9a317f7ce689fe374a1c109324eeace1.ppt

- Количество слайдов: 42

Valuation by Tanushree Seth

Company Snapshot Global Headquarters: Bangalore, India Founded: 1981 Global Presence: 36 Sales Offices in 17 countries 37 Global Development Centers Employees: 49, 422 LTM Dec ’ 05 Revenue/ 5 Year CAGR: $2, 014 million/ 41% LTM Dec ’ 05 Net Income/ 5 Year CAGR: $530 million/ 37%

Company Statistics Employer Type: Public Company Stock Symbol: INFY Stock Exchange: NASDAQ Market Share price: $74. 98* Key Executives President, CEO, MD: N. R. Narayana Murthy Nandan M Nilekani T. V. Mohandas Pai. S. Gopalakrishnan V. Balakrishnan. K. Dinesh. S. D Shibulal. Srinath Batni *As of 4/14/2006 CEO, President and MD: N. R. Narayan Murthy

Outline • Overview • Investment Highlights Business model Investment positives • Addressing Key market challenges: Risks • Valuation Estimated growth rates of 30% and 25% • Comparable company analysis • Recommendation

Overview Smart investments v In 1999, the firm became the first Indian company to list on NASDAQ v In 2002, Infosys started a recruiting and marketing blitz v The firm registered sales of $740 million, up 50 percent over the previous year, 2002 v In 2004, , the firm hit its first billion

Overview The U. S. dream team v The company turned its attention to the U. S. consulting market in April 2004, forming Infosys Consulting v Stephen Pratt, who was named CEO of the subsidiary; Romil Bahl, former head of EDS' consulting practice; Pal Cole, former head of global operations at CGE&Y; and Raj Joshi, former CEO of Deloitte Offshore. v In April 2004, the publication e. Week. com pointed out that the move was a step toward competing in the U. S. consulting market against the big guys like Accenture.

Moving forward v In 2003, Infosys launched a business-processing subsidiary, Progeon, and secured a five-year, $30 -million contract from U. S. mortgage firm Green. Point. v In November 2004, Infosys and Microsoft announced an enterprise IT transformation initiative v In December 2003, the firm announced its intentions to acquire Expert Information Services, an Australian IT services firm, for around $23 million.

Infosys Work Culture v. Open-door culture v. Hard work, lots of passion v. A piece of heaven in Bangalore

Investment Highlights ü Large, Expanding Addressable Market ü Highly-evolved Global Delivery Model ü Rapid Differentiation ü Scalable Execution ü Exceptional Financial performance

Large, Expandable Addressable Market

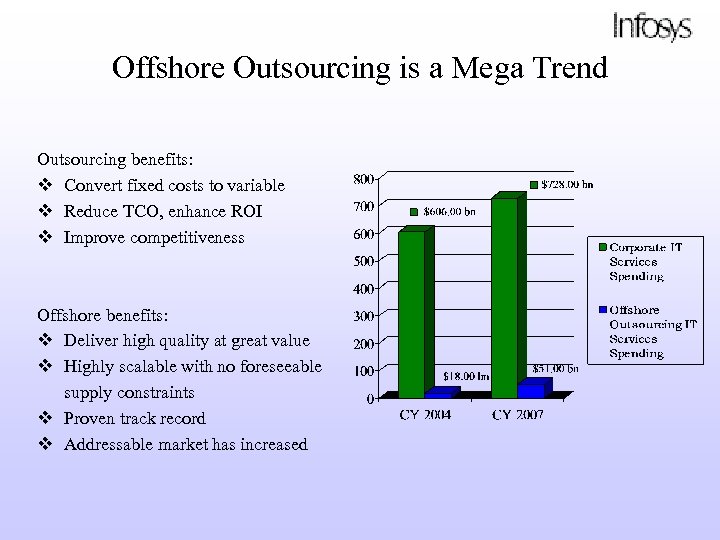

Offshore Outsourcing is a Mega Trend Outsourcing benefits: v Convert fixed costs to variable v Reduce TCO, enhance ROI v Improve competitiveness Offshore benefits: v Deliver high quality at great value v Highly scalable with no foreseeable supply constraints v Proven track record v Addressable market has increased

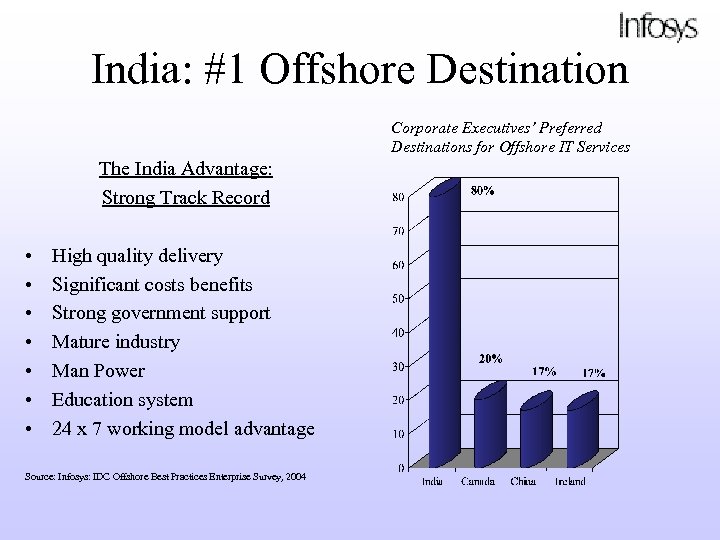

India: #1 Offshore Destination Corporate Executives’ Preferred Destinations for Offshore IT Services The India Advantage: Strong Track Record • • High quality delivery Significant costs benefits Strong government support Mature industry Man Power Education system 24 x 7 working model advantage Source: Infosys: IDC Offshore Best Practices Enterprise Survey, 2004

