4f2dd4ccb5c66a2c113583a537b75bb6.ppt

- Количество слайдов: 49

UNIT 7: Firm Costs, Revenues, and Profits

UNIT 7: Firm Costs, Revenues, and Profits

Key Topics 1. Cost concepts a. b. c. d. e. 2. Revenue concepts a. b. 3. Cash and Non Cash Variable and Fixed Total: TFC, TVC, TC Average: AFC, AVC, ATC, AVC & AP Marginal: MC, MC & MP Total Marginal Profit concepts a. b. Profit maximizing output Firm & market supply

Key Topics 1. Cost concepts a. b. c. d. e. 2. Revenue concepts a. b. 3. Cash and Non Cash Variable and Fixed Total: TFC, TVC, TC Average: AFC, AVC, ATC, AVC & AP Marginal: MC, MC & MP Total Marginal Profit concepts a. b. Profit maximizing output Firm & market supply

Key Topics - continued 4. SR production a. b. c. Profits in P, ATC graph Shut down condition (loss min. ) Firm & industry supply curves 5. LR production a. b. c. Isocost lines & LR cost min. (Ch. 6 Appendix) Returns to scale and LRAC Equilibrium

Key Topics - continued 4. SR production a. b. c. Profits in P, ATC graph Shut down condition (loss min. ) Firm & industry supply curves 5. LR production a. b. c. Isocost lines & LR cost min. (Ch. 6 Appendix) Returns to scale and LRAC Equilibrium

Profit Overview (recall) l Profit = TR – TC l TR depends on P of output, Q of output l TC depends on P of inputs, Q of inputs, productivity of inputs, production technology used

Profit Overview (recall) l Profit = TR – TC l TR depends on P of output, Q of output l TC depends on P of inputs, Q of inputs, productivity of inputs, production technology used

Recent Examples of Firm ‘Cost’ Concerns GM 1. Spent $5 billion to costs of producing Saturn cars Labor costs per car for GM were 2 x Toyota’s - United, Delta, & other airlines 2. - Southwest’s costs often 50% less Sears, K-Mart, Target 3. - Trying to compete with Walmart on basis of costs Georgia Pacific 4. - Started using ‘thinner’ saws Less saw dust 800 more rail cars of lumber per year

Recent Examples of Firm ‘Cost’ Concerns GM 1. Spent $5 billion to costs of producing Saturn cars Labor costs per car for GM were 2 x Toyota’s - United, Delta, & other airlines 2. - Southwest’s costs often 50% less Sears, K-Mart, Target 3. - Trying to compete with Walmart on basis of costs Georgia Pacific 4. - Started using ‘thinner’ saws Less saw dust 800 more rail cars of lumber per year

Cost Concepts l Cash and Non Cash l Fixed and Variable l Total, Average, and Marginal

Cost Concepts l Cash and Non Cash l Fixed and Variable l Total, Average, and Marginal

Opportunity Cost Examples Activity Opportunity Cost Operate own business Lost wages and interest Own and farm land Lost rent and interest Buy and operate equipment Lost interest and rent

Opportunity Cost Examples Activity Opportunity Cost Operate own business Lost wages and interest Own and farm land Lost rent and interest Buy and operate equipment Lost interest and rent

Total Fixed vs. Total Variable Costs TFC TVC TC = = = = = total fixed costs that have to be paid even if output = 0 costs that do NOT vary with changes in output ‘overhead’ and ‘sunk’ costs total variable costs that DO vary with changes in output 0 if output = 0 total costs TFC + TVC

Total Fixed vs. Total Variable Costs TFC TVC TC = = = = = total fixed costs that have to be paid even if output = 0 costs that do NOT vary with changes in output ‘overhead’ and ‘sunk’ costs total variable costs that DO vary with changes in output 0 if output = 0 total costs TFC + TVC

Average Costs AFC = = AVC = = ATC = = fixed costs per unit of output TFC/q variable costs per unit of output TVC/q total costs per unit of output TC/q = AFC + AVC

Average Costs AFC = = AVC = = ATC = = fixed costs per unit of output TFC/q variable costs per unit of output TVC/q total costs per unit of output TC/q = AFC + AVC

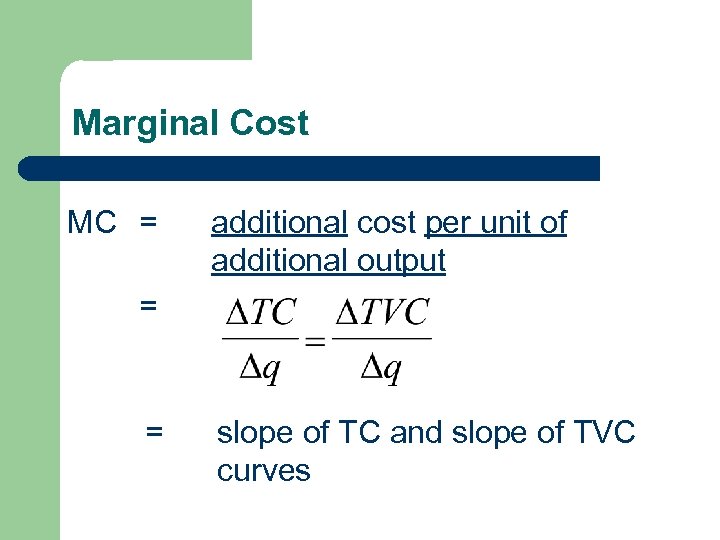

Marginal Cost MC = additional cost per unit of additional output = = slope of TC and slope of TVC curves

