5cb7366f2f8720aa6262610df157dc7f.ppt

- Количество слайдов: 89

Using the State’s Accounting Procedures Manual and the Uniform Chart of Accounts Presented to Michigan Townships Association Annual Educational Conference January, 2015 David R. Williamson, CPA, Partner PSLZ, LLP Plymouth, Michigan 734 -453 -8770 david@pslz. com

Using the State’s Accounting Procedures Manual and the Uniform Chart of Accounts Presented to Michigan Townships Association Annual Educational Conference January, 2015 David R. Williamson, CPA, Partner PSLZ, LLP Plymouth, Michigan 734 -453 -8770 david@pslz. com

Special Thanks To Providers of Some of the Materials Michigan Department of Treasury Local Audit and Finance American Institute of Certified Public Accountants Prentice Hall Professional Business Publications, Arens/Elder/Beasly Presentation to LCPA Baton Rouge Chapter, Suzanne Elliott, May 29, 2007

Special Thanks To Providers of Some of the Materials Michigan Department of Treasury Local Audit and Finance American Institute of Certified Public Accountants Prentice Hall Professional Business Publications, Arens/Elder/Beasly Presentation to LCPA Baton Rouge Chapter, Suzanne Elliott, May 29, 2007

Accounting Procedures Manual Published by the Department of Treasury in 2007 Townships and other local units of government required to follow Each Chapter is divided into three sections: “Concept” Statements Required Procedures Best Practices

Accounting Procedures Manual Published by the Department of Treasury in 2007 Townships and other local units of government required to follow Each Chapter is divided into three sections: “Concept” Statements Required Procedures Best Practices

Chapter 1 -Internal Accounting Control Internal accounting control is a series of procedures designed to promote and protect sound practices, both general and financial. Internal control procedures will significantly increase the likelihood that: financial information is reliable assets and records of the organization are not stolen or misused the organization’s policies are followed government regulations are met

Chapter 1 -Internal Accounting Control Internal accounting control is a series of procedures designed to promote and protect sound practices, both general and financial. Internal control procedures will significantly increase the likelihood that: financial information is reliable assets and records of the organization are not stolen or misused the organization’s policies are followed government regulations are met

Developing an Internal Accounting Control System Control environment-setting the “tone at the top” of the organization, meaning the integrity, ethical values, and competence of the entity’s people Risk Assessment-Identify areas where errors or irregularities can occur Cash Receipts Cash Disbursements Payroll Fixed Assets/Inventory

Developing an Internal Accounting Control System Control environment-setting the “tone at the top” of the organization, meaning the integrity, ethical values, and competence of the entity’s people Risk Assessment-Identify areas where errors or irregularities can occur Cash Receipts Cash Disbursements Payroll Fixed Assets/Inventory

Developing an Internal Accounting Control System Control environment-setting the “tone at the top” of the organization, meaning the integrity, ethical values, and competence of the entity’s people Risk Assessment-Identify areas where errors or irregularities can occur Cash Receipts Cash Disbursements Payroll Fixed Assets/Inventory

Developing an Internal Accounting Control System Control environment-setting the “tone at the top” of the organization, meaning the integrity, ethical values, and competence of the entity’s people Risk Assessment-Identify areas where errors or irregularities can occur Cash Receipts Cash Disbursements Payroll Fixed Assets/Inventory

Developing an Internal Accounting Control System Control activities. -Policies and procedures that help ensure that directives are carried out. These include activities such as approvals, authorizations, verifications, reconciliations, reviews of operating performance, security of assets, and segregation of duties. Information and communication- Components that address the need in the organization to identify, capture, and communicate information to the right people to enable them to carry out their responsibilities. Information systems within the organization are key to this element of internal control.

Developing an Internal Accounting Control System Control activities. -Policies and procedures that help ensure that directives are carried out. These include activities such as approvals, authorizations, verifications, reconciliations, reviews of operating performance, security of assets, and segregation of duties. Information and communication- Components that address the need in the organization to identify, capture, and communicate information to the right people to enable them to carry out their responsibilities. Information systems within the organization are key to this element of internal control.

Developing an Internal Accounting Control System Monitoring- The activity undertaken by management and others in the organization with regard to the internal control system. It is key that internal control deficiencies reported to the township board. These components are linked together, thus forming an integrated system that can react dynamically to changing conditions.

Developing an Internal Accounting Control System Monitoring- The activity undertaken by management and others in the organization with regard to the internal control system. It is key that internal control deficiencies reported to the township board. These components are linked together, thus forming an integrated system that can react dynamically to changing conditions.

Whose responsibility is it to design and maintain internal control? According to Michigan Law, and professional auditing Literature, this responsibility lies with the Township. Management, Other Personnel, and “Those Charged With Governance” (The Township Board) are required to design, monitor, adjust, and maintain the system of accounting control

Whose responsibility is it to design and maintain internal control? According to Michigan Law, and professional auditing Literature, this responsibility lies with the Township. Management, Other Personnel, and “Those Charged With Governance” (The Township Board) are required to design, monitor, adjust, and maintain the system of accounting control

Financial Policies-Chapter 2 Adopt required policies. Electronic Transactions Credit Card Investment Others Build on required with optional policies Purchasing Travel Ethics/Conflicts of Interest • • •

Financial Policies-Chapter 2 Adopt required policies. Electronic Transactions Credit Card Investment Others Build on required with optional policies Purchasing Travel Ethics/Conflicts of Interest • • •

Electronic Payments Permissible Under Michigan Law PA 738 of 2002 (MCL 124. 301) requires the governing body of all local units of government to approve a resolution authorizing payments of “automated clearing house (ACH) transactions, ” which is a way to process electronic payments or receipts to external parties. The act requires the resolution the following: an ACH policy; designation of electronic transfer officer; documentation of payments, and The establishment of internal controls system.

Electronic Payments Permissible Under Michigan Law PA 738 of 2002 (MCL 124. 301) requires the governing body of all local units of government to approve a resolution authorizing payments of “automated clearing house (ACH) transactions, ” which is a way to process electronic payments or receipts to external parties. The act requires the resolution the following: an ACH policy; designation of electronic transfer officer; documentation of payments, and The establishment of internal controls system.

Internal Controls/Fraud Protection Prior to commencing electronic payments and receipts, townships should work with their banks, data processing professionals and auditors to ensure that the township is protected from fraud. A recent study conducted by the Government Finance Officers Association showed that governments are using the ACH system more frequently to accomplish vendor payments, payroll, and intergovernmental payments (e. g. property tax disbursements), and accept payments, but lag in implementing fraud protection.

Internal Controls/Fraud Protection Prior to commencing electronic payments and receipts, townships should work with their banks, data processing professionals and auditors to ensure that the township is protected from fraud. A recent study conducted by the Government Finance Officers Association showed that governments are using the ACH system more frequently to accomplish vendor payments, payroll, and intergovernmental payments (e. g. property tax disbursements), and accept payments, but lag in implementing fraud protection.

Internal Control Suggestions Use ACH Filters and Blocks-in the GFOA study, only 34% of the governments use ACH filters and blocks. These tools would allow the township to “block” all ACH transactions in specified accounts, or “filter” the ACH transactions to allow payments and receipts from authorized sources only. Use separate ACH bank account-only 24% of the governments surveyed in the GFOA study use separate bank accounts.

Internal Control Suggestions Use ACH Filters and Blocks-in the GFOA study, only 34% of the governments use ACH filters and blocks. These tools would allow the township to “block” all ACH transactions in specified accounts, or “filter” the ACH transactions to allow payments and receipts from authorized sources only. Use separate ACH bank account-only 24% of the governments surveyed in the GFOA study use separate bank accounts.

GFOA Recommendations Enhancing computer virus protections Passwords for initiating transactions Periodic internal control reviews that address control, data confidentiality, data integrity, and other general computer security controls Written agreements with financial institutions covering ACH transactions Dollar limits for authorized personnel, and dual passwords required for dollars above a specific limit. Dual controls to establish repetitive transactions, and non repetitive payments Reconcile ACH transactions or accounts dailyperson other than originating party

GFOA Recommendations Enhancing computer virus protections Passwords for initiating transactions Periodic internal control reviews that address control, data confidentiality, data integrity, and other general computer security controls Written agreements with financial institutions covering ACH transactions Dollar limits for authorized personnel, and dual passwords required for dollars above a specific limit. Dual controls to establish repetitive transactions, and non repetitive payments Reconcile ACH transactions or accounts dailyperson other than originating party

Credit Card Policies-Requirements Use must be in compliance with PA 266 of 1995, which also requires the township board to adopt a resolution and adoption of a credit card policy that indicates responsibility for the cards use, and monitoring and oversight. credit cards can only be used for official township business. persons using the card are responsible for protection and custody of the cards. persons using the card must return it immediately after termination of employment.

Credit Card Policies-Requirements Use must be in compliance with PA 266 of 1995, which also requires the township board to adopt a resolution and adoption of a credit card policy that indicates responsibility for the cards use, and monitoring and oversight. credit cards can only be used for official township business. persons using the card are responsible for protection and custody of the cards. persons using the card must return it immediately after termination of employment.

Credit Card Policies-Requirements Continued requires adoption of a system of internal controls monitoring use approval of credit card bills prior to payment. timing of payments on the card (no later than 60 days from statement date) disciplinary actions for failure to follow policy

Credit Card Policies-Requirements Continued requires adoption of a system of internal controls monitoring use approval of credit card bills prior to payment. timing of payments on the card (no later than 60 days from statement date) disciplinary actions for failure to follow policy

Investment Policies Required by PA 20, of 1943, as amended-MCL 129. 91, Townships should review their policies (required since 1997) to ensure they address: Credit Risk-The risk that the issuer will not pay off on the investment when it matures. Third Party Risk-Risk of fraud in connection with the physical existence of the securities being purchased.

Investment Policies Required by PA 20, of 1943, as amended-MCL 129. 91, Townships should review their policies (required since 1997) to ensure they address: Credit Risk-The risk that the issuer will not pay off on the investment when it matures. Third Party Risk-Risk of fraud in connection with the physical existence of the securities being purchased.

Investment Policies-Continued Interest Rate Risk-The risk that a change in interest rates will cause an investment to decline in value. Maturity Risk-Cash may be tied up for a long time, and the townships must pay a penalty or suffer decrease in value if the investment is cashed in early. Opportunity Risk-Risk that interest rates will rise during an investment’s term, and the township will have foregone the higher return.

Investment Policies-Continued Interest Rate Risk-The risk that a change in interest rates will cause an investment to decline in value. Maturity Risk-Cash may be tied up for a long time, and the townships must pay a penalty or suffer decrease in value if the investment is cashed in early. Opportunity Risk-Risk that interest rates will rise during an investment’s term, and the township will have foregone the higher return.

Purchasing Policies-help insure that purchases of goods and services provide the best value for the township and that vendors are treated equally. Most communities have several different methods used to select vendors: competitive bidding quotations small purchase orders (blankets)

Purchasing Policies-help insure that purchases of goods and services provide the best value for the township and that vendors are treated equally. Most communities have several different methods used to select vendors: competitive bidding quotations small purchase orders (blankets)

Policy Development Challenges Townships must weigh the costs of developing bid specs, and administration, with the benefits of the competitive bidding through a formalized process. Many communities have a high dollar threshold for purchasing through competitive bids, or RFP (request for proposals), a mid term policy for other purchases (quotes), and a small purchase policy, where department heads and employees can accomplish small purchases through “blanket orders”.

