734a18aecc84a9ae4e9f0dd89b666ebe.ppt

- Количество слайдов: 14

Using Options and Swaps to Hedge Risk You are subject to interest rate risk and wish to hedge. Alternative Bond Option Hedging Strategies in Order of Aggressiveness (just reverse the arguments if Interest Rate Options are to be used). 1. Buy Put Options on Bonds This is the traditional approach to insuring against interest rate increases. One pays a premium to avoid the risk that interest rates will rise and the fixed income securities you hold will fall in value. If interest rates rise (fall) you lose (gain) on the bonds but gain (lose only) on the options (premiums).

Using Options and Swaps to Hedge Risk You are subject to interest rate risk and wish to hedge. Alternative Bond Option Hedging Strategies in Order of Aggressiveness (just reverse the arguments if Interest Rate Options are to be used). 1. Buy Put Options on Bonds This is the traditional approach to insuring against interest rate increases. One pays a premium to avoid the risk that interest rates will rise and the fixed income securities you hold will fall in value. If interest rates rise (fall) you lose (gain) on the bonds but gain (lose only) on the options (premiums).

2. Sell Bonds and Buy Bond Call Options This strategy is similar to strategy 1 but increases your cash position by selling bonds already owned and insuring against a large increase in bond prices. 3. Hold the Bonds You Own and Sell Bond Call Options This strategy offers some protection if bond prices fall up to the amount of the option premiums you receive. You are still exposed to large drops in bond prices. Selling options is typically looked on unfavorably by regulators and boards of directors.

2. Sell Bonds and Buy Bond Call Options This strategy is similar to strategy 1 but increases your cash position by selling bonds already owned and insuring against a large increase in bond prices. 3. Hold the Bonds You Own and Sell Bond Call Options This strategy offers some protection if bond prices fall up to the amount of the option premiums you receive. You are still exposed to large drops in bond prices. Selling options is typically looked on unfavorably by regulators and boards of directors.

4. Marginal Approach - Buy Call Option to Cover Cash Suppose you hold cash now or expect to receive cash that would normally be invested in bonds (insurance premiums). This strategy is to hold cash and buy options to insure that if bonds rally (interest rates fall) strongly, then you have covered your cash position. But any bonds already owned are exposed. The hedging process is similar to that described for futures in the previous lecture except that in addition to the effect of interest rate changes on the underlying bond price, the option has a delta (- ) that measures option price sensitivity to a bond price change.

4. Marginal Approach - Buy Call Option to Cover Cash Suppose you hold cash now or expect to receive cash that would normally be invested in bonds (insurance premiums). This strategy is to hold cash and buy options to insure that if bonds rally (interest rates fall) strongly, then you have covered your cash position. But any bonds already owned are exposed. The hedging process is similar to that described for futures in the previous lecture except that in addition to the effect of interest rate changes on the underlying bond price, the option has a delta (- ) that measures option price sensitivity to a bond price change.

