09077c0c12879d7096d354cfd10ce0f4.ppt

- Количество слайдов: 18

union Budget 2016 indirect tax changes rajesh Kumar T. r. Partner, hiregange & associates Hiregange & Associates

Service Tax • No Change in the Basic Rate of Service Tax and continues @ 14%; • Introduced new Krishi Kalyan Cess @ 0. 5% on Value of Taxable Service; - Credit only for KKC. • Transportation of passengers by air conditioned stage carriage taxable; • Services by way of transportation of goods by vessel from outside India is made taxable; • Assignment by the Government of the right to use the radio-frequency spectrum and subsequent transfers added in the declared service list;

Service Tax • Limitation period for issuing notice increased from 18 Months to 30 Months; • Interest rate rationalised – Collected not paid 24% p. a. – Others 15% – If preceeding value less than 60 Lakhs 3% discount. • Higher prosecution limit increased to Rs 200 lakh from Rs. 50 Lakh; • Arrest provision only in cases of collected but not paid.

Service Tax • Construction, erection or commissioning of mono rail and metro rail made taxable for contracts entered into post March 2016; • Exemptions to certain work where contract entered prior to specified date. – Exemption and refund as case may be for canal, dam or other irrigation works (from period 1 st July 12 to 29 th January, 14) – Exemption or refund as the case may be for construction of specified structures for specified purposes (period 1 st April, 15 to 29 th Feb, 16) – Exemption or refund as the case may be for construction of port or airport for specified purposes (period 1 st April, 15 to 29 th Feb, 16)

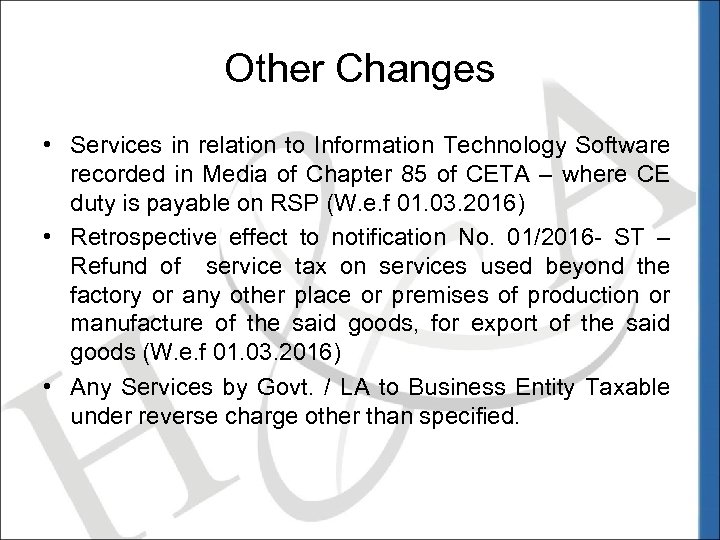

Other Changes • Services in relation to Information Technology Software recorded in Media of Chapter 85 of CETA – where CE duty is payable on RSP (W. e. f 01. 03. 2016) • Retrospective effect to notification No. 01/2016 - ST – Refund of service tax on services used beyond the factory or any other place or premises of production or manufacture of the said goods, for export of the said goods (W. e. f 01. 03. 2016) • Any Services by Govt. / LA to Business Entity Taxable under reverse charge other than specified.

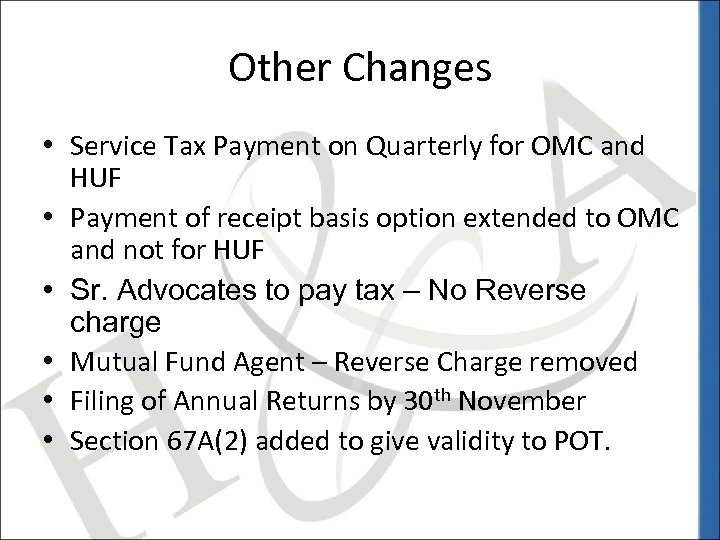

Other Changes • Service Tax Payment on Quarterly for OMC and HUF • Payment of receipt basis option extended to OMC and not for HUF • Sr. Advocates to pay tax – No Reverse charge • Mutual Fund Agent – Reverse Charge removed • Filing of Annual Returns by 30 th November • Section 67 A(2) added to give validity to POT.

