b399cd312bd7d9859d3070ff8d6fffa9.ppt

- Количество слайдов: 34

Unit 7: Financial Statement Fraud and the Enron Scandal Professor Thomas Genovese

Unit 7: Financial Statement Fraud and the Enron Scandal Professor Thomas Genovese

Financial Statement Frauds 1. Revenue/Accounts Receivable Frauds (Global Crossing, Quest, ZZZZ Best) 2. Inventory/Cost of Goods Sold Frauds (Phar. Mor) 3. Understating Liability/Expense Frauds (Enron) 4. Overstating Asset Frauds (World. Com) 5. Inadequate Disclosure/Misrepresentation (Bre-X Minerals)

Financial Statement Frauds 1. Revenue/Accounts Receivable Frauds (Global Crossing, Quest, ZZZZ Best) 2. Inventory/Cost of Goods Sold Frauds (Phar. Mor) 3. Understating Liability/Expense Frauds (Enron) 4. Overstating Asset Frauds (World. Com) 5. Inadequate Disclosure/Misrepresentation (Bre-X Minerals)

1. Revenue Related Financial Statement Frauds By far, the most common accounts manipulated when perpetrating financial statement fraud are revenues and/or accounts receivable.

1. Revenue Related Financial Statement Frauds By far, the most common accounts manipulated when perpetrating financial statement fraud are revenues and/or accounts receivable.

Revenue-Related Fraud Schemes Two reasons for the prevalence of revenue -related financial statement fraud: 1. The availability of acceptable alternatives for recognizing revenue. 2. The ease of manipulating net income using revenue and receivable accounts.

Revenue-Related Fraud Schemes Two reasons for the prevalence of revenue -related financial statement fraud: 1. The availability of acceptable alternatives for recognizing revenue. 2. The ease of manipulating net income using revenue and receivable accounts.

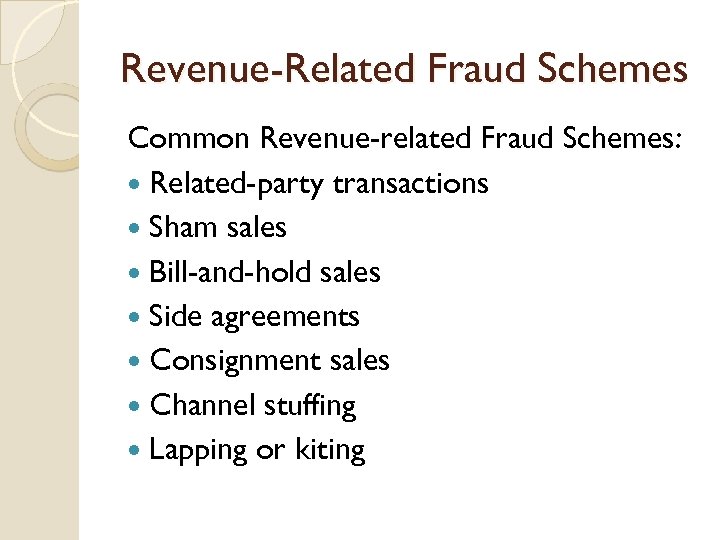

Revenue-Related Fraud Schemes Common Revenue-related Fraud Schemes: Related-party transactions Sham sales Bill-and-hold sales Side agreements Consignment sales Channel stuffing Lapping or kiting

Revenue-Related Fraud Schemes Common Revenue-related Fraud Schemes: Related-party transactions Sham sales Bill-and-hold sales Side agreements Consignment sales Channel stuffing Lapping or kiting

