dad42a6464131948d4ba7188c0a06ff4.ppt

- Количество слайдов: 33

Updates on MVAT Laws with special emphasis on builders & developers Presentation by CA Rajat Talati, Mumbai on 14. 10. 2012 rajat@talatico. com organised by J. B. Nagar CPE Study Circle of WIRC

Updates on MVAT Laws with special emphasis on builders & developers Presentation by CA Rajat Talati, Mumbai on 14. 10. 2012 rajat@talatico. com organised by J. B. Nagar CPE Study Circle of WIRC

Agenda • Recent amendments to Maharashtra Value Added Tax Act, 2005 • Recent amendments to Profession Tax Act - Maharashtra State • Taxation of builders & developers CA Rajat B. Talati, Mumbai 2

Agenda • Recent amendments to Maharashtra Value Added Tax Act, 2005 • Recent amendments to Profession Tax Act - Maharashtra State • Taxation of builders & developers CA Rajat B. Talati, Mumbai 2

Amendments Maharashtra Value Added Tax Act, 2005 CA Rajat B. Talati, Mumbai

Amendments Maharashtra Value Added Tax Act, 2005 CA Rajat B. Talati, Mumbai

Purchase Tax • Sec 6 A & 6 B - Purchase tax @ 5% on cotton and oil seeds purchased from URD – URD includes persons -farmers. – PT u/s 6 B on purchases of oil seeds effective from 1. 5. 12 – PT u/s 6 A on URD purchase of cotton not made effective • Registration compulsory when purchase turnover exceeds 5 lacs. – Prescribed limits would also include TO liable to PT – Sec 4(5 A) – Till such time exemption from PT –Sec 3(2) CA Rajat B. Talati, Mumbai

Purchase Tax • Sec 6 A & 6 B - Purchase tax @ 5% on cotton and oil seeds purchased from URD – URD includes persons -farmers. – PT u/s 6 B on purchases of oil seeds effective from 1. 5. 12 – PT u/s 6 A on URD purchase of cotton not made effective • Registration compulsory when purchase turnover exceeds 5 lacs. – Prescribed limits would also include TO liable to PT – Sec 4(5 A) – Till such time exemption from PT –Sec 3(2) CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • The purchase tax is payable in the following circumstances: – Oil seeds so purchased are dispatched by way of stock transfer to places outside the states within India or – Oil seeds so purchased are used in manufacture of – taxable goods and the goods so manufactured are transferred outside the state within India as stock transfer or – tax free goods CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • The purchase tax is payable in the following circumstances: – Oil seeds so purchased are dispatched by way of stock transfer to places outside the states within India or – Oil seeds so purchased are used in manufacture of – taxable goods and the goods so manufactured are transferred outside the state within India as stock transfer or – tax free goods CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • The rate of purchase tax is equal to the vat applicable to sale of oil seed i. e. 5% (current rate) • Purchase tax payable in the month when the contingencies occur • Purchase tax paid would also qualify for set off, subject to rule 53 & 54 CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • The rate of purchase tax is equal to the vat applicable to sale of oil seed i. e. 5% (current rate) • Purchase tax payable in the month when the contingencies occur • Purchase tax paid would also qualify for set off, subject to rule 53 & 54 CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • Is it that purchases from RD & URD put at par? - it would be appropriate to make purchases from registered dealer on payment of vat wherever there is some reduction in the ITC/ set off • Is it liable to stk of URD seeds on 30. 4. 12? CA Rajat B. Talati, Mumbai

Purchase Tax (cont. . . ) • Is it that purchases from RD & URD put at par? - it would be appropriate to make purchases from registered dealer on payment of vat wherever there is some reduction in the ITC/ set off • Is it liable to stk of URD seeds on 30. 4. 12? CA Rajat B. Talati, Mumbai

Tax Collection at Source • Sec 31 A – TCS - by – Persons who auctions right to excavates and – Or who is in temporary possession over goods that may be notified • Rate to be notified • Form 421 to be issued by auctioneer/ person • TCS allowed to be adjusted against tax liability of buyer • Notification yet to be issued CA Rajat B. Talati, Mumbai

Tax Collection at Source • Sec 31 A – TCS - by – Persons who auctions right to excavates and – Or who is in temporary possession over goods that may be notified • Rate to be notified • Form 421 to be issued by auctioneer/ person • TCS allowed to be adjusted against tax liability of buyer • Notification yet to be issued CA Rajat B. Talati, Mumbai

Textile processors • Sec 8(3 C) –exemption from VAT on value of material transferred in execution of WC effective 15. 8. 2007 to textile processors – Amendment in ADE wef 8. 4. 11 – Amendment to MVAT act effective 1. 5. 2012 provides –reference to ADE as it stood before Finance Act 2011 – Thus w. e. f. 1. 5. 12 – textile processors – exempted – Therefore taxable bet 8. 4. 11 to 30. 4. 12 CA Rajat B. Talati, Mumbai

