48b37d72f08f248d4a4003a5dc72404d.ppt

- Количество слайдов: 31

UNIVERSITY OF REGINA FACULTY OF ENGINEERING Master of Applied Science In Industrial Engineering “AN INFERENCE SYSTEM APPROACH TO FINANCIAL MODELING” Maria M. Ortiz Lerma Dr. Rene V. Mayorga Fall 2003 1

UNIVERSITY OF REGINA FACULTY OF ENGINEERING Master of Applied Science In Industrial Engineering “AN INFERENCE SYSTEM APPROACH TO FINANCIAL MODELING” Maria M. Ortiz Lerma Dr. Rene V. Mayorga Fall 2003 1

Contents 1. Thesis Objective 2. Introduction 3. Technical Analysis 4. Scenario Analysis 5. Portfolio Selection 6. Conclusion 2

Contents 1. Thesis Objective 2. Introduction 3. Technical Analysis 4. Scenario Analysis 5. Portfolio Selection 6. Conclusion 2

Thesis Objective Ø The use of Intelligent Systems methodologies for the modeling of some systems behaviours characterized by highly non-linear relationships and having a high degree of uncertainty. Ø In particular, the implementation of Artificial/Computational Intelligence and Soft Computing techniques in some Financial Engineering (closely related to Operations Research) problems. 3

Thesis Objective Ø The use of Intelligent Systems methodologies for the modeling of some systems behaviours characterized by highly non-linear relationships and having a high degree of uncertainty. Ø In particular, the implementation of Artificial/Computational Intelligence and Soft Computing techniques in some Financial Engineering (closely related to Operations Research) problems. 3

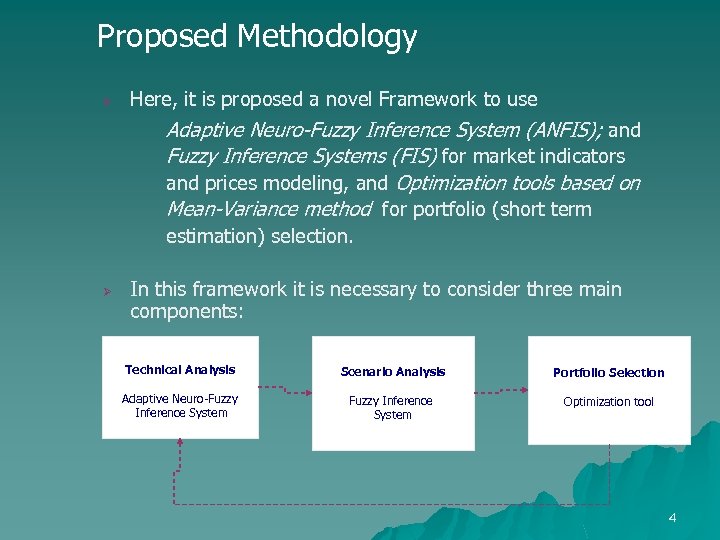

Proposed Methodology Ø Here, it is proposed a novel Framework to use Adaptive Neuro-Fuzzy Inference System (ANFIS); and Fuzzy Inference Systems (FIS) for market indicators and prices modeling, and Optimization tools based on Mean-Variance method for portfolio (short term estimation) selection. Ø In this framework it is necessary to consider three main components: Technical Analysis Scenario Analysis Portfolio Selection Adaptive Neuro-Fuzzy Inference System Optimization tool 4

Proposed Methodology Ø Here, it is proposed a novel Framework to use Adaptive Neuro-Fuzzy Inference System (ANFIS); and Fuzzy Inference Systems (FIS) for market indicators and prices modeling, and Optimization tools based on Mean-Variance method for portfolio (short term estimation) selection. Ø In this framework it is necessary to consider three main components: Technical Analysis Scenario Analysis Portfolio Selection Adaptive Neuro-Fuzzy Inference System Optimization tool 4

