c5183b924ea0ff9269d5446bb329913f.ppt

- Количество слайдов: 78

US Internet Companies Presented by: Tiantian Wang Rustam Ong

Outline Industry Analysis n Yahoo Inc. n Amazon. Inc. n

Internet Industry Overview n 679. 7 Million people use the Internet n 10. 76% Specific Internet Service has opportunities n Estimated of Internet users is 940 M. (with a growth rate of 38. 29%) in 2004 n

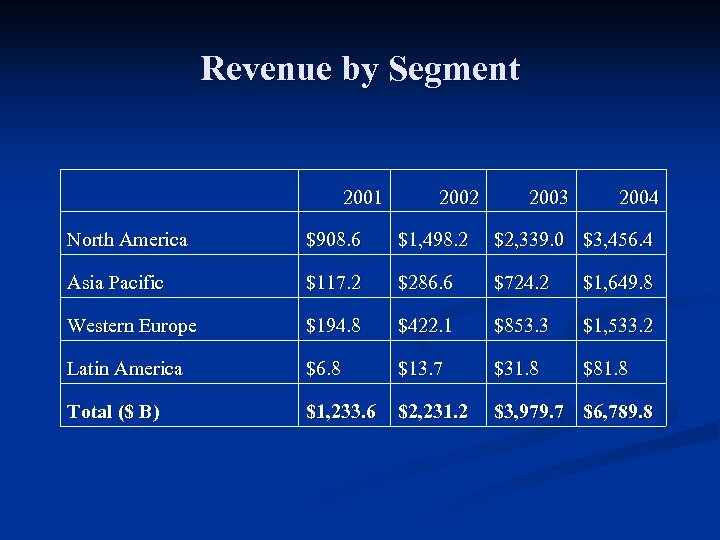

Revenue by Segment 2001 2002 2003 2004 North America $908. 6 $1, 498. 2 $2, 339. 0 $3, 456. 4 Asia Pacific $117. 2 $286. 6 $724. 2 $1, 649. 8 Western Europe $194. 8 $422. 1 $853. 3 $1, 533. 2 Latin America $6. 8 $13. 7 $31. 8 $81. 8 Total ($ B) $1, 233. 6 $2, 231. 2 $3, 979. 7 $6, 789. 8

Internet Business Market Analysis 2003: n Canadian GDP=>$ 860 Billion n Internet Business Revenue=>$3, 980 Billion

Internet Overview (USA) n 2002 Internet Users => 118 million n 2003 Internet Users => 151 million n %27. 9 Growth from 2002 -2003

Significance of the US The online markets in the USA are still witnessing strong growth n 22. 2% of all Internet users are in the US. n Americans form 4. 4% of the world population. n

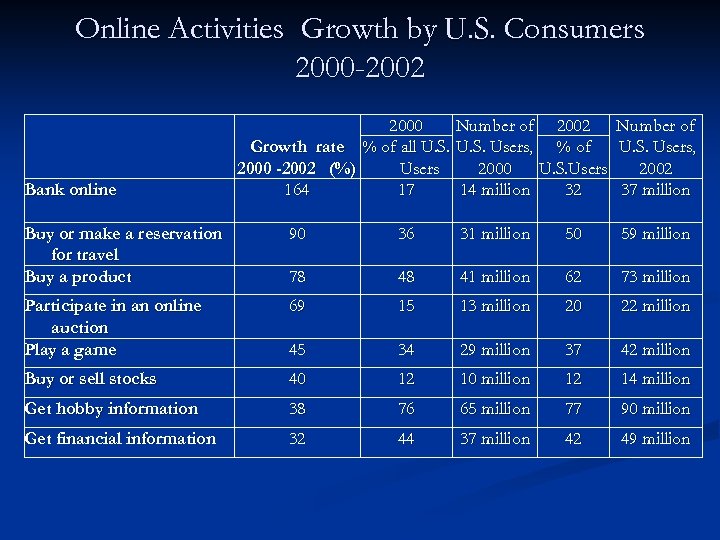

Online Activities Growth by U. S. Consumers 2000 -2002 Bank online 2000 Number of 2002 Growth rate % of all U. S. Users, % of Users U. S. Users 2000 -2002 (%) 2000 164 17 14 million 32 Number of U. S. Users, 2002 37 million Buy or make a reservation for travel Buy a product 90 36 31 million 50 59 million 78 48 41 million 62 73 million Participate in an online auction Play a game 69 15 13 million 20 22 million 45 34 29 million 37 42 million Buy or sell stocks 40 12 10 million 12 14 million Get hobby information 38 76 65 million 77 90 million Get financial information 32 44 37 million 42 49 million

Overview Company Analysis n Competitor Analysis n Industry Analysis n Conclusion n

Yahoo Inc. Overview n n n Sector: Technology Industry: Internet Information Provider Full Time Employees: 7, 600 Founded in 1995 by David Filo and Jerry Yang It offers communications services, commerce services, content and media programming services, personalized information on wireless devices, corporate service Strategic Alliances : Microsoft Inc. ; BT Group plc; Rogers Cable, Inc. ; Alibaba. com Corporation; and Verizon Communications, Inc

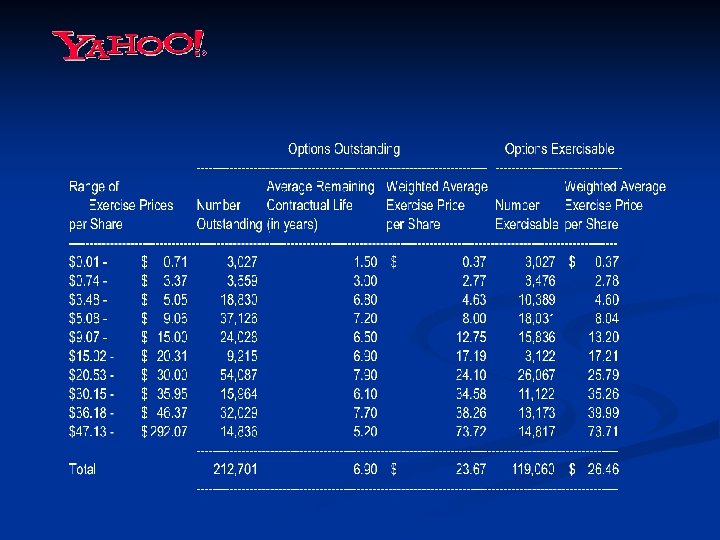

Financial Analysis as of Nov 9 n n n n Symbol : YHOO Listed: Nasdaq, S&P 500, S&P 1500 Supergroup # of shares outstanding : 1. 41 B # of option outstanding: 212, 701 Stock price : $ 37. 75 Market Capitalization : $53. 19 B 52 -week high : 39. 79 low : 30. 30

