acae66b43cf5083023d104e953ecd9bc.ppt

- Количество слайдов: 43

University General Accounting Jane Patterson Controller’s Office MS 124 (775)784 -7776 janep@unr. edu

University General Accounting Jane Patterson Controller’s Office MS 124 (775)784 -7776 janep@unr. edu

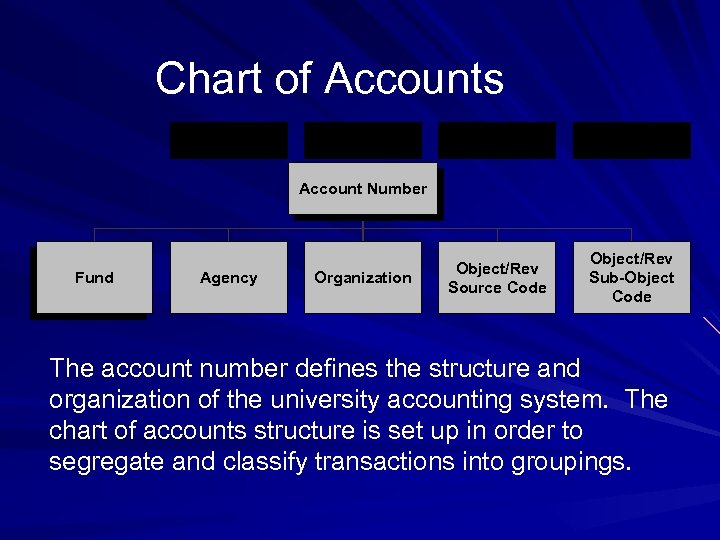

Chart of Accounts Account Number Fund Agency Organization Object/Rev Source Code Object/Rev Sub-Object Code The account number defines the structure and organization of the university accounting system. The chart of accounts structure is set up in order to segregate and classify transactions into groupings.

Chart of Accounts Account Number Fund Agency Organization Object/Rev Source Code Object/Rev Sub-Object Code The account number defines the structure and organization of the university accounting system. The chart of accounts structure is set up in order to segregate and classify transactions into groupings.

Source of Funds The fund is the four digit numeric code which defines the source of funds such as where it is coming from and spending rules applicable to the fund. 1101 to 1199: State funds, revert back to the State of Nevada at the end of each fiscal year. 1200 to 1299: Non-state funds, generally unrestricted. Any funds remaining at year end roll forward to the next year. Any non-state funds from which salaries are paid or expenses exceed $25, 000 must be budgeted. Contact Planning, Budget and Analysis at 784 -6516. 1207 and 1210: Indirect Cost recovery accounts.

Source of Funds The fund is the four digit numeric code which defines the source of funds such as where it is coming from and spending rules applicable to the fund. 1101 to 1199: State funds, revert back to the State of Nevada at the end of each fiscal year. 1200 to 1299: Non-state funds, generally unrestricted. Any funds remaining at year end roll forward to the next year. Any non-state funds from which salaries are paid or expenses exceed $25, 000 must be budgeted. Contact Planning, Budget and Analysis at 784 -6516. 1207 and 1210: Indirect Cost recovery accounts.

Source of Funds cont. 1300 to 1399: Non-state restricted funds. Includes Foundation accounts (1311) Scholarship (1312) Grants and Contracts (1320 -1373). Grant Accounts are multi year accounts, roll at fiscal year end and have grant end dates. 1400 to 1850: Various other non-state sources such as endowments, agency funds, loan funds etc… 1900: Agency Funds. 4101 to 4850: Nevada System of Higher Education.

Source of Funds cont. 1300 to 1399: Non-state restricted funds. Includes Foundation accounts (1311) Scholarship (1312) Grants and Contracts (1320 -1373). Grant Accounts are multi year accounts, roll at fiscal year end and have grant end dates. 1400 to 1850: Various other non-state sources such as endowments, agency funds, loan funds etc… 1900: Agency Funds. 4101 to 4850: Nevada System of Higher Education.

Agency Three digit numeric code identifying the College or Vice President. This 3 digit code follows the fund in each account number. Examples: 102 is the Provost’s Office 105 is Student Services 107 is Athletics 113 is Education 117 is Engineering

Agency Three digit numeric code identifying the College or Vice President. This 3 digit code follows the fund in each account number. Examples: 102 is the Provost’s Office 105 is Student Services 107 is Athletics 113 is Education 117 is Engineering

Organization Four digit alpha/numeric code identifying the department or project. The combination of Agency & Organization form a unique account structure within the financial system. Examples: 112 -0200 to 112 -0299 is the Art Department in the College of Liberal Arts. 114 -2300 to 114 -2399 is the Biology Department in the College of Science. Area and organization form a unique code. If account number 1101 -102 -0028 exists, there will NOT be a 1200 -102 -0028 account number. 102 -0028 is a unique identifier for that specific account number. Grant accounts always start at 0050. All other university accounts range from 0001 to 0049.

Organization Four digit alpha/numeric code identifying the department or project. The combination of Agency & Organization form a unique account structure within the financial system. Examples: 112 -0200 to 112 -0299 is the Art Department in the College of Liberal Arts. 114 -2300 to 114 -2399 is the Biology Department in the College of Science. Area and organization form a unique code. If account number 1101 -102 -0028 exists, there will NOT be a 1200 -102 -0028 account number. 102 -0028 is a unique identifier for that specific account number. Grant accounts always start at 0050. All other university accounts range from 0001 to 0049.

