7c6cfdd4aa402daea5f7a8820cb5e31d.ppt

- Количество слайдов: 69

VALUE ADDED TAX

VALUE ADDED TAX

What is VAT? Value-Added Tax is a form of sales and indirect tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. 2

What is VAT? Value-Added Tax is a form of sales and indirect tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. 2

Who Are Required To File VAT Returns? • Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the amount of actual gross sales or receipts exceed P 1, 919, 500. • A person required to register as VAT taxpayer. • Any person, whether or not made in the course of his trade or business, who imports goods. 3

Who Are Required To File VAT Returns? • Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the amount of actual gross sales or receipts exceed P 1, 919, 500. • A person required to register as VAT taxpayer. • Any person, whether or not made in the course of his trade or business, who imports goods. 3

What Tax Rates ARE used? • On sale of goods and properties/ On sale of services and use or lease of properties – 12% of GSP/gross value/gross receipts of the goods/properties/services sold, bartered or exchanged, including the use or lease of properties. • On importation of goods - 12% based on Landed Cost, plus customs duties, excise taxes, if any, and other charges, such as tax to be paid by the importer prior to the release of such goods; provided, that customs duties are determined on the basis of quantity/volume of the goods. • On export sales and other zero-rated sales - 0% 4

What Tax Rates ARE used? • On sale of goods and properties/ On sale of services and use or lease of properties – 12% of GSP/gross value/gross receipts of the goods/properties/services sold, bartered or exchanged, including the use or lease of properties. • On importation of goods - 12% based on Landed Cost, plus customs duties, excise taxes, if any, and other charges, such as tax to be paid by the importer prior to the release of such goods; provided, that customs duties are determined on the basis of quantity/volume of the goods. • On export sales and other zero-rated sales - 0% 4

Who are liable to register as VAT taxpayers? Any person shall be liable to register if his gross sales or receipts (there is reasonable ground to believe that for the past/next twelve (12) months, other than those that are exempt under Section 109 (A) to (U)) have exceeded/will exceed P 1, 919, 500. 5

Who are liable to register as VAT taxpayers? Any person shall be liable to register if his gross sales or receipts (there is reasonable ground to believe that for the past/next twelve (12) months, other than those that are exempt under Section 109 (A) to (U)) have exceeded/will exceed P 1, 919, 500. 5

WHEN IS A NEW VAT TAXPAYER REQUIRED TO APPLY FOR REGISTRATION AND PAY THE REGISTRATION FEE? Pay registration fee of P 500. 00 using BIR Form No. 0605 for every separate/distinct establishment/place of business. Thereafter, pay the annual registration fee of P 500. 00 not later than January 31, every year. 6

WHEN IS A NEW VAT TAXPAYER REQUIRED TO APPLY FOR REGISTRATION AND PAY THE REGISTRATION FEE? Pay registration fee of P 500. 00 using BIR Form No. 0605 for every separate/distinct establishment/place of business. Thereafter, pay the annual registration fee of P 500. 00 not later than January 31, every year. 6

What compliance activities should a VAT taxpayer, after registration as such, do promptly or periodically? • Pay annual registration fee of P 500. 00 for every place of business or establishment; • Register the books of accounts; • Register the sales invoices and official receipts as VAT-invoices/receipts; • Submit with the RDO/LTDO having jurisdiction over the taxpayer, on or before the deadline set in the filing of VAT Returns. 7

What compliance activities should a VAT taxpayer, after registration as such, do promptly or periodically? • Pay annual registration fee of P 500. 00 for every place of business or establishment; • Register the books of accounts; • Register the sales invoices and official receipts as VAT-invoices/receipts; • Submit with the RDO/LTDO having jurisdiction over the taxpayer, on or before the deadline set in the filing of VAT Returns. 7

How do we determine the main or principal business of a taxpayer who is engaged in mixed business activities? we apply the predominance test. Under this test, if more than fifty (50%) of its gross sales and/or gross receipts comes from its business/es subject to VAT, its shall fall within the VAT system. 8

How do we determine the main or principal business of a taxpayer who is engaged in mixed business activities? we apply the predominance test. Under this test, if more than fifty (50%) of its gross sales and/or gross receipts comes from its business/es subject to VAT, its shall fall within the VAT system. 8

What is the liability of a taxpayer becoming liable to VAT and did not register as such? He shall be liable to pay the output tax as if he is a VAT-registered person, but without the benefit of input tax credits for the period in which he was not properly registered. 9

What is the liability of a taxpayer becoming liable to VAT and did not register as such? He shall be liable to pay the output tax as if he is a VAT-registered person, but without the benefit of input tax credits for the period in which he was not properly registered. 9

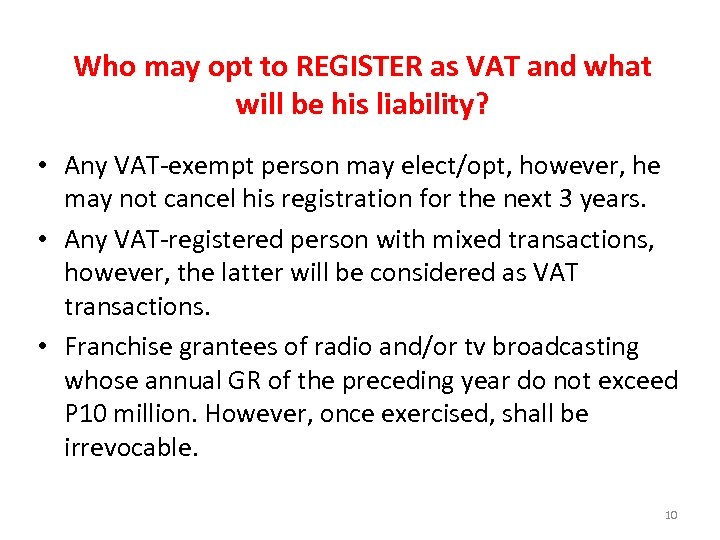

Who may opt to REGISTER as VAT and what will be his liability? • Any VAT-exempt person may elect/opt, however, he may not cancel his registration for the next 3 years. • Any VAT-registered person with mixed transactions, however, the latter will be considered as VAT transactions. • Franchise grantees of radio and/or tv broadcasting whose annual GR of the preceding year do not exceed P 10 million. However, once exercised, shall be irrevocable. 10

Who may opt to REGISTER as VAT and what will be his liability? • Any VAT-exempt person may elect/opt, however, he may not cancel his registration for the next 3 years. • Any VAT-registered person with mixed transactions, however, the latter will be considered as VAT transactions. • Franchise grantees of radio and/or tv broadcasting whose annual GR of the preceding year do not exceed P 10 million. However, once exercised, shall be irrevocable. 10

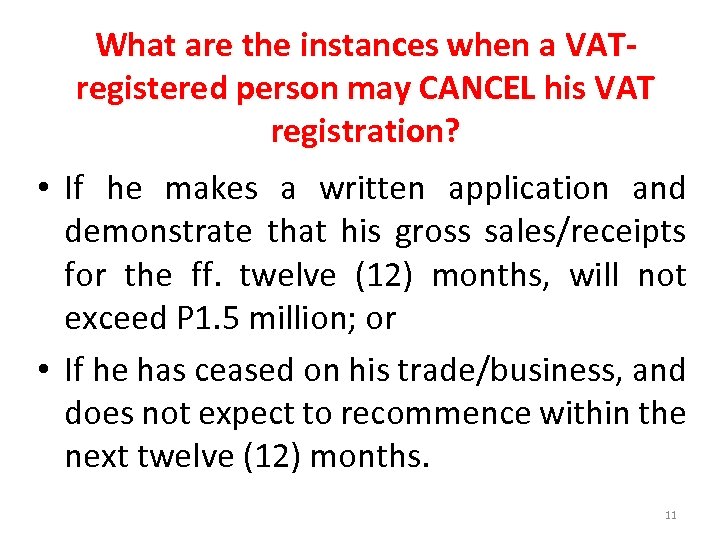

What are the instances when a VATregistered person may CANCEL his VAT registration? • If he makes a written application and demonstrate that his gross sales/receipts for the ff. twelve (12) months, will not exceed P 1. 5 million; or • If he has ceased on his trade/business, and does not expect to recommence within the next twelve (12) months. 11

What are the instances when a VATregistered person may CANCEL his VAT registration? • If he makes a written application and demonstrate that his gross sales/receipts for the ff. twelve (12) months, will not exceed P 1. 5 million; or • If he has ceased on his trade/business, and does not expect to recommence within the next twelve (12) months. 11

When will the cancellation for registration be effective? The cancellation will be effective from the first day of the following month it was approved. 12

When will the cancellation for registration be effective? The cancellation will be effective from the first day of the following month it was approved. 12

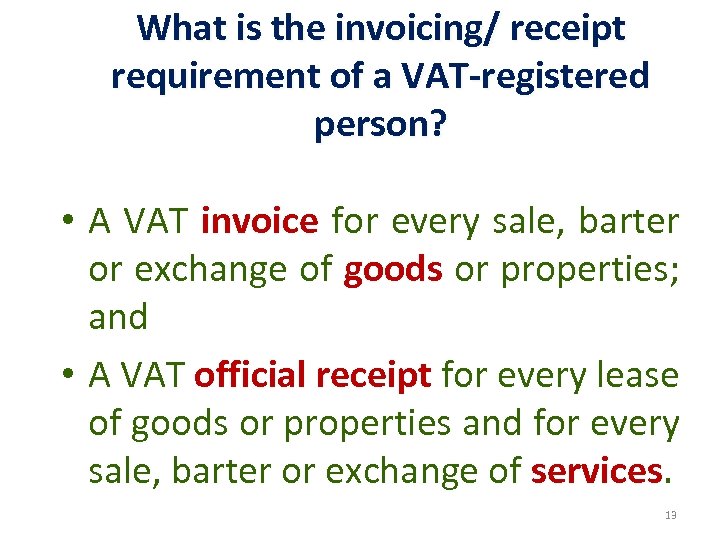

What is the invoicing/ receipt requirement of a VAT-registered person? • A VAT invoice for every sale, barter or exchange of goods or properties; and • A VAT official receipt for every lease of goods or properties and for every sale, barter or exchange of services. 13

What is the invoicing/ receipt requirement of a VAT-registered person? • A VAT invoice for every sale, barter or exchange of goods or properties; and • A VAT official receipt for every lease of goods or properties and for every sale, barter or exchange of services. 13

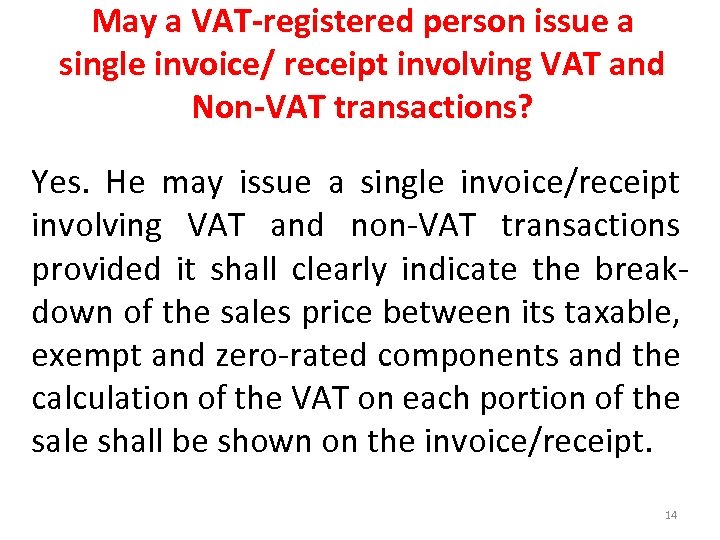

May a VAT-registered person issue a single invoice/ receipt involving VAT and Non-VAT transactions? Yes. He may issue a single invoice/receipt involving VAT and non-VAT transactions provided it shall clearly indicate the breakdown of the sales price between its taxable, exempt and zero-rated components and the calculation of the VAT on each portion of the sale shall be shown on the invoice/receipt. 14

May a VAT-registered person issue a single invoice/ receipt involving VAT and Non-VAT transactions? Yes. He may issue a single invoice/receipt involving VAT and non-VAT transactions provided it shall clearly indicate the breakdown of the sales price between its taxable, exempt and zero-rated components and the calculation of the VAT on each portion of the sale shall be shown on the invoice/receipt. 14

May a VAT-registered person issue separate invoices/receipts involving VAT and Non-VAT transactions? Yes. A VAT registered person may issue separate invoices/receipts for the taxable, exempt, and zero-rated component of its sales provided that if the sales is exempt from VAT, the term "VATEXEMPT SALE" shall be written/printed on the invoice/receipt and if the sale is zero percent (0%) VAT, "ZERO-RATED SALE" shall be written/printed. 15

May a VAT-registered person issue separate invoices/receipts involving VAT and Non-VAT transactions? Yes. A VAT registered person may issue separate invoices/receipts for the taxable, exempt, and zero-rated component of its sales provided that if the sales is exempt from VAT, the term "VATEXEMPT SALE" shall be written/printed on the invoice/receipt and if the sale is zero percent (0%) VAT, "ZERO-RATED SALE" shall be written/printed. 15

What is the liability of a taxpayer not registered as VAT and issues a VAT invoice/ receipt? The non-VAT registered person shall pay percentage tax, be liable to VAT imposed in Section 106 or 108 of the Tax Code without the benefit of any input tax credit plus 50% surcharge on the VAT payable (output tax). 16

What is the liability of a taxpayer not registered as VAT and issues a VAT invoice/ receipt? The non-VAT registered person shall pay percentage tax, be liable to VAT imposed in Section 106 or 108 of the Tax Code without the benefit of any input tax credit plus 50% surcharge on the VAT payable (output tax). 16

What is the liability of a VAT-registered person in the issuance of a VAT invoice/ receipt for VAT-exempt transactions? If a VAT-registered person issues a VAT invoice/O. R. for a VAT-exempt transaction but fails to display "VAT-EXEMPT SALE", the transaction shall become taxable and the issuer shall be liable to pay VAT. 17

What is the liability of a VAT-registered person in the issuance of a VAT invoice/ receipt for VAT-exempt transactions? If a VAT-registered person issues a VAT invoice/O. R. for a VAT-exempt transaction but fails to display "VAT-EXEMPT SALE", the transaction shall become taxable and the issuer shall be liable to pay VAT. 17

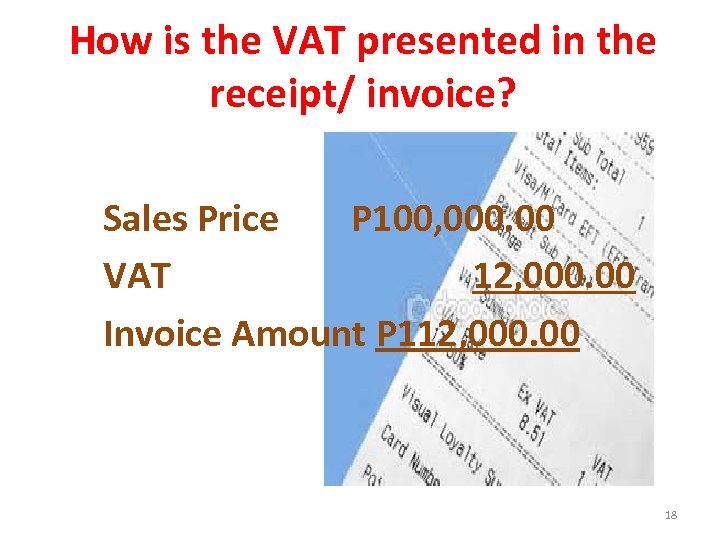

How is the VAT presented in the receipt/ invoice? Sales Price P 100, 000. 00 VAT 12, 000. 00 Invoice Amount P 112, 000. 00 18