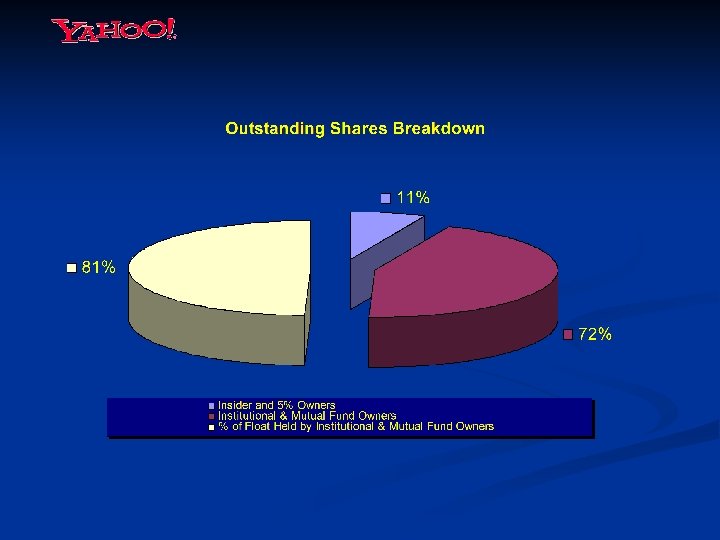

Financial Analysis Continues… Price/Book: 7. 09 n P/E : 35. 25 n EPS: 1. 07 n Div & Yield: 0 n Return on Equity: 23. 31% n 11. 02% held by Insiders n 72. 3% held by Institutions n

One Year Performance

Five Year Performance

Yahoo Inc. Management Team n n n Terry Semel Chairman, Chief Executive Officer and Director Join in May, 2001 Semel spent 24 years at Warner Bros. , as chairman and co-chief executive officer Building Warner Bros. from a single revenue source generating less than $1 billion to $11 billion Semel managed Walt Disney's Theatrical Distribution division, and CBS' Theatrical Distribution division

Yahoo Inc. Management Team n n n Jerry Yang Co-founder, Chief Yahoo and Director 4. 8% - 0% of Common Shares, as May 2005 Jerry Yang, a Taiwanese native raised in San Jose, Calif. , co-created the Yahoo! Internet navigational guide in April 1994 A member of Yahoo's board of directors Yang works closely with the company's president and CEO to develop corporate business strategies and guide the future direction

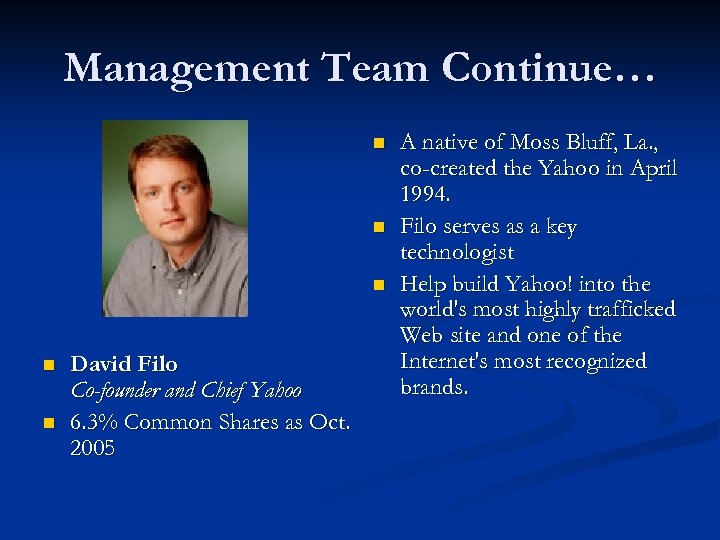

Management Team Continue… n n n David Filo Co-founder and Chief Yahoo 6. 3% Common Shares as Oct. 2005 A native of Moss Bluff, La. , co-created the Yahoo in April 1994. Filo serves as a key technologist Help build Yahoo! into the world's most highly trafficked Web site and one of the Internet's most recognized brands.

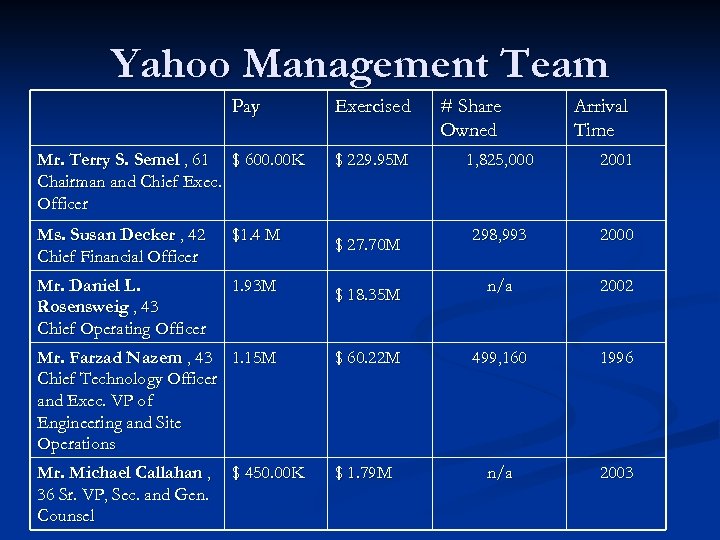

Yahoo Management Team Pay Mr. Terry S. Semel , 61 $ 600. 00 K Chairman and Chief Exec. Officer Ms. Susan Decker , 42 Chief Financial Officer $1. 4 M Mr. Daniel L. Rosensweig , 43 Chief Operating Officer 1. 93 M Exercised $ 229. 95 M $ 27. 70 M $ 18. 35 M # Share Owned Arrival Time 1, 825, 000 2001 298, 993 2000 n/a 2002 Mr. Farzad Nazem , 43 1. 15 M Chief Technology Officer and Exec. VP of Engineering and Site Operations $ 60. 22 M 499, 160 1996 Mr. Michael Callahan , 36 Sr. VP, Sec. and Gen. Counsel $ 1. 79 M n/a 2003 $ 450. 00 K

