920f05bf3406157d667207555c051882.ppt

- Количество слайдов: 18

Unit 3: Aggregate Demand Supply and Fiscal Policy Copyright ACDC Leadership 2015 1

Unit 3: Aggregate Demand Supply and Fiscal Policy Copyright ACDC Leadership 2015 1

Aggregate Demand Copyright ACDC Leadership 2015

Aggregate Demand Copyright ACDC Leadership 2015

What is Aggregate Demand? Aggregate- “added all together. ” When we use aggregates we combine all prices and all quantities. Aggregate Demand is all the goods and services (real GDP) that buyers are willing and able to purchase at different price levels. The Demand for everything by everyone in the US. There is an inverse relationship between price level and Real GDP. If the price level: • Increases (Inflation), then real GDP demanded falls. • Decreases (deflation), the real GDP demanded increases. Copyright ACDC Leadership 2015 3

What is Aggregate Demand? Aggregate- “added all together. ” When we use aggregates we combine all prices and all quantities. Aggregate Demand is all the goods and services (real GDP) that buyers are willing and able to purchase at different price levels. The Demand for everything by everyone in the US. There is an inverse relationship between price level and Real GDP. If the price level: • Increases (Inflation), then real GDP demanded falls. • Decreases (deflation), the real GDP demanded increases. Copyright ACDC Leadership 2015 3

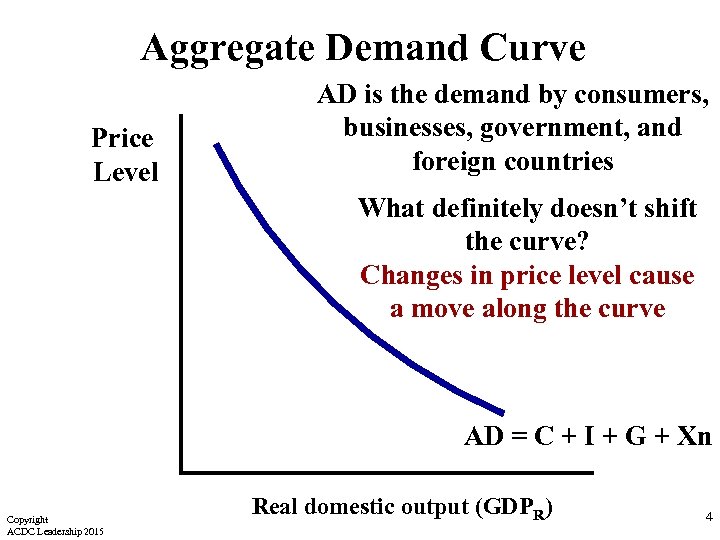

Aggregate Demand Curve Price Level AD is the demand by consumers, businesses, government, and foreign countries What definitely doesn’t shift the curve? Changes in price level cause a move along the curve AD = C + I + G + Xn Copyright ACDC Leadership 2015 Real domestic output (GDPR) 4

Aggregate Demand Curve Price Level AD is the demand by consumers, businesses, government, and foreign countries What definitely doesn’t shift the curve? Changes in price level cause a move along the curve AD = C + I + G + Xn Copyright ACDC Leadership 2015 Real domestic output (GDPR) 4

Why is AD downward sloping? 1. The Wealth Effect • Higher price levels reduce the purchasing power of money. This decreases the quantity of expenditures • Lower price levels increase purchasing power and increase expenditures Example: • If the price level doubles, people are going to buy less stuff because they have less purchasing power. • So…price level goes up, GDP demanded goes down. Copyright ACDC Leadership 2015 5

Why is AD downward sloping? 1. The Wealth Effect • Higher price levels reduce the purchasing power of money. This decreases the quantity of expenditures • Lower price levels increase purchasing power and increase expenditures Example: • If the price level doubles, people are going to buy less stuff because they have less purchasing power. • So…price level goes up, GDP demanded goes down. Copyright ACDC Leadership 2015 5

