b0c2e964368abc2344dd00b9c6026ece.ppt

- Количество слайдов: 48

Value for Customers Valuing Customers ² Measuring value for customers ² Measuring value of customers (CLV) ² Targeting based on customer value

Quotes for the Day Anyone can measure the number of seeds in an apple. Who can measure the number of apples in a seed? --Anon Price is an observable description of a state of the market. Customer value is the hidden source of ideas about what to do to make a market more profitable for the business. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 2

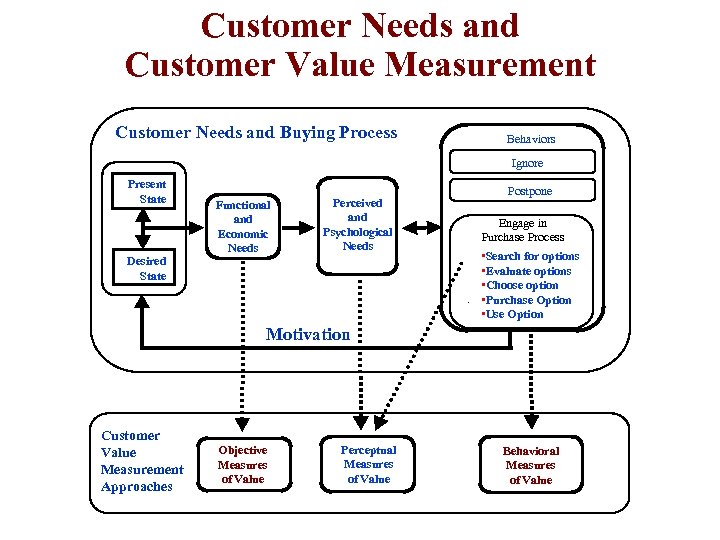

Customer Needs and Customer Value Measurement Customer Needs and Buying Process Behaviors Ignore Present State Desired State Functional and Economic Needs Postpone Perceived and Psychological Needs Engage in Purchase Process · • Search for options • Evaluate options • Choose option • Purchase Option • Use Option Motivation Customer Value Measurement Approaches Objective Measures of Value Perceptual Measures of Value Behavioral Measures of Value

Definition of Objective Customer Value The hypothetical price for a supplier’s offering at which a particular customer would be at overall economic break-even relative to the best alternative available to that customer for performing a set of functions. This approach to measuring customer value is typically useful in B 2 B situations. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 4

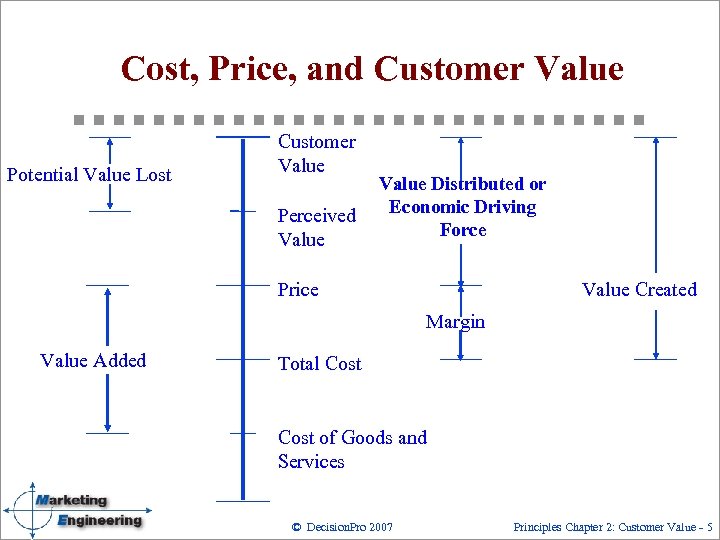

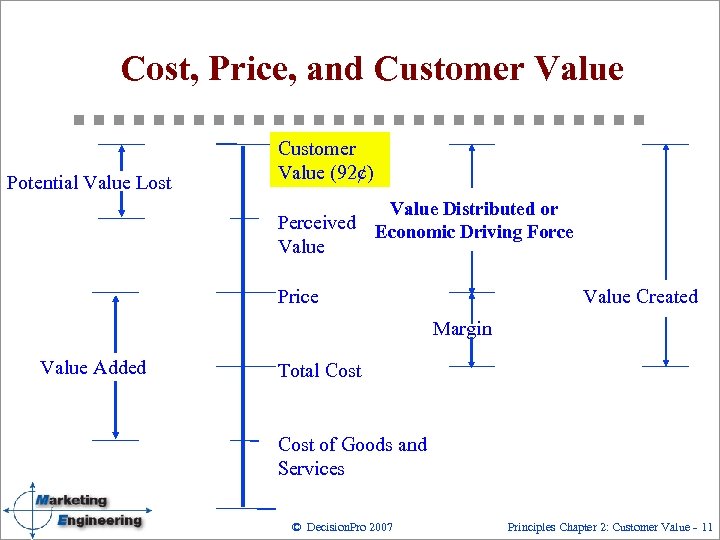

Cost, Price, and Customer Value Potential Value Lost Customer Value Perceived Value Distributed or Economic Driving Force Value Created Price Margin Value Added Total Cost of Goods and Services © Decision. Pro 2007 Principles Chapter 2: Customer Value - 5

An Example… Steel Manufacturer develops new “Rapid. Form” steel for a muffler application: ² Reduces Scrap ² Runs Faster …Than the “Incumbent” – High Carbon Steel. What is the value-in-use of Rapid. Form in this application for this customer? © Decision. Pro 2007 Principles Chapter 2: Customer Value - 6

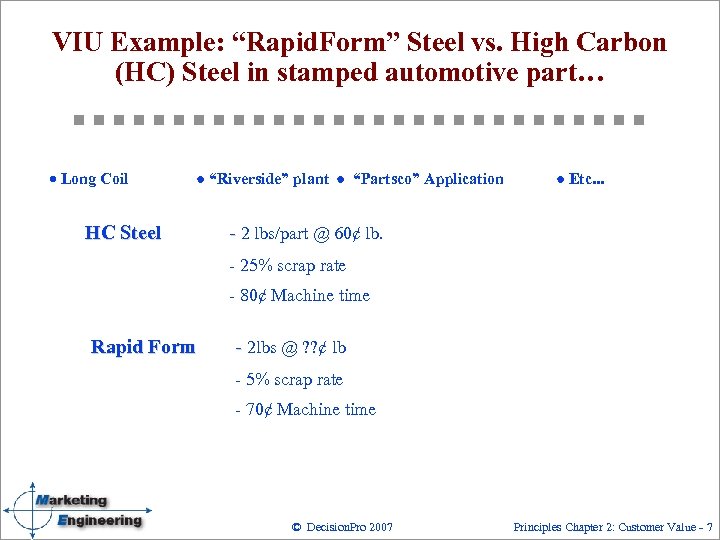

VIU Example: “Rapid. Form” Steel vs. High Carbon (HC) Steel in stamped automotive part… Long Coil HC Steel “Riverside” plant “Partsco” Application Etc. . . - 2 lbs/part @ 60¢ lb. - 25% scrap rate - 80¢ Machine time Rapid Form - 2 lbs @ ? ? ¢ lb - 5% scrap rate - 70¢ Machine time © Decision. Pro 2007 Principles Chapter 2: Customer Value - 7

