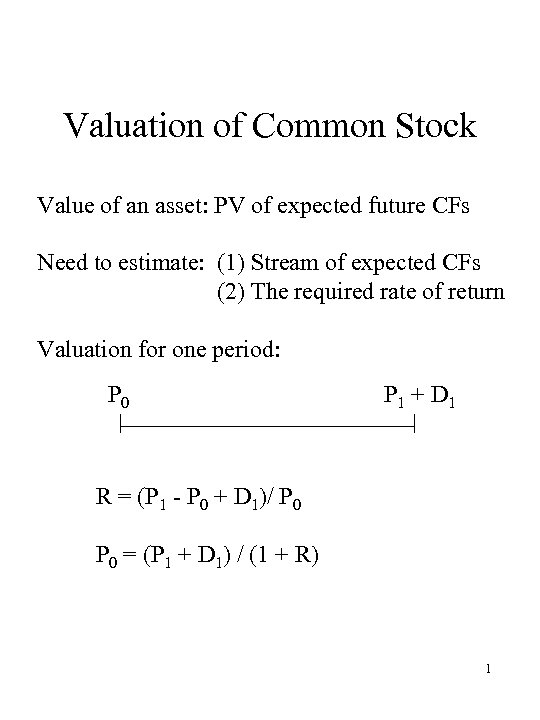

Valuation of Common Stock Value of an asset: PV of expected future CFs Need to estimate: (1) Stream of expected CFs (2) The required rate of return Valuation for one period: P 0 P 1 + D 1 R = (P 1 - P 0 + D 1)/ P 0 = (P 1 + D 1) / (1 + R) 1

Valuation of Common Stock Value of an asset: PV of expected future CFs Need to estimate: (1) Stream of expected CFs (2) The required rate of return Valuation for one period: P 0 P 1 + D 1 R = (P 1 - P 0 + D 1)/ P 0 = (P 1 + D 1) / (1 + R) 1

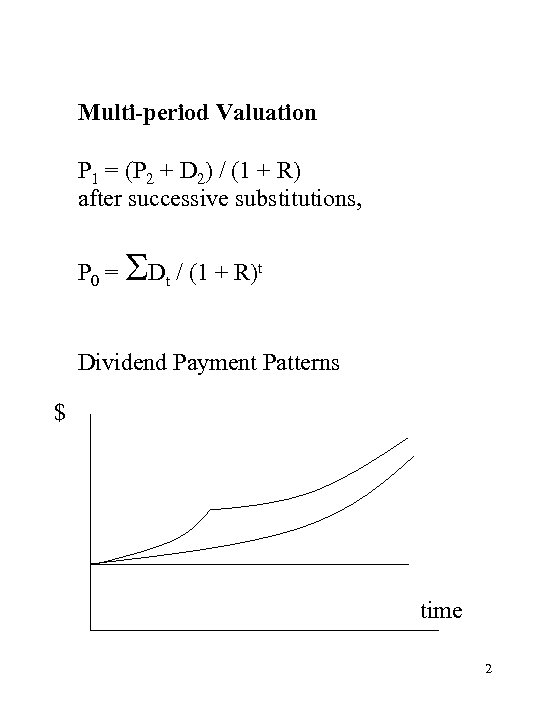

Multi-period Valuation P 1 = (P 2 + D 2) / (1 + R) after successive substitutions, P 0 = D / (1 + R) t t Dividend Payment Patterns $ time 2

Multi-period Valuation P 1 = (P 2 + D 2) / (1 + R) after successive substitutions, P 0 = D / (1 + R) t t Dividend Payment Patterns $ time 2

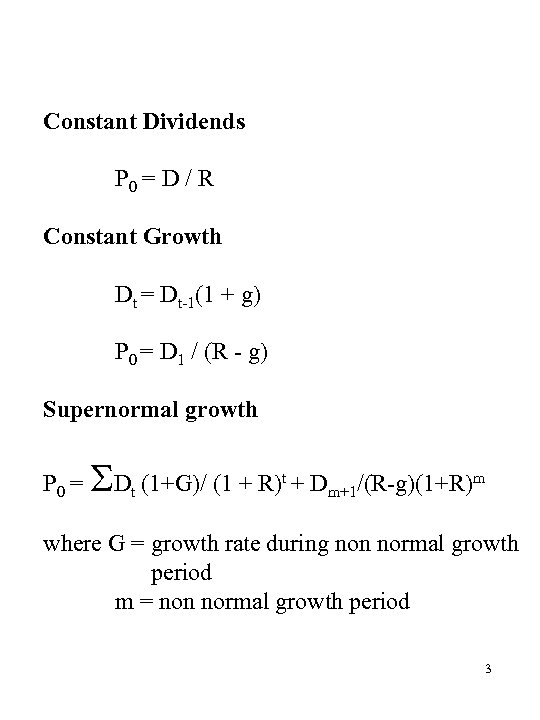

Constant Dividends P 0 = D / R Constant Growth Dt = Dt-1(1 + g) P 0 = D 1 / (R - g) Supernormal growth P 0 = D (1+G)/ (1 + R) + D t t /(R-g)(1+R)m m+1 where G = growth rate during non normal growth period m = non normal growth period 3

