374d6fc11e3d1cfecc9bf40b37ee5dad.ppt

- Количество слайдов: 36

US Omnichannel Retail Stat. Pack Marketer and Consumer Trends May 2017 Krista Garcia Contributor: Ricky Costa © 2017 e. Marketer Inc.

US Omnichannel Retail Stat. Pack Marketer and Consumer Trends May 2017 Krista Garcia Contributor: Ricky Costa © 2017 e. Marketer Inc.

This Stat. Pack provides an overview of omnichannel retailing trends Two definitions to know: Omnichannel retailing: The evolution from multichannel retailing, omnichannel is the practice of using all available shopping channels to buy or sell goods or services. Includes in-store, internet, mobile and catalog sales. Shipping and delivery: Activities involved in moving a product or service from the supplier/retailer to the customer. Includes shipping, delivery, supply chain, fulfillment, as well as buy online, pick up instore, and click-and-collect. © 2017 e. Marketer Inc.

This Stat. Pack provides an overview of omnichannel retailing trends Two definitions to know: Omnichannel retailing: The evolution from multichannel retailing, omnichannel is the practice of using all available shopping channels to buy or sell goods or services. Includes in-store, internet, mobile and catalog sales. Shipping and delivery: Activities involved in moving a product or service from the supplier/retailer to the customer. Includes shipping, delivery, supply chain, fulfillment, as well as buy online, pick up instore, and click-and-collect. © 2017 e. Marketer Inc.

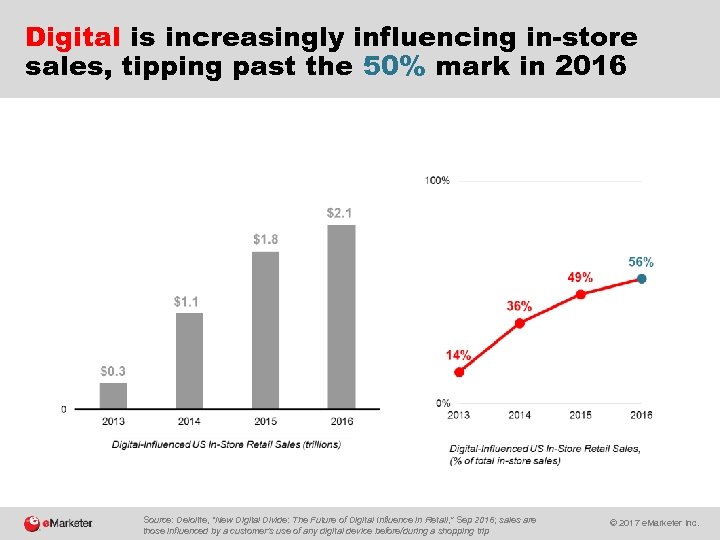

Digital is increasingly influencing in-store sales, tipping past the 50% mark in 2016 Source: Deloitte, “New Digital Divide: The Future of Digital Influence in Retail, ” Sep 2016; sales are those influenced by a customer’s use of any digital device before/during a shopping trip © 2017 e. Marketer Inc.

Digital is increasingly influencing in-store sales, tipping past the 50% mark in 2016 Source: Deloitte, “New Digital Divide: The Future of Digital Influence in Retail, ” Sep 2016; sales are those influenced by a customer’s use of any digital device before/during a shopping trip © 2017 e. Marketer Inc.

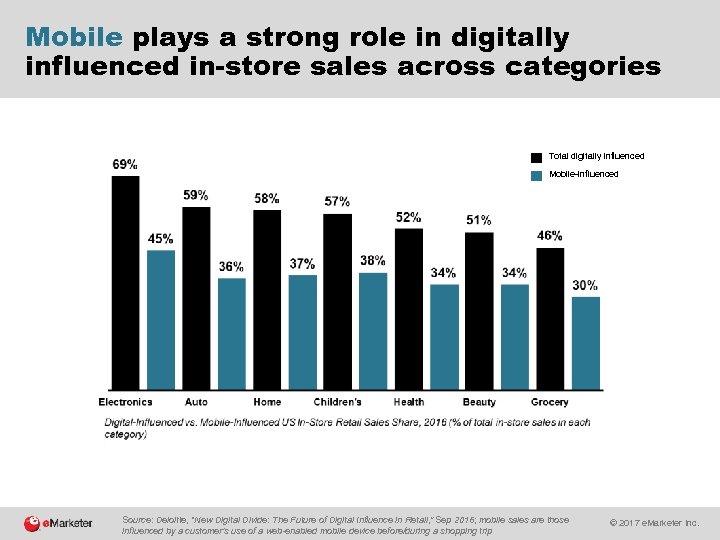

Mobile plays a strong role in digitally influenced in-store sales across categories Total digitally influenced Mobile-influenced Source: Deloitte, “New Digital Divide: The Future of Digital Influence in Retail, ” Sep 2016; mobile sales are those influenced by a customer’s use of a web-enabled mobile device before/during a shopping trip © 2017 e. Marketer Inc.

Mobile plays a strong role in digitally influenced in-store sales across categories Total digitally influenced Mobile-influenced Source: Deloitte, “New Digital Divide: The Future of Digital Influence in Retail, ” Sep 2016; mobile sales are those influenced by a customer’s use of a web-enabled mobile device before/during a shopping trip © 2017 e. Marketer Inc.

Omnichannel shoppers spend more than singlechannel shoppers 4% more on in-store shopping 10% more on online shopping Source: Harvard Business Review, Aug 2016 Conducting online research prepurchase led to 13% more in-store spending among omnichannel shoppers © 2017 e. Marketer Inc.

Omnichannel shoppers spend more than singlechannel shoppers 4% more on in-store shopping 10% more on online shopping Source: Harvard Business Review, Aug 2016 Conducting online research prepurchase led to 13% more in-store spending among omnichannel shoppers © 2017 e. Marketer Inc.

Retailers: Adoption, Drivers and Challenges © 2017 e. Marketer Inc.

Retailers: Adoption, Drivers and Challenges © 2017 e. Marketer Inc.