Marginal Cost MC = additional cost per unit of additional output = = slope of TC and slope of TVC curves

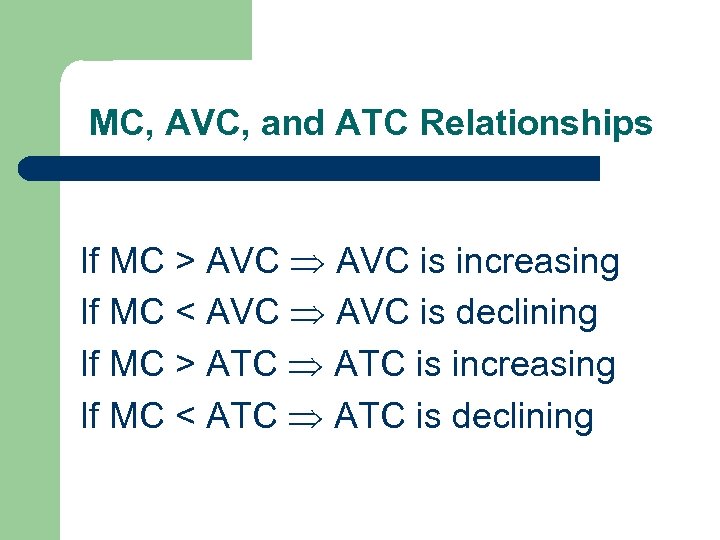

MC, AVC, and ATC Relationships If MC > AVC is increasing If MC < AVC is declining If MC > ATC is increasing If MC < ATC is declining

MC, AVC, and ATC Relationships If MC > AVC is increasing If MC < AVC is declining If MC > ATC is increasing If MC < ATC is declining

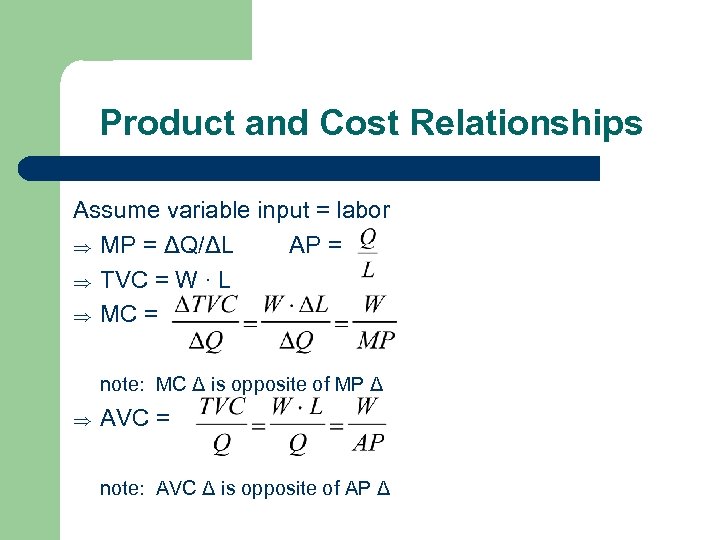

Product and Cost Relationships Assume variable input = labor MP = ΔQ/ΔL AP = TVC = W ∙ L MC = note: MC Δ is opposite of MP Δ AVC = note: AVC Δ is opposite of AP Δ

Product and Cost Relationships Assume variable input = labor MP = ΔQ/ΔL AP = TVC = W ∙ L MC = note: MC Δ is opposite of MP Δ AVC = note: AVC Δ is opposite of AP Δ

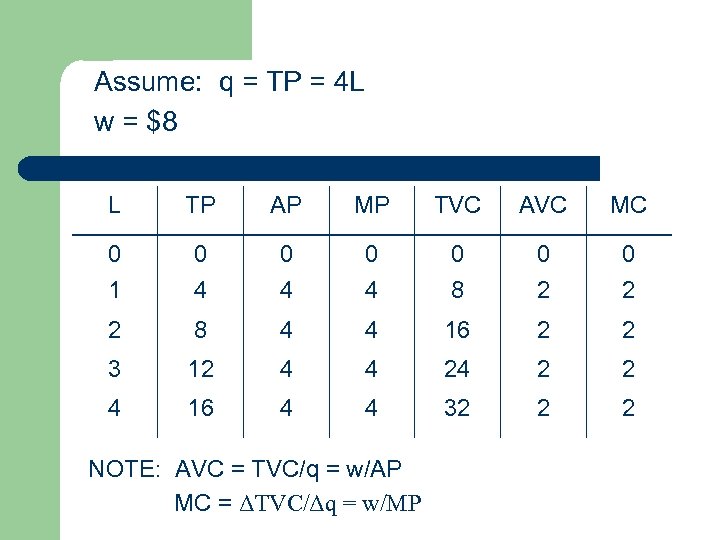

A ‘Janitor’ Production Example Assume the only variable input a janitorial service firm uses to clean offices is workers who are paid a wage, w, of $8 an hour. Each worker can clean four offices in an hour. Use math to determine the variable cost, the average variable cost, and the marginal cost of cleaning one more office.