Friday, October 6 th • Happy Fri-YAY! • Notes today HW: Work on your first set of outside work for Unit III – due Tuesday. 6

Friday, October 6 th • Happy Fri-YAY! • Notes today HW: Work on your first set of outside work for Unit III – due Tuesday. 6

Friday, October th 6 • Happy Fri-Yay! • Guided Reading Packet Due • You will need something to grade with today and your notes on How a Bill Becomes a Law! 7

Friday, October th 6 • Happy Fri-Yay! • Guided Reading Packet Due • You will need something to grade with today and your notes on How a Bill Becomes a Law! 7

Why is AD downward sloping? 2. Interest-Rate Effect- • When the price level increases, lenders need to charge higher interest rates to get a REAL return on their loans. • Higher interest rates discourage consumer spending and business investment. • Example: An increase in prices leads to an increase in the interest rate from 5% to 25%. You are less likely to take out loans to improve your business. • So…price level goes up, GDP demanded goes down. Copyright ACDC Leadership 2015 8

Why is AD downward sloping? 2. Interest-Rate Effect- • When the price level increases, lenders need to charge higher interest rates to get a REAL return on their loans. • Higher interest rates discourage consumer spending and business investment. • Example: An increase in prices leads to an increase in the interest rate from 5% to 25%. You are less likely to take out loans to improve your business. • So…price level goes up, GDP demanded goes down. Copyright ACDC Leadership 2015 8

Why is AD downward sloping? 3. Foreign Trade Effect • When U. S. price level rises, foreign buyers purchase fewer U. S. goods and Americans buy more foreign goods • Exports fall and imports rise causing real GDP demanded to fall. (XN Decreases) • Example: If prices triple in the US, Canada will no longer buy US goods causing quantity demanded of US products to fall. • So…price level goes up, GDP demanded goes down Copyright ACDC Leadership 2015 9

Why is AD downward sloping? 3. Foreign Trade Effect • When U. S. price level rises, foreign buyers purchase fewer U. S. goods and Americans buy more foreign goods • Exports fall and imports rise causing real GDP demanded to fall. (XN Decreases) • Example: If prices triple in the US, Canada will no longer buy US goods causing quantity demanded of US products to fall. • So…price level goes up, GDP demanded goes down Copyright ACDC Leadership 2015 9

Shifters of Aggregate Demand GDP = C + I + G + Xn Copyright ACDC Leadership 2015 10

Shifters of Aggregate Demand GDP = C + I + G + Xn Copyright ACDC Leadership 2015 10

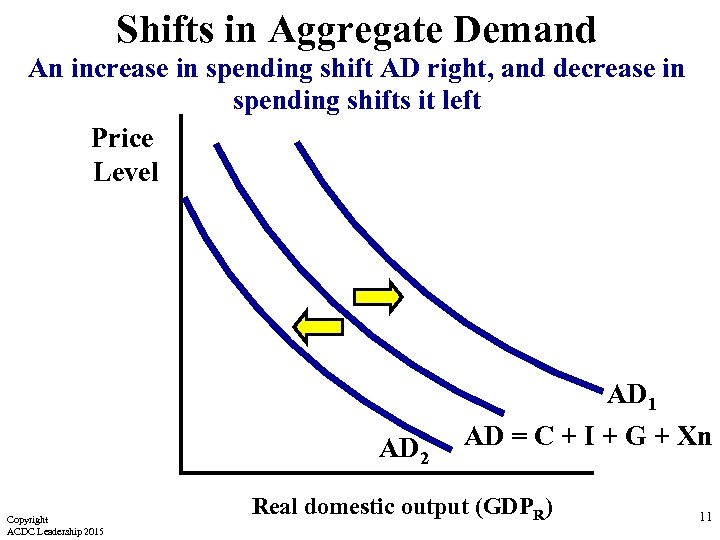

Shifts in Aggregate Demand An increase in spending shift AD right, and decrease in spending shifts it left Price Level AD 1 AD 2 Copyright ACDC Leadership 2015 AD = C + I + G + Xn Real domestic output (GDPR) 11

