a569009f3fac53301fc10691d96fec19.ppt

- Количество слайдов: 21

Universidad de Chile Facultad de Derecho Comercial Profesor Sr. José Luis López Blanco CURRENCY MARKETS A presentation by Paula Pera C.

Universidad de Chile Facultad de Derecho Comercial Profesor Sr. José Luis López Blanco CURRENCY MARKETS A presentation by Paula Pera C.

CURRENCY MARKETS A currency market is the one in which international currencies as the US dollar, euros, yen, etc. , are traded Different people participate in these markets, individuals and corporations such as: the Central Bank, banks, currency exchange houses, importers, exporters, investors, and others. These markets don’t operate in a physical place most of the time. They often work using communication, monitors and screens, such as the Internet, phone and other technological communication mechanisms. These communication systems allow transactions as well as money wirings to take place instantly between the participants.

CURRENCY MARKETS A currency market is the one in which international currencies as the US dollar, euros, yen, etc. , are traded Different people participate in these markets, individuals and corporations such as: the Central Bank, banks, currency exchange houses, importers, exporters, investors, and others. These markets don’t operate in a physical place most of the time. They often work using communication, monitors and screens, such as the Internet, phone and other technological communication mechanisms. These communication systems allow transactions as well as money wirings to take place instantly between the participants.

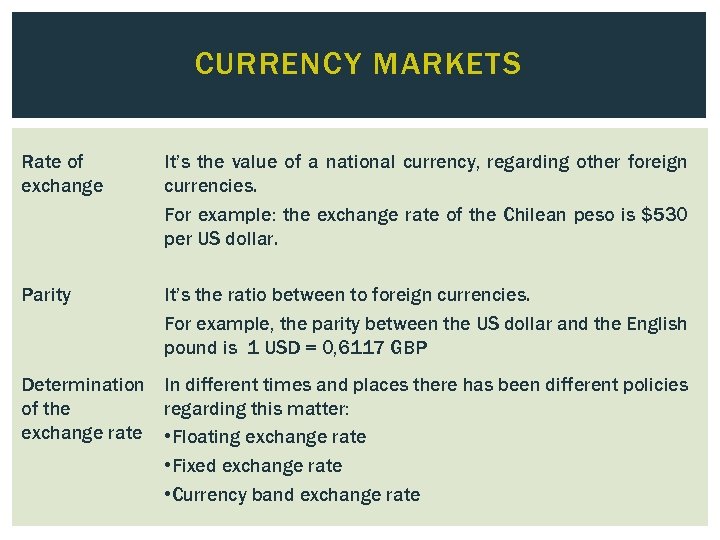

CURRENCY MARKETS Rate of exchange It’s the value of a national currency, regarding other foreign currencies. For example: the exchange rate of the Chilean peso is $530 per US dollar. Parity It’s the ratio between to foreign currencies. For example, the parity between the US dollar and the English pound is 1 USD = 0, 6117 GBP Determination In different times and places there has been different policies of the regarding this matter: exchange rate • Floating exchange rate • Fixed exchange rate • Currency band exchange rate

CURRENCY MARKETS Rate of exchange It’s the value of a national currency, regarding other foreign currencies. For example: the exchange rate of the Chilean peso is $530 per US dollar. Parity It’s the ratio between to foreign currencies. For example, the parity between the US dollar and the English pound is 1 USD = 0, 6117 GBP Determination In different times and places there has been different policies of the regarding this matter: exchange rate • Floating exchange rate • Fixed exchange rate • Currency band exchange rate

CURRENCY MARKETS CURRENCY PROVIDERS Chilean and foreign banks to liquidate positions. Insurance companies to liquidate positions. Exporters, when they return the value of exported goods. Foreign investors, when they bring their investment into the country. National investors when they bring their investment into the country Debtors of foreign loans to enter their loans into the country. Foreigners and tourists when they visit the country and make expenditures.

CURRENCY MARKETS CURRENCY PROVIDERS Chilean and foreign banks to liquidate positions. Insurance companies to liquidate positions. Exporters, when they return the value of exported goods. Foreign investors, when they bring their investment into the country. National investors when they bring their investment into the country Debtors of foreign loans to enter their loans into the country. Foreigners and tourists when they visit the country and make expenditures.

CURRENCY MARKETS CURRENCY DEMANDERS Chilean and foreign banks, to buy positions. Insurance companies, to buy positions. Importers, to pay the price of the goods they import. Foreign investors, to remit their capital and profits abroad. National investors, to remit their capital and profits abroad. Debtors of foreign loans to pay their loans abroad. Chilean tourists abroad.

