40aa953f2f372cd408fc73a89364eff4.ppt

- Количество слайдов: 22

Updates on Regional Initiatives and World Bank Activities Massimo Cirasino Jose‘ Antonio Garcia Mario Guadamillas Payment Systems Development Group The World Bank

Updates on Regional Initatives

OBJECTIVE: Supporting improvements to payment, remittance and securities settlement systems in the Region Strategic Pillars Integration of securities and payments Cooperation with international organizations Country Ownership

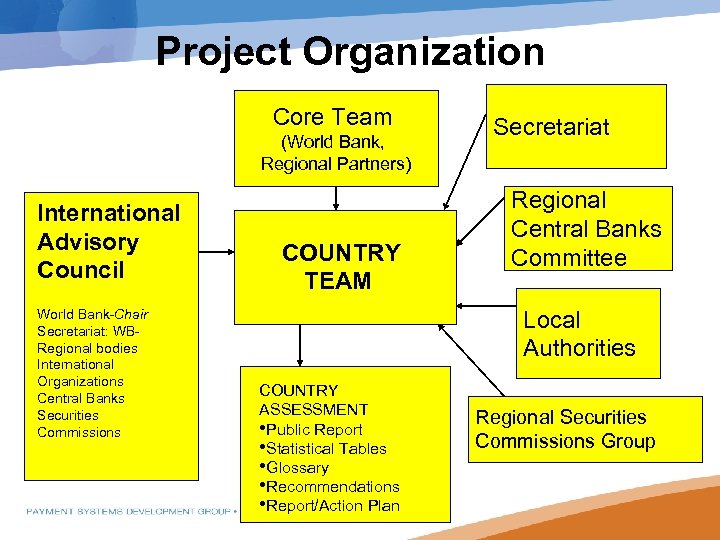

Project Organization Core Team (World Bank, Regional Partners) International Advisory Council World Bank-Chair Secretariat: WBRegional bodies International Organizations Central Banks Securities Commissions COUNTRY TEAM Secretariat Regional Central Banks Committee Local Authorities COUNTRY ASSESSMENT • Public Report • Statistical Tables • Glossary • Recommendations • Report/Action Plan Regional Securities Commissions Group

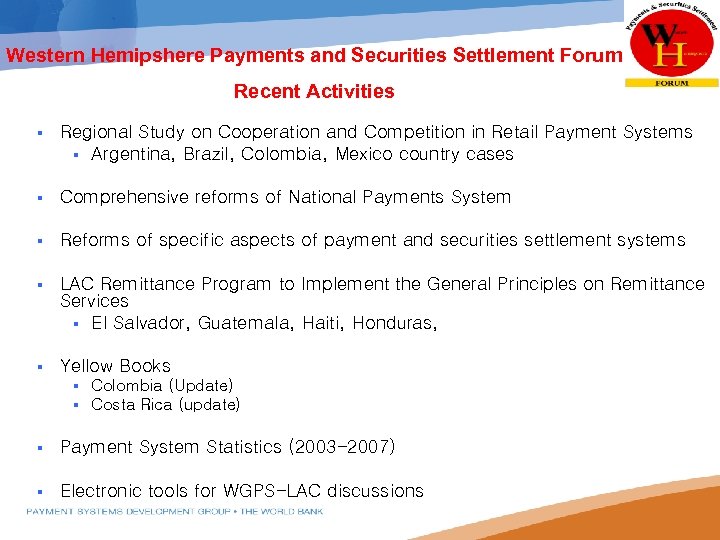

Western Hemipshere Payments and Securities Settlement Forum Recent Activities § Regional Study on Cooperation and Competition in Retail Payment Systems § Argentina, Brazil, Colombia, Mexico country cases § Comprehensive reforms of National Payments System § Reforms of specific aspects of payment and securities settlement systems § LAC Remittance Program to Implement the General Principles on Remittance Services § El Salvador, Guatemala, Haiti, Honduras, § Yellow Books § § Colombia (Update) Costa Rica (update) § Payment System Statistics (2003 -2007) § Electronic tools for WGPS-LAC discussions

Western Hemisphere Payments and Securities Settlement Forum Future Plans § Advance payment system integration agenda § Enhance the knowledge and raise awereness on Business continuity and Operational Reliability § Continue reform efforts § Continue updates to Yellow Books and Statistics § LAC Remittance Program § Assessment of countries § Follow-up/implementation of identified actions

Arab Payments Initiative Recent Activities § Country studies completed in Bahrain, Egypt, Jordan, Morocco, Palestine, Qatar, Sudan, Syria, Yemen § Comprehensive reforms of National Payments System § Creation of the Arab Committee of Central Banks § Feasibility Study for Arab regional payment system (launched) Future Plans § Completion of country visits § Payment System Statistics § Preparation of White Books

Commonwealth of Independent States Payments And Securities Settlement Initiative (CISPI) Recent Activities § Country studies completed in 11 out of 12 countries § Comprehensive reforms of National Payments System § Creation of the CIS Working Group on Payment System Issues § Silver Books (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan) Future Plans § Creation of a Working Group of Securities Commissions § Payment System Statistics and Comparative Analysis § Study on models of payment system oversight