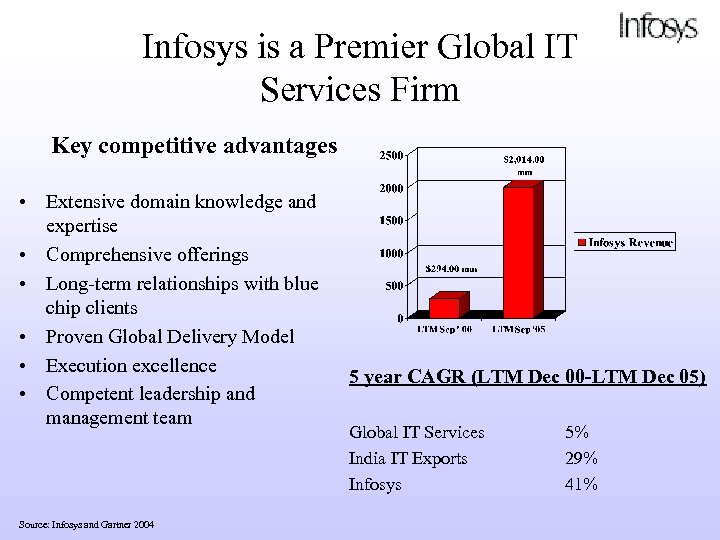

Infosys is a Premier Global IT Services Firm Key competitive advantages • Extensive domain knowledge and expertise • Comprehensive offerings • Long-term relationships with blue chip clients • Proven Global Delivery Model • Execution excellence • Competent leadership and management team Source: Infosys and Gartner 2004 5 year CAGR (LTM Dec 00 -LTM Dec 05) Global IT Services India IT Exports Infosys 5% 29% 41%

Business Model: Highly-evolved Global Delivery Model

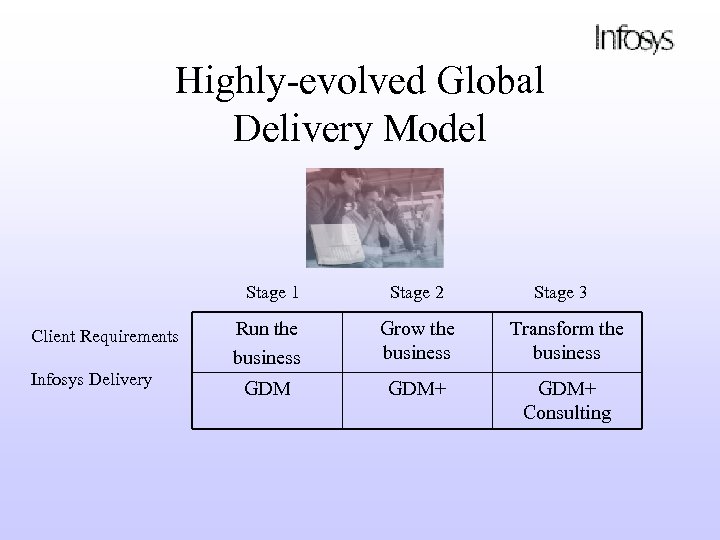

Highly-evolved Global Delivery Model Stage 1 Client Requirements Infosys Delivery Stage 2 Stage 3 Run the business Grow the business Transform the business GDM+ Consulting

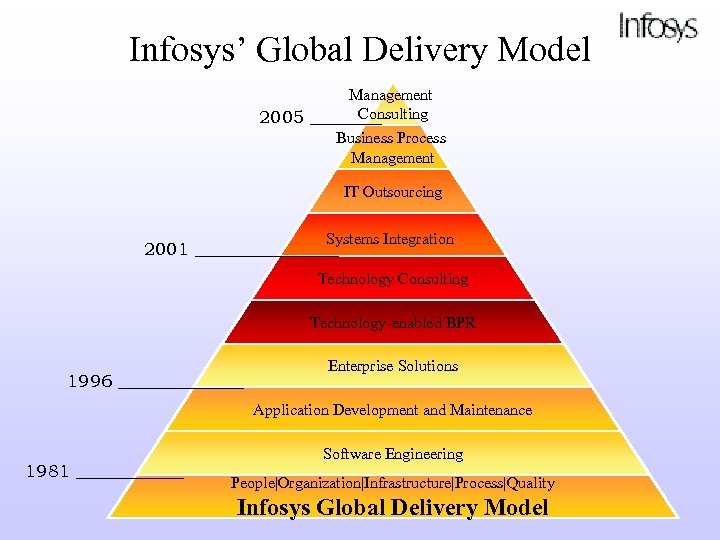

Infosys’ Global Delivery Model Management Consulting 2005 ____ Business Process Management IT Outsourcing Systems Integration 2001 ________ Technology Consulting Technology-enabled BPR 1996 _______ Enterprise Solutions Application Development and Maintenance 1981 ______ Software Engineering People|Organization|Infrastructure|Process|Quality Infosys Global Delivery Model

