c2c4a9449cb112ff1b2c6865575dd6e7.ppt

- Количество слайдов: 12

Universal Deferred Payments: Designing the new scheme David Hayward – Department of Health NAFAO Conference 18 October 2012

Universal Deferred Payments: Designing the new scheme David Hayward – Department of Health NAFAO Conference 18 October 2012

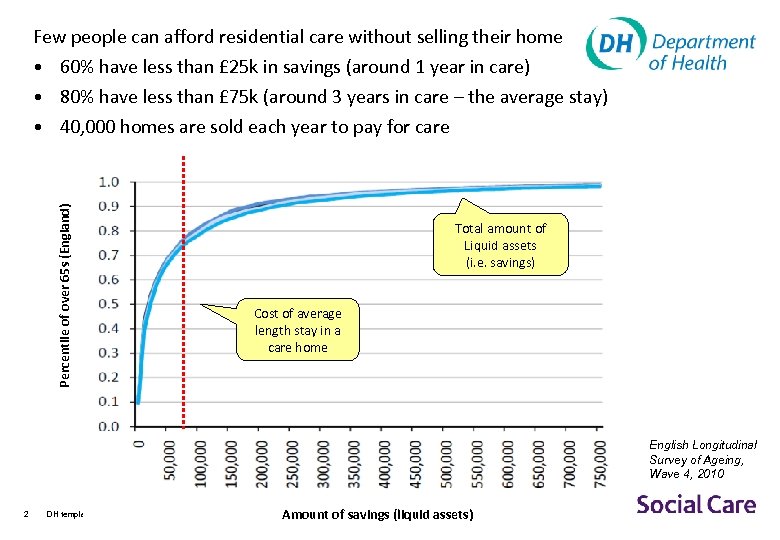

Few people can afford residential care without selling their home Percentile of over 65 s (England) • 60% have less than £ 25 k in savings (around 1 year in care) • 80% have less than £ 75 k (around 3 years in care – the average stay) • 40, 000 homes are sold each year to pay for care Total amount of Liquid assets (i. e. savings) Cost of average length stay in a care home English Longitudinal Survey of Ageing, Wave 4, 2010 2 DH template Amount of savings (liquid assets)

Few people can afford residential care without selling their home Percentile of over 65 s (England) • 60% have less than £ 25 k in savings (around 1 year in care) • 80% have less than £ 75 k (around 3 years in care – the average stay) • 40, 000 homes are sold each year to pay for care Total amount of Liquid assets (i. e. savings) Cost of average length stay in a care home English Longitudinal Survey of Ageing, Wave 4, 2010 2 DH template Amount of savings (liquid assets)

