ff3e24f235b34dc1a0268711d6203eb1.ppt

- Количество слайдов: 79

Understanding Stock Options Practical Strategy Applications Utilizing Educational Software

Understanding Stock Options Practical Strategy Applications Utilizing Educational Software

Practical Strategy Applications Options involve risks and are not suitable for everyone. Prior to buying or selling options, an investor must receive a copy of Characteristics and Risks of standardized Options. Copies may be obtained by contacting your broker or the Options Industry Council at 440 S. La. Salle St. , Chicago, IL 60605 In order to simplify the computations, commissions, fees, margin interest and taxes have not been included in the examples used in these materials. These costs will impact the outcome of all stock and options transactions and must be considered prior to entering into any transactions. Investors should consult their tax advisor about any potential tax consequences. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities. Past performance is not a guarantee of future results. 2

Practical Strategy Applications Options involve risks and are not suitable for everyone. Prior to buying or selling options, an investor must receive a copy of Characteristics and Risks of standardized Options. Copies may be obtained by contacting your broker or the Options Industry Council at 440 S. La. Salle St. , Chicago, IL 60605 In order to simplify the computations, commissions, fees, margin interest and taxes have not been included in the examples used in these materials. These costs will impact the outcome of all stock and options transactions and must be considered prior to entering into any transactions. Investors should consult their tax advisor about any potential tax consequences. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities. Past performance is not a guarantee of future results. 2

Review of Basics Options are contracts m m giving the owner the right to buy or sell an asset at a fixed price for a specific period of time and obligating the seller to take the opposite side if and when the option is exercised by the owner 3

Review of Basics Options are contracts m m giving the owner the right to buy or sell an asset at a fixed price for a specific period of time and obligating the seller to take the opposite side if and when the option is exercised by the owner 3

Option Components Example: XYZ June 60 call at $4 underlying instrument m expiration date m strike or exercise price m type: put or call m price or premium m 4

Option Components Example: XYZ June 60 call at $4 underlying instrument m expiration date m strike or exercise price m type: put or call m price or premium m 4

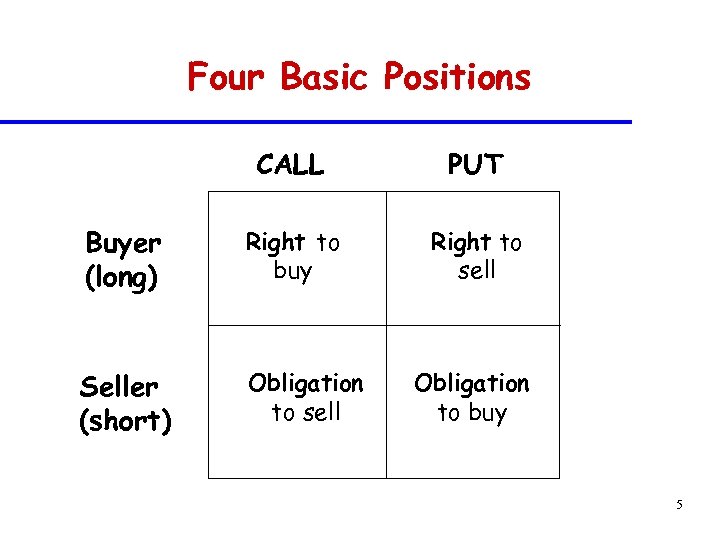

Four Basic Positions CALL PUT Buyer (long) Right to buy Right to sell Seller (short) Obligation to sell Obligation to buy 5

Four Basic Positions CALL PUT Buyer (long) Right to buy Right to sell Seller (short) Obligation to sell Obligation to buy 5