Policy Development Challenges Townships must weigh the costs of developing bid specs, and administration, with the benefits of the competitive bidding through a formalized process. Many communities have a high dollar threshold for purchasing through competitive bids, or RFP (request for proposals), a mid term policy for other purchases (quotes), and a small purchase policy, where department heads and employees can accomplish small purchases through “blanket orders”.

Other Challenges to Policy Development Procurement standards for purchases of goods and services for state and federal grants usually require adherence to Office of Management and Budgeting (OMB) standards. Centralized or Decentralized Systems?

Other Challenges to Policy Development Procurement standards for purchases of goods and services for state and federal grants usually require adherence to Office of Management and Budgeting (OMB) standards. Centralized or Decentralized Systems?

Other “Optional” Policies-Travel Elements to Consider: a copy of the form used to request reimbursement list of supporting documents to attach to the form the timeline to submit the reimbursement request; we recommend 30 days after travel a list of when prior authorizations are needed the reimbursement rates for mileage, hotel stays, meals and airfare. Many travel policies specify maximum amounts for meals, airfare or other items.

Other “Optional” Policies-Travel Elements to Consider: a copy of the form used to request reimbursement list of supporting documents to attach to the form the timeline to submit the reimbursement request; we recommend 30 days after travel a list of when prior authorizations are needed the reimbursement rates for mileage, hotel stays, meals and airfare. Many travel policies specify maximum amounts for meals, airfare or other items.

Chapter 3 -Bank Accounts and Reconciliation All Funds can be ‘pooled’ except those that specifically are required to have separate funds: Debt Service-State says SAD’s can be pooled with other SAD’s and GO Unlimited Bond DSF can be pooled with other GO Unlimited. Property Tax Collection

Chapter 3 -Bank Accounts and Reconciliation All Funds can be ‘pooled’ except those that specifically are required to have separate funds: Debt Service-State says SAD’s can be pooled with other SAD’s and GO Unlimited Bond DSF can be pooled with other GO Unlimited. Property Tax Collection

Cash Account Recommendations Separate Depository Accounts From Disbursing Accounts-GFOA Recommendation-creates a ‘firewall’ around the Township’s largest cash deposit. Pooling Depository Accounts Will Reduce Bank Fees, However State Law will Require Certain Accounts to Be Separately Maintained-Tax Collection, Debt Service.

Cash Account Recommendations Separate Depository Accounts From Disbursing Accounts-GFOA Recommendation-creates a ‘firewall’ around the Township’s largest cash deposit. Pooling Depository Accounts Will Reduce Bank Fees, However State Law will Require Certain Accounts to Be Separately Maintained-Tax Collection, Debt Service.

Recommended Cash Disbursement Accounts Payable (small dollar limited individual transactions) Accounts Payable Larger transactions EFT Account (Should be reconciled daily) Payroll Account Property Taxes

Recommended Cash Disbursement Accounts Payable (small dollar limited individual transactions) Accounts Payable Larger transactions EFT Account (Should be reconciled daily) Payroll Account Property Taxes

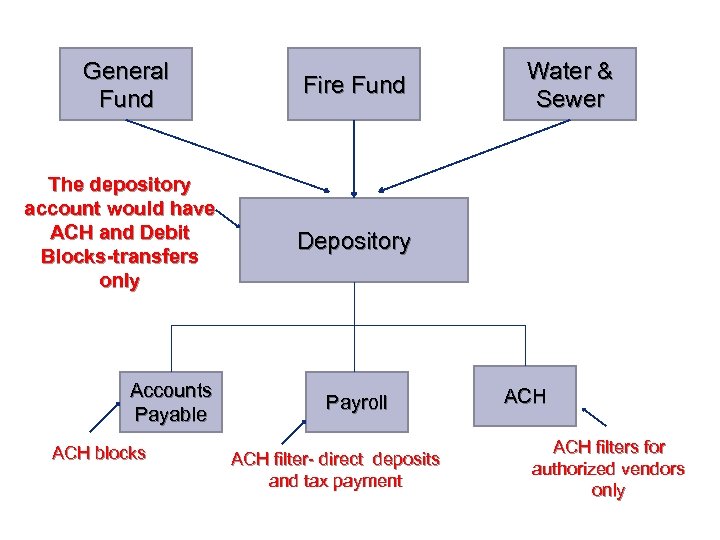

General Fund The depository account would have ACH and Debit Blocks-transfers only Accounts Payable ACH blocks Fire Fund Water & Sewer Depository Payroll ACH filter- direct deposits and tax payment ACH filters for authorized vendors only

General Fund The depository account would have ACH and Debit Blocks-transfers only Accounts Payable ACH blocks Fire Fund Water & Sewer Depository Payroll ACH filter- direct deposits and tax payment ACH filters for authorized vendors only

Key Control Activity for Most Township is the Bank Reconciliation Challenges: Frequently prepared late (why would the State put on the APR otherwise) Not Reconciled to the General Ledger Reconciled by the custodian of the accounts-ideally this should be someone independent of the process

Key Control Activity for Most Township is the Bank Reconciliation Challenges: Frequently prepared late (why would the State put on the APR otherwise) Not Reconciled to the General Ledger Reconciled by the custodian of the accounts-ideally this should be someone independent of the process

Bank Reconciliation Should be (ideally) performed by someone NOT involved in cash receipts or disbursements. Involves comparison of information coming from the bank to the books of the township, specifically the general ledger account(s) Cash in the Bank. Often, “reconciliation” process involves only the Treasurer’s check register. In this case problems often arise as the township’s books are not reconciled to the outside source (bank)-this also results in poor segregation of duties.

Bank Reconciliation Should be (ideally) performed by someone NOT involved in cash receipts or disbursements. Involves comparison of information coming from the bank to the books of the township, specifically the general ledger account(s) Cash in the Bank. Often, “reconciliation” process involves only the Treasurer’s check register. In this case problems often arise as the township’s books are not reconciled to the outside source (bank)-this also results in poor segregation of duties.

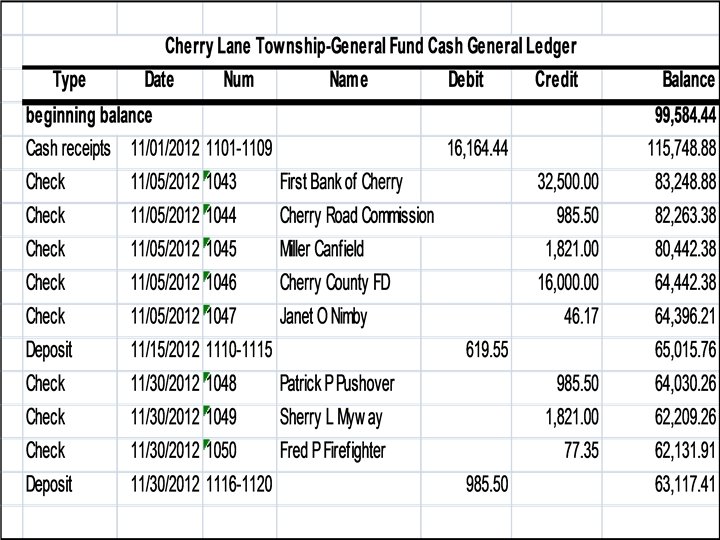

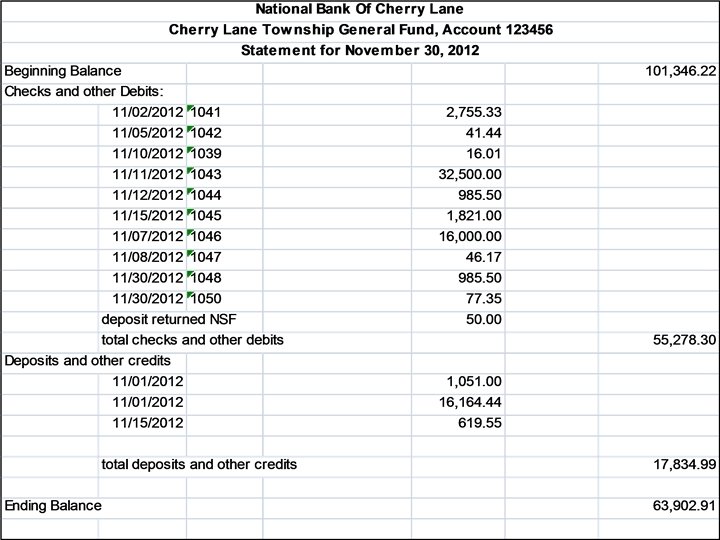

Bank Reconciliation Specifics Monthly bank statement is a listing of all the deposits, checks, other debits and credits which cleared the bank. General ledger shows all cash received and paid within the month. Neither balance is “correct” without adjustment for timing differences, know as reconciling items.

Bank Reconciliation Specifics Monthly bank statement is a listing of all the deposits, checks, other debits and credits which cleared the bank. General ledger shows all cash received and paid within the month. Neither balance is “correct” without adjustment for timing differences, know as reconciling items.

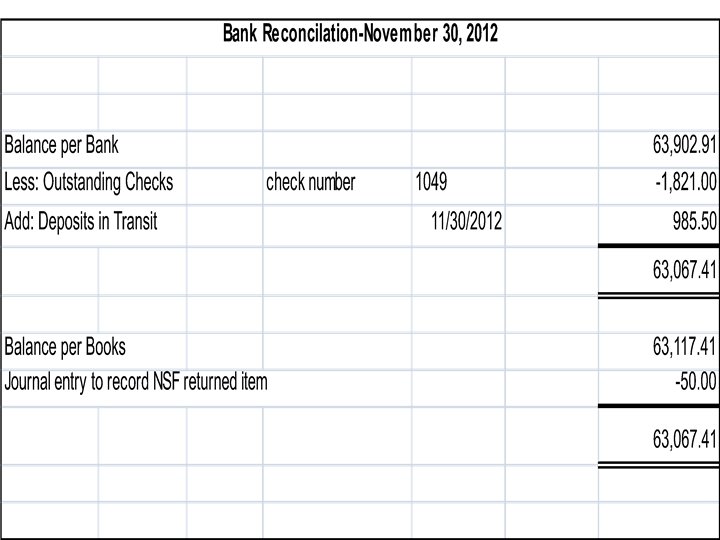

Bank Reconciliation Steps The purpose is to start with each balance (book and bank) and work towards the “true” balance. Bank adjustments Deposits in transits-should be deposits within the last few days of the month. Outstanding Checks-checks written but not clearedwatch for old outstanding items. Bank Errors-rare these days but they happen!

Bank Reconciliation Steps The purpose is to start with each balance (book and bank) and work towards the “true” balance. Bank adjustments Deposits in transits-should be deposits within the last few days of the month. Outstanding Checks-checks written but not clearedwatch for old outstanding items. Bank Errors-rare these days but they happen!

Bank Reconciliation Steps Book balance adjustments are generally for items that cleared without information. NSF deposits Bank service charges Book Errors Good communication between Clerk and Treasurer can minimize these reconciliation adjustments. Book adjustments generally require adjusting journal entries to “fix” the error.

