47216e00f18b022394157ea45fee6e2c.ppt

- Количество слайдов: 75

VA Guaranteed Home Loans Roanoke VA Regional Loan Center Compliments of Roanoke and Cleveland RLC

VA Guaranteed Home Loans Roanoke VA Regional Loan Center Compliments of Roanoke and Cleveland RLC

Contact Information National VA website: www. homeloans. va. gov Roanoke VA website: http: //www. vba. va. gov/ro/roanoke/rlc/ Toll Free: (800) 933 -5499

Contact Information National VA website: www. homeloans. va. gov Roanoke VA website: http: //www. vba. va. gov/ro/roanoke/rlc/ Toll Free: (800) 933 -5499

Types Of VA Loans l l l l Purchase or construct a home Purchase a VA/HUD approved condo or townhouse Purchase farm property Purchase a home and improve at the same time Manufactured home on permanent foundation Interest Rate Reduction Refinance Loans (IRRRL) Cashout Refinances Energy Efficient Improvement

Types Of VA Loans l l l l Purchase or construct a home Purchase a VA/HUD approved condo or townhouse Purchase farm property Purchase a home and improve at the same time Manufactured home on permanent foundation Interest Rate Reduction Refinance Loans (IRRRL) Cashout Refinances Energy Efficient Improvement

WHAT A VA LOAN CAN DO l l l l Ensures Equal Opportunity to Veterans No Down Payment Program Negotiable Fixed Interest Rate Streamlined Processing for Lenders Right to Prepay without Penalty Assumable Mortgage Limitations on Closing Costs Forbearance Extended to VA Homeowners Experiencing Temporary Financial Difficulty

WHAT A VA LOAN CAN DO l l l l Ensures Equal Opportunity to Veterans No Down Payment Program Negotiable Fixed Interest Rate Streamlined Processing for Lenders Right to Prepay without Penalty Assumable Mortgage Limitations on Closing Costs Forbearance Extended to VA Homeowners Experiencing Temporary Financial Difficulty

Dispelling The Myths Appraisals take forever! Too much red tape! Too much paperwork! VA takes too long!

Dispelling The Myths Appraisals take forever! Too much red tape! Too much paperwork! VA takes too long!

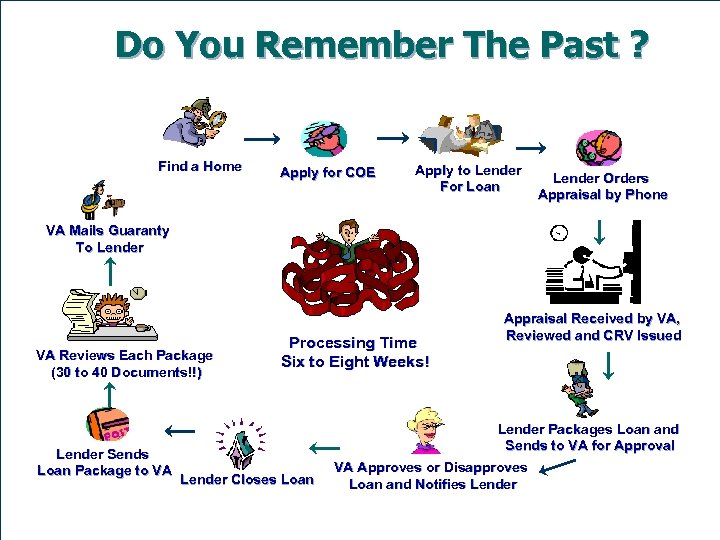

Do You Remember The Past ? Find a Home Apply for COE Apply to Lender For Loan Lender Orders Appraisal by Phone VA Mails Guaranty To Lender VA Reviews Each Package (30 to 40 Documents!!) Lender Sends Loan Package to VA Processing Time Six to Eight Weeks! Lender Closes Loan Appraisal Received by VA, Reviewed and CRV Issued Lender Packages Loan and Sends to VA for Approval VA Approves or Disapproves Loan and Notifies Lender

Do You Remember The Past ? Find a Home Apply for COE Apply to Lender For Loan Lender Orders Appraisal by Phone VA Mails Guaranty To Lender VA Reviews Each Package (30 to 40 Documents!!) Lender Sends Loan Package to VA Processing Time Six to Eight Weeks! Lender Closes Loan Appraisal Received by VA, Reviewed and CRV Issued Lender Packages Loan and Sends to VA for Approval VA Approves or Disapproves Loan and Notifies Lender

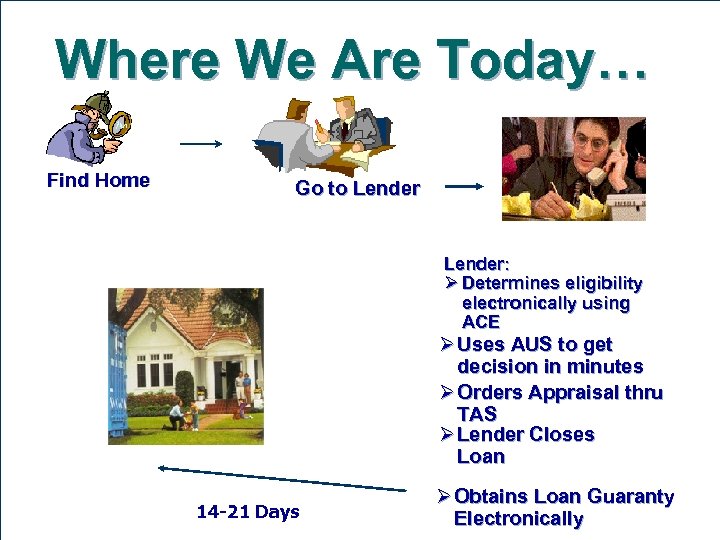

Where We Are Today… Find Home Go to Lender: Ø Determines eligibility electronically using ACE Ø Uses AUS to get decision in minutes Ø Orders Appraisal thru TAS Ø Lender Closes Loan 14 -21 Days Ø Obtains Loan Guaranty Electronically

Where We Are Today… Find Home Go to Lender: Ø Determines eligibility electronically using ACE Ø Uses AUS to get decision in minutes Ø Orders Appraisal thru TAS Ø Lender Closes Loan 14 -21 Days Ø Obtains Loan Guaranty Electronically

What Changed? How we got from there. . …. . To Here Ø Ø Consolidation Automation Delegation Oversight

What Changed? How we got from there. . …. . To Here Ø Ø Consolidation Automation Delegation Oversight

How Long Does The Average VA Loan Sit On a Government Employee’s Desk? q q q 0 days 15 days 30 days 45 days Forever

How Long Does The Average VA Loan Sit On a Government Employee’s Desk? q q q 0 days 15 days 30 days 45 days Forever

Automatic Procedure Lender. . Ø Originates Ø Processes Ø Underwrites Income & Credit packages and the Appraisal Ø Closes loan without sending anything to VA Ø Lender guarantees loan online through a system called Web. LGY

Automatic Procedure Lender. . Ø Originates Ø Processes Ø Underwrites Income & Credit packages and the Appraisal Ø Closes loan without sending anything to VA Ø Lender guarantees loan online through a system called Web. LGY

Loans That Must Be Submitted As Prior Approval • • Joint Loans Vets in receipt of non-service connected pension Vets rated incompetent by VA Interest Rate Reduction Loans when refinancing a delinquent loan ******************

Loans That Must Be Submitted As Prior Approval • • Joint Loans Vets in receipt of non-service connected pension Vets rated incompetent by VA Interest Rate Reduction Loans when refinancing a delinquent loan ******************

Prior Approval Lender. . Ø Originates Ø Processes Ø Submits loan to VA for underwriting Ø Closes after VA issues commitment, usually in 3 -5 days

Prior Approval Lender. . Ø Originates Ø Processes Ø Submits loan to VA for underwriting Ø Closes after VA issues commitment, usually in 3 -5 days

