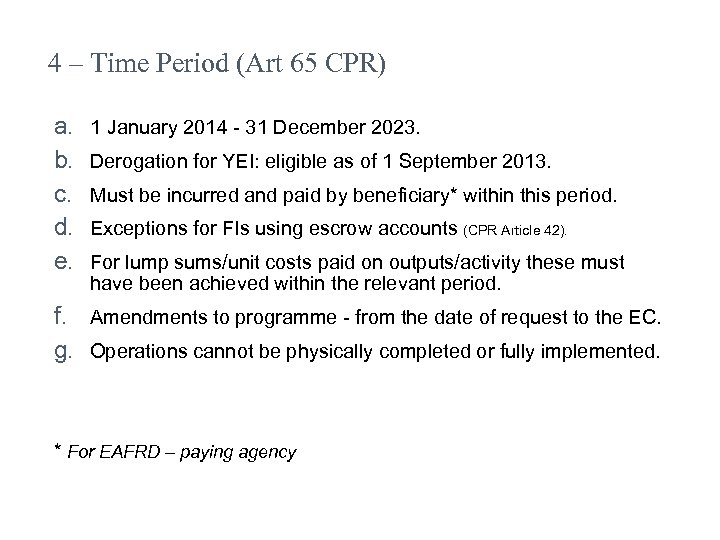

4 – Time Period (Art 65 CPR) a. b. c. d. e. 1 January 2014 - 31 December 2023. Derogation for YEI: eligible as of 1 September 2013. Must be incurred and paid by beneficiary* within this period. Exceptions for FIs using escrow accounts (CPR Article 42). For lump sums/unit costs paid on outputs/activity these must have been achieved within the relevant period. f. Amendments to programme - from the date of request to the EC. g. Operations cannot be physically completed or fully implemented. * For EAFRD – paying agency

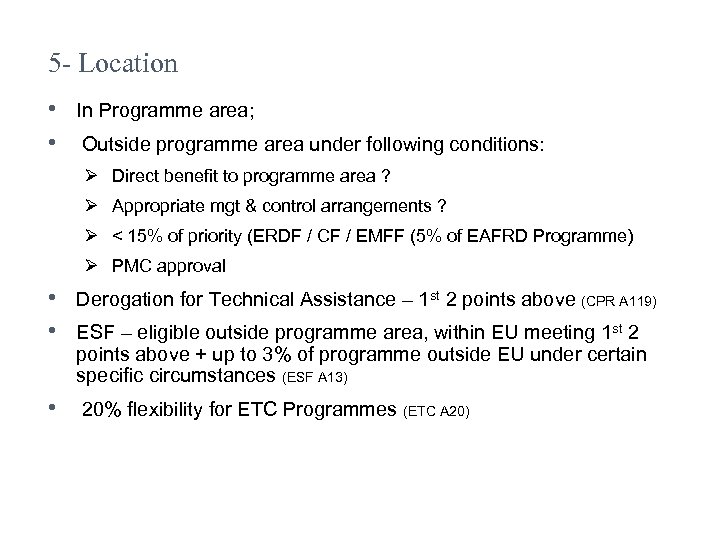

5 - Location • In Programme area; • Outside programme area under following conditions: Ø Direct benefit to programme area ? Ø Appropriate mgt & control arrangements ? Ø < 15% of priority (ERDF / CF / EMFF (5% of EAFRD Programme) Ø PMC approval • Derogation for Technical Assistance – 1 st 2 points above (CPR A 119) • ESF – eligible outside programme area, within EU meeting 1 st 2 points above + up to 3% of programme outside EU under certain specific circumstances (ESF A 13) • 20% flexibility for ETC Programmes (ETC A 20)

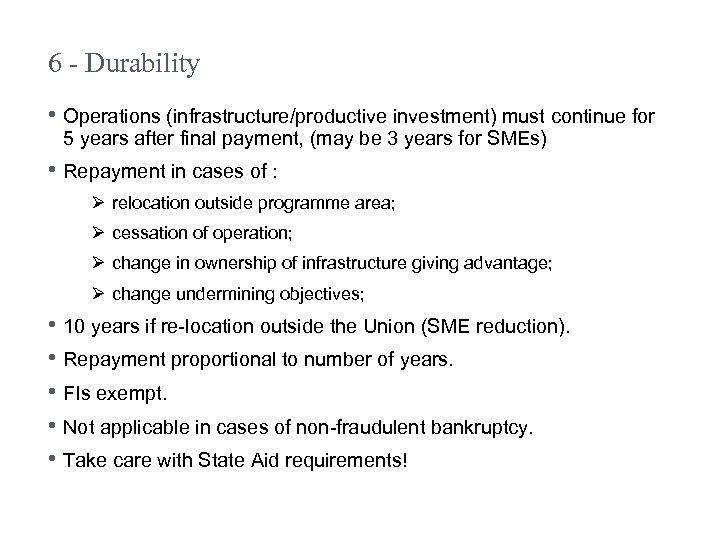

6 - Durability • Operations (infrastructure/productive investment) must continue for 5 years after final payment, (may be 3 years for SMEs) • Repayment in cases of : Ø relocation outside programme area; Ø cessation of operation; Ø change in ownership of infrastructure giving advantage; Ø change undermining objectives; • 10 years if re-location outside the Union (SME reduction). • Repayment proportional to number of years. • FIs exempt. • Not applicable in cases of non-fraudulent bankruptcy. • Take care with State Aid requirements!

