2f8cc48679f33c5b406f770e3e525b3f.ppt

- Количество слайдов: 139

US Chemicals & Gases Sunny Chan l Randy Yoon l Jason Seo l Duc Nguyen

US Chemicals & Gases Sunny Chan l Randy Yoon l Jason Seo l Duc Nguyen

Agenda Industry Overview Du Pont Monsanto Praxiar

Agenda Industry Overview Du Pont Monsanto Praxiar

Chemical application Transportation Textile Automotive Personal and home care Building and construction Health and nutrition Aerospace Packaging Fiber – optics Electronics Water treatment

Chemical application Transportation Textile Automotive Personal and home care Building and construction Health and nutrition Aerospace Packaging Fiber – optics Electronics Water treatment

Industry Overview Global Chemical industry valued at $2. 4 trillion US Approx. 25% of industry from pharmaceutical output 35 -40% dominated by petrochemical 35 -40% controlled by inorganic chemicals

Industry Overview Global Chemical industry valued at $2. 4 trillion US Approx. 25% of industry from pharmaceutical output 35 -40% dominated by petrochemical 35 -40% controlled by inorganic chemicals

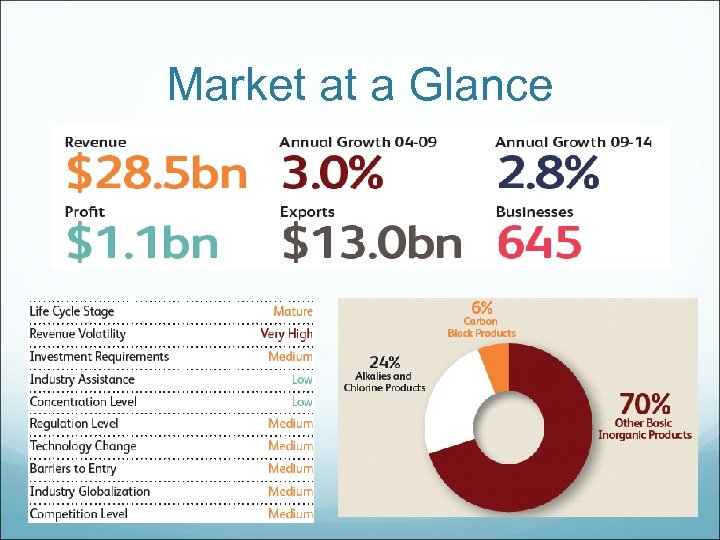

Market at a Glance

Market at a Glance

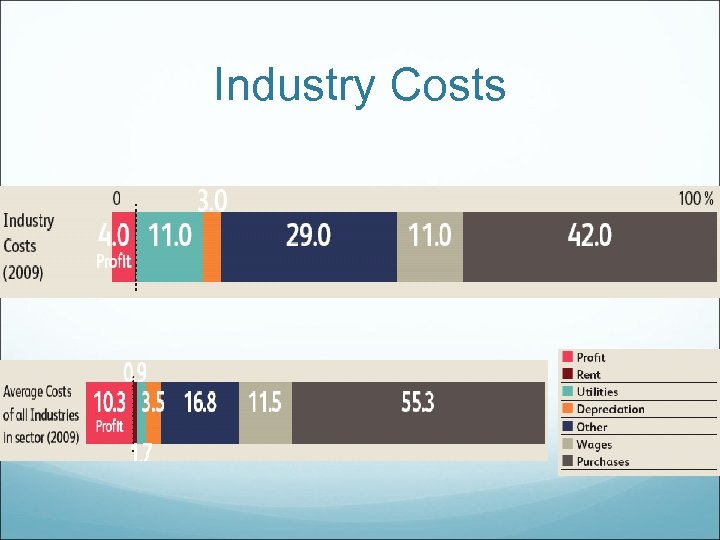

Industry Costs

Industry Costs

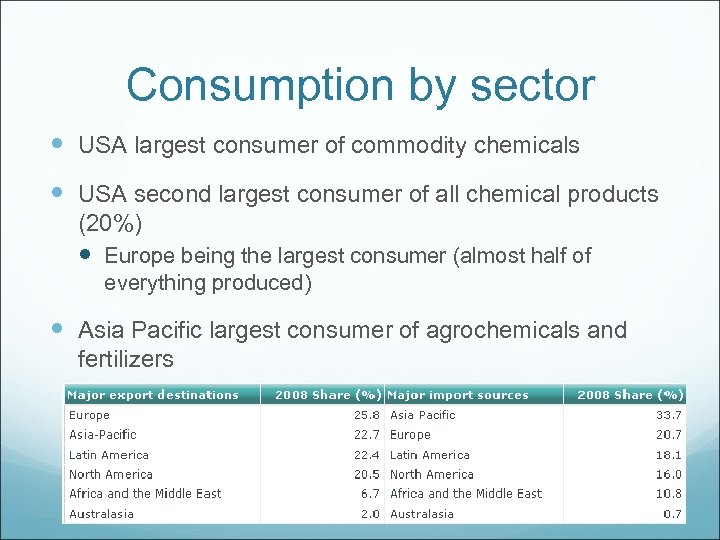

Consumption by sector USA largest consumer of commodity chemicals USA second largest consumer of all chemical products (20%) Europe being the largest consumer (almost half of everything produced) Asia Pacific largest consumer of agrochemicals and fertilizers

Consumption by sector USA largest consumer of commodity chemicals USA second largest consumer of all chemical products (20%) Europe being the largest consumer (almost half of everything produced) Asia Pacific largest consumer of agrochemicals and fertilizers

Major Players Monsanto Company-$41. 1 B Du. Pont - $30. 6 B Dow Chemical - $28. 0 B Praxiar - $25. 4 B Others include Air Products, PPG Industries, Mosaic, etc…

Major Players Monsanto Company-$41. 1 B Du. Pont - $30. 6 B Dow Chemical - $28. 0 B Praxiar - $25. 4 B Others include Air Products, PPG Industries, Mosaic, etc…

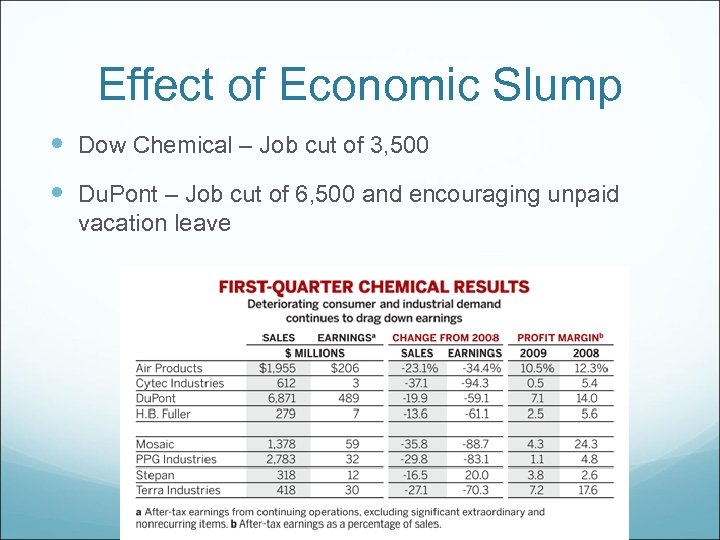

Effect of Economic Slump Dow Chemical – Job cut of 3, 500 Du. Pont – Job cut of 6, 500 and encouraging unpaid vacation leave

Effect of Economic Slump Dow Chemical – Job cut of 3, 500 Du. Pont – Job cut of 6, 500 and encouraging unpaid vacation leave

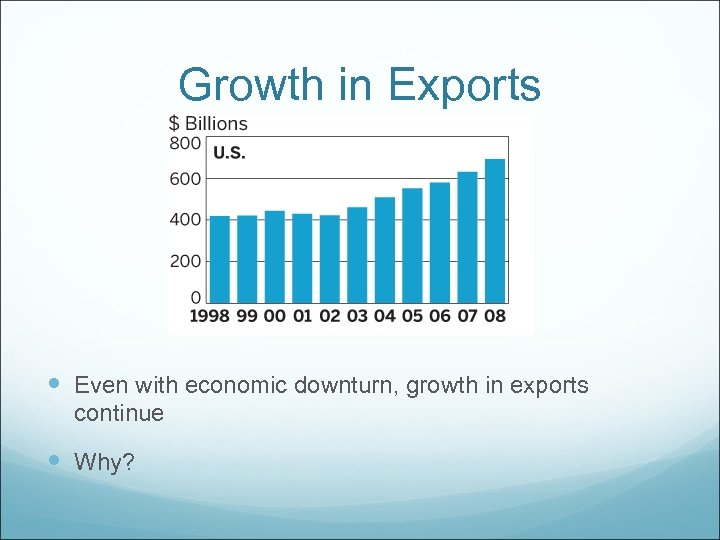

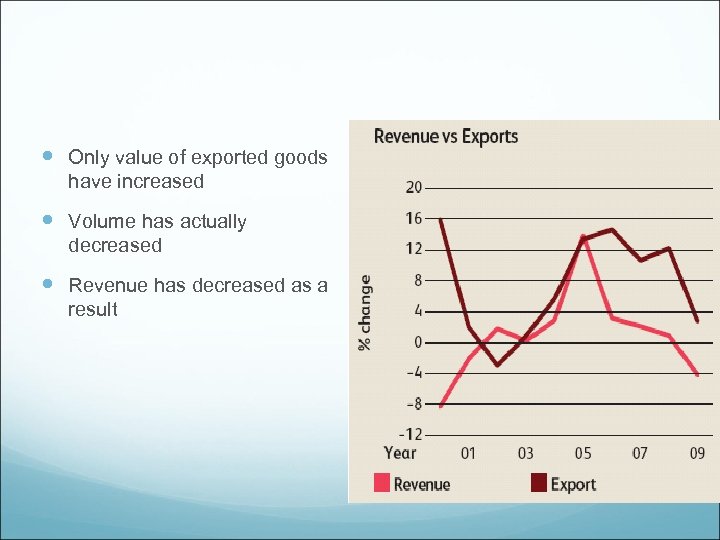

Growth in Exports Even with economic downturn, growth in exports continue Why?

Growth in Exports Even with economic downturn, growth in exports continue Why?

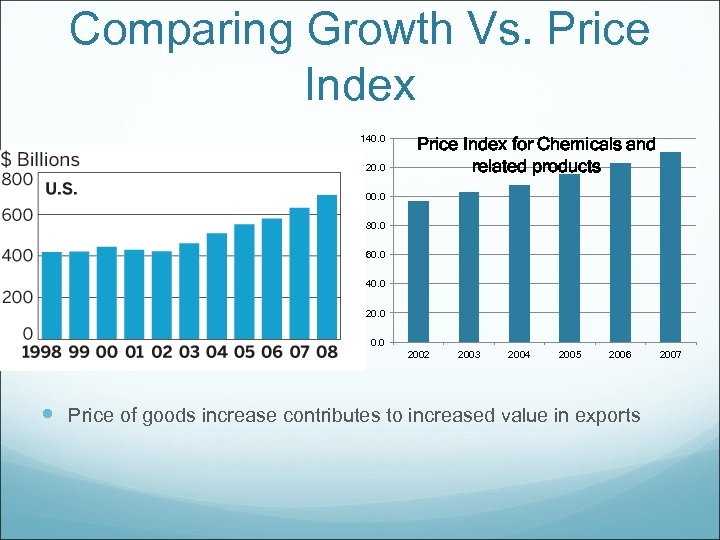

Comparing Growth Vs. Price Index 140. 0 120. 0 Price Index for Chemicals and related products 100. 0 80. 0 60. 0 40. 0 2002 2003 2004 2005 2006 Price of goods increase contributes to increased value in exports 2007

Comparing Growth Vs. Price Index 140. 0 120. 0 Price Index for Chemicals and related products 100. 0 80. 0 60. 0 40. 0 2002 2003 2004 2005 2006 Price of goods increase contributes to increased value in exports 2007

Only value of exported goods have increased Volume has actually decreased Revenue has decreased as a result

Only value of exported goods have increased Volume has actually decreased Revenue has decreased as a result

Agricultural Chemical Products Seeds and genomic New seeds ensure optimal yield Better tasting food More nutrients Faster growth cycles Higher yield Crop protection, pesticides Growth regulator Protein or hormone for animals

Agricultural Chemical Products Seeds and genomic New seeds ensure optimal yield Better tasting food More nutrients Faster growth cycles Higher yield Crop protection, pesticides Growth regulator Protein or hormone for animals

Corn Prices

Corn Prices

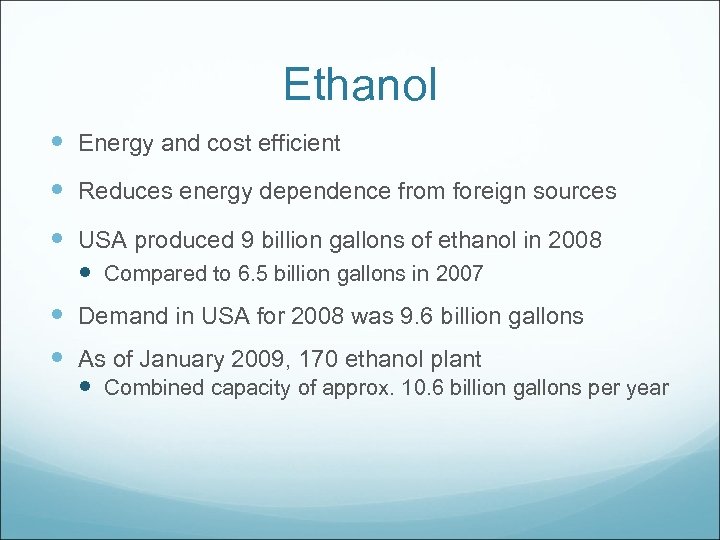

Ethanol Energy and cost efficient Reduces energy dependence from foreign sources USA produced 9 billion gallons of ethanol in 2008 Compared to 6. 5 billion gallons in 2007 Demand in USA for 2008 was 9. 6 billion gallons As of January 2009, 170 ethanol plant Combined capacity of approx. 10. 6 billion gallons per year

Ethanol Energy and cost efficient Reduces energy dependence from foreign sources USA produced 9 billion gallons of ethanol in 2008 Compared to 6. 5 billion gallons in 2007 Demand in USA for 2008 was 9. 6 billion gallons As of January 2009, 170 ethanol plant Combined capacity of approx. 10. 6 billion gallons per year