Introduction Non-conventional Techniques: ü Increasing literature on Fuzzy Inference Systems (FIS) and their use in Financial Engineering; • Many of these examples are related to stock market trading, Deboeck (1994), and recently Tseng et al. (2001) integrate Fuzzy and ARIMA models to forecast the Taiwan/US exchange rate. ü Artificial Neural Networks has been used as a tool forecasting financial markets • Peray (1999) determines an opportunity for equity fund investments using market fundamentals. Conventional techniques: ü Optimization and Mean-Variance Model • Asymmetric risk measures for portfolio optimization under uncertainty (King, 1993), and the arithmetic mean and the standard deviation of the different financial assets (Markowitz, 1952, 1987. Levy, 1970) 5

Introduction Non-conventional Techniques: ü Increasing literature on Fuzzy Inference Systems (FIS) and their use in Financial Engineering; • Many of these examples are related to stock market trading, Deboeck (1994), and recently Tseng et al. (2001) integrate Fuzzy and ARIMA models to forecast the Taiwan/US exchange rate. ü Artificial Neural Networks has been used as a tool forecasting financial markets • Peray (1999) determines an opportunity for equity fund investments using market fundamentals. Conventional techniques: ü Optimization and Mean-Variance Model • Asymmetric risk measures for portfolio optimization under uncertainty (King, 1993), and the arithmetic mean and the standard deviation of the different financial assets (Markowitz, 1952, 1987. Levy, 1970) 5

Introduction ü Financial markets: Reasons of uncertainty • • Expansive fluctuations in prices over short and long terms Each model in portfolio selection has its own advantages and disadvantages Market risk cannot be avoided with diversification Large number of deals produced by agents that act independently from each other The effective operation of the portfolio selection in practice requires an integrated decision support framework 6

Introduction ü Financial markets: Reasons of uncertainty • • Expansive fluctuations in prices over short and long terms Each model in portfolio selection has its own advantages and disadvantages Market risk cannot be avoided with diversification Large number of deals produced by agents that act independently from each other The effective operation of the portfolio selection in practice requires an integrated decision support framework 6

Framework General Structure TECHNICAL ANALYSIS STAGE I Inputs (ti) Price (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) Market indicator (ti) • Very Pessimistic Price (ti+6) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) Market indicator SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 7

Framework General Structure TECHNICAL ANALYSIS STAGE I Inputs (ti) Price (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) Market indicator (ti) • Very Pessimistic Price (ti+6) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) Market indicator SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 7

Technical Analysis: Stage I Historical data from January 1 st, 1993 to August 29 th, 2003 TECHNICAL ANALYSIS STAGE I Inputs (ti) Price (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) Market indicator (ti) • Very Pessimistic Price (ti+6) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) Market indicator SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 8

Technical Analysis: Stage I Historical data from January 1 st, 1993 to August 29 th, 2003 TECHNICAL ANALYSIS STAGE I Inputs (ti) Price (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) Market indicator (ti) • Very Pessimistic Price (ti+6) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) Market indicator SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 8

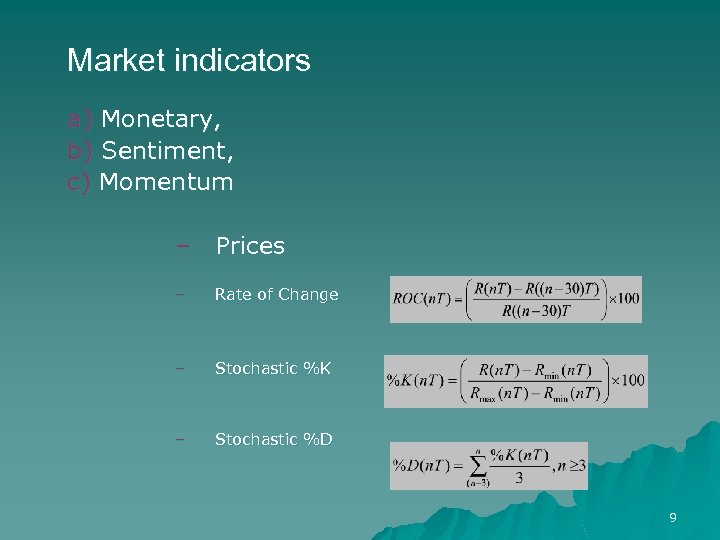

Market indicators a) Monetary, b) Sentiment, c) Momentum – Prices – Rate of Change – Stochastic %K – Stochastic %D 9