A ‘Janitor’ Production Example Assume the only variable input a janitorial service firm uses to clean offices is workers who are paid a wage, w, of $8 an hour. Each worker can clean four offices in an hour. Use math to determine the variable cost, the average variable cost, and the marginal cost of cleaning one more office.

Assume: q = TP = 4 L w = $8 L TP AP MP TVC AVC MC 0 1 0 4 0 4 0 8 0 2 2 8 4 4 16 2 2 3 12 4 4 24 2 2 4 16 4 4 32 2 2 NOTE: AVC = TVC/q = w/AP MC = ΔTVC/Δq = w/MP

Assume: q = TP = 4 L w = $8 L TP AP MP TVC AVC MC 0 1 0 4 0 4 0 8 0 2 2 8 4 4 16 2 2 3 12 4 4 24 2 2 4 16 4 4 32 2 2 NOTE: AVC = TVC/q = w/AP MC = ΔTVC/Δq = w/MP

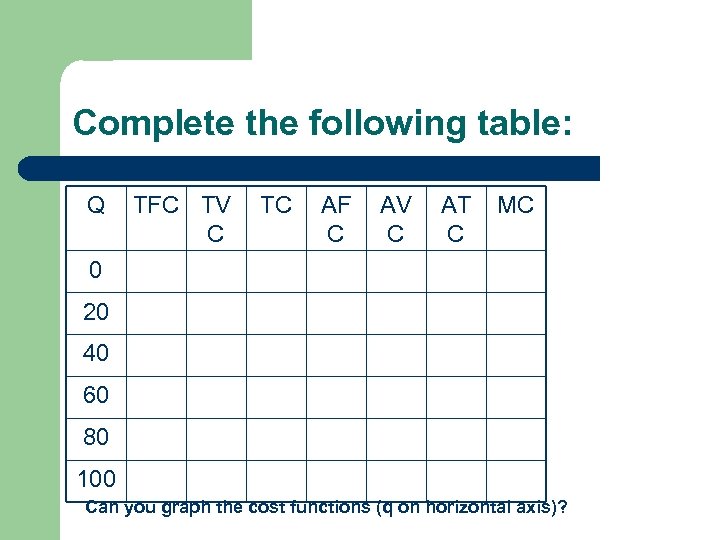

Another Cost of Production Example Assume a production process has the following costs: TFC = 120 TVC =. 1 q 2 MC =. 2 q

Another Cost of Production Example Assume a production process has the following costs: TFC = 120 TVC =. 1 q 2 MC =. 2 q

Complete the following table: Q TFC TV C TC AF C AV C AT C MC 0 20 40 60 80 100 Can you graph the cost functions (q on horizontal axis)?

Complete the following table: Q TFC TV C TC AF C AV C AT C MC 0 20 40 60 80 100 Can you graph the cost functions (q on horizontal axis)?

Total Costs of Production TFC = AFC x q = (fixed cost per unit of output) (units of output) TVC = AVC x q = (variable cost per unit of output) (units of output) TC = ATC x q = (total cost per unit of output) (units of output)

Total Costs of Production TFC = AFC x q = (fixed cost per unit of output) (units of output) TVC = AVC x q = (variable cost per unit of output) (units of output) TC = ATC x q = (total cost per unit of output) (units of output)