99% of VA Loans are Automatics 1% are Priors

99% of VA Loans are Automatics 1% are Priors

Who Is Eligible For A VA Home Loan? Honorably discharged veterans who served: Ø 2 years on active duty Ø 6 years in the Reserve/National guard Ø POW’s held in captivity for 90 days of more Ø 90 days of wartime duty when called up or ordered under U. S. C. Title 10 (this US code must appear on DD 214). Ø 181 days of peacetime duty called up under U. S. C. Title 10 Ø Some unmarried surviving spouses

Who Is Eligible For A VA Home Loan? Honorably discharged veterans who served: Ø 2 years on active duty Ø 6 years in the Reserve/National guard Ø POW’s held in captivity for 90 days of more Ø 90 days of wartime duty when called up or ordered under U. S. C. Title 10 (this US code must appear on DD 214). Ø 181 days of peacetime duty called up under U. S. C. Title 10 Ø Some unmarried surviving spouses

90 Days Wartime Ø World War II – (9/16/40 - 07/25/47) Ø Korean Conflict – (06/27/50 - 1/31/55) Ø Vietnam – (08/05/64 - 05/07/75) Ø Persian Gulf - 08/02/90 …

90 Days Wartime Ø World War II – (9/16/40 - 07/25/47) Ø Korean Conflict – (06/27/50 - 1/31/55) Ø Vietnam – (08/05/64 - 05/07/75) Ø Persian Gulf - 08/02/90 …

181 Days Peacetime l Post WWII - 7/26/47 - 6/26/50 l Post Korean - 2/1/55 - 8/4/64 l Post Vietnam - 5/8/75 - 8/1/90

181 Days Peacetime l Post WWII - 7/26/47 - 6/26/50 l Post Korean - 2/1/55 - 8/4/64 l Post Vietnam - 5/8/75 - 8/1/90

2 Year Requirement Ø Enlisted person - After September 7, 1980 Ø Officer – After October 16, 1981 (90 days applies to Persian Gulf wartime service called up under U. S. C. Title 10)

2 Year Requirement Ø Enlisted person - After September 7, 1980 Ø Officer – After October 16, 1981 (90 days applies to Persian Gulf wartime service called up under U. S. C. Title 10)

Reserve & National Guard 6 Years Total Service unless activated under Title 10

Reserve & National Guard 6 Years Total Service unless activated under Title 10

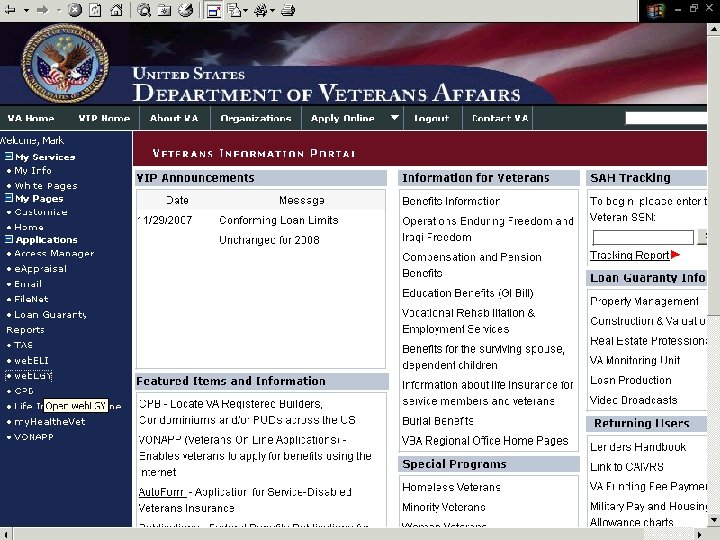

VETERANS INFORMATION PORTAL (VIP) http: //vip. vba. va. gov

VETERANS INFORMATION PORTAL (VIP) http: //vip. vba. va. gov

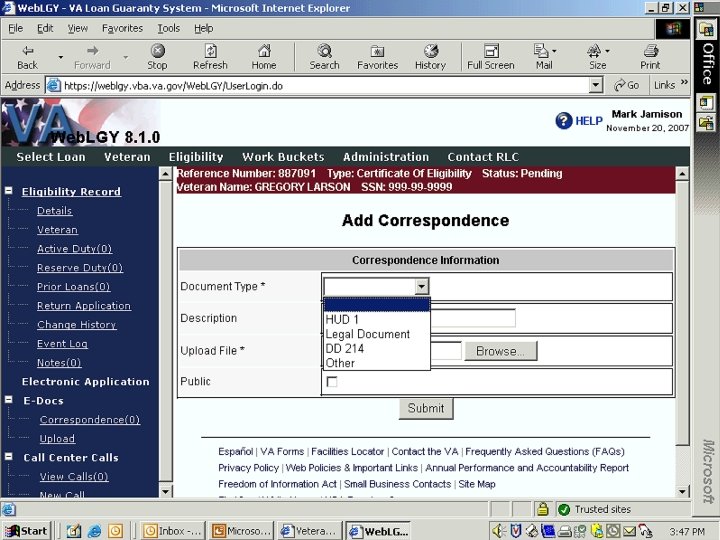

Obtaining A COE Ø VA Form 26 -1880 Ø Proof of service documentation (DD 214, active duty statement of service or Reserve/National Guard points statement) Ø If veteran had previous VA home that was sold, a copy of the HUD-1 Settlement Statement

Obtaining A COE Ø VA Form 26 -1880 Ø Proof of service documentation (DD 214, active duty statement of service or Reserve/National Guard points statement) Ø If veteran had previous VA home that was sold, a copy of the HUD-1 Settlement Statement

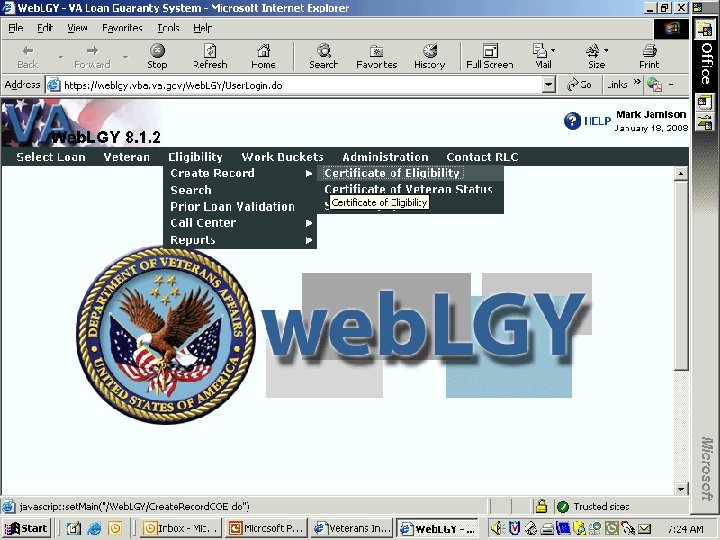

Automated Certificates Of Eligibility (ACE) Ø An automated system used by lenders to obtain an online certificate of eligibility Ø Accessed through the VIP http: //vip. vba. va. gov

Automated Certificates Of Eligibility (ACE) Ø An automated system used by lenders to obtain an online certificate of eligibility Ø Accessed through the VIP http: //vip. vba. va. gov

