caa4608cd292125a169b6b1f5e8c59db.ppt

- Количество слайдов: 41

University Budgeting. Some tips on how to get by at University Aimee Ellis Student Finance Outreach Officer

2

3

Enter your email details to receive updates 4

Overview of Finances £ Student finances can be sorted into two categories: Money coming in: Money going out: • Tuition Fee Loan • Tuition Fees • Maintenance Loan • Maintenance Grant • Bursaries • Scholarships • Accommodation • Living costs • Course resources * Wages & Parental Support 5

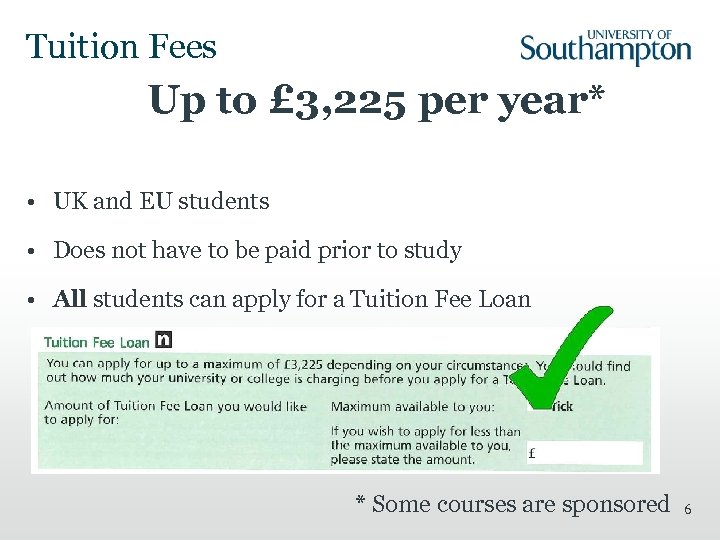

Tuition Fees Up to £ 3, 225 per year* • UK and EU students • Does not have to be paid prior to study • All students can apply for a Tuition Fee Loan * Some courses are sponsored 6

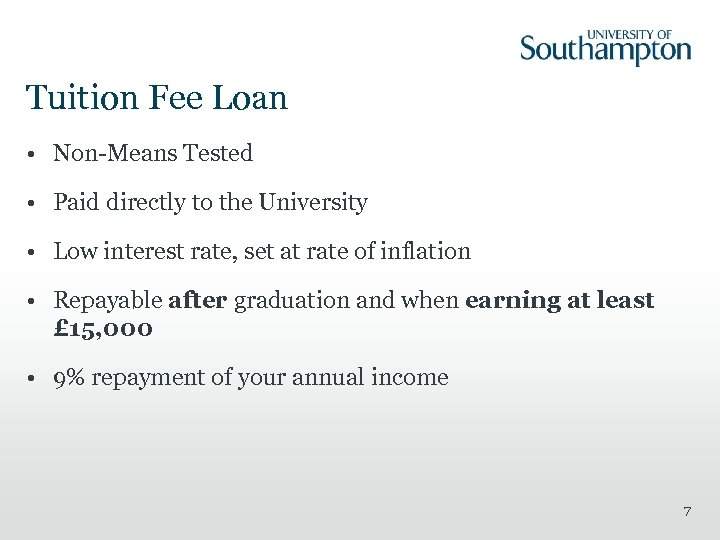

Tuition Fee Loan • Non-Means Tested • Paid directly to the University • Low interest rate, set at rate of inflation • Repayable after graduation and when earning at least £ 15, 000 • 9% repayment of your annual income 7

Overview of Finances £ Student finances can be sorted into two categories: Money coming in: Money going out: • Tuition Fee Loan • Tuition Fees • Maintenance Loan • Maintenance Grant • Bursaries • Scholarships • Accommodation • Living costs • Course resources * Wages & Parental Support 8

Accommodation Your second biggest expense at university is likely to be the rent for your accommodation. Exactly how much this costs depends upon: • Your choice of university • Where it is • What facilities you choose 9