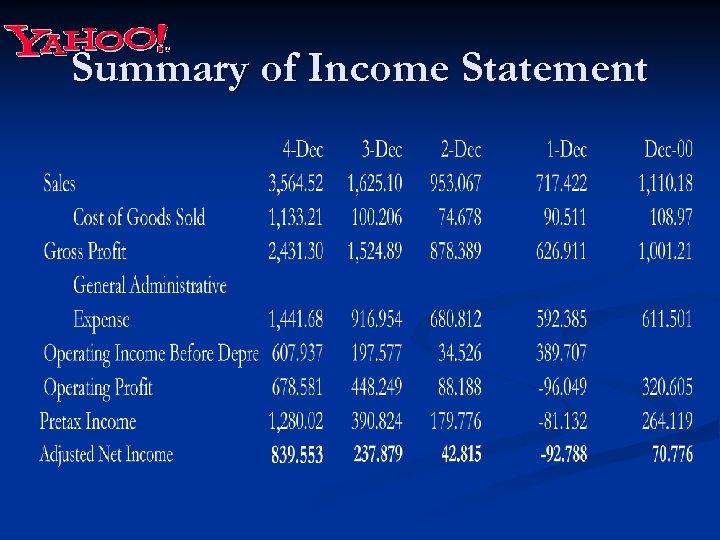

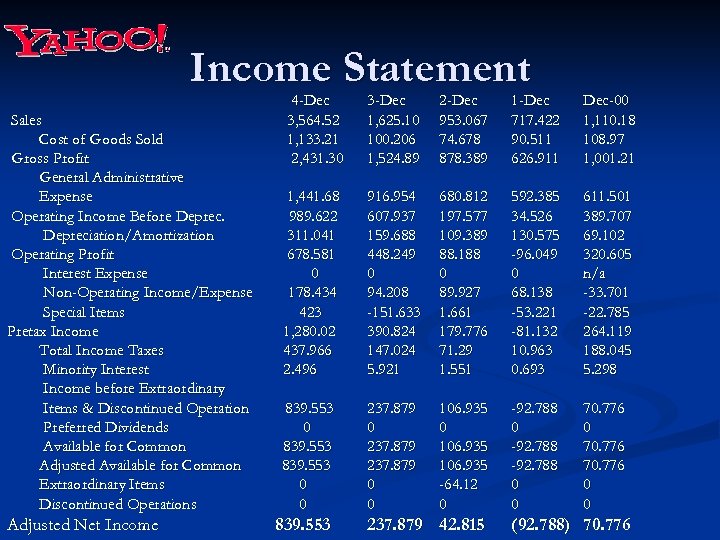

Summary of Income Statement

Income Statement Sales Cost of Goods Sold Gross Profit General Administrative Expense Operating Income Before Depreciation/Amortization Operating Profit Interest Expense Non-Operating Income/Expense Special Items Pretax Income Total Income Taxes Minority Interest Income before Extraordinary Items & Discontinued Operation Preferred Dividends Available for Common Adjusted Available for Common Extraordinary Items Discontinued Operations Adjusted Net Income 4 -Dec 3, 564. 52 1, 133. 21 2, 431. 30 3 -Dec 1, 625. 10 100. 206 1, 524. 89 2 -Dec 953. 067 74. 678 878. 389 1 -Dec 717. 422 90. 511 626. 911 Dec-00 1, 110. 18 108. 97 1, 001. 21 1, 441. 68 989. 622 311. 041 678. 581 0 178. 434 423 1, 280. 02 437. 966 2. 496 916. 954 607. 937 159. 688 448. 249 0 94. 208 -151. 633 390. 824 147. 024 5. 921 680. 812 197. 577 109. 389 88. 188 0 89. 927 1. 661 179. 776 71. 29 1. 551 592. 385 34. 526 130. 575 -96. 049 0 68. 138 -53. 221 -81. 132 10. 963 0. 693 611. 501 389. 707 69. 102 320. 605 n/a -33. 701 -22. 785 264. 119 188. 045 5. 298 839. 553 0 0 237. 879 0 0 106. 935 -64. 12 0 -92. 788 0 0 70. 776 0 0 839. 553 237. 879 42. 815 (92. 788) 70. 776

