5cda23c7d9139404d87e4fd0a4a3e541.ppt

- Количество слайдов: 58

Venture Capital and Private Equity Contracting: An International Perspective Douglas Cumming B. Com. (Hons), M. A. , J. D. , Ph. D. , CFA York University Schulich School of Business Sofia Johan LL. B. , LL. M. , Ph. D. York University Schulich School of Business Tilburg Law and Economics Centre (TILEC) 1 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Venture Capital and Private Equity Contracting: An International Perspective Douglas Cumming B. Com. (Hons), M. A. , J. D. , Ph. D. , CFA York University Schulich School of Business Sofia Johan LL. B. , LL. M. , Ph. D. York University Schulich School of Business Tilburg Law and Economics Centre (TILEC) 1 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Materials • Textbook: – • Cumming, D. J. , and S. A. Johan, 2013. Venture Capital and Private Equity Contracting: An International Perspective, 2 nd Edition, Elsevier Science Academic Press. Web: – http: //booksite. elsevier. com/9780124095373/ 2 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Materials • Textbook: – • Cumming, D. J. , and S. A. Johan, 2013. Venture Capital and Private Equity Contracting: An International Perspective, 2 nd Edition, Elsevier Science Academic Press. Web: – http: //booksite. elsevier. com/9780124095373/ 2 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

3 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

3 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Chapter 1 Objectives • Introduction • Venture Capital and Private Equity Definitions • Issues addressed in course and textbook 4 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Chapter 1 Objectives • Introduction • Venture Capital and Private Equity Definitions • Issues addressed in course and textbook 4 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

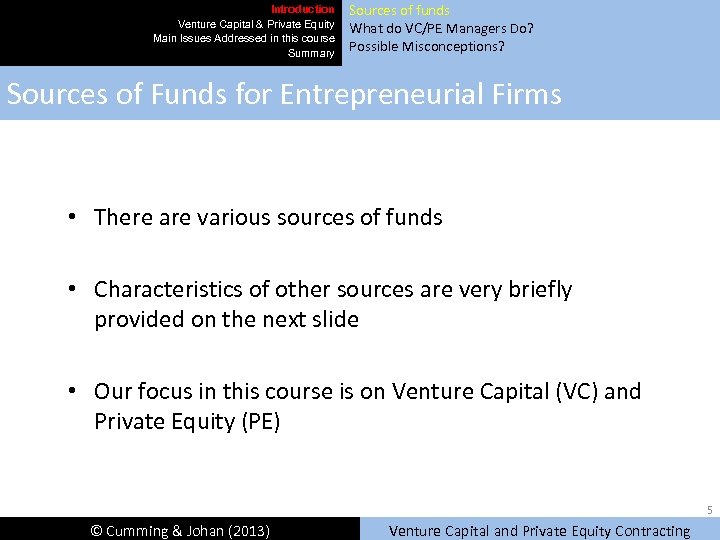

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? Sources of Funds for Entrepreneurial Firms • There are various sources of funds • Characteristics of other sources are very briefly provided on the next slide • Our focus in this course is on Venture Capital (VC) and Private Equity (PE) 5 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? Sources of Funds for Entrepreneurial Firms • There are various sources of funds • Characteristics of other sources are very briefly provided on the next slide • Our focus in this course is on Venture Capital (VC) and Private Equity (PE) 5 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

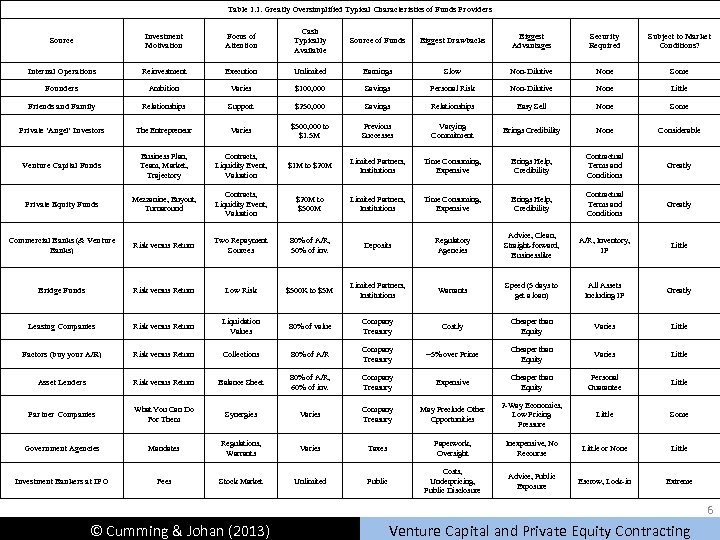

Table 1. 1. Greatly Oversimplified Typical Characteristics of Funds Providers Source Investment Motivation Focus of Attention Cash Typically Available Source of Funds Biggest Drawbacks Biggest Advantages Security Required Subject to Market Conditions? Internal Operations Reinvestment Execution Unlimited Earnings Slow Non-Dilutive None Some Founders Ambition Varies $100, 000 Savings Personal Risk Non-Dilutive None Little Friends and Family Relationships Support $250, 000 Savings Relationships Easy Sell None Some Private ‘Angel’ Investors The Entrepreneur Varies $500, 000 to $1. 5 M Previous Successes Varying Commitment Brings Credibility None Considerable Venture Capital Funds Business Plan, Team, Market, Trajectory Contracts, Liquidity Event, Valuation $1 M to $20 M Limited Partners, Institutions Time Consuming, Expensive Brings Help, Credibility Contractual Terms and Conditions Greatly Private Equity Funds Mezzanine, Buyout, Turnaround Contracts, Liquidity Event, Valuation $20 M to $500 M Limited Partners, Institutions Time Consuming, Expensive Brings Help, Credibility Contractual Terms and Conditions Greatly Commercial Banks (& Venture Banks) Risk versus Return Two Repayment Sources 80% of A/R, 50% of inv. Deposits Regulatory Agencies Advice, Clean, Straight-forward, Businesslike A/R, Inventory, IP Little Bridge Funds Risk versus Return Low Risk $500 K to $5 M Limited Partners, Institutions Warrants Speed (5 days to get a loan) All Assets Including IP Greatly Leasing Companies Risk versus Return Liquidation Values 80% of value Company Treasury Costly Cheaper than Equity Varies Little Factors (buy your A/R) Risk versus Return Collections 80% of A/R Company Treasury ~5% over Prime Cheaper than Equity Varies Little Asset Lenders Risk versus Return Balance Sheet 80% of A/R, 60% of inv. Company Treasury Expensive Cheaper than Equity Personal Guarantee Little Partner Companies What You Can Do For Them Synergies Varies Company Treasury May Preclude Other Opportunities 2 -Way Economics, Low Pricing Pressure Little Some Government Agencies Mandates Regulations, Warrants Varies Taxes Paperwork, Oversight Inexpensive, No Recourse Little or None Little Investment Bankers at IPO Fees Stock Market Unlimited Public Costs, Underpricing, Public Disclosure Advice, Public Exposure Escrow, Lock-in Extreme 6 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Table 1. 1. Greatly Oversimplified Typical Characteristics of Funds Providers Source Investment Motivation Focus of Attention Cash Typically Available Source of Funds Biggest Drawbacks Biggest Advantages Security Required Subject to Market Conditions? Internal Operations Reinvestment Execution Unlimited Earnings Slow Non-Dilutive None Some Founders Ambition Varies $100, 000 Savings Personal Risk Non-Dilutive None Little Friends and Family Relationships Support $250, 000 Savings Relationships Easy Sell None Some Private ‘Angel’ Investors The Entrepreneur Varies $500, 000 to $1. 5 M Previous Successes Varying Commitment Brings Credibility None Considerable Venture Capital Funds Business Plan, Team, Market, Trajectory Contracts, Liquidity Event, Valuation $1 M to $20 M Limited Partners, Institutions Time Consuming, Expensive Brings Help, Credibility Contractual Terms and Conditions Greatly Private Equity Funds Mezzanine, Buyout, Turnaround Contracts, Liquidity Event, Valuation $20 M to $500 M Limited Partners, Institutions Time Consuming, Expensive Brings Help, Credibility Contractual Terms and Conditions Greatly Commercial Banks (& Venture Banks) Risk versus Return Two Repayment Sources 80% of A/R, 50% of inv. Deposits Regulatory Agencies Advice, Clean, Straight-forward, Businesslike A/R, Inventory, IP Little Bridge Funds Risk versus Return Low Risk $500 K to $5 M Limited Partners, Institutions Warrants Speed (5 days to get a loan) All Assets Including IP Greatly Leasing Companies Risk versus Return Liquidation Values 80% of value Company Treasury Costly Cheaper than Equity Varies Little Factors (buy your A/R) Risk versus Return Collections 80% of A/R Company Treasury ~5% over Prime Cheaper than Equity Varies Little Asset Lenders Risk versus Return Balance Sheet 80% of A/R, 60% of inv. Company Treasury Expensive Cheaper than Equity Personal Guarantee Little Partner Companies What You Can Do For Them Synergies Varies Company Treasury May Preclude Other Opportunities 2 -Way Economics, Low Pricing Pressure Little Some Government Agencies Mandates Regulations, Warrants Varies Taxes Paperwork, Oversight Inexpensive, No Recourse Little or None Little Investment Bankers at IPO Fees Stock Market Unlimited Public Costs, Underpricing, Public Disclosure Advice, Public Exposure Escrow, Lock-in Extreme 6 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