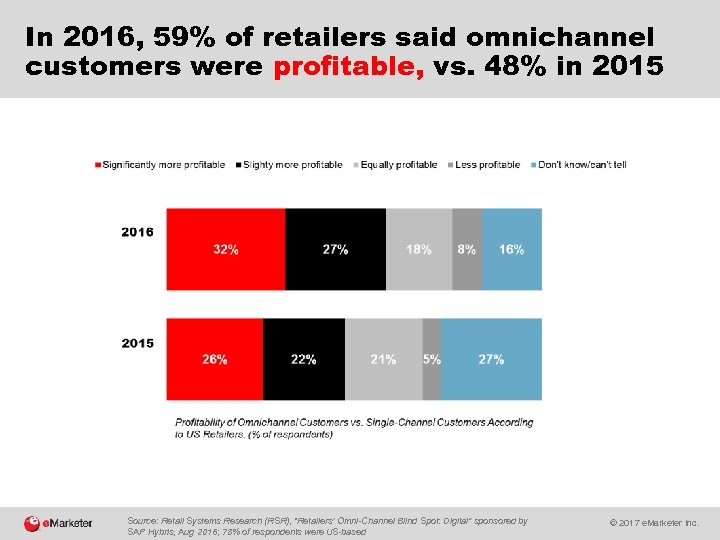

In 2016, 59% of retailers said omnichannel customers were profitable, vs. 48% in 2015 Source: Retail Systems Research (RSR), “Retailers’ Omni-Channel Blind Spot: Digital” sponsored by SAP Hybris, Aug 2016; 78% of respondents were US-based © 2017 e. Marketer Inc.

In 2016, 59% of retailers said omnichannel customers were profitable, vs. 48% in 2015 Source: Retail Systems Research (RSR), “Retailers’ Omni-Channel Blind Spot: Digital” sponsored by SAP Hybris, Aug 2016; 78% of respondents were US-based © 2017 e. Marketer Inc.

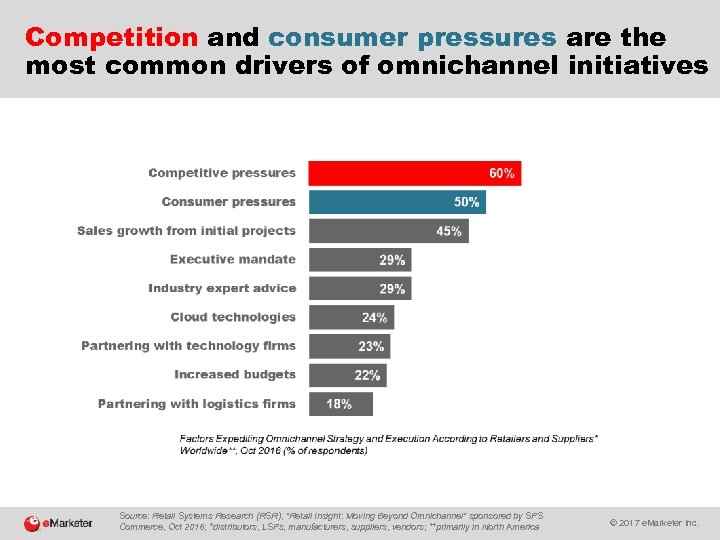

Competition and consumer pressures are the most common drivers of omnichannel initiatives Source: Retail Systems Research (RSR), “Retail Insight: Moving Beyond Omnichannel” sponsored by SPS Commerce, Oct 2016; *distributors, LSPs, manufacturers, suppliers, vendors; **primarily in North America © 2017 e. Marketer Inc.

Competition and consumer pressures are the most common drivers of omnichannel initiatives Source: Retail Systems Research (RSR), “Retail Insight: Moving Beyond Omnichannel” sponsored by SPS Commerce, Oct 2016; *distributors, LSPs, manufacturers, suppliers, vendors; **primarily in North America © 2017 e. Marketer Inc.

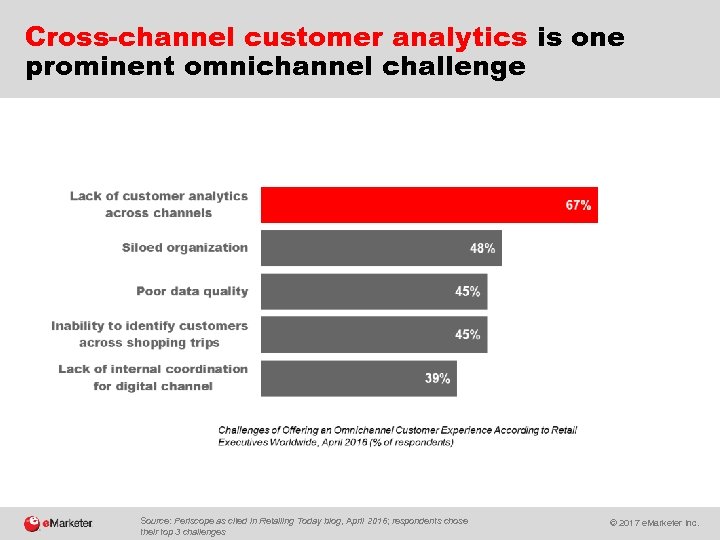

Cross-channel customer analytics is one prominent omnichannel challenge Source: Periscope as cited in Retailing Today blog, April 2016; respondents chose their top 3 challenges © 2017 e. Marketer Inc.

Cross-channel customer analytics is one prominent omnichannel challenge Source: Periscope as cited in Retailing Today blog, April 2016; respondents chose their top 3 challenges © 2017 e. Marketer Inc.

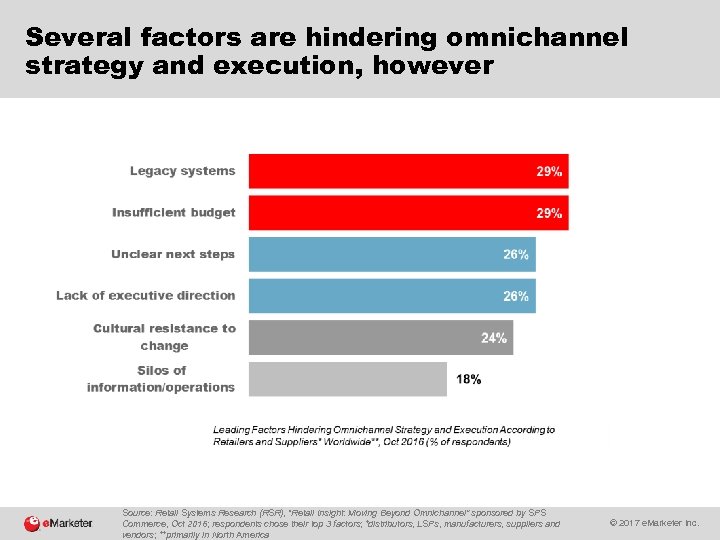

Several factors are hindering omnichannel strategy and execution, however Source: Retail Systems Research (RSR), “Retail Insight: Moving Beyond Omnichannel” sponsored by SPS Commerce, Oct 2016; respondents chose their top 3 factors; *distributors, LSPs, manufacturers, suppliers and vendors; **primarily in North America © 2017 e. Marketer Inc.

Several factors are hindering omnichannel strategy and execution, however Source: Retail Systems Research (RSR), “Retail Insight: Moving Beyond Omnichannel” sponsored by SPS Commerce, Oct 2016; respondents chose their top 3 factors; *distributors, LSPs, manufacturers, suppliers and vendors; **primarily in North America © 2017 e. Marketer Inc.

