90d9eea6d5e211a69540041c22f38b65.ppt

- Количество слайдов: 32

University of Louisville School of Medicine Financial Aid Leslie R. Kaelin M. Ed. Financial Aid Director Uof. L School of Medicine

University of Louisville School of Medicine Financial Aid Leslie R. Kaelin M. Ed. Financial Aid Director Uof. L School of Medicine

SOM Financial Aid Office Part of SOM Student Affairs • Staff: Leslie R. Kaelin-Director, School of Medicine Cynthia Morse-Financial Aid Advisor, Senior • Location: Instructional Bldg. Room B-230 (Ped-way) • Office hours: M-F 9: 00 a. m. -5: 00 p. m. phone: 502 -852 -5187

SOM Financial Aid Office Part of SOM Student Affairs • Staff: Leslie R. Kaelin-Director, School of Medicine Cynthia Morse-Financial Aid Advisor, Senior • Location: Instructional Bldg. Room B-230 (Ped-way) • Office hours: M-F 9: 00 a. m. -5: 00 p. m. phone: 502 -852 -5187

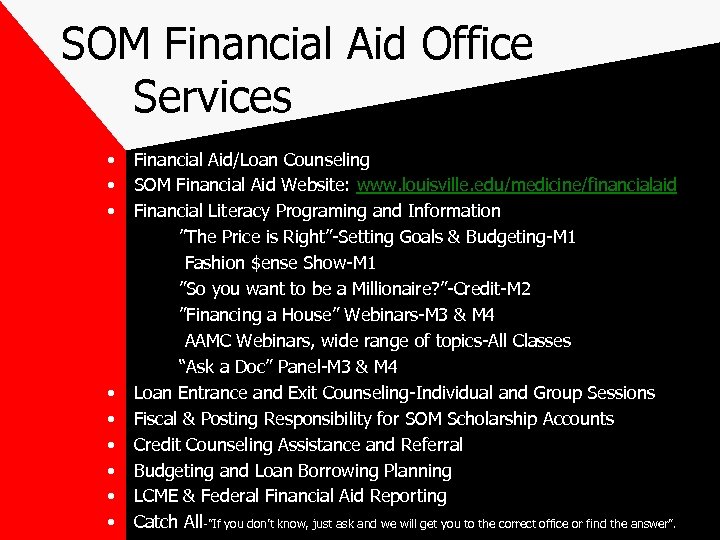

SOM Financial Aid Office Services • • • Financial Aid/Loan Counseling SOM Financial Aid Website: www. louisville. edu/medicine/financialaid Financial Literacy Programing and Information ”The Price is Right”-Setting Goals & Budgeting-M 1 Fashion $ense Show-M 1 ”So you want to be a Millionaire? ”-Credit-M 2 ”Financing a House” Webinars-M 3 & M 4 AAMC Webinars, wide range of topics-All Classes “Ask a Doc” Panel-M 3 & M 4 Loan Entrance and Exit Counseling-Individual and Group Sessions Fiscal & Posting Responsibility for SOM Scholarship Accounts Credit Counseling Assistance and Referral Budgeting and Loan Borrowing Planning LCME & Federal Financial Aid Reporting Catch All-”If you don’t know, just ask and we will get you to the correct office or find the answer”.

SOM Financial Aid Office Services • • • Financial Aid/Loan Counseling SOM Financial Aid Website: www. louisville. edu/medicine/financialaid Financial Literacy Programing and Information ”The Price is Right”-Setting Goals & Budgeting-M 1 Fashion $ense Show-M 1 ”So you want to be a Millionaire? ”-Credit-M 2 ”Financing a House” Webinars-M 3 & M 4 AAMC Webinars, wide range of topics-All Classes “Ask a Doc” Panel-M 3 & M 4 Loan Entrance and Exit Counseling-Individual and Group Sessions Fiscal & Posting Responsibility for SOM Scholarship Accounts Credit Counseling Assistance and Referral Budgeting and Loan Borrowing Planning LCME & Federal Financial Aid Reporting Catch All-”If you don’t know, just ask and we will get you to the correct office or find the answer”.