Textile processors • Sec 8(3 C) –exemption from VAT on value of material transferred in execution of WC effective 15. 8. 2007 to textile processors – Amendment in ADE wef 8. 4. 11 – Amendment to MVAT act effective 1. 5. 2012 provides –reference to ADE as it stood before Finance Act 2011 – Thus w. e. f. 1. 5. 12 – textile processors – exempted – Therefore taxable bet 8. 4. 11 to 30. 4. 12 CA Rajat B. Talati, Mumbai

Penalty provisions • Non- Registration in time –Sec 29(2 A) – Penalty equal to amt of tax payable – Builders developers? ? • Saved in view of Admn relief scheme [14 T/2012] • Late fees of Rs. 5000/- on late filing of returns w. e. f. 1. 8. 2012. – Penalty u/s 29(8) deleted – Late retns filed upto 31. 7. 12 penalty applicable CA Rajat B. Talati, Mumbai

Penalty provisions • Non- Registration in time –Sec 29(2 A) – Penalty equal to amt of tax payable – Builders developers? ? • Saved in view of Admn relief scheme [14 T/2012] • Late fees of Rs. 5000/- on late filing of returns w. e. f. 1. 8. 2012. – Penalty u/s 29(8) deleted – Late retns filed upto 31. 7. 12 penalty applicable CA Rajat B. Talati, Mumbai

Others • Appeal stay - on 3 rd adjournment / fails to attend – stay to be vacated subject to payment of 15% of disputed amt or Rs. 15 cr whichever is less – Order of additional part payment is non-appealable order • Period for maintenance of sales invoice increased from 3 to 8 yrs (retrospective) and other books of a/cs remains 8 yrs. • Dealers not subjected to VAT audit are now supposed to file Annexure J 1 & J 2 by 29 th June 2012 for the year 2011 -12. CA Rajat B. Talati, Mumbai

Others • Appeal stay - on 3 rd adjournment / fails to attend – stay to be vacated subject to payment of 15% of disputed amt or Rs. 15 cr whichever is less – Order of additional part payment is non-appealable order • Period for maintenance of sales invoice increased from 3 to 8 yrs (retrospective) and other books of a/cs remains 8 yrs. • Dealers not subjected to VAT audit are now supposed to file Annexure J 1 & J 2 by 29 th June 2012 for the year 2011 -12. CA Rajat B. Talati, Mumbai

Others (cont. . ) • First return of a dealer is defined to be quarterly. • Natural Gas –defined as fuel –u/r 53(1) retention -3% • Stock Transfer retention- retention u/r 53(3) -4% • Tax if paid by the claimant dealer & to give credit for the total value of collection certificate received is included in Rule 55 (1), (1 b), (3). • Submission of Audit report proponed to 30 th November. • Dealers of PSI can avail ITC on purchases other than raw materials. CA Rajat B. Talati, Mumbai

Others (cont. . ) • First return of a dealer is defined to be quarterly. • Natural Gas –defined as fuel –u/r 53(1) retention -3% • Stock Transfer retention- retention u/r 53(3) -4% • Tax if paid by the claimant dealer & to give credit for the total value of collection certificate received is included in Rule 55 (1), (1 b), (3). • Submission of Audit report proponed to 30 th November. • Dealers of PSI can avail ITC on purchases other than raw materials. CA Rajat B. Talati, Mumbai

![Taxation of Furnishing fabrics [FF] • Sch entry – C- 101(a) – Fabric & Taxation of Furnishing fabrics [FF] • Sch entry – C- 101(a) – Fabric &](https://present5.com/presentation/dad42a6464131948d4ba7188c0a06ff4/image-13.jpg) Taxation of Furnishing fabrics [FF] • Sch entry – C- 101(a) – Fabric & Sugar –as defined under Sec 14 of the CST Act • Sch Entry C- 101(b)- varieties of textiles- notified • Both attract VAT @ 5% wef 1. 5. 2011 • T. O. of sales of FF not included in retailer’s composition. So no composition qua that T. O. of sales CA Rajat B. Talati, Mumbai

Taxation of Furnishing fabrics [FF] • Sch entry – C- 101(a) – Fabric & Sugar –as defined under Sec 14 of the CST Act • Sch Entry C- 101(b)- varieties of textiles- notified • Both attract VAT @ 5% wef 1. 5. 2011 • T. O. of sales of FF not included in retailer’s composition. So no composition qua that T. O. of sales CA Rajat B. Talati, Mumbai

