d849cb38f205663ad87359455af1d621.ppt

- Количество слайдов: 43

Update on the Cytotechnology Workforce: Current Market Data Supports the Prediction of a Shrinking Workforce Janie Roberson, SCT(ASCP) Isam Eltoum, MD, MBA University of Alabama at Birmingham

Update on the Cytotechnology Workforce: Current Market Data Supports the Prediction of a Shrinking Workforce Janie Roberson, SCT(ASCP) Isam Eltoum, MD, MBA University of Alabama at Birmingham

Conflict of interest The authors have no conflicts of interest to disclose.

Conflict of interest The authors have no conflicts of interest to disclose.

Update on the Cytotechnology Workforce Like any market forecast, predictions on the Cytotechnology Workforce are dependent on Supply and Demand

Update on the Cytotechnology Workforce Like any market forecast, predictions on the Cytotechnology Workforce are dependent on Supply and Demand

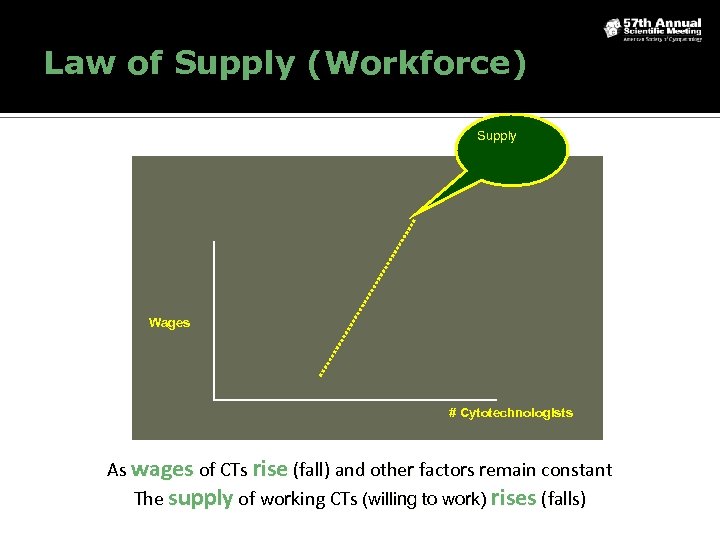

Law of Supply (Workforce) Supply Wages # Cytotechnologists As wages of CTs rise (fall) and other factors remain constant The supply of working CTs (willing to work) rises (falls)

Law of Supply (Workforce) Supply Wages # Cytotechnologists As wages of CTs rise (fall) and other factors remain constant The supply of working CTs (willing to work) rises (falls)

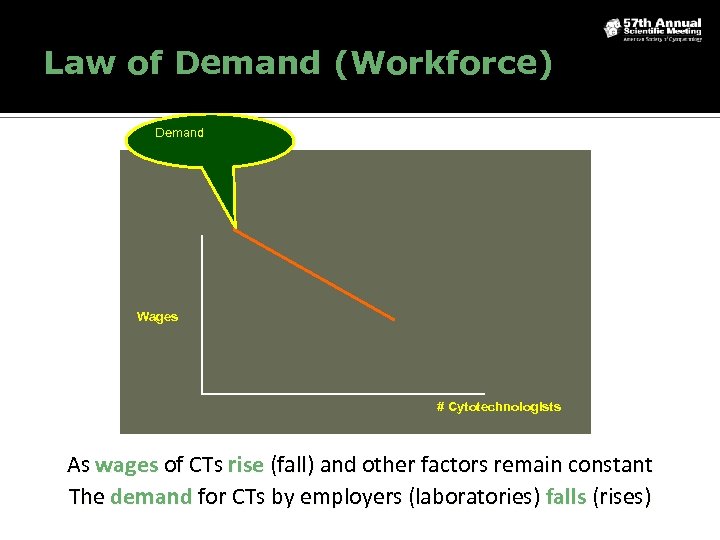

Law of Demand (Workforce) Demand Wages # Cytotechnologists As wages of CTs rise (fall) and other factors remain constant The demand for CTs by employers (laboratories) falls (rises)

Law of Demand (Workforce) Demand Wages # Cytotechnologists As wages of CTs rise (fall) and other factors remain constant The demand for CTs by employers (laboratories) falls (rises)

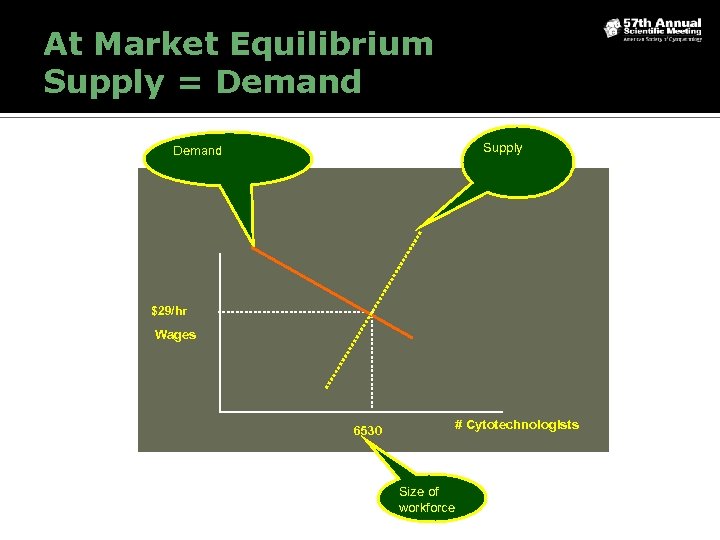

At Market Equilibrium Supply = Demand Supply Demand $29/hr Wages 6530 # Cytotechnologists Size of workforce

At Market Equilibrium Supply = Demand Supply Demand $29/hr Wages 6530 # Cytotechnologists Size of workforce

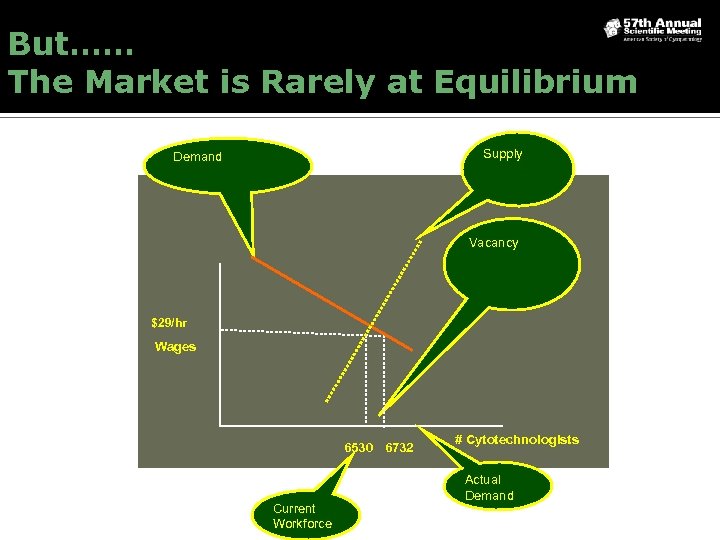

But…… The Market is Rarely at Equilibrium Supply Demand Vacancy $29/hr Wages 6530 6732 Current Workforce # Cytotechnologists Actual Demand