Original Rapid. Form Pricing ² It cost very little more to make Rapid. Form ² And H-C sells for $0. 60/lb ² Let’s try $0. 70/lb ² They’ll buy at $0. 68/lb ² We’ll make a bundle… © Decision. Pro 2007 Principles Chapter 2: Customer Value - 8

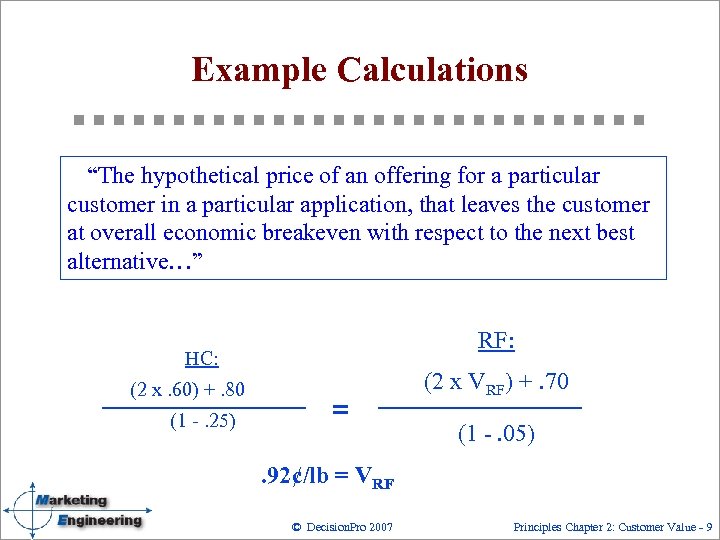

Example Calculations “The hypothetical price of an offering for a particular customer in a particular application, that leaves the customer at overall economic breakeven with respect to the next best alternative…” RF: HC: (2 x. 60) +. 80 (1 -. 25) = (2 x VRF) +. 70 (1 -. 05) . 92¢/lb = VRF © Decision. Pro 2007 Principles Chapter 2: Customer Value - 9

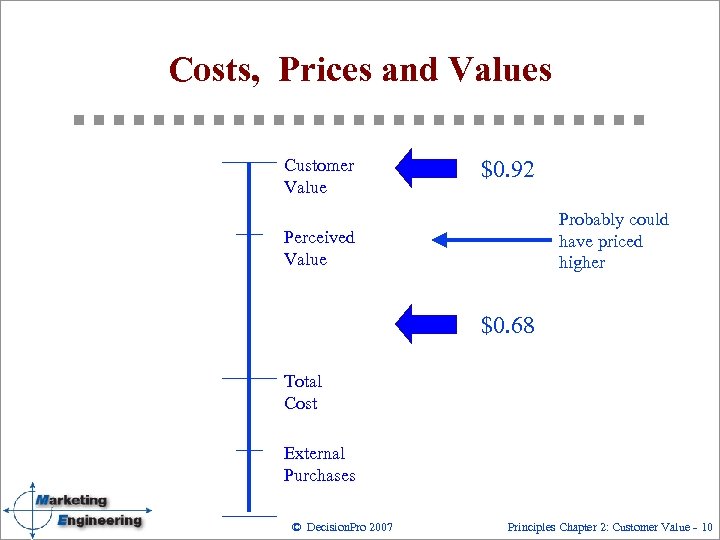

Costs, Prices and Values Customer Value $0. 92 Probably could have priced higher Perceived Value $0. 68 Total Cost External Purchases © Decision. Pro 2007 Principles Chapter 2: Customer Value - 10

Cost, Price, and Customer Value Potential Value Lost Customer Value (92¢) Value Distributed or Perceived Economic Driving Force Value Created Price Margin Value Added Total Cost of Goods and Services © Decision. Pro 2007 Principles Chapter 2: Customer Value - 11

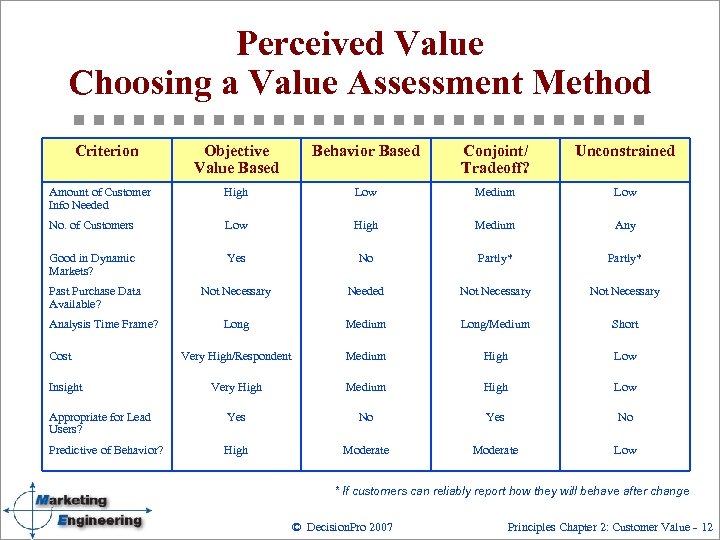

Perceived Value Choosing a Value Assessment Method Criterion Objective Value Based Behavior Based Conjoint/ Tradeoff? Unconstrained Amount of Customer Info Needed High Low Medium Low No. of Customers Low High Medium Any Good in Dynamic Markets? Yes No Partly* Past Purchase Data Available? Not Necessary Needed Not Necessary Long Medium Long/Medium Short Very High/Respondent Medium High Low Very High Medium High Low Appropriate for Lead Users? Yes No Predictive of Behavior? High Moderate Low Analysis Time Frame? Cost Insight * If customers can reliably report how they will behave after change © Decision. Pro 2007 Principles Chapter 2: Customer Value - 12

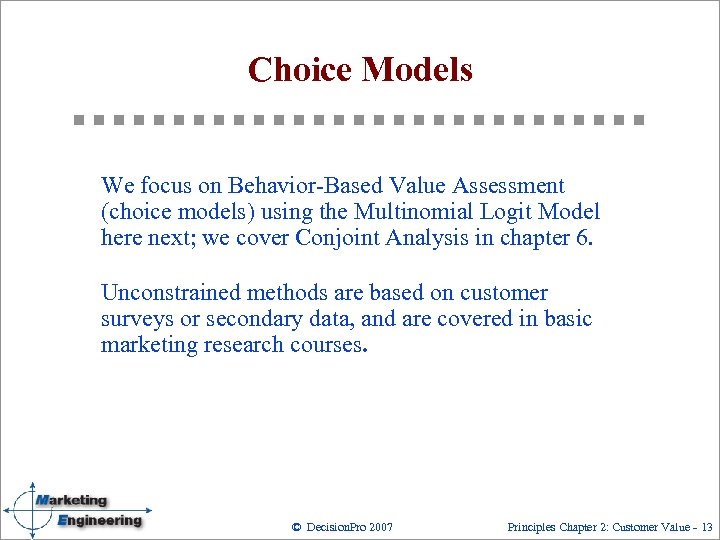

Choice Models We focus on Behavior-Based Value Assessment (choice models) using the Multinomial Logit Model here next; we cover Conjoint Analysis in chapter 6. Unconstrained methods are based on customer surveys or secondary data, and are covered in basic marketing research courses. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 13

