f963a7c2f8b430eae2bdaf90b5ad3785.ppt

- Количество слайдов: 25

Update on Worldwide Greenhouse Gas Market Developments Michael J. Walsh, Ph. D. Senior Vice President +1. 312. 554. 3350 www. chicagoclimateexchange. com CHICAGO CLIMATE EXCHANGE, INC. © 2004

Update on Worldwide Greenhouse Gas Market Developments Michael J. Walsh, Ph. D. Senior Vice President +1. 312. 554. 3350 www. chicagoclimateexchange. com CHICAGO CLIMATE EXCHANGE, INC. © 2004

Summary: Carbon Market Status Worldwide • Now live: CCX, UK (pre-EU) • Regulatory: Kyoto and before • being implemented (e. g. EU) • under discussion (Canada, NZ) • unclear (Japan) • State-level regulatory: • active: New South Wales • under discussion: Northeast U. S. • Russia, Ukraine: will they be trade-eligible at 2008? • Developing Countries: sellers from mitigation projects CHICAGO CLIMATE EXCHANGE, INC. © 2004

Summary: Carbon Market Status Worldwide • Now live: CCX, UK (pre-EU) • Regulatory: Kyoto and before • being implemented (e. g. EU) • under discussion (Canada, NZ) • unclear (Japan) • State-level regulatory: • active: New South Wales • under discussion: Northeast U. S. • Russia, Ukraine: will they be trade-eligible at 2008? • Developing Countries: sellers from mitigation projects CHICAGO CLIMATE EXCHANGE, INC. © 2004

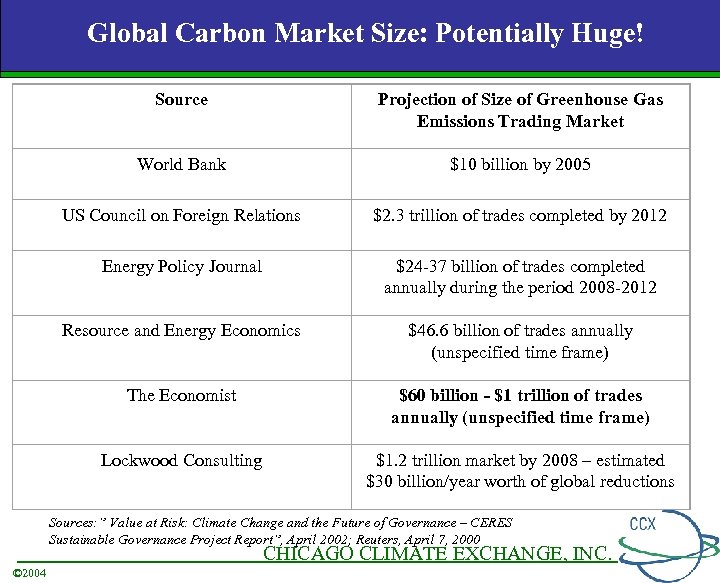

Global Carbon Market Size: Potentially Huge! Source World Bank $10 billion by 2005 US Council on Foreign Relations $2. 3 trillion of trades completed by 2012 Energy Policy Journal $24 -37 billion of trades completed annually during the period 2008 -2012 Resource and Energy Economics $46. 6 billion of trades annually (unspecified time frame) The Economist $60 billion - $1 trillion of trades annually (unspecified time frame) Lockwood Consulting Projection of Size of Greenhouse Gas Emissions Trading Market $1. 2 trillion market by 2008 – estimated $30 billion/year worth of global reductions Sources: ” Value at Risk: Climate Change and the Future of Governance – CERES Sustainable Governance Project Report”, April 2002; Reuters, April 7, 2000 CHICAGO CLIMATE EXCHANGE, INC. © 2004

Global Carbon Market Size: Potentially Huge! Source World Bank $10 billion by 2005 US Council on Foreign Relations $2. 3 trillion of trades completed by 2012 Energy Policy Journal $24 -37 billion of trades completed annually during the period 2008 -2012 Resource and Energy Economics $46. 6 billion of trades annually (unspecified time frame) The Economist $60 billion - $1 trillion of trades annually (unspecified time frame) Lockwood Consulting Projection of Size of Greenhouse Gas Emissions Trading Market $1. 2 trillion market by 2008 – estimated $30 billion/year worth of global reductions Sources: ” Value at Risk: Climate Change and the Future of Governance – CERES Sustainable Governance Project Report”, April 2002; Reuters, April 7, 2000 CHICAGO CLIMATE EXCHANGE, INC. © 2004