But…… The Market is Rarely at Equilibrium Supply Demand Vacancy $29/hr Wages 6530 6732 Current Workforce # Cytotechnologists Actual Demand

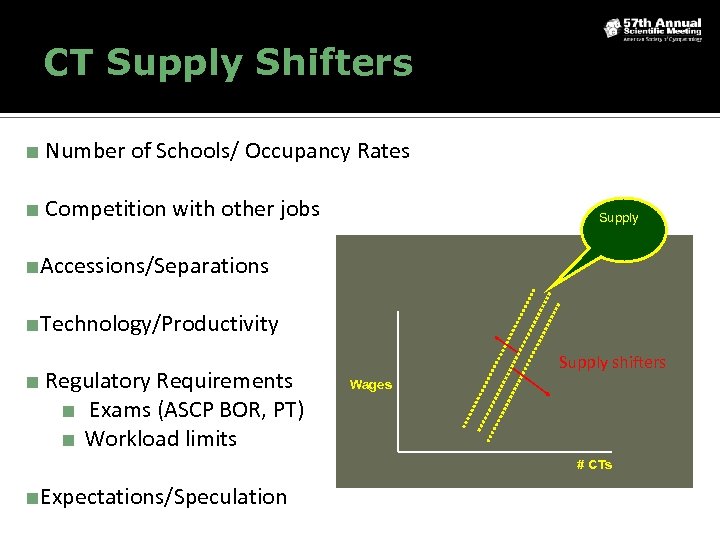

CT Supply Shifters ■ Number of Schools/ Occupancy Rates ■ Competition with other jobs Supply ■Accessions/Separations ■Technology/Productivity ■ Regulatory Requirements ■ Exams (ASCP BOR, PT) ■ Workload limits Supply shifters Wages # CTs ■Expectations/Speculation

CT Supply Shifters ■ Number of Schools/ Occupancy Rates ■ Competition with other jobs Supply ■Accessions/Separations ■Technology/Productivity ■ Regulatory Requirements ■ Exams (ASCP BOR, PT) ■ Workload limits Supply shifters Wages # CTs ■Expectations/Speculation

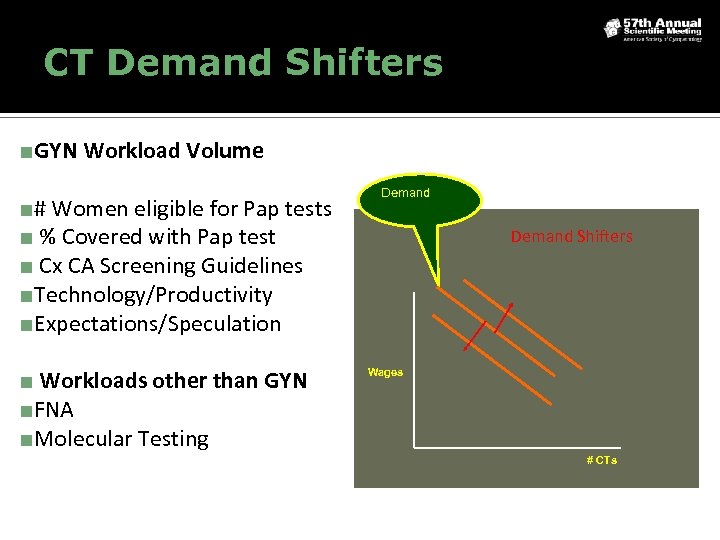

CT Demand Shifters ■GYN Workload Volume ■# Women eligible for Pap tests ■ % Covered with Pap test ■ Cx CA Screening Guidelines ■Technology/Productivity ■Expectations/Speculation ■ Workloads other than GYN ■FNA ■Molecular Testing Demand Shifters Wages # CTs

CT Demand Shifters ■GYN Workload Volume ■# Women eligible for Pap tests ■ % Covered with Pap test ■ Cx CA Screening Guidelines ■Technology/Productivity ■Expectations/Speculation ■ Workloads other than GYN ■FNA ■Molecular Testing Demand Shifters Wages # CTs

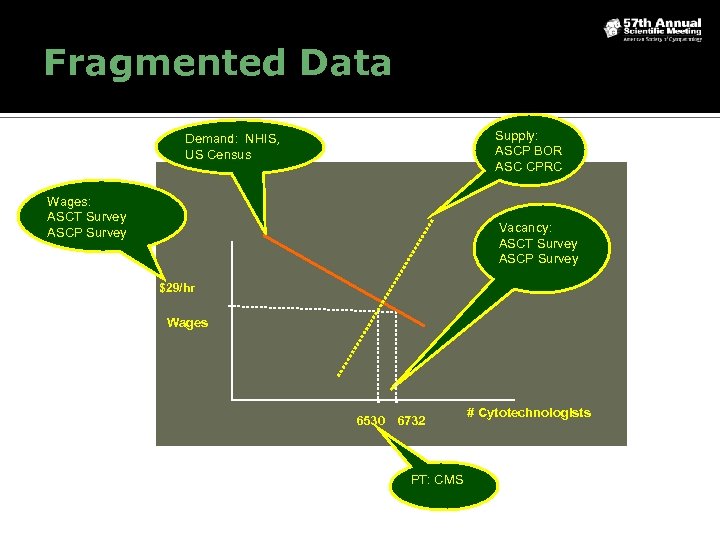

Fragmented Data Supply: ASCP BOR ASC CPRC Demand: NHIS, US Census Wages: ASCT Survey ASCP Survey Vacancy: ASCT Survey ASCP Survey $29/hr Wages 6530 6732 PT: CMS # Cytotechnologists

Fragmented Data Supply: ASCP BOR ASC CPRC Demand: NHIS, US Census Wages: ASCT Survey ASCP Survey Vacancy: ASCT Survey ASCP Survey $29/hr Wages 6530 6732 PT: CMS # Cytotechnologists

And so these men of Indostan Disputed loud and long, Each in his own opinion Exceeding stiff and strong, Though each was partly in the right, And all were in the wrong!

And so these men of Indostan Disputed loud and long, Each in his own opinion Exceeding stiff and strong, Though each was partly in the right, And all were in the wrong!