• Now that I have been accepted…How am I going to pay for my medical school education? • Applying for and receiving Federal Financial aid is much easier than what you had to do to get admitted!

• Now that I have been accepted…How am I going to pay for my medical school education? • Applying for and receiving Federal Financial aid is much easier than what you had to do to get admitted!

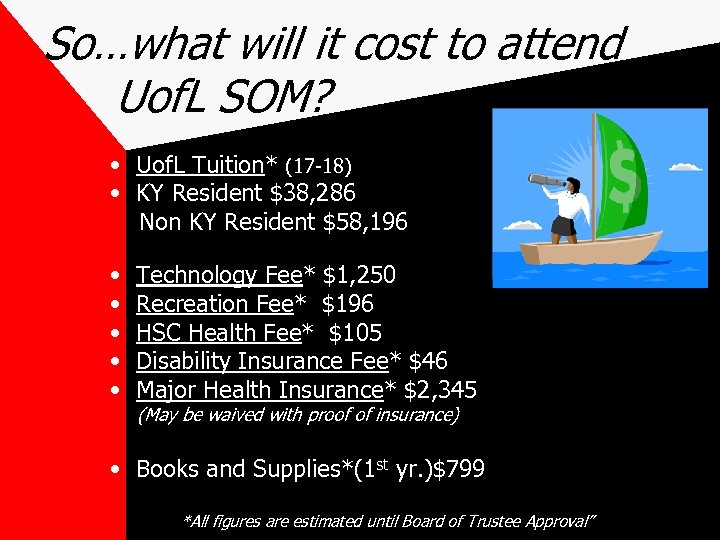

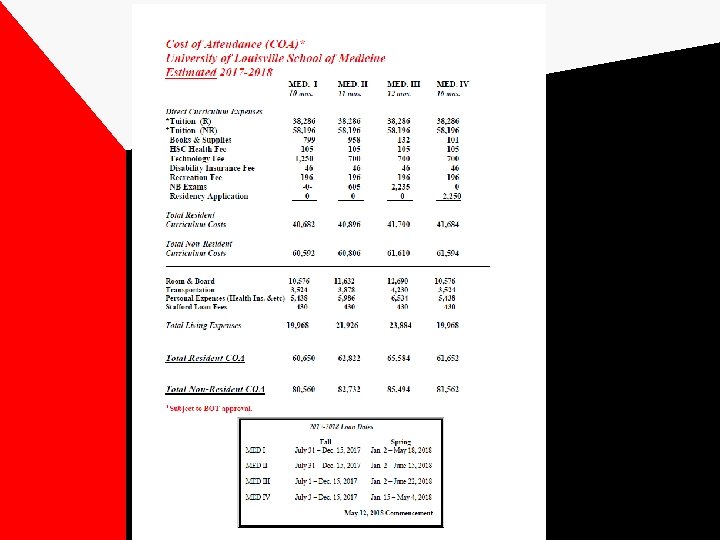

So…what will it cost to attend Uof. L SOM? • Uof. L Tuition* (17 -18) • KY Resident $38, 286 Non KY Resident $58, 196 • • • Technology Fee* $1, 250 Recreation Fee* $196 HSC Health Fee* $105 Disability Insurance Fee* $46 Major Health Insurance* $2, 345 (May be waived with proof of insurance) • Books and Supplies*(1 st yr. )$799 *All figures are estimated until Board of Trustee Approval”

So…what will it cost to attend Uof. L SOM? • Uof. L Tuition* (17 -18) • KY Resident $38, 286 Non KY Resident $58, 196 • • • Technology Fee* $1, 250 Recreation Fee* $196 HSC Health Fee* $105 Disability Insurance Fee* $46 Major Health Insurance* $2, 345 (May be waived with proof of insurance) • Books and Supplies*(1 st yr. )$799 *All figures are estimated until Board of Trustee Approval”