U. S. Situation • Total emissions: 6. 9 billion mt CO 2 (2002) (11% >1990) • President Bush: reduce emissions intensity (CO 2/GDP) 18% by 2012; fund R&D • “Crediting” under revised 1605 b program legally unclear • Mc. Cain/Lieberman bill: • return U. S. emissions to 2000 levels by 2010 • trading upstream and downstream; sequestration • latest Senate vote: 43 yes, 55 no • Chicago Climate Exchange is live and growing CHICAGO CLIMATE EXCHANGE, INC. © 2004

U. S. Situation • Total emissions: 6. 9 billion mt CO 2 (2002) (11% >1990) • President Bush: reduce emissions intensity (CO 2/GDP) 18% by 2012; fund R&D • “Crediting” under revised 1605 b program legally unclear • Mc. Cain/Lieberman bill: • return U. S. emissions to 2000 levels by 2010 • trading upstream and downstream; sequestration • latest Senate vote: 43 yes, 55 no • Chicago Climate Exchange is live and growing CHICAGO CLIMATE EXCHANGE, INC. © 2004

Chicago Climate Exchange® is a voluntary, legally binding pilot greenhouse gas trading program for emission sources and offset projects in North America and offset projects in Brazil. CHICAGO CLIMATE EXCHANGE, INC. © 2004

Chicago Climate Exchange® is a voluntary, legally binding pilot greenhouse gas trading program for emission sources and offset projects in North America and offset projects in Brazil. CHICAGO CLIMATE EXCHANGE, INC. © 2004

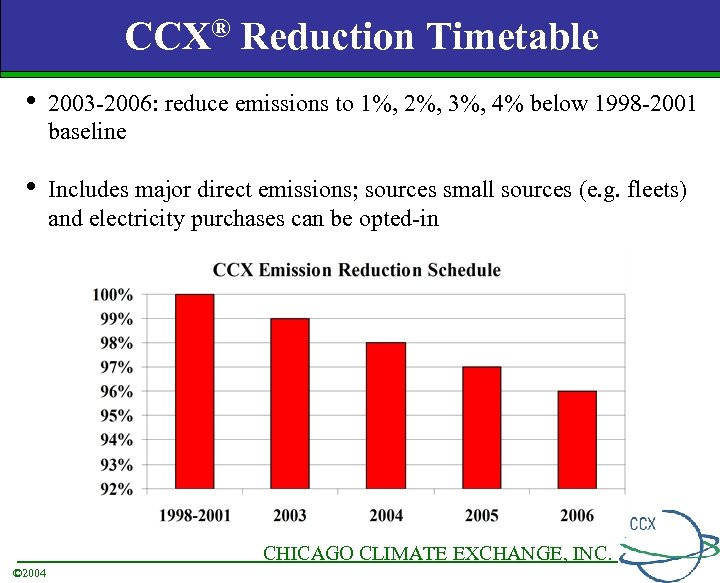

CCX® Reduction Timetable • 2003 -2006: reduce emissions to 1%, 2%, 3%, 4% below 1998 -2001 baseline • Includes major direct emissions; sources small sources (e. g. fleets) and electricity purchases can be opted-in CHICAGO CLIMATE EXCHANGE, INC. © 2004

CCX® Reduction Timetable • 2003 -2006: reduce emissions to 1%, 2%, 3%, 4% below 1998 -2001 baseline • Includes major direct emissions; sources small sources (e. g. fleets) and electricity purchases can be opted-in CHICAGO CLIMATE EXCHANGE, INC. © 2004

