6f615bbe18eef41f00dc2c2935ae5907.ppt

- Количество слайдов: 47

Unit 3: Costs of Production and Perfect Competition Copyright ACDC Leadership 2015 1

Unit 3: Costs of Production and Perfect Competition Copyright ACDC Leadership 2015 1

4 Market Structures Candy Markets Simulation Copyright ACDC Leadership 2015 2

4 Market Structures Candy Markets Simulation Copyright ACDC Leadership 2015 2

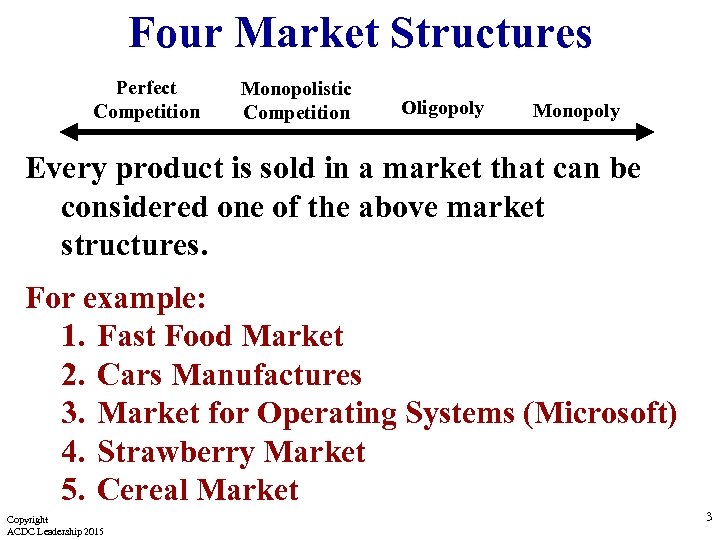

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Every product is sold in a market that can be considered one of the above market structures. For example: 1. Fast Food Market 2. Cars Manufactures 3. Market for Operating Systems (Microsoft) 4. Strawberry Market 5. Cereal Market Copyright ACDC Leadership 2015 3

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Every product is sold in a market that can be considered one of the above market structures. For example: 1. Fast Food Market 2. Cars Manufactures 3. Market for Operating Systems (Microsoft) 4. Strawberry Market 5. Cereal Market Copyright ACDC Leadership 2015 3

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Imperfect Competition Characteristics of Perfect Competition: Examples: Corn, Strawberries, Milk, etc. • Many small firms • Identical products (perfect substitutes) • Low Barriers- Easy for firms to enter and exit the industry • Seller has no need to advertise • Firms are “Price Takers” The seller has NO control over price. Copyright ACDC Leadership 2015 4

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Imperfect Competition Characteristics of Perfect Competition: Examples: Corn, Strawberries, Milk, etc. • Many small firms • Identical products (perfect substitutes) • Low Barriers- Easy for firms to enter and exit the industry • Seller has no need to advertise • Firms are “Price Takers” The seller has NO control over price. Copyright ACDC Leadership 2015 4

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Monopoly: Examples: The Electric Company, De Beers, • One large firm (the firm is the market) • Unique product (no close substitutes) • High Barriers- Firms cannot enter the industry • Monopolies are “Price Makers” Copyright ACDC Leadership 2015 5

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Monopoly: Examples: The Electric Company, De Beers, • One large firm (the firm is the market) • Unique product (no close substitutes) • High Barriers- Firms cannot enter the industry • Monopolies are “Price Makers” Copyright ACDC Leadership 2015 5

Barriers to Entry A monopoly wouldn’t last long if there were not high barriers to keep other firms from entering. Types of Barriers to Entry 1. Economies of Scale • Ex: There is only one electric company because they are the only ones that can make electricity ay the lowest cost. This is a “natural monopoly” 2. Superior Technology 3. Geography or Ownership of Raw Materials 4. Government Created Barriers • The government issues patents to protect inventors and forbids others from using their invention Copyright ACDC Leadership 2015 6

Barriers to Entry A monopoly wouldn’t last long if there were not high barriers to keep other firms from entering. Types of Barriers to Entry 1. Economies of Scale • Ex: There is only one electric company because they are the only ones that can make electricity ay the lowest cost. This is a “natural monopoly” 2. Superior Technology 3. Geography or Ownership of Raw Materials 4. Government Created Barriers • The government issues patents to protect inventors and forbids others from using their invention Copyright ACDC Leadership 2015 6

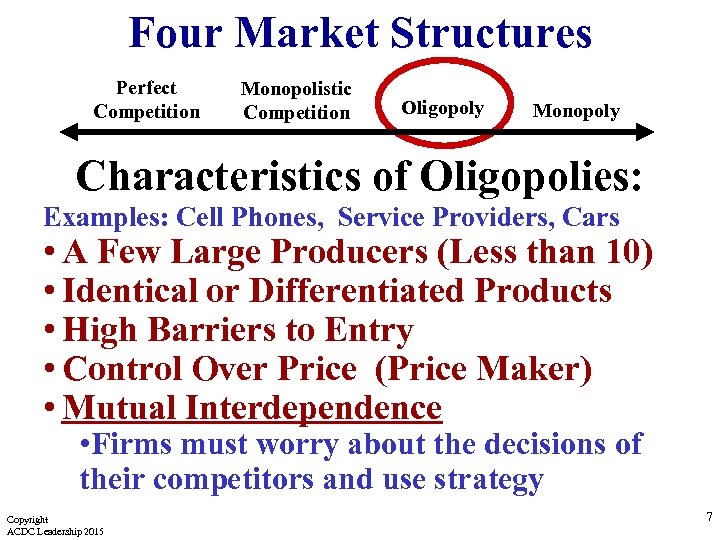

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Oligopolies: Examples: Cell Phones, Service Providers, Cars • A Few Large Producers (Less than 10) • Identical or Differentiated Products • High Barriers to Entry • Control Over Price (Price Maker) • Mutual Interdependence • Firms must worry about the decisions of their competitors and use strategy Copyright ACDC Leadership 2015 7

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Oligopolies: Examples: Cell Phones, Service Providers, Cars • A Few Large Producers (Less than 10) • Identical or Differentiated Products • High Barriers to Entry • Control Over Price (Price Maker) • Mutual Interdependence • Firms must worry about the decisions of their competitors and use strategy Copyright ACDC Leadership 2015 7

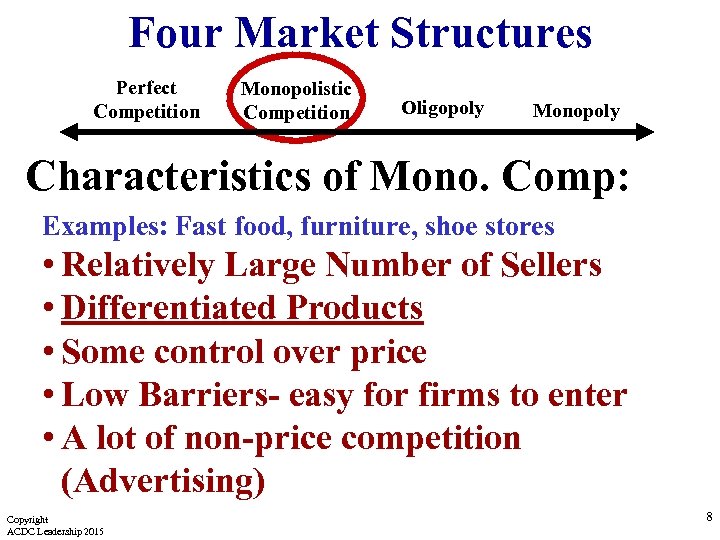

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Mono. Comp: Examples: Fast food, furniture, shoe stores • Relatively Large Number of Sellers • Differentiated Products • Some control over price • Low Barriers- easy for firms to enter • A lot of non-price competition (Advertising) Copyright ACDC Leadership 2015 8

Four Market Structures Perfect Competition Monopolistic Competition Oligopoly Monopoly Characteristics of Mono. Comp: Examples: Fast food, furniture, shoe stores • Relatively Large Number of Sellers • Differentiated Products • Some control over price • Low Barriers- easy for firms to enter • A lot of non-price competition (Advertising) Copyright ACDC Leadership 2015 8