Income Statement by Segment

Summary of Revenue By Segment

Revenue Analysis

Expense Analysis

Balance Sheet

Summary of Balance Sheet

Debt Payment Due

Cash Flow Analysis

Five Year Key Cash Flow Statement

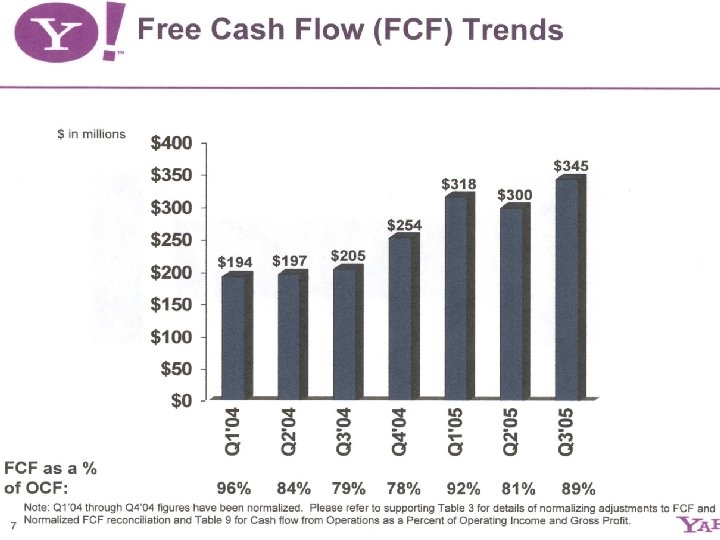

Historical Free Cash Flow

Acquisitions

Acquisition by Segment

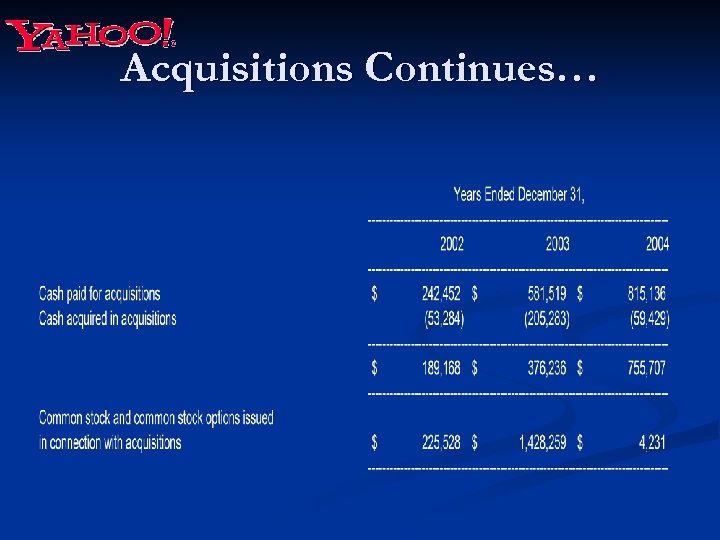

Acquisitions Continues…

Quarterly Analysis

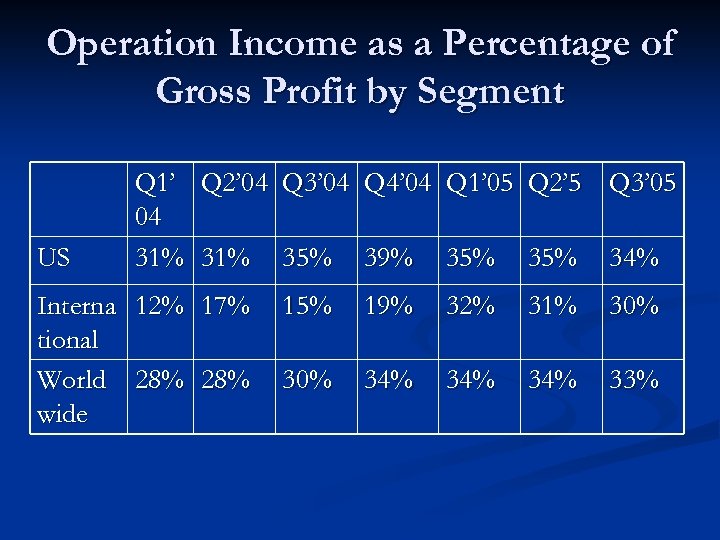

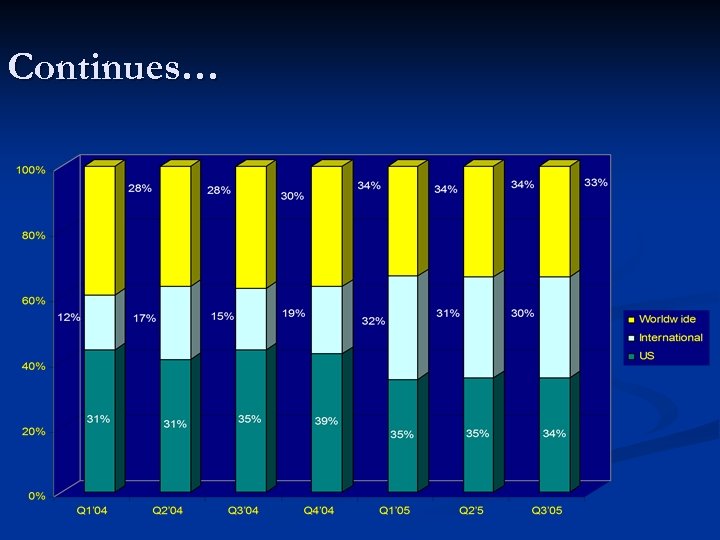

Operation Income as a Percentage of Gross Profit by Segment US Q 1’ Q 2’ 04 Q 3’ 04 Q 4’ 04 Q 1’ 05 Q 2’ 5 Q 3’ 05 04 31% 35% 39% 35% 34% Interna 12% 17% tional World 28% wide 15% 19% 32% 31% 30% 34% 34% 33%

Continues…

Competitor Analysis

Major Competitors Google Inc. n Microsoft Inc. n American Online Inc. n Internet providers and searching engines n

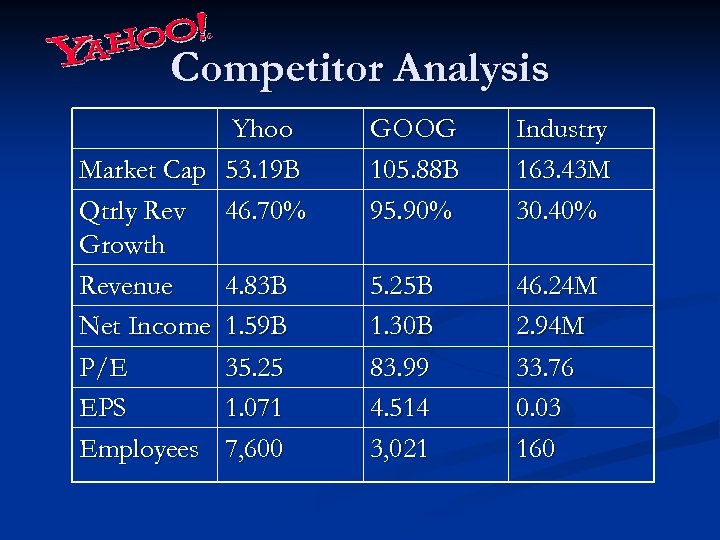

Competitor Analysis Yhoo Market Cap 53. 19 B Qtrly Rev 46. 70% Growth Revenue 4. 83 B Net Income 1. 59 B P/E 35. 25 EPS 1. 071 Employees 7, 600 GOOG 105. 88 B 95. 90% Industry 163. 43 M 30. 40% 5. 25 B 1. 30 B 83. 99 4. 514 3, 021 46. 24 M 2. 94 M 33. 76 0. 03 160

