a3eea6da42e358a0f711df526ffda3d0.ppt

- Количество слайдов: 14

Venture Philanthropy: From Operations to Finance UBS Philanthropy Services Dr. Maximilian Martin October 12, 2007

Table of Contents Section 1 The Fundamentals Section 2 The Finance Frontier 1

SECTION 1 The Fundamentals

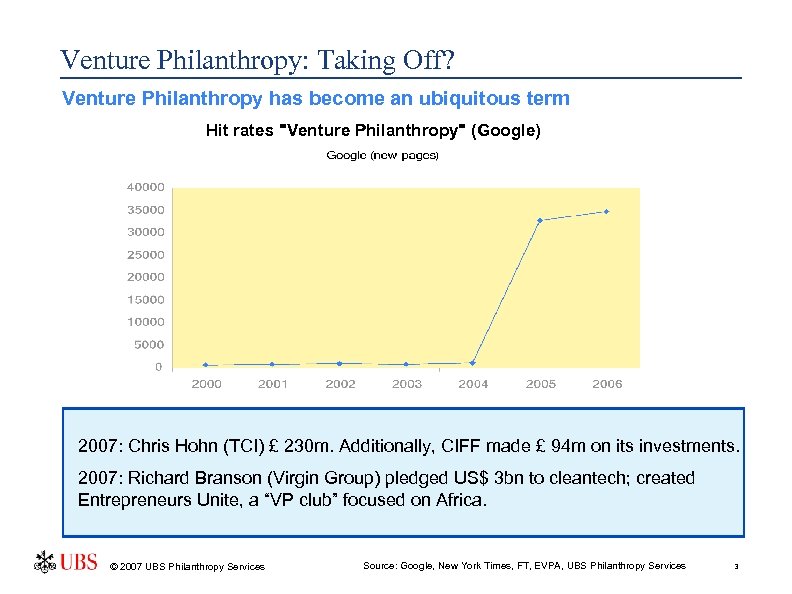

Venture Philanthropy: Taking Off? Venture Philanthropy has become an ubiquitous term Hit rates "Venture Philanthropy" (Google) 2007: Chris Hohn (TCI) £ 230 m. Additionally, CIFF made £ 94 m on its investments. 2007: Richard Branson (Virgin Group) pledged US$ 3 bn to cleantech; created Entrepreneurs Unite, a “VP club” focused on Africa. © 2007 UBS Philanthropy Services Source: Google, New York Times, FT, EVPA, UBS Philanthropy Services 3

Definitions of Venture Philanthropy Competing views John D. Rockefeller III (1969): “Private foundations often are established to engage in what has been described as ‘Venture Philanthropy, ’ or the imaginative pursuit of less conventional charitable purposes than those normally undertaken by established public charitable organizations. ” ¨ EVPA: Venture Philanthropy is an approach to charitable giving that applies venture capital principles, such as long-term investment and hands-on support, to the social economy. Venture philanthropists work in partnership with a wide range of organizations that have a clear social objective. These organizations may be charities, social enterprises or socially driven commercial businesses. ¨ Sustainability Dictionary: Philanthropy that draws upon the traditional venture capital model to invest in nonprofits and socially entrepreneurial organizations to build their capacity, rather than to support discrete programs. Venture philanthropists typically assess progress and track the outcomes of their investments in terms of the social value produced. They often maintain a close and active relationship with grantees. © 2007 UBS Philanthropy Services Source: Co. P, EVPA, Sustainability Dictionary 4