Shifts in Aggregate Demand An increase in spending shift AD right, and decrease in spending shifts it left Price Level AD 1 AD 2 Copyright ACDC Leadership 2015 AD = C + I + G + Xn Real domestic output (GDPR) 11

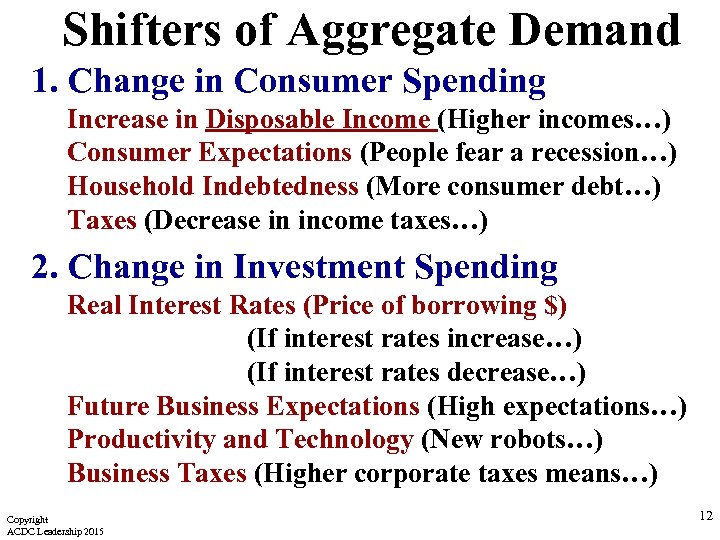

Shifters of Aggregate Demand 1. Change in Consumer Spending Increase in Disposable Income (Higher incomes…) Consumer Expectations (People fear a recession…) Household Indebtedness (More consumer debt…) Taxes (Decrease in income taxes…) 2. Change in Investment Spending Real Interest Rates (Price of borrowing $) (If interest rates increase…) (If interest rates decrease…) Future Business Expectations (High expectations…) Productivity and Technology (New robots…) Business Taxes (Higher corporate taxes means…) Copyright ACDC Leadership 2015 12

Shifters of Aggregate Demand 1. Change in Consumer Spending Increase in Disposable Income (Higher incomes…) Consumer Expectations (People fear a recession…) Household Indebtedness (More consumer debt…) Taxes (Decrease in income taxes…) 2. Change in Investment Spending Real Interest Rates (Price of borrowing $) (If interest rates increase…) (If interest rates decrease…) Future Business Expectations (High expectations…) Productivity and Technology (New robots…) Business Taxes (Higher corporate taxes means…) Copyright ACDC Leadership 2015 12

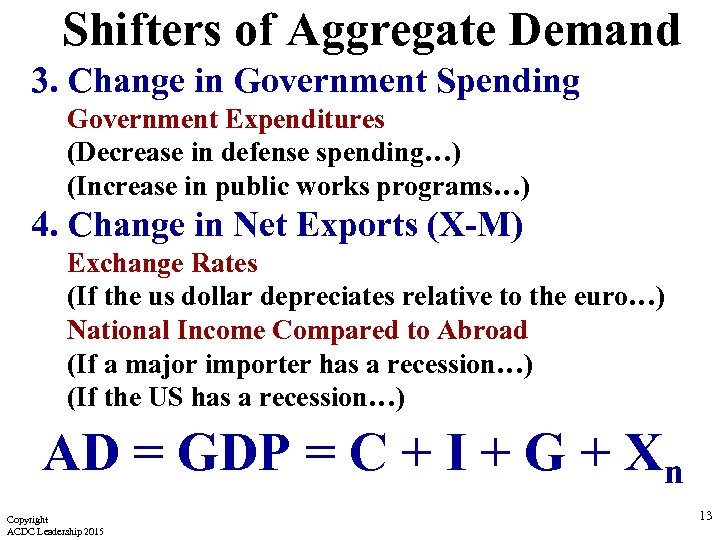

Shifters of Aggregate Demand 3. Change in Government Spending Government Expenditures (Decrease in defense spending…) (Increase in public works programs…) 4. Change in Net Exports (X-M) Exchange Rates (If the us dollar depreciates relative to the euro…) National Income Compared to Abroad (If a major importer has a recession…) (If the US has a recession…) AD = GDP = C + I + G + Xn Copyright ACDC Leadership 2015 13