Perfect Competition Copyright ACDC Leadership 2015 9

Perfect Competition Copyright ACDC Leadership 2015 9

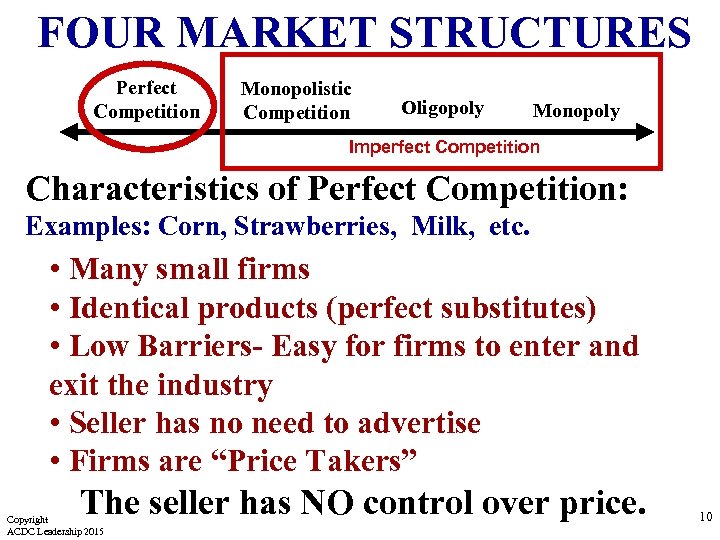

FOUR MARKET STRUCTURES Perfect Competition Monopolistic Competition Oligopoly Monopoly Imperfect Competition Characteristics of Perfect Competition: Examples: Corn, Strawberries, Milk, etc. • Many small firms • Identical products (perfect substitutes) • Low Barriers- Easy for firms to enter and exit the industry • Seller has no need to advertise • Firms are “Price Takers” The seller has NO control over price. Copyright ACDC Leadership 2015 10

FOUR MARKET STRUCTURES Perfect Competition Monopolistic Competition Oligopoly Monopoly Imperfect Competition Characteristics of Perfect Competition: Examples: Corn, Strawberries, Milk, etc. • Many small firms • Identical products (perfect substitutes) • Low Barriers- Easy for firms to enter and exit the industry • Seller has no need to advertise • Firms are “Price Takers” The seller has NO control over price. Copyright ACDC Leadership 2015 10

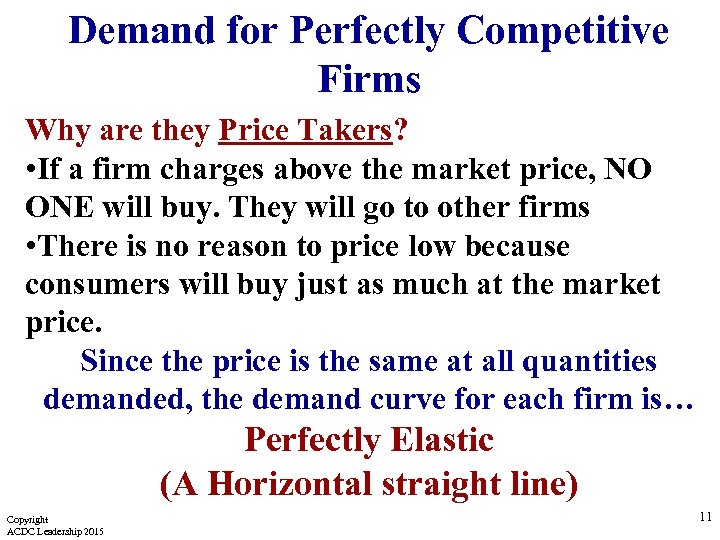

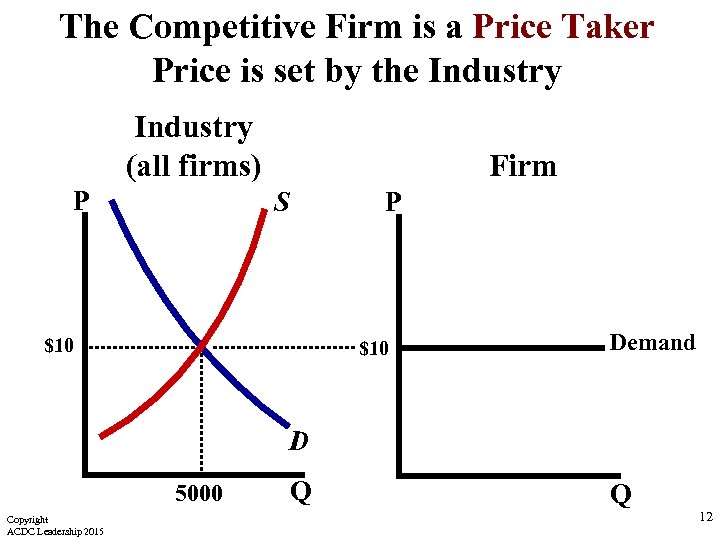

Demand for Perfectly Competitive Firms Why are they Price Takers? • If a firm charges above the market price, NO ONE will buy. They will go to other firms • There is no reason to price low because consumers will buy just as much at the market price. Since the price is the same at all quantities demanded, the demand curve for each firm is… Perfectly Elastic (A Horizontal straight line) Copyright ACDC Leadership 2015 11

Demand for Perfectly Competitive Firms Why are they Price Takers? • If a firm charges above the market price, NO ONE will buy. They will go to other firms • There is no reason to price low because consumers will buy just as much at the market price. Since the price is the same at all quantities demanded, the demand curve for each firm is… Perfectly Elastic (A Horizontal straight line) Copyright ACDC Leadership 2015 11

The Competitive Firm is a Price Taker Price is set by the Industry (all firms) P Firm S P $10 Demand D 5000 Copyright ACDC Leadership 2015 Q Q 12

The Competitive Firm is a Price Taker Price is set by the Industry (all firms) P Firm S P $10 Demand D 5000 Copyright ACDC Leadership 2015 Q Q 12

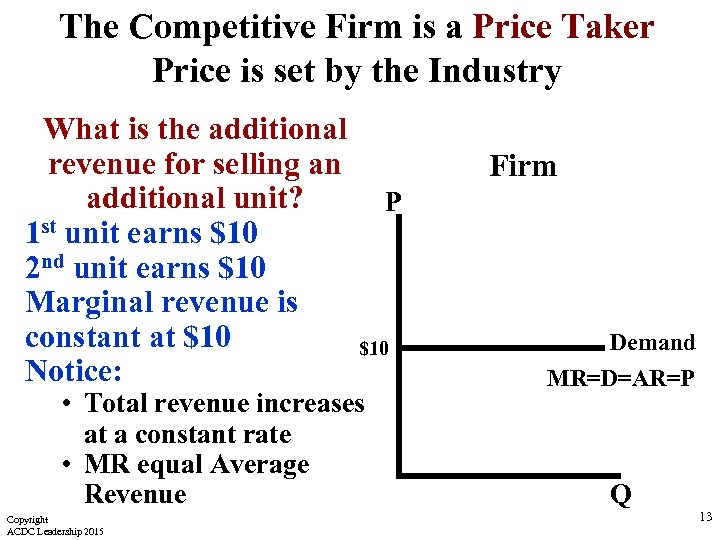

The Competitive Firm is a Price Taker Price is set by the Industry What is the additional revenue for selling an additional unit? 1 st unit earns $10 2 nd unit earns $10 Marginal revenue is constant at $10 Notice: Firm P $10 • Total revenue increases at a constant rate • MR equal Average Revenue Copyright ACDC Leadership 2015 Demand MR=D=AR=P Q 13

The Competitive Firm is a Price Taker Price is set by the Industry What is the additional revenue for selling an additional unit? 1 st unit earns $10 2 nd unit earns $10 Marginal revenue is constant at $10 Notice: Firm P $10 • Total revenue increases at a constant rate • MR equal Average Revenue Copyright ACDC Leadership 2015 Demand MR=D=AR=P Q 13

The Competitive Firm is a Price Taker Price is set by the Industry What is the additional revenue for selling an Firm additional unit? Competition: For Perfect P 1 st unit earns $10 2 nd unit earns. Demand = MR $10 Marginal revenue is (Marginal$10 Revenue) Demand constant at $10 Notice: MR=D=AR=P • Total revenue increases at a constant rate • MR equal Average Revenue Copyright ACDC Leadership 2015 Q 14

The Competitive Firm is a Price Taker Price is set by the Industry What is the additional revenue for selling an Firm additional unit? Competition: For Perfect P 1 st unit earns $10 2 nd unit earns. Demand = MR $10 Marginal revenue is (Marginal$10 Revenue) Demand constant at $10 Notice: MR=D=AR=P • Total revenue increases at a constant rate • MR equal Average Revenue Copyright ACDC Leadership 2015 Q 14