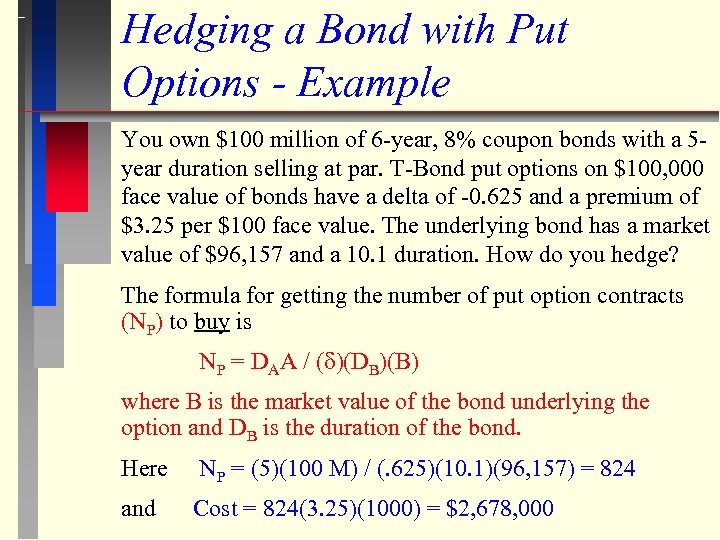

Hedging a Bond with Put Options - Example You own $100 million of 6 -year, 8% coupon bonds with a 5 year duration selling at par. T-Bond put options on $100, 000 face value of bonds have a delta of -0. 625 and a premium of $3. 25 per $100 face value. The underlying bond has a market value of $96, 157 and a 10. 1 duration. How do you hedge? The formula for getting the number of put option contracts (NP) to buy is NP = DAA / ( )(DB)(B) where B is the market value of the bond underlying the option and DB is the duration of the bond. Here NP = (5)(100 M) / (. 625)(10. 1)(96, 157) = 824 and Cost = 824(3. 25)(1000) = $2, 678, 000

Hedging a Bond with Put Options - Example You own $100 million of 6 -year, 8% coupon bonds with a 5 year duration selling at par. T-Bond put options on $100, 000 face value of bonds have a delta of -0. 625 and a premium of $3. 25 per $100 face value. The underlying bond has a market value of $96, 157 and a 10. 1 duration. How do you hedge? The formula for getting the number of put option contracts (NP) to buy is NP = DAA / ( )(DB)(B) where B is the market value of the bond underlying the option and DB is the duration of the bond. Here NP = (5)(100 M) / (. 625)(10. 1)(96, 157) = 824 and Cost = 824(3. 25)(1000) = $2, 678, 000

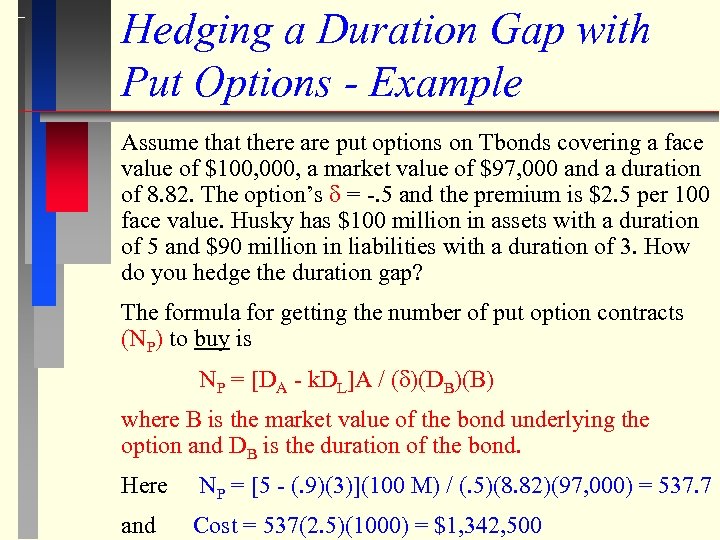

Hedging a Duration Gap with Put Options - Example Assume that there are put options on Tbonds covering a face value of $100, 000, a market value of $97, 000 and a duration of 8. 82. The option’s = -. 5 and the premium is $2. 5 per 100 face value. Husky has $100 million in assets with a duration of 5 and $90 million in liabilities with a duration of 3. How do you hedge the duration gap? The formula for getting the number of put option contracts (NP) to buy is NP = [DA - k. DL]A / ( )(DB)(B) where B is the market value of the bond underlying the option and DB is the duration of the bond. Here NP = [5 - (. 9)(3)](100 M) / (. 5)(8. 82)(97, 000) = 537. 7 and Cost = 537(2. 5)(1000) = $1, 342, 500