Shifters of Aggregate Demand 3. Change in Government Spending Government Expenditures (Decrease in defense spending…) (Increase in public works programs…) 4. Change in Net Exports (X-M) Exchange Rates (If the us dollar depreciates relative to the euro…) National Income Compared to Abroad (If a major importer has a recession…) (If the US has a recession…) AD = GDP = C + I + G + Xn Copyright ACDC Leadership 2015 13

Determinants of AD – Changes to Fiscal v. Monetary Policy Fiscal Policy and Monetary Policy • Government can use fiscal policy to influence aggregate demand. • Fiscal policy is when the government changes taxes, transfer payments, and government expenditures on goods and services. • The Federal Reserve can use monetary policy to influence aggregate demand. • Monetary policy is when the Federal Reserves changes the quantity of money in circulation and the interest rate.

Determinants of AD – Changes to Fiscal v. Monetary Policy Fiscal Policy and Monetary Policy • Government can use fiscal policy to influence aggregate demand. • Fiscal policy is when the government changes taxes, transfer payments, and government expenditures on goods and services. • The Federal Reserve can use monetary policy to influence aggregate demand. • Monetary policy is when the Federal Reserves changes the quantity of money in circulation and the interest rate.

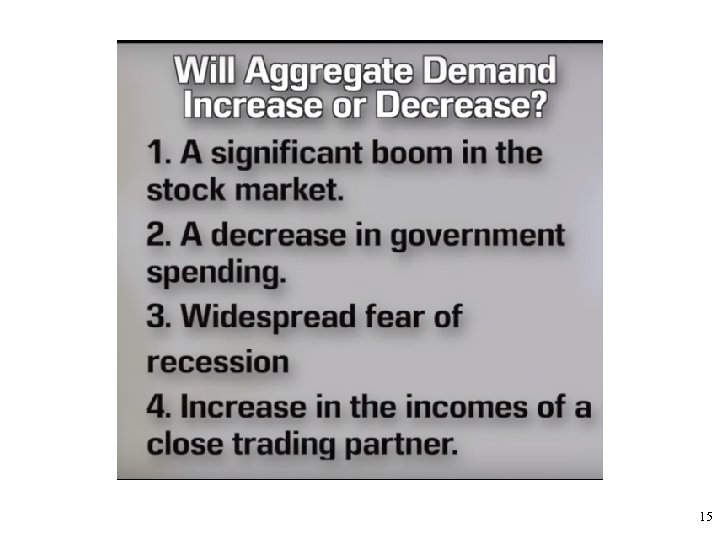

15

15

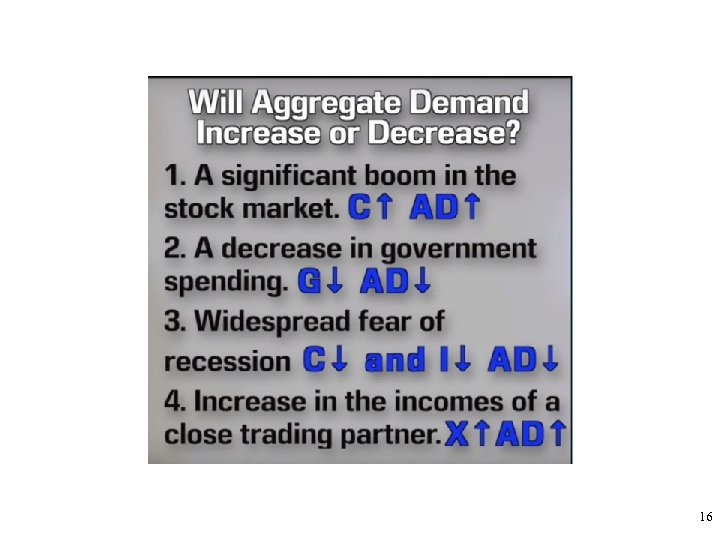

16

16

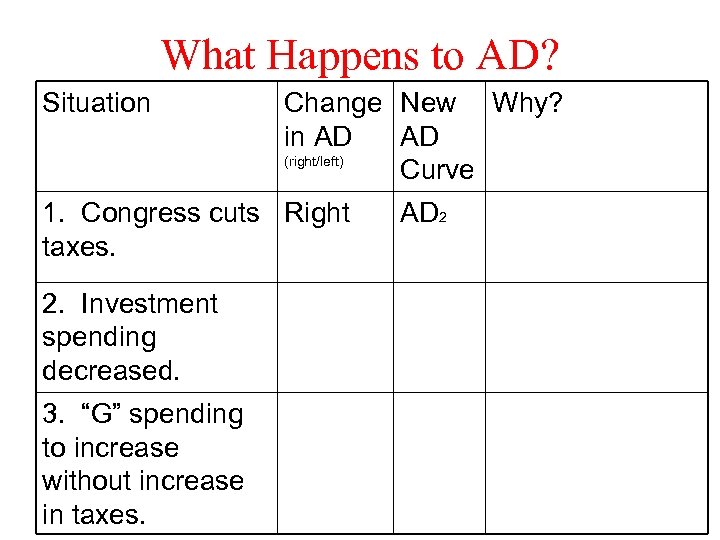

What Happens to AD? Situation Change New Why? in AD AD (right/left) Curve 1. Congress cuts Right taxes. 2. Investment spending decreased. 3. “G” spending to increase without increase in taxes. AD 2

What Happens to AD? Situation Change New Why? in AD AD (right/left) Curve 1. Congress cuts Right taxes. 2. Investment spending decreased. 3. “G” spending to increase without increase in taxes. AD 2

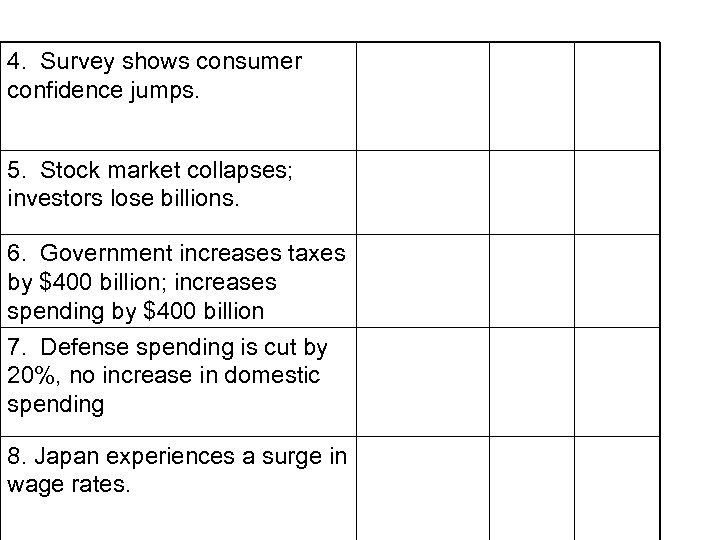

4. Survey shows consumer confidence jumps. 5. Stock market collapses; investors lose billions. 6. Government increases taxes by $400 billion; increases spending by $400 billion 7. Defense spending is cut by 20%, no increase in domestic spending 8. Japan experiences a surge in wage rates.

4. Survey shows consumer confidence jumps. 5. Stock market collapses; investors lose billions. 6. Government increases taxes by $400 billion; increases spending by $400 billion 7. Defense spending is cut by 20%, no increase in domestic spending 8. Japan experiences a surge in wage rates.