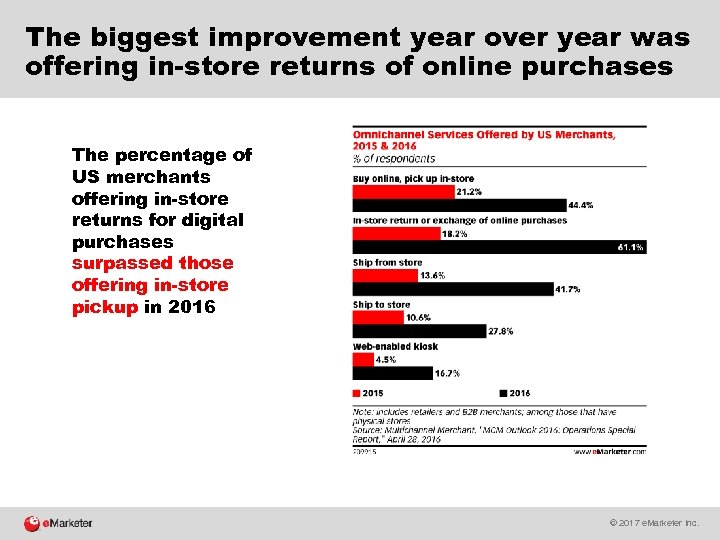

The biggest improvement year over year was offering in-store returns of online purchases The percentage of US merchants offering in-store returns for digital purchases surpassed those offering in-store pickup in 2016 © 2017 e. Marketer Inc.

The biggest improvement year over year was offering in-store returns of online purchases The percentage of US merchants offering in-store returns for digital purchases surpassed those offering in-store pickup in 2016 © 2017 e. Marketer Inc.

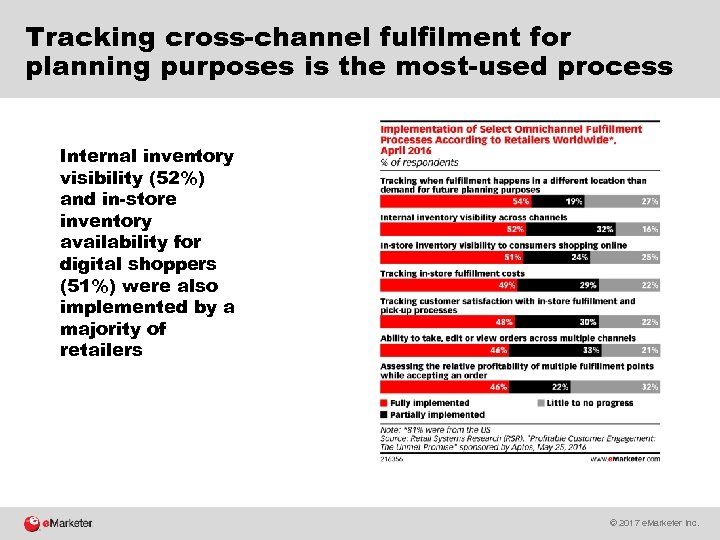

Tracking cross-channel fulfilment for planning purposes is the most-used process Internal inventory visibility (52%) and in-store inventory availability for digital shoppers (51%) were also implemented by a majority of retailers © 2017 e. Marketer Inc.

Tracking cross-channel fulfilment for planning purposes is the most-used process Internal inventory visibility (52%) and in-store inventory availability for digital shoppers (51%) were also implemented by a majority of retailers © 2017 e. Marketer Inc.

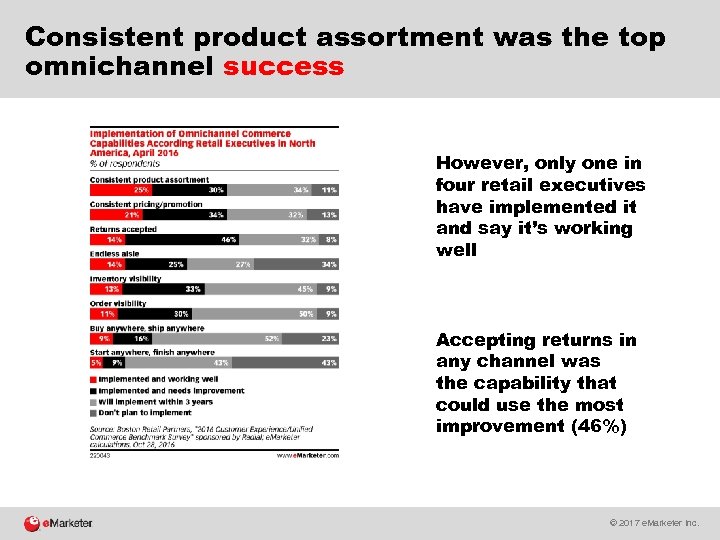

Consistent product assortment was the top omnichannel success However, only one in four retail executives have implemented it and say it’s working well Accepting returns in any channel was the capability that could use the most improvement (46%) © 2017 e. Marketer Inc.

Consistent product assortment was the top omnichannel success However, only one in four retail executives have implemented it and say it’s working well Accepting returns in any channel was the capability that could use the most improvement (46%) © 2017 e. Marketer Inc.

Consumer Path to Purchase © 2017 e. Marketer Inc.

Consumer Path to Purchase © 2017 e. Marketer Inc.

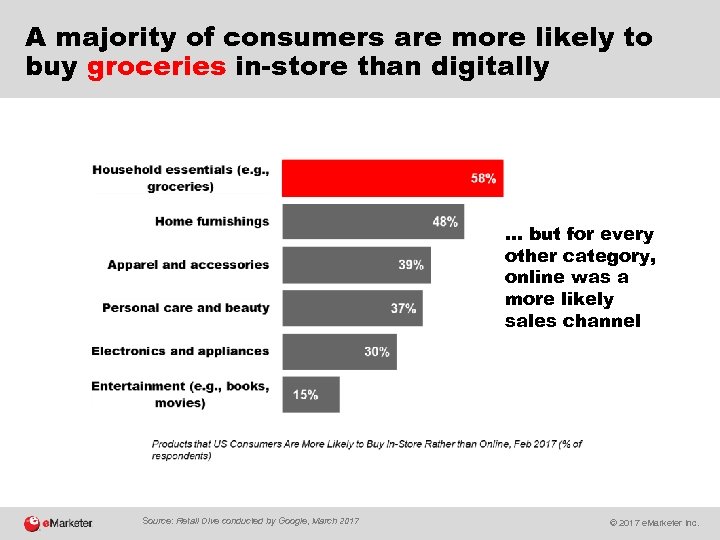

A majority of consumers are more likely to buy groceries in-store than digitally . . . but for every other category, online was a more likely sales channel Source: Retail Dive conducted by Google, March 2017 © 2017 e. Marketer Inc.