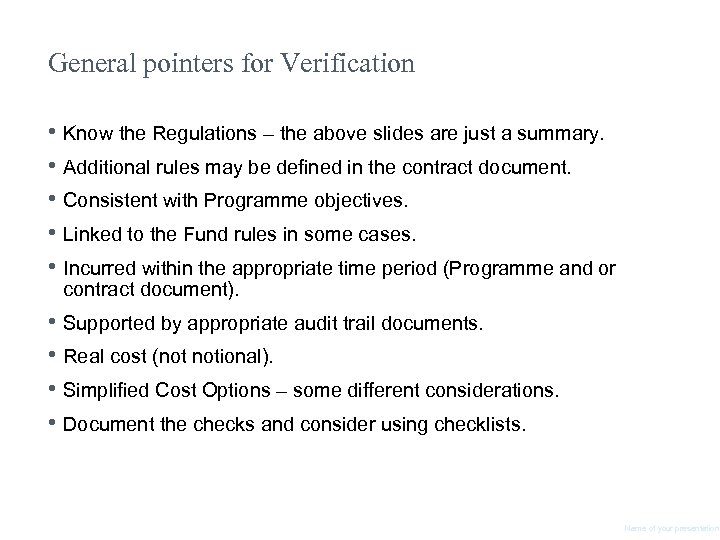

General pointers for Verification • Know the Regulations – the above slides are just a summary. • Additional rules may be defined in the contract document. • Consistent with Programme objectives. • Linked to the Fund rules in some cases. • Incurred within the appropriate time period (Programme and or contract document). • Supported by appropriate audit trail documents. • Real cost (not notional). • Simplified Cost Options – some different considerations. • Document the checks and consider using checklists. Name of your presentation

Using checklists – Why? • Ensures that all relevant aspects are covered in sufficient detail. • Can be used as an ‘aide memoire’ – particularly in complex areas. • Enables review and quality control checks. • Issues are readily identified. • Aids reporting, follow-up and closure. • Avoid asking irrelevant questions. • Provides an audit trail of the verification process. Name of your presentation

What tailored checklists could be used? • Labour Costs • Infrastructure / Revenue Generation • State Aid (separate for each type of aid) • Procurement (tailored for scale/nature) • Publicity • Grant expenditure • Training • Travel • Overheads • Capital/Equipment/Depreciation • Where SCOs are present Name of your presentation

Checklists – some of the problems • Checklist overload – sometimes less really is more! • Designed by theory experts – practitioners must help design. • Sometimes a tick is not enough. • No logical flow – leads to frustration /duplication. • Set in stone – no scope to tailor/refine.

Checklists – Designing a good one • Small – focus on critical actions that matter • Logical – Like a flowchart in a sequence • Clear – include guidance. • Include reasoning / explanations - not just tick boxes but also recording observations, recommendations, and actions. • Evolving – adjusted with feedback from practical use.

Verification of transactions with Simplified Costs Options First thing to do is : Name of your presentation

Then : remember why SCOs were introduced • To reduce the administrative burden of beneficiaries and implementing entities. • To reduce the risk of errors. • To focus on what really matters, on outputs and results. • To stop controlling every cent.

Know what needs to be verified. • Soundness of the calculation method made at MA/IB level. • Correct application of the method in individual projects at final beneficiary/recipient level. • Verification on the basis of the “real cost” principle of the direct costs in the case of flat rates for indirect costs. • Verification of the outputs in case of use a unit cost or lump sum: ØHour worked ØParticipant trained ØQualification achieved

Cost Categories and Simplified Costs • • Cost categories must be clearly defined by the MA. What is essential is that there is a clear distinction and costs cannot fall into 2 categories: Ø Staff costs are costs deriving from a formal agreement between and employer and employee, including a contract with an external provider, providing that the contract and invoice clearly separate salary and other costs such as training materials. Usually include remuneration, taxes, social security contributions, employers compulsory and voluntary contributions. . Ø Direct costs are those costs which are directly related to an individual activity of the entity where the link can be evidenced e. g. Timesheets. Ø Indirect costs are usually not or cannot be linked directly e. g. Recruitment costs, management costs, cleaning, electricity etc. .