Differentiation within the IT industry

Uniquely Positioned in Global IT Services and Consulting IN PROCESS • Consulting + Solution mindset • Build stronger brand • Strengthen Board-level relationships NEED TO: • • • Replace resources Overcome “offshore-is-cost-center” mindset Combat revenue cannibalization Provide seamless sales and delivery Reduce SG&A

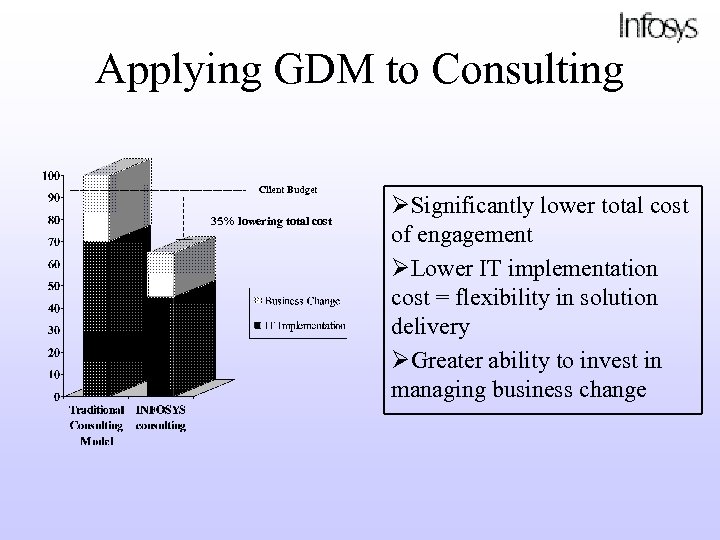

Applying GDM to Consulting --------------------------- Client Budget -------| 35% lowering total cost ØSignificantly lower total cost of engagement ØLower IT implementation cost = flexibility in solution delivery ØGreater ability to invest in managing business change

Drivers of Scalability Superior Talent Management World Class Processes and Systems Flexible Organization Structure Modular and Robust Global Infrastructure LEADS TO SCALABLE EXECUTION

Scalable Execution Superior Talent Management: Hiring the Best q Able to simultaneously evaluate 10, 000 people across 7 cities in India q Augmenting talent through new geographies q China, Eastern Europe q Supplementing with experienced local hires q Currently hiring people 59 nationalities World Class Processes and Systems Quality par excellence: q Benchmarked to Global Standards such as EFQM Award-winning Knowledge Management Processes q PRIDE q 2004 Asian MAKE Award

Scalable Execution Flexible Organization Structure Modular and Robust Infrastructure q 37 Global Development Centers (“GDC”) q Integrated platform for delivery of end-to-end solutions from Consulting to BPM q Ability to rapidly scale new engagements q Self-governed business units q By domain q Flexibility to distribute q By Market engagements and capacity q By Service across centers worldwide