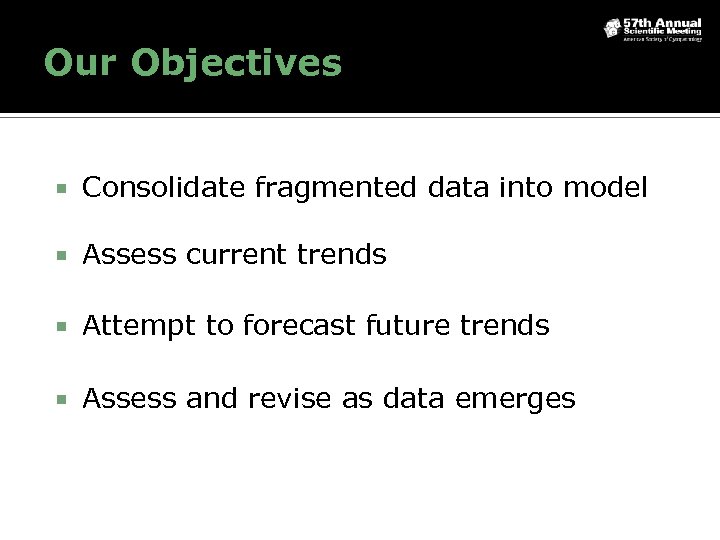

Our Objectives Consolidate fragmented data into model Assess current trends Attempt to forecast future trends Assess and revise as data emerges

Our Objectives Consolidate fragmented data into model Assess current trends Attempt to forecast future trends Assess and revise as data emerges

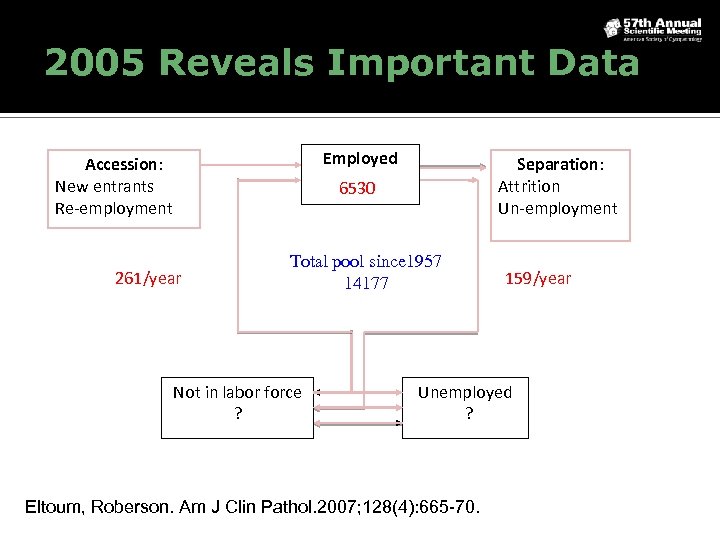

2005 Reveals Important Data Employed Accession: New entrants Re-employment Separation: Attrition Un-employment 6530 261/year Total pool since 1957 14177 Not in labor force ? 159/year Unemployed ? Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

2005 Reveals Important Data Employed Accession: New entrants Re-employment Separation: Attrition Un-employment 6530 261/year Total pool since 1957 14177 Not in labor force ? 159/year Unemployed ? Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

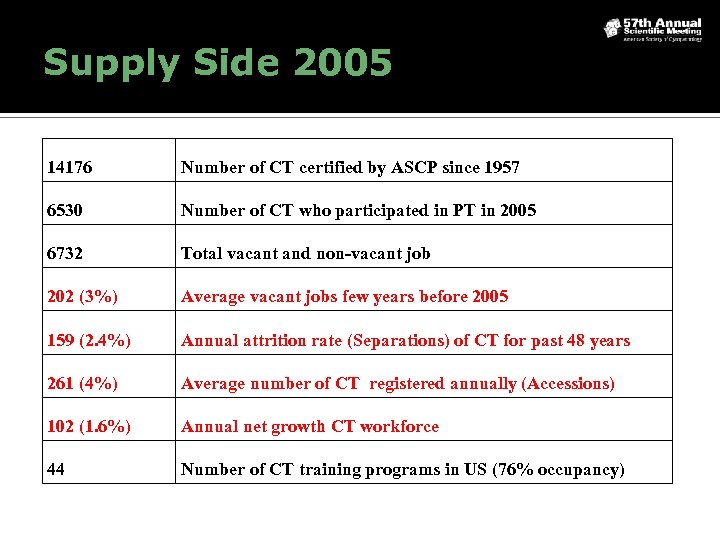

Supply Side 2005 14176 Number of CT certified by ASCP since 1957 6530 Number of CT who participated in PT in 2005 6732 Total vacant and non-vacant job 202 (3%) Average vacant jobs few years before 2005 159 (2. 4%) Annual attrition rate (Separations) of CT for past 48 years 261 (4%) Average number of CT registered annually (Accessions) 102 (1. 6%) Annual net growth CT workforce 44 Number of CT training programs in US (76% occupancy)

Supply Side 2005 14176 Number of CT certified by ASCP since 1957 6530 Number of CT who participated in PT in 2005 6732 Total vacant and non-vacant job 202 (3%) Average vacant jobs few years before 2005 159 (2. 4%) Annual attrition rate (Separations) of CT for past 48 years 261 (4%) Average number of CT registered annually (Accessions) 102 (1. 6%) Annual net growth CT workforce 44 Number of CT training programs in US (76% occupancy)

DEMAND………

DEMAND………

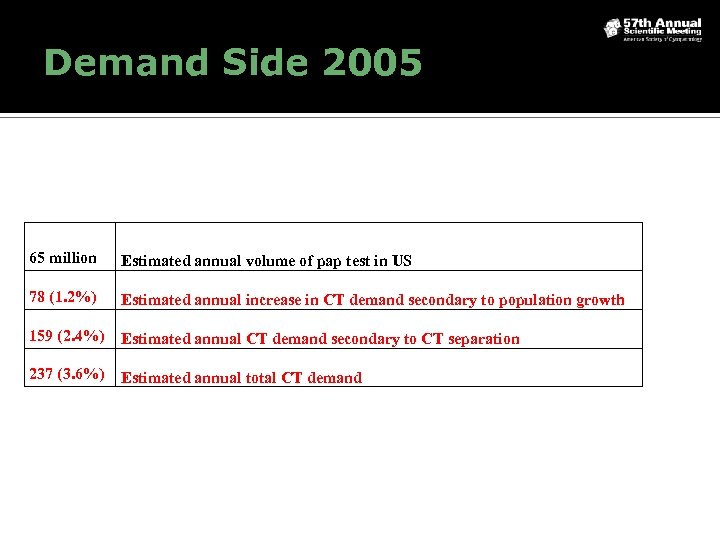

Demand Side 2005 65 million Estimated annual volume of pap test in US 78 (1. 2%) Estimated annual increase in CT demand secondary to population growth 159 (2. 4%) Estimated annual CT demand secondary to CT separation 237 (3. 6%) Estimated annual total CT demand

Demand Side 2005 65 million Estimated annual volume of pap test in US 78 (1. 2%) Estimated annual increase in CT demand secondary to population growth 159 (2. 4%) Estimated annual CT demand secondary to CT separation 237 (3. 6%) Estimated annual total CT demand