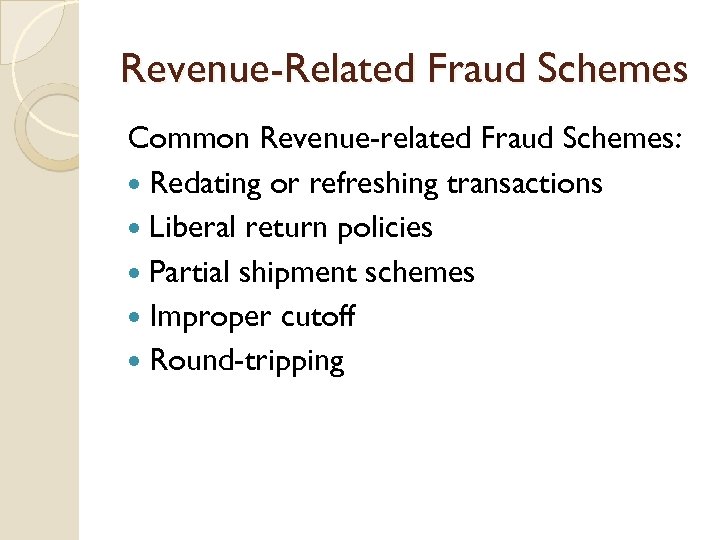

Revenue-Related Fraud Schemes Common Revenue-related Fraud Schemes: Redating or refreshing transactions Liberal return policies Partial shipment schemes Improper cutoff Round-tripping

Revenue-Related Fraud Schemes Common Revenue-related Fraud Schemes: Redating or refreshing transactions Liberal return policies Partial shipment schemes Improper cutoff Round-tripping

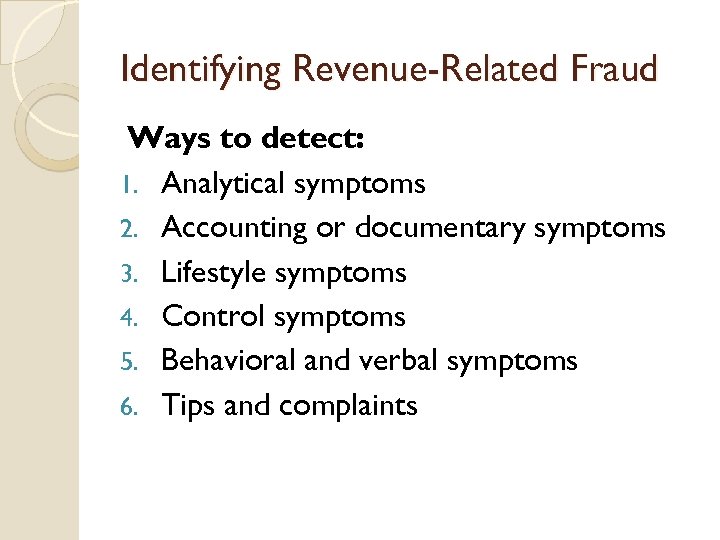

Identifying Revenue-Related Fraud Ways to detect: 1. Analytical symptoms 2. Accounting or documentary symptoms 3. Lifestyle symptoms 4. Control symptoms 5. Behavioral and verbal symptoms 6. Tips and complaints

Identifying Revenue-Related Fraud Ways to detect: 1. Analytical symptoms 2. Accounting or documentary symptoms 3. Lifestyle symptoms 4. Control symptoms 5. Behavioral and verbal symptoms 6. Tips and complaints