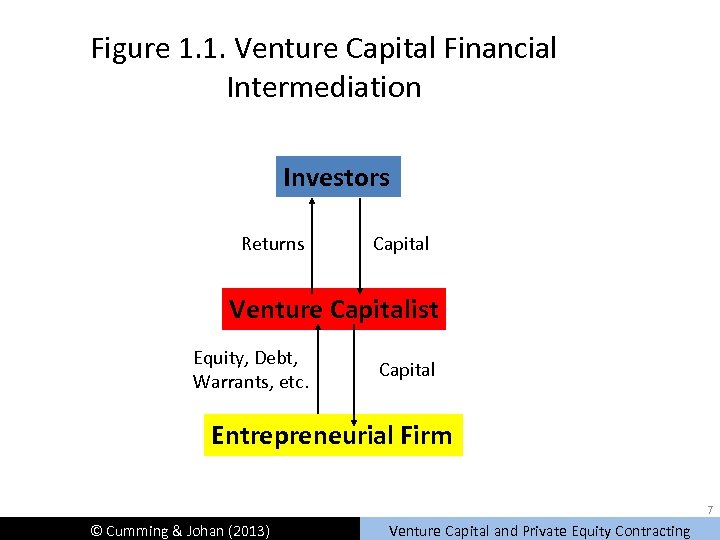

Figure 1. 1. Venture Capital Financial Intermediation Investors Returns Capital Venture Capitalist Equity, Debt, Warrants, etc. Capital Entrepreneurial Firm 7 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 1. Venture Capital Financial Intermediation Investors Returns Capital Venture Capitalist Equity, Debt, Warrants, etc. Capital Entrepreneurial Firm 7 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

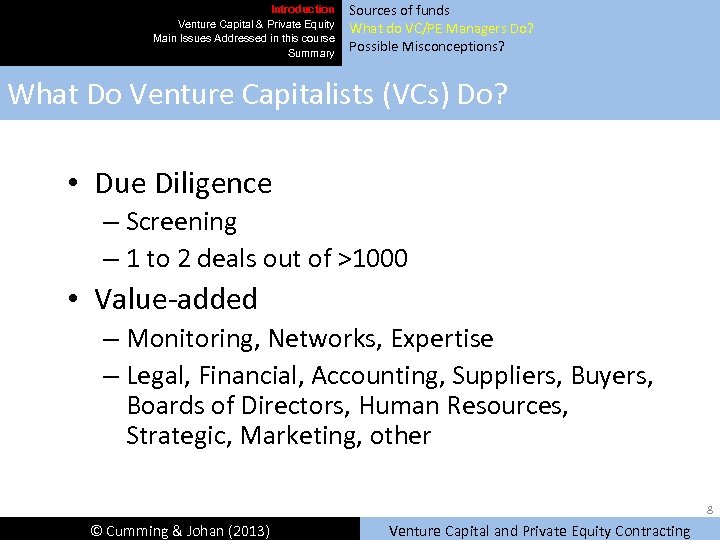

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? What Do Venture Capitalists (VCs) Do? • Due Diligence – Screening – 1 to 2 deals out of >1000 • Value-added – Monitoring, Networks, Expertise – Legal, Financial, Accounting, Suppliers, Buyers, Boards of Directors, Human Resources, Strategic, Marketing, other 8 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? What Do Venture Capitalists (VCs) Do? • Due Diligence – Screening – 1 to 2 deals out of >1000 • Value-added – Monitoring, Networks, Expertise – Legal, Financial, Accounting, Suppliers, Buyers, Boards of Directors, Human Resources, Strategic, Marketing, other 8 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? Possible Misconceptions (? !) • “Vulture” capital: significant ownership and control rights • Insufficient funds • Sell bad investee firms public in initial public offerings (IPOs) 9 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Sources of funds What do VC/PE Managers Do? Possible Misconceptions? Possible Misconceptions (? !) • “Vulture” capital: significant ownership and control rights • Insufficient funds • Sell bad investee firms public in initial public offerings (IPOs) 9 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital and Private Equity Some Definitions 10 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital and Private Equity Some Definitions 10 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