How is the VAT presented in the receipt/ invoice? Sales Price P 100, 000. 00 VAT 12, 000. 00 Invoice Amount P 112, 000. 00 18

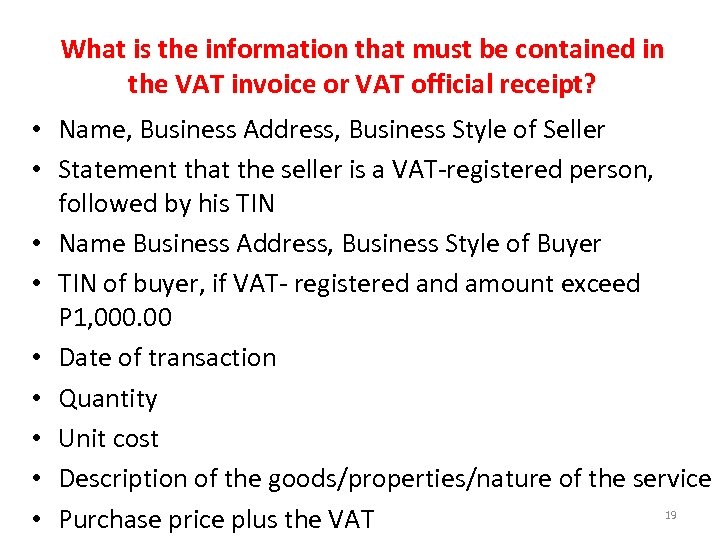

• • • What is the information that must be contained in the VAT invoice or VAT official receipt? Name, Business Address, Business Style of Seller Statement that the seller is a VAT-registered person, followed by his TIN Name Business Address, Business Style of Buyer TIN of buyer, if VAT- registered and amount exceed P 1, 000. 00 Date of transaction Quantity Unit cost Description of the goods/properties/nature of the service 19 Purchase price plus the VAT

• • • What is the information that must be contained in the VAT invoice or VAT official receipt? Name, Business Address, Business Style of Seller Statement that the seller is a VAT-registered person, followed by his TIN Name Business Address, Business Style of Buyer TIN of buyer, if VAT- registered and amount exceed P 1, 000. 00 Date of transaction Quantity Unit cost Description of the goods/properties/nature of the service 19 Purchase price plus the VAT

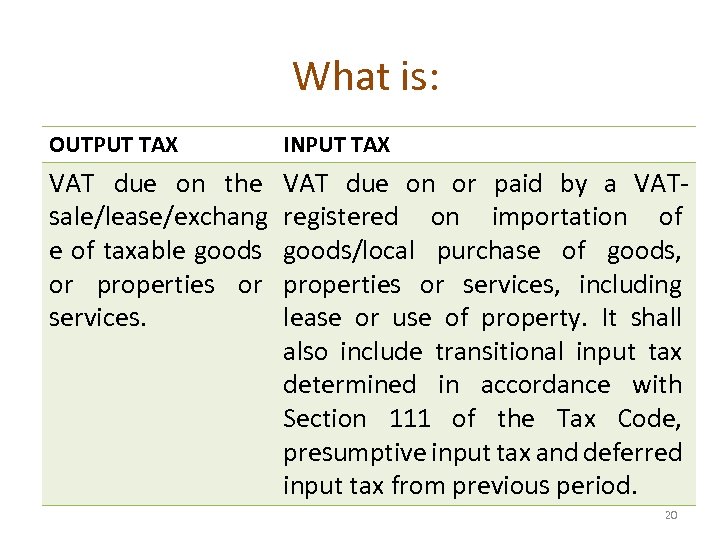

What is: OUTPUT TAX INPUT TAX VAT due on the sale/lease/exchang e of taxable goods or properties or services. VAT due on or paid by a VATregistered on importation of goods/local purchase of goods, properties or services, including lease or use of property. It shall also include transitional input tax determined in accordance with Section 111 of the Tax Code, presumptive input tax and deferred input tax from previous period. 20

What is: OUTPUT TAX INPUT TAX VAT due on the sale/lease/exchang e of taxable goods or properties or services. VAT due on or paid by a VATregistered on importation of goods/local purchase of goods, properties or services, including lease or use of property. It shall also include transitional input tax determined in accordance with Section 111 of the Tax Code, presumptive input tax and deferred input tax from previous period. 20

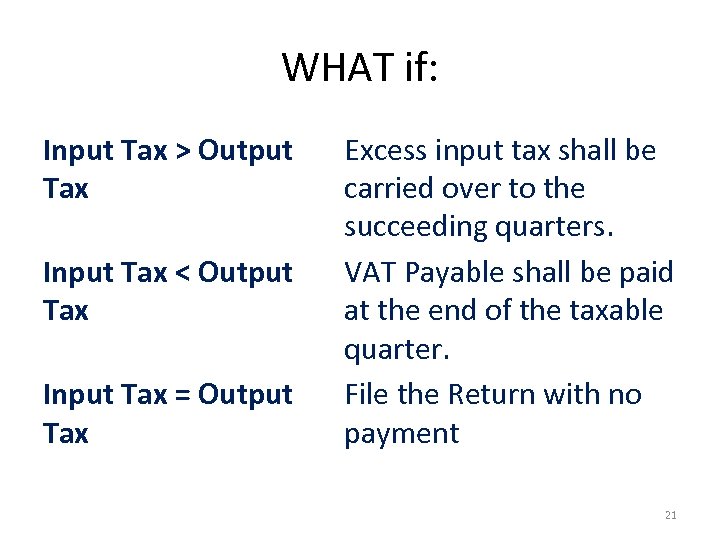

WHAT if: Input Tax > Output Tax Input Tax < Output Tax Input Tax = Output Tax Excess input tax shall be carried over to the succeeding quarters. VAT Payable shall be paid at the end of the taxable quarter. File the Return with no payment 21

WHAT if: Input Tax > Output Tax Input Tax < Output Tax Input Tax = Output Tax Excess input tax shall be carried over to the succeeding quarters. VAT Payable shall be paid at the end of the taxable quarter. File the Return with no payment 21

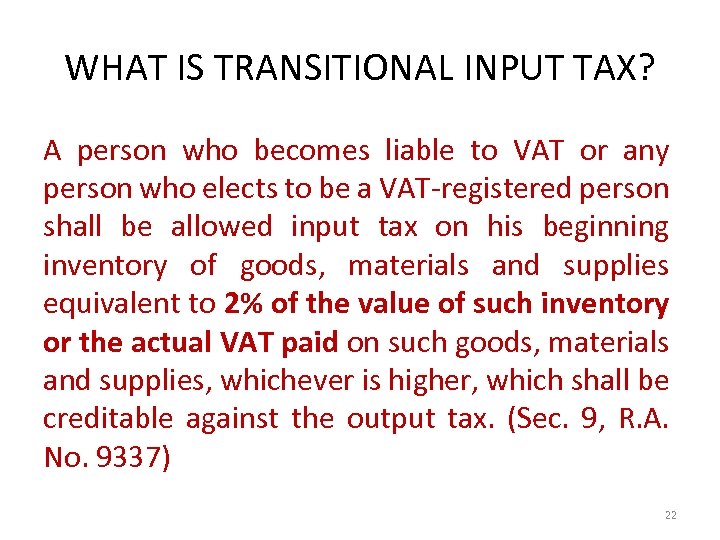

WHAT IS TRANSITIONAL INPUT TAX? A person who becomes liable to VAT or any person who elects to be a VAT-registered person shall be allowed input tax on his beginning inventory of goods, materials and supplies equivalent to 2% of the value of such inventory or the actual VAT paid on such goods, materials and supplies, whichever is higher, which shall be creditable against the output tax. (Sec. 9, R. A. No. 9337) 22

WHAT IS TRANSITIONAL INPUT TAX? A person who becomes liable to VAT or any person who elects to be a VAT-registered person shall be allowed input tax on his beginning inventory of goods, materials and supplies equivalent to 2% of the value of such inventory or the actual VAT paid on such goods, materials and supplies, whichever is higher, which shall be creditable against the output tax. (Sec. 9, R. A. No. 9337) 22

WHAT IS PRESUMPTIVE INPUT TAX? Persons or firms engaged in the processing of sardines, mackerel and milk, and in manufacturing refined sugar and cooking oil, shall be allowed a presumptive input tax, creditable against the output tax, equivalent to 4% of the gross value in money of their purchases of primary agricultural products which are used as inputs to their production. (Sec. 9, R. A. No. 9337) 23

WHAT IS PRESUMPTIVE INPUT TAX? Persons or firms engaged in the processing of sardines, mackerel and milk, and in manufacturing refined sugar and cooking oil, shall be allowed a presumptive input tax, creditable against the output tax, equivalent to 4% of the gross value in money of their purchases of primary agricultural products which are used as inputs to their production. (Sec. 9, R. A. No. 9337) 23

WHAT IS PROCESSING? "As used in this Subsection, the term 'processing' shall mean pasteurization, canning and activities which through physical or chemical process alter the exterior texture or form or inner substance of a product in such manner as to prepare it for special use to which it could not have been put in its original form or condition. (Sec. 9, R. A. No. 9337) 24

WHAT IS PROCESSING? "As used in this Subsection, the term 'processing' shall mean pasteurization, canning and activities which through physical or chemical process alter the exterior texture or form or inner substance of a product in such manner as to prepare it for special use to which it could not have been put in its original form or condition. (Sec. 9, R. A. No. 9337) 24

What comprises "goods or properties"? mean all tangible and intangible objects, capable of pecuniary estimation: Real properties held primarily for sale or lease in the ordinary course of trade/business; Right/privilege to use patent, copyright, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; right or privilege to use in the Philippines of any industrial, commercial or scientific equipment; right or the privilege to use motion picture films, tapes and discs; and Radio, television, satellite transmission and cable television time. 25

What comprises "goods or properties"? mean all tangible and intangible objects, capable of pecuniary estimation: Real properties held primarily for sale or lease in the ordinary course of trade/business; Right/privilege to use patent, copyright, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; right or privilege to use in the Philippines of any industrial, commercial or scientific equipment; right or the privilege to use motion picture films, tapes and discs; and Radio, television, satellite transmission and cable television time. 25

What comprises "sale or exchange of services"? means the performance of all kinds of services for a fee, remuneration or consideration, whether in kind or cash, including those performed/rendered by the ff: Construction and service contractors; Stock, real estate, commercial, customs and immigration brokers; Lessors of property, whether personal or real; Lessors or distributors of cinematographic films; Persons engaged in warehousing services; Persons engaged in milling, processing, manufacturing or repacking goods for others; Proprietors, operators or keepers of hotels, motels, rest houses, pension houses, inns, resorts, theatres, and movie houses; Proprietors or operators of restaurants, refreshment parlors, cafes, and other eating places, including clubs and caterers; 26

What comprises "sale or exchange of services"? means the performance of all kinds of services for a fee, remuneration or consideration, whether in kind or cash, including those performed/rendered by the ff: Construction and service contractors; Stock, real estate, commercial, customs and immigration brokers; Lessors of property, whether personal or real; Lessors or distributors of cinematographic films; Persons engaged in warehousing services; Persons engaged in milling, processing, manufacturing or repacking goods for others; Proprietors, operators or keepers of hotels, motels, rest houses, pension houses, inns, resorts, theatres, and movie houses; Proprietors or operators of restaurants, refreshment parlors, cafes, and other eating places, including clubs and caterers; 26

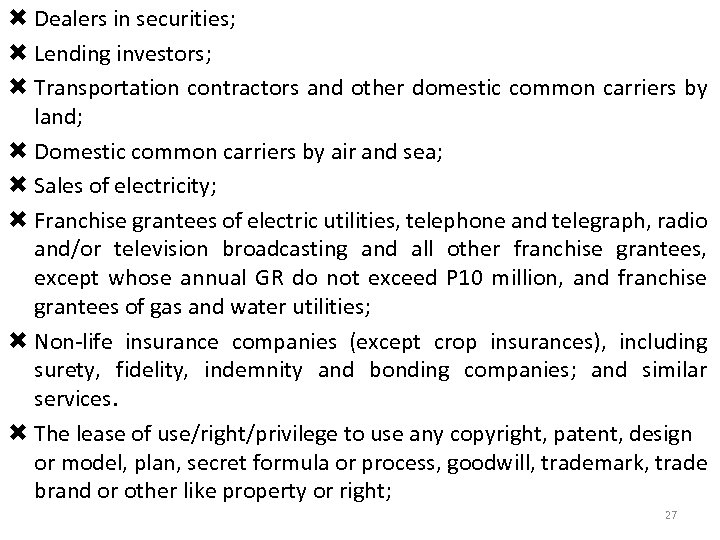

Dealers in securities; Lending investors; Transportation contractors and other domestic common carriers by land; Domestic common carriers by air and sea; Sales of electricity; Franchise grantees of electric utilities, telephone and telegraph, radio and/or television broadcasting and all other franchise grantees, except whose annual GR do not exceed P 10 million, and franchise grantees of gas and water utilities; Non-life insurance companies (except crop insurances), including surety, fidelity, indemnity and bonding companies; and similar services. The lease of use/right/privilege to use any copyright, patent, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; 27

Dealers in securities; Lending investors; Transportation contractors and other domestic common carriers by land; Domestic common carriers by air and sea; Sales of electricity; Franchise grantees of electric utilities, telephone and telegraph, radio and/or television broadcasting and all other franchise grantees, except whose annual GR do not exceed P 10 million, and franchise grantees of gas and water utilities; Non-life insurance companies (except crop insurances), including surety, fidelity, indemnity and bonding companies; and similar services. The lease of use/right/privilege to use any copyright, patent, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right; 27

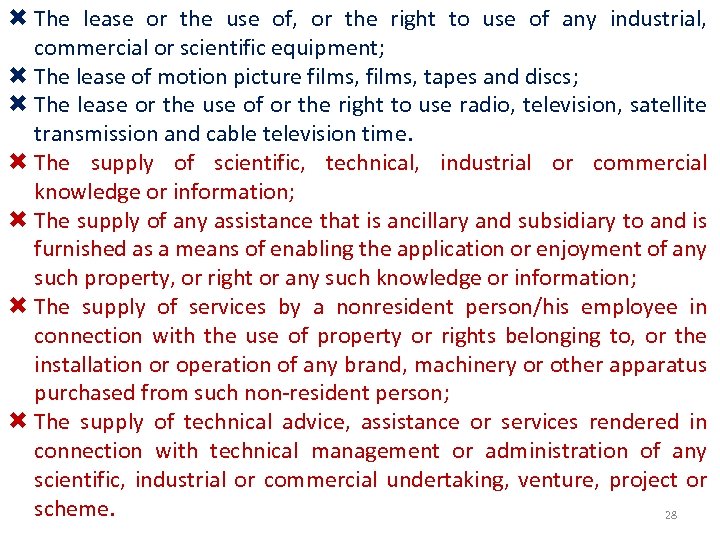

The lease or the use of, or the right to use of any industrial, commercial or scientific equipment; The lease of motion picture films, tapes and discs; The lease or the use of or the right to use radio, television, satellite transmission and cable television time. The supply of scientific, technical, industrial or commercial knowledge or information; The supply of any assistance that is ancillary and subsidiary to and is furnished as a means of enabling the application or enjoyment of any such property, or right or any such knowledge or information; The supply of services by a nonresident person/his employee in connection with the use of property or rights belonging to, or the installation or operation of any brand, machinery or other apparatus purchased from such non-resident person; The supply of technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme. 28