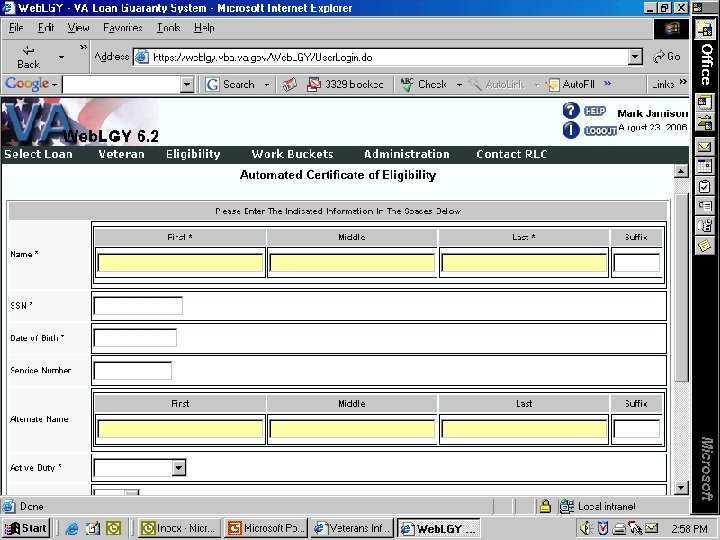

ACE Facts Ø For use by lenders and mortgage brokers Ø No application for certificate of eligibility needed Ø Vet’s SSN & Name all that’s required to use ACE system Ø Typical successful ACE candidate is a first time user of VA program, discharged after 1980 and served on active duty for 2 years

ACE Facts Ø For use by lenders and mortgage brokers Ø No application for certificate of eligibility needed Ø Vet’s SSN & Name all that’s required to use ACE system Ø Typical successful ACE candidate is a first time user of VA program, discharged after 1980 and served on active duty for 2 years

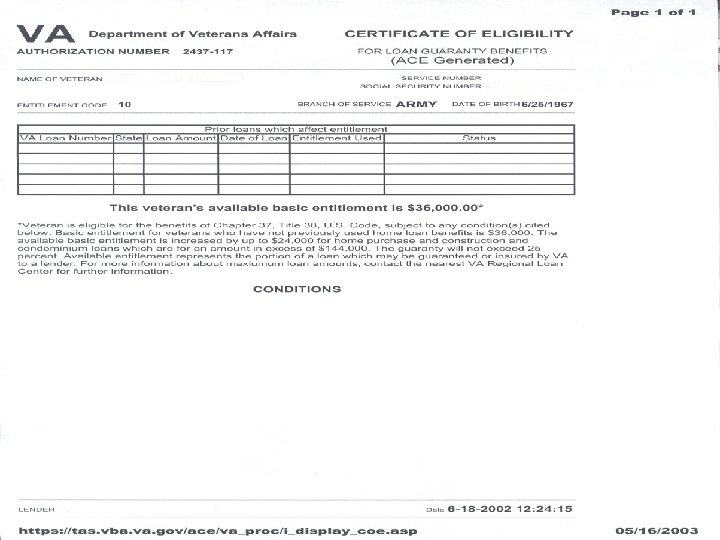

ACE Facts (cont. ) Ø ACE certificates of eligibility no longer printed on green or gold safety paper. Ø ACE certificates printed from computer on white paper. Ø Authorization number distinguishes authenticity

ACE Facts (cont. ) Ø ACE certificates of eligibility no longer printed on green or gold safety paper. Ø ACE certificates printed from computer on white paper. Ø Authorization number distinguishes authenticity

ACE Can’t Make All Determinations Ø Reserves/National Ø Prior Guard VA loan foreclosure Ø Insufficient Ø Unmarried time/discharge type surviving spouse

ACE Can’t Make All Determinations Ø Reserves/National Ø Prior Guard VA loan foreclosure Ø Insufficient Ø Unmarried time/discharge type surviving spouse

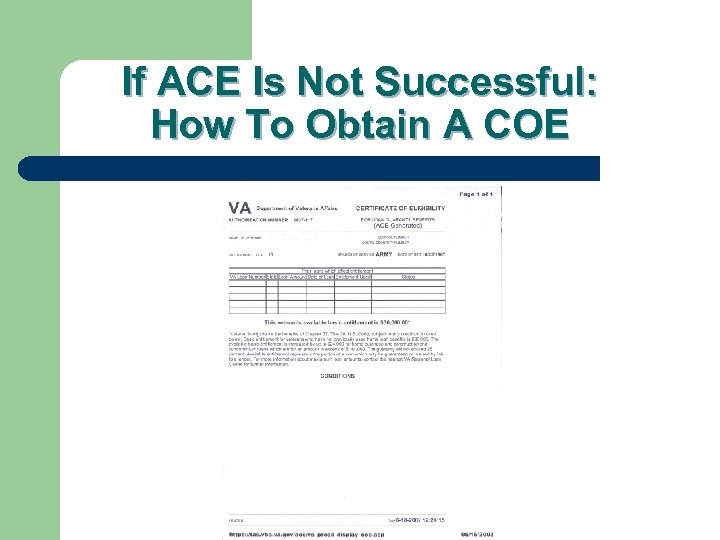

If ACE Is Not Successful: How To Obtain A COE

If ACE Is Not Successful: How To Obtain A COE

VA Eligibility Center Winston Salem Eligibility Center P. O. Box 20729 Winston Salem, NC 27120

VA Eligibility Center Winston Salem Eligibility Center P. O. Box 20729 Winston Salem, NC 27120

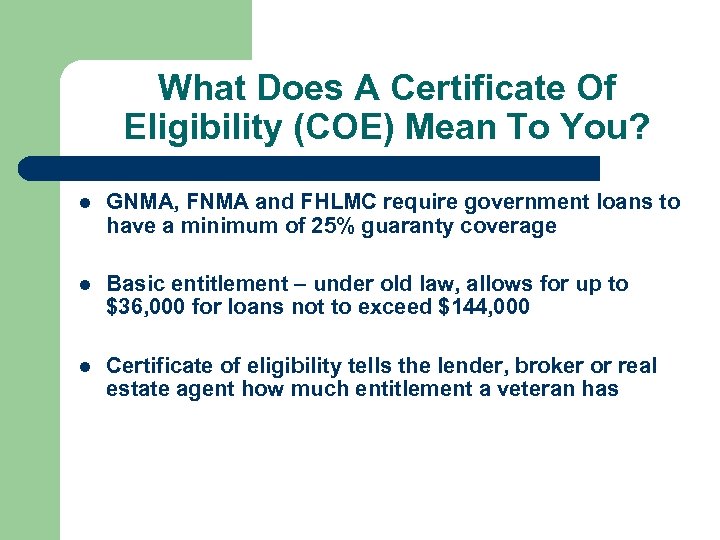

What Does A Certificate Of Eligibility (COE) Mean To You? l GNMA, FNMA and FHLMC require government loans to have a minimum of 25% guaranty coverage l Basic entitlement – under old law, allows for up to $36, 000 for loans not to exceed $144, 000 l Certificate of eligibility tells the lender, broker or real estate agent how much entitlement a veteran has

What Does A Certificate Of Eligibility (COE) Mean To You? l GNMA, FNMA and FHLMC require government loans to have a minimum of 25% guaranty coverage l Basic entitlement – under old law, allows for up to $36, 000 for loans not to exceed $144, 000 l Certificate of eligibility tells the lender, broker or real estate agent how much entitlement a veteran has

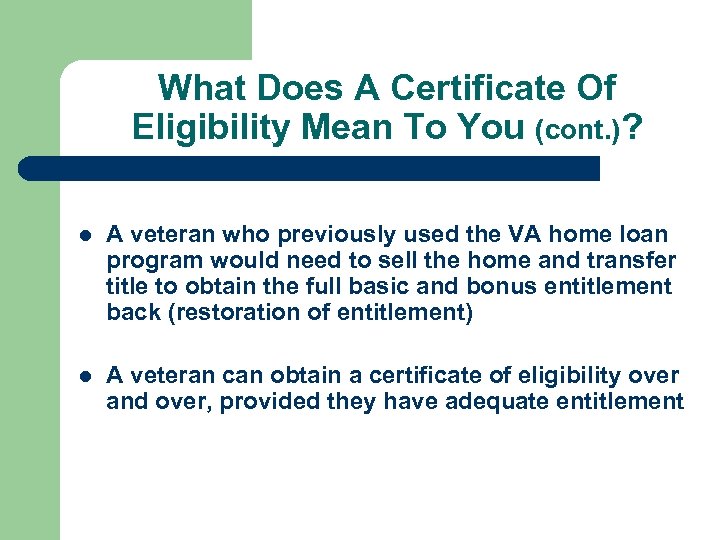

What Does A Certificate Of Eligibility Mean To You (cont. )? l A veteran who previously used the VA home loan program would need to sell the home and transfer title to obtain the full basic and bonus entitlement back (restoration of entitlement) l A veteran can obtain a certificate of eligibility over and over, provided they have adequate entitlement