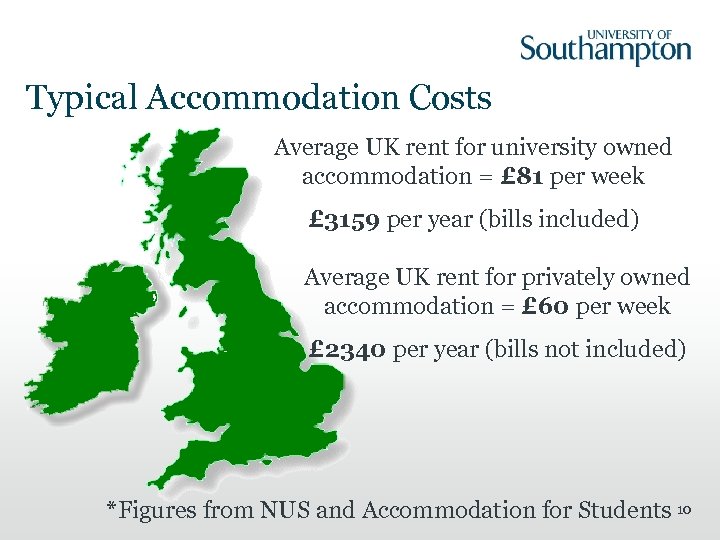

Typical Accommodation Costs Average UK rent for university owned accommodation = £ 81 per week £ 3159 per year (bills included) Average UK rent for privately owned accommodation = £ 60 per week £ 2340 per year (bills not included) *Figures from NUS and Accommodation for Students 10

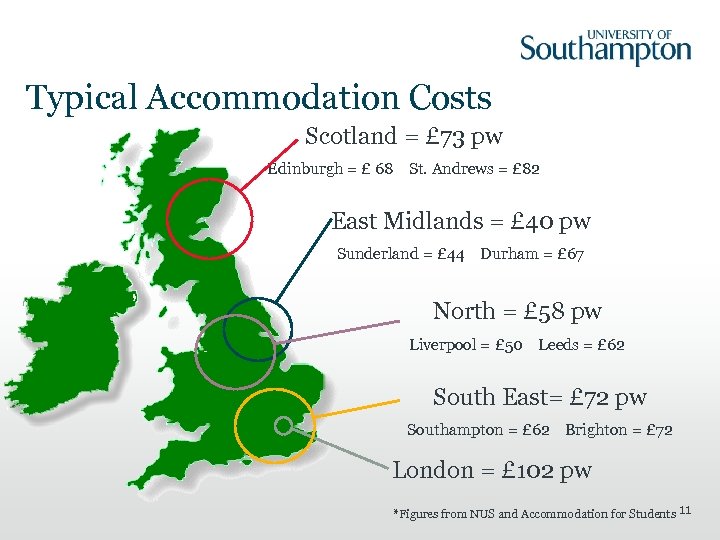

Typical Accommodation Costs Scotland = £ 73 pw Edinburgh = £ 68 St. Andrews = £ 82 East Midlands = £ 40 pw Sunderland = £ 44 Durham = £ 67 North = £ 58 pw Liverpool = £ 50 Leeds = £ 62 South East= £ 72 pw Southampton = £ 62 Brighton = £ 72 London = £ 102 pw *Figures from NUS and Accommodation for Students 11

A basic room in our Wessex Lanes Halls costs £ 65. 45 pw £ 2552. 55 per year 12

An en-suite room in our Glen Eyre Halls costs £ 96. 95 pw £ 3781. 05 per year 13

Most halls are self-catered with shared kitchens Self-catered kitchen in halls You can have catered facilities. These are typically £ 30 -£ 40 a week in addition to your rent 14 The Galley Restaurant Connaught Hall –

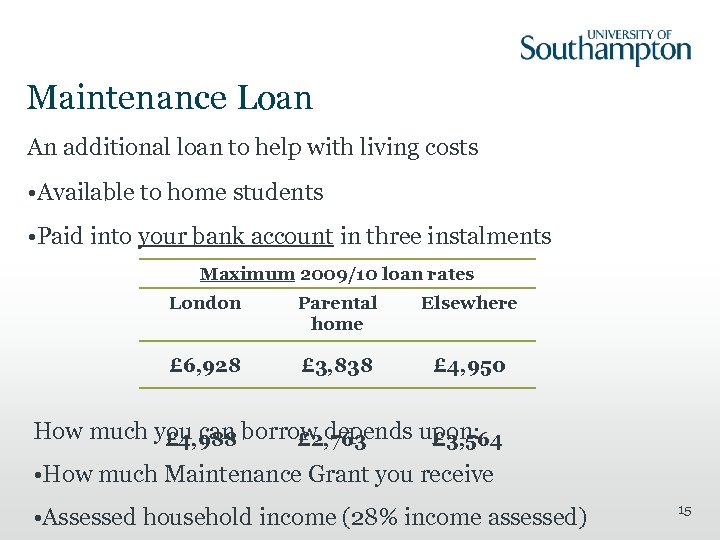

Maintenance Loan An additional loan to help with living costs • Available to home students • Paid into your bank account in three instalments Maximum 2009/10 loan rates London Parental home Elsewhere £ 6, 928 £ 3, 838 £ 4, 950 How much you can borrow depends upon: £ 4, 988 £ 2, 763 £ 3, 564 • How much Maintenance Grant you receive • Assessed household income (28% income assessed) 15