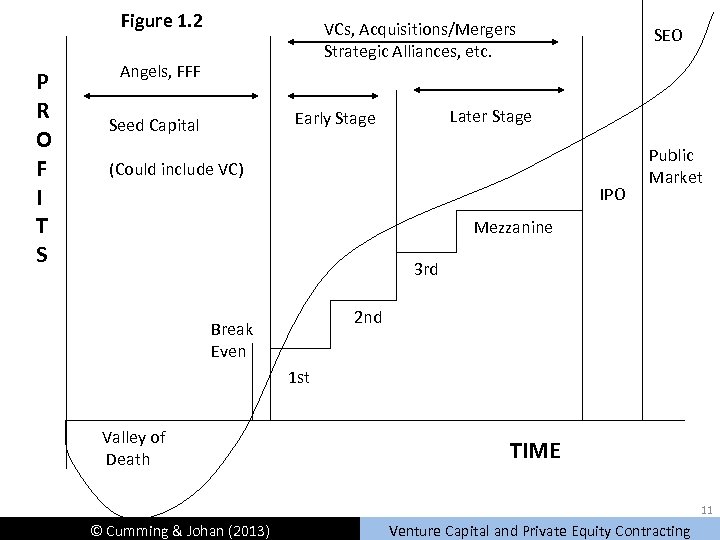

Figure 1. 2 P R O F I T S VCs, Acquisitions/Mergers Strategic Alliances, etc. Angels, FFF Later Stage Early Stage Seed Capital SEO (Could include VC) IPO Public Market Mezzanine 3 rd 2 nd Break Even 1 st Valley of Death TIME 11 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 2 P R O F I T S VCs, Acquisitions/Mergers Strategic Alliances, etc. Angels, FFF Later Stage Early Stage Seed Capital SEO (Could include VC) IPO Public Market Mezzanine 3 rd 2 nd Break Even 1 st Valley of Death TIME 11 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (1/3) • Seed – Financing provided to research, assess and develop an initial concept before a business has reached the start-up phase. • Start-up – Financing provided to companies firms for product development and initial marketing. Companies Firms may be in the process of being set up or may have been in business for a short time, but have not sold their product commercially. • Other Early Stage – Financing to companies firms that have completed the product development stage and require further funds to initiate commercial manufacturing and sales. They will not yet be generating a profit. • Expansion – Financing provided for the growth and expansion of a company firm which is breaking even or trading profitably. Capital may be used to finance increased production capacity, market or product development, and/or to provide additional working capital. 12 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (1/3) • Seed – Financing provided to research, assess and develop an initial concept before a business has reached the start-up phase. • Start-up – Financing provided to companies firms for product development and initial marketing. Companies Firms may be in the process of being set up or may have been in business for a short time, but have not sold their product commercially. • Other Early Stage – Financing to companies firms that have completed the product development stage and require further funds to initiate commercial manufacturing and sales. They will not yet be generating a profit. • Expansion – Financing provided for the growth and expansion of a company firm which is breaking even or trading profitably. Capital may be used to finance increased production capacity, market or product development, and/or to provide additional working capital. 12 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (2/3) • Bridge Financing – • Secondary Purchase / Replacement Capital – • To reduce a company’s firm’s level of gearing. Management Buyout – • Financing made available to an existing business firm which has experienced trading difficulties (firm is not earning its cost of capital (WACC)), with a view to re-establishing prosperity. Refinancing Bank Debt – • Purchase of existing shares in a company firm from another private equity investment organization or from another shareholder or shareholders. Rescue / Turnaround – • Financing made available to a company firm in the period of transition from being privately owned to being publicly quoted. Financing provided to enable current operating management and investors to acquire an existing product line or business. Management Buyin – Financing provided to enable a manager or group of managers from outside the company firm to buyin to the company firm with the support of private equity investors. 13 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (2/3) • Bridge Financing – • Secondary Purchase / Replacement Capital – • To reduce a company’s firm’s level of gearing. Management Buyout – • Financing made available to an existing business firm which has experienced trading difficulties (firm is not earning its cost of capital (WACC)), with a view to re-establishing prosperity. Refinancing Bank Debt – • Purchase of existing shares in a company firm from another private equity investment organization or from another shareholder or shareholders. Rescue / Turnaround – • Financing made available to a company firm in the period of transition from being privately owned to being publicly quoted. Financing provided to enable current operating management and investors to acquire an existing product line or business. Management Buyin – Financing provided to enable a manager or group of managers from outside the company firm to buyin to the company firm with the support of private equity investors. 13 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (3/3) • Venture Purchase of Quoted Shares – Purchase of quoted shares with the purpose of delisting the firm. • Other Purchase of Quoted Shares – Purchase of shares on a public stock market. • In practice, sometimes broader categories of definitions are used. For example, – Start-up: sometimes used in practice to refers to Start-up, and Other Early Stage – Expansion: sometimes used in practice to refers to Expansion, Bridge Financing, Rescue/Turnaround – Replacement Capital: sometimes used in practice to refers to Secondary Purchase/Replacement Capital, Refinancing Bank Debt – Buyouts: sometimes used in practice to refers to Management Buyout, Management Buyin, Venture Purchase of Quoted Shares. 14 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data “Venture Capital” vs “Private Equity” (3/3) • Venture Purchase of Quoted Shares – Purchase of quoted shares with the purpose of delisting the firm. • Other Purchase of Quoted Shares – Purchase of shares on a public stock market. • In practice, sometimes broader categories of definitions are used. For example, – Start-up: sometimes used in practice to refers to Start-up, and Other Early Stage – Expansion: sometimes used in practice to refers to Expansion, Bridge Financing, Rescue/Turnaround – Replacement Capital: sometimes used in practice to refers to Secondary Purchase/Replacement Capital, Refinancing Bank Debt – Buyouts: sometimes used in practice to refers to Management Buyout, Management Buyin, Venture Purchase of Quoted Shares. 14 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

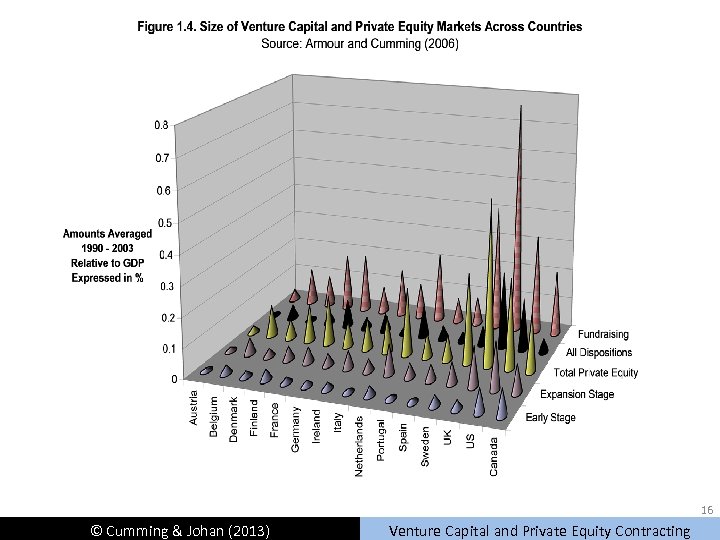

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Size of VC and PE Markets? • VC is a small but important sector of the economy • Connected to: – – IPO markets (stock markets) Legality: shareholder protection, bankruptcy law, tax Government programs Armour and Cumming (2006 Oxford Economic Papers) 15 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Size of VC and PE Markets? • VC is a small but important sector of the economy • Connected to: – – IPO markets (stock markets) Legality: shareholder protection, bankruptcy law, tax Government programs Armour and Cumming (2006 Oxford Economic Papers) 15 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

16 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

16 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

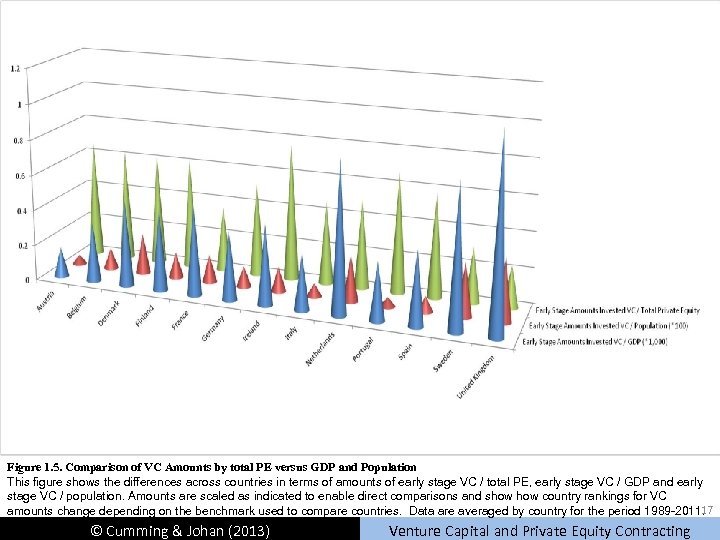

Figure 1. 5. Comparison of VC Amounts by total PE versus GDP and Population This figure shows the differences across countries in terms of amounts of early stage VC / total PE, early stage VC / GDP and early stage VC / population. Amounts are scaled as indicated to enable direct comparisons and show country rankings for VC 17 amounts change depending on the benchmark used to compare countries. Data are averaged by country for the period 1989 -2011. © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 5. Comparison of VC Amounts by total PE versus GDP and Population This figure shows the differences across countries in terms of amounts of early stage VC / total PE, early stage VC / GDP and early stage VC / population. Amounts are scaled as indicated to enable direct comparisons and show country rankings for VC 17 amounts change depending on the benchmark used to compare countries. Data are averaged by country for the period 1989 -2011. © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

