65fda0478113c234deecd2531813ae4a.ppt

- Количество слайдов: 31

UNECE International Forum on Trade Facilitation Session III: Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002

UNECE International Forum on Trade Facilitation Session III: Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002

UNECE International Forum on Trade Facilitation… Session III Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002

UNECE International Forum on Trade Facilitation… Session III Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002

The Facts of International Trade - a US$7 Trillion Business With Huge Inefficiencies n UN estimates that up to US$420 billion is wasted on inefficient processing, arising from: Vast number of trading parties and service providers communicating with paper-based processes - Incompatible business processes and systems - Very little process integration - The high error rates from re-keying of data - n Companies involved in international trade require solutions that can streamline ‘end-to-end’ processing by use of e-commerce.

The Facts of International Trade - a US$7 Trillion Business With Huge Inefficiencies n UN estimates that up to US$420 billion is wasted on inefficient processing, arising from: Vast number of trading parties and service providers communicating with paper-based processes - Incompatible business processes and systems - Very little process integration - The high error rates from re-keying of data - n Companies involved in international trade require solutions that can streamline ‘end-to-end’ processing by use of e-commerce.

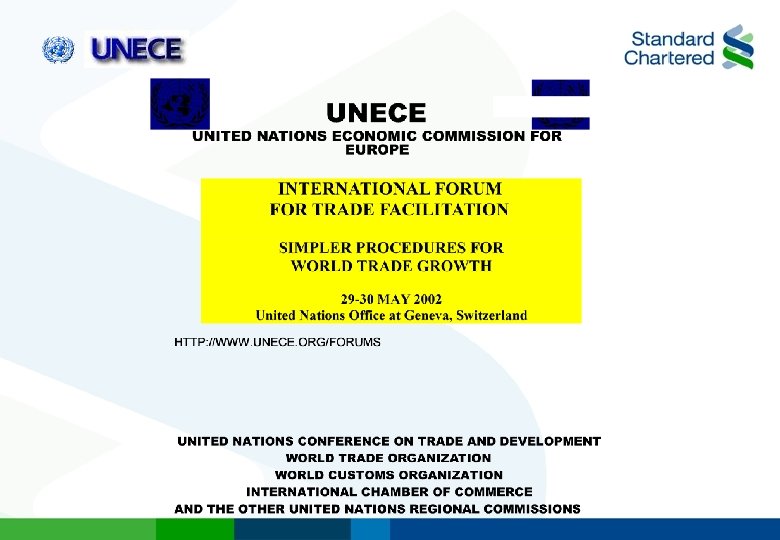

Business To Business Complexity 1. Request for Quote 3. Purchase Order 4. P. O. Confirmation 2. Quotation 13. Payment Order 6. Ship Order / Instr. 14. Remittance Buyer Bank st a. M 7 a e nif an ife st 5. Order Shipper Air Express Terminal at Destination 11. Pre Bank . M 7 a 16. Proof of Delivery Supplier 12. Export documents 15. Import documents t nifes rrival N Air Carrier otice 7 a. Ship Instr. Cycle Freight Forwarder Capture g Ord in hipp 7 b. S gate movement 12. Gate-in/ gate-out 10. Bay Plan Terminal at Destination 8. Gate-out/ gate-in Invoice Terminal at Origin a 7 a. M -alert / A / Instr. + er o. L /O, B e (S Cycl ) Freight Forwarder Capture gate movement (gate-out/in) 9. Bay Plan Ocean Carrier 5. Shipper Order/Instr. + Invoice + Packing List Terminal at Origin

Business To Business Complexity 1. Request for Quote 3. Purchase Order 4. P. O. Confirmation 2. Quotation 13. Payment Order 6. Ship Order / Instr. 14. Remittance Buyer Bank st a. M 7 a e nif an ife st 5. Order Shipper Air Express Terminal at Destination 11. Pre Bank . M 7 a 16. Proof of Delivery Supplier 12. Export documents 15. Import documents t nifes rrival N Air Carrier otice 7 a. Ship Instr. Cycle Freight Forwarder Capture g Ord in hipp 7 b. S gate movement 12. Gate-in/ gate-out 10. Bay Plan Terminal at Destination 8. Gate-out/ gate-in Invoice Terminal at Origin a 7 a. M -alert / A / Instr. + er o. L /O, B e (S Cycl ) Freight Forwarder Capture gate movement (gate-out/in) 9. Bay Plan Ocean Carrier 5. Shipper Order/Instr. + Invoice + Packing List Terminal at Origin