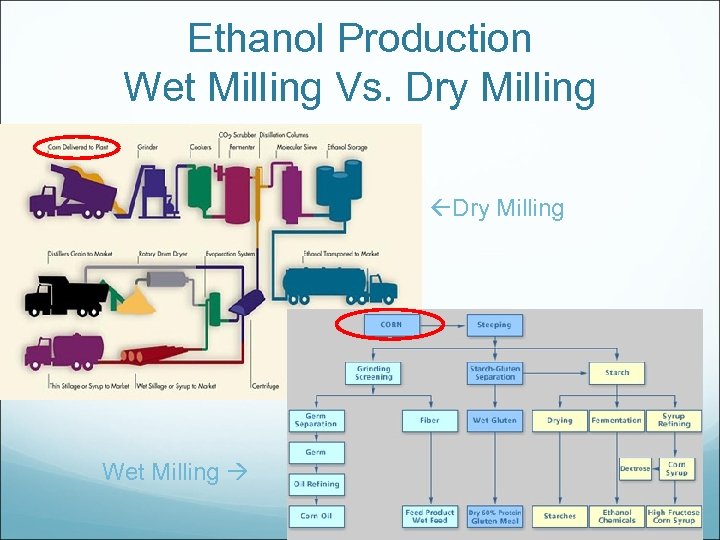

Ethanol Production Wet Milling Vs. Dry Milling Wet Milling

Ethanol Production Wet Milling Vs. Dry Milling Wet Milling

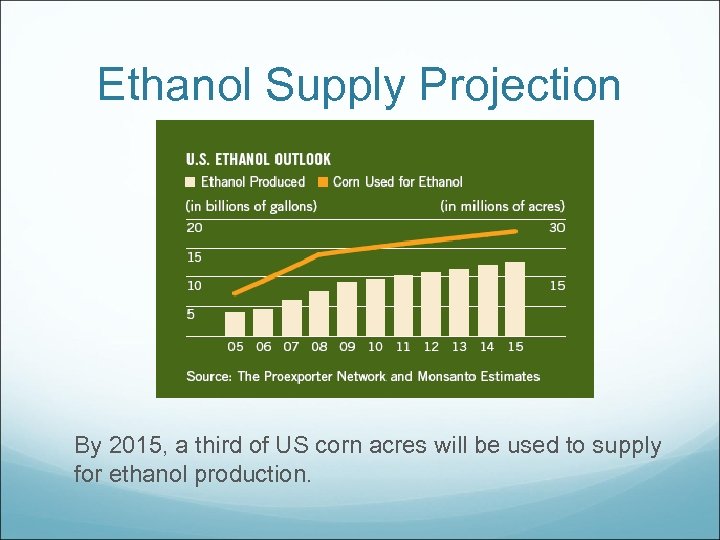

Ethanol Supply Projection By 2015, a third of US corn acres will be used to supply for ethanol production.

Ethanol Supply Projection By 2015, a third of US corn acres will be used to supply for ethanol production.

Inorganic chemical Chemicals that are often of a mineral origin but are not of a basic carbon molecular Products produced by this industry are intermediate products used as basic chemicals in industrial processes or manufacturing products. Key identifiable product segments: Chlor-alkali products Carbon black products Common gases

Inorganic chemical Chemicals that are often of a mineral origin but are not of a basic carbon molecular Products produced by this industry are intermediate products used as basic chemicals in industrial processes or manufacturing products. Key identifiable product segments: Chlor-alkali products Carbon black products Common gases

Carbon black common uses Created from soot of burning hydrocarbons 70% used in automobile tires Pigment Reinforcing – conducts heat away from tread to reduce tread loss Photocopier and laser printer toner Carbon paper Production of other rubber products

Carbon black common uses Created from soot of burning hydrocarbons 70% used in automobile tires Pigment Reinforcing – conducts heat away from tread to reduce tread loss Photocopier and laser printer toner Carbon paper Production of other rubber products

Applications of Nitrogen Liquid nitrogen - used to freeze soft or tough substances prior to their entering a size reduction process. Metals - manufacture of steel and other metals Manufacturing and Construction - shrink fitting Cooling needs - Chemicals, Pharmaceuticals and Petroleum, Rubber and Plastics (refineries use Nitrogen to cool reactors filled with catalyst during maintenance work to reduce cooling time), food and beverages, health care (storing donated blood, livestock semen), etc…

Applications of Nitrogen Liquid nitrogen - used to freeze soft or tough substances prior to their entering a size reduction process. Metals - manufacture of steel and other metals Manufacturing and Construction - shrink fitting Cooling needs - Chemicals, Pharmaceuticals and Petroleum, Rubber and Plastics (refineries use Nitrogen to cool reactors filled with catalyst during maintenance work to reduce cooling time), food and beverages, health care (storing donated blood, livestock semen), etc…

Application of Oxygen Metals steel industry relies heavily on the use of oxygen to enrich air and increase combustion temperatures in blast furnaces Chemicals, Pharmaceuticals and Petroleum oxidation processes Functions as catalysts in refineries, helps increase capacity Destruction of hazardous and waste materials in incinerators.

Application of Oxygen Metals steel industry relies heavily on the use of oxygen to enrich air and increase combustion temperatures in blast furnaces Chemicals, Pharmaceuticals and Petroleum oxidation processes Functions as catalysts in refineries, helps increase capacity Destruction of hazardous and waste materials in incinerators.

Application of Argon Metals - used as a blowing gas during manufacture of higher quality steels (aluminum, titanium) Manufacturing and Construction- filler gas in fluorescent and incandescent light bulbs, glass panels of high-efficiency thermopane Electronics – used in manufacture of silicone and germanium crystals used in the semiconductor industry.

Application of Argon Metals - used as a blowing gas during manufacture of higher quality steels (aluminum, titanium) Manufacturing and Construction- filler gas in fluorescent and incandescent light bulbs, glass panels of high-efficiency thermopane Electronics – used in manufacture of silicone and germanium crystals used in the semiconductor industry.

Manufacture Most cost effective method Used to produce oxygen, nitrogen, argon Purity levels above 99% by using cryogenic method Adsorption based and membrane methods also used Separates compressed gases into desired products Cheaper than Cryogenic method

Manufacture Most cost effective method Used to produce oxygen, nitrogen, argon Purity levels above 99% by using cryogenic method Adsorption based and membrane methods also used Separates compressed gases into desired products Cheaper than Cryogenic method

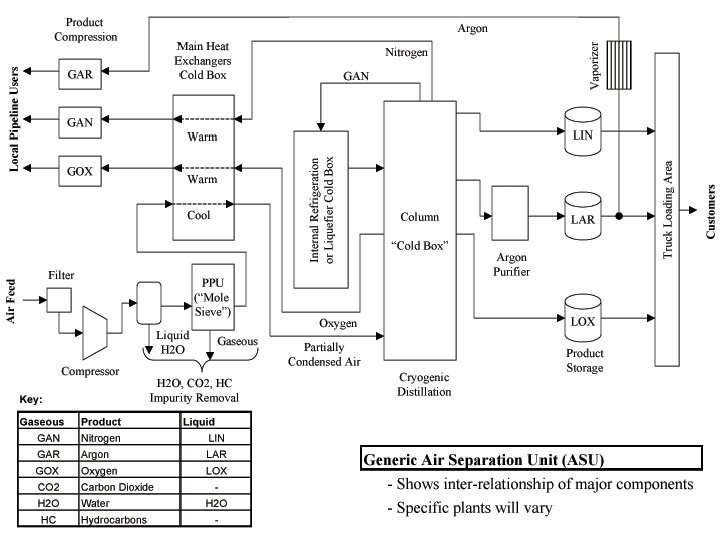

Cryogenic

Cryogenic

Future of the Industry R & D focused on sustainability Reduction in pollution (CO 2) Lower cost of manufacturing Water conservation

Future of the Industry R & D focused on sustainability Reduction in pollution (CO 2) Lower cost of manufacturing Water conservation

Stock Performance

Stock Performance

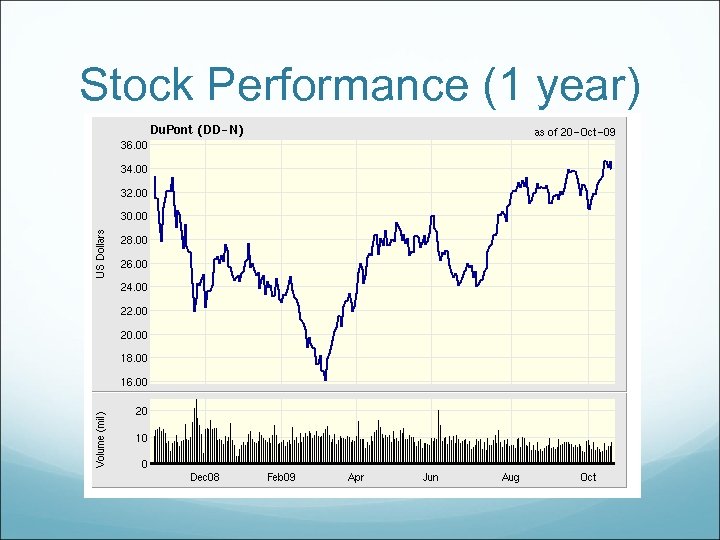

Stock Performance (1 year)

Stock Performance (1 year)

Stock Performance (5 years)

Stock Performance (5 years)

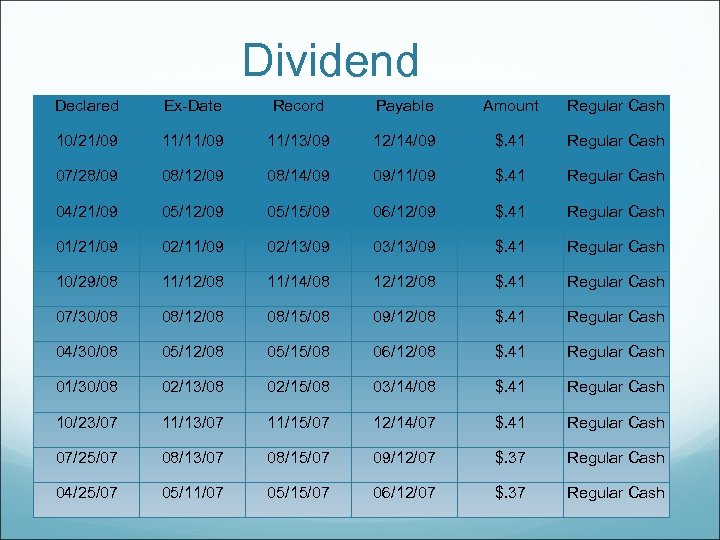

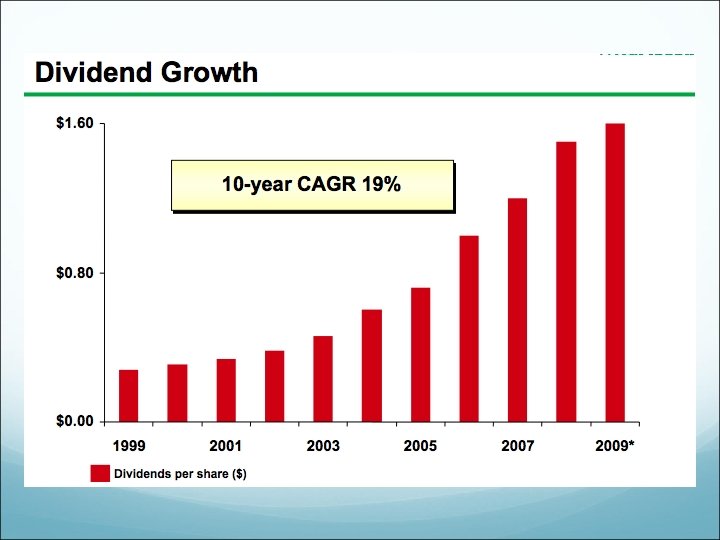

Dividend Declared Ex-Date Record Payable Amount Regular Cash 10/21/09 11/13/09 12/14/09 $. 41 Regular Cash 07/28/09 08/12/09 08/14/09 09/11/09 $. 41 Regular Cash 04/21/09 05/12/09 05/15/09 06/12/09 $. 41 Regular Cash 01/21/09 02/13/09 03/13/09 $. 41 Regular Cash 10/29/08 11/12/08 11/14/08 12/12/08 $. 41 Regular Cash 07/30/08 08/12/08 08/15/08 09/12/08 $. 41 Regular Cash 04/30/08 05/12/08 05/15/08 06/12/08 $. 41 Regular Cash 01/30/08 02/13/08 02/15/08 03/14/08 $. 41 Regular Cash 10/23/07 11/15/07 12/14/07 $. 41 Regular Cash 07/25/07 08/13/07 08/15/07 09/12/07 $. 37 Regular Cash 04/25/07 05/11/07 05/15/07 06/12/07 $. 37 Regular Cash

Dividend Declared Ex-Date Record Payable Amount Regular Cash 10/21/09 11/13/09 12/14/09 $. 41 Regular Cash 07/28/09 08/12/09 08/14/09 09/11/09 $. 41 Regular Cash 04/21/09 05/12/09 05/15/09 06/12/09 $. 41 Regular Cash 01/21/09 02/13/09 03/13/09 $. 41 Regular Cash 10/29/08 11/12/08 11/14/08 12/12/08 $. 41 Regular Cash 07/30/08 08/12/08 08/15/08 09/12/08 $. 41 Regular Cash 04/30/08 05/12/08 05/15/08 06/12/08 $. 41 Regular Cash 01/30/08 02/13/08 02/15/08 03/14/08 $. 41 Regular Cash 10/23/07 11/15/07 12/14/07 $. 41 Regular Cash 07/25/07 08/13/07 08/15/07 09/12/07 $. 37 Regular Cash 04/25/07 05/11/07 05/15/07 06/12/07 $. 37 Regular Cash

Products and Services Five market- and technology-focused growth platforms • Agriculture & Nutrition • Coatings & Color Technologies • Electronic & Communication Technologies • Performance Materials • Safety & Protection

Products and Services Five market- and technology-focused growth platforms • Agriculture & Nutrition • Coatings & Color Technologies • Electronic & Communication Technologies • Performance Materials • Safety & Protection

Agriculture & Nutrition Animal Health Solution Crop Protection Land & Pasture Management Pioneer® Seeds & Inoculants Professional Pest Management Turf & Ornamental/Green Industry Vegetation Management

Agriculture & Nutrition Animal Health Solution Crop Protection Land & Pasture Management Pioneer® Seeds & Inoculants Professional Pest Management Turf & Ornamental/Green Industry Vegetation Management

Coatings & Color Technologies Automotive Systems Automotive refinishes Industrial Coatings Power Coatings Ink Jet

Coatings & Color Technologies Automotive Systems Automotive refinishes Industrial Coatings Power Coatings Ink Jet

Electronic & Communication Technologies Displays (LCD etc. ) Semiconductor Fabrication Materials Semiconductor Packaging & Circuit Materials

Electronic & Communication Technologies Displays (LCD etc. ) Semiconductor Fabrication Materials Semiconductor Packaging & Circuit Materials