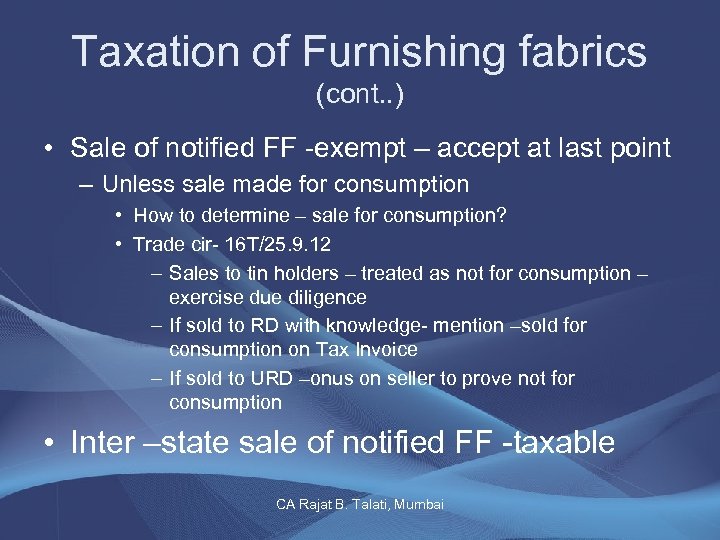

Taxation of Furnishing fabrics (cont. . ) • Sale of notified FF -exempt – accept at last point – Unless sale made for consumption • How to determine – sale for consumption? • Trade cir- 16 T/25. 9. 12 – Sales to tin holders – treated as not for consumption – exercise due diligence – If sold to RD with knowledge- mention –sold for consumption on Tax Invoice – If sold to URD –onus on seller to prove not for consumption • Inter –state sale of notified FF -taxable CA Rajat B. Talati, Mumbai

Taxation of Furnishing fabrics (cont. . ) • Sale of notified FF -exempt – accept at last point – Unless sale made for consumption • How to determine – sale for consumption? • Trade cir- 16 T/25. 9. 12 – Sales to tin holders – treated as not for consumption – exercise due diligence – If sold to RD with knowledge- mention –sold for consumption on Tax Invoice – If sold to URD –onus on seller to prove not for consumption • Inter –state sale of notified FF -taxable CA Rajat B. Talati, Mumbai

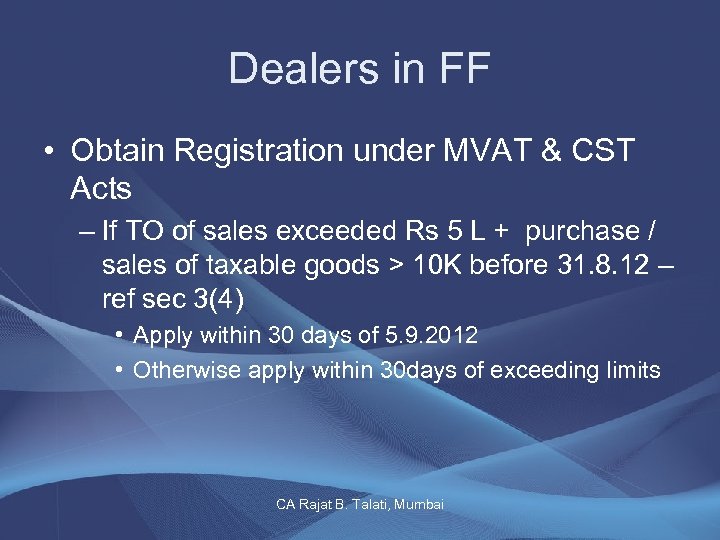

Dealers in FF • Obtain Registration under MVAT & CST Acts – If TO of sales exceeded Rs 5 L + purchase / sales of taxable goods > 10 K before 31. 8. 12 – ref sec 3(4) • Apply within 30 days of 5. 9. 2012 • Otherwise apply within 30 days of exceeding limits CA Rajat B. Talati, Mumbai

Dealers in FF • Obtain Registration under MVAT & CST Acts – If TO of sales exceeded Rs 5 L + purchase / sales of taxable goods > 10 K before 31. 8. 12 – ref sec 3(4) • Apply within 30 days of 5. 9. 2012 • Otherwise apply within 30 days of exceeding limits CA Rajat B. Talati, Mumbai

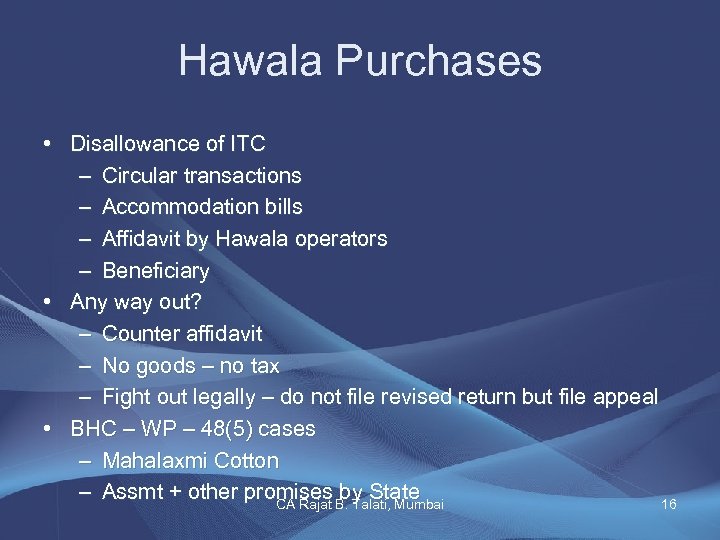

Hawala Purchases • Disallowance of ITC – Circular transactions – Accommodation bills – Affidavit by Hawala operators – Beneficiary • Any way out? – Counter affidavit – No goods – no tax – Fight out legally – do not file revised return but file appeal • BHC – WP – 48(5) cases – Mahalaxmi Cotton – Assmt + other promises by State CA Rajat B. Talati, Mumbai 16