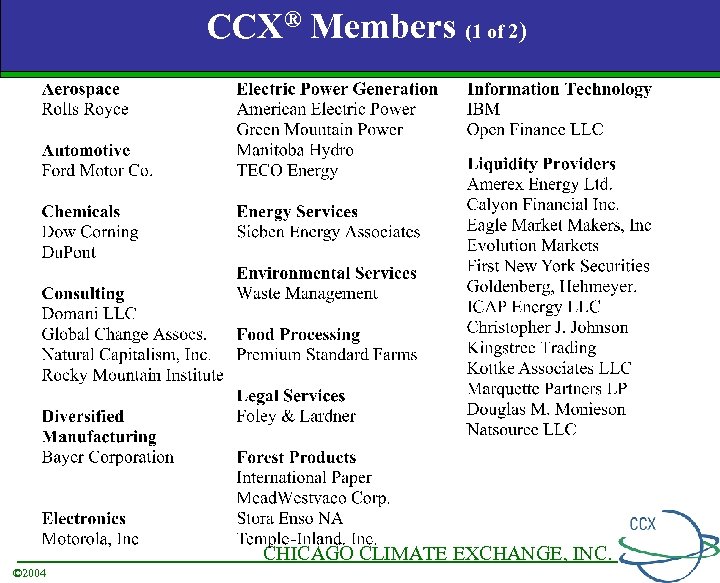

CCX® Members (1 of 2) CHICAGO CLIMATE EXCHANGE, INC. © 2004

CCX® Members (1 of 2) CHICAGO CLIMATE EXCHANGE, INC. © 2004

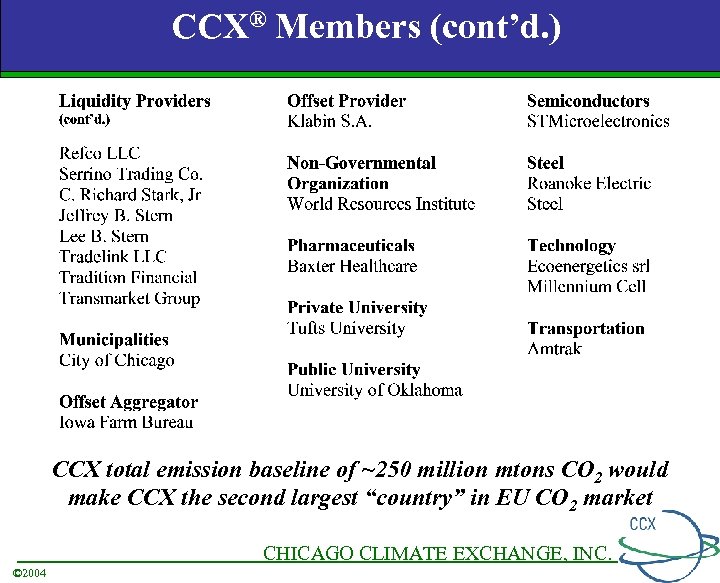

CCX® Members (cont’d. ) CCX total emission baseline of ~250 million mtons CO 2 would make CCX the second largest “country” in EU CO 2 market CHICAGO CLIMATE EXCHANGE, INC. © 2004

CCX® Members (cont’d. ) CCX total emission baseline of ~250 million mtons CO 2 would make CCX the second largest “country” in EU CO 2 market CHICAGO CLIMATE EXCHANGE, INC. © 2004

Initial list of CCX® eligible offset projects • Landfill and agricultural methane destruction • Sequestration: reforestation and agricultural soil projects • Brazil: energy, methane, forestry (reforestation + conservation) • CCX® protocols: eligibility, quantification, verification • Early Action Credits CHICAGO CLIMATE EXCHANGE, INC. © 2004

Initial list of CCX® eligible offset projects • Landfill and agricultural methane destruction • Sequestration: reforestation and agricultural soil projects • Brazil: energy, methane, forestry (reforestation + conservation) • CCX® protocols: eligibility, quantification, verification • Early Action Credits CHICAGO CLIMATE EXCHANGE, INC. © 2004

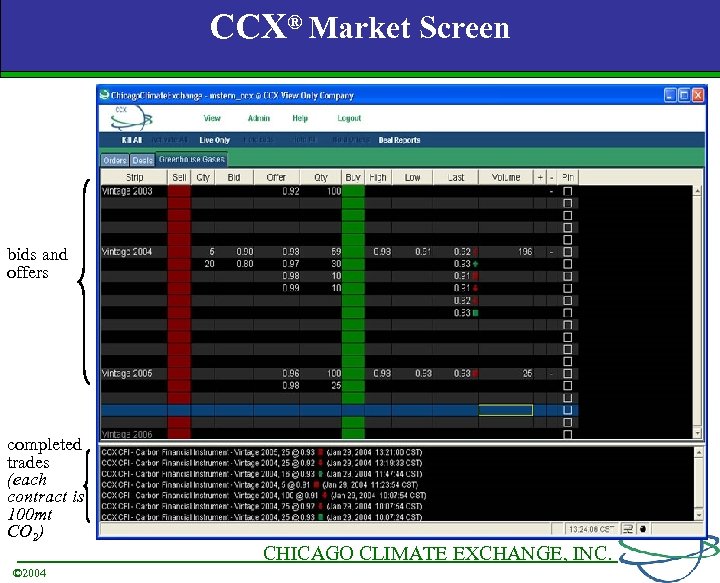

CCX® Market Screen bids and offers completed trades (each contract is 100 mt CO 2) CHICAGO CLIMATE EXCHANGE, INC. © 2004

CCX® Market Screen bids and offers completed trades (each contract is 100 mt CO 2) CHICAGO CLIMATE EXCHANGE, INC. © 2004

