743b109f9b39bdebc71310bdab49b3d9.ppt

- Количество слайдов: 44

UNIVERSAL LIFE INTRODUCTION 1

UNIVERSAL LIFE INTRODUCTION 1

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 2

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 2

INVESTMENT PRODUCT Investment product is a combination of Investment product Insurance Part: Provide insurance protection Investment part: provide investment tool to get profit 3

INVESTMENT PRODUCT Investment product is a combination of Investment product Insurance Part: Provide insurance protection Investment part: provide investment tool to get profit 3

INVESTMENT PRODUCT Investment product includes: Unit Link Universal life üInterest is declared and base on monthly investment result. üGuaranteed rate üInterest is from difference on bid price and ask price üMany fund options for customer Profit is safer because UL fund invest on safe assets Investment products has same features: üExpense clear üFlexible payment üPO get investment result Higher profit when customer select higher risk funds 4

INVESTMENT PRODUCT Investment product includes: Unit Link Universal life üInterest is declared and base on monthly investment result. üGuaranteed rate üInterest is from difference on bid price and ask price üMany fund options for customer Profit is safer because UL fund invest on safe assets Investment products has same features: üExpense clear üFlexible payment üPO get investment result Higher profit when customer select higher risk funds 4

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 5

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 5

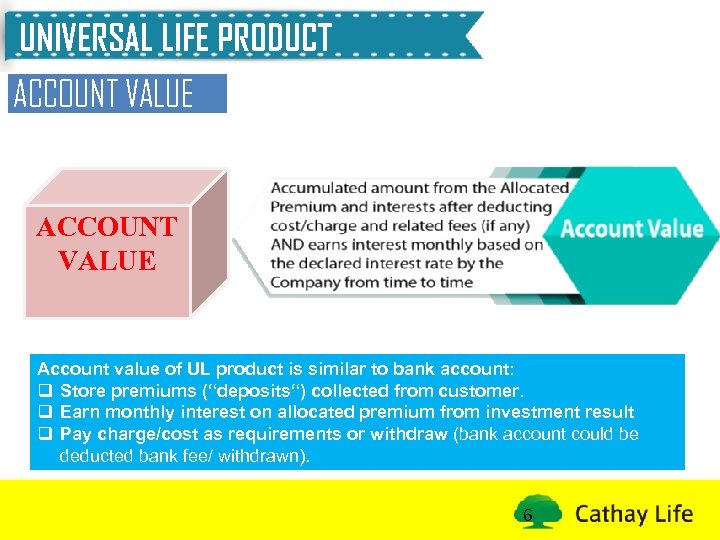

UNIVERSAL LIFE PRODUCT ACCOUNT VALUE Account value of UL product is similar to bank account: q Store premiums (“deposits“) collected from customer. q Earn monthly interest on allocated premium from investment result q Pay charge/cost as requirements or withdraw (bank account could be deducted bank fee/ withdrawn). 6

UNIVERSAL LIFE PRODUCT ACCOUNT VALUE Account value of UL product is similar to bank account: q Store premiums (“deposits“) collected from customer. q Earn monthly interest on allocated premium from investment result q Pay charge/cost as requirements or withdraw (bank account could be deducted bank fee/ withdrawn). 6

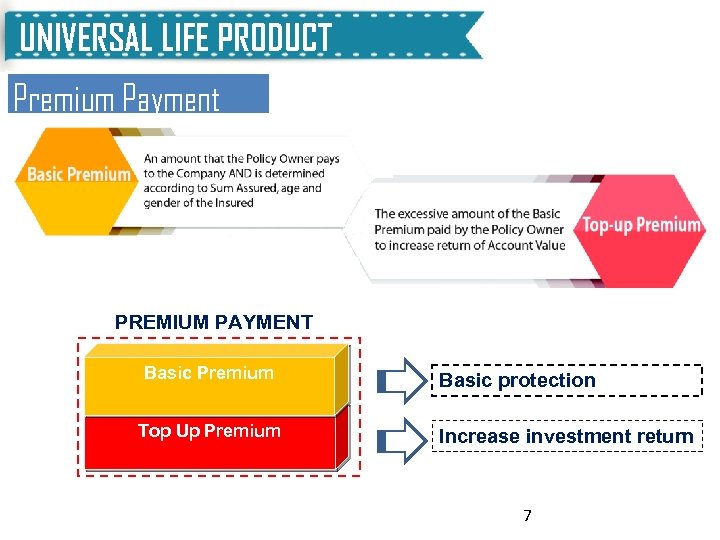

UNIVERSAL LIFE PRODUCT Premium Payment PREMIUM PAYMENT Basic Premium Top Up Premium Basic protection Increase investment return 7

UNIVERSAL LIFE PRODUCT Premium Payment PREMIUM PAYMENT Basic Premium Top Up Premium Basic protection Increase investment return 7

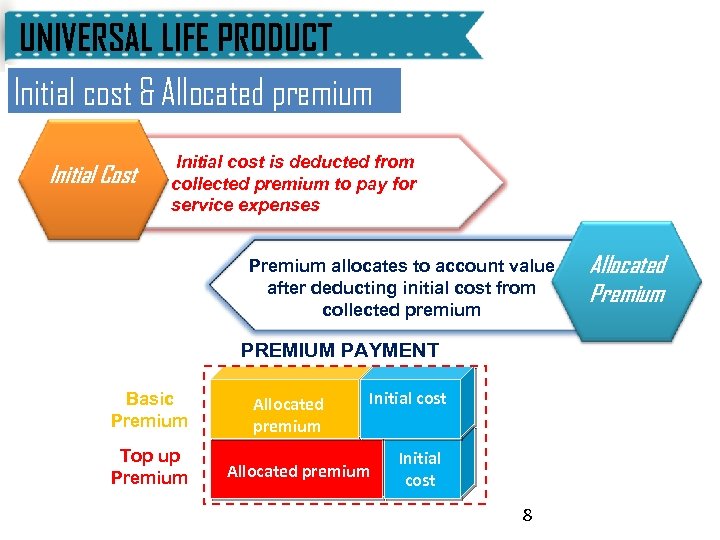

UNIVERSAL LIFE PRODUCT Initial cost & Allocated premium Initial Cost Initial cost is deducted from collected premium to pay for service expenses Premium allocates to account value after deducting initial cost from collected premium PREMIUM PAYMENT Basic Premium Top up Premium Allocated premium Initial cost 8 Allocated Premium

UNIVERSAL LIFE PRODUCT Initial cost & Allocated premium Initial Cost Initial cost is deducted from collected premium to pay for service expenses Premium allocates to account value after deducting initial cost from collected premium PREMIUM PAYMENT Basic Premium Top up Premium Allocated premium Initial cost 8 Allocated Premium

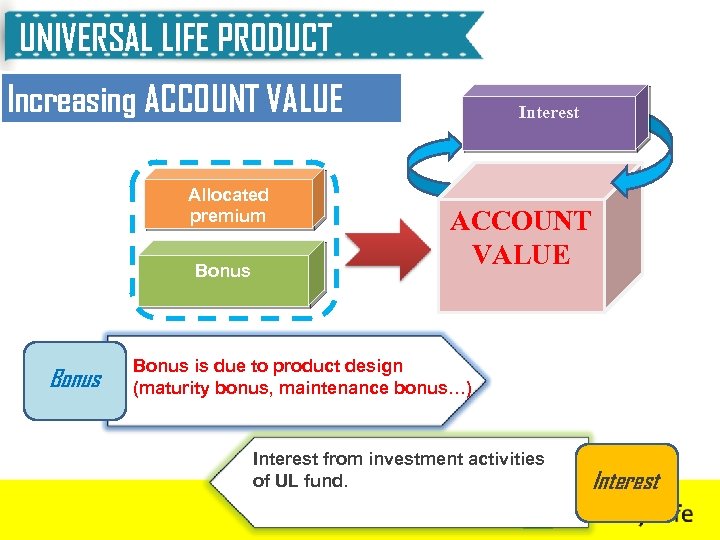

UNIVERSAL LIFE PRODUCT Increasing ACCOUNT VALUE Allocated premium Bonus Interest ACCOUNT VALUE Bonus is due to product design (maturity bonus, maintenance bonus…) Interest from investment activities of UL fund. 9 Interest Initial Cost

UNIVERSAL LIFE PRODUCT Increasing ACCOUNT VALUE Allocated premium Bonus Interest ACCOUNT VALUE Bonus is due to product design (maturity bonus, maintenance bonus…) Interest from investment activities of UL fund. 9 Interest Initial Cost

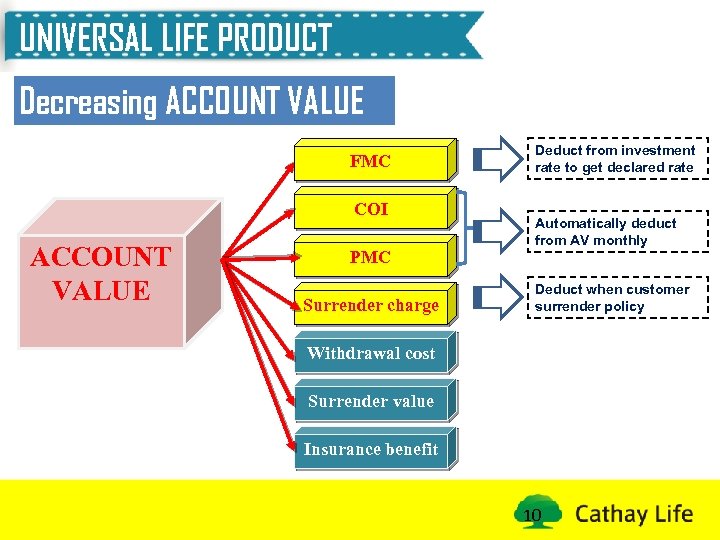

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE FMC COI ACCOUNT VALUE PMC Surrender charge Deduct from investment rate to get declared rate Automatically deduct from AV monthly Deduct when customer surrender policy Withdrawal cost Surrender value Insurance benefit 10