CURRENCY MARKETS CURRENCY DEMANDERS Chilean and foreign banks, to buy positions. Insurance companies, to buy positions. Importers, to pay the price of the goods they import. Foreign investors, to remit their capital and profits abroad. National investors, to remit their capital and profits abroad. Debtors of foreign loans to pay their loans abroad. Chilean tourists abroad.

CURRENCY MARKETS FLOATING EXCHANGE RATE The national currency value is determined freely in every market, following the rules of supply and demand of currency, mainly (in the Chilean case), US dollars. If there’s a high supply of US dollars, the exchange rate will tend to go lower. For example, if the exchange rate today is $530, it could drop to $500, then $480 and so on. If there’s a high demand low supply of US dollars, the exchange rate tends to increase. For example, if the exchange rate today is $530, it could go up to $560, then $590, and so on. In this system, the government does not intervene in any way.

CURRENCY MARKETS FLOATING EXCHANGE RATE The national currency value is determined freely in every market, following the rules of supply and demand of currency, mainly (in the Chilean case), US dollars. If there’s a high supply of US dollars, the exchange rate will tend to go lower. For example, if the exchange rate today is $530, it could drop to $500, then $480 and so on. If there’s a high demand low supply of US dollars, the exchange rate tends to increase. For example, if the exchange rate today is $530, it could go up to $560, then $590, and so on. In this system, the government does not intervene in any way.

CURRENCY MARKETS FIXED EXCHANGE RATE The exchange rate is determined by the government, through some institution that has authority on the economic matter. In our case, this institution has been the Central Bank since 1925. There has been times in Chile’s modern history that the exchange rate has had to be fixed. For example, after the 1930’s world economic crisis, our Central Bank has had to act, fixing the exchange rate. . Another example we can find is the action that the Central Bank took on June, 1979, fixing the rate at $39 per US dollar. . After that, the government allowed small variations in the market value of the dollar, always keeping as a base indicator the price of $39. The currency transactions were subject to control and overview of the Central Bank, and people who participated in this market couldn't sell, nor buy dollars at a higher rate that the official one.

CURRENCY MARKETS FIXED EXCHANGE RATE The exchange rate is determined by the government, through some institution that has authority on the economic matter. In our case, this institution has been the Central Bank since 1925. There has been times in Chile’s modern history that the exchange rate has had to be fixed. For example, after the 1930’s world economic crisis, our Central Bank has had to act, fixing the exchange rate. . Another example we can find is the action that the Central Bank took on June, 1979, fixing the rate at $39 per US dollar. . After that, the government allowed small variations in the market value of the dollar, always keeping as a base indicator the price of $39. The currency transactions were subject to control and overview of the Central Bank, and people who participated in this market couldn't sell, nor buy dollars at a higher rate that the official one.

CURRENCY MARKETS CURRENCY BAND EXCHANGE RATES This system is based on the recognition of some freedom to trade currencies, but the monetary authority intervenes buying or selling currency if the exchange rates fluctuates above or below the maximum and minimum levels that the same authority has set. A theoretical example would be this: we assume that the Central Bank has set a max of $600 and a min of $490. In this case, if the currency transactions in the market, because of an excessive increase in the demand take the price over $600, the Central Bank would sell dollar on the market to lower the price. On the contrary, if the price of the dollar, because of an excessive increase of supply, drops down lower than $490, then the Central Bank would buy dollars to make the price go up.

CURRENCY MARKETS CURRENCY BAND EXCHANGE RATES This system is based on the recognition of some freedom to trade currencies, but the monetary authority intervenes buying or selling currency if the exchange rates fluctuates above or below the maximum and minimum levels that the same authority has set. A theoretical example would be this: we assume that the Central Bank has set a max of $600 and a min of $490. In this case, if the currency transactions in the market, because of an excessive increase in the demand take the price over $600, the Central Bank would sell dollar on the market to lower the price. On the contrary, if the price of the dollar, because of an excessive increase of supply, drops down lower than $490, then the Central Bank would buy dollars to make the price go up.