Expense Object and Sub Object Expense Codes Expense Object Codes Two digit alpha/numeric code identifying the general type of expenditure category. 11 – Professional Salaries 20 – Travel 14 – Classified Salaries 25 – Hosting 16 – Fringe 30 – Operating Expense Sub Object Codes Two character alpha/numeric code providing additional detail about the transaction. Required on all university forms for expenditures and deposits at the Cashier’s office. 20 – 01 In-State Travel 20 – 02 Out-of-State Travel 20 – 03 Foreign Travel

Expense Object and Sub Object Expense Codes Expense Object Codes Two digit alpha/numeric code identifying the general type of expenditure category. 11 – Professional Salaries 20 – Travel 14 – Classified Salaries 25 – Hosting 16 – Fringe 30 – Operating Expense Sub Object Codes Two character alpha/numeric code providing additional detail about the transaction. Required on all university forms for expenditures and deposits at the Cashier’s office. 20 – 01 In-State Travel 20 – 02 Out-of-State Travel 20 – 03 Foreign Travel

Revenue Source & Sub Revenue Source Codes Two digit alpha/numeric code identifying the source of the revenue. 68 – Tuition & Fees 78 – Sales & Services 85 – Private Gifts, Grants & Contracts Restricted Sub Revenue Source Codes Two character alpha/numeric code providing additional detail about the transaction. Required on all university forms for deposits at the Cashier’s office. 78 – 01 Misc. Sales/Service Rev 78 – 02 Athletic Events 78 – 03 Gate Receipt/Other

Revenue Source & Sub Revenue Source Codes Two digit alpha/numeric code identifying the source of the revenue. 68 – Tuition & Fees 78 – Sales & Services 85 – Private Gifts, Grants & Contracts Restricted Sub Revenue Source Codes Two character alpha/numeric code providing additional detail about the transaction. Required on all university forms for deposits at the Cashier’s office. 78 – 01 Misc. Sales/Service Rev 78 – 02 Athletic Events 78 – 03 Gate Receipt/Other

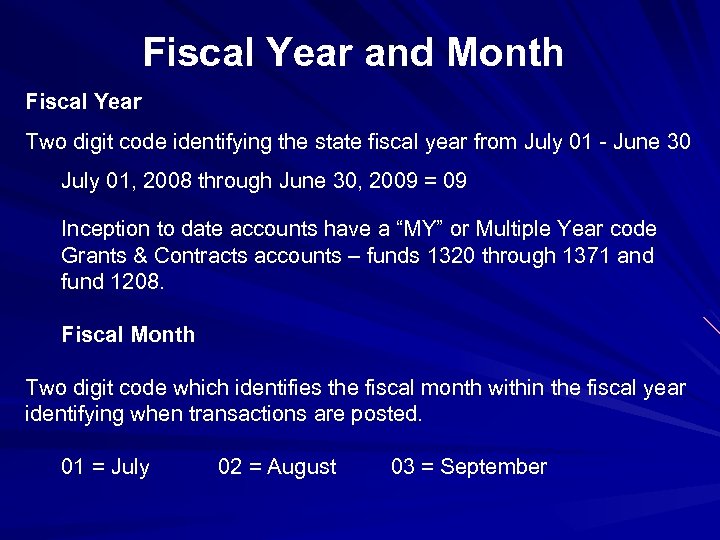

Fiscal Year and Month Fiscal Year Two digit code identifying the state fiscal year from July 01 - June 30 July 01, 2008 through June 30, 2009 = 09 Inception to date accounts have a “MY” or Multiple Year code Grants & Contracts accounts – funds 1320 through 1371 and fund 1208. Fiscal Month Two digit code which identifies the fiscal month within the fiscal year identifying when transactions are posted. 01 = July 02 = August 03 = September

Fiscal Year and Month Fiscal Year Two digit code identifying the state fiscal year from July 01 - June 30 July 01, 2008 through June 30, 2009 = 09 Inception to date accounts have a “MY” or Multiple Year code Grants & Contracts accounts – funds 1320 through 1371 and fund 1208. Fiscal Month Two digit code which identifies the fiscal month within the fiscal year identifying when transactions are posted. 01 = July 02 = August 03 = September

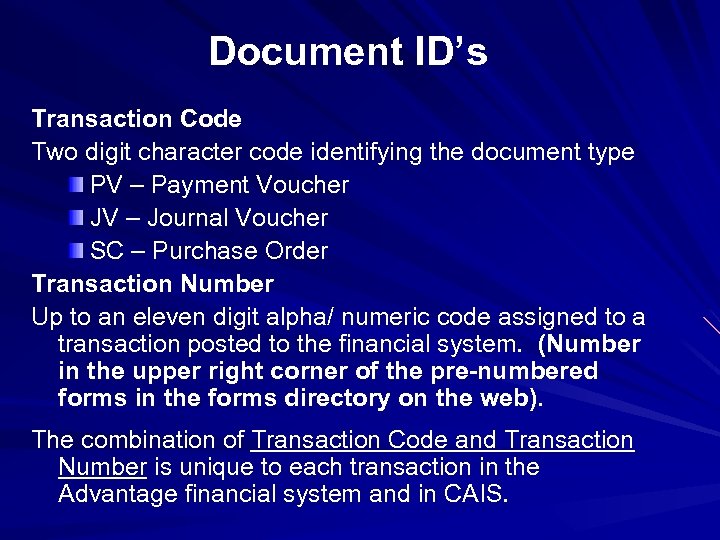

Document ID’s Transaction Code Two digit character code identifying the document type PV – Payment Voucher JV – Journal Voucher SC – Purchase Order Transaction Number Up to an eleven digit alpha/ numeric code assigned to a transaction posted to the financial system. (Number in the upper right corner of the pre-numbered forms in the forms directory on the web). The combination of Transaction Code and Transaction Number is unique to each transaction in the Advantage financial system and in CAIS.

Document ID’s Transaction Code Two digit character code identifying the document type PV – Payment Voucher JV – Journal Voucher SC – Purchase Order Transaction Number Up to an eleven digit alpha/ numeric code assigned to a transaction posted to the financial system. (Number in the upper right corner of the pre-numbered forms in the forms directory on the web). The combination of Transaction Code and Transaction Number is unique to each transaction in the Advantage financial system and in CAIS.