The Fragmented Process Translates into Inefficiency Data re-entry, errors n Inability for right people to access right information at right time n Can’t track entire transactions; analysis and reconciliation are difficult n No cross sector process integration n

The Fragmented Process Translates into Inefficiency Data re-entry, errors n Inability for right people to access right information at right time n Can’t track entire transactions; analysis and reconciliation are difficult n No cross sector process integration n

The prize for fixing the problem is substantial n Paperwork accounts for 5 -10% of the cost of int’l trade n a material impact on net margins Automation can reduce the cost by over half n Other forms of collaboration can also yield significant benefit n n product design, inventory planning, etc

The prize for fixing the problem is substantial n Paperwork accounts for 5 -10% of the cost of int’l trade n a material impact on net margins Automation can reduce the cost by over half n Other forms of collaboration can also yield significant benefit n n product design, inventory planning, etc

But Customer needs in international trade are unique n n n Operating efficiency for existing trading groups Direct sourcing Accommodate all types of trading partners n The SME in Asia to the MNC in the OECD End-to-end solution that is open Global access

But Customer needs in international trade are unique n n n Operating efficiency for existing trading groups Direct sourcing Accommodate all types of trading partners n The SME in Asia to the MNC in the OECD End-to-end solution that is open Global access

Solutions that address these inefficiencies include… A collaborative channel for the products and services that make businesses more efficient. n A paperless E- commerce environment where trade processes can be conducted electronically. n B 2 B products and services that are web-based : n - Trade banking services, LC, Open account, Payments, Collections etc Trade document management Customer Purchase order management services Catalog services, public and private Logistics, Shipping, Airfreight, Multi-modal, Inspection, Track and trace Market intelligence Management information reports Third party service access

Solutions that address these inefficiencies include… A collaborative channel for the products and services that make businesses more efficient. n A paperless E- commerce environment where trade processes can be conducted electronically. n B 2 B products and services that are web-based : n - Trade banking services, LC, Open account, Payments, Collections etc Trade document management Customer Purchase order management services Catalog services, public and private Logistics, Shipping, Airfreight, Multi-modal, Inspection, Track and trace Market intelligence Management information reports Third party service access

“EDI or Die” was the cry of the ’ 70 s. It was Expensive Complicated & Difficult to maintain and is in it’s death throes today!

“EDI or Die” was the cry of the ’ 70 s. It was Expensive Complicated & Difficult to maintain and is in it’s death throes today!

B 2 B e-commerce is the Solution E-Commerce Providers Insurance Government ~ Customs Buyer Terminals ANY TO ANY MESSAGING EDIFACT, X. 12 SWIFT, SAP, Notes Proprietary… Banks B 2 Be. X EDIFACT, Flat file, Notes, Excel… Any to Any Freight Forwarders Air Couriers Carriers Supplier Communication, standards and media conversion.

B 2 B e-commerce is the Solution E-Commerce Providers Insurance Government ~ Customs Buyer Terminals ANY TO ANY MESSAGING EDIFACT, X. 12 SWIFT, SAP, Notes Proprietary… Banks B 2 Be. X EDIFACT, Flat file, Notes, Excel… Any to Any Freight Forwarders Air Couriers Carriers Supplier Communication, standards and media conversion.