Hawala Purchases • Disallowance of ITC – Circular transactions – Accommodation bills – Affidavit by Hawala operators – Beneficiary • Any way out? – Counter affidavit – No goods – no tax – Fight out legally – do not file revised return but file appeal • BHC – WP – 48(5) cases – Mahalaxmi Cotton – Assmt + other promises by State CA Rajat B. Talati, Mumbai 16

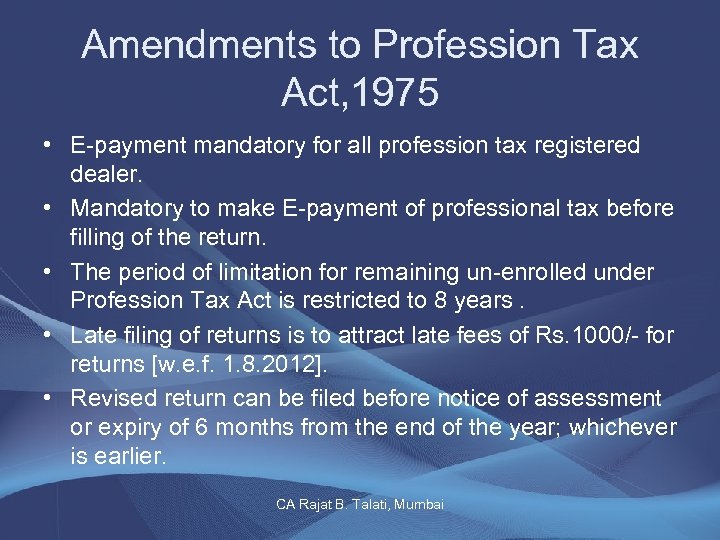

Amendments to Profession Tax Act, 1975 • E-payment mandatory for all profession tax registered dealer. • Mandatory to make E-payment of professional tax before filling of the return. • The period of limitation for remaining un-enrolled under Profession Tax Act is restricted to 8 years. • Late filing of returns is to attract late fees of Rs. 1000/- for returns [w. e. f. 1. 8. 2012]. • Revised return can be filed before notice of assessment or expiry of 6 months from the end of the year; whichever is earlier. CA Rajat B. Talati, Mumbai

Amendments to Profession Tax Act, 1975 • E-payment mandatory for all profession tax registered dealer. • Mandatory to make E-payment of professional tax before filling of the return. • The period of limitation for remaining un-enrolled under Profession Tax Act is restricted to 8 years. • Late filing of returns is to attract late fees of Rs. 1000/- for returns [w. e. f. 1. 8. 2012]. • Revised return can be filed before notice of assessment or expiry of 6 months from the end of the year; whichever is earlier. CA Rajat B. Talati, Mumbai

Taxation of builders & developers CA Rajat B. Talati, Mumbai 18

Taxation of builders & developers CA Rajat B. Talati, Mumbai 18

Overview – Brief history • Levy of tax – how for legal ? – Tax on immovable property • MOFA Act • SC – K Raheja Development Corporation • Karnataka v/s Maharashtra – Difference in agreements • Insertion of definition of w/c under MVAT Act • Trade Circular no. 12 T of 2007 CA Rajat B. Talati, Mumbai 19

Overview – Brief history • Levy of tax – how for legal ? – Tax on immovable property • MOFA Act • SC – K Raheja Development Corporation • Karnataka v/s Maharashtra – Difference in agreements • Insertion of definition of w/c under MVAT Act • Trade Circular no. 12 T of 2007 CA Rajat B. Talati, Mumbai 19

Overview – Brief history (cont. . ) • • Challenge by MCHI Interim stay by BHC – 7. 12. 2007 Final judgment upholding levy – 10. 4. 2012 Intervening period – Builders not forced for registration – MCHI members to file quarterly information statement CA Rajat B. Talati, Mumbai 20

Overview – Brief history (cont. . ) • • Challenge by MCHI Interim stay by BHC – 7. 12. 2007 Final judgment upholding levy – 10. 4. 2012 Intervening period – Builders not forced for registration – MCHI members to file quarterly information statement CA Rajat B. Talati, Mumbai 20

VAT Liability – builders & developers - Administrative relief • Trade Circular no. 14 T/2012 dt. 6. 8. 12 • Administrative relief will be allowed to the builder / developer for a period exceeding 5 yrs i. e. their registration certificate would be made effective from 20. 6. 2006 [wherever reqd] – Application for registration is to be made before 16. 8. 12 [ now extended to 15. 10. 12] CA Rajat B. Talati, Mumbai 21

VAT Liability – builders & developers - Administrative relief • Trade Circular no. 14 T/2012 dt. 6. 8. 12 • Administrative relief will be allowed to the builder / developer for a period exceeding 5 yrs i. e. their registration certificate would be made effective from 20. 6. 2006 [wherever reqd] – Application for registration is to be made before 16. 8. 12 [ now extended to 15. 10. 12] CA Rajat B. Talati, Mumbai 21