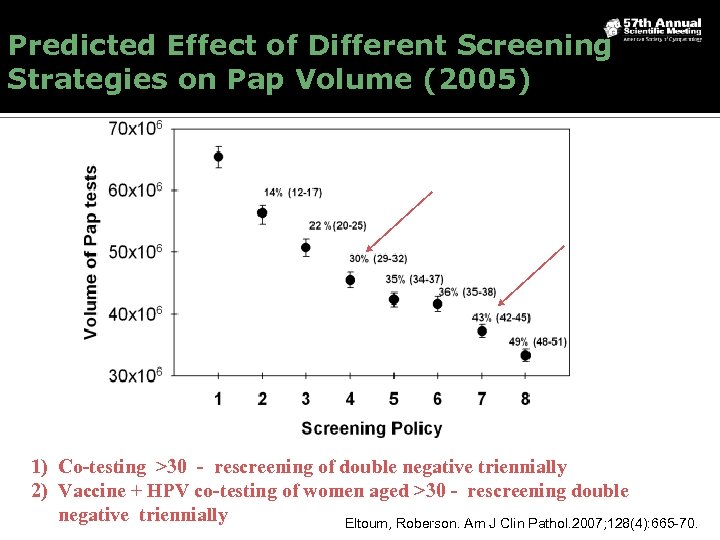

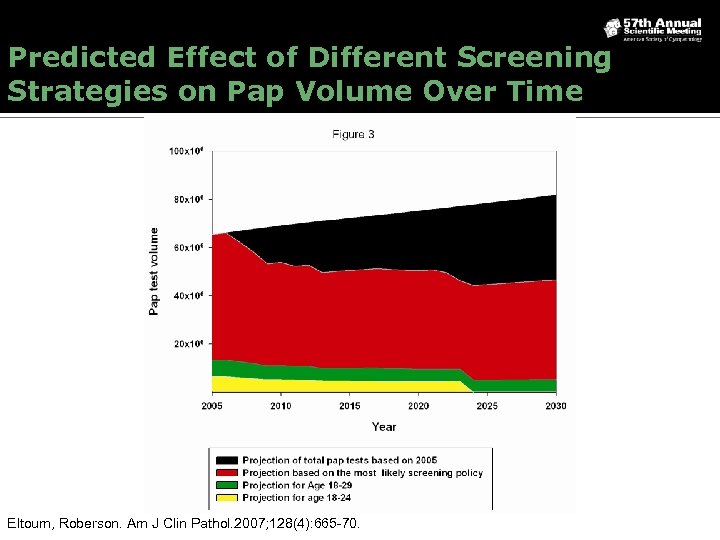

Predicted Effect of Different Screening Strategies on Pap Volume (2005) 1) Co-testing >30 - rescreening of double negative triennially 2) Vaccine + HPV co-testing of women aged >30 - rescreening double negative triennially Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

Predicted Effect of Different Screening Strategies on Pap Volume (2005) 1) Co-testing >30 - rescreening of double negative triennially 2) Vaccine + HPV co-testing of women aged >30 - rescreening double negative triennially Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

Predicted Effect of Different Screening Strategies on Pap Volume Over Time Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

Predicted Effect of Different Screening Strategies on Pap Volume Over Time Eltoum, Roberson. Am J Clin Pathol. 2007; 128(4): 665 -70.

Similar Independent Projections of Pap Volume By 2010 75 m if screening behavior is unchanged 65 m (15% reduction) if screening hysterectomized women is eliminated 34 m (50% reduction) if the screening frequency and HPV testing guidelines are strictly followed Solomon D et al, CA Cancer J Clin. 2007 Mar-Apr; 57(2): 105 -11

Similar Independent Projections of Pap Volume By 2010 75 m if screening behavior is unchanged 65 m (15% reduction) if screening hysterectomized women is eliminated 34 m (50% reduction) if the screening frequency and HPV testing guidelines are strictly followed Solomon D et al, CA Cancer J Clin. 2007 Mar-Apr; 57(2): 105 -11

Effect of Different Screening Strategies on CT Demand Over Time Projected demand: Demographics Projected demand: HPV test and Vaccine

Effect of Different Screening Strategies on CT Demand Over Time Projected demand: Demographics Projected demand: HPV test and Vaccine

Then, Now, Beyond What critical data will validate this model?

Then, Now, Beyond What critical data will validate this model?

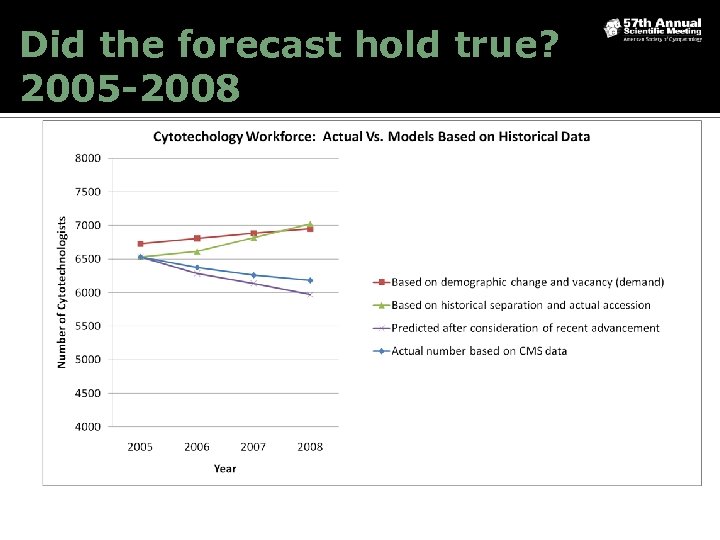

Did the forecast hold true? 2005 -2008

Did the forecast hold true? 2005 -2008

This Workforce shrinkage is likely due to reduced demand.

This Workforce shrinkage is likely due to reduced demand.

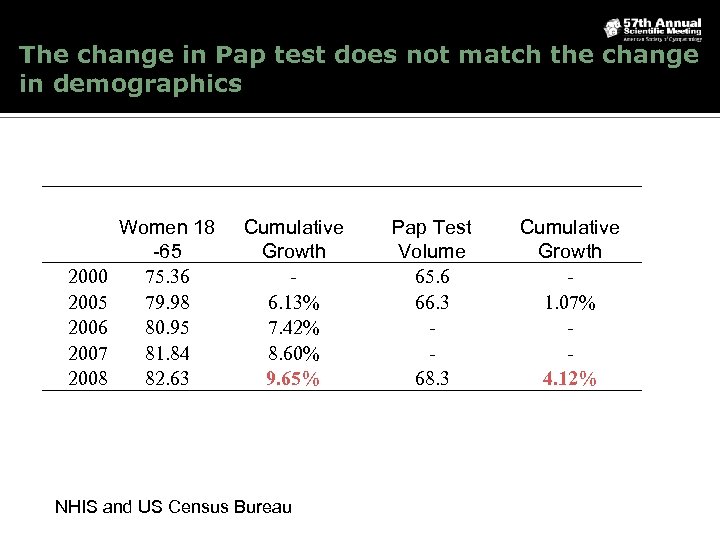

The change in Pap test does not match the change in demographics 2000 2005 2006 2007 2008 Women 18 -65 75. 36 79. 98 80. 95 81. 84 82. 63 Cumulative Growth 6. 13% 7. 42% 8. 60% 9. 65% NHIS and US Census Bureau Pap Test Volume 65. 6 66. 3 68. 3 Cumulative Growth 1. 07% 4. 12%

The change in Pap test does not match the change in demographics 2000 2005 2006 2007 2008 Women 18 -65 75. 36 79. 98 80. 95 81. 84 82. 63 Cumulative Growth 6. 13% 7. 42% 8. 60% 9. 65% NHIS and US Census Bureau Pap Test Volume 65. 6 66. 3 68. 3 Cumulative Growth 1. 07% 4. 12%

