United Arab Emirates T ax haven

nalogovaya_sistema_oae.ppt

- Размер: 48.5 Кб

- Автор: Феруз Розметов

- Количество слайдов: 7

Описание презентации United Arab Emirates T ax haven по слайдам

United Arab Emirates T ax haven

United Arab Emirates T ax haven

• Index of Economic Freedom • The American Heritage Foundation and The Wall Street Journal • In the category of «financial freedom» UAE gets 99. 9 points annually. • three basic quantitative factors: The maximum rate of tax on personal income The maximum rate of corporate income tax Total tax revenues k. A per cent of GDP).

• Index of Economic Freedom • The American Heritage Foundation and The Wall Street Journal • In the category of «financial freedom» UAE gets 99. 9 points annually. • three basic quantitative factors: The maximum rate of tax on personal income The maximum rate of corporate income tax Total tax revenues k. A per cent of GDP).

The country does not have: • VAT • tax personal income • tax capital gains • corporate tax • income tax • Income tax withheld from wages • and some other

The country does not have: • VAT • tax personal income • tax capital gains • corporate tax • income tax • Income tax withheld from wages • and some other

The emirates have different corporate tax system in different spheres of activity Thus, the entire oil industry and the banking sector and pay: • income tax • capital tax • corporate tax

The emirates have different corporate tax system in different spheres of activity Thus, the entire oil industry and the banking sector and pay: • income tax • capital tax • corporate tax

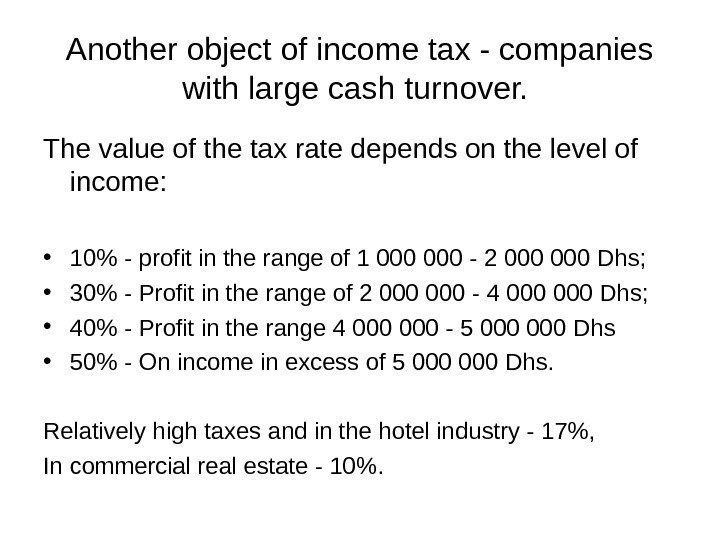

Another object of income tax — companies with large cash turnover. The value of the tax rate depends on the level of income: • 10% — profit in the range of 1 000 — 2 000 Dhs; • 30% — Profit in the range of 2 000 — 4 000 Dhs; • 40% — Profit in the range 4 000 — 5 000 Dhs • 50% — On income in excess of 5 000 Dhs. Relatively high taxes and in the hotel industry — 17%, In commercial real estate — 10%.

Another object of income tax — companies with large cash turnover. The value of the tax rate depends on the level of income: • 10% — profit in the range of 1 000 — 2 000 Dhs; • 30% — Profit in the range of 2 000 — 4 000 Dhs; • 40% — Profit in the range 4 000 — 5 000 Dhs • 50% — On income in excess of 5 000 Dhs. Relatively high taxes and in the hotel industry — 17%, In commercial real estate — 10%.

The UAE has a «circle 5%» — several tax is 5%. • Tax on Housing • Tax on hotels services • Tax on recreational activities

The UAE has a «circle 5%» — several tax is 5%. • Tax on Housing • Tax on hotels services • Tax on recreational activities

In the United Arab Emirates are more than ten free economic zones • Each free economic zone is regulated by a separate state agency that registers enterprises and gives them a license in the UAE. • enterprises registered in FEZ are exempt from corporate taxes for 15 years. • The law also provides the opportunity to extend the regime for a further term of 15 years. • Employees of companies are exempt from all taxes on personal income.

In the United Arab Emirates are more than ten free economic zones • Each free economic zone is regulated by a separate state agency that registers enterprises and gives them a license in the UAE. • enterprises registered in FEZ are exempt from corporate taxes for 15 years. • The law also provides the opportunity to extend the regime for a further term of 15 years. • Employees of companies are exempt from all taxes on personal income.