6468a5397fe5543312de074143a6d002.ppt

- Количество слайдов: 16

United Nations Public Service Award 2007 Category: “Improving Transparency, the Delivery of Services” for “Taxpayer Service” UN HQ Vienna June 2007

1975 -1990: The Lebanese war seriously damaged Lebanon's economic infrastructure. Immediately following the end of the war, there were extensive efforts to revive the economy and rebuild national infrastructure. The ability of the Ministry of Finance to deliver on its mandate was severely challenged. The strategy to face this challenge consisted of adopting a comprehensive and integrated reform program to re-haul its operations.

Lebanon is a centralized country: the power to levy taxes is held by the parliament Direct Taxes: §Income Tax -Personal Income Tax -Corporate Income Tax -DASS -Capital Gain §Built Property Tax §Inheritance Taxes established by laws are applied by the Tax Administration in the Ministry of Finance Indirect Taxes: §VAT §Stamp Duty §Excise §Others

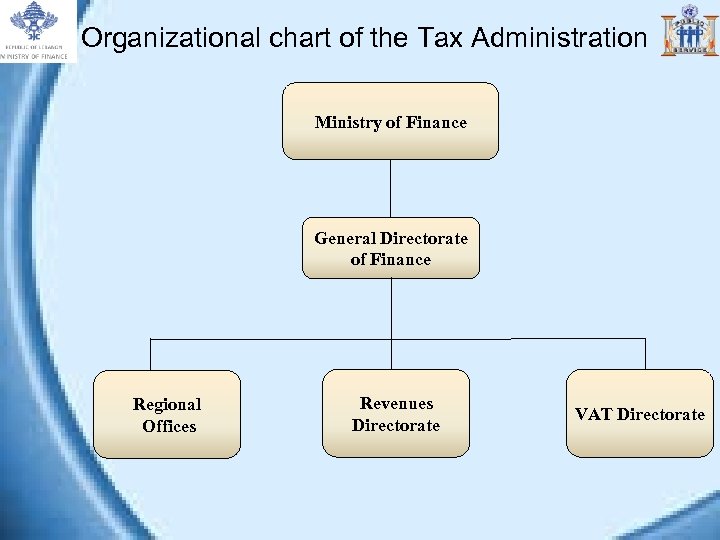

Organizational chart of the Tax Administration Ministry of Finance General Directorate of Finance Regional Offices Revenues Directorate VAT Directorate

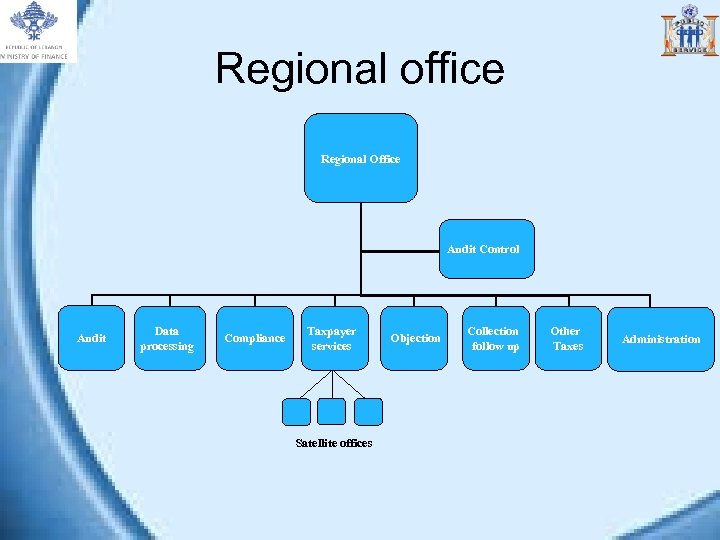

Regional office Regional Office Audit Control Audit Data processing Compliance Taxpayer services Satellite offices Objection Collection follow up Other Taxes Administration