Exceptional Financial Performance

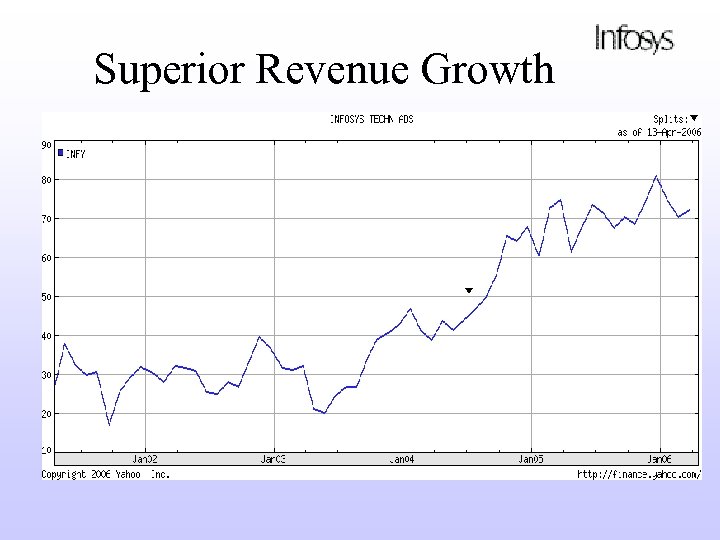

Superior Revenue Growth

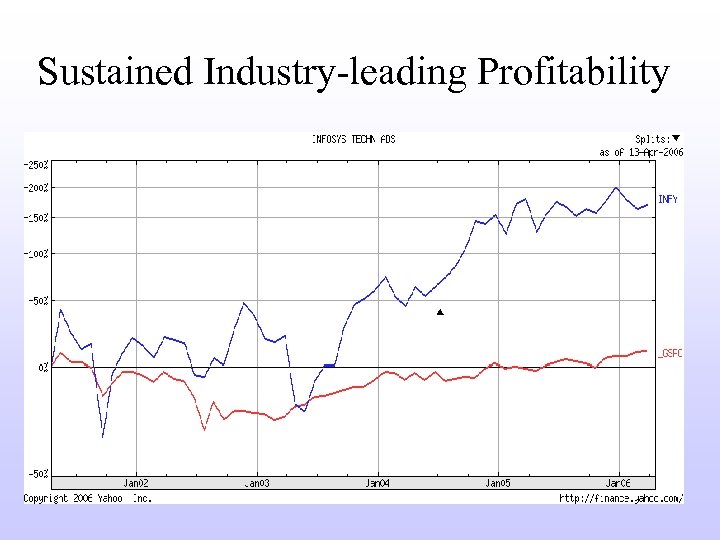

Sustained Industry-leading Profitability

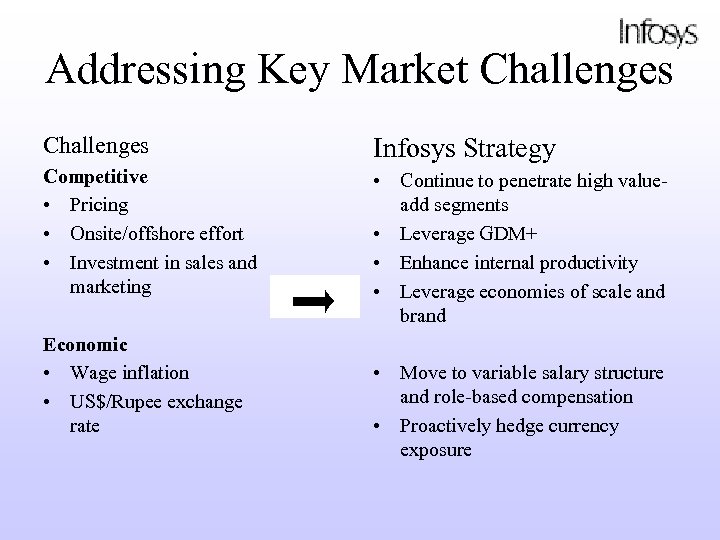

Addressing Key Market Challenges Infosys Strategy Competitive • Pricing • Onsite/offshore effort • Investment in sales and marketing • Continue to penetrate high valueadd segments • Leverage GDM+ • Enhance internal productivity • Leverage economies of scale and brand Economic • Wage inflation • US$/Rupee exchange rate • Move to variable salary structure and role-based compensation • Proactively hedge currency exposure

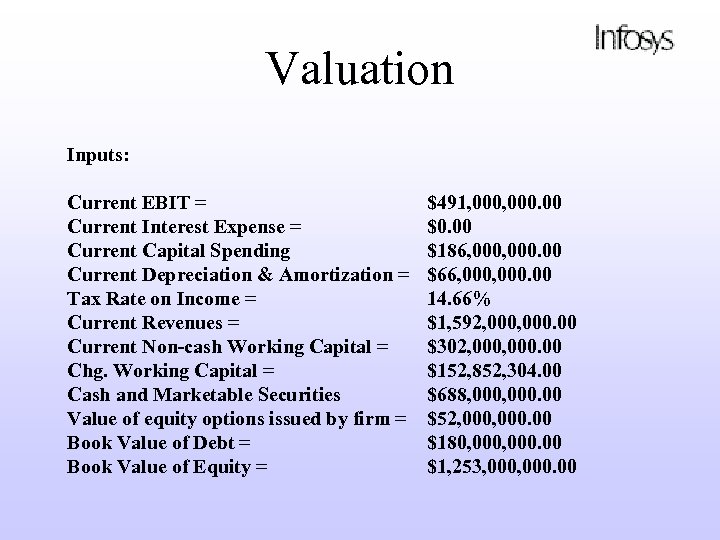

Valuation Inputs: Current EBIT = Current Interest Expense = Current Capital Spending Current Depreciation & Amortization = Tax Rate on Income = Current Revenues = Current Non-cash Working Capital = Chg. Working Capital = Cash and Marketable Securities Value of equity options issued by firm = Book Value of Debt = Book Value of Equity = $491, 000. 00 $0. 00 $186, 000. 00 $66, 000. 00 14. 66% $1, 592, 000. 00 $302, 000. 00 $152, 852, 304. 00 $688, 000. 00 $52, 000. 00 $180, 000. 00 $1, 253, 000. 00

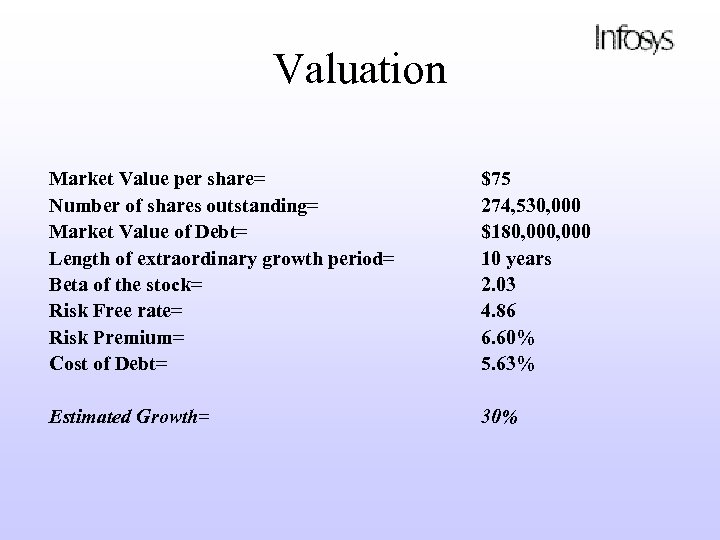

Valuation Market Value per share= Number of shares outstanding= Market Value of Debt= Length of extraordinary growth period= Beta of the stock= Risk Free rate= Risk Premium= Cost of Debt= $75 274, 530, 000 $180, 000 10 years 2. 03 4. 86 6. 60% 5. 63% Estimated Growth= 30%

