1f9b0fff241beeadbb826f6341ad9c02.ppt

- Количество слайдов: 37

United States Department of Agriculture Office of the Chief Financial Officer National Finance Center Customer Board Meeting September 11, 2014

United States Department of Agriculture Office of the Chief Financial Officer National Finance Center Customer Board Meeting September 11, 2014

USDA, National Finance Center Customer Board Meeting September 11, 2014 Old Business Updates

USDA, National Finance Center Customer Board Meeting September 11, 2014 Old Business Updates

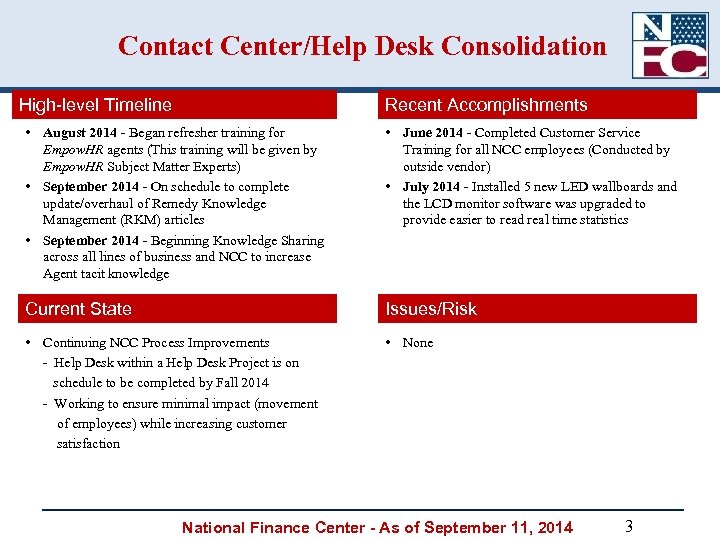

Contact Center/Help Desk Consolidation High-level Timeline Recent Accomplishments • August 2014 - Began refresher training for Empow. HR agents (This training will be given by Empow. HR Subject Matter Experts) • September 2014 - On schedule to complete update/overhaul of Remedy Knowledge Management (RKM) articles • September 2014 - Beginning Knowledge Sharing across all lines of business and NCC to increase Agent tacit knowledge • June 2014 - Completed Customer Service Training for all NCC employees (Conducted by outside vendor) • July 2014 - Installed 5 new LED wallboards and the LCD monitor software was upgraded to provide easier to read real time statistics Current State Issues/Risk • Continuing NCC Process Improvements - Help Desk within a Help Desk Project is on schedule to be completed by Fall 2014 - Working to ensure minimal impact (movement of employees) while increasing customer satisfaction • None National Finance Center - As of September 11, 2014 3

Contact Center/Help Desk Consolidation High-level Timeline Recent Accomplishments • August 2014 - Began refresher training for Empow. HR agents (This training will be given by Empow. HR Subject Matter Experts) • September 2014 - On schedule to complete update/overhaul of Remedy Knowledge Management (RKM) articles • September 2014 - Beginning Knowledge Sharing across all lines of business and NCC to increase Agent tacit knowledge • June 2014 - Completed Customer Service Training for all NCC employees (Conducted by outside vendor) • July 2014 - Installed 5 new LED wallboards and the LCD monitor software was upgraded to provide easier to read real time statistics Current State Issues/Risk • Continuing NCC Process Improvements - Help Desk within a Help Desk Project is on schedule to be completed by Fall 2014 - Working to ensure minimal impact (movement of employees) while increasing customer satisfaction • None National Finance Center - As of September 11, 2014 3

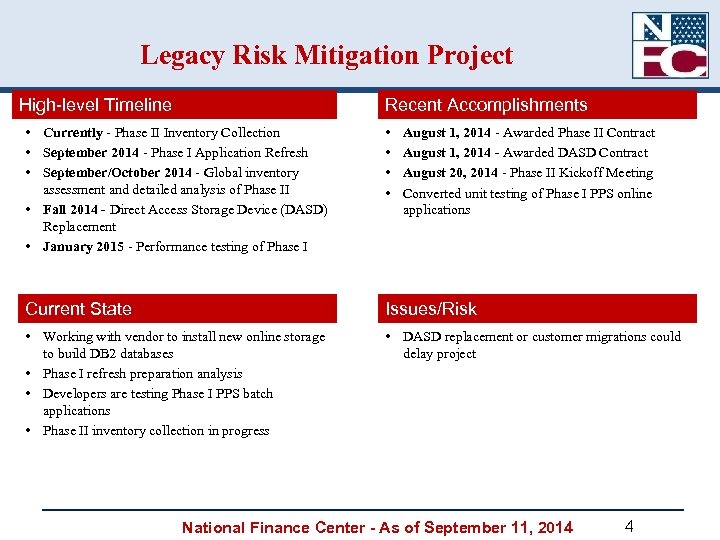

Legacy Risk Mitigation Project High-level Timeline Recent Accomplishments • Currently - Phase II Inventory Collection • September 2014 - Phase I Application Refresh • September/October 2014 - Global inventory assessment and detailed analysis of Phase II • Fall 2014 - Direct Access Storage Device (DASD) Replacement • January 2015 - Performance testing of Phase I • • Current State Issues/Risk • Working with vendor to install new online storage to build DB 2 databases • Phase I refresh preparation analysis • Developers are testing Phase I PPS batch applications • Phase II inventory collection in progress • DASD replacement or customer migrations could delay project August 1, 2014 - Awarded Phase II Contract August 1, 2014 - Awarded DASD Contract August 20, 2014 - Phase II Kickoff Meeting Converted unit testing of Phase I PPS online applications National Finance Center - As of September 11, 2014 4

Legacy Risk Mitigation Project High-level Timeline Recent Accomplishments • Currently - Phase II Inventory Collection • September 2014 - Phase I Application Refresh • September/October 2014 - Global inventory assessment and detailed analysis of Phase II • Fall 2014 - Direct Access Storage Device (DASD) Replacement • January 2015 - Performance testing of Phase I • • Current State Issues/Risk • Working with vendor to install new online storage to build DB 2 databases • Phase I refresh preparation analysis • Developers are testing Phase I PPS batch applications • Phase II inventory collection in progress • DASD replacement or customer migrations could delay project August 1, 2014 - Awarded Phase II Contract August 1, 2014 - Awarded DASD Contract August 20, 2014 - Phase II Kickoff Meeting Converted unit testing of Phase I PPS online applications National Finance Center - As of September 11, 2014 4

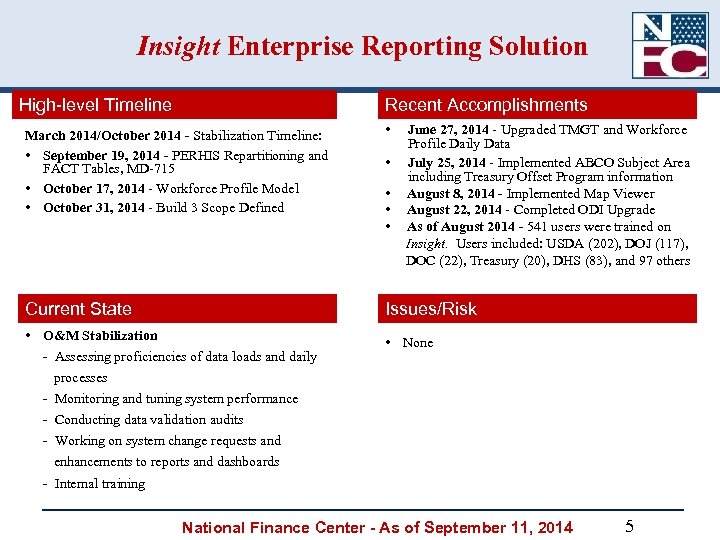

Insight Enterprise Reporting Solution High-level Timeline Recent Accomplishments March 2014/October 2014 - Stabilization Timeline: • September 19, 2014 - PERHIS Repartitioning and FACT Tables, MD-715 • October 17, 2014 - Workforce Profile Model • October 31, 2014 - Build 3 Scope Defined • Current State Issues/Risk • O&M Stabilization - Assessing proficiencies of data loads and daily processes - Monitoring and tuning system performance - Conducting data validation audits - Working on system change requests and enhancements to reports and dashboards - Internal training • • June 27, 2014 - Upgraded TMGT and Workforce Profile Daily Data July 25, 2014 - Implemented ABCO Subject Area including Treasury Offset Program information August 8, 2014 - Implemented Map Viewer August 22, 2014 - Completed ODI Upgrade As of August 2014 - 541 users were trained on Insight. Users included: USDA (202), DOJ (117), DOC (22), Treasury (20), DHS (83), and 97 others • None National Finance Center - As of September 11, 2014 5

Insight Enterprise Reporting Solution High-level Timeline Recent Accomplishments March 2014/October 2014 - Stabilization Timeline: • September 19, 2014 - PERHIS Repartitioning and FACT Tables, MD-715 • October 17, 2014 - Workforce Profile Model • October 31, 2014 - Build 3 Scope Defined • Current State Issues/Risk • O&M Stabilization - Assessing proficiencies of data loads and daily processes - Monitoring and tuning system performance - Conducting data validation audits - Working on system change requests and enhancements to reports and dashboards - Internal training • • June 27, 2014 - Upgraded TMGT and Workforce Profile Daily Data July 25, 2014 - Implemented ABCO Subject Area including Treasury Offset Program information August 8, 2014 - Implemented Map Viewer August 22, 2014 - Completed ODI Upgrade As of August 2014 - 541 users were trained on Insight. Users included: USDA (202), DOJ (117), DOC (22), Treasury (20), DHS (83), and 97 others • None National Finance Center - As of September 11, 2014 5