Maximizing PROFIT! Copyright ACDC Leadership 2015 15

Maximizing PROFIT! Copyright ACDC Leadership 2015 15

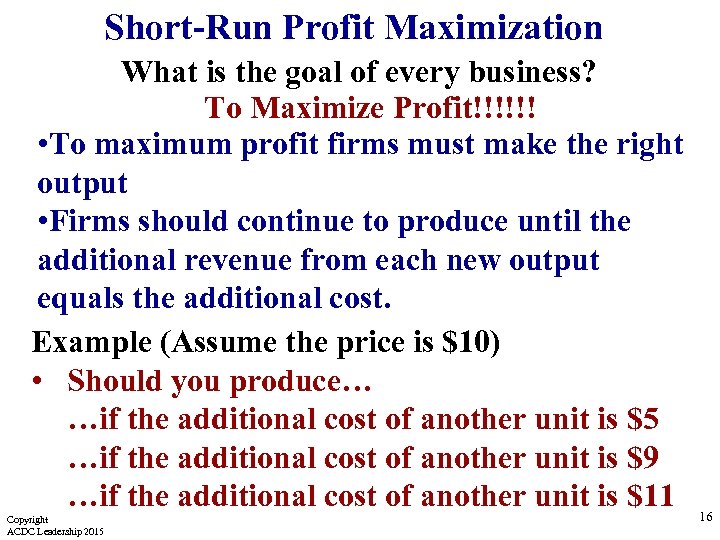

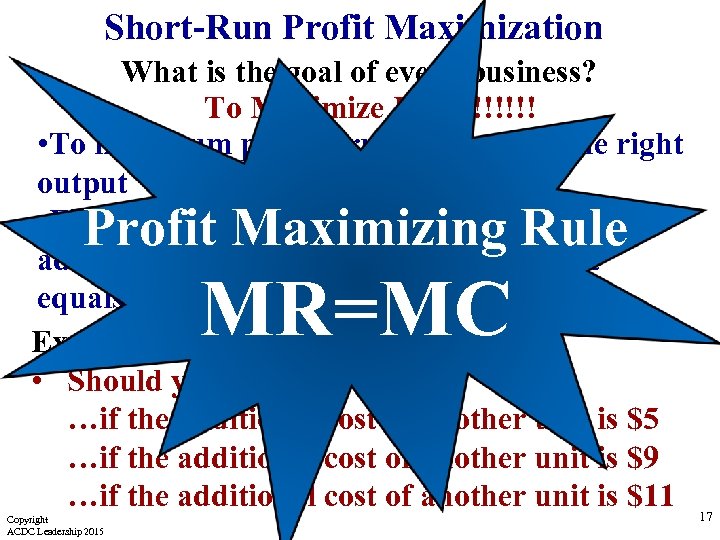

Short-Run Profit Maximization What is the goal of every business? To Maximize Profit!!!!!! • To maximum profit firms must make the right output • Firms should continue to produce until the additional revenue from each new output equals the additional cost. Example (Assume the price is $10) • Should you produce… …if the additional cost of another unit is $5 …if the additional cost of another unit is $9 …if the additional cost of another unit is $11 Copyright ACDC Leadership 2015 16

Short-Run Profit Maximization What is the goal of every business? To Maximize Profit!!!!!! • To maximum profit firms must make the right output • Firms should continue to produce until the additional revenue from each new output equals the additional cost. Example (Assume the price is $10) • Should you produce… …if the additional cost of another unit is $5 …if the additional cost of another unit is $9 …if the additional cost of another unit is $11 Copyright ACDC Leadership 2015 16

Short-Run Profit Maximization What is the goal of every business? To Maximize Profit!!!!!! • To maximum profit firms must make the right output • Firms should continue to produce until the additional revenue from each new output equals the additional cost. Example (Assume the price is $10) • Should you produce… …if the additional cost of another unit is $5 …if the additional cost of another unit is $9 …if the additional cost of another unit is $11 Profit Maximizing Rule MR=MC Copyright ACDC Leadership 2015 17

Short-Run Profit Maximization What is the goal of every business? To Maximize Profit!!!!!! • To maximum profit firms must make the right output • Firms should continue to produce until the additional revenue from each new output equals the additional cost. Example (Assume the price is $10) • Should you produce… …if the additional cost of another unit is $5 …if the additional cost of another unit is $9 …if the additional cost of another unit is $11 Profit Maximizing Rule MR=MC Copyright ACDC Leadership 2015 17

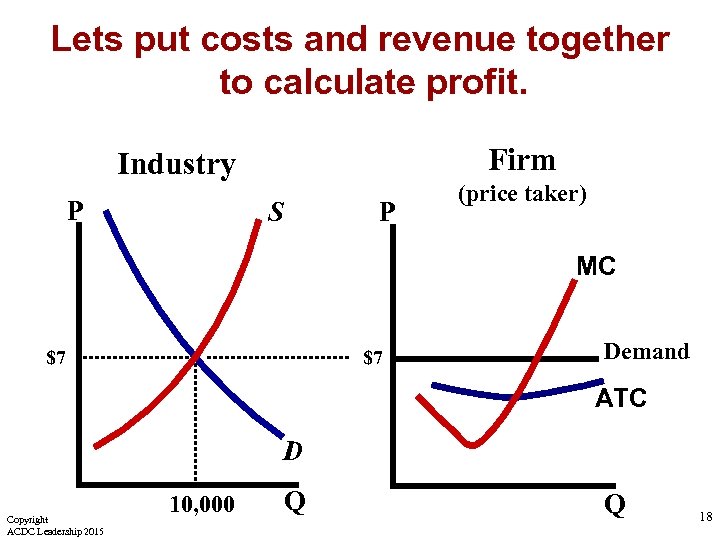

Lets put costs and revenue together to calculate profit. Firm Industry P S P (price taker) MC $7 $7 Demand ATC D Copyright ACDC Leadership 2015 10, 000 Q Q 18

Lets put costs and revenue together to calculate profit. Firm Industry P S P (price taker) MC $7 $7 Demand ATC D Copyright ACDC Leadership 2015 10, 000 Q Q 18

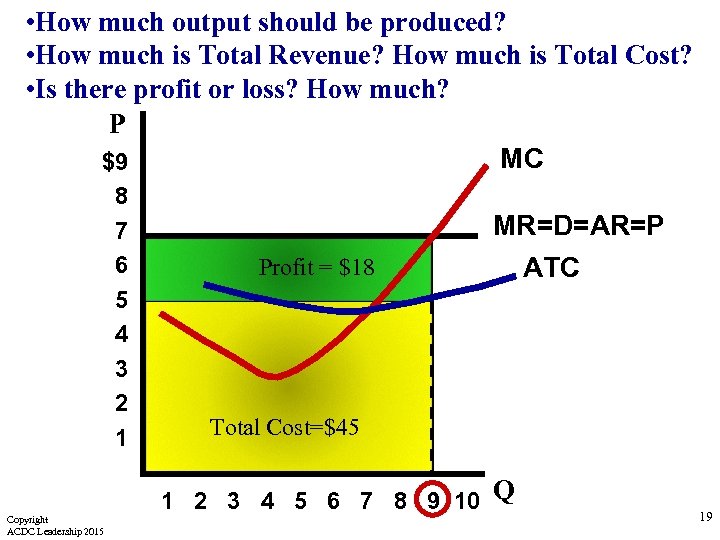

• How much output should be produced? • How much is Total Revenue? How much is Total Cost? • Is there profit or loss? How much? P MC $9 8 7 6 5 4 3 2 1 Profit = $18 MR=D=AR=P ATC Total Cost=$45 Total Revenue =$63 1 2 3 4 5 6 7 8 9 10 Q Copyright ACDC Leadership 2015 19

• How much output should be produced? • How much is Total Revenue? How much is Total Cost? • Is there profit or loss? How much? P MC $9 8 7 6 5 4 3 2 1 Profit = $18 MR=D=AR=P ATC Total Cost=$45 Total Revenue =$63 1 2 3 4 5 6 7 8 9 10 Q Copyright ACDC Leadership 2015 19