Constant Dividends P 0 = D / R Constant Growth Dt = Dt-1(1 + g) P 0 = D 1 / (R - g) Supernormal growth P 0 = D (1+G)/ (1 + R) + D t t /(R-g)(1+R)m m+1 where G = growth rate during non normal growth period m = non normal growth period 3

FUTURES • The Futures contract • Futures Markets – CBT – Chicago Mercantile Exchange – CMX • The Clearinghouse – Initial margin – marking to market – Maintenance margin – Reversing trades – Open interest • Basis = spot price - futures price 4

FUTURES • The Futures contract • Futures Markets – CBT – Chicago Mercantile Exchange – CMX • The Clearinghouse – Initial margin – marking to market – Maintenance margin – Reversing trades – Open interest • Basis = spot price - futures price 4

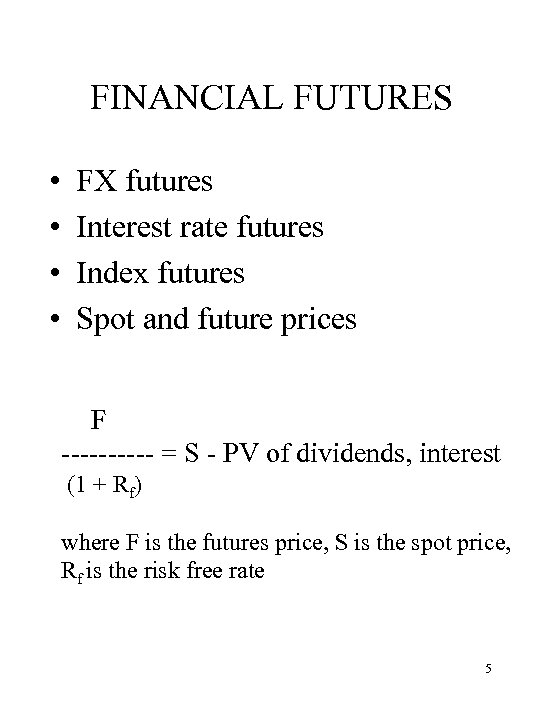

FINANCIAL FUTURES • • FX futures Interest rate futures Index futures Spot and future prices F ----- = S - PV of dividends, interest (1 + Rf) where F is the futures price, S is the spot price, Rf is the risk free rate 5

FINANCIAL FUTURES • • FX futures Interest rate futures Index futures Spot and future prices F ----- = S - PV of dividends, interest (1 + Rf) where F is the futures price, S is the spot price, Rf is the risk free rate 5

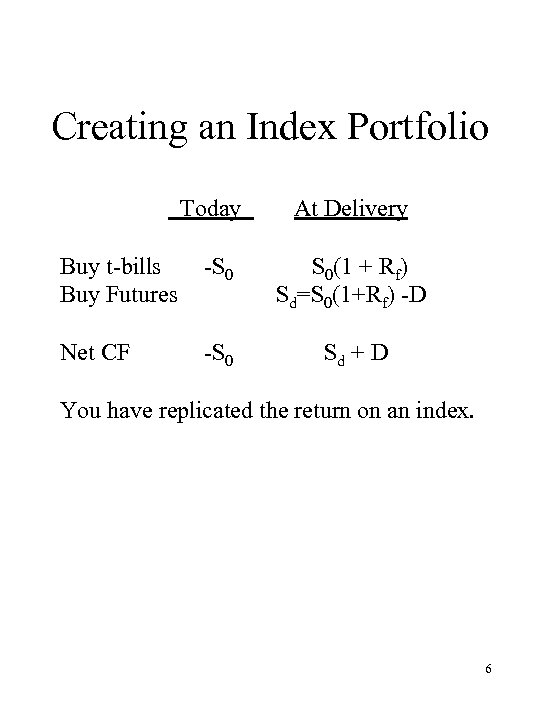

Creating an Index Portfolio Today At Delivery Buy t-bills Buy Futures -S 0 S 0(1 + Rf) Sd=S 0(1+Rf) -D Net CF -S 0 Sd + D You have replicated the return on an index. 6