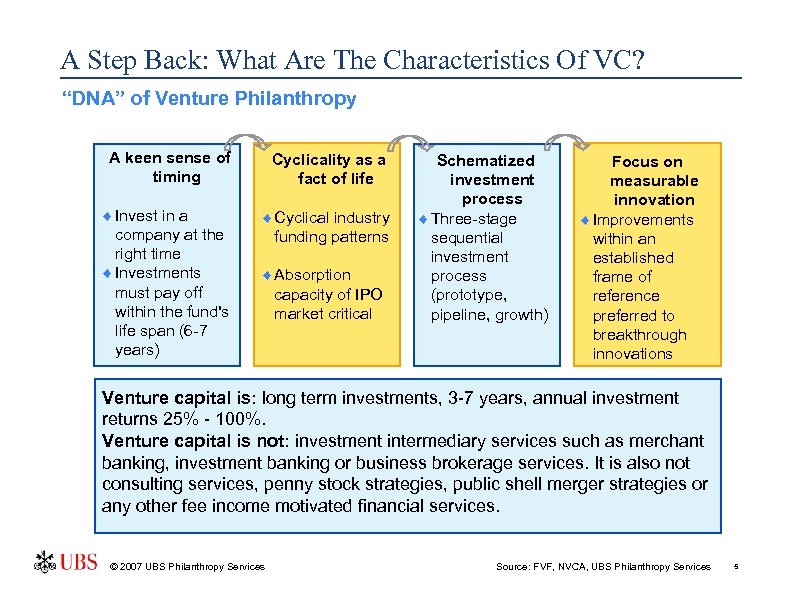

A Step Back: What Are The Characteristics Of VC? “DNA” of Venture Philanthropy A keen sense of timing Cyclicality as a fact of life ¨ Invest in a company at the right time ¨ Investments must pay off within the fund's life span (6 -7 years) ¨ Cyclical industry funding patterns ¨ Absorption capacity of IPO market critical Schematized investment process ¨ Three-stage sequential investment process (prototype, pipeline, growth) Focus on measurable innovation ¨ Improvements within an established frame of reference preferred to breakthrough innovations Venture capital is: long term investments, 3 -7 years, annual investment returns 25% - 100%. Venture capital is not: investment intermediary services such as merchant banking, investment banking or business brokerage services. It is also not consulting services, penny stock strategies, public shell merger strategies or any other fee income motivated financial services. © 2007 UBS Philanthropy Services Source: FVF, NVCA, UBS Philanthropy Services 5

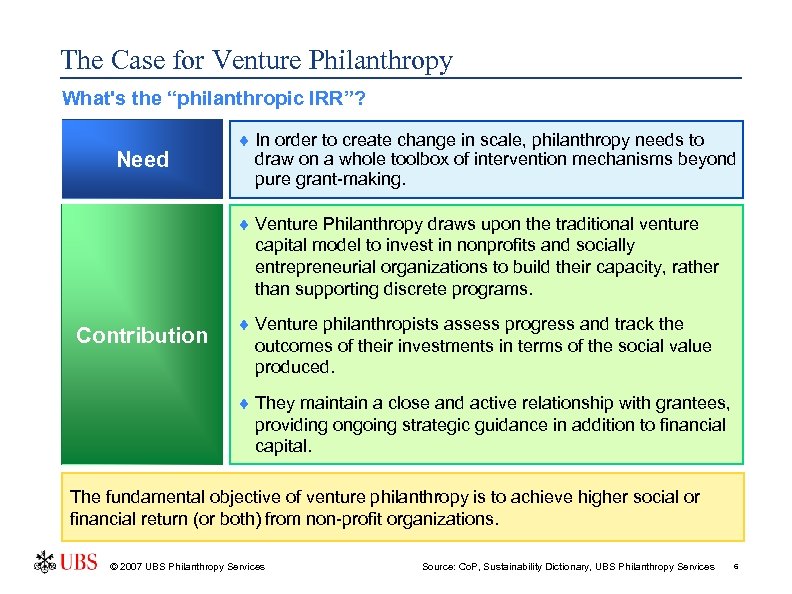

The Case for Venture Philanthropy What's the “philanthropic IRR”? Need ¨ In order to create change in scale, philanthropy needs to draw on a whole toolbox of intervention mechanisms beyond pure grant-making. ¨ Venture Philanthropy draws upon the traditional venture capital model to invest in nonprofits and socially entrepreneurial organizations to build their capacity, rather than supporting discrete programs. Contribution ¨ Venture philanthropists assess progress and track the outcomes of their investments in terms of the social value produced. ¨ They maintain a close and active relationship with grantees, providing ongoing strategic guidance in addition to financial capital. The fundamental objective of venture philanthropy is to achieve higher social or financial return (or both) from non-profit organizations. © 2007 UBS Philanthropy Services Source: Co. P, Sustainability Dictionary, UBS Philanthropy Services 6