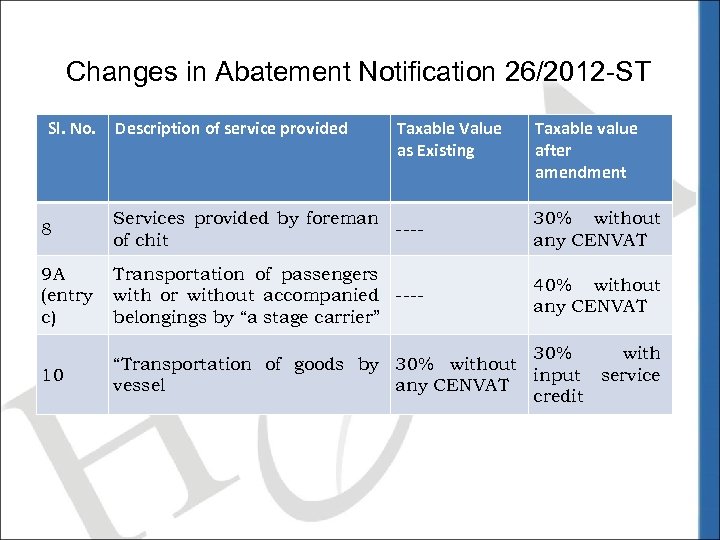

Changes in Abatement Notification 26/2012 -ST Sl. No. Description of service provided Taxable Value as Existing Taxable value after amendment 8 Services provided by foreman ---of chit 30% without any CENVAT 9 A (entry c) Transportation of passengers with or without accompanied ---belongings by “a stage carrier” 40% without any CENVAT 10 30% with “Transportation of goods by 30% without input service vessel any CENVAT credit

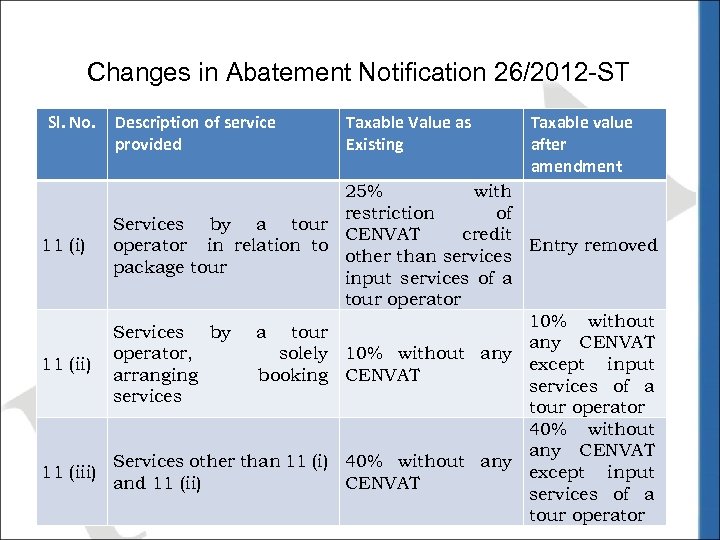

Changes in Abatement Notification 26/2012 -ST Sl. No. Description of service provided Taxable Value as Existing Taxable value after amendment 25% with restriction of Services by a tour CENVAT credit 11 (i) operator in relation to Entry removed other than services package tour input services of a tour operator 10% without Services by a tour any CENVAT operator, solely 10% without any 11 (ii) except input arranging booking CENVAT services of a services tour operator 40% without any CENVAT Services other than 11 (i) 40% without any 11 (iii) except input and 11 (ii) CENVAT services of a tour operator