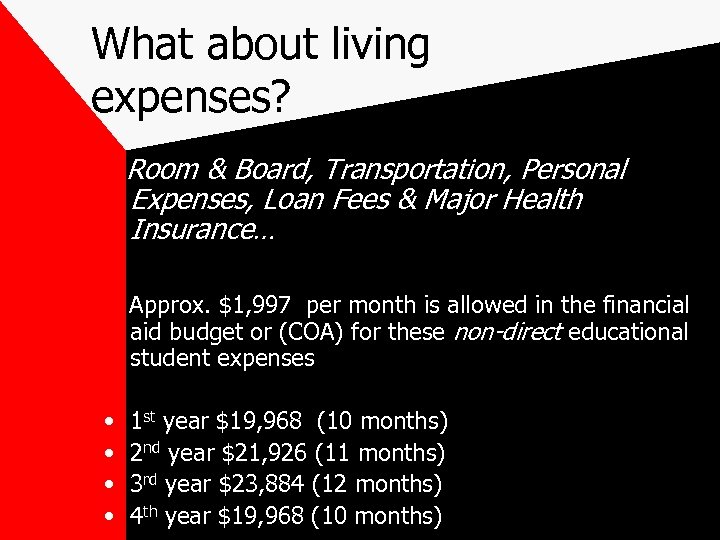

What about living expenses? Room & Board, Transportation, Personal Expenses, Loan Fees & Major Health Insurance… Approx. $1, 997 per month is allowed in the financial aid budget or (COA) for these non-direct educational student expenses • • 1 st year $19, 968 (10 months) 2 nd year $21, 926 (11 months) 3 rd year $23, 884 (12 months) 4 th year $19, 968 (10 months)

What about living expenses? Room & Board, Transportation, Personal Expenses, Loan Fees & Major Health Insurance… Approx. $1, 997 per month is allowed in the financial aid budget or (COA) for these non-direct educational student expenses • • 1 st year $19, 968 (10 months) 2 nd year $21, 926 (11 months) 3 rd year $23, 884 (12 months) 4 th year $19, 968 (10 months)

Cost of Attendance-(COA) Always includes: • Tuition & Required Fees • Books & Supplies, Board Exams, R & B, Transportation, Health and Misc. Personal Expenses May Include: • Dependent child care expenses-PJ • Expenses associated with a disability-PJ • Excessive Medical expenses of the student-PJ

Cost of Attendance-(COA) Always includes: • Tuition & Required Fees • Books & Supplies, Board Exams, R & B, Transportation, Health and Misc. Personal Expenses May Include: • Dependent child care expenses-PJ • Expenses associated with a disability-PJ • Excessive Medical expenses of the student-PJ

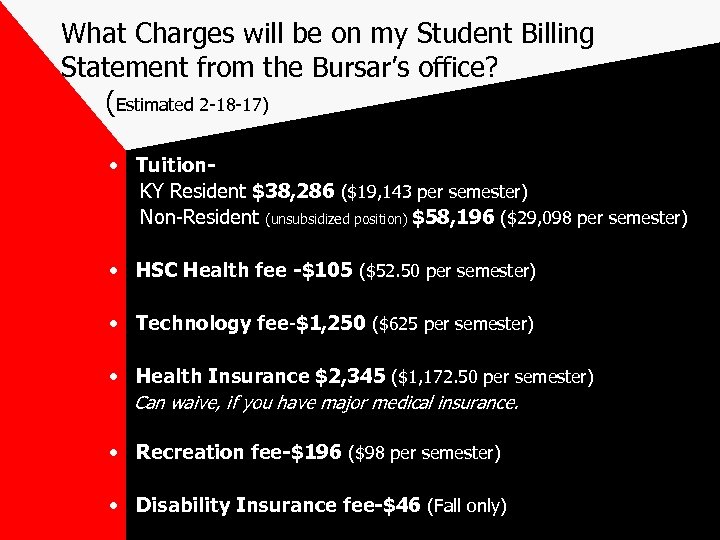

What Charges will be on my Student Billing Statement from the Bursar’s office? (Estimated 2 -18 -17) • Tuition. KY Resident $38, 286 ($19, 143 per semester) Non-Resident (unsubsidized position) $58, 196 ($29, 098 per semester) • HSC Health fee -$105 ($52. 50 per semester) • Technology fee-$1, 250 ($625 per semester) • Health Insurance $2, 345 ($1, 172. 50 per semester) Can waive, if you have major medical insurance. • Recreation fee-$196 ($98 per semester) • Disability Insurance fee-$46 (Fall only)