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE FMC COI ACCOUNT VALUE PMC Surrender charge Deduct from investment rate to get declared rate Automatically deduct from AV monthly Deduct when customer surrender policy Withdrawal cost Surrender value Insurance benefit 10

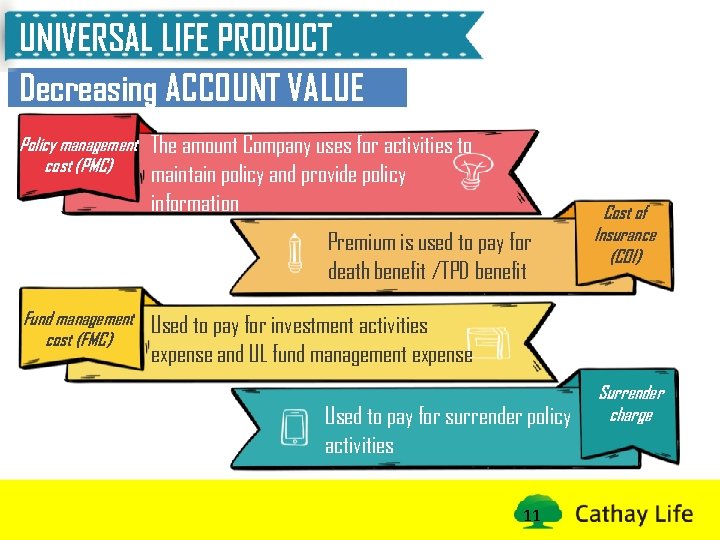

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE Policy management cost (PMC) The amount Company uses for activities to maintain policy and provide policy information Premium is used to pay for death benefit /TPD benefit Fund management cost (FMC) Cost of Insurance (COI) Used to pay for investment activities expense and UL fund management expense Used to pay for surrender policy activities 11 Surrender charge

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE Policy management cost (PMC) The amount Company uses for activities to maintain policy and provide policy information Premium is used to pay for death benefit /TPD benefit Fund management cost (FMC) Cost of Insurance (COI) Used to pay for investment activities expense and UL fund management expense Used to pay for surrender policy activities 11 Surrender charge

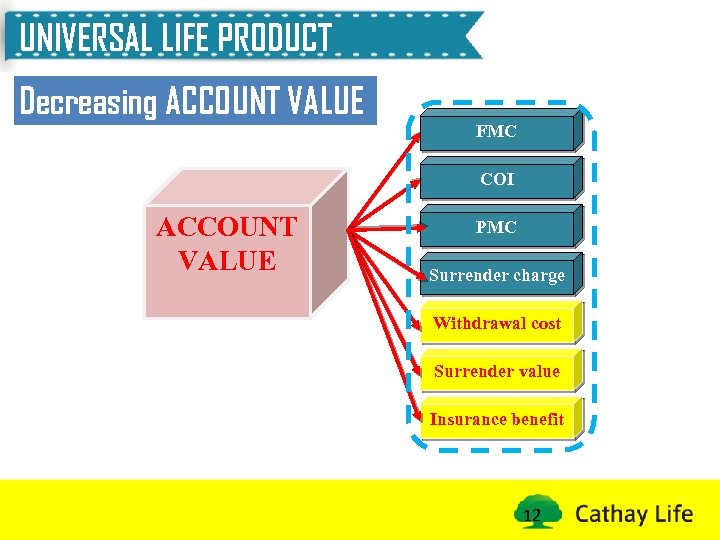

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE FMC COI ACCOUNT VALUE PMC Surrender charge Withdrawal cost Surrender value Insurance benefit 12

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE FMC COI ACCOUNT VALUE PMC Surrender charge Withdrawal cost Surrender value Insurance benefit 12

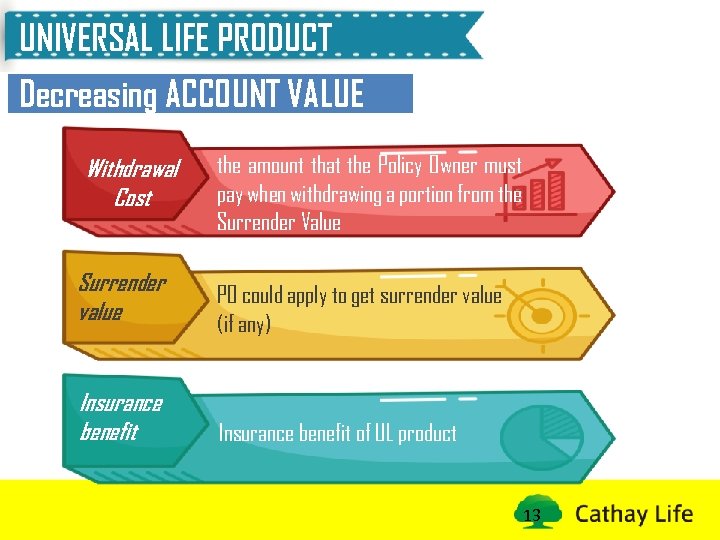

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE Withdrawal Cost the amount that the Policy Owner must pay when withdrawing a portion from the Surrender Value Surrender value PO could apply to get surrender value (if any) Insurance benefit of UL product 13

UNIVERSAL LIFE PRODUCT Decreasing ACCOUNT VALUE Withdrawal Cost the amount that the Policy Owner must pay when withdrawing a portion from the Surrender Value Surrender value PO could apply to get surrender value (if any) Insurance benefit of UL product 13

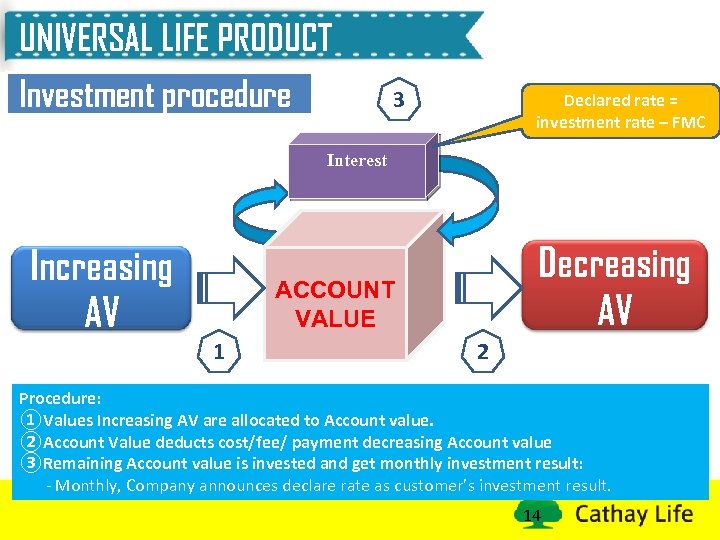

UNIVERSAL LIFE PRODUCT Investment procedure 3 Declared rate = investment rate – FMC Interest Increasing AV Decreasing AV ACCOUNT VALUE 1 2 Procedure: ①Values Increasing AV are allocated to Account value. ②Account Value deducts cost/fee/ payment decreasing Account value ③Remaining Account value is invested and get monthly investment result: - Monthly, Company announces declare rate as customer’s investment result. 14

UNIVERSAL LIFE PRODUCT Investment procedure 3 Declared rate = investment rate – FMC Interest Increasing AV Decreasing AV ACCOUNT VALUE 1 2 Procedure: ①Values Increasing AV are allocated to Account value. ②Account Value deducts cost/fee/ payment decreasing Account value ③Remaining Account value is invested and get monthly investment result: - Monthly, Company announces declare rate as customer’s investment result. 14

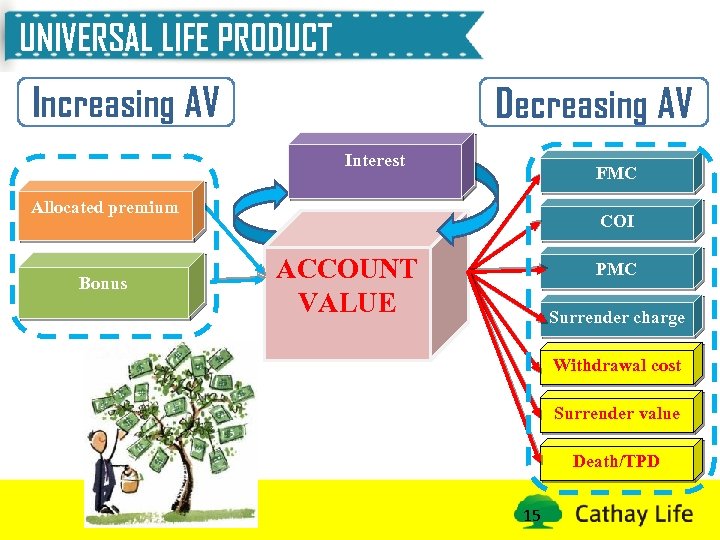

UNIVERSAL LIFE PRODUCT Increasing AV Decreasing AV Interest FMC Allocated premium Bonus COI ACCOUNT VALUE PMC Surrender charge Withdrawal cost Surrender value Death/TPD 15