TFC in AFC graph AFC = TFC/q TFC = AFC x q $ AFC 1 TFC AFC q 1 q

TFC in AFC graph AFC = TFC/q TFC = AFC x q $ AFC 1 TFC AFC q 1 q

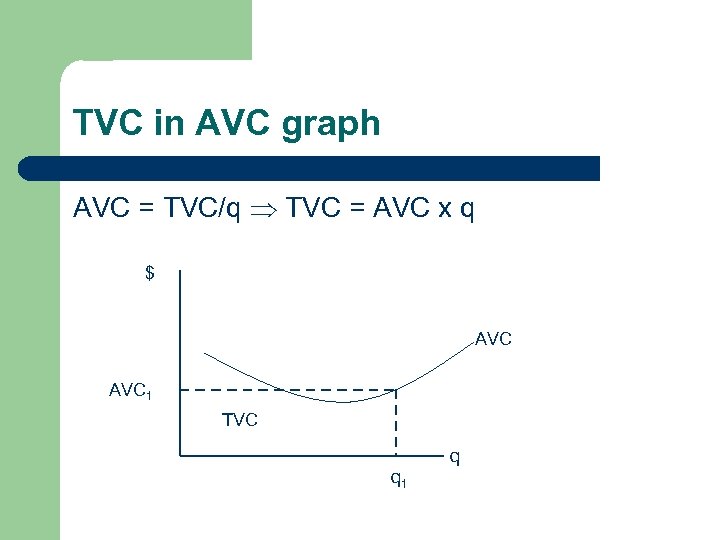

TVC in AVC graph AVC = TVC/q TVC = AVC x q $ AVC 1 TVC q q 1

TVC in AVC graph AVC = TVC/q TVC = AVC x q $ AVC 1 TVC q q 1

TC in ATC graph ATC = TC/q TC = ATC x q $ ATC 1 TC q q 1

TC in ATC graph ATC = TC/q TC = ATC x q $ ATC 1 TC q q 1

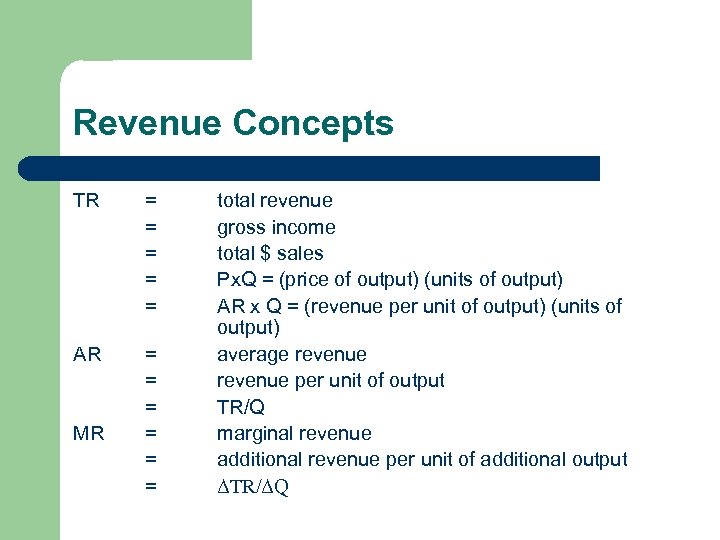

Revenue Concepts TR = = = AR = = = MR total revenue gross income total $ sales Px. Q = (price of output) (units of output) AR x Q = (revenue per unit of output) (units of output) average revenue per unit of output TR/Q marginal revenue additional revenue per unit of additional output ΔTR/ΔQ

Revenue Concepts TR = = = AR = = = MR total revenue gross income total $ sales Px. Q = (price of output) (units of output) AR x Q = (revenue per unit of output) (units of output) average revenue per unit of output TR/Q marginal revenue additional revenue per unit of additional output ΔTR/ΔQ

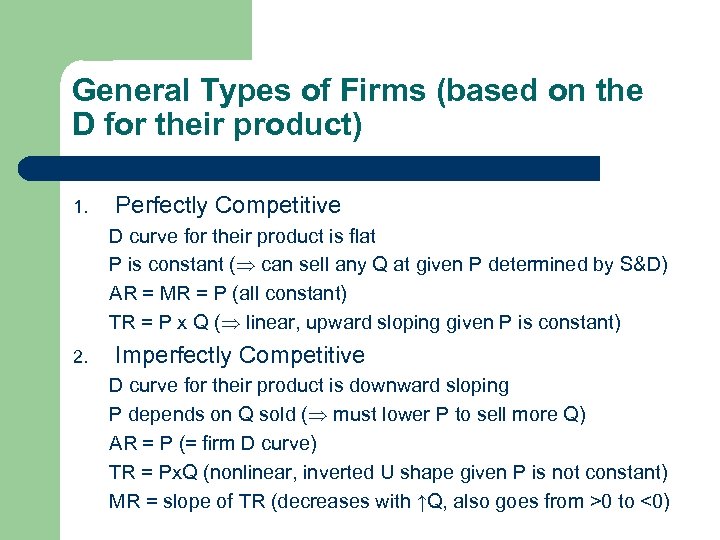

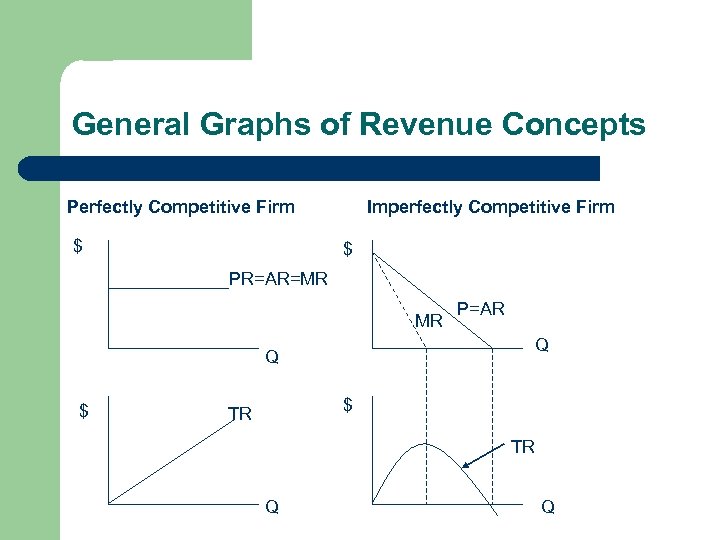

General Types of Firms (based on the D for their product) 1. Perfectly Competitive D curve for their product is flat P is constant ( can sell any Q at given P determined by S&D) AR = MR = P (all constant) TR = P x Q ( linear, upward sloping given P is constant) 2. Imperfectly Competitive D curve for their product is downward sloping P depends on Q sold ( must lower P to sell more Q) AR = P (= firm D curve) TR = Px. Q (nonlinear, inverted U shape given P is not constant) MR = slope of TR (decreases with ↑Q, also goes from >0 to <0)