Bank Reconciliation Steps Book balance adjustments are generally for items that cleared without information. NSF deposits Bank service charges Book Errors Good communication between Clerk and Treasurer can minimize these reconciliation adjustments. Book adjustments generally require adjusting journal entries to “fix” the error.

Bank Reconciliation Steps Checks should be reconciled to cancelled checks clearing the account, not to the listing on the statement. It is important to review the checks clearing for agreement to date, amount, payee and endorsement. All unusual items should be followed up; e. g. check clears for the correct amount; but payees are different. Deposits in transit should not be outstanding for more than a few days.

Bank Reconciliation Steps Checks should be reconciled to cancelled checks clearing the account, not to the listing on the statement. It is important to review the checks clearing for agreement to date, amount, payee and endorsement. All unusual items should be followed up; e. g. check clears for the correct amount; but payees are different. Deposits in transit should not be outstanding for more than a few days.

Bank Reconciliation-Final Step Review bank reconciliation example on worksheet. Very important the Clerk and Treasurer reconcile the general ledger bank balance to the Treasurer’s cash records. Key element of control-Treasurer should insist on getting a copy of the bank reconciliation, along with the cancelled checks, and bank statements to facilitate reconciliation.

Bank Reconciliation-Final Step Review bank reconciliation example on worksheet. Very important the Clerk and Treasurer reconcile the general ledger bank balance to the Treasurer’s cash records. Key element of control-Treasurer should insist on getting a copy of the bank reconciliation, along with the cancelled checks, and bank statements to facilitate reconciliation.

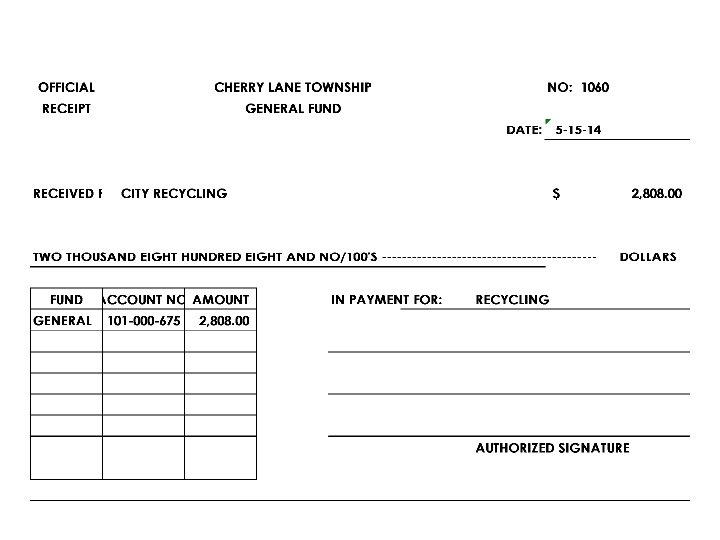

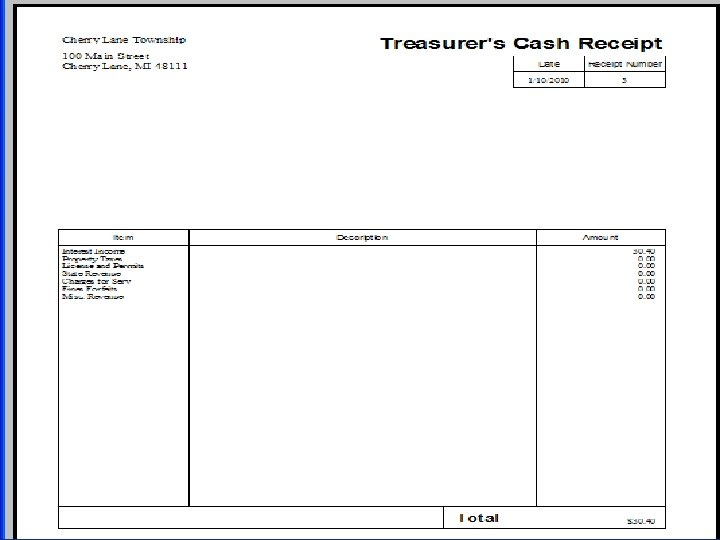

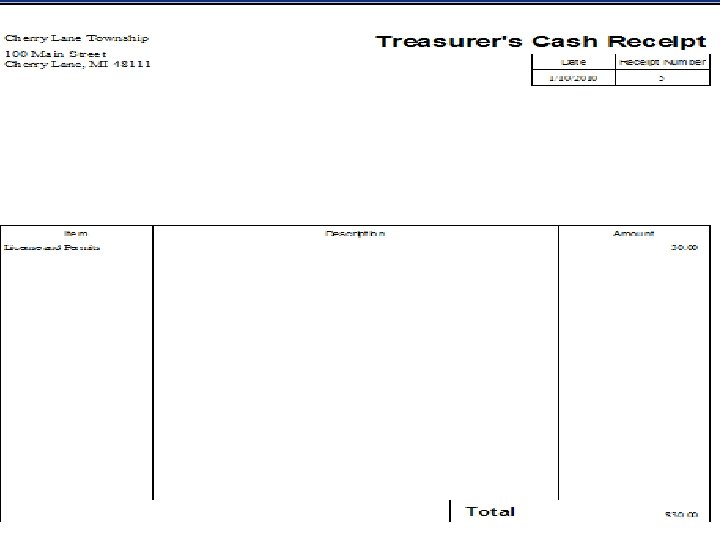

Cash Receipting (Chapter 4)Michigan Law Requires: Township Treasurer must complete a formal receipt for all revenues coming into the Township. This can be accomplished by: Computerized point of sales systems Cash registers Manual three part receipts

Cash Receipting (Chapter 4)Michigan Law Requires: Township Treasurer must complete a formal receipt for all revenues coming into the Township. This can be accomplished by: Computerized point of sales systems Cash registers Manual three part receipts

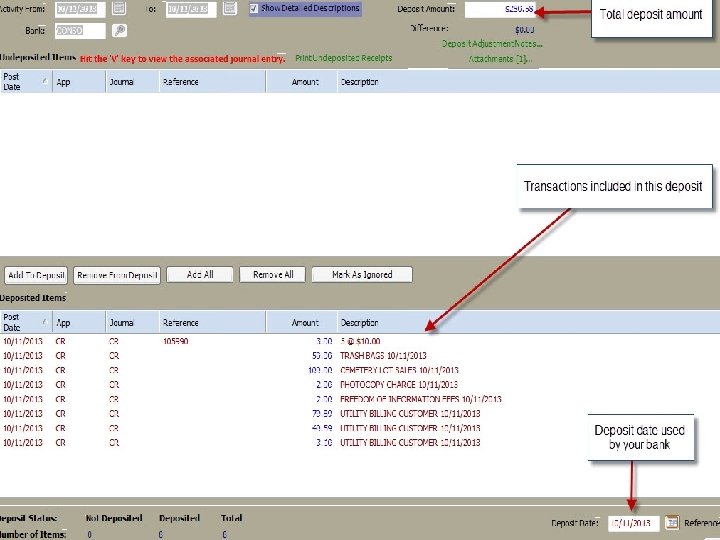

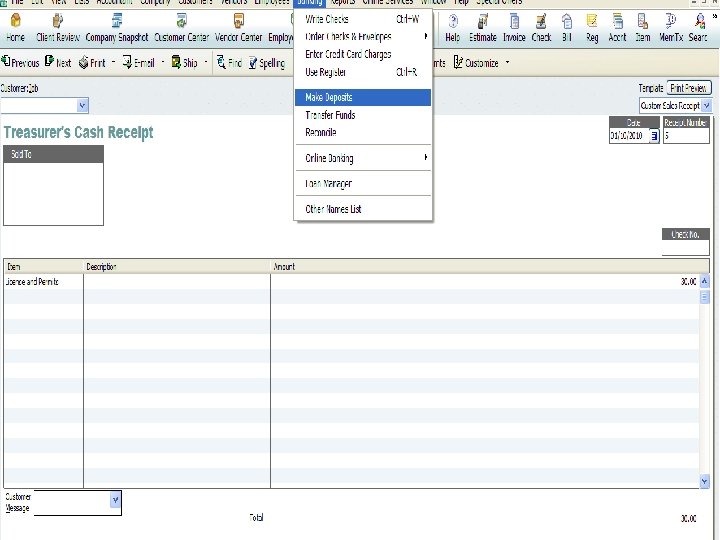

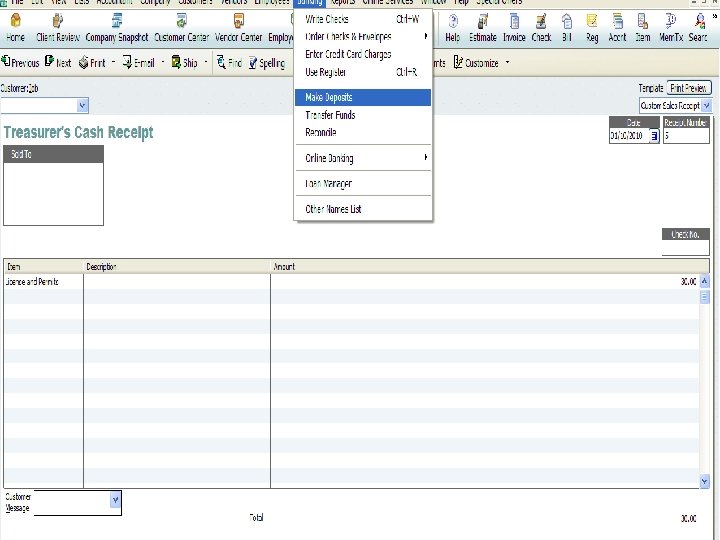

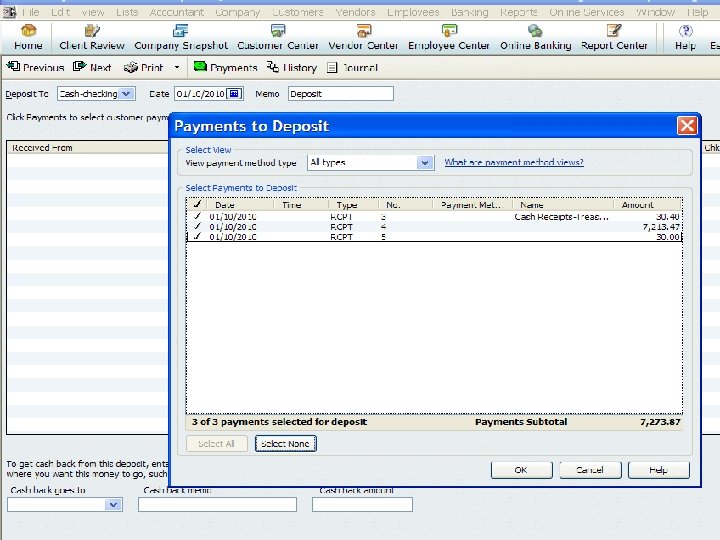

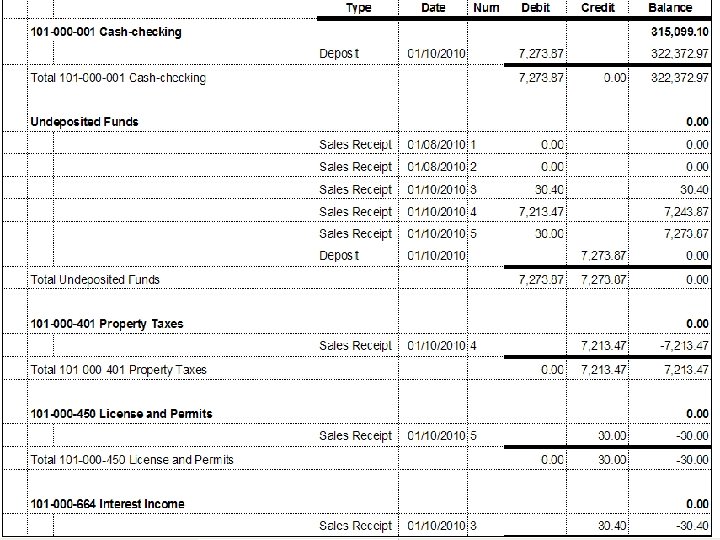

USE AUTOMATED PROCESSES TO RECONCILE CASH RECIEPTS BS&A Has An Automated Processes To Batch Deposit Entries in the Same Way the Treasurer Batches Deposits. Quick Book Users? Have To Do ‘Work Arounds”