UNIVERSAL LIFE PRODUCT Increasing AV Decreasing AV Interest FMC Allocated premium Bonus COI ACCOUNT VALUE PMC Surrender charge Withdrawal cost Surrender value Death/TPD 15

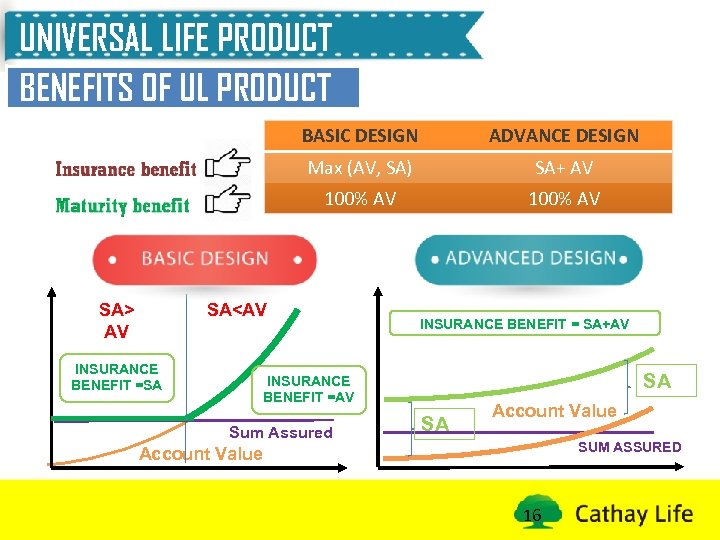

UNIVERSAL LIFE PRODUCT BENEFITS OF UL PRODUCT BASIC DESIGN Max (AV, SA) SA+ AV 100% AV SA> AV ADVANCE DESIGN 100% AV SA

UNIVERSAL LIFE PRODUCT BENEFITS OF UL PRODUCT BASIC DESIGN Max (AV, SA) SA+ AV 100% AV SA> AV ADVANCE DESIGN 100% AV SA

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 17

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 17

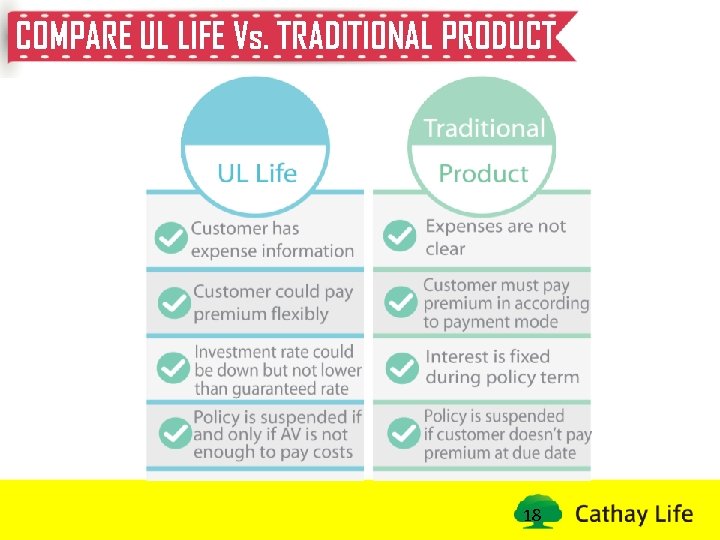

COMPARE UL LIFE Vs. TRADITIONAL PRODUCT 18

COMPARE UL LIFE Vs. TRADITIONAL PRODUCT 18

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 19

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 19

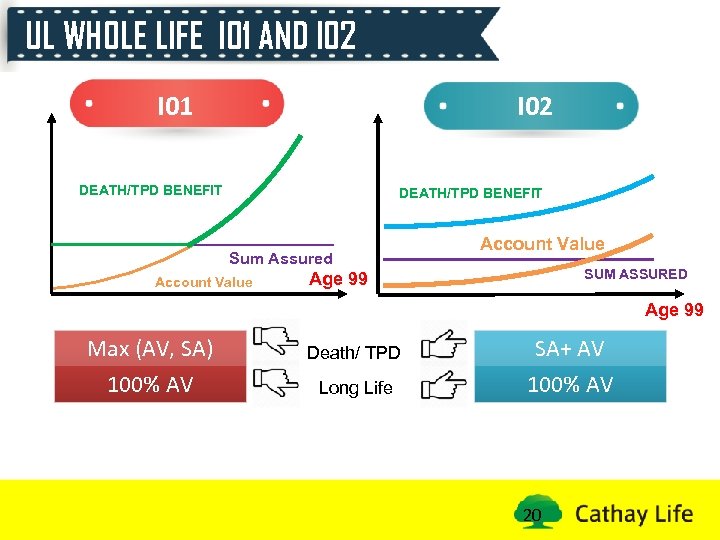

UL WHOLE LIFE I 01 AND I 02 I 01 I 02 DEATH/TPD BENEFIT Sum Assured Account Value SUM ASSURED Age 99 Max (AV, SA) 100% AV Death/ TPD Long Life SA+ AV 100% AV 20

UL WHOLE LIFE I 01 AND I 02 I 01 I 02 DEATH/TPD BENEFIT Sum Assured Account Value SUM ASSURED Age 99 Max (AV, SA) 100% AV Death/ TPD Long Life SA+ AV 100% AV 20

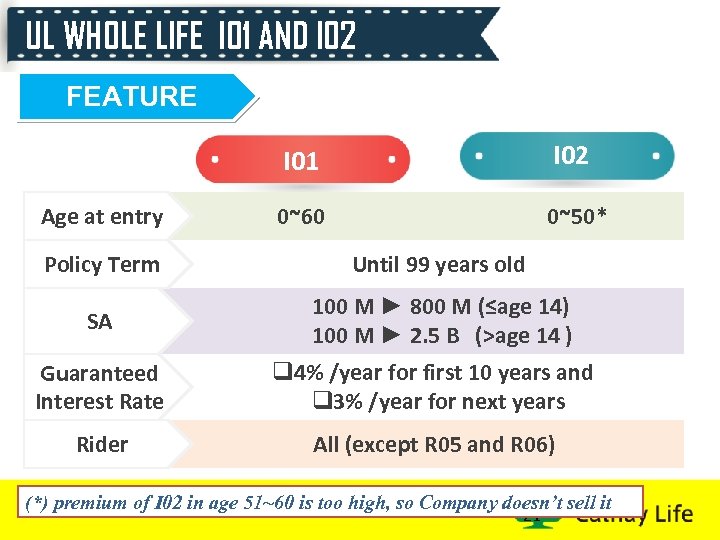

UL WHOLE LIFE I 01 AND I 02 FEATURE I 01 Age at entry I 02 0~60 0~50* Policy Term Until 99 years old SA 100 M ► 800 M (≤age 14) 100 M ► 2. 5 B (>age 14 ) Guaranteed Interest Rate q 4% /year for first 10 years and q 3% /year for next years Rider All (except R 05 and R 06) (*) premium of I 02 in age 51~60 is too high, so Company doesn’t sell it 21

UL WHOLE LIFE I 01 AND I 02 FEATURE I 01 Age at entry I 02 0~60 0~50* Policy Term Until 99 years old SA 100 M ► 800 M (≤age 14) 100 M ► 2. 5 B (>age 14 ) Guaranteed Interest Rate q 4% /year for first 10 years and q 3% /year for next years Rider All (except R 05 and R 06) (*) premium of I 02 in age 51~60 is too high, so Company doesn’t sell it 21

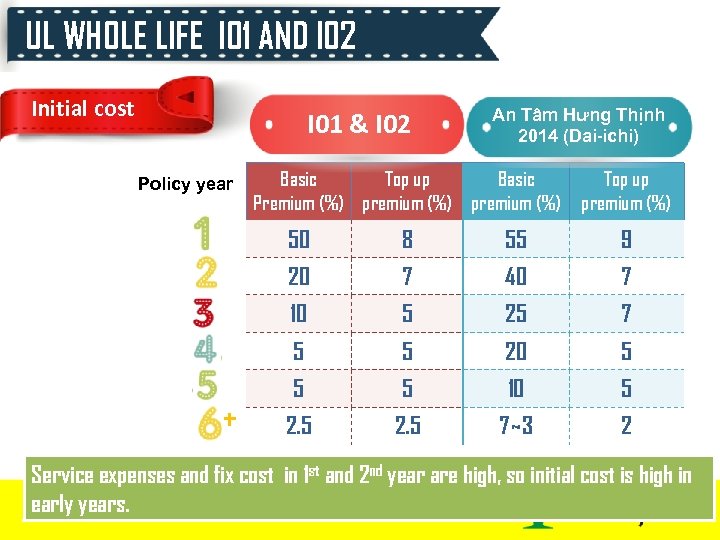

UL WHOLE LIFE I 01 AND I 02 Initial cost I 01 & I 02 Policy year An Tâm Hưng Thịnh 2014 (Dai-ichi) Basic Top up Basic Premium (%) premium (%) Top up premium (%) 50 55 9 20 7 40 7 10 5 25 7 5 + 8 5 20 5 5 5 10 5 2. 5 7~3 2 Service expenses and fix cost in 1 st and 2 nd year are high, so initial cost is high in early years. 22