Five Year Competitive Performance

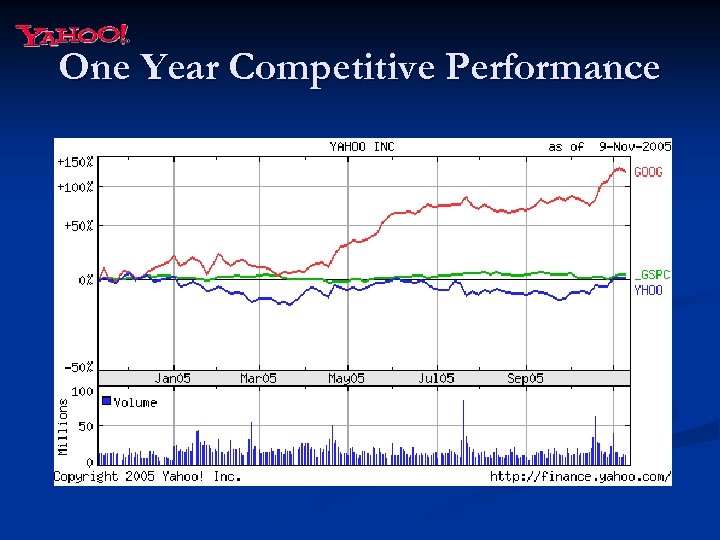

One Year Competitive Performance

Recent Trends n n 10 -12 -05 Microsoft and Yahoo! Announce Landmark Interoperability Agreement to Connect Consumer Instant Messaging Communities Globally 10 -26 -05 Microsoft joins Yahoo on digital library alliance 11 -07 -05 Yahoo! Announces Plans to Purchase Remaining Shares of Yahoo! Europe and Yahoo! Korea 11 -03 -05 Yahoo! Introduces New Mapping Service With Focus On Interactivity, Ease Of Use And Personalization

Philip Fisher Approach n Functional Factors n n People Factors n n Experienced officers and directors Essential Business Characteristic n n Focus on customer experienced by convenience, and wide selection of products and services through on – line Fierce competition and strategic alliances Value of stock n n n High P/E No dividend Risk is high

Result? ? ? n HOLD n Watch the news regarding Yahoo and Microsoft digital alliance

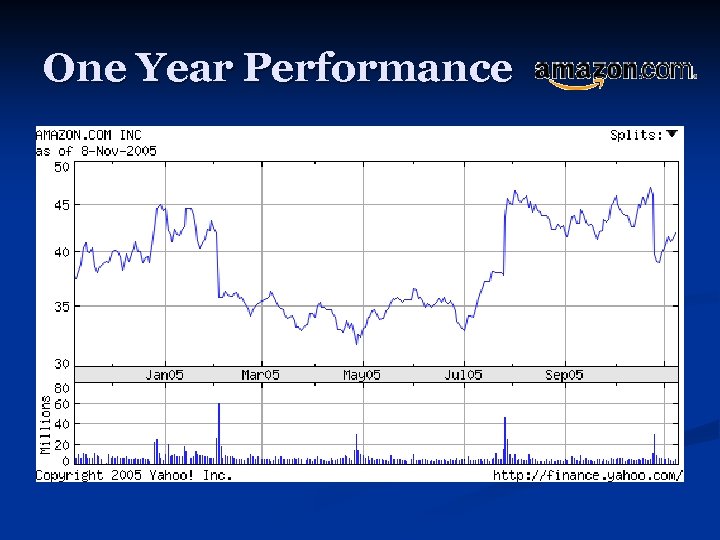

Financial Analysis as of Nov 8 n n n n Symbol : AMZN Listed in Nasdaq stock market # of shares outstanding : 410, 690, 180 Stock price : $ 41. 95 Market Capitalization : $17. 39 B 52 -week high : $47. 00 low : $30. 60 Dividend : Never paid cash dividend

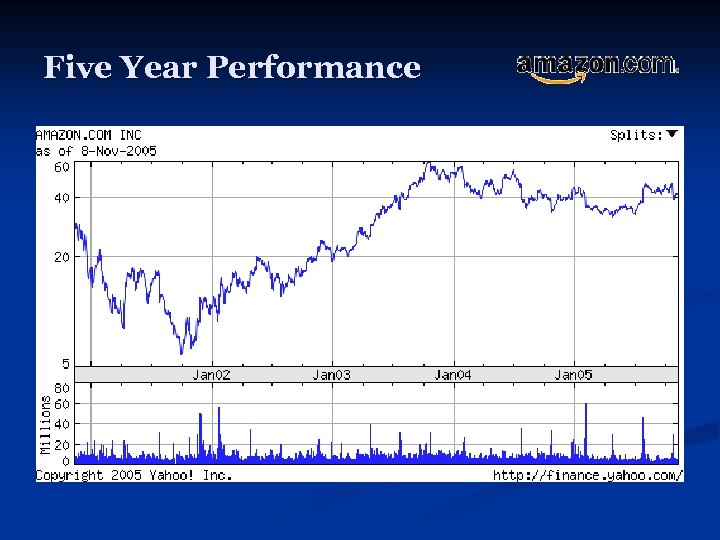

Five Year Performance

History n Incorporated in July 1994 by founder and CEO Jeff P. Bezos. n Opened the virtual doors of Amazon. com's online store in July 1995. n Went public on May 15, 1997, and the price was $18. 00, n $1. 50 adjusted for the stocks splits that occurred on June 2, 1998 (2 -for-1 split), January 5, 1999 (3 -for-1 split), and September 1, 1999 (2 -for-1 split).

Corporate Committee n n n n n Jeffrey P. Bezos – Founder, President, and CEO as well as Chairman of the board since 1994 Rick Dalzell – Senior VP, Worldwide Architecture and Platform software, and Chief Information Officer since 2001. (Joined amazon. com in 1997) Jeffrey Holden – Senior VP, Discovery since 2005. (Joined Amazon. com in 1997) Jason Kilar – Senior VP, Worldwide Application Software since 2003 (Joined Amazon. com in 1997) Mark S. Peek – VP, Chief Accounting Officer since 2000 Tom Szkutak – Senior VP, Chief Financial Officer since 2002 (former CFO of GE) Diego Piacentini – Senior VP, Worldwide retail and marketing since 2000 Kal Raman – Senior VP, Worldwide hardlines retail since 2004 (former CEO of drugstore. com) Jeff Wilke – Senior VP, Worldwide operation and customer service since 1999 (Former GM of pharmaceutical fine chemicals)

Qualitative Analysis n Business Strategy n Price (low everyday product pricing and free shipping cost) n Convenience (easy to use program) n Such as 1 Click ® technology, secure payment system n Selection (widest possible selection) n Baby care products, office supplies, electronics n Competition Ø Physical world retailer, catalog retailer, publishers, vendors Ø Other online e commerce sites: ebay Ø Indirect competitors, including media companies, web search engines Ø Companies that provide e-commerce services

Qualitative Analysis n Operates in seven retail websites Ø US, Canada, UK, Germany, Japan, and France n Intellectual property Ø n They regard their trademarks, service marks, copyrights, patents, domain names, trade dress, trade secrets, proprietary technologies, and similar intellectual property as critical to their success Employees n 9, 000 full-time and part-time employees at December 31, 2004. Also utilize independent contractors and temporary personnel on a seasonal basis. None of the employees is represented by a labor union. Competition for qualified personnel in the industry is intense, particularly for software engineers, computer scientists, and other technical staff.