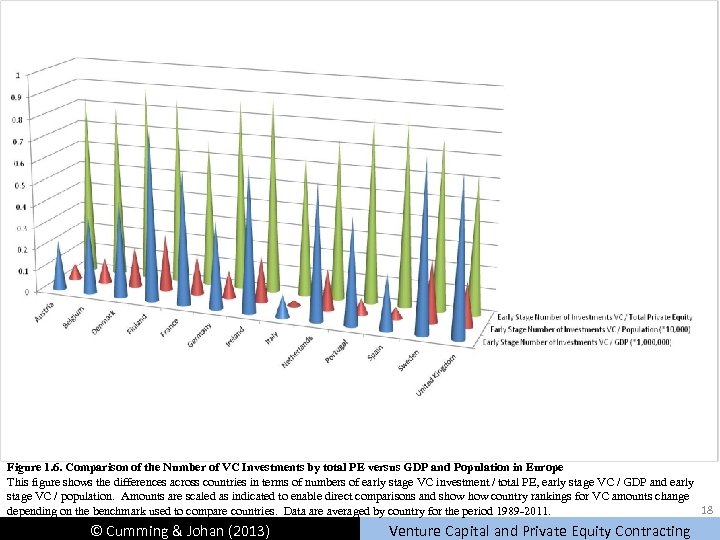

Figure 1. 6. Comparison of the Number of VC Investments by total PE versus GDP and Population in Europe This figure shows the differences across countries in terms of numbers of early stage VC investment / total PE, early stage VC / GDP and early stage VC / population. Amounts are scaled as indicated to enable direct comparisons and show country rankings for VC amounts change 18 depending on the benchmark used to compare countries. Data are averaged by country for the period 1989 -2011. © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 6. Comparison of the Number of VC Investments by total PE versus GDP and Population in Europe This figure shows the differences across countries in terms of numbers of early stage VC investment / total PE, early stage VC / GDP and early stage VC / population. Amounts are scaled as indicated to enable direct comparisons and show country rankings for VC amounts change 18 depending on the benchmark used to compare countries. Data are averaged by country for the period 1989 -2011. © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

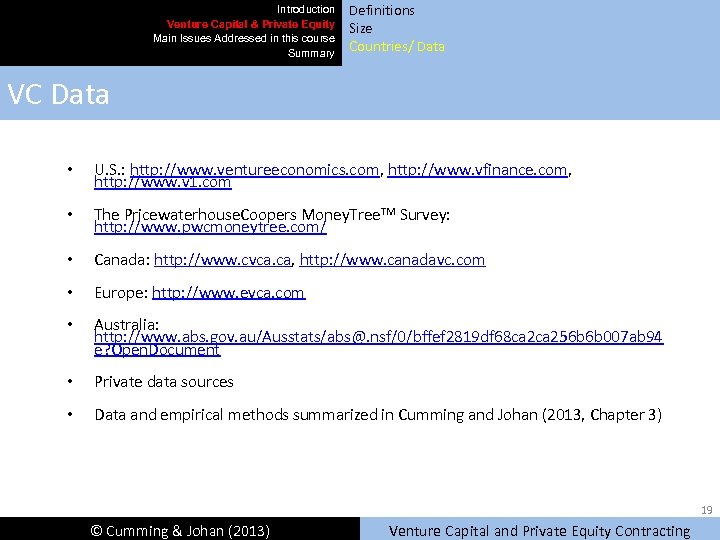

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Data • U. S. : http: //www. ventureeconomics. com, http: //www. vfinance. com, http: //www. v 1. com • The Pricewaterhouse. Coopers Money. Tree. TM Survey: http: //www. pwcmoneytree. com/ • Canada: http: //www. cvca. ca, http: //www. canadavc. com • Europe: http: //www. evca. com • Australia: http: //www. abs. gov. au/Ausstats/abs@. nsf/0/bffef 2819 df 68 ca 256 b 6 b 007 ab 94 e? Open. Document • Private data sources • Data and empirical methods summarized in Cumming and Johan (2013, Chapter 3) 19 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Data • U. S. : http: //www. ventureeconomics. com, http: //www. vfinance. com, http: //www. v 1. com • The Pricewaterhouse. Coopers Money. Tree. TM Survey: http: //www. pwcmoneytree. com/ • Canada: http: //www. cvca. ca, http: //www. canadavc. com • Europe: http: //www. evca. com • Australia: http: //www. abs. gov. au/Ausstats/abs@. nsf/0/bffef 2819 df 68 ca 256 b 6 b 007 ab 94 e? Open. Document • Private data sources • Data and empirical methods summarized in Cumming and Johan (2013, Chapter 3) 19 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Industry in US Over 1000 funds Geographic concentration Specialized focus Over $US 100 billion capital under management • Predominantly Private Limited Partnership VC Funds • • 20 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Industry in US Over 1000 funds Geographic concentration Specialized focus Over $US 100 billion capital under management • Predominantly Private Limited Partnership VC Funds • • 20 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

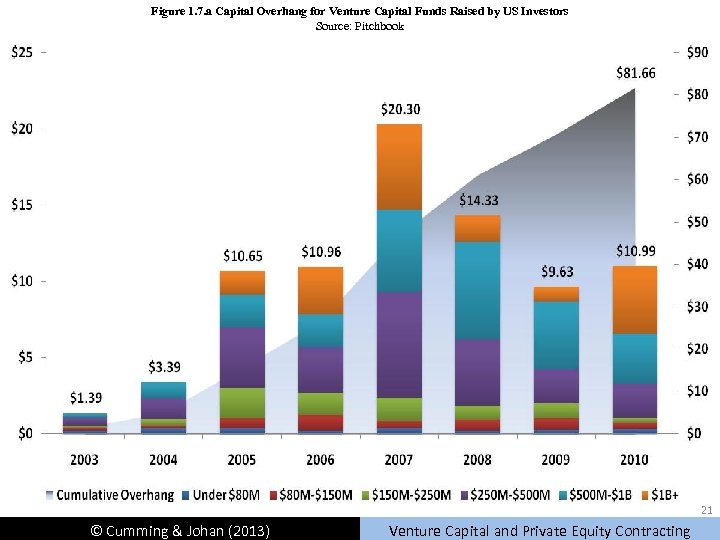

Figure 1. 7. a Capital Overhang for Venture Capital Funds Raised by US Investors Source: Pitchbook 21 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 7. a Capital Overhang for Venture Capital Funds Raised by US Investors Source: Pitchbook 21 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

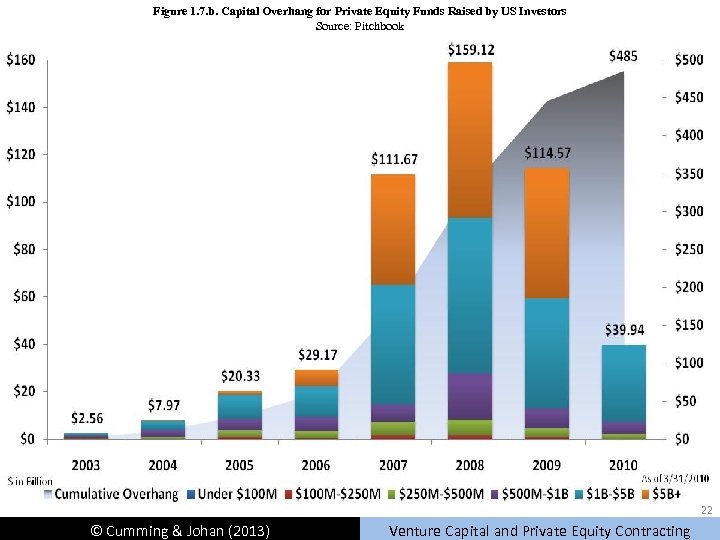

Figure 1. 7. b. Capital Overhang for Private Equity Funds Raised by US Investors Source: Pitchbook 22 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 7. b. Capital Overhang for Private Equity Funds Raised by US Investors Source: Pitchbook 22 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