Hedging a Duration Gap with Put Options - Example Assume that there are put options on Tbonds covering a face value of $100, 000, a market value of $97, 000 and a duration of 8. 82. The option’s = -. 5 and the premium is $2. 5 per 100 face value. Husky has $100 million in assets with a duration of 5 and $90 million in liabilities with a duration of 3. How do you hedge the duration gap? The formula for getting the number of put option contracts (NP) to buy is NP = [DA - k. DL]A / ( )(DB)(B) where B is the market value of the bond underlying the option and DB is the duration of the bond. Here NP = [5 - (. 9)(3)](100 M) / (. 5)(8. 82)(97, 000) = 537. 7 and Cost = 537(2. 5)(1000) = $1, 342, 500

Question: If the duration gap was negative instead of positive, how would you hedge interest rate risk? Using a No-Cost Collar In the previous examples, we purchased put options for $2. 67 and $1. 34 million to construct our hedge. Boards of directors often find this acceptable when interest rates actually rise but when interest rates fall or stay the same, they see the premium losses as wasteful. An alternative to only buying put options is to simultaneously sell call options with the same premium value as the puts. In this case, if interest rates do nothing there is no cost. If interest rates rise, the puts pay off as before plus you gain the premiums. If interest rates fall, you will lose on the calls you sold but gain on the underlying bond (assets).

Question: If the duration gap was negative instead of positive, how would you hedge interest rate risk? Using a No-Cost Collar In the previous examples, we purchased put options for $2. 67 and $1. 34 million to construct our hedge. Boards of directors often find this acceptable when interest rates actually rise but when interest rates fall or stay the same, they see the premium losses as wasteful. An alternative to only buying put options is to simultaneously sell call options with the same premium value as the puts. In this case, if interest rates do nothing there is no cost. If interest rates rise, the puts pay off as before plus you gain the premiums. If interest rates fall, you will lose on the calls you sold but gain on the underlying bond (assets).

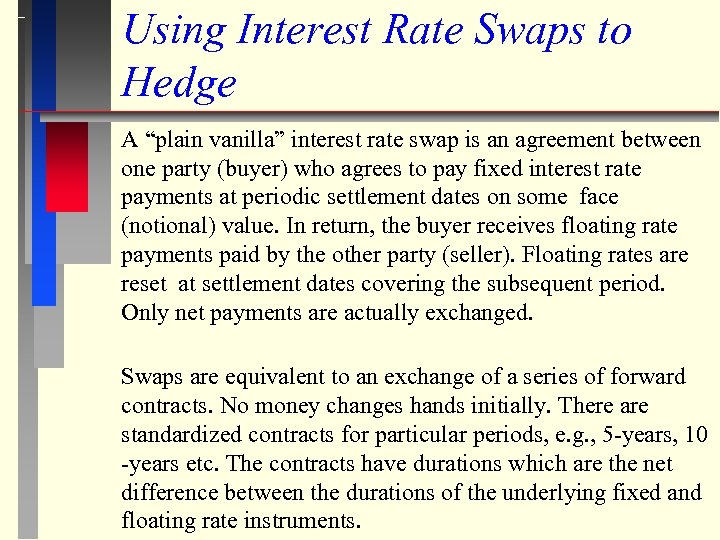

Using Interest Rate Swaps to Hedge A “plain vanilla” interest rate swap is an agreement between one party (buyer) who agrees to pay fixed interest rate payments at periodic settlement dates on some face (notional) value. In return, the buyer receives floating rate payments paid by the other party (seller). Floating rates are reset at settlement dates covering the subsequent period. Only net payments are actually exchanged. Swaps are equivalent to an exchange of a series of forward contracts. No money changes hands initially. There are standardized contracts for particular periods, e. g. , 5 -years, 10 -years etc. The contracts have durations which are the net difference between the durations of the underlying fixed and floating rate instruments.

Using Interest Rate Swaps to Hedge A “plain vanilla” interest rate swap is an agreement between one party (buyer) who agrees to pay fixed interest rate payments at periodic settlement dates on some face (notional) value. In return, the buyer receives floating rate payments paid by the other party (seller). Floating rates are reset at settlement dates covering the subsequent period. Only net payments are actually exchanged. Swaps are equivalent to an exchange of a series of forward contracts. No money changes hands initially. There are standardized contracts for particular periods, e. g. , 5 -years, 10 -years etc. The contracts have durations which are the net difference between the durations of the underlying fixed and floating rate instruments.