Personnel and Overhead Cost Issues Use of Simplified Costs

Personnel costs • Staff working on a project should be clearly identified • Written contract/ terms of engagement • Staff working part-time (or if using a SCO) should have timesheets that record the hours worked on the project and the hours worked on other activities. • Timesheets should be signed by the employee and their superior, dated, and completed in a timely manner. • Payroll data and payslips - for the duration of the project. • Other employer costs (pension and social services contributions). • Taxable benefits (if eligible).

Apportioning personnel costs • Apportioning method should be set out by the Managing Authority. • For ETC apportionment method set out by the programme. • Gross salary generally contractual costs to the employer. • Discretionary costs only eligible if allowed by MA/National Rules. • Hourly rate calculated taking account of the contractual yearly salary and normal conditioned hours (can use /1720). • Hours worked on the project should be actual and not an estimate. • Changes in salary should be reflected in the hourly rate claimed (unless the rate is fixed using a SCO for project duration).

Key principles for overheads • Those costs essential to the operating of the project and contributing to the objectives. • They can also be required for other operations – e. g: Ø Support staff costs not directly engaged in the project Ø Premises costs such as heat, light Ø Corporate costs such as insurance • Indirect costs must be actual (real) not estimated • Notional / out of period / opportunity costs - not eligible. • Apportionment method agreed in advance and relevant.

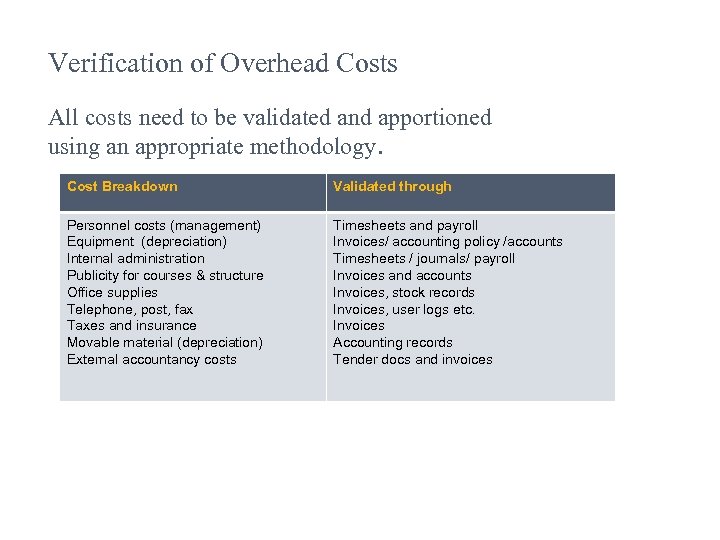

Verification of Overhead Costs All costs need to be validated and apportioned using an appropriate methodology. Cost Breakdown Validated through Personnel costs (management) Timesheets and payroll Equipment (depreciation) Invoices/ accounting policy /accounts Internal administration Timesheets / journals/ payroll Publicity for courses & structure Invoices and accounts Office supplies Invoices, stock records Telephone, post, fax Invoices, user logs etc. Taxes and insurance Invoices Movable material (depreciation) Accounting records External accountancy costs Tender docs and invoices

Common Issues • Double counting as direct and indirect costs. • Using inappropriate apportionment methods – should use a recognised and relevant method (e. g. Full time equivalents, floor space, hours worked on the project etc. ). • Use of a flat rate not approved in advance. • Notional, out of period, or opportunity costs. • Costs claimed which are not relevant to the project being funded (core costs not impacted by project). • Reduction of direct costs without a corresponding reduction in the overheads.

Risk Analysis and Sampling

Risk Analysis / Assessment • Identify risk factors. • Take account of audit and other verification findings. • Determine how risk factors will be scored. • Rank and weight risks based on likelihood and impact value. • Establish rules for impact on frequency and intensity of monitoring. • Establish rules for impact on sample sizes. • Risk assessment should be a continuous process. • Remember - once risks are identified and assessed they can be managed.