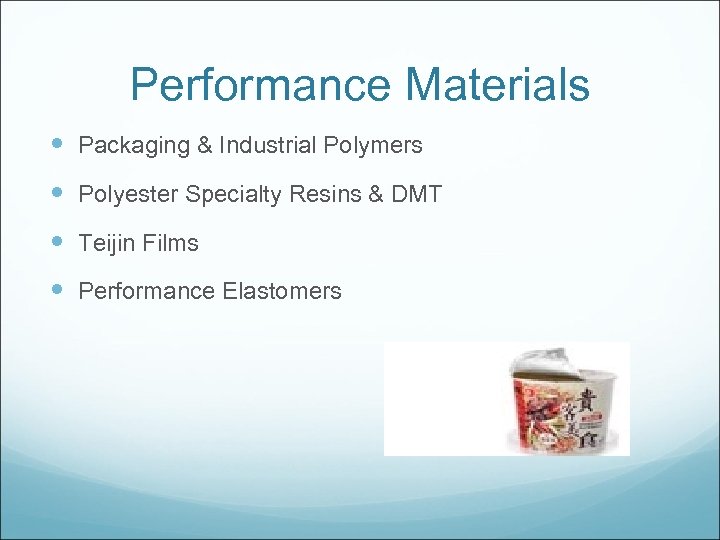

Performance Materials Packaging & Industrial Polymers Polyester Specialty Resins & DMT Teijin Films Performance Elastomers

Performance Materials Packaging & Industrial Polymers Polyester Specialty Resins & DMT Teijin Films Performance Elastomers

Safety & Protection Consulting Services & Safety Products Emergency Response Industrial Safety & Haz. Mat Law Enforcement & Military

Safety & Protection Consulting Services & Safety Products Emergency Response Industrial Safety & Haz. Mat Law Enforcement & Military

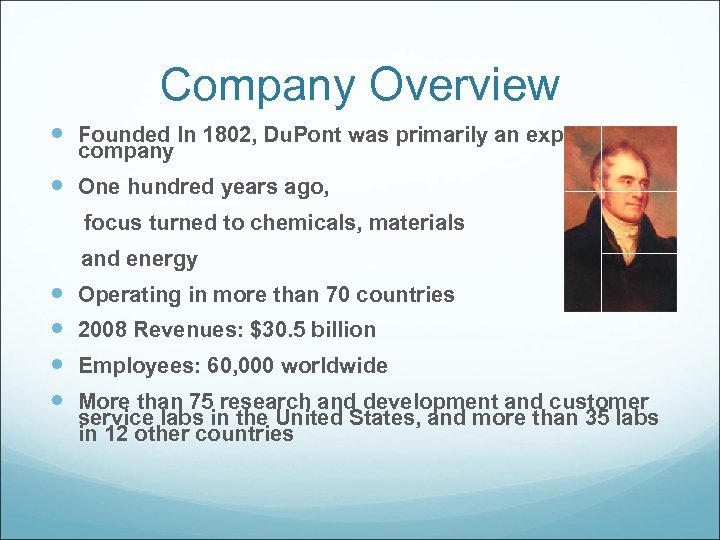

Company Overview Founded In 1802, Du. Pont was primarily an explosives company One hundred years ago, focus turned to chemicals, materials and energy Operating in more than 70 countries 2008 Revenues: $30. 5 billion Employees: 60, 000 worldwide More than 75 research and development and customer service labs in the United States, and more than 35 labs in 12 other countries

Company Overview Founded In 1802, Du. Pont was primarily an explosives company One hundred years ago, focus turned to chemicals, materials and energy Operating in more than 70 countries 2008 Revenues: $30. 5 billion Employees: 60, 000 worldwide More than 75 research and development and customer service labs in the United States, and more than 35 labs in 12 other countries

Management § Ellen J. Kullman § Chief Executive Officer of Du. Pont since § § Jan. 1, 2009 She has been with Du. Pont for more than 20 years Joined Du. Pont as marketing manager in the Medical Imaging business. Bachelor of science degree in mechanical engineering; master's degree in management. Annual Salary: $0. 70 M

Management § Ellen J. Kullman § Chief Executive Officer of Du. Pont since § § Jan. 1, 2009 She has been with Du. Pont for more than 20 years Joined Du. Pont as marketing manager in the Medical Imaging business. Bachelor of science degree in mechanical engineering; master's degree in management. Annual Salary: $0. 70 M

Management § Charles O. Holliday, Jr § § Chairman of the Board § § Bachelor's degree in industrial engineering He started at Du. Pont in the summer of 1970 He has been with Du. Pont for more than 30 years He became CEO on February 1, 1998 and Chairman on January 1, 1999 A licensed Professional Engineer Owned 315, 838 shares Salary: $ 1. 32 M

Management § Charles O. Holliday, Jr § § Chairman of the Board § § Bachelor's degree in industrial engineering He started at Du. Pont in the summer of 1970 He has been with Du. Pont for more than 30 years He became CEO on February 1, 1998 and Chairman on January 1, 1999 A licensed Professional Engineer Owned 315, 838 shares Salary: $ 1. 32 M

Management § Nicholas C. Fanandakis § Chief Financial Officer and Senior Vice President of § § Du. Pont He joined Du. Pont in 1979 as an accounting and business analyst Assigned to his current position in November 2009 MBA degree from Northeastern University Annual Salary: $0. 5 M

Management § Nicholas C. Fanandakis § Chief Financial Officer and Senior Vice President of § § Du. Pont He joined Du. Pont in 1979 as an accounting and business analyst Assigned to his current position in November 2009 MBA degree from Northeastern University Annual Salary: $0. 5 M

Management § Thomas M. Connelly, Jr. § Executive Vice President and Chief Innovation Officer § Started career with Du. Pont in 1977, as research engineer. § Assigned to his current position in July, 2006 § Doctorate in chemical engineering from University of Cambridge § Annual Salary: $0. 63 M

Management § Thomas M. Connelly, Jr. § Executive Vice President and Chief Innovation Officer § Started career with Du. Pont in 1977, as research engineer. § Assigned to his current position in July, 2006 § Doctorate in chemical engineering from University of Cambridge § Annual Salary: $0. 63 M

Highlights § Du. Pont’s third quarter 2009 earnings were $. 45 per share § Total company sales for third quarter 2009 were $6. 0 billion § Companywide fixed cost reduction and productivity actions boosted third quarter pre-tax earning by $300 million § Cost of raw material, freight cost were 12 % lower than 2008 § New patented Seed Production Technology will reduce the cost

Highlights § Du. Pont’s third quarter 2009 earnings were $. 45 per share § Total company sales for third quarter 2009 were $6. 0 billion § Companywide fixed cost reduction and productivity actions boosted third quarter pre-tax earning by $300 million § Cost of raw material, freight cost were 12 % lower than 2008 § New patented Seed Production Technology will reduce the cost

Suppliers § Utilizes numerous firms as well as internal sources to supply a wide range of raw materials, energy, supplies, services and equipment. § A substantial portion of the production and sales in Performance Materials is dependent upon the availability of hydrocarbon and hydrocarbon derivative feedstocks - purchases from major energy and petrochemical companies § Seed production is performed directly by the company or contracted with independent growers and conditioners.

Suppliers § Utilizes numerous firms as well as internal sources to supply a wide range of raw materials, energy, supplies, services and equipment. § A substantial portion of the production and sales in Performance Materials is dependent upon the availability of hydrocarbon and hydrocarbon derivative feedstocks - purchases from major energy and petrochemical companies § Seed production is performed directly by the company or contracted with independent growers and conditioners.

Major Customers Not materially dependent on a single customer or small group of customers Coatings & Color Technologies and Performance Materials have several large customers, primarily in the automotive original equipment manufacturer (OEM) industry

Major Customers Not materially dependent on a single customer or small group of customers Coatings & Color Technologies and Performance Materials have several large customers, primarily in the automotive original equipment manufacturer (OEM) industry

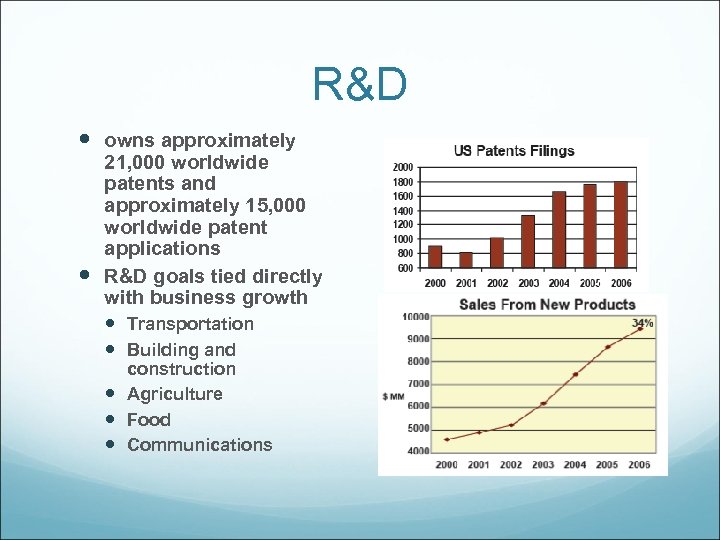

R&D owns approximately 21, 000 worldwide patents and approximately 15, 000 worldwide patent applications R&D goals tied directly with business growth Transportation Building and construction Agriculture Food Communications

R&D owns approximately 21, 000 worldwide patents and approximately 15, 000 worldwide patent applications R&D goals tied directly with business growth Transportation Building and construction Agriculture Food Communications

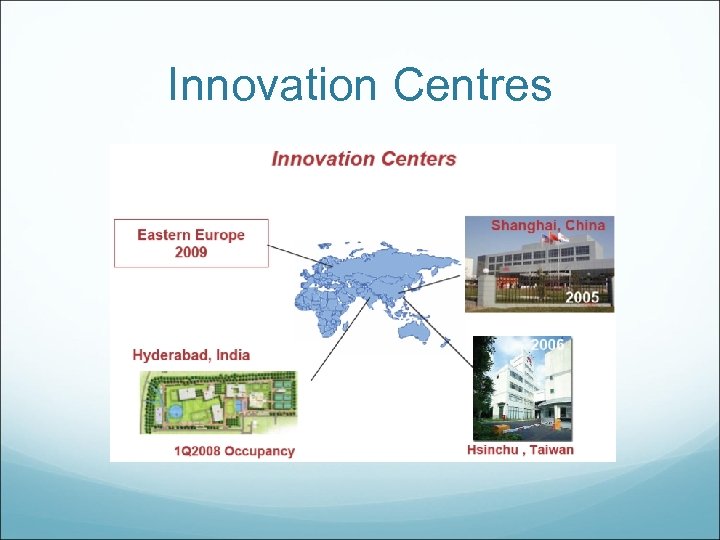

Innovation Centres

Innovation Centres

Risks and Concerns § Agriculture & Nutrition are affected by seasonal patterns. § Price increases for energy costs and raw materials § Failure to develop and market new products § Could incur significant environmental liabilities § Exchange rates, interest rates and commodity prices

Risks and Concerns § Agriculture & Nutrition are affected by seasonal patterns. § Price increases for energy costs and raw materials § Failure to develop and market new products § Could incur significant environmental liabilities § Exchange rates, interest rates and commodity prices

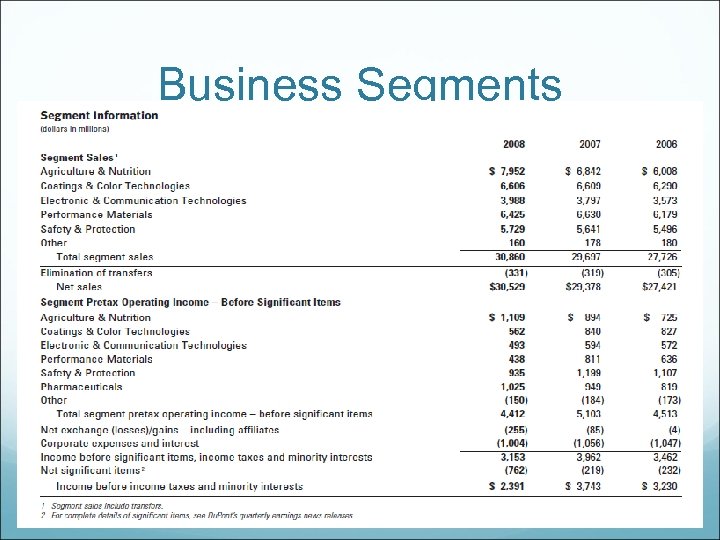

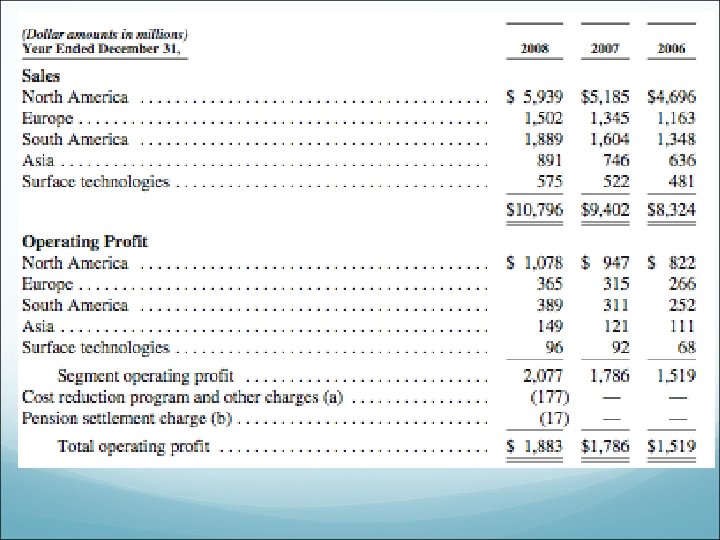

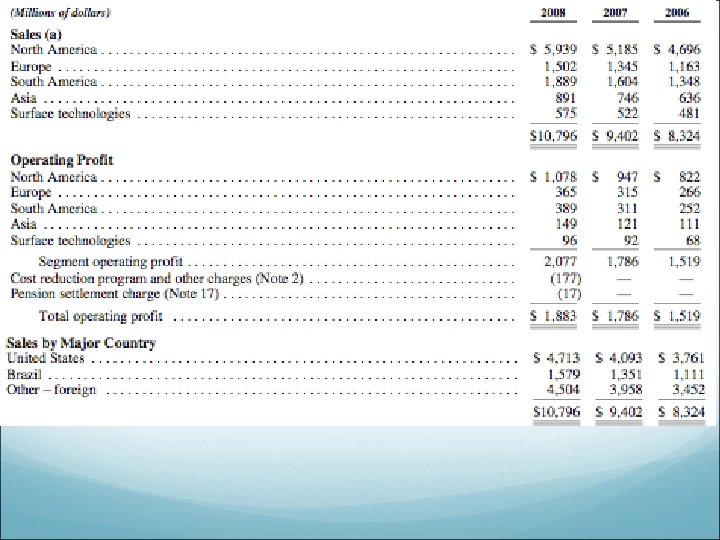

Business Segments

Business Segments

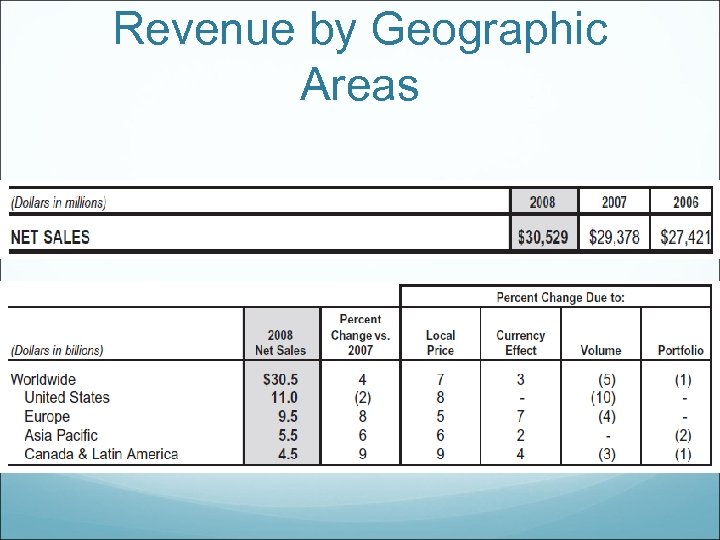

Revenue by Geographic Areas

Revenue by Geographic Areas

Growth Strategies § Putting Science to Work - research and development programs are focused on creating new technologies, processes and business opportunities in relevant fields, as well as improving existing product and processes. § Leveraging the. Power of One Du. Pont - reduce fixed costs , standardize and simplify its supply chains, and increase sales effectiveness ( exceeded fix cost saving goal by 107 mil in 2006) § Going Where the Growth Is - has a strong presence in the fastest-growing emerging markets and continues to leverage resources and market position to realize new growth. ( reflected in international sales 36% 2006)