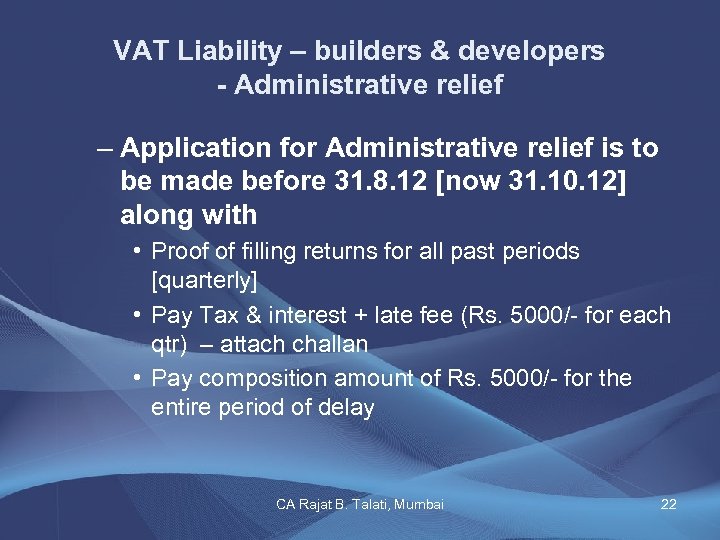

VAT Liability – builders & developers - Administrative relief – Application for Administrative relief is to be made before 31. 8. 12 [now 31. 10. 12] along with • Proof of filling returns for all past periods [quarterly] • Pay Tax & interest + late fee (Rs. 5000/- for each qtr) – attach challan • Pay composition amount of Rs. 5000/- for the entire period of delay CA Rajat B. Talati, Mumbai 22

VAT Liability – builders & developers - Administrative relief – Application for Administrative relief is to be made before 31. 8. 12 [now 31. 10. 12] along with • Proof of filling returns for all past periods [quarterly] • Pay Tax & interest + late fee (Rs. 5000/- for each qtr) – attach challan • Pay composition amount of Rs. 5000/- for the entire period of delay CA Rajat B. Talati, Mumbai 22

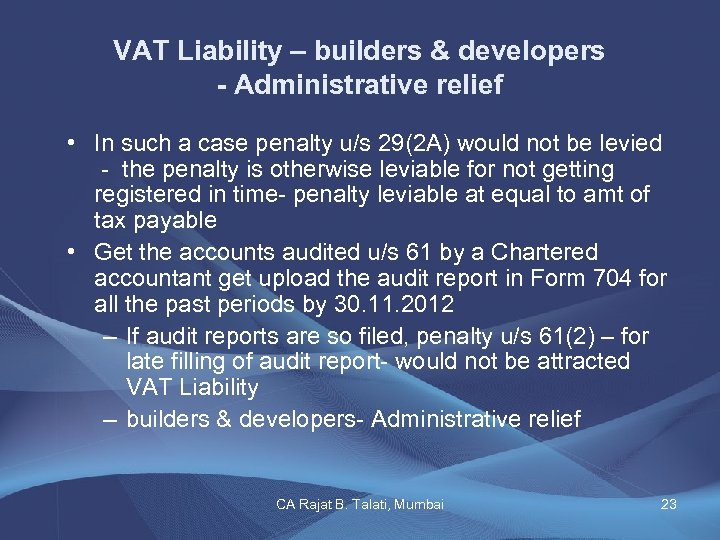

VAT Liability – builders & developers - Administrative relief • In such a case penalty u/s 29(2 A) would not be levied - the penalty is otherwise leviable for not getting registered in time- penalty leviable at equal to amt of tax payable • Get the accounts audited u/s 61 by a Chartered accountant get upload the audit report in Form 704 for all the past periods by 30. 11. 2012 – If audit reports are so filed, penalty u/s 61(2) – for late filling of audit report- would not be attracted VAT Liability – builders & developers- Administrative relief CA Rajat B. Talati, Mumbai 23

VAT Liability – builders & developers - Administrative relief • In such a case penalty u/s 29(2 A) would not be levied - the penalty is otherwise leviable for not getting registered in time- penalty leviable at equal to amt of tax payable • Get the accounts audited u/s 61 by a Chartered accountant get upload the audit report in Form 704 for all the past periods by 30. 11. 2012 – If audit reports are so filed, penalty u/s 61(2) – for late filling of audit report- would not be attracted VAT Liability – builders & developers- Administrative relief CA Rajat B. Talati, Mumbai 23