A Worked Example

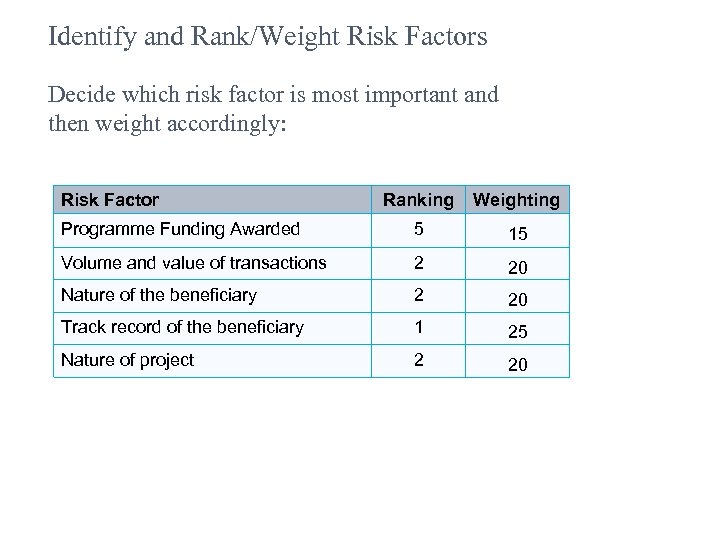

Identify and Rank/Weight Risk Factors Decide which risk factor is most important and then weight accordingly: Risk Factor Ranking Weighting Programme Funding Awarded 5 15 Volume and value of transactions 2 20 Nature of the beneficiary 2 20 Track record of the beneficiary 1 25 Nature of project 2 20

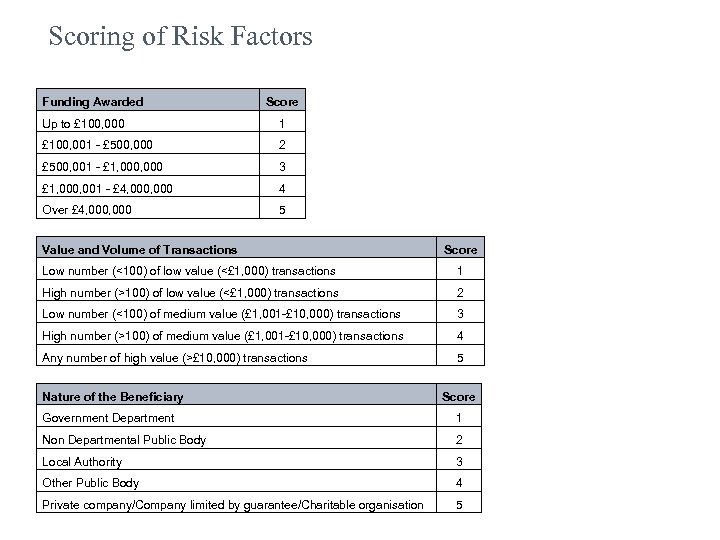

Scoring of Risk Factors Funding Awarded Score Up to £ 100, 000 1 £ 100, 001 - £ 500, 000 2 £ 500, 001 - £ 1, 000 3 £ 1, 000, 001 - £ 4, 000 4 Over £ 4, 000 5 Value and Volume of Transactions Score Low number (<100) of low value (<£ 1, 000) transactions 1 High number (>100) of low value (<£ 1, 000) transactions 2 Low number (<100) of medium value (£ 1, 001 -£ 10, 000) transactions 3 High number (>100) of medium value (£ 1, 001 -£ 10, 000) transactions 4 Any number of high value (>£ 10, 000) transactions 5 Nature of the Beneficiary Score Government Department 1 Non Departmental Public Body 2 Local Authority 3 Other Public Body 4 Private company/Company limited by guarantee/Charitable organisation 5

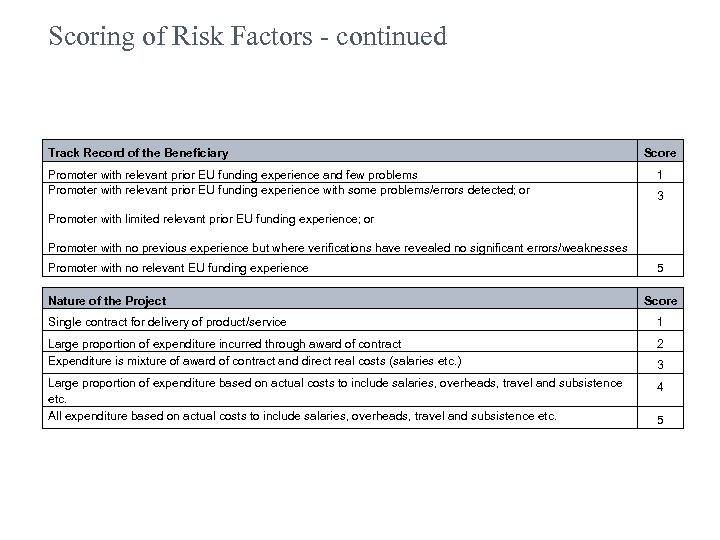

Scoring of Risk Factors - continued Track Record of the Beneficiary Promoter with relevant prior EU funding experience and few problems Promoter with relevant prior EU funding experience with some problems/errors detected; or Score 1 3 Promoter with limited relevant prior EU funding experience; or Promoter with no previous experience but where verifications have revealed no significant errors/weaknesses Promoter with no relevant EU funding experience Nature of the Project 5 Score Single contract for delivery of product/service 1 Large proportion of expenditure incurred through award of contract Expenditure is mixture of award of contract and direct real costs (salaries etc. ) 2 Large proportion of expenditure based on actual costs to include salaries, overheads, travel and subsistence etc. All expenditure based on actual costs to include salaries, overheads, travel and subsistence etc. 4 3 5