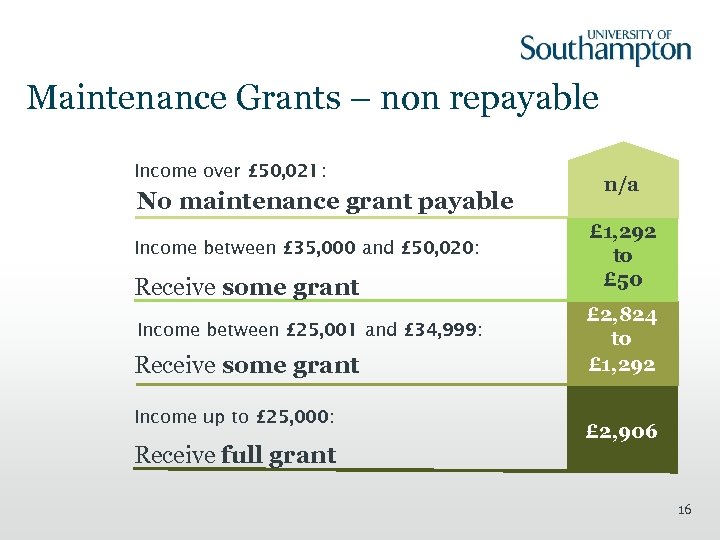

Maintenance Grants – non repayable Income over £ 50, 021: No maintenance grant payable Income between £ 35, 000 and £ 50, 020: Receive some grant Income between £ 25, 001 and £ 34, 999: Receive some grant Income up to £ 25, 000: Receive full grant n/a £ 1, 292 to £ 50 £ 2, 824 to £ 1, 292 £ 2, 906 16

Repayment in real terms • Average Graduate salary = £ 20, 000 • Monthly repayment = £ 37. 50 • 10 -15 years to repay • After 25 years, all debt is wiped clean 17

Alex Chris 18

Other Outgoings - Food £ 25 - £ 30 per week would get you a healthy balanced diet. • Carbohydrates are good as the main part of your diet (Bread, cereal, potatoes, pasta, rice etc) 19

Other Outgoings - Food • Fruit and veg give important minerals and vitamins. Frozen • Carbohydrates are good as the main part of your diet (Bread, veg is cheap and healthy. Try local markets too. cereal, potatoes, pasta, rice etc) 20

Other Outgoings - Food £ 25 - £ 30 per week would get you a healthy balanced diet. • Protein can come from meat, fish, eggs and quorn. As meat tends to be more expensive try cooking big meals that will last • Fruit and Veg give important minerals and vitamins. Frozen you more then one sitting e. g. spaghetti bolognaise veg is cheap and healthy. Try local markets too. 21

Other Outgoings - Food • Protein can come from meat, fish, eggs and quorn. As meat Calcium is good for your bones and teeth and can be gained from milk, cheese, yogurt and fromage frais. tends to be more expensive try cooking big meals that will last you more then one sitting e. g. spaghetti bolognaise • Dairy products are expensive and go off quickly so try to organise a rota, buy in bulk and share with your housemates. 22

Other Outgoings - Food • Calcium is good for your bones and teeth and can be gained Fats and sugars should be eaten sparingly as your calorie intake is likely to have risen. from milk, cheese, yogurt and fromage frais. • Dairy products are expensive and go off quickly so try to Use butter/margarine sparingly and try to avoid frying too frequently. organise a rota, buy in bulk and share with your housemates. • Buy snacks in bulk and try to be disciplined. 23

Other Outgoings - Food • • Dehydration is a common problem for students (largely due Fats and sugars should be eaten sparingly as your calorie intake is likely to have risen. to alcohol consumption). Fizzy drinks, tea and coffee are all diuretic. • Use butter/margarine sparingly and try to avoid frying too frequently. • Try drinking water which will aid concentration, help your liver, your skin and save you money. • Buy snacks in bulk and try to be disciplined. 24

Other Outgoings - Bills In University Halls bills are usually inclusive (check internet and phone connection) In private houses budget £ 5 -£ 10 per week for utilities such as heating, gas, electric 25

Other Outgoings – Contents Insurance A real essential. This can be as little as £ 2 per week to protect all your possessions. Some Halls of Residence fees include basic cover which you should consider topping up. Get your parents/guardian to check their home insurance policy as some policies can insure family members living away from home. 26

What to bring? Just WAIT! Only buy things you will need for your room: duvet, pillows and bedding Ask family if they have spares of the things you need 27