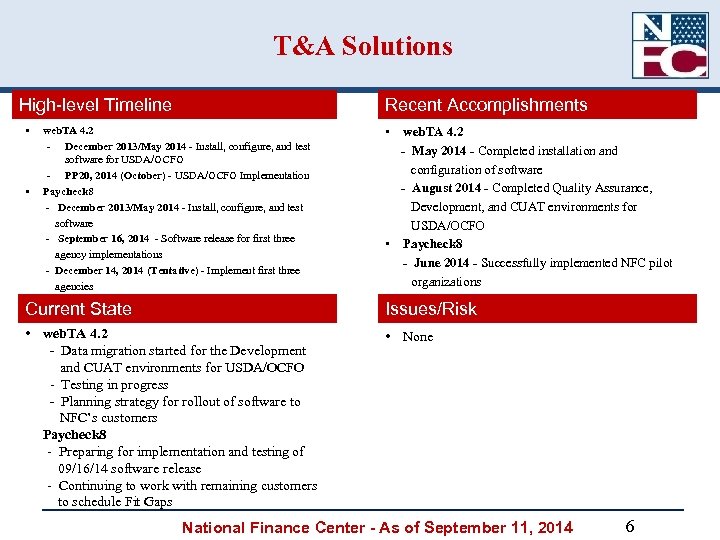

T&A Solutions High-level Timeline • • Recent Accomplishments web. TA 4. 2 - December 2013/May 2014 - Install, configure, and test software for USDA/OCFO - PP 20, 2014 (October) - USDA/OCFO Implementation Paycheck 8 - December 2013/May 2014 - Install, configure, and test software - September 16, 2014 - Software release for first three agency implementations - December 14, 2014 (Tentative) - Implement first three agencies • web. TA 4. 2 - May 2014 - Completed installation and configuration of software - August 2014 - Completed Quality Assurance, Development, and CUAT environments for USDA/OCFO • Paycheck 8 - June 2014 - Successfully implemented NFC pilot organizations Current State Issues/Risk • web. TA 4. 2 - Data migration started for the Development and CUAT environments for USDA/OCFO - Testing in progress - Planning strategy for rollout of software to NFC’s customers Paycheck 8 - Preparing for implementation and testing of 09/16/14 software release - Continuing to work with remaining customers to schedule Fit Gaps • None National Finance Center - As of September 11, 2014 6

T&A Solutions High-level Timeline • • Recent Accomplishments web. TA 4. 2 - December 2013/May 2014 - Install, configure, and test software for USDA/OCFO - PP 20, 2014 (October) - USDA/OCFO Implementation Paycheck 8 - December 2013/May 2014 - Install, configure, and test software - September 16, 2014 - Software release for first three agency implementations - December 14, 2014 (Tentative) - Implement first three agencies • web. TA 4. 2 - May 2014 - Completed installation and configuration of software - August 2014 - Completed Quality Assurance, Development, and CUAT environments for USDA/OCFO • Paycheck 8 - June 2014 - Successfully implemented NFC pilot organizations Current State Issues/Risk • web. TA 4. 2 - Data migration started for the Development and CUAT environments for USDA/OCFO - Testing in progress - Planning strategy for rollout of software to NFC’s customers Paycheck 8 - Preparing for implementation and testing of 09/16/14 software release - Continuing to work with remaining customers to schedule Fit Gaps • None National Finance Center - As of September 11, 2014 6

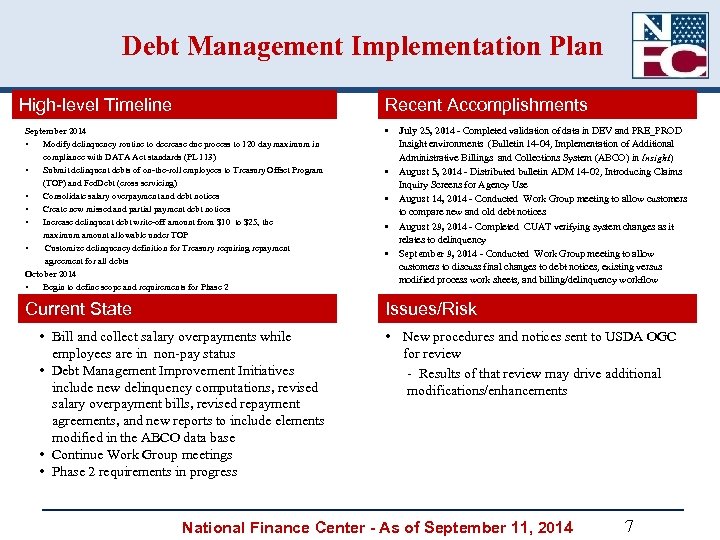

Debt Management Implementation Plan High-level Timeline Recent Accomplishments September 2014 • Modify delinquency routine to decrease due process to 120 day maximum in compliance with DATA Act standards (PL 113) • Submit delinquent debts of on-the-roll employees to Treasury Offset Program (TOP) and Fed. Debt (cross servicing) • Consolidate salary overpayment and debt notices • Create new missed and partial payment debt notices • Increase delinquent debt write-off amount from $10 to $25, the maximum amount allowable under TOP • Customize delinquency definition for Treasury requiring repayment agreement for all debts October 2014 • Begin to define scope and requirements for Phase 2 • July 25, 2014 - Completed validation of data in DEV and PRE_PROD Insight environments (Bulletin 14 -04, Implementation of Additional Administrative Billings and Collections System (ABCO) in Insight) • August 5, 2014 - Distributed bulletin ADM 14 -02, Introducing Claims Inquiry Screens for Agency Use • August 14, 2014 - Conducted Work Group meeting to allow customers to compare new and old debt notices • August 29, 2014 - Completed CUAT verifying system changes as it relates to delinquency • September 9, 2014 - Conducted Work Group meeting to allow customers to discuss final changes to debt notices, existing versus modified process work sheets, and billing/delinquency workflow Current State Issues/Risk • Bill and collect salary overpayments while employees are in non-pay status • Debt Management Improvement Initiatives include new delinquency computations, revised salary overpayment bills, revised repayment agreements, and new reports to include elements modified in the ABCO data base • Continue Work Group meetings • Phase 2 requirements in progress • New procedures and notices sent to USDA OGC for review - Results of that review may drive additional modifications/enhancements National Finance Center - As of September 11, 2014 7

Debt Management Implementation Plan High-level Timeline Recent Accomplishments September 2014 • Modify delinquency routine to decrease due process to 120 day maximum in compliance with DATA Act standards (PL 113) • Submit delinquent debts of on-the-roll employees to Treasury Offset Program (TOP) and Fed. Debt (cross servicing) • Consolidate salary overpayment and debt notices • Create new missed and partial payment debt notices • Increase delinquent debt write-off amount from $10 to $25, the maximum amount allowable under TOP • Customize delinquency definition for Treasury requiring repayment agreement for all debts October 2014 • Begin to define scope and requirements for Phase 2 • July 25, 2014 - Completed validation of data in DEV and PRE_PROD Insight environments (Bulletin 14 -04, Implementation of Additional Administrative Billings and Collections System (ABCO) in Insight) • August 5, 2014 - Distributed bulletin ADM 14 -02, Introducing Claims Inquiry Screens for Agency Use • August 14, 2014 - Conducted Work Group meeting to allow customers to compare new and old debt notices • August 29, 2014 - Completed CUAT verifying system changes as it relates to delinquency • September 9, 2014 - Conducted Work Group meeting to allow customers to discuss final changes to debt notices, existing versus modified process work sheets, and billing/delinquency workflow Current State Issues/Risk • Bill and collect salary overpayments while employees are in non-pay status • Debt Management Improvement Initiatives include new delinquency computations, revised salary overpayment bills, revised repayment agreements, and new reports to include elements modified in the ABCO data base • Continue Work Group meetings • Phase 2 requirements in progress • New procedures and notices sent to USDA OGC for review - Results of that review may drive additional modifications/enhancements National Finance Center - As of September 11, 2014 7

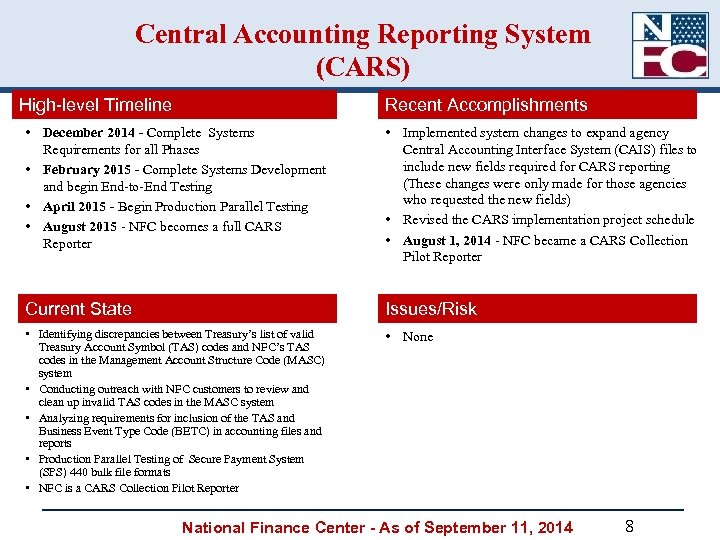

Central Accounting Reporting System (CARS) High-level Timeline Recent Accomplishments • December 2014 - Complete Systems Requirements for all Phases • February 2015 - Complete Systems Development and begin End-to-End Testing • April 2015 - Begin Production Parallel Testing • August 2015 - NFC becomes a full CARS Reporter • Implemented system changes to expand agency Central Accounting Interface System (CAIS) files to include new fields required for CARS reporting (These changes were only made for those agencies who requested the new fields) • Revised the CARS implementation project schedule • August 1, 2014 - NFC became a CARS Collection Pilot Reporter Current State Issues/Risk • Identifying discrepancies between Treasury’s list of valid Treasury Account Symbol (TAS) codes and NFC’s TAS codes in the Management Account Structure Code (MASC) system • Conducting outreach with NFC customers to review and clean up invalid TAS codes in the MASC system • Analyzing requirements for inclusion of the TAS and Business Event Type Code (BETC) in accounting files and reports • Production Parallel Testing of Secure Payment System (SPS) 440 bulk file formats • NFC is a CARS Collection Pilot Reporter • None National Finance Center - As of September 11, 2014 8

