7d4c01ddb41d51018b726ff5fff38e8d.ppt

- Количество слайдов: 29

Unit 3 RISK AND CAPITAL

Unit 3 RISK AND CAPITAL

What is risk? “The chance of financial loss or, more formally, the variability of returns associated with a given loss. ”

What is risk? “The chance of financial loss or, more formally, the variability of returns associated with a given loss. ”

What is return? “The total gain or loss experienced on an investment over a given period of time; calculated by dividing the asset’s cash distributions during the period, plus change in value, by its beginning-of-period investment value. ”

What is return? “The total gain or loss experienced on an investment over a given period of time; calculated by dividing the asset’s cash distributions during the period, plus change in value, by its beginning-of-period investment value. ”

Risk and Return Typically, the riskier a stock is, the greater the return should be.

Risk and Return Typically, the riskier a stock is, the greater the return should be.

Beta is a measure of a stock's volatility in relation to the market. By definition, the market has a beta of 1. 0, and individual stocks are ranked according to how much they deviate from the market. A stock that swings more than the market over time has a beta above 1. 0. If a stock moves less than the market, the stock's beta is less than 1. 0. High-beta stocks are supposed to be riskier but provide a potential for higher returns; low-beta stocks pose less risk but also lower returns.

Beta is a measure of a stock's volatility in relation to the market. By definition, the market has a beta of 1. 0, and individual stocks are ranked according to how much they deviate from the market. A stock that swings more than the market over time has a beta above 1. 0. If a stock moves less than the market, the stock's beta is less than 1. 0. High-beta stocks are supposed to be riskier but provide a potential for higher returns; low-beta stocks pose less risk but also lower returns.

Beta is a key component for the 'capital asset pricing model' (CAPM), which is used to calculate cost of equity.

Beta is a key component for the 'capital asset pricing model' (CAPM), which is used to calculate cost of equity.

Beta n Advantages of Beta To followers of CAPM, beta is a useful measure. A stock's price variability is important to consider when assessing risk. If you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense. Think of an early-stage technology stock with a price that bounces up and down more than the market. It's hard not to think that stock will be riskier than, say, a safe-haven utility industry stock with a low beta. Besides, beta offers a clear, quantifiable measure, which makes it easy to work with.

Beta n Advantages of Beta To followers of CAPM, beta is a useful measure. A stock's price variability is important to consider when assessing risk. If you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense. Think of an early-stage technology stock with a price that bounces up and down more than the market. It's hard not to think that stock will be riskier than, say, a safe-haven utility industry stock with a low beta. Besides, beta offers a clear, quantifiable measure, which makes it easy to work with.

Beta n Disadvantages of Beta However, if you are investing in a stock's fundamentals, beta has plenty of shortcomings. For starters, beta doesn't incorporate new information. Consider the electrical utility company American Electric Power (AEP). Historically, AEP has been considered a defensive stock with a low beta. But when it entered the merchant energy business and assumed high debt levels, AEP's historic beta no longer captured the substantial risks the company took on. At the same time, many technology stocks, such as Google, are so new to the market they have insufficient price history to establish a reliable beta.

Beta n Disadvantages of Beta However, if you are investing in a stock's fundamentals, beta has plenty of shortcomings. For starters, beta doesn't incorporate new information. Consider the electrical utility company American Electric Power (AEP). Historically, AEP has been considered a defensive stock with a low beta. But when it entered the merchant energy business and assumed high debt levels, AEP's historic beta no longer captured the substantial risks the company took on. At the same time, many technology stocks, such as Google, are so new to the market they have insufficient price history to establish a reliable beta.

Beta Another troubling factor is that past price movements are very poor predictors of the future. Betas are merely rear-view mirrors, reflecting very little of what lies ahead. Furthermore, the beta measure on a single stock tends to flip around over time, which makes it unreliable. Granted, for traders looking to buy and sell stocks within short time periods, beta is a fairly good risk metric. But for investors with long-term horizons, it's less useful.

Beta Another troubling factor is that past price movements are very poor predictors of the future. Betas are merely rear-view mirrors, reflecting very little of what lies ahead. Furthermore, the beta measure on a single stock tends to flip around over time, which makes it unreliable. Granted, for traders looking to buy and sell stocks within short time periods, beta is a fairly good risk metric. But for investors with long-term horizons, it's less useful.