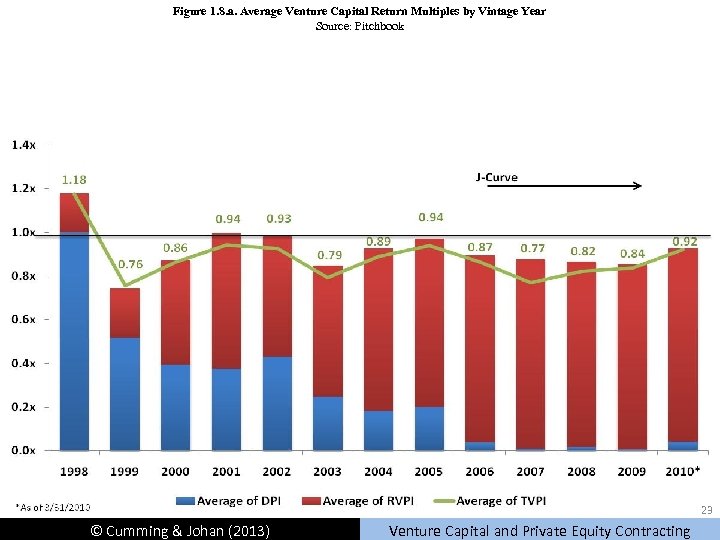

Figure 1. 8. a. Average Venture Capital Return Multiples by Vintage Year Source: Pitchbook 23 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 8. a. Average Venture Capital Return Multiples by Vintage Year Source: Pitchbook 23 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

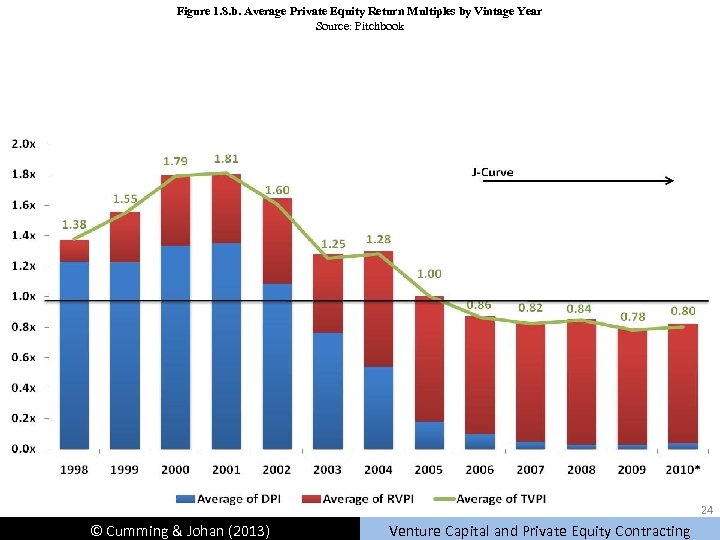

Figure 1. 8. b. Average Private Equity Return Multiples by Vintage Year Source: Pitchbook 24 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 8. b. Average Private Equity Return Multiples by Vintage Year Source: Pitchbook 24 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

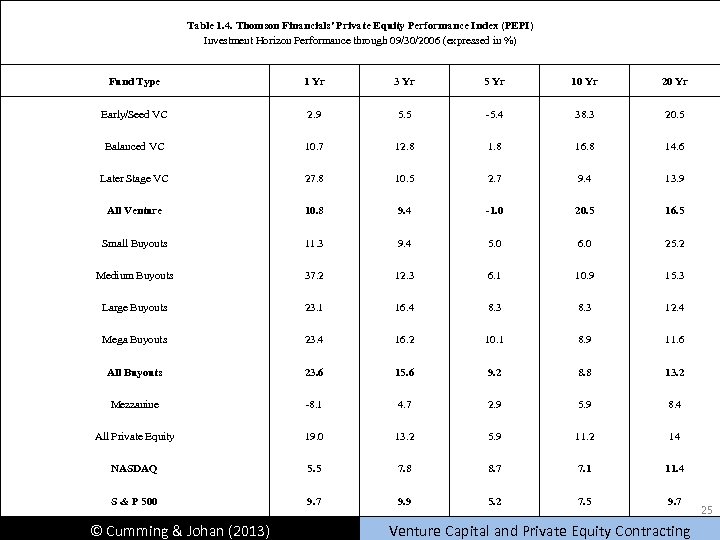

Table 1. 4. Thomson Financials' Private Equity Performance Index (PEPI) Investment Horizon Performance through 09/30/2006 (expressed in %) Fund Type 1 Yr 3 Yr 5 Yr 10 Yr 20 Yr Early/Seed VC 2. 9 5. 5 -5. 4 38. 3 20. 5 Balanced VC 10. 7 12. 8 16. 8 14. 6 Later Stage VC 27. 8 10. 5 2. 7 9. 4 13. 9 All Venture 10. 8 9. 4 -1. 0 20. 5 16. 5 Small Buyouts 11. 3 9. 4 5. 0 6. 0 25. 2 Medium Buyouts 37. 2 12. 3 6. 1 10. 9 15. 3 Large Buyouts 23. 1 16. 4 8. 3 12. 4 Mega Buyouts 23. 4 16. 2 10. 1 8. 9 11. 6 All Buyouts 23. 6 15. 6 9. 2 8. 8 13. 2 Mezzanine -8. 1 4. 7 2. 9 5. 9 8. 4 All Private Equity 19. 0 13. 2 5. 9 11. 2 14 NASDAQ 5. 5 7. 8 8. 7 7. 1 11. 4 S & P 500 9. 7 9. 9 5. 2 7. 5 9. 7 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting 25

Table 1. 4. Thomson Financials' Private Equity Performance Index (PEPI) Investment Horizon Performance through 09/30/2006 (expressed in %) Fund Type 1 Yr 3 Yr 5 Yr 10 Yr 20 Yr Early/Seed VC 2. 9 5. 5 -5. 4 38. 3 20. 5 Balanced VC 10. 7 12. 8 16. 8 14. 6 Later Stage VC 27. 8 10. 5 2. 7 9. 4 13. 9 All Venture 10. 8 9. 4 -1. 0 20. 5 16. 5 Small Buyouts 11. 3 9. 4 5. 0 6. 0 25. 2 Medium Buyouts 37. 2 12. 3 6. 1 10. 9 15. 3 Large Buyouts 23. 1 16. 4 8. 3 12. 4 Mega Buyouts 23. 4 16. 2 10. 1 8. 9 11. 6 All Buyouts 23. 6 15. 6 9. 2 8. 8 13. 2 Mezzanine -8. 1 4. 7 2. 9 5. 9 8. 4 All Private Equity 19. 0 13. 2 5. 9 11. 2 14 NASDAQ 5. 5 7. 8 8. 7 7. 1 11. 4 S & P 500 9. 7 9. 9 5. 2 7. 5 9. 7 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting 25

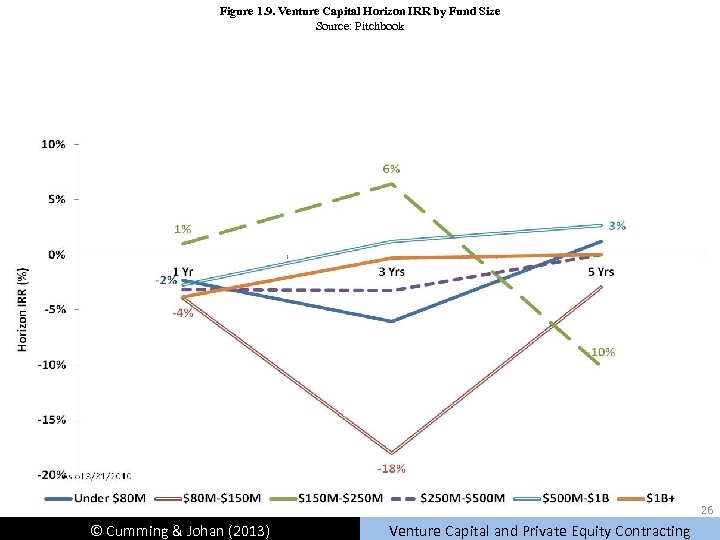

Figure 1. 9. Venture Capital Horizon IRR by Fund Size Source: Pitchbook 26 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 9. Venture Capital Horizon IRR by Fund Size Source: Pitchbook 26 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