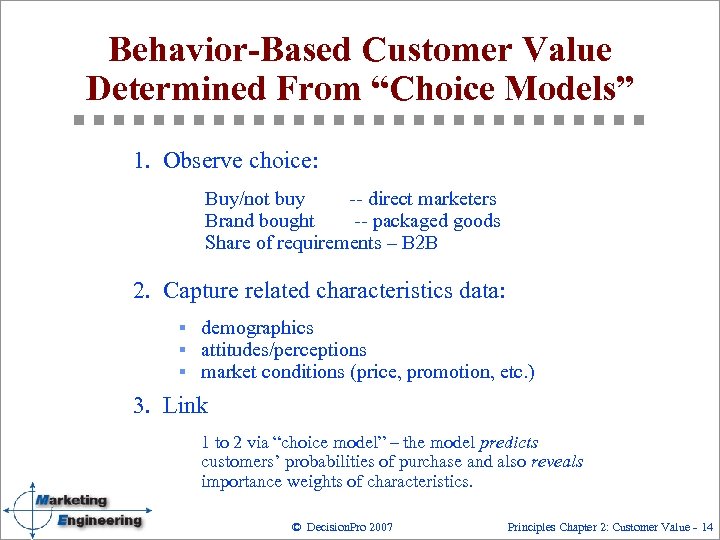

Behavior-Based Customer Value Determined From “Choice Models” 1. Observe choice: Buy/not buy -- direct marketers Brand bought -- packaged goods Share of requirements – B 2 B 2. Capture related characteristics data: § demographics § attitudes/perceptions § market conditions (price, promotion, etc. ) 3. Link 1 to 2 via “choice model” – the model predicts customers’ probabilities of purchase and also reveals importance weights of characteristics. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 14

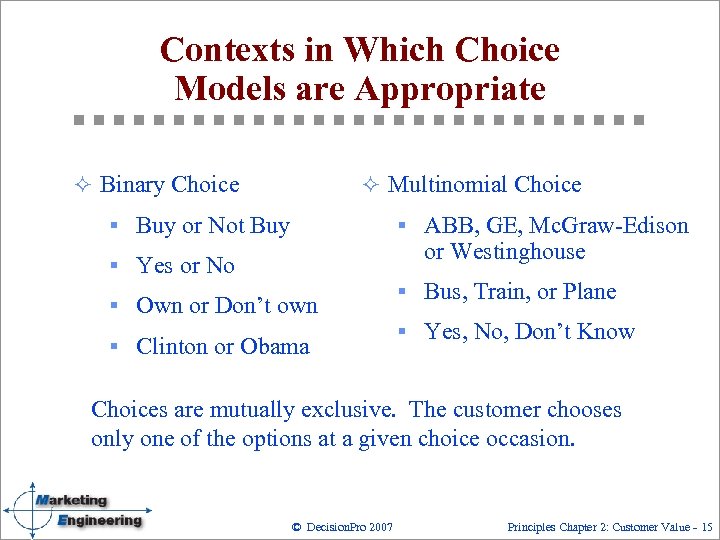

Contexts in Which Choice Models are Appropriate ² Binary Choice ² Multinomial Choice § Buy or Not Buy § ABB, GE, Mc. Graw-Edison or Westinghouse § Yes or No § Own or Don’t own § Clinton or Obama § Bus, Train, or Plane § Yes, No, Don’t Know Choices are mutually exclusive. The customer chooses only one of the options at a given choice occasion. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 15

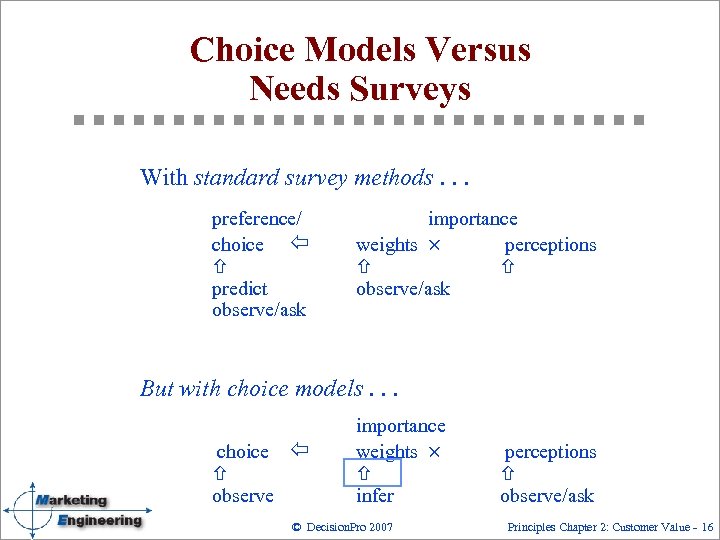

Choice Models Versus Needs Surveys With standard survey methods. . . preference/ choice ï ñ predict observe/ask importance weights perceptions ñ ñ observe/ask But with choice models. . . choice ñ observe ï importance weights ñ infer © Decision. Pro 2007 perceptions ñ observe/ask Principles Chapter 2: Customer Value - 16

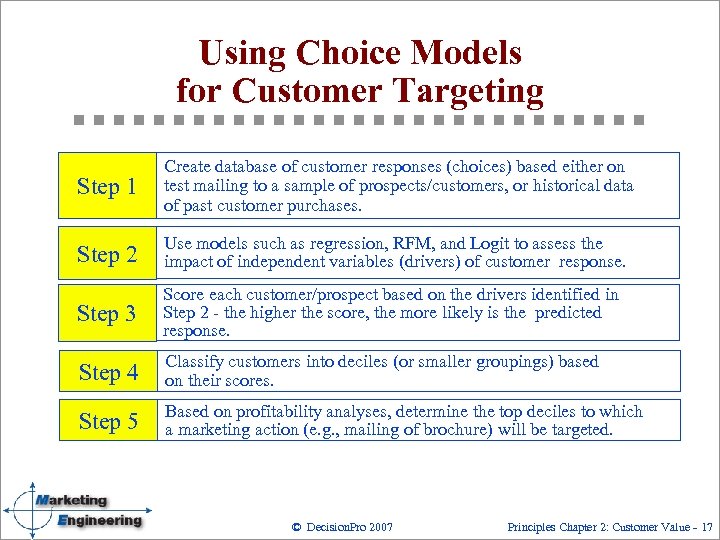

Using Choice Models for Customer Targeting Step 1 Create database of customer responses (choices) based either on test mailing to a sample of prospects/customers, or historical data of past customer purchases. Step 2 Use models such as regression, RFM, and Logit to assess the impact of independent variables (drivers) of customer response. Step 3 Score each customer/prospect based on the drivers identified in Step 2 - the higher the score, the more likely is the predicted response. Step 4 Classify customers into deciles (or smaller groupings) based on their scores. Step 5 Based on profitability analyses, determine the top deciles to which a marketing action (e. g. , mailing of brochure) will be targeted. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 17