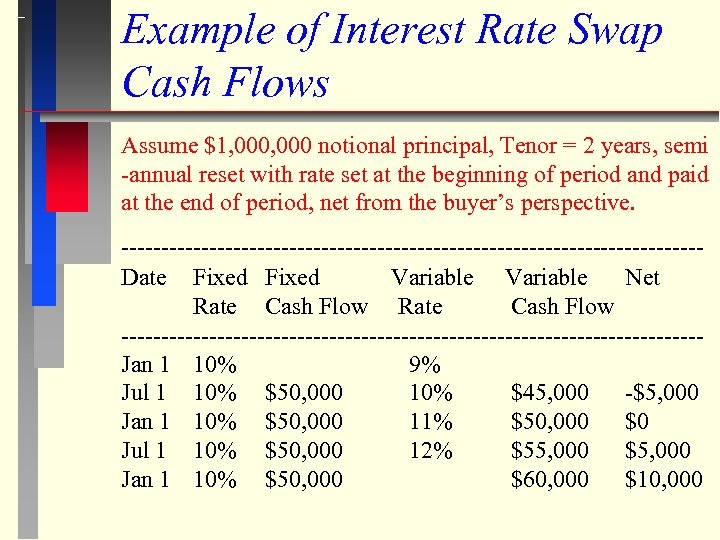

Example of Interest Rate Swap Cash Flows Assume $1, 000 notional principal, Tenor = 2 years, semi -annual reset with rate set at the beginning of period and paid at the end of period, net from the buyer’s perspective. ------------------------------------Date Fixed Variable Net Rate Cash Flow ------------------------------------Jan 1 10% 9% Jul 1 10% $50, 000 10% $45, 000 -$5, 000 Jan 1 10% $50, 000 11% $50, 000 $0 Jul 1 10% $50, 000 12% $55, 000 $5, 000 Jan 1 10% $50, 000 $60, 000 $10, 000

Example of Interest Rate Swap Cash Flows Assume $1, 000 notional principal, Tenor = 2 years, semi -annual reset with rate set at the beginning of period and paid at the end of period, net from the buyer’s perspective. ------------------------------------Date Fixed Variable Net Rate Cash Flow ------------------------------------Jan 1 10% 9% Jul 1 10% $50, 000 10% $45, 000 -$5, 000 Jan 1 10% $50, 000 11% $50, 000 $0 Jul 1 10% $50, 000 12% $55, 000 $5, 000 Jan 1 10% $50, 000 $60, 000 $10, 000