Consolidated Financial Statement

Risk Factors n n n n n Foreign exchange risk Accumulated deficit and may incur additional losses Significant indebtedness Intense competition Expansion into international market segments may not be successful The seasonality of business places increased strain on operations Recent acquisition of Joyo. com creates risks and uncertainties relating to the laws of people’s republic of China Dependency of particular key senior management System interruption and the lack of integration and redundancy in the system affect sales Significant inventory risk

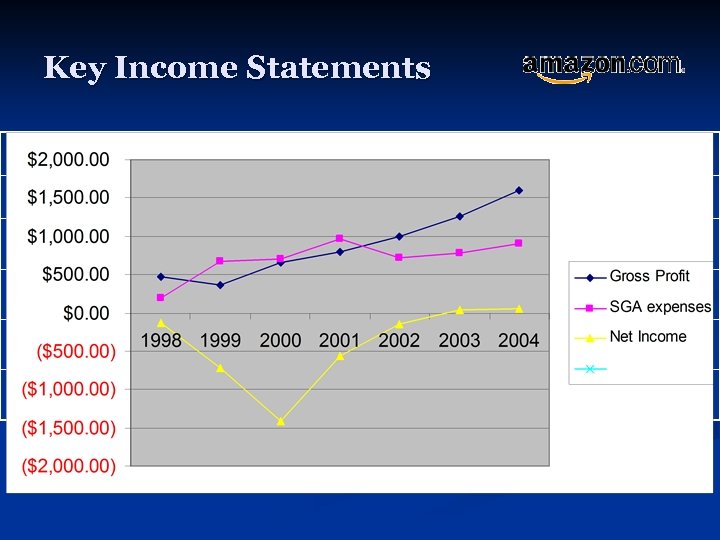

Key Income Statements 2004 2003 2002 2001 2000 1999 1998 Net sales $6, 921 $5, 264 $3, 933 $3, 123 $2, 762 $1, 639. 80 $610 Cost of sales $5, 319 $4, 006 $2, 941 $2, 324 $2, 105. 20 $1, 281. 80 $145. 9 Gross Profit $1, 602 $1258 $992 $799 $656. 8 $358 $464. 1 SGA expenses $910. 38 $778. 76 $712. 88 $969. 65 $703. 45 $673. 7 $195. 6 Net Income $58 $35 $(149) $(567) $(1, 411. 27) $(720) $(124. 5)

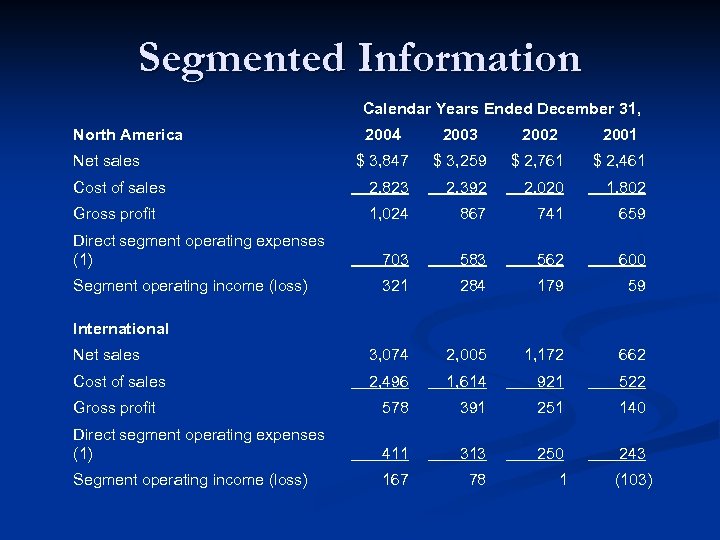

Segmented Information Calendar Years Ended December 31, North America 2004 2003 2002 2001 $ 3, 847 $ 3, 259 $ 2, 761 $ 2, 461 Cost of sales 2, 823 2, 392 2, 020 1, 802 Gross profit 1, 024 867 741 659 Direct segment operating expenses (1) 703 583 562 600 Segment operating income (loss) 321 284 179 59 Net sales 3, 074 2, 005 1, 172 662 Cost of sales 2, 496 1, 614 921 522 Gross profit 578 391 251 140 Direct segment operating expenses (1) 411 313 250 243 Segment operating income (loss) 167 78 1 Net sales International (103)

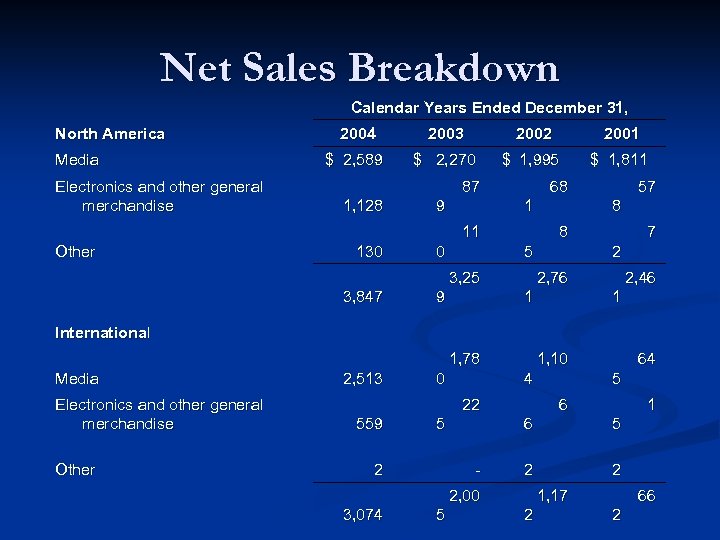

Net Sales Breakdown Calendar Years Ended December 31, North America Media Electronics and other general merchandise 2004 2003 2002 2001 $ 2, 589 $ 2, 270 $ 1, 995 $ 1, 811 87 1, 128 9 68 1 11 Other 130 0 8 8 5 3, 25 3, 847 9 57 7 2 2, 76 1 2, 46 1 International 1, 78 Media Electronics and other general merchandise Other 2, 513 0 1, 10 4 22 559 5 2 1 6 - 5 5 6 5 2 2 2, 00 3, 074 64 1, 17 2 66 2