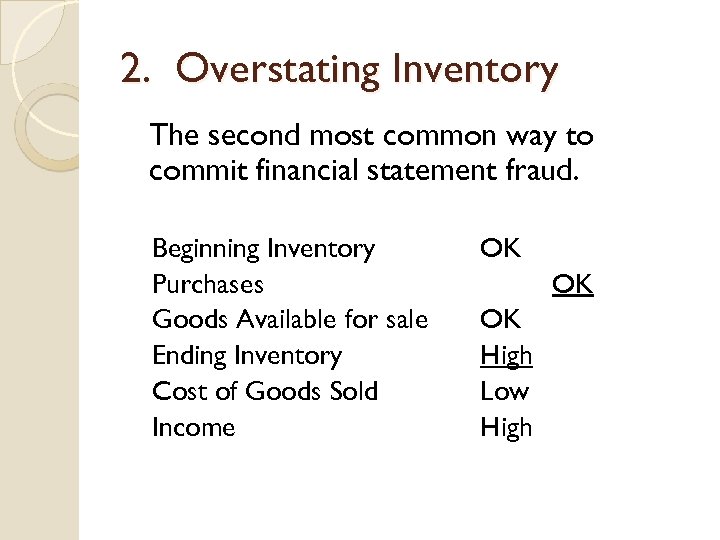

2. Overstating Inventory The second most common way to commit financial statement fraud. Beginning Inventory Purchases Goods Available for sale Ending Inventory Cost of Goods Sold Income OK OK OK High Low High

2. Overstating Inventory The second most common way to commit financial statement fraud. Beginning Inventory Purchases Goods Available for sale Ending Inventory Cost of Goods Sold Income OK OK OK High Low High

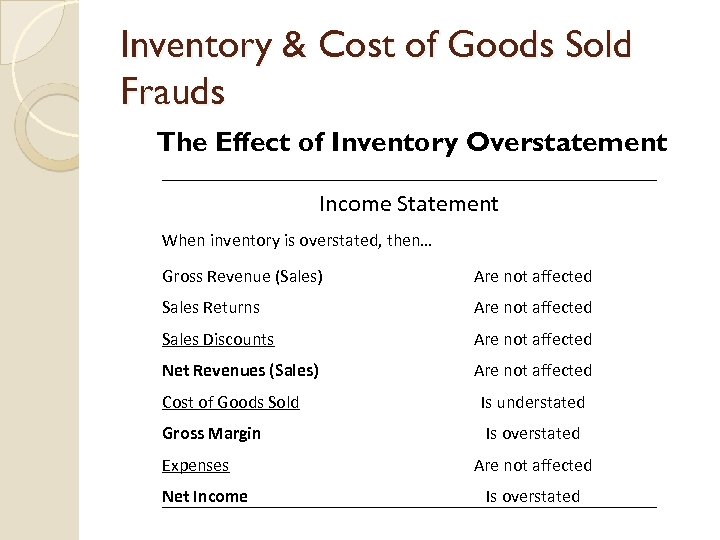

Inventory & Cost of Goods Sold Frauds The Effect of Inventory Overstatement Income Statement When inventory is overstated, then… Gross Revenue (Sales) Are not affected Sales Returns Are not affected Sales Discounts Are not affected Net Revenues (Sales) Are not affected Cost of Goods Sold Is understated Gross Margin Is overstated Expenses Net Income Are not affected Is overstated

Inventory & Cost of Goods Sold Frauds The Effect of Inventory Overstatement Income Statement When inventory is overstated, then… Gross Revenue (Sales) Are not affected Sales Returns Are not affected Sales Discounts Are not affected Net Revenues (Sales) Are not affected Cost of Goods Sold Is understated Gross Margin Is overstated Expenses Net Income Are not affected Is overstated

Inventory & Cost of Goods Sold Frauds Most common inventory-related fraud schemes: Double counting Capitalizing Cutoff problems Overestimating inventory Bill-and-hold sales Consigned inventory

Inventory & Cost of Goods Sold Frauds Most common inventory-related fraud schemes: Double counting Capitalizing Cutoff problems Overestimating inventory Bill-and-hold sales Consigned inventory

3. Understatement of Liabilities Fraud Schemes that understate liabilities Understating accounts payable Understating Accrued Liabilities Recognizing Unearned Revenue as Earned Revenue Under recording Future Obligations Not Recording or Under recording Various Types or Debt (Notes, Mortgages, etc. ) Omission of Contingent Liabilities

3. Understatement of Liabilities Fraud Schemes that understate liabilities Understating accounts payable Understating Accrued Liabilities Recognizing Unearned Revenue as Earned Revenue Under recording Future Obligations Not Recording or Under recording Various Types or Debt (Notes, Mortgages, etc. ) Omission of Contingent Liabilities