A majority of consumers are more likely to buy groceries in-store than digitally . . . but for every other category, online was a more likely sales channel Source: Retail Dive conducted by Google, March 2017 © 2017 e. Marketer Inc.

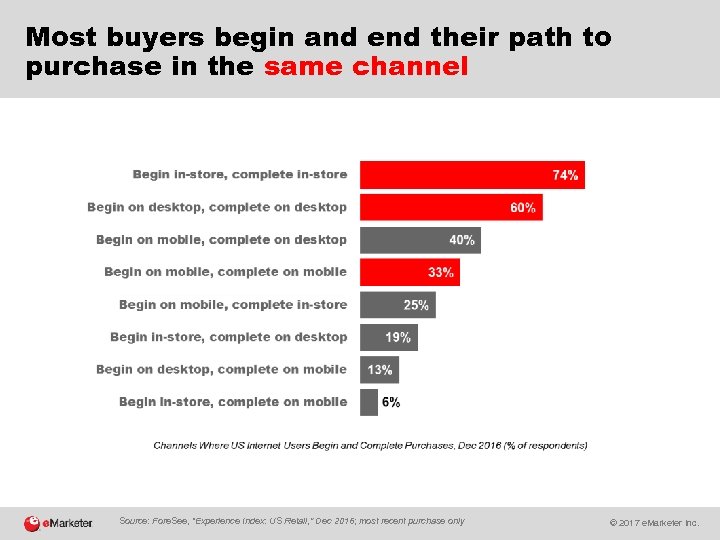

Most buyers begin and end their path to purchase in the same channel Source: Fore. See, “Experience Index: US Retail, ” Dec 2016; most recent purchase only © 2017 e. Marketer Inc.

Most buyers begin and end their path to purchase in the same channel Source: Fore. See, “Experience Index: US Retail, ” Dec 2016; most recent purchase only © 2017 e. Marketer Inc.

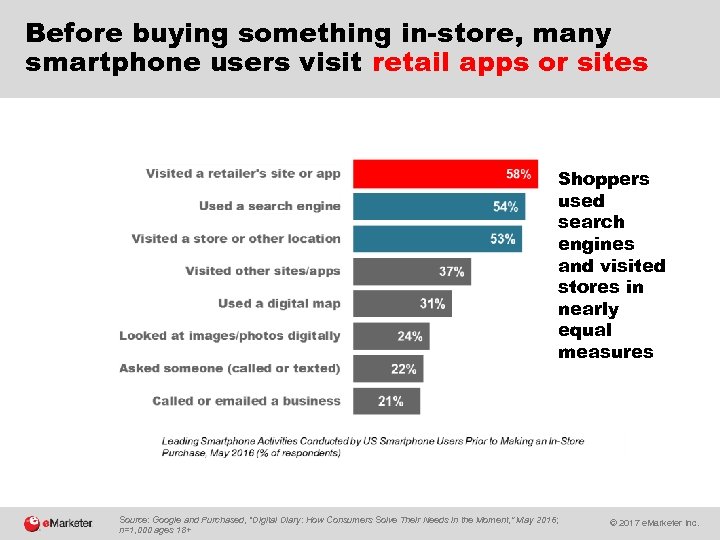

Before buying something in-store, many smartphone users visit retail apps or sites Shoppers used search engines and visited stores in nearly equal measures Source: Google and Purchased, “Digital Diary: How Consumers Solve Their Needs in the Moment, ” May 2016; n=1, 000 ages 18+ © 2017 e. Marketer Inc.

Before buying something in-store, many smartphone users visit retail apps or sites Shoppers used search engines and visited stores in nearly equal measures Source: Google and Purchased, “Digital Diary: How Consumers Solve Their Needs in the Moment, ” May 2016; n=1, 000 ages 18+ © 2017 e. Marketer Inc.

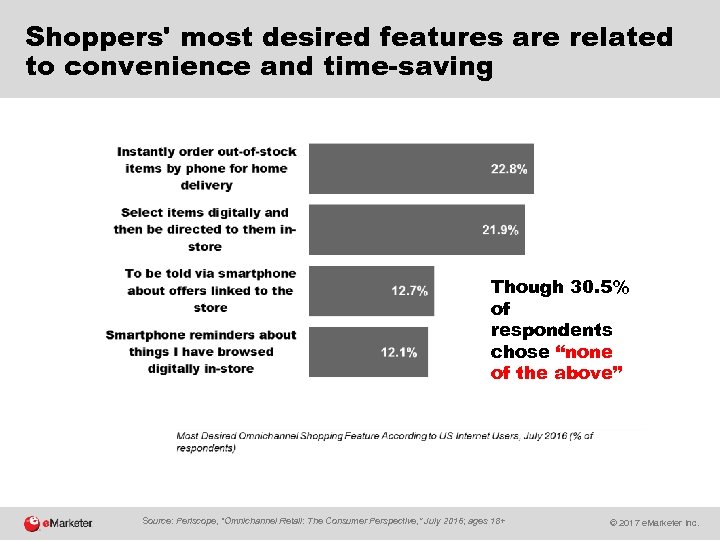

Shoppers' most desired features are related to convenience and time-saving Though 30. 5% of respondents chose “none of the above” Source: Periscope, “Omnichannel Retail: The Consumer Perspective, ” July 2016; ages 18+ © 2017 e. Marketer Inc.

Shoppers' most desired features are related to convenience and time-saving Though 30. 5% of respondents chose “none of the above” Source: Periscope, “Omnichannel Retail: The Consumer Perspective, ” July 2016; ages 18+ © 2017 e. Marketer Inc.

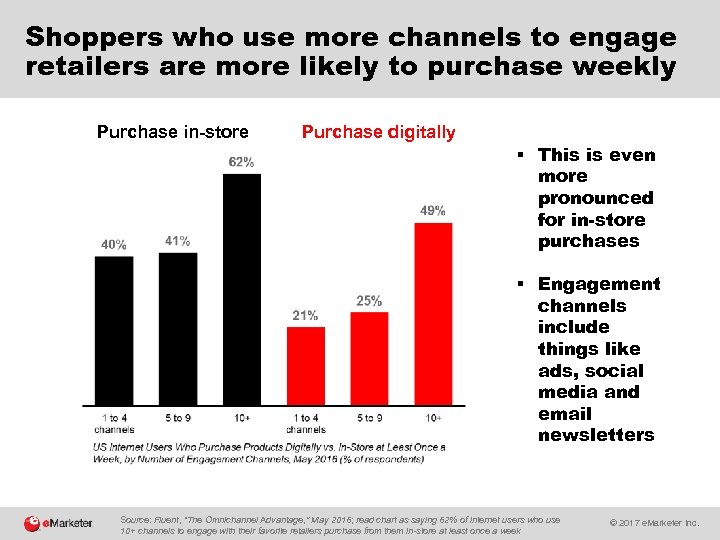

Shoppers who use more channels to engage retailers are more likely to purchase weekly Purchase in-store Purchase digitally § This is even more pronounced for in-store purchases § Engagement channels include things like ads, social media and email newsletters Source: Fluent, “The Omnichannel Advantage, ” May 2016; read chart as saying 62% of internet users who use 10+ channels to engage with their favorite retailers purchase from them in-store at least once a week © 2017 e. Marketer Inc.