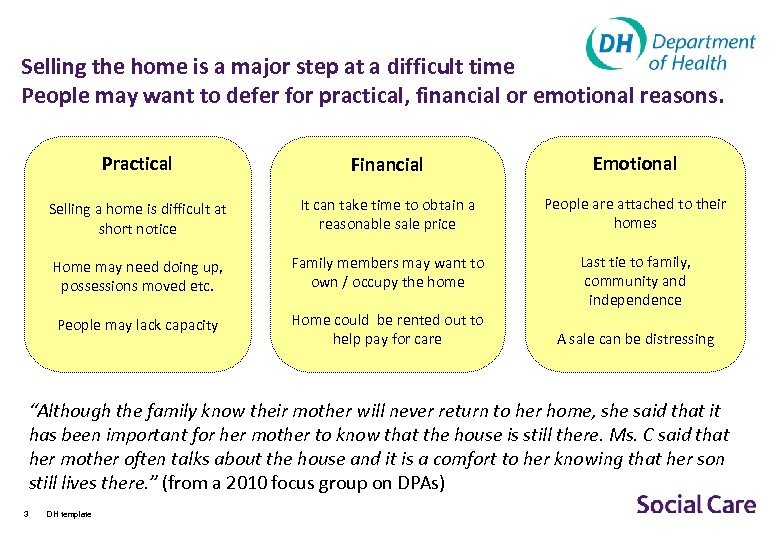

Selling the home is a major step at a difficult time People may want to defer for practical, financial or emotional reasons. Practical Financial Emotional Selling a home is difficult at short notice It can take time to obtain a reasonable sale price People are attached to their homes Home may need doing up, possessions moved etc. Family members may want to own / occupy the home Last tie to family, community and independence People may lack capacity Home could be rented out to help pay for care A sale can be distressing “Although the family know their mother will never return to her home, she said that it has been important for her mother to know that the house is still there. Ms. C said that her mother often talks about the house and it is a comfort to her knowing that her son still lives there. ” (from a 2010 focus group on DPAs) 3 DH template

Selling the home is a major step at a difficult time People may want to defer for practical, financial or emotional reasons. Practical Financial Emotional Selling a home is difficult at short notice It can take time to obtain a reasonable sale price People are attached to their homes Home may need doing up, possessions moved etc. Family members may want to own / occupy the home Last tie to family, community and independence People may lack capacity Home could be rented out to help pay for care A sale can be distressing “Although the family know their mother will never return to her home, she said that it has been important for her mother to know that the house is still there. Ms. C said that her mother often talks about the house and it is a comfort to her knowing that her son still lives there. ” (from a 2010 focus group on DPAs) 3 DH template

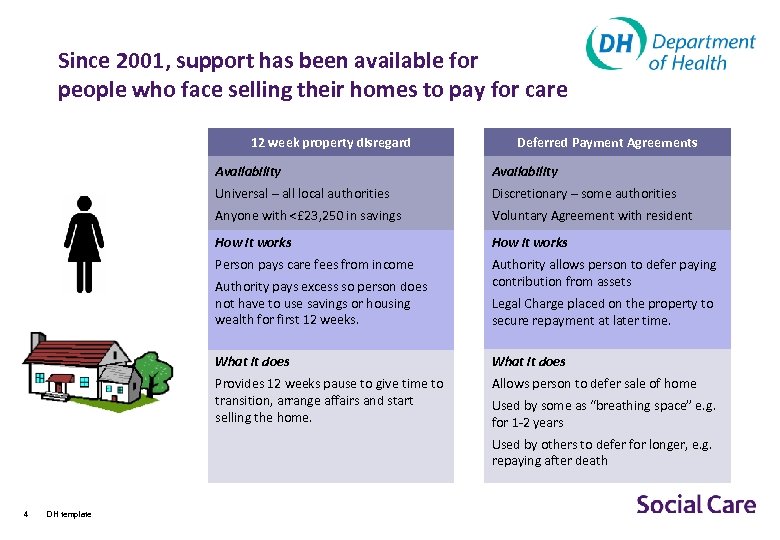

Since 2001, support has been available for people who face selling their homes to pay for care 12 week property disregard Deferred Payment Agreements Availability Universal – all local authorities Discretionary – some authorities Anyone with <£ 23, 250 in savings Voluntary Agreement with resident How it works Person pays care fees from income Authority allows person to defer paying contribution from assets Authority pays excess so person does not have to use savings or housing wealth for first 12 weeks. Legal Charge placed on the property to secure repayment at later time. What it does Provides 12 weeks pause to give time to transition, arrange affairs and start selling the home. Allows person to defer sale of home Used by some as “breathing space” e. g. for 1 -2 years Used by others to defer for longer, e. g. repaying after death 4 DH template

Since 2001, support has been available for people who face selling their homes to pay for care 12 week property disregard Deferred Payment Agreements Availability Universal – all local authorities Discretionary – some authorities Anyone with <£ 23, 250 in savings Voluntary Agreement with resident How it works Person pays care fees from income Authority allows person to defer paying contribution from assets Authority pays excess so person does not have to use savings or housing wealth for first 12 weeks. Legal Charge placed on the property to secure repayment at later time. What it does Provides 12 weeks pause to give time to transition, arrange affairs and start selling the home. Allows person to defer sale of home Used by some as “breathing space” e. g. for 1 -2 years Used by others to defer for longer, e. g. repaying after death 4 DH template