CAPM n Equation that equates the expected rate of return on a stock to the risk-free rate plus a risk premium for the systematic risk. n CAPM provides for an intuitive approach for thinking about the return that an investor should require on an investment, given the asset’s systematic or market risk.

CAPM n Equation that equates the expected rate of return on a stock to the risk-free rate plus a risk premium for the systematic risk. n CAPM provides for an intuitive approach for thinking about the return that an investor should require on an investment, given the asset’s systematic or market risk.

![Capital Asset Pricing Model n E(ri)=rf+[E(rm)-rf] X Bi n Where “rf” is equal to Capital Asset Pricing Model n E(ri)=rf+[E(rm)-rf] X Bi n Where “rf” is equal to](https://present5.com/presentation/7d4c01ddb41d51018b726ff5fff38e8d/image-11.jpg) Capital Asset Pricing Model n E(ri)=rf+[E(rm)-rf] X Bi n Where “rf” is equal to the risk-free rate, “[E(rm)-rf]” is equal to the market risk premium of 7. 5% and “Bi” represents beta. n Be sure to read up on these specific components on page 234 of your textbook! n OR you may use the following equation to solve for CAPM: Kj=RF+[bjx(km-RF)] Think of CAPM as three separate components: "RF" = risk-free rate "(km-RF)" = market risk premium "bj" = beta.

Capital Asset Pricing Model n E(ri)=rf+[E(rm)-rf] X Bi n Where “rf” is equal to the risk-free rate, “[E(rm)-rf]” is equal to the market risk premium of 7. 5% and “Bi” represents beta. n Be sure to read up on these specific components on page 234 of your textbook! n OR you may use the following equation to solve for CAPM: Kj=RF+[bjx(km-RF)] Think of CAPM as three separate components: "RF" = risk-free rate "(km-RF)" = market risk premium "bj" = beta.

Required Rate of Return n Minimum rate of return necessary to attract an investor to purchase or hold a security n Considers the opportunity cost of funds n The next best investment

Required Rate of Return n Minimum rate of return necessary to attract an investor to purchase or hold a security n Considers the opportunity cost of funds n The next best investment

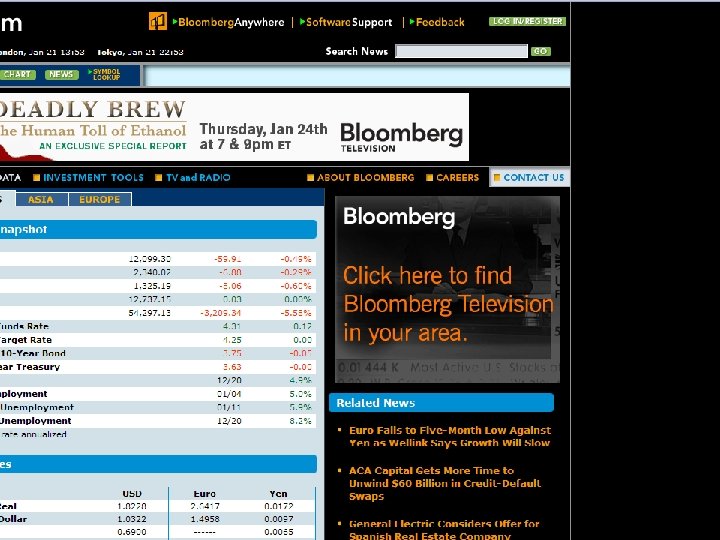

Risk-Free Rate (rf) n Required rate of return or discount rate for risk-less investments n Typically measured by U. S. Treasury Bill Rate (found on the Bloomberg website)

Risk-Free Rate (rf) n Required rate of return or discount rate for risk-less investments n Typically measured by U. S. Treasury Bill Rate (found on the Bloomberg website)

![Risk Premium [E(rm)-rf] n Additional return we must expect to receive for assuming risk Risk Premium [E(rm)-rf] n Additional return we must expect to receive for assuming risk](https://present5.com/presentation/7d4c01ddb41d51018b726ff5fff38e8d/image-14.jpg) Risk Premium [E(rm)-rf] n Additional return we must expect to receive for assuming risk n As risk increases, we will demand additional expected returns

Risk Premium [E(rm)-rf] n Additional return we must expect to receive for assuming risk n As risk increases, we will demand additional expected returns