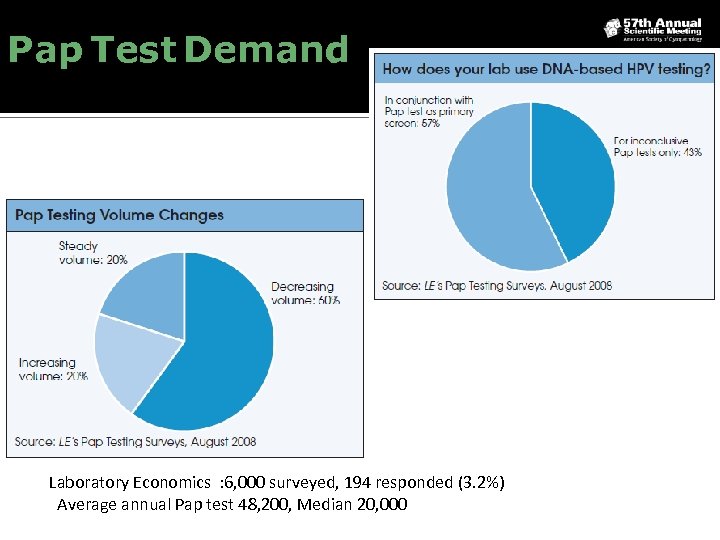

Pap Test Demand Laboratory Economics : 6, 000 surveyed, 194 responded (3. 2%) Average annual Pap test 48, 200, Median 20, 000

Pap Test Demand Laboratory Economics : 6, 000 surveyed, 194 responded (3. 2%) Average annual Pap test 48, 200, Median 20, 000

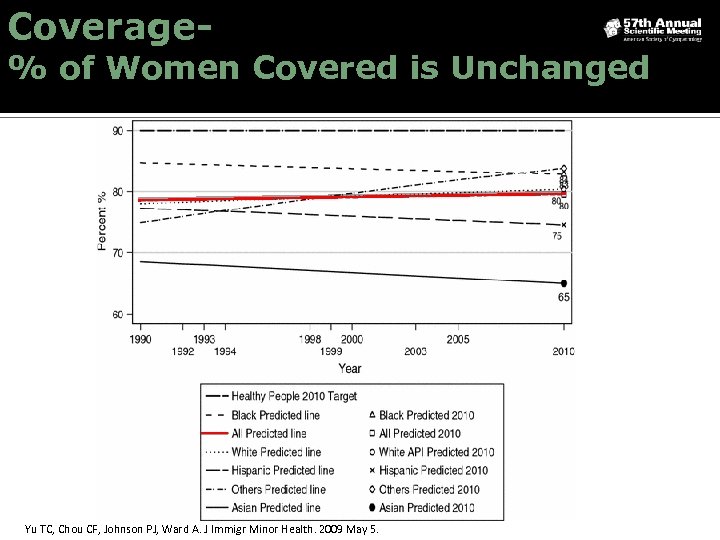

Coverage- % of Women Covered is Unchanged Yu TC, Chou CF, Johnson PJ, Ward A. J Immigr Minor Health. 2009 May 5.

Coverage- % of Women Covered is Unchanged Yu TC, Chou CF, Johnson PJ, Ward A. J Immigr Minor Health. 2009 May 5.

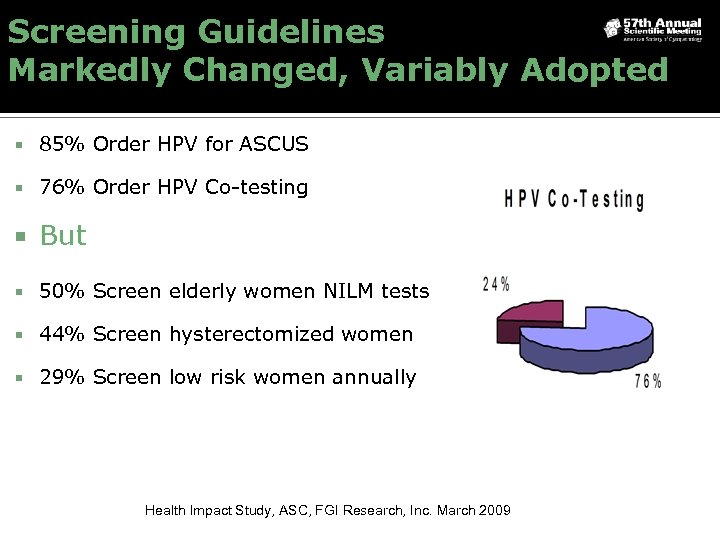

Screening Guidelines Markedly Changed, Variably Adopted 85% Order HPV for ASCUS 76% Order HPV Co-testing But 50% Screen elderly women NILM tests 44% Screen hysterectomized women 29% Screen low risk women annually Health Impact Study, ASC, FGI Research, Inc. March 2009

Screening Guidelines Markedly Changed, Variably Adopted 85% Order HPV for ASCUS 76% Order HPV Co-testing But 50% Screen elderly women NILM tests 44% Screen hysterectomized women 29% Screen low risk women annually Health Impact Study, ASC, FGI Research, Inc. March 2009

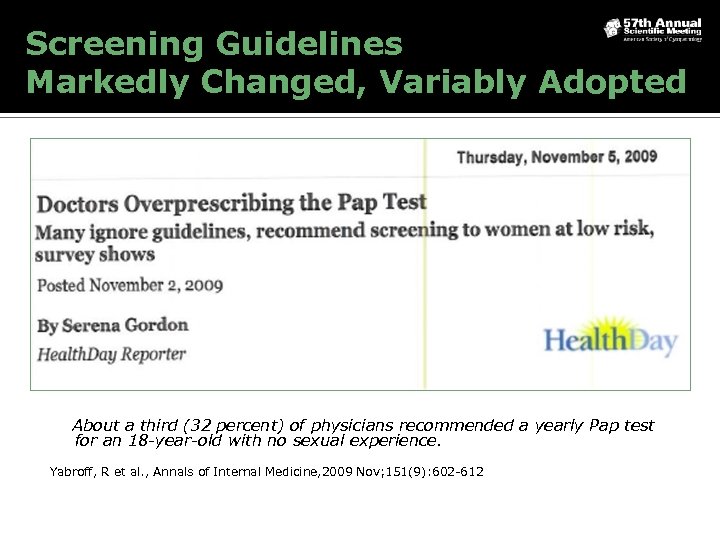

Screening Guidelines Markedly Changed, Variably Adopted About a third (32 percent) of physicians recommended a yearly Pap test for an 18 -year-old with no sexual experience. Yabroff, R et al. , Annals of Internal Medicine, 2009 Nov; 151(9): 602 -612

Screening Guidelines Markedly Changed, Variably Adopted About a third (32 percent) of physicians recommended a yearly Pap test for an 18 -year-old with no sexual experience. Yabroff, R et al. , Annals of Internal Medicine, 2009 Nov; 151(9): 602 -612