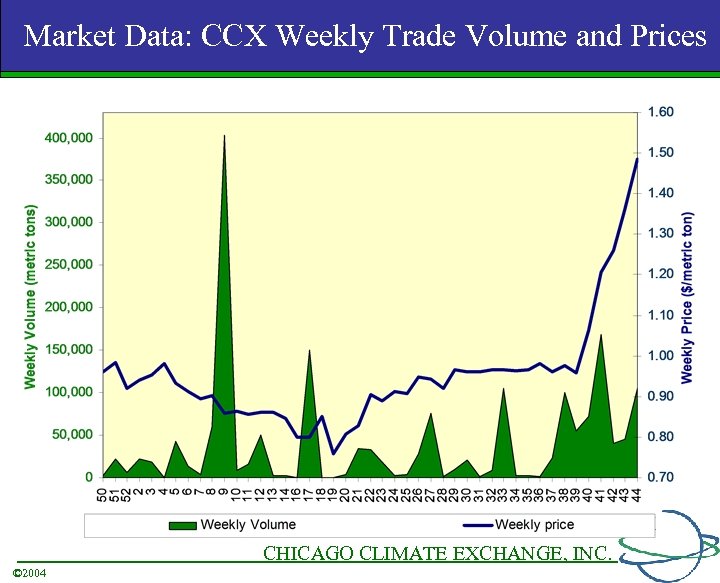

Market Data: CCX Weekly Trade Volume and Prices CHICAGO CLIMATE EXCHANGE, INC. © 2004

Market Data: CCX Weekly Trade Volume and Prices CHICAGO CLIMATE EXCHANGE, INC. © 2004

Canada • Total emissions ~743 million mt CO 2 • 2012 Kyoto Goal: -6% by 2012 (currently ~20%>1990) • Planned GHG trading system (2008): Large Final Emitters • 600 sites ~46% of Canada’s total emissions (342 mt): • Feds promising per-ton net cost cap of C$15/mt. CO 2 • National government to be active (CDM) purchaser? CHICAGO CLIMATE EXCHANGE, INC. © 2004

Canada • Total emissions ~743 million mt CO 2 • 2012 Kyoto Goal: -6% by 2012 (currently ~20%>1990) • Planned GHG trading system (2008): Large Final Emitters • 600 sites ~46% of Canada’s total emissions (342 mt): • Feds promising per-ton net cost cap of C$15/mt. CO 2 • National government to be active (CDM) purchaser? CHICAGO CLIMATE EXCHANGE, INC. © 2004

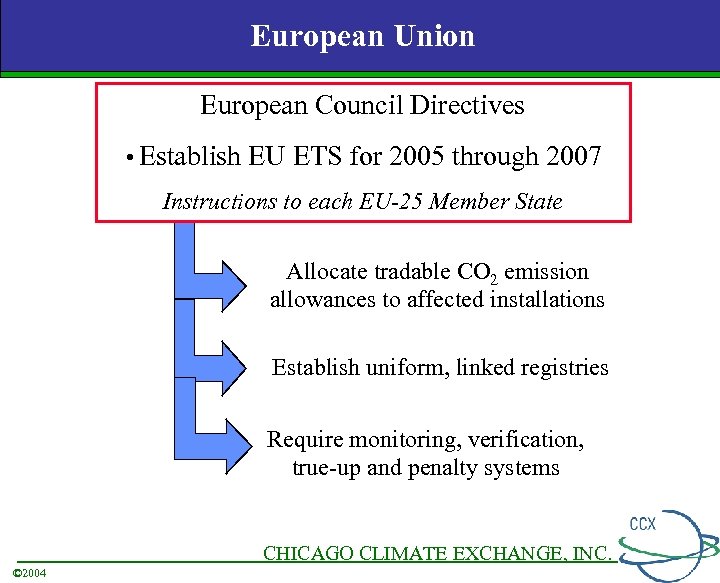

European Union European Council Directives • Establish EU ETS for 2005 through 2007 Instructions to each EU-25 Member State Allocate tradable CO 2 emission allowances to affected installations Establish uniform, linked registries Require monitoring, verification, true-up and penalty systems CHICAGO CLIMATE EXCHANGE, INC. © 2004

European Union European Council Directives • Establish EU ETS for 2005 through 2007 Instructions to each EU-25 Member State Allocate tradable CO 2 emission allowances to affected installations Establish uniform, linked registries Require monitoring, verification, true-up and penalty systems CHICAGO CLIMATE EXCHANGE, INC. © 2004

EU ETS (2005 – 2007) • Covers CO 2 emissions from 12, 000 installations • combustion devices >20 mw (electricity, heat, steam) • oil refineries, metals, cement, glass, ceramics • pulp and paper • Covers ~46% of total emissions (total~ 4. 9 bil mt CO 2) • Annual true-up by April 30, independent verification • Encourages Linkages (e. g. Japan, Canada, Norway) • Allows UN-approved CDM credits CHICAGO CLIMATE EXCHANGE, INC. © 2004