What Does A Certificate Of Eligibility Mean To You (cont. )? l A veteran who previously used the VA home loan program would need to sell the home and transfer title to obtain the full basic and bonus entitlement back (restoration of entitlement) l A veteran can obtain a certificate of eligibility over and over, provided they have adequate entitlement

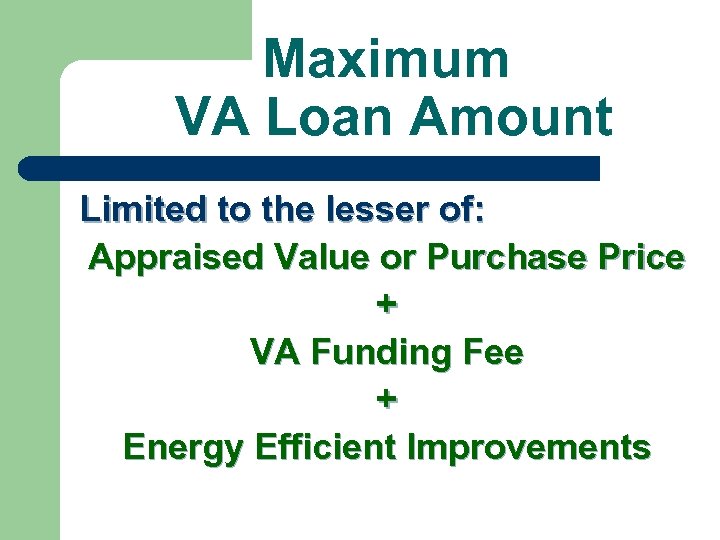

Maximum VA Loan Amount Limited to the lesser of: Appraised Value or Purchase Price + VA Funding Fee + Energy Efficient Improvements

Maximum VA Loan Amount Limited to the lesser of: Appraised Value or Purchase Price + VA Funding Fee + Energy Efficient Improvements

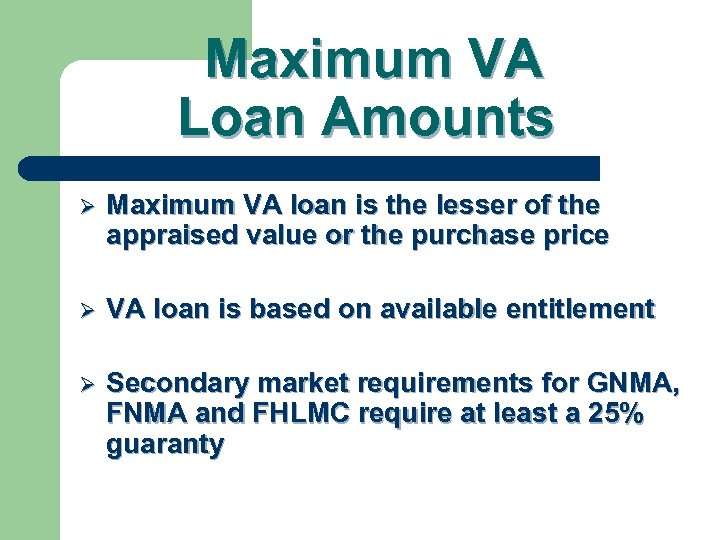

Maximum VA Loan Amounts Ø Maximum VA loan is the lesser of the appraised value or the purchase price Ø VA loan is based on available entitlement Ø Secondary market requirements for GNMA, FNMA and FHLMC require at least a 25% guaranty

Maximum VA Loan Amounts Ø Maximum VA loan is the lesser of the appraised value or the purchase price Ø VA loan is based on available entitlement Ø Secondary market requirements for GNMA, FNMA and FHLMC require at least a 25% guaranty

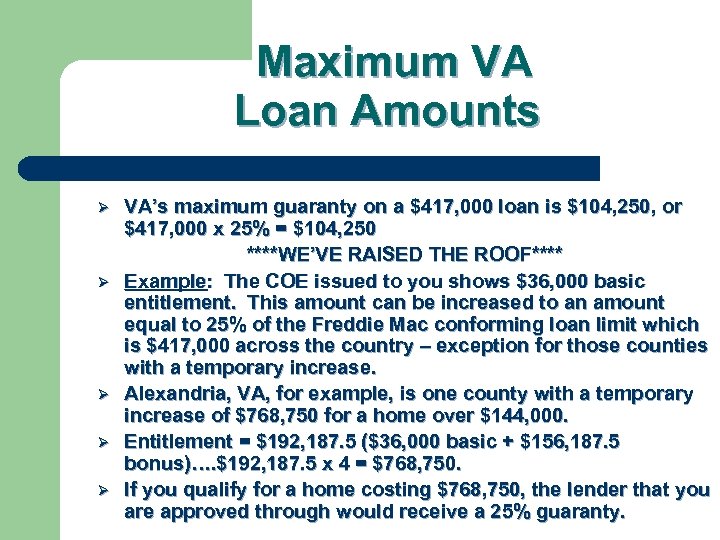

Maximum VA Loan Amounts Ø Ø Ø VA’s maximum guaranty on a $417, 000 loan is $104, 250, or $417, 000 x 25% = $104, 250 ****WE’VE RAISED THE ROOF**** Example: The COE issued to you shows $36, 000 basic entitlement. This amount can be increased to an amount equal to 25% of the Freddie Mac conforming loan limit which is $417, 000 across the country – exception for those counties with a temporary increase. Alexandria, VA, for example, is one county with a temporary increase of $768, 750 for a home over $144, 000. Entitlement = $192, 187. 5 ($36, 000 basic + $156, 187. 5 bonus)…. $192, 187. 5 x 4 = $768, 750. If you qualify for a home costing $768, 750, the lender that you are approved through would receive a 25% guaranty.

Maximum VA Loan Amounts Ø Ø Ø VA’s maximum guaranty on a $417, 000 loan is $104, 250, or $417, 000 x 25% = $104, 250 ****WE’VE RAISED THE ROOF**** Example: The COE issued to you shows $36, 000 basic entitlement. This amount can be increased to an amount equal to 25% of the Freddie Mac conforming loan limit which is $417, 000 across the country – exception for those counties with a temporary increase. Alexandria, VA, for example, is one county with a temporary increase of $768, 750 for a home over $144, 000. Entitlement = $192, 187. 5 ($36, 000 basic + $156, 187. 5 bonus)…. $192, 187. 5 x 4 = $768, 750. If you qualify for a home costing $768, 750, the lender that you are approved through would receive a 25% guaranty.