General Types of Firms (based on the D for their product) 1. Perfectly Competitive D curve for their product is flat P is constant ( can sell any Q at given P determined by S&D) AR = MR = P (all constant) TR = P x Q ( linear, upward sloping given P is constant) 2. Imperfectly Competitive D curve for their product is downward sloping P depends on Q sold ( must lower P to sell more Q) AR = P (= firm D curve) TR = Px. Q (nonlinear, inverted U shape given P is not constant) MR = slope of TR (decreases with ↑Q, also goes from >0 to <0)

General Graphs of Revenue Concepts Perfectly Competitive Firm $ Imperfectly Competitive Firm $ PR=AR=MR MR P=AR Q Q $ $ TR TR Q Q

General Graphs of Revenue Concepts Perfectly Competitive Firm $ Imperfectly Competitive Firm $ PR=AR=MR MR P=AR Q Q $ $ TR TR Q Q

Specific Firm Revenue Examples Perfectly Competitive Firm Imperfectly Competitive Firm P = AR = 10 P = AR = 44 – Q TR = PQ = 10 Q TR = PQ = 44 Q – Q 2 MR = 10 MR = 44 – 2 Q

Specific Firm Revenue Examples Perfectly Competitive Firm Imperfectly Competitive Firm P = AR = 10 P = AR = 44 – Q TR = PQ = 10 Q TR = PQ = 44 Q – Q 2 MR = 10 MR = 44 – 2 Q

TR in P graph (competitive firm) TR = P x q $ P P TR q 1 q

TR in P graph (competitive firm) TR = P x q $ P P TR q 1 q

Revenue-Cost Concepts Profit = TR – TC Operating profit = TR - TVC

Revenue-Cost Concepts Profit = TR – TC Operating profit = TR - TVC

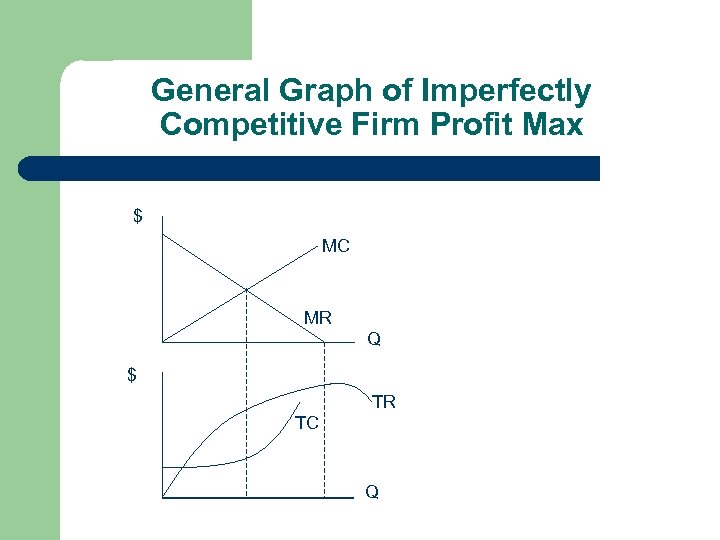

Comparing Costs and Revenues to Maximize Profit l l l The profit-maximizing level of output for all firms is the output level where MR = MC. In perfect competition, MR = P, therefore, the firm will produce up to the point where the price of its output is just equal to short-run marginal cost. The key idea here is that firms will produce as long as marginal revenue exceeds marginal cost.

Comparing Costs and Revenues to Maximize Profit l l l The profit-maximizing level of output for all firms is the output level where MR = MC. In perfect competition, MR = P, therefore, the firm will produce up to the point where the price of its output is just equal to short-run marginal cost. The key idea here is that firms will produce as long as marginal revenue exceeds marginal cost.

General Graph of Perfectly Competitive Firm Profit Max $ MC MR Q $ TR TC Q

General Graph of Perfectly Competitive Firm Profit Max $ MC MR Q $ TR TC Q

Perfectly Competitive Firm Profit Max (Example) P = MR = 10 MC =. 2 Q TR = 10 Q TC = 120 +. 1 Q 2 Π Max Q MR = MC 10 =. 2 Q Q = 50 Max π = = TR-TC (at Q = 50) 10(50) – [120 +. 1(50)2] 500 – 120 – 250 130

Perfectly Competitive Firm Profit Max (Example) P = MR = 10 MC =. 2 Q TR = 10 Q TC = 120 +. 1 Q 2 Π Max Q MR = MC 10 =. 2 Q Q = 50 Max π = = TR-TC (at Q = 50) 10(50) – [120 +. 1(50)2] 500 – 120 – 250 130