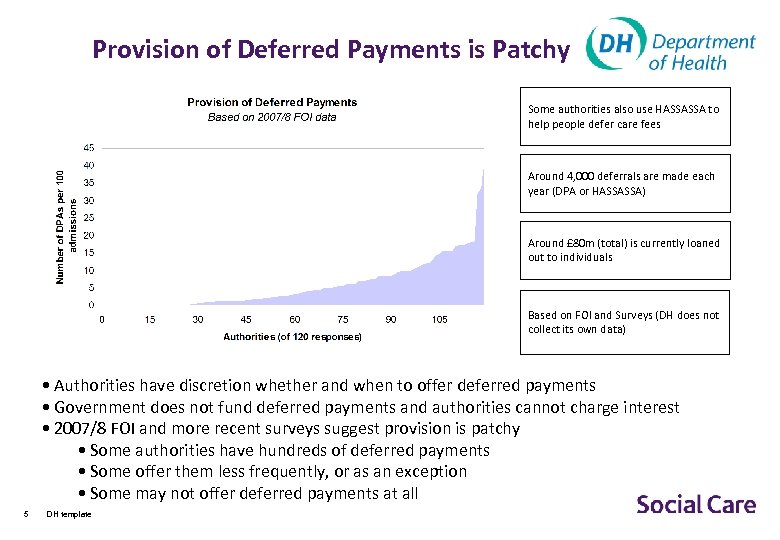

Provision of Deferred Payments is Patchy Some authorities also use HASSASSA to help people defer care fees Around 4, 000 deferrals are made each year (DPA or HASSASSA) Around £ 80 m (total) is currently loaned out to individuals Based on FOI and Surveys (DH does not collect its own data) • Authorities have discretion whether and when to offer deferred payments • Government does not fund deferred payments and authorities cannot charge interest • 2007/8 FOI and more recent surveys suggest provision is patchy • Some authorities have hundreds of deferred payments • Some offer them less frequently, or as an exception • Some may not offer deferred payments at all 5 DH template

Provision of Deferred Payments is Patchy Some authorities also use HASSASSA to help people defer care fees Around 4, 000 deferrals are made each year (DPA or HASSASSA) Around £ 80 m (total) is currently loaned out to individuals Based on FOI and Surveys (DH does not collect its own data) • Authorities have discretion whether and when to offer deferred payments • Government does not fund deferred payments and authorities cannot charge interest • 2007/8 FOI and more recent surveys suggest provision is patchy • Some authorities have hundreds of deferred payments • Some offer them less frequently, or as an exception • Some may not offer deferred payments at all 5 DH template