Growth Strategies § Putting Science to Work - research and development programs are focused on creating new technologies, processes and business opportunities in relevant fields, as well as improving existing product and processes. § Leveraging the. Power of One Du. Pont - reduce fixed costs , standardize and simplify its supply chains, and increase sales effectiveness ( exceeded fix cost saving goal by 107 mil in 2006) § Going Where the Growth Is - has a strong presence in the fastest-growing emerging markets and continues to leverage resources and market position to realize new growth. ( reflected in international sales 36% 2006)

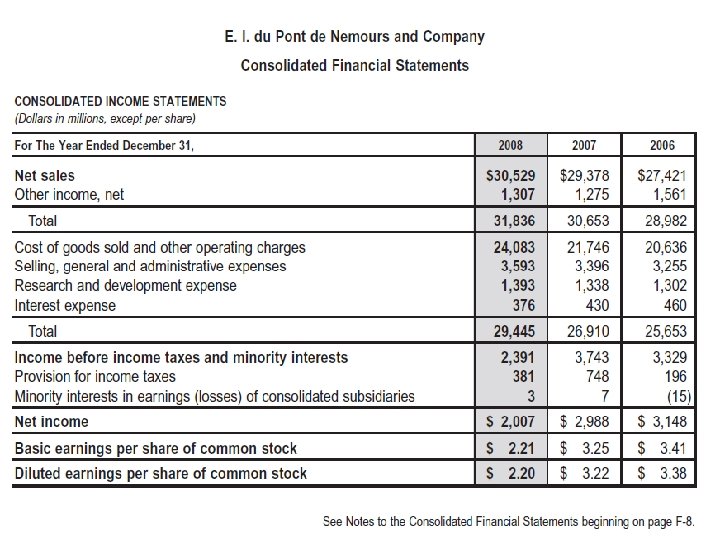

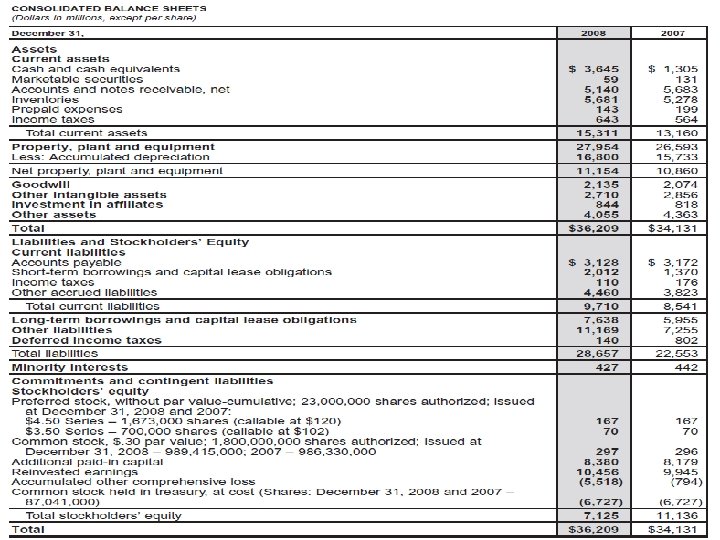

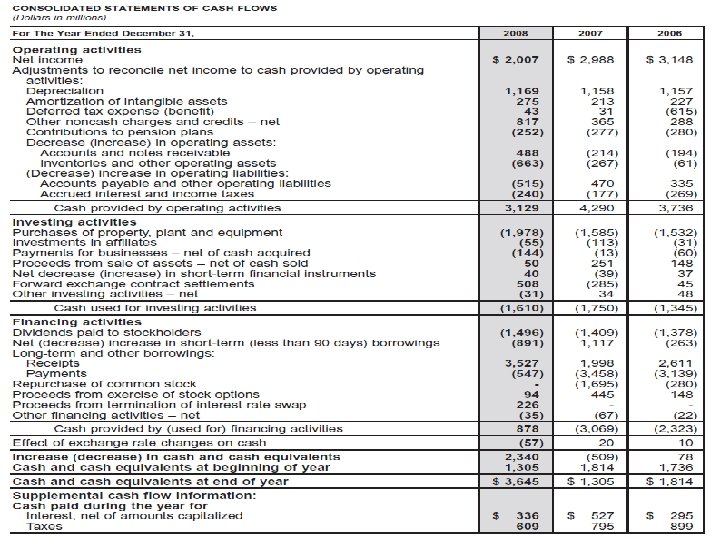

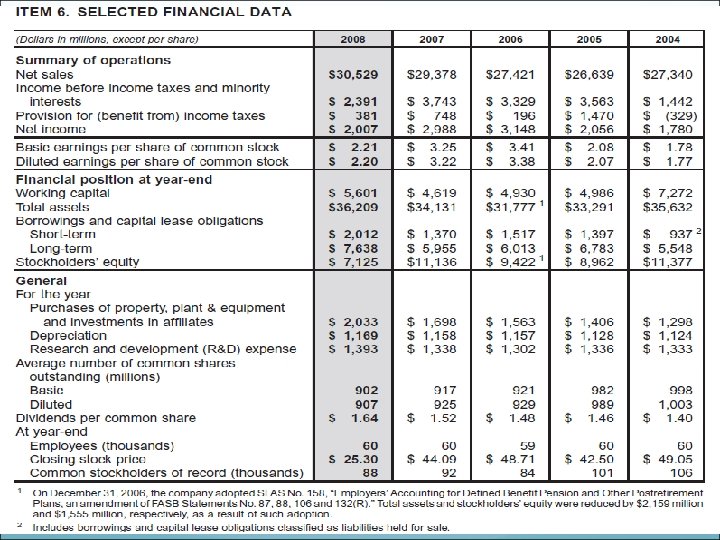

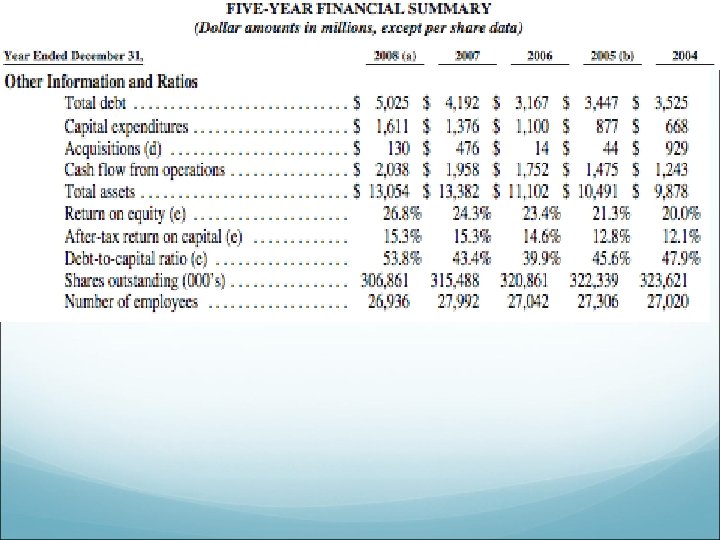

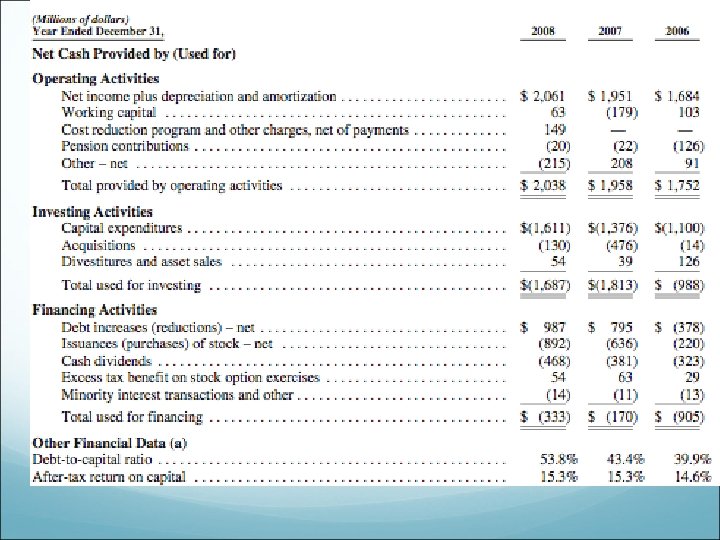

Financial Information

Financial Information

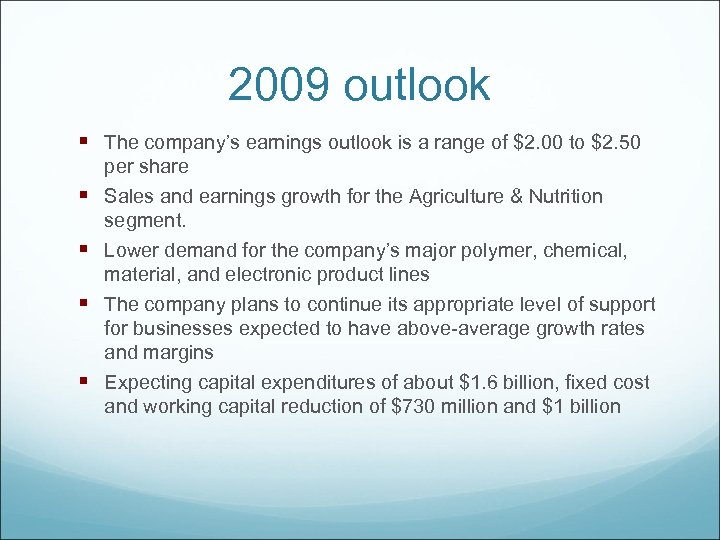

2009 outlook § The company’s earnings outlook is a range of $2. 00 to $2. 50 per share § Sales and earnings growth for the Agriculture & Nutrition segment. § Lower demand for the company’s major polymer, chemical, material, and electronic product lines § The company plans to continue its appropriate level of support for businesses expected to have above-average growth rates and margins § Expecting capital expenditures of about $1. 6 billion, fixed cost and working capital reduction of $730 million and $1 billion

2009 outlook § The company’s earnings outlook is a range of $2. 00 to $2. 50 per share § Sales and earnings growth for the Agriculture & Nutrition segment. § Lower demand for the company’s major polymer, chemical, material, and electronic product lines § The company plans to continue its appropriate level of support for businesses expected to have above-average growth rates and margins § Expecting capital expenditures of about $1. 6 billion, fixed cost and working capital reduction of $730 million and $1 billion

Recommendation Buy

Recommendation Buy

Stock Performance Shares outstanding: 559 M

Stock Performance Shares outstanding: 559 M

Stock Performance (1 year)

Stock Performance (1 year)

Stock Performance (2 year)

Stock Performance (2 year)

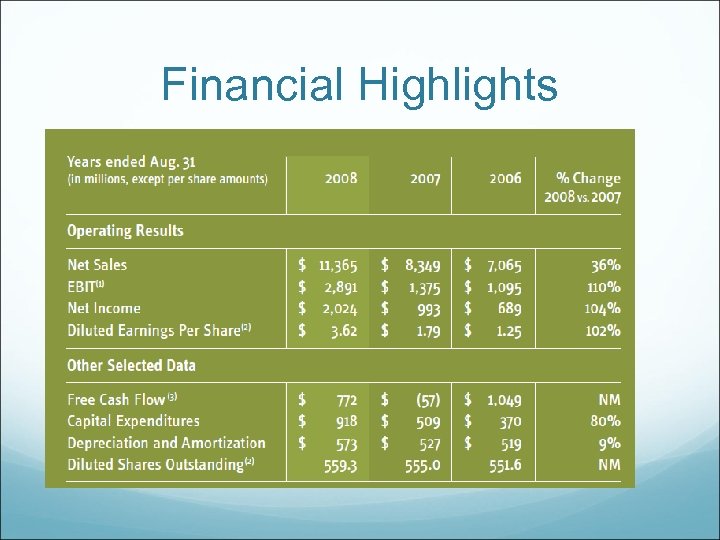

Financial Highlights

Financial Highlights

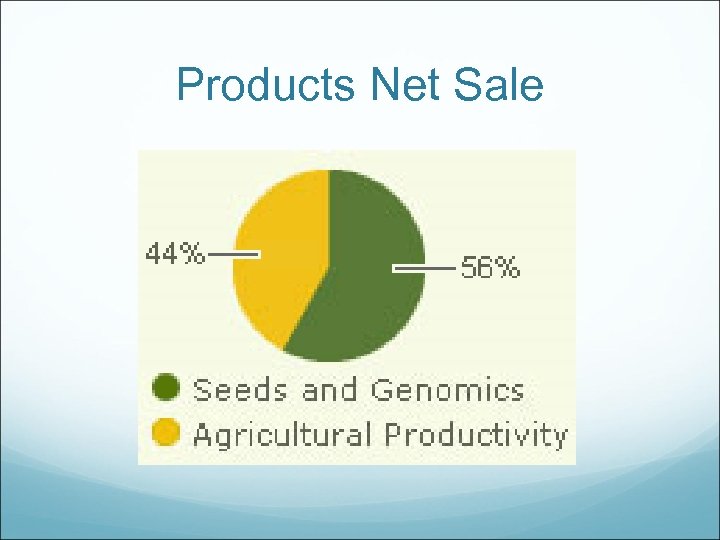

Products Net Sale

Products Net Sale

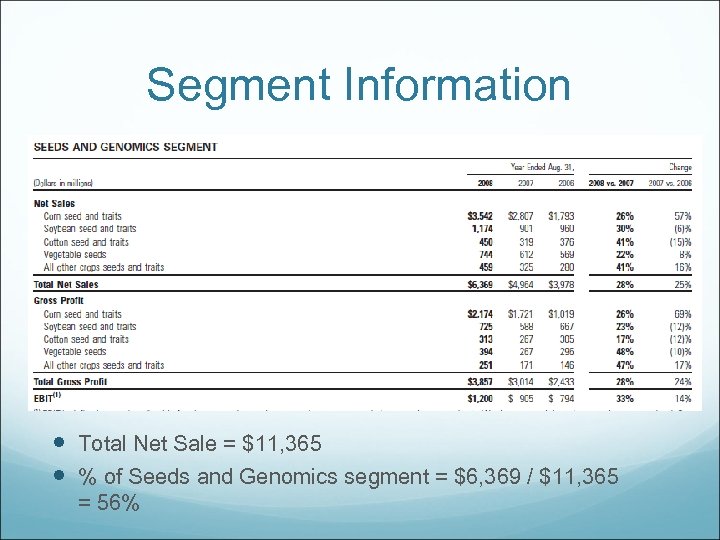

Segment Information Total Net Sale = $11, 365 % of Seeds and Genomics segment = $6, 369 / $11, 365 = 56%