General Graph of Imperfectly Competitive Firm Profit Max $ MC MR Q $ TR TC Q

General Graph of Imperfectly Competitive Firm Profit Max $ MC MR Q $ TR TC Q

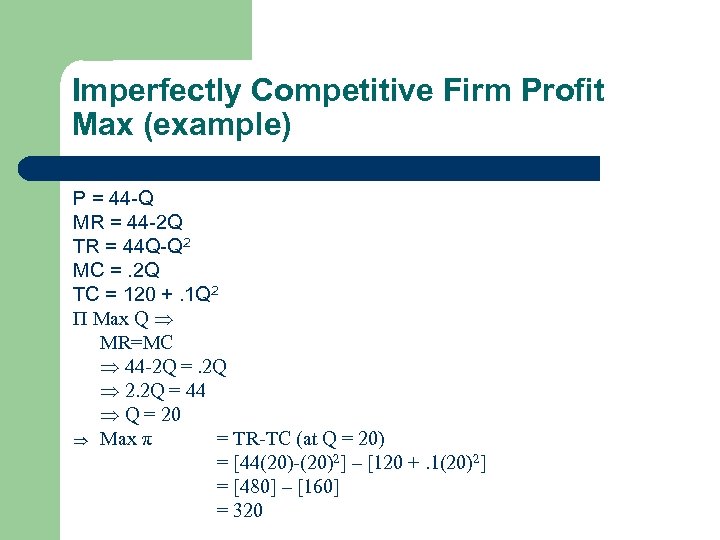

Imperfectly Competitive Firm Profit Max (example) P = 44 -Q MR = 44 -2 Q TR = 44 Q-Q 2 MC =. 2 Q TC = 120 +. 1 Q 2 Π Max Q MR=MC 44 -2 Q =. 2 Q 2. 2 Q = 44 Q = 20 Max π = TR-TC (at Q = 20) = [44(20)-(20)2] – [120 +. 1(20)2] = [480] – [160] = 320

Imperfectly Competitive Firm Profit Max (example) P = 44 -Q MR = 44 -2 Q TR = 44 Q-Q 2 MC =. 2 Q TC = 120 +. 1 Q 2 Π Max Q MR=MC 44 -2 Q =. 2 Q 2. 2 Q = 44 Q = 20 Max π = TR-TC (at Q = 20) = [44(20)-(20)2] – [120 +. 1(20)2] = [480] – [160] = 320

Fixed Costs and Profit Max Q. True or False? Fixed costs do not affect the profitmaximizing level of output? A. True. Only, marginal costs (changes in variable costs) determine profit-maximizing level of output. Recall, profit-max output rule is to produce where MR = MC.

Fixed Costs and Profit Max Q. True or False? Fixed costs do not affect the profitmaximizing level of output? A. True. Only, marginal costs (changes in variable costs) determine profit-maximizing level of output. Recall, profit-max output rule is to produce where MR = MC.

Q. Should a firm ‘shut down’ in SR? A. Profit if ‘produce’ = TR – TVC – TFC Profit if ‘don’t produce’ or ‘shut down’ = -TFC Shut down if TR – TVC – TFC < -TFC TR – TVC < 0 TR < TVC

Q. Should a firm ‘shut down’ in SR? A. Profit if ‘produce’ = TR – TVC – TFC Profit if ‘don’t produce’ or ‘shut down’ = -TFC Shut down if TR – TVC – TFC < -TFC TR – TVC < 0 TR < TVC

Perfectly Competitive Firm & Market Supply Firm S = Market S = MC curve above AVC (P=MR) > AVC sum of individual firm supplies

Perfectly Competitive Firm & Market Supply Firm S = Market S = MC curve above AVC (P=MR) > AVC sum of individual firm supplies

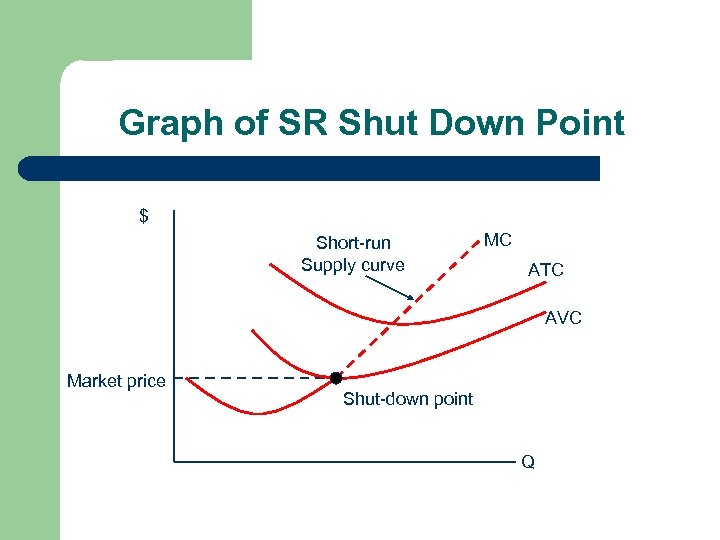

Graph of SR Shut Down Point $ Short-run Supply curve MC ATC AVC Market price Shut-down point Q

Graph of SR Shut Down Point $ Short-run Supply curve MC ATC AVC Market price Shut-down point Q

SR Profit Scenarios 1. 2. 3. Produce, π > 0 Produce, π < 0 (loss less than – TFC) Don’t produce, π = -TFC

SR Profit Scenarios 1. 2. 3. Produce, π > 0 Produce, π < 0 (loss less than – TFC) Don’t produce, π = -TFC

SR vs LR Production if q = f(K, L) SR: K is fixed only decision is q which determines L LR: K is NOT fixed decisions = 1) q and 2) what combination of K & L to use to produce q Recall, π = TR – TC to max π of producing given q, need to min. TC