Study Costs The NUS estimates the average annual cost for materials, books, photocopying and printing is approx £ 350 per year. You can make big savings here though. When you get your reading list, don't immediately buy all of the books. Wait until you know which books you need regularly and try to buy them second hand. 28

Auction sites like www. studentbooks. co. uk are good places to get cheap textbooks. Buy second hand texts from the likes of www. amazon. co. uk. 29

Student Unions often sort out book sales within Fresher’s Week so keep an eye out and be prompt. Some student bank accounts give discount cards e. g. Barclays offer a 15% Waterstone’s discount card. Don’t forget the university library. Photocopying also helps save money. It is legal to copy one full chapter or 5% of a book. 30

Petrol Tax Insurance MOT Service Parking Could you bike it? How will you travel? Young Person Railcards cost £ 24 per year and saves 1/3 travel costs. 31

Cost varies from student to student. Some advise getting a pay-as-you-go contract so you know exactly how much you’ve spent. 32

Remember if you’re going to take a television you’ll need to pay for a licence. A colour license is £ 139. 50 for a year. £ 1, 000 You can claim back the cost for the summer months you won’t be using the license for. Visit www. tvlicensing. co. uk 33

Other Outgoings - Washing You’ll need to remember to set aside some money to buy washing powder and use machines in the laundrette. A couple of pounds a week would easily be enough. 34

Other Outgoings – Leisure You’ll probably have a lot of nights out. Check with your student union about discount nights. Discounts are also available to students. These range from national NUS discounts (10% at HMV, Top Shop/Man, Mc. Donalds etc. ) to local deals at shops, bars and cafes. Make sure to check with the Students Union once you are at your institution. 35

• How to pay… • Genuine Windows Vista (R) Home Premium • 2 GB Memory • 160 GB Hard Drive • 15. 4" Brightview Widescreen • DVD Rewriter Dual Layer • Wifi Enabled How much does it cost? • Intel Core 2 Duo Processor T 5250 (1. 50 GHz, 667 MHz FSB, 2 MB Cache) £ 500 36

How much would it cost if you were to buy it on your Overdraft? = £ 500 Most student bank accounts now come with an interest free overdraft for the duration of study, so as long as you don’t go over your overdraft limit you will not pay any extra for you new toy! 37

How much does it cost if you were to buy it on your Credit Card? = £ 750 The typical rate of interest for a credit card is around 17%. For this cost, the minimum repayment would be £ 12. 50 per month meaning it would take 5 years to repay and would accrue £ 250 in interest alone. 38

How much does it cost if you were to buy it on your Store Card? = £ 1080 The typical rate of interest for a store card is around 25%. For this cost, the minimum repayment would be £ 12. 50 per month meaning it would take 7 years to repay and would accrue £ 580 in interest alone. 39

Good Luck! Any questions? Aimee Ellis – a. r. ellis@southampton. ac. uk Student Finance Outreach Officer

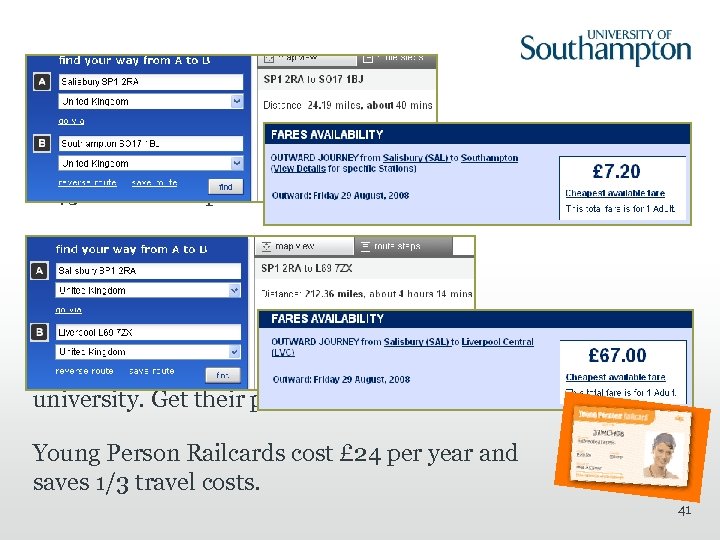

Other Outgoings - Travel NUS estimates the average travel cost per year for students is £ 452. This is dependent upon a number of factors: • Where your university is • How you will be able to get there Use sites like www. multimap. com and www. nationalrail. co. uk to sum up travel costs to and from university. Get their postcodes from their websites or UCAS. Young Person Railcards cost £ 24 per year and saves 1/3 travel costs. 41

caa4608cd292125a169b6b1f5e8c59db.ppt