The lease or the use of, or the right to use of any industrial, commercial or scientific equipment; The lease of motion picture films, tapes and discs; The lease or the use of or the right to use radio, television, satellite transmission and cable television time. The supply of scientific, technical, industrial or commercial knowledge or information; The supply of any assistance that is ancillary and subsidiary to and is furnished as a means of enabling the application or enjoyment of any such property, or right or any such knowledge or information; The supply of services by a nonresident person/his employee in connection with the use of property or rights belonging to, or the installation or operation of any brand, machinery or other apparatus purchased from such non-resident person; The supply of technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme. 28

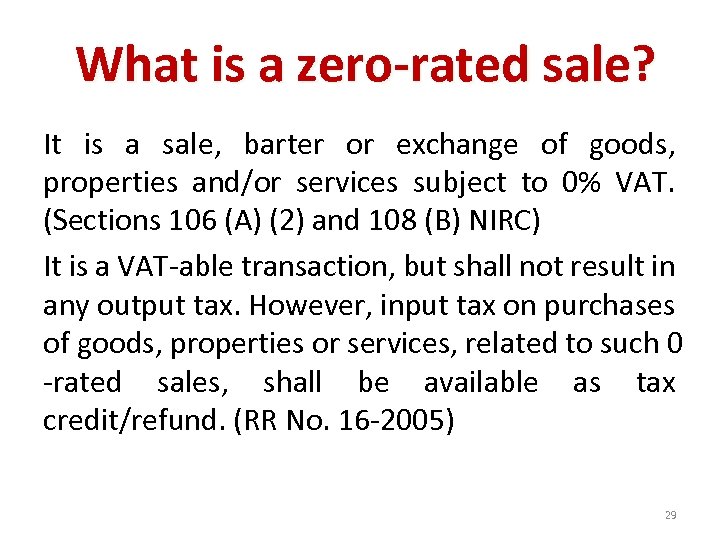

What is a zero-rated sale? It is a sale, barter or exchange of goods, properties and/or services subject to 0% VAT. (Sections 106 (A) (2) and 108 (B) NIRC) It is a VAT-able transaction, but shall not result in any output tax. However, input tax on purchases of goods, properties or services, related to such 0 -rated sales, shall be available as tax credit/refund. (RR No. 16 -2005) 29

What is a zero-rated sale? It is a sale, barter or exchange of goods, properties and/or services subject to 0% VAT. (Sections 106 (A) (2) and 108 (B) NIRC) It is a VAT-able transaction, but shall not result in any output tax. However, input tax on purchases of goods, properties or services, related to such 0 -rated sales, shall be available as tax credit/refund. (RR No. 16 -2005) 29

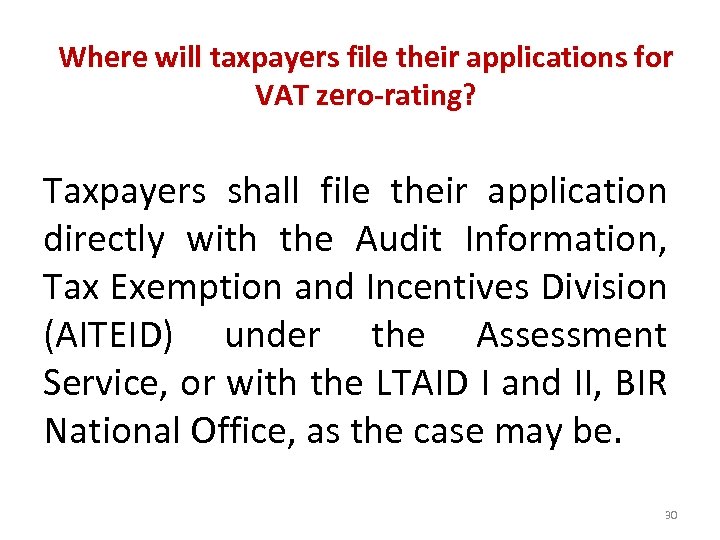

Where will taxpayers file their applications for VAT zero-rating? Taxpayers shall file their application directly with the Audit Information, Tax Exemption and Incentives Division (AITEID) under the Assessment Service, or with the LTAID I and II, BIR National Office, as the case may be. 30

Where will taxpayers file their applications for VAT zero-rating? Taxpayers shall file their application directly with the Audit Information, Tax Exemption and Incentives Division (AITEID) under the Assessment Service, or with the LTAID I and II, BIR National Office, as the case may be. 30

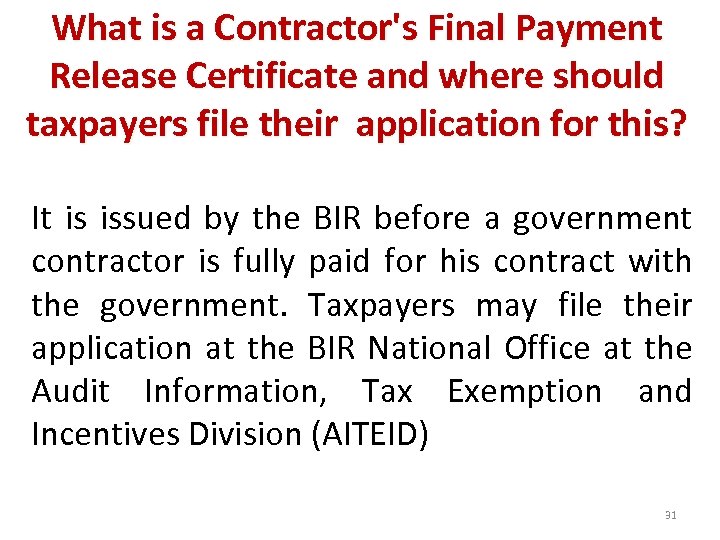

What is a Contractor's Final Payment Release Certificate and where should taxpayers file their application for this? It is issued by the BIR before a government contractor is fully paid for his contract with the government. Taxpayers may file their application at the BIR National Office at the Audit Information, Tax Exemption and Incentives Division (AITEID) 31

What is a Contractor's Final Payment Release Certificate and where should taxpayers file their application for this? It is issued by the BIR before a government contractor is fully paid for his contract with the government. Taxpayers may file their application at the BIR National Office at the Audit Information, Tax Exemption and Incentives Division (AITEID) 31

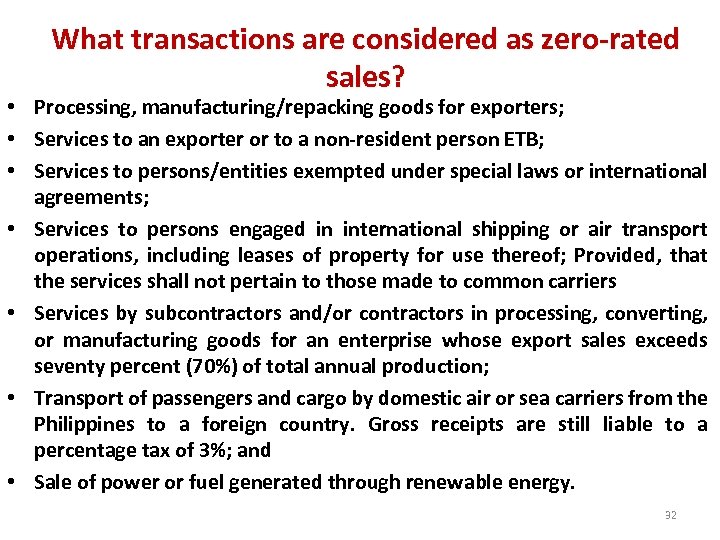

What transactions are considered as zero-rated sales? • Processing, manufacturing/repacking goods for exporters; • Services to an exporter or to a non-resident person ETB; • Services to persons/entities exempted under special laws or international agreements; • Services to persons engaged in international shipping or air transport operations, including leases of property for use thereof; Provided, that the services shall not pertain to those made to common carriers • Services by subcontractors and/or contractors in processing, converting, or manufacturing goods for an enterprise whose export sales exceeds seventy percent (70%) of total annual production; • Transport of passengers and cargo by domestic air or sea carriers from the Philippines to a foreign country. Gross receipts are still liable to a percentage tax of 3%; and • Sale of power or fuel generated through renewable energy. 32

What transactions are considered as zero-rated sales? • Processing, manufacturing/repacking goods for exporters; • Services to an exporter or to a non-resident person ETB; • Services to persons/entities exempted under special laws or international agreements; • Services to persons engaged in international shipping or air transport operations, including leases of property for use thereof; Provided, that the services shall not pertain to those made to common carriers • Services by subcontractors and/or contractors in processing, converting, or manufacturing goods for an enterprise whose export sales exceeds seventy percent (70%) of total annual production; • Transport of passengers and cargo by domestic air or sea carriers from the Philippines to a foreign country. Gross receipts are still liable to a percentage tax of 3%; and • Sale of power or fuel generated through renewable energy. 32

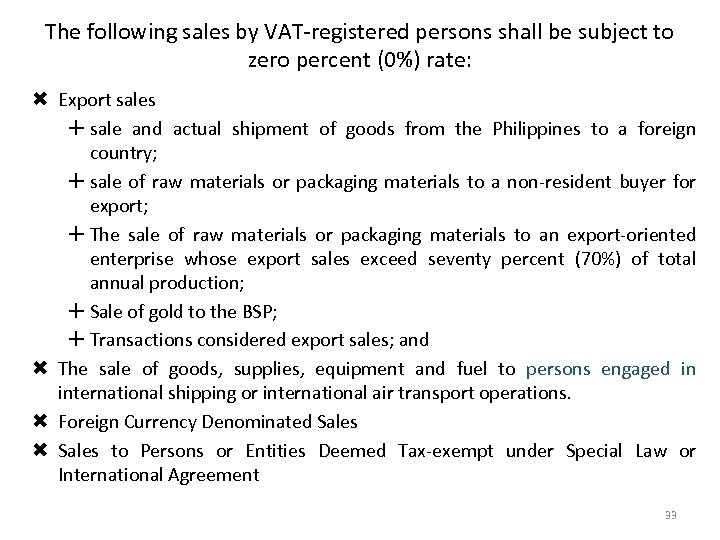

The following sales by VAT-registered persons shall be subject to zero percent (0%) rate: Export sales sale and actual shipment of goods from the Philippines to a foreign country; sale of raw materials or packaging materials to a non-resident buyer for export; The sale of raw materials or packaging materials to an export-oriented enterprise whose export sales exceed seventy percent (70%) of total annual production; Sale of gold to the BSP; Transactions considered export sales; and The sale of goods, supplies, equipment and fuel to persons engaged in international shipping or international air transport operations. Foreign Currency Denominated Sales to Persons or Entities Deemed Tax-exempt under Special Law or International Agreement 33

The following sales by VAT-registered persons shall be subject to zero percent (0%) rate: Export sales sale and actual shipment of goods from the Philippines to a foreign country; sale of raw materials or packaging materials to a non-resident buyer for export; The sale of raw materials or packaging materials to an export-oriented enterprise whose export sales exceed seventy percent (70%) of total annual production; Sale of gold to the BSP; Transactions considered export sales; and The sale of goods, supplies, equipment and fuel to persons engaged in international shipping or international air transport operations. Foreign Currency Denominated Sales to Persons or Entities Deemed Tax-exempt under Special Law or International Agreement 33

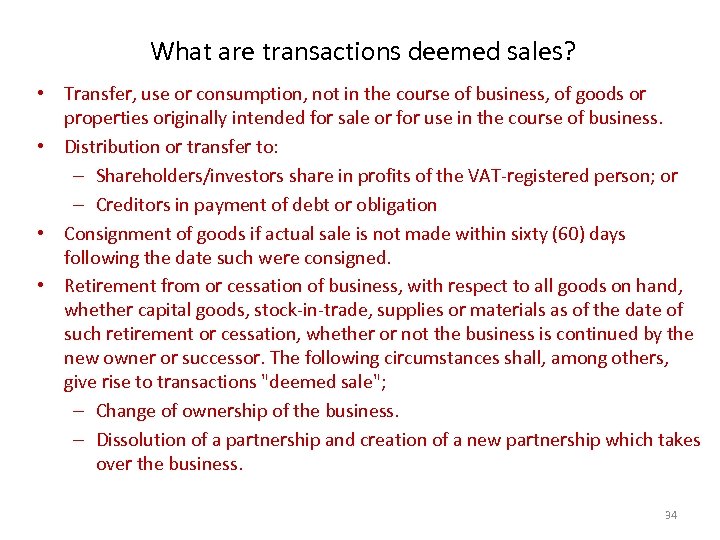

What are transactions deemed sales? • Transfer, use or consumption, not in the course of business, of goods or properties originally intended for sale or for use in the course of business. • Distribution or transfer to: – Shareholders/investors share in profits of the VAT-registered person; or – Creditors in payment of debt or obligation • Consignment of goods if actual sale is not made within sixty (60) days following the date such were consigned. • Retirement from or cessation of business, with respect to all goods on hand, whether capital goods, stock-in-trade, supplies or materials as of the date of such retirement or cessation, whether or not the business is continued by the new owner or successor. The following circumstances shall, among others, give rise to transactions "deemed sale"; – Change of ownership of the business. – Dissolution of a partnership and creation of a new partnership which takes over the business. 34

What are transactions deemed sales? • Transfer, use or consumption, not in the course of business, of goods or properties originally intended for sale or for use in the course of business. • Distribution or transfer to: – Shareholders/investors share in profits of the VAT-registered person; or – Creditors in payment of debt or obligation • Consignment of goods if actual sale is not made within sixty (60) days following the date such were consigned. • Retirement from or cessation of business, with respect to all goods on hand, whether capital goods, stock-in-trade, supplies or materials as of the date of such retirement or cessation, whether or not the business is continued by the new owner or successor. The following circumstances shall, among others, give rise to transactions "deemed sale"; – Change of ownership of the business. – Dissolution of a partnership and creation of a new partnership which takes over the business. 34

What are the previously exempt transactions that are now subject to VAT? Medical services such as dental & veterinary services by professionals; Legal services; Non-food agricultural products; Marine and forest products; Cotton and cotton seeds; Coal and natural gas; Petroleum products; Passenger cargo vessels of more than 5, 000 tons; Work of art, literary works, musical composition; Generation, transmission and distribution of electricity including that of electric cooperatives; • Sale of residential lot valued at more than P 1, 500, 000. 00; • Sale of residential house & lot/dwellings valued at more than P 2, 500, 000. 00; • Lease of residential unit with a monthly rental of more than P 10, 000. • • • 35

What are the previously exempt transactions that are now subject to VAT? Medical services such as dental & veterinary services by professionals; Legal services; Non-food agricultural products; Marine and forest products; Cotton and cotton seeds; Coal and natural gas; Petroleum products; Passenger cargo vessels of more than 5, 000 tons; Work of art, literary works, musical composition; Generation, transmission and distribution of electricity including that of electric cooperatives; • Sale of residential lot valued at more than P 1, 500, 000. 00; • Sale of residential house & lot/dwellings valued at more than P 2, 500, 000. 00; • Lease of residential unit with a monthly rental of more than P 10, 000. • • • 35

What is VAT-exempt sale? It is a sale of goods, properties or service and the use or lease of properties which is not subject to output tax and whereby the buyer is not allowed any tax credit or input tax related to such exempt sale. 36

What is VAT-exempt sale? It is a sale of goods, properties or service and the use or lease of properties which is not subject to output tax and whereby the buyer is not allowed any tax credit or input tax related to such exempt sale. 36