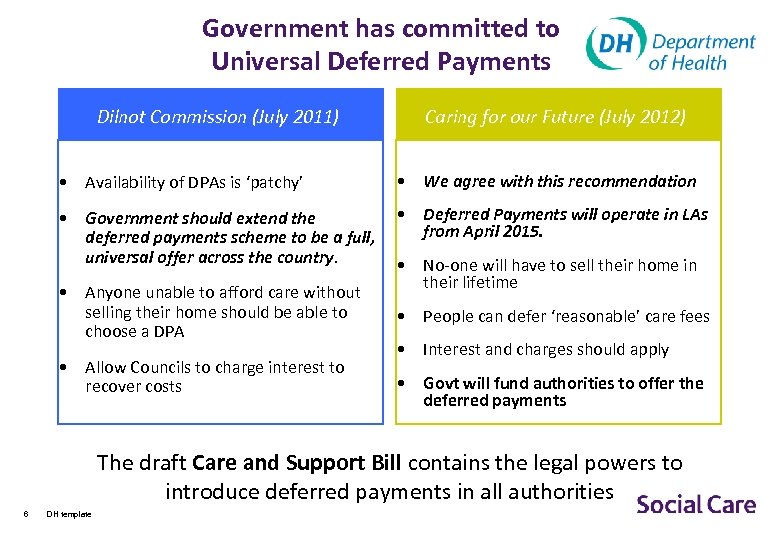

Government has committed to Universal Deferred Payments Dilnot Commission (July 2011) Caring for our Future (July 2012) • Availability of DPAs is ‘patchy’ • We agree with this recommendation • Government should extend the deferred payments scheme to be a full, universal offer across the country. • Deferred Payments will operate in LAs from April 2015. • Anyone unable to afford care without selling their home should be able to choose a DPA • Allow Councils to charge interest to recover costs • No-one will have to sell their home in their lifetime • People can defer ‘reasonable’ care fees • Interest and charges should apply • Govt will fund authorities to offer the deferred payments The draft Care and Support Bill contains the legal powers to introduce deferred payments in all authorities 6 DH template

Government has committed to Universal Deferred Payments Dilnot Commission (July 2011) Caring for our Future (July 2012) • Availability of DPAs is ‘patchy’ • We agree with this recommendation • Government should extend the deferred payments scheme to be a full, universal offer across the country. • Deferred Payments will operate in LAs from April 2015. • Anyone unable to afford care without selling their home should be able to choose a DPA • Allow Councils to charge interest to recover costs • No-one will have to sell their home in their lifetime • People can defer ‘reasonable’ care fees • Interest and charges should apply • Govt will fund authorities to offer the deferred payments The draft Care and Support Bill contains the legal powers to introduce deferred payments in all authorities 6 DH template

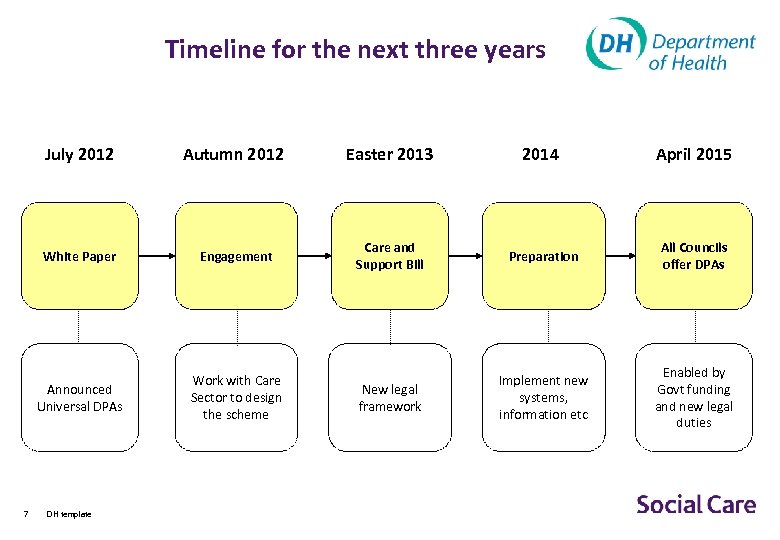

Timeline for the next three years July 2012 Easter 2013 2014 April 2015 White Paper Engagement Care and Support Bill Preparation All Councils offer DPAs Announced Universal DPAs 7 Autumn 2012 Work with Care Sector to design the scheme New legal framework Implement new systems, information etc Enabled by Govt funding and new legal duties DH template

Timeline for the next three years July 2012 Easter 2013 2014 April 2015 White Paper Engagement Care and Support Bill Preparation All Councils offer DPAs Announced Universal DPAs 7 Autumn 2012 Work with Care Sector to design the scheme New legal framework Implement new systems, information etc Enabled by Govt funding and new legal duties DH template

Deferred Payments – The Future • Built on the current system • Operated by local authorities (all authorities) • One legal mechanism for deferral agreements • Clear and consistent legal rules – we will work with the sector on what these will be • Funding from Government to help authorities finance the loans 8 DH template

Deferred Payments – The Future • Built on the current system • Operated by local authorities (all authorities) • One legal mechanism for deferral agreements • Clear and consistent legal rules – we will work with the sector on what these will be • Funding from Government to help authorities finance the loans 8 DH template