Understatement of Liabilities Fraud Ways to detect understatement of liabilities Abnormal analytical symptoms Documentary symptoms

Understatement of Liabilities Fraud Ways to detect understatement of liabilities Abnormal analytical symptoms Documentary symptoms

4. Asset Overstatement Frauds Overstatement of current assets (e. g. marketable securities) Overstating pension assets Capitalizing as assets amounts that should be expensed Failing to record depreciation/amortization expense Overstating assets through mergers and acquisitions Overstating inventory and receivables (covered earlier)

4. Asset Overstatement Frauds Overstatement of current assets (e. g. marketable securities) Overstating pension assets Capitalizing as assets amounts that should be expensed Failing to record depreciation/amortization expense Overstating assets through mergers and acquisitions Overstating inventory and receivables (covered earlier)

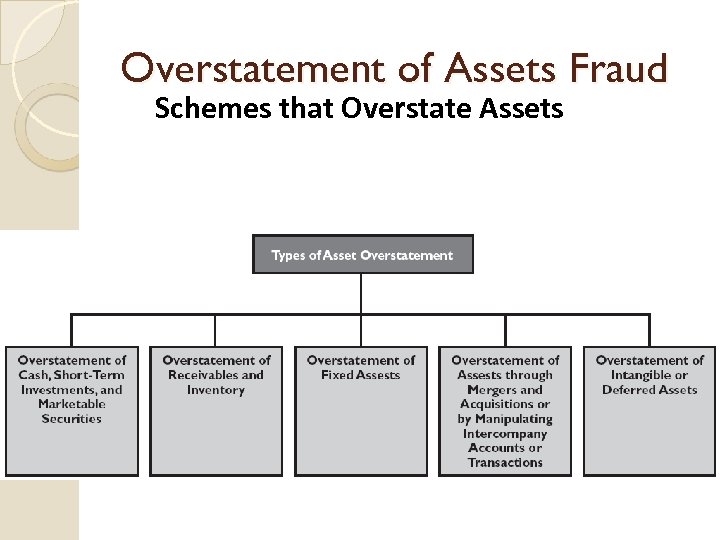

Overstatement of Assets Fraud Schemes that Overstate Assets

Overstatement of Assets Fraud Schemes that Overstate Assets

Overstatement of Assets Fraud Ways to detect overstatement of assets Compare changes and trends in financial statement account balances Compare changes and trends in financial statement relationships Compare financial statement balances with nonfinancial information or things, such as the assets they represent Compare financial statement balances and policies with those used by other similar companies

Overstatement of Assets Fraud Ways to detect overstatement of assets Compare changes and trends in financial statement account balances Compare changes and trends in financial statement relationships Compare financial statement balances with nonfinancial information or things, such as the assets they represent Compare financial statement balances and policies with those used by other similar companies

4. Disclosure Frauds Three Categories of Disclosure Frauds: 1. Overall misrepresentations about the nature of the company or its products, usually made through news reports, interviews, annual reports, and elsewhere 2. Misrepresentations in the management discussions and other non-financial statement sections of annual reports, 10 -Ks, 10 -Qs, and other reports 3. Misrepresentations in the footnotes to the financial statements

4. Disclosure Frauds Three Categories of Disclosure Frauds: 1. Overall misrepresentations about the nature of the company or its products, usually made through news reports, interviews, annual reports, and elsewhere 2. Misrepresentations in the management discussions and other non-financial statement sections of annual reports, 10 -Ks, 10 -Qs, and other reports 3. Misrepresentations in the footnotes to the financial statements

Inadequate Disclosure Fraud Ways to identify Disclosure Fraud Look for inconsistencies between disclosures and information in the financial statements Inquire of management concerning related -party transactions, contingent liabilities, and contractual obligations Review a company’s files and records with the SEC and other regulatory agencies

Inadequate Disclosure Fraud Ways to identify Disclosure Fraud Look for inconsistencies between disclosures and information in the financial statements Inquire of management concerning related -party transactions, contingent liabilities, and contractual obligations Review a company’s files and records with the SEC and other regulatory agencies