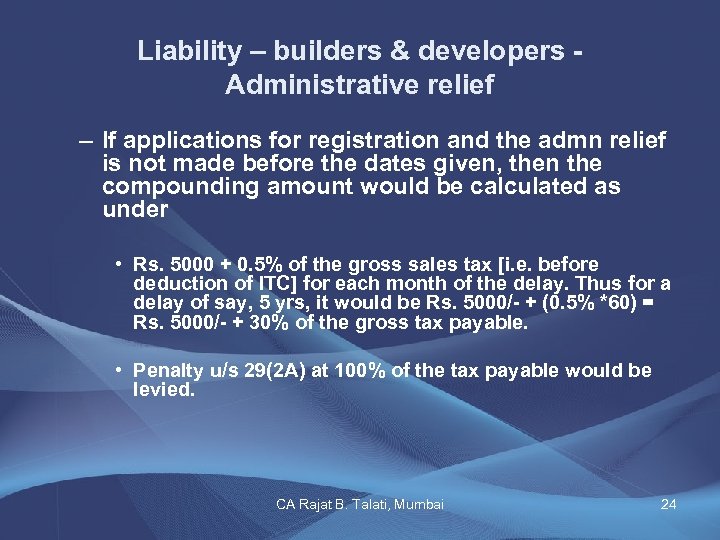

Liability – builders & developers Administrative relief – If applications for registration and the admn relief is not made before the dates given, then the compounding amount would be calculated as under • Rs. 5000 + 0. 5% of the gross sales tax [i. e. before deduction of ITC] for each month of the delay. Thus for a delay of say, 5 yrs, it would be Rs. 5000/- + (0. 5% *60) = Rs. 5000/- + 30% of the gross tax payable. • Penalty u/s 29(2 A) at 100% of the tax payable would be levied. CA Rajat B. Talati, Mumbai 24

Liability – builders & developers Administrative relief – If applications for registration and the admn relief is not made before the dates given, then the compounding amount would be calculated as under • Rs. 5000 + 0. 5% of the gross sales tax [i. e. before deduction of ITC] for each month of the delay. Thus for a delay of say, 5 yrs, it would be Rs. 5000/- + (0. 5% *60) = Rs. 5000/- + 30% of the gross tax payable. • Penalty u/s 29(2 A) at 100% of the tax payable would be levied. CA Rajat B. Talati, Mumbai 24

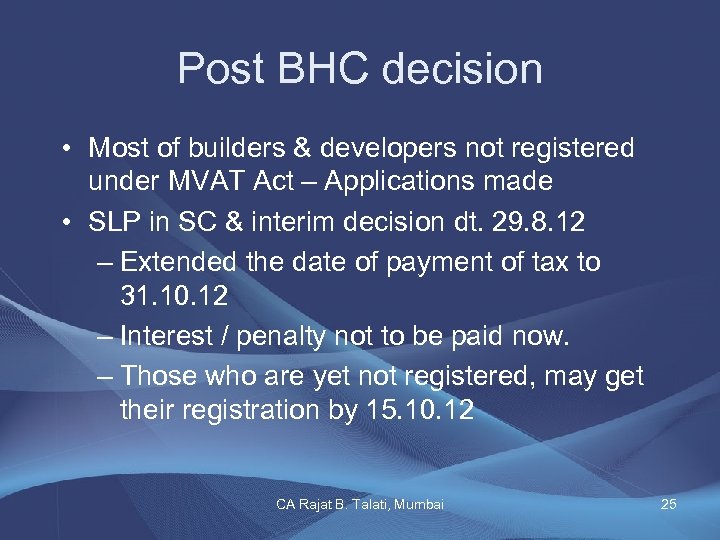

Post BHC decision • Most of builders & developers not registered under MVAT Act – Applications made • SLP in SC & interim decision dt. 29. 8. 12 – Extended the date of payment of tax to 31. 10. 12 – Interest / penalty not to be paid now. – Those who are yet not registered, may get their registration by 15. 10. 12 CA Rajat B. Talati, Mumbai 25

Post BHC decision • Most of builders & developers not registered under MVAT Act – Applications made • SLP in SC & interim decision dt. 29. 8. 12 – Extended the date of payment of tax to 31. 10. 12 – Interest / penalty not to be paid now. – Those who are yet not registered, may get their registration by 15. 10. 12 CA Rajat B. Talati, Mumbai 25

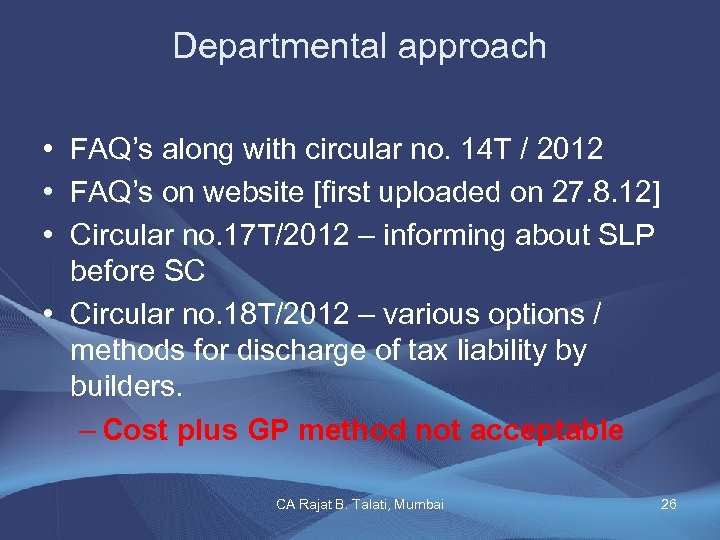

Departmental approach • FAQ’s along with circular no. 14 T / 2012 • FAQ’s on website [first uploaded on 27. 8. 12] • Circular no. 17 T/2012 – informing about SLP before SC • Circular no. 18 T/2012 – various options / methods for discharge of tax liability by builders. – Cost plus GP method not acceptable CA Rajat B. Talati, Mumbai 26