USE AUTOMATED PROCESSES TO RECONCILE CASH RECIEPTS BS&A Has An Automated Processes To Batch Deposit Entries in the Same Way the Treasurer Batches Deposits. Quick Book Users? Have To Do ‘Work Arounds”

Property Tax Fund Books should be maintained by both clerk and treasurer. Treasurer’s records tracks monies collected and disbursed by tax roll, usually totaled by deposit, by month. Clerk should post General Ledger by month. 48

Property Tax Fund Books should be maintained by both clerk and treasurer. Treasurer’s records tracks monies collected and disbursed by tax roll, usually totaled by deposit, by month. Clerk should post General Ledger by month. 48

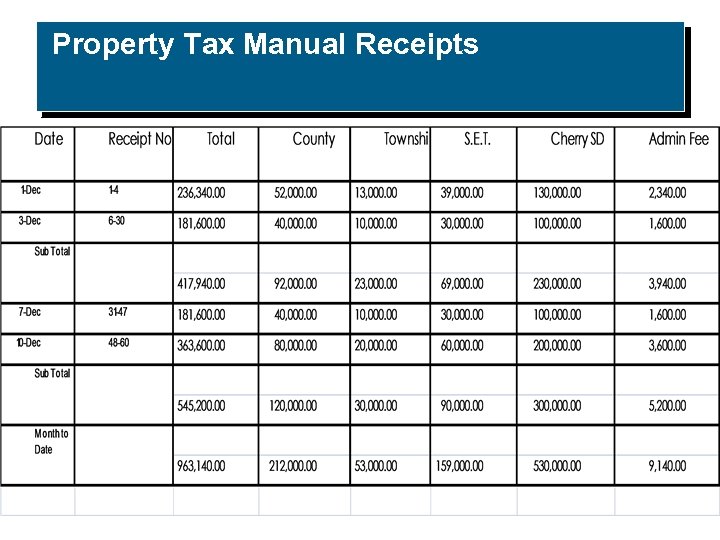

Tax Collections The treasurer must maintain a Tax Collection Receipts Journal of the property tax collections. At least one entry per day for the total amount collected must be made. If desired, the treasurer may enter each individual tax receipt in the journal, however, it is not mandatory. The form of the journal may vary, but it must provide for an immediate determination of the amount collected for each tax collected Note BSA Equalizer provides reports that meet this purpose

Tax Collections The treasurer must maintain a Tax Collection Receipts Journal of the property tax collections. At least one entry per day for the total amount collected must be made. If desired, the treasurer may enter each individual tax receipt in the journal, however, it is not mandatory. The form of the journal may vary, but it must provide for an immediate determination of the amount collected for each tax collected Note BSA Equalizer provides reports that meet this purpose

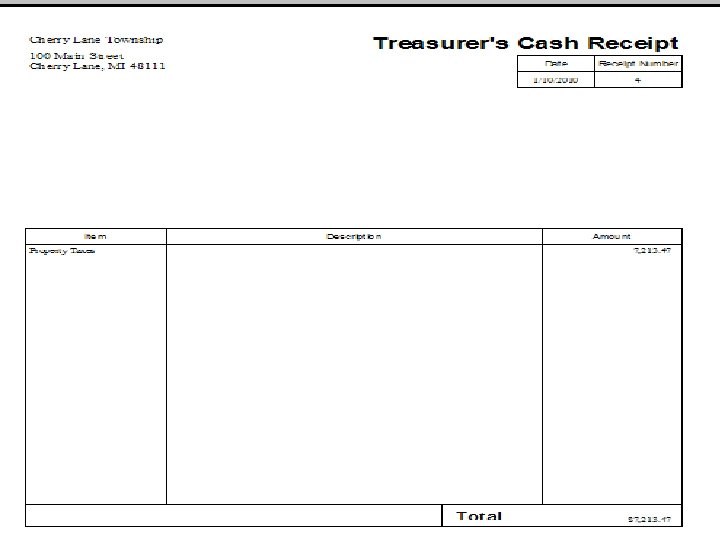

Property Tax Manual Receipts

Property Tax Manual Receipts

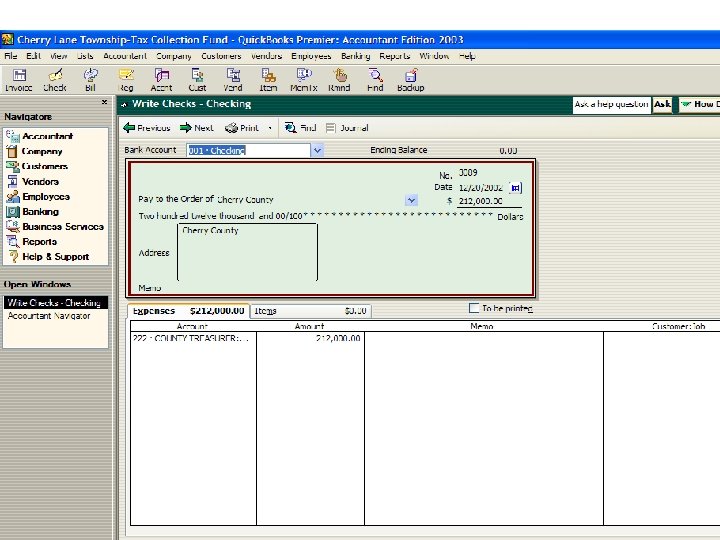

Cash Disbursements-Tax Fund Should be charged to liability accounts. Generally are initiated by treasurer and signed by treasurer. Townships should consider improvements to internal control over taxes. 51

Cash Disbursements-Tax Fund Should be charged to liability accounts. Generally are initiated by treasurer and signed by treasurer. Townships should consider improvements to internal control over taxes. 51

PSLZ, LLP-Certified Public Accountants 52

PSLZ, LLP-Certified Public Accountants 52

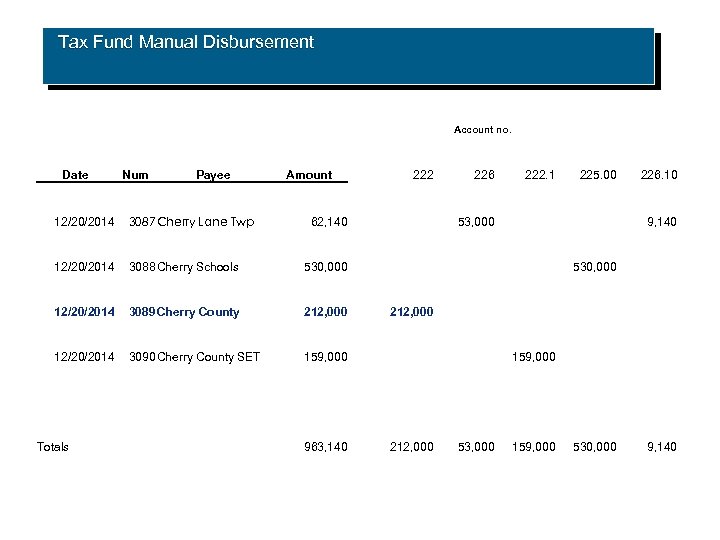

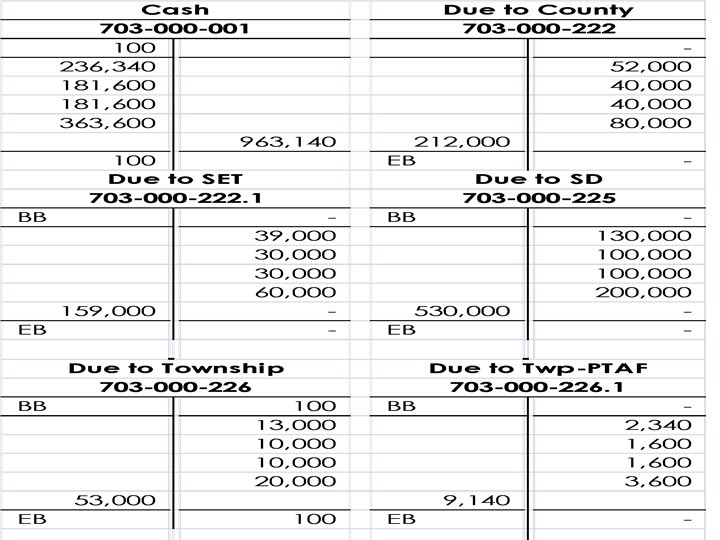

Tax Fund Manual Disbursement Date Num Payee Account no. Amount 222 226 222. 1 225. 00 226. 10 12/20/2014 3087 Cherry Lane Twp 62, 140 53, 000 9, 140 12/20/2014 3088 Cherry Schools 530, 000 12/20/2014 3089 Cherry County 212, 000 12/20/2014 3090 Cherry County SET 159, 000 Totals 963, 140 212, 000 53, 000 159, 000 530, 000 9, 140

Tax Fund Manual Disbursement Date Num Payee Account no. Amount 222 226 222. 1 225. 00 226. 10 12/20/2014 3087 Cherry Lane Twp 62, 140 53, 000 9, 140 12/20/2014 3088 Cherry Schools 530, 000 12/20/2014 3089 Cherry County 212, 000 12/20/2014 3090 Cherry County SET 159, 000 Totals 963, 140 212, 000 53, 000 159, 000 530, 000 9, 140

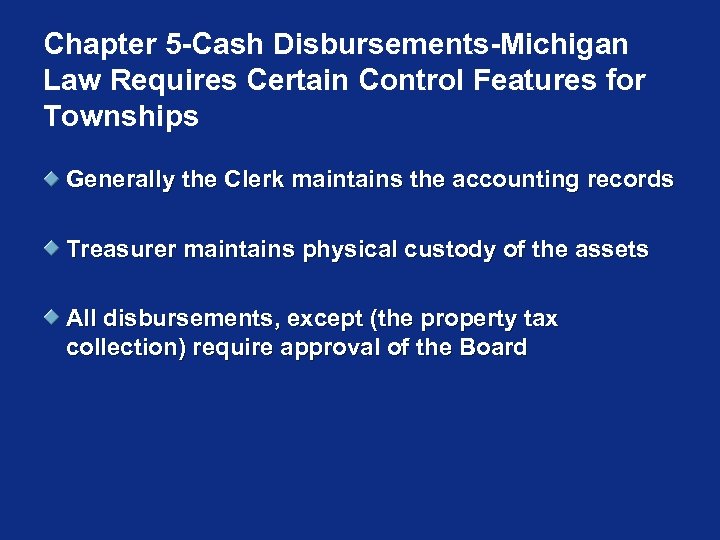

Chapter 5 -Cash Disbursements-Michigan Law Requires Certain Control Features for Townships Generally the Clerk maintains the accounting records Treasurer maintains physical custody of the assets All disbursements, except (the property tax collection) require approval of the Board