What Charges will be on my Student Billing Statement from the Bursar’s office? (Estimated 2 -18 -17) • Tuition. KY Resident $38, 286 ($19, 143 per semester) Non-Resident (unsubsidized position) $58, 196 ($29, 098 per semester) • HSC Health fee -$105 ($52. 50 per semester) • Technology fee-$1, 250 ($625 per semester) • Health Insurance $2, 345 ($1, 172. 50 per semester) Can waive, if you have major medical insurance. • Recreation fee-$196 ($98 per semester) • Disability Insurance fee-$46 (Fall only)

Uof. L Admissions Uof. L Endowed Scholarship Accounts are used to make the following types of awards: • • • Academic GEMS Diversity MD/Ph. D Misc. All incoming student scholarship awards are offered by the SOM Admissions Office. No application is needed.

Uof. L Admissions Uof. L Endowed Scholarship Accounts are used to make the following types of awards: • • • Academic GEMS Diversity MD/Ph. D Misc. All incoming student scholarship awards are offered by the SOM Admissions Office. No application is needed.

Some Types of Outside Scholarships • • Military HPSP Religious Affiliation Ethnicity Employer offered Practice interests Commitment-NHSC Misc. www. finaid. org

Some Types of Outside Scholarships • • Military HPSP Religious Affiliation Ethnicity Employer offered Practice interests Commitment-NHSC Misc. www. finaid. org

• Most students borrow Federal Loans to finance their medical school education % SOM Graduates with Federal Loan Debt: 76% (Class of 2016) 90% (Class of 2015) 83% (Class of 2014)

• Most students borrow Federal Loans to finance their medical school education % SOM Graduates with Federal Loan Debt: 76% (Class of 2016) 90% (Class of 2015) 83% (Class of 2014)

Educational Indebtedness 2014 -15 Average Indebtedness for Graduates WITH DEBT • ALL U. S. Medical Students $156, 120* • U of L Medical Students $181, 605* (90%-Class of 2015 w/Debt) *Figure does not include prior educational debt-medical debt only. (Data from the 2014 -15 Financial Aid Summary Report-AAMC)

Educational Indebtedness 2014 -15 Average Indebtedness for Graduates WITH DEBT • ALL U. S. Medical Students $156, 120* • U of L Medical Students $181, 605* (90%-Class of 2015 w/Debt) *Figure does not include prior educational debt-medical debt only. (Data from the 2014 -15 Financial Aid Summary Report-AAMC)

Free Application for Federal Student Aid (FAFSA) • Student’s personal and financial information required to perform need analysis is collected on the FAFSA • Complete each year • Electronic 2017 -18 FAFSA on the Web: www. fafsa. ed. gov

Free Application for Federal Student Aid (FAFSA) • Student’s personal and financial information required to perform need analysis is collected on the FAFSA • Complete each year • Electronic 2017 -18 FAFSA on the Web: www. fafsa. ed. gov

in applying for Federal Aid • Obtain a FSAID at www. fafsa. ed. gov • Complete the FAFSA on the Web at www. fafsa. ed. gov • Complete any forms requested by Financial Aid Office www. ulink. louisville. edu • Complete MPN’s on-line (Direct Unsubsidized & Direct Graduate PLUS) as needed www. studentloans. gov • Uof. L on-line FAN: Accept, Reject or Reduce Federal Loans offered (You do not have to accept scholarship aid) • Any residual funds sent to “Bank Mobile” to disburse based on your selection

in applying for Federal Aid • Obtain a FSAID at www. fafsa. ed. gov • Complete the FAFSA on the Web at www. fafsa. ed. gov • Complete any forms requested by Financial Aid Office www. ulink. louisville. edu • Complete MPN’s on-line (Direct Unsubsidized & Direct Graduate PLUS) as needed www. studentloans. gov • Uof. L on-line FAN: Accept, Reject or Reduce Federal Loans offered (You do not have to accept scholarship aid) • Any residual funds sent to “Bank Mobile” to disburse based on your selection