What are the VAT-exempt transactions? • Sale or importation of agricultural and marine food products in their original state; • Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, livestock and poultry feeds; • Importation of personal and household effects belonging to citizens coming to resettle in the Philippines; • Importation of professional instruments and implements, wearing apparel, domestic animals, and personal household effects (except any vehicle, vessel, aircraft, machinery and other goods for use in the manufacture and merchandise of any kind in commercial quantity) belonging to persons coming to settle in the Philippines, for their own use and not for sale, barter or exchange, accompanying such persons, or arriving within ninety (90) days before or after their arrival, ; • Services subject to percentage tax; • Services by agricultural contract growers and milling for others of palay into rice, corn into grits, and sugar cane into raw sugar; 37

What are the VAT-exempt transactions? • Sale or importation of agricultural and marine food products in their original state; • Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, livestock and poultry feeds; • Importation of personal and household effects belonging to citizens coming to resettle in the Philippines; • Importation of professional instruments and implements, wearing apparel, domestic animals, and personal household effects (except any vehicle, vessel, aircraft, machinery and other goods for use in the manufacture and merchandise of any kind in commercial quantity) belonging to persons coming to settle in the Philippines, for their own use and not for sale, barter or exchange, accompanying such persons, or arriving within ninety (90) days before or after their arrival, ; • Services subject to percentage tax; • Services by agricultural contract growers and milling for others of palay into rice, corn into grits, and sugar cane into raw sugar; 37

Medical, dental, hospital and veterinary services except those rendered by professionals; Educational services rendered by private educational institutions duly accredited by Dep. ED, CHED) and TESDA and rendered by government educational institutions; Services rendered by individuals pursuant to an employer-employee relationship; Services rendered by regional or area headquarters established in the Philippines by multinational corporations which act as supervisory, communications and coordinating centers and do not earn or derive income from the Philippines; Transactions which are exempt under international agreements; Sales by agricultural cooperatives duly registered with the CDA; Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered with the CDA; Sales by non-agricultural, non-electric and non-credit cooperatives duly registered with and in good standing with CDA; Provided, that the share capital contribution of each member does not exceed P 15, 000; 38 Export sales by persons who are not VAT-registered;

Medical, dental, hospital and veterinary services except those rendered by professionals; Educational services rendered by private educational institutions duly accredited by Dep. ED, CHED) and TESDA and rendered by government educational institutions; Services rendered by individuals pursuant to an employer-employee relationship; Services rendered by regional or area headquarters established in the Philippines by multinational corporations which act as supervisory, communications and coordinating centers and do not earn or derive income from the Philippines; Transactions which are exempt under international agreements; Sales by agricultural cooperatives duly registered with the CDA; Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered with the CDA; Sales by non-agricultural, non-electric and non-credit cooperatives duly registered with and in good standing with CDA; Provided, that the share capital contribution of each member does not exceed P 15, 000; 38 Export sales by persons who are not VAT-registered;

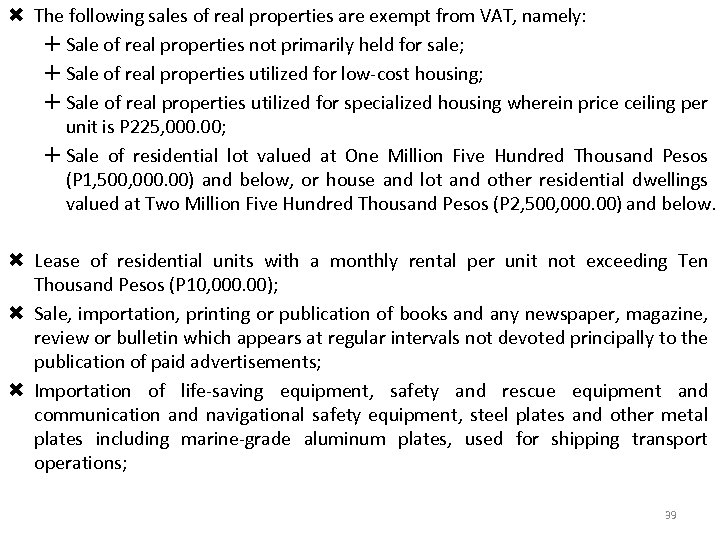

The following sales of real properties are exempt from VAT, namely: Sale of real properties not primarily held for sale; Sale of real properties utilized for low-cost housing; Sale of real properties utilized for specialized housing wherein price ceiling per unit is P 225, 000. 00; Sale of residential lot valued at One Million Five Hundred Thousand Pesos (P 1, 500, 000. 00) and below, or house and lot and other residential dwellings valued at Two Million Five Hundred Thousand Pesos (P 2, 500, 000. 00) and below. Lease of residential units with a monthly rental per unit not exceeding Ten Thousand Pesos (P 10, 000. 00); Sale, importation, printing or publication of books and any newspaper, magazine, review or bulletin which appears at regular intervals not devoted principally to the publication of paid advertisements; Importation of life-saving equipment, safety and rescue equipment and communication and navigational safety equipment, steel plates and other metal plates including marine-grade aluminum plates, used for shipping transport operations; 39

The following sales of real properties are exempt from VAT, namely: Sale of real properties not primarily held for sale; Sale of real properties utilized for low-cost housing; Sale of real properties utilized for specialized housing wherein price ceiling per unit is P 225, 000. 00; Sale of residential lot valued at One Million Five Hundred Thousand Pesos (P 1, 500, 000. 00) and below, or house and lot and other residential dwellings valued at Two Million Five Hundred Thousand Pesos (P 2, 500, 000. 00) and below. Lease of residential units with a monthly rental per unit not exceeding Ten Thousand Pesos (P 10, 000. 00); Sale, importation, printing or publication of books and any newspaper, magazine, review or bulletin which appears at regular intervals not devoted principally to the publication of paid advertisements; Importation of life-saving equipment, safety and rescue equipment and communication and navigational safety equipment, steel plates and other metal plates including marine-grade aluminum plates, used for shipping transport operations; 39

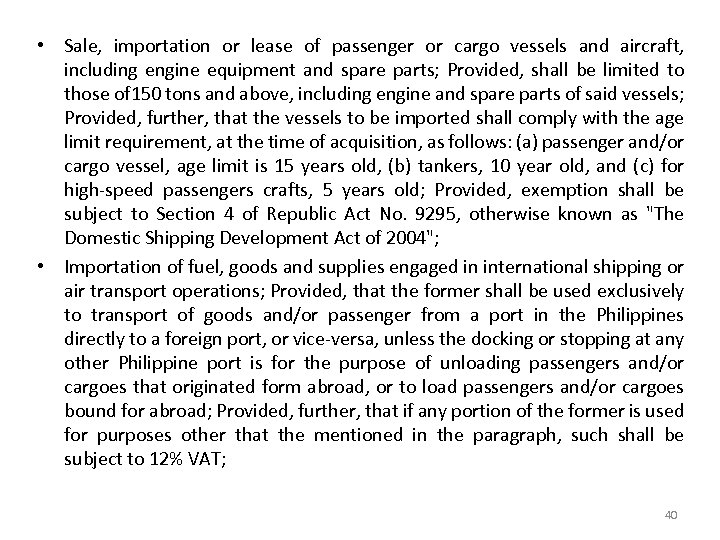

• Sale, importation or lease of passenger or cargo vessels and aircraft, including engine equipment and spare parts; Provided, shall be limited to those of 150 tons and above, including engine and spare parts of said vessels; Provided, further, that the vessels to be imported shall comply with the age limit requirement, at the time of acquisition, as follows: (a) passenger and/or cargo vessel, age limit is 15 years old, (b) tankers, 10 year old, and (c) for high-speed passengers crafts, 5 years old; Provided, exemption shall be subject to Section 4 of Republic Act No. 9295, otherwise known as "The Domestic Shipping Development Act of 2004"; • Importation of fuel, goods and supplies engaged in international shipping or air transport operations; Provided, that the former shall be used exclusively to transport of goods and/or passenger from a port in the Philippines directly to a foreign port, or vice-versa, unless the docking or stopping at any other Philippine port is for the purpose of unloading passengers and/or cargoes that originated form abroad, or to load passengers and/or cargoes bound for abroad; Provided, further, that if any portion of the former is used for purposes other that the mentioned in the paragraph, such shall be subject to 12% VAT; 40

• Sale, importation or lease of passenger or cargo vessels and aircraft, including engine equipment and spare parts; Provided, shall be limited to those of 150 tons and above, including engine and spare parts of said vessels; Provided, further, that the vessels to be imported shall comply with the age limit requirement, at the time of acquisition, as follows: (a) passenger and/or cargo vessel, age limit is 15 years old, (b) tankers, 10 year old, and (c) for high-speed passengers crafts, 5 years old; Provided, exemption shall be subject to Section 4 of Republic Act No. 9295, otherwise known as "The Domestic Shipping Development Act of 2004"; • Importation of fuel, goods and supplies engaged in international shipping or air transport operations; Provided, that the former shall be used exclusively to transport of goods and/or passenger from a port in the Philippines directly to a foreign port, or vice-versa, unless the docking or stopping at any other Philippine port is for the purpose of unloading passengers and/or cargoes that originated form abroad, or to load passengers and/or cargoes bound for abroad; Provided, further, that if any portion of the former is used for purposes other that the mentioned in the paragraph, such shall be subject to 12% VAT; 40

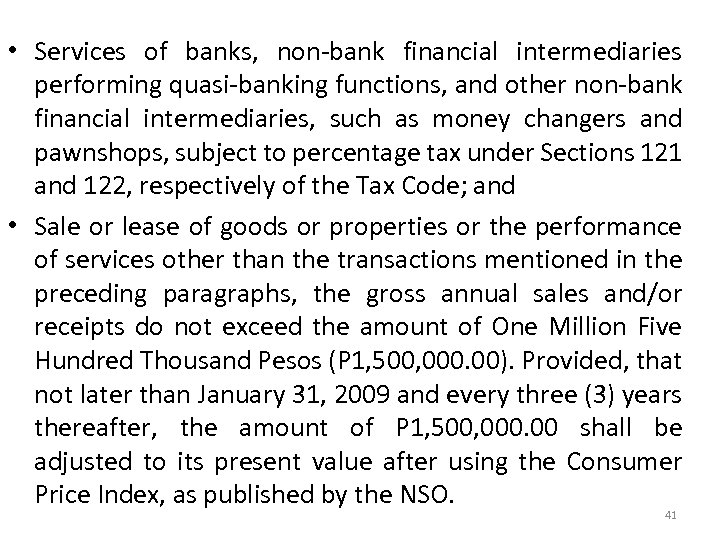

• Services of banks, non-bank financial intermediaries performing quasi-banking functions, and other non-bank financial intermediaries, such as money changers and pawnshops, subject to percentage tax under Sections 121 and 122, respectively of the Tax Code; and • Sale or lease of goods or properties or the performance of services other than the transactions mentioned in the preceding paragraphs, the gross annual sales and/or receipts do not exceed the amount of One Million Five Hundred Thousand Pesos (P 1, 500, 000. 00). Provided, that not later than January 31, 2009 and every three (3) years thereafter, the amount of P 1, 500, 000. 00 shall be adjusted to its present value after using the Consumer Price Index, as published by the NSO. 41

• Services of banks, non-bank financial intermediaries performing quasi-banking functions, and other non-bank financial intermediaries, such as money changers and pawnshops, subject to percentage tax under Sections 121 and 122, respectively of the Tax Code; and • Sale or lease of goods or properties or the performance of services other than the transactions mentioned in the preceding paragraphs, the gross annual sales and/or receipts do not exceed the amount of One Million Five Hundred Thousand Pesos (P 1, 500, 000. 00). Provided, that not later than January 31, 2009 and every three (3) years thereafter, the amount of P 1, 500, 000. 00 shall be adjusted to its present value after using the Consumer Price Index, as published by the NSO. 41

What is "RELIEF"? RELIEF means Reconciliation of Listing for Enforcement. It supports the third party information program of the Bureau through the cross referencing of third party information from the taxpayers' Summary Lists of Sales and Purchases prescribed to be submitted on a quarterly basis. 42

What is "RELIEF"? RELIEF means Reconciliation of Listing for Enforcement. It supports the third party information program of the Bureau through the cross referencing of third party information from the taxpayers' Summary Lists of Sales and Purchases prescribed to be submitted on a quarterly basis. 42

Who are required to submit Summary List of Sales? VAT taxpayers with quarterly total sales/receipts (net of VAT), exceeding P 2, 500, 000. 43

Who are required to submit Summary List of Sales? VAT taxpayers with quarterly total sales/receipts (net of VAT), exceeding P 2, 500, 000. 43

Who are required to submit Summary List of Purchases? VAT taxpayers with quarterly total purchases (net of VAT) of goods and services, including importation exceeding P 1, 500, 000. 44

Who are required to submit Summary List of Purchases? VAT taxpayers with quarterly total purchases (net of VAT) of goods and services, including importation exceeding P 1, 500, 000. 44

What are the Summary Lists required to be submitted? • Quarterly Summary List of Sales to Regular Buyers/ Customers Casual Buyers/ Customers and Output Tax • Quarterly Summary of List of Local Purchases and Input tax; and • Quarterly Summary List of Importation. 45

What are the Summary Lists required to be submitted? • Quarterly Summary List of Sales to Regular Buyers/ Customers Casual Buyers/ Customers and Output Tax • Quarterly Summary of List of Local Purchases and Input tax; and • Quarterly Summary List of Importation. 45

When is the deadline for submission of the above Summary Lists? The Summary List of Sales/Purchases, whichever is applicable, shall be submitted on or before the 25 th day of the month following the close of the taxable quarter - calendar quarter or fiscal quarter. 46

When is the deadline for submission of the above Summary Lists? The Summary List of Sales/Purchases, whichever is applicable, shall be submitted on or before the 25 th day of the month following the close of the taxable quarter - calendar quarter or fiscal quarter. 46

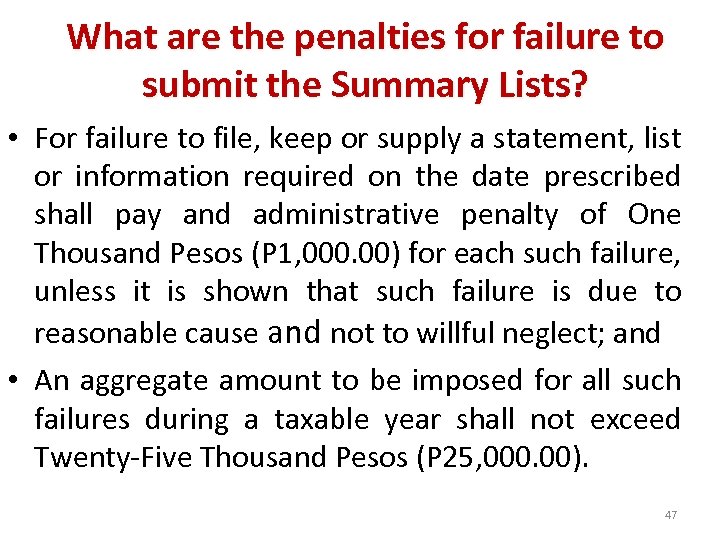

What are the penalties for failure to submit the Summary Lists? • For failure to file, keep or supply a statement, list or information required on the date prescribed shall pay and administrative penalty of One Thousand Pesos (P 1, 000. 00) for each such failure, unless it is shown that such failure is due to reasonable cause and not to willful neglect; and • An aggregate amount to be imposed for all such failures during a taxable year shall not exceed Twenty-Five Thousand Pesos (P 25, 000. 00). 47