Why so many financial statement frauds all of a sudden? Moral decay in society Executive incentives Wall Street expectations—rewards for shortterm behavior Nature of accounting rules Behavior of CPA firms and lawyers Greed by investment banks, commercial banks, and investors Education failures

Why so many financial statement frauds all of a sudden? Moral decay in society Executive incentives Wall Street expectations—rewards for shortterm behavior Nature of accounting rules Behavior of CPA firms and lawyers Greed by investment banks, commercial banks, and investors Education failures

Executive Incentives Meeting Wall Street’s Expectations ◦ Stock prices are tied to meeting Wall Street’s earnings forecasts ◦ Focus is on short-term performance only ◦ Companies are heavily punished for not meeting forecasts ◦ Executives have been endowed with hundreds of millions of dollars worth of stock options—far exceeds compensation (tied to stock price) ◦ Performance is based on earnings & stock price

Executive Incentives Meeting Wall Street’s Expectations ◦ Stock prices are tied to meeting Wall Street’s earnings forecasts ◦ Focus is on short-term performance only ◦ Companies are heavily punished for not meeting forecasts ◦ Executives have been endowed with hundreds of millions of dollars worth of stock options—far exceeds compensation (tied to stock price) ◦ Performance is based on earnings & stock price

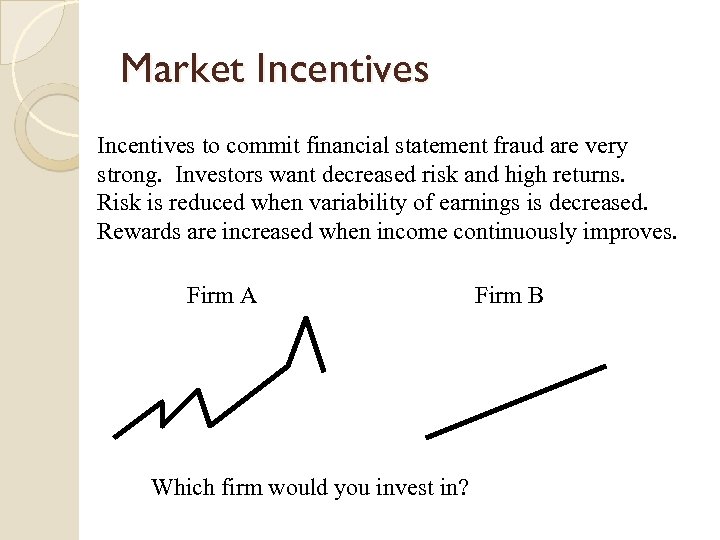

Market Incentives to commit financial statement fraud are very strong. Investors want decreased risk and high returns. Risk is reduced when variability of earnings is decreased. Rewards are increased when income continuously improves. Firm A Which firm would you invest in? Firm B

Market Incentives to commit financial statement fraud are very strong. Investors want decreased risk and high returns. Risk is reduced when variability of earnings is decreased. Rewards are increased when income continuously improves. Firm A Which firm would you invest in? Firm B

Nature of Accounting Rules In the U. S. , accounting standards are “rulesbased” instead of “principles based. ” ◦ Allows companies and auditors to be extremely creative when not specifically prohibited by standards. ◦ Examples are SPEs and other types of off-balance sheet financing, revenue recognition approaches, merger reserves, pension accounting, and other accounting schemes.

Nature of Accounting Rules In the U. S. , accounting standards are “rulesbased” instead of “principles based. ” ◦ Allows companies and auditors to be extremely creative when not specifically prohibited by standards. ◦ Examples are SPEs and other types of off-balance sheet financing, revenue recognition approaches, merger reserves, pension accounting, and other accounting schemes.