Central Accounting Reporting System (CARS) High-level Timeline Recent Accomplishments • December 2014 - Complete Systems Requirements for all Phases • February 2015 - Complete Systems Development and begin End-to-End Testing • April 2015 - Begin Production Parallel Testing • August 2015 - NFC becomes a full CARS Reporter • Implemented system changes to expand agency Central Accounting Interface System (CAIS) files to include new fields required for CARS reporting (These changes were only made for those agencies who requested the new fields) • Revised the CARS implementation project schedule • August 1, 2014 - NFC became a CARS Collection Pilot Reporter Current State Issues/Risk • Identifying discrepancies between Treasury’s list of valid Treasury Account Symbol (TAS) codes and NFC’s TAS codes in the Management Account Structure Code (MASC) system • Conducting outreach with NFC customers to review and clean up invalid TAS codes in the MASC system • Analyzing requirements for inclusion of the TAS and Business Event Type Code (BETC) in accounting files and reports • Production Parallel Testing of Secure Payment System (SPS) 440 bulk file formats • NFC is a CARS Collection Pilot Reporter • None National Finance Center - As of September 11, 2014 8

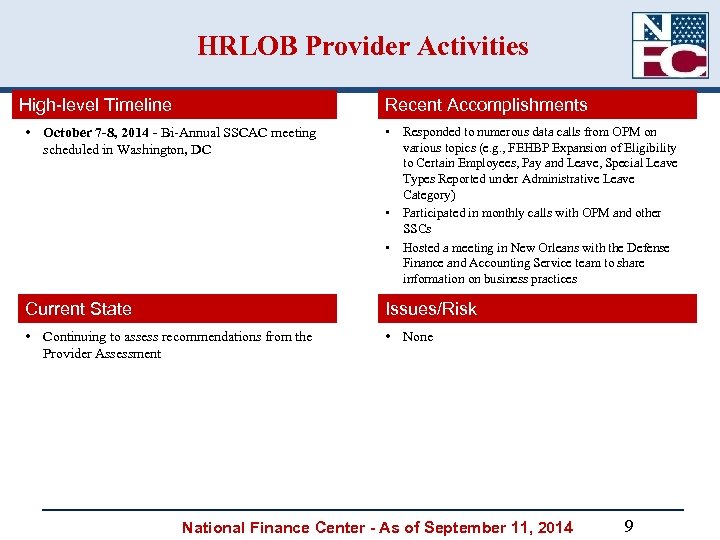

HRLOB Provider Activities High-level Timeline Recent Accomplishments • October 7 -8, 2014 - Bi-Annual SSCAC meeting scheduled in Washington, DC • Responded to numerous data calls from OPM on various topics (e. g. , FEHBP Expansion of Eligibility to Certain Employees, Pay and Leave, Special Leave Types Reported under Administrative Leave Category) • Participated in monthly calls with OPM and other SSCs • Hosted a meeting in New Orleans with the Defense Finance and Accounting Service team to share information on business practices Current State Issues/Risk • Continuing to assess recommendations from the Provider Assessment • None National Finance Center - As of September 11, 2014 9

HRLOB Provider Activities High-level Timeline Recent Accomplishments • October 7 -8, 2014 - Bi-Annual SSCAC meeting scheduled in Washington, DC • Responded to numerous data calls from OPM on various topics (e. g. , FEHBP Expansion of Eligibility to Certain Employees, Pay and Leave, Special Leave Types Reported under Administrative Leave Category) • Participated in monthly calls with OPM and other SSCs • Hosted a meeting in New Orleans with the Defense Finance and Accounting Service team to share information on business practices Current State Issues/Risk • Continuing to assess recommendations from the Provider Assessment • None National Finance Center - As of September 11, 2014 9

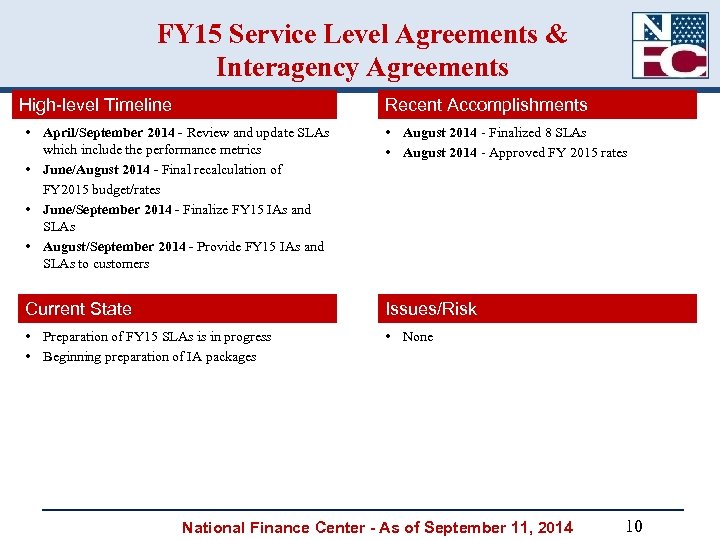

FY 15 Service Level Agreements & Interagency Agreements High-level Timeline Recent Accomplishments • April/September 2014 - Review and update SLAs which include the performance metrics • June/August 2014 - Final recalculation of FY 2015 budget/rates • June/September 2014 - Finalize FY 15 IAs and SLAs • August/September 2014 - Provide FY 15 IAs and SLAs to customers • August 2014 - Finalized 8 SLAs • August 2014 - Approved FY 2015 rates Current State Issues/Risk • Preparation of FY 15 SLAs is in progress • Beginning preparation of IA packages • None National Finance Center - As of September 11, 2014 10

FY 15 Service Level Agreements & Interagency Agreements High-level Timeline Recent Accomplishments • April/September 2014 - Review and update SLAs which include the performance metrics • June/August 2014 - Final recalculation of FY 2015 budget/rates • June/September 2014 - Finalize FY 15 IAs and SLAs • August/September 2014 - Provide FY 15 IAs and SLAs to customers • August 2014 - Finalized 8 SLAs • August 2014 - Approved FY 2015 rates Current State Issues/Risk • Preparation of FY 15 SLAs is in progress • Beginning preparation of IA packages • None National Finance Center - As of September 11, 2014 10

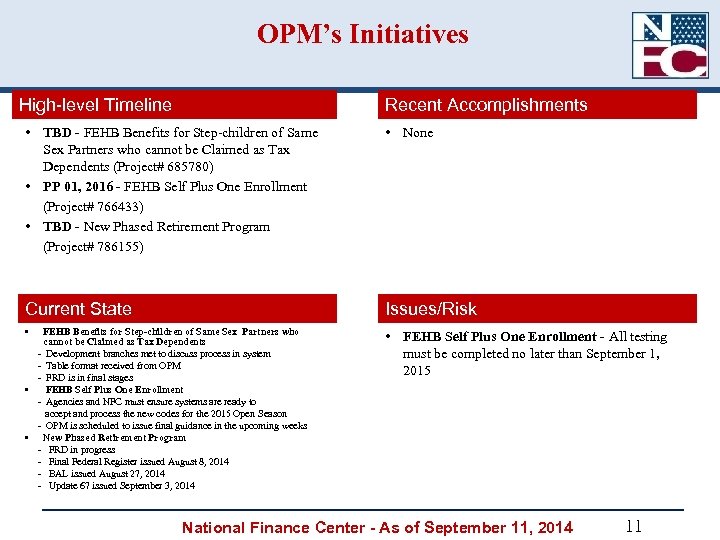

OPM’s Initiatives High-level Timeline Recent Accomplishments • TBD - FEHB Benefits for Step-children of Same Sex Partners who cannot be Claimed as Tax Dependents (Project# 685780) • PP 01, 2016 - FEHB Self Plus One Enrollment (Project# 766433) • TBD - New Phased Retirement Program (Project# 786155) • None Current State Issues/Risk • • FEHB Self Plus One Enrollment - All testing must be completed no later than September 1, 2015 FEHB Benefits for Step-children of Same Sex Partners who cannot be Claimed as Tax Dependents - Development branches met to discuss process in system - Table format received from OPM - FRD is in final stages • FEHB Self Plus One Enrollment - Agencies and NFC must ensure systems are ready to accept and process the new codes for the 2015 Open Season - OPM is scheduled to issue final guidance in the upcoming weeks • New Phased Retirement Program - FRD in progress - Final Federal Register issued August 8, 2014 - BAL issued August 27, 2014 - Update 67 issued September 3, 2014 National Finance Center - As of September 11, 2014 11