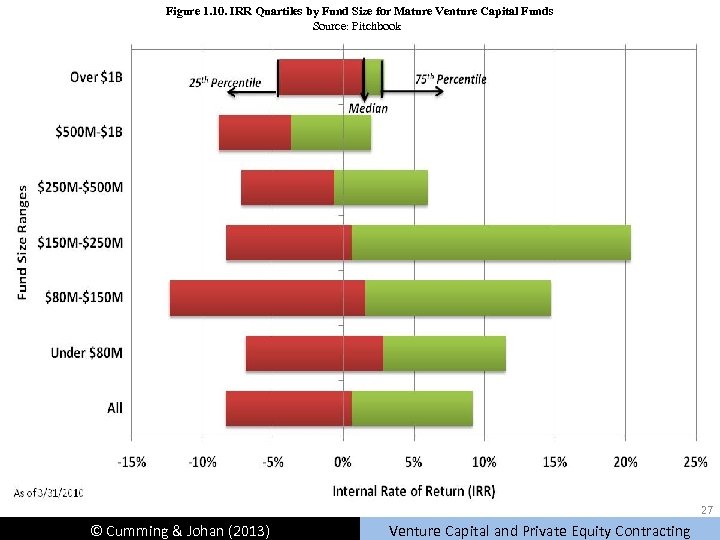

Figure 1. 10. IRR Quartiles by Fund Size for Mature Venture Capital Funds Source: Pitchbook 27 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 10. IRR Quartiles by Fund Size for Mature Venture Capital Funds Source: Pitchbook 27 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

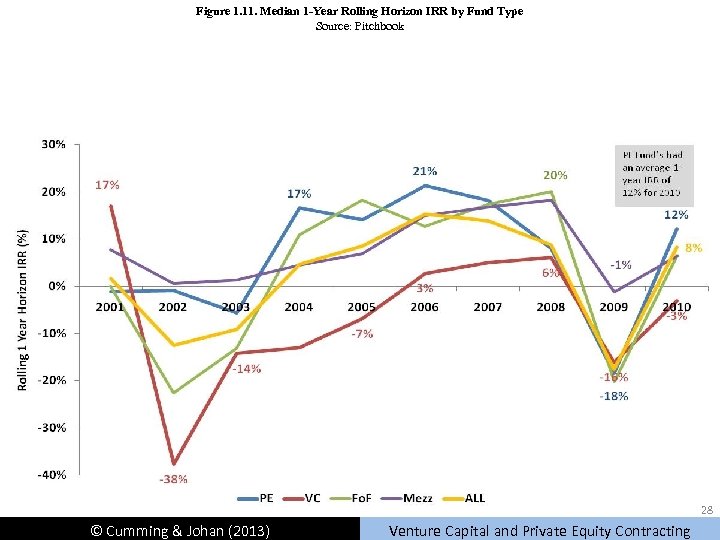

Figure 1. 11. Median 1 -Year Rolling Horizon IRR by Fund Type Source: Pitchbook 28 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 11. Median 1 -Year Rolling Horizon IRR by Fund Type Source: Pitchbook 28 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

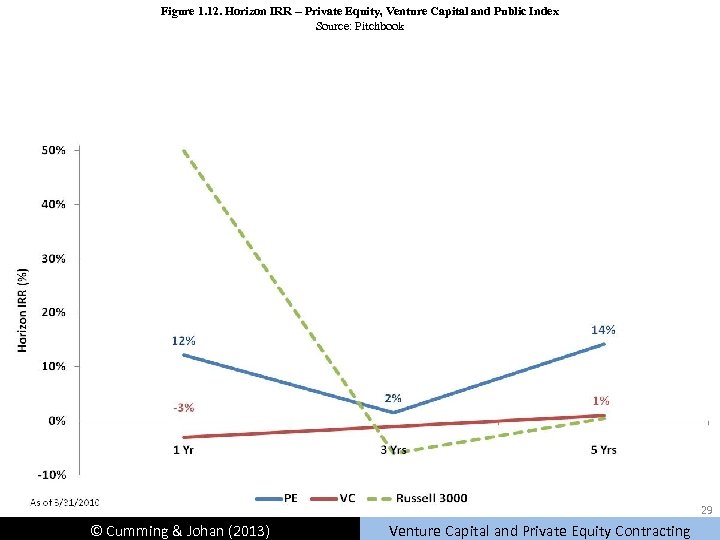

Figure 1. 12. Horizon IRR – Private Equity, Venture Capital and Public Index Source: Pitchbook 29 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 12. Horizon IRR – Private Equity, Venture Capital and Public Index Source: Pitchbook 29 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

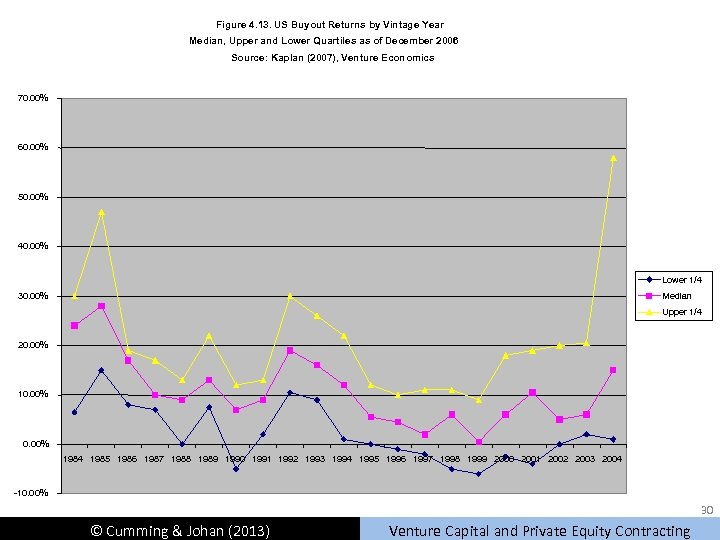

Figure 4. 13. US Buyout Returns by Vintage Year Median, Upper and Lower Quartiles as of December 2006 Source: Kaplan (2007), Venture Economics 70. 00% 60. 00% 50. 00% 40. 00% Lower 1/4 30. 00% Median Upper 1/4 20. 00% 10. 00% 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 -10. 00% 30 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 4. 13. US Buyout Returns by Vintage Year Median, Upper and Lower Quartiles as of December 2006 Source: Kaplan (2007), Venture Economics 70. 00% 60. 00% 50. 00% 40. 00% Lower 1/4 30. 00% Median Upper 1/4 20. 00% 10. 00% 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 -10. 00% 30 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

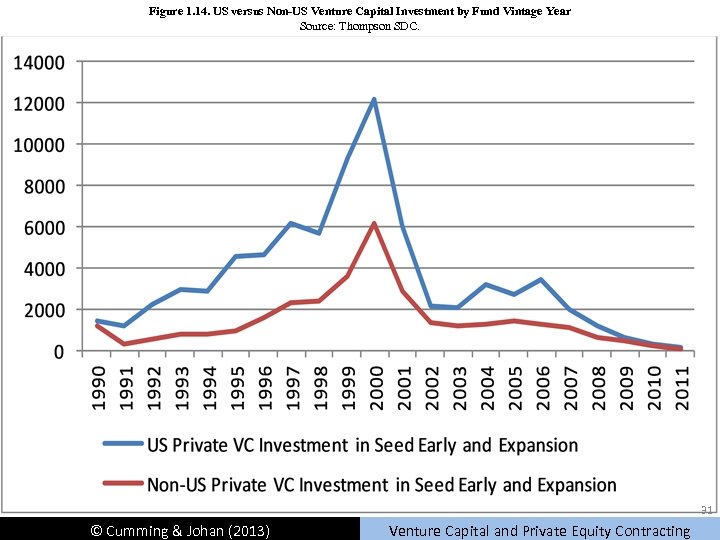

Figure 1. 14. US versus Non-US Venture Capital Investment by Fund Vintage Year Source: Thompson SDC. 31 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 14. US versus Non-US Venture Capital Investment by Fund Vintage Year Source: Thompson SDC. 31 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