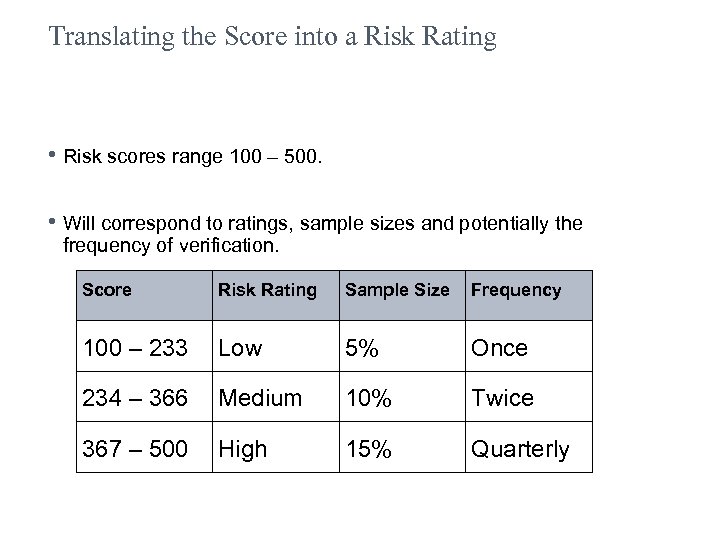

Translating the Score into a Risk Rating • Risk scores range 100 – 500. • Will correspond to ratings, sample sizes and potentially the frequency of verification. Score Risk Rating Sample Size Frequency 100 – 233 Low 5% Once 234 – 366 Medium 10% Twice 367 – 500 High 15% Quarterly

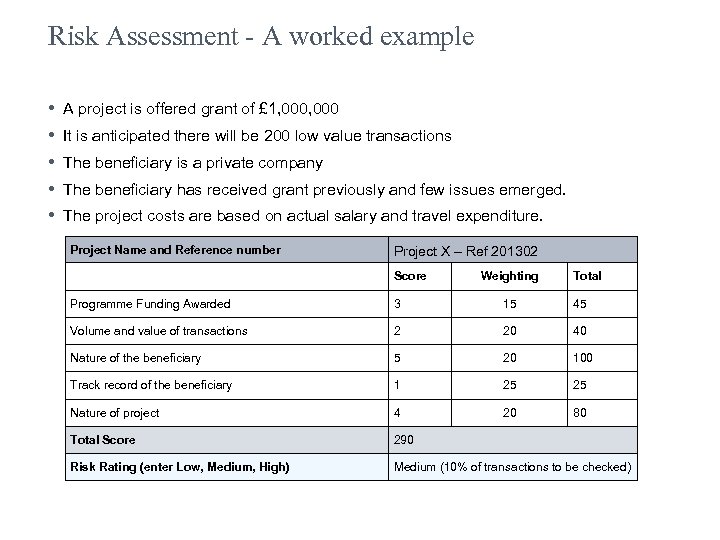

Risk Assessment - A worked example • • • A project is offered grant of £ 1, 000 It is anticipated there will be 200 low value transactions The beneficiary is a private company The beneficiary has received grant previously and few issues emerged. The project costs are based on actual salary and travel expenditure. Project Name and Reference number Project X – Ref 201302 Score Weighting Total Programme Funding Awarded 3 15 45 Volume and value of transactions 2 20 40 Nature of the beneficiary 5 20 100 Track record of the beneficiary 1 25 25 Nature of project 4 20 80 Total Score 290 Risk Rating (enter Low, Medium, High) Medium (10% of transactions to be checked)

Sampling

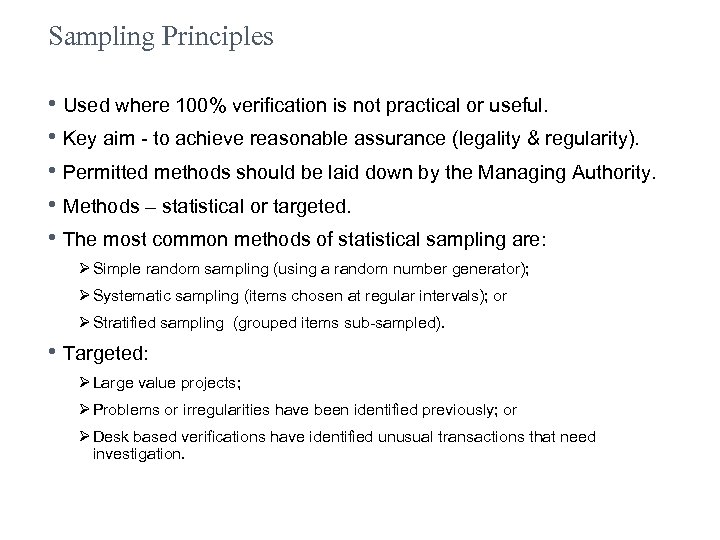

Sampling Principles • Used where 100% verification is not practical or useful. • Key aim - to achieve reasonable assurance (legality & regularity). • Permitted methods should be laid down by the Managing Authority. • Methods – statistical or targeted. • The most common methods of statistical sampling are: Ø Simple random sampling (using a random number generator); Ø Systematic sampling (items chosen at regular intervals); or Ø Stratified sampling (grouped items sub-sampled). • Targeted: Ø Large value projects; Ø Problems or irregularities have been identified previously; or Ø Desk based verifications have identified unusual transactions that need investigation.