Market indicators a) Monetary, b) Sentiment, c) Momentum – Prices – Rate of Change – Stochastic %K – Stochastic %D 9

Indexes üDow Jones Average (DOW) • DJ 65 Composite Average : DJA New York Stock Exchange (NYSE) ü . • NYSE Financial : FNA National Association of Securities Dealers Automated Quotation System (NASDAQ) ü • 259 Telecommunications: IXUT U. S. Treasury securities (Yieldx 10) ü • 30 year bond : TYX 10

Indexes üDow Jones Average (DOW) • DJ 65 Composite Average : DJA New York Stock Exchange (NYSE) ü . • NYSE Financial : FNA National Association of Securities Dealers Automated Quotation System (NASDAQ) ü • 259 Telecommunications: IXUT U. S. Treasury securities (Yieldx 10) ü • 30 year bond : TYX 10

ANFIS Process • Multidimensional input-output highly non-linear mapping y = f (x). • Time Series : Mackey-Glass Differential Delay Equation n. The quantity of nodes, linear and non-linear parameters in the hidden layers is the same for each index 11

ANFIS Process • Multidimensional input-output highly non-linear mapping y = f (x). • Time Series : Mackey-Glass Differential Delay Equation n. The quantity of nodes, linear and non-linear parameters in the hidden layers is the same for each index 11

ANFIS Structure Information DJA NFA IXUT TYX Number of Nodes 193 193 Number of linear parameters 405 405 36 36 441 441 Number of training data pairs 1000 Number of checking data pairs 1000 81 81 Number of non-linear parameters Total number of parameters Number of fuzzy rules 12

ANFIS Structure Information DJA NFA IXUT TYX Number of Nodes 193 193 Number of linear parameters 405 405 36 36 441 441 Number of training data pairs 1000 Number of checking data pairs 1000 81 81 Number of non-linear parameters Total number of parameters Number of fuzzy rules 12

ANFIS Process for Prices and Rate of Change in one index Inputs (ti) Hidden Layers 2 1 3 Outputs (ti+6) R(n. T) R 1(1) R 1(n. T) N R 1(2) x(t 12) N 2 x(t-6) N 3 x(t) N 4 N Y(n. T) 1 x(t+6) Price (ti) x(t 18) R 1(3) R 1(4) R(n. T) Y 1(n. T) 5 R 2(1) Rate of Change (ti) R 2(n. T) Price (ti+6) x(t 18) N R 2(2) x(t 12) N 2 x(t 6) N 3 x(t) N 4 x(t+6) N Y(n. T) 1 5 R 2(3) R 2(4) x(t-18), x(t-12), x(t-6), and x(t) to predict x(t+6). Rate of Change (ti+6) Y 2(n. T) 13

ANFIS Process for Prices and Rate of Change in one index Inputs (ti) Hidden Layers 2 1 3 Outputs (ti+6) R(n. T) R 1(1) R 1(n. T) N R 1(2) x(t 12) N 2 x(t-6) N 3 x(t) N 4 N Y(n. T) 1 x(t+6) Price (ti) x(t 18) R 1(3) R 1(4) R(n. T) Y 1(n. T) 5 R 2(1) Rate of Change (ti) R 2(n. T) Price (ti+6) x(t 18) N R 2(2) x(t 12) N 2 x(t 6) N 3 x(t) N 4 x(t+6) N Y(n. T) 1 5 R 2(3) R 2(4) x(t-18), x(t-12), x(t-6), and x(t) to predict x(t+6). Rate of Change (ti+6) Y 2(n. T) 13