Shoppers who use more channels to engage retailers are more likely to purchase weekly Purchase in-store Purchase digitally § This is even more pronounced for in-store purchases § Engagement channels include things like ads, social media and email newsletters Source: Fluent, “The Omnichannel Advantage, ” May 2016; read chart as saying 62% of internet users who use 10+ channels to engage with their favorite retailers purchase from them in-store at least once a week © 2017 e. Marketer Inc.

A combination of mobile and in-store product research is more common in the US 67% of US smartphone users complement product research via smartphone with in-store visits. That percentage is higher than in China (59%), Germany (52%), Japan (45%) and the UK (47%). Source: x. Ad, March 2016 © 2017 e. Marketer Inc.

A combination of mobile and in-store product research is more common in the US 67% of US smartphone users complement product research via smartphone with in-store visits. That percentage is higher than in China (59%), Germany (52%), Japan (45%) and the UK (47%). Source: x. Ad, March 2016 © 2017 e. Marketer Inc.

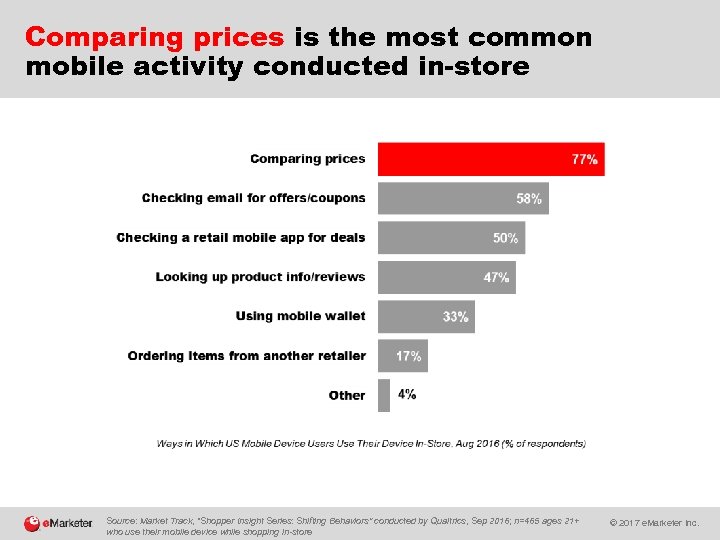

Comparing prices is the most common mobile activity conducted in-store Source: Market Track, “Shopper Insight Series: Shifting Behaviors” conducted by Qualtrics, Sep 2016; n=465 ages 21+ who use their mobile device while shopping in-store © 2017 e. Marketer Inc.

Comparing prices is the most common mobile activity conducted in-store Source: Market Track, “Shopper Insight Series: Shifting Behaviors” conducted by Qualtrics, Sep 2016; n=465 ages 21+ who use their mobile device while shopping in-store © 2017 e. Marketer Inc.

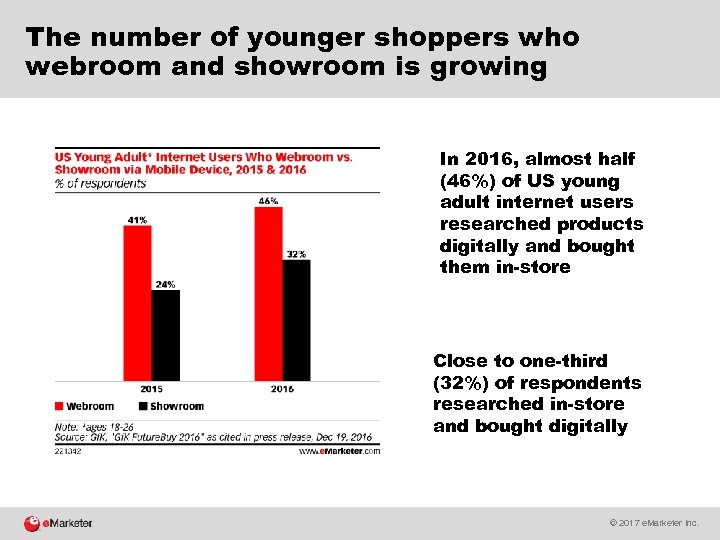

The number of younger shoppers who webroom and showroom is growing In 2016, almost half (46%) of US young adult internet users researched products digitally and bought them in-store Close to one-third (32%) of respondents researched in-store and bought digitally © 2017 e. Marketer Inc.

The number of younger shoppers who webroom and showroom is growing In 2016, almost half (46%) of US young adult internet users researched products digitally and bought them in-store Close to one-third (32%) of respondents researched in-store and bought digitally © 2017 e. Marketer Inc.

The In-Store Experience © 2017 e. Marketer Inc.

The In-Store Experience © 2017 e. Marketer Inc.

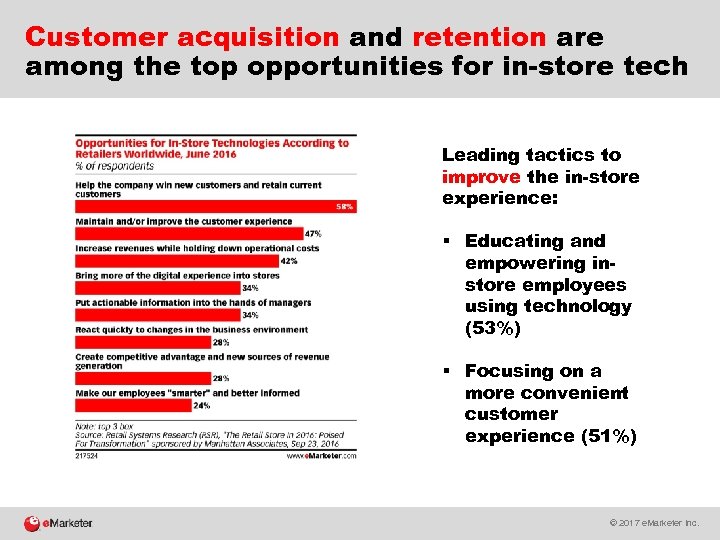

Customer acquisition and retention are among the top opportunities for in-store tech Leading tactics to improve the in-store experience: § Educating and empowering instore employees using technology (53%) § Focusing on a more convenient customer experience (51%) © 2017 e. Marketer Inc.

Customer acquisition and retention are among the top opportunities for in-store tech Leading tactics to improve the in-store experience: § Educating and empowering instore employees using technology (53%) § Focusing on a more convenient customer experience (51%) © 2017 e. Marketer Inc.