Random Number Generator Name of your presentation

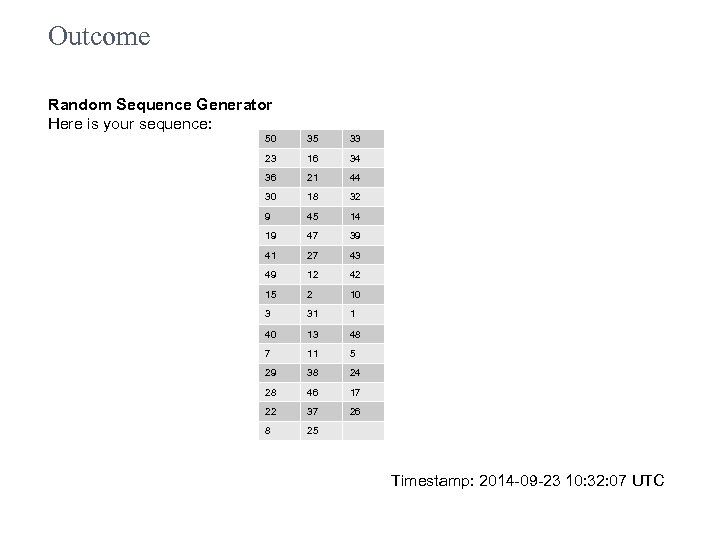

Outcome Random Sequence Generator Here is your sequence: 50 35 33 23 16 34 36 21 44 30 18 32 9 45 14 19 47 39 41 27 43 49 12 42 15 2 10 3 31 1 40 13 48 7 11 5 29 38 24 28 46 17 22 37 26 8 25 Timestamp: 2014 -09 -23 10: 32: 07 UTC

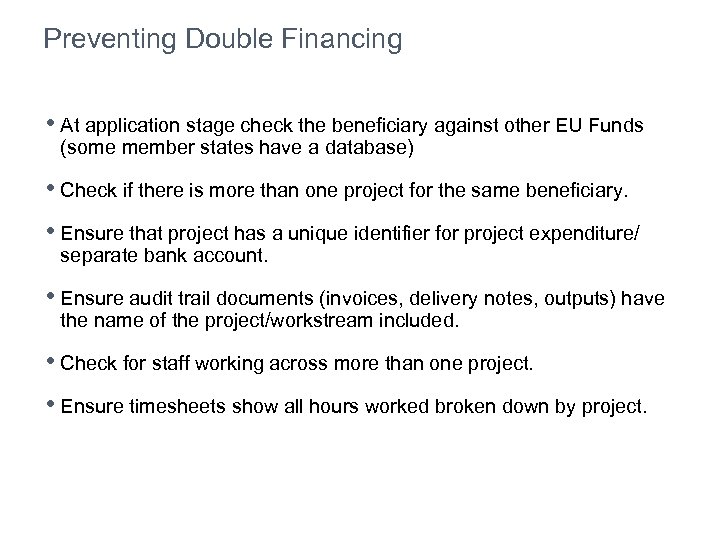

Preventing Double Financing • At application stage check the beneficiary against other EU Funds (some member states have a database) • Check if there is more than one project for the same beneficiary. • Ensure that project has a unique identifier for project expenditure/ separate bank account. • Ensure audit trail documents (invoices, delivery notes, outputs) have the name of the project/workstream included. • Check for staff working across more than one project. • Ensure timesheets show all hours worked broken down by project.