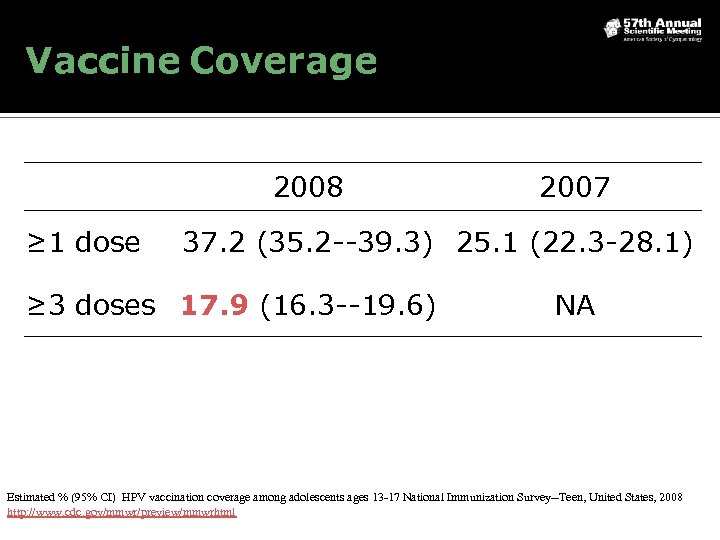

Vaccine Coverage 2008 ≥ 1 dose 2007 37. 2 (35. 2 --39. 3) 25. 1 (22. 3 -28. 1) ≥ 3 doses 17. 9 (16. 3 --19. 6) NA Estimated % (95% CI) HPV vaccination coverage among adolescents ages 13 -17 National Immunization Survey--Teen, United States, 2008 http: //www. cdc. gov/mmwr/preview/mmwrhtml

Vaccine Coverage 2008 ≥ 1 dose 2007 37. 2 (35. 2 --39. 3) 25. 1 (22. 3 -28. 1) ≥ 3 doses 17. 9 (16. 3 --19. 6) NA Estimated % (95% CI) HPV vaccination coverage among adolescents ages 13 -17 National Immunization Survey--Teen, United States, 2008 http: //www. cdc. gov/mmwr/preview/mmwrhtml

The Workforce Shrinkage is likely not due to decreased supply

The Workforce Shrinkage is likely not due to decreased supply

A Shrinking Workforce but …………not a Decreased Supply If there is labor shortage (decreased supply), then there would be: Rising Vacancy Rates Rising Compensation Levels Low Unemployment Levels

A Shrinking Workforce but …………not a Decreased Supply If there is labor shortage (decreased supply), then there would be: Rising Vacancy Rates Rising Compensation Levels Low Unemployment Levels

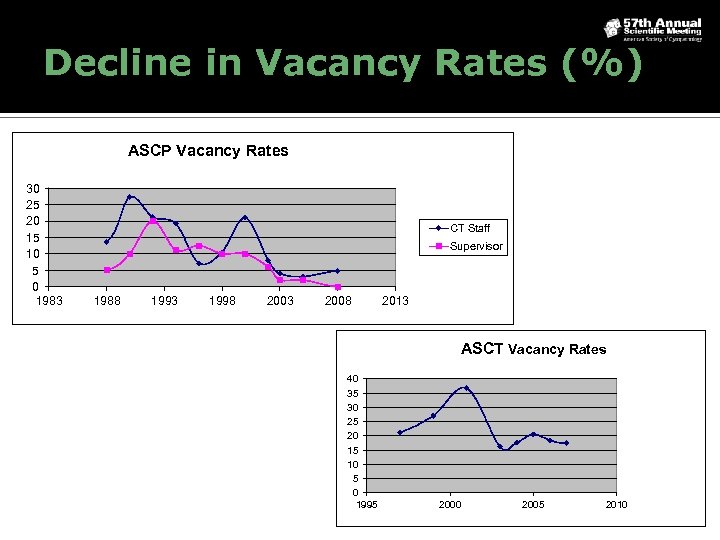

Decline in Vacancy Rates (%) ASCP Vacancy Rates 30 25 20 15 10 5 0 1983 CT Staff Supervisor 1988 1993 1998 2003 2008 2013 ASCT Vacancy Rates 40 35 30 25 20 15 10 5 0 1995 2000 2005 2010

Decline in Vacancy Rates (%) ASCP Vacancy Rates 30 25 20 15 10 5 0 1983 CT Staff Supervisor 1988 1993 1998 2003 2008 2013 ASCT Vacancy Rates 40 35 30 25 20 15 10 5 0 1995 2000 2005 2010

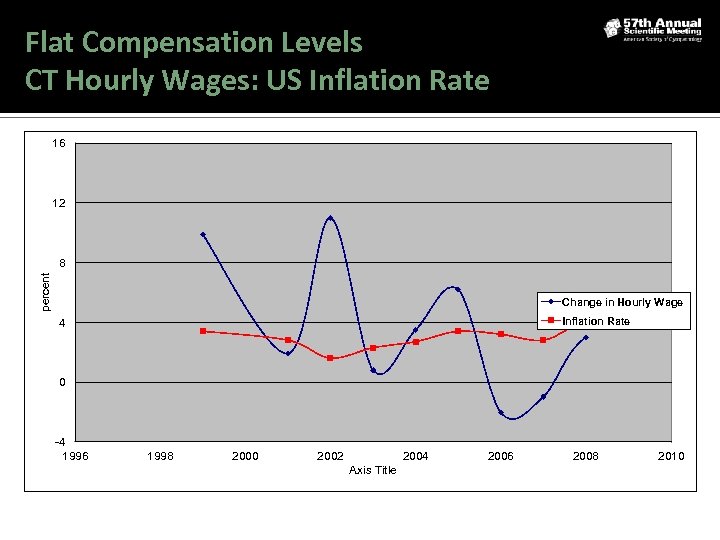

Flat Compensation Levels CT Hourly Wages: US Inflation Rate 16 12 percent 8 Change in Hourly Wage Inflation Rate 4 0 -4 1996 1998 2000 2002 2004 Axis Title 2006 2008 2010

Flat Compensation Levels CT Hourly Wages: US Inflation Rate 16 12 percent 8 Change in Hourly Wage Inflation Rate 4 0 -4 1996 1998 2000 2002 2004 Axis Title 2006 2008 2010

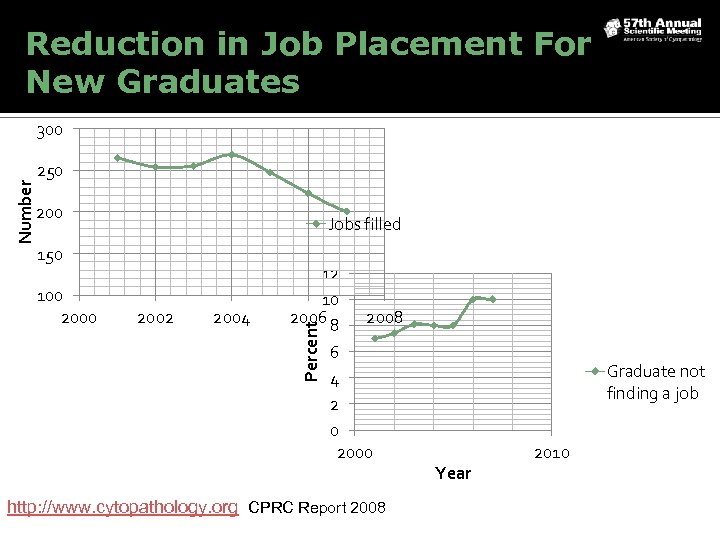

Reduction in Job Placement For New Graduates 250 200 Jobs filled 150 100 2002 2004 12 10 2006 8 2008 6 4 2 0 2000 Percent Number 300 http: //www. cytopathology. org CPRC Report 2008 Graduate not finding a job Year 2010