What are the penalties for failure to submit the Summary Lists? • For failure to file, keep or supply a statement, list or information required on the date prescribed shall pay and administrative penalty of One Thousand Pesos (P 1, 000. 00) for each such failure, unless it is shown that such failure is due to reasonable cause and not to willful neglect; and • An aggregate amount to be imposed for all such failures during a taxable year shall not exceed Twenty-Five Thousand Pesos (P 25, 000. 00). 47

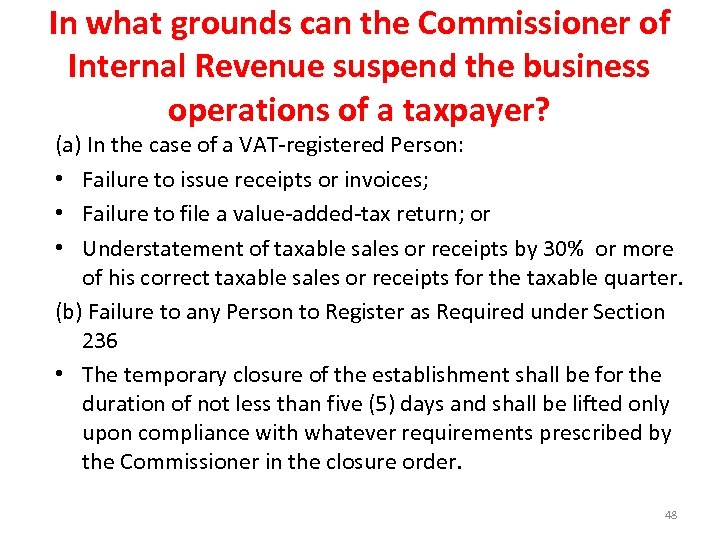

In what grounds can the Commissioner of Internal Revenue suspend the business operations of a taxpayer? (a) In the case of a VAT-registered Person: • Failure to issue receipts or invoices; • Failure to file a value-added-tax return; or • Understatement of taxable sales or receipts by 30% or more of his correct taxable sales or receipts for the taxable quarter. (b) Failure to any Person to Register as Required under Section 236 • The temporary closure of the establishment shall be for the duration of not less than five (5) days and shall be lifted only upon compliance with whatever requirements prescribed by the Commissioner in the closure order. 48

In what grounds can the Commissioner of Internal Revenue suspend the business operations of a taxpayer? (a) In the case of a VAT-registered Person: • Failure to issue receipts or invoices; • Failure to file a value-added-tax return; or • Understatement of taxable sales or receipts by 30% or more of his correct taxable sales or receipts for the taxable quarter. (b) Failure to any Person to Register as Required under Section 236 • The temporary closure of the establishment shall be for the duration of not less than five (5) days and shall be lifted only upon compliance with whatever requirements prescribed by the Commissioner in the closure order. 48

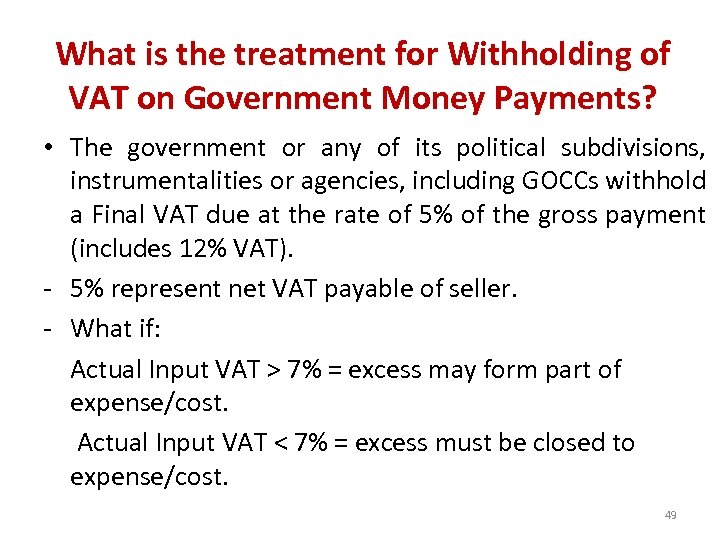

What is the treatment for Withholding of VAT on Government Money Payments? • The government or any of its political subdivisions, instrumentalities or agencies, including GOCCs withhold a Final VAT due at the rate of 5% of the gross payment (includes 12% VAT). - 5% represent net VAT payable of seller. - What if: Actual Input VAT > 7% = excess may form part of expense/cost. Actual Input VAT < 7% = excess must be closed to expense/cost. 49

What is the treatment for Withholding of VAT on Government Money Payments? • The government or any of its political subdivisions, instrumentalities or agencies, including GOCCs withhold a Final VAT due at the rate of 5% of the gross payment (includes 12% VAT). - 5% represent net VAT payable of seller. - What if: Actual Input VAT > 7% = excess may form part of expense/cost. Actual Input VAT < 7% = excess must be closed to expense/cost. 49

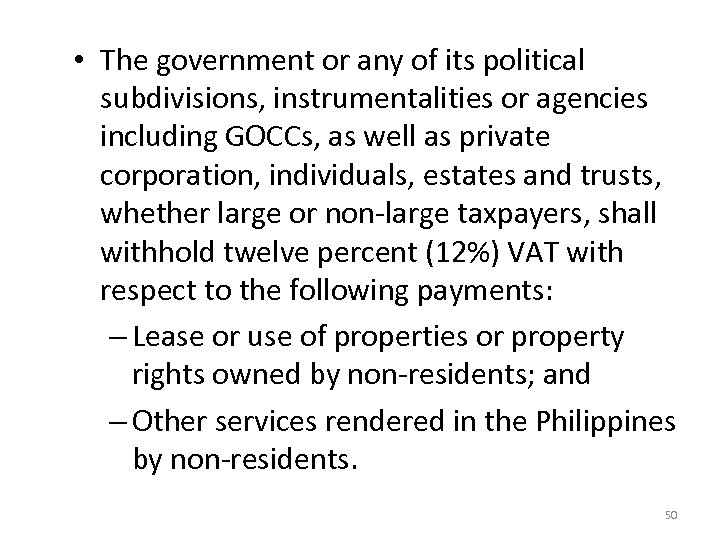

• The government or any of its political subdivisions, instrumentalities or agencies including GOCCs, as well as private corporation, individuals, estates and trusts, whether large or non-large taxpayers, shall withhold twelve percent (12%) VAT with respect to the following payments: – Lease or use of properties or property rights owned by non-residents; and – Other services rendered in the Philippines by non-residents. 50

• The government or any of its political subdivisions, instrumentalities or agencies including GOCCs, as well as private corporation, individuals, estates and trusts, whether large or non-large taxpayers, shall withhold twelve percent (12%) VAT with respect to the following payments: – Lease or use of properties or property rights owned by non-residents; and – Other services rendered in the Philippines by non-residents. 50

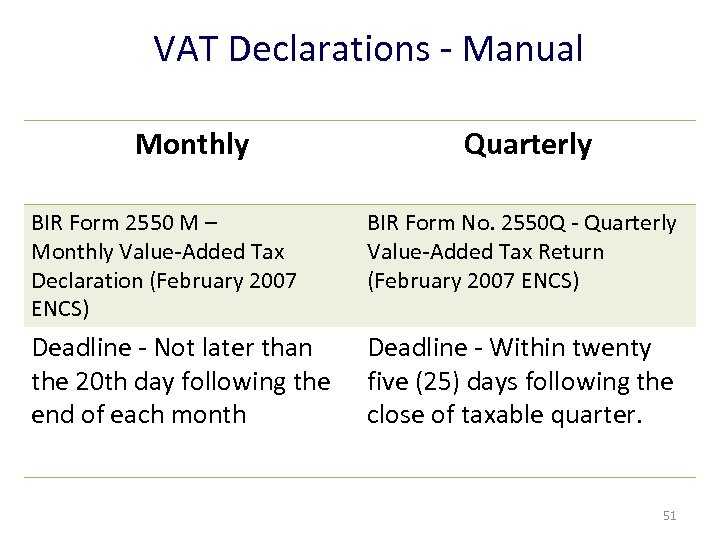

VAT Declarations - Manual Monthly Quarterly BIR Form 2550 M – Monthly Value-Added Tax Declaration (February 2007 ENCS) BIR Form No. 2550 Q - Quarterly Value-Added Tax Return (February 2007 ENCS) Deadline - Not later than the 20 th day following the end of each month Deadline - Within twenty five (25) days following the close of taxable quarter. 51

VAT Declarations - Manual Monthly Quarterly BIR Form 2550 M – Monthly Value-Added Tax Declaration (February 2007 ENCS) BIR Form No. 2550 Q - Quarterly Value-Added Tax Return (February 2007 ENCS) Deadline - Not later than the 20 th day following the end of each month Deadline - Within twenty five (25) days following the close of taxable quarter. 51

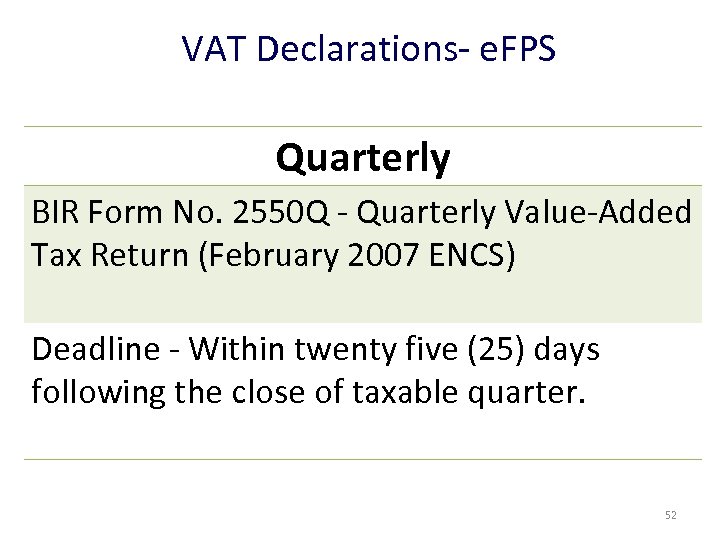

VAT Declarations- e. FPS Quarterly BIR Form No. 2550 Q - Quarterly Value-Added Tax Return (February 2007 ENCS) Deadline - Within twenty five (25) days following the close of taxable quarter. 52

VAT Declarations- e. FPS Quarterly BIR Form No. 2550 Q - Quarterly Value-Added Tax Return (February 2007 ENCS) Deadline - Within twenty five (25) days following the close of taxable quarter. 52

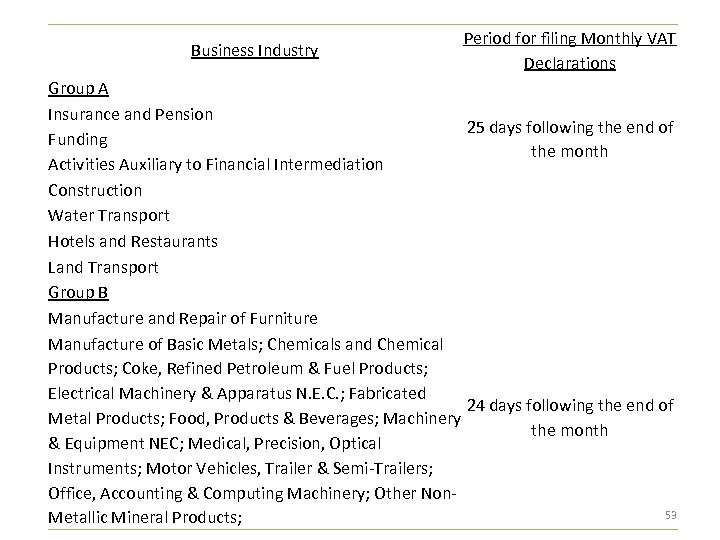

Business Industry Period for filing Monthly VAT Declarations Group A Insurance and Pension 25 days following the end of Funding the month Activities Auxiliary to Financial Intermediation Construction Water Transport Hotels and Restaurants Land Transport Group B Manufacture and Repair of Furniture Manufacture of Basic Metals; Chemicals and Chemical Products; Coke, Refined Petroleum & Fuel Products; Electrical Machinery & Apparatus N. E. C. ; Fabricated 24 days following the end of Metal Products; Food, Products & Beverages; Machinery the month & Equipment NEC; Medical, Precision, Optical Instruments; Motor Vehicles, Trailer & Semi-Trailers; Office, Accounting & Computing Machinery; Other Non 53 Metallic Mineral Products;

Business Industry Period for filing Monthly VAT Declarations Group A Insurance and Pension 25 days following the end of Funding the month Activities Auxiliary to Financial Intermediation Construction Water Transport Hotels and Restaurants Land Transport Group B Manufacture and Repair of Furniture Manufacture of Basic Metals; Chemicals and Chemical Products; Coke, Refined Petroleum & Fuel Products; Electrical Machinery & Apparatus N. E. C. ; Fabricated 24 days following the end of Metal Products; Food, Products & Beverages; Machinery the month & Equipment NEC; Medical, Precision, Optical Instruments; Motor Vehicles, Trailer & Semi-Trailers; Office, Accounting & Computing Machinery; Other Non 53 Metallic Mineral Products;

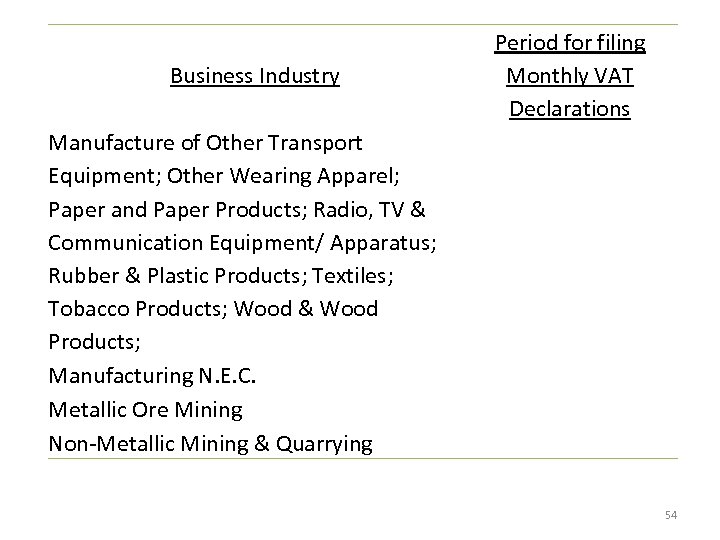

Business Industry Period for filing Monthly VAT Declarations Manufacture of Other Transport Equipment; Other Wearing Apparel; Paper and Paper Products; Radio, TV & Communication Equipment/ Apparatus; Rubber & Plastic Products; Textiles; Tobacco Products; Wood & Wood Products; Manufacturing N. E. C. Metallic Ore Mining Non-Metallic Mining & Quarrying 54

Business Industry Period for filing Monthly VAT Declarations Manufacture of Other Transport Equipment; Other Wearing Apparel; Paper and Paper Products; Radio, TV & Communication Equipment/ Apparatus; Rubber & Plastic Products; Textiles; Tobacco Products; Wood & Wood Products; Manufacturing N. E. C. Metallic Ore Mining Non-Metallic Mining & Quarrying 54