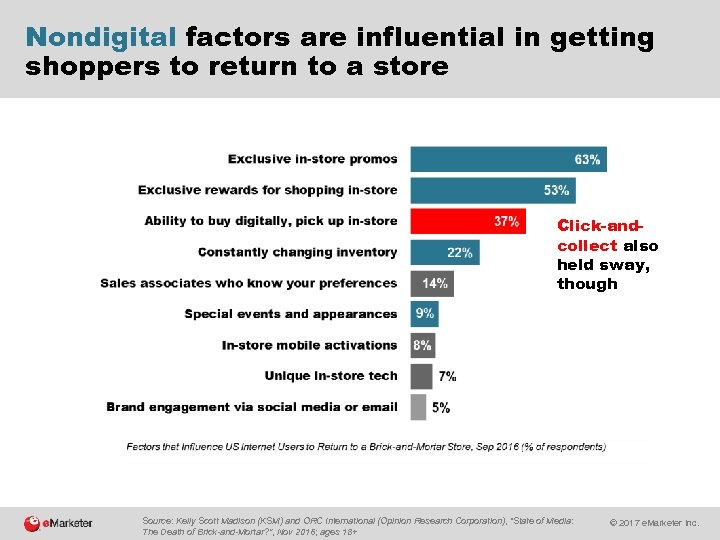

Nondigital factors are influential in getting shoppers to return to a store Click-andcollect also held sway, though Source: Kelly Scott Madison (KSM) and ORC International (Opinion Research Corporation), “State of Media: The Death of Brick-and-Mortar? ”, Nov 2016; ages 18+ © 2017 e. Marketer Inc.

Nondigital factors are influential in getting shoppers to return to a store Click-andcollect also held sway, though Source: Kelly Scott Madison (KSM) and ORC International (Opinion Research Corporation), “State of Media: The Death of Brick-and-Mortar? ”, Nov 2016; ages 18+ © 2017 e. Marketer Inc.

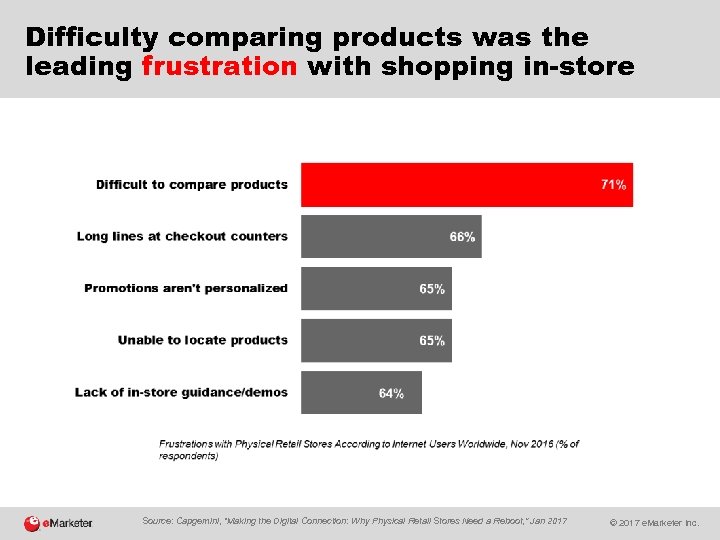

Difficulty comparing products was the leading frustration with shopping in-store Source: Capgemini, “Making the Digital Connection: Why Physical Retail Stores Need a Reboot, ” Jan 2017 © 2017 e. Marketer Inc.

Difficulty comparing products was the leading frustration with shopping in-store Source: Capgemini, “Making the Digital Connection: Why Physical Retail Stores Need a Reboot, ” Jan 2017 © 2017 e. Marketer Inc.

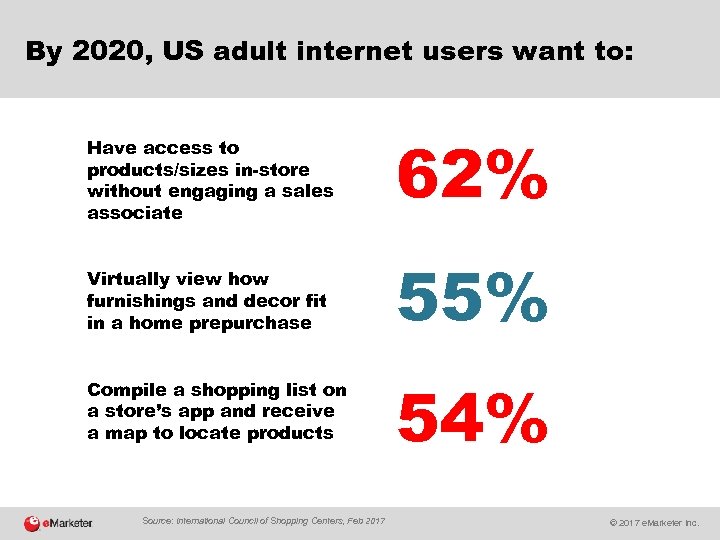

By 2020, US adult internet users want to: Have access to products/sizes in-store without engaging a sales associate 62% Virtually view how furnishings and decor fit in a home prepurchase 55% Compile a shopping list on a store’s app and receive a map to locate products 54% Source: International Council of Shopping Centers, Feb 2017 © 2017 e. Marketer Inc.

By 2020, US adult internet users want to: Have access to products/sizes in-store without engaging a sales associate 62% Virtually view how furnishings and decor fit in a home prepurchase 55% Compile a shopping list on a store’s app and receive a map to locate products 54% Source: International Council of Shopping Centers, Feb 2017 © 2017 e. Marketer Inc.

Buy Online, Pick Up In-Store © 2017 e. Marketer Inc.

Buy Online, Pick Up In-Store © 2017 e. Marketer Inc.

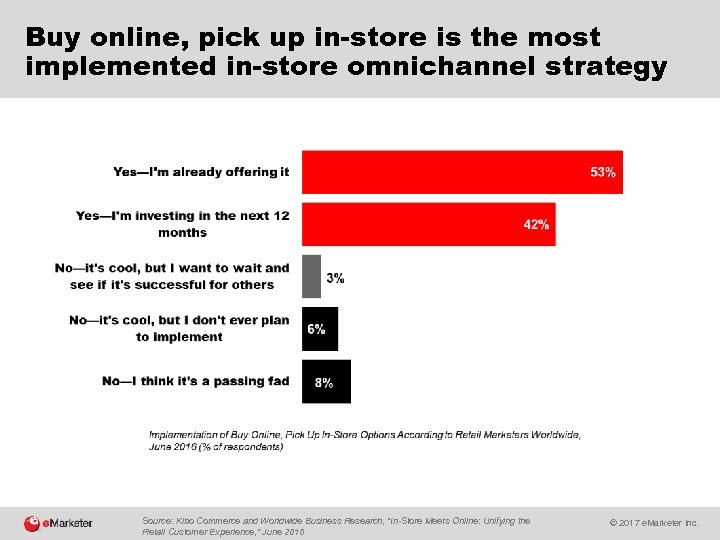

Buy online, pick up in-store is the most implemented in-store omnichannel strategy Source: Kibo Commerce and Worldwide Business Research, “In-Store Meets Online: Unifying the Retail Customer Experience, ” June 2016 © 2017 e. Marketer Inc.