South Asia Payments Initiative (SAPI) Recent Activities § Official Launch with approval from SA central bank Governors § Establishment of organizational arrangements § Creation of the SA council of central banks Future Plans § Preparation of the methodology § Country visits and purple books § Support to harmonization in payment arrangements

Updates on Other World Bank Activities

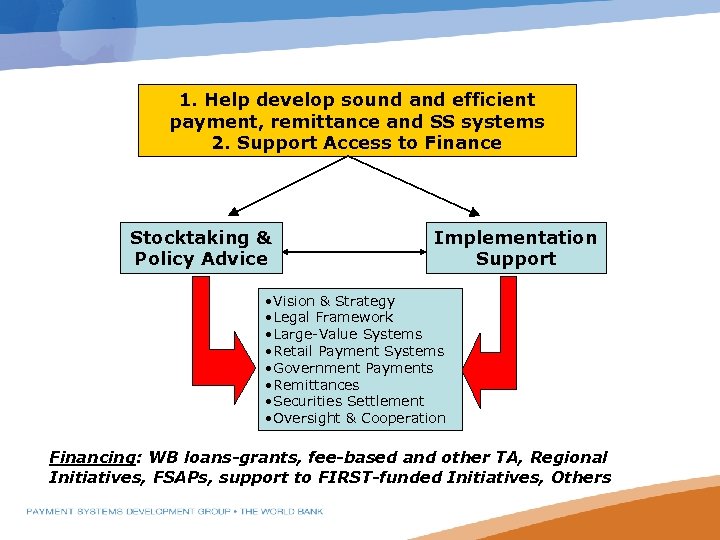

1. Help develop sound and efficient payment, remittance and SS systems 2. Support Access to Finance Stocktaking & Policy Advice Implementation Support • Vision & Strategy • Legal Framework • Large-Value Systems • Retail Payment Systems • Government Payments • Remittances • Securities Settlement • Oversight & Cooperation Financing: WB loans-grants, fee-based and other TA, Regional Initiatives, FSAPs, support to FIRST-funded Initiatives, Others

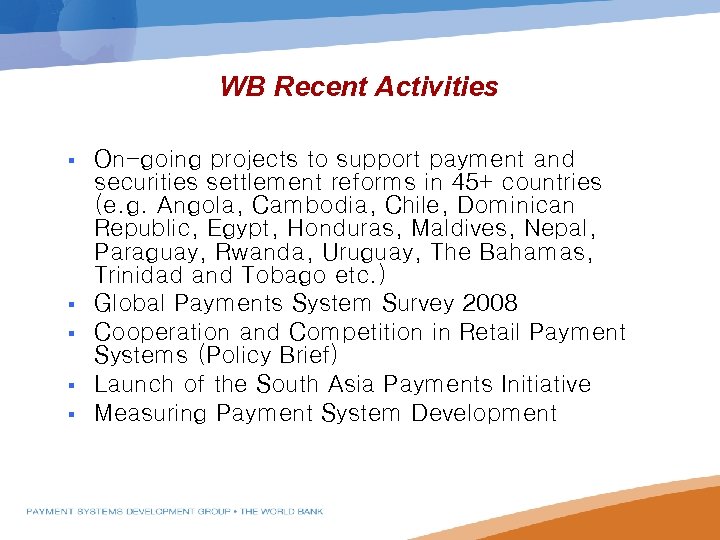

WB Recent Activities § § § On-going projects to support payment and securities settlement reforms in 45+ countries (e. g. Angola, Cambodia, Chile, Dominican Republic, Egypt, Honduras, Maldives, Nepal, Paraguay, Rwanda, Uruguay, The Bahamas, Trinidad and Tobago etc. ) Global Payments System Survey 2008 Cooperation and Competition in Retail Payment Systems (Policy Brief) Launch of the South Asia Payments Initiative Measuring Payment System Development