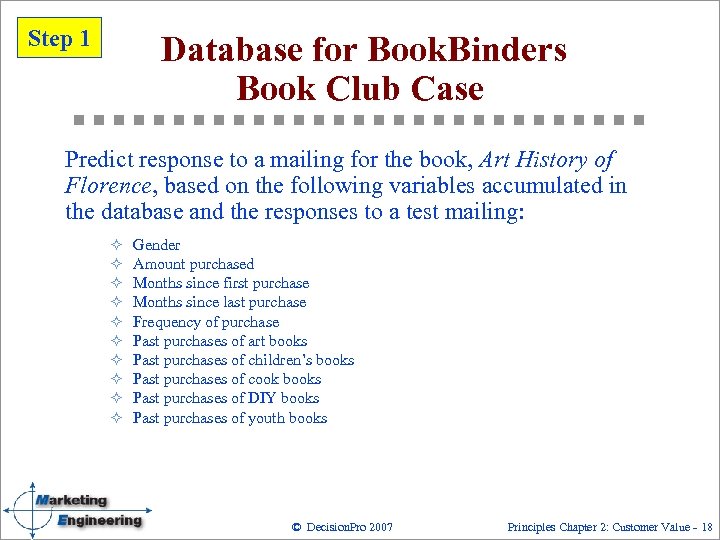

Step 1 Database for Book. Binders Book Club Case Predict response to a mailing for the book, Art History of Florence, based on the following variables accumulated in the database and the responses to a test mailing: ² ² ² ² ² Gender Amount purchased Months since first purchase Months since last purchase Frequency of purchase Past purchases of art books Past purchases of children’s books Past purchases of cook books Past purchases of DIY books Past purchases of youth books © Decision. Pro 2007 Principles Chapter 2: Customer Value - 18

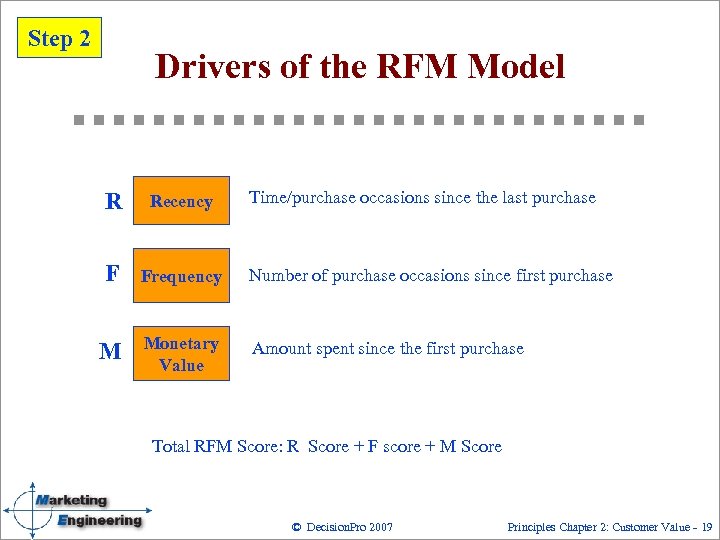

Step 2 Drivers of the RFM Model Time/purchase occasions since the last purchase R Recency F Frequency Number of purchase occasions since first purchase M Monetary Value Amount spent since the first purchase Total RFM Score: R Score + F score + M Score © Decision. Pro 2007 Principles Chapter 2: Customer Value - 19

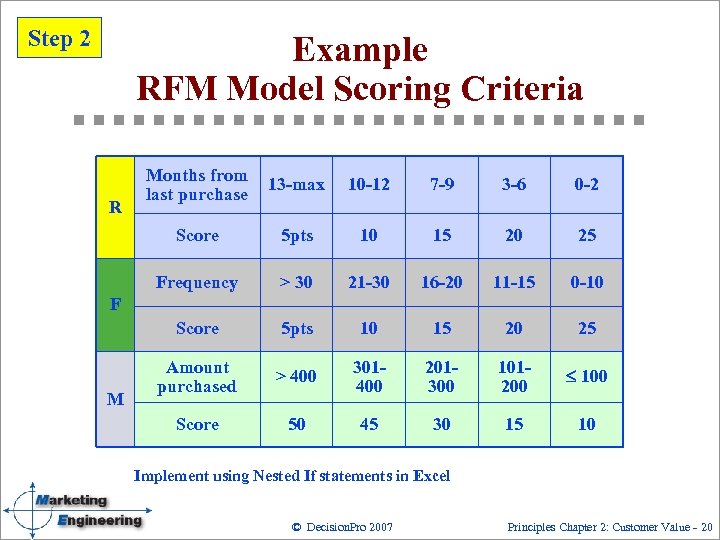

Step 2 Example RFM Model Scoring Criteria 13 -max 10 -12 7 -9 3 -6 0 -2 Score 5 pts 10 15 20 25 Frequency > 30 21 -30 16 -20 11 -15 0 -10 Score R Months from last purchase 5 pts 10 15 20 25 Amount purchased > 400 301400 201300 101200 100 Score 50 45 30 15 10 F M Implement using Nested If statements in Excel © Decision. Pro 2007 Principles Chapter 2: Customer Value - 20

Step 2 Computing Scores Based on Regression Run regression model to predict probability of purchase: Probability of Choice (0 or 1) = a 0 +a 1 x Gender+a 2 x Income +… Note that predicted choice probabilities from the regression model need not necessarily lie between 0 and 1, although most of the probabilities will fall in that range. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 21

Step 2 The Customer Choice (Logit) Model in MEXL The primary objective of the model is to predict the probabilities that the individual will choose each of several choice alternatives. The model has the following properties: ² The probabilities lie between 0 and 1, and sum to 1. ² The model is consistent with the proposition that customers pick the choice alternative that offers them the highest utility on a purchase occasion, but the utility has a random component that varies from one purchase occasion to the next. ² The model has the proportional draw property -- each choice alternative draws from other choice alternatives in proportion to their utility. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 22

Step 2 Logit Model of Response to Direct Mail Probability of behavior, responding to = effort, direct mail characteristics of solicitation function of (past response marketing customers) © Decision. Pro 2007 Principles Chapter 2: Customer Value - 23

Step 2 The Multinomial Logit Model Purchase probability (Product A) = Utility of A Sum of Utilities of other alternatives Where… Utility(Product A)= (a function of) a 0 + a 1 x Rating of A on attribute 1+ a 2 x Rating of A on attribute 2+ + etc. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 24