ANFIS Modeling Results: NYSE Financial FNA Modeling algorithm NFA CLOSING PRICE Lineal Regression ANFIS (Experiments 1) 2000 1000 2000 Input partition 4 x 4 x 4 x 4 Number of epochs 2000 Training RMSE 2. 4563 0. 0013 Checking RMSE 4. 5451 0. 3876 0. 0045 1430 s 2210 s Number of data Training time ANFIS (Experiments 2) 14

ANFIS Modeling Results: NYSE Financial FNA Modeling algorithm NFA CLOSING PRICE Lineal Regression ANFIS (Experiments 1) 2000 1000 2000 Input partition 4 x 4 x 4 x 4 Number of epochs 2000 Training RMSE 2. 4563 0. 0013 Checking RMSE 4. 5451 0. 3876 0. 0045 1430 s 2210 s Number of data Training time ANFIS (Experiments 2) 14

NYSE Financial FNA: Price and Rate of Change modeling 15

NYSE Financial FNA: Price and Rate of Change modeling 15

NYSE Financial FNA: Stochastic %K and %D modeling 16

NYSE Financial FNA: Stochastic %K and %D modeling 16

ANFIS modeling results for Market Indicators and Price in ti+6 MARKET INDICATOR NFA Output 6 days after. IXUT Output 6 days after. $2751. 7 593. 6 160. 2 5. 4 2, 695. 1 584. 56 156. 33 5. 22 Rate of Change Y 2(n. T) -0. 69 -0. 37 -0. 32 -1. 33 2. 51 12. 12 6. 98 -0. 57 Stochastic %K Y 3(n. T) 52. 04 86. 30 2. 917 18. 85 33. 9 85. 73 0. 01 31. 71 Stochastic %D Y 4(n. T) 49. 98 85. 72 2. 8014 21. 18 33. 4 84. 73 0. 01 34. 25 Price Y 1(n. T) DJA Output 6 days after. TYX Output 6 days after. 17

ANFIS modeling results for Market Indicators and Price in ti+6 MARKET INDICATOR NFA Output 6 days after. IXUT Output 6 days after. $2751. 7 593. 6 160. 2 5. 4 2, 695. 1 584. 56 156. 33 5. 22 Rate of Change Y 2(n. T) -0. 69 -0. 37 -0. 32 -1. 33 2. 51 12. 12 6. 98 -0. 57 Stochastic %K Y 3(n. T) 52. 04 86. 30 2. 917 18. 85 33. 9 85. 73 0. 01 31. 71 Stochastic %D Y 4(n. T) 49. 98 85. 72 2. 8014 21. 18 33. 4 84. 73 0. 01 34. 25 Price Y 1(n. T) DJA Output 6 days after. TYX Output 6 days after. 17

Scenario Analysis: Stage II TECHNICAL ANALYSIS STAGE I Market indicator ANFIS (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS (ti) Market indicator • Very Pessimistic Market indicator (ti+6) (ti) Market indicator Outputs Scenario (ti+6) Inputs (ti) FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 18

Scenario Analysis: Stage II TECHNICAL ANALYSIS STAGE I Market indicator ANFIS (ti) P R E A N A L Y S I S Market indicator ANFIS (ti) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS (ti) Market indicator • Very Pessimistic Market indicator (ti+6) (ti) Market indicator Outputs Scenario (ti+6) Inputs (ti) FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III SCENARIO ANALYSIS STAGE II • Weakly Pessimistic OPTIMIZATION • Hold • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs 18

Fuzzy Inference System • 18 fuzzy rules in the system • Reasoning used to develop these fuzzy rules are statements such as: Scenario If the rate of change is large, (+) Optimistic then the price is likely to move higher If the stochastic %K is low, then the price is likely to move lower (-) Pessimistic 1 0. 5 0 19

Fuzzy Inference System • 18 fuzzy rules in the system • Reasoning used to develop these fuzzy rules are statements such as: Scenario If the rate of change is large, (+) Optimistic then the price is likely to move higher If the stochastic %K is low, then the price is likely to move lower (-) Pessimistic 1 0. 5 0 19