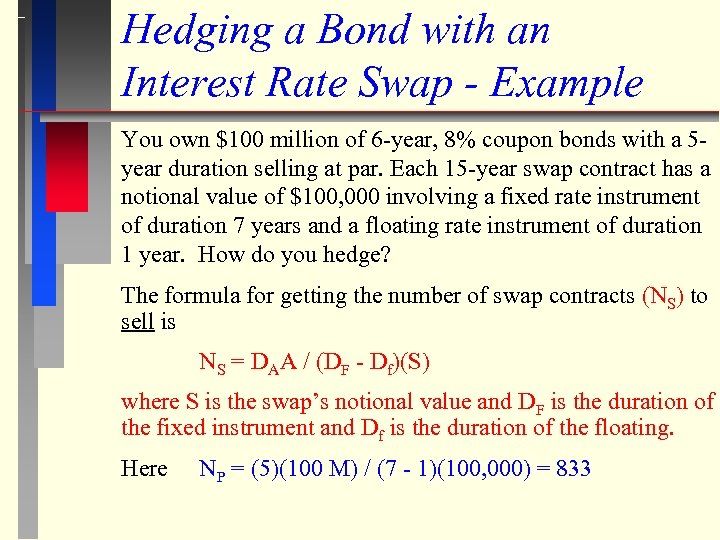

Hedging a Bond with an Interest Rate Swap - Example You own $100 million of 6 -year, 8% coupon bonds with a 5 year duration selling at par. Each 15 -year swap contract has a notional value of $100, 000 involving a fixed rate instrument of duration 7 years and a floating rate instrument of duration 1 year. How do you hedge? The formula for getting the number of swap contracts (NS) to sell is NS = DAA / (DF - Df)(S) where S is the swap’s notional value and DF is the duration of the fixed instrument and Df is the duration of the floating. Here NP = (5)(100 M) / (7 - 1)(100, 000) = 833

Hedging a Bond with an Interest Rate Swap - Example You own $100 million of 6 -year, 8% coupon bonds with a 5 year duration selling at par. Each 15 -year swap contract has a notional value of $100, 000 involving a fixed rate instrument of duration 7 years and a floating rate instrument of duration 1 year. How do you hedge? The formula for getting the number of swap contracts (NS) to sell is NS = DAA / (DF - Df)(S) where S is the swap’s notional value and DF is the duration of the fixed instrument and Df is the duration of the floating. Here NP = (5)(100 M) / (7 - 1)(100, 000) = 833

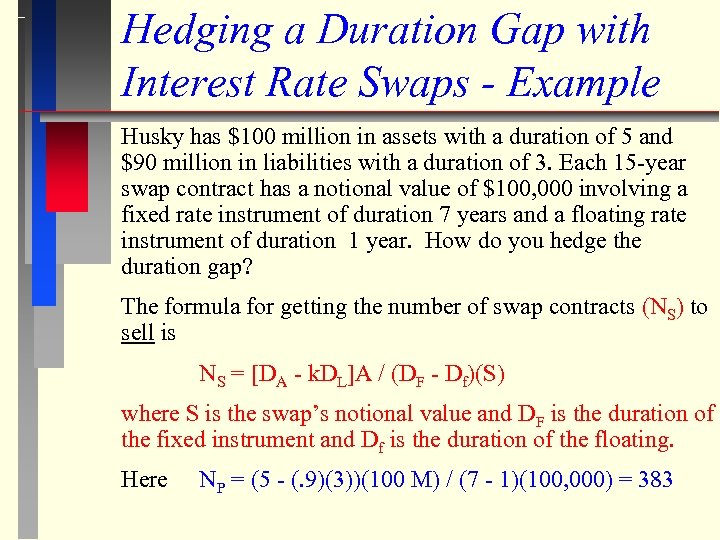

Hedging a Duration Gap with Interest Rate Swaps - Example Husky has $100 million in assets with a duration of 5 and $90 million in liabilities with a duration of 3. Each 15 -year swap contract has a notional value of $100, 000 involving a fixed rate instrument of duration 7 years and a floating rate instrument of duration 1 year. How do you hedge the duration gap? The formula for getting the number of swap contracts (NS) to sell is NS = [DA - k. DL]A / (DF - Df)(S) where S is the swap’s notional value and DF is the duration of the fixed instrument and Df is the duration of the floating. Here NP = (5 - (. 9)(3))(100 M) / (7 - 1)(100, 000) = 383

Hedging a Duration Gap with Interest Rate Swaps - Example Husky has $100 million in assets with a duration of 5 and $90 million in liabilities with a duration of 3. Each 15 -year swap contract has a notional value of $100, 000 involving a fixed rate instrument of duration 7 years and a floating rate instrument of duration 1 year. How do you hedge the duration gap? The formula for getting the number of swap contracts (NS) to sell is NS = [DA - k. DL]A / (DF - Df)(S) where S is the swap’s notional value and DF is the duration of the fixed instrument and Df is the duration of the floating. Here NP = (5 - (. 9)(3))(100 M) / (7 - 1)(100, 000) = 383