Auditors—the CPAs Failed to accept responsibility for fraud detection (SEC, Supreme Court, and the public expects them to detect fraud). Became greedy--$500, 000 per year per partner compensation wasn’t enough. Audit became a loss leader ◦ Easier to sell lucrative consulting services from the inside ◦ Became largest consulting firms in the U. S. very quickly A few auditors got too close to their clients

Auditors—the CPAs Failed to accept responsibility for fraud detection (SEC, Supreme Court, and the public expects them to detect fraud). Became greedy--$500, 000 per year per partner compensation wasn’t enough. Audit became a loss leader ◦ Easier to sell lucrative consulting services from the inside ◦ Became largest consulting firms in the U. S. very quickly A few auditors got too close to their clients

Enron’s History In 1985 after federal deregulation of natural gas pipelines, Enron was born from the merger of Houston Natural Gas and Inter North, a Nebraska pipeline company. Enron incurred massive debt and no longer had exclusive rights to its pipelines. Needed new and innovative business strategy. Kenneth Lay, CEO, hired Mc. Kinsey & Company to assist in developing business strategy. They assigned a young consultant named Jeffrey Skilling. His background was in banking and asset and liability management. His recommendation: that Enron create a “Gas Bank” —to buy and sell gas.

Enron’s History In 1985 after federal deregulation of natural gas pipelines, Enron was born from the merger of Houston Natural Gas and Inter North, a Nebraska pipeline company. Enron incurred massive debt and no longer had exclusive rights to its pipelines. Needed new and innovative business strategy. Kenneth Lay, CEO, hired Mc. Kinsey & Company to assist in developing business strategy. They assigned a young consultant named Jeffrey Skilling. His background was in banking and asset and liability management. His recommendation: that Enron create a “Gas Bank” —to buy and sell gas.

Enron’s History (cont’d) Created Energy derivative. Lay created a new division in 1990 called Enron Finance Corp. and hired Skilling to run it. Enron soon had more contracts than any of its competitors and, with market dominance, could predict future prices with great accuracy, thereby guaranteeing superior profits. Skilling hired the “best and brightest” traders and rewarded them handsomely—so long as they produced. Fastow was a Kellogg MBA hired by Skilling in 1990— Became CFO in 1998 Created Performance Review Committee (PRC) that became known as the harshest employee ranking system in the country---based on earnings generated, creating fierce internal competition

Enron’s History (cont’d) Created Energy derivative. Lay created a new division in 1990 called Enron Finance Corp. and hired Skilling to run it. Enron soon had more contracts than any of its competitors and, with market dominance, could predict future prices with great accuracy, thereby guaranteeing superior profits. Skilling hired the “best and brightest” traders and rewarded them handsomely—so long as they produced. Fastow was a Kellogg MBA hired by Skilling in 1990— Became CFO in 1998 Created Performance Review Committee (PRC) that became known as the harshest employee ranking system in the country---based on earnings generated, creating fierce internal competition

The Motivation Enron delivered smoothly growing earnings (but not cash flows. ) Wall Street took Enron on its word but probably did not understand its financial statements. It was all about the price of the stock. Enron was a trading company and Wall Street normally does not reward volatile earnings of trading companies. (For example, Goldman Sacks is a trading company. Its stock price was 20 times earnings while Enron’s was at one time 70 times earnings. ) In its last 5 years, Enron reported 20 straight quarters of increasing income. Enron, that had once made its money from hard assets like pipelines, generated more than 80% of its earnings from a vaguer business known as “wholesale energy operations and services. ”

The Motivation Enron delivered smoothly growing earnings (but not cash flows. ) Wall Street took Enron on its word but probably did not understand its financial statements. It was all about the price of the stock. Enron was a trading company and Wall Street normally does not reward volatile earnings of trading companies. (For example, Goldman Sacks is a trading company. Its stock price was 20 times earnings while Enron’s was at one time 70 times earnings. ) In its last 5 years, Enron reported 20 straight quarters of increasing income. Enron, that had once made its money from hard assets like pipelines, generated more than 80% of its earnings from a vaguer business known as “wholesale energy operations and services. ”

The Role of Stock Options Enron (and many other companies) avoided hundreds of millions of dollars in taxes by its use of stock options. Corporate executives received large quantities of stock options. When they exercised these options, the company claimed compensation expense on their tax returns. Accounting rules let them omit that same expense from the earnings statement. The options only needed to be disclosed in a footnote. Options allowed them to pay less taxes and report higher earnings.