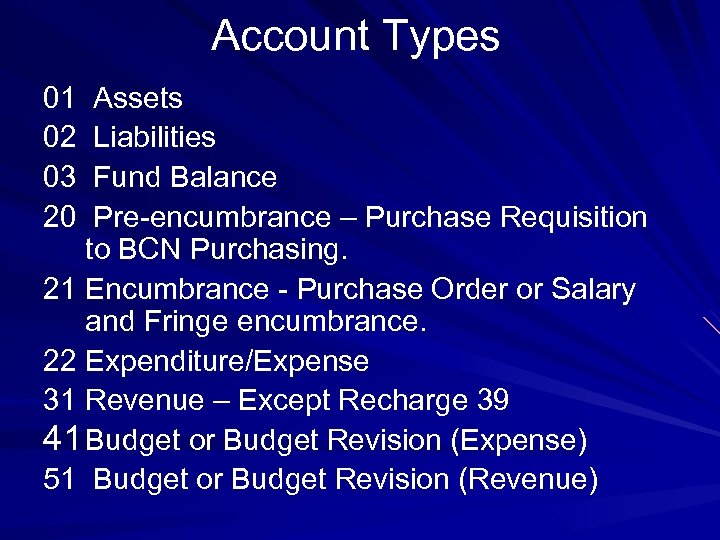

Account Types 01 02 03 20 Assets Liabilities Fund Balance Pre-encumbrance – Purchase Requisition to BCN Purchasing. 21 Encumbrance - Purchase Order or Salary and Fringe encumbrance. 22 Expenditure/Expense 31 Revenue – Except Recharge 39 41 Budget or Budget Revision (Expense) 51 Budget or Budget Revision (Revenue)

Account Types 01 02 03 20 Assets Liabilities Fund Balance Pre-encumbrance – Purchase Requisition to BCN Purchasing. 21 Encumbrance - Purchase Order or Salary and Fringe encumbrance. 22 Expenditure/Expense 31 Revenue – Except Recharge 39 41 Budget or Budget Revision (Expense) 51 Budget or Budget Revision (Revenue)

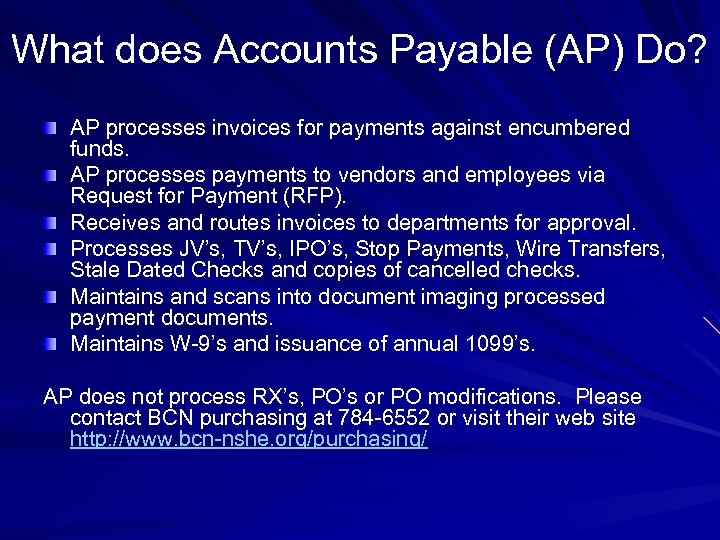

What does Accounts Payable (AP) Do? AP processes invoices for payments against encumbered funds. AP processes payments to vendors and employees via Request for Payment (RFP). Receives and routes invoices to departments for approval. Processes JV’s, TV’s, IPO’s, Stop Payments, Wire Transfers, Stale Dated Checks and copies of cancelled checks. Maintains and scans into document imaging processed payment documents. Maintains W-9’s and issuance of annual 1099’s. AP does not process RX’s, PO’s or PO modifications. Please contact BCN purchasing at 784 -6552 or visit their web site http: //www. bcn-nshe. org/purchasing/

What does Accounts Payable (AP) Do? AP processes invoices for payments against encumbered funds. AP processes payments to vendors and employees via Request for Payment (RFP). Receives and routes invoices to departments for approval. Processes JV’s, TV’s, IPO’s, Stop Payments, Wire Transfers, Stale Dated Checks and copies of cancelled checks. Maintains and scans into document imaging processed payment documents. Maintains W-9’s and issuance of annual 1099’s. AP does not process RX’s, PO’s or PO modifications. Please contact BCN purchasing at 784 -6552 or visit their web site http: //www. bcn-nshe. org/purchasing/

Which Form/Document Do I Use? First ask yourself, am I paying a vendor or an individual? To pay a vendor for goods/services in the future exceeding $2, 000 submit a requisition to BCN Purchasing http: //www. bcn-nshe. org/purchasing/. To pay a vendor for goods/services in the future less than $2, 000 use the university pcard (Master. Card). To pay an Individual (non UNR) for future services submit an Independent Contractor Agreement or Guest Speaker form. To reimburse for interview expenditures submit a Request for Payment form with original receipts. To reimburse an employee for expenditures submit a Request for Payment form with original receipts.

Which Form/Document Do I Use? First ask yourself, am I paying a vendor or an individual? To pay a vendor for goods/services in the future exceeding $2, 000 submit a requisition to BCN Purchasing http: //www. bcn-nshe. org/purchasing/. To pay a vendor for goods/services in the future less than $2, 000 use the university pcard (Master. Card). To pay an Individual (non UNR) for future services submit an Independent Contractor Agreement or Guest Speaker form. To reimburse for interview expenditures submit a Request for Payment form with original receipts. To reimburse an employee for expenditures submit a Request for Payment form with original receipts.

Request for Payments RFP’s are used for the following when the university pcard is not accepted: Employee or student reimbursements (non-travel) original receipts required Hosting Reimbursements Prizes or Awards Guest, Interview Candidate & Moving Expenses Conference Registration fees Memberships, Subscriptions, Accreditation, Licenses, Royalty/Patent Fees, Sponsorships & Dues After the fact payments – Subject to purchasing violations being issued. Petty Cash Replenishment See second page of the RFP for a complete list.