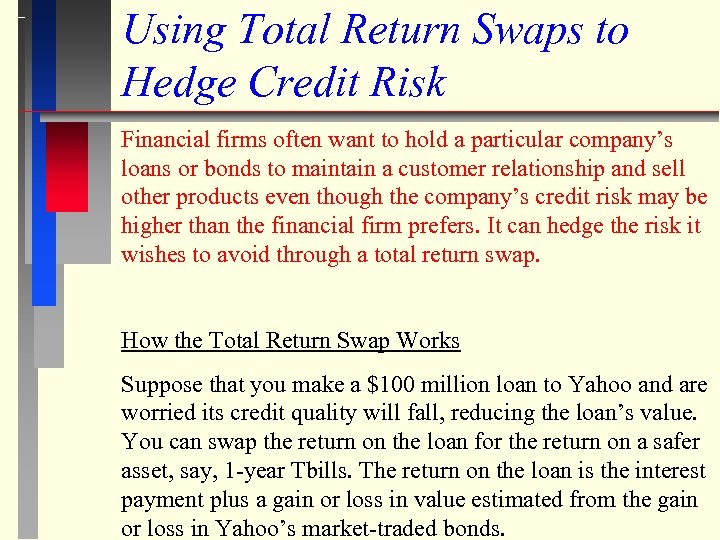

Using Total Return Swaps to Hedge Credit Risk Financial firms often want to hold a particular company’s loans or bonds to maintain a customer relationship and sell other products even though the company’s credit risk may be higher than the financial firm prefers. It can hedge the risk it wishes to avoid through a total return swap. How the Total Return Swap Works Suppose that you make a $100 million loan to Yahoo and are worried its credit quality will fall, reducing the loan’s value. You can swap the return on the loan for the return on a safer asset, say, 1 -year Tbills. The return on the loan is the interest payment plus a gain or loss in value estimated from the gain or loss in Yahoo’s market-traded bonds.

Using Total Return Swaps to Hedge Credit Risk Financial firms often want to hold a particular company’s loans or bonds to maintain a customer relationship and sell other products even though the company’s credit risk may be higher than the financial firm prefers. It can hedge the risk it wishes to avoid through a total return swap. How the Total Return Swap Works Suppose that you make a $100 million loan to Yahoo and are worried its credit quality will fall, reducing the loan’s value. You can swap the return on the loan for the return on a safer asset, say, 1 -year Tbills. The return on the loan is the interest payment plus a gain or loss in value estimated from the gain or loss in Yahoo’s market-traded bonds.

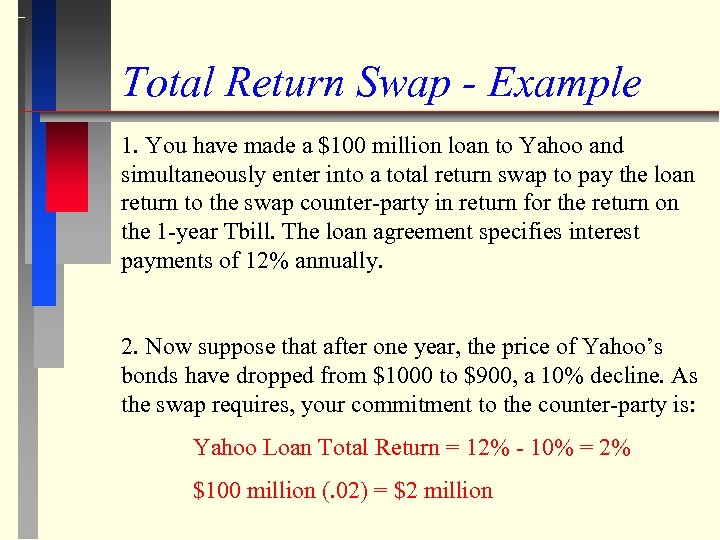

Total Return Swap - Example 1. You have made a $100 million loan to Yahoo and simultaneously enter into a total return swap to pay the loan return to the swap counter-party in return for the return on the 1 -year Tbill. The loan agreement specifies interest payments of 12% annually. 2. Now suppose that after one year, the price of Yahoo’s bonds have dropped from $1000 to $900, a 10% decline. As the swap requires, your commitment to the counter-party is: Yahoo Loan Total Return = 12% - 10% = 2% $100 million (. 02) = $2 million