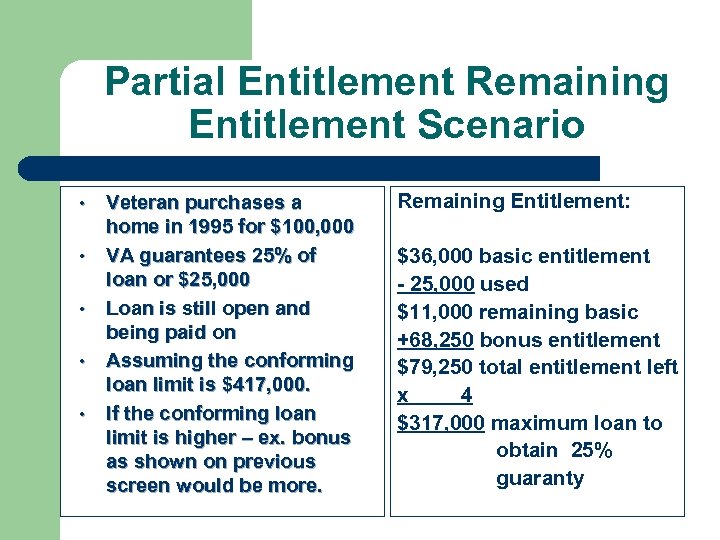

Partial Entitlement Remaining Entitlement Scenario • • • Veteran purchases a home in 1995 for $100, 000 VA guarantees 25% of loan or $25, 000 Loan is still open and being paid on Assuming the conforming loan limit is $417, 000. If the conforming loan limit is higher – ex. bonus as shown on previous screen would be more. Remaining Entitlement: $36, 000 basic entitlement - 25, 000 used $11, 000 remaining basic +68, 250 bonus entitlement $79, 250 total entitlement left x 4 $317, 000 maximum loan to obtain 25% guaranty

Partial Entitlement Remaining Entitlement Scenario • • • Veteran purchases a home in 1995 for $100, 000 VA guarantees 25% of loan or $25, 000 Loan is still open and being paid on Assuming the conforming loan limit is $417, 000. If the conforming loan limit is higher – ex. bonus as shown on previous screen would be more. Remaining Entitlement: $36, 000 basic entitlement - 25, 000 used $11, 000 remaining basic +68, 250 bonus entitlement $79, 250 total entitlement left x 4 $317, 000 maximum loan to obtain 25% guaranty

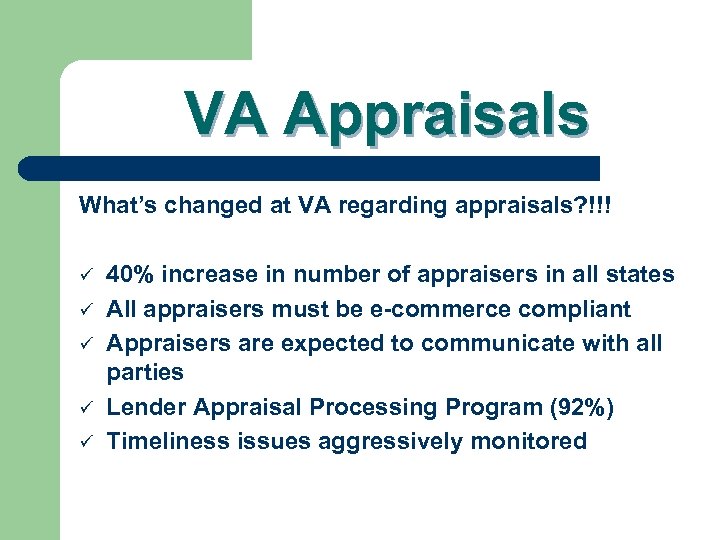

VA Appraisals What’s changed at VA regarding appraisals? !!! ü ü ü 40% increase in number of appraisers in all states All appraisers must be e-commerce compliant Appraisers are expected to communicate with all parties Lender Appraisal Processing Program (92%) Timeliness issues aggressively monitored

VA Appraisals What’s changed at VA regarding appraisals? !!! ü ü ü 40% increase in number of appraisers in all states All appraisers must be e-commerce compliant Appraisers are expected to communicate with all parties Lender Appraisal Processing Program (92%) Timeliness issues aggressively monitored

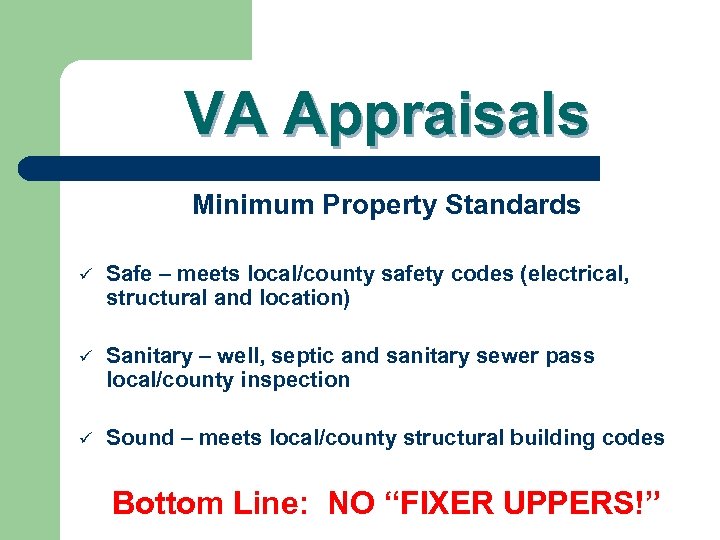

VA Appraisals Minimum Property Standards ü Safe – meets local/county safety codes (electrical, structural and location) ü Sanitary – well, septic and sanitary sewer pass local/county inspection ü Sound – meets local/county structural building codes Bottom Line: NO “FIXER UPPERS!”

VA Appraisals Minimum Property Standards ü Safe – meets local/county safety codes (electrical, structural and location) ü Sanitary – well, septic and sanitary sewer pass local/county inspection ü Sound – meets local/county structural building codes Bottom Line: NO “FIXER UPPERS!”

Basic Rule Of VA Loans Regarding Owner Occupancy • Generally, must occupy within 60 days Exceptions – • IRRRLs – do not have to occupy • Spouse of veteran can satisfy occupancy • If veteran is on active duty, must occupy within 12 months

Basic Rule Of VA Loans Regarding Owner Occupancy • Generally, must occupy within 60 days Exceptions – • IRRRLs – do not have to occupy • Spouse of veteran can satisfy occupancy • If veteran is on active duty, must occupy within 12 months

VA FUNDING FEE l l Funding fee can be added to the based loan amount Funding fee amount varies depending on loan type, down payment, and whether or not veteran had VA loan previously Funding fee is paid online at www. pay. gov/va Some borrowers are exempt

VA FUNDING FEE l l Funding fee can be added to the based loan amount Funding fee amount varies depending on loan type, down payment, and whether or not veteran had VA loan previously Funding fee is paid online at www. pay. gov/va Some borrowers are exempt

Veterans Exempt From Funding Fee l l l Veteran receiving 10% disability compensation from VA Veteran receiving military pension from VA, in lieu of compensation Surviving spouse of a veteran who died as a result of active duty injuries ****************

Veterans Exempt From Funding Fee l l l Veteran receiving 10% disability compensation from VA Veteran receiving military pension from VA, in lieu of compensation Surviving spouse of a veteran who died as a result of active duty injuries ****************

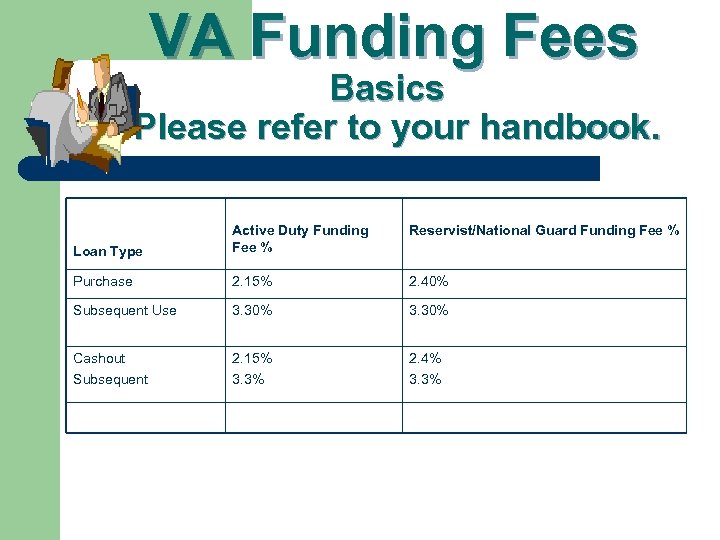

VA Funding Fees Basics Please refer to your handbook. Reservist/National Guard Funding Fee % Loan Type Active Duty Funding Fee % Purchase 2. 15% 2. 40% Subsequent Use 3. 30% Cashout Subsequent 2. 15% 3. 3% 2. 4% 3. 3%

