dd7d8cb808bb8ec2c7d3cc72749b8ffb.ppt

- Количество слайдов: 10

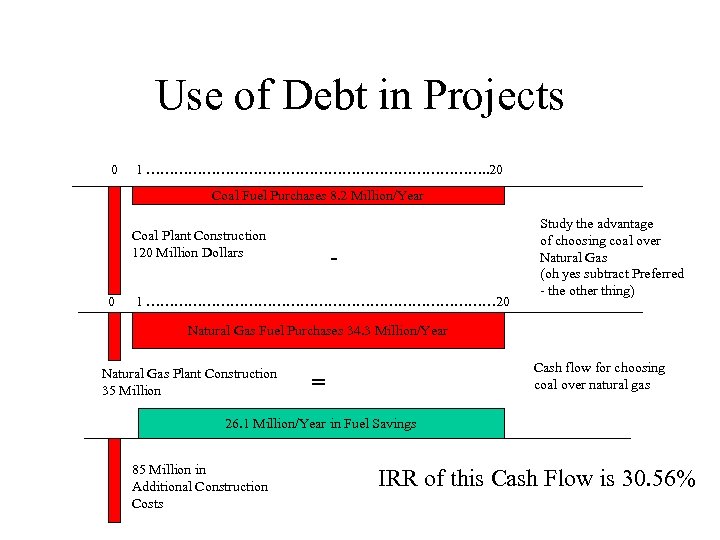

Use of Debt in Projects 0 1 ………………………………. . 20 Coal Fuel Purchases 8. 2 Million/Year Coal Plant Construction 120 Million Dollars 0 - 1 ………………………………… 20 Study the advantage of choosing coal over Natural Gas (oh yes subtract Preferred - the other thing) Natural Gas Fuel Purchases 34. 3 Million/Year Natural Gas Plant Construction 35 Million Cash flow for choosing coal over natural gas = 26. 1 Million/Year in Fuel Savings 85 Million in Additional Construction Costs IRR of this Cash Flow is 30. 56%

Change the Financial Structure $26. 1 Million Each Year in Fuel Savings $6. 57 Million Each Year in Debt Service $25 Million additional capital up front The remaining $60 million dollars we finance with bank loans over 20 years at 9% interest The IRR of this Cash Flow is 78. 12%

What Happened? ? ? !! • We applied a principle called leverage – analogy is to the use of a lever that magnifies your strength • We use someone else's money at a lower rate of interest than the rate of return in the project and pocket the difference for ourselves

Use of Leverage • Most companies will try to sweeten investor returns by use of leverage • Some People buy stock on “Margin” – if the stock price is growing faster than the interest rate it increases your return – What makes more money than 400 shares doubling their price – 4000 shares of stock doubling their price • May have heard of leveraged buy outs where company operators buy the company using debt

How Can You Do That? • If the project is so good why doesn't the bank just buy it? – The expertise factor - banks know how to lend money - not necessarily run projects – Banks are more risk adverse - they don’t take as many chances and have a lower risk premium on investment • It’s the same project - how can the bank have less risk?

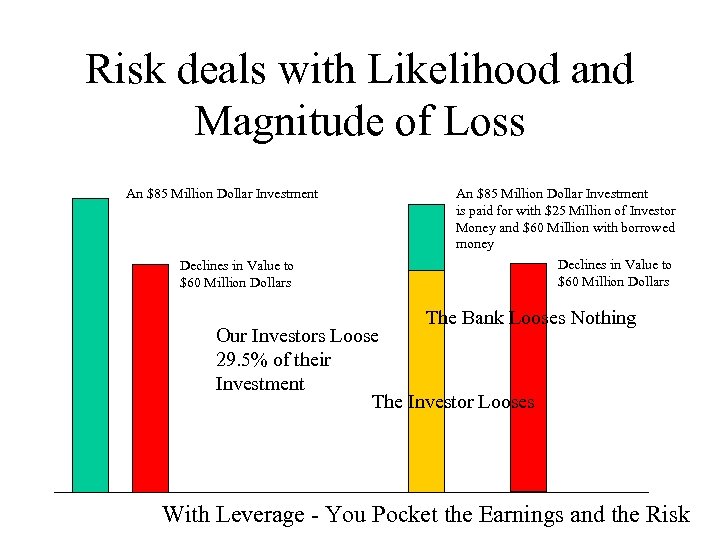

Risk deals with Likelihood and Magnitude of Loss An $85 Million Dollar Investment Declines in Value to $60 Million Dollars An $85 Million Dollar Investment is paid for with $25 Million of Investor Money and $60 Million with borrowed money Declines in Value to $60 Million Dollars The Bank Looses Nothing Our Investors Loose 29. 5% of their Investment The Investor Looses With Leverage - You Pocket the Earnings and the Risk