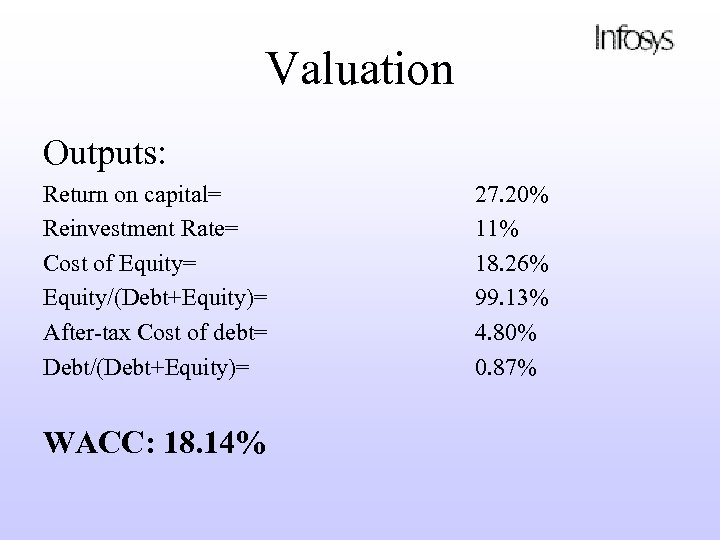

Valuation Outputs: Return on capital= Reinvestment Rate= Cost of Equity= Equity/(Debt+Equity)= After-tax Cost of debt= Debt/(Debt+Equity)= WACC: 18. 14% 27. 20% 11% 18. 26% 99. 13% 4. 80% 0. 87%

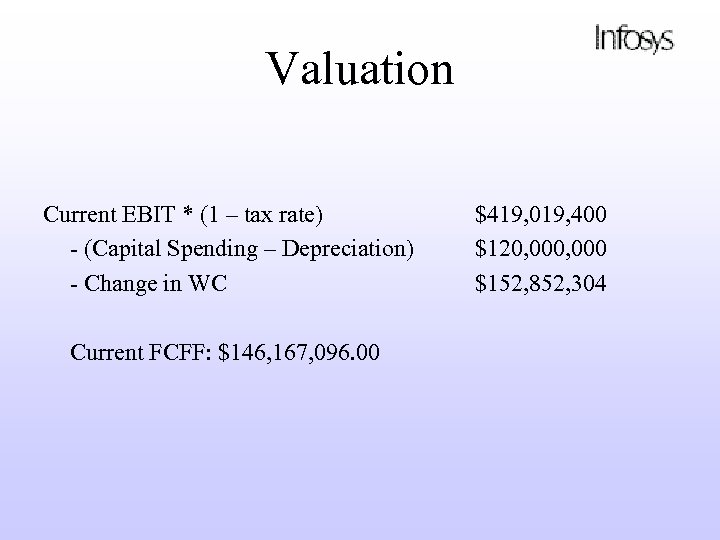

Valuation Current EBIT * (1 – tax rate) - (Capital Spending – Depreciation) - Change in WC Current FCFF: $146, 167, 096. 00 $419, 019, 400 $120, 000 $152, 852, 304

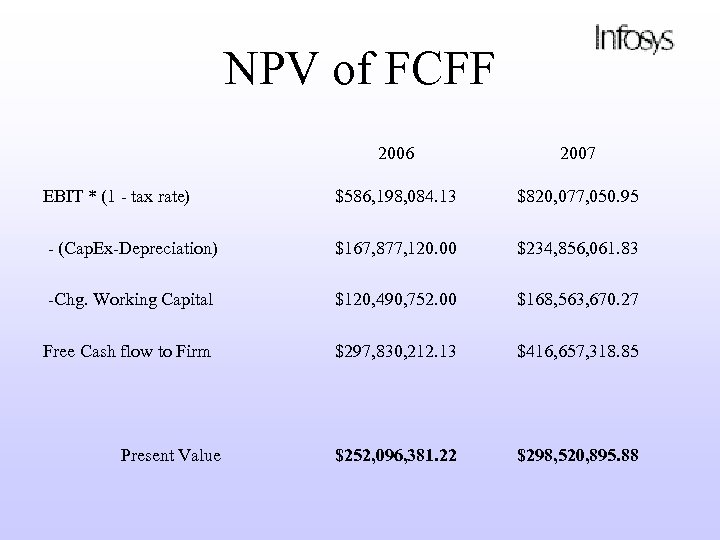

NPV of FCFF 2006 2007 EBIT * (1 - tax rate) $586, 198, 084. 13 $820, 077, 050. 95 - (Cap. Ex-Depreciation) $167, 877, 120. 00 $234, 856, 061. 83 -Chg. Working Capital $120, 490, 752. 00 $168, 563, 670. 27 Free Cash flow to Firm $297, 830, 212. 13 $416, 657, 318. 85 $252, 096, 381. 22 $298, 520, 895. 88 Present Value

