b3dd1f16706a66cbb3a582e914cc0b37.ppt

- Количество слайдов: 17

Unit 4: International Economics SSEIN 1 (part 2)

Unit 4: International Economics SSEIN 1 (part 2)

n SSEIN 1 The student will explain why individuals, businesses, and governments trade goods andservices. n c. Explain the difference between balance of trade and balance of payments.

n SSEIN 1 The student will explain why individuals, businesses, and governments trade goods andservices. n c. Explain the difference between balance of trade and balance of payments.

Financing International Trade n Every country has their own currency, when they conduct business, they want the right currency in return… n America uses dollars, they expect their exports to be for with dollars. n Great Britain uses “pounds sterling” and they expect their exports to be paid for with that.

Financing International Trade n Every country has their own currency, when they conduct business, they want the right currency in return… n America uses dollars, they expect their exports to be for with dollars. n Great Britain uses “pounds sterling” and they expect their exports to be paid for with that.

Financing International Trade n To make transactions, companies that import goods have to go to banks and trade their money in n Typically, it is not a 1 for 1 exchange, and it might change every day based on the economic conditions of each country (more on this later) n The price of one currency over another is called the “foreign exchange rate” n Ex: if £ 1 = $1. 58, then what the British pay £ 1 for in England, would cost the importing company $1. 58 n £ is the symbol for “pound sterling” like $ is the symbol for dollar

Financing International Trade n To make transactions, companies that import goods have to go to banks and trade their money in n Typically, it is not a 1 for 1 exchange, and it might change every day based on the economic conditions of each country (more on this later) n The price of one currency over another is called the “foreign exchange rate” n Ex: if £ 1 = $1. 58, then what the British pay £ 1 for in England, would cost the importing company $1. 58 n £ is the symbol for “pound sterling” like $ is the symbol for dollar

Financing International Trade n There are basically two types of exchange rates. . . fixed and flexible

Financing International Trade n There are basically two types of exchange rates. . . fixed and flexible

Financing International Trade n With fixed exchanged rates, the price of the currency is set by something else and does not change n Not as common today n Gold was one of the most common things to base a fixed rate on n Any exporting country can demand to be paid in whatever the fixed standard is (like gold), so countries try to keep their currency value around the same as the value of gold

Financing International Trade n With fixed exchanged rates, the price of the currency is set by something else and does not change n Not as common today n Gold was one of the most common things to base a fixed rate on n Any exporting country can demand to be paid in whatever the fixed standard is (like gold), so countries try to keep their currency value around the same as the value of gold

Financing International Trade n In the 1960 s, Americans began to buy a lot of imports, and foreign countries accepted the dollar as payment n As dollars were collected by foreign countries, many began to cash them in for their value in gold n As our gold reserves began to go down, President Nixon declared that we would not trade dollars for gold any more…

Financing International Trade n In the 1960 s, Americans began to buy a lot of imports, and foreign countries accepted the dollar as payment n As dollars were collected by foreign countries, many began to cash them in for their value in gold n As our gold reserves began to go down, President Nixon declared that we would not trade dollars for gold any more…

Financing International Trade n Nixon’s decision made other countries mad, so they began demanding their own currency in exchange for goods n This led to “Flexible Exchange Rates”

Financing International Trade n Nixon’s decision made other countries mad, so they began demanding their own currency in exchange for goods n This led to “Flexible Exchange Rates”

Financing International Trade n As Americans buy a currency, the supply of the dollar in the market goes up (lowering its value) and the demand for the other currency goes up (raising its value) n So as the value of the foreign currency goes up, the price of the import goes up, and it will become less attractive, lowering demand for the product (and the currency) n The flexible exchange rate is ever changing, and can be very complicated n Some investors even buy up currency when its value is low, because they expect that it will rise.

Financing International Trade n As Americans buy a currency, the supply of the dollar in the market goes up (lowering its value) and the demand for the other currency goes up (raising its value) n So as the value of the foreign currency goes up, the price of the import goes up, and it will become less attractive, lowering demand for the product (and the currency) n The flexible exchange rate is ever changing, and can be very complicated n Some investors even buy up currency when its value is low, because they expect that it will rise.