Request for Payments RFP’s are used for the following when the university pcard is not accepted: Employee or student reimbursements (non-travel) original receipts required Hosting Reimbursements Prizes or Awards Guest, Interview Candidate & Moving Expenses Conference Registration fees Memberships, Subscriptions, Accreditation, Licenses, Royalty/Patent Fees, Sponsorships & Dues After the fact payments – Subject to purchasing violations being issued. Petty Cash Replenishment See second page of the RFP for a complete list.

Acceptable Receipts for all Reimbursements and Pcard Receipts must contain the following: – Business Name and Address – Itemization of Purchase – Total Amount Paid – Method of Payment – Date of Purchase – Original Receipt

Acceptable Receipts for all Reimbursements and Pcard Receipts must contain the following: – Business Name and Address – Itemization of Purchase – Total Amount Paid – Method of Payment – Date of Purchase – Original Receipt

Non-Reimbursable Expenses The following expenditures will not be reimbursed: – – – Parking Permits Annual fees for personal credit cards Vehicle Cleaning Gift Certificates for non-research participants Corporate credit card delinquency fees, finance charges, or annual charges Loss/theft of personal property Parking fines or traffic fines Personal clothing or hygiene items Personal entertainment including sporting events Personal telephone calls in addition to prepaid phone cards or other prepaid cards. Fees associated with booking travel on-line such as Orbits, Travelocity, etc… in excess of 25. 00

Non-Reimbursable Expenses The following expenditures will not be reimbursed: – – – Parking Permits Annual fees for personal credit cards Vehicle Cleaning Gift Certificates for non-research participants Corporate credit card delinquency fees, finance charges, or annual charges Loss/theft of personal property Parking fines or traffic fines Personal clothing or hygiene items Personal entertainment including sporting events Personal telephone calls in addition to prepaid phone cards or other prepaid cards. Fees associated with booking travel on-line such as Orbits, Travelocity, etc… in excess of 25. 00

Gift Certificates Due to the accountability issue with gift certificates the current policy is that you may neither purchase or be reimbursed for the purchase of gift certificates for the following reasons: Gift certificates can be cashed for their face value. There is no effective way to account for gift certificate purchased or how and whom they are distributed. The ONLY exception is gift certificates are allowable for research participants with approval from the Office of Sponsored Projects.

Gift Certificates Due to the accountability issue with gift certificates the current policy is that you may neither purchase or be reimbursed for the purchase of gift certificates for the following reasons: Gift certificates can be cashed for their face value. There is no effective way to account for gift certificate purchased or how and whom they are distributed. The ONLY exception is gift certificates are allowable for research participants with approval from the Office of Sponsored Projects.

Membership Dues & Licenses Institutional Memberships, Dues, Licenses & Associations. Held in the University of Nevada, Reno name. May be paid with state funds. May be paid with either a RFP or pcard. Requires Dean or VP approval. Individual Memberships, Dues, Licenses & Associations. Held in the name of the individual. Are NOT permitted to be paid with state funds May be paid with either a RFP or pcard. Requires Dean or VP approval. Dues asses a qualified individual by education, field or interest. Individual licenses must be required in the employee’s work position.

Membership Dues & Licenses Institutional Memberships, Dues, Licenses & Associations. Held in the University of Nevada, Reno name. May be paid with state funds. May be paid with either a RFP or pcard. Requires Dean or VP approval. Individual Memberships, Dues, Licenses & Associations. Held in the name of the individual. Are NOT permitted to be paid with state funds May be paid with either a RFP or pcard. Requires Dean or VP approval. Dues asses a qualified individual by education, field or interest. Individual licenses must be required in the employee’s work position.

Petty Cash Contact Robert Andrews 784 -1203 in AP to set up a Petty Cash Account. Funds are used for small dollar purchases of goods that cannot be purchased on a Pcard. To replenish the fund, a RFP must be filled out with the original receipts and submitted to AP. Cannot be used for Hosting. The amount requested plus the balance remaining in the fun, should equal the authorized amount of the petty cash fund. Visit the web for policies, procedures and forms. http: //www. unr. edu/vpaf/controller/accountspayable/petty-cash. html

Petty Cash Contact Robert Andrews 784 -1203 in AP to set up a Petty Cash Account. Funds are used for small dollar purchases of goods that cannot be purchased on a Pcard. To replenish the fund, a RFP must be filled out with the original receipts and submitted to AP. Cannot be used for Hosting. The amount requested plus the balance remaining in the fun, should equal the authorized amount of the petty cash fund. Visit the web for policies, procedures and forms. http: //www. unr. edu/vpaf/controller/accountspayable/petty-cash. html

How to Spend Money Purchasing Card The Pcard is to be used for small dollar purchases up to $2, 000 for external vendors who accept Master Card. Pcard training is provided by Bob Andrews 784 -1203. Each card holder can access payment net to edit their own pcard transactions. Each card has a default account number and it can be changed via payment net for specific transactions. Biweekly statements with supporting documentation are submitted to the Controller’s Office after being signed by the appropriate authority. Does not create an encumbrance on the account.

How to Spend Money Purchasing Card The Pcard is to be used for small dollar purchases up to $2, 000 for external vendors who accept Master Card. Pcard training is provided by Bob Andrews 784 -1203. Each card holder can access payment net to edit their own pcard transactions. Each card has a default account number and it can be changed via payment net for specific transactions. Biweekly statements with supporting documentation are submitted to the Controller’s Office after being signed by the appropriate authority. Does not create an encumbrance on the account.

How to Spend Money RFP, IPO or PO’s Request for Payment: To be used for small dollar purchases up to $2, 000 if the vendor does not take Master Card. Used to reimburse expenses, request for check and other various payments listed on the RFP form. Does not create and encumbrance on the account. Internal Purchase Order: Used for internal purchases of goods or services of any amount from other units on campus. For example: Locks Department, IT computer software etc… Purchase Orders or Purchase Requisitions: Contact BCN Purchasing Department at 784 -6552 for additional information or visit their web site at http: //www. bcnnshe. org/purchasing/ Use the Purchase Requisition forms to initiate purchases from off campus vendors of anything over $2, 000.