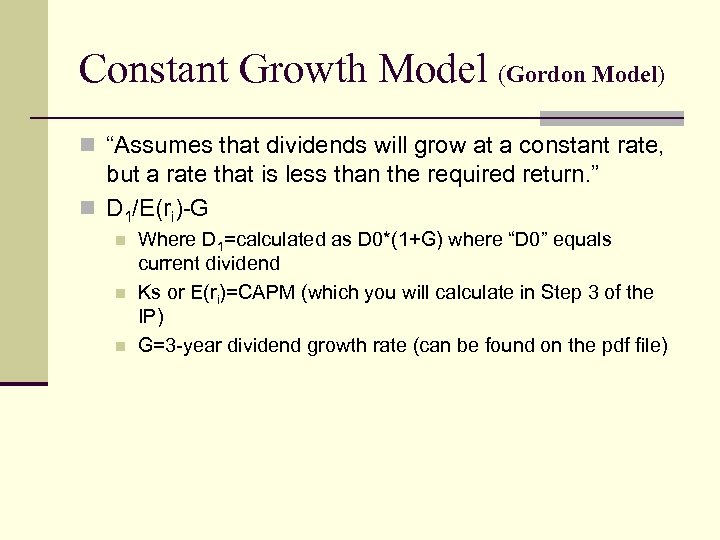

Constant Growth Model (Gordon Model) n “Assumes that dividends will grow at a constant rate, but a rate that is less than the required return. ” n D 1/E(ri)-G n n n Where D 1=calculated as D 0*(1+G) where “D 0” equals current dividend Ks or E(ri)=CAPM (which you will calculate in Step 3 of the IP) G=3 -year dividend growth rate (can be found on the pdf file)

Constant Growth Model (Gordon Model) n “Assumes that dividends will grow at a constant rate, but a rate that is less than the required return. ” n D 1/E(ri)-G n n n Where D 1=calculated as D 0*(1+G) where “D 0” equals current dividend Ks or E(ri)=CAPM (which you will calculate in Step 3 of the IP) G=3 -year dividend growth rate (can be found on the pdf file)

Unit 3 IP-Your assignment

Unit 3 IP-Your assignment

Assignment Instructions n Find an estimate of the risk-free rate of interest, rf. To obtain this value, go to Bloomberg. com: Market Data [http: //www. bloomberg. com/markets/index. html] and use the "U. S. 10 -year Treasury“ rate as the risk-free rate. n In addition, you also need a value for the market risk premium. Use an assumed market risk premium of 7. 5%.

Assignment Instructions n Find an estimate of the risk-free rate of interest, rf. To obtain this value, go to Bloomberg. com: Market Data [http: //www. bloomberg. com/markets/index. html] and use the "U. S. 10 -year Treasury“ rate as the risk-free rate. n In addition, you also need a value for the market risk premium. Use an assumed market risk premium of 7. 5%.

Assignment Instructions n Download this Stock Information document (. pdf file). Please note that the following information contained in this document must be used to complete the subsequent questions.

Assignment Instructions n Download this Stock Information document (. pdf file). Please note that the following information contained in this document must be used to complete the subsequent questions.

Assignment Instructions n Company’s beta (ß) n Company’s current annual dividend n Company’s 3 -year dividend growth rate (g) n Industry P/E n Company’s EPS n USE A STOCK PRICE OF $128 FOR YOUR ANALYSIS! n *NOTE: all of the information you need for this IP can be found on the pdf file with the exception of the current stock price and the risk-free rate (Bloomberg site)

Assignment Instructions n Company’s beta (ß) n Company’s current annual dividend n Company’s 3 -year dividend growth rate (g) n Industry P/E n Company’s EPS n USE A STOCK PRICE OF $128 FOR YOUR ANALYSIS! n *NOTE: all of the information you need for this IP can be found on the pdf file with the exception of the current stock price and the risk-free rate (Bloomberg site)

Assignment Instructions n With the information you now have, use the CAPM to calculate the company’s required rate of return or E(ri) (also called Ks). n Use the CGM to find the current stock price for the company. We will call this theoretical price or Po. n Compare Po and P ($128). Do you see any differences? Can you explain what factors may be at work for such a difference in the two prices? This section is especially important - with more weight in grading - so you may want to do some study before answering such a question. Explain your thoughts clearly.