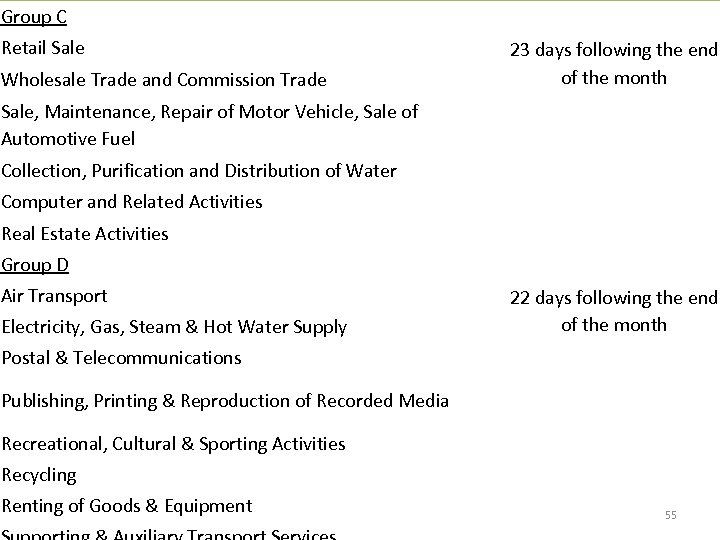

Group C Retail Sale Wholesale Trade and Commission Trade 23 days following the end of the month Sale, Maintenance, Repair of Motor Vehicle, Sale of Automotive Fuel Collection, Purification and Distribution of Water Computer and Related Activities Real Estate Activities Group D Air Transport Electricity, Gas, Steam & Hot Water Supply 22 days following the end of the month Postal & Telecommunications Publishing, Printing & Reproduction of Recorded Media Recreational, Cultural & Sporting Activities Recycling Renting of Goods & Equipment 55

Group C Retail Sale Wholesale Trade and Commission Trade 23 days following the end of the month Sale, Maintenance, Repair of Motor Vehicle, Sale of Automotive Fuel Collection, Purification and Distribution of Water Computer and Related Activities Real Estate Activities Group D Air Transport Electricity, Gas, Steam & Hot Water Supply 22 days following the end of the month Postal & Telecommunications Publishing, Printing & Reproduction of Recorded Media Recreational, Cultural & Sporting Activities Recycling Renting of Goods & Equipment 55

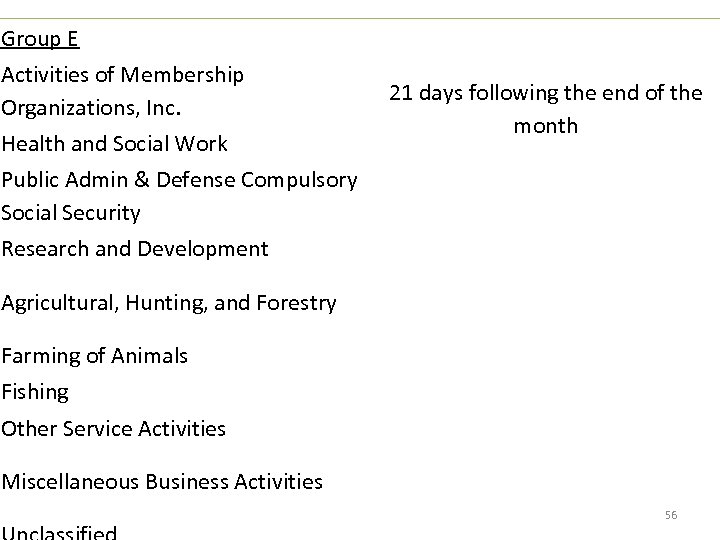

Group E Activities of Membership Organizations, Inc. Health and Social Work Public Admin & Defense Compulsory Social Security 21 days following the end of the month Research and Development Agricultural, Hunting, and Forestry Farming of Animals Fishing Other Service Activities Miscellaneous Business Activities 56

Group E Activities of Membership Organizations, Inc. Health and Social Work Public Admin & Defense Compulsory Social Security 21 days following the end of the month Research and Development Agricultural, Hunting, and Forestry Farming of Animals Fishing Other Service Activities Miscellaneous Business Activities 56

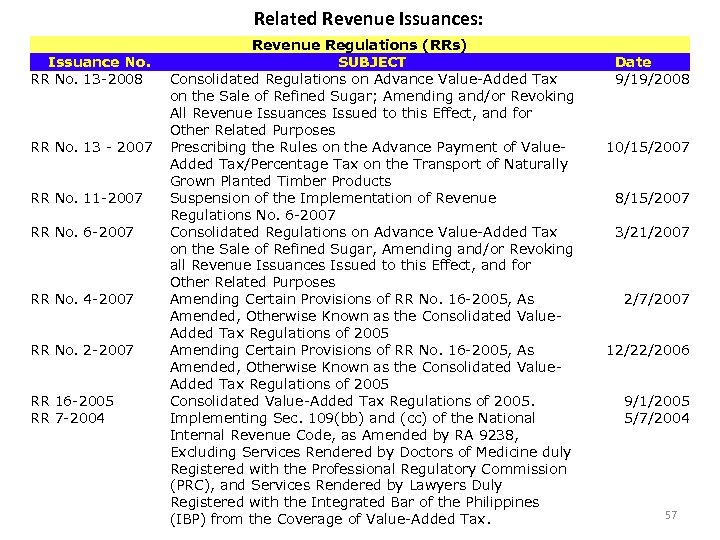

Related Revenue Issuances: Issuance No. RR No. 13 -2008 RR No. 13 - 2007 RR No. 11 -2007 RR No. 6 -2007 RR No. 4 -2007 RR No. 2 -2007 RR 16 -2005 RR 7 -2004 Revenue Regulations (RRs) SUBJECT Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar; Amending and/or Revoking All Revenue Issuances Issued to this Effect, and for Other Related Purposes Prescribing the Rules on the Advance Payment of Value. Added Tax/Percentage Tax on the Transport of Naturally Grown Planted Timber Products Suspension of the Implementation of Revenue Regulations No. 6 -2007 Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar, Amending and/or Revoking all Revenue Issuances Issued to this Effect, and for Other Related Purposes Amending Certain Provisions of RR No. 16 -2005, As Amended, Otherwise Known as the Consolidated Value. Added Tax Regulations of 2005 Consolidated Value-Added Tax Regulations of 2005. Implementing Sec. 109(bb) and (cc) of the National Internal Revenue Code, as Amended by RA 9238, Excluding Services Rendered by Doctors of Medicine duly Registered with the Professional Regulatory Commission (PRC), and Services Rendered by Lawyers Duly Registered with the Integrated Bar of the Philippines (IBP) from the Coverage of Value-Added Tax. Date 9/19/2008 10/15/2007 8/15/2007 3/21/2007 2/7/2007 12/22/2006 9/1/2005 5/7/2004 57

Related Revenue Issuances: Issuance No. RR No. 13 -2008 RR No. 13 - 2007 RR No. 11 -2007 RR No. 6 -2007 RR No. 4 -2007 RR No. 2 -2007 RR 16 -2005 RR 7 -2004 Revenue Regulations (RRs) SUBJECT Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar; Amending and/or Revoking All Revenue Issuances Issued to this Effect, and for Other Related Purposes Prescribing the Rules on the Advance Payment of Value. Added Tax/Percentage Tax on the Transport of Naturally Grown Planted Timber Products Suspension of the Implementation of Revenue Regulations No. 6 -2007 Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar, Amending and/or Revoking all Revenue Issuances Issued to this Effect, and for Other Related Purposes Amending Certain Provisions of RR No. 16 -2005, As Amended, Otherwise Known as the Consolidated Value. Added Tax Regulations of 2005 Consolidated Value-Added Tax Regulations of 2005. Implementing Sec. 109(bb) and (cc) of the National Internal Revenue Code, as Amended by RA 9238, Excluding Services Rendered by Doctors of Medicine duly Registered with the Professional Regulatory Commission (PRC), and Services Rendered by Lawyers Duly Registered with the Integrated Bar of the Philippines (IBP) from the Coverage of Value-Added Tax. Date 9/19/2008 10/15/2007 8/15/2007 3/21/2007 2/7/2007 12/22/2006 9/1/2005 5/7/2004 57

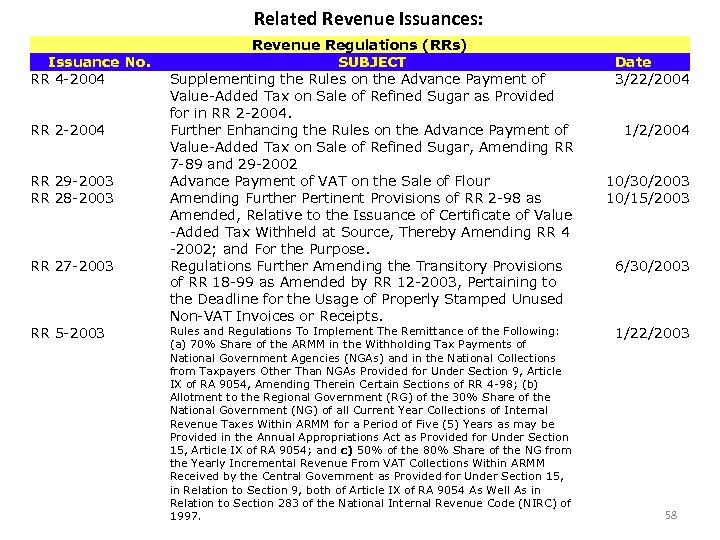

Related Revenue Issuances: Issuance No. RR 4 -2004 RR 29 -2003 RR 28 -2003 RR 27 -2003 RR 5 -2003 Revenue Regulations (RRs) SUBJECT Supplementing the Rules on the Advance Payment of Value-Added Tax on Sale of Refined Sugar as Provided for in RR 2 -2004. Further Enhancing the Rules on the Advance Payment of Value-Added Tax on Sale of Refined Sugar, Amending RR 7 -89 and 29 -2002 Advance Payment of VAT on the Sale of Flour Amending Further Pertinent Provisions of RR 2 -98 as Amended, Relative to the Issuance of Certificate of Value -Added Tax Withheld at Source, Thereby Amending RR 4 -2002; and For the Purpose. Regulations Further Amending the Transitory Provisions of RR 18 -99 as Amended by RR 12 -2003, Pertaining to the Deadline for the Usage of Properly Stamped Unused Non-VAT Invoices or Receipts. Rules and Regulations To Implement The Remittance of the Following: (a) 70% Share of the ARMM in the Withholding Tax Payments of National Government Agencies (NGAs) and in the National Collections from Taxpayers Other Than NGAs Provided for Under Section 9, Article IX of RA 9054, Amending Therein Certain Sections of RR 4 -98; (b) Allotment to the Regional Government (RG) of the 30% Share of the National Government (NG) of all Current Year Collections of Internal Revenue Taxes Within ARMM for a Period of Five (5) Years as may be Provided in the Annual Appropriations Act as Provided for Under Section 15, Article IX of RA 9054; and c) 50% of the 80% Share of the NG from the Yearly Incremental Revenue From VAT Collections Within ARMM Received by the Central Government as Provided for Under Section 15, in Relation to Section 9, both of Article IX of RA 9054 As Well As in Relation to Section 283 of the National Internal Revenue Code (NIRC) of 1997. Date 3/22/2004 1/2/2004 10/30/2003 10/15/2003 6/30/2003 1/22/2003 58

Related Revenue Issuances: Issuance No. RR 4 -2004 RR 29 -2003 RR 28 -2003 RR 27 -2003 RR 5 -2003 Revenue Regulations (RRs) SUBJECT Supplementing the Rules on the Advance Payment of Value-Added Tax on Sale of Refined Sugar as Provided for in RR 2 -2004. Further Enhancing the Rules on the Advance Payment of Value-Added Tax on Sale of Refined Sugar, Amending RR 7 -89 and 29 -2002 Advance Payment of VAT on the Sale of Flour Amending Further Pertinent Provisions of RR 2 -98 as Amended, Relative to the Issuance of Certificate of Value -Added Tax Withheld at Source, Thereby Amending RR 4 -2002; and For the Purpose. Regulations Further Amending the Transitory Provisions of RR 18 -99 as Amended by RR 12 -2003, Pertaining to the Deadline for the Usage of Properly Stamped Unused Non-VAT Invoices or Receipts. Rules and Regulations To Implement The Remittance of the Following: (a) 70% Share of the ARMM in the Withholding Tax Payments of National Government Agencies (NGAs) and in the National Collections from Taxpayers Other Than NGAs Provided for Under Section 9, Article IX of RA 9054, Amending Therein Certain Sections of RR 4 -98; (b) Allotment to the Regional Government (RG) of the 30% Share of the National Government (NG) of all Current Year Collections of Internal Revenue Taxes Within ARMM for a Period of Five (5) Years as may be Provided in the Annual Appropriations Act as Provided for Under Section 15, Article IX of RA 9054; and c) 50% of the 80% Share of the NG from the Yearly Incremental Revenue From VAT Collections Within ARMM Received by the Central Government as Provided for Under Section 15, in Relation to Section 9, both of Article IX of RA 9054 As Well As in Relation to Section 283 of the National Internal Revenue Code (NIRC) of 1997. Date 3/22/2004 1/2/2004 10/30/2003 10/15/2003 6/30/2003 1/22/2003 58

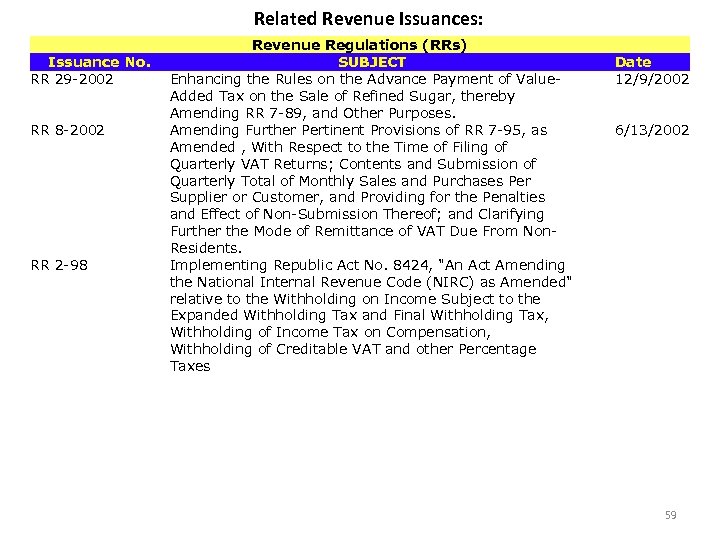

Related Revenue Issuances: Issuance No. RR 29 -2002 RR 8 -2002 RR 2 -98 Revenue Regulations (RRs) SUBJECT Enhancing the Rules on the Advance Payment of Value. Added Tax on the Sale of Refined Sugar, thereby Amending RR 7 -89, and Other Purposes. Amending Further Pertinent Provisions of RR 7 -95, as Amended , With Respect to the Time of Filing of Quarterly VAT Returns; Contents and Submission of Quarterly Total of Monthly Sales and Purchases Per Supplier or Customer, and Providing for the Penalties and Effect of Non-Submission Thereof; and Clarifying Further the Mode of Remittance of VAT Due From Non. Residents. Implementing Republic Act No. 8424, "An Act Amending the National Internal Revenue Code (NIRC) as Amended" relative to the Withholding on Income Subject to the Expanded Withholding Tax and Final Withholding Tax, Withholding of Income Tax on Compensation, Withholding of Creditable VAT and other Percentage Taxes Date 12/9/2002 6/13/2002 59