Building such a solution is expensive n Conventional EDI has proved too difficult for many n Significant up-front investment and resources/skills required Select B 2 B Exchanges will develop specialised supply chain / int’l trade solutions that are “rented” to customers

Building such a solution is expensive n Conventional EDI has proved too difficult for many n Significant up-front investment and resources/skills required Select B 2 B Exchanges will develop specialised supply chain / int’l trade solutions that are “rented” to customers

…the basic B 2 B Exchange n n n Ø Ø Ø n Uses the Internet & “IP” - Internet protocol An open platform - any to any messaging Cost effective electronic business medium eb. XML replaces traditional VAN EDI Provides for Personal computer browser access Creates a secure environment for trade Builds a supply chain management tool Provides for back office integration Ø Delivers an extensive range of on-line trade services Ø n Recognises the e - future of international trade

…the basic B 2 B Exchange n n n Ø Ø Ø n Uses the Internet & “IP” - Internet protocol An open platform - any to any messaging Cost effective electronic business medium eb. XML replaces traditional VAN EDI Provides for Personal computer browser access Creates a secure environment for trade Builds a supply chain management tool Provides for back office integration Ø Delivers an extensive range of on-line trade services Ø n Recognises the e - future of international trade

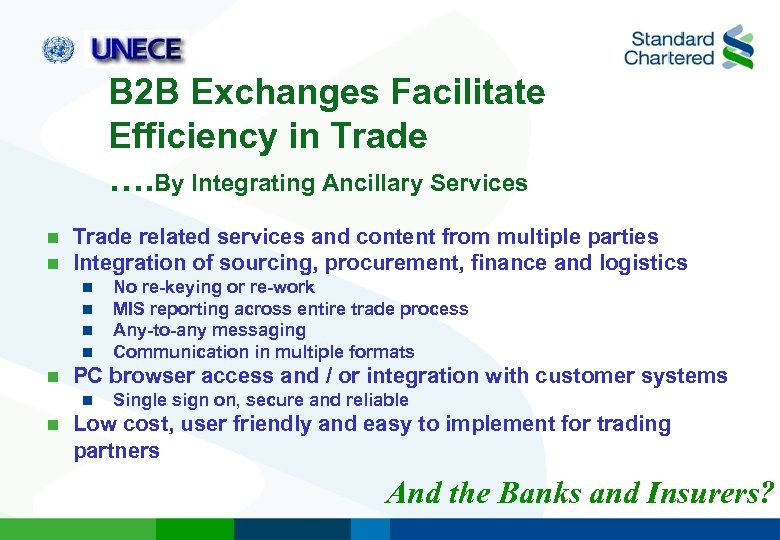

B 2 B Exchanges Facilitate Efficiency in Trade …. By Integrating Ancillary Services n n Trade related services and content from multiple parties Integration of sourcing, procurement, finance and logistics n n n PC browser access and / or integration with customer systems n n No re-keying or re-work MIS reporting across entire trade process Any-to-any messaging Communication in multiple formats Single sign on, secure and reliable Low cost, user friendly and easy to implement for trading partners And the Banks and Insurers?

B 2 B Exchanges Facilitate Efficiency in Trade …. By Integrating Ancillary Services n n Trade related services and content from multiple parties Integration of sourcing, procurement, finance and logistics n n n PC browser access and / or integration with customer systems n n No re-keying or re-work MIS reporting across entire trade process Any-to-any messaging Communication in multiple formats Single sign on, secure and reliable Low cost, user friendly and easy to implement for trading partners And the Banks and Insurers?

The Regulatory environment for Banking and Insurance Banks and Insurers are both Regulated Industries in most territories. Banks in particular are restricted in terms of the types of “nonbanking” services that they are permitted to offer. As major players in the trade process Banks and Insurers can facilitate improved and therefore more efficient processes through deeper participation in the integration of services that are ancillary to banking

The Regulatory environment for Banking and Insurance Banks and Insurers are both Regulated Industries in most territories. Banks in particular are restricted in terms of the types of “nonbanking” services that they are permitted to offer. As major players in the trade process Banks and Insurers can facilitate improved and therefore more efficient processes through deeper participation in the integration of services that are ancillary to banking

The “non –banking” Ancillary Services? Deemed by some to Sourcing include… Procurement Provision of e – Catalog’s Trade Document Creation and Management Logistics Inspection Insurance Customs and Regulatory Compliance Services Business Intelligence Services

The “non –banking” Ancillary Services? Deemed by some to Sourcing include… Procurement Provision of e – Catalog’s Trade Document Creation and Management Logistics Inspection Insurance Customs and Regulatory Compliance Services Business Intelligence Services

The New Age Service Delivery Channel for …Bankers, Insurers, traders and trade service providers The Internet offers an extraordinary means to market with significant advantages in terms of cost and efficiency and provides an opportunity for global collaboration on a scale never before possible. The basic capability to gather and re-use data from multiple sources across multiple processes without re-keying; securely and with certainty, heralds a new age of trade facilitation. But not so easy for a Bank!