The Role of Stock Options Enron (and many other companies) avoided hundreds of millions of dollars in taxes by its use of stock options. Corporate executives received large quantities of stock options. When they exercised these options, the company claimed compensation expense on their tax returns. Accounting rules let them omit that same expense from the earnings statement. The options only needed to be disclosed in a footnote. Options allowed them to pay less taxes and report higher earnings.

Enron’s Corporate Strategy Enron’s core business was losing money It shifted its focus from bricks-and-mortar energy business to trading of derivatives (most derivatives profits were more imagined than real. Employees systematically lied and misstated their profits and losses in order to make their trading businesses appear less volatile than they were). During 2000, Enron’s derivatives-related assets increased from $2. 2 billion to $12 billion and derivates-related liabilities increased from $1. 8 billion to $10. 5 billion Enron’s top management gave its managers a blank order to “just do it”. Thus, its business had no natural boundaries. Deals in unrelated areas such as weather derivatives, water services, metals trading, broadband supply and power plant were all justified.

Enron’s Corporate Strategy Enron’s core business was losing money It shifted its focus from bricks-and-mortar energy business to trading of derivatives (most derivatives profits were more imagined than real. Employees systematically lied and misstated their profits and losses in order to make their trading businesses appear less volatile than they were). During 2000, Enron’s derivatives-related assets increased from $2. 2 billion to $12 billion and derivates-related liabilities increased from $1. 8 billion to $10. 5 billion Enron’s top management gave its managers a blank order to “just do it”. Thus, its business had no natural boundaries. Deals in unrelated areas such as weather derivatives, water services, metals trading, broadband supply and power plant were all justified.

Role of Enron’s Use of Special Purpose Entities (SPEs) To hide bad investments and poor-performing assets (Rhythms Net Connections). Declines in value of assets would not be recognized by Enron (Mark to Market). To “manage” earnings—(LJM 1 and Chewco) To quickly execute related-party transactions at desired prices. (LJM 1 and LJM 2) To report over $1 billion of false income. To hide debt (Borrowed money was not put on financial statements of Enron) To manipulate cash flows, especially in 4 th quarters Many SPE transactions were timed (or illegally back-dated) just near end of quarters so that income could be booked just in time and in amounts needed, to meet investor expectations.

Role of Enron’s Use of Special Purpose Entities (SPEs) To hide bad investments and poor-performing assets (Rhythms Net Connections). Declines in value of assets would not be recognized by Enron (Mark to Market). To “manage” earnings—(LJM 1 and Chewco) To quickly execute related-party transactions at desired prices. (LJM 1 and LJM 2) To report over $1 billion of false income. To hide debt (Borrowed money was not put on financial statements of Enron) To manipulate cash flows, especially in 4 th quarters Many SPE transactions were timed (or illegally back-dated) just near end of quarters so that income could be booked just in time and in amounts needed, to meet investor expectations.

Role of Arthur Andersen Was paid $52 million in 2000, the majority for non-audit related consulting services. Failed to spot many of Enron’s losses. Should have assessed Enron management’s internal controls on derivatives trading. Expressed approval of internal controls during 1998 through 2000 Kept a whole floor of auditors assigned at Enron year around. Enron was Andersen’s second largest client Provided both external and internal audits CFOs and controllers were former Andersen executives Accused of document destruction—was criminally indicted. Went out of business.

Role of Arthur Andersen Was paid $52 million in 2000, the majority for non-audit related consulting services. Failed to spot many of Enron’s losses. Should have assessed Enron management’s internal controls on derivatives trading. Expressed approval of internal controls during 1998 through 2000 Kept a whole floor of auditors assigned at Enron year around. Enron was Andersen’s second largest client Provided both external and internal audits CFOs and controllers were former Andersen executives Accused of document destruction—was criminally indicted. Went out of business.

