f084a75dd49facf9d3fef871a55c405a.ppt

- Количество слайдов: 12

UNECE – SECOND INTERNATIONAL FORUM ON TRADE FACILITATION GENEVA, 14 -15 MAY 2003 COSTS AND BENEFITS OF TRADE FACILITATION Anthony Kleitz Trade Directorate, OECD 1

UNECE – SECOND INTERNATIONAL FORUM ON TRADE FACILITATION GENEVA, 14 -15 MAY 2003 COSTS AND BENEFITS OF TRADE FACILITATION Anthony Kleitz Trade Directorate, OECD 1

I. OBJECTIVE OF THIS PRESENTATION n n Understand better the nature and importance of trade facilitation. Focus on a quantitative rather qualitative assessment. 2

I. OBJECTIVE OF THIS PRESENTATION n n Understand better the nature and importance of trade facilitation. Focus on a quantitative rather qualitative assessment. 2

II. DEFINITIONS Trade facilitation (TF) – an imprecise term n WTO: simplification and harmonisation of trade procedures; n Often considered to include other procedural NTBs. Costs and benefits – not the flip side of each other n Trade transaction costs (TTC): what TF aims to reduce; n Implementation costs of TF; n Benefits of TF: come from the reduction of TTC; n Public and private sectors see different costs and benefits. 3

II. DEFINITIONS Trade facilitation (TF) – an imprecise term n WTO: simplification and harmonisation of trade procedures; n Often considered to include other procedural NTBs. Costs and benefits – not the flip side of each other n Trade transaction costs (TTC): what TF aims to reduce; n Implementation costs of TF; n Benefits of TF: come from the reduction of TTC; n Public and private sectors see different costs and benefits. 3

III. QUANTITATIVE ANALYSIS OF COSTS AND BENEFITS OF TF a) Challenges: 1. 2. 3. 4. Inconsistent data on TTC and implementation costs; No standard methodology for analysis; Results vary according to parameters and assumptions. Public and private sectors face different costs and benefits. b) Implementation costs for governments - an example of data for automated customs systems: § § § Chile – $ 5 m. ; Chinese Taipei – $ 5 m. (air-cargo system), $ 6. 5 m. (sea-cargo system); US – overall $ 1 b. (ACE estimate). 4

III. QUANTITATIVE ANALYSIS OF COSTS AND BENEFITS OF TF a) Challenges: 1. 2. 3. 4. Inconsistent data on TTC and implementation costs; No standard methodology for analysis; Results vary according to parameters and assumptions. Public and private sectors face different costs and benefits. b) Implementation costs for governments - an example of data for automated customs systems: § § § Chile – $ 5 m. ; Chinese Taipei – $ 5 m. (air-cargo system), $ 6. 5 m. (sea-cargo system); US – overall $ 1 b. (ACE estimate). 4

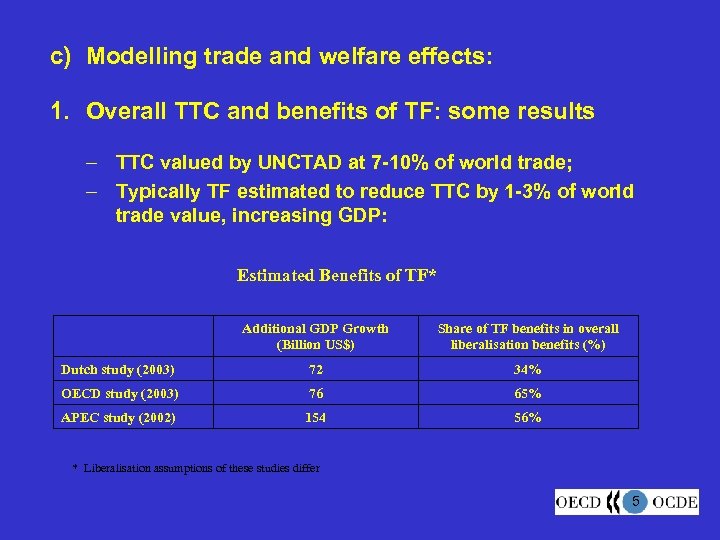

c) Modelling trade and welfare effects: 1. Overall TTC and benefits of TF: some results – TTC valued by UNCTAD at 7 -10% of world trade; – Typically TF estimated to reduce TTC by 1 -3% of world trade value, increasing GDP: Estimated Benefits of TF* Additional GDP Growth (Billion US$) Share of TF benefits in overall liberalisation benefits (%) Dutch study (2003) 72 34% OECD study (2003) 76 65% APEC study (2002) 154 56% * Liberalisation assumptions of these studies differ 5

c) Modelling trade and welfare effects: 1. Overall TTC and benefits of TF: some results – TTC valued by UNCTAD at 7 -10% of world trade; – Typically TF estimated to reduce TTC by 1 -3% of world trade value, increasing GDP: Estimated Benefits of TF* Additional GDP Growth (Billion US$) Share of TF benefits in overall liberalisation benefits (%) Dutch study (2003) 72 34% OECD study (2003) 76 65% APEC study (2002) 154 56% * Liberalisation assumptions of these studies differ 5

2. Quantitative cost indications for particular sectors: Some goods more susceptible to border controls -- e. g. border delays for agricultural products: • • Korea – typically 10 -18 days for new products (cf. less than 3 -4 days for most other agricultural products); Japan – 1 day more for sea-cargoes subject to other government procedures (e. g. animal and plant quarantine, food sanitary). 6

2. Quantitative cost indications for particular sectors: Some goods more susceptible to border controls -- e. g. border delays for agricultural products: • • Korea – typically 10 -18 days for new products (cf. less than 3 -4 days for most other agricultural products); Japan – 1 day more for sea-cargoes subject to other government procedures (e. g. animal and plant quarantine, food sanitary). 6