How to Spend Money RFP, IPO or PO’s Request for Payment: To be used for small dollar purchases up to $2, 000 if the vendor does not take Master Card. Used to reimburse expenses, request for check and other various payments listed on the RFP form. Does not create and encumbrance on the account. Internal Purchase Order: Used for internal purchases of goods or services of any amount from other units on campus. For example: Locks Department, IT computer software etc… Purchase Orders or Purchase Requisitions: Contact BCN Purchasing Department at 784 -6552 for additional information or visit their web site at http: //www. bcnnshe. org/purchasing/ Use the Purchase Requisition forms to initiate purchases from off campus vendors of anything over $2, 000.

How to Spend Money Purchase Orders All expenditures that are 2, 000 or greater require a Purchase Orders (PO). PO’s are used for purchasing goods or services and will create an encumbrance on the account Items between $2, 000 - $24, 999 must be documented with a quotation or price list. Items between $25, 000 - $49, 999 require quotes from two or more responsible vendors. Items over $50, 000 will be awarded after Purchasing completes a formal bid process. Proprietary/sole source purchases are allowed under certain circumstances. BPO’s Blanket Purchase Orders: For goods and services that are purchased on a regular, periodic basis. May be used for recurring payments and must be used if the total annual recurring expenditures exceed $10, 000. http: //www. bcn-nshe. org/purchasing/

How to Spend Money Purchase Orders All expenditures that are 2, 000 or greater require a Purchase Orders (PO). PO’s are used for purchasing goods or services and will create an encumbrance on the account Items between $2, 000 - $24, 999 must be documented with a quotation or price list. Items between $25, 000 - $49, 999 require quotes from two or more responsible vendors. Items over $50, 000 will be awarded after Purchasing completes a formal bid process. Proprietary/sole source purchases are allowed under certain circumstances. BPO’s Blanket Purchase Orders: For goods and services that are purchased on a regular, periodic basis. May be used for recurring payments and must be used if the total annual recurring expenditures exceed $10, 000. http: //www. bcn-nshe. org/purchasing/

Vendor Invoices If a vendor is not in the database a W 9 will need to be completed prior to payment. All foreign vendors require a W-8 BEN. Invoices are paid against encumbered PO’s. The invoice should contain the PO number issued by BCN Purchasing. Payments are for goods and services purchased by the university. Vendor invoices should be mailed to the department for department approval. AP will only pay invoices without department approval if they are established in Advantage with “no approval required”.

Vendor Invoices If a vendor is not in the database a W 9 will need to be completed prior to payment. All foreign vendors require a W-8 BEN. Invoices are paid against encumbered PO’s. The invoice should contain the PO number issued by BCN Purchasing. Payments are for goods and services purchased by the university. Vendor invoices should be mailed to the department for department approval. AP will only pay invoices without department approval if they are established in Advantage with “no approval required”.

After-the-Fact Purchases All goods and services 2, 000 and over must go through BCN Purchasing. If you have services rendered without a PO you will need to complete the following steps: Submit an RX to BCN Purchasing with a copy of the invoice and a letter explaining why a PO was not issued before the services were rendered. A Purchasing Violation will be issued and documented on the PO so the vendor and department will know the PO was not requested before the services. A copy of the purchasing violation letter and the PO will be sent to the department’s Dean or VP. BCN Purchasing will send the PO and invoice to AP requesting a “cash with order” after the PO and purchasing violation are complete.

After-the-Fact Purchases All goods and services 2, 000 and over must go through BCN Purchasing. If you have services rendered without a PO you will need to complete the following steps: Submit an RX to BCN Purchasing with a copy of the invoice and a letter explaining why a PO was not issued before the services were rendered. A Purchasing Violation will be issued and documented on the PO so the vendor and department will know the PO was not requested before the services. A copy of the purchasing violation letter and the PO will be sent to the department’s Dean or VP. BCN Purchasing will send the PO and invoice to AP requesting a “cash with order” after the PO and purchasing violation are complete.

How to Spend Money Payroll Expenses: Spending money from object codes 11, 12, 14, 15 also affects object code 16 fringe benefits. For state accounts (1101) fringe is covered from a central fringe pool. For all other state accounts and for non-state accounts, the fringe needs to be paid from the same account number that is being charged the salary. Use PAFs, Payroll Action Form to initiate a salary expenditure. Many employees will also need a contract “Terms of Employment” document as well. A PAF will create an encumbrance on the account accept for hourly wage employees. PR-45: Use this form to transfer payroll expenditures between accounts. Salary and fringe expenditures will be moved together.

How to Spend Money Payroll Expenses: Spending money from object codes 11, 12, 14, 15 also affects object code 16 fringe benefits. For state accounts (1101) fringe is covered from a central fringe pool. For all other state accounts and for non-state accounts, the fringe needs to be paid from the same account number that is being charged the salary. Use PAFs, Payroll Action Form to initiate a salary expenditure. Many employees will also need a contract “Terms of Employment” document as well. A PAF will create an encumbrance on the account accept for hourly wage employees. PR-45: Use this form to transfer payroll expenditures between accounts. Salary and fringe expenditures will be moved together.

How to Spend Money Independent Contractors & Guest Speakers Visit the Controller’s Office web site http: //www. unr. edu/vpaf/controllers-office/indycontractors. html or contact SJ Yoon at 784 -6663. SJ also offers training classes!!! To be used to pay for services provided by external vendors but subject to many regulations. Cannot be used for teaching of classes. Cannot be used for anyone who is employed by any campus in the NSHE or a relative of someone employed by NSHE. Can be used to pay an honorarium to a speaker but special care is to be taken if the speaker is international. Can usually be used to pay for services that are not typically provided by employees of the NSHE.