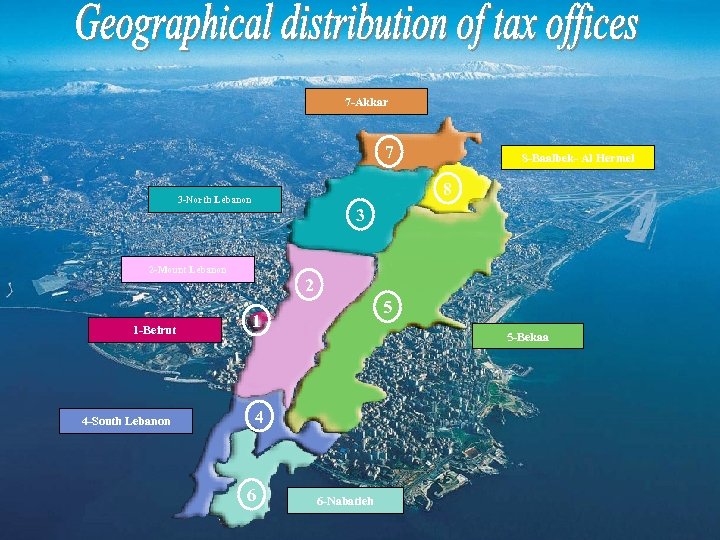

7 -Akkar 7 8 3 -North Lebanon 3 2 -Mount Lebanon 1 -Beirut 4 -South Lebanon 8 -Baalbek- Al Hermel 2 5 1 5 -Bekaa 4 6 6 -Nabatieh

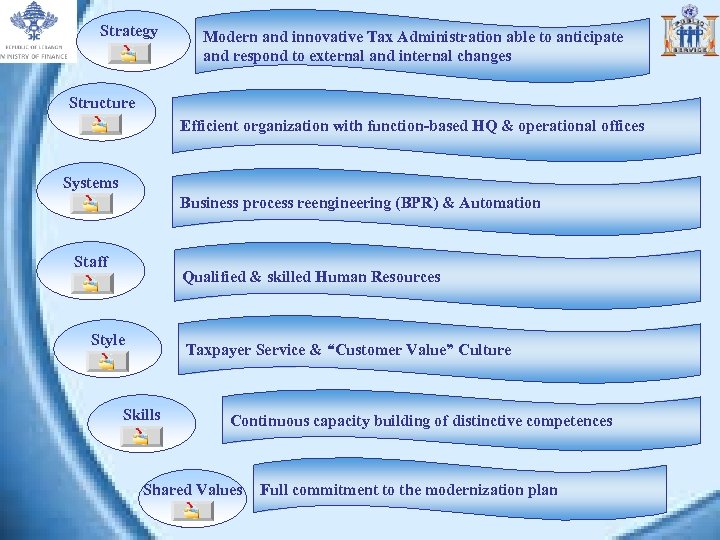

Tax Reform Program Strategy Systems Structure Shared values Staff Skills Style

Strategy Modern and innovative Tax Administration able to anticipate and respond to external and internal changes Structure Efficient organization with function-based HQ & operational offices Systems Business process reengineering (BPR) & Automation Staff Qualified & skilled Human Resources Style Taxpayer Service & “Customer Value” Culture Skills Continuous capacity building of distinctive competences Shared Values Full commitment to the modernization plan