Chapter 5 -Cash Disbursements-Michigan Law Requires Certain Control Features for Townships Generally the Clerk maintains the accounting records Treasurer maintains physical custody of the assets All disbursements, except (the property tax collection) require approval of the Board

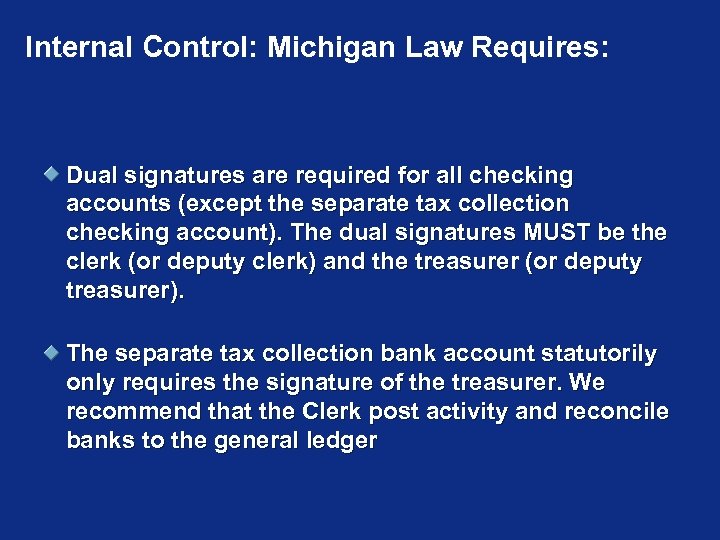

Internal Control: Michigan Law Requires: Dual signatures are required for all checking accounts (except the separate tax collection checking account). The dual signatures MUST be the clerk (or deputy clerk) and the treasurer (or deputy treasurer). The separate tax collection bank account statutorily only requires the signature of the treasurer. We recommend that the Clerk post activity and reconcile banks to the general ledger

Internal Control: Michigan Law Requires: Dual signatures are required for all checking accounts (except the separate tax collection checking account). The dual signatures MUST be the clerk (or deputy clerk) and the treasurer (or deputy treasurer). The separate tax collection bank account statutorily only requires the signature of the treasurer. We recommend that the Clerk post activity and reconcile banks to the general ledger

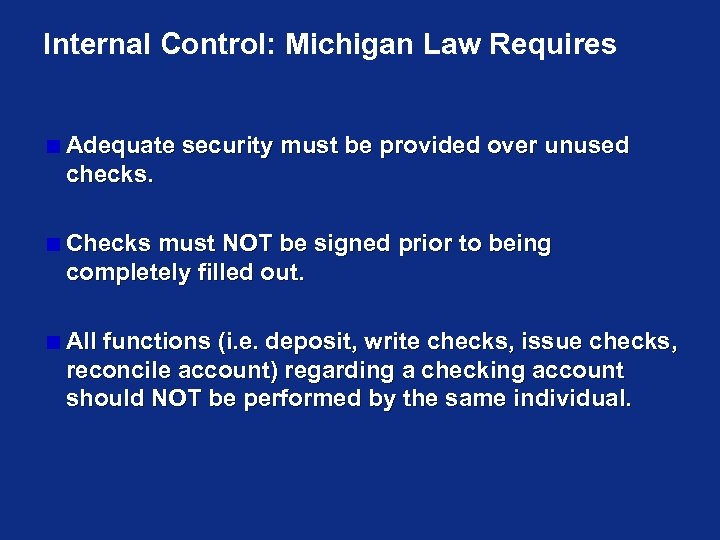

Internal Control: Michigan Law Requires Adequate security must be provided over unused checks. Checks must NOT be signed prior to being completely filled out. All functions (i. e. deposit, write checks, issue checks, reconcile account) regarding a checking account should NOT be performed by the same individual.

Internal Control: Michigan Law Requires Adequate security must be provided over unused checks. Checks must NOT be signed prior to being completely filled out. All functions (i. e. deposit, write checks, issue checks, reconcile account) regarding a checking account should NOT be performed by the same individual.

Internal Control: Michigan Law Requires Numerically controlled, pre-numbered checks must be used. Actual checks must be returned to the township (record retention requirement). Under the Records Media Act electronically stored checks should meet this requirement. Appropriate documentation (supporting invoices) must be attached for all disbursements. Original bills, not copies, must be used for documentation.

Internal Control: Michigan Law Requires Numerically controlled, pre-numbered checks must be used. Actual checks must be returned to the township (record retention requirement). Under the Records Media Act electronically stored checks should meet this requirement. Appropriate documentation (supporting invoices) must be attached for all disbursements. Original bills, not copies, must be used for documentation.

Internal Control: Michigan Law Requires All disbursements must be approved by the legislative body. The board may establish a formal policy to authorize payments prior to approval to avoid finance or late charges and to pay appropriated amounts and payroll (including related payroll taxes and withholdings).

Internal Control: Michigan Law Requires All disbursements must be approved by the legislative body. The board may establish a formal policy to authorize payments prior to approval to avoid finance or late charges and to pay appropriated amounts and payroll (including related payroll taxes and withholdings).

Internal Control: Michigan Law Requires This policy must be very limited and a list of payments made prior to approval must be presented to the legislative body for approval. Checks should not be returned to the originating office for distribution. OUR SUGGGESTION-after the Board approves payments, Treasurer should counter sign and mail payments to vendors. THEY SHOULD NOT BE RETURNED TO THE CLERK’S OFFICE, OR THE OFFICE WHICH ORIGINATES THE CHECKS.

Internal Control: Michigan Law Requires This policy must be very limited and a list of payments made prior to approval must be presented to the legislative body for approval. Checks should not be returned to the originating office for distribution. OUR SUGGGESTION-after the Board approves payments, Treasurer should counter sign and mail payments to vendors. THEY SHOULD NOT BE RETURNED TO THE CLERK’S OFFICE, OR THE OFFICE WHICH ORIGINATES THE CHECKS.

Building on the Basics Use Positive Pay- township provides its disbursement bank with an electronic check register as often as checks are issued. Whenever a check is presented for payment but there is no record of it being issued, the bank refers the check to its customer client for a pay/no pay decision. The bank delivers MICR line information describing exception items, and banks such can also deliver images of those items to clients. Consider moving from “entry level software”, e. g. Quick. Books, to more robust programs that have built in “audit trails” and internal control features.

Building on the Basics Use Positive Pay- township provides its disbursement bank with an electronic check register as often as checks are issued. Whenever a check is presented for payment but there is no record of it being issued, the bank refers the check to its customer client for a pay/no pay decision. The bank delivers MICR line information describing exception items, and banks such can also deliver images of those items to clients. Consider moving from “entry level software”, e. g. Quick. Books, to more robust programs that have built in “audit trails” and internal control features.

What is Positive Pay? An Electronic check register is sent to the bank as often as checks are issued. Whenever a check is presented for payment but there is no record of it being issued, or a difference in the amount, the bank refers the check to its customer client for a pay/no pay decision, or is rejected for payment. According to the GFOA, only 15% of the governments under 50, 000 use positive pay, even though many of these smaller units have poor internal control. 62

What is Positive Pay? An Electronic check register is sent to the bank as often as checks are issued. Whenever a check is presented for payment but there is no record of it being issued, or a difference in the amount, the bank refers the check to its customer client for a pay/no pay decision, or is rejected for payment. According to the GFOA, only 15% of the governments under 50, 000 use positive pay, even though many of these smaller units have poor internal control. 62

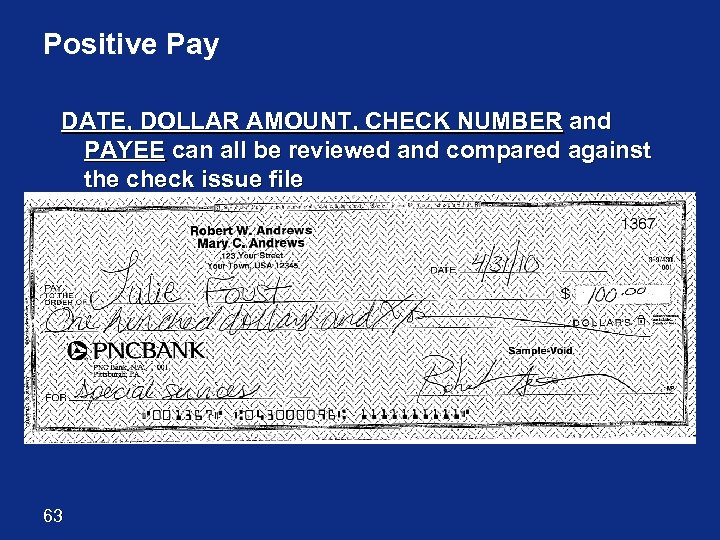

Positive Pay DATE, DOLLAR AMOUNT, CHECK NUMBER and PAYEE can all be reviewed and compared against the check issue file 63

Positive Pay DATE, DOLLAR AMOUNT, CHECK NUMBER and PAYEE can all be reviewed and compared against the check issue file 63

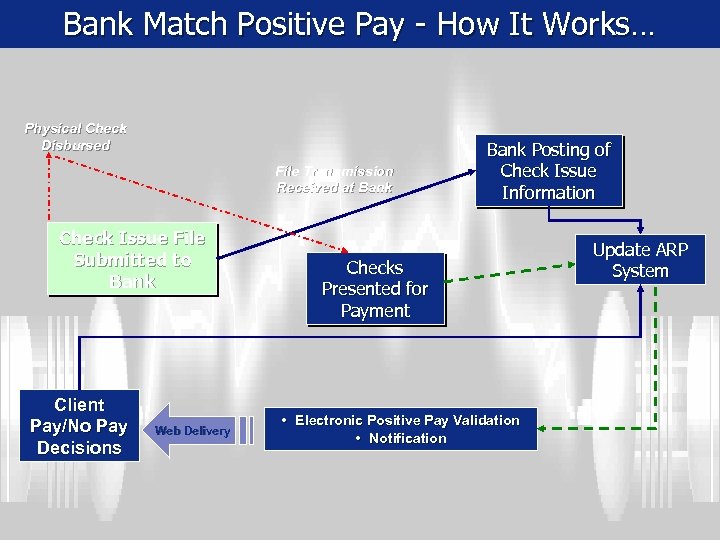

Bank Match Positive Pay - How It Works… Physical Check Disbursed File Transmission Received at Bank Check Issue File Submitted to Bank Client Pay/No Pay Decisions Bank Posting of Check Issue Information Checks Presented for Payment • Electronic Positive Pay Validation • Notification Web Delivery 64 Update ARP System

Bank Match Positive Pay - How It Works… Physical Check Disbursed File Transmission Received at Bank Check Issue File Submitted to Bank Client Pay/No Pay Decisions Bank Posting of Check Issue Information Checks Presented for Payment • Electronic Positive Pay Validation • Notification Web Delivery 64 Update ARP System

Ch 6 -Payroll Human and Human Resources -we have a full workshop today but consider… Elected Officials Have a “Full Plate” in keeping up with fast changing payroll rules and regulations. Many Townships Don’t Have Dedicated HR person. Rely on a Single Employee to Accomplish Payroll, File and Pay Taxes.