OPM’s Initiatives High-level Timeline Recent Accomplishments • TBD - FEHB Benefits for Step-children of Same Sex Partners who cannot be Claimed as Tax Dependents (Project# 685780) • PP 01, 2016 - FEHB Self Plus One Enrollment (Project# 766433) • TBD - New Phased Retirement Program (Project# 786155) • None Current State Issues/Risk • • FEHB Self Plus One Enrollment - All testing must be completed no later than September 1, 2015 FEHB Benefits for Step-children of Same Sex Partners who cannot be Claimed as Tax Dependents - Development branches met to discuss process in system - Table format received from OPM - FRD is in final stages • FEHB Self Plus One Enrollment - Agencies and NFC must ensure systems are ready to accept and process the new codes for the 2015 Open Season - OPM is scheduled to issue final guidance in the upcoming weeks • New Phased Retirement Program - FRD in progress - Final Federal Register issued August 8, 2014 - BAL issued August 27, 2014 - Update 67 issued September 3, 2014 National Finance Center - As of September 11, 2014 11

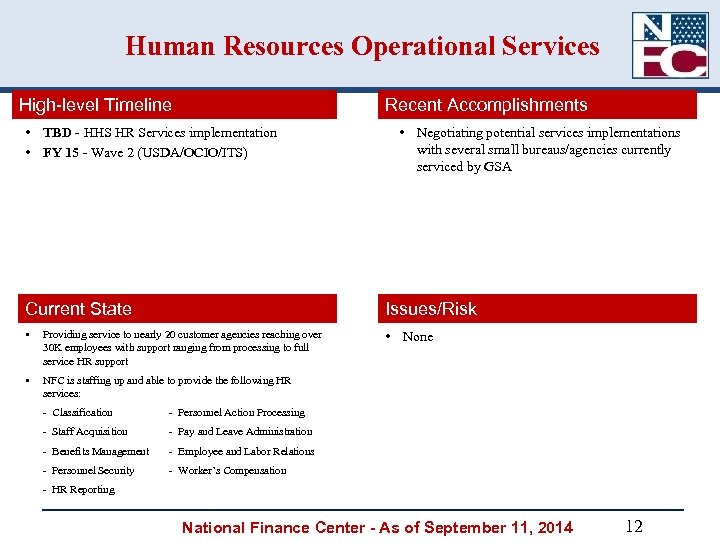

Human Resources Operational Services High-level Timeline Recent Accomplishments • TBD - HHS HR Services implementation • FY 15 - Wave 2 (USDA/OCIO/ITS) • Negotiating potential services implementations with several small bureaus/agencies currently serviced by GSA Current State Issues/Risk • Providing service to nearly 20 customer agencies reaching over 30 K employees with support ranging from processing to full service HR support • None • NFC is staffing up and able to provide the following HR services: - Classification - Personnel Action Processing - Staff Acquisition - Pay and Leave Administration - Benefits Management - Employee and Labor Relations - Personnel Security - Worker’s Compensation - HR Reporting National Finance Center - As of September 11, 2014 12

Human Resources Operational Services High-level Timeline Recent Accomplishments • TBD - HHS HR Services implementation • FY 15 - Wave 2 (USDA/OCIO/ITS) • Negotiating potential services implementations with several small bureaus/agencies currently serviced by GSA Current State Issues/Risk • Providing service to nearly 20 customer agencies reaching over 30 K employees with support ranging from processing to full service HR support • None • NFC is staffing up and able to provide the following HR services: - Classification - Personnel Action Processing - Staff Acquisition - Pay and Leave Administration - Benefits Management - Employee and Labor Relations - Personnel Security - Worker’s Compensation - HR Reporting National Finance Center - As of September 11, 2014 12

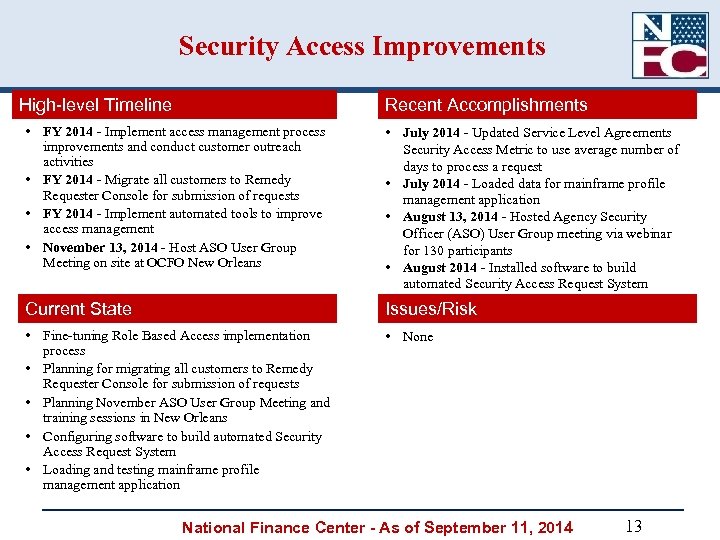

Security Access Improvements High-level Timeline Recent Accomplishments • FY 2014 - Implement access management process improvements and conduct customer outreach activities • FY 2014 - Migrate all customers to Remedy Requester Console for submission of requests • FY 2014 - Implement automated tools to improve access management • November 13, 2014 - Host ASO User Group Meeting on site at OCFO New Orleans • July 2014 - Updated Service Level Agreements Security Access Metric to use average number of days to process a request • July 2014 - Loaded data for mainframe profile management application • August 13, 2014 - Hosted Agency Security Officer (ASO) User Group meeting via webinar for 130 participants • August 2014 - Installed software to build automated Security Access Request System Current State Issues/Risk • Fine-tuning Role Based Access implementation process • Planning for migrating all customers to Remedy Requester Console for submission of requests • Planning November ASO User Group Meeting and training sessions in New Orleans • Configuring software to build automated Security Access Request System • Loading and testing mainframe profile management application • None National Finance Center - As of September 11, 2014 13

Security Access Improvements High-level Timeline Recent Accomplishments • FY 2014 - Implement access management process improvements and conduct customer outreach activities • FY 2014 - Migrate all customers to Remedy Requester Console for submission of requests • FY 2014 - Implement automated tools to improve access management • November 13, 2014 - Host ASO User Group Meeting on site at OCFO New Orleans • July 2014 - Updated Service Level Agreements Security Access Metric to use average number of days to process a request • July 2014 - Loaded data for mainframe profile management application • August 13, 2014 - Hosted Agency Security Officer (ASO) User Group meeting via webinar for 130 participants • August 2014 - Installed software to build automated Security Access Request System Current State Issues/Risk • Fine-tuning Role Based Access implementation process • Planning for migrating all customers to Remedy Requester Console for submission of requests • Planning November ASO User Group Meeting and training sessions in New Orleans • Configuring software to build automated Security Access Request System • Loading and testing mainframe profile management application • None National Finance Center - As of September 11, 2014 13

Other Updates • Annual Emergency T&A Letters - As of July, all agencies have submitted their emergency T&A letters • Charter - No agencies had any comments • Signature of Non-Disclosure Form - There are 5 agencies who have not signed and returned form 14

Other Updates • Annual Emergency T&A Letters - As of July, all agencies have submitted their emergency T&A letters • Charter - No agencies had any comments • Signature of Non-Disclosure Form - There are 5 agencies who have not signed and returned form 14

USDA, National Finance Center Customer Board Meeting September 11, 2014 Payroll/Personnel System (PPS) & web. TA Statistics

USDA, National Finance Center Customer Board Meeting September 11, 2014 Payroll/Personnel System (PPS) & web. TA Statistics

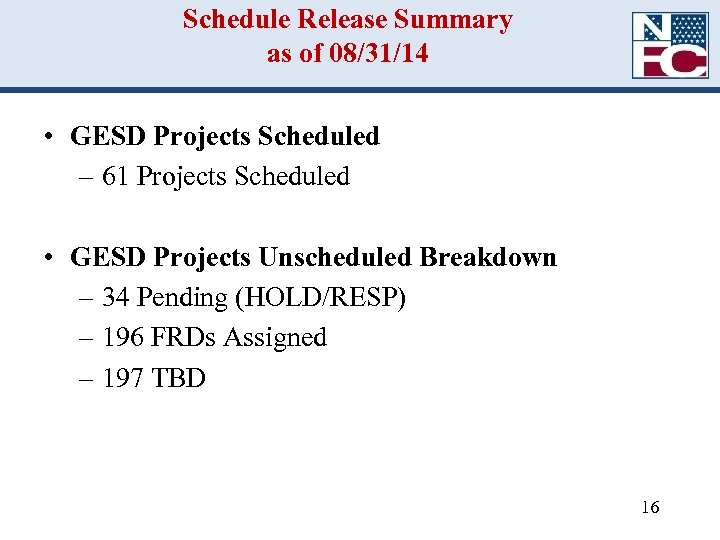

Schedule Release Summary as of 08/31/14 • GESD Projects Scheduled – 61 Projects Scheduled • GESD Projects Unscheduled Breakdown – 34 Pending (HOLD/RESP) – 196 FRDs Assigned – 197 TBD 16

Schedule Release Summary as of 08/31/14 • GESD Projects Scheduled – 61 Projects Scheduled • GESD Projects Unscheduled Breakdown – 34 Pending (HOLD/RESP) – 196 FRDs Assigned – 197 TBD 16