UL WHOLE LIFE I 01 AND I 02 Initial cost I 01 & I 02 Policy year An Tâm Hưng Thịnh 2014 (Dai-ichi) Basic Top up Basic Premium (%) premium (%) Top up premium (%) 50 55 9 20 7 40 7 10 5 25 7 5 + 8 5 20 5 5 5 10 5 2. 5 7~3 2 Service expenses and fix cost in 1 st and 2 nd year are high, so initial cost is high in early years. 22

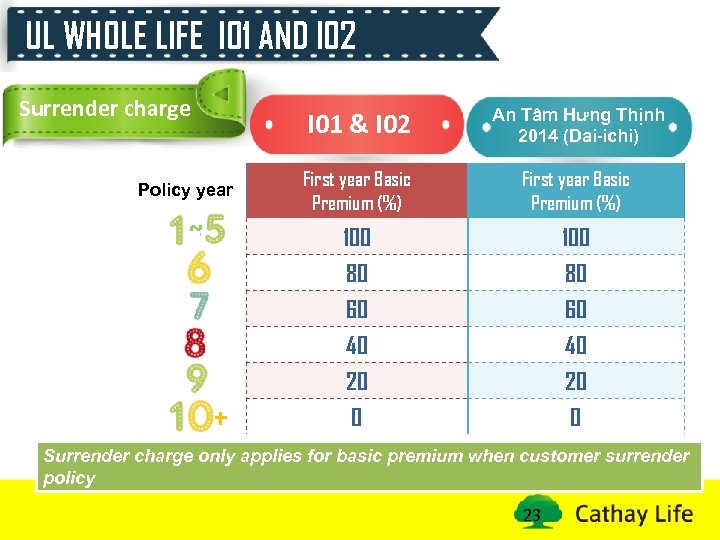

UL WHOLE LIFE I 01 AND I 02 Surrender charge I 01 & I 02 + First year Basic Premium (%) 100 80 60 ~ First year Basic Premium (%) 100 Policy year An Tâm Hưng Thịnh 2014 (Dai-ichi) 80 60 40 20 0 Surrender charge only applies for basic premium when customer surrender policy 23

UL WHOLE LIFE I 01 AND I 02 Surrender charge I 01 & I 02 + First year Basic Premium (%) 100 80 60 ~ First year Basic Premium (%) 100 Policy year An Tâm Hưng Thịnh 2014 (Dai-ichi) 80 60 40 20 0 Surrender charge only applies for basic premium when customer surrender policy 23

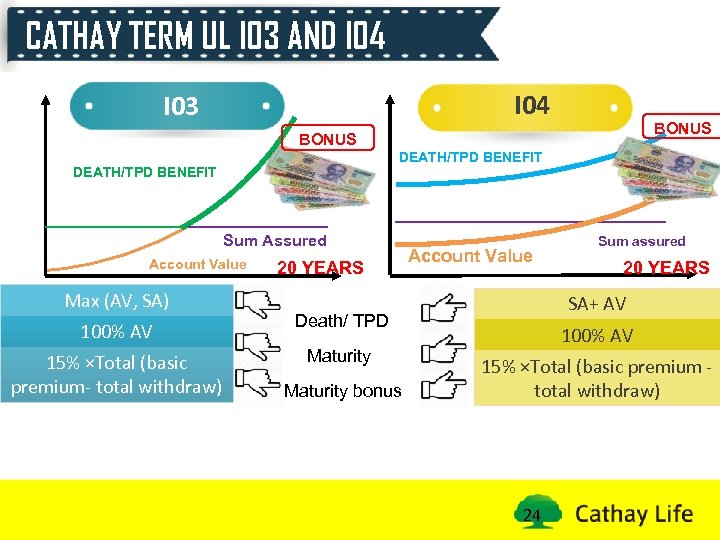

CATHAY TERM UL I 03 AND I 04 I 03 BONUS DEATH/TPD BENEFIT Sum Assured Account Value Max (AV, SA) 20 YEARS 100% AV Maturity bonus 20 YEARS SA+ AV Death/ TPD 15% ×Total (basic premium- total withdraw) Account Value Sum assured 100% AV 15% ×Total (basic premium total withdraw) 24

CATHAY TERM UL I 03 AND I 04 I 03 BONUS DEATH/TPD BENEFIT Sum Assured Account Value Max (AV, SA) 20 YEARS 100% AV Maturity bonus 20 YEARS SA+ AV Death/ TPD 15% ×Total (basic premium- total withdraw) Account Value Sum assured 100% AV 15% ×Total (basic premium total withdraw) 24

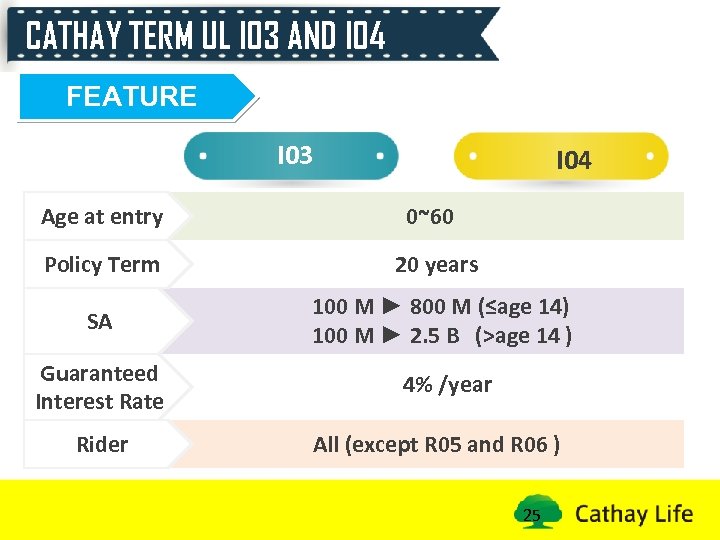

CATHAY TERM UL I 03 AND I 04 FEATURE I 03 I 04 Age at entry 0~60 Policy Term 20 years SA 100 M ► 800 M (≤age 14) 100 M ► 2. 5 B (>age 14 ) Guaranteed Interest Rate 4% /year Rider All (except R 05 and R 06 ) 25

CATHAY TERM UL I 03 AND I 04 FEATURE I 03 I 04 Age at entry 0~60 Policy Term 20 years SA 100 M ► 800 M (≤age 14) 100 M ► 2. 5 B (>age 14 ) Guaranteed Interest Rate 4% /year Rider All (except R 05 and R 06 ) 25

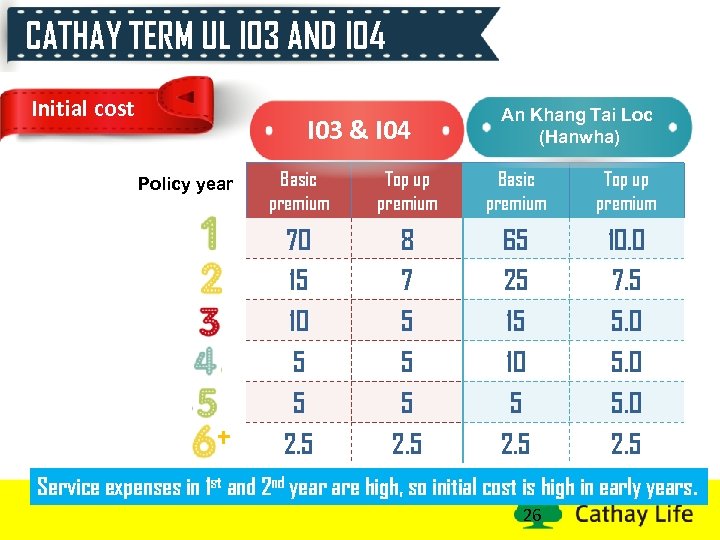

CATHAY TERM UL I 03 AND I 04 Initial cost I 03 & I 04 Policy year + An Khang Tai Loc (Hanwha) Basic premium Top up premium 70 15 10 5 5 2. 5 8 7 5 5 5 2. 5 65 25 15 10 5 2. 5 10. 0 7. 5 5. 0 2. 5 Service expenses in 1 st and 2 nd year are high, so initial cost is high in early years. 26

CATHAY TERM UL I 03 AND I 04 Initial cost I 03 & I 04 Policy year + An Khang Tai Loc (Hanwha) Basic premium Top up premium 70 15 10 5 5 2. 5 8 7 5 5 5 2. 5 65 25 15 10 5 2. 5 10. 0 7. 5 5. 0 2. 5 Service expenses in 1 st and 2 nd year are high, so initial cost is high in early years. 26