Segment Information Total Net Sale = $11, 365 % of Seeds and Genomics segment = $6, 369 / $11, 365 = 56%

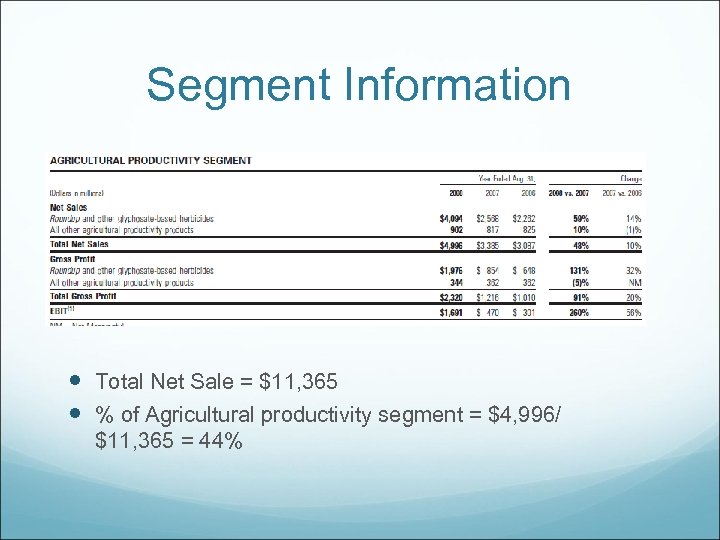

Segment Information Total Net Sale = $11, 365 % of Agricultural productivity segment = $4, 996/ $11, 365 = 44%

Segment Information Total Net Sale = $11, 365 % of Agricultural productivity segment = $4, 996/ $11, 365 = 44%

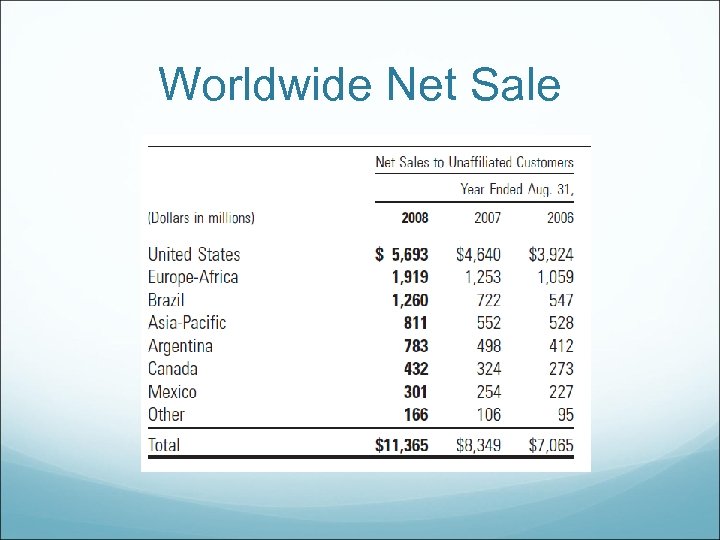

Worldwide Net Sale

Worldwide Net Sale

Worldwide Net Sale

Worldwide Net Sale

Monsanto company A leading global provider of technology-based solutions and agricultural products for farmers Provide a solution to more efficiently and cost effectively produce crops at higher yields while controlling diseases and insects Combination of herbicides, seeds and genetic trait product

Monsanto company A leading global provider of technology-based solutions and agricultural products for farmers Provide a solution to more efficiently and cost effectively produce crops at higher yields while controlling diseases and insects Combination of herbicides, seeds and genetic trait product

Products • Seeds & Traits Corn Cotton Oilseeds(soybeans and canola) Wheat Vegetable seeds • Agricultural Productivity Roundup

Products • Seeds & Traits Corn Cotton Oilseeds(soybeans and canola) Wheat Vegetable seeds • Agricultural Productivity Roundup

Seeds and Traits Offering seeds improved genetics, for a higher yield Biotechnology seeds Get more out of each seeds by inserting one or more genes in the seeds Control weeds and insects Yield is preserved throughout the growing season

Seeds and Traits Offering seeds improved genetics, for a higher yield Biotechnology seeds Get more out of each seeds by inserting one or more genes in the seeds Control weeds and insects Yield is preserved throughout the growing season

Agricultural Productivity Non-seed-based products play a vital role in improving productivity and controlling invasive weeds Crop Protection Products: Roundup® Agricultural Herbicides Industrial, Turf & Ornamental weed control for industrial and large non-farm areas such as parks, golf courses, zoos, roadsides and other large green spaces.

Agricultural Productivity Non-seed-based products play a vital role in improving productivity and controlling invasive weeds Crop Protection Products: Roundup® Agricultural Herbicides Industrial, Turf & Ornamental weed control for industrial and large non-farm areas such as parks, golf courses, zoos, roadsides and other large green spaces.

Roundup is the number one selling herbicide worldwide since 1980 Roundup line of products represents about half of Monsanto's yearly revenue Active ingredient glyphosate To kill weeds without harming the crop

Roundup is the number one selling herbicide worldwide since 1980 Roundup line of products represents about half of Monsanto's yearly revenue Active ingredient glyphosate To kill weeds without harming the crop

Main source money Roundup and other glyphosate based herbicides = 43. 2% Corn Seeds = 31. 2% Total of above two segments = 74. 4%

Main source money Roundup and other glyphosate based herbicides = 43. 2% Corn Seeds = 31. 2% Total of above two segments = 74. 4%

Stock Performance (5 years)

Stock Performance (5 years)

Monsanto Company Overview

Monsanto Company Overview

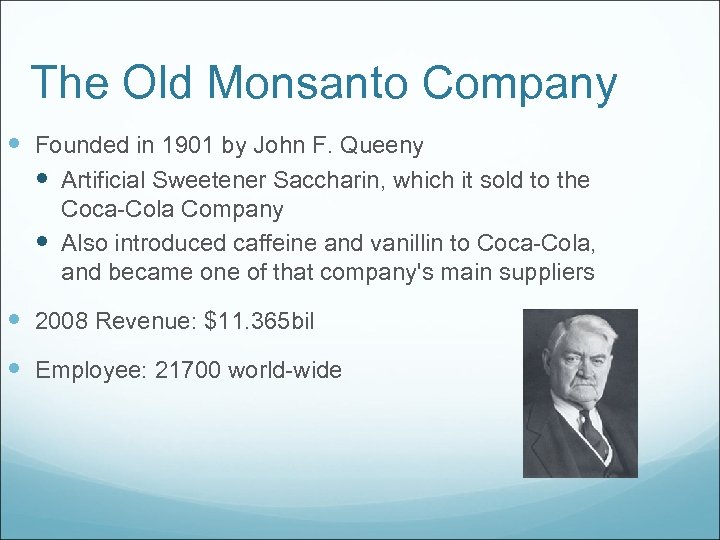

The Old Monsanto Company Founded in 1901 by John F. Queeny Artificial Sweetener Saccharin, which it sold to the Coca-Cola Company Also introduced caffeine and vanillin to Coca-Cola, and became one of that company's main suppliers 2008 Revenue: $11. 365 bil Employee: 21700 world-wide

The Old Monsanto Company Founded in 1901 by John F. Queeny Artificial Sweetener Saccharin, which it sold to the Coca-Cola Company Also introduced caffeine and vanillin to Coca-Cola, and became one of that company's main suppliers 2008 Revenue: $11. 365 bil Employee: 21700 world-wide

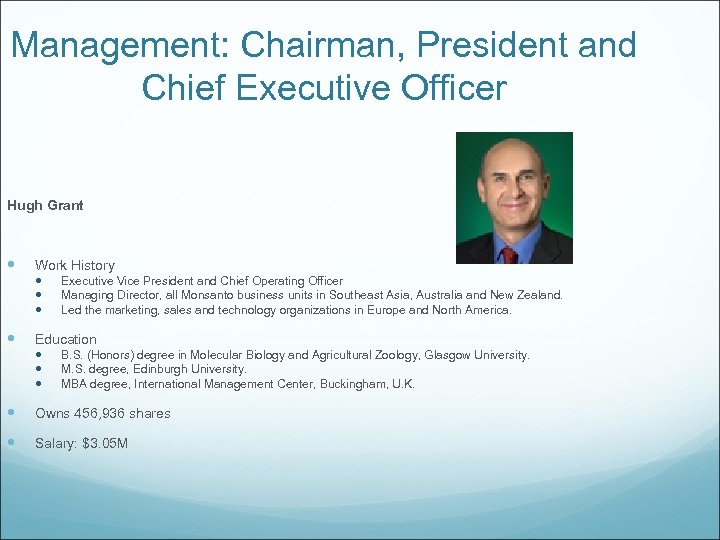

Management: Chairman, President and Chief Executive Officer Hugh Grant Work History Executive Vice President and Chief Operating Officer Managing Director, all Monsanto business units in Southeast Asia, Australia and New Zealand. Led the marketing, sales and technology organizations in Europe and North America. Education B. S. (Honors) degree in Molecular Biology and Agricultural Zoology, Glasgow University. M. S. degree, Edinburgh University. MBA degree, International Management Center, Buckingham, U. K. Owns 456, 936 shares Salary: $3. 05 M

Management: Chairman, President and Chief Executive Officer Hugh Grant Work History Executive Vice President and Chief Operating Officer Managing Director, all Monsanto business units in Southeast Asia, Australia and New Zealand. Led the marketing, sales and technology organizations in Europe and North America. Education B. S. (Honors) degree in Molecular Biology and Agricultural Zoology, Glasgow University. M. S. degree, Edinburgh University. MBA degree, International Management Center, Buckingham, U. K. Owns 456, 936 shares Salary: $3. 05 M

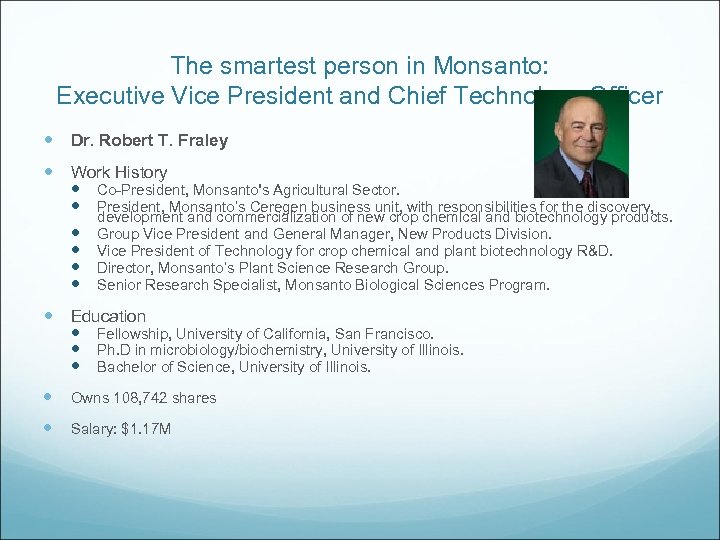

The smartest person in Monsanto: Executive Vice President and Chief Technology Officer Dr. Robert T. Fraley Work History Co-President, Monsanto's Agricultural Sector. President, Monsanto’s Ceregen business unit, with responsibilities for the discovery, development and commercialization of new crop chemical and biotechnology products. Group Vice President and General Manager, New Products Division. Vice President of Technology for crop chemical and plant biotechnology R&D. Director, Monsanto’s Plant Science Research Group. Senior Research Specialist, Monsanto Biological Sciences Program. Education Fellowship, University of California, San Francisco. Ph. D in microbiology/biochemistry, University of Illinois. Bachelor of Science, University of Illinois. Owns 108, 742 shares Salary: $1. 17 M

The smartest person in Monsanto: Executive Vice President and Chief Technology Officer Dr. Robert T. Fraley Work History Co-President, Monsanto's Agricultural Sector. President, Monsanto’s Ceregen business unit, with responsibilities for the discovery, development and commercialization of new crop chemical and biotechnology products. Group Vice President and General Manager, New Products Division. Vice President of Technology for crop chemical and plant biotechnology R&D. Director, Monsanto’s Plant Science Research Group. Senior Research Specialist, Monsanto Biological Sciences Program. Education Fellowship, University of California, San Francisco. Ph. D in microbiology/biochemistry, University of Illinois. Bachelor of Science, University of Illinois. Owns 108, 742 shares Salary: $1. 17 M

Executive Vice President and Chief Technology Officer Significant Activities more than 100 publications and patent applications Awards Received: National Medal of Technology National Award for Agricultural Excellence in Science, Kenneth A. Spencer Award for Outstanding Achievement in Agricultural and Food Chemistry. Monsanto Edgar M. Queeny Award in recognition of the discovery, development and successful commercialization of Roundup Ready® Monsanto Thomas and Hochwalt Award Progressive Farming Magazine’s Man of the Year in 1995.

Executive Vice President and Chief Technology Officer Significant Activities more than 100 publications and patent applications Awards Received: National Medal of Technology National Award for Agricultural Excellence in Science, Kenneth A. Spencer Award for Outstanding Achievement in Agricultural and Food Chemistry. Monsanto Edgar M. Queeny Award in recognition of the discovery, development and successful commercialization of Roundup Ready® Monsanto Thomas and Hochwalt Award Progressive Farming Magazine’s Man of the Year in 1995.