VA Funding Fees Basics Please refer to your handbook. Reservist/National Guard Funding Fee % Loan Type Active Duty Funding Fee % Purchase 2. 15% 2. 40% Subsequent Use 3. 30% Cashout Subsequent 2. 15% 3. 3% 2. 4% 3. 3%

UNDERWRITING Underwriter’s Objective: Determine that the veteran is a satisfactory credit risk, and has the income to qualify for the loan

UNDERWRITING Underwriter’s Objective: Determine that the veteran is a satisfactory credit risk, and has the income to qualify for the loan

INCOME Ø Stable and Reliable Ø Anticipated Ø Sufficient to continue in amount Ø Reportable/Verifiable

INCOME Ø Stable and Reliable Ø Anticipated Ø Sufficient to continue in amount Ø Reportable/Verifiable

Income • • Income must be “verifiable” Prefer a 2 year history, but consideration given for at least 12 months on the job Veteran can obtain VA loan immediately out of the military if employment is related to military technical experience Explain significant gaps in employment

Income • • Income must be “verifiable” Prefer a 2 year history, but consideration given for at least 12 months on the job Veteran can obtain VA loan immediately out of the military if employment is related to military technical experience Explain significant gaps in employment

Verification Standard: • • VA Form 26 -8497, Verification of Employment, or Pay stubs Alternative: • • • Telephone verification Pay stubs (30 days) W 2 s for 2 years

Verification Standard: • • VA Form 26 -8497, Verification of Employment, or Pay stubs Alternative: • • • Telephone verification Pay stubs (30 days) W 2 s for 2 years

Other Types of Verifications • • • Faxed & Internet Verifications Employment Verification Services Leave & Earning Statement (LES) for Active Duty Service (available at “my pay” Income tax returns (self employment) & YTD P&L and balance sheet Other……

Other Types of Verifications • • • Faxed & Internet Verifications Employment Verification Services Leave & Earning Statement (LES) for Active Duty Service (available at “my pay” Income tax returns (self employment) & YTD P&L and balance sheet Other……

Income less than 12 months… Generally not considered stable and reliable l Carefully consider: ~ Employer’s evaluation of probability of continued employment ~ Special training/education/skills required If using this income… … you must explain why!!! l

Income less than 12 months… Generally not considered stable and reliable l Carefully consider: ~ Employer’s evaluation of probability of continued employment ~ Special training/education/skills required If using this income… … you must explain why!!! l

Overtime, Part Time and Bonus Income l Generally not considered stable and reliable unless 2 year history l Verification for at least 12 months – income may be used to offset debts of 10 to 24 months

Overtime, Part Time and Bonus Income l Generally not considered stable and reliable unless 2 year history l Verification for at least 12 months – income may be used to offset debts of 10 to 24 months

Credit History Ø 3 -File Merged (MCR) Ø Residential Mortgage Credit Report (RMCR) Ø Verify Rent/Mortgage history

Credit History Ø 3 -File Merged (MCR) Ø Residential Mortgage Credit Report (RMCR) Ø Verify Rent/Mortgage history

Does VA Consider Credit Scores? q q YES NO

Does VA Consider Credit Scores? q q YES NO

Automated Underwriting Systems (AUS) Most major lenders approved to use AUS systems v Typical VA “Accept” is in the 640 credit score range v

Automated Underwriting Systems (AUS) Most major lenders approved to use AUS systems v Typical VA “Accept” is in the 640 credit score range v

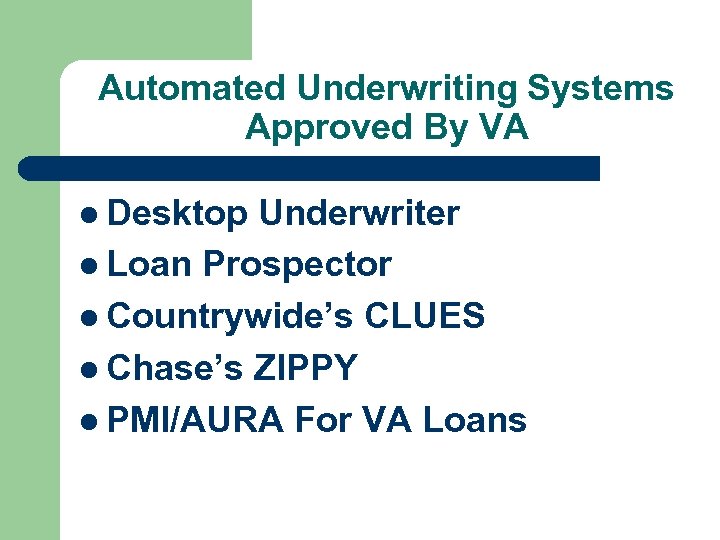

Automated Underwriting Systems Approved By VA l Desktop Underwriter l Loan Prospector l Countrywide’s CLUES l Chase’s ZIPPY l PMI/AURA For VA Loans

Automated Underwriting Systems Approved By VA l Desktop Underwriter l Loan Prospector l Countrywide’s CLUES l Chase’s ZIPPY l PMI/AURA For VA Loans

AUS “Accept” For VA Loans In the 640 mid-credit score range l “Accept” gives credit clearance with waiver of certain derogatory issues l AUS “Accept” does not mean loan is clear to close l Veteran must still meet debt ratio and residual income factors l

AUS “Accept” For VA Loans In the 640 mid-credit score range l “Accept” gives credit clearance with waiver of certain derogatory issues l AUS “Accept” does not mean loan is clear to close l Veteran must still meet debt ratio and residual income factors l

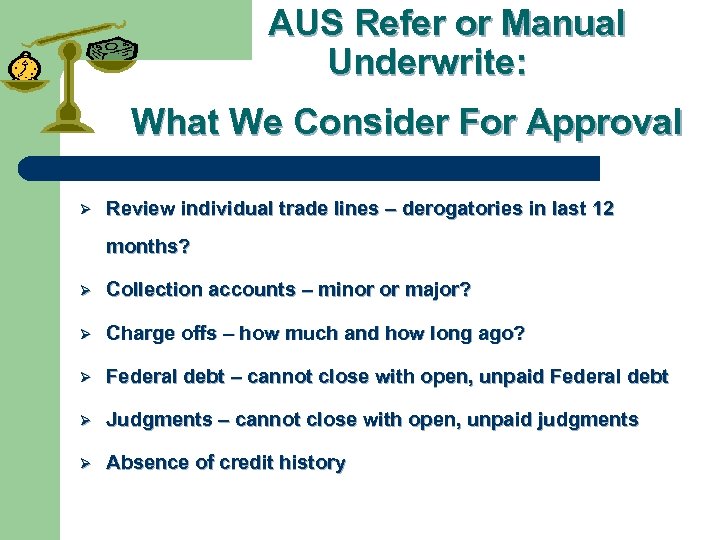

AUS Refer or Manual Underwrite: What We Consider For Approval Ø Review individual trade lines – derogatories in last 12 months? Ø Collection accounts – minor or major? Ø Charge offs – how much and how long ago? Ø Federal debt – cannot close with open, unpaid Federal debt Ø Judgments – cannot close with open, unpaid judgments Ø Absence of credit history

AUS Refer or Manual Underwrite: What We Consider For Approval Ø Review individual trade lines – derogatories in last 12 months? Ø Collection accounts – minor or major? Ø Charge offs – how much and how long ago? Ø Federal debt – cannot close with open, unpaid Federal debt Ø Judgments – cannot close with open, unpaid judgments Ø Absence of credit history