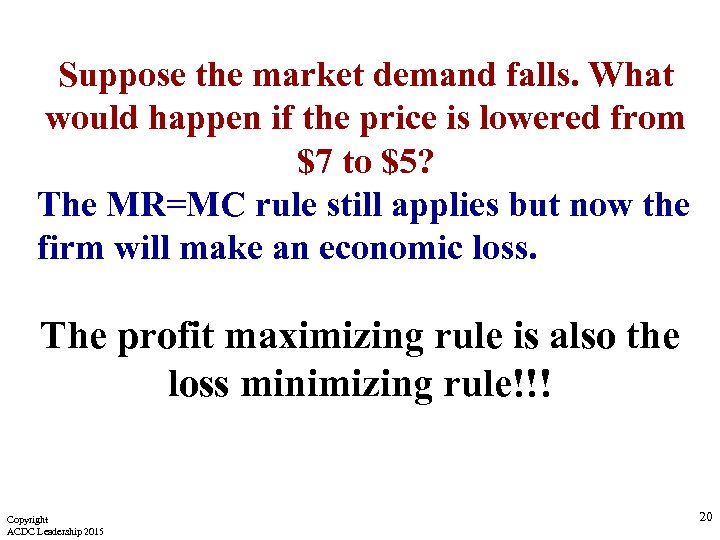

Suppose the market demand falls. What would happen if the price is lowered from $7 to $5? The MR=MC rule still applies but now the firm will make an economic loss. The profit maximizing rule is also the loss minimizing rule!!! Copyright ACDC Leadership 2015 20

Suppose the market demand falls. What would happen if the price is lowered from $7 to $5? The MR=MC rule still applies but now the firm will make an economic loss. The profit maximizing rule is also the loss minimizing rule!!! Copyright ACDC Leadership 2015 20

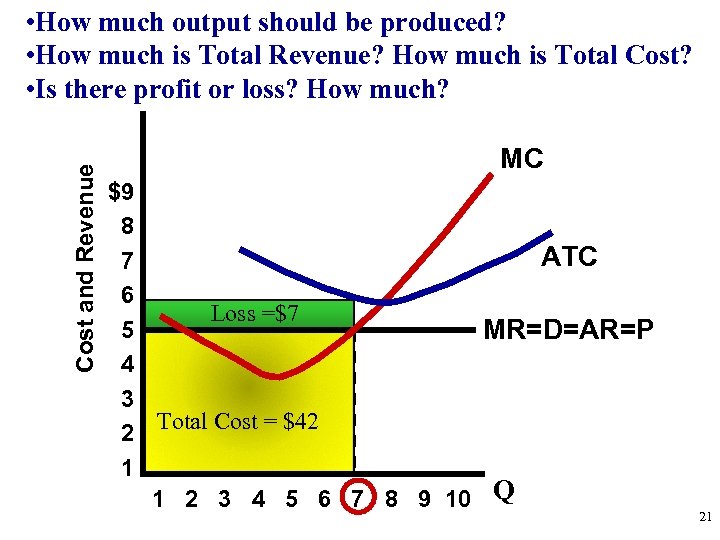

Cost and Revenue • How much output should be produced? • How much is Total Revenue? How much is Total Cost? • Is there profit or loss? How much? MC $9 8 ATC 7 6 Loss =$7 5 MR=D=AR=P 4 3 Total Cost = $42 2 Total Revenue=$35 1 1 2 3 4 5 6 7 8 9 10 Q 21

Cost and Revenue • How much output should be produced? • How much is Total Revenue? How much is Total Cost? • Is there profit or loss? How much? MC $9 8 ATC 7 6 Loss =$7 5 MR=D=AR=P 4 3 Total Cost = $42 2 Total Revenue=$35 1 1 2 3 4 5 6 7 8 9 10 Q 21

The Shut Down Rule Copyright ACDC Leadership 2015 22

The Shut Down Rule Copyright ACDC Leadership 2015 22

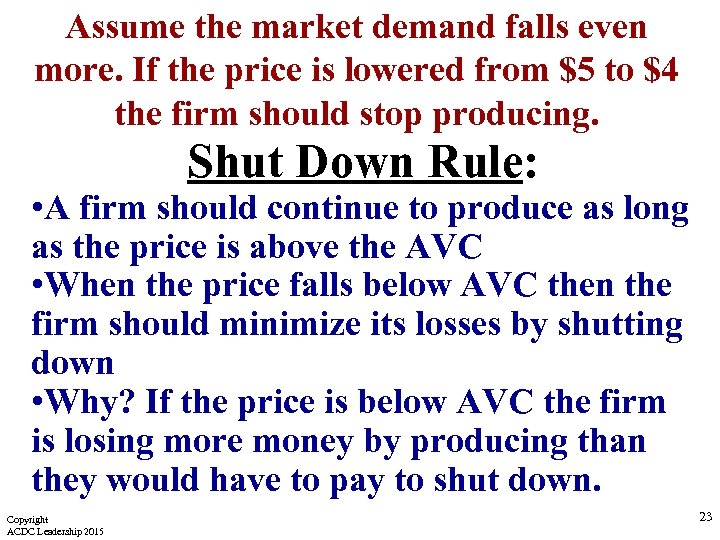

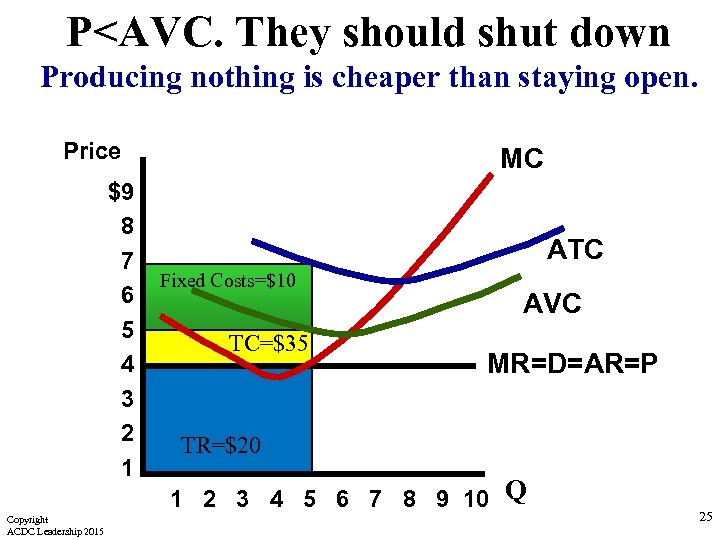

Assume the market demand falls even more. If the price is lowered from $5 to $4 the firm should stop producing. Shut Down Rule: • A firm should continue to produce as long as the price is above the AVC • When the price falls below AVC then the firm should minimize its losses by shutting down • Why? If the price is below AVC the firm is losing more money by producing than they would have to pay to shut down. Copyright ACDC Leadership 2015 23

Assume the market demand falls even more. If the price is lowered from $5 to $4 the firm should stop producing. Shut Down Rule: • A firm should continue to produce as long as the price is above the AVC • When the price falls below AVC then the firm should minimize its losses by shutting down • Why? If the price is below AVC the firm is losing more money by producing than they would have to pay to shut down. Copyright ACDC Leadership 2015 23

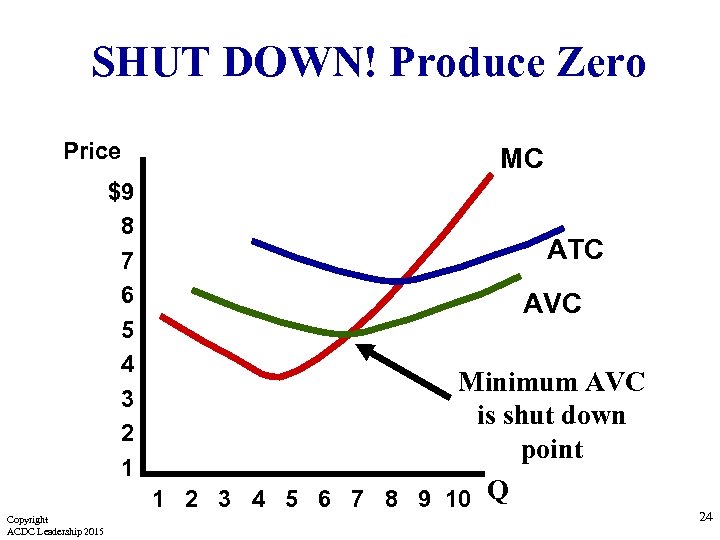

SHUT DOWN! Produce Zero Price $9 8 7 6 5 4 3 2 1 Copyright ACDC Leadership 2015 MC ATC AVC Minimum AVC is shut down point 1 2 3 4 5 6 7 8 9 10 Q 24

SHUT DOWN! Produce Zero Price $9 8 7 6 5 4 3 2 1 Copyright ACDC Leadership 2015 MC ATC AVC Minimum AVC is shut down point 1 2 3 4 5 6 7 8 9 10 Q 24