Role of Law Firms Enron’s outside law firm was paid substantial fees and had previously employed Enron’s general counsel Failed to correct or disclose problems related to derivatives and special purpose entities Helped draft the legal documentation for the SPEs.

Role of Law Firms Enron’s outside law firm was paid substantial fees and had previously employed Enron’s general counsel Failed to correct or disclose problems related to derivatives and special purpose entities Helped draft the legal documentation for the SPEs.

Role of Credit Rating Agencies The three major credit rating agencies—Moody’s, Standard & Poor’s and Fitch/IBCA—received substantial fees from Enron. Just weeks prior to Enron’s bankruptcy filing—after most of the negative news was out and Enron’s stock was trading for $3 per share—all three agencies still gave investment grade ratings to Enron’s debt. Being rated as “investment grade” was necessary to make SPEs work

Role of Credit Rating Agencies The three major credit rating agencies—Moody’s, Standard & Poor’s and Fitch/IBCA—received substantial fees from Enron. Just weeks prior to Enron’s bankruptcy filing—after most of the negative news was out and Enron’s stock was trading for $3 per share—all three agencies still gave investment grade ratings to Enron’s debt. Being rated as “investment grade” was necessary to make SPEs work

2001 - Notable Events Jeff Skilling left on August 14—gave no reason for his departure. By mid-August , the stock price began to fall Former CEO, Kenneth Lay, returned in August Oct. 16…announced $618 million loss but not that it had written down equity by $1. 2 billion October…Moody’s downgraded Enron’s debt Nov. 8…Told investors they were restating earnings for the past 4 and ¾ years Dec. 2…Filed bankruptcy

2001 - Notable Events Jeff Skilling left on August 14—gave no reason for his departure. By mid-August , the stock price began to fall Former CEO, Kenneth Lay, returned in August Oct. 16…announced $618 million loss but not that it had written down equity by $1. 2 billion October…Moody’s downgraded Enron’s debt Nov. 8…Told investors they were restating earnings for the past 4 and ¾ years Dec. 2…Filed bankruptcy

So Why Did Enron Happen? Individual and collective greed—company, its employees, analysts, auditors, bankers, rating agencies and investors—didn’t want to believe the company looked too good to be true Atmosphere of market euphoria and corporate arrogance. High risk deals that went sour Deceptive reporting practices—lack of transparency in reporting financial affairs Unduly aggressive earnings targets and management bonuses based on meeting targets. Excessive interest in maintaining stock prices.

So Why Did Enron Happen? Individual and collective greed—company, its employees, analysts, auditors, bankers, rating agencies and investors—didn’t want to believe the company looked too good to be true Atmosphere of market euphoria and corporate arrogance. High risk deals that went sour Deceptive reporting practices—lack of transparency in reporting financial affairs Unduly aggressive earnings targets and management bonuses based on meeting targets. Excessive interest in maintaining stock prices.

Will there be another Enron? Yes ◦ Trending increases in the number of financial statement frauds: 1977 -87 (300); 1987 -1997 (300); 1997 -2002 (over 300) ◦ Incentives still there (e. g. , Stock Options, etc. ) No ◦ Sarbanes-Oxley Bill contains many key provisions Executive “sign off” Requirement to have internal controls Rules for accountants (mandatory audit partner rotation; Oversight Board, limitations on services, etc. )

Will there be another Enron? Yes ◦ Trending increases in the number of financial statement frauds: 1977 -87 (300); 1987 -1997 (300); 1997 -2002 (over 300) ◦ Incentives still there (e. g. , Stock Options, etc. ) No ◦ Sarbanes-Oxley Bill contains many key provisions Executive “sign off” Requirement to have internal controls Rules for accountants (mandatory audit partner rotation; Oversight Board, limitations on services, etc. )