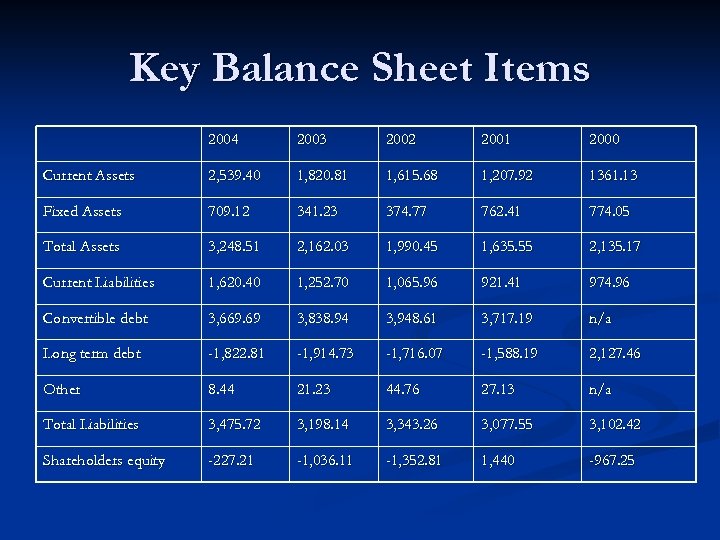

Key Balance Sheet Items 2004 2003 2002 2001 2000 Current Assets 2, 539. 40 1, 820. 81 1, 615. 68 1, 207. 92 1361. 13 Fixed Assets 709. 12 341. 23 374. 77 762. 41 774. 05 Total Assets 3, 248. 51 2, 162. 03 1, 990. 45 1, 635. 55 2, 135. 17 Current Liabilities 1, 620. 40 1, 252. 70 1, 065. 96 921. 41 974. 96 Convertible debt 3, 669. 69 3, 838. 94 3, 948. 61 3, 717. 19 n/a Long term debt -1, 822. 81 -1, 914. 73 -1, 716. 07 -1, 588. 19 2, 127. 46 Other 8. 44 21. 23 44. 76 27. 13 n/a Total Liabilities 3, 475. 72 3, 198. 14 3, 343. 26 3, 077. 55 3, 102. 42 Shareholders equity -227. 21 -1, 036. 11 -1, 352. 81 1, 440 -967. 25

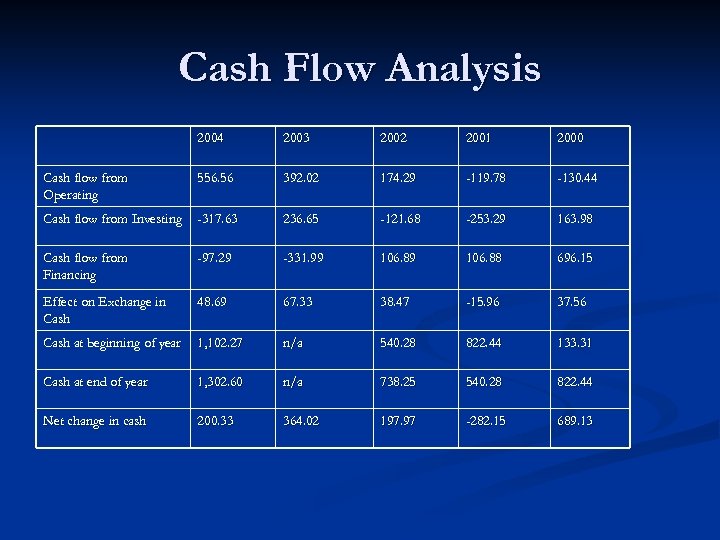

Cash Flow Analysis 2004 2003 2002 2001 2000 Cash flow from Operating 556. 56 392. 02 174. 29 -119. 78 -130. 44 Cash flow from Investing -317. 63 236. 65 -121. 68 -253. 29 163. 98 Cash flow from Financing -97. 29 -331. 99 106. 88 696. 15 Effect on Exchange in Cash 48. 69 67. 33 38. 47 -15. 96 37. 56 Cash at beginning of year 1, 102. 27 n/a 540. 28 822. 44 133. 31 Cash at end of year 1, 302. 60 n/a 738. 25 540. 28 822. 44 Net change in cash 200. 33 364. 02 197. 97 -282. 15 689. 13