Understanding Stock Options Part I: Option’s Pricing

Understanding Stock Options Part I: Option’s Pricing

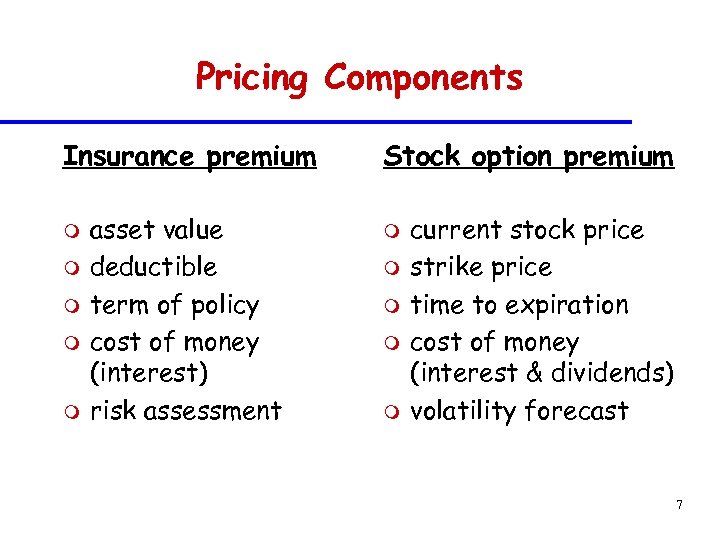

Pricing Components Insurance premium m m asset value deductible term of policy cost of money (interest) risk assessment Stock option premium m m current stock price strike price time to expiration cost of money (interest & dividends) volatility forecast 7

Pricing Components Insurance premium m m asset value deductible term of policy cost of money (interest) risk assessment Stock option premium m m current stock price strike price time to expiration cost of money (interest & dividends) volatility forecast 7

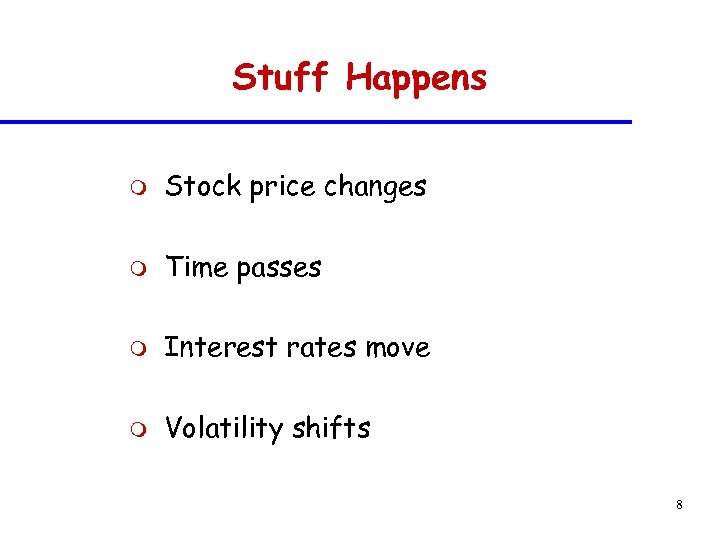

Stuff Happens m Stock price changes m Time passes m Interest rates move m Volatility shifts 8

Stuff Happens m Stock price changes m Time passes m Interest rates move m Volatility shifts 8

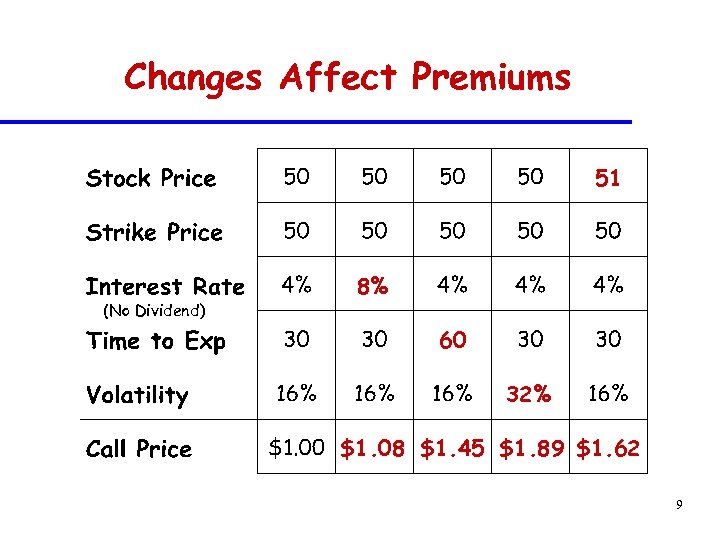

Changes Affect Premiums 51 (No Dividend) 8% 60 32% $1. 08 $1. 45 $1. 89 $1. 62 9

Changes Affect Premiums 51 (No Dividend) 8% 60 32% $1. 08 $1. 45 $1. 89 $1. 62 9

Speaking Greek Delta Rate of change in option theoretical value for one-unit change in underlying stock price i. e. ‘how much the option acts like stock’ 10

Speaking Greek Delta Rate of change in option theoretical value for one-unit change in underlying stock price i. e. ‘how much the option acts like stock’ 10