EU ETS (2005 – 2007) • Covers CO 2 emissions from 12, 000 installations • combustion devices >20 mw (electricity, heat, steam) • oil refineries, metals, cement, glass, ceramics • pulp and paper • Covers ~46% of total emissions (total~ 4. 9 bil mt CO 2) • Annual true-up by April 30, independent verification • Encourages Linkages (e. g. Japan, Canada, Norway) • Allows UN-approved CDM credits CHICAGO CLIMATE EXCHANGE, INC. © 2004

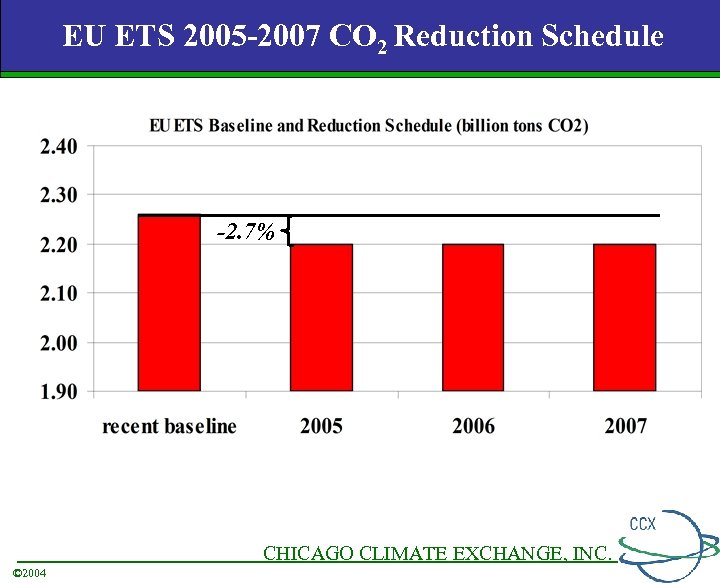

EU ETS 2005 -2007 CO 2 Reduction Schedule -2. 7% CHICAGO CLIMATE EXCHANGE, INC. © 2004

EU ETS 2005 -2007 CO 2 Reduction Schedule -2. 7% CHICAGO CLIMATE EXCHANGE, INC. © 2004

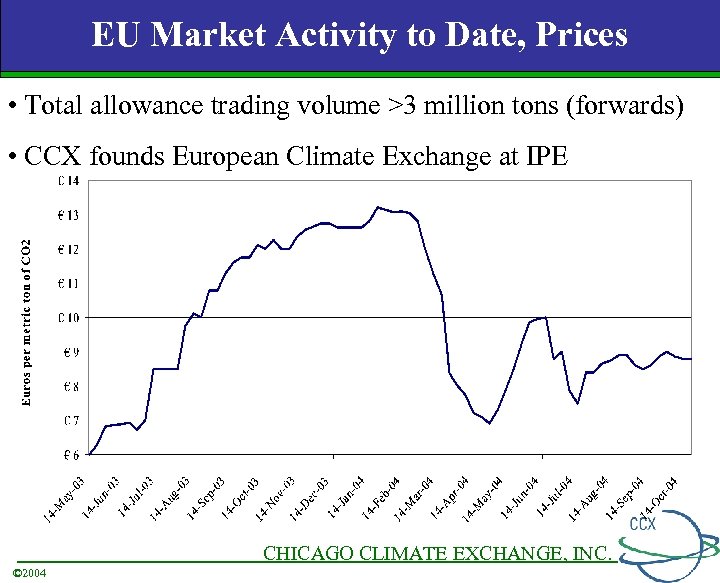

EU Market Activity to Date, Prices • Total allowance trading volume >3 million tons (forwards) • CCX founds European Climate Exchange at IPE CHICAGO CLIMATE EXCHANGE, INC. © 2004

EU Market Activity to Date, Prices • Total allowance trading volume >3 million tons (forwards) • CCX founds European Climate Exchange at IPE CHICAGO CLIMATE EXCHANGE, INC. © 2004