Related Revenue Issuances: Issuance No. RR 29 -2002 RR 8 -2002 RR 2 -98 Revenue Regulations (RRs) SUBJECT Enhancing the Rules on the Advance Payment of Value. Added Tax on the Sale of Refined Sugar, thereby Amending RR 7 -89, and Other Purposes. Amending Further Pertinent Provisions of RR 7 -95, as Amended , With Respect to the Time of Filing of Quarterly VAT Returns; Contents and Submission of Quarterly Total of Monthly Sales and Purchases Per Supplier or Customer, and Providing for the Penalties and Effect of Non-Submission Thereof; and Clarifying Further the Mode of Remittance of VAT Due From Non. Residents. Implementing Republic Act No. 8424, "An Act Amending the National Internal Revenue Code (NIRC) as Amended" relative to the Withholding on Income Subject to the Expanded Withholding Tax and Final Withholding Tax, Withholding of Income Tax on Compensation, Withholding of Creditable VAT and other Percentage Taxes Date 12/9/2002 6/13/2002 59

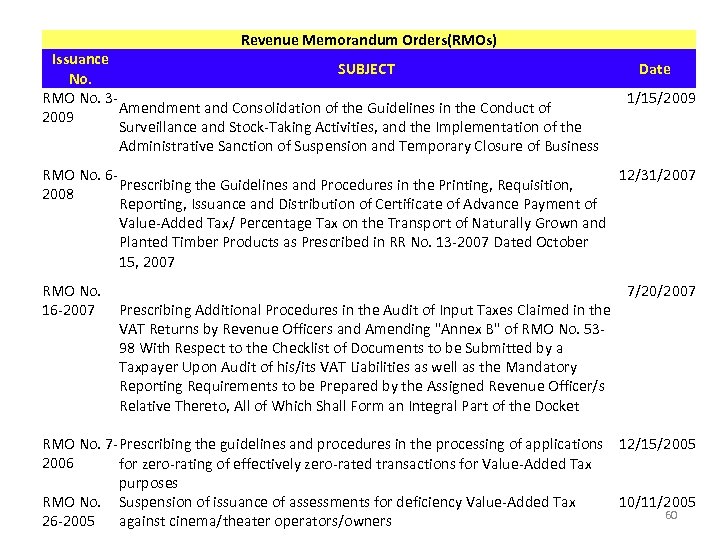

Revenue Memorandum Orders(RMOs) Issuance SUBJECT No. RMO No. 3 Amendment and Consolidation of the Guidelines in the Conduct of 2009 Surveillance and Stock-Taking Activities, and the Implementation of the Administrative Sanction of Suspension and Temporary Closure of Business Date 1/15/2009 RMO No. 612/31/2007 Prescribing the Guidelines and Procedures in the Printing, Requisition, 2008 Reporting, Issuance and Distribution of Certificate of Advance Payment of Value-Added Tax/ Percentage Tax on the Transport of Naturally Grown and Planted Timber Products as Prescribed in RR No. 13 -2007 Dated October 15, 2007 RMO No. 7/20/2007 16 -2007 Prescribing Additional Procedures in the Audit of Input Taxes Claimed in the VAT Returns by Revenue Officers and Amending "Annex B" of RMO No. 5398 With Respect to the Checklist of Documents to be Submitted by a Taxpayer Upon Audit of his/its VAT Liabilities as well as the Mandatory Reporting Requirements to be Prepared by the Assigned Revenue Officer/s Relative Thereto, All of Which Shall Form an Integral Part of the Docket RMO No. 7 - Prescribing the guidelines and procedures in the processing of applications 12/15/2005 2006 for zero-rating of effectively zero-rated transactions for Value-Added Tax purposes RMO No. Suspension of issuance of assessments for deficiency Value-Added Tax 10/11/2005 60 26 -2005 against cinema/theater operators/owners

Revenue Memorandum Orders(RMOs) Issuance SUBJECT No. RMO No. 3 Amendment and Consolidation of the Guidelines in the Conduct of 2009 Surveillance and Stock-Taking Activities, and the Implementation of the Administrative Sanction of Suspension and Temporary Closure of Business Date 1/15/2009 RMO No. 612/31/2007 Prescribing the Guidelines and Procedures in the Printing, Requisition, 2008 Reporting, Issuance and Distribution of Certificate of Advance Payment of Value-Added Tax/ Percentage Tax on the Transport of Naturally Grown and Planted Timber Products as Prescribed in RR No. 13 -2007 Dated October 15, 2007 RMO No. 7/20/2007 16 -2007 Prescribing Additional Procedures in the Audit of Input Taxes Claimed in the VAT Returns by Revenue Officers and Amending "Annex B" of RMO No. 5398 With Respect to the Checklist of Documents to be Submitted by a Taxpayer Upon Audit of his/its VAT Liabilities as well as the Mandatory Reporting Requirements to be Prepared by the Assigned Revenue Officer/s Relative Thereto, All of Which Shall Form an Integral Part of the Docket RMO No. 7 - Prescribing the guidelines and procedures in the processing of applications 12/15/2005 2006 for zero-rating of effectively zero-rated transactions for Value-Added Tax purposes RMO No. Suspension of issuance of assessments for deficiency Value-Added Tax 10/11/2005 60 26 -2005 against cinema/theater operators/owners

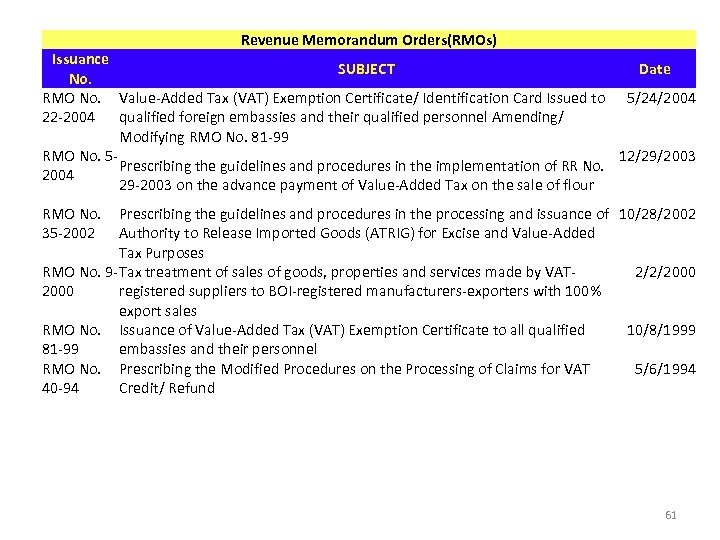

Revenue Memorandum Orders(RMOs) Issuance SUBJECT Date No. RMO No. Value-Added Tax (VAT) Exemption Certificate/ Identification Card Issued to 5/24/2004 22 -2004 qualified foreign embassies and their qualified personnel Amending/ Modifying RMO No. 81 -99 RMO No. 512/29/2003 Prescribing the guidelines and procedures in the implementation of RR No. 2004 29 -2003 on the advance payment of Value-Added Tax on the sale of flour RMO No. Prescribing the guidelines and procedures in the processing and issuance of 10/28/2002 35 -2002 Authority to Release Imported Goods (ATRIG) for Excise and Value-Added Tax Purposes RMO No. 9 - Tax treatment of sales of goods, properties and services made by VAT- 2/2/2000 registered suppliers to BOI-registered manufacturers-exporters with 100% export sales RMO No. Issuance of Value-Added Tax (VAT) Exemption Certificate to all qualified 10/8/1999 81 -99 embassies and their personnel RMO No. Prescribing the Modified Procedures on the Processing of Claims for VAT 5/6/1994 40 -94 Credit/ Refund 61

Revenue Memorandum Orders(RMOs) Issuance SUBJECT Date No. RMO No. Value-Added Tax (VAT) Exemption Certificate/ Identification Card Issued to 5/24/2004 22 -2004 qualified foreign embassies and their qualified personnel Amending/ Modifying RMO No. 81 -99 RMO No. 512/29/2003 Prescribing the guidelines and procedures in the implementation of RR No. 2004 29 -2003 on the advance payment of Value-Added Tax on the sale of flour RMO No. Prescribing the guidelines and procedures in the processing and issuance of 10/28/2002 35 -2002 Authority to Release Imported Goods (ATRIG) for Excise and Value-Added Tax Purposes RMO No. 9 - Tax treatment of sales of goods, properties and services made by VAT- 2/2/2000 registered suppliers to BOI-registered manufacturers-exporters with 100% export sales RMO No. Issuance of Value-Added Tax (VAT) Exemption Certificate to all qualified 10/8/1999 81 -99 embassies and their personnel RMO No. Prescribing the Modified Procedures on the Processing of Claims for VAT 5/6/1994 40 -94 Credit/ Refund 61

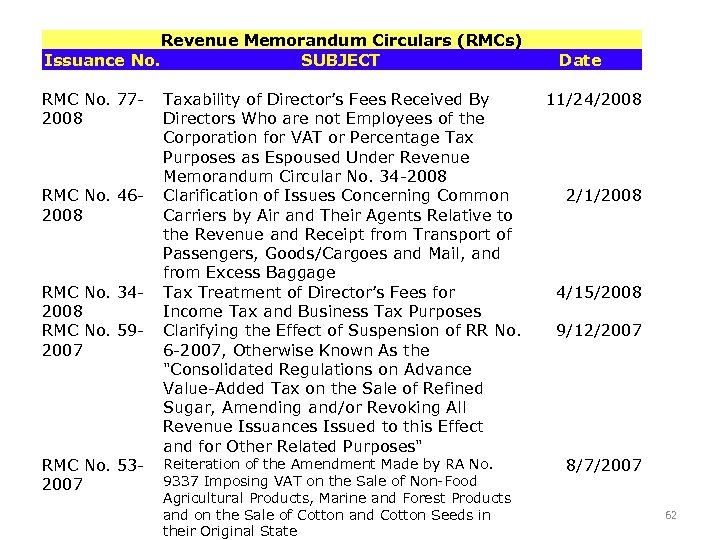

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 772008 RMC No. 462008 RMC No. 342008 RMC No. 592007 RMC No. 532007 Taxability of Director’s Fees Received By Directors Who are not Employees of the Corporation for VAT or Percentage Tax Purposes as Espoused Under Revenue Memorandum Circular No. 34 -2008 Clarification of Issues Concerning Common Carriers by Air and Their Agents Relative to the Revenue and Receipt from Transport of Passengers, Goods/Cargoes and Mail, and from Excess Baggage Tax Treatment of Director’s Fees for Income Tax and Business Tax Purposes Clarifying the Effect of Suspension of RR No. 6 -2007, Otherwise Known As the "Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar, Amending and/or Revoking All Revenue Issuances Issued to this Effect and for Other Related Purposes" Reiteration of the Amendment Made by RA No. 9337 Imposing VAT on the Sale of Non-Food Agricultural Products, Marine and Forest Products and on the Sale of Cotton and Cotton Seeds in their Original State Date 11/24/2008 2/1/2008 4/15/2008 9/12/2007 8/7/2007 62

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 772008 RMC No. 462008 RMC No. 342008 RMC No. 592007 RMC No. 532007 Taxability of Director’s Fees Received By Directors Who are not Employees of the Corporation for VAT or Percentage Tax Purposes as Espoused Under Revenue Memorandum Circular No. 34 -2008 Clarification of Issues Concerning Common Carriers by Air and Their Agents Relative to the Revenue and Receipt from Transport of Passengers, Goods/Cargoes and Mail, and from Excess Baggage Tax Treatment of Director’s Fees for Income Tax and Business Tax Purposes Clarifying the Effect of Suspension of RR No. 6 -2007, Otherwise Known As the "Consolidated Regulations on Advance Value-Added Tax on the Sale of Refined Sugar, Amending and/or Revoking All Revenue Issuances Issued to this Effect and for Other Related Purposes" Reiteration of the Amendment Made by RA No. 9337 Imposing VAT on the Sale of Non-Food Agricultural Products, Marine and Forest Products and on the Sale of Cotton and Cotton Seeds in their Original State Date 11/24/2008 2/1/2008 4/15/2008 9/12/2007 8/7/2007 62

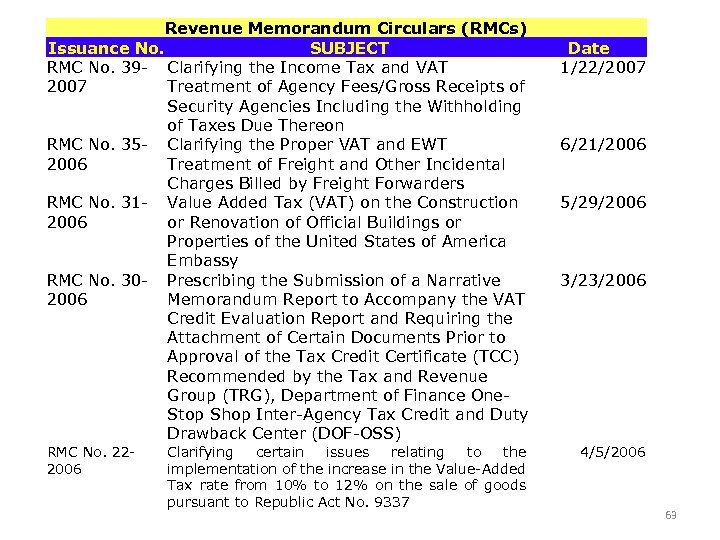

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 39 - Clarifying the Income Tax and VAT 2007 Treatment of Agency Fees/Gross Receipts of Security Agencies Including the Withholding of Taxes Due Thereon RMC No. 35 - Clarifying the Proper VAT and EWT 2006 Treatment of Freight and Other Incidental Charges Billed by Freight Forwarders RMC No. 31 - Value Added Tax (VAT) on the Construction 2006 or Renovation of Official Buildings or Properties of the United States of America Embassy RMC No. 30 - Prescribing the Submission of a Narrative 2006 Memorandum Report to Accompany the VAT Credit Evaluation Report and Requiring the Attachment of Certain Documents Prior to Approval of the Tax Credit Certificate (TCC) Recommended by the Tax and Revenue Group (TRG), Department of Finance One. Stop Shop Inter-Agency Tax Credit and Duty Drawback Center (DOF-OSS) RMC No. 222006 Clarifying certain issues relating to the implementation of the increase in the Value-Added Tax rate from 10% to 12% on the sale of goods pursuant to Republic Act No. 9337 Date 1/22/2007 6/21/2006 5/29/2006 3/23/2006 4/5/2006 63

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 39 - Clarifying the Income Tax and VAT 2007 Treatment of Agency Fees/Gross Receipts of Security Agencies Including the Withholding of Taxes Due Thereon RMC No. 35 - Clarifying the Proper VAT and EWT 2006 Treatment of Freight and Other Incidental Charges Billed by Freight Forwarders RMC No. 31 - Value Added Tax (VAT) on the Construction 2006 or Renovation of Official Buildings or Properties of the United States of America Embassy RMC No. 30 - Prescribing the Submission of a Narrative 2006 Memorandum Report to Accompany the VAT Credit Evaluation Report and Requiring the Attachment of Certain Documents Prior to Approval of the Tax Credit Certificate (TCC) Recommended by the Tax and Revenue Group (TRG), Department of Finance One. Stop Shop Inter-Agency Tax Credit and Duty Drawback Center (DOF-OSS) RMC No. 222006 Clarifying certain issues relating to the implementation of the increase in the Value-Added Tax rate from 10% to 12% on the sale of goods pursuant to Republic Act No. 9337 Date 1/22/2007 6/21/2006 5/29/2006 3/23/2006 4/5/2006 63