Buy online, pick up in-store is the most implemented in-store omnichannel strategy Source: Kibo Commerce and Worldwide Business Research, “In-Store Meets Online: Unifying the Retail Customer Experience, ” June 2016 © 2017 e. Marketer Inc.

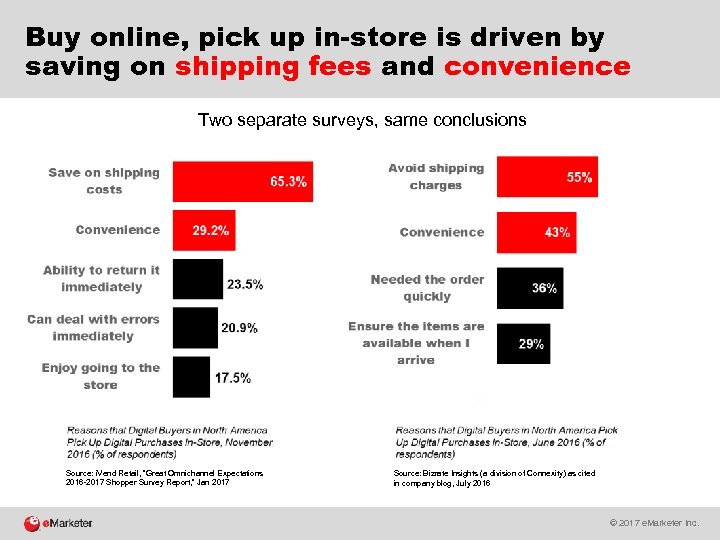

Buy online, pick up in-store is driven by saving on shipping fees and convenience Two separate surveys, same conclusions Source: i. Vend Retail, “Great Omnichannel Expectations 2016 -2017 Shopper Survey Report, ” Jan 2017 Source: Bizrate Insights (a division of Connexity) as cited in company blog, July 2016 © 2017 e. Marketer Inc.

Buy online, pick up in-store is driven by saving on shipping fees and convenience Two separate surveys, same conclusions Source: i. Vend Retail, “Great Omnichannel Expectations 2016 -2017 Shopper Survey Report, ” Jan 2017 Source: Bizrate Insights (a division of Connexity) as cited in company blog, July 2016 © 2017 e. Marketer Inc.

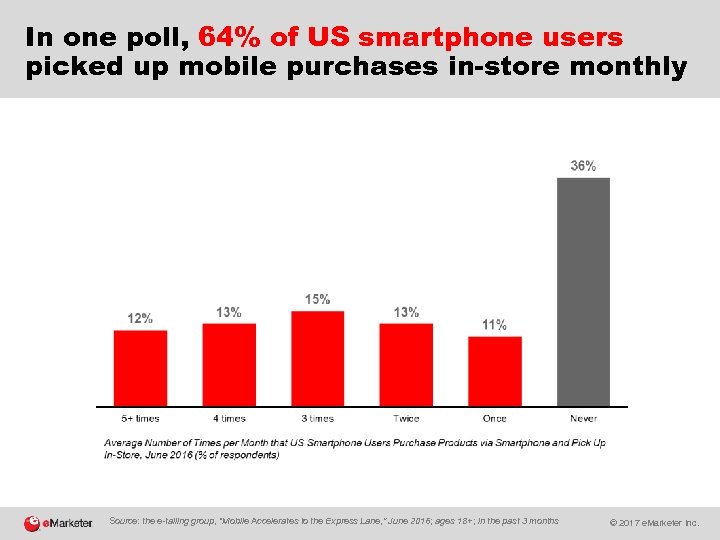

In one poll, 64% of US smartphone users picked up mobile purchases in-store monthly Source: the e-tailing group, “Mobile Accelerates to the Express Lane, ” June 2016; ages 18+; in the past 3 months © 2017 e. Marketer Inc.

In one poll, 64% of US smartphone users picked up mobile purchases in-store monthly Source: the e-tailing group, “Mobile Accelerates to the Express Lane, ” June 2016; ages 18+; in the past 3 months © 2017 e. Marketer Inc.

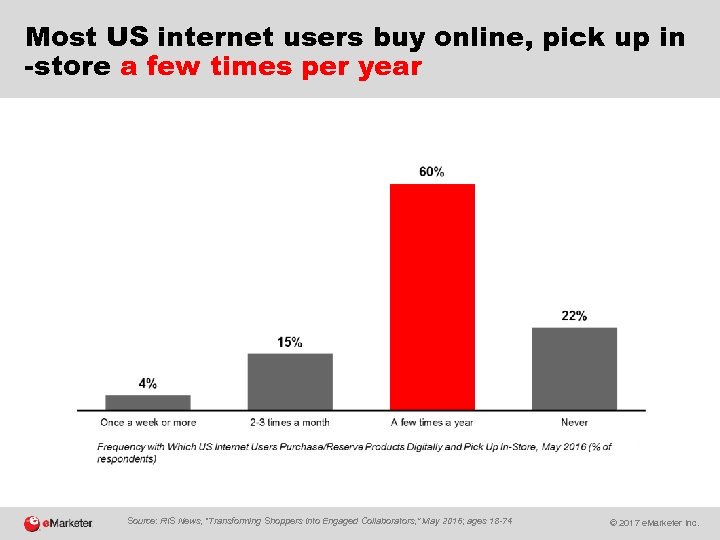

Most US internet users buy online, pick up in -store a few times per year Source: RIS News, “Transforming Shoppers Into Engaged Collaborators, ” May 2016; ages 18 -74 © 2017 e. Marketer Inc.

Most US internet users buy online, pick up in -store a few times per year Source: RIS News, “Transforming Shoppers Into Engaged Collaborators, ” May 2016; ages 18 -74 © 2017 e. Marketer Inc.