P

P

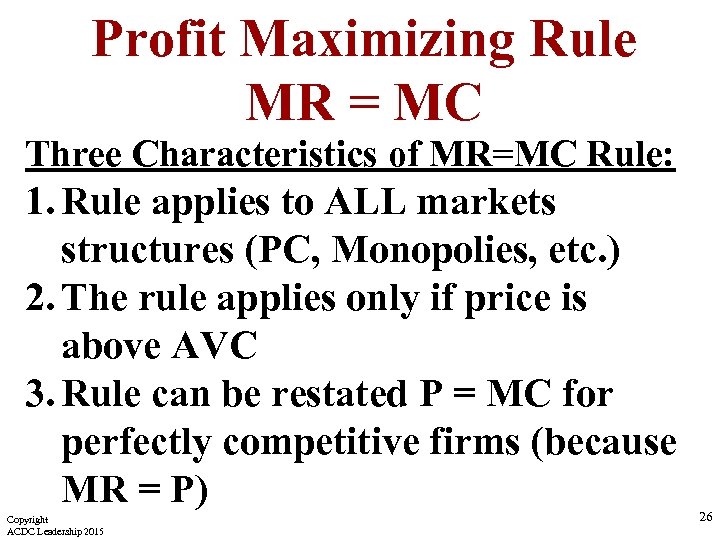

Profit Maximizing Rule MR = MC Three Characteristics of MR=MC Rule: 1. Rule applies to ALL markets structures (PC, Monopolies, etc. ) 2. The rule applies only if price is above AVC 3. Rule can be restated P = MC for perfectly competitive firms (because MR = P) Copyright ACDC Leadership 2015 26

Profit Maximizing Rule MR = MC Three Characteristics of MR=MC Rule: 1. Rule applies to ALL markets structures (PC, Monopolies, etc. ) 2. The rule applies only if price is above AVC 3. Rule can be restated P = MC for perfectly competitive firms (because MR = P) Copyright ACDC Leadership 2015 26

Practice Copyright ACDC Leadership 2015 27

Practice Copyright ACDC Leadership 2015 27

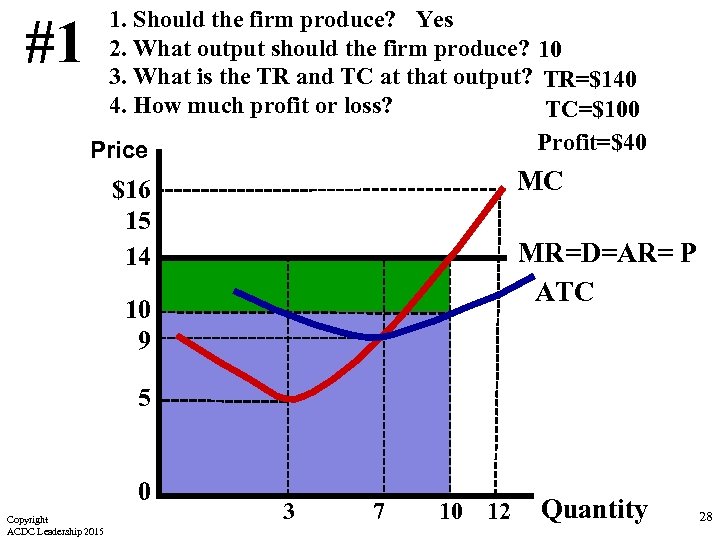

#1 1. Should the firm produce? Yes 2. What output should the firm produce? 10 3. What is the TR and TC at that output? TR=$140 4. How much profit or loss? TC=$100 Profit=$40 Price MC $16 15 14 MR=D=AR= P ATC 10 9 5 0 Copyright ACDC Leadership 2015 3 7 10 12 Quantity 28

#1 1. Should the firm produce? Yes 2. What output should the firm produce? 10 3. What is the TR and TC at that output? TR=$140 4. How much profit or loss? TC=$100 Profit=$40 Price MC $16 15 14 MR=D=AR= P ATC 10 9 5 0 Copyright ACDC Leadership 2015 3 7 10 12 Quantity 28

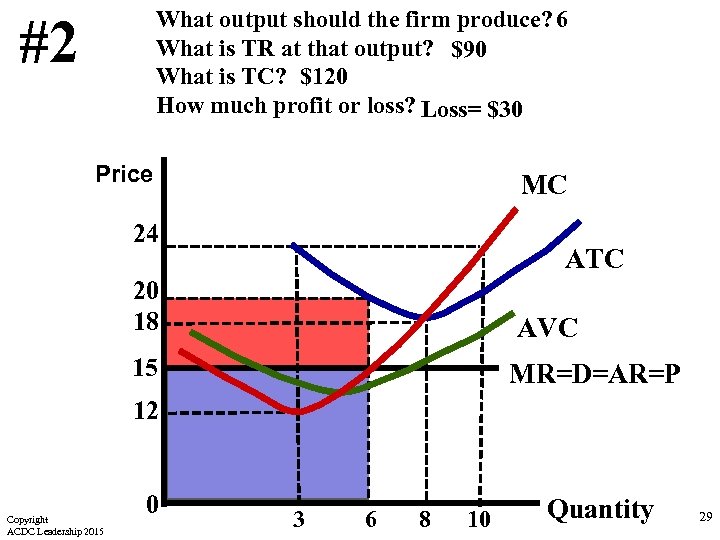

What output should the firm produce? 6 What is TR at that output? $90 What is TC? $120 How much profit or loss? Loss= $30 #2 Price MC 24 ATC 20 18 AVC 15 MR=D=AR=P 12 Copyright ACDC Leadership 2015 0 3 6 8 10 Quantity 29

What output should the firm produce? 6 What is TR at that output? $90 What is TC? $120 How much profit or loss? Loss= $30 #2 Price MC 24 ATC 20 18 AVC 15 MR=D=AR=P 12 Copyright ACDC Leadership 2015 0 3 6 8 10 Quantity 29

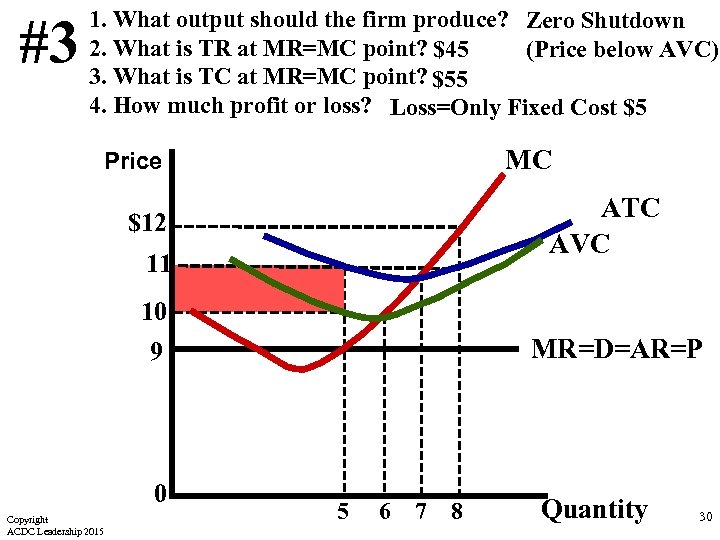

#3 1. What output should the firm produce? Zero Shutdown 2. What is TR at MR=MC point? $45 (Price below AVC) 3. What is TC at MR=MC point? $55 4. How much profit or loss? Loss=Only Fixed Cost $5 MC Price ATC AVC $12 11 10 MR=D=AR=P 9 0 Copyright ACDC Leadership 2015 5 6 7 8 Quantity 30

#3 1. What output should the firm produce? Zero Shutdown 2. What is TR at MR=MC point? $45 (Price below AVC) 3. What is TC at MR=MC point? $55 4. How much profit or loss? Loss=Only Fixed Cost $5 MC Price ATC AVC $12 11 10 MR=D=AR=P 9 0 Copyright ACDC Leadership 2015 5 6 7 8 Quantity 30