Ch 6 -Payroll Human and Human Resources -we have a full workshop today but consider… Elected Officials Have a “Full Plate” in keeping up with fast changing payroll rules and regulations. Many Townships Don’t Have Dedicated HR person. Rely on a Single Employee to Accomplish Payroll, File and Pay Taxes.

Third Party Solutions Large Publically Traded Companies like Paychex, and ADP offer HR and Payroll services, that many private sector employers use. Payroll can be “no reconcile” accounts, by either writing all payroll disbursements off of third party account, or using ACH direct deposits and prepaid debit cards for those without bank accounts. Third parties can mail or email payroll reports directly to the Clerk AND Treasurer, or other board members. EFT Drafts can be transferred by the Treasurer, based on authorized payroll and withholdings.

Third Party Solutions Large Publically Traded Companies like Paychex, and ADP offer HR and Payroll services, that many private sector employers use. Payroll can be “no reconcile” accounts, by either writing all payroll disbursements off of third party account, or using ACH direct deposits and prepaid debit cards for those without bank accounts. Third parties can mail or email payroll reports directly to the Clerk AND Treasurer, or other board members. EFT Drafts can be transferred by the Treasurer, based on authorized payroll and withholdings.

Chapters 7 -11 Chapter 7 covers general ledger postings, journal entries and the like. Chapter 8 –internal accounting and reporting, what reports do you run and when? Chapter 9 - External reporting audit due dates, and F 65 reporting Chapter 10 -Capital Assets and related record keeping. Chapter 11 -Special Reporting for TIFA’s and IFT’s special record keeping and reporting

Chapters 7 -11 Chapter 7 covers general ledger postings, journal entries and the like. Chapter 8 –internal accounting and reporting, what reports do you run and when? Chapter 9 - External reporting audit due dates, and F 65 reporting Chapter 10 -Capital Assets and related record keeping. Chapter 11 -Special Reporting for TIFA’s and IFT’s special record keeping and reporting

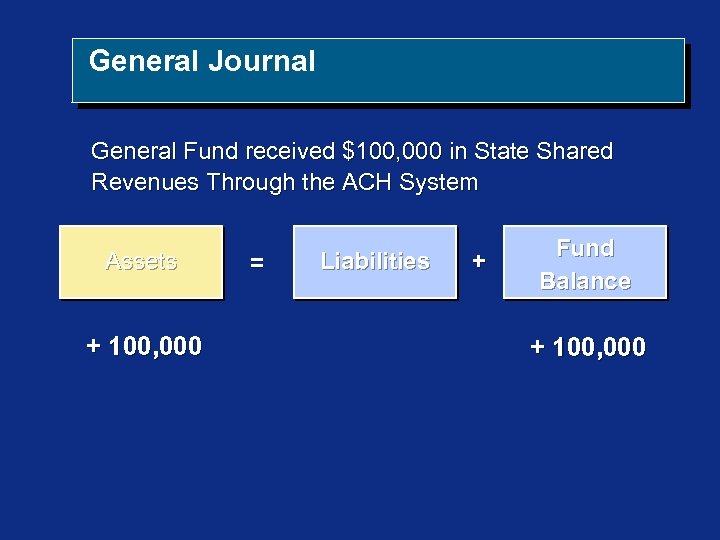

General Journal General Fund received $100, 000 in State Shared Revenues Through the ACH System Assets + 100, 000 = Liabilities + Fund Balance + 100, 000

General Journal General Fund received $100, 000 in State Shared Revenues Through the ACH System Assets + 100, 000 = Liabilities + Fund Balance + 100, 000

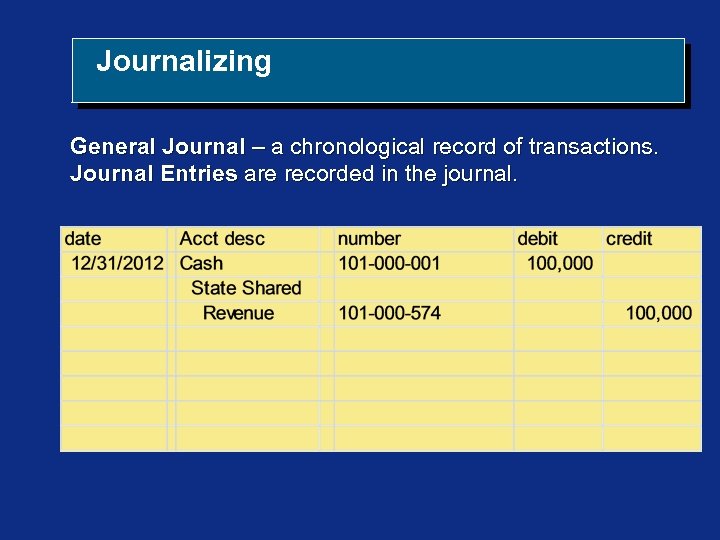

Journalizing General Journal – a chronological record of transactions. Journal Entries are recorded in the journal.

Journalizing General Journal – a chronological record of transactions. Journal Entries are recorded in the journal.

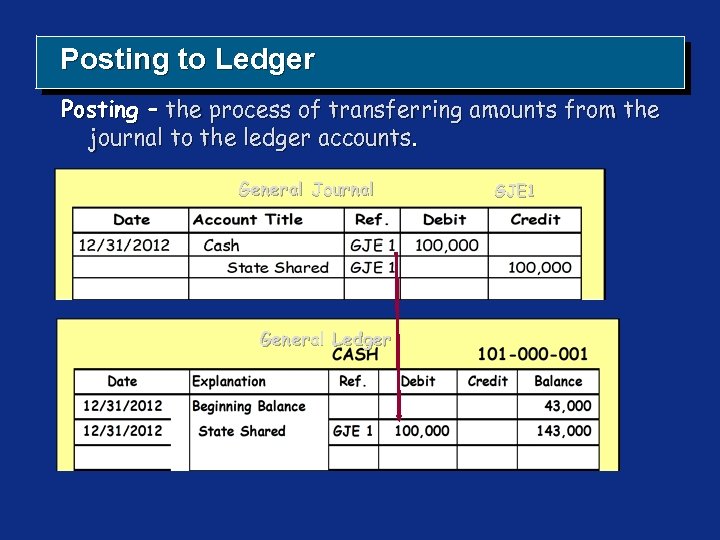

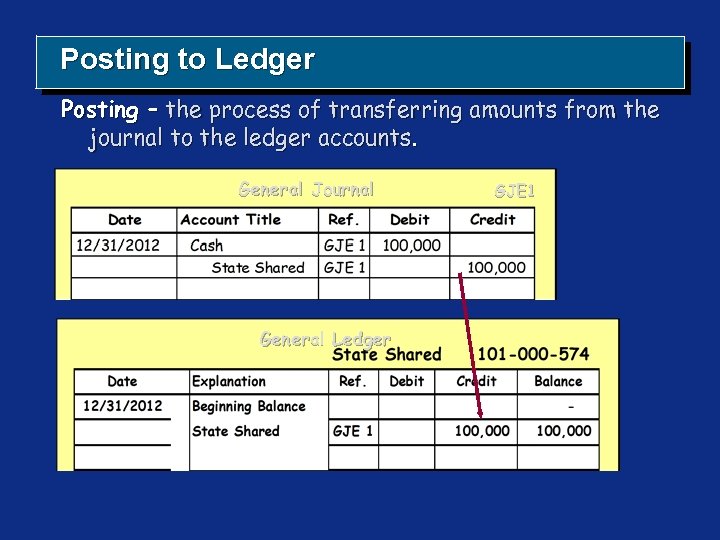

Posting to Ledger Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal General Ledger GJE 1

Posting to Ledger Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal General Ledger GJE 1

Posting to Ledger Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal General Ledger GJE 1

Posting to Ledger Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal General Ledger GJE 1

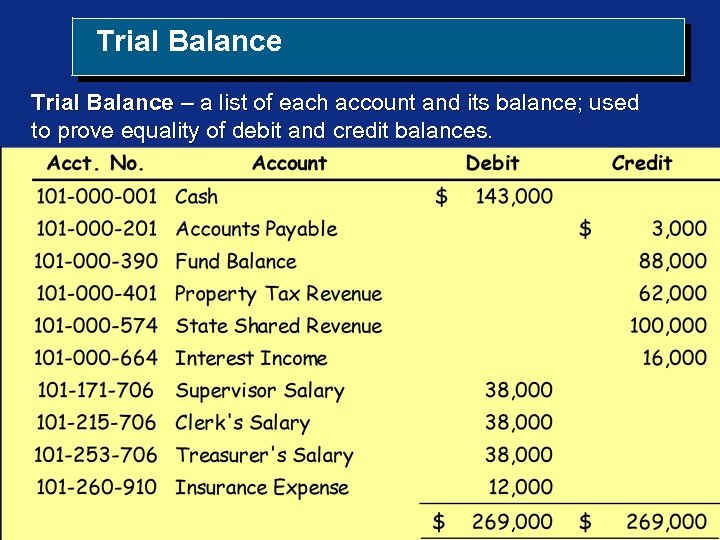

Trial Balance – a list of each account and its balance; used to prove equality of debit and credit balances.

Trial Balance – a list of each account and its balance; used to prove equality of debit and credit balances.

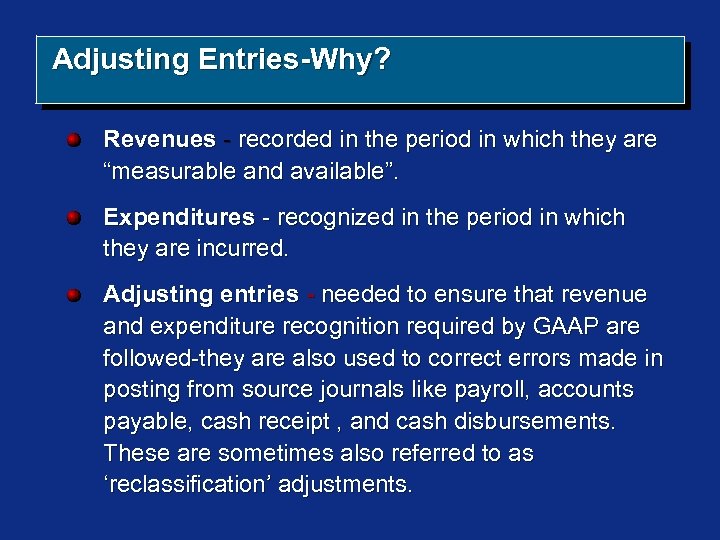

Adjusting Entries-Why? Revenues - recorded in the period in which they are “measurable and available”. Expenditures - recognized in the period in which they are incurred. Adjusting entries - needed to ensure that revenue and expenditure recognition required by GAAP are followed-they are also used to correct errors made in posting from source journals like payroll, accounts payable, cash receipt , and cash disbursements. These are sometimes also referred to as ‘reclassification’ adjustments.