The New Age Service Delivery Channel for …Bankers, Insurers, traders and trade service providers The Internet offers an extraordinary means to market with significant advantages in terms of cost and efficiency and provides an opportunity for global collaboration on a scale never before possible. The basic capability to gather and re-use data from multiple sources across multiple processes without re-keying; securely and with certainty, heralds a new age of trade facilitation. But not so easy for a Bank!

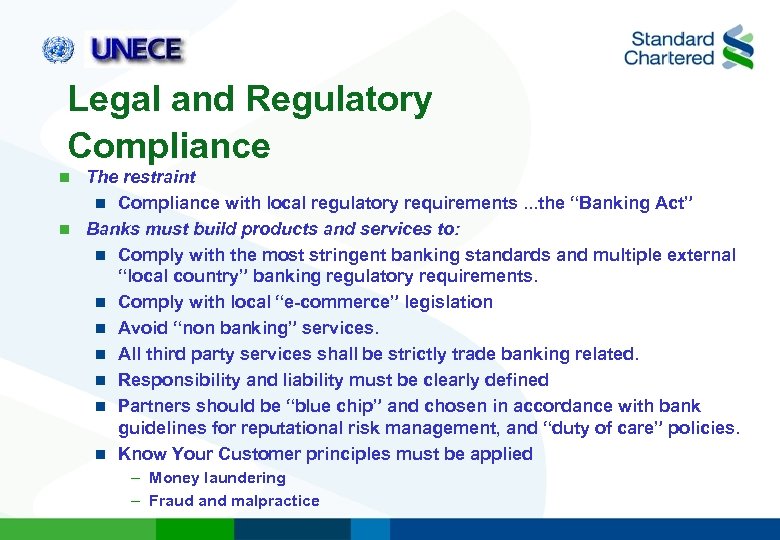

Legal and Regulatory Compliance The restraint n Compliance with local regulatory requirements. . . the “Banking Act” n Banks must build products and services to: n Comply with the most stringent banking standards and multiple external “local country” banking regulatory requirements. n Comply with local “e-commerce” legislation n Avoid “non banking” services. n All third party services shall be strictly trade banking related. n Responsibility and liability must be clearly defined n Partners should be “blue chip” and chosen in accordance with bank guidelines for reputational risk management, and “duty of care” policies. n Know Your Customer principles must be applied n – Money laundering – Fraud and malpractice

Legal and Regulatory Compliance The restraint n Compliance with local regulatory requirements. . . the “Banking Act” n Banks must build products and services to: n Comply with the most stringent banking standards and multiple external “local country” banking regulatory requirements. n Comply with local “e-commerce” legislation n Avoid “non banking” services. n All third party services shall be strictly trade banking related. n Responsibility and liability must be clearly defined n Partners should be “blue chip” and chosen in accordance with bank guidelines for reputational risk management, and “duty of care” policies. n Know Your Customer principles must be applied n – Money laundering – Fraud and malpractice

Legal and Regulatory Compliance The Singapore view of change…enlightened "Our supervisory approach towards Internet banking will have to evolve as the technologies and business strategies in banking themselves keep changing, " said the Deputy Managing Director of the Monetary Authority of Singapore. "We want to maintain prudent regulatory oversight so as to preserve public confidence in the financial system, while encouraging financial institutions to take full advantage of new technologies to improve efficiency and competitiveness. "

Legal and Regulatory Compliance The Singapore view of change…enlightened "Our supervisory approach towards Internet banking will have to evolve as the technologies and business strategies in banking themselves keep changing, " said the Deputy Managing Director of the Monetary Authority of Singapore. "We want to maintain prudent regulatory oversight so as to preserve public confidence in the financial system, while encouraging financial institutions to take full advantage of new technologies to improve efficiency and competitiveness. "

The Competitive World today Banks as with all businesses compete at all levels n Price n Quality n Business process n Technology n Customer Service n Logistics efficiency n Speed of service, quality of service and flexibility n Location n Greater visibility means that all of these factors are readily assessed n