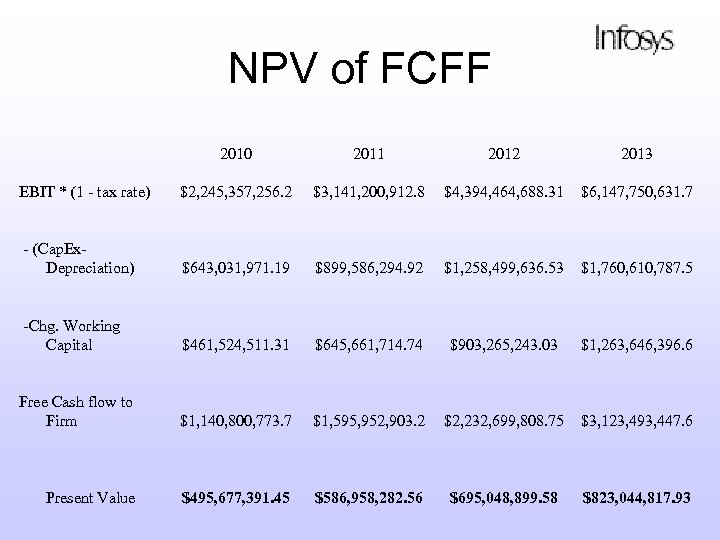

NPV of FCFF 2010 2011 2012 EBIT * (1 - tax rate) $2, 245, 357, 256. 2 $3, 141, 200, 912. 8 $4, 394, 464, 688. 31 $6, 147, 750, 631. 7 - (Cap. Ex. Depreciation) $643, 031, 971. 19 $899, 586, 294. 92 $1, 258, 499, 636. 53 $1, 760, 610, 787. 5 -Chg. Working Capital $461, 524, 511. 31 $645, 661, 714. 74 Free Cash flow to Firm $1, 140, 800, 773. 7 $1, 595, 952, 903. 2 Present Value $495, 677, 391. 45 $586, 958, 282. 56 $903, 265, 243. 03 2013 $1, 263, 646, 396. 6 $2, 232, 699, 808. 75 $3, 123, 493, 447. 6 $695, 048, 899. 58 $823, 044, 817. 93

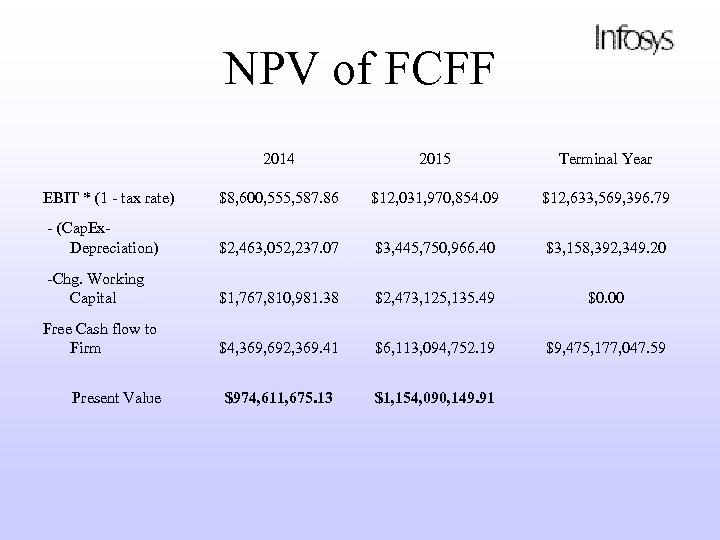

NPV of FCFF 2014 2015 Terminal Year EBIT * (1 - tax rate) $8, 600, 555, 587. 86 $12, 031, 970, 854. 09 $12, 633, 569, 396. 79 - (Cap. Ex. Depreciation) $2, 463, 052, 237. 07 $3, 445, 750, 966. 40 $3, 158, 392, 349. 20 -Chg. Working Capital $1, 767, 810, 981. 38 $2, 473, 125, 135. 49 $0. 00 Free Cash flow to Firm $4, 369, 692, 369. 41 $6, 113, 094, 752. 19 $9, 475, 177, 047. 59 $974, 611, 675. 13 $1, 154, 090, 149. 91 Present Value

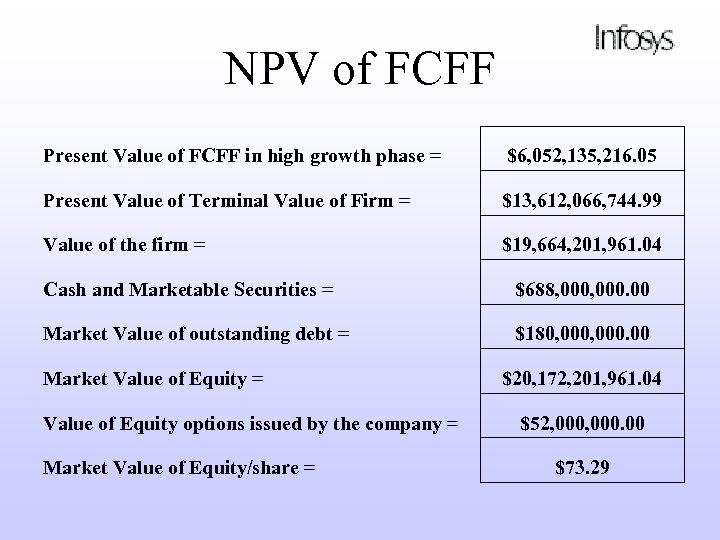

NPV of FCFF Present Value of FCFF in high growth phase = $6, 052, 135, 216. 05 Present Value of Terminal Value of Firm = $13, 612, 066, 744. 99 Value of the firm = $19, 664, 201, 961. 04 Cash and Marketable Securities = $688, 000. 00 Market Value of outstanding debt = $180, 000. 00 Market Value of Equity = Value of Equity options issued by the company = Market Value of Equity/share = $20, 172, 201, 961. 04 $52, 000. 00 $73. 29