Management Most executives have education related to the agriculture and technology Biotech (biology and chemistry related) Agricultural economics Zoology

Management Most executives have education related to the agriculture and technology Biotech (biology and chemistry related) Agricultural economics Zoology

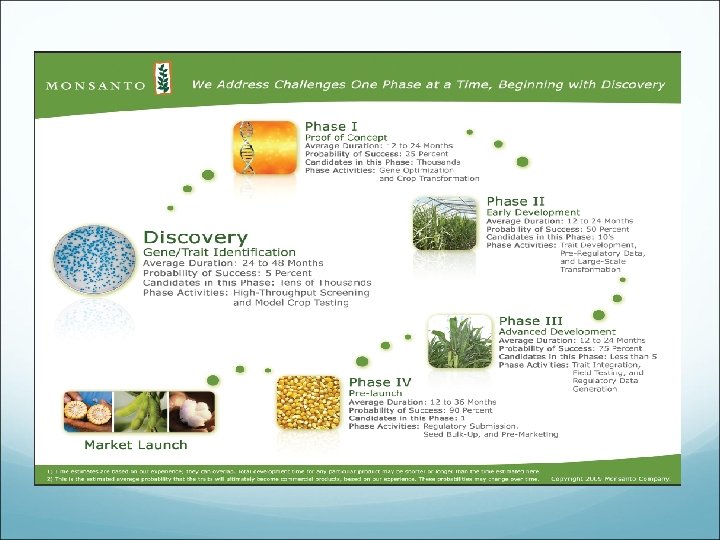

R&D Invested more than $980 million last fiscal year New biotech traits Elite germplasm Breeding Variety and hybrid development Genomics research Other R&D projects support the company’s current products, including improved formulations of Roundup herbicide. The annual R&D budget is targeted at roughly 9% to 10% of sales.

R&D Invested more than $980 million last fiscal year New biotech traits Elite germplasm Breeding Variety and hybrid development Genomics research Other R&D projects support the company’s current products, including improved formulations of Roundup herbicide. The annual R&D budget is targeted at roughly 9% to 10% of sales.

R&D

R&D

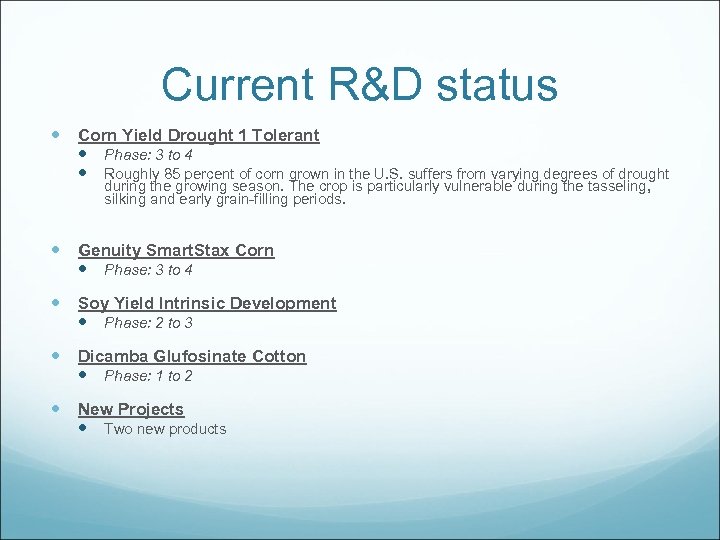

Current R&D status Corn Yield Drought 1 Tolerant Phase: 3 to 4 Roughly 85 percent of corn grown in the U. S. suffers from varying degrees of drought during the growing season. The crop is particularly vulnerable during the tasseling, silking and early grain-filling periods. Genuity Smart. Stax Corn Phase: 3 to 4 Soy Yield Intrinsic Development Phase: 2 to 3 Dicamba Glufosinate Cotton Phase: 1 to 2 New Projects Two new products

Current R&D status Corn Yield Drought 1 Tolerant Phase: 3 to 4 Roughly 85 percent of corn grown in the U. S. suffers from varying degrees of drought during the growing season. The crop is particularly vulnerable during the tasseling, silking and early grain-filling periods. Genuity Smart. Stax Corn Phase: 3 to 4 Soy Yield Intrinsic Development Phase: 2 to 3 Dicamba Glufosinate Cotton Phase: 1 to 2 New Projects Two new products

Financial Information

Financial Information

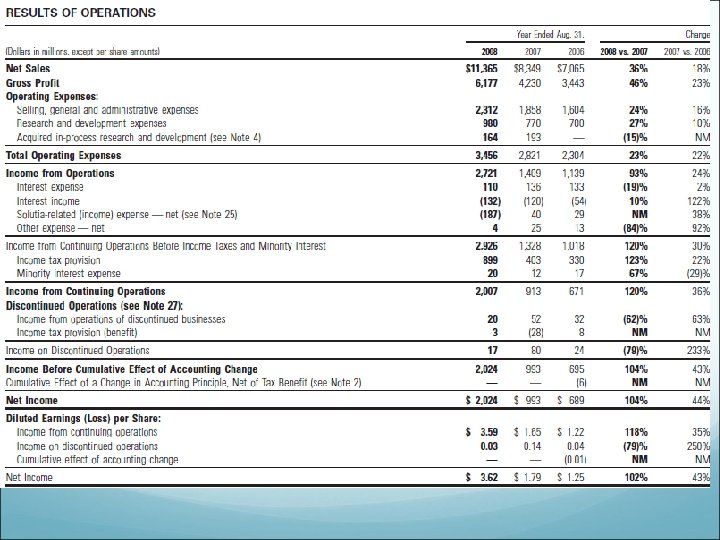

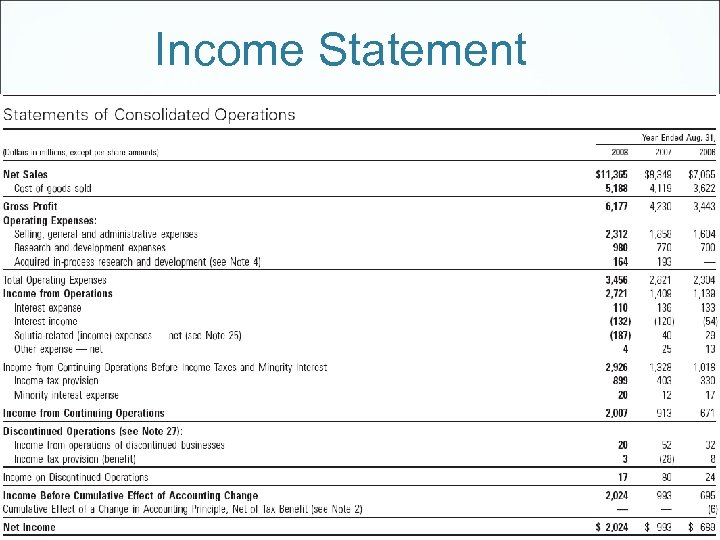

Income Statement

Income Statement

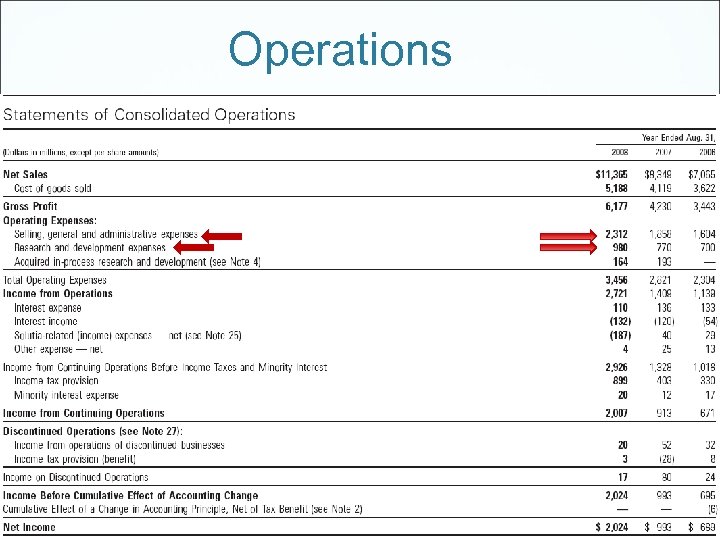

Operations

Operations

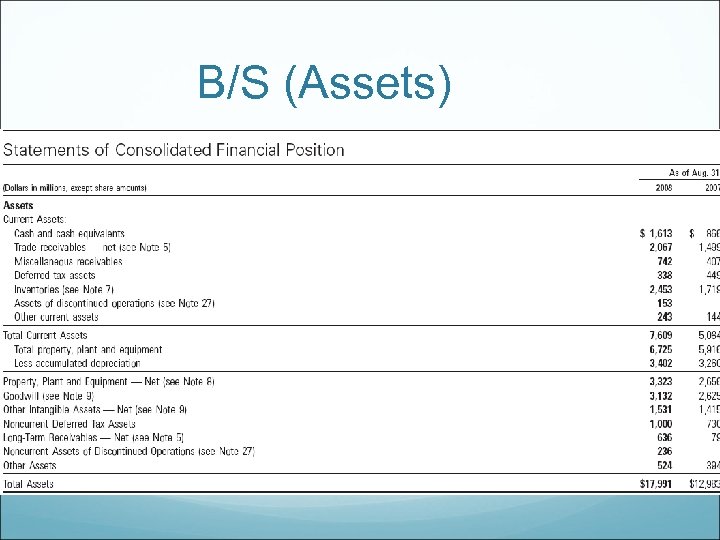

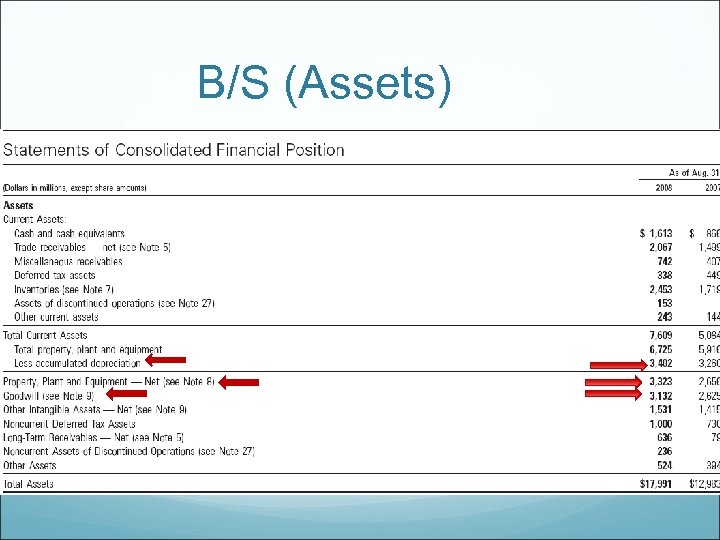

B/S (Assets)

B/S (Assets)

B/S (Assets)

B/S (Assets)

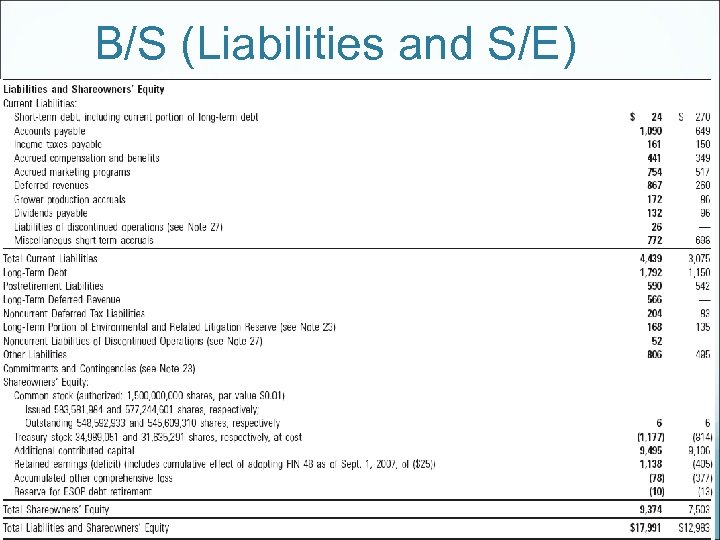

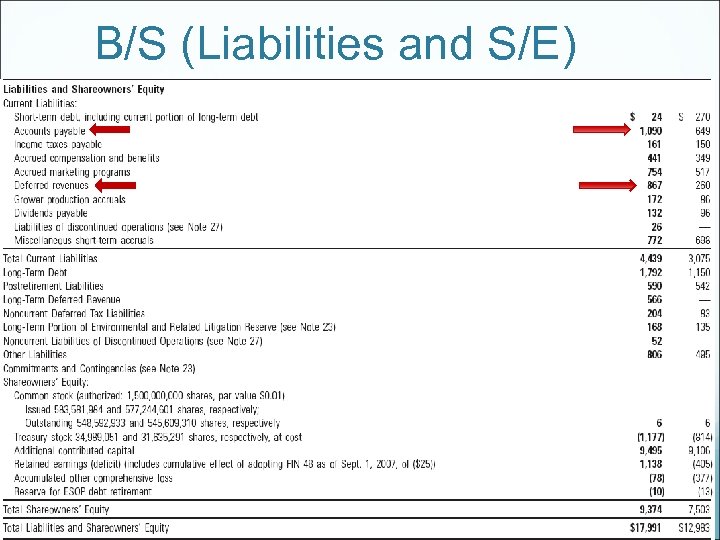

B/S (Liabilities and S/E)

B/S (Liabilities and S/E)

B/S (Liabilities and S/E)

B/S (Liabilities and S/E)