The Competitive World today Banks as with all businesses compete at all levels n Price n Quality n Business process n Technology n Customer Service n Logistics efficiency n Speed of service, quality of service and flexibility n Location n Greater visibility means that all of these factors are readily assessed n

Greater Visibility? The availability of trade data from Purchase Order to Delivery Order (“PO to DO”) n Access to that data, and re-use of that data enables a bank to have more control of risk and to offer improved trade products and services n The Product source data RFI Quote PO Invoice LC Application Inspection and Insurance and Logistics instructions to DO and the Customs declaration forex payment and settlement and collection…… and more n Improved credit terms faster payments n

Greater Visibility? The availability of trade data from Purchase Order to Delivery Order (“PO to DO”) n Access to that data, and re-use of that data enables a bank to have more control of risk and to offer improved trade products and services n The Product source data RFI Quote PO Invoice LC Application Inspection and Insurance and Logistics instructions to DO and the Customs declaration forex payment and settlement and collection…… and more n Improved credit terms faster payments n

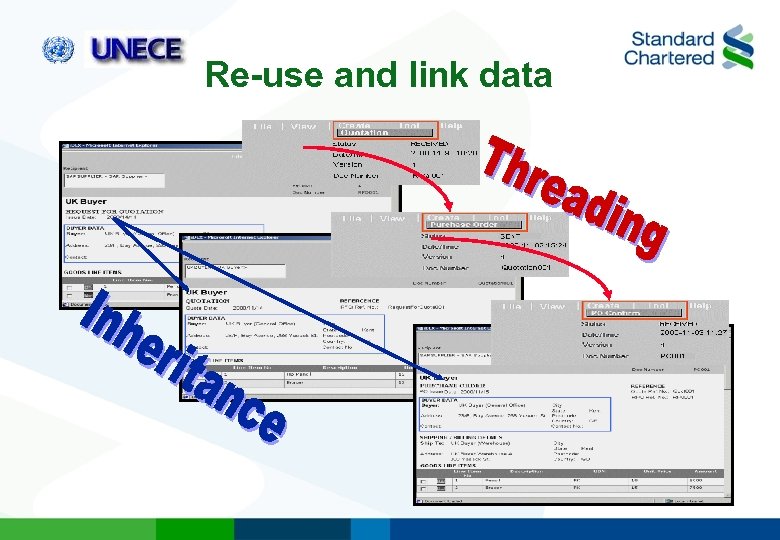

Re-use and link data

Re-use and link data

Standard Chartered Bank - Trade Services n Market Position Major International bank n Rapidly growing business in providing value added trade services for its large and small customers n n n Trade Document Manager n Facilitates standard and nonstandard document (RFQ, Q, PO Confirmation, SO Confirmation, Dispatch Advice and Commercial Invoice) exchange Provides integration with the Bank’s internal system via XML n Integrated with PKI to enable secure transactions required by the Bank n Ensures Non repudiation n Solution a B 2 B Exchange n The Bank provides an online service that facilitates trade transactions & payments between its customers, logistics partners, SCB and other banks n Benefits Economic Extended Market Data – Information Knowledge –Visibility n Less risk n n n

Standard Chartered Bank - Trade Services n Market Position Major International bank n Rapidly growing business in providing value added trade services for its large and small customers n n n Trade Document Manager n Facilitates standard and nonstandard document (RFQ, Q, PO Confirmation, SO Confirmation, Dispatch Advice and Commercial Invoice) exchange Provides integration with the Bank’s internal system via XML n Integrated with PKI to enable secure transactions required by the Bank n Ensures Non repudiation n Solution a B 2 B Exchange n The Bank provides an online service that facilitates trade transactions & payments between its customers, logistics partners, SCB and other banks n Benefits Economic Extended Market Data – Information Knowledge –Visibility n Less risk n n n