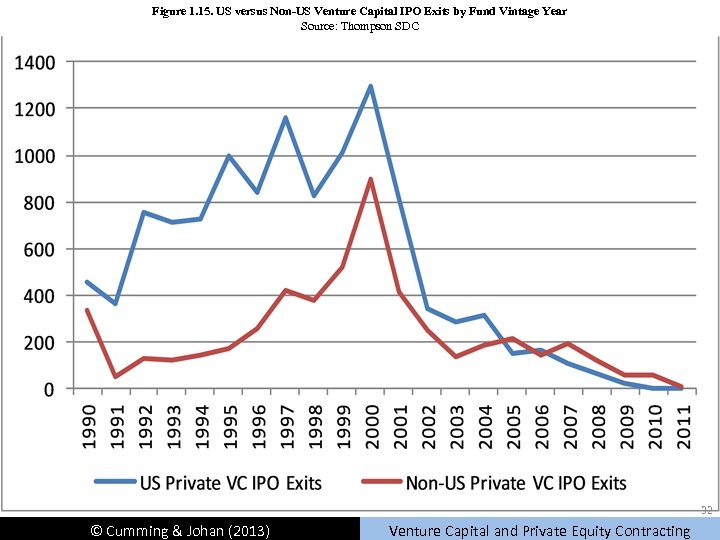

Figure 1. 15. US versus Non-US Venture Capital IPO Exits by Fund Vintage Year Source: Thompson SDC 32 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Figure 1. 15. US versus Non-US Venture Capital IPO Exits by Fund Vintage Year Source: Thompson SDC 32 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

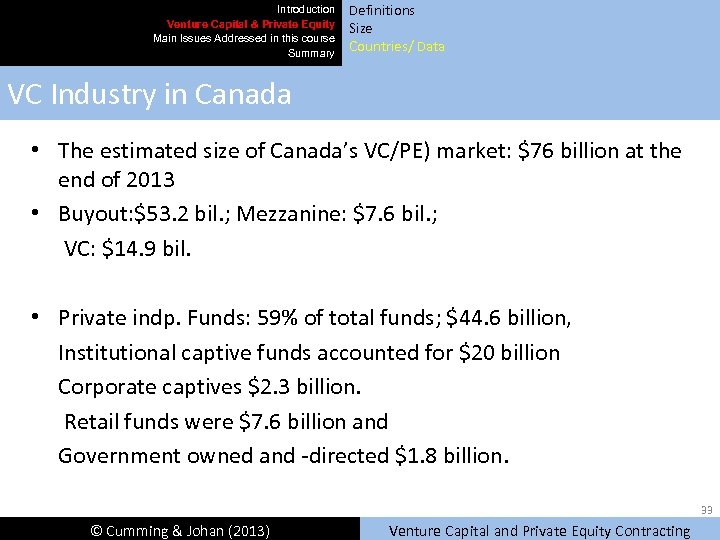

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Industry in Canada • The estimated size of Canada’s VC/PE) market: $76 billion at the end of 2013 • Buyout: $53. 2 bil. ; Mezzanine: $7. 6 bil. ; VC: $14. 9 bil. • Private indp. Funds: 59% of total funds; $44. 6 billion, Institutional captive funds accounted for $20 billion Corporate captives $2. 3 billion. Retail funds were $7. 6 billion and Government owned and -directed $1. 8 billion. 33 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data VC Industry in Canada • The estimated size of Canada’s VC/PE) market: $76 billion at the end of 2013 • Buyout: $53. 2 bil. ; Mezzanine: $7. 6 bil. ; VC: $14. 9 bil. • Private indp. Funds: 59% of total funds; $44. 6 billion, Institutional captive funds accounted for $20 billion Corporate captives $2. 3 billion. Retail funds were $7. 6 billion and Government owned and -directed $1. 8 billion. 33 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital in Australia Table 1: Amount of Funds Raised by Fiscal Year, Australia (in A$ Millions) Year Venture Capital Private Equity TOTAL FY 2001 325. 50 585. 20 910. 70 FY 2002 55. 60 780. 40 836. 00 FY 2003 161. 70 521. 70 683. 40 FY 2004 155. 30 863. 20 1, 018. 50 FY 2005 84. 30 2, 094. 60 2, 178. 90 FY 2006 184. 70 3, 933. 60 4, 118. 30 FY 2007 435. 60 4, 951. 90 5, 387. 50 FY 2008 343. 60 5, 581. 70 5, 925. 30 FY 2013 298. 92 1, 412. 31 1, 711. 23 FY 2010 168. 28 1, 456. 07 1, 624. 35 34 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital in Australia Table 1: Amount of Funds Raised by Fiscal Year, Australia (in A$ Millions) Year Venture Capital Private Equity TOTAL FY 2001 325. 50 585. 20 910. 70 FY 2002 55. 60 780. 40 836. 00 FY 2003 161. 70 521. 70 683. 40 FY 2004 155. 30 863. 20 1, 018. 50 FY 2005 84. 30 2, 094. 60 2, 178. 90 FY 2006 184. 70 3, 933. 60 4, 118. 30 FY 2007 435. 60 4, 951. 90 5, 387. 50 FY 2008 343. 60 5, 581. 70 5, 925. 30 FY 2013 298. 92 1, 412. 31 1, 711. 23 FY 2010 168. 28 1, 456. 07 1, 624. 35 34 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

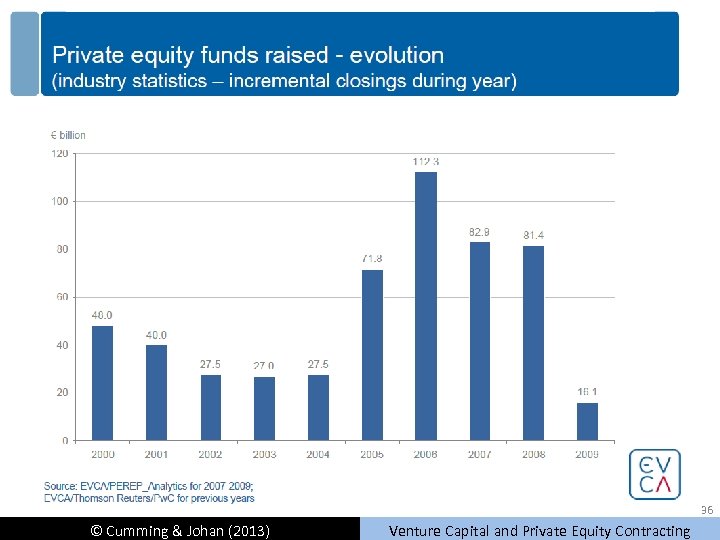

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital in Europe • Fundraising by European private equity houses reached € 16 bn in 2013, 80% below the € 81 bn raised in 2008 35 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Definitions Size Countries/ Data Venture Capital in Europe • Fundraising by European private equity houses reached € 16 bn in 2013, 80% below the € 81 bn raised in 2008 35 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

