ee046930959ab66a906324d986b62681.ppt

- Количество слайдов: 11

unit. ZXchange™ brings you Unitized Managed Portfolios

unit. ZXchange™ • Gives plan sponsors the ability to offer customized 401(k) investment options to their employees • Employees can invest in top performing managed portfolios as alternatives to mutual funds • Ability to have same investment managers for defined benefit and defined contribution 401(k) plans • Control expense ratios for investment options to improve long term performance

unit. ZXchange™ Key system features • • • Ability to create unitized fund to trade in 401(k) plans like a mutual fund, using any investment manager or managed portfolio Ability to combine unitized funds into multiple manager funds or life style funds Secure, internet based system with automated processing and reporting

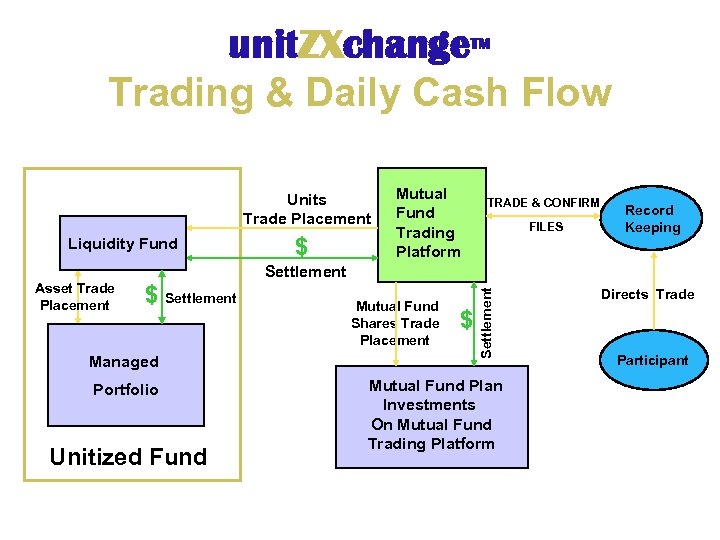

unit. ZXchange™ Trading & Daily Cash Flow Units Trade Placement Liquidity Fund TRADE & CONFIRM FILES Record Keeping Settlement $ Settlement Managed Portfolio Unitized Fund Mutual Fund Shares Trade Placement $ Settlement Asset Trade Placement $ Mutual Fund Trading Platform Mutual Fund Plan Investments On Mutual Fund Trading Platform Directs Trade Participant

unit. ZXchange™ System operation • User access • Internal user • External user • Audit user • Security procedures • Trading platform set up

unit. ZXchange™ System operation • Fund set up • Type – company stock, GIC, managed portfolios • Parent-child funds – sequential NAV calculations • Asset up • Asset types • Individual issues – equities or fixed income • Managed portfolios

unit. ZXchange™ System operation • Data input • FTP files or Manual alternative • Notice of file acceptance or rejection • Trade entries • Unit trades • Asset Trades • Price files

unit. ZXchange™ System operation • Daily NAV calculation • Trade date based processing • Automatically when requirements met • Automated reports • Trade price files • Processing completion • Settlement and cash flow reports

unit. ZXchange™ System operation • Client Statements • NAV Calculation • Statement - Automatic or select statement period • Internal Reports • Variance calculation • Proof calculation • Price differential reports

unit. ZXchange, Inc. facilitates internet based unitization and trading of unique assets. These assets can be offered in 401(k), 403(b), non-qualified and other individual account retirement plans. Larry Harris and Richard Deuber have over 15 years combined experience in unitizing assets including company stock, managed portfolios, managed separate accounts and group annuity contracts. unit. ZXchange’s staff have unitized assets in excess of $850 million with individual accounts ranging from $200 thousand to $100 million. unit. ZXchange works directly with portfolio managers, trustees, plan sponsors and investment advisors to provide a low cost investment alternative to mutual funds. Larry Harris (703)869 -2551 lharris@unitzxchange. com Richard Deuber (410)746 -6803 rdeuber@unitzxchange. com

Technology for the customized 401(k) plan

ee046930959ab66a906324d986b62681.ppt