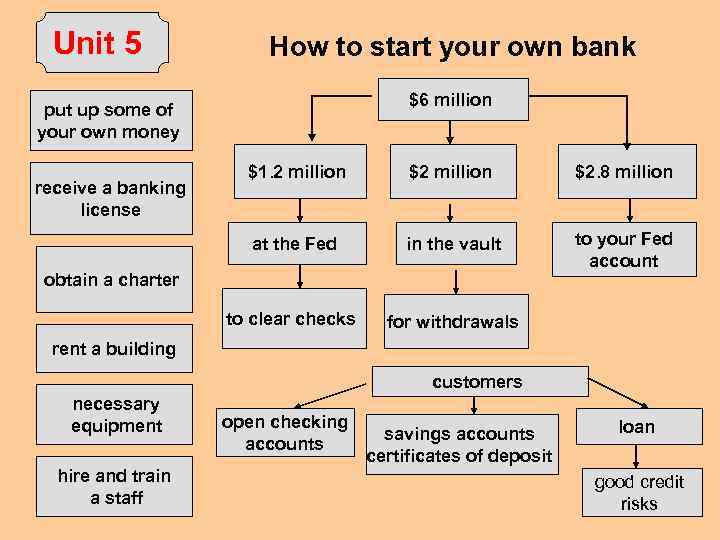

Unit 5 How to start your own bank $6 million put up some of your own money $2 million $2. 8 million at the Fed in the vault to your Fed account to clear checks receive a banking license $1. 2 million for withdrawals obtain a charter rent a building customers necessary equipment hire and train a staff open checking accounts savings accounts certificates of deposit loan good credit risks

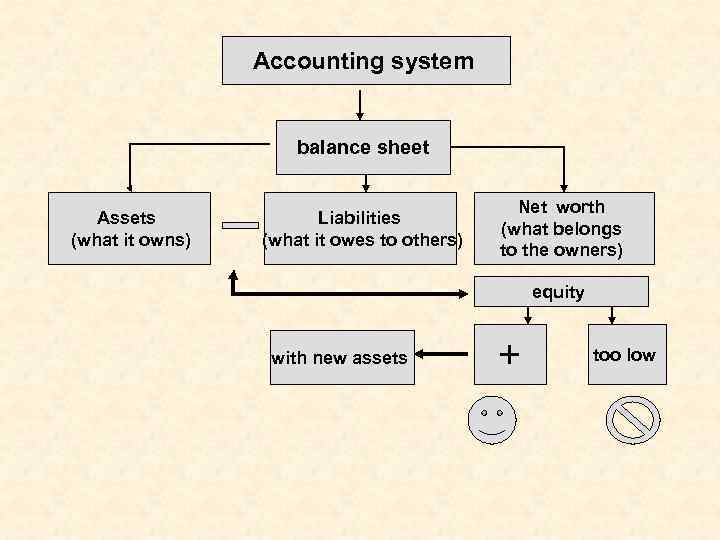

Accounting system balance sheet Assets (what it owns) Liabilities (what it owes to others) Net worth (what belongs to the owners) equity with new assets + too low

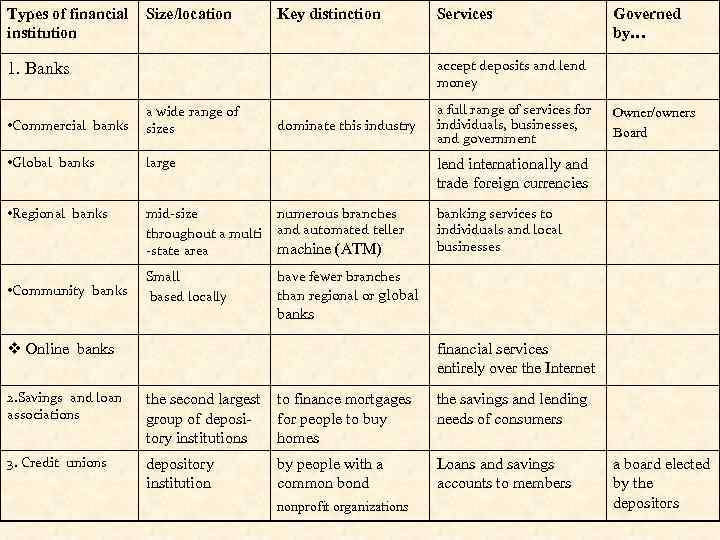

Types of financial institution Size/location Key distinction Services Governed by… accept deposits and lend money 1. Banks • Commercial banks a wide range of sizes • Global banks large • Regional banks mid-size throughout a multi -state area numerous branches and automated teller Small based locally a full range of services for individuals, businesses, and government have fewer branches than regional or global • Community banks dominate this industry Owner/owners Board lend internationally and trade foreign currencies machine (ATM) banking services to individuals and local businesses banks v Online banks financial services entirely over the Internet 2. Savings and loan associations the second largest group of depository institutions to finance mortgages for people to buy homes the savings and lending needs of consumers 3. Credit unions depository institution by people with a common bond Loans and savings accounts to members nonprofit organizations a board elected by the depositors

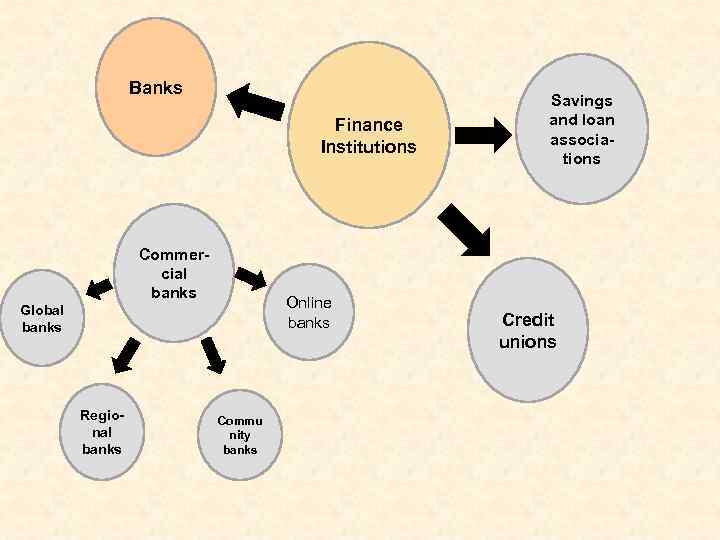

Types of financial institution 1. Banks • Commercial banks • Global banks • Regional banks • Community banks v Online banks 2. Savings and loan associations 3. Credit unions Size/location Key distinction Services Governed by…

Banks Finance Institutions Commercial banks Online banks Global banks Regional banks Commu nity banks Savings and loan associations Credit unions