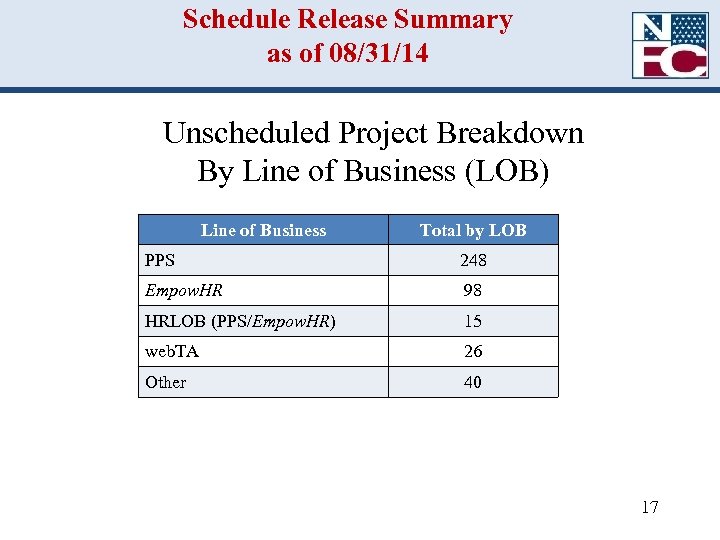

Schedule Release Summary as of 08/31/14 Unscheduled Project Breakdown By Line of Business (LOB) Line of Business Total by LOB PPS 248 Empow. HR 98 HRLOB (PPS/Empow. HR) 15 web. TA 26 Other 40 17

Schedule Release Summary as of 08/31/14 Unscheduled Project Breakdown By Line of Business (LOB) Line of Business Total by LOB PPS 248 Empow. HR 98 HRLOB (PPS/Empow. HR) 15 web. TA 26 Other 40 17

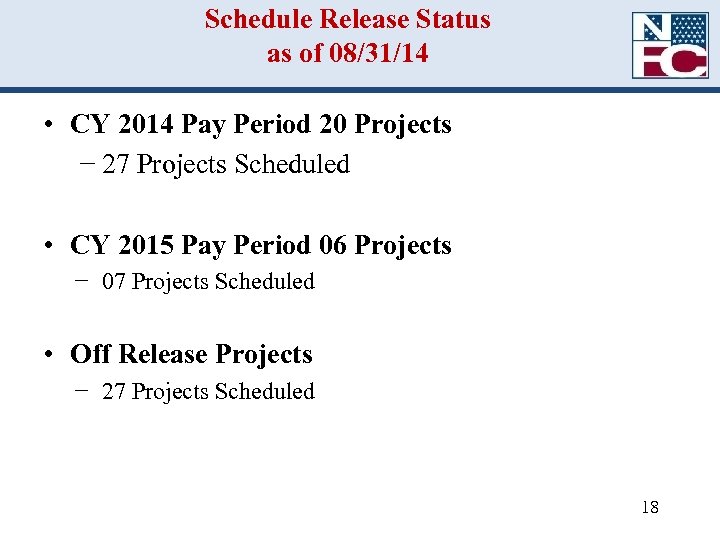

Schedule Release Status as of 08/31/14 • CY 2014 Pay Period 20 Projects − 27 Projects Scheduled • CY 2015 Pay Period 06 Projects − 07 Projects Scheduled • Off Release Projects − 27 Projects Scheduled 18

Schedule Release Status as of 08/31/14 • CY 2014 Pay Period 20 Projects − 27 Projects Scheduled • CY 2015 Pay Period 06 Projects − 07 Projects Scheduled • Off Release Projects − 27 Projects Scheduled 18

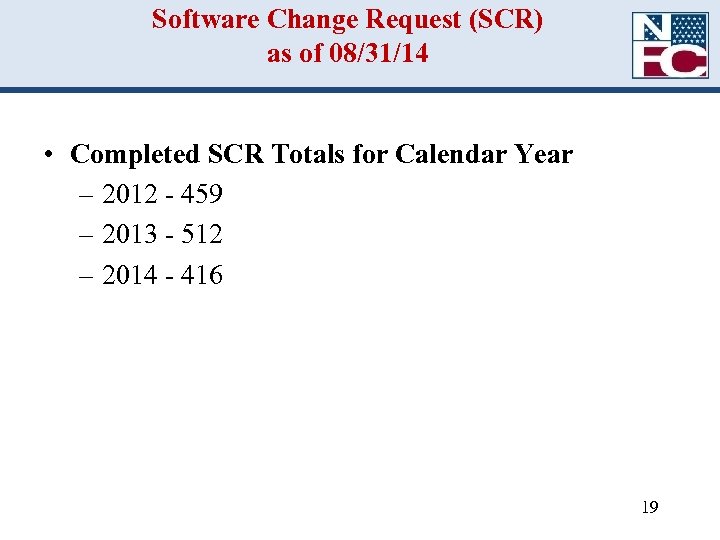

Software Change Request (SCR) as of 08/31/14 • Completed SCR Totals for Calendar Year – 2012 - 459 – 2013 - 512 – 2014 - 416 19

Software Change Request (SCR) as of 08/31/14 • Completed SCR Totals for Calendar Year – 2012 - 459 – 2013 - 512 – 2014 - 416 19

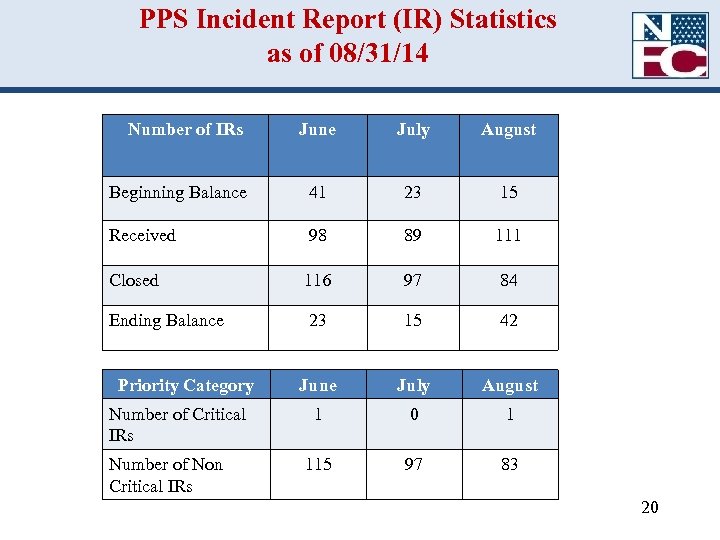

PPS Incident Report (IR) Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 41 23 15 Received 98 89 111 Closed 116 97 84 Ending Balance 23 15 42 June July August 1 0 1 115 97 83 Priority Category Number of Critical IRs Number of Non Critical IRs 20

PPS Incident Report (IR) Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 41 23 15 Received 98 89 111 Closed 116 97 84 Ending Balance 23 15 42 June July August 1 0 1 115 97 83 Priority Category Number of Critical IRs Number of Non Critical IRs 20

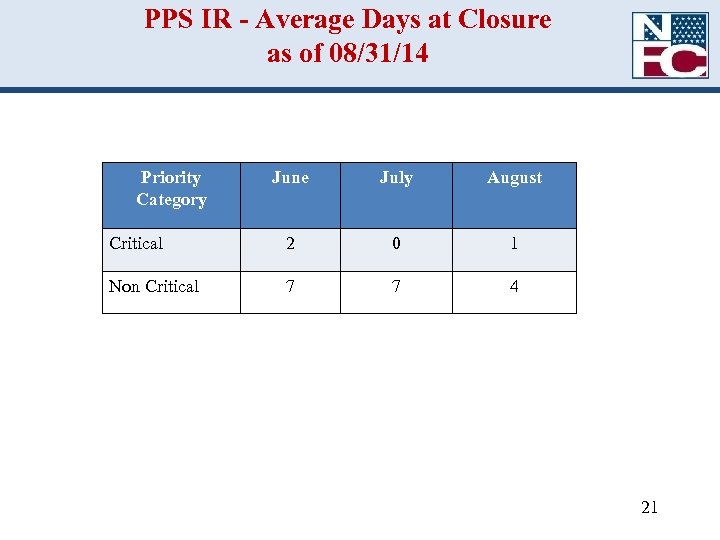

PPS IR - Average Days at Closure as of 08/31/14 Priority Category June July August Critical 2 0 1 Non Critical 7 7 4 21

PPS IR - Average Days at Closure as of 08/31/14 Priority Category June July August Critical 2 0 1 Non Critical 7 7 4 21

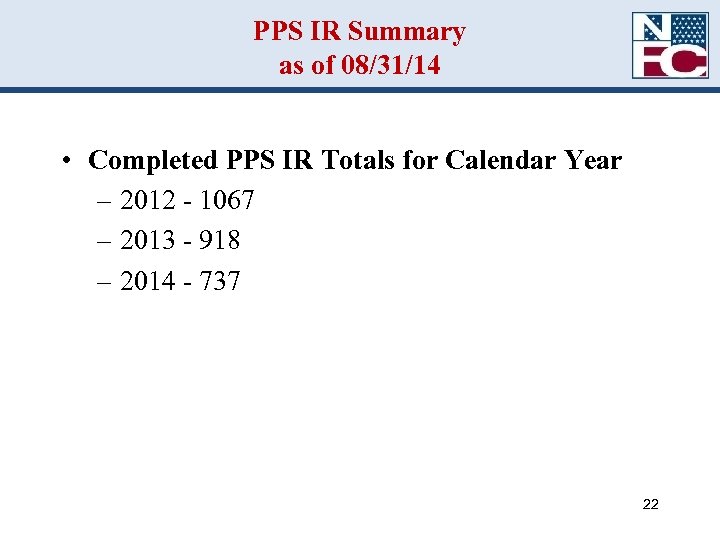

PPS IR Summary as of 08/31/14 • Completed PPS IR Totals for Calendar Year – 2012 - 1067 – 2013 - 918 – 2014 - 737 22

