UNIT 14 BANKING

BANKING PRODUCTS AND SERVICES v. A CURRENT/CHECKING ACCOUNT v. A SAVINGS OR DEPOSIT/TIME OR NOTICE ACCOUNT v. ATMs/CASH DISPENSERS v. A CHEQUEBOOK/CHECKBOOK v. A CREDIT/DEBIT CARD v. A MORTGAGE v. AN OVERDRAFT v. INVESTMENT ADVICE/FINANCIAL CONSULTANCY v. INTERNET/TELEPHONE BANKING

BANKS AND FINANCIAL INSTITUTIONS ØCOMMERCIAL BANKS ØINVESTMENT BANKS ØPRIVATE BANKS ØSAVING BANKS ØPENSION FUNDS ØINSURANCE COMPANIES

DOMINO RESULTS 1 – 11 – 6 – 8 – 3 – 12 – 5 – 2 – 10 – 4 – 7 – 9 – 13 RECEIVE DEPOSIT MAKE LOANS GIVE FINANCIAL ADVICE RAISE CAPITAL ISSUE SHARES ARRANGE MERGERS

OFFER PORTFOLIO MANAGEMENT USE INVESTING STRATEGIES ACHIEVE HIGH RETURNS GO BANKRUPT PASS A LAW SHARE PROFITS OR LOSSES

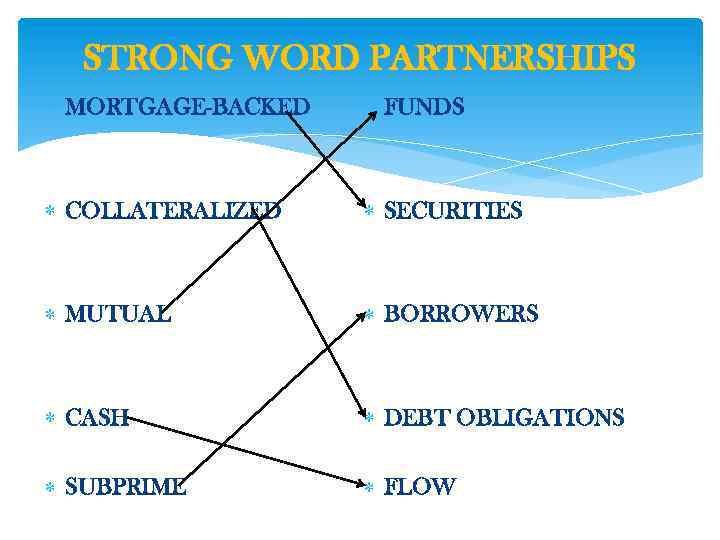

STRONG WORD PARTNERSHIPS MORTGAGE-BACKED FUNDS COLLATERALIZED SECURITIES MUTUAL BORROWERS CASH DEBT OBLIGATIONS SUBPRIME FLOW

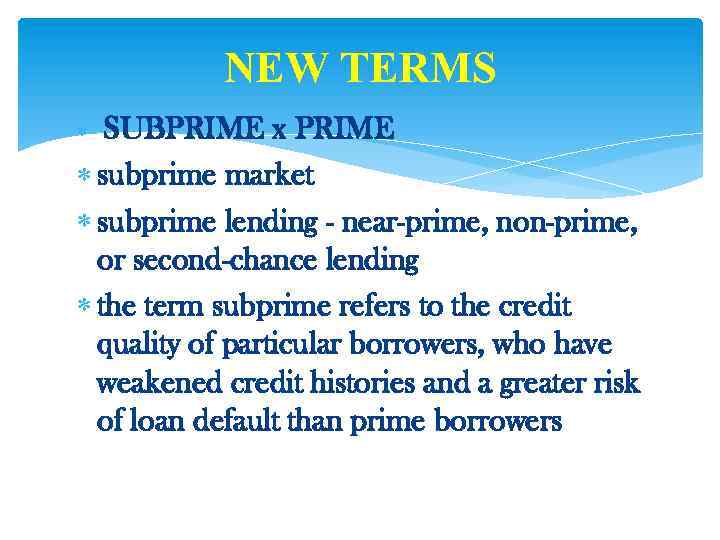

NEW TERMS SUBPRIME x PRIME subprime market subprime lending - near-prime, non-prime, or second-chance lending the term subprime refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers

CREDIT CRUNCH (also known as a credit squeeze or credit crisis) a reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from the banks An economic condition in which investment capital is difficult to obtain. Banks and investors become wary of lending funds to corporations, which drives up the price of debt products for borrowers. ÚVĚROVÝ STROP ÚVĚROVÁ KONTRAKCE ÚVĚROVÁ KRIZE

q. SUBPRIME BORROWERS q. MBS - CDO q. SECURITIZATION q. THE CAUSE FOR THE FALL OF SUBPRIME SECURITIES q. THE IMPACT OF THE DECLINE IN THE VALUE OF SUBPRIME SECURITIES

SUBPRIME BORROWERS with poor credit ratings and high risk of default MBS – CDO mortgage backed securities –collateralized debt obligations SECURITIZATION Process of buying MBS and CDO by financial institutions, grouping them and converted into securities offered then to investors

THE CAUSE FOR THE FALL Subprime borrowers stopped paying their mortgages THE IMPACT OF THE DECLINE Banks suffered losses, some went bankrupt Necessity to write off worthless subprime MBS → credit crunch

FROM AAA TO C RATING Bonds are regarded as among the safest investments available. When a company collapses, the bond holders are closest to the front of the queue to have their investment paid back, while shareholders have to wait until later, when much of the cash may already have been paid out. However, the possibility of default is a key consideration for investors, and as a result a complex apparatus has been constructed to guide them as to the safety or otherwise of any particular bond. Credit-ratings agencies exist to rate government and corporate bonds based on the likehood of defaults. These ratings range from AAA, the best quality, to C. Typically, bonds rated BAA or above are regarded as a “investment grade” and those below are called “junk bonds”. In recompense for the higher risk of default, the junk bonds’ interest rates are usually far higher.