CURRENCY MARKETS WHERE CAN THE EXCHANGE RATE STAND? The variations on the rate of exchange allow us to distinguish 3 situations in which we can find said rate: Equilibrium in the exchange rate Revaluation Devaluation

CURRENCY MARKETS WHERE CAN THE EXCHANGE RATE STAND? The variations on the rate of exchange allow us to distinguish 3 situations in which we can find said rate: Equilibrium in the exchange rate Revaluation Devaluation

CURRENCY MARKETS EQUILIBRIUM IN THE EXCHANGE RATE It allows to maintain a general situation of equilibrium in the economy and international business that one country conducts. The exchange rate is one of many factors (such as interest rates), that allows a balanced and harmonic development of the economy. If the economy is set on an equilibrium situation, one can observe the following effects: Inflation rate is low. Economy tends to grow. Unemployment levels are low. Exports and imports grow. At some points, there’s a trade surplus, which means that there’s a positive balance of trade, where a country's exports exceed its imports.

CURRENCY MARKETS EQUILIBRIUM IN THE EXCHANGE RATE It allows to maintain a general situation of equilibrium in the economy and international business that one country conducts. The exchange rate is one of many factors (such as interest rates), that allows a balanced and harmonic development of the economy. If the economy is set on an equilibrium situation, one can observe the following effects: Inflation rate is low. Economy tends to grow. Unemployment levels are low. Exports and imports grow. At some points, there’s a trade surplus, which means that there’s a positive balance of trade, where a country's exports exceed its imports.

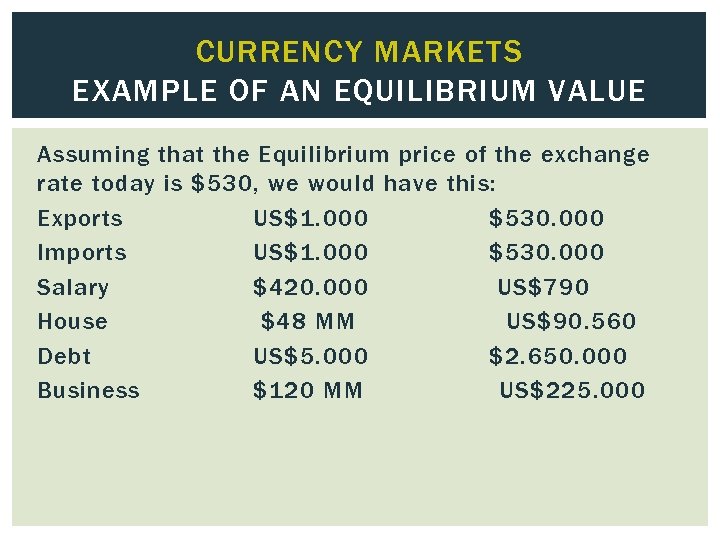

CURRENCY MARKETS EXAMPLE OF AN EQUILIBRIUM VALUE Assuming that the Equilibrium price of the exchange rate today is $530, we would have this: Exports US$1. 000 $530. 000 Imports US$1. 000 $530. 000 Salary $420. 000 US$790 House $48 MM US$90. 560 Debt US$5. 000 $2. 650. 000 Business $120 MM US$225. 000

CURRENCY MARKETS EXAMPLE OF AN EQUILIBRIUM VALUE Assuming that the Equilibrium price of the exchange rate today is $530, we would have this: Exports US$1. 000 $530. 000 Imports US$1. 000 $530. 000 Salary $420. 000 US$790 House $48 MM US$90. 560 Debt US$5. 000 $2. 650. 000 Business $120 MM US$225. 000

CURRENCY MARKETS REVALUATION The exchange rate drops down from its equilibrium price. In this case, if that price was $530, we can assume a revaluation down to $400. Causes of this devaluation could range from a huge economic growth on national economy, to a high supply of dollars in other economies.

CURRENCY MARKETS REVALUATION The exchange rate drops down from its equilibrium price. In this case, if that price was $530, we can assume a revaluation down to $400. Causes of this devaluation could range from a huge economic growth on national economy, to a high supply of dollars in other economies.

CURRENCY MARKETS EXAMPLES AT A REVALUATED PRICE With the new exchange rate revaluated at $400, we would have: Exports US$1. 000 $400. 000 Imports US$1. 000 $400. 000 Salary $420. 000 US$1. 050 House $48 MM US$120. 000 Debt US$5. 000 $2. 000 Business $120 MM US$300. 000

CURRENCY MARKETS EXAMPLES AT A REVALUATED PRICE With the new exchange rate revaluated at $400, we would have: Exports US$1. 000 $400. 000 Imports US$1. 000 $400. 000 Salary $420. 000 US$1. 050 House $48 MM US$120. 000 Debt US$5. 000 $2. 000 Business $120 MM US$300. 000

CURRENCY MARKETS EFFECTS OF REVALUATION It affects exports, since exporters receive less Chilean pesos per dollar they sell abroad. It favors imports, since importers spend less pesos per dollar of purchase. Value of Chilean assets increases (like the house and business), because one needs more dollars to equal the value in pesos of it. People who have salaries get an increase on their currency purchasing power. The value of debts in foreign currencies diminishes, since you need less pesos to pay for it.