Total Return Swap - Example 1. You have made a $100 million loan to Yahoo and simultaneously enter into a total return swap to pay the loan return to the swap counter-party in return for the return on the 1 -year Tbill. The loan agreement specifies interest payments of 12% annually. 2. Now suppose that after one year, the price of Yahoo’s bonds have dropped from $1000 to $900, a 10% decline. As the swap requires, your commitment to the counter-party is: Yahoo Loan Total Return = 12% - 10% = 2% $100 million (. 02) = $2 million

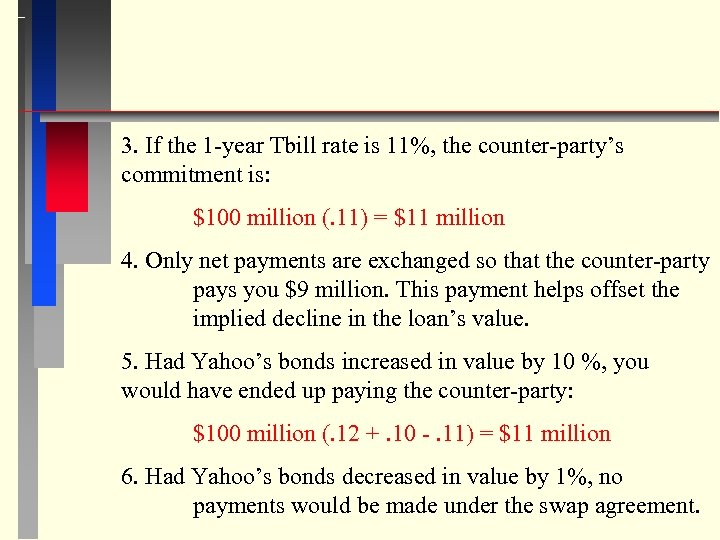

3. If the 1 -year Tbill rate is 11%, the counter-party’s commitment is: $100 million (. 11) = $11 million 4. Only net payments are exchanged so that the counter-party pays you $9 million. This payment helps offset the implied decline in the loan’s value. 5. Had Yahoo’s bonds increased in value by 10 %, you would have ended up paying the counter-party: $100 million (. 12 +. 10 -. 11) = $11 million 6. Had Yahoo’s bonds decreased in value by 1%, no payments would be made under the swap agreement.

3. If the 1 -year Tbill rate is 11%, the counter-party’s commitment is: $100 million (. 11) = $11 million 4. Only net payments are exchanged so that the counter-party pays you $9 million. This payment helps offset the implied decline in the loan’s value. 5. Had Yahoo’s bonds increased in value by 10 %, you would have ended up paying the counter-party: $100 million (. 12 +. 10 -. 11) = $11 million 6. Had Yahoo’s bonds decreased in value by 1%, no payments would be made under the swap agreement.

Total return swaps are available for any assets. For example, suppose you own a stock portfolio indexed to the London Stock Exchange. You can swap the total return on the London Stock Market Index for the total return on Brazilian bonds. Swapping returns saves the transactions costs of having to sell a large portfolio and buy other assets. If you change your mind later, you can swap back into stocks again without having to pay transactions fees.

Total return swaps are available for any assets. For example, suppose you own a stock portfolio indexed to the London Stock Exchange. You can swap the total return on the London Stock Market Index for the total return on Brazilian bonds. Swapping returns saves the transactions costs of having to sell a large portfolio and buy other assets. If you change your mind later, you can swap back into stocks again without having to pay transactions fees.