USDA Sources of Price Information for Market Analysis

USDA Sources of Price Information for Market Analysis

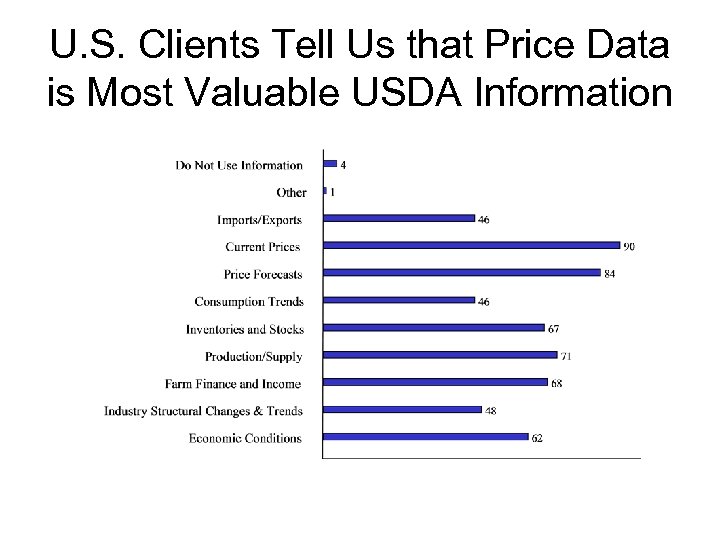

U. S. Clients Tell Us that Price Data is Most Valuable USDA Information

U. S. Clients Tell Us that Price Data is Most Valuable USDA Information

Price information • Our price information comes from two sources – USDA Agricultural Marketing Service (AMS) • Farm prices • Wholesale prices – U. S. Department of Labor Bureau of Labor Statistics (BLS) • Retail prices

Price information • Our price information comes from two sources – USDA Agricultural Marketing Service (AMS) • Farm prices • Wholesale prices – U. S. Department of Labor Bureau of Labor Statistics (BLS) • Retail prices

USDA AMS • http: //marketnews. usda. gov/portal/lg • Publishes daily and weekly reports of livestock, meat, and grain market news – For livestock, one can get a noon report on that morning’s prices – Daily slaughter estimates posted the next morning

USDA AMS • http: //marketnews. usda. gov/portal/lg • Publishes daily and weekly reports of livestock, meat, and grain market news – For livestock, one can get a noon report on that morning’s prices – Daily slaughter estimates posted the next morning

Price reporting in theory • Prices are the most important coordinating signal in a market-based economy – Higher prices encourage producers to expand consumers to buy less. (Supply and demand theory. )

Price reporting in theory • Prices are the most important coordinating signal in a market-based economy – Higher prices encourage producers to expand consumers to buy less. (Supply and demand theory. )

More theory on price reporting and other market information • Markets can be effective ways of coordination of economic activity for many products • Information is a special case – If I eat (use) a piece of pork, you cannot – If I use a “piece” of information, you can too, but it might be to my advantage to keep it from you – Market is likely to under-produce or under-share information • There are private price reporting services in USA. “Yellow Sheet” for meat, for example.

More theory on price reporting and other market information • Markets can be effective ways of coordination of economic activity for many products • Information is a special case – If I eat (use) a piece of pork, you cannot – If I use a “piece” of information, you can too, but it might be to my advantage to keep it from you – Market is likely to under-produce or under-share information • There are private price reporting services in USA. “Yellow Sheet” for meat, for example.

Pricing arrangements in U. S. livestock & meat markets • Auctions: bring animals to central location, many buyers bid on them – Less and less important over time for livestock, not used much for meat ever – Futures markets are one example of an auction market that is not declining

Pricing arrangements in U. S. livestock & meat markets • Auctions: bring animals to central location, many buyers bid on them – Less and less important over time for livestock, not used much for meat ever – Futures markets are one example of an auction market that is not declining

Pricing arrangements in U. S. livestock & meat markets • Direct negotiations between buyers and sellers – Always important for meat – Increasingly important for livestock • Pricing methods and relationships vary in direct marketing

Pricing arrangements in U. S. livestock & meat markets • Direct negotiations between buyers and sellers – Always important for meat – Increasingly important for livestock • Pricing methods and relationships vary in direct marketing

Contracting versus “Spot” • Contracted sales are based on a longerterm relationship between buyer & seller – “Contract” usually means a formal legal agreement – Many “contracts” are informal arrangements – Contracted hogs are becoming more important • Spot sales are made “on the spot” and do not imply a longer term relationship

Contracting versus “Spot” • Contracted sales are based on a longerterm relationship between buyer & seller – “Contract” usually means a formal legal agreement – Many “contracts” are informal arrangements – Contracted hogs are becoming more important • Spot sales are made “on the spot” and do not imply a longer term relationship

Negotiated and formula prices • Negotiated prices are those where buyer and seller actually negotiate over the price • Formula prices, buyer and seller agree on some volume of sales, base price on reported price (plus or minus) – Reported price can come from USDA-AMS or other.

Negotiated and formula prices • Negotiated prices are those where buyer and seller actually negotiate over the price • Formula prices, buyer and seller agree on some volume of sales, base price on reported price (plus or minus) – Reported price can come from USDA-AMS or other.

Sales relationships and pricing types • In spot markets you will see both negotiated and formula pricing for hogs and pork • “Contracts” invariably use some type of formula pricing

Sales relationships and pricing types • In spot markets you will see both negotiated and formula pricing for hogs and pork • “Contracts” invariably use some type of formula pricing