PPS IR Summary as of 08/31/14 • Completed PPS IR Totals for Calendar Year – 2012 - 1067 – 2013 - 918 – 2014 - 737 22

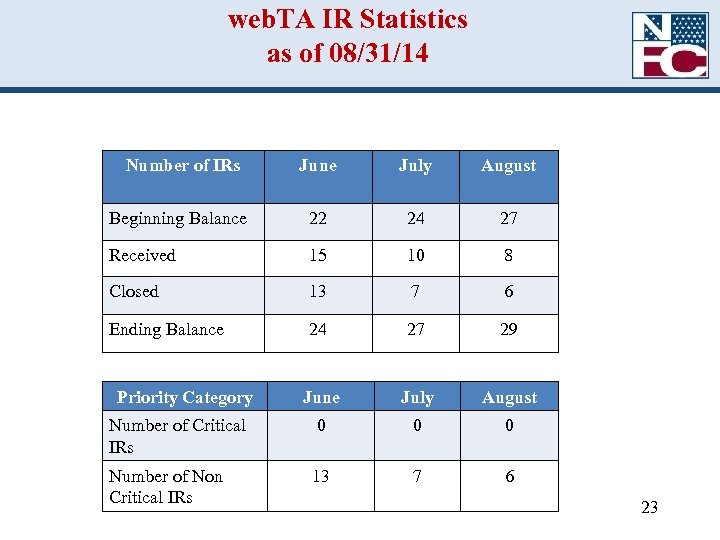

web. TA IR Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 22 24 27 Received 15 10 8 Closed 13 7 6 Ending Balance 24 27 29 June July August Number of Critical IRs 0 0 0 Number of Non Critical IRs 13 7 6 Priority Category 23

web. TA IR Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 22 24 27 Received 15 10 8 Closed 13 7 6 Ending Balance 24 27 29 June July August Number of Critical IRs 0 0 0 Number of Non Critical IRs 13 7 6 Priority Category 23

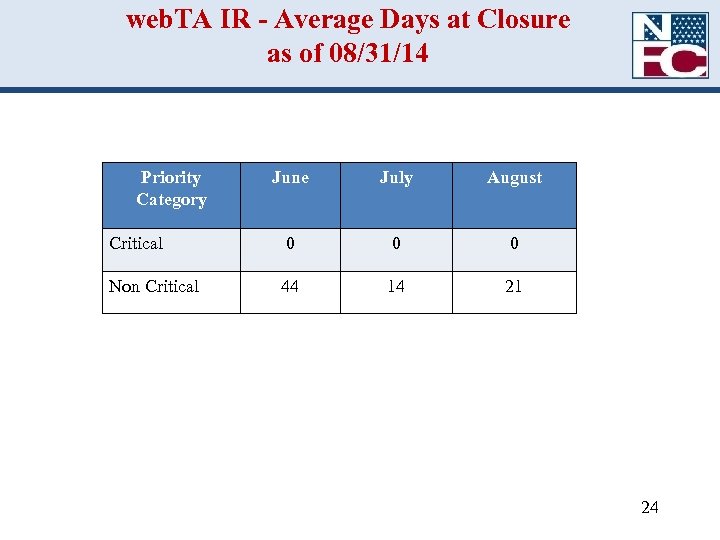

web. TA IR - Average Days at Closure as of 08/31/14 Priority Category June July August Critical 0 0 0 Non Critical 44 14 21 24

web. TA IR - Average Days at Closure as of 08/31/14 Priority Category June July August Critical 0 0 0 Non Critical 44 14 21 24

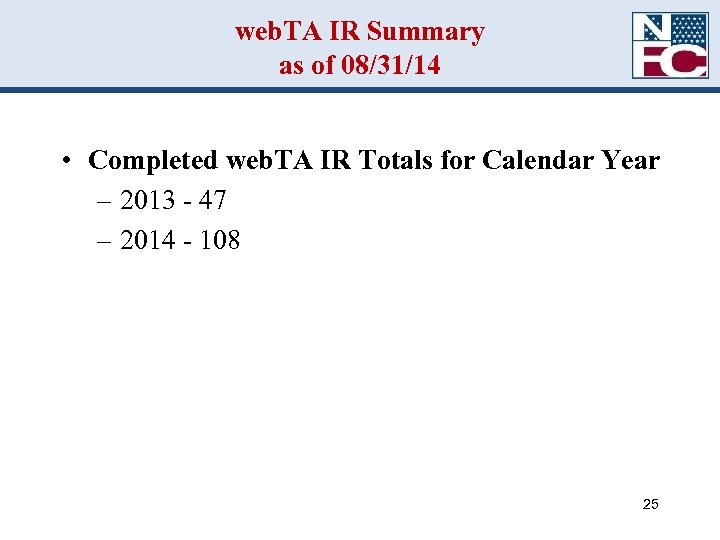

web. TA IR Summary as of 08/31/14 • Completed web. TA IR Totals for Calendar Year – 2013 - 47 – 2014 - 108 25

web. TA IR Summary as of 08/31/14 • Completed web. TA IR Totals for Calendar Year – 2013 - 47 – 2014 - 108 25

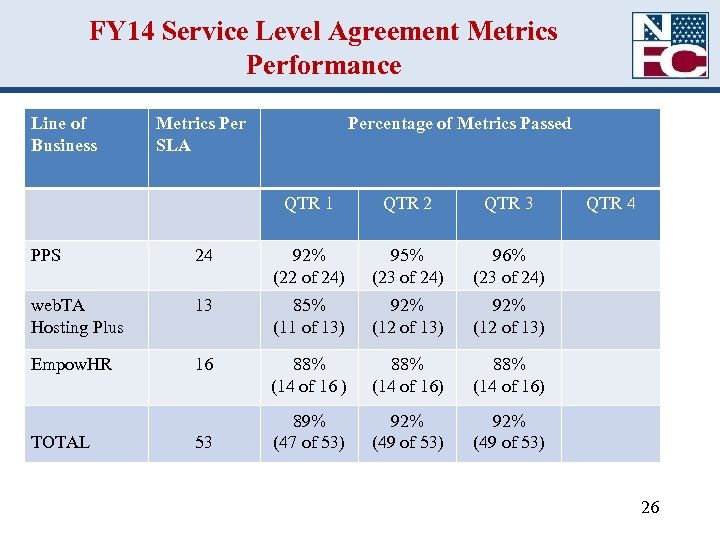

FY 14 Service Level Agreement Metrics Performance Line of Business Metrics Per SLA Percentage of Metrics Passed QTR 1 QTR 2 QTR 3 PPS 24 92% (22 of 24) 95% (23 of 24) 96% (23 of 24) web. TA Hosting Plus 13 85% (11 of 13) 92% (12 of 13) Empow. HR 16 88% (14 of 16 ) 88% (14 of 16) 89% (47 of 53) 92% (49 of 53) QTR 4 92% (49 of 53) TOTAL 53 26

FY 14 Service Level Agreement Metrics Performance Line of Business Metrics Per SLA Percentage of Metrics Passed QTR 1 QTR 2 QTR 3 PPS 24 92% (22 of 24) 95% (23 of 24) 96% (23 of 24) web. TA Hosting Plus 13 85% (11 of 13) 92% (12 of 13) Empow. HR 16 88% (14 of 16 ) 88% (14 of 16) 89% (47 of 53) 92% (49 of 53) QTR 4 92% (49 of 53) TOTAL 53 26

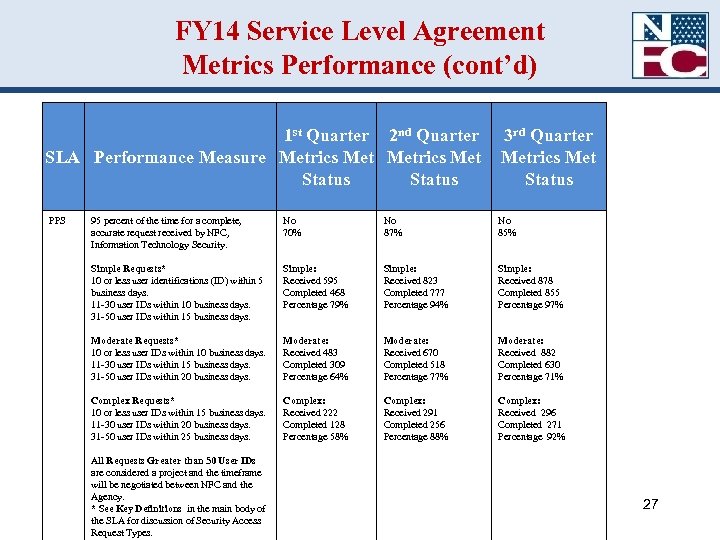

FY 14 Service Level Agreement Metrics Performance (cont’d) 1 st Quarter 2 nd Quarter SLA Performance Measure Metrics Met Status PPS 3 rd Quarter Metrics Met Status 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security. No 70% No 87% No 85% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 595 Completed 468 Percentage 79% Simple: Received 823 Completed 777 Percentage 94% Simple: Received 878 Completed 855 Percentage 97% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Moderate: Received 483 Completed 309 Percentage 64% Moderate: Received 670 Completed 518 Percentage 77% Moderate: Received 882 Completed 630 Percentage 71% Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. Complex: Received 222 Completed 128 Percentage 58% Complex: Received 291 Completed 256 Percentage 88% Complex: Received 296 Completed 271 Percentage 92% All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLA for discussion of Security Access Request Types. 27