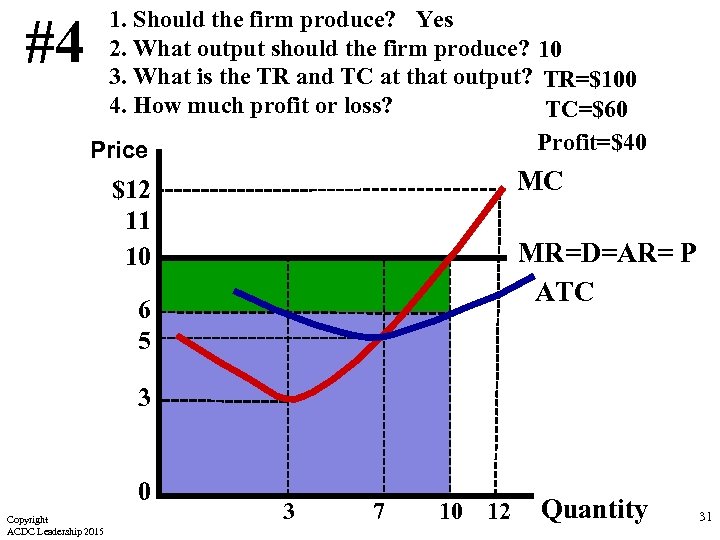

#4 1. Should the firm produce? Yes 2. What output should the firm produce? 10 3. What is the TR and TC at that output? TR=$100 4. How much profit or loss? TC=$60 Profit=$40 Price MC $12 11 10 MR=D=AR= P ATC 6 5 3 0 Copyright ACDC Leadership 2015 3 7 10 12 Quantity 31

#4 1. Should the firm produce? Yes 2. What output should the firm produce? 10 3. What is the TR and TC at that output? TR=$100 4. How much profit or loss? TC=$60 Profit=$40 Price MC $12 11 10 MR=D=AR= P ATC 6 5 3 0 Copyright ACDC Leadership 2015 3 7 10 12 Quantity 31

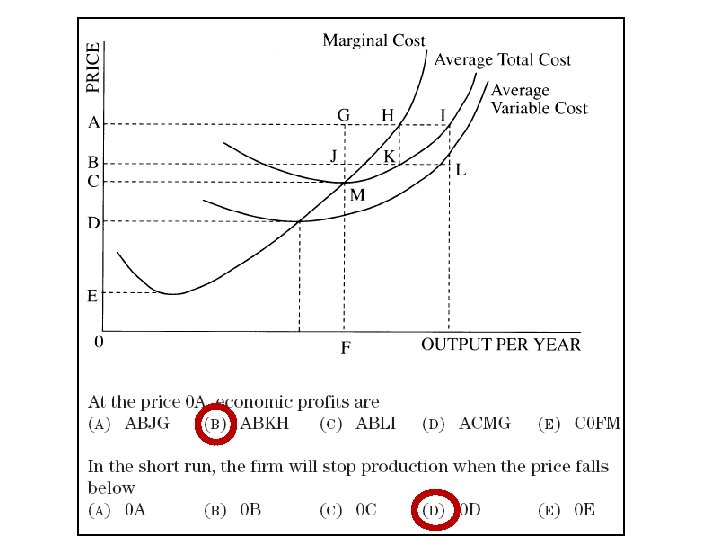

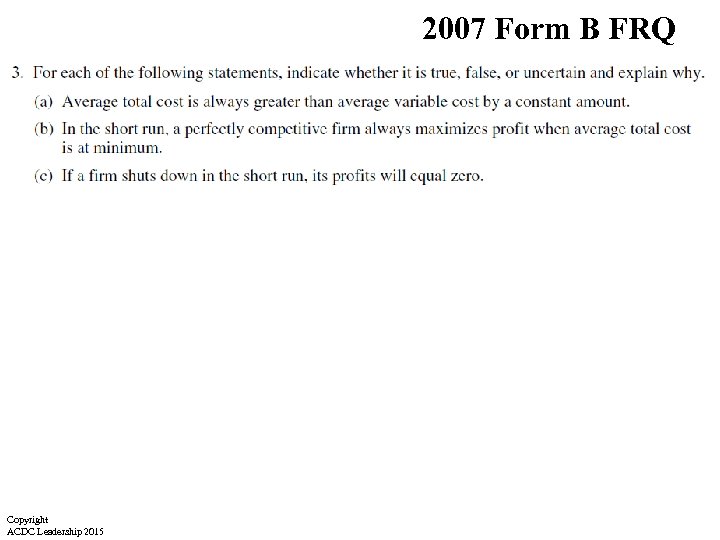

2007 Form B FRQ Copyright ACDC Leadership 2015

2007 Form B FRQ Copyright ACDC Leadership 2015

2007 Form B FRQ Copyright ACDC Leadership 2015

2007 Form B FRQ Copyright ACDC Leadership 2015

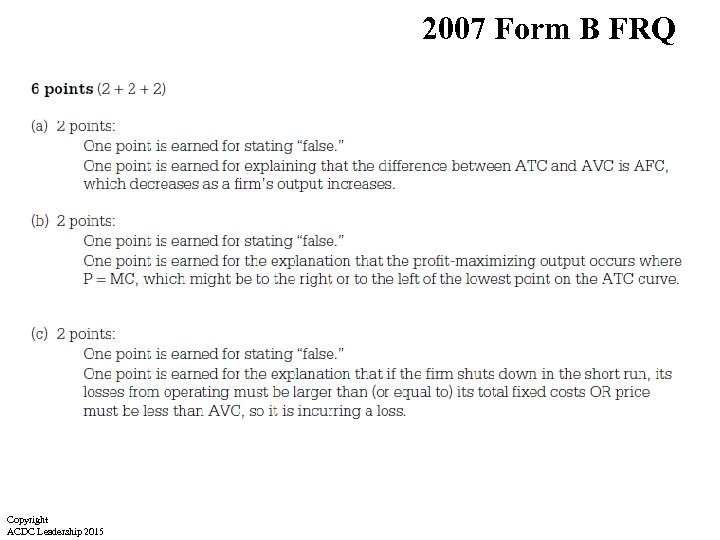

Maximizing Profit Output Variable Fixed Cost 0 1 2 3 4 5 6 $0 $12 $27 $40 $60 $100 $20 Total Cost Marginal Cost - Assume the firm can sell each unit at a price of $30 1. How many units should the firm produce to maximize profit? 2. What is the total revenue at that quantity? 3. How much is the profit? Notice that at 6 units the firm is still making profit. It’s just not maximizing profit Copyright ACDC Leadership 2015 35

Maximizing Profit Output Variable Fixed Cost 0 1 2 3 4 5 6 $0 $12 $27 $40 $60 $100 $20 Total Cost Marginal Cost - Assume the firm can sell each unit at a price of $30 1. How many units should the firm produce to maximize profit? 2. What is the total revenue at that quantity? 3. How much is the profit? Notice that at 6 units the firm is still making profit. It’s just not maximizing profit Copyright ACDC Leadership 2015 35

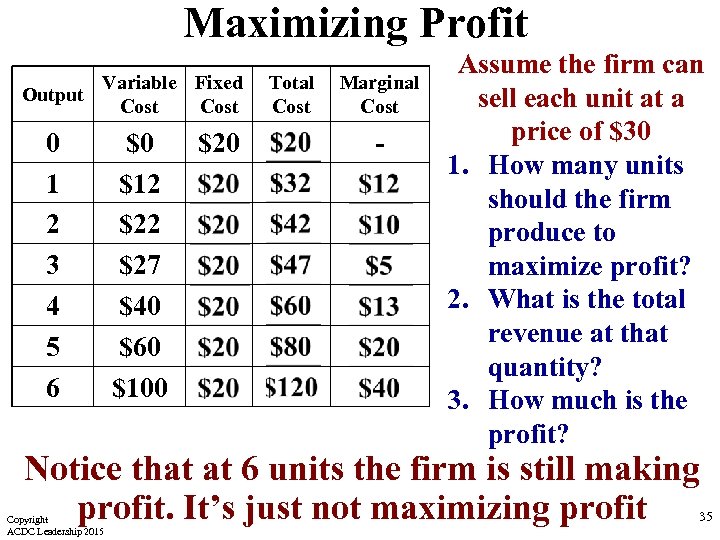

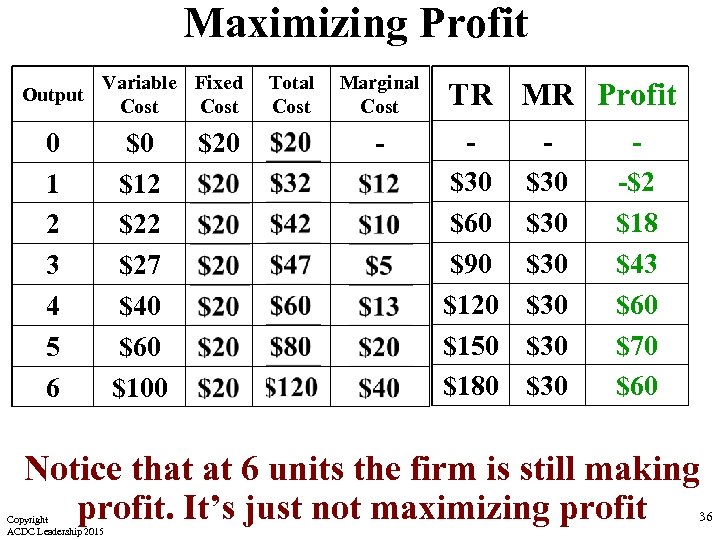

Maximizing Profit Output Variable Fixed Cost 0 1 2 3 4 5 6 $0 $12 $27 $40 $60 $100 $20 Total Cost Marginal Cost - TR MR Profit $30 $60 $90 $120 $150 $180 $30 $30 $30 -$2 $18 $43 $60 $70 $60 Notice that at 6 units the firm is still making profit. It’s just not maximizing profit Copyright ACDC Leadership 2015 36