Creating an Index Portfolio Today At Delivery Buy t-bills Buy Futures -S 0 S 0(1 + Rf) Sd=S 0(1+Rf) -D Net CF -S 0 Sd + D You have replicated the return on an index. 6

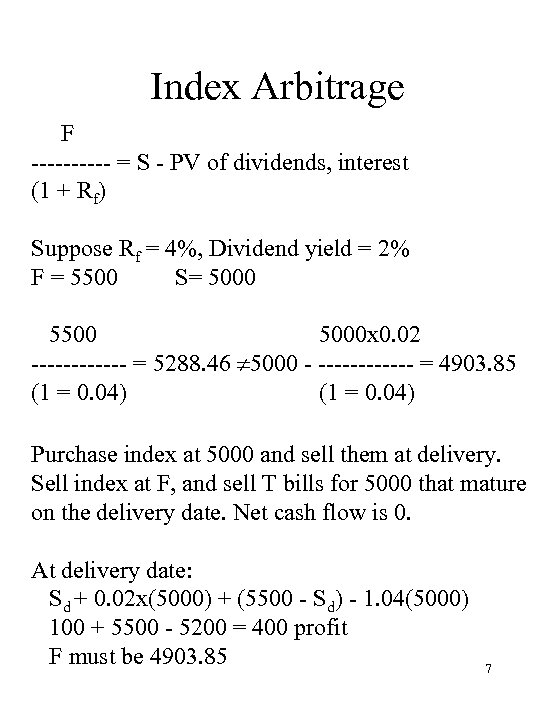

Index Arbitrage F ----- = S - PV of dividends, interest (1 + Rf) Suppose Rf = 4%, Dividend yield = 2% F = 5500 S= 5000 5500 5000 x 0. 02 ------ = 5288. 46 5000 - ------ = 4903. 85 (1 = 0. 04) Purchase index at 5000 and sell them at delivery. Sell index at F, and sell T bills for 5000 that mature on the delivery date. Net cash flow is 0. At delivery date: Sd + 0. 02 x(5000) + (5500 - Sd) - 1. 04(5000) 100 + 5500 - 5200 = 400 profit F must be 4903. 85 7

Index Arbitrage F ----- = S - PV of dividends, interest (1 + Rf) Suppose Rf = 4%, Dividend yield = 2% F = 5500 S= 5000 5500 5000 x 0. 02 ------ = 5288. 46 5000 - ------ = 4903. 85 (1 = 0. 04) Purchase index at 5000 and sell them at delivery. Sell index at F, and sell T bills for 5000 that mature on the delivery date. Net cash flow is 0. At delivery date: Sd + 0. 02 x(5000) + (5500 - Sd) - 1. 04(5000) 100 + 5500 - 5200 = 400 profit F must be 4903. 85 7

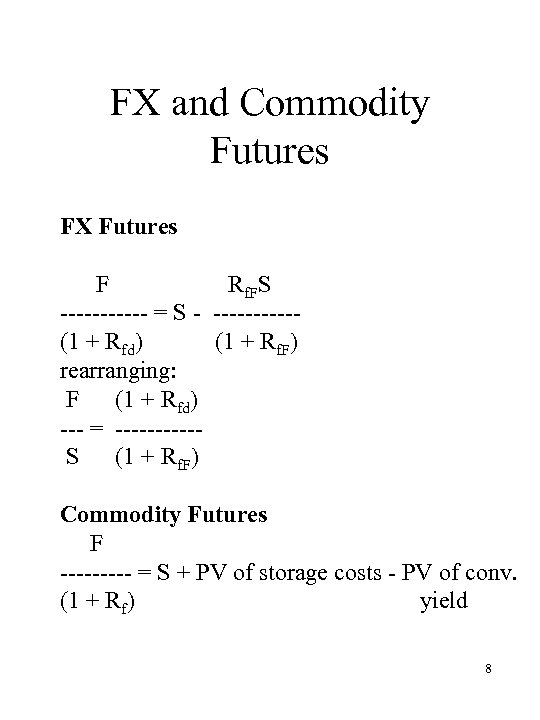

FX and Commodity Futures FX Futures F Rf. FS ------ = S - -----(1 + Rfd) (1 + Rf. F) rearranging: F (1 + Rfd) --- = -----S (1 + Rf. F) Commodity Futures F ----- = S + PV of storage costs - PV of conv. (1 + Rf) yield 8