Reduction in Job Placement For New Graduates 250 200 Jobs filled 150 100 2002 2004 12 10 2006 8 2008 6 4 2 0 2000 Percent Number 300 http: //www. cytopathology. org CPRC Report 2008 Graduate not finding a job Year 2010

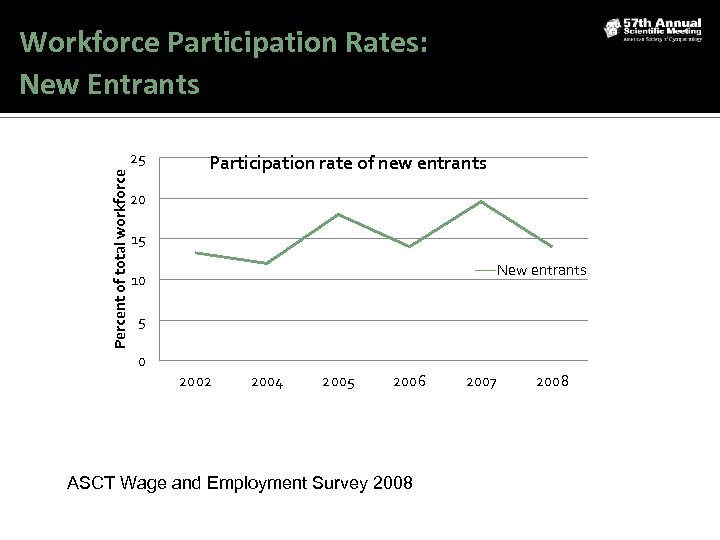

Workforce Participation Rates: New Entrants Percent of total workforce 25 Participation rate of new entrants 20 15 New entrants 10 5 0 2002 2004 2005 2006 ASCT Wage and Employment Survey 2008 2007 2008

Workforce Participation Rates: New Entrants Percent of total workforce 25 Participation rate of new entrants 20 15 New entrants 10 5 0 2002 2004 2005 2006 ASCT Wage and Employment Survey 2008 2007 2008

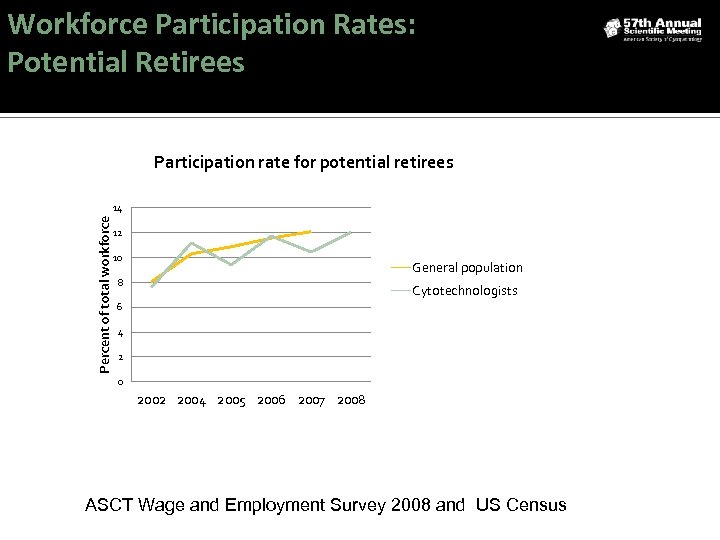

Workforce Participation Rates: Potential Retirees Participation rate for potential retirees Percent of total workforce 14 12 10 General population 8 Cytotechnologists 6 4 2 0 2002 2004 2005 2006 2007 2008 ASCT Wage and Employment Survey 2008 and US Census

Workforce Participation Rates: Potential Retirees Participation rate for potential retirees Percent of total workforce 14 12 10 General population 8 Cytotechnologists 6 4 2 0 2002 2004 2005 2006 2007 2008 ASCT Wage and Employment Survey 2008 and US Census

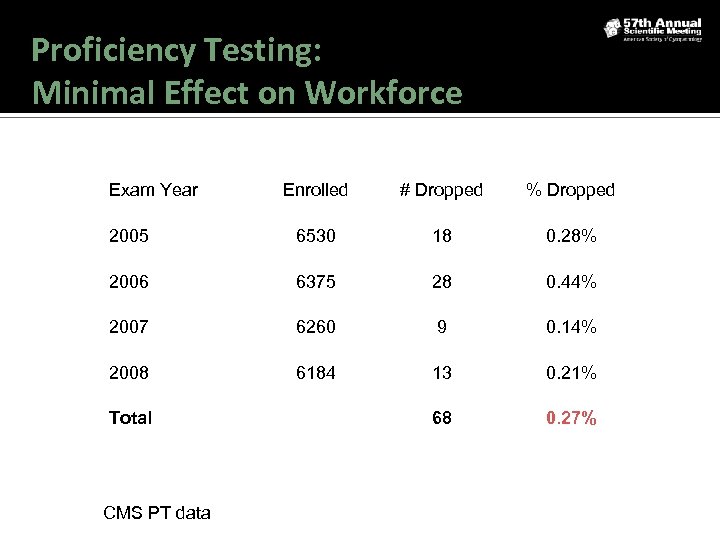

Proficiency Testing: Minimal Effect on Workforce Exam Year Enrolled # Dropped % Dropped 2005 6530 18 0. 28% 2006 6375 28 0. 44% 2007 6260 9 0. 14% 2008 6184 13 0. 21% 68 0. 27% Total CMS PT data

Proficiency Testing: Minimal Effect on Workforce Exam Year Enrolled # Dropped % Dropped 2005 6530 18 0. 28% 2006 6375 28 0. 44% 2007 6260 9 0. 14% 2008 6184 13 0. 21% 68 0. 27% Total CMS PT data

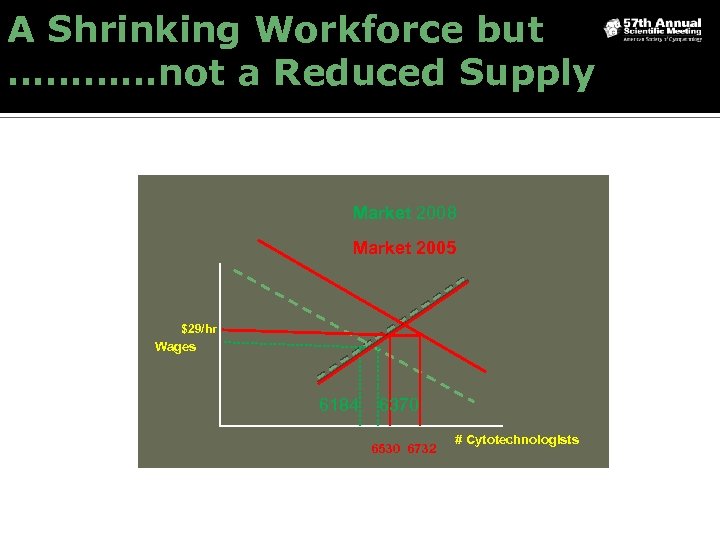

A Shrinking Workforce but …………not a Reduced Supply Market 2008 Market 2005 $29/hr Wages 6184 6370 6530 6732 # Cytotechnologists