Adjusting Entries-Why? Revenues - recorded in the period in which they are “measurable and available”. Expenditures - recognized in the period in which they are incurred. Adjusting entries - needed to ensure that revenue and expenditure recognition required by GAAP are followed-they are also used to correct errors made in posting from source journals like payroll, accounts payable, cash receipt , and cash disbursements. These are sometimes also referred to as ‘reclassification’ adjustments.

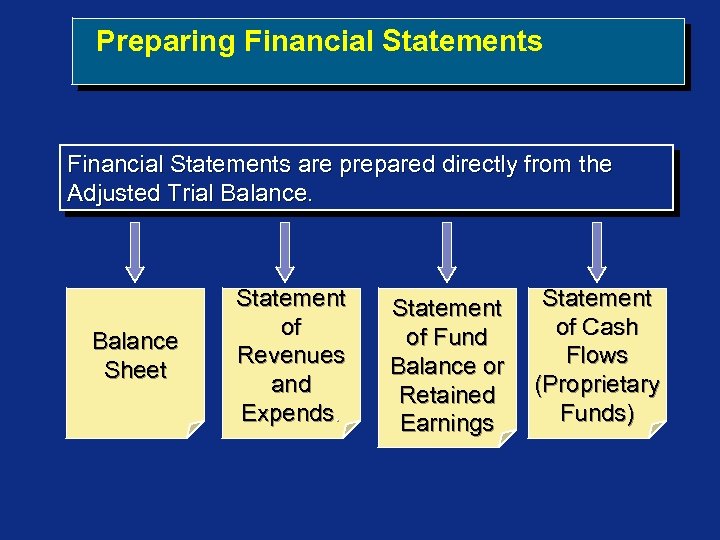

Preparing Financial Statements are prepared directly from the Adjusted Trial Balance Sheet Statement of Revenues and Expends. Statement of Fund Balance or Retained Earnings Statement of Cash Flows (Proprietary Funds)

Preparing Financial Statements are prepared directly from the Adjusted Trial Balance Sheet Statement of Revenues and Expends. Statement of Fund Balance or Retained Earnings Statement of Cash Flows (Proprietary Funds)

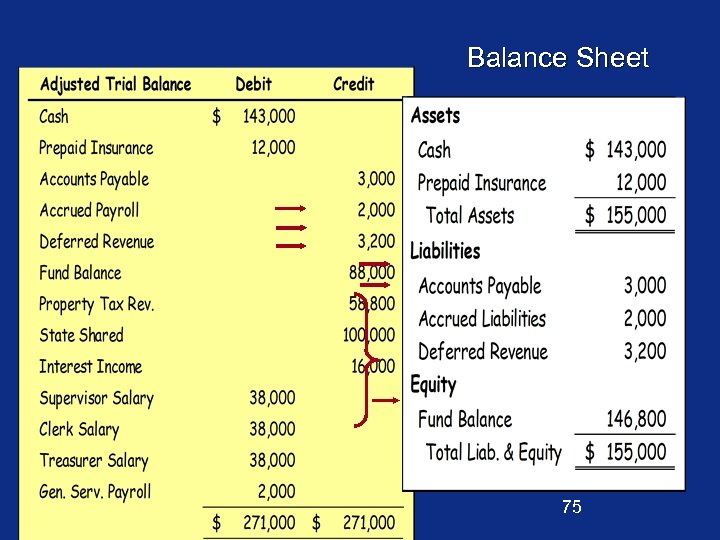

Balance Sheet 75

Balance Sheet 75

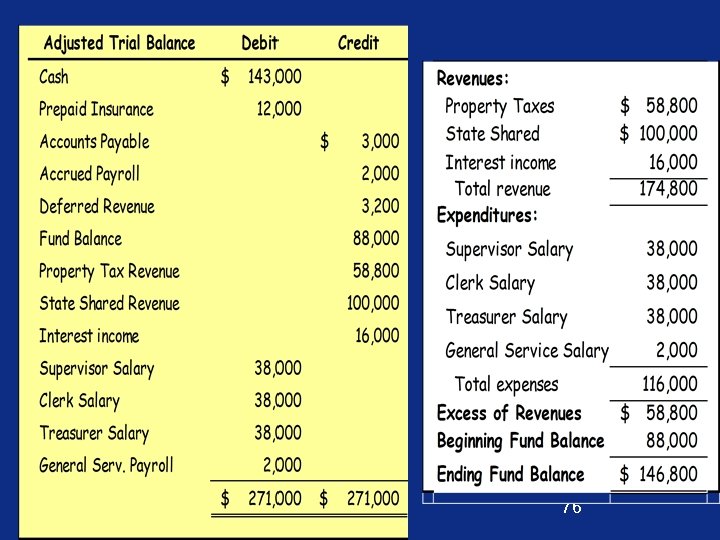

76

76

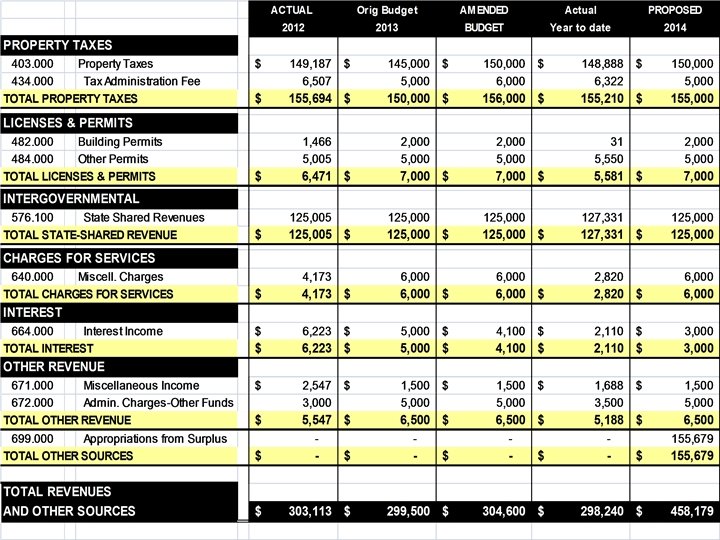

Internal Reporting Chapter 8 in manual indicates Townships should produce the budget to actual reports at least quarterly (required by law for Charter Townships) Best practices-monthly: Treasurer’s Report General Ledger Budget to Actual Balance Sheet

Internal Reporting Chapter 8 in manual indicates Townships should produce the budget to actual reports at least quarterly (required by law for Charter Townships) Best practices-monthly: Treasurer’s Report General Ledger Budget to Actual Balance Sheet

External Audits and F-65 Due six months after fiscal year, with very limited exceptions Late filing will impact ‘qualifying status’-delay revenue sharing payments, and other possible state actions F-65 somewhat complex, should consider including in audit proposal. Annual audits required for populations above 4, 000, everyone should consider

External Audits and F-65 Due six months after fiscal year, with very limited exceptions Late filing will impact ‘qualifying status’-delay revenue sharing payments, and other possible state actions F-65 somewhat complex, should consider including in audit proposal. Annual audits required for populations above 4, 000, everyone should consider

State Uniform Chart of Accounts All Michigan Townships must use the State mandated general ledger number system called the Uniform Chart of Accounts-available at: http: //www. michigan. gov/documents/uniformchart_245 24_7. PDF

State Uniform Chart of Accounts All Michigan Townships must use the State mandated general ledger number system called the Uniform Chart of Accounts-available at: http: //www. michigan. gov/documents/uniformchart_245 24_7. PDF

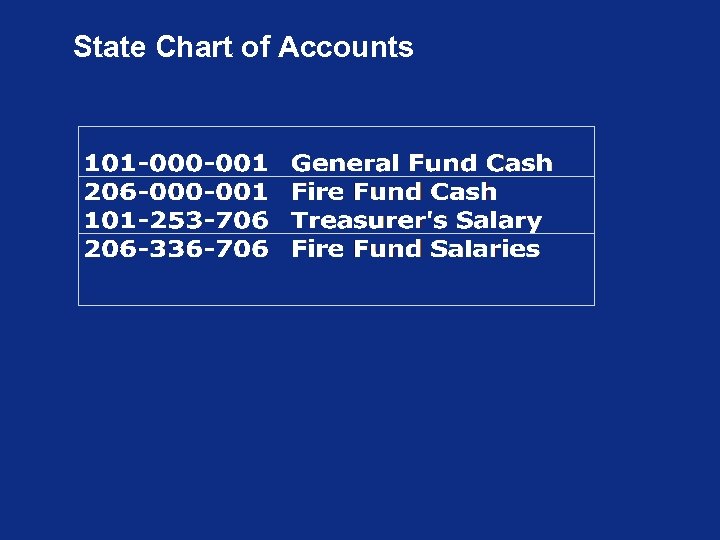

State Uniform Chart of Accounts The Michigan chart of accounts uses nine digits, with an option for an additional three numbers for “sub accounts”: • The first three digits indicate the fund number. • The next three indicate the department (no departments for balance sheet accounts or revenues). • The last three digits are line item.

State Uniform Chart of Accounts The Michigan chart of accounts uses nine digits, with an option for an additional three numbers for “sub accounts”: • The first three digits indicate the fund number. • The next three indicate the department (no departments for balance sheet accounts or revenues). • The last three digits are line item.

State Chart of Accounts

State Chart of Accounts

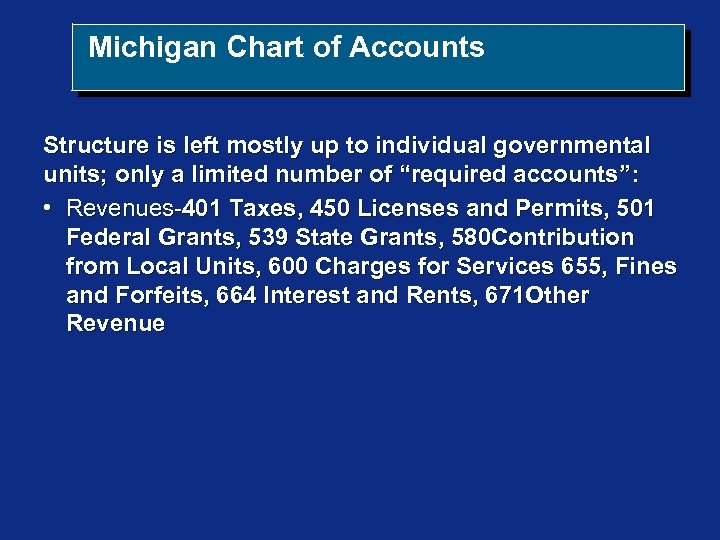

Michigan Chart of Accounts Structure is left mostly up to individual governmental units; only a limited number of “required accounts”: • Revenues-401 Taxes, 450 Licenses and Permits, 501 Federal Grants, 539 State Grants, 580 Contribution from Local Units, 600 Charges for Services 655, Fines and Forfeits, 664 Interest and Rents, 671 Other Revenue

Michigan Chart of Accounts Structure is left mostly up to individual governmental units; only a limited number of “required accounts”: • Revenues-401 Taxes, 450 Licenses and Permits, 501 Federal Grants, 539 State Grants, 580 Contribution from Local Units, 600 Charges for Services 655, Fines and Forfeits, 664 Interest and Rents, 671 Other Revenue

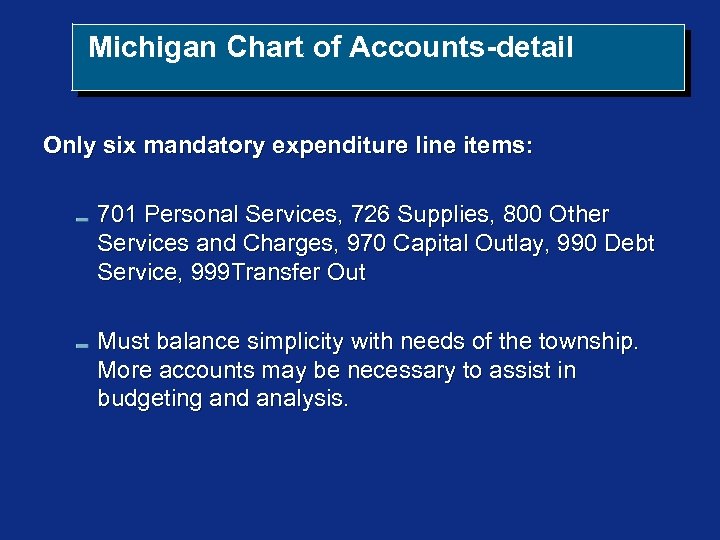

Michigan Chart of Accounts-detail Only six mandatory expenditure line items: 701 Personal Services, 726 Supplies, 800 Other Services and Charges, 970 Capital Outlay, 990 Debt Service, 999 Transfer Out Must balance simplicity with needs of the township. More accounts may be necessary to assist in budgeting and analysis.