Common Errors on FAFSA • • Social Security Numbers Untaxed income U. S. income taxes paid Real estate and investment net worth For PCL or LDS eligibility consideration: • • Divorced/remarried parent information Income earned by parents/stepparents Household size Number in college

Common Errors on FAFSA • • Social Security Numbers Untaxed income U. S. income taxes paid Real estate and investment net worth For PCL or LDS eligibility consideration: • • Divorced/remarried parent information Income earned by parents/stepparents Household size Number in college

Who should provide parental information on the FAFSA? • Only students that are interested in being considered for the DHHS Loan Programs Primary Care Loan (PCL) or the Loan for Disadvantaged Students (LDS)

Who should provide parental information on the FAFSA? • Only students that are interested in being considered for the DHHS Loan Programs Primary Care Loan (PCL) or the Loan for Disadvantaged Students (LDS)

Financial Aid Award (FAN) Notification The FAN is e-mailed to student (or can be found on-line at the ULINK web site). The SOM will have a link to click on for specific SOM information The FAN outlines the: • Type and amount of aid offered • How and when aid will be disbursed (FALL/SPRING) • Terms and conditions of aid awarded (Full time, Promissory Note, etc. )

Financial Aid Award (FAN) Notification The FAN is e-mailed to student (or can be found on-line at the ULINK web site). The SOM will have a link to click on for specific SOM information The FAN outlines the: • Type and amount of aid offered • How and when aid will be disbursed (FALL/SPRING) • Terms and conditions of aid awarded (Full time, Promissory Note, etc. )

Federal Aid Department of Education Title IV • Direct Unsubsidized Loan • Direct Graduate PLUS Loan

Federal Aid Department of Education Title IV • Direct Unsubsidized Loan • Direct Graduate PLUS Loan

Direct Unsubsidized • • • Maximum limit-Up to COA: After Scholarships Maximum Direct Unsubsidized Loan up to: $42, 722 per 10 month academic year (M 1 & M 4) $44, 944 per 11 month academic year (M 2) $47, 167 per 12 month academic year (M 3) Max. Combined Aggregate Sub. & Unsub. Limit: $224, 000 “Non Need Based” 5. 31% fixed rate (July 1, 2016) (will change 7 -1 -17 -changes yearly) Requires Master Promissory Note (MPN) (once for Medical School) • Loan Fee: 1. 069% (may change ) • • “Unsubsidized” interest during all periods: Grace, Forbearance, Deferment Repayment options: 10 yr. Level, Extended, Graduated, IBR, PAYE & REPAYE -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan -“NHSC Loan Forgiveness Program”-Eligible Loan -“NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan

Direct Unsubsidized • • • Maximum limit-Up to COA: After Scholarships Maximum Direct Unsubsidized Loan up to: $42, 722 per 10 month academic year (M 1 & M 4) $44, 944 per 11 month academic year (M 2) $47, 167 per 12 month academic year (M 3) Max. Combined Aggregate Sub. & Unsub. Limit: $224, 000 “Non Need Based” 5. 31% fixed rate (July 1, 2016) (will change 7 -1 -17 -changes yearly) Requires Master Promissory Note (MPN) (once for Medical School) • Loan Fee: 1. 069% (may change ) • • “Unsubsidized” interest during all periods: Grace, Forbearance, Deferment Repayment options: 10 yr. Level, Extended, Graduated, IBR, PAYE & REPAYE -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan -“NHSC Loan Forgiveness Program”-Eligible Loan -“NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan

Direct Graduate PLUS • • Maximum limit-Up to COA: After Scholarships and Direct Unsubsidized Loan “Non Need Based” Graduate/Professional Student as Borrower (not the parent!) 6. 31% fixed rate (July 1, 2016) (will change 7 -1 -17 -changes yearly) Requires Master Promissory Note-MPN (once for Medical School) Loan Fee: 4. 276% (may change ) “Unsubsidized” interest during all periods: Grace, Forbearance, Deferment Repayment options: 10 yr. Level, Extended, Graduated, IBR, PAYE & REPAYE -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan -“NHSC Loan Forgiveness Program”-Eligible Loan - “NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan

Direct Graduate PLUS • • Maximum limit-Up to COA: After Scholarships and Direct Unsubsidized Loan “Non Need Based” Graduate/Professional Student as Borrower (not the parent!) 6. 31% fixed rate (July 1, 2016) (will change 7 -1 -17 -changes yearly) Requires Master Promissory Note-MPN (once for Medical School) Loan Fee: 4. 276% (may change ) “Unsubsidized” interest during all periods: Grace, Forbearance, Deferment Repayment options: 10 yr. Level, Extended, Graduated, IBR, PAYE & REPAYE -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan -“NHSC Loan Forgiveness Program”-Eligible Loan - “NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan

Department of Health and Human Services-Title VII Loan Programs To be considered, the student must provide parental data on FAFSA !!! • Primary Care Loan (PCL) • Loan for Disadvantaged Students (LDS)

Department of Health and Human Services-Title VII Loan Programs To be considered, the student must provide parental data on FAFSA !!! • Primary Care Loan (PCL) • Loan for Disadvantaged Students (LDS)

Primary Care Loan (PCL) • Subsidized during school and approved primary care residency • Interest rate 5% • Determination of award based on parental and student income data • 10 year level repayment

Primary Care Loan (PCL) • Subsidized during school and approved primary care residency • Interest rate 5% • Determination of award based on parental and student income data • 10 year level repayment

Primary Care Loan Continued… • Must complete Primary Care Residency: Pediatrics, Internal Medicine, Medicine/Pediatrics, Family Practice and Preventive Medicine –NO SPECIALITIES • The PCL Loan Cannot be forgiven under: -”Public Service Loan Forgiveness” (PSLF) -“NHSC Loan Forgiveness Program” -“NHSC Students 2 Service Loan Forgiveness Program” • Penalties for non-primary care Residency Contact the SOM Financial Aid-Leslie or Cynthia if you would like to be considered for PCL

Primary Care Loan Continued… • Must complete Primary Care Residency: Pediatrics, Internal Medicine, Medicine/Pediatrics, Family Practice and Preventive Medicine –NO SPECIALITIES • The PCL Loan Cannot be forgiven under: -”Public Service Loan Forgiveness” (PSLF) -“NHSC Loan Forgiveness Program” -“NHSC Students 2 Service Loan Forgiveness Program” • Penalties for non-primary care Residency Contact the SOM Financial Aid-Leslie or Cynthia if you would like to be considered for PCL

Loan for Disadvantaged Students (LDS) • Subsidized during School and Residency • Interest rate 5% • Determination of award based on parental and student income data. Students from PEPP counties given priority. Low income-”Need Based” • 10 year level repayment • No Application needed-Parental data will be viewed, if provided on the FAFSA and eligibility determined. -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan-Only if consolidated with Direct Consolidation Loan -“NHSC Loan Forgiveness Program”-Eligible Loan* -”NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan*

Loan for Disadvantaged Students (LDS) • Subsidized during School and Residency • Interest rate 5% • Determination of award based on parental and student income data. Students from PEPP counties given priority. Low income-”Need Based” • 10 year level repayment • No Application needed-Parental data will be viewed, if provided on the FAFSA and eligibility determined. -”Public Service Loan Forgiveness” (PSLF)-Eligible Loan-Only if consolidated with Direct Consolidation Loan -“NHSC Loan Forgiveness Program”-Eligible Loan* -”NHSC Students 2 Service Loan Forgiveness Program”-Eligible Loan*

Outside Scholarships & Loans All outside scholarships or aid must be reported to Financial Aid as soon as you know of the award Some EXAMPLES: Military Scholarships-HPSP NHSC Scholarships Daviess County Medical Society Community or Outside Scholarships National Medical Fellowships Scholarships

Outside Scholarships & Loans All outside scholarships or aid must be reported to Financial Aid as soon as you know of the award Some EXAMPLES: Military Scholarships-HPSP NHSC Scholarships Daviess County Medical Society Community or Outside Scholarships National Medical Fellowships Scholarships