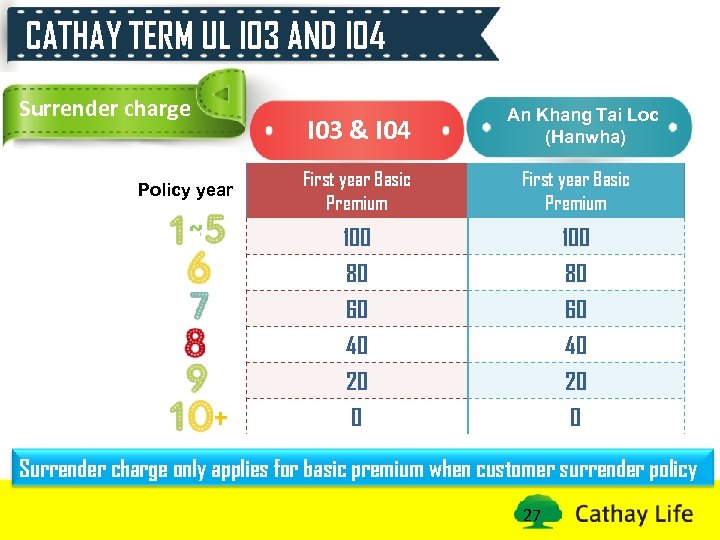

CATHAY TERM UL I 03 AND I 04 Surrender charge I 03 & I 04 An Khang Tai Loc (Hanwha) + First year Basic Premium 100 80 60 ~ First year Basic Premium 100 Policy year 80 60 40 20 0 Surrender charge only applies for basic premium when customer surrender policy 27

CATHAY TERM UL I 03 AND I 04 Surrender charge I 03 & I 04 An Khang Tai Loc (Hanwha) + First year Basic Premium 100 80 60 ~ First year Basic Premium 100 Policy year 80 60 40 20 0 Surrender charge only applies for basic premium when customer surrender policy 27

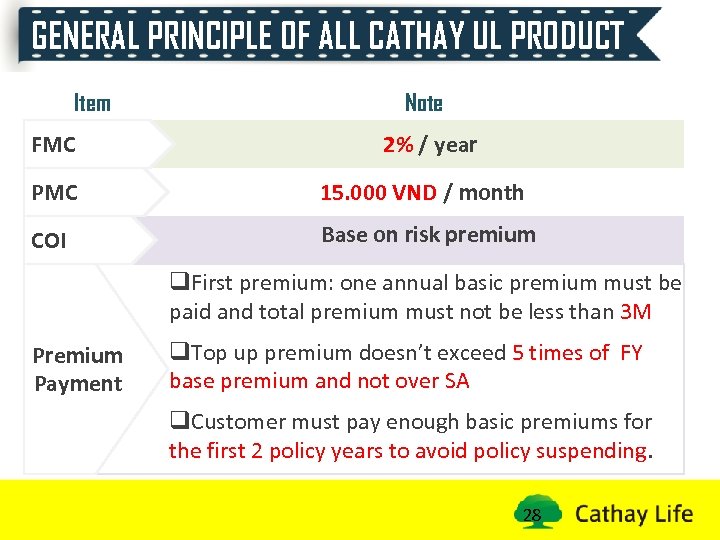

GENERAL PRINCIPLE OF ALL CATHAY UL PRODUCT Item FMC Note 2% / year PMC 15. 000 VND / month COI Base on risk premium q. First premium: one annual basic premium must be paid and total premium must not be less than 3 M Premium Payment q. Top up premium doesn’t exceed 5 times of FY base premium and not over SA q. Customer must pay enough basic premiums for the first 2 policy years to avoid policy suspending. 28

GENERAL PRINCIPLE OF ALL CATHAY UL PRODUCT Item FMC Note 2% / year PMC 15. 000 VND / month COI Base on risk premium q. First premium: one annual basic premium must be paid and total premium must not be less than 3 M Premium Payment q. Top up premium doesn’t exceed 5 times of FY base premium and not over SA q. Customer must pay enough basic premiums for the first 2 policy years to avoid policy suspending. 28

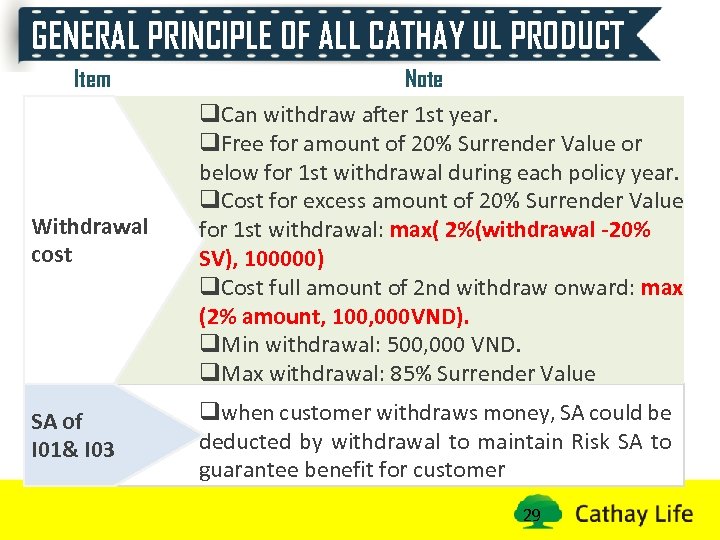

GENERAL PRINCIPLE OF ALL CATHAY UL PRODUCT Item Withdrawal cost SA of I 01& I 03 Note q. Can withdraw after 1 st year. q. Free for amount of 20% Surrender Value or below for 1 st withdrawal during each policy year. q. Cost for excess amount of 20% Surrender Value for 1 st withdrawal: max( 2%(withdrawal -20% SV), 100000) q. Cost full amount of 2 nd withdraw onward: max (2% amount, 100, 000 VND). q. Min withdrawal: 500, 000 VND. q. Max withdrawal: 85% Surrender Value qwhen customer withdraws money, SA could be deducted by withdrawal to maintain Risk SA to guarantee benefit for customer 29

GENERAL PRINCIPLE OF ALL CATHAY UL PRODUCT Item Withdrawal cost SA of I 01& I 03 Note q. Can withdraw after 1 st year. q. Free for amount of 20% Surrender Value or below for 1 st withdrawal during each policy year. q. Cost for excess amount of 20% Surrender Value for 1 st withdrawal: max( 2%(withdrawal -20% SV), 100000) q. Cost full amount of 2 nd withdraw onward: max (2% amount, 100, 000 VND). q. Min withdrawal: 500, 000 VND. q. Max withdrawal: 85% Surrender Value qwhen customer withdraws money, SA could be deducted by withdrawal to maintain Risk SA to guarantee benefit for customer 29

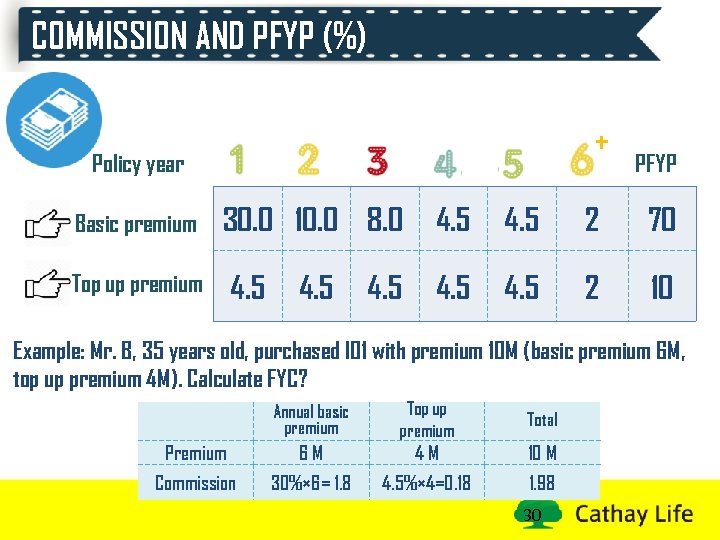

COMMISSION AND PFYP (%) + Policy year Basic premium Top up premium PFYP 30. 0 10. 0 8. 0 4. 5 2 70 4. 5 2 10 4. 5 Example: Mr. B, 35 years old, purchased I 01 with premium 10 M (basic premium 6 M, top up premium 4 M). Calculate FYC? Annual basic premium Premium Commission 6 M 30%× 6= 1. 8 Top up premium 4 M 4. 5%× 4=0. 18 Total 10 M 1. 98 30

COMMISSION AND PFYP (%) + Policy year Basic premium Top up premium PFYP 30. 0 10. 0 8. 0 4. 5 2 70 4. 5 2 10 4. 5 Example: Mr. B, 35 years old, purchased I 01 with premium 10 M (basic premium 6 M, top up premium 4 M). Calculate FYC? Annual basic premium Premium Commission 6 M 30%× 6= 1. 8 Top up premium 4 M 4. 5%× 4=0. 18 Total 10 M 1. 98 30

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 31

CONTENT INVESTMENT PRODUCT UNIVERSAL LIFE PRODUCT UL VS. TRADITIONAL PRODUCT CATHAY UL PRODUCT Q&A 31

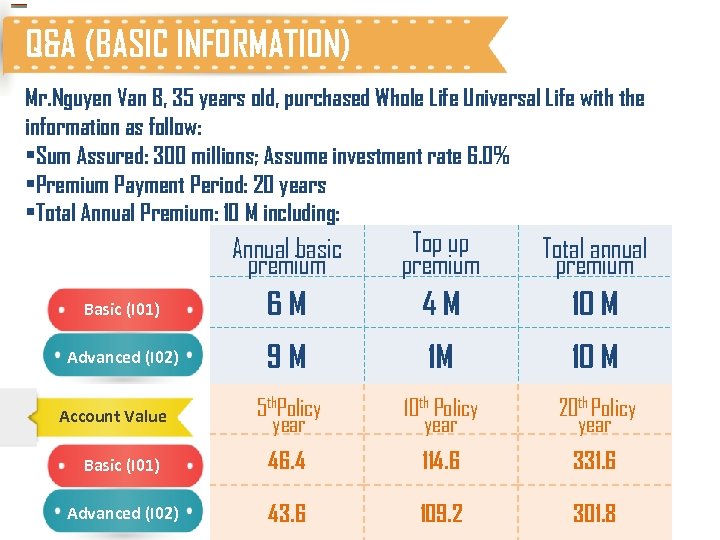

Q&A (BASIC INFORMATION) Mr. Nguyen Van B, 35 years old, purchased Whole Life Universal Life with the information as follow: • Sum Assured: 300 millions; Assume investment rate 6. 0% • Premium Payment Period: 20 years • Total Annual Premium: 10 M including: Annual basic premium Top up premium Total annual premium Basic (I 01) 6 M 4 M 10 M Advanced (I 02) 9 M 1 M 10 M 5 th. Policy year 10 th Policy year 20 th Policy year Basic (I 01) 46. 4 114. 6 331. 6 Advanced (I 02) 43. 6 109. 2 Account Value 32 301. 8