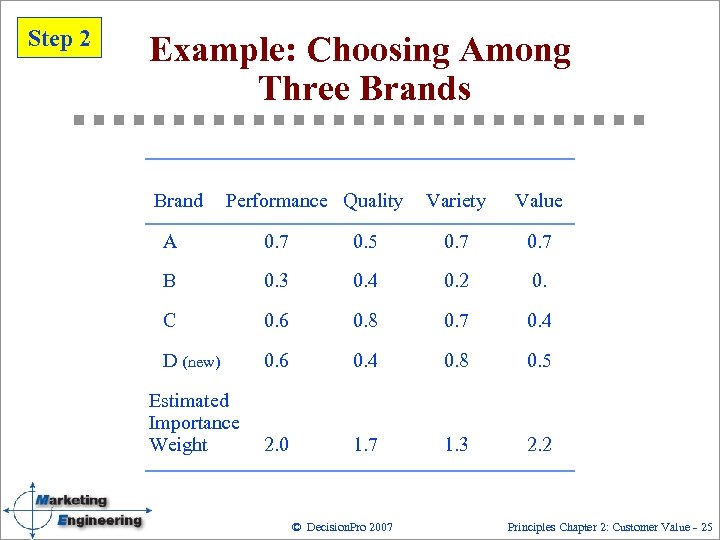

Step 2 Example: Choosing Among Three Brands Brand Performance Quality Variety Value A 0. 7 0. 5 0. 7 B 0. 3 0. 4 0. 2 0. C 0. 6 0. 8 0. 7 0. 4 D (new) 0. 6 0. 4 0. 8 0. 5 Estimated Importance Weight 2. 0 1. 7 1. 3 2. 2 © Decision. Pro 2007 Principles Chapter 2: Customer Value - 25

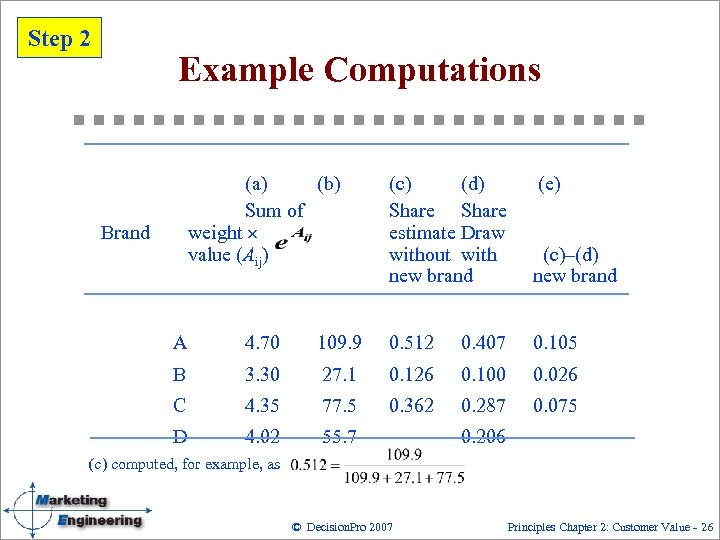

Step 2 Example Computations (a) (b) Sum of weight value (Aij) Brand (c) (d) Share estimate Draw without with new brand (e) (c)–(d) new brand A 4. 70 109. 9 0. 512 0. 407 0. 105 B 3. 30 27. 1 0. 126 0. 100 0. 026 C 4. 35 77. 5 0. 362 0. 287 0. 075 D 4. 02 55. 7 0. 206 (c) computed, for example, as © Decision. Pro 2007 Principles Chapter 2: Customer Value - 26

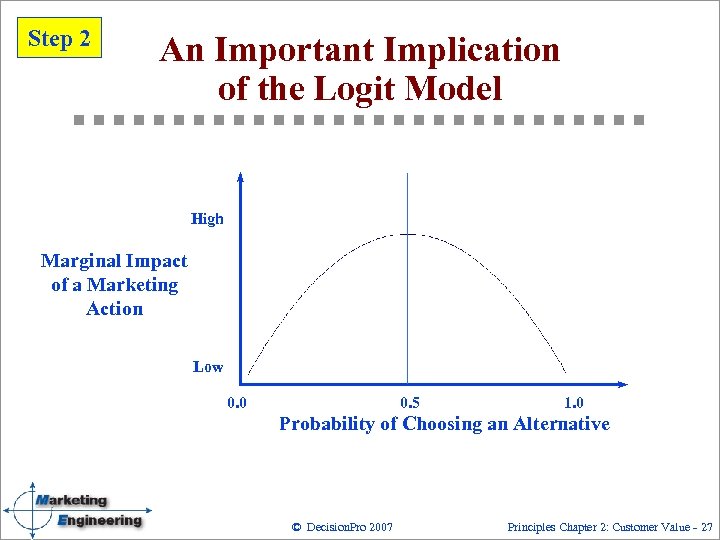

Step 2 An Important Implication of the Logit Model High Marginal Impact of a Marketing Action Low 0. 0 0. 5 1. 0 Probability of Choosing an Alternative © Decision. Pro 2007 Principles Chapter 2: Customer Value - 27

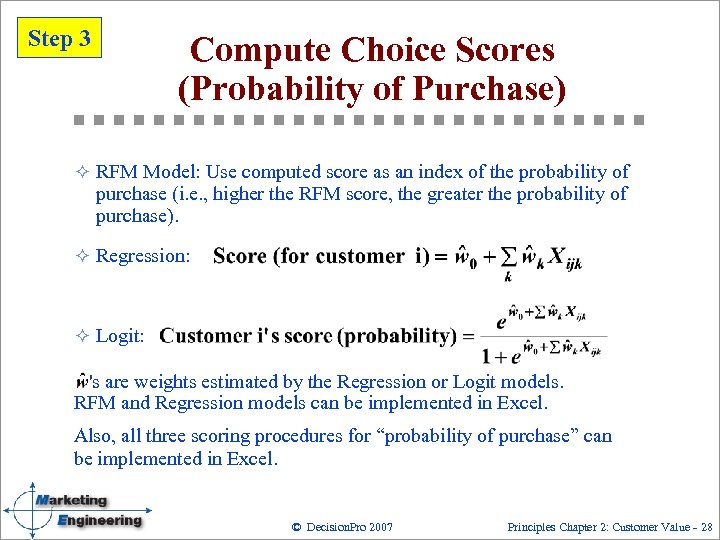

Step 3 Compute Choice Scores (Probability of Purchase) ² RFM Model: Use computed score as an index of the probability of purchase (i. e. , higher the RFM score, the greater the probability of purchase). ² Regression: ² Logit: 's are weights estimated by the Regression or Logit models. RFM and Regression models can be implemented in Excel. Also, all three scoring procedures for “probability of purchase” can be implemented in Excel. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 28