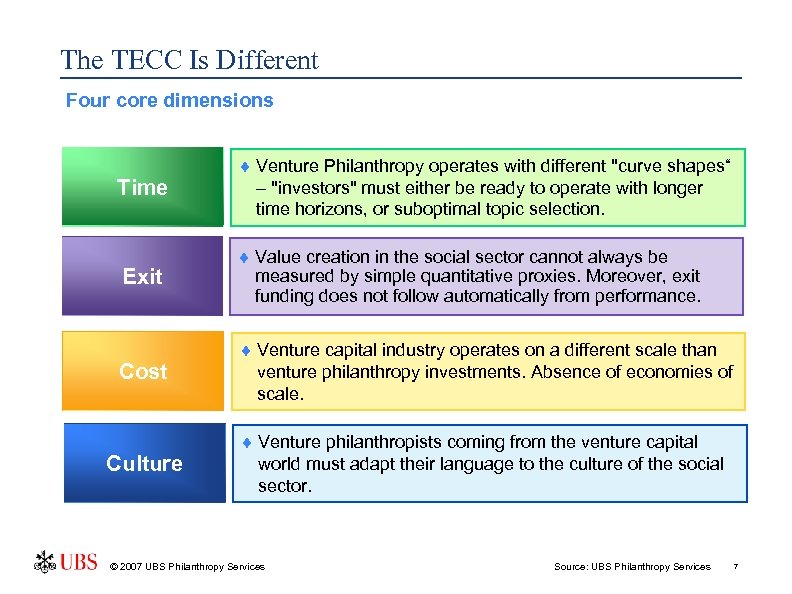

The TECC Is Different Four core dimensions Time ¨ Venture Philanthropy operates with different "curve shapes“ – "investors" must either be ready to operate with longer time horizons, or suboptimal topic selection. Exit ¨ Value creation in the social sector cannot always be measured by simple quantitative proxies. Moreover, exit funding does not follow automatically from performance. Cost ¨ Venture capital industry operates on a different scale than venture philanthropy investments. Absence of economies of scale. Culture ¨ Venture philanthropists coming from the venture capital world must adapt their language to the culture of the social sector. © 2007 UBS Philanthropy Services Source: UBS Philanthropy Services 7

SECTION 2 The Finance Frontier

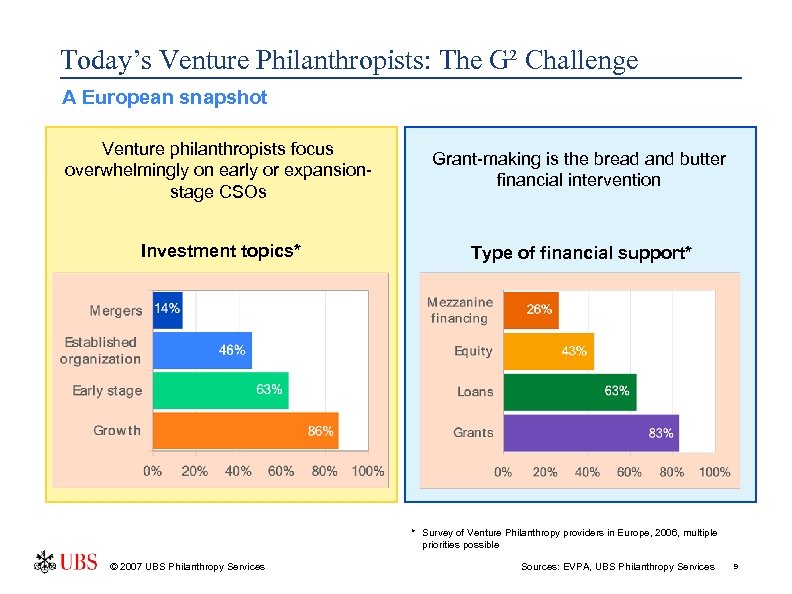

Today’s Venture Philanthropists: The G² Challenge A European snapshot Venture philanthropists focus overwhelmingly on early or expansionstage CSOs Grant-making is the bread and butter financial intervention Investment topics* Type of financial support* * Survey of Venture Philanthropy providers in Europe, 2006, multiple priorities possible © 2007 UBS Philanthropy Services Sources: EVPA, UBS Philanthropy Services 9

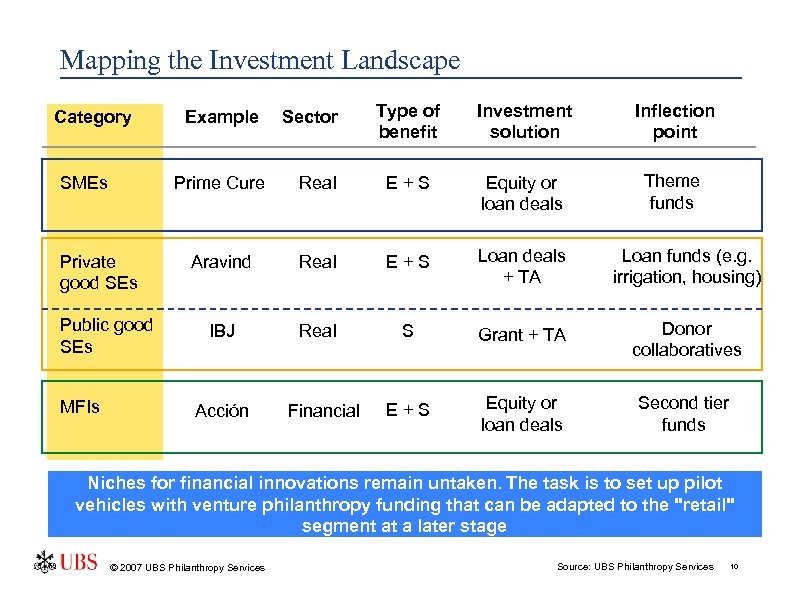

Mapping the Investment Landscape Category SMEs Sector Type of benefit Investment solution Inflection point Theme funds Prime Cure Private good SEs Public good SEs MFIs Example Real E+S Equity or loan deals Aravind Real E+S Loan deals + TA Loan funds (e. g. irrigation, housing) IBJ Real S Grant + TA Donor collaboratives E+S Equity or loan deals Second tier funds Acción Financial Niches for financial innovations remain untaken. The task is to set up pilot vehicles with venture philanthropy funding that can be adapted to the "retail" segment at a later stage © 2007 UBS Philanthropy Services Source: UBS Philanthropy Services 10