Q&A (BASIC INFORMATION) Mr. Nguyen Van B, 35 years old, purchased Whole Life Universal Life with the information as follow: • Sum Assured: 300 millions; Assume investment rate 6. 0% • Premium Payment Period: 20 years • Total Annual Premium: 10 M including: Annual basic premium Top up premium Total annual premium Basic (I 01) 6 M 4 M 10 M Advanced (I 02) 9 M 1 M 10 M 5 th. Policy year 10 th Policy year 20 th Policy year Basic (I 01) 46. 4 114. 6 331. 6 Advanced (I 02) 43. 6 109. 2 Account Value 32 301. 8

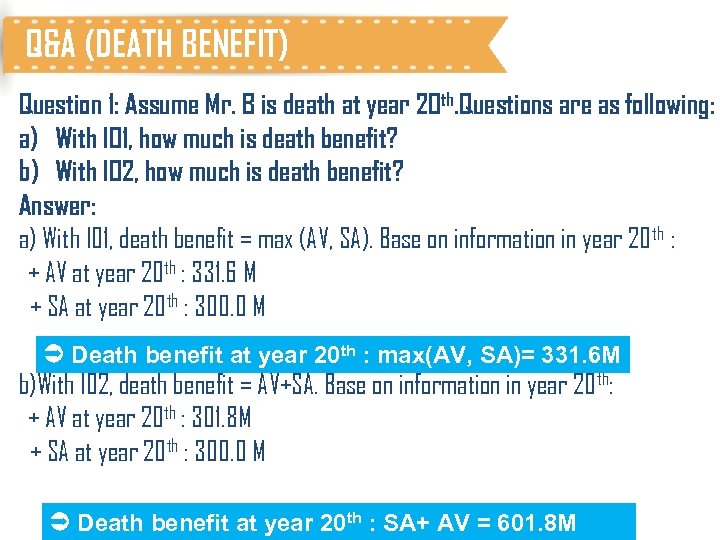

Q&A (DEATH BENEFIT) Question 1: Assume Mr. B is death at year 20 th. Questions are as following: a) With I 01, how much is death benefit? b) With I 02, how much is death benefit? Answer: a) With I 01, death benefit = max (AV, SA). Base on information in year 20 th : + AV at year 20 th : 331. 6 M + SA at year 20 th : 300. 0 M Death benefit at year 20 th : max(AV, SA)= 331. 6 M b)With I 02, death benefit = AV+SA. Base on information in year 20 th: + AV at year 20 th : 301. 8 M + SA at year 20 th : 300. 0 M 33 Death benefit at year 20 th : SA+ AV = 601. 8 M

Q&A (DEATH BENEFIT) Question 1: Assume Mr. B is death at year 20 th. Questions are as following: a) With I 01, how much is death benefit? b) With I 02, how much is death benefit? Answer: a) With I 01, death benefit = max (AV, SA). Base on information in year 20 th : + AV at year 20 th : 331. 6 M + SA at year 20 th : 300. 0 M Death benefit at year 20 th : max(AV, SA)= 331. 6 M b)With I 02, death benefit = AV+SA. Base on information in year 20 th: + AV at year 20 th : 301. 8 M + SA at year 20 th : 300. 0 M 33 Death benefit at year 20 th : SA+ AV = 601. 8 M

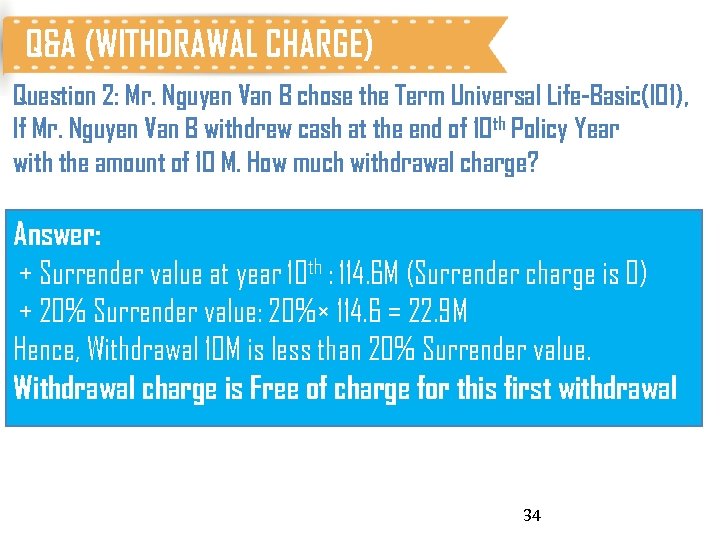

Q&A (WITHDRAWAL CHARGE) Question 2: Mr. Nguyen Van B chose the Term Universal Life-Basic(I 01), If Mr. Nguyen Van B withdrew cash at the end of 10 th Policy Year with the amount of 10 M. How much withdrawal charge? Answer: + Surrender value at year 10 th : 114. 6 M (Surrender charge is 0) + 20% Surrender value: 20%× 114. 6 = 22. 9 M Hence, Withdrawal 10 M is less than 20% Surrender value. Withdrawal charge is Free of charge for this first withdrawal 34

Q&A (WITHDRAWAL CHARGE) Question 2: Mr. Nguyen Van B chose the Term Universal Life-Basic(I 01), If Mr. Nguyen Van B withdrew cash at the end of 10 th Policy Year with the amount of 10 M. How much withdrawal charge? Answer: + Surrender value at year 10 th : 114. 6 M (Surrender charge is 0) + 20% Surrender value: 20%× 114. 6 = 22. 9 M Hence, Withdrawal 10 M is less than 20% Surrender value. Withdrawal charge is Free of charge for this first withdrawal 34

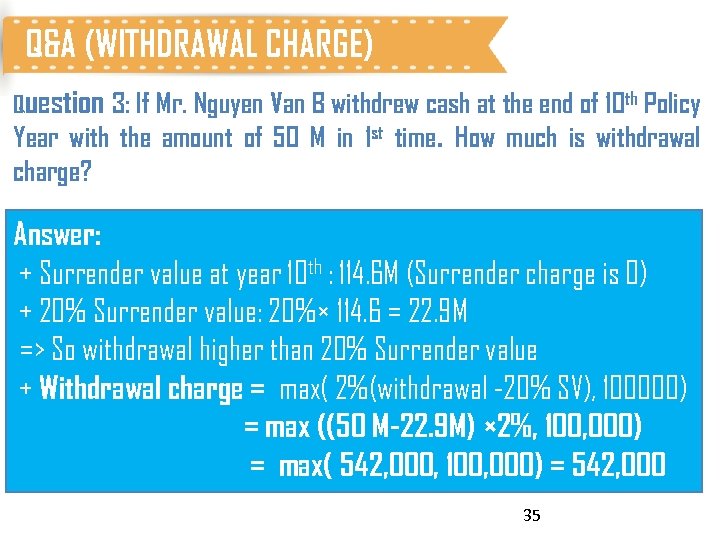

Q&A (WITHDRAWAL CHARGE) Question 3: If Mr. Nguyen Van B withdrew cash at the end of 10 th Policy Year with the amount of 50 M in 1 st time. How much is withdrawal charge? Answer: + Surrender value at year 10 th : 114. 6 M (Surrender charge is 0) + 20% Surrender value: 20%× 114. 6 = 22. 9 M => So withdrawal higher than 20% Surrender value + Withdrawal charge = max( 2%(withdrawal -20% SV), 100000) = max ((50 M-22. 9 M) × 2%, 100, 000) = max( 542, 000, 100, 000) = 542, 000 35

Q&A (WITHDRAWAL CHARGE) Question 3: If Mr. Nguyen Van B withdrew cash at the end of 10 th Policy Year with the amount of 50 M in 1 st time. How much is withdrawal charge? Answer: + Surrender value at year 10 th : 114. 6 M (Surrender charge is 0) + 20% Surrender value: 20%× 114. 6 = 22. 9 M => So withdrawal higher than 20% Surrender value + Withdrawal charge = max( 2%(withdrawal -20% SV), 100000) = max ((50 M-22. 9 M) × 2%, 100, 000) = max( 542, 000, 100, 000) = 542, 000 35