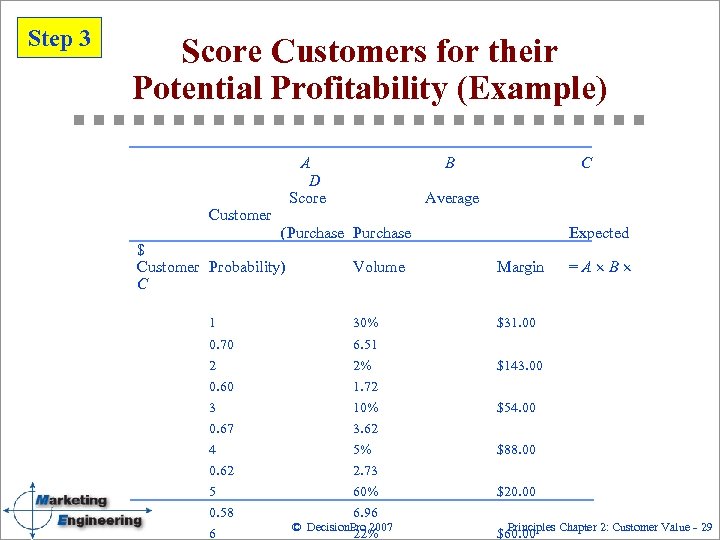

Step 3 Score Customers for their Potential Profitability (Example) Customer A D Score B C Average (Purchase $ Customer Probability) C Expected Volume Margin 1 30% $31. 00 0. 70 2 0. 60 6. 51 2% 1. 72 $143. 00 3 10% =A B $54. 00 0. 67 4 0. 62 5 0. 58 6 3. 62 5% 2. 73 60% 6. 96 © Decision. Pro 2007 22% $88. 00 $20. 00 Principles Chapter 2: Customer Value - 29 $60. 00

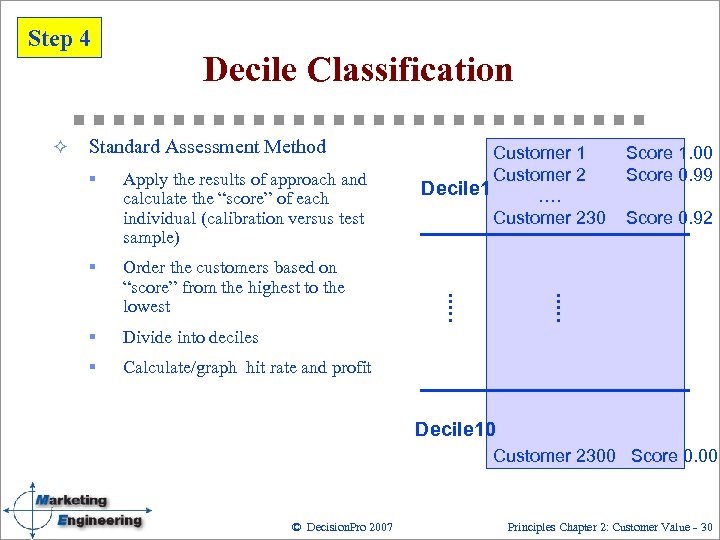

Step 4 ² Decile Classification Standard Assessment Method § Apply the results of approach and calculate the “score” of each individual (calibration versus test sample) § Score 0. 92 Divide into deciles § Score 1. 00 Score 0. 99 Calculate/graph hit rate and profit …. . Order the customers based on “score” from the highest to the lowest …. . § Customer 1 Customer 2 Decile 1 …. Customer 230 Decile 10 Customer 2300 Score 0. 00 © Decision. Pro 2007 Principles Chapter 2: Customer Value - 30

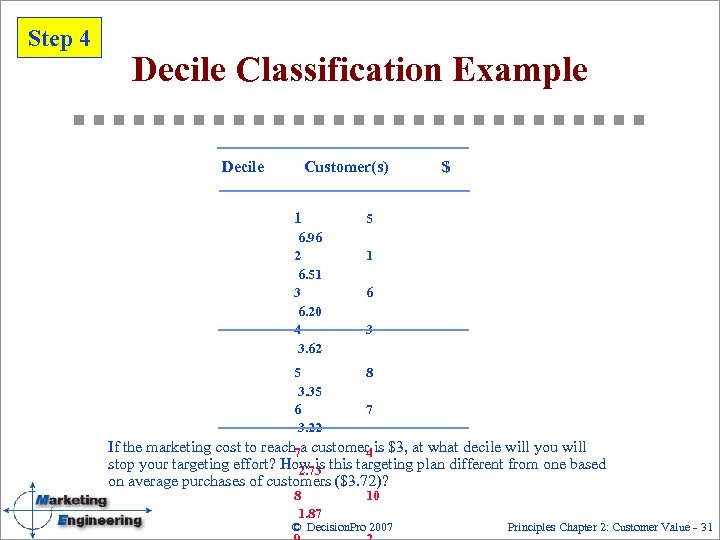

Step 4 Decile Classification Example Decile Customer(s) 1 6. 96 2 6. 51 3 6. 20 4 3. 62 5 3. 35 6 3. 22 $ 5 1 6 3 8 7 If the marketing cost to reach 7 a customer is $3, at what decile will you will 4 stop your targeting effort? How is this targeting plan different from one based 2. 73 on average purchases of customers ($3. 72)? 8 1. 87 10 © Decision. Pro 2007 Principles Chapter 2: Customer Value - 31

Step 5 Determine Targeting Plan (Example shows potential profitability of mailing to the top 6 deciles) Compute profit/ROI for the models based on the number of mailings recommended by each model and compare that to mailing to the entire list (equivalently to a randomly selected list of the same size). © Decision. Pro 2007 Principles Chapter 2: Customer Value - 32

Step 5 Develop Lift Charts and Choose Model for Implementation © Decision. Pro 2007 Principles Chapter 2: Customer Value - 33

Applying the MNL Model in Customer Targeting Key idea: Segment on the basis of probability of choice— 1. Loyal to us 2. Loyal to competitor 3. Switchables: losable/winnable customers © Decision. Pro 2007 Principles Chapter 2: Customer Value - 34

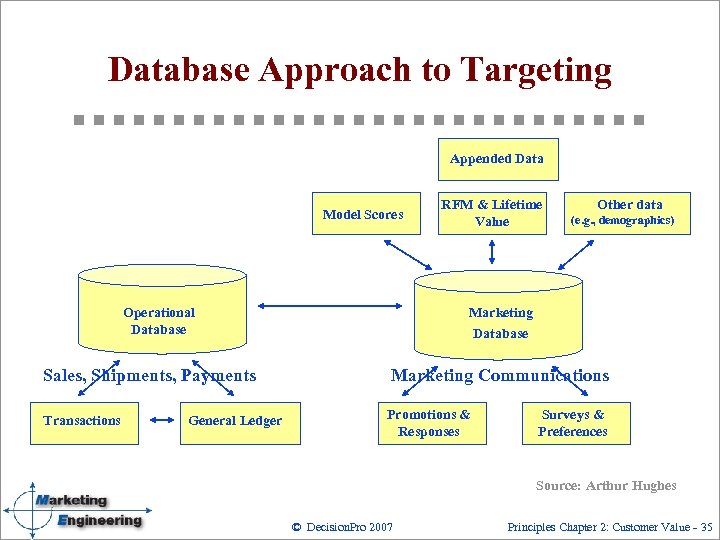

Database Approach to Targeting Appended Data Model Scores Operational Database Sales, Shipments, Payments Transactions General Ledger RFM & Lifetime Value Other data (e. g. , demographics) Marketing Database Marketing Communications Promotions & Responses Surveys & Preferences Source: Arthur Hughes © Decision. Pro 2007 Principles Chapter 2: Customer Value - 35