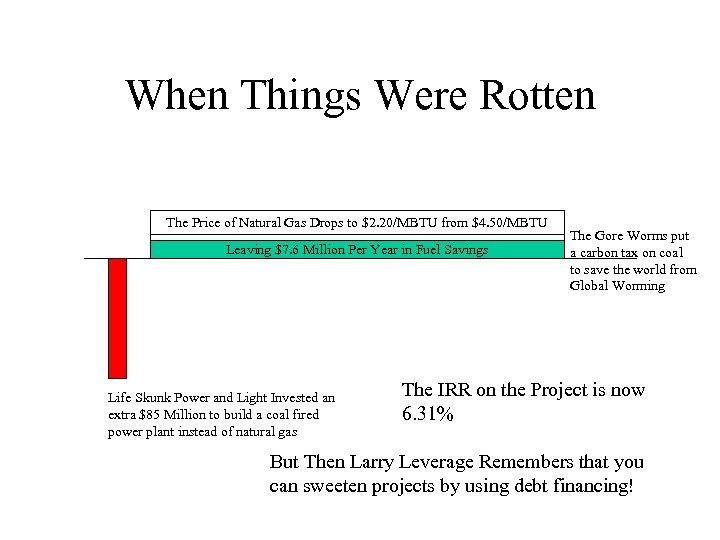

When Things Were Rotten The Price of Natural Gas Drops to $2. 20/MBTU from $4. 50/MBTU Leaving $7. 6 Million Per Year in Fuel Savings Life Skunk Power and Light Invested an extra $85 Million to build a coal fired power plant instead of natural gas The Gore Worms put a carbon tax on coal to save the world from Global Worming The IRR on the Project is now 6. 31% But Then Larry Leverage Remembers that you can sweeten projects by using debt financing!

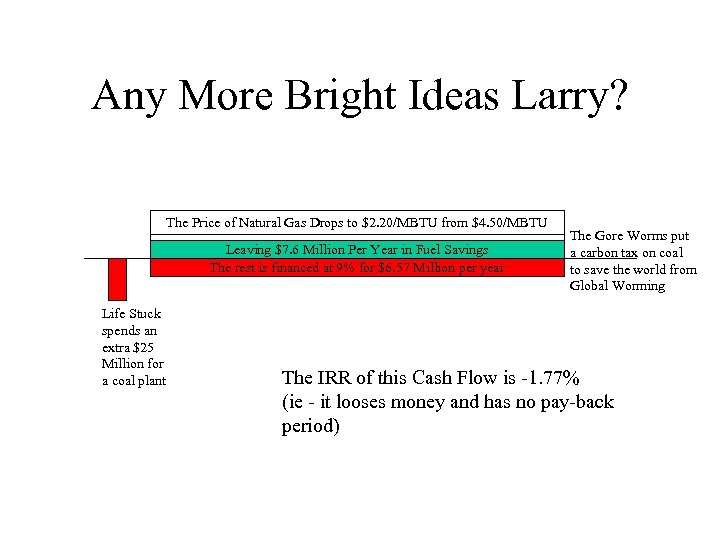

Any More Bright Ideas Larry? The Price of Natural Gas Drops to $2. 20/MBTU from $4. 50/MBTU Leaving $7. 6 Million Per Year in Fuel Savings The rest is financed at 9% for $6. 57 Million per year Life Stuck spends an extra $25 Million for a coal plant The Gore Worms put a carbon tax on coal to save the world from Global Worming The IRR of this Cash Flow is -1. 77% (ie - it looses money and has no pay-back period)

The Dark Side of Leverage • Many people do not understand that if the return in a project drops below the interest rate that they will get levered down – They take the risk – The Bank takes the money • Leverage magnifies often improves project rate of return • But it can also increase down-side risk

Use Leverage with Caution And a Generous Helping of Understanding

dd7d8cb808bb8ec2c7d3cc72749b8ffb.ppt