36 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

36 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Main Issues addressed in this Course [Not a comprehensive list] 37 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Main Issues addressed in this Course [Not a comprehensive list] 37 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? I. Why Do VCs Exist? • Why not simply borrow from banks? • What does this imply about any theory / evidence in venture capital? – Review agency theory in detail because it is paramount to all issues addressed in this course – Cumming and Johan (2013 Chapter 2) 38 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? I. Why Do VCs Exist? • Why not simply borrow from banks? • What does this imply about any theory / evidence in venture capital? – Review agency theory in detail because it is paramount to all issues addressed in this course – Cumming and Johan (2013 Chapter 2) 38 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (1/6) • What do institutional investors care about? – Return expectations, Reporting, Liquidity • How does this affect fundraising? • How does this affect specialized fund mandates, such as socially responsible funds? – Cumming and Johan (2013, Chapter 4) 39 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (1/6) • What do institutional investors care about? – Return expectations, Reporting, Liquidity • How does this affect fundraising? • How does this affect specialized fund mandates, such as socially responsible funds? – Cumming and Johan (2013, Chapter 4) 39 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (2/6) • What terms with institutional investors? – Limited partnership agreements – Restrictive covenants – Limited liability – What clauses to use and when to use them – Cumming and Johan (2013, Chapter 5) 40 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (2/6) • What terms with institutional investors? – Limited partnership agreements – Restrictive covenants – Limited liability – What clauses to use and when to use them – Cumming and Johan (2013, Chapter 5) 40 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (3/6) • How to structure compensation? – Fixed fees – Carried interest – Cash versus share distributions – Clawbacks – Cumming and Johan (2013, Chapter 6) 41 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (3/6) • How to structure compensation? – Fixed fees – Carried interest – Cash versus share distributions – Clawbacks – Cumming and Johan (2013, Chapter 6) 41 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (4/6) • Style Drift – Why and when should institutional investors care? – Why and when does it matter to fund managers? – Cumming and Johan (2013, Chapter 7) 42 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (4/6) • Style Drift – Why and when should institutional investors care? – Why and when does it matter to fund managers? – Cumming and Johan (2013, Chapter 7) 42 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (5/6) • Listed private equity (LPE) – What are the differences between LPE and limited partnerships? – Who invests in LPE, and when and why? – Cumming and Johan (2013, Chapter 8) 43 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (5/6) • Listed private equity (LPE) – What are the differences between LPE and limited partnerships? – Who invests in LPE, and when and why? – Cumming and Johan (2013, Chapter 8) 43 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (6/6) • What role for government? – Existence of capital gaps? – Economic sources of capital gaps – Legal sources of capital gaps – Direct government investment programs – Legislation – Evidence from US, UK, Continental Europe, Israel, Australia, Canada – Cumming and Johan (2013, Chapter 9) 44 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? II. What Matters in Running a Fund? (6/6) • What role for government? – Existence of capital gaps? – Economic sources of capital gaps – Legal sources of capital gaps – Direct government investment programs – Legislation – Evidence from US, UK, Continental Europe, Israel, Australia, Canada – Cumming and Johan (2013, Chapter 9) 44 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (1/4) • Investment process – – – Due diligence Stage of development and industry Location Staging Fund flows and valuations Syndication Portfolio size / manager Board seats Contracts Innovative activity Investment duration Cumming and Johan (2013, Chapter 10) 45 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (1/4) • Investment process – – – Due diligence Stage of development and industry Location Staging Fund flows and valuations Syndication Portfolio size / manager Board seats Contracts Innovative activity Investment duration Cumming and Johan (2013, Chapter 10) 45 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (2/4) • What structure of investment? – Security design • Warrants • Common equity • Preferred equity • Convertible preferred equity • Convertible debt • Debt – Other veto and control rights – Cumming and Johan (2013, Chapter 11) 46 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (2/4) • What structure of investment? – Security design • Warrants • Common equity • Preferred equity • Convertible preferred equity • Convertible debt • Debt – Other veto and control rights – Cumming and Johan (2013, Chapter 11) 46 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (3/4) • Specific veto, control and cash flow rights – Definitions and terms – Role of preplanned exits – Cumming and Johan (2013 Chapter 12) 47 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (3/4) • Specific veto, control and cash flow rights – Definitions and terms – Role of preplanned exits – Cumming and Johan (2013 Chapter 12) 47 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (4/4) • International differences in contracts, due diligence, board seats, syndication, coinvestment – Role of legal systems – Cumming and Johan (2013, Chapter 13) 48 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? III. Financial Contracting with Entrepreneurs (4/4) • International differences in contracts, due diligence, board seats, syndication, coinvestment – Role of legal systems – Cumming and Johan (2013, Chapter 13) 48 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (1/4) • VC and PE Value-Added – Jobs – Total Factor Productivity – Patents – Locusts? – Cumming and Johan (2013 Chapter 14) 49 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (1/4) • VC and PE Value-Added – Jobs – Total Factor Productivity – Patents – Locusts? – Cumming and Johan (2013 Chapter 14) 49 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (2/4) • Do contracts ensure effort? – Advice – Monitoring – Conflicts – When more pronounced – Role for contracts in facilitating effort and mitigating problems – Cumming and Johan (2013 Chapter 15) 50 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (2/4) • Do contracts ensure effort? – Advice – Monitoring – Conflicts – When more pronounced – Role for contracts in facilitating effort and mitigating problems – Cumming and Johan (2013 Chapter 15) 50 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (3/4) • Where to invest? – Distance between investor and investee in the US – Inter- versus intra-provincial in Canada – Implications of proximity and local bias – Cumming and Johan (2013 Chapter 16) 51 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (3/4) • Where to invest? – Distance between investor and investee in the US – Inter- versus intra-provincial in Canada – Implications of proximity and local bias – Cumming and Johan (2013 Chapter 16) 51 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (4/4) • How many investments? • Portfolio size/manager – Trade-off: • Diversification • Diffusion in effort – Cumming and Johan (2013 Chapter 17) 52 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (4/4) • How many investments? • Portfolio size/manager – Trade-off: • Diversification • Diffusion in effort – Cumming and Johan (2013 Chapter 17) 52 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (4/4) • Fund size – Scale economies versus limited attention – Cumming and Johan (2013 Chapter 18) 53 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? IV. Investor Value-Added (4/4) • Fund size – Scale economies versus limited attention – Cumming and Johan (2013 Chapter 18) 53 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (1/4) • Overview of divestment process – Exit vehicle • IPO, Acquisition, Secondary sale, Buyback, Write-off • Issues with IPOs – IPO short-term underpricing, long-term overpricing – Impact of venture capital backing – Cumming and Johan (2013 Chapter 19) 54 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (1/4) • Overview of divestment process – Exit vehicle • IPO, Acquisition, Secondary sale, Buyback, Write-off • Issues with IPOs – IPO short-term underpricing, long-term overpricing – Impact of venture capital backing – Cumming and Johan (2013 Chapter 19) 54 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (2/4) • Investment Duration – How long to invest – Economic conditions versus fund and investee characteristics – Cumming and Johan (2013 Chapter 20) 55 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (2/4) • Investment Duration – How long to invest – Economic conditions versus fund and investee characteristics – Cumming and Johan (2013 Chapter 20) 55 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (3/4) • Which exit vehicle? – Market conditions – Legal conditions – Fund characteristics – Investee firm characteristics – Allocation of control rights – Cumming and Johan (2013 Chapters 21) 56 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (3/4) • Which exit vehicle? – Market conditions – Legal conditions – Fund characteristics – Investee firm characteristics – Allocation of control rights – Cumming and Johan (2013 Chapters 21) 56 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (4/4) • Returns, Valuation and Disclosure – Mechanics of valuation – What enhances returns? – How to make adjustments with valuations based on return expectations? – How to disclose valuations of unexited investments to institutional investors? – Cumming and Johan (2013 Chapter 22) 57 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary Why do VCs exist? What matters when running a fund? Financial contracting with entrepreneurs Investor Value-Added How to Successfully Divest? V. How to Successfully Divest? (4/4) • Returns, Valuation and Disclosure – Mechanics of valuation – What enhances returns? – How to make adjustments with valuations based on return expectations? – How to disclose valuations of unexited investments to institutional investors? – Cumming and Johan (2013 Chapter 22) 57 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary • VC/PE unique form of financing • Idiosyncratic risk matters • Contracts matter – Fund structures: relations with limited partners – Public policy and design of statutes – Relations between investors and entrepreneurs – Exits, Returns, Valuations, Disclosure 58 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting

Introduction Venture Capital & Private Equity Main Issues Addressed in this course Summary • VC/PE unique form of financing • Idiosyncratic risk matters • Contracts matter – Fund structures: relations with limited partners – Public policy and design of statutes – Relations between investors and entrepreneurs – Exits, Returns, Valuations, Disclosure 58 © Cumming & Johan (2013) Venture Capital and Private Equity Contracting