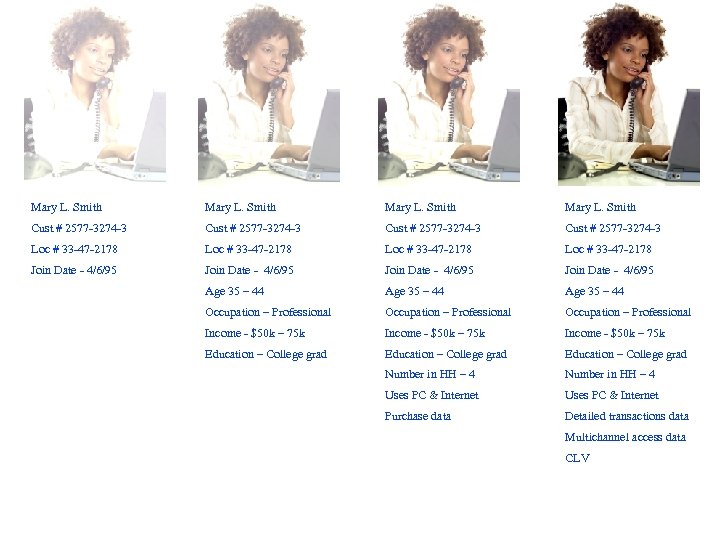

Mary L. Smith Cust # 2577 -3274 -3 Loc # 33 -47 -2178 Join Date - 4/6/95 Age 35 – 44 Occupation – Professional Income - $50 k – 75 k Education – College grad Number in HH – 4 Uses PC & Internet Purchase data Detailed transactions data Multichannel access data CLV

The Downside of Behavior-Based Targeting By following the behavior-based targeting approach over a long-period of time, a firm may systematically eliminate potentially valuable customers, who may not deliver high economic value in the short term, but may offer substantial value in the long term. It pays to view customers through more lenses than just economic value. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 37

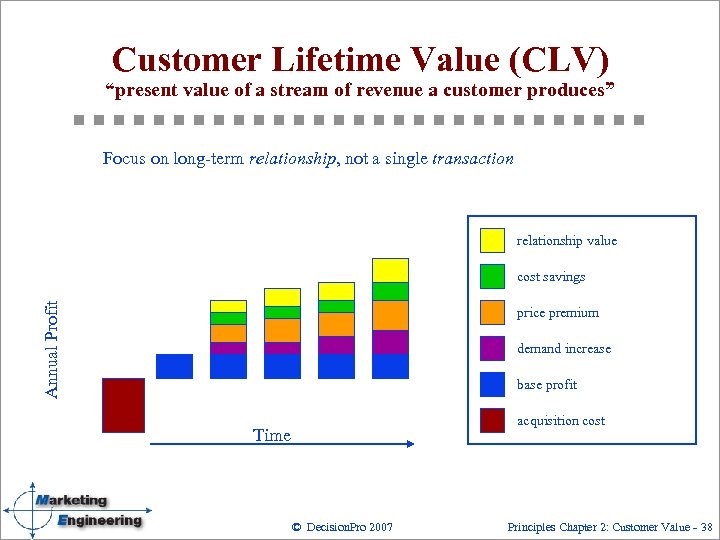

Customer Lifetime Value (CLV) “present value of a stream of revenue a customer produces” Focus on long-term relationship, not a single transaction relationship value Annual Profit cost savings price premium demand increase base profit acquisition cost Time © Decision. Pro 2007 Principles Chapter 2: Customer Value - 38

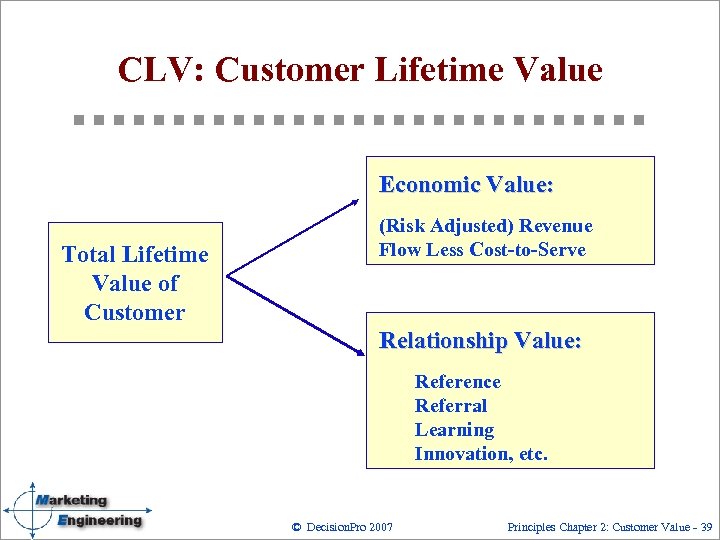

CLV: Customer Lifetime Value Economic Value: Total Lifetime Value of Customer (Risk Adjusted) Revenue Flow Less Cost-to-Serve Relationship Value: Reference Referral Learning Innovation, etc. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 39

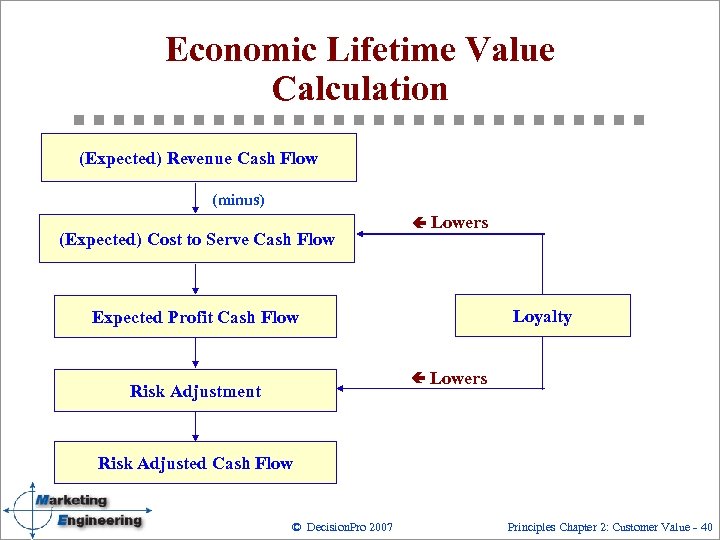

Economic Lifetime Value Calculation (Expected) Revenue Cash Flow (minus) (Expected) Cost to Serve Cash Flow Lowers Loyalty Expected Profit Cash Flow Lowers Risk Adjustment Risk Adjusted Cash Flow © Decision. Pro 2007 Principles Chapter 2: Customer Value - 40