Maximizing Profit Output Variable Fixed Cost 0 1 2 3 4 5 6 $0 $12 $27 $40 $60 $100 $20 Total Cost Marginal Cost - TR MR Profit $30 $60 $90 $120 $150 $180 $30 $30 $30 -$2 $18 $43 $60 $70 $60 Notice that at 6 units the firm is still making profit. It’s just not maximizing profit Copyright ACDC Leadership 2015 36

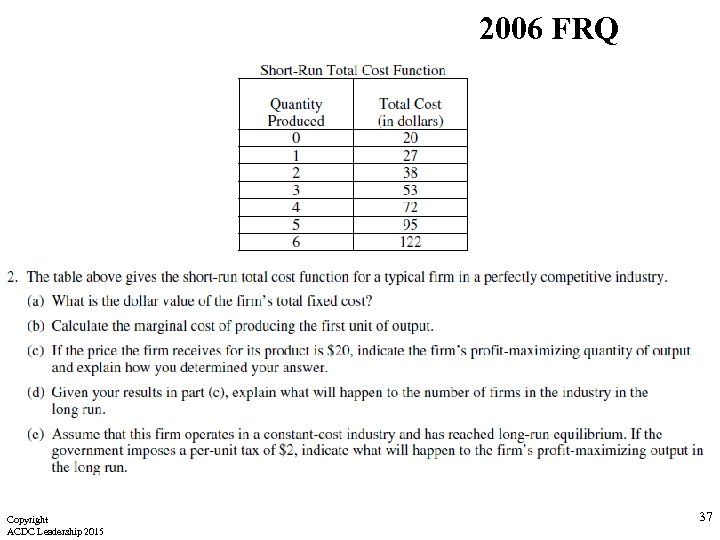

2006 FRQ Copyright ACDC Leadership 2015 37

2006 FRQ Copyright ACDC Leadership 2015 37

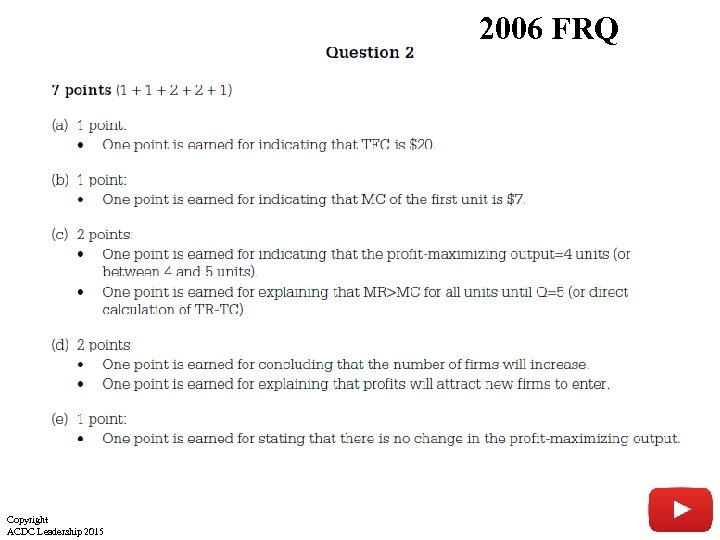

2006 FRQ Copyright ACDC Leadership 2015 38

2006 FRQ Copyright ACDC Leadership 2015 38

Short-run Supply Curve Copyright ACDC Leadership 2015 39

Short-run Supply Curve Copyright ACDC Leadership 2015 39

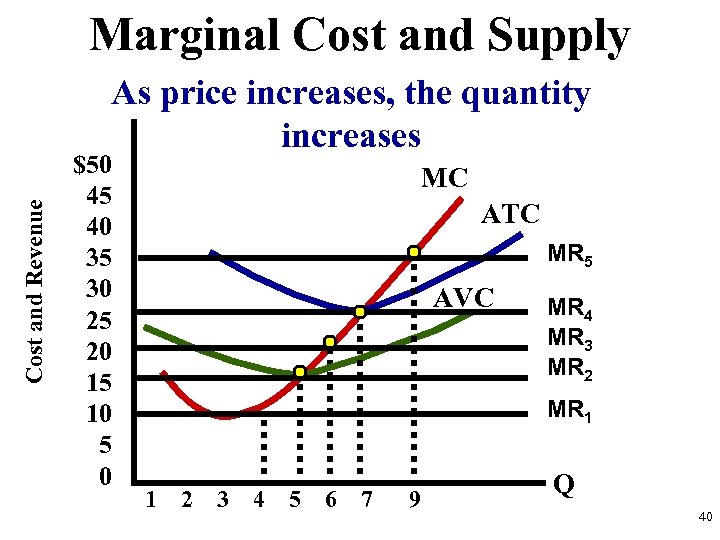

Marginal Cost and Supply Cost and Revenue As price increases, the quantity increases $50 45 40 35 30 25 20 15 10 5 0 MC ATC MR 5 AVC MR 4 MR 3 MR 2 MR 1 1 2 3 4 5 6 7 9 Q 40

Marginal Cost and Supply Cost and Revenue As price increases, the quantity increases $50 45 40 35 30 25 20 15 10 5 0 MC ATC MR 5 AVC MR 4 MR 3 MR 2 MR 1 1 2 3 4 5 6 7 9 Q 40

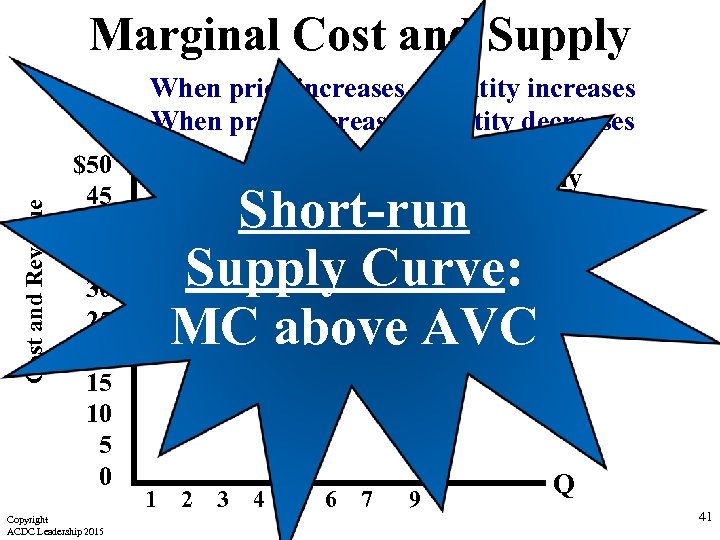

Marginal Cost and Supply Cost and Revenue When price increases, quantity increases When price decrease, quantity decreases $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC = Supply ATC Short-run Supply Curve: AVC MC above AVC 1 2 3 4 5 6 7 9 Q 41

Marginal Cost and Supply Cost and Revenue When price increases, quantity increases When price decrease, quantity decreases $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC = Supply ATC Short-run Supply Curve: AVC MC above AVC 1 2 3 4 5 6 7 9 Q 41