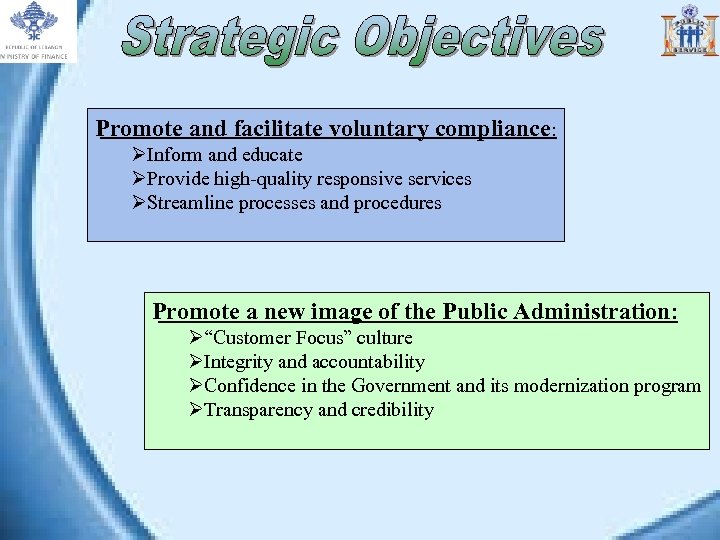

Promote and facilitate voluntary compliance: ØInform and educate ØProvide high-quality responsive services ØStreamline processes and procedures Promote a new image of the Public Administration: Ø“Customer Focus” culture ØIntegrity and accountability ØConfidence in the Government and its modernization program ØTransparency and credibility

Reengineering & modernization of the existing systems and processes Simplifying tax returns Simplifying tax laws for fair, equitable and transparent application Developing tax guides & other communication material informing taxpayers of their rights & obligations Continuous dissemination of information on new developments through media channels Improving staff skills and professionalism, enhancing the working environment and strengthening management controls Improving working tools for the fast and reliable delivery of services Minimizing the personal contact with taxpayers through the use of regular mail and electronic tools to process their operations and inquiries Creation of an exhaustive and user-friendly website constantly updated Developing a business continuity plan to ensure sustainability of operations in risk situations

Ø 2002: VAT Ø 2005: LTO Ø 2006: All Regions Ø 2007 -2008: Gradual implementation of Satellite offices (proximity counters)

Filing exclusively by mail Payment exclusively through banks Expansion of mail services enabling taxpayers to process their transactions by mail and receive the result at specified address Automated document tracking for taxpayers’ enquiries Introduction of e-services enabling taxpayers to file and process their tax transactions through the web Instant communication by e-mails with taxpayers Distribution of guides, bulletins, newsletters and brochures Specified due dates for all transactions Taxpayer Services Launching of a 24/7 call center to provide “around the clock” services for all taxpayers’ enquiries Continuous update and publishing of information on the website Delivery of conferences, seminars and workshops aimed at increasing taxpayers awareness and education

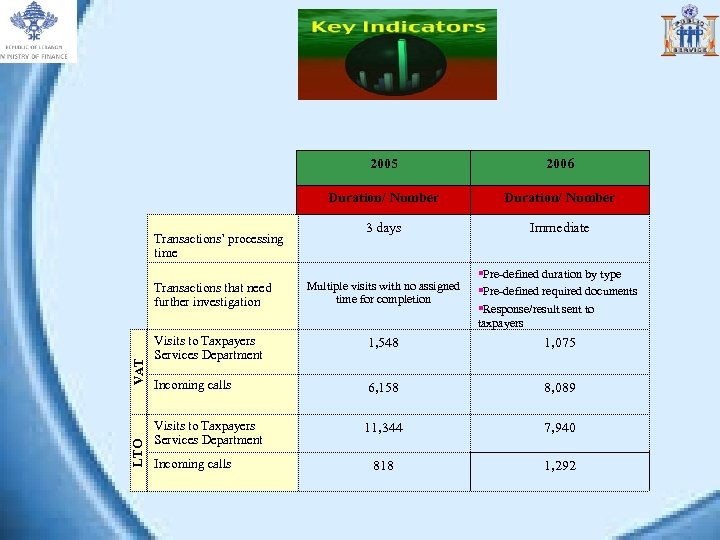

2005 2006 Duration/ Number 3 days Immediate Multiple visits with no assigned time for completion §Pre-defined duration by type §Pre-defined required documents §Response/result sent to taxpayers Visits to Taxpayers Services Department 1, 548 1, 075 Incoming calls 6, 158 8, 089 Visits to Taxpayers Services Department 11, 344 7, 940 818 1, 292 Transactions’ processing time LTO VAT Transactions that need further investigation Incoming calls

• Higher voluntary compliance rate • Reduced number of cases of disputes • Increased revenues collection • Updated taxpayer database

Thank You

6468a5397fe5543312de074143a6d002.ppt