Signs of the Times m Calls have positive delta (0 to +1. 00) – buy 2 calls: +. 45 x (+2) = +. 90 – sell 4 calls: +. 45 x (-4) = -1. 80 m Puts have negative delta (-1. 00 to 0) – buy 1 put: -. 33 x (+1) = -. 33 – sell 3 puts: -. 33 x (-3) = +. 99 11

Signs of the Times m Calls have positive delta (0 to +1. 00) – buy 2 calls: +. 45 x (+2) = +. 90 – sell 4 calls: +. 45 x (-4) = -1. 80 m Puts have negative delta (-1. 00 to 0) – buy 1 put: -. 33 x (+1) = -. 33 – sell 3 puts: -. 33 x (-3) = +. 99 11

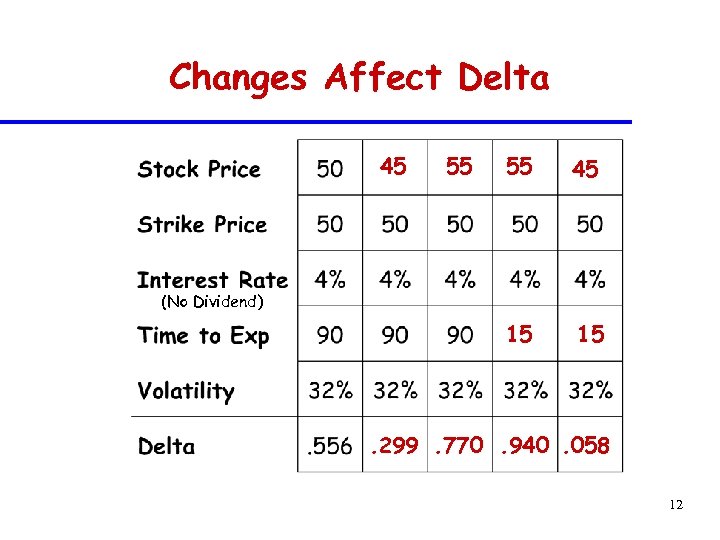

Changes Affect Delta 45 55 55 45 15 15 (No Dividend) . 299. 770. 940. 058 12

Changes Affect Delta 45 55 55 45 15 15 (No Dividend) . 299. 770. 940. 058 12

13

13

Another Greek Lesson Delta does not change at a constant rate m m sometimes change is rapid, sometimes slow rate of change of delta is known as ‘gamma’ 14

Another Greek Lesson Delta does not change at a constant rate m m sometimes change is rapid, sometimes slow rate of change of delta is known as ‘gamma’ 14

Gamma Change in an option’s delta for a one-unit change in underlying stock price m m not constant highest for near-term, at-the-money option 15 Note: Gamma is a sophisticated concept; it may not necessarily be pertinent to non-professional traders

Gamma Change in an option’s delta for a one-unit change in underlying stock price m m not constant highest for near-term, at-the-money option 15 Note: Gamma is a sophisticated concept; it may not necessarily be pertinent to non-professional traders

16

16

Time Decay m m Erosion of time value is “Public Enemy # 1” for option buyers Time decay accelerates as expiration approaches 17

Time Decay m m Erosion of time value is “Public Enemy # 1” for option buyers Time decay accelerates as expiration approaches 17