Assignment Instructions n With the information you now have, use the CAPM to calculate the company’s required rate of return or E(ri) (also called Ks). n Use the CGM to find the current stock price for the company. We will call this theoretical price or Po. n Compare Po and P ($128). Do you see any differences? Can you explain what factors may be at work for such a difference in the two prices? This section is especially important - with more weight in grading - so you may want to do some study before answering such a question. Explain your thoughts clearly.

Assignment Instructions n Step 3: Calculate the company’s rate of return using CAPM n Step 4: Calculate the company’s theoretical stock price using the Gordon Model (Constant Growth Model)

Assignment Instructions n Step 3: Calculate the company’s rate of return using CAPM n Step 4: Calculate the company’s theoretical stock price using the Gordon Model (Constant Growth Model)

Assignment Instructions n Step 5: Compare theoretical stock price and the company’s actual stock price (Po with P)

Assignment Instructions n Step 5: Compare theoretical stock price and the company’s actual stock price (Po with P)

Assignment Instructions Now assume the market risk premium has increased from 7. 5% to 10%; and this increase is due only to the increased risk in the market. In other words, assume krf and stock's beta remains the same for this exercise. What will the new price be? Explain what happened.

Assignment Instructions Now assume the market risk premium has increased from 7. 5% to 10%; and this increase is due only to the increased risk in the market. In other words, assume krf and stock's beta remains the same for this exercise. What will the new price be? Explain what happened.

Assignment Instructions Recalculate the company’s stock using the P/E ratio model and the needed info found in the pdf file. Explain why the present stock price is different from the price arrived at using CGM (Constant Growth Model). Formula you will use to calculate: Stock price = Industry PE x EPS

Assignment Instructions Recalculate the company’s stock using the P/E ratio model and the needed info found in the pdf file. Explain why the present stock price is different from the price arrived at using CGM (Constant Growth Model). Formula you will use to calculate: Stock price = Industry PE x EPS

Assignment Instructions n. To receive full credit on this assignment, please show all work, including formulae and calculations used to arrive at financial values.

Assignment Instructions n. To receive full credit on this assignment, please show all work, including formulae and calculations used to arrive at financial values.

Discussion

Discussion

Discussion n You work for an large investment firm and recently wrote a position article on your firm's approach to investing for the small investor, titled "Investing is for the little guy". The article now appears on your company's website. It has, interestingly enough, generated e-mailed responses from potential clients and your firm is asking you to address some of their questions for a Frequently Asked Questions (FAQ) segment that will be posted to the site soon. Specifically, some of the respondents have compared investing in the stock market as a no win situation and only the institutional investors can win. These respondents would like a response that further clarifies your firm's position regarding risk in light of these type of statements. n In your response, your company has asked that you address these questions building upon the risk-return concepts you identified in the position piece you wrote for the firm.

Discussion n You work for an large investment firm and recently wrote a position article on your firm's approach to investing for the small investor, titled "Investing is for the little guy". The article now appears on your company's website. It has, interestingly enough, generated e-mailed responses from potential clients and your firm is asking you to address some of their questions for a Frequently Asked Questions (FAQ) segment that will be posted to the site soon. Specifically, some of the respondents have compared investing in the stock market as a no win situation and only the institutional investors can win. These respondents would like a response that further clarifies your firm's position regarding risk in light of these type of statements. n In your response, your company has asked that you address these questions building upon the risk-return concepts you identified in the position piece you wrote for the firm.

Discussion n You may provide a list of F. A. Q. s OR simply discuss ways that the “average investor” can meet with some measure of success on the stock market. n Incorporate some of the risk/return concepts you’ve studied about in the Unit n Keep the concept of “diversification” in mind n Do not forget to participate in the discussion on at least two separate days and comment on the discussions of at least two other students n Your comments should further illustrate your comprehension of the subject matter!

Discussion n You may provide a list of F. A. Q. s OR simply discuss ways that the “average investor” can meet with some measure of success on the stock market. n Incorporate some of the risk/return concepts you’ve studied about in the Unit n Keep the concept of “diversification” in mind n Do not forget to participate in the discussion on at least two separate days and comment on the discussions of at least two other students n Your comments should further illustrate your comprehension of the subject matter!