How to Spend Money Independent Contractors & Guest Speakers Visit the Controller’s Office web site http: //www. unr. edu/vpaf/controllers-office/indycontractors. html or contact SJ Yoon at 784 -6663. SJ also offers training classes!!! To be used to pay for services provided by external vendors but subject to many regulations. Cannot be used for teaching of classes. Cannot be used for anyone who is employed by any campus in the NSHE or a relative of someone employed by NSHE. Can be used to pay an honorarium to a speaker but special care is to be taken if the speaker is international. Can usually be used to pay for services that are not typically provided by employees of the NSHE.

Nonresident Aliens Visit the Controller’s Office web site at http: //www. unr. edu/vpaf/controller/nrat/index. html Contact SJ Yoon at 784 -6663 or attend one of her training classes PRIOR to making a commitment to pay any foreign person. All UNR departments and organizations must be in compliance with the federal rules and regulations and with the UNR NRAT policies and procedures. Contact the Office of International Students and Scholars when hiring any foreign nationals. It is important the individual have the correct immigration status for the type of payment requested or we may not legally be able to pay the individual under immigration law.

Nonresident Aliens Visit the Controller’s Office web site at http: //www. unr. edu/vpaf/controller/nrat/index. html Contact SJ Yoon at 784 -6663 or attend one of her training classes PRIOR to making a commitment to pay any foreign person. All UNR departments and organizations must be in compliance with the federal rules and regulations and with the UNR NRAT policies and procedures. Contact the Office of International Students and Scholars when hiring any foreign nationals. It is important the individual have the correct immigration status for the type of payment requested or we may not legally be able to pay the individual under immigration law.

Hosting Documentation/Approval Please review the University Administrative Manual Spending money using object code 25 from an approved hosting account. Expenditures can be paid by using the pcard, RFP, PO or IPO. The expense must have an attached Host Expense Documentation/Approval form and flyer or agenda documenting the event. The form must be completed for any and all types of hosting payments. The form must state who, how, when, where and why? If hosting is paid for on a pcard, hosting documents must be submitted with the pcard statement.

Hosting Documentation/Approval Please review the University Administrative Manual Spending money using object code 25 from an approved hosting account. Expenditures can be paid by using the pcard, RFP, PO or IPO. The expense must have an attached Host Expense Documentation/Approval form and flyer or agenda documenting the event. The form must be completed for any and all types of hosting payments. The form must state who, how, when, where and why? If hosting is paid for on a pcard, hosting documents must be submitted with the pcard statement.

Hosting Documentation/Approval Cont. All hosting payments must have the approval of the Dean or VP. If hosting is charged to a grant account, the grant must have prior approval from OSPA and be listed as an approved expense. Each Dean or VP has a host account for their area and all hosting must run through those designated accounts. Table purchases at fund-raising events are subject to prior approval by the President. On-campus hosting must be through Chartwells unless the total amount is less that $50. 00.

Hosting Documentation/Approval Cont. All hosting payments must have the approval of the Dean or VP. If hosting is charged to a grant account, the grant must have prior approval from OSPA and be listed as an approved expense. Each Dean or VP has a host account for their area and all hosting must run through those designated accounts. Table purchases at fund-raising events are subject to prior approval by the President. On-campus hosting must be through Chartwells unless the total amount is less that $50. 00.

Why Does Accounts Payable have so many policies and procedures that must be followed? University Administrative Manual http: //www. unr. edu/business_finance/forms/uam. pdf NRS - Nevada Revised Statutes http: //www. leg. state. nv. us/NRS/ NAC – Nevada Administrative Code http: //www. leg. state. nv. us/NCA/CHAPTERS. HTML SAM – State Administrative Manual http: //www. budget. state. nv. us/SAM 24/ IRS – Internal Revenue Service for tax code, regulations, revenue rulings and procedures and case law. http: //www. irs. ustreas. gov USCIS – US Citizenship and Immigration Services for legal payments to nonresident aliens. http: //uscis. gov/graphics/ Board of Regents http: //system. nevada. edu/Board-of. R/Handbook/index. htm http: //system. nevada. edu/Board-of. R/Procedures/index. htm

Why Does Accounts Payable have so many policies and procedures that must be followed? University Administrative Manual http: //www. unr. edu/business_finance/forms/uam. pdf NRS - Nevada Revised Statutes http: //www. leg. state. nv. us/NRS/ NAC – Nevada Administrative Code http: //www. leg. state. nv. us/NCA/CHAPTERS. HTML SAM – State Administrative Manual http: //www. budget. state. nv. us/SAM 24/ IRS – Internal Revenue Service for tax code, regulations, revenue rulings and procedures and case law. http: //www. irs. ustreas. gov USCIS – US Citizenship and Immigration Services for legal payments to nonresident aliens. http: //uscis. gov/graphics/ Board of Regents http: //system. nevada. edu/Board-of. R/Handbook/index. htm http: //system. nevada. edu/Board-of. R/Procedures/index. htm

Tax Information NSHE Tax Identification Number 88 -6000024 Sales Tax Exemption Letter http: //www. unr. edu/vpaf/controller/accounting/documents /taxexemptltr 05. pdf UNR completed W-9 http: //www. unr. edu/vpaf/controller/accounting/documents /UNR_W 9. pdf 1099 related questions please contact Robert Andrews at 784 -1203 Nonresident alien and independent contractors tax questions please contact SJ Yoon at 784 -6663

Tax Information NSHE Tax Identification Number 88 -6000024 Sales Tax Exemption Letter http: //www. unr. edu/vpaf/controller/accounting/documents /taxexemptltr 05. pdf UNR completed W-9 http: //www. unr. edu/vpaf/controller/accounting/documents /UNR_W 9. pdf 1099 related questions please contact Robert Andrews at 784 -1203 Nonresident alien and independent contractors tax questions please contact SJ Yoon at 784 -6663

Forms on the Web http: //www. unr. edu/forms Internal Accounting Forms Request to Establish/Modify Account PDF Internal Purchase Order PDF Journal Voucher PDF General Invoice PDF Transfer Voucher PDF Cash Transmittal Receipt PDF Cashier Deposit Slip PDF ETC…

Forms on the Web http: //www. unr. edu/forms Internal Accounting Forms Request to Establish/Modify Account PDF Internal Purchase Order PDF Journal Voucher PDF General Invoice PDF Transfer Voucher PDF Cash Transmittal Receipt PDF Cashier Deposit Slip PDF ETC…

Controller’s Office Forms General Invoice: Used to invoice an outside entity for services or products provided by the university, including other institutions within NSHE. Nevada System of Higher Education (NSHE) the system office is considered internal and you should use an IPO instead of a general invoice. Cash Receipt (CR): Document used to record income and/or reimbursement of expense received from an outside entity. The Cashier’s office excepts checks, cash, and credit cards and posts to the appropriate account in the Advantage financial system.