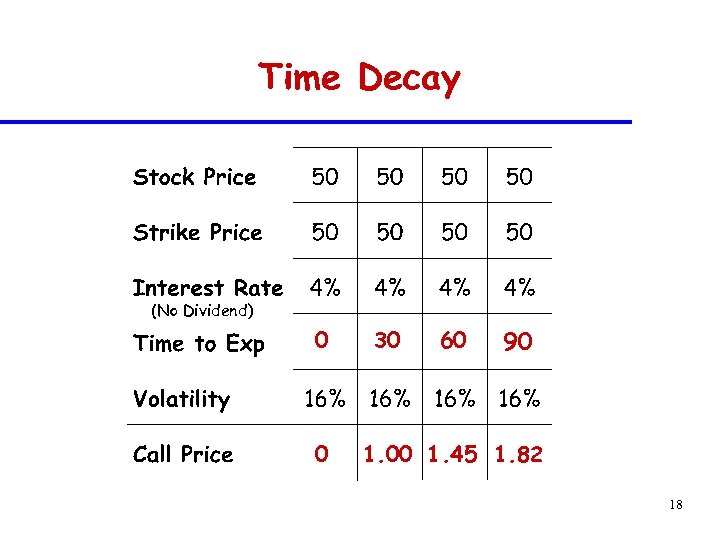

Time Decay (No Dividend) 0 0 30 60 90 1. 00 1. 45 1. 82 18

Time Decay (No Dividend) 0 0 30 60 90 1. 00 1. 45 1. 82 18

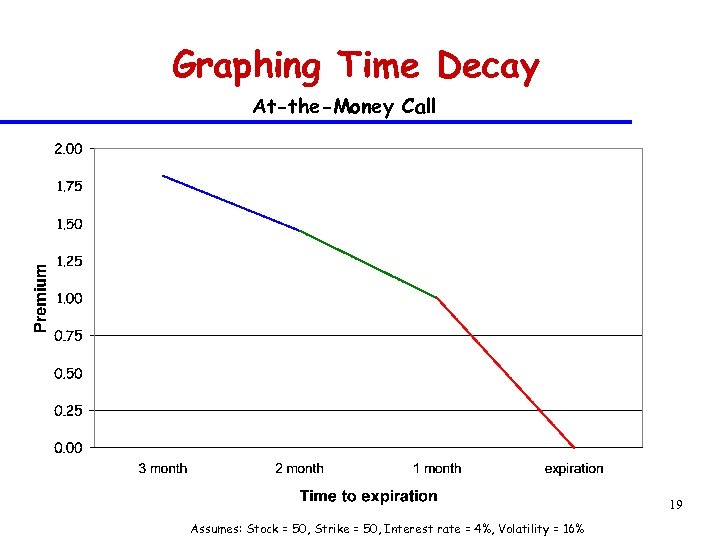

Graphing Time Decay At-the-Money Call 19 Assumes: Stock = 50, Strike = 50, Interest rate = 4%, Volatility = 16%

Graphing Time Decay At-the-Money Call 19 Assumes: Stock = 50, Strike = 50, Interest rate = 4%, Volatility = 16%

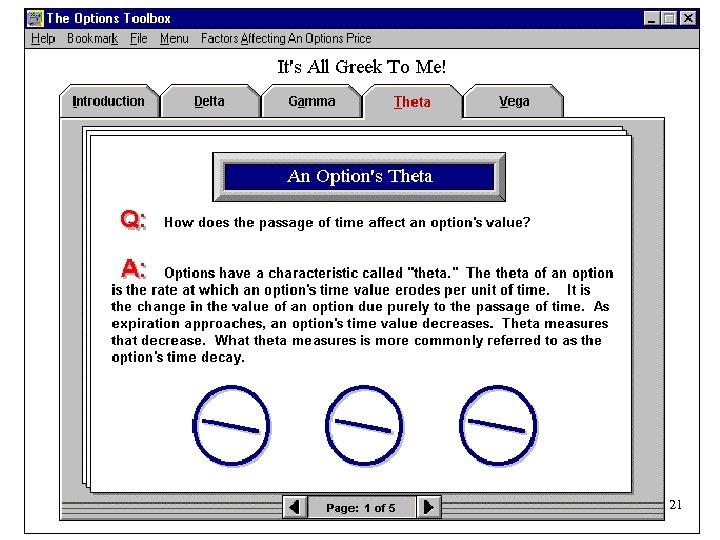

Theta A measure of the rate of change in an option’s price for a one-unit change in the time to the option’s expiration 20

Theta A measure of the rate of change in an option’s price for a one-unit change in the time to the option’s expiration 20

21

21

Part I: Summary m Options prices are derived from five different variables – – – stock price strike price time to expiration cost of money volatility m When using options it is important to understand how changes in each component can affect an option’s price – knowing the greeks helps develop the understanding 22

Part I: Summary m Options prices are derived from five different variables – – – stock price strike price time to expiration cost of money volatility m When using options it is important to understand how changes in each component can affect an option’s price – knowing the greeks helps develop the understanding 22