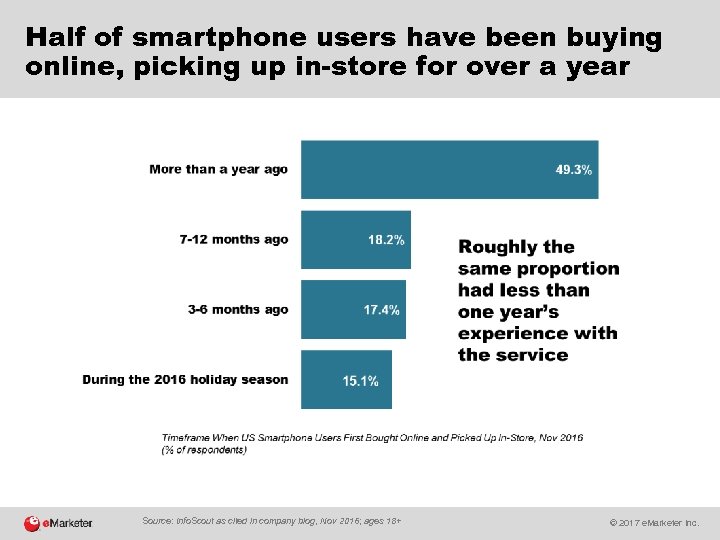

Half of smartphone users have been buying online, picking up in-store for over a year Source: Info. Scout as cited in company blog, Nov 2016; ages 18+ © 2017 e. Marketer Inc.

Half of smartphone users have been buying online, picking up in-store for over a year Source: Info. Scout as cited in company blog, Nov 2016; ages 18+ © 2017 e. Marketer Inc.

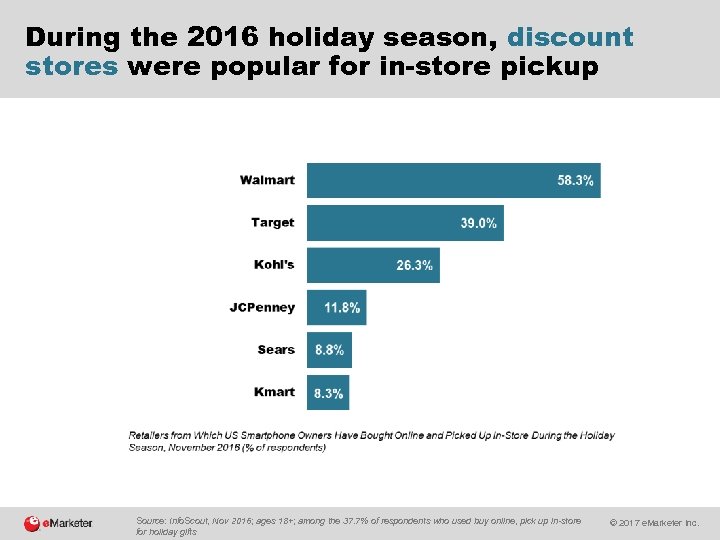

During the 2016 holiday season, discount stores were popular for in-store pickup Source: Info. Scout, Nov 2016; ages 18+; among the 37. 7% of respondents who used buy online, pick up in-store for holiday gifts © 2017 e. Marketer Inc.

During the 2016 holiday season, discount stores were popular for in-store pickup Source: Info. Scout, Nov 2016; ages 18+; among the 37. 7% of respondents who used buy online, pick up in-store for holiday gifts © 2017 e. Marketer Inc.

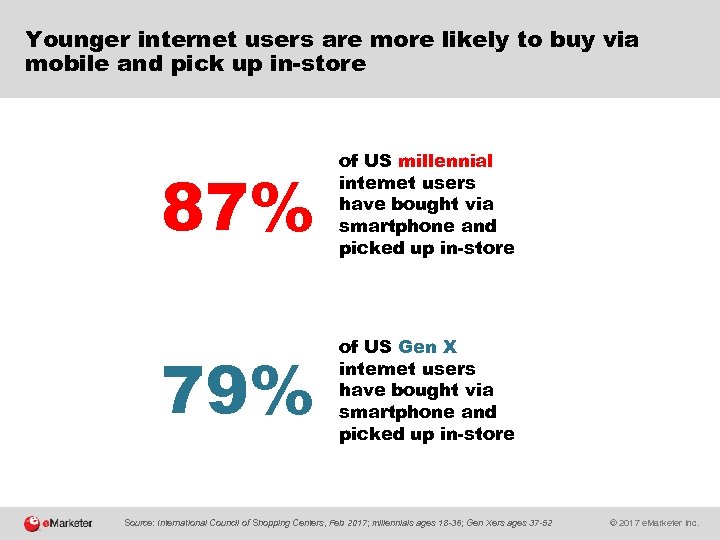

Younger internet users are more likely to buy via mobile and pick up in-store 87% of US millennial internet users have bought via smartphone and picked up in-store 79% of US Gen X internet users have bought via smartphone and picked up in-store Source: International Council of Shopping Centers, Feb 2017; millennials ages 18 -36; Gen Xers ages 37 -52 © 2017 e. Marketer Inc.

Younger internet users are more likely to buy via mobile and pick up in-store 87% of US millennial internet users have bought via smartphone and picked up in-store 79% of US Gen X internet users have bought via smartphone and picked up in-store Source: International Council of Shopping Centers, Feb 2017; millennials ages 18 -36; Gen Xers ages 37 -52 © 2017 e. Marketer Inc.

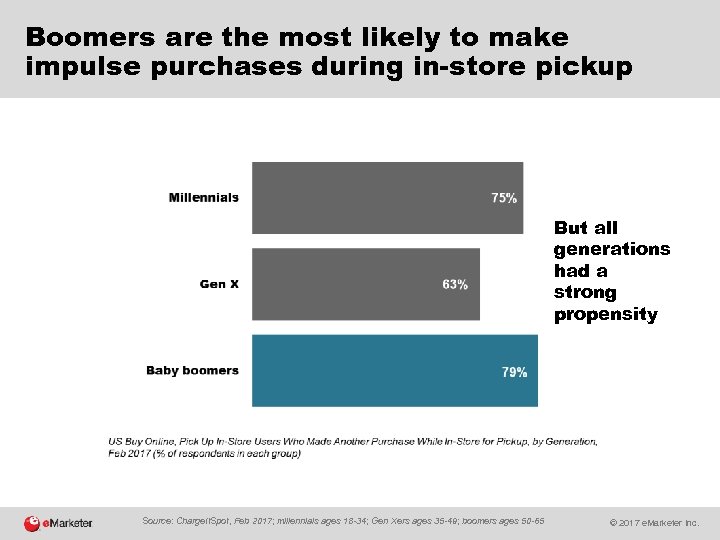

Boomers are the most likely to make impulse purchases during in-store pickup But all generations had a strong propensity Source: Charge. It. Spot, Feb 2017; millennials ages 18 -34; Gen Xers ages 35 -49; boomers ages 50 -65 © 2017 e. Marketer Inc.

Boomers are the most likely to make impulse purchases during in-store pickup But all generations had a strong propensity Source: Charge. It. Spot, Feb 2017; millennials ages 18 -34; Gen Xers ages 35 -49; boomers ages 50 -65 © 2017 e. Marketer Inc.