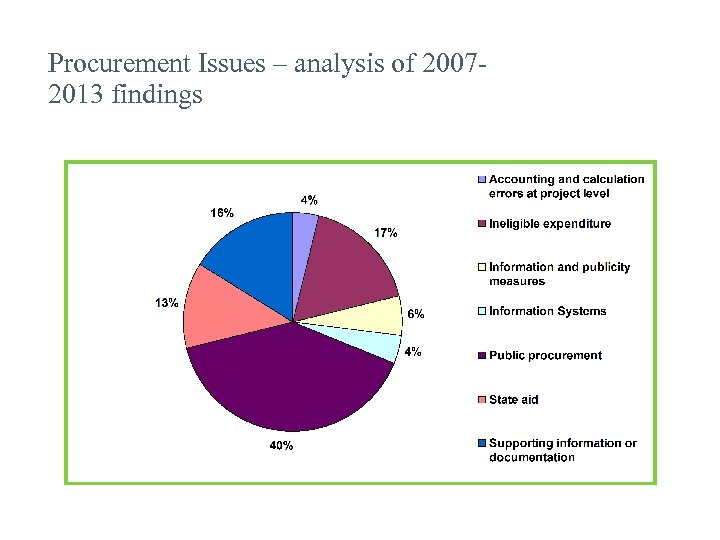

Procurement Issues – analysis of 20072013 findings

Common Issues • Single Tender Action/Direct Award • Splitting of projects to avoid higher threshold requirements. • Selection and Award procedures overlapped or confused. • Unlawful Award Criteria. • Additional works awarded (not justified as unforeseen). • Failure to comply with advertising requirements (timing and means). • Application of criteria not in tender documents. • Discriminatory technical requirements – restricting/favouring tenders. • Criteria not applied in a transparent, equitable manner. • Inadequate documentation of the process, scoring and comments. • Deficiencies in the calculation of the contract value.

Reminder of Procurement Principles The European Union Treaty requires: Ø Non-discrimination – for suppliers across the EU Ø Equal treatment – between potential suppliers Ø Transparency – of the entire tender process Ø Proportionality – contract value to procedures Strictest Rules Apply!!

Ensuring Success in Verification

Successful Verification Strategies • Establish a verification strategy with objectives to: Ø outline management and control checks Ø demonstrate compliance with European legislation Ø satisfy the Managing, Certifying and Audit Authority requirements Ø ensure a consistent monitoring approach Ø promote best practice Ø manage expectations

Successful Verification Strategies • Three rules of thumb Ø Start early – be clear with the beneficiary your information requirements at the operation approval stage to allow them sufficient time to plan and resource it. Provide clear forms/templates using simple language. Ø Justify – your need for information. It is not sufficient to impose a requirement. Ø Give feedback – a good open dialogue between the MA and beneficiaries helps to build trust, identify and overcome risks, and improve delivery. Existence of a “black hole” is de-motivating.

Management Verifications – general tips • Guidance prepared centrally by MA to ensure consistency. • Detailed guidance should be issued to all IBs. • Beneficiaries should also receive tailored written guidance. • Beneficiaries should receive training so that they know: Ø what costs are eligible; and Ø what records to keep. • Reports following verification should clearly detail findings. • The verification findings should be collated and reviewed regularly to: Ø Identify weaknesses in M&C systems; and Ø Identify guidance/training needs.

Workshop – Eligible or Not?

Exercise 1 – Scenario • Local government infrastructure project; • Proposal - construction of an elephant house at the city zoo. • The city zoo is a well established local facility, regularly visited by tourists. • The elephant house will bring in more visitors. • The new construction also includes an indoor ‘wet weather’ visitor centre. • Exhibitions regularly refreshed to help ensure repeat tourist visits.

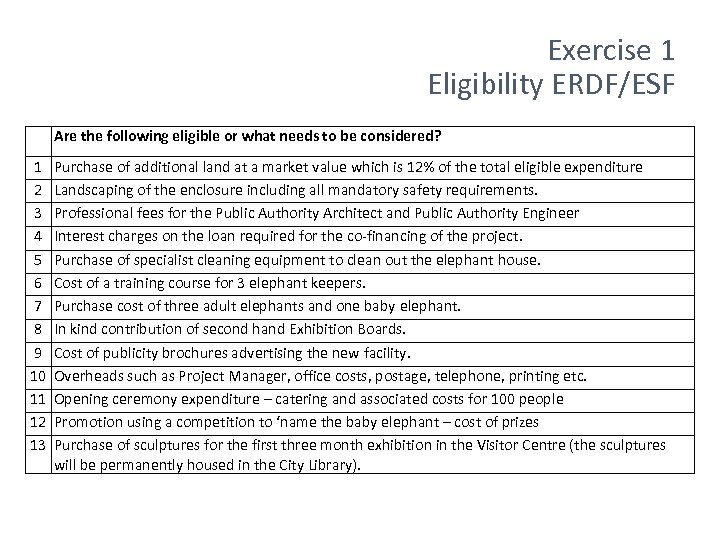

Exercise 1 Eligibility ERDF/ESF Are the following eligible or what needs to be considered? 1 2 3 4 5 6 7 8 9 10 11 12 13 Purchase of additional land at a market value which is 12% of the total eligible expenditure Landscaping of the enclosure including all mandatory safety requirements. Professional fees for the Public Authority Architect and Public Authority Engineer Interest charges on the loan required for the co-financing of the project. Purchase of specialist cleaning equipment to clean out the elephant house. Cost of a training course for 3 elephant keepers. Purchase cost of three adult elephants and one baby elephant. In kind contribution of second hand Exhibition Boards. Cost of publicity brochures advertising the new facility. Overheads such as Project Manager, office costs, postage, telephone, printing etc. Opening ceremony expenditure – catering and associated costs for 100 people Promotion using a competition to ‘name the baby elephant – cost of prizes Purchase of sculptures for the first three month exhibition in the Visitor Centre (the sculptures will be permanently housed in the City Library).