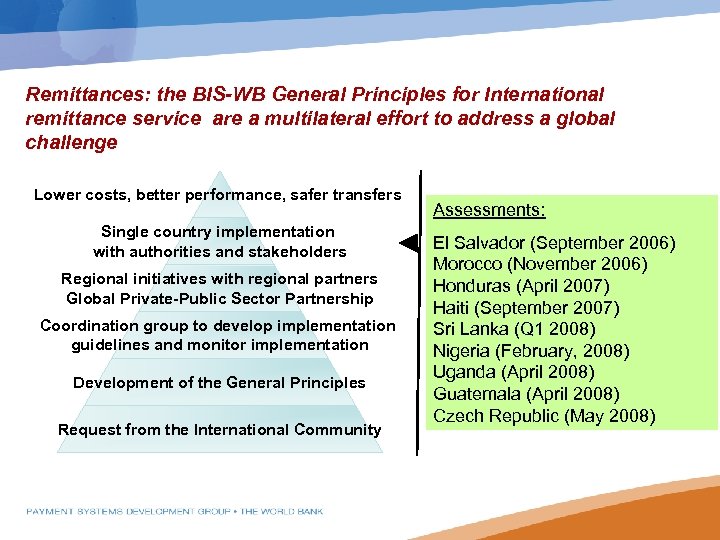

Remittances: the BIS-WB General Principles for International remittance service are a multilateral effort to address a global challenge Lower costs, better performance, safer transfers Single country implementation with authorities and stakeholders Regional initiatives with regional partners Global Private-Public Sector Partnership Coordination group to develop implementation guidelines and monitor implementation Development of the General Principles Request from the International Community Assessments: El Salvador (September 2006) Morocco (November 2006) Honduras (April 2007) Haiti (September 2007) Sri Lanka (Q 1 2008) Nigeria (February, 2008) Uganda (April 2008) Guatemala (April 2008) Czech Republic (May 2008)

§ The General Principles have been formally endorsed by the G-8, G-20 and the Financial Stability Forum § Both Sending and Receiving Countries have been urged to adopt them!!!

§ Improvements in the remittance market are achievable, when international and national authorities work with the private sector to achieve the goals of the Principles. § The pilots undertaken so far have led to remittance market improvements, and the assessments developed are a good tool to provide recommendations and promote cooperation between authorities. § The World Bank will continue to lead teams in implementing the principles (with an increased focus on Africa and South Asia within regional initiatives going forward)

World Bank Remittance Price Database LAUNCHED SEPTEMBER 2008! Remittanceprices. worldbank. org § To design a refined methodology to gather comparable remittance price data and measure the economic gains from lower costs to consumers § Increase transparency § Increase competition § Inform consumers The project will assist with the delivery of General Principle 1 §

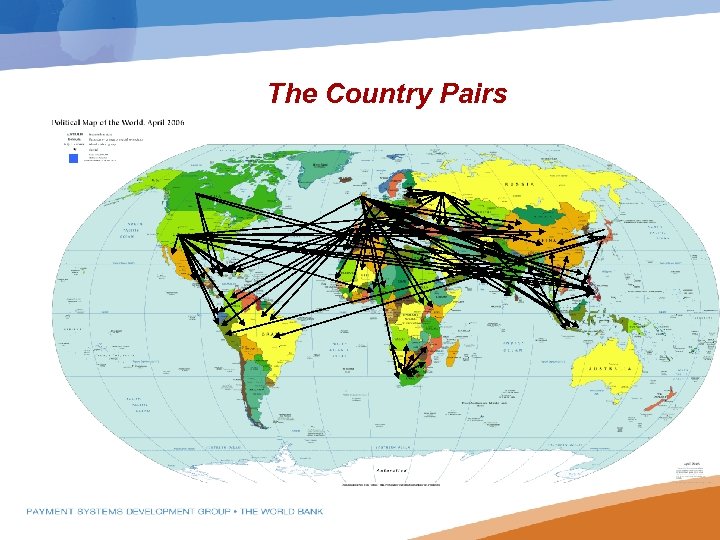

The Country Pairs §The Country Pairs (“The corridors”)

Word Bank-led Public/Private Partnership to Enhance the Efficiency of and Expand Access to Remittance Services § One of the recommendations endorsed at the G-8 Outreach Meeting on Remittances, held in Berlin in November 2007, was to create a public/private partnership to take forward international remittances work § In this vein, the suggested proposal is to create a group of international organizations, donors, national authorities from developed and developing countries, and the private sector to meet regularly to set concrete goals and actions for the international remittance market, and to co-ordinate efforts to avoid duplication

PPP Goals § Primary goals of this group would be: § to seek practical, actionable mechanisms to implement the General Principles for International Remittance Services § structure the international discussion between regulators and industry on legal and regulatory issues related to remittance § facilitate the flow of remittances through regulated channels § provide a forum for international discussions between regulators and industry generally § The forum would hold an annual plenary meeting where focal topics would be chosen for subcommittee work. These subcommittees would meet separately and regularly to meet their stated goal. Subcommittees will be both topically and regionally focused § First meeting to take place in Vienna in September, 2008

WB Future Plans § Study on the Future of RTGS systems § International Remittances: a Matter of Principles – Lessons from the Implementation of the WB-BIS GPs § Define guidelines for payment system integration efforts § Define a strategy for the World Bank Group to support more efficient, affordable and inclusive retail payments § Launch of a forum of cooperation on remittance and payment systems in the Africa region § Global Conference: “Redefining the Landscape of Payment Systems” Cape Town, April 7 -10, 2008 § ………………. .

GLOBAL PAYMENTS WEEK 2008 OVERCOMING SHORTFALLS IN PAYMENT SYSTEMS TIME IS NOW!!!

PPP Goals Thank you Payment Systems Development Group The World Bank mcirasino@worldbank. org jgarcialun@worldbank. org mguadamillas@worldbank. org

40aa953f2f372cd408fc73a89364eff4.ppt