FY 14 Service Level Agreement Metrics Performance (cont’d) 1 st Quarter 2 nd Quarter SLA Performance Measure Metrics Met Status PPS 3 rd Quarter Metrics Met Status 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security. No 70% No 87% No 85% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 595 Completed 468 Percentage 79% Simple: Received 823 Completed 777 Percentage 94% Simple: Received 878 Completed 855 Percentage 97% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Moderate: Received 483 Completed 309 Percentage 64% Moderate: Received 670 Completed 518 Percentage 77% Moderate: Received 882 Completed 630 Percentage 71% Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. Complex: Received 222 Completed 128 Percentage 58% Complex: Received 291 Completed 256 Percentage 88% Complex: Received 296 Completed 271 Percentage 92% All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLA for discussion of Security Access Request Types. 27

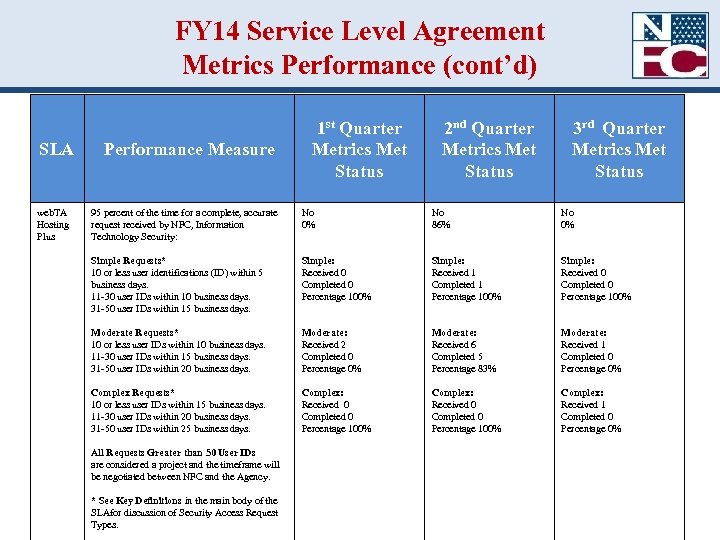

FY 14 Service Level Agreement Metrics Performance (cont’d) SLA web. TA Hosting Plus Performance Measure 1 st Quarter Metrics Met Status 2 nd Quarter Metrics Met Status 3 rd Quarter Metrics Met Status 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security: No 0% No 86% No 0% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 0 Completed 0 Percentage 100% Simple: Received 1 Completed 1 Percentage 100% Simple: Received 0 Completed 0 Percentage 100% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Moderate: Received 2 Completed 0 Percentage 0% Moderate: Received 6 Completed 5 Percentage 83% Moderate: Received 1 Completed 0 Percentage 0% Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. Complex: Received 0 Completed 0 Percentage 100% Complex: Received 1 Completed 0 Percentage 0% All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLAfor discussion of Security Access Request Types. 28

FY 14 Service Level Agreement Metrics Performance (cont’d) SLA web. TA Hosting Plus Performance Measure 1 st Quarter Metrics Met Status 2 nd Quarter Metrics Met Status 3 rd Quarter Metrics Met Status 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security: No 0% No 86% No 0% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 0 Completed 0 Percentage 100% Simple: Received 1 Completed 1 Percentage 100% Simple: Received 0 Completed 0 Percentage 100% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Moderate: Received 2 Completed 0 Percentage 0% Moderate: Received 6 Completed 5 Percentage 83% Moderate: Received 1 Completed 0 Percentage 0% Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. Complex: Received 0 Completed 0 Percentage 100% Complex: Received 1 Completed 0 Percentage 0% All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLAfor discussion of Security Access Request Types. 28

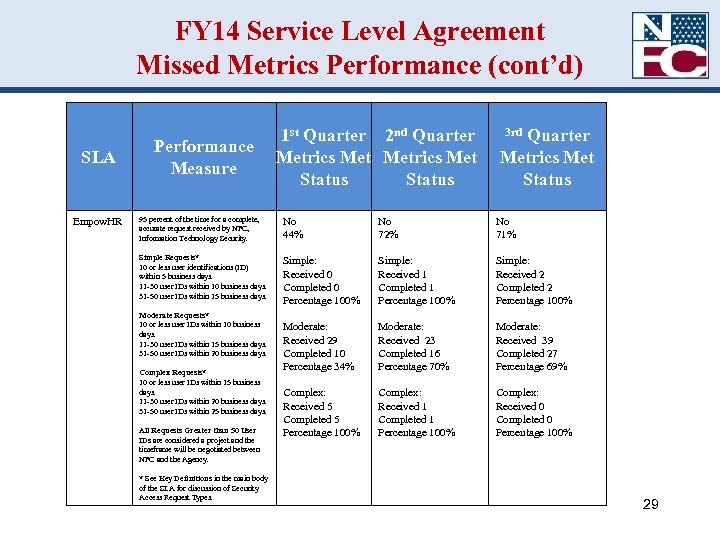

FY 14 Service Level Agreement Missed Metrics Performance (cont’d) SLA Empow. HR Performance Measure 1 st Quarter 2 nd Quarter Metrics Met Status 3 rd 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security. No 44% No 72% No 71% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 0 Completed 0 Percentage 100% Simple: Received 1 Completed 1 Percentage 100% Simple: Received 2 Completed 2 Percentage 100% Moderate: Received 29 Completed 10 Percentage 34% Moderate: Received 23 Completed 16 Percentage 70% Moderate: Received 39 Completed 27 Percentage 69% Complex: Received 5 Completed 5 Percentage 100% Complex: Received 1 Completed 1 Percentage 100% Complex: Received 0 Completed 0 Percentage 100% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLA for discussion of Security Access Request Types. 29

FY 14 Service Level Agreement Missed Metrics Performance (cont’d) SLA Empow. HR Performance Measure 1 st Quarter 2 nd Quarter Metrics Met Status 3 rd 95 percent of the time for a complete, accurate request received by NFC, Information Technology Security. No 44% No 72% No 71% Simple Requests* 10 or less user identifications (ID) within 5 business days. 11 -30 user IDs within 10 business days. 31 -50 user IDs within 15 business days. Simple: Received 0 Completed 0 Percentage 100% Simple: Received 1 Completed 1 Percentage 100% Simple: Received 2 Completed 2 Percentage 100% Moderate: Received 29 Completed 10 Percentage 34% Moderate: Received 23 Completed 16 Percentage 70% Moderate: Received 39 Completed 27 Percentage 69% Complex: Received 5 Completed 5 Percentage 100% Complex: Received 1 Completed 1 Percentage 100% Complex: Received 0 Completed 0 Percentage 100% Moderate Requests* 10 or less user IDs within 10 business days. 11 -30 user IDs within 15 business days. 31 -50 user IDs within 20 business days. Complex Requests* 10 or less user IDs within 15 business days. 11 -30 user IDs within 20 business days. 31 -50 user IDs within 25 business days. All Requests Greater than 50 User IDs are considered a project and the timeframe will be negotiated between NFC and the Agency. * See Key Definitions in the main body of the SLA for discussion of Security Access Request Types. 29

USDA, National Finance Center Customer Board Meeting September 11, 2014 New Business

USDA, National Finance Center Customer Board Meeting September 11, 2014 New Business

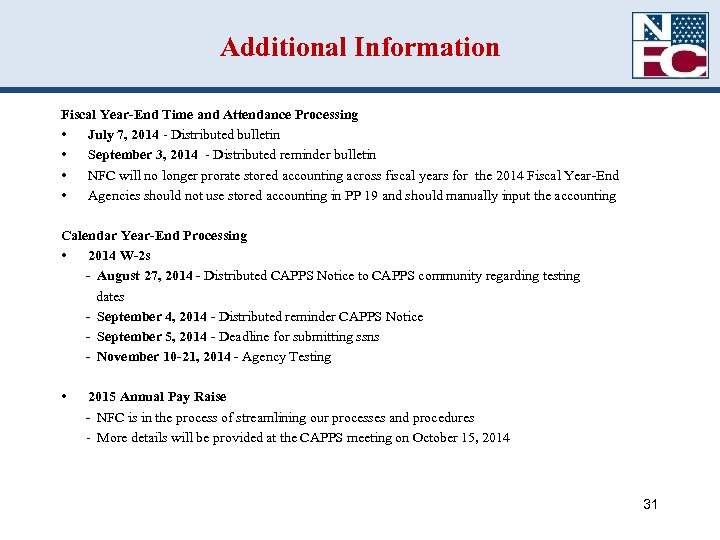

Additional Information Fiscal Year-End Time and Attendance Processing • July 7, 2014 - Distributed bulletin • September 3, 2014 - Distributed reminder bulletin • NFC will no longer prorate stored accounting across fiscal years for the 2014 Fiscal Year-End • Agencies should not use stored accounting in PP 19 and should manually input the accounting Calendar Year-End Processing • 2014 W-2 s - August 27, 2014 - Distributed CAPPS Notice to CAPPS community regarding testing dates - September 4, 2014 - Distributed reminder CAPPS Notice - September 5, 2014 - Deadline for submitting ssns - November 10 -21, 2014 - Agency Testing • 2015 Annual Pay Raise - NFC is in the process of streamlining our processes and procedures - More details will be provided at the CAPPS meeting on October 15, 2014 31