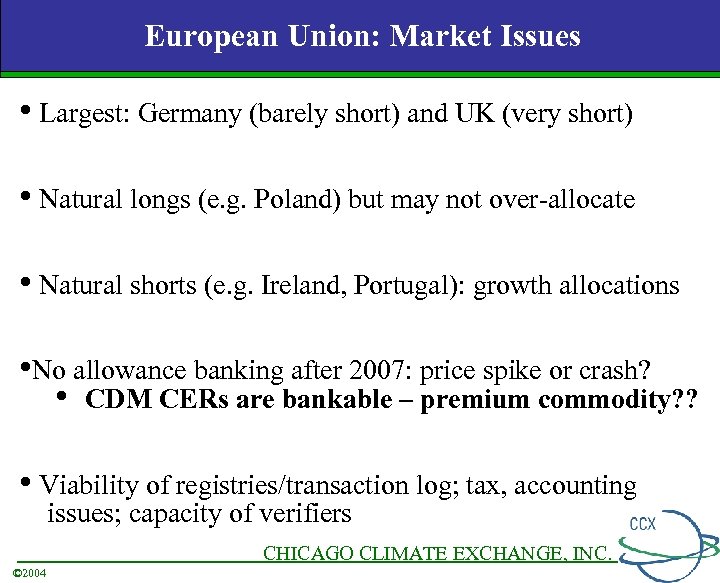

European Union: Market Issues • Largest: Germany (barely short) and UK (very short) • Natural longs (e. g. Poland) but may not over-allocate • Natural shorts (e. g. Ireland, Portugal): growth allocations • No allowance banking after 2007: price spike or crash? • CDM CERs are bankable – premium commodity? ? • Viability of registries/transaction log; tax, accounting issues; capacity of verifiers CHICAGO CLIMATE EXCHANGE, INC. © 2004

European Union: Market Issues • Largest: Germany (barely short) and UK (very short) • Natural longs (e. g. Poland) but may not over-allocate • Natural shorts (e. g. Ireland, Portugal): growth allocations • No allowance banking after 2007: price spike or crash? • CDM CERs are bankable – premium commodity? ? • Viability of registries/transaction log; tax, accounting issues; capacity of verifiers CHICAGO CLIMATE EXCHANGE, INC. © 2004

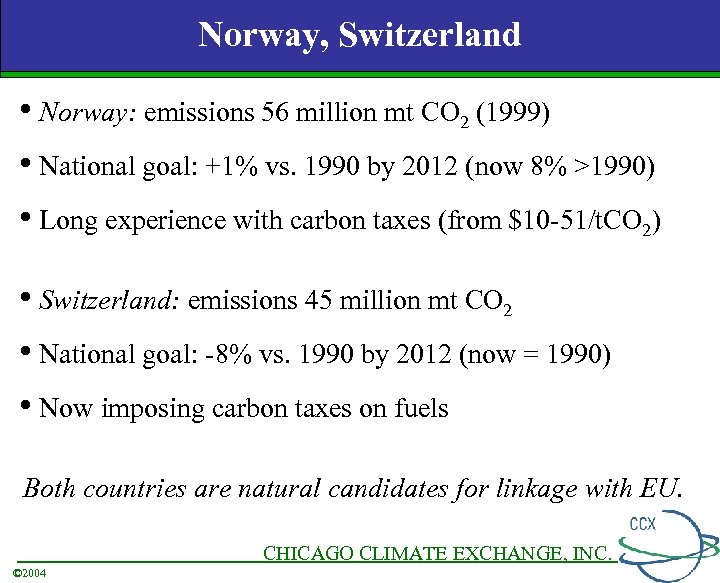

Norway, Switzerland • Norway: emissions 56 million mt CO 2 (1999) • National goal: +1% vs. 1990 by 2012 (now 8% >1990) • Long experience with carbon taxes (from $10 -51/t. CO 2) • Switzerland: emissions 45 million mt CO 2 • National goal: -8% vs. 1990 by 2012 (now = 1990) • Now imposing carbon taxes on fuels Both countries are natural candidates for linkage with EU. CHICAGO CLIMATE EXCHANGE, INC. © 2004

Norway, Switzerland • Norway: emissions 56 million mt CO 2 (1999) • National goal: +1% vs. 1990 by 2012 (now 8% >1990) • Long experience with carbon taxes (from $10 -51/t. CO 2) • Switzerland: emissions 45 million mt CO 2 • National goal: -8% vs. 1990 by 2012 (now = 1990) • Now imposing carbon taxes on fuels Both countries are natural candidates for linkage with EU. CHICAGO CLIMATE EXCHANGE, INC. © 2004