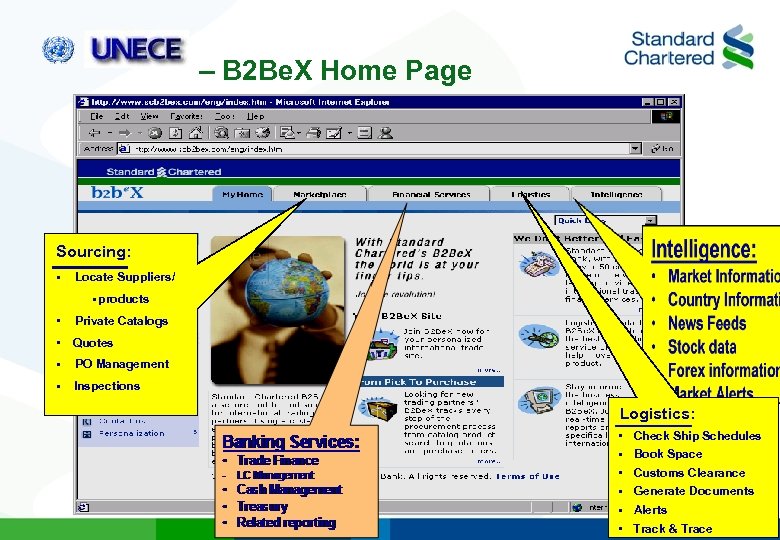

– B 2 Be. X Home Page Sourcing: • Locate Suppliers/ • products • Private Catalogs • Quotes • PO Management • Inspections Logistics: • Check Ship Schedules • Book Space • Customs Clearance • Generate Documents • Alerts • Track & Trace

– B 2 Be. X Home Page Sourcing: • Locate Suppliers/ • products • Private Catalogs • Quotes • PO Management • Inspections Logistics: • Check Ship Schedules • Book Space • Customs Clearance • Generate Documents • Alerts • Track & Trace

Standard Chartered B 2 Be. X is about getting the supply chain basics right n Ability to exchange “intelligent” trade documents and data, with anybody suppliers and buyers n catalog services, logistics, banking, insurance, etc. n all integrated with comprehensive messaging, and supported by solid infrastructure

Standard Chartered B 2 Be. X is about getting the supply chain basics right n Ability to exchange “intelligent” trade documents and data, with anybody suppliers and buyers n catalog services, logistics, banking, insurance, etc. n all integrated with comprehensive messaging, and supported by solid infrastructure

with “industrial strength” infrastructure to support mission-critical processes n Highest security message authentication, confidentiality, integrity and nonrepudiation n transaction and network security n anti-virus, hacking, denial of service protection n End-to-end high availability and disaster recovery n 24/7 multi-lingual, integrated + “human” support n

with “industrial strength” infrastructure to support mission-critical processes n Highest security message authentication, confidentiality, integrity and nonrepudiation n transaction and network security n anti-virus, hacking, denial of service protection n End-to-end high availability and disaster recovery n 24/7 multi-lingual, integrated + “human” support n

Yielding significant efficiencies for importers and exporters n n n Reliable turn-key solution for local and int’l trade Reduced trade administration Automated transactions with trading partners Comprehensive, integrated MIS Access to other marketplaces and technologies

Yielding significant efficiencies for importers and exporters n n n Reliable turn-key solution for local and int’l trade Reduced trade administration Automated transactions with trading partners Comprehensive, integrated MIS Access to other marketplaces and technologies

Summary The banking industry is committed to streamlining international trade processing and to becoming a participant in the global E-Trading movement n That is a basic contribution to Trade Facilitation n Automation, efficiency, straight through processing by involvement in and promotion of improved supply chain processes lead to… n Cost savings n Time savings n Faster payment n n Improved return on investment – For banks and their customers

Summary The banking industry is committed to streamlining international trade processing and to becoming a participant in the global E-Trading movement n That is a basic contribution to Trade Facilitation n Automation, efficiency, straight through processing by involvement in and promotion of improved supply chain processes lead to… n Cost savings n Time savings n Faster payment n n Improved return on investment – For banks and their customers

Thank you

Thank you

UNECE International Forum on Trade Facilitation… Session III Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002

UNECE International Forum on Trade Facilitation… Session III Implementation: The Role of the Business Community Supply Chains and the facilitation of payments John Hammond Head, Supply Chain Services Standard Chartered Bank, Hong Kong john. hammond@hk. standardchartered. com Wednesday 29 May 2002