Fuzzy Inference System Classification OUTPUTS SCENARIO (ti+6) INPUTS (ti+6) 1. Very Pessimistic Rate of Change Stochastic %K Stochastic %D 1. Very low Closing prices FUZZY INFERENCE SYSTEM 2. Low 3. Medium Pessimistic Rate of Change 3. Medium low 4. Weakly low Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 5. Stable 6. Weakly large 7. Medium Large 4. Weakly Pessimistic 5. Hold Rate of Change Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 8. Large 9. Very large 2. Pessimistic 6. Weakly Optimistic 7. Medium Optimistic Rate of Change Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 8. Optimistic 9. Very Optimistic 20

Fuzzy Inference System Classification OUTPUTS SCENARIO (ti+6) INPUTS (ti+6) 1. Very Pessimistic Rate of Change Stochastic %K Stochastic %D 1. Very low Closing prices FUZZY INFERENCE SYSTEM 2. Low 3. Medium Pessimistic Rate of Change 3. Medium low 4. Weakly low Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 5. Stable 6. Weakly large 7. Medium Large 4. Weakly Pessimistic 5. Hold Rate of Change Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 8. Large 9. Very large 2. Pessimistic 6. Weakly Optimistic 7. Medium Optimistic Rate of Change Stochastic %K Stochastic %D Closing prices FUZZY INFERENCE SYSTEM 8. Optimistic 9. Very Optimistic 20

Investment Scenario Very pessimistic (vp) do not invest Interval Values (Z) 0 < Z <= 11. 11 Pessimistic (p) do not invest 11. 11 < Z <= 22. 22 Medium pessimistic (mp) do not invest 22. 22 < Z <= 33. 33 Weakly pessimistic (wp) do not invest 33. 33 < Z <= 44. 44 Hold (h) 44. 44 < Z <= 55. 55 Weakly optimistic (wo) do invest 55. 55 < Z <= 66. 66 Medium optimistic (mo) do invest 66. 66 < Z <= 77. 77 Optimistic (o) do invest 77. 77 < Z <= 88. 88 Very optimistic (vo) do invest 88. 88 < Z <= 100 21

Investment Scenario Very pessimistic (vp) do not invest Interval Values (Z) 0 < Z <= 11. 11 Pessimistic (p) do not invest 11. 11 < Z <= 22. 22 Medium pessimistic (mp) do not invest 22. 22 < Z <= 33. 33 Weakly pessimistic (wp) do not invest 33. 33 < Z <= 44. 44 Hold (h) 44. 44 < Z <= 55. 55 Weakly optimistic (wo) do invest 55. 55 < Z <= 66. 66 Medium optimistic (mo) do invest 66. 66 < Z <= 77. 77 Optimistic (o) do invest 77. 77 < Z <= 88. 88 Very optimistic (vo) do invest 88. 88 < Z <= 100 21

Deffuzification for NFA Defuzzification system for NFA index: inputs rules and output scenario Scenario Value = 62. 8 0 100 22

Deffuzification for NFA Defuzzification system for NFA index: inputs rules and output scenario Scenario Value = 62. 8 0 100 22

Investment Scenario for NFA Weakly Optimistic scenario NFA weakly optimistic scenario surface 23

Investment Scenario for NFA Weakly Optimistic scenario NFA weakly optimistic scenario surface 23

Portfolio Selection: Stage III TECHNICAL ANALYSIS STAGE I Inputs (ti) Market indicator ANFIS Market indicator (ti) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS (ti) Market indicator • Very Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) P R E A N A L Y S I S SCENARIO ANALYSIS STAGE II • Weakly Pessimistic • Hold OPTIMIZATION • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs Input 24