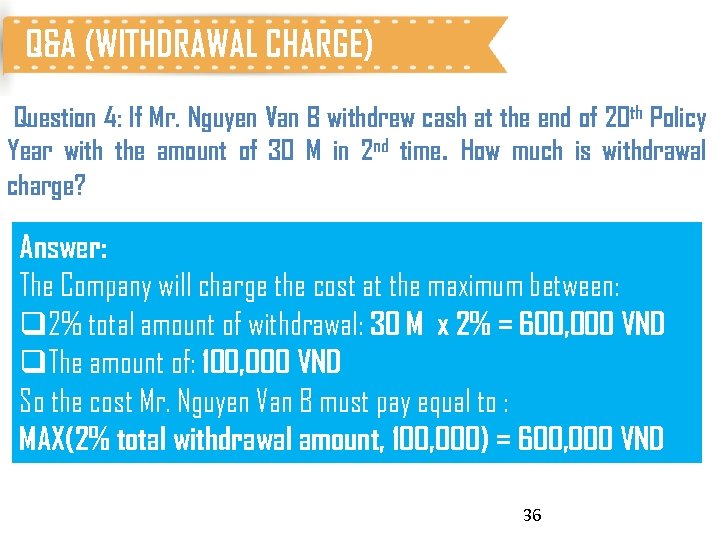

Q&A (WITHDRAWAL CHARGE) Question 4: If Mr. Nguyen Van B withdrew cash at the end of 20 th Policy Year with the amount of 30 M in 2 nd time. How much is withdrawal charge? Answer: The Company will charge the cost at the maximum between: q 2% total amount of withdrawal: 30 M x 2% = 600, 000 VND q. The amount of: 100, 000 VND So the cost Mr. Nguyen Van B must pay equal to : MAX(2% total withdrawal amount, 100, 000) = 600, 000 VND 36

Q&A (WITHDRAWAL CHARGE) Question 4: If Mr. Nguyen Van B withdrew cash at the end of 20 th Policy Year with the amount of 30 M in 2 nd time. How much is withdrawal charge? Answer: The Company will charge the cost at the maximum between: q 2% total amount of withdrawal: 30 M x 2% = 600, 000 VND q. The amount of: 100, 000 VND So the cost Mr. Nguyen Van B must pay equal to : MAX(2% total withdrawal amount, 100, 000) = 600, 000 VND 36

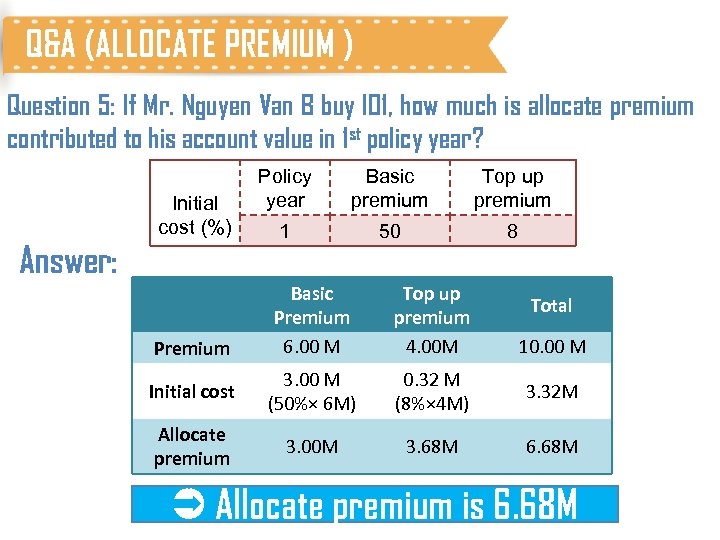

Q&A (ALLOCATE PREMIUM ) Question 5: If Mr. Nguyen Van B buy I 01, how much is allocate premium contributed to his account value in 1 st policy year? Initial cost (%) Answer: Policy year Basic premium Top up premium 1 50 8 Basic Premium 6. 00 M Top up premium 4. 00 M Initial cost 3. 00 M (50%× 6 M) 0. 32 M (8%× 4 M) 3. 32 M Allocate premium 3. 00 M 3. 68 M 6. 68 M Premium Total 10. 00 M Allocate premium is 6. 68 M 37

Q&A (ALLOCATE PREMIUM ) Question 5: If Mr. Nguyen Van B buy I 01, how much is allocate premium contributed to his account value in 1 st policy year? Initial cost (%) Answer: Policy year Basic premium Top up premium 1 50 8 Basic Premium 6. 00 M Top up premium 4. 00 M Initial cost 3. 00 M (50%× 6 M) 0. 32 M (8%× 4 M) 3. 32 M Allocate premium 3. 00 M 3. 68 M 6. 68 M Premium Total 10. 00 M Allocate premium is 6. 68 M 37

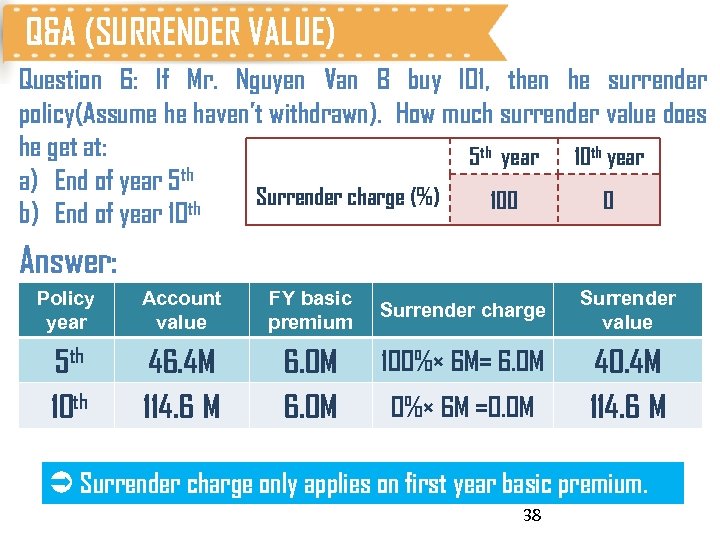

Q&A (SURRENDER VALUE) Question 6: If Mr. Nguyen Van B buy I 01, then he surrender policy(Assume he haven’t withdrawn). How much surrender value does he get at: 5 th year 10 th year a) End of year 5 th Surrender charge (%) 100 0 th b) End of year 10 Answer: Policy year Account value FY basic premium 5 th 10 th 46. 4 M 114. 6 M 6. 0 M Surrender charge 100%× 6 M= 6. 0 M 0%× 6 M =0. 0 M Surrender value 40. 4 M 114. 6 M Surrender charge only applies on first year basic premium. 38

Q&A (SURRENDER VALUE) Question 6: If Mr. Nguyen Van B buy I 01, then he surrender policy(Assume he haven’t withdrawn). How much surrender value does he get at: 5 th year 10 th year a) End of year 5 th Surrender charge (%) 100 0 th b) End of year 10 Answer: Policy year Account value FY basic premium 5 th 10 th 46. 4 M 114. 6 M 6. 0 M Surrender charge 100%× 6 M= 6. 0 M 0%× 6 M =0. 0 M Surrender value 40. 4 M 114. 6 M Surrender charge only applies on first year basic premium. 38

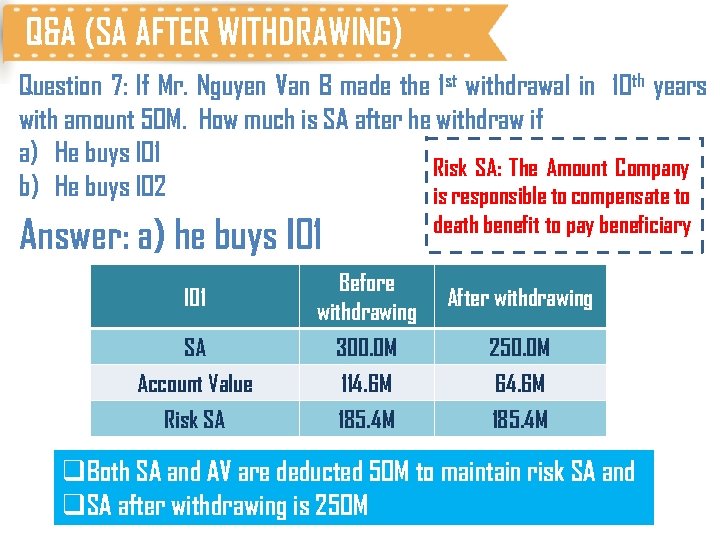

Q&A (SA AFTER WITHDRAWING) Question 7: If Mr. Nguyen Van B made the 1 st withdrawal in 10 th years with amount 50 M. How much is SA after he withdraw if a) He buys I 01 Risk SA: The Amount Company b) He buys I 02 is responsible to compensate to death benefit to pay beneficiary Answer: a) he buys I 01 Before withdrawing After withdrawing SA Account Value 300. 0 M 114. 6 M 250. 0 M 64. 6 M Risk SA 185. 4 M q. Both SA and AV are deducted 50 M to maintain risk SA and q. SA after withdrawing is 250 M 39

Q&A (SA AFTER WITHDRAWING) Question 7: If Mr. Nguyen Van B made the 1 st withdrawal in 10 th years with amount 50 M. How much is SA after he withdraw if a) He buys I 01 Risk SA: The Amount Company b) He buys I 02 is responsible to compensate to death benefit to pay beneficiary Answer: a) he buys I 01 Before withdrawing After withdrawing SA Account Value 300. 0 M 114. 6 M 250. 0 M 64. 6 M Risk SA 185. 4 M q. Both SA and AV are deducted 50 M to maintain risk SA and q. SA after withdrawing is 250 M 39