CURRENCY MARKETS EFFECTS OF REVALUATION It affects exports, since exporters receive less Chilean pesos per dollar they sell abroad. It favors imports, since importers spend less pesos per dollar of purchase. Value of Chilean assets increases (like the house and business), because one needs more dollars to equal the value in pesos of it. People who have salaries get an increase on their currency purchasing power. The value of debts in foreign currencies diminishes, since you need less pesos to pay for it.

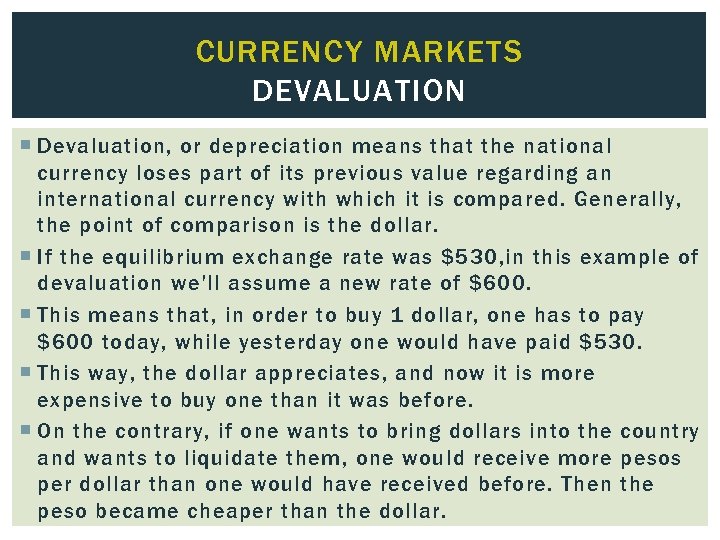

CURRENCY MARKETS DEVALUATION Devaluation, or depreciation means that the national currency loses part of its previous value regarding an international currency with which it is compared. Generally, the point of comparison is the dollar. If the equilibrium exchange rate was $530, in this example of devaluation we’ll assume a new rate of $600. This means that, in order to buy 1 dollar, one has to pay $600 today, while yesterday one would have paid $530. This way, the dollar appreciates, and now it is more expensive to buy one than it was before. On the contrary, if one wants to bring dollars into the country and wants to liquidate them, one would receive more pesos per dollar than one would have received before. Then the peso became cheaper than the dollar.

CURRENCY MARKETS DEVALUATION Devaluation, or depreciation means that the national currency loses part of its previous value regarding an international currency with which it is compared. Generally, the point of comparison is the dollar. If the equilibrium exchange rate was $530, in this example of devaluation we’ll assume a new rate of $600. This means that, in order to buy 1 dollar, one has to pay $600 today, while yesterday one would have paid $530. This way, the dollar appreciates, and now it is more expensive to buy one than it was before. On the contrary, if one wants to bring dollars into the country and wants to liquidate them, one would receive more pesos per dollar than one would have received before. Then the peso became cheaper than the dollar.