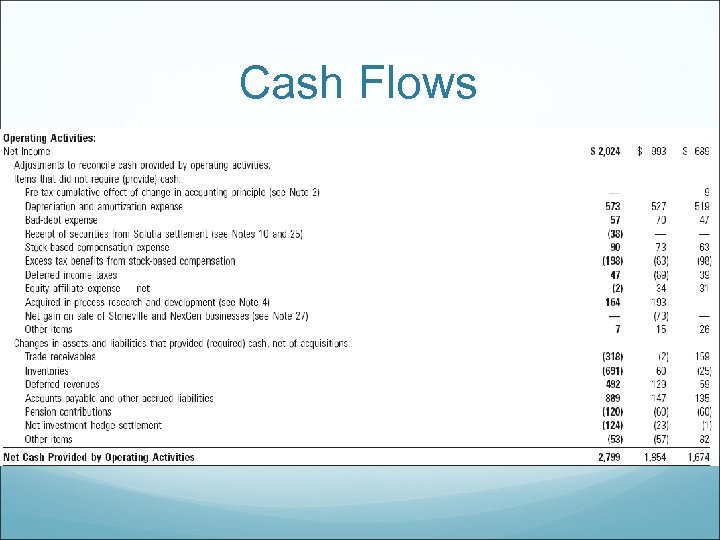

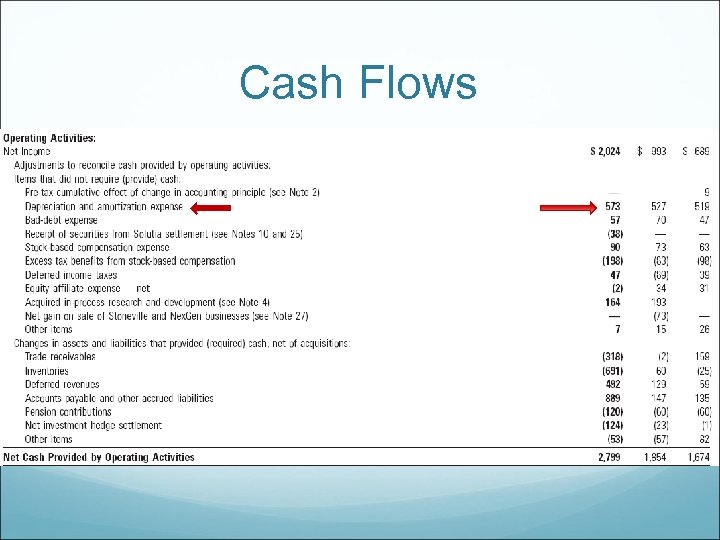

Cash Flows

Cash Flows

Cash Flows

Cash Flows

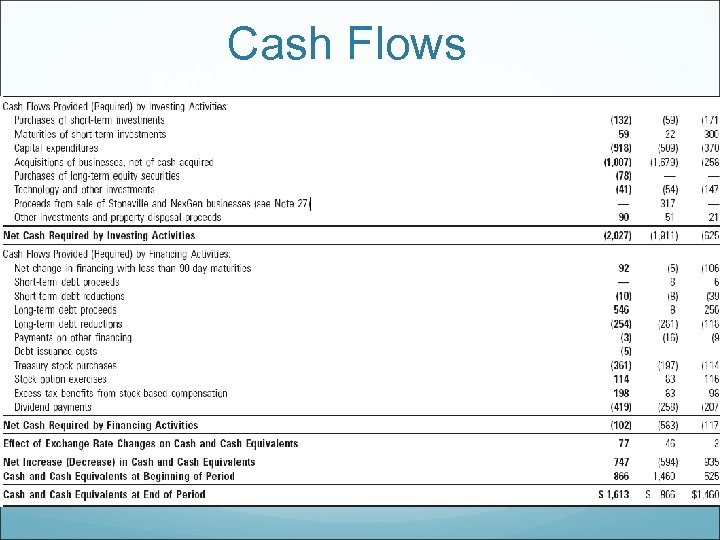

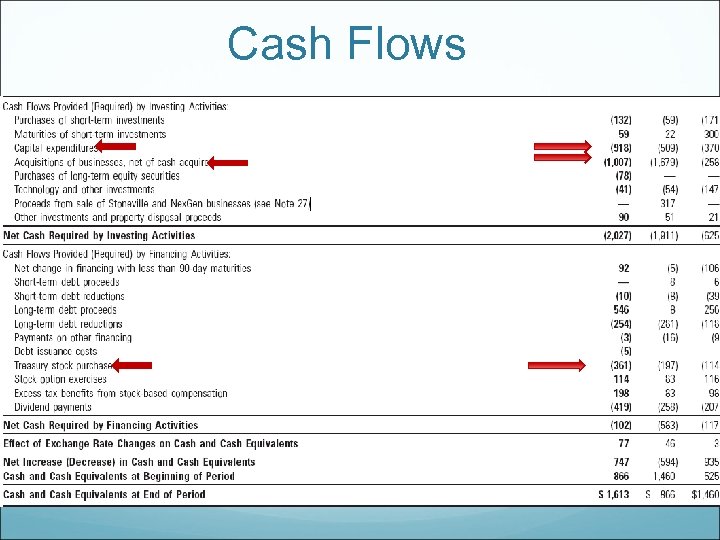

Cash Flows

Cash Flows

Cash Flows

Cash Flows

Recent News (2009) Corn Technologies approved by European Union helping to increase yields while using fewer inputs, thus contributing to greater sustainability in agriculture. Passed regulation US Environmental Protection Agency and Canadian Food inspection agency in July 2009 Smart. Stax scheduled to launch for commercial in 2010

Recent News (2009) Corn Technologies approved by European Union helping to increase yields while using fewer inputs, thus contributing to greater sustainability in agriculture. Passed regulation US Environmental Protection Agency and Canadian Food inspection agency in July 2009 Smart. Stax scheduled to launch for commercial in 2010

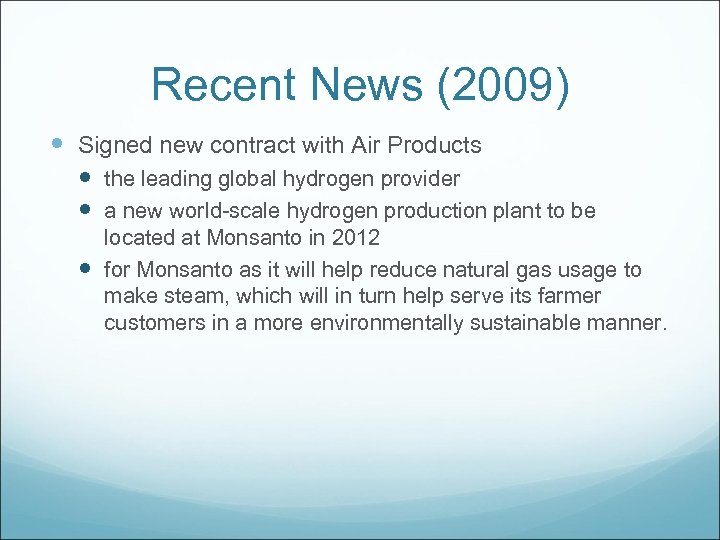

Recent News (2009) Signed new contract with Air Products the leading global hydrogen provider a new world-scale hydrogen production plant to be located at Monsanto in 2012 for Monsanto as it will help reduce natural gas usage to make steam, which will in turn help serve its farmer customers in a more environmentally sustainable manner.

Recent News (2009) Signed new contract with Air Products the leading global hydrogen provider a new world-scale hydrogen production plant to be located at Monsanto in 2012 for Monsanto as it will help reduce natural gas usage to make steam, which will in turn help serve its farmer customers in a more environmentally sustainable manner.

Recent News (2009) SDA Omega-3 Soybean Oil Finished Develop and Test Foods Containing SDA Omega-3 Soybean Oil The U. S. Food and Drug Administration (FDA) issued a Generally Recognized as Safe (GRAS) notice Demand for omega-3 fatty acids is growing help play an important role in maintaining health, including heart health.

Recent News (2009) SDA Omega-3 Soybean Oil Finished Develop and Test Foods Containing SDA Omega-3 Soybean Oil The U. S. Food and Drug Administration (FDA) issued a Generally Recognized as Safe (GRAS) notice Demand for omega-3 fatty acids is growing help play an important role in maintaining health, including heart health.

Recent News (2009) Not raising the price as expected Raising 7% not as 8 -10% expectation Aims at defending its market share in increasingly competitive market for biotech corn

Recent News (2009) Not raising the price as expected Raising 7% not as 8 -10% expectation Aims at defending its market share in increasingly competitive market for biotech corn

Major Risk Increase in competition Control manufacturing and marketing costs without affecting sales Predict and response to competitor pricing and marketing Meeting the needs of customers and farmers Maintain an efficient distribution system Develop new product

Major Risk Increase in competition Control manufacturing and marketing costs without affecting sales Predict and response to competitor pricing and marketing Meeting the needs of customers and farmers Maintain an efficient distribution system Develop new product

Other Risks Subject to extensive regulation, which might slow down the development with costs Degree of public acceptance of biotechnology product Operation outside of US(regulation, currency, etc) Fluctuation in commodity price

Other Risks Subject to extensive regulation, which might slow down the development with costs Degree of public acceptance of biotechnology product Operation outside of US(regulation, currency, etc) Fluctuation in commodity price

Future Strategy Maintain its leading position in the industry Commercial potential of R&D pipeline Smart. Stax launch to commercial in 2010 Key product to doubling the yield by 2030 Maintain Roundup product remains market leader Meet future demand Managing the selling price and costs associated with agricultural chemistry business

Future Strategy Maintain its leading position in the industry Commercial potential of R&D pipeline Smart. Stax launch to commercial in 2010 Key product to doubling the yield by 2030 Maintain Roundup product remains market leader Meet future demand Managing the selling price and costs associated with agricultural chemistry business

Future Strategy International opportunity is poised for growth and improvement (Recent acquisition) De Ruiter Seeds ($756 mil) Leading protected-culture vegetable seeds company in Netherlands with operation world wide potential vegetable seeds segment growth Marmot S. A ($135 mil) Guatemala, offers to Central America Will build corn business leadership Enable it to offer farmers in Central America broader access to highyielding corn seed varieties Agroeste Sementes ($91 m) Brazil, serves throughout Brazil Hybrid corn seed production and serves farmers throughout Brazil

Future Strategy International opportunity is poised for growth and improvement (Recent acquisition) De Ruiter Seeds ($756 mil) Leading protected-culture vegetable seeds company in Netherlands with operation world wide potential vegetable seeds segment growth Marmot S. A ($135 mil) Guatemala, offers to Central America Will build corn business leadership Enable it to offer farmers in Central America broader access to highyielding corn seed varieties Agroeste Sementes ($91 m) Brazil, serves throughout Brazil Hybrid corn seed production and serves farmers throughout Brazil

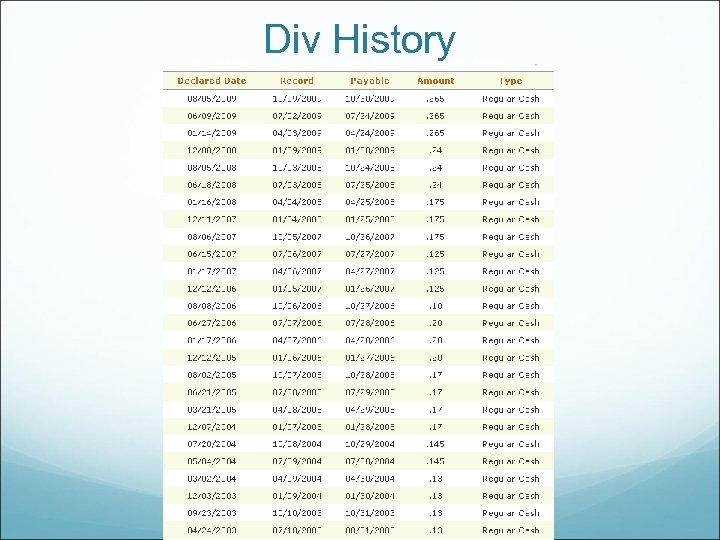

Div History

Div History

Recommendation Buy

Recommendation Buy

PRAXAIR, INC.

PRAXAIR, INC.

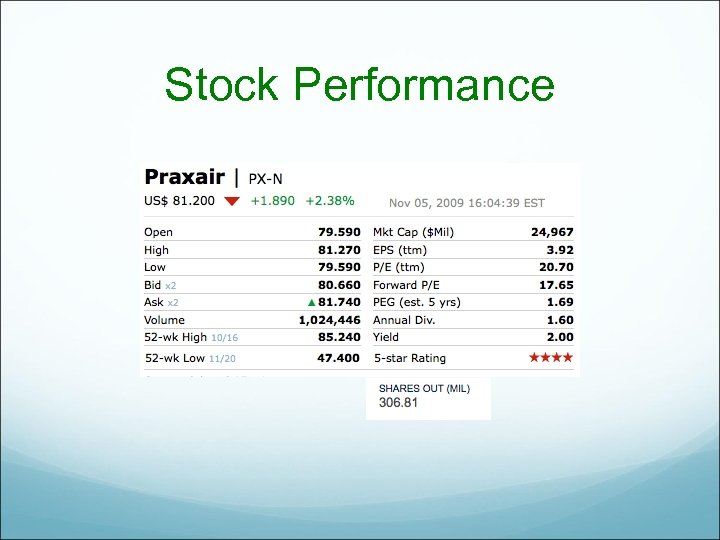

Stock Performance

Stock Performance

1 -Year History

1 -Year History

5 -Year History

5 -Year History

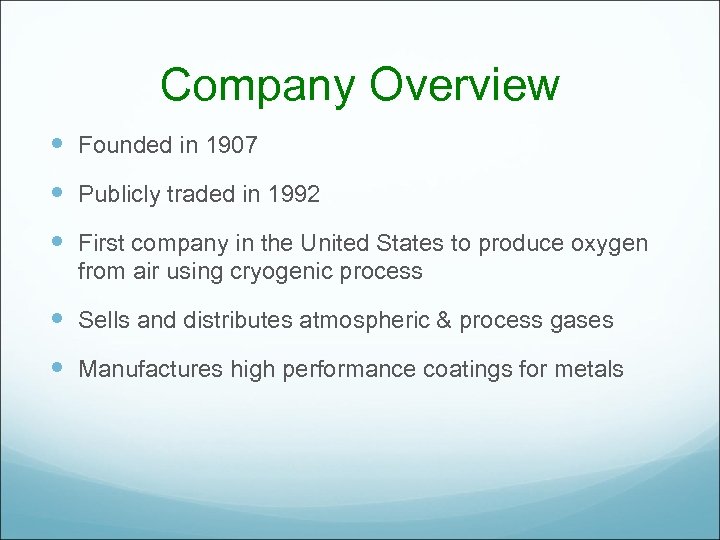

Company Overview Founded in 1907 Publicly traded in 1992 First company in the United States to produce oxygen from air using cryogenic process Sells and distributes atmospheric & process gases Manufactures high performance coatings for metals

Company Overview Founded in 1907 Publicly traded in 1992 First company in the United States to produce oxygen from air using cryogenic process Sells and distributes atmospheric & process gases Manufactures high performance coatings for metals

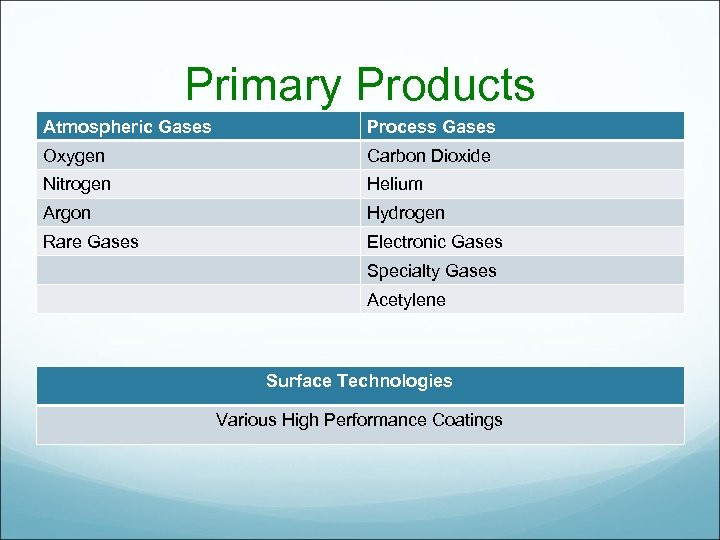

Primary Products Atmospheric Gases Process Gases Oxygen Carbon Dioxide Nitrogen Helium Argon Hydrogen Rare Gases Electronic Gases Specialty Gases Acetylene Surface Technologies Various High Performance Coatings