Additional Information Fiscal Year-End Time and Attendance Processing • July 7, 2014 - Distributed bulletin • September 3, 2014 - Distributed reminder bulletin • NFC will no longer prorate stored accounting across fiscal years for the 2014 Fiscal Year-End • Agencies should not use stored accounting in PP 19 and should manually input the accounting Calendar Year-End Processing • 2014 W-2 s - August 27, 2014 - Distributed CAPPS Notice to CAPPS community regarding testing dates - September 4, 2014 - Distributed reminder CAPPS Notice - September 5, 2014 - Deadline for submitting ssns - November 10 -21, 2014 - Agency Testing • 2015 Annual Pay Raise - NFC is in the process of streamlining our processes and procedures - More details will be provided at the CAPPS meeting on October 15, 2014 31

USDA, National Finance Center Customer Board Meeting September 11, 2014 Empow. HR

USDA, National Finance Center Customer Board Meeting September 11, 2014 Empow. HR

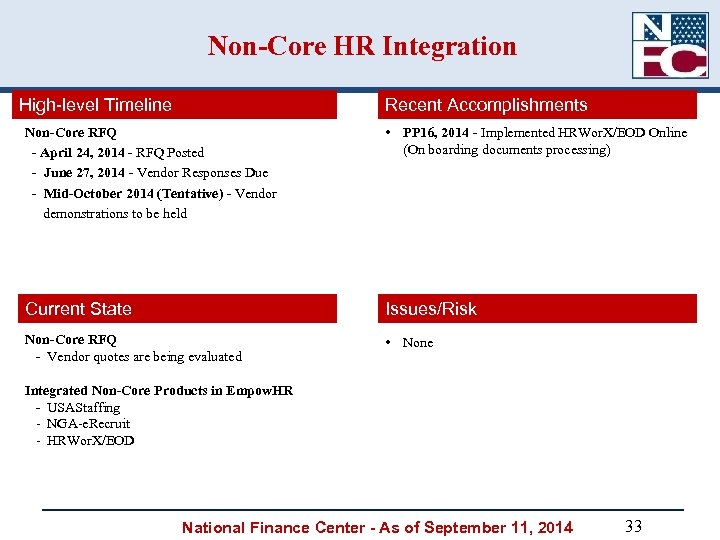

Non-Core HR Integration High-level Timeline Recent Accomplishments Non-Core RFQ - April 24, 2014 - RFQ Posted - June 27, 2014 - Vendor Responses Due - Mid-October 2014 (Tentative) - Vendor demonstrations to be held • PP 16, 2014 - Implemented HRWor. X/EOD Online (On boarding documents processing) Current State Issues/Risk Non-Core RFQ - Vendor quotes are being evaluated • None Integrated Non-Core Products in Empow. HR - USAStaffing - NGA-e. Recruit - HRWor. X/EOD National Finance Center - As of September 11, 2014 33

Non-Core HR Integration High-level Timeline Recent Accomplishments Non-Core RFQ - April 24, 2014 - RFQ Posted - June 27, 2014 - Vendor Responses Due - Mid-October 2014 (Tentative) - Vendor demonstrations to be held • PP 16, 2014 - Implemented HRWor. X/EOD Online (On boarding documents processing) Current State Issues/Risk Non-Core RFQ - Vendor quotes are being evaluated • None Integrated Non-Core Products in Empow. HR - USAStaffing - NGA-e. Recruit - HRWor. X/EOD National Finance Center - As of September 11, 2014 33

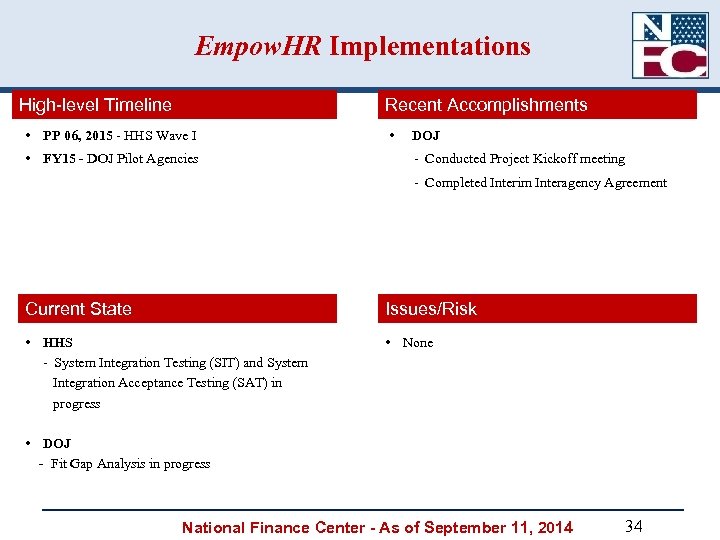

Empow. HR Implementations High-level Timeline Recent Accomplishments • PP 06, 2015 - HHS Wave I • FY 15 - DOJ Pilot Agencies • DOJ - Conducted Project Kickoff meeting - Completed Interim Interagency Agreement Current State Issues/Risk • HHS - System Integration Testing (SIT) and System Integration Acceptance Testing (SAT) in progress • None • DOJ - Fit Gap Analysis in progress National Finance Center - As of September 11, 2014 34

Empow. HR Implementations High-level Timeline Recent Accomplishments • PP 06, 2015 - HHS Wave I • FY 15 - DOJ Pilot Agencies • DOJ - Conducted Project Kickoff meeting - Completed Interim Interagency Agreement Current State Issues/Risk • HHS - System Integration Testing (SIT) and System Integration Acceptance Testing (SAT) in progress • None • DOJ - Fit Gap Analysis in progress National Finance Center - As of September 11, 2014 34

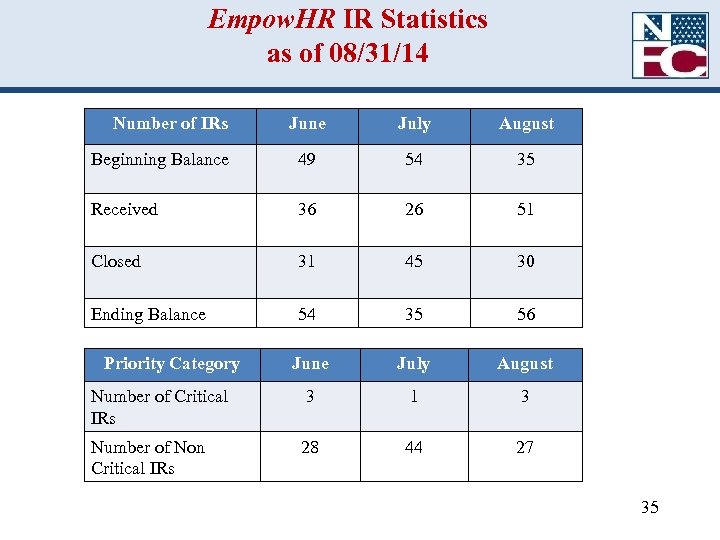

Empow. HR IR Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 49 54 35 Received 36 26 51 Closed 31 45 30 Ending Balance 54 35 56 June July August Number of Critical IRs 3 1 3 Number of Non Critical IRs 28 44 27 Priority Category 35

Empow. HR IR Statistics as of 08/31/14 Number of IRs June July August Beginning Balance 49 54 35 Received 36 26 51 Closed 31 45 30 Ending Balance 54 35 56 June July August Number of Critical IRs 3 1 3 Number of Non Critical IRs 28 44 27 Priority Category 35

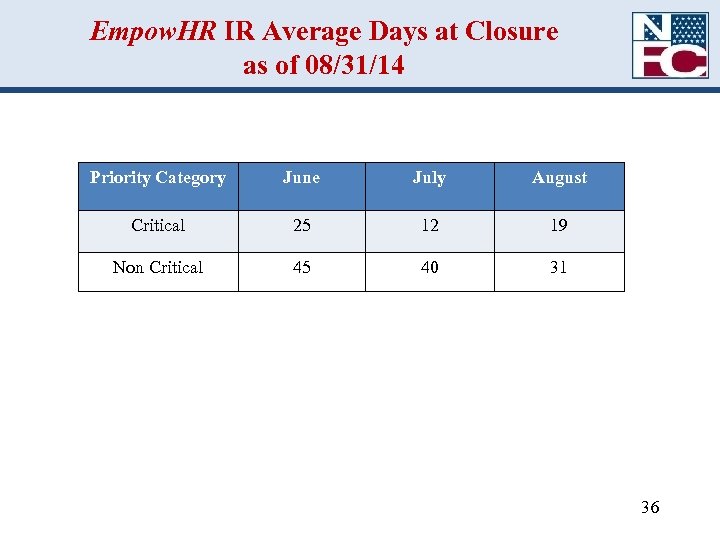

Empow. HR IR Average Days at Closure as of 08/31/14 Priority Category June July August Critical 25 12 19 Non Critical 45 40 31 36

Empow. HR IR Average Days at Closure as of 08/31/14 Priority Category June July August Critical 25 12 19 Non Critical 45 40 31 36

Empow. HR IR Summary as of 08/31/14 • Completed Empow. HR IR Totals for Calendar Year – 2012 - 222 – 2013 - 246 – 2014 - 300 37

Empow. HR IR Summary as of 08/31/14 • Completed Empow. HR IR Totals for Calendar Year – 2012 - 222 – 2013 - 246 – 2014 - 300 37