Customer Relationship Value ² Reference Accounts (Give us prestige, high credibility) ² Referral Accounts (Give us high-quality leads) ² Learning Accounts (Help us refine our offerings/beta testers) ² Innovation Accounts (Help us to develop new offerings) © Decision. Pro 2007 Principles Chapter 2: Customer Value - 41

Objectives for CLV-Based Management ² Increase customer retention (costs/ benefits of customers) ² Improve customer selectivity (Who to serve? How to increase CLV? ) ² Meet competitive imperatives (Drive or be driven? ) ² Boost cost efficiency (“A”, “B”, “C” customers? Do we know true costs? ) © Decision. Pro 2007 Principles Chapter 2: Customer Value - 42

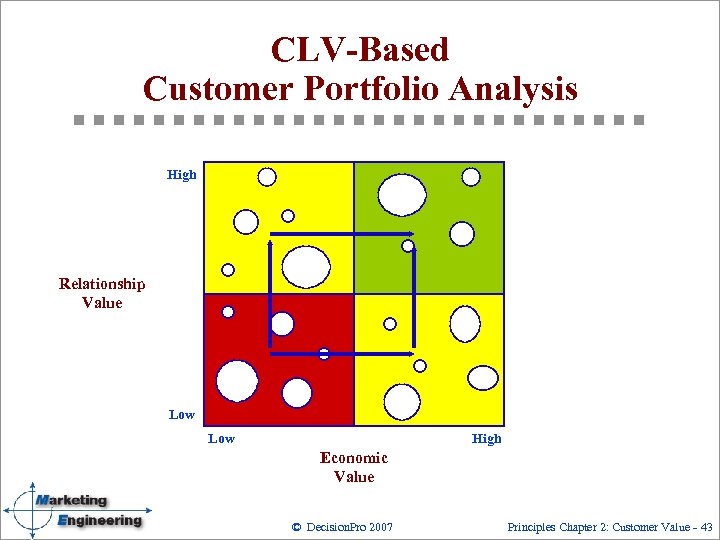

CLV-Based Customer Portfolio Analysis High Relationship Value Low High Economic Value © Decision. Pro 2007 Principles Chapter 2: Customer Value - 43

Approaches to Increasing CLV (Implemented via CRM) ² Reduce rate of defection ² Increase longevity ² Enhance share of wallet ² Attempt to alter behavior of low-profit customers ² Focus more effort on high-profit customers © Decision. Pro 2007 Principles Chapter 2: Customer Value - 44

Questions…What is the lifetime value of a…. Walmart customer? AMEX customer? Ritz Carlton customer? Sony customer? Singapore Airline customer? An MBA student? © Decision. Pro 2007 Principles Chapter 2: Customer Value - 45

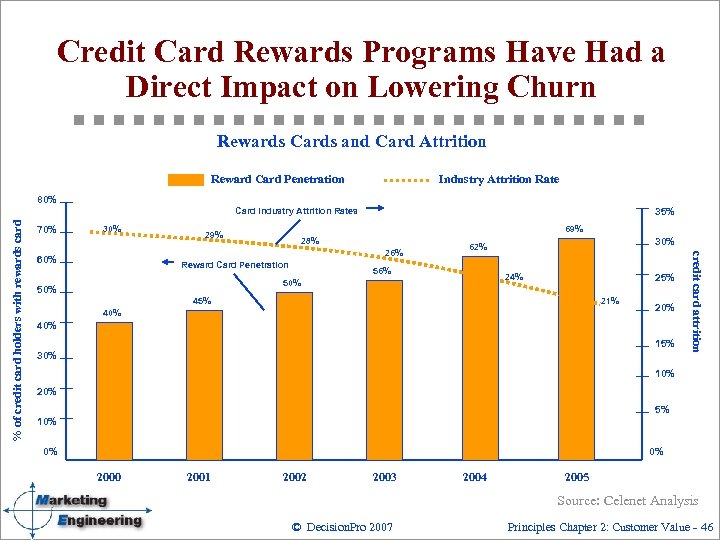

Credit Card Rewards Programs Have Had a Direct Impact on Lowering Churn Rewards Cards and Card Attrition Reward Card Penetration Industry Attrition Rate 80% 70% 35% 69% 28% 26% 60% Reward Card Penetration 56% 24% 50% 30% 62% 25% 45% 21% 40% 20% 40% 15% 30% credit card attrition % of credit card holders with rewards card Card Industry Attrition Rates 10% 20% 5% 10% 0% 0% 2000 2001 2002 2003 2004 2005 Source: Celenet Analysis © Decision. Pro 2007 Principles Chapter 2: Customer Value - 46

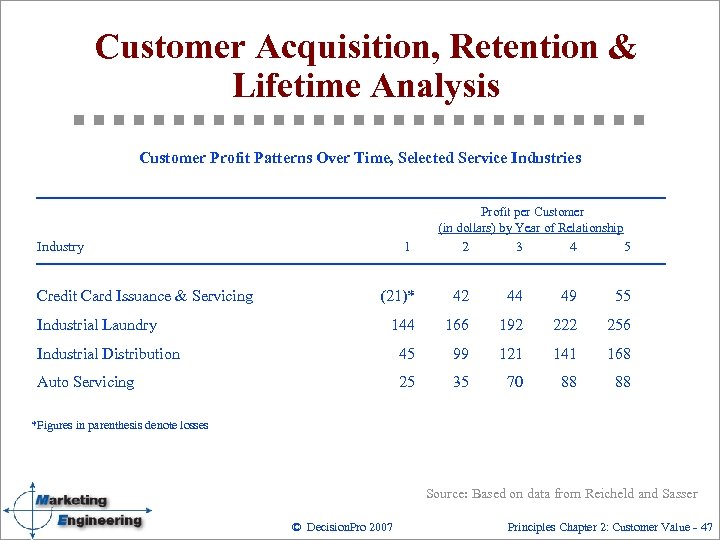

Customer Acquisition, Retention & Lifetime Analysis Customer Profit Patterns Over Time, Selected Service Industries Profit per Customer (in dollars) by Year of Relationship Industry 1 2 3 4 5 (21)* 42 44 49 55 144 166 192 222 256 Industrial Distribution 45 99 121 141 168 Auto Servicing 25 35 70 88 88 Credit Card Issuance & Servicing Industrial Laundry *Figures in parenthesis denote losses Source: Based on data from Reicheld and Sasser © Decision. Pro 2007 Principles Chapter 2: Customer Value - 47

Summary of Customer Value Assessment ² Customer value is hidden, but can be assessed using several different techniques. ² A company generates “value from customers” by understanding the value of its offerings to its customers. ² Behavior-based targeting can generate incremental short- term profits for a company. ² To generate long-term and sustainable profits from customers, a company has to understand manage Customer Lifetime Value (CLV), which includes both the economic value and the relationship value associated with a customer. © Decision. Pro 2007 Principles Chapter 2: Customer Value - 48

b0c2e964368abc2344dd00b9c6026ece.ppt