Primary Products Atmospheric Gases Process Gases Oxygen Carbon Dioxide Nitrogen Helium Argon Hydrogen Rare Gases Electronic Gases Specialty Gases Acetylene Surface Technologies Various High Performance Coatings

Serves 25 Industries Healthcare and petroleum refining Computer-chip manufacturing Beverage Carbonation Fiber Optics and Steel Manufacturing Chemicals and Water Treatment

Serves 25 Industries Healthcare and petroleum refining Computer-chip manufacturing Beverage Carbonation Fiber Optics and Steel Manufacturing Chemicals and Water Treatment

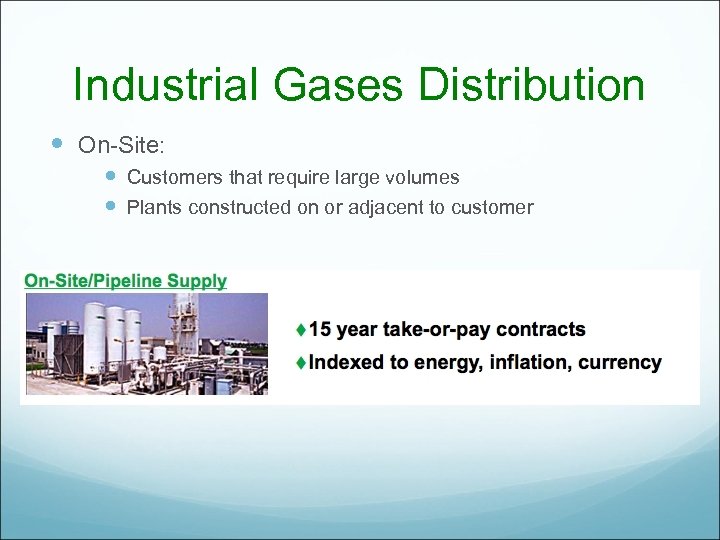

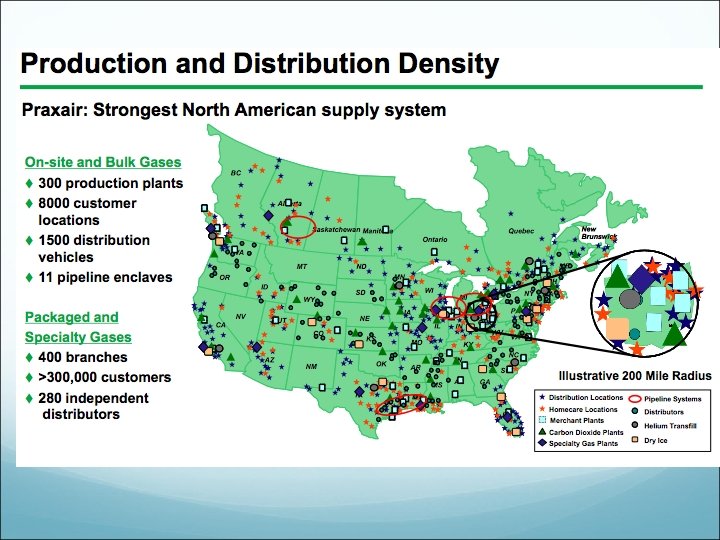

Industrial Gases Distribution On-Site: Customers that require large volumes Plants constructed on or adjacent to customer

Industrial Gases Distribution On-Site: Customers that require large volumes Plants constructed on or adjacent to customer

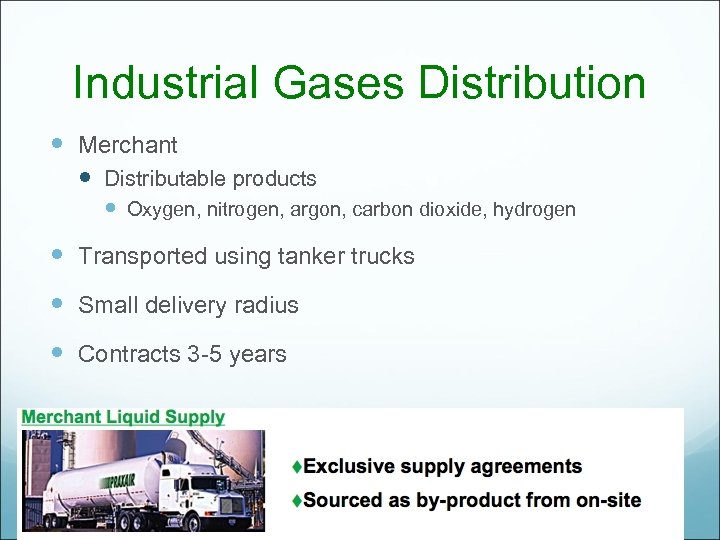

Industrial Gases Distribution Merchant Distributable products Oxygen, nitrogen, argon, carbon dioxide, hydrogen Transported using tanker trucks Small delivery radius Contracts 3 -5 years

Industrial Gases Distribution Merchant Distributable products Oxygen, nitrogen, argon, carbon dioxide, hydrogen Transported using tanker trucks Small delivery radius Contracts 3 -5 years

Industrial Gases Distribution Packaged Gases Sold by purchase orders

Industrial Gases Distribution Packaged Gases Sold by purchase orders

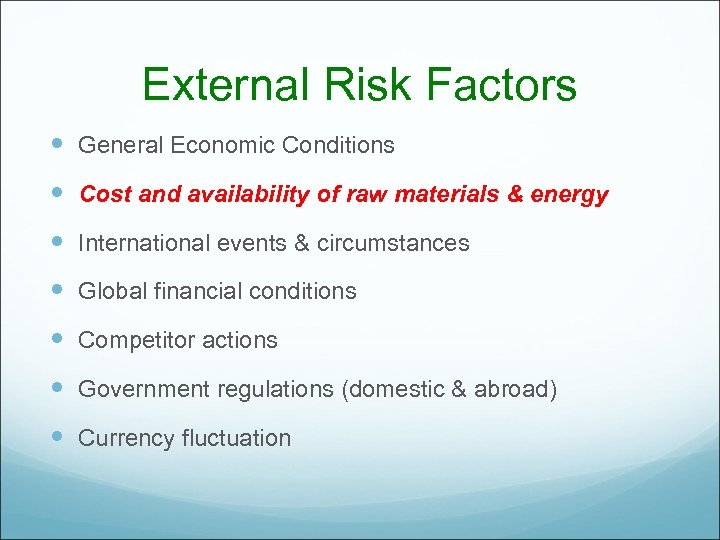

External Risk Factors General Economic Conditions Cost and availability of raw materials & energy International events & circumstances Global financial conditions Competitor actions Government regulations (domestic & abroad) Currency fluctuation

External Risk Factors General Economic Conditions Cost and availability of raw materials & energy International events & circumstances Global financial conditions Competitor actions Government regulations (domestic & abroad) Currency fluctuation

Internal Risk Factors Retaining qualified personnel Technological advances Litigation & government investigations Environmental laws & regulations Tax liabilities Operational risks Acquisitions

Internal Risk Factors Retaining qualified personnel Technological advances Litigation & government investigations Environmental laws & regulations Tax liabilities Operational risks Acquisitions

Competitive Landscape Highly Competitive Environment Based on: Price Product quality Delivery Reliability Technology Customer Service

Competitive Landscape Highly Competitive Environment Based on: Price Product quality Delivery Reliability Technology Customer Service

Industrial Gases Air Products and Chemicals, Inc. Airgas, Inc. L’Air. Liquide S. A. , Linde AG

Industrial Gases Air Products and Chemicals, Inc. Airgas, Inc. L’Air. Liquide S. A. , Linde AG

Surface Technologies Chromalloy Gas Turbine Corporation Subsidiary of Sequa Corporation Sermatech International, Inc. Subsidiary of Telefex Chemtronics, Inc. Subsidiary of GKN p. l. c.

Surface Technologies Chromalloy Gas Turbine Corporation Subsidiary of Sequa Corporation Sermatech International, Inc. Subsidiary of Telefex Chemtronics, Inc. Subsidiary of GKN p. l. c.

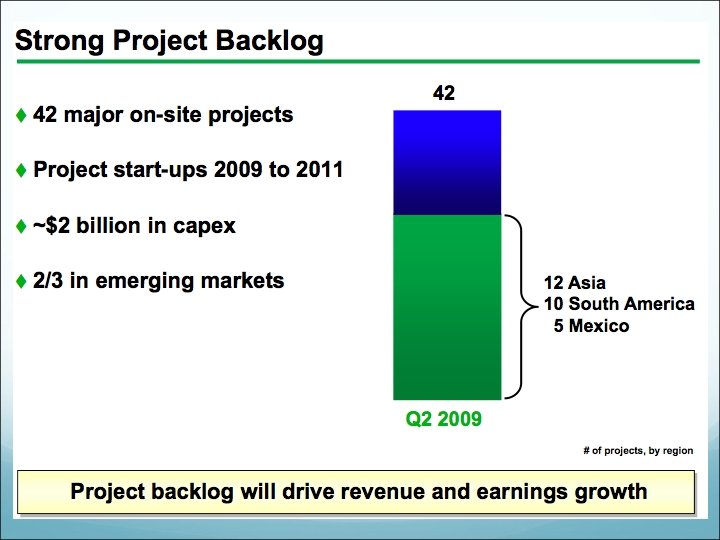

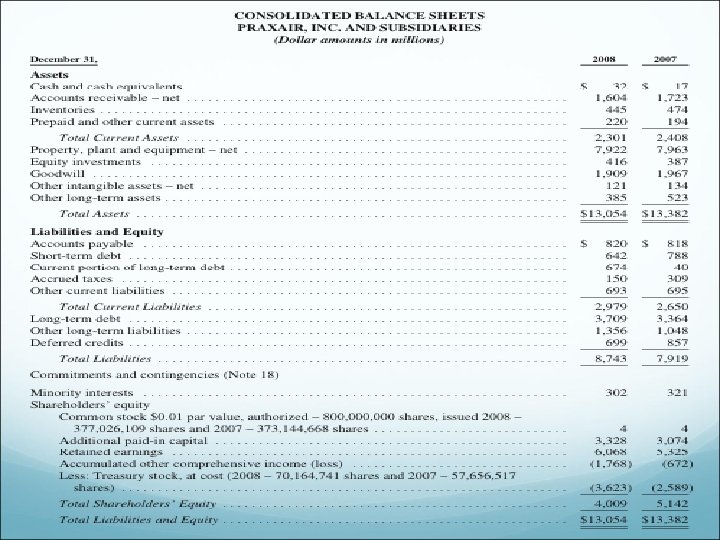

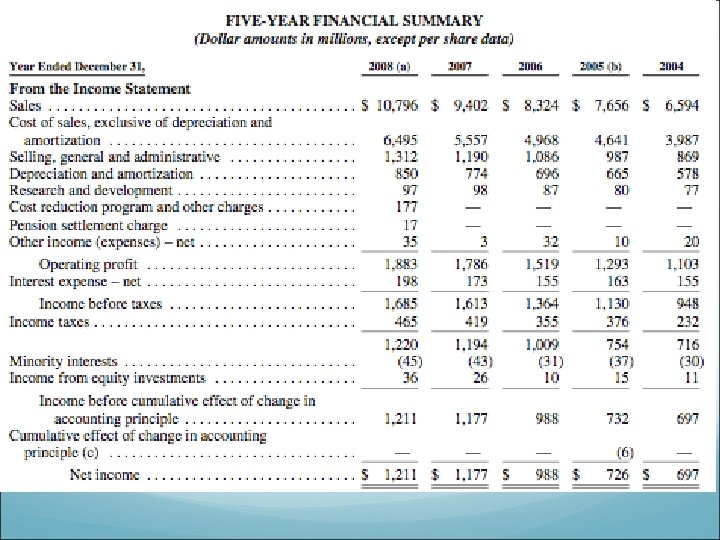

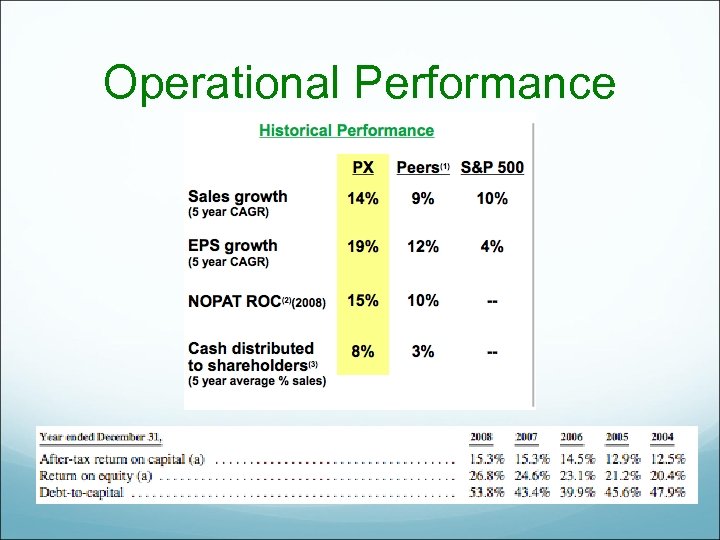

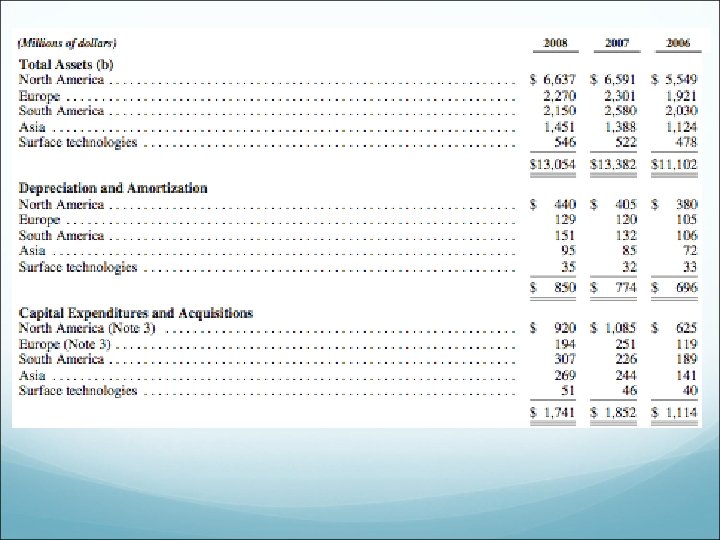

Operational Performance

Operational Performance

Praxair Recommendation Hold

Praxair Recommendation Hold

Summary Industry • Unfavourable Dupont • Buy Monsanto • Buy Praxair • Hold

Summary Industry • Unfavourable Dupont • Buy Monsanto • Buy Praxair • Hold

Q&A

Q&A