SR vs LR Production if q = f(K, L) SR: K is fixed only decision is q which determines L LR: K is NOT fixed decisions = 1) q and 2) what combination of K & L to use to produce q Recall, π = TR – TC to max π of producing given q, need to min. TC

Budget Line = maximum combinations of 2 goods that can be bought given one’s income = combinations of 2 goods whose cost equals one’s income

Budget Line = maximum combinations of 2 goods that can be bought given one’s income = combinations of 2 goods whose cost equals one’s income

Isocost Line = maximum combinations of 2 inputs that can be purchased given a production ‘budget’ (cost level) = combinations of 2 inputs that are equal in cost

Isocost Line = maximum combinations of 2 inputs that can be purchased given a production ‘budget’ (cost level) = combinations of 2 inputs that are equal in cost

Isocost Line Equation TC 1 = r. K = r. K + w. L TC 1 – w. L TC 1/r – w/r L Note: ¯slope = ‘inverse’ input price ratio = ΔK / ΔL = rate at which capital can be exchanged for 1 unit of labor, while holding costs constant

Isocost Line Equation TC 1 = r. K = r. K + w. L TC 1 – w. L TC 1/r – w/r L Note: ¯slope = ‘inverse’ input price ratio = ΔK / ΔL = rate at which capital can be exchanged for 1 unit of labor, while holding costs constant

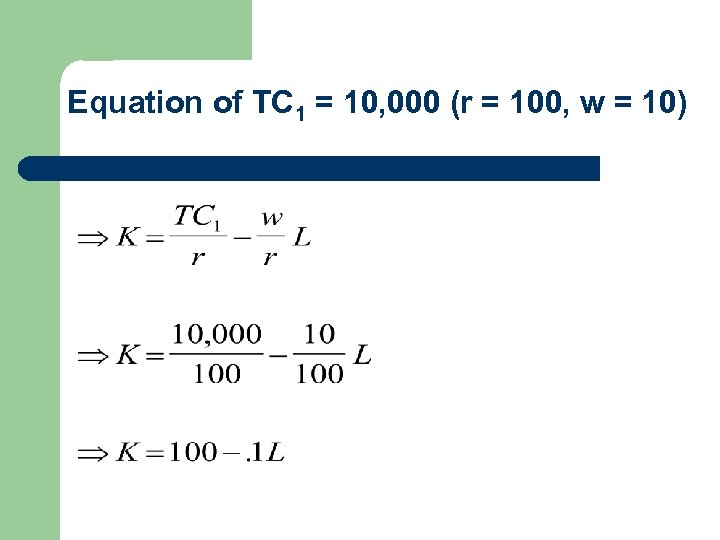

Equation of TC 1 = 10, 000 (r = 100, w = 10)

Equation of TC 1 = 10, 000 (r = 100, w = 10)

Isocost Line (specific example) TC 1 = r = w = 10, 000 100 max K = 10, 000/100 = 100 10 max L = 10, 000/10 = 1000 K 100 TC 1 = 10, 000 K = 100 -. 1 L L 1000

Isocost Line (specific example) TC 1 = r = w = 10, 000 100 max K = 10, 000/100 = 100 10 max L = 10, 000/10 = 1000 K 100 TC 1 = 10, 000 K = 100 -. 1 L L 1000