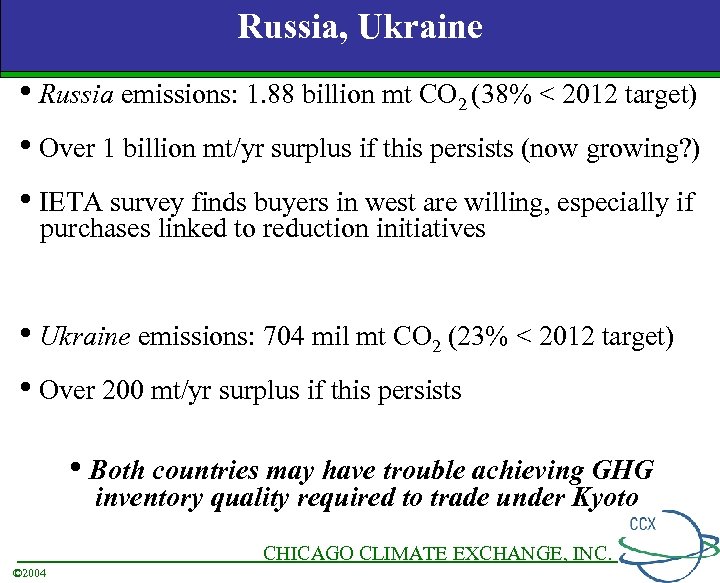

Russia, Ukraine • Russia emissions: 1. 88 billion mt CO 2 (38% < 2012 target) • Over 1 billion mt/yr surplus if this persists (now growing? ) • IETA survey finds buyers in west are willing, especially if purchases linked to reduction initiatives • Ukraine emissions: 704 mil mt CO 2 (23% < 2012 target) • Over 200 mt/yr surplus if this persists • Both countries may have trouble achieving GHG inventory quality required to trade under Kyoto CHICAGO CLIMATE EXCHANGE, INC. © 2004

Russia, Ukraine • Russia emissions: 1. 88 billion mt CO 2 (38% < 2012 target) • Over 1 billion mt/yr surplus if this persists (now growing? ) • IETA survey finds buyers in west are willing, especially if purchases linked to reduction initiatives • Ukraine emissions: 704 mil mt CO 2 (23% < 2012 target) • Over 200 mt/yr surplus if this persists • Both countries may have trouble achieving GHG inventory quality required to trade under Kyoto CHICAGO CLIMATE EXCHANGE, INC. © 2004

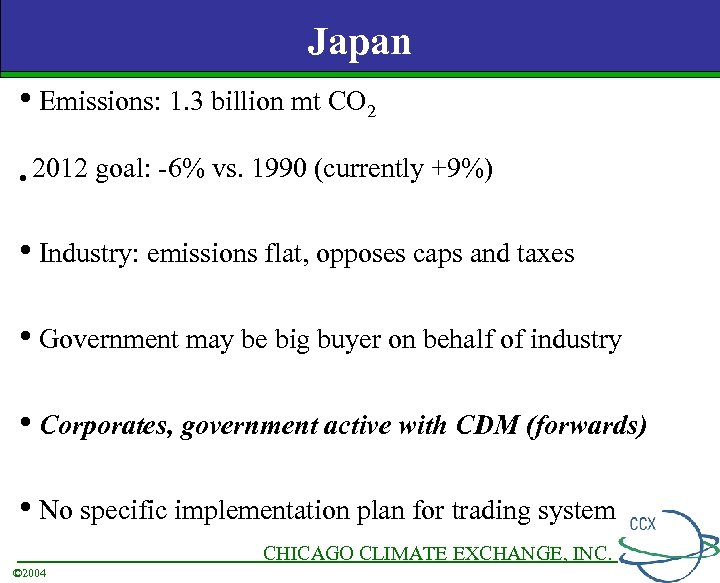

Japan • Emissions: 1. 3 billion mt CO 2 • 2012 goal: -6% vs. 1990 (currently +9%) • Industry: emissions flat, opposes caps and taxes • Government may be big buyer on behalf of industry • Corporates, government active with CDM (forwards) • No specific implementation plan for trading system CHICAGO CLIMATE EXCHANGE, INC. © 2004

Japan • Emissions: 1. 3 billion mt CO 2 • 2012 goal: -6% vs. 1990 (currently +9%) • Industry: emissions flat, opposes caps and taxes • Government may be big buyer on behalf of industry • Corporates, government active with CDM (forwards) • No specific implementation plan for trading system CHICAGO CLIMATE EXCHANGE, INC. © 2004

Developing Countries • Clean Development Mechanism (CDM) under Kyoto • Certified Emission Reductions from mitigation projects • Predominant project types to date: • HFCs: 31% of tons • • • Landfill gas: 18% biomass energy: small hydro: 11% 14% • CERs usable in ETS, bankable past 2007: still discounted • Prices: non-Kyoto: buyer takes CDM risk: seller takes CDM risk: $0. 30 -$3. 00 -$4. 25 $3. 00 - $6. 50 CHICAGO CLIMATE EXCHANGE, INC. © 2004

Developing Countries • Clean Development Mechanism (CDM) under Kyoto • Certified Emission Reductions from mitigation projects • Predominant project types to date: • HFCs: 31% of tons • • • Landfill gas: 18% biomass energy: small hydro: 11% 14% • CERs usable in ETS, bankable past 2007: still discounted • Prices: non-Kyoto: buyer takes CDM risk: seller takes CDM risk: $0. 30 -$3. 00 -$4. 25 $3. 00 - $6. 50 CHICAGO CLIMATE EXCHANGE, INC. © 2004