Uof. L Bank Mobile Card (for Student Refunds-Residual) • Select from Two Refund Choices: 1. Bank Mobile Vibe Checking Account OR 2. Transfer to your personal checking account (ACH) (ACH is what SOM FA recommends) (It will contain your Uof. L “Personal Code” to secure access to the Bank Mobile Refund Selection Website. )

Uof. L Bank Mobile Card (for Student Refunds-Residual) • Select from Two Refund Choices: 1. Bank Mobile Vibe Checking Account OR 2. Transfer to your personal checking account (ACH) (ACH is what SOM FA recommends) (It will contain your Uof. L “Personal Code” to secure access to the Bank Mobile Refund Selection Website. )

Basic information • • • Bursar’s Office-Billing & Student Account 852 -6503 Health Insurance 852 -6519 Bank Mobile 852 -2308 Student Loan Deferment Forms-Your Loan Servicer ULink www. ulink. louisville. edu -Go to “for first time users” -Will get user ID & Password -Click on Student Services Tab -Category “Financial Aid” -Click on “View my to do list” -Print forms requested

Basic information • • • Bursar’s Office-Billing & Student Account 852 -6503 Health Insurance 852 -6519 Bank Mobile 852 -2308 Student Loan Deferment Forms-Your Loan Servicer ULink www. ulink. louisville. edu -Go to “for first time users” -Will get user ID & Password -Click on Student Services Tab -Category “Financial Aid” -Click on “View my to do list” -Print forms requested

Credit 101 www. annualcreditreport. com (Trans. Union, Experian & Equifax) • Credit Report-provides a snapshot of a borrower’s creditworthiness and helps lenders calculate the amount of risk they will assume when providing a borrower access to borrowed funds. • Credit Score-is a numerical calculation that is based on your financial behavior as reported on your credit report (Payment History, Amounts Owed, Length of Credit History, New Credit & Types of Credit Used) Benefits of Good Credit… Better loan offers, lower interest rates, faster credit approvals, increased leasing & rental options, reduced security deposits & reduced premiums on auto, home, and renter’s insurance

Credit 101 www. annualcreditreport. com (Trans. Union, Experian & Equifax) • Credit Report-provides a snapshot of a borrower’s creditworthiness and helps lenders calculate the amount of risk they will assume when providing a borrower access to borrowed funds. • Credit Score-is a numerical calculation that is based on your financial behavior as reported on your credit report (Payment History, Amounts Owed, Length of Credit History, New Credit & Types of Credit Used) Benefits of Good Credit… Better loan offers, lower interest rates, faster credit approvals, increased leasing & rental options, reduced security deposits & reduced premiums on auto, home, and renter’s insurance

FIRST Financial Information, Resources, Services and Tools www. aamc. org/FIRST What can FIRST do for you? • Help you navigate the complexities of student debt • Provide resources to expand your financial literacy skills • Assist you with managing your student debt wisely -Education Debt Manager (EDM) for Matriculating Medical School Students-(Essential Reading) -Education Debt Manager (EDM) for Graduating Medical School Students-(Essential Reading when you graduate) -Medloans Organizer and Calculator -$ALT-Money Management & Saving and Investing -FIRST Financial Aid FACT Sheets -FIRST Videos & Webinars -Budgeting Worksheets for Students & Residents

FIRST Financial Information, Resources, Services and Tools www. aamc. org/FIRST What can FIRST do for you? • Help you navigate the complexities of student debt • Provide resources to expand your financial literacy skills • Assist you with managing your student debt wisely -Education Debt Manager (EDM) for Matriculating Medical School Students-(Essential Reading) -Education Debt Manager (EDM) for Graduating Medical School Students-(Essential Reading when you graduate) -Medloans Organizer and Calculator -$ALT-Money Management & Saving and Investing -FIRST Financial Aid FACT Sheets -FIRST Videos & Webinars -Budgeting Worksheets for Students & Residents

University of Louisville School of Medicine Congratulations to the Class of 2021 ! See you in July ! Leslie & Cynthia

University of Louisville School of Medicine Congratulations to the Class of 2021 ! See you in July ! Leslie & Cynthia