Portfolio Selection: Stage III TECHNICAL ANALYSIS STAGE I Inputs (ti) Market indicator ANFIS Market indicator (ti) • Pessimistic • Medium Pessimistic Market indicator (ti+6) ANFIS (ti) Market indicator • Very Pessimistic Market indicator (ti+6) ANFIS FUZZY INFERENCE SYSTEM Market indicator (ti+6) ANFIS PORTFOLIO SELECTION STAGE III Outputs Scenario (ti+6) Outputs (ti+6) (ti) P R E A N A L Y S I S SCENARIO ANALYSIS STAGE II • Weakly Pessimistic • Hold OPTIMIZATION • Weakly Optimistic • Medium Optimistic Market indicator • Optimistic • Very Optimistic (ti+6) Inputs Input 24

Securities from NYSE Financial Name Number of Securities Insurance (accident and Health) 80 Consumer Financial Services 56 Regional Banks 40 Savings Banks 70 Miscellaneous Financial Services 60 Money Center Banks 84 Insurance Prop. And Casualty 40 Total 430 25

Securities from NYSE Financial Name Number of Securities Insurance (accident and Health) 80 Consumer Financial Services 56 Regional Banks 40 Savings Banks 70 Miscellaneous Financial Services 60 Money Center Banks 84 Insurance Prop. And Casualty 40 Total 430 25

Mean-Variance Criterion n Markowitz (1959) The return estimate is represented by the mean and asset risk is represented by the standard deviation n General Optimization Problem § Optimal portfolio must meet the following constraints: The sum of the portfolio weights must be equal to 1. The weight of each asset must be greater than or equal to zero. 26

Mean-Variance Criterion n Markowitz (1959) The return estimate is represented by the mean and asset risk is represented by the standard deviation n General Optimization Problem § Optimal portfolio must meet the following constraints: The sum of the portfolio weights must be equal to 1. The weight of each asset must be greater than or equal to zero. 26

Portfolio Selection Objective function Subject to n. The monthly return rates and risk are calculated for each one of the 430 assets in accordance with the Mean-Variance model §Monthly data from January 2 nd 1997 to September 2 nd, 2003 27

Portfolio Selection Objective function Subject to n. The monthly return rates and risk are calculated for each one of the 430 assets in accordance with the Mean-Variance model §Monthly data from January 2 nd 1997 to September 2 nd, 2003 27

Returns and Standard Deviations of the Optimal Interval for the Portfolio Selection Number of Security (S) Optimal Interval Returns Minimum Risk (Standard deviation) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 10. 03 10. 06 10. 07 10. 08 10. 09 10. 11 10. 15 10. 18 10. 21 10. 23 10. 25 10. 27 10. 31 10. 32 10. 37 10. 47 10. 48 10. 49 10. 51 10. 53 2. 45 2. 46 2. 48 2. 49 2. 51 2. 52 2. 53 2. 54 2. 55 2. 57 2. 58 2. 59 2. 61 28

Returns and Standard Deviations of the Optimal Interval for the Portfolio Selection Number of Security (S) Optimal Interval Returns Minimum Risk (Standard deviation) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 10. 03 10. 06 10. 07 10. 08 10. 09 10. 11 10. 15 10. 18 10. 21 10. 23 10. 25 10. 27 10. 31 10. 32 10. 37 10. 47 10. 48 10. 49 10. 51 10. 53 2. 45 2. 46 2. 48 2. 49 2. 51 2. 52 2. 53 2. 54 2. 55 2. 57 2. 58 2. 59 2. 61 28

Optimal Portfolio Selection 29

Optimal Portfolio Selection 29

Conclusions u This is an innovative methodology, principaly, because of the use of Soft Computer technologies such as, Fuzzy Inference Systems (FIS), and Adaptive Neuro-Fuzzy Inference Systems (ANFIS). u In addition, the originality of this work consists in the application of the simulated framework where before solving financial problems based on future security values in the short term, we construct a good representation of this future. 30

Conclusions u This is an innovative methodology, principaly, because of the use of Soft Computer technologies such as, Fuzzy Inference Systems (FIS), and Adaptive Neuro-Fuzzy Inference Systems (ANFIS). u In addition, the originality of this work consists in the application of the simulated framework where before solving financial problems based on future security values in the short term, we construct a good representation of this future. 30

Thank you 31

Thank you 31