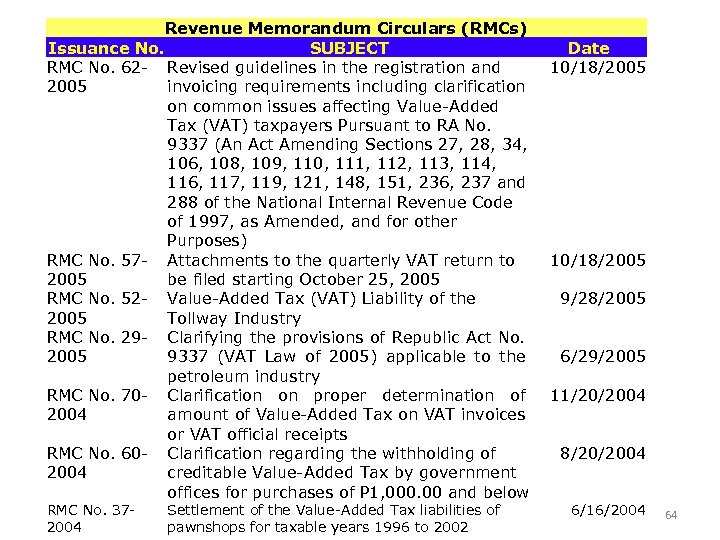

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 62 - Revised guidelines in the registration and 2005 invoicing requirements including clarification on common issues affecting Value-Added Tax (VAT) taxpayers Pursuant to RA No. 9337 (An Act Amending Sections 27, 28, 34, 106, 108, 109, 110, 111, 112, 113, 114, 116, 117, 119, 121, 148, 151, 236, 237 and 288 of the National Internal Revenue Code of 1997, as Amended, and for other Purposes) RMC No. 57 - Attachments to the quarterly VAT return to 2005 be filed starting October 25, 2005 RMC No. 52 - Value-Added Tax (VAT) Liability of the 2005 Tollway Industry RMC No. 29 - Clarifying the provisions of Republic Act No. 2005 9337 (VAT Law of 2005) applicable to the petroleum industry RMC No. 70 - Clarification on proper determination of 2004 amount of Value-Added Tax on VAT invoices or VAT official receipts RMC No. 60 - Clarification regarding the withholding of 2004 creditable Value-Added Tax by government offices for purchases of P 1, 000. 00 and below RMC No. 372004 Settlement of the Value-Added Tax liabilities of pawnshops for taxable years 1996 to 2002 Date 10/18/2005 9/28/2005 6/29/2005 11/20/2004 8/20/2004 6/16/2004 64

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 62 - Revised guidelines in the registration and 2005 invoicing requirements including clarification on common issues affecting Value-Added Tax (VAT) taxpayers Pursuant to RA No. 9337 (An Act Amending Sections 27, 28, 34, 106, 108, 109, 110, 111, 112, 113, 114, 116, 117, 119, 121, 148, 151, 236, 237 and 288 of the National Internal Revenue Code of 1997, as Amended, and for other Purposes) RMC No. 57 - Attachments to the quarterly VAT return to 2005 be filed starting October 25, 2005 RMC No. 52 - Value-Added Tax (VAT) Liability of the 2005 Tollway Industry RMC No. 29 - Clarifying the provisions of Republic Act No. 2005 9337 (VAT Law of 2005) applicable to the petroleum industry RMC No. 70 - Clarification on proper determination of 2004 amount of Value-Added Tax on VAT invoices or VAT official receipts RMC No. 60 - Clarification regarding the withholding of 2004 creditable Value-Added Tax by government offices for purchases of P 1, 000. 00 and below RMC No. 372004 Settlement of the Value-Added Tax liabilities of pawnshops for taxable years 1996 to 2002 Date 10/18/2005 9/28/2005 6/29/2005 11/20/2004 8/20/2004 6/16/2004 64

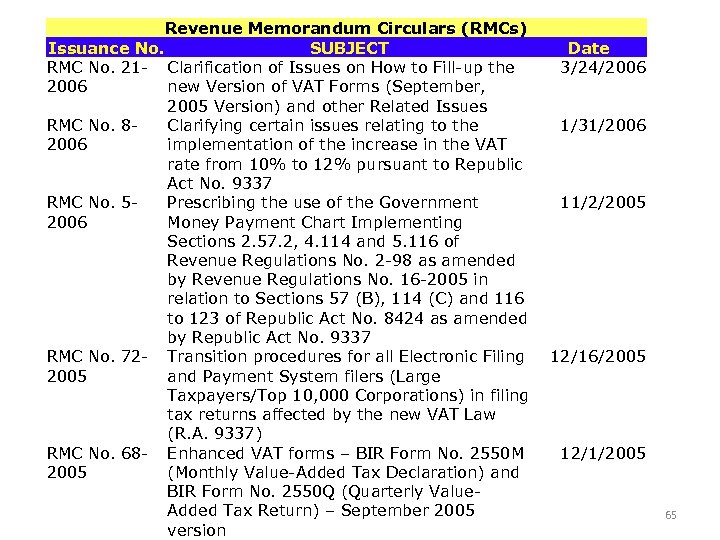

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 21 - Clarification of Issues on How to Fill-up the 2006 new Version of VAT Forms (September, 2005 Version) and other Related Issues RMC No. 8 Clarifying certain issues relating to the 2006 implementation of the increase in the VAT rate from 10% to 12% pursuant to Republic Act No. 9337 RMC No. 5 Prescribing the use of the Government 2006 Money Payment Chart Implementing Sections 2. 57. 2, 4. 114 and 5. 116 of Revenue Regulations No. 2 -98 as amended by Revenue Regulations No. 16 -2005 in relation to Sections 57 (B), 114 (C) and 116 to 123 of Republic Act No. 8424 as amended by Republic Act No. 9337 RMC No. 72 - Transition procedures for all Electronic Filing 2005 and Payment System filers (Large Taxpayers/Top 10, 000 Corporations) in filing tax returns affected by the new VAT Law (R. A. 9337) RMC No. 68 - Enhanced VAT forms – BIR Form No. 2550 M 2005 (Monthly Value-Added Tax Declaration) and BIR Form No. 2550 Q (Quarterly Value. Added Tax Return) – September 2005 version Date 3/24/2006 1/31/2006 11/2/2005 12/16/2005 12/1/2005 65

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 21 - Clarification of Issues on How to Fill-up the 2006 new Version of VAT Forms (September, 2005 Version) and other Related Issues RMC No. 8 Clarifying certain issues relating to the 2006 implementation of the increase in the VAT rate from 10% to 12% pursuant to Republic Act No. 9337 RMC No. 5 Prescribing the use of the Government 2006 Money Payment Chart Implementing Sections 2. 57. 2, 4. 114 and 5. 116 of Revenue Regulations No. 2 -98 as amended by Revenue Regulations No. 16 -2005 in relation to Sections 57 (B), 114 (C) and 116 to 123 of Republic Act No. 8424 as amended by Republic Act No. 9337 RMC No. 72 - Transition procedures for all Electronic Filing 2005 and Payment System filers (Large Taxpayers/Top 10, 000 Corporations) in filing tax returns affected by the new VAT Law (R. A. 9337) RMC No. 68 - Enhanced VAT forms – BIR Form No. 2550 M 2005 (Monthly Value-Added Tax Declaration) and BIR Form No. 2550 Q (Quarterly Value. Added Tax Return) – September 2005 version Date 3/24/2006 1/31/2006 11/2/2005 12/16/2005 12/1/2005 65

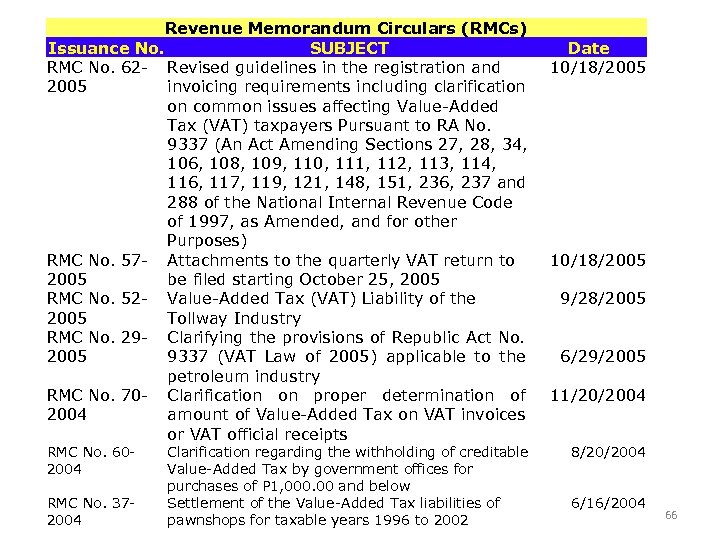

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 62 - Revised guidelines in the registration and 2005 invoicing requirements including clarification on common issues affecting Value-Added Tax (VAT) taxpayers Pursuant to RA No. 9337 (An Act Amending Sections 27, 28, 34, 106, 108, 109, 110, 111, 112, 113, 114, 116, 117, 119, 121, 148, 151, 236, 237 and 288 of the National Internal Revenue Code of 1997, as Amended, and for other Purposes) RMC No. 57 - Attachments to the quarterly VAT return to 2005 be filed starting October 25, 2005 RMC No. 52 - Value-Added Tax (VAT) Liability of the 2005 Tollway Industry RMC No. 29 - Clarifying the provisions of Republic Act No. 2005 9337 (VAT Law of 2005) applicable to the petroleum industry RMC No. 70 - Clarification on proper determination of 2004 amount of Value-Added Tax on VAT invoices or VAT official receipts RMC No. 602004 RMC No. 372004 Clarification regarding the withholding of creditable Value-Added Tax by government offices for purchases of P 1, 000. 00 and below Settlement of the Value-Added Tax liabilities of pawnshops for taxable years 1996 to 2002 Date 10/18/2005 9/28/2005 6/29/2005 11/20/2004 8/20/2004 6/16/2004 66

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 62 - Revised guidelines in the registration and 2005 invoicing requirements including clarification on common issues affecting Value-Added Tax (VAT) taxpayers Pursuant to RA No. 9337 (An Act Amending Sections 27, 28, 34, 106, 108, 109, 110, 111, 112, 113, 114, 116, 117, 119, 121, 148, 151, 236, 237 and 288 of the National Internal Revenue Code of 1997, as Amended, and for other Purposes) RMC No. 57 - Attachments to the quarterly VAT return to 2005 be filed starting October 25, 2005 RMC No. 52 - Value-Added Tax (VAT) Liability of the 2005 Tollway Industry RMC No. 29 - Clarifying the provisions of Republic Act No. 2005 9337 (VAT Law of 2005) applicable to the petroleum industry RMC No. 70 - Clarification on proper determination of 2004 amount of Value-Added Tax on VAT invoices or VAT official receipts RMC No. 602004 RMC No. 372004 Clarification regarding the withholding of creditable Value-Added Tax by government offices for purchases of P 1, 000. 00 and below Settlement of the Value-Added Tax liabilities of pawnshops for taxable years 1996 to 2002 Date 10/18/2005 9/28/2005 6/29/2005 11/20/2004 8/20/2004 6/16/2004 66

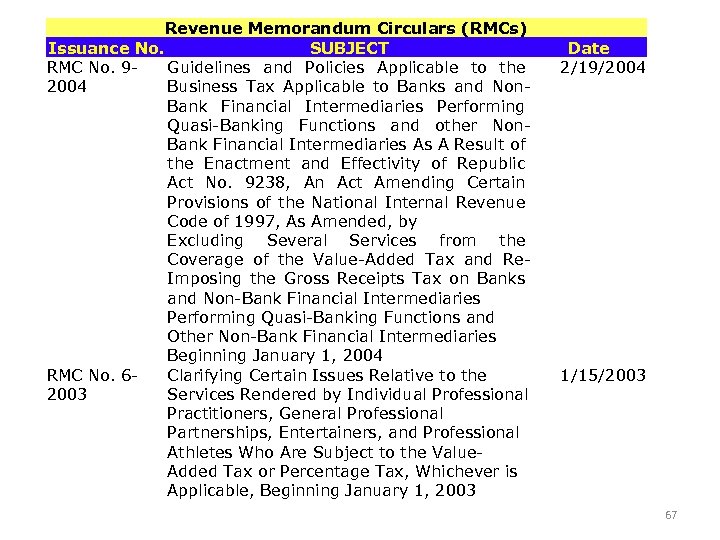

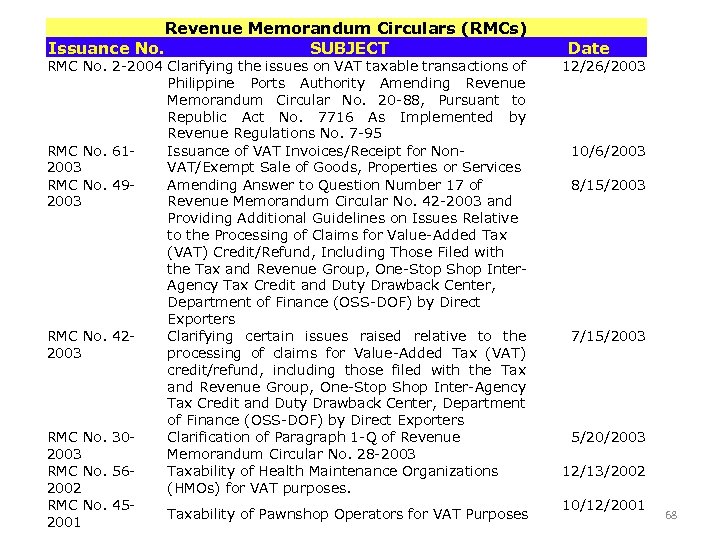

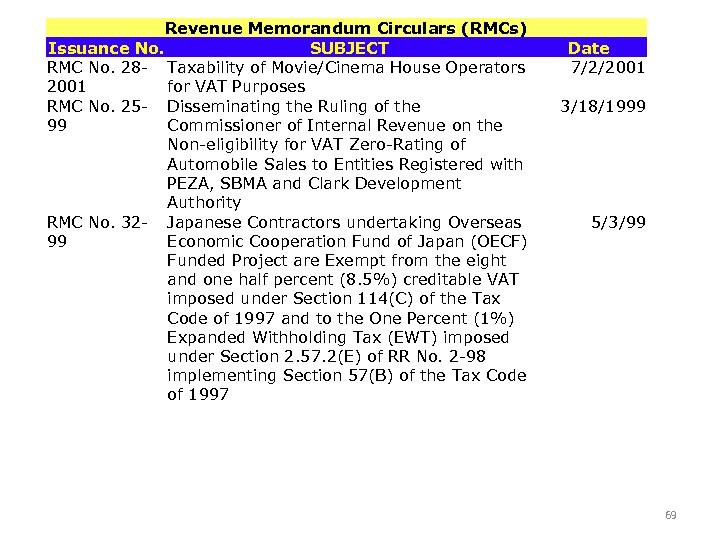

Revenue Memorandum Circulars (RMCs) Issuance No. SUBJECT RMC No. 9 Guidelines and Policies Applicable to the 2004 Business Tax Applicable to Banks and Non. Bank Financial Intermediaries Performing Quasi-Banking Functions and other Non. Bank Financial Intermediaries As A Result of the Enactment and Effectivity of Republic Act No. 9238, An Act Amending Certain Provisions of the National Internal Revenue Code of 1997, As Amended, by Excluding Several Services from the Coverage of the Value-Added Tax and Re. Imposing the Gross Receipts Tax on Banks and Non-Bank Financial Intermediaries Performing Quasi-Banking Functions and Other Non-Bank Financial Intermediaries Beginning January 1, 2004 RMC No. 6 Clarifying Certain Issues Relative to the 2003 Services Rendered by Individual Professional Practitioners, General Professional Partnerships, Entertainers, and Professional Athletes Who Are Subject to the Value. Added Tax or Percentage Tax, Whichever is Applicable, Beginning January 1, 2003 Date 2/19/2004 1/15/2003 67