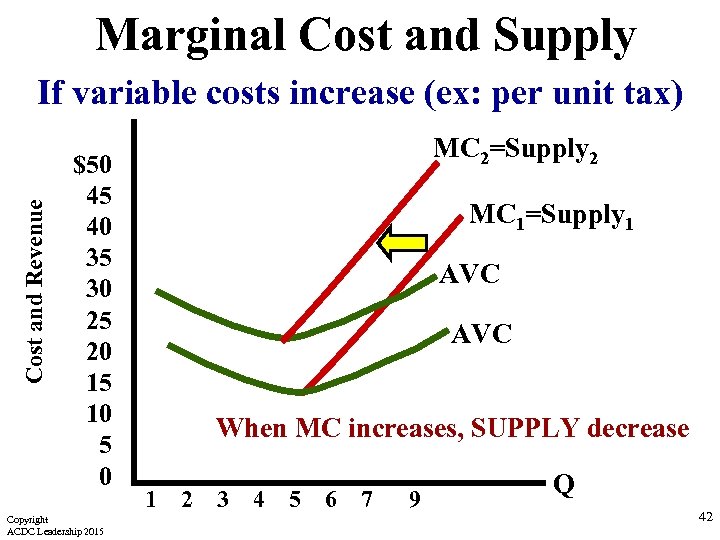

Marginal Cost and Supply Cost and Revenue If variable costs increase (ex: per unit tax) $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC 2=Supply 2 MC 1=Supply 1 AVC When MC increases, SUPPLY decrease 1 2 3 4 5 6 7 9 Q 42

Marginal Cost and Supply Cost and Revenue If variable costs increase (ex: per unit tax) $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC 2=Supply 2 MC 1=Supply 1 AVC When MC increases, SUPPLY decrease 1 2 3 4 5 6 7 9 Q 42

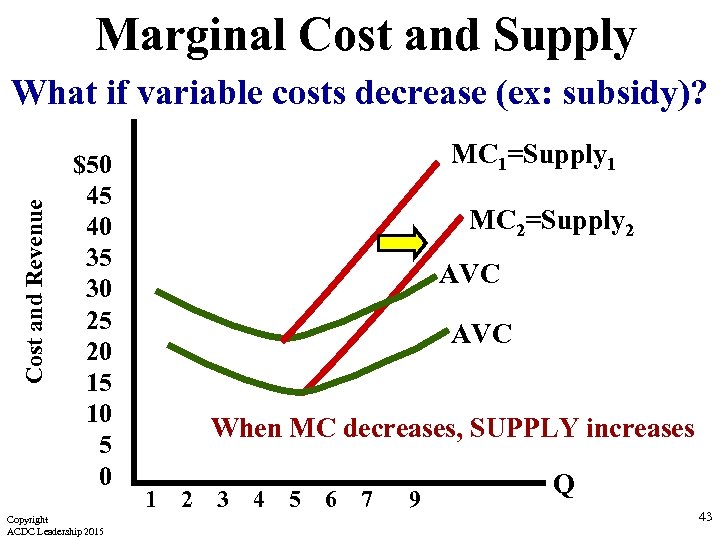

Marginal Cost and Supply Cost and Revenue What if variable costs decrease (ex: subsidy)? $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC 1=Supply 1 MC 2=Supply 2 AVC When MC decreases, SUPPLY increases 1 2 3 4 5 6 7 9 Q 43

Marginal Cost and Supply Cost and Revenue What if variable costs decrease (ex: subsidy)? $50 45 40 35 30 25 20 15 10 5 0 Copyright ACDC Leadership 2015 MC 1=Supply 1 MC 2=Supply 2 AVC When MC decreases, SUPPLY increases 1 2 3 4 5 6 7 9 Q 43

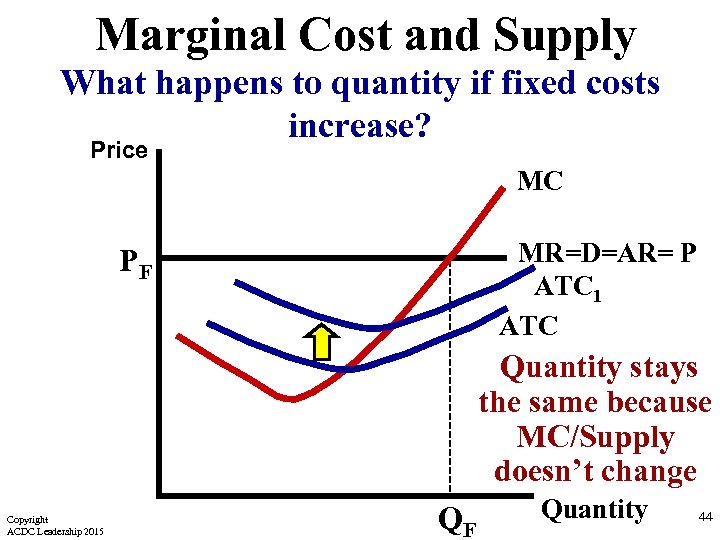

Marginal Cost and Supply What happens to quantity if fixed costs increase? Price MC MR=D=AR= P ATC 1 ATC PF Quantity stays the same because MC/Supply doesn’t change Copyright ACDC Leadership 2015 QF Quantity 44

Marginal Cost and Supply What happens to quantity if fixed costs increase? Price MC MR=D=AR= P ATC 1 ATC PF Quantity stays the same because MC/Supply doesn’t change Copyright ACDC Leadership 2015 QF Quantity 44

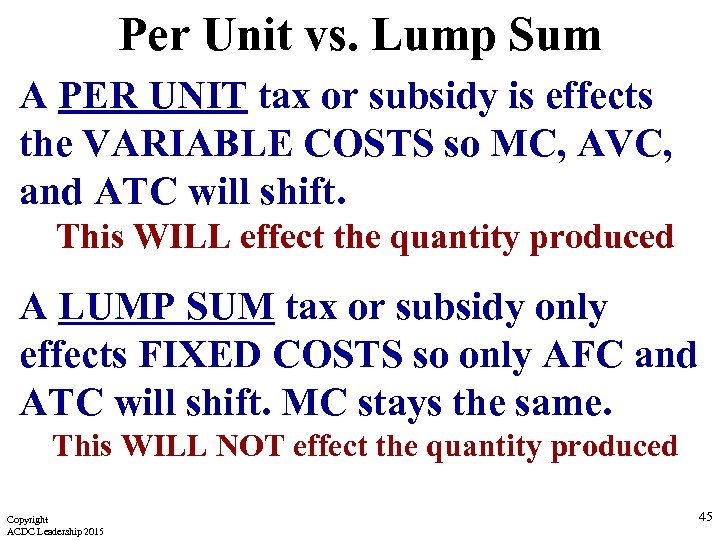

Per Unit vs. Lump Sum A PER UNIT tax or subsidy is effects the VARIABLE COSTS so MC, AVC, and ATC will shift. This WILL effect the quantity produced A LUMP SUM tax or subsidy only effects FIXED COSTS so only AFC and ATC will shift. MC stays the same. This WILL NOT effect the quantity produced Copyright ACDC Leadership 2015 45

Per Unit vs. Lump Sum A PER UNIT tax or subsidy is effects the VARIABLE COSTS so MC, AVC, and ATC will shift. This WILL effect the quantity produced A LUMP SUM tax or subsidy only effects FIXED COSTS so only AFC and ATC will shift. MC stays the same. This WILL NOT effect the quantity produced Copyright ACDC Leadership 2015 45

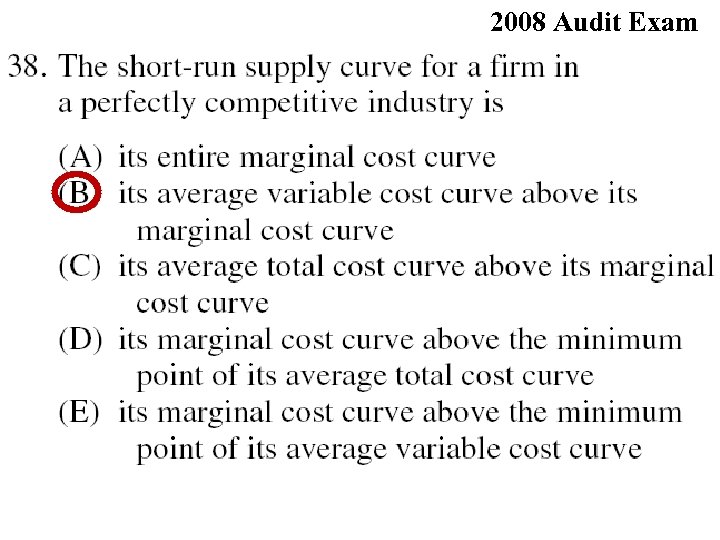

2008 Audit Exam

2008 Audit Exam

No Profit, No Product 47

No Profit, No Product 47