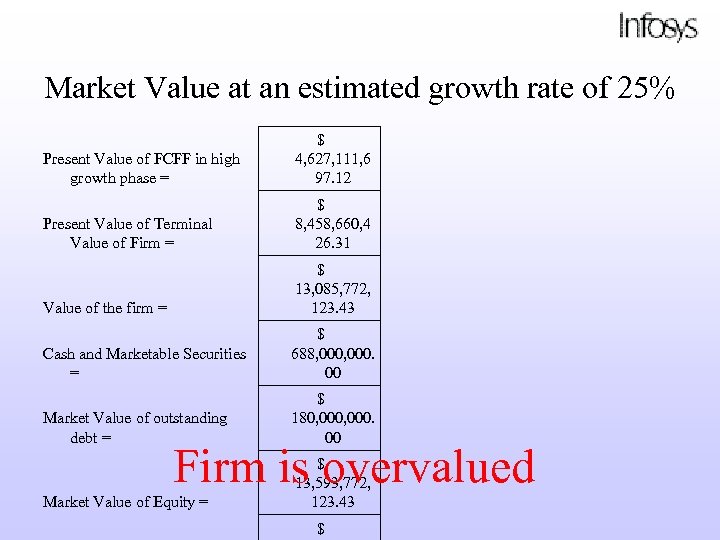

Market Value at an estimated growth rate of 25% Present Value of FCFF in high growth phase = $ 4, 627, 111, 6 97. 12 Present Value of Terminal Value of Firm = $ 8, 458, 660, 4 26. 31 Value of the firm = $ 13, 085, 772, 123. 43 Cash and Marketable Securities = $ 688, 000. 00 Market Value of outstanding debt = $ 180, 000. 00 Market Value of Equity = $ 13, 593, 772, 123. 43 Firm is overvalued $

Competitive Landscape Infosys Technologies (INFY) Competitors: • • Wipro (WIT) HCL Technologies Ltd. Satyam Computer Services (SAY) Cognizant Technology Solutions Corp. Syntel Inc. Tata Consultancy Services Ltd. i-flex Patni Computer Systems Ltd.

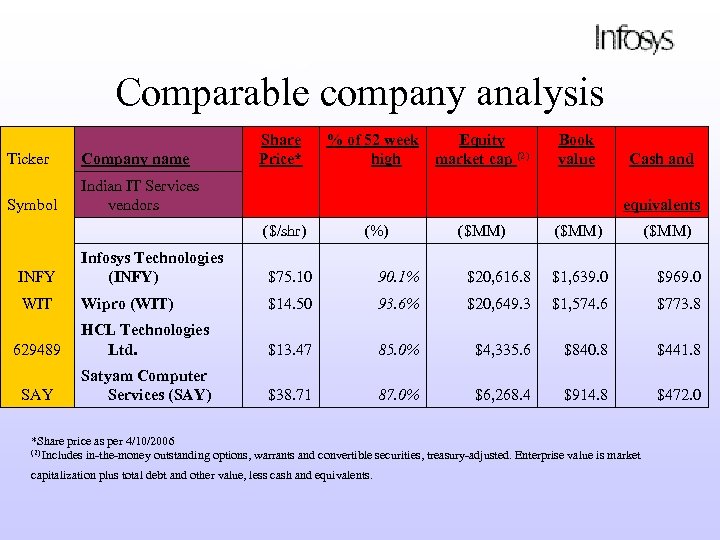

Share Price Comparable company analysis Ticker Company name Symbol % of 52 week Equity high market cap (2) Book value Indian IT Services vendors Share Price* Cash and equivalents ($/shr) (%) ($MM) INFY Infosys Technologies (INFY) $75. 10 90. 1% $20, 616. 8 $1, 639. 0 $969. 0 WIT Wipro (WIT) $14. 50 93. 6% $20, 649. 3 $1, 574. 6 $773. 8 629489 HCL Technologies Ltd. $13. 47 85. 0% $4, 335. 6 $840. 8 $441. 8 SAY Satyam Computer Services (SAY) $38. 71 87. 0% $6, 268. 4 $914. 8 $472. 0 *Share price as per 4/10/2006 (2) Includes in-the-money outstanding options, warrants and convertible securities, treasury-adjusted. Enterprise value is market capitalization plus total debt and other value, less cash and equivalents.