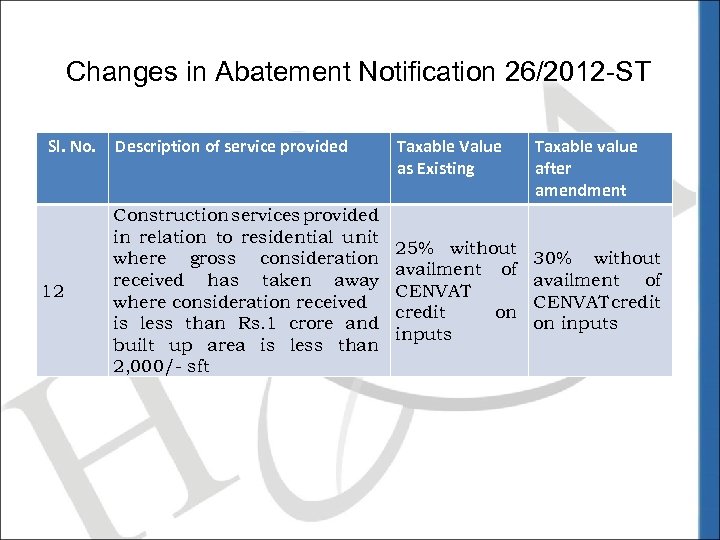

Changes in Abatement Notification 26/2012 -ST Sl. No. 12 Description of service provided Construction services provided in relation to residential unit where gross consideration received has taken away where consideration received is less than Rs. 1 crore and built up area is less than 2, 000/- sft Taxable Value as Existing 25% without availment of CENVAT credit on inputs Taxable value after amendment 30% without availment of CENVAT credit on inputs

Dispute Resolution Scheme • Applicable for declarations made upto 31 December 2016 • Applicable in case of Service Tax/Excise/Customs disputes pending before Commissioner (Appeals) as on 1 March, 2016 • Designated authority will issue an acknowledgment of declaration received • Declarant will be required to pay tax, interest and 25% of penalty imposed within 15 days of receipt of an acknowledgment • Declarant will intimate designated authority within 7 days of making such payment giving details of payment • Within 15 days from date of receiving an intimation from declarant, designated authority will pass an order of discharge of dues • Not Applicable in certain cases

CENTRAL EXCISE Hiregange & Associates

Central Excise Changes • Central Excise Duty Rate – No change • Exemption withdrawn on Non-branded Jewellery • Exemption withdrawn on Readymade Garments and other products of textile and textile madeups • RMC at site exempted • Deemed Manufacture – 01. 03. 2016 a) all goods falling under CETSH 3401 and 3402 – soap and other cleaning products; b) aluminum foils of a thickness < 0. 2 mm; c) wrist wearable devices (smart watches) and d) accessories of motor vehicle.

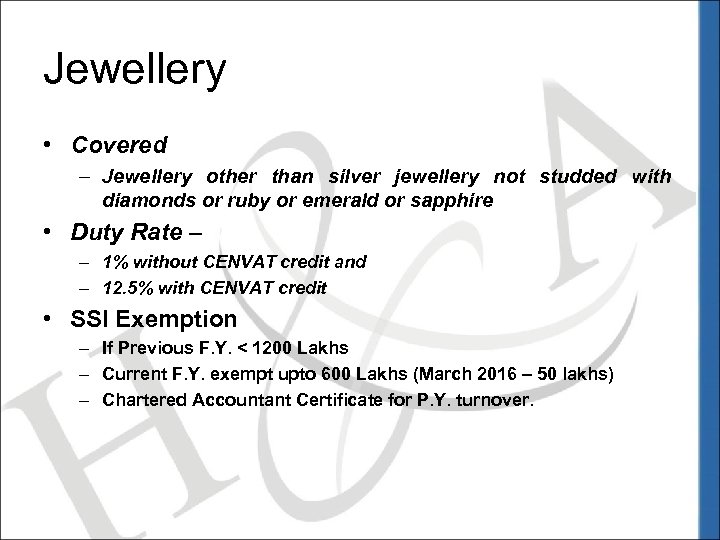

Jewellery • Covered – Jewellery other than silver jewellery not studded with diamonds or ruby or emerald or sapphire • Duty Rate – – 1% without CENVAT credit and – 12. 5% with CENVAT credit • SSI Exemption – If Previous F. Y. < 1200 Lakhs – Current F. Y. exempt upto 600 Lakhs (March 2016 – 50 lakhs) – Chartered Accountant Certificate for P. Y. turnover.