FX and Commodity Futures FX Futures F Rf. FS ------ = S - -----(1 + Rfd) (1 + Rf. F) rearranging: F (1 + Rfd) --- = -----S (1 + Rf. F) Commodity Futures F ----- = S + PV of storage costs - PV of conv. (1 + Rf) yield 8

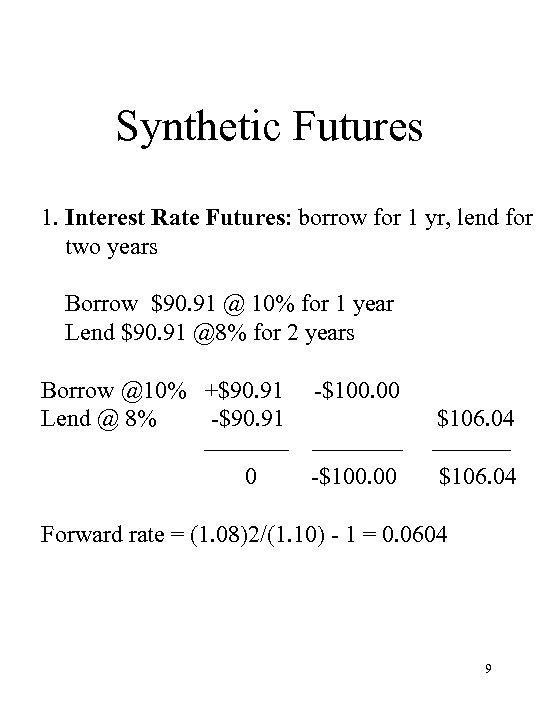

Synthetic Futures 1. Interest Rate Futures: borrow for 1 yr, lend for two years Borrow $90. 91 @ 10% for 1 year Lend $90. 91 @8% for 2 years Borrow @10% +$90. 91 Lend @ 8% -$90. 91 0 -$100. 00 $106. 04 Forward rate = (1. 08)2/(1. 10) - 1 = 0. 0604 9

Synthetic Futures 1. Interest Rate Futures: borrow for 1 yr, lend for two years Borrow $90. 91 @ 10% for 1 year Lend $90. 91 @8% for 2 years Borrow @10% +$90. 91 Lend @ 8% -$90. 91 0 -$100. 00 $106. 04 Forward rate = (1. 08)2/(1. 10) - 1 = 0. 0604 9

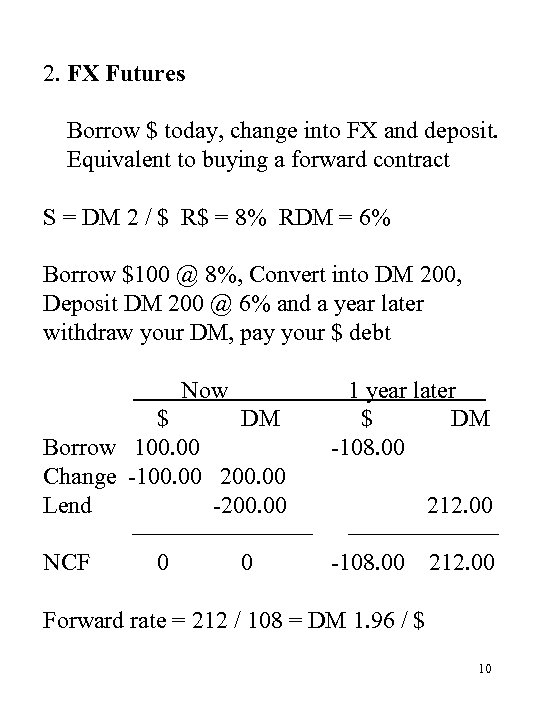

2. FX Futures Borrow $ today, change into FX and deposit. Equivalent to buying a forward contract S = DM 2 / $ R$ = 8% RDM = 6% Borrow $100 @ 8%, Convert into DM 200, Deposit DM 200 @ 6% and a year later withdraw your DM, pay your $ debt Now $ DM Borrow 100. 00 Change -100. 00 200. 00 Lend -200. 00 NCF 0 0 1 year later $ DM -108. 00 212. 00 Forward rate = 212 / 108 = DM 1. 96 / $ 10

2. FX Futures Borrow $ today, change into FX and deposit. Equivalent to buying a forward contract S = DM 2 / $ R$ = 8% RDM = 6% Borrow $100 @ 8%, Convert into DM 200, Deposit DM 200 @ 6% and a year later withdraw your DM, pay your $ debt Now $ DM Borrow 100. 00 Change -100. 00 200. 00 Lend -200. 00 NCF 0 0 1 year later $ DM -108. 00 212. 00 Forward rate = 212 / 108 = DM 1. 96 / $ 10