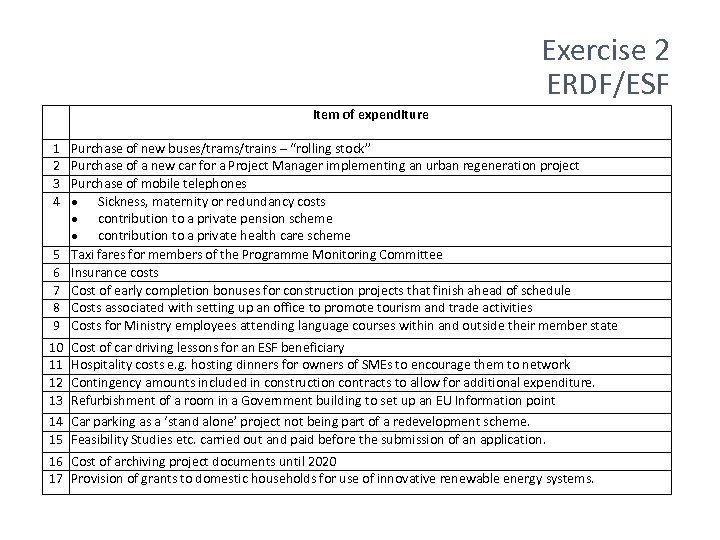

Exercise 2 ERDF/ESF Item of expenditure 1 2 3 4 5 6 7 8 9 Purchase of new buses/trams/trains – “rolling stock” Purchase of a new car for a Project Manager implementing an urban regeneration project Purchase of mobile telephones Sickness, maternity or redundancy costs contribution to a private pension scheme contribution to a private health care scheme Taxi fares for members of the Programme Monitoring Committee Insurance costs Cost of early completion bonuses for construction projects that finish ahead of schedule Costs associated with setting up an office to promote tourism and trade activities Costs for Ministry employees attending language courses within and outside their member state 10 11 12 13 Cost of car driving lessons for an ESF beneficiary Hospitality costs e. g. hosting dinners for owners of SMEs to encourage them to network Contingency amounts included in construction contracts to allow for additional expenditure. Refurbishment of a room in a Government building to set up an EU Information point 14 Car parking as a ‘stand alone’ project not being part of a redevelopment scheme. 15 Feasibility Studies etc. carried out and paid before the submission of an application. 16 Cost of archiving project documents until 2020 17 Provision of grants to domestic households for use of innovative renewable energy systems.

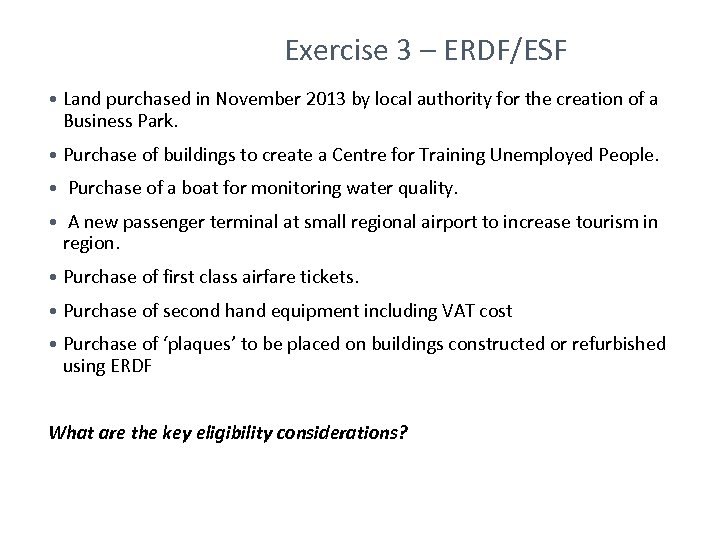

Exercise 3 – ERDF/ESF • Land purchased in November 2013 by local authority for the creation of a Business Park. • Purchase of buildings to create a Centre for Training Unemployed People. • Purchase of a boat for monitoring water quality. • A new passenger terminal at small regional airport to increase tourism in region. • Purchase of first class airfare tickets. • Purchase of second hand equipment including VAT cost • Purchase of ‘plaques’ to be placed on buildings constructed or refurbished using ERDF What are the key eligibility considerations?

Questions / Discussion Name of your presentation

00fc4890d5e67a339b0c63916c066ed7.ppt