Departmental approach • FAQ’s along with circular no. 14 T / 2012 • FAQ’s on website [first uploaded on 27. 8. 12] • Circular no. 17 T/2012 – informing about SLP before SC • Circular no. 18 T/2012 – various options / methods for discharge of tax liability by builders. – Cost plus GP method not acceptable CA Rajat B. Talati, Mumbai 26

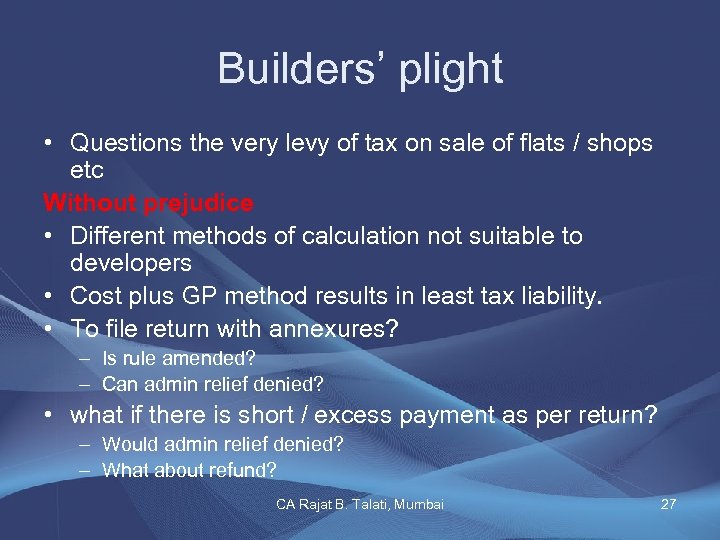

Builders’ plight • Questions the very levy of tax on sale of flats / shops etc Without prejudice • Different methods of calculation not suitable to developers • Cost plus GP method results in least tax liability. • To file return with annexures? – Is rule amended? – Can admin relief denied? • what if there is short / excess payment as per return? – Would admin relief denied? – What about refund? CA Rajat B. Talati, Mumbai 27

Builders’ plight • Questions the very levy of tax on sale of flats / shops etc Without prejudice • Different methods of calculation not suitable to developers • Cost plus GP method results in least tax liability. • To file return with annexures? – Is rule amended? – Can admin relief denied? • what if there is short / excess payment as per return? – Would admin relief denied? – What about refund? CA Rajat B. Talati, Mumbai 27

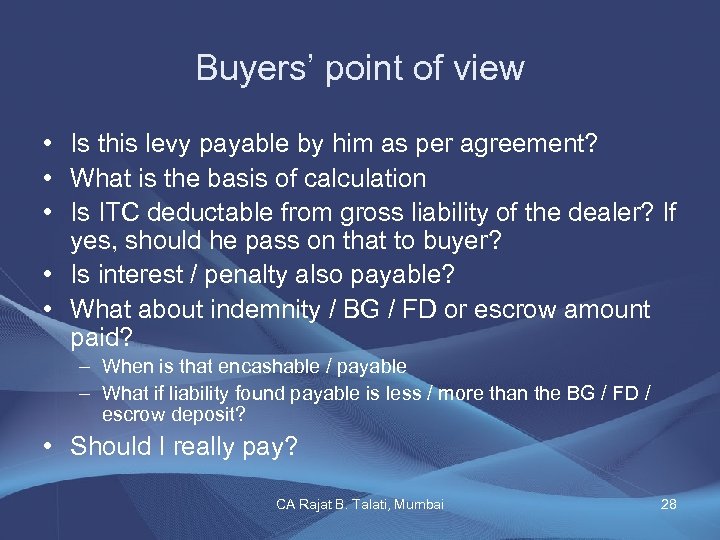

Buyers’ point of view • Is this levy payable by him as per agreement? • What is the basis of calculation • Is ITC deductable from gross liability of the dealer? If yes, should he pass on that to buyer? • Is interest / penalty also payable? • What about indemnity / BG / FD or escrow amount paid? – When is that encashable / payable – What if liability found payable is less / more than the BG / FD / escrow deposit? • Should I really pay? CA Rajat B. Talati, Mumbai 28

Buyers’ point of view • Is this levy payable by him as per agreement? • What is the basis of calculation • Is ITC deductable from gross liability of the dealer? If yes, should he pass on that to buyer? • Is interest / penalty also payable? • What about indemnity / BG / FD or escrow amount paid? – When is that encashable / payable – What if liability found payable is less / more than the BG / FD / escrow deposit? • Should I really pay? CA Rajat B. Talati, Mumbai 28