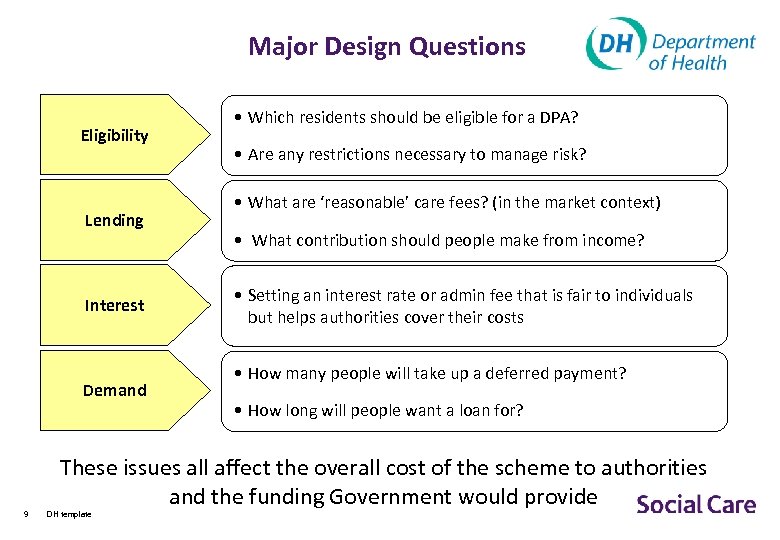

Major Design Questions Eligibility Lending Interest Demand 9 • Which residents should be eligible for a DPA? • Are any restrictions necessary to manage risk? • What are ‘reasonable’ care fees? (in the market context) • What contribution should people make from income? • Setting an interest rate or admin fee that is fair to individuals but helps authorities cover their costs • How many people will take up a deferred payment? • How long will people want a loan for? These issues all affect the overall cost of the scheme to authorities and the funding Government would provide DH template

Major Design Questions Eligibility Lending Interest Demand 9 • Which residents should be eligible for a DPA? • Are any restrictions necessary to manage risk? • What are ‘reasonable’ care fees? (in the market context) • What contribution should people make from income? • Setting an interest rate or admin fee that is fair to individuals but helps authorities cover their costs • How many people will take up a deferred payment? • How long will people want a loan for? These issues all affect the overall cost of the scheme to authorities and the funding Government would provide DH template

DH / NAFAO / ADASS survey • We are surveying authorities on deferred payments and use of HASSASSA charges • Survey will launch in late October • Your responses will help us design the scheme • Key issues we want to understand – Council policies on allowing people to defer care fees – Costs to Councils – How quickly are loans repaid – Practicalities • Confidential (we will keep your responses private) • Please take part 10 DH template

DH / NAFAO / ADASS survey • We are surveying authorities on deferred payments and use of HASSASSA charges • Survey will launch in late October • Your responses will help us design the scheme • Key issues we want to understand – Council policies on allowing people to defer care fees – Costs to Councils – How quickly are loans repaid – Practicalities • Confidential (we will keep your responses private) • Please take part 10 DH template

We would like your views on four questions… FOR GROUP DISCUSSION AND FEEDBACK Demand: • What do you think the demand will be for deferred payments? • What proportion of people will want short-term “breathing space” and what proportion will want a longer / lifetime loan? Implementation: • Could we improve the process for setting up a deferred payment? What works well now and what does not? • What are the biggest challenges to local implementation of universal deferred payments? 11 DH template

We would like your views on four questions… FOR GROUP DISCUSSION AND FEEDBACK Demand: • What do you think the demand will be for deferred payments? • What proportion of people will want short-term “breathing space” and what proportion will want a longer / lifetime loan? Implementation: • Could we improve the process for setting up a deferred payment? What works well now and what does not? • What are the biggest challenges to local implementation of universal deferred payments? 11 DH template

Thank You 12 DH template

Thank You 12 DH template