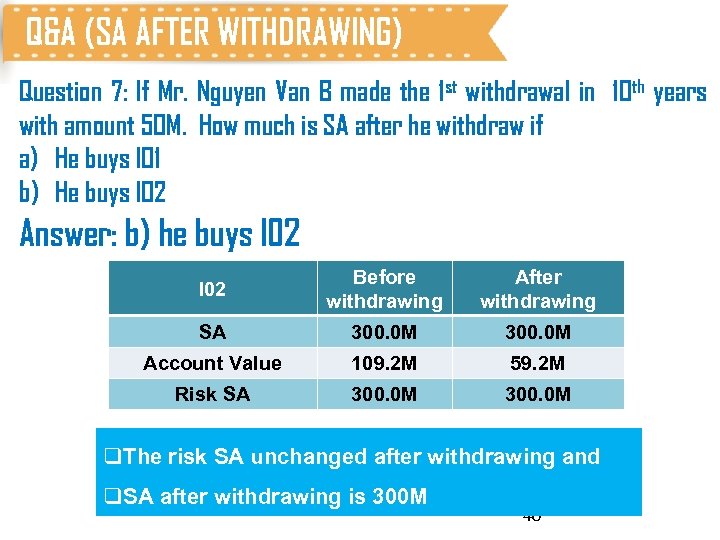

Q&A (SA AFTER WITHDRAWING) Question 7: If Mr. Nguyen Van B made the 1 st withdrawal in 10 th years with amount 50 M. How much is SA after he withdraw if a) He buys I 01 b) He buys I 02 Answer: b) he buys I 02 Before withdrawing After withdrawing SA 300. 0 M Account Value 109. 2 M 59. 2 M Risk SA 300. 0 M q. The risk SA unchanged after withdrawing and q. SA after withdrawing is 300 M 40

Q&A (SA AFTER WITHDRAWING) Question 7: If Mr. Nguyen Van B made the 1 st withdrawal in 10 th years with amount 50 M. How much is SA after he withdraw if a) He buys I 01 b) He buys I 02 Answer: b) he buys I 02 Before withdrawing After withdrawing SA 300. 0 M Account Value 109. 2 M 59. 2 M Risk SA 300. 0 M q. The risk SA unchanged after withdrawing and q. SA after withdrawing is 300 M 40

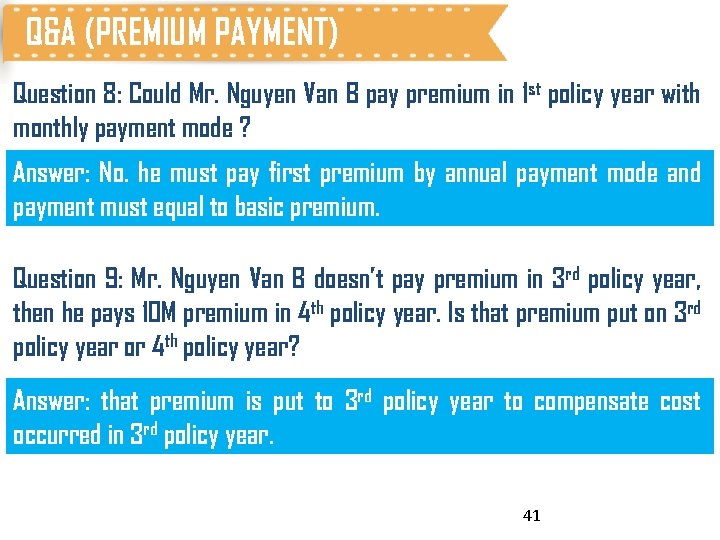

Q&A (PREMIUM PAYMENT) Question 8: Could Mr. Nguyen Van B pay premium in 1 st policy year with monthly payment mode ? Answer: No. he must pay first premium by annual payment mode and payment must equal to basic premium. Question 9: Mr. Nguyen Van B doesn’t pay premium in 3 rd policy year, then he pays 10 M premium in 4 th policy year. Is that premium put on 3 rd policy year or 4 th policy year? Answer: that premium is put to 3 rd policy year to compensate cost occurred in 3 rd policy year. 41

Q&A (PREMIUM PAYMENT) Question 8: Could Mr. Nguyen Van B pay premium in 1 st policy year with monthly payment mode ? Answer: No. he must pay first premium by annual payment mode and payment must equal to basic premium. Question 9: Mr. Nguyen Van B doesn’t pay premium in 3 rd policy year, then he pays 10 M premium in 4 th policy year. Is that premium put on 3 rd policy year or 4 th policy year? Answer: that premium is put to 3 rd policy year to compensate cost occurred in 3 rd policy year. 41

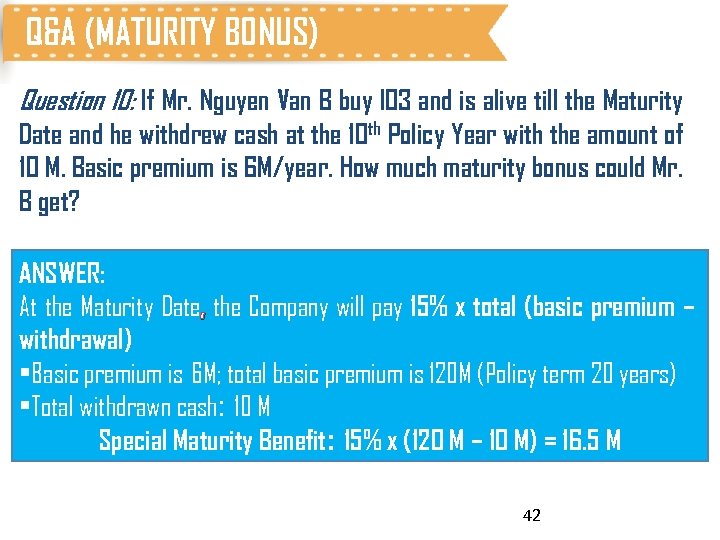

Q&A (MATURITY BONUS) Question 10: If Mr. Nguyen Van B buy I 03 and is alive till the Maturity Date and he withdrew cash at the 10 th Policy Year with the amount of 10 M. Basic premium is 6 M/year. How much maturity bonus could Mr. B get? ANSWER: At the Maturity Date, the Company will pay 15% x total (basic premium – withdrawal) • Basic premium is 6 M; total basic premium is 120 M (Policy term 20 years) • Total withdrawn cash: 10 M Special Maturity Benefit: 15% x (120 M – 10 M) = 16. 5 M 42

Q&A (MATURITY BONUS) Question 10: If Mr. Nguyen Van B buy I 03 and is alive till the Maturity Date and he withdrew cash at the 10 th Policy Year with the amount of 10 M. Basic premium is 6 M/year. How much maturity bonus could Mr. B get? ANSWER: At the Maturity Date, the Company will pay 15% x total (basic premium – withdrawal) • Basic premium is 6 M; total basic premium is 120 M (Policy term 20 years) • Total withdrawn cash: 10 M Special Maturity Benefit: 15% x (120 M – 10 M) = 16. 5 M 42

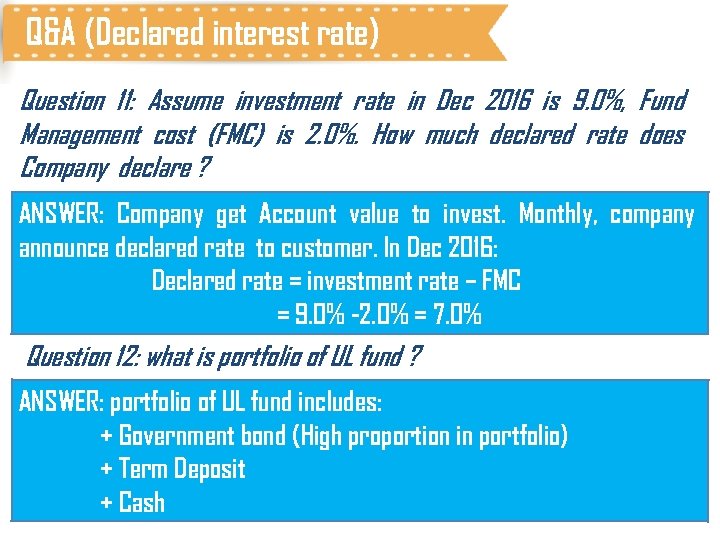

Q&A (Declared interest rate) Question 11: Assume investment rate in Dec 2016 is 9. 0%, Fund Management cost (FMC) is 2. 0%. How much declared rate does Company declare ? ANSWER: Company get Account value to invest. Monthly, company announce declared rate to customer. In Dec 2016: Declared rate = investment rate – FMC = 9. 0% -2. 0% = 7. 0% Question 12: what is portfolio of UL fund ? ANSWER: portfolio of UL fund includes: + Government bond (High proportion in portfolio) + Term Deposit + Cash 43

Q&A (Declared interest rate) Question 11: Assume investment rate in Dec 2016 is 9. 0%, Fund Management cost (FMC) is 2. 0%. How much declared rate does Company declare ? ANSWER: Company get Account value to invest. Monthly, company announce declared rate to customer. In Dec 2016: Declared rate = investment rate – FMC = 9. 0% -2. 0% = 7. 0% Question 12: what is portfolio of UL fund ? ANSWER: portfolio of UL fund includes: + Government bond (High proportion in portfolio) + Term Deposit + Cash 43

44

44