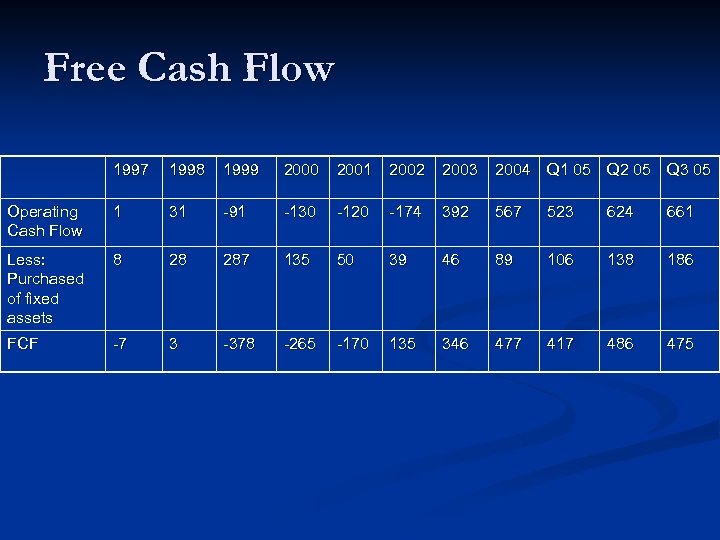

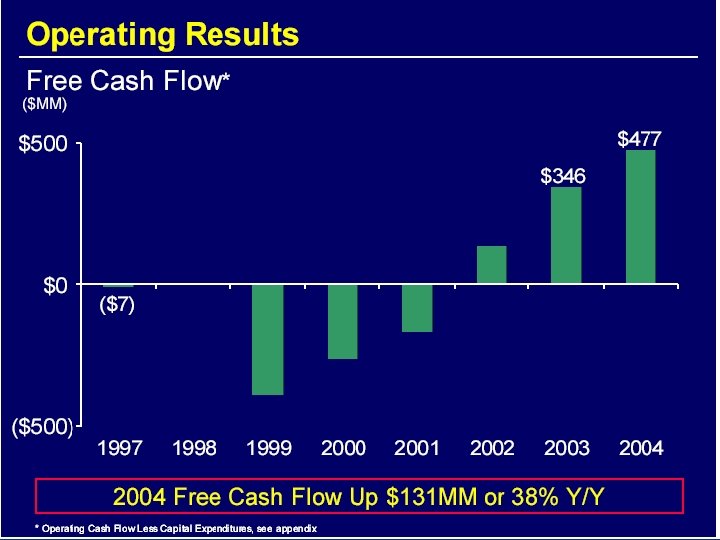

Free Cash Flow 1997 1998 1999 2000 2001 2002 2003 2004 Q 1 05 Q 2 05 Q 3 05 Operating Cash Flow 1 31 -91 -130 -120 -174 392 567 523 624 661 Less: Purchased of fixed assets 8 28 287 135 50 39 46 89 106 138 186 FCF -7 3 -378 -265 -170 135 346 477 417 486 475

One Year Performance

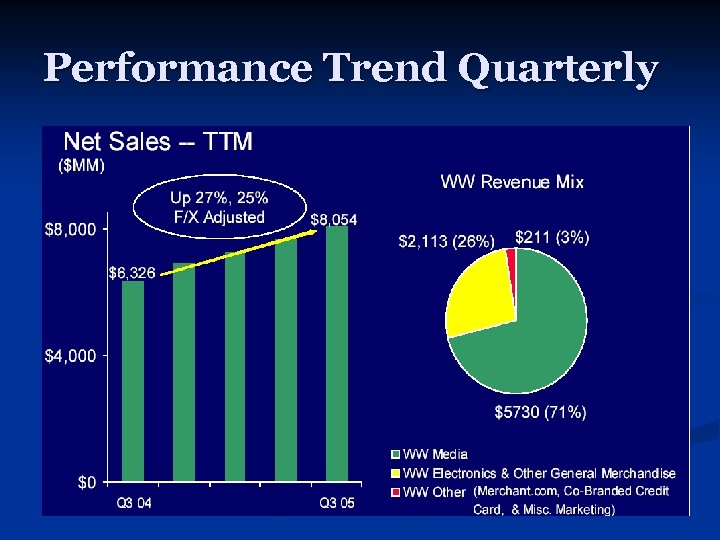

Performance Trend Quarterly

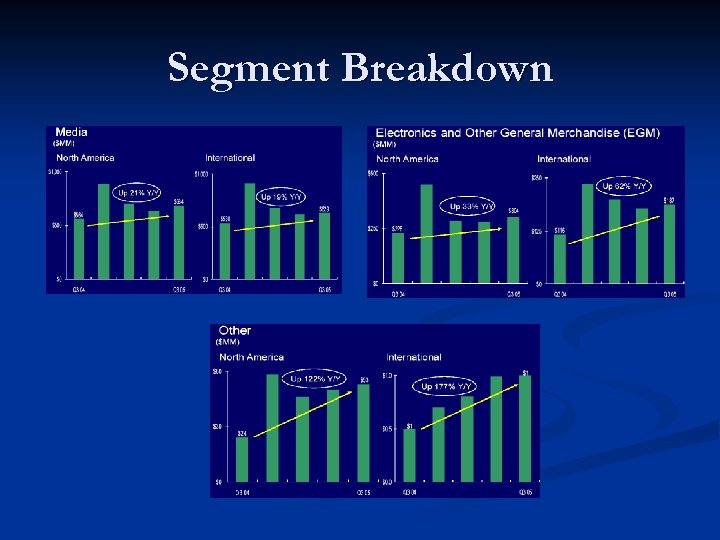

Segment Breakdown

Expected Performance in 2005 n Net sales are expected to be between $8. 373 billion and $8. 673 billion, or grow between 21% and 25%, compared with 2004. n Operating income is expected to be between $403 million and $478 million, or between (9%) decline and 8% growth, compared with 2004.

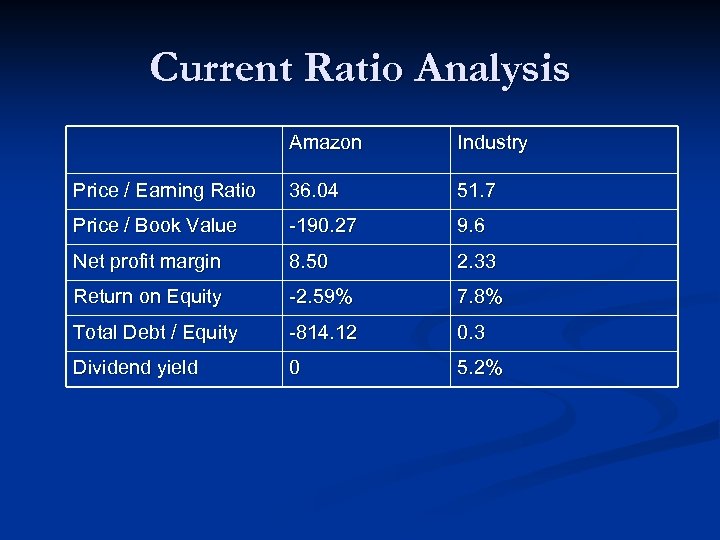

Current Ratio Analysis Amazon Industry Price / Earning Ratio 36. 04 51. 7 Price / Book Value -190. 27 9. 6 Net profit margin 8. 50 2. 33 Return on Equity -2. 59% 7. 8% Total Debt / Equity -814. 12 0. 3 Dividend yield 0 5. 2%

Philip Fisher Approach n Functional Factors n n People Factors n n Experienced officers and directors Essential Business Characteristic n n Focus on customer experienced by offering low price, convenience, wide selection of products Fierce competition Value of stock n n n High P/E No dividend Stock price is highly volatile

Recommendation HOLD

Sources http: //yhoo. client. shareholder. com/index. cfm n www. amazon. com n Research Insight n Previous Internet Presentation n

c5183b924ea0ff9269d5446bb329913f.ppt