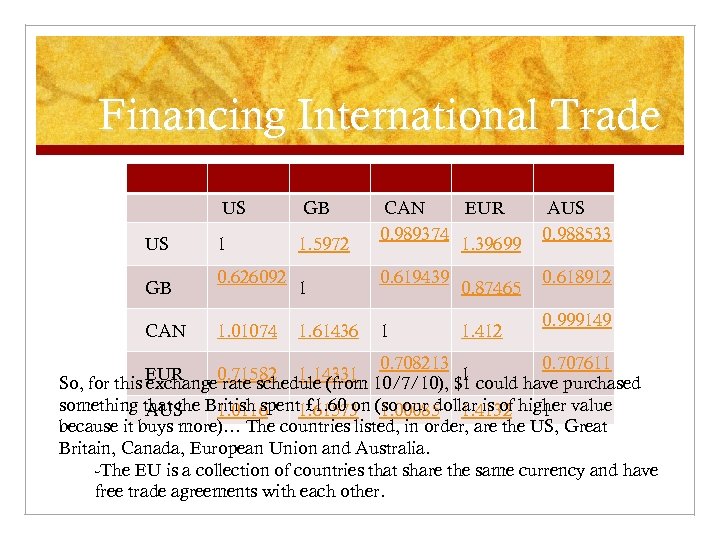

Financing International Trade US GB CAN EUR AUS 0. 989374 0. 988533 US 1 1. 5972 1. 39699 0. 626092 0. 619439 0. 618912 GB 1 0. 87465 0. 999149 CAN 1. 01074 1. 61436 1 1. 412 0. 708213 0. 707611 EUR 0. 71582 1. 14331 1 So, for this exchange rate schedule (from 10/7/10), $1 could have purchased something that the British spent £ 1. 60 on 1. 00085 1. 4132 higher value AUS 1. 0116 1. 61573 (so our dollar is of 1 because it buys more)… The countries listed, in order, are the US, Great Britain, Canada, European Union and Australia. -The EU is a collection of countries that share the same currency and have free trade agreements with each other.

Financing International Trade US GB CAN EUR AUS 0. 989374 0. 988533 US 1 1. 5972 1. 39699 0. 626092 0. 619439 0. 618912 GB 1 0. 87465 0. 999149 CAN 1. 01074 1. 61436 1 1. 412 0. 708213 0. 707611 EUR 0. 71582 1. 14331 1 So, for this exchange rate schedule (from 10/7/10), $1 could have purchased something that the British spent £ 1. 60 on 1. 00085 1. 4132 higher value AUS 1. 0116 1. 61573 (so our dollar is of 1 because it buys more)… The countries listed, in order, are the US, Great Britain, Canada, European Union and Australia. -The EU is a collection of countries that share the same currency and have free trade agreements with each other.

Trade Deficits and Surpluses n If the value of imports for a country is higher than the value of its exports, then that country has a “trade deficit” n If the opposite is true (exports > imports), the country has a “trade surplus” n In 2009, America exported $1. 046 tril and imported $1. 563 tril n Which do we have?

Trade Deficits and Surpluses n If the value of imports for a country is higher than the value of its exports, then that country has a “trade deficit” n If the opposite is true (exports > imports), the country has a “trade surplus” n In 2009, America exported $1. 046 tril and imported $1. 563 tril n Which do we have?

Trade Deficits and Surpluses n To ensure that America is in the best trading position possible, the Fed keeps an eye on the “trade-weighted value of the dollar” n n An index that lists the strength of the dollar against foreign money If the dollar is strong, then foreign goods are less expensive, and our exports are more expensive n This means we’ll be importing more than we export (trade deficit)

Trade Deficits and Surpluses n To ensure that America is in the best trading position possible, the Fed keeps an eye on the “trade-weighted value of the dollar” n n An index that lists the strength of the dollar against foreign money If the dollar is strong, then foreign goods are less expensive, and our exports are more expensive n This means we’ll be importing more than we export (trade deficit)

Trade Deficits and Surpluses n Long periods of a trade deficit lowers the value of currency, which affects income and employment n When we import more than we export, our dollars are sent around the world, which will lower the value of the currency (similar to inflation) n Weaker dollar means imports are more expensive, and industries that depend on imports will have to fire employees, leading to increased unemployment

Trade Deficits and Surpluses n Long periods of a trade deficit lowers the value of currency, which affects income and employment n When we import more than we export, our dollars are sent around the world, which will lower the value of the currency (similar to inflation) n Weaker dollar means imports are more expensive, and industries that depend on imports will have to fire employees, leading to increased unemployment

Trade Deficits and Surpluses n Eventually, foreign markets will begin to buy more of our products (because they’re cheaper now), and the trend will reverse n As we start to import more, the value of our currency will rise and foreign markets won’t be able to afford as much of our exports n So the export industries will be forced to let workers go

Trade Deficits and Surpluses n Eventually, foreign markets will begin to buy more of our products (because they’re cheaper now), and the trend will reverse n As we start to import more, the value of our currency will rise and foreign markets won’t be able to afford as much of our exports n So the export industries will be forced to let workers go

Trade Deficits and Surpluses n The shift in employment and currency value are the biggest problems with trade deficits, but they usually balance each other out n Flexible exchange rates usually allow the problems with deficits to correct themselves.

Trade Deficits and Surpluses n The shift in employment and currency value are the biggest problems with trade deficits, but they usually balance each other out n Flexible exchange rates usually allow the problems with deficits to correct themselves.

Trade Deficits and Surpluses n Under the “flexible exchange rate occasions ”

Trade Deficits and Surpluses n Under the “flexible exchange rate occasions ”

Trade Deficits and Surpluses

Trade Deficits and Surpluses