Bankruptcy ~ Chapter 7 • Discharged 2 + years ago if bankruptcy was caused by borrower’s financial mismanagement • Discharged 12 months ago - must be due to circumstances beyond borrower’s control • Must have documentation • Must have re-established credit in most recent 12 months

Bankruptcy ~ Chapter 7 • Discharged 2 + years ago if bankruptcy was caused by borrower’s financial mismanagement • Discharged 12 months ago - must be due to circumstances beyond borrower’s control • Must have documentation • Must have re-established credit in most recent 12 months

Bankruptcy ~ Chapter 13 & Consumer Credit Counseling Ø This indicates an effort to pay and may be viewed as evidence of acceptable credit if: Ø 12 month payment history, no lates Acknowledgment of trustee or agency Ø

Bankruptcy ~ Chapter 13 & Consumer Credit Counseling Ø This indicates an effort to pay and may be viewed as evidence of acceptable credit if: Ø 12 month payment history, no lates Acknowledgment of trustee or agency Ø

Foreclosures Ø Develop facts and circumstances Ø Same waiting periods as Chapter 7 Bankruptcy Ø Prior VA Loan: Ensure no debt to Government and entitlement restored

Foreclosures Ø Develop facts and circumstances Ø Same waiting periods as Chapter 7 Bankruptcy Ø Prior VA Loan: Ensure no debt to Government and entitlement restored

Debts & Obligations Ø Ø Ø May remove debts with 10 monthly payments remaining (if not significant) Only monthly revolving and installment accounts considered Child care is a monthly obligation Investigate allotments on LES or pay stubs Verify and consider Alimony and Child Support

Debts & Obligations Ø Ø Ø May remove debts with 10 monthly payments remaining (if not significant) Only monthly revolving and installment accounts considered Child care is a monthly obligation Investigate allotments on LES or pay stubs Verify and consider Alimony and Child Support

Debts & Obligations You May Disregard Ø Ø Ø Co-obligor on another’s loan: § evidence payments made by someone else § No reason to believe applicant will need to make payments in the future Student Loan payments deferred 12 months or more. 401 K loans (or other loans secured against deposited funds).

Debts & Obligations You May Disregard Ø Ø Ø Co-obligor on another’s loan: § evidence payments made by someone else § No reason to believe applicant will need to make payments in the future Student Loan payments deferred 12 months or more. 401 K loans (or other loans secured against deposited funds).

Assets Ø Sufficient in amount Ø VA Form 26 -8497 a, Verification of Deposit Ø Alt Docs: Last two bank statements Ø Internet and faxed verifications ***********

Assets Ø Sufficient in amount Ø VA Form 26 -8497 a, Verification of Deposit Ø Alt Docs: Last two bank statements Ø Internet and faxed verifications ***********

VA’s Standards ü Debt-to-income Ratio – 41% ü Residual Income - should meet VA’s residual income tables ü Lender must complete Loan Analysis, VA Form 26 -6393

VA’s Standards ü Debt-to-income Ratio – 41% ü Residual Income - should meet VA’s residual income tables ü Lender must complete Loan Analysis, VA Form 26 -6393

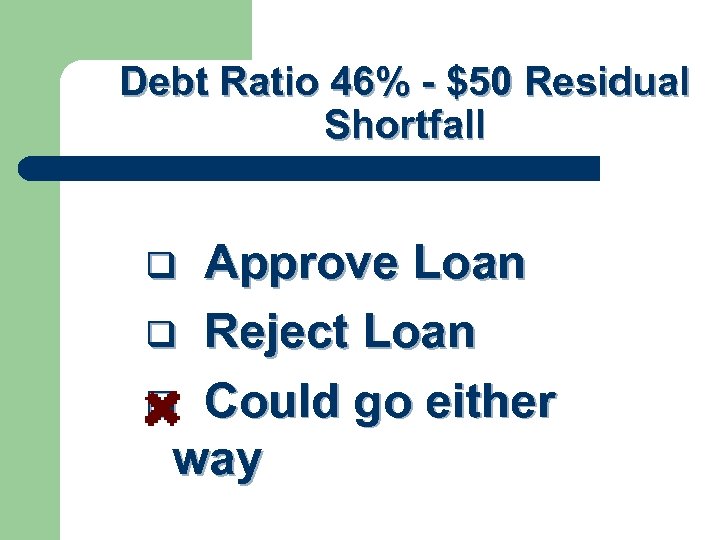

Debt Ratio 46% - $50 Residual Shortfall Approve Loan q Reject Loan q Could go either way q

Debt Ratio 46% - $50 Residual Shortfall Approve Loan q Reject Loan q Could go either way q

Contract Issues • Contingent on VA financing VA • “Escape Clause” is mandatory • Seller must pay termite inspection ************

Contract Issues • Contingent on VA financing VA • “Escape Clause” is mandatory • Seller must pay termite inspection ************

Allowable Fees & Charges l l l l l Appraisal Report & Compliance Inspections Credit Report Prepaid Taxes and Hazard Insurance Title Exam and Title Insurance Fees Flood Zone Determination Environmental Endorsements (3. 0, 8. 1, 103. 5) Recording Fees and Taxes EPA Endorsement Origination Fee (1%) Reasonable Discount Points (May roll up to 2 points into an IRRRL)

Allowable Fees & Charges l l l l l Appraisal Report & Compliance Inspections Credit Report Prepaid Taxes and Hazard Insurance Title Exam and Title Insurance Fees Flood Zone Determination Environmental Endorsements (3. 0, 8. 1, 103. 5) Recording Fees and Taxes EPA Endorsement Origination Fee (1%) Reasonable Discount Points (May roll up to 2 points into an IRRRL)

Fees That Can Never Be Charged To A Veteran Termite/Pest Inspection l Septic Inspection (as mandated by county) l Well Inspection (as mandated by county) l Mortgage Broker Fee l

Fees That Can Never Be Charged To A Veteran Termite/Pest Inspection l Septic Inspection (as mandated by county) l Well Inspection (as mandated by county) l Mortgage Broker Fee l

WHAT’S NEW IMPACT OF RESPA FOR VA l l New HUD 1 and Good Faith Estimate VA will continue to have a cap on the origination fee and limit the type of charges that may be paid by the veteran. In order to monitor these fees, VA is requiring lenders to itemize these charges in the empty 800 lines of the HUD-1 (effective 5/1/2010). Lenders will be required to maintain a copy of the GFE and invoices for third party charges as part of their origination package.

WHAT’S NEW IMPACT OF RESPA FOR VA l l New HUD 1 and Good Faith Estimate VA will continue to have a cap on the origination fee and limit the type of charges that may be paid by the veteran. In order to monitor these fees, VA is requiring lenders to itemize these charges in the empty 800 lines of the HUD-1 (effective 5/1/2010). Lenders will be required to maintain a copy of the GFE and invoices for third party charges as part of their origination package.

One Percent Origination Fee l l The lender may charge the veteran a flat fee up to one percent of the loan amount. The flat fee is intended to cover the lender’s costs and services which are not reimbursable as itemized fees. For Interest Rate Reduction Refinance Loans – this fee may not exceed 1% of the existing loan balance of the loan being refinanced plus the cost of energy efficient items less any cash payments from the veteran. Circular 26 -10 -01 – Lists Reasonable and Customary Items along with Unallowable Itemized Fees – Also refer to Chapter 8, section 2 d of the Lenders Handbook.

One Percent Origination Fee l l The lender may charge the veteran a flat fee up to one percent of the loan amount. The flat fee is intended to cover the lender’s costs and services which are not reimbursable as itemized fees. For Interest Rate Reduction Refinance Loans – this fee may not exceed 1% of the existing loan balance of the loan being refinanced plus the cost of energy efficient items less any cash payments from the veteran. Circular 26 -10 -01 – Lists Reasonable and Customary Items along with Unallowable Itemized Fees – Also refer to Chapter 8, section 2 d of the Lenders Handbook.