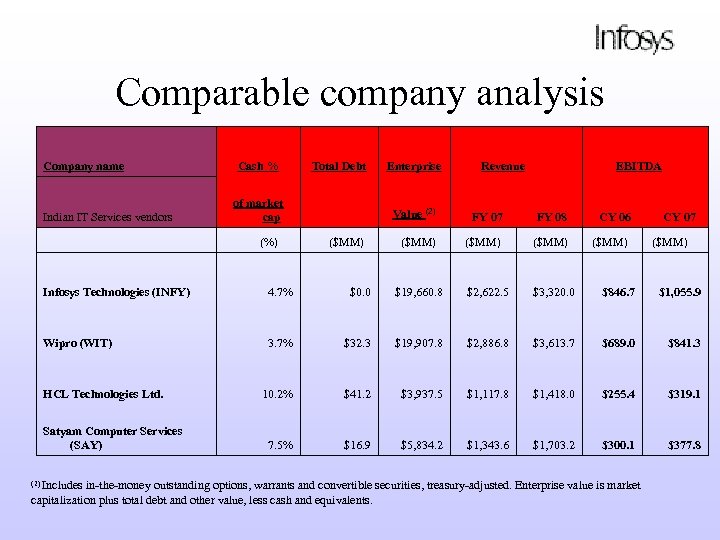

Comparable company analysis Company name Indian IT Services vendors Cash % of market cap (%) Total Debt Enterprise Revenue EBITDA Value (2) ($MM) FY 07 FY 08 ($MM) CY 06 ($MM) CY 07 ($MM) Infosys Technologies (INFY) 4. 7% $0. 0 $19, 660. 8 $2, 622. 5 $3, 320. 0 $846. 7 $1, 055. 9 Wipro (WIT) 3. 7% $32. 3 $19, 907. 8 $2, 886. 8 $3, 613. 7 $689. 0 $841. 3 10. 2% $41. 2 $3, 937. 5 $1, 117. 8 $1, 418. 0 $255. 4 $319. 1 7. 5% $16. 9 $5, 834. 2 $1, 343. 6 $1, 703. 2 $300. 1 $377. 8 HCL Technologies Ltd. Satyam Computer Services (SAY) (2) Includes in-the-money outstanding options, warrants and convertible securities, treasury-adjusted. Enterprise value is market capitalization plus total debt and other value, less cash and equivalents.

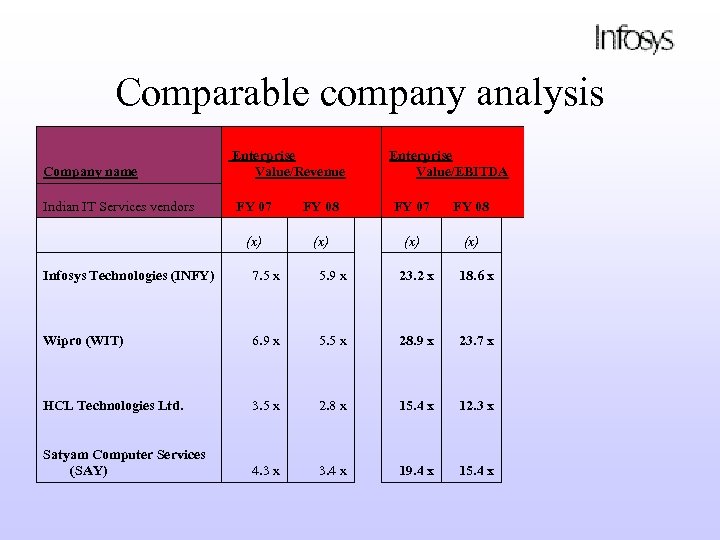

Comparable company analysis Company name Indian IT Services vendors Enterprise Value/Revenue FY 07 (x) Enterprise Value/EBITDA FY 08 FY 07 FY 08 (x) (x) Infosys Technologies (INFY) 7. 5 x 5. 9 x Wipro (WIT) 6. 9 x HCL Technologies Ltd. Satyam Computer Services (SAY) 23. 2 x 18. 6 x 5. 5 x 28. 9 x 23. 7 x 3. 5 x 2. 8 x 15. 4 x 12. 3 x 4. 3 x 3. 4 x 19. 4 x 15. 4 x

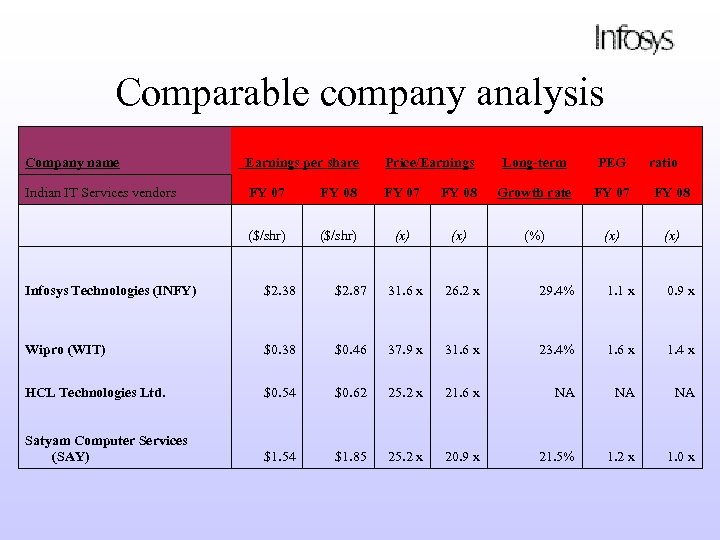

Comparable company analysis Company name Earnings per share Price/Earnings Long-term PEG ratio Indian IT Services vendors FY 07 FY 08 Growth rate FY 07 FY 08 ($/shr) (x) (%) (x) Infosys Technologies (INFY) $2. 38 $2. 87 31. 6 x 26. 2 x 29. 4% 1. 1 x 0. 9 x Wipro (WIT) $0. 38 $0. 46 37. 9 x 31. 6 x 23. 4% 1. 6 x 1. 4 x HCL Technologies Ltd. $0. 54 $0. 62 25. 2 x 21. 6 x NA NA Satyam Computer Services (SAY) $1. 54 $1. 85 25. 2 x 20. 9 x 21. 5% 1. 2 x 1. 0 x

Recommendation: Buy at low

Thank you!

9a317f7ce689fe374a1c109324eeace1.ppt