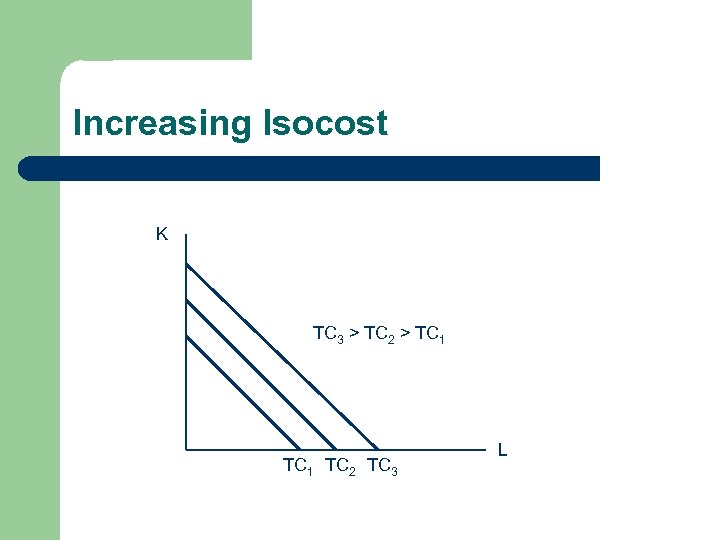

Increasing Isocost K TC 3 > TC 2 > TC 1 TC 2 TC 3 L

Increasing Isocost K TC 3 > TC 2 > TC 1 TC 2 TC 3 L

Changing Input Prices K TC 1 r w L L

Changing Input Prices K TC 1 r w L L

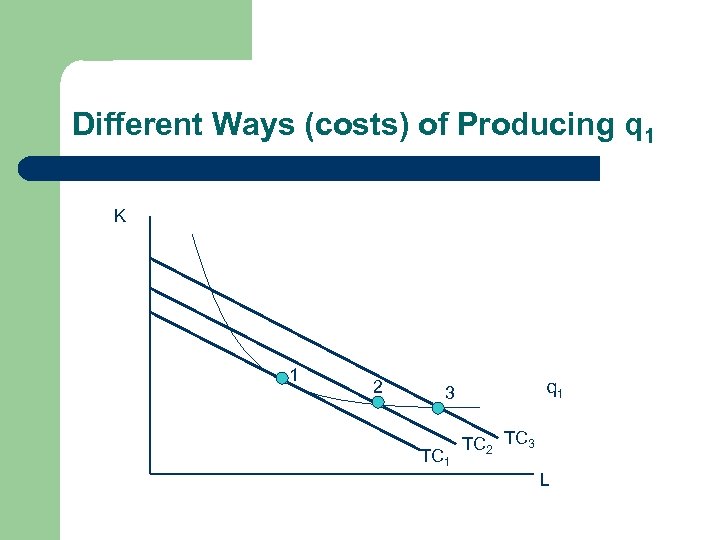

Different Ways (costs) of Producing q 1 K 1 2 q 1 3 TC 1 TC 2 TC 3 L

Different Ways (costs) of Producing q 1 K 1 2 q 1 3 TC 1 TC 2 TC 3 L

Cost Min Way of Producing q 1 K K* & L* are cost-min. combinations Min cost of producing q 1 = TC 1 K* 1 2 TC 1 L* q 1 3 TC 2 TC 3 L

Cost Min Way of Producing q 1 K K* & L* are cost-min. combinations Min cost of producing q 1 = TC 1 K* 1 2 TC 1 L* q 1 3 TC 2 TC 3 L

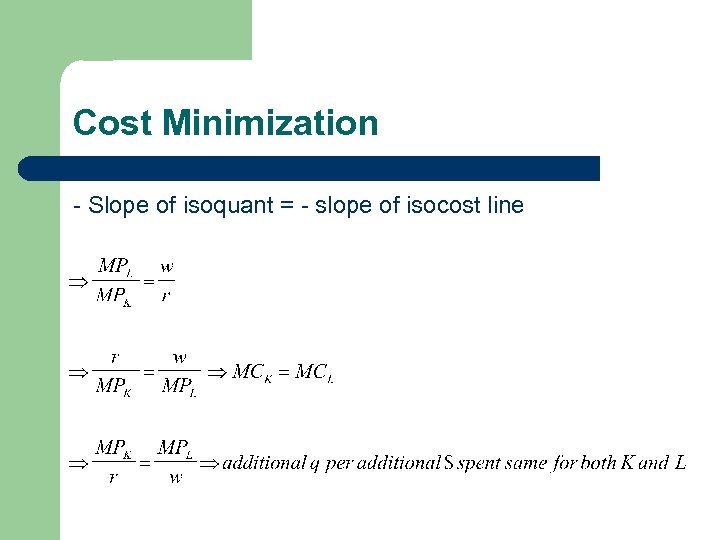

Cost Minimization - Slope of isoquant = - slope of isocost line

Cost Minimization - Slope of isoquant = - slope of isocost line

Average Cost and Output 1) 2) SR Avg cost will eventually increase due to law of diminish MP ( MC will start to and eventually pull avg cost up) LR economics of scale a) If increasing LR AC will with q b) If constant LR AC does not change with q c) If decreasing LR AC will if q

Average Cost and Output 1) 2) SR Avg cost will eventually increase due to law of diminish MP ( MC will start to and eventually pull avg cost up) LR economics of scale a) If increasing LR AC will with q b) If constant LR AC does not change with q c) If decreasing LR AC will if q

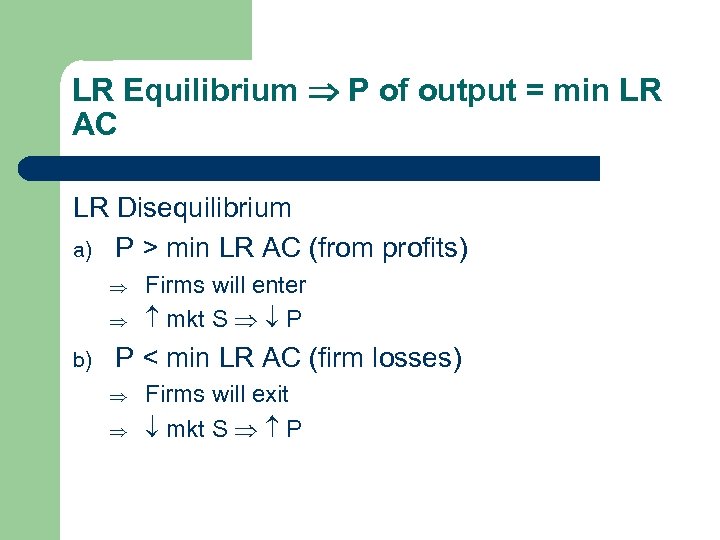

LR Equilibrium P of output = min LR AC LR Disequilibrium a) P > min LR AC (from profits) b) Firms will enter mkt S P P < min LR AC (firm losses) Firms will exit mkt S P

LR Equilibrium P of output = min LR AC LR Disequilibrium a) P > min LR AC (from profits) b) Firms will enter mkt S P P < min LR AC (firm losses) Firms will exit mkt S P