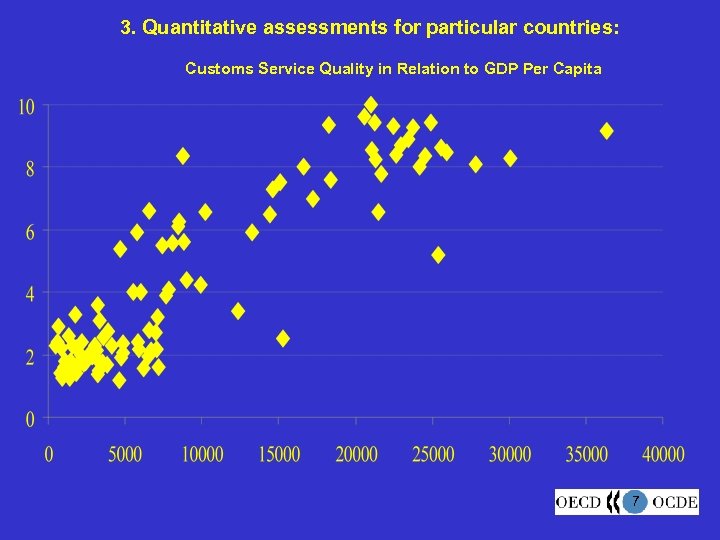

3. Quantitative assessments for particular countries: Customs Service Quality in Relation to GDP Per Capita 7

3. Quantitative assessments for particular countries: Customs Service Quality in Relation to GDP Per Capita 7

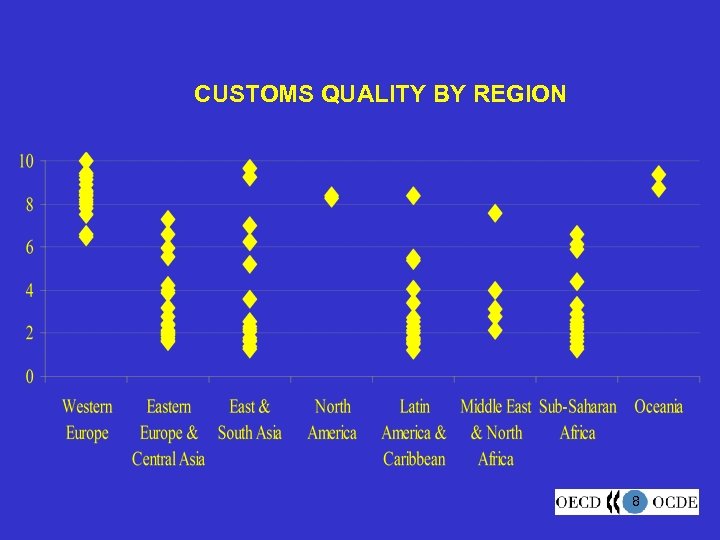

CUSTOMS QUALITY BY REGION 8

CUSTOMS QUALITY BY REGION 8

OBSERVATIONS ON PERCEIVED QUALITY OF THE CUSTOMS ENVIRONMENT n n n “Customs service quality” is an average of three survey indicators; SMEs and developing country firms frequently seen as disadvantaged in meeting TTC and implementation costs; Positive correlation between income and customs quality; Yet many examples of low-income countries with good customs services; Examples of countries with good customs found in all major regions; Suggests that benefits can be within grasp. 9

OBSERVATIONS ON PERCEIVED QUALITY OF THE CUSTOMS ENVIRONMENT n n n “Customs service quality” is an average of three survey indicators; SMEs and developing country firms frequently seen as disadvantaged in meeting TTC and implementation costs; Positive correlation between income and customs quality; Yet many examples of low-income countries with good customs services; Examples of countries with good customs found in all major regions; Suggests that benefits can be within grasp. 9

4. Calculations for particular kinds of costs and benefits: • Administrative costs: Japan MITI estimates feasible reductions of import prices: – 0. 5 -1. 2% for transport machinery; – 1. 5 -2. 4% for other machinery and equipment. • Savings from paperless trading: – estimated 1. 5 -15% of landed value by Australian DFAT; – 3% average $60 b. savings across APEC. • Time required for customs release. 10

4. Calculations for particular kinds of costs and benefits: • Administrative costs: Japan MITI estimates feasible reductions of import prices: – 0. 5 -1. 2% for transport machinery; – 1. 5 -2. 4% for other machinery and equipment. • Savings from paperless trading: – estimated 1. 5 -15% of landed value by Australian DFAT; – 3% average $60 b. savings across APEC. • Time required for customs release. 10

Average Customs Clearance Time for Imports through trade facilitation (Hours) Economy Before After 240 0. 2 48 - 96 0. 25 Greece 5 -6 0. 5 Korea 2. 8 0. 75 Costa Rica 144 0. 2 - 1. 9 360 - 720 2 - 24 New Zealand Singapore Peru Source: WTO, OECD, and others 11

Average Customs Clearance Time for Imports through trade facilitation (Hours) Economy Before After 240 0. 2 48 - 96 0. 25 Greece 5 -6 0. 5 Korea 2. 8 0. 75 Costa Rica 144 0. 2 - 1. 9 360 - 720 2 - 24 New Zealand Singapore Peru Source: WTO, OECD, and others 11

IV. CONCLUDING REMARKS No single answer; work continues. Important to identify key areas where TF may produce greatest benefits. • One size does not fit all; • Importance of a coherent approach to streamlining procedures and improving infrastructure. 12

IV. CONCLUDING REMARKS No single answer; work continues. Important to identify key areas where TF may produce greatest benefits. • One size does not fit all; • Importance of a coherent approach to streamlining procedures and improving infrastructure. 12