A Shrinking Workforce but …………not a Reduced Supply Market 2008 Market 2005 $29/hr Wages 6184 6370 6530 6732 # Cytotechnologists

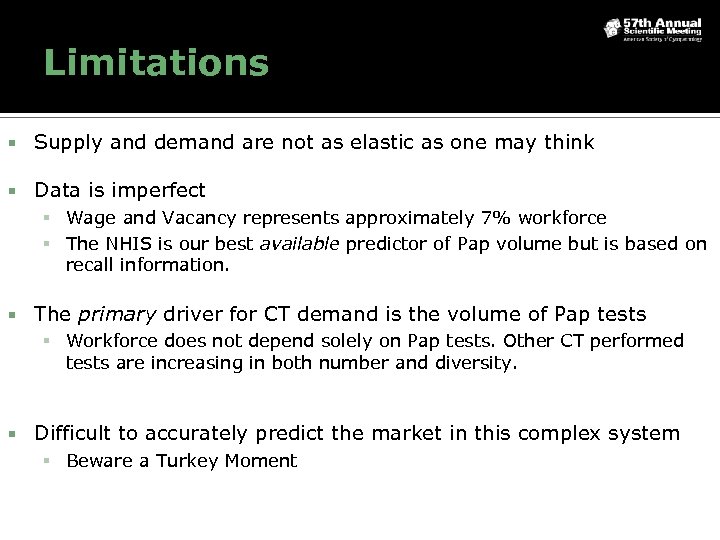

Limitations Supply and demand are not as elastic as one may think Data is imperfect Wage and Vacancy represents approximately 7% workforce The NHIS is our best available predictor of Pap volume but is based on recall information. The primary driver for CT demand is the volume of Pap tests Workforce does not depend solely on Pap tests. Other CT performed tests are increasing in both number and diversity. Difficult to accurately predict the market in this complex system Beware a Turkey Moment

Limitations Supply and demand are not as elastic as one may think Data is imperfect Wage and Vacancy represents approximately 7% workforce The NHIS is our best available predictor of Pap volume but is based on recall information. The primary driver for CT demand is the volume of Pap tests Workforce does not depend solely on Pap tests. Other CT performed tests are increasing in both number and diversity. Difficult to accurately predict the market in this complex system Beware a Turkey Moment

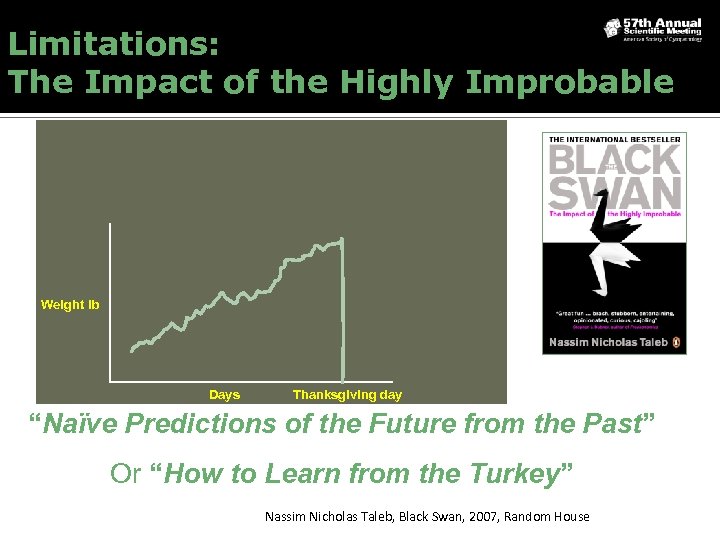

Limitations: The Impact of the Highly Improbable Weight lb Days Thanksgiving day “Naïve Predictions of the Future from the Past” Or “How to Learn from the Turkey” Nassim Nicholas Taleb, Black Swan, 2007, Random House

Limitations: The Impact of the Highly Improbable Weight lb Days Thanksgiving day “Naïve Predictions of the Future from the Past” Or “How to Learn from the Turkey” Nassim Nicholas Taleb, Black Swan, 2007, Random House

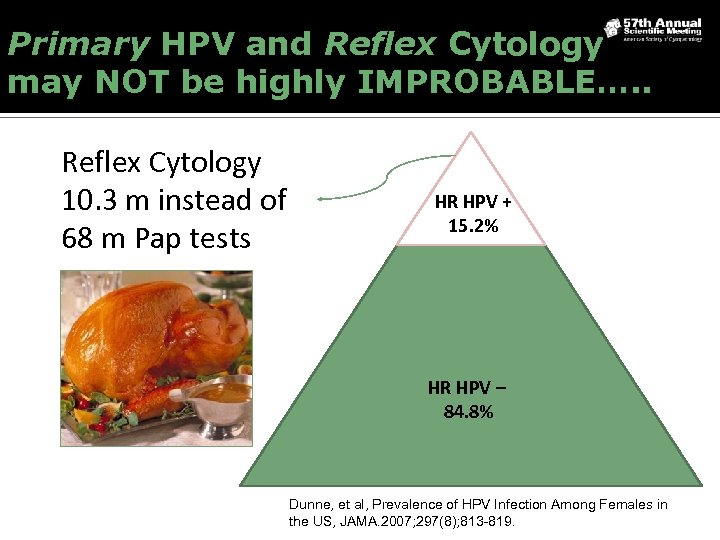

Primary HPV and Reflex Cytology may NOT be highly IMPROBABLE…. . Reflex Cytology 10. 3 m instead of 68 m Pap tests HR HPV + 15. 2% HR HPV – 84. 8% Dunne, et al, Prevalence of HPV Infection Among Females in the US, JAMA. 2007; 297(8); 813 -819.

Primary HPV and Reflex Cytology may NOT be highly IMPROBABLE…. . Reflex Cytology 10. 3 m instead of 68 m Pap tests HR HPV + 15. 2% HR HPV – 84. 8% Dunne, et al, Prevalence of HPV Infection Among Females in the US, JAMA. 2007; 297(8); 813 -819.

Conclusions • Current data shows a stagnant market and sluggish demand for cytotechnologists as evident by the number of working cytotechnologist (PT data) This stagnant market is due to reduced demand secondary to reduction of Pap test performed in the US. • There is a high need for prospective data to guide workforce decisions, preferably collected by PT Providers and Cytology organizations •

Conclusions • Current data shows a stagnant market and sluggish demand for cytotechnologists as evident by the number of working cytotechnologist (PT data) This stagnant market is due to reduced demand secondary to reduction of Pap test performed in the US. • There is a high need for prospective data to guide workforce decisions, preferably collected by PT Providers and Cytology organizations •

Acknowledgment Dr. Isam Eltoum for his expertise and enthusiasm on this subject.

Acknowledgment Dr. Isam Eltoum for his expertise and enthusiasm on this subject.