Michigan Chart of Accounts-detail Only six mandatory expenditure line items: 701 Personal Services, 726 Supplies, 800 Other Services and Charges, 970 Capital Outlay, 990 Debt Service, 999 Transfer Out Must balance simplicity with needs of the township. More accounts may be necessary to assist in budgeting and analysis.

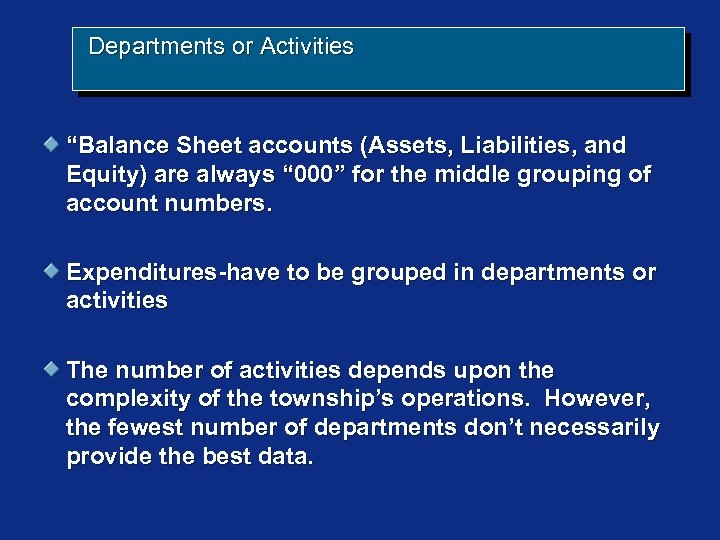

Departments or Activities “Balance Sheet accounts (Assets, Liabilities, and Equity) are always “ 000” for the middle grouping of account numbers. Expenditures-have to be grouped in departments or activities The number of activities depends upon the complexity of the township’s operations. However, the fewest number of departments don’t necessarily provide the best data.

Departments or Activities “Balance Sheet accounts (Assets, Liabilities, and Equity) are always “ 000” for the middle grouping of account numbers. Expenditures-have to be grouped in departments or activities The number of activities depends upon the complexity of the township’s operations. However, the fewest number of departments don’t necessarily provide the best data.

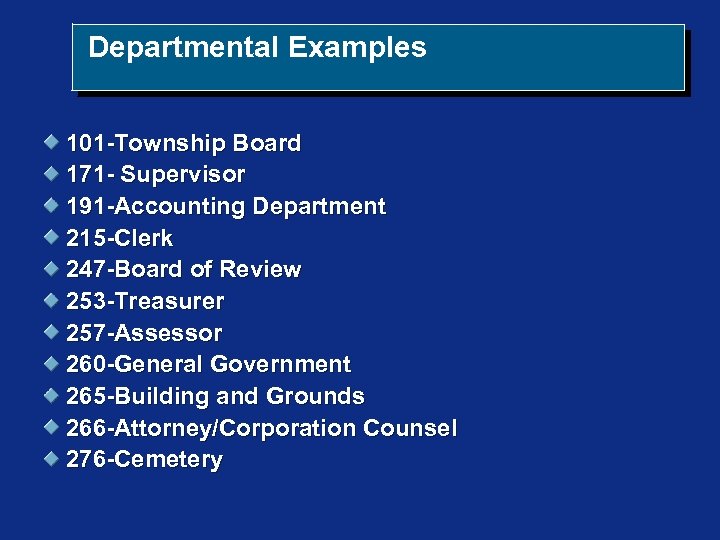

Departmental Examples 101 -Township Board 171 - Supervisor 191 -Accounting Department 215 -Clerk 247 -Board of Review 253 -Treasurer 257 -Assessor 260 -General Government 265 -Building and Grounds 266 -Attorney/Corporation Counsel 276 -Cemetery

Departmental Examples 101 -Township Board 171 - Supervisor 191 -Accounting Department 215 -Clerk 247 -Board of Review 253 -Treasurer 257 -Assessor 260 -General Government 265 -Building and Grounds 266 -Attorney/Corporation Counsel 276 -Cemetery

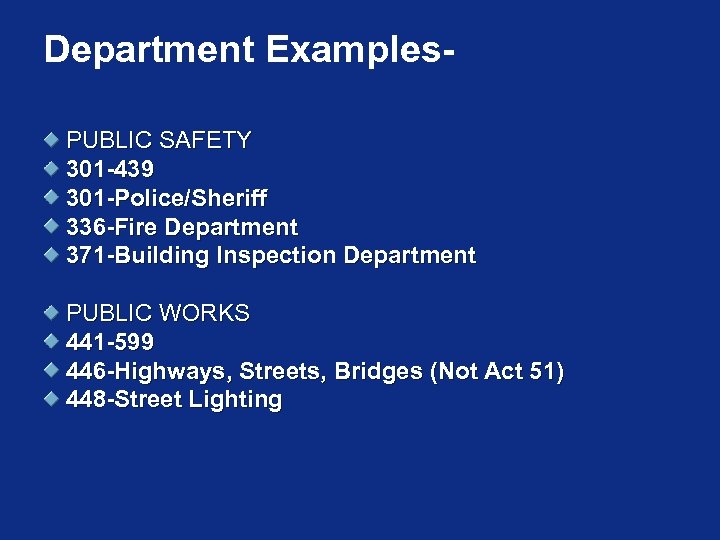

Department Examples. PUBLIC SAFETY 301 -439 301 -Police/Sheriff 336 -Fire Department 371 -Building Inspection Department PUBLIC WORKS 441 -599 446 -Highways, Streets, Bridges (Not Act 51) 448 -Street Lighting

Department Examples. PUBLIC SAFETY 301 -439 301 -Police/Sheriff 336 -Fire Department 371 -Building Inspection Department PUBLIC WORKS 441 -599 446 -Highways, Streets, Bridges (Not Act 51) 448 -Street Lighting

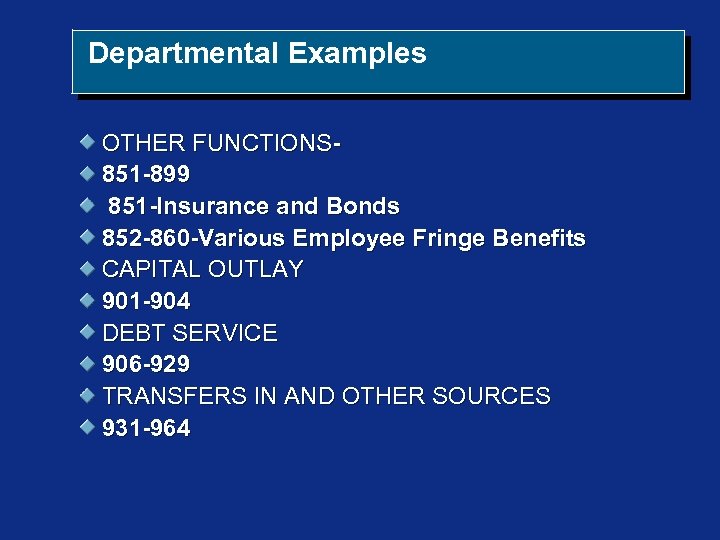

Departmental Examples OTHER FUNCTIONS 851 -899 851 -Insurance and Bonds 852 -860 -Various Employee Fringe Benefits CAPITAL OUTLAY 901 -904 DEBT SERVICE 906 -929 TRANSFERS IN AND OTHER SOURCES 931 -964

Departmental Examples OTHER FUNCTIONS 851 -899 851 -Insurance and Bonds 852 -860 -Various Employee Fringe Benefits CAPITAL OUTLAY 901 -904 DEBT SERVICE 906 -929 TRANSFERS IN AND OTHER SOURCES 931 -964

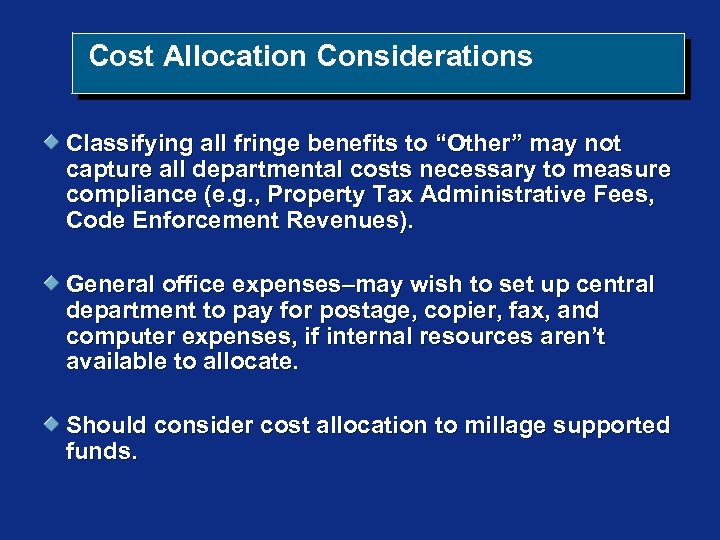

Cost Allocation Considerations Classifying all fringe benefits to “Other” may not capture all departmental costs necessary to measure compliance (e. g. , Property Tax Administrative Fees, Code Enforcement Revenues). General office expenses–may wish to set up central department to pay for postage, copier, fax, and computer expenses, if internal resources aren’t available to allocate. Should consider cost allocation to millage supported funds.

Cost Allocation Considerations Classifying all fringe benefits to “Other” may not capture all departmental costs necessary to measure compliance (e. g. , Property Tax Administrative Fees, Code Enforcement Revenues). General office expenses–may wish to set up central department to pay for postage, copier, fax, and computer expenses, if internal resources aren’t available to allocate. Should consider cost allocation to millage supported funds.