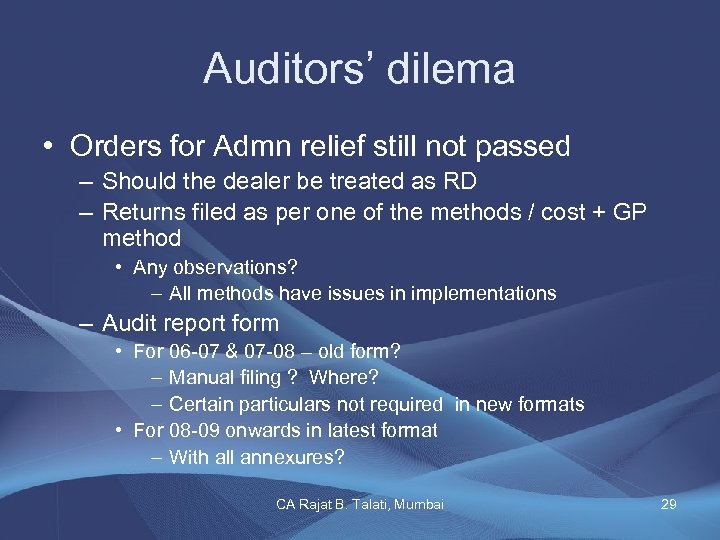

Auditors’ dilema • Orders for Admn relief still not passed – Should the dealer be treated as RD – Returns filed as per one of the methods / cost + GP method • Any observations? – All methods have issues in implementations – Audit report form • For 06 -07 & 07 -08 – old form? – Manual filing ? Where? – Certain particulars not required in new formats • For 08 -09 onwards in latest format – With all annexures? CA Rajat B. Talati, Mumbai 29

Auditors’ dilema • Orders for Admn relief still not passed – Should the dealer be treated as RD – Returns filed as per one of the methods / cost + GP method • Any observations? – All methods have issues in implementations – Audit report form • For 06 -07 & 07 -08 – old form? – Manual filing ? Where? – Certain particulars not required in new formats • For 08 -09 onwards in latest format – With all annexures? CA Rajat B. Talati, Mumbai 29

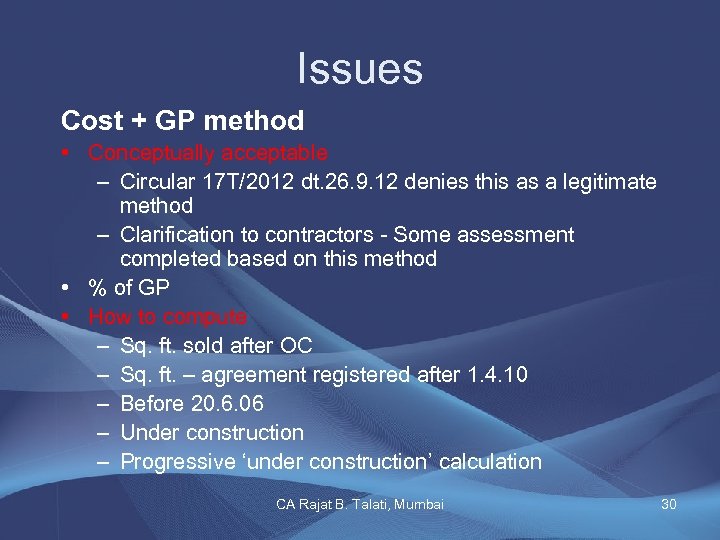

Issues Cost + GP method • Conceptually acceptable – Circular 17 T/2012 dt. 26. 9. 12 denies this as a legitimate method – Clarification to contractors - Some assessment completed based on this method • % of GP • How to compute – Sq. ft. sold after OC – Sq. ft. – agreement registered after 1. 4. 10 – Before 20. 6. 06 – Under construction – Progressive ‘under construction’ calculation CA Rajat B. Talati, Mumbai 30

Issues Cost + GP method • Conceptually acceptable – Circular 17 T/2012 dt. 26. 9. 12 denies this as a legitimate method – Clarification to contractors - Some assessment completed based on this method • % of GP • How to compute – Sq. ft. sold after OC – Sq. ft. – agreement registered after 1. 4. 10 – Before 20. 6. 06 – Under construction – Progressive ‘under construction’ calculation CA Rajat B. Talati, Mumbai 30

![Issues • Land cost deduction [ for Rule 58(1) & it’s proviso] – How Issues • Land cost deduction [ for Rule 58(1) & it’s proviso] – How](https://present5.com/presentation/dad42a6464131948d4ba7188c0a06ff4/image-31.jpg) Issues • Land cost deduction [ for Rule 58(1) & it’s proviso] – How to calculate? – Cost v/s ready recknor – Should it be the same for all flats / should it change every year? – TDR/ premium paid to MCGB? • Rule 58(1) –deductions for exps on – Marketing, interest, depreciation & other cost – Solicitor fees, general Admn cost etc • Sub-contractor’s payment – If RD – form 407 / 408 not received? – If tax not separately charged & if 407 / 408 not received – URD – sub-contractor CA Rajat B. Talati, Mumbai 31

Issues • Land cost deduction [ for Rule 58(1) & it’s proviso] – How to calculate? – Cost v/s ready recknor – Should it be the same for all flats / should it change every year? – TDR/ premium paid to MCGB? • Rule 58(1) –deductions for exps on – Marketing, interest, depreciation & other cost – Solicitor fees, general Admn cost etc • Sub-contractor’s payment – If RD – form 407 / 408 not received? – If tax not separately charged & if 407 / 408 not received – URD – sub-contractor CA Rajat B. Talati, Mumbai 31

Any Queries ? ? CA Rajat B. Talati, Mumbai 32

Any Queries ? ? CA Rajat B. Talati, Mumbai 32