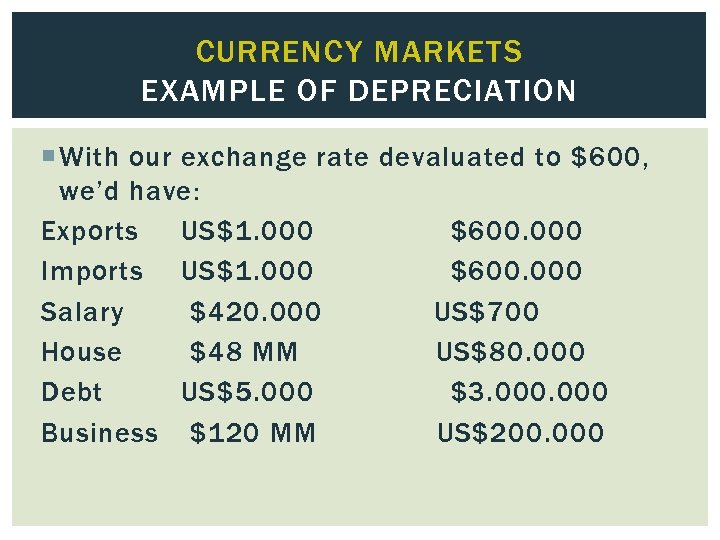

CURRENCY MARKETS EXAMPLE OF DEPRECIATION With our exchange rate devaluated to $600, we’d have: Exports US$1. 000 $600. 000 Imports US$1. 000 $600. 000 Salary $420. 000 US$700 House $48 MM US$80. 000 Debt US$5. 000 $3. 000 Business $120 MM US$200. 000

CURRENCY MARKETS EXAMPLE OF DEPRECIATION With our exchange rate devaluated to $600, we’d have: Exports US$1. 000 $600. 000 Imports US$1. 000 $600. 000 Salary $420. 000 US$700 House $48 MM US$80. 000 Debt US$5. 000 $3. 000 Business $120 MM US$200. 000

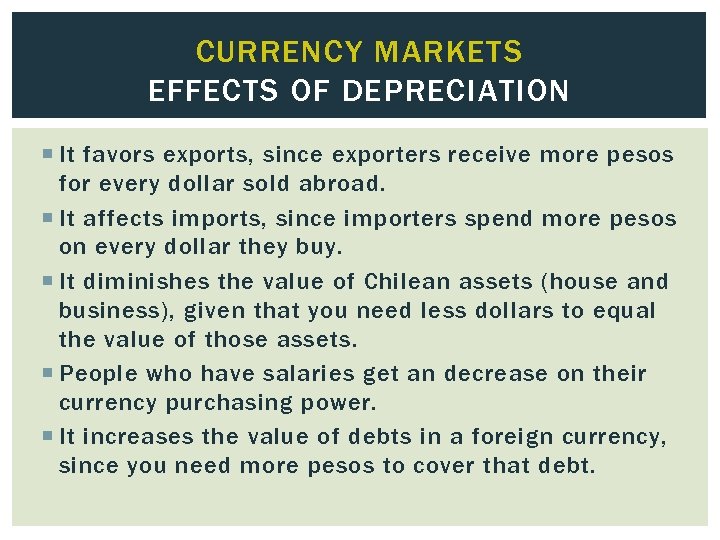

CURRENCY MARKETS EFFECTS OF DEPRECIATION It favors exports, since exporters receive more pesos for every dollar sold abroad. It affects imports, since importers spend more pesos on every dollar they buy. It diminishes the value of Chilean assets (house and business), given that you need less dollars to equal the value of those assets. People who have salaries get an decrease on their currency purchasing power. It increases the value of debts in a foreign currency, since you need more pesos to cover that debt.

CURRENCY MARKETS EFFECTS OF DEPRECIATION It favors exports, since exporters receive more pesos for every dollar sold abroad. It affects imports, since importers spend more pesos on every dollar they buy. It diminishes the value of Chilean assets (house and business), given that you need less dollars to equal the value of those assets. People who have salaries get an decrease on their currency purchasing power. It increases the value of debts in a foreign currency, since you need more pesos to cover that debt.

CURRENCY MARKETS PRICES GIVEN THE SITUATION OF THE EXCHANGE MARKET Equilibrium Revaluation Devaluation $530 $400 $600 Exports US$1. 000 $530. 000 $400. 000 $600. 000 Imports US$1. 000 $530. 000 $400. 000 $600. 000 Salary $420. 000 US$790 US$1. 050 US$700 House $48 MM US$90. 560 US$120. 000 US$80. 000 Debt US$5. ooo $2. 650. 000 $2. 000 $3. 000 Business $120 MM US$225. 000 US$300. 000 US$200. 000

CURRENCY MARKETS PRICES GIVEN THE SITUATION OF THE EXCHANGE MARKET Equilibrium Revaluation Devaluation $530 $400 $600 Exports US$1. 000 $530. 000 $400. 000 $600. 000 Imports US$1. 000 $530. 000 $400. 000 $600. 000 Salary $420. 000 US$790 US$1. 050 US$700 House $48 MM US$90. 560 US$120. 000 US$80. 000 Debt US$5. ooo $2. 650. 000 $2. 000 $3. 000 Business $120 MM US$225. 000 US$300. 000 US$200. 000