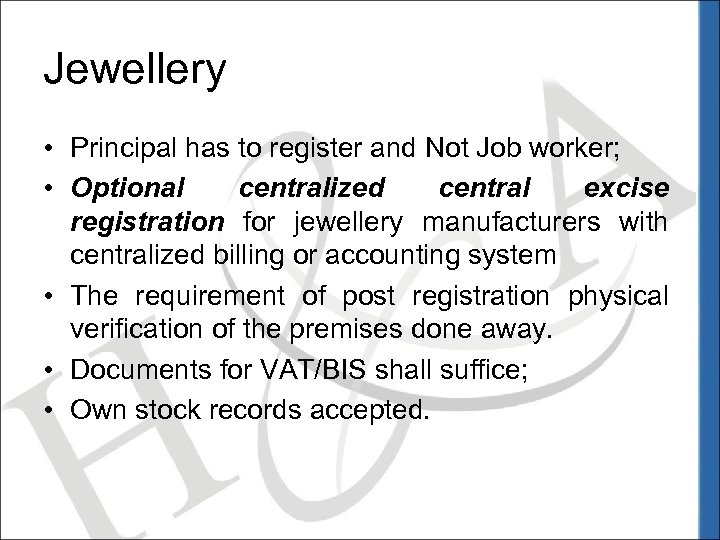

Jewellery • Principal has to register and Not Job worker; • Optional centralized central excise registration for jewellery manufacturers with centralized billing or accounting system • The requirement of post registration physical verification of the premises done away. • Documents for VAT/BIS shall suffice; • Own stock records accepted.

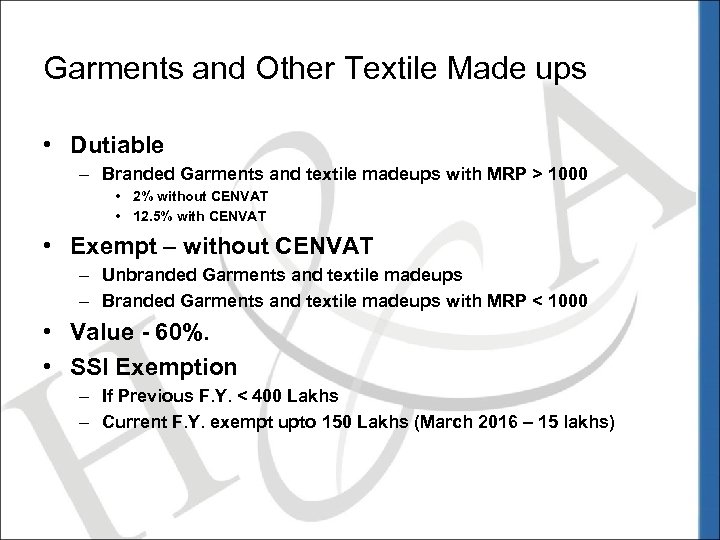

Garments and Other Textile Made ups • Dutiable – Branded Garments and textile madeups with MRP > 1000 • 2% without CENVAT • 12. 5% with CENVAT • Exempt – without CENVAT – Unbranded Garments and textile madeups – Branded Garments and textile madeups with MRP < 1000 • Value - 60%. • SSI Exemption – If Previous F. Y. < 400 Lakhs – Current F. Y. exempt upto 150 Lakhs (March 2016 – 15 lakhs)

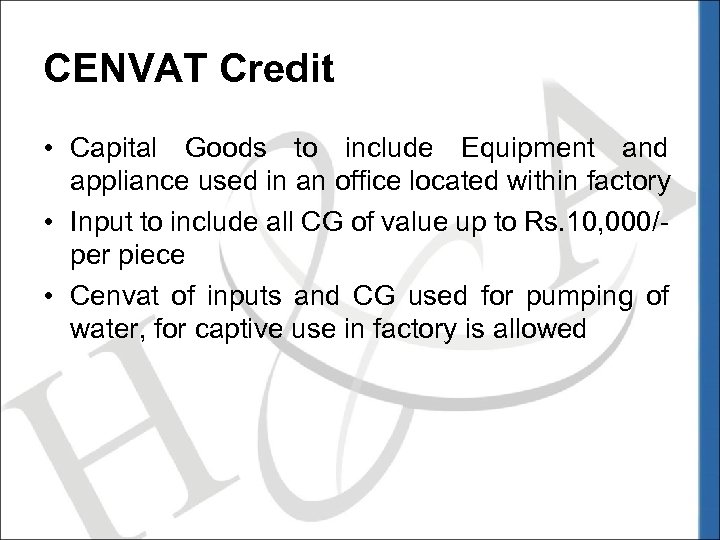

CENVAT Credit • Capital Goods to include Equipment and appliance used in an office located within factory • Input to include all CG of value up to Rs. 10, 000/per piece • Cenvat of inputs and CG used for pumping of water, for captive use in factory is allowed

Other Changes in CENVAT Credit Rules • Credit relating to goods used at Job premises rationalized. • Proportionate credit in case of right natural resources; • Rule 6(3) rationalised; • Centralised warehousing for multiple permitted under ISD registration • Capital goods credit even if used for activity within 2 years. workers to use units is dutiable

Thank You rajesh@hiregange. com Hiregange & Associates

09077c0c12879d7096d354cfd10ce0f4.ppt