Controller’s Office Forms General Invoice: Used to invoice an outside entity for services or products provided by the university, including other institutions within NSHE. Nevada System of Higher Education (NSHE) the system office is considered internal and you should use an IPO instead of a general invoice. Cash Receipt (CR): Document used to record income and/or reimbursement of expense received from an outside entity. The Cashier’s office excepts checks, cash, and credit cards and posts to the appropriate account in the Advantage financial system.

Controller’s Office Forms Request to Establish/Modify Account: Create a new non-grant account within the Advantage financial system. Modify an existing account such as add/delete signature authority or change the account manager. All 1311 requests must go through the Foundation office. Internal Purchase Order (IPO): Used for purchases between departments of the university and/or the NSHE. No dollar limit

Controller’s Office Forms Request to Establish/Modify Account: Create a new non-grant account within the Advantage financial system. Modify an existing account such as add/delete signature authority or change the account manager. All 1311 requests must go through the Foundation office. Internal Purchase Order (IPO): Used for purchases between departments of the university and/or the NSHE. No dollar limit

Controller’s Office Forms Journal Voucher (JV): Use the JV form to correct a previously posted non-payroll expenditure or revenue transaction from one account to another. Also used to correct object/subobject and revenue and sub revenue source codes. Expenses & revenue can be transferred between funding sources as long as they are transferred to funds that allow the expense/revenue. For example, a host expense can NOT be transferred to a non-hosting account. Post foreign wires and drafts to/from the bank account to appropriate operating account in the financial system. If you need to JV salaries from one account to another use the PR-45 form. The JV form must contain the fund, agency, org, object/ revenue source codes and sub object/source codes. The original posted transaction must be on the form. The JV must be signed by someone with signature authority on the account. The comment section must be filled out stating why the JV is being processed.

Controller’s Office Forms Journal Voucher (JV): Use the JV form to correct a previously posted non-payroll expenditure or revenue transaction from one account to another. Also used to correct object/subobject and revenue and sub revenue source codes. Expenses & revenue can be transferred between funding sources as long as they are transferred to funds that allow the expense/revenue. For example, a host expense can NOT be transferred to a non-hosting account. Post foreign wires and drafts to/from the bank account to appropriate operating account in the financial system. If you need to JV salaries from one account to another use the PR-45 form. The JV form must contain the fund, agency, org, object/ revenue source codes and sub object/source codes. The original posted transaction must be on the form. The JV must be signed by someone with signature authority on the account. The comment section must be filled out stating why the JV is being processed.

Controller’s Office Forms Transfer Voucher (TV): Non-state funds only. The Transfer Voucher form allows you to transfer “cash” from one account to another account. Please note the following restrictions: Cannot move cash into our out of state accounts (funds 1101 to 1199). The TB 1 form allows you to move funds between object codes within a state account or between other state accounts with the same fund. Note, you cannot transfer funds between functions. Submit the form to Planning, Budget, & Analysis 784 -6516. You cannot move cash in or out of state funds to self supporting funds. (1101 to 1200) Grant accounts require OSPA approval for funds 1320 to 1373 and 4320 to 4371. You can NOT transfer in or out of a Foundation (1311 fund) account without prior approval from the foundation. Processed through the financial system as ‘JV’ document.

Controller’s Office Forms Transfer Voucher (TV): Non-state funds only. The Transfer Voucher form allows you to transfer “cash” from one account to another account. Please note the following restrictions: Cannot move cash into our out of state accounts (funds 1101 to 1199). The TB 1 form allows you to move funds between object codes within a state account or between other state accounts with the same fund. Note, you cannot transfer funds between functions. Submit the form to Planning, Budget, & Analysis 784 -6516. You cannot move cash in or out of state funds to self supporting funds. (1101 to 1200) Grant accounts require OSPA approval for funds 1320 to 1373 and 4320 to 4371. You can NOT transfer in or out of a Foundation (1311 fund) account without prior approval from the foundation. Processed through the financial system as ‘JV’ document.

Controller’s Office Forms Request for Payment (RFP): Small dollar purchases up to $2, 000 for products or services where the vendors does not accept pcard as a method of payment. All purchases $2, 000 or greater MUST go through the BCN Purchasing Department. Services paid to a vendor who is NOT doing business under his/her social security number. If it is under a social security number, an independent contractor or guest speaker form is used to process the payment request. Reimburse employees for out-of-pocket, (non-travel) related expenses. Original detailed receipts are required. Written explanation of why the pcard was not used. Employee’s supervisor or higher has to approve payment, even if they do not have signature authority on the account being charged. Reimburse job candidates interview expenses.

Controller’s Office Forms Request for Payment (RFP): Small dollar purchases up to $2, 000 for products or services where the vendors does not accept pcard as a method of payment. All purchases $2, 000 or greater MUST go through the BCN Purchasing Department. Services paid to a vendor who is NOT doing business under his/her social security number. If it is under a social security number, an independent contractor or guest speaker form is used to process the payment request. Reimburse employees for out-of-pocket, (non-travel) related expenses. Original detailed receipts are required. Written explanation of why the pcard was not used. Employee’s supervisor or higher has to approve payment, even if they do not have signature authority on the account being charged. Reimburse job candidates interview expenses.