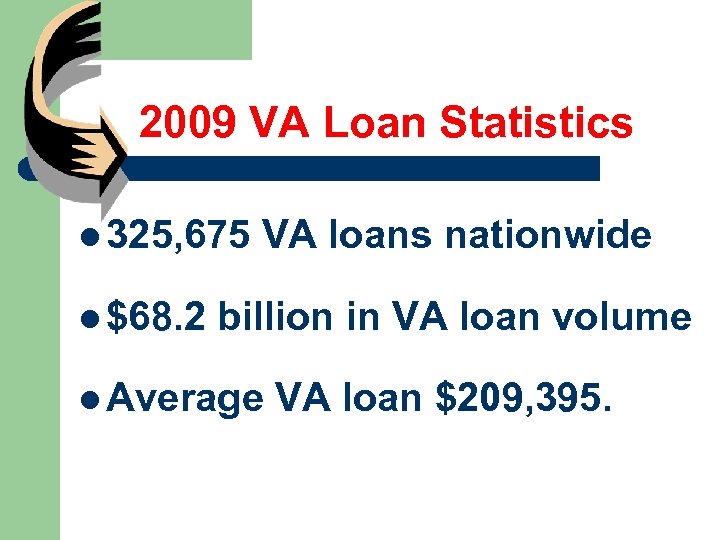

2009 VA Loan Statistics l 325, 675 l $68. 2 VA loans nationwide billion in VA loan volume l Average VA loan $209, 395.

2009 VA Loan Statistics l 325, 675 l $68. 2 VA loans nationwide billion in VA loan volume l Average VA loan $209, 395.

Foreclosure Avoidance Options l l l Repayment Plans Deed In Lieu of Foreclosure Loan Modification VA Refunding Compromise Sale THE HOMEOWNER NEEDS TO CONTACT THEIR LENDER

Foreclosure Avoidance Options l l l Repayment Plans Deed In Lieu of Foreclosure Loan Modification VA Refunding Compromise Sale THE HOMEOWNER NEEDS TO CONTACT THEIR LENDER

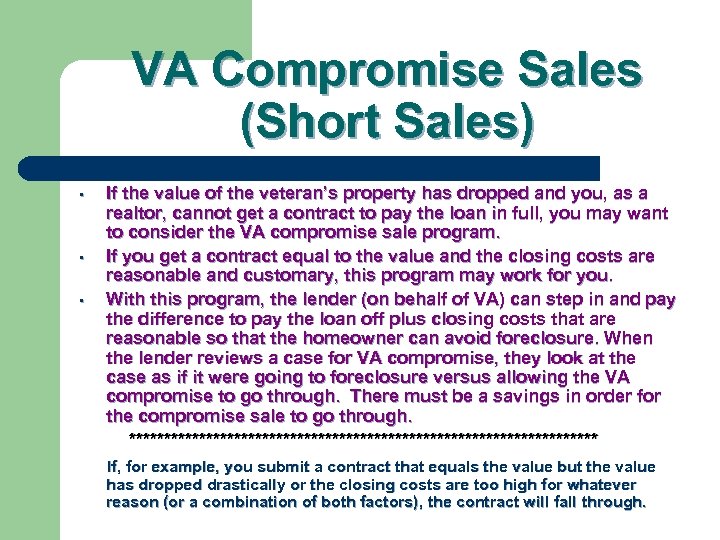

VA Compromise Sales (Short Sales) • • • If the value of the veteran’s property has dropped and you, as a realtor, cannot get a contract to pay the loan in full, you may want to consider the VA compromise sale program. If you get a contract equal to the value and the closing costs are reasonable and customary, this program may work for you. With this program, the lender (on behalf of VA) can step in and pay the difference to pay the loan off plus closing costs that are reasonable so that the homeowner can avoid foreclosure. When the lender reviews a case for VA compromise, they look at the case as if it were going to foreclosure versus allowing the VA compromise to go through. There must be a savings in order for the compromise sale to go through. ********************************** If, for example, you submit a contract that equals the value but the value has dropped drastically or the closing costs are too high for whatever reason (or a combination of both factors), the contract will fall through.

VA Compromise Sales (Short Sales) • • • If the value of the veteran’s property has dropped and you, as a realtor, cannot get a contract to pay the loan in full, you may want to consider the VA compromise sale program. If you get a contract equal to the value and the closing costs are reasonable and customary, this program may work for you. With this program, the lender (on behalf of VA) can step in and pay the difference to pay the loan off plus closing costs that are reasonable so that the homeowner can avoid foreclosure. When the lender reviews a case for VA compromise, they look at the case as if it were going to foreclosure versus allowing the VA compromise to go through. There must be a savings in order for the compromise sale to go through. ********************************** If, for example, you submit a contract that equals the value but the value has dropped drastically or the closing costs are too high for whatever reason (or a combination of both factors), the contract will fall through.

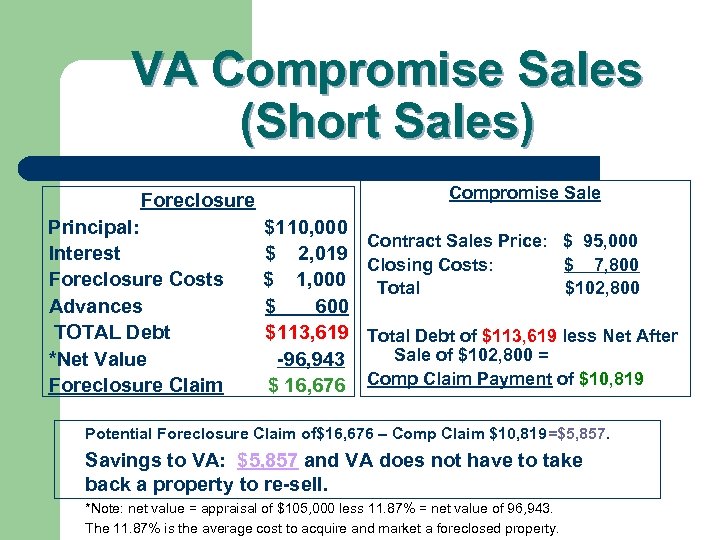

VA Compromise Sales (Short Sales) Compromise Sale Foreclosure Principal: Interest Foreclosure Costs Advances TOTAL Debt *Net Value Foreclosure Claim $110, 000 $ 2, 019 $ 1, 000 $ 600 $113, 619 -96, 943 $ 16, 676 Contract Sales Price: $ 95, 000 Closing Costs: $ 7, 800 Total $102, 800 Total Debt of $113, 619 less Net After Sale of $102, 800 = Comp Claim Payment of $10, 819 Potential Foreclosure Claim of$16, 676 – Comp Claim $10, 819=$5, 857. Savings to VA: $5, 857 and VA does not have to take back a property to re-sell. *Note: net value = appraisal of $105, 000 less 11. 87% = net value of 96, 943. The 11. 87% is the average cost to acquire and market a foreclosed property.

VA Compromise Sales (Short Sales) Compromise Sale Foreclosure Principal: Interest Foreclosure Costs Advances TOTAL Debt *Net Value Foreclosure Claim $110, 000 $ 2, 019 $ 1, 000 $ 600 $113, 619 -96, 943 $ 16, 676 Contract Sales Price: $ 95, 000 Closing Costs: $ 7, 800 Total $102, 800 Total Debt of $113, 619 less Net After Sale of $102, 800 = Comp Claim Payment of $10, 819 Potential Foreclosure Claim of$16, 676 – Comp Claim $10, 819=$5, 857. Savings to VA: $5, 857 and VA does not have to take back a property to re-sell. *Note: net value = appraisal of $105, 000 less 11. 87% = net value of 96, 943. The 11. 87% is the average cost to acquire and market a foreclosed property.