Developing Countries • 65 countries now have Designated National Authorities • Includes Brazil, Mexico, China, India • Four approved verification firms (“Designated Operational Entities”) • Japan Quality Assurance, DNV, SGS, TUV • CDM Executive Board has approved 11 projects, 5 more on “B” list (good candidates), 14 incomplete, 2 withdrawn • Forest projects yield temporary CERs CHICAGO CLIMATE EXCHANGE, INC. © 2004

Developing Countries • 65 countries now have Designated National Authorities • Includes Brazil, Mexico, China, India • Four approved verification firms (“Designated Operational Entities”) • Japan Quality Assurance, DNV, SGS, TUV • CDM Executive Board has approved 11 projects, 5 more on “B” list (good candidates), 14 incomplete, 2 withdrawn • Forest projects yield temporary CERs CHICAGO CLIMATE EXCHANGE, INC. © 2004

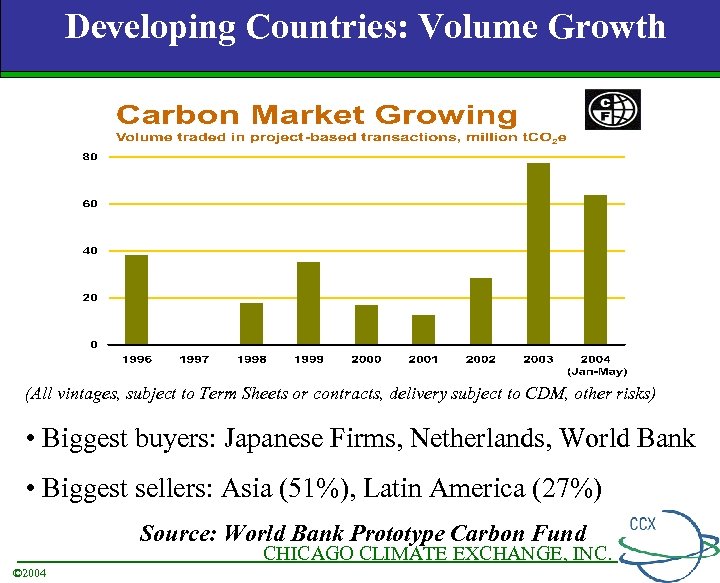

Developing Countries: Volume Growth (All vintages, subject to Term Sheets or contracts, delivery subject to CDM, other risks) • Biggest buyers: Japanese Firms, Netherlands, World Bank • Biggest sellers: Asia (51%), Latin America (27%) Source: World Bank Prototype Carbon Fund CHICAGO CLIMATE EXCHANGE, INC. © 2004

Developing Countries: Volume Growth (All vintages, subject to Term Sheets or contracts, delivery subject to CDM, other risks) • Biggest buyers: Japanese Firms, Netherlands, World Bank • Biggest sellers: Asia (51%), Latin America (27%) Source: World Bank Prototype Carbon Fund CHICAGO CLIMATE EXCHANGE, INC. © 2004

How to Raise Opportunities for Brazil(1)? • Near-term: grow ability to profit from global market • Long-term: Brazil must bring superior knowledge, built through hands-on MARKET experience, in order to effectively influence Kyoto Phase II and beyond • Aggressive education/support for CDM projects • DNA, other bodies • Natural CER customers – global corporates with Brazil operations CHICAGO CLIMATE EXCHANGE, INC. © 2004

How to Raise Opportunities for Brazil(1)? • Near-term: grow ability to profit from global market • Long-term: Brazil must bring superior knowledge, built through hands-on MARKET experience, in order to effectively influence Kyoto Phase II and beyond • Aggressive education/support for CDM projects • DNA, other bodies • Natural CER customers – global corporates with Brazil operations CHICAGO CLIMATE EXCHANGE, INC. © 2004

How to Raise Opportunities for Brazil (2)? • Industrials - adopt offset purchase commitments • Provide additional market for Brazil offsets • Stimulate knowledge base • Preparation for international policy evolution • Participate in existing/emerging markets • Take emission reduction commitments in CCX (North America and Brazil operations? ) • Pure trader: EU, Chicago • Submit alternative projects into CCX CHICAGO CLIMATE EXCHANGE, INC. © 2004

How to Raise Opportunities for Brazil (2)? • Industrials - adopt offset purchase commitments • Provide additional market for Brazil offsets • Stimulate knowledge base • Preparation for international policy evolution • Participate in existing/emerging markets • Take emission reduction commitments in CCX (North America and Brazil operations? ) • Pure trader: EU, Chicago • Submit alternative projects into CCX CHICAGO CLIMATE EXCHANGE, INC. © 2004