Controller’s Office Forms Scholarship Request: SJ Yoon (784 -6663) provides Scholarship and Award training. All scholarship requests must be approved by the Scholarship Coordinator, Suzanne Bach and the Nonresident Alien Tax Specialist, SJ Yoon. Always check with the Scholarship office regarding scholarships. Failure to do so may cause the student to not qualify for financial aid. All payments to students MUST be approved by Financial Aid. Students are required to read the section on taxability, check whether or not they are a US citizen/lawful permanent resident and sign. Types of Scholarships: Compensatory Scholarship – income for services i. e. researcher, teaching assistant or graduate assistant. The individual must be set up as an employee and the payments must be paid through the payroll system. This income is reported on a W-2 form and is taxed.

Controller’s Office Forms Scholarship Request: SJ Yoon (784 -6663) provides Scholarship and Award training. All scholarship requests must be approved by the Scholarship Coordinator, Suzanne Bach and the Nonresident Alien Tax Specialist, SJ Yoon. Always check with the Scholarship office regarding scholarships. Failure to do so may cause the student to not qualify for financial aid. All payments to students MUST be approved by Financial Aid. Students are required to read the section on taxability, check whether or not they are a US citizen/lawful permanent resident and sign. Types of Scholarships: Compensatory Scholarship – income for services i. e. researcher, teaching assistant or graduate assistant. The individual must be set up as an employee and the payments must be paid through the payroll system. This income is reported on a W-2 form and is taxed.

Controller’s Office Forms Scholarship Request continued: Non-compensatory Scholarship – income paid to or on behalf of an individual for the purpose of aiding study, training, or research and does not represent compensation for services. It is specifically intended to defray the expenses of study, training, or research. Qualified Scholarships: This income is to pay for tuition, fees, books, supplies and equipment required for courses. Nonqualified Scholarship: This is income the student receives that is above the cost of required tuition, fees, books, supplies and equipment.

Controller’s Office Forms Scholarship Request continued: Non-compensatory Scholarship – income paid to or on behalf of an individual for the purpose of aiding study, training, or research and does not represent compensation for services. It is specifically intended to defray the expenses of study, training, or research. Qualified Scholarships: This income is to pay for tuition, fees, books, supplies and equipment required for courses. Nonqualified Scholarship: This is income the student receives that is above the cost of required tuition, fees, books, supplies and equipment.

Controller’s Office Forms Award Request: The student must check the appropriate box regarding their citizenship status. All Award Requests must be approved by the Scholarship Coordinator and the Nonresident Alien Tax Specialist. All payments to students must be approved by Financial Aid. There are two types of award payments: Compensatory Award: There must be an employer-employee relationship existing between the one making the award and the recipient of the award. If no such relationship exists, the award will not constitute wages. Non Compensatory Award: An example of this would be if the non-employed student wrote a paper, and unexpectedly received an award for writing the best paper.

Controller’s Office Forms Award Request: The student must check the appropriate box regarding their citizenship status. All Award Requests must be approved by the Scholarship Coordinator and the Nonresident Alien Tax Specialist. All payments to students must be approved by Financial Aid. There are two types of award payments: Compensatory Award: There must be an employer-employee relationship existing between the one making the award and the recipient of the award. If no such relationship exists, the award will not constitute wages. Non Compensatory Award: An example of this would be if the non-employed student wrote a paper, and unexpectedly received an award for writing the best paper.

Controller’s Office Forms Travel Request: Travel training classes are available through Bob Andrews at 784 -1203 Required when an employee is traveling out of the state for over 24 hours. The employee’s travel request must be completed, approved and received at the Controller’s office prior to the departure date. If college or department travel policies are more restrictive, the employee is to follow the policies which are more restrictive. If a cash advance is requested, the approval form needs to be received in the Controller’s office 10 working days prior to departure date. Only approved for extreme circumstances or student travel. Travel Expense Claim: Must be completed and submitted to the travel department within ten working days of the travel return date for all travel. Travel expense claim form must be completed if there are no expenses to be reimbursed to the employee.

Controller’s Office Forms Travel Request: Travel training classes are available through Bob Andrews at 784 -1203 Required when an employee is traveling out of the state for over 24 hours. The employee’s travel request must be completed, approved and received at the Controller’s office prior to the departure date. If college or department travel policies are more restrictive, the employee is to follow the policies which are more restrictive. If a cash advance is requested, the approval form needs to be received in the Controller’s office 10 working days prior to departure date. Only approved for extreme circumstances or student travel. Travel Expense Claim: Must be completed and submitted to the travel department within ten working days of the travel return date for all travel. Travel expense claim form must be completed if there are no expenses to be reimbursed to the employee.

Controller’s Office Forms W-9: Required when adding new vendors to the university vendor database. Federal regulation require the completion of this form for any payment paid to an individual (non-employee/student), corporation, partnership and or sole proprietor. If not completed, the payment will be delayed until the form is complete and on file. Pcard payments do not require a W-9 to be on file. State of Nevada Sales Tax Exemption Letter: Letter from the State Department of Taxation exempting the university from sales tax. The university is a ‘State Entity’ and does not pay Nevada State Sales Tax. If you are physically in another state and purchase/receive a product, the university is to pay the state sales tax applicable to the sale.

Controller’s Office Forms W-9: Required when adding new vendors to the university vendor database. Federal regulation require the completion of this form for any payment paid to an individual (non-employee/student), corporation, partnership and or sole proprietor. If not completed, the payment will be delayed until the form is complete and on file. Pcard payments do not require a W-9 to be on file. State of Nevada Sales Tax Exemption Letter: Letter from the State Department of Taxation exempting the university from sales tax. The university is a ‘State Entity’ and does not pay Nevada State Sales Tax. If you are physically in another state and purchase/receive a product, the university is to pay the state sales tax applicable to the sale.

The End Thank You!

The End Thank You!