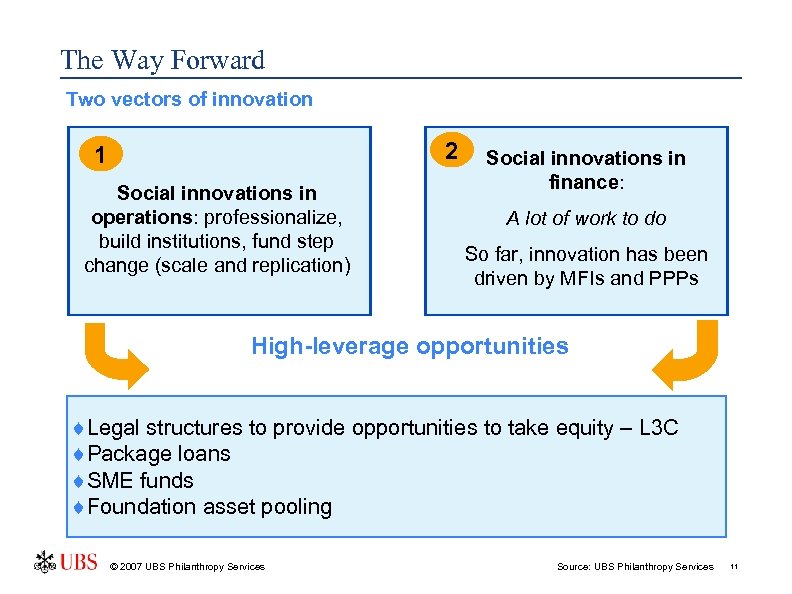

The Way Forward Two vectors of innovation 2 1 Social innovations in operations: professionalize, build institutions, fund step change (scale and replication) Social innovations in finance: A lot of work to do So far, innovation has been driven by MFIs and PPPs High-leverage opportunities ¨Legal structures to provide opportunities to take equity – L 3 C ¨Package loans ¨SME funds ¨Foundation asset pooling © 2007 UBS Philanthropy Services Source: UBS Philanthropy Services 11

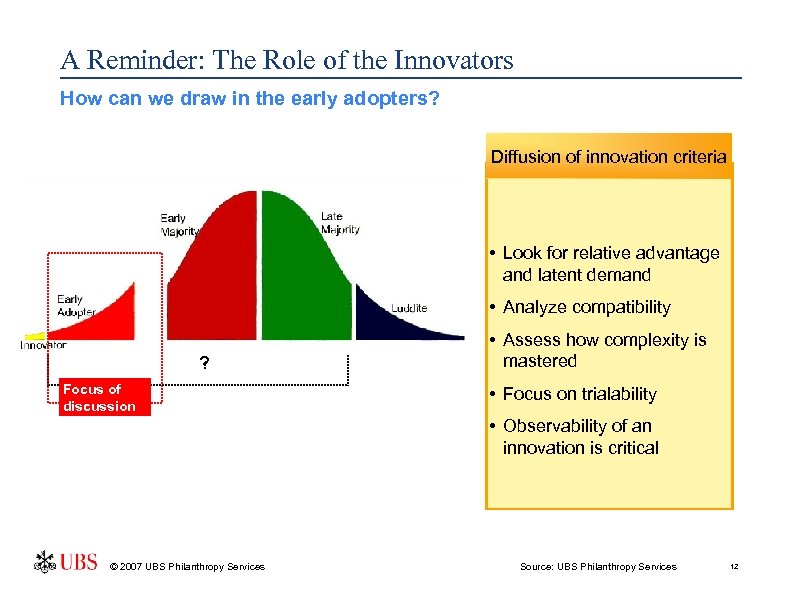

A Reminder: The Role of the Innovators How can we draw in the early adopters? Diffusion of innovation criteria • Look for relative advantage and latent demand • Analyze compatibility ? Focus of discussion • Assess how complexity is mastered • Focus on trialability • Observability of an innovation is critical © 2007 UBS Philanthropy Services Source: UBS Philanthropy Services 12

Disclaimer This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. Although all information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are subject to change without notice. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis. 14

a3eea6da42e358a0f711df526ffda3d0.ppt