Understanding Stock Options Section II: Strategy Case Study & Volatility

Understanding Stock Options Section II: Strategy Case Study & Volatility

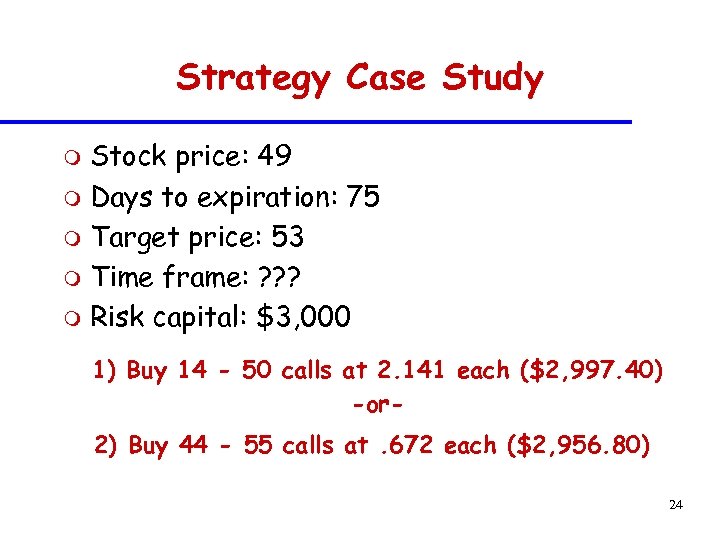

Strategy Case Study Stock price: 49 m Days to expiration: 75 m Target price: 53 m Time frame: ? ? ? m Risk capital: $3, 000 m 1) Buy 14 - 50 calls at 2. 141 each ($2, 997. 40) -or 2) Buy 44 - 55 calls at. 672 each ($2, 956. 80) 24

Strategy Case Study Stock price: 49 m Days to expiration: 75 m Target price: 53 m Time frame: ? ? ? m Risk capital: $3, 000 m 1) Buy 14 - 50 calls at 2. 141 each ($2, 997. 40) -or 2) Buy 44 - 55 calls at. 672 each ($2, 956. 80) 24

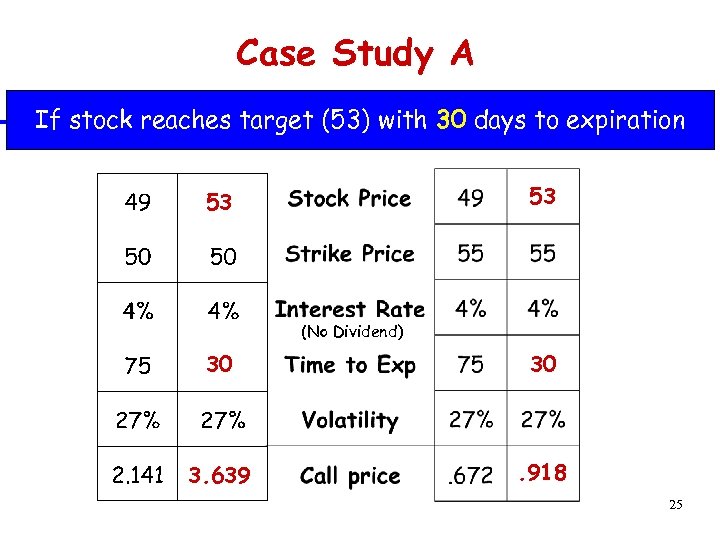

Case Study A If stock reaches target (53) with 30 days to expiration 53 53 (No Dividend) 30 30 3. 639 . 918 25

Case Study A If stock reaches target (53) with 30 days to expiration 53 53 (No Dividend) 30 30 3. 639 . 918 25

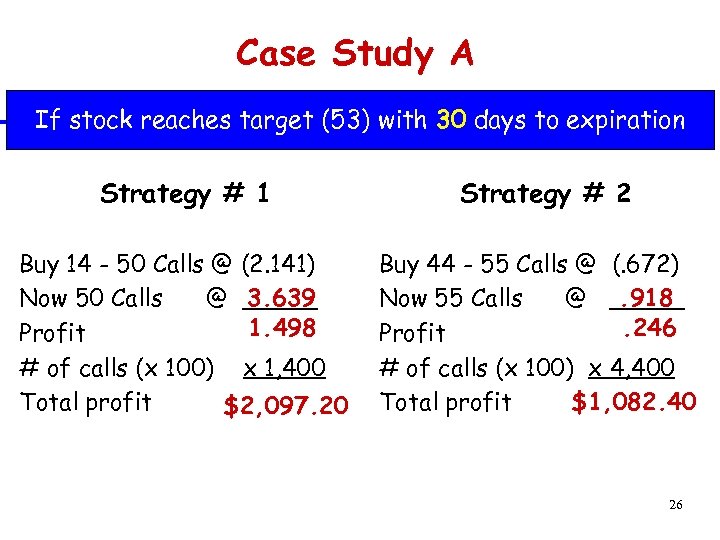

Case Study A If stock reaches target (53) with 30 days to expiration Strategy # 1 Buy 14 - 50 Calls @ (2. 141) 3. 639 Now 50 Calls @ _____ 1. 498 Profit # of calls (x 100) x 1, 400 Total profit $2, 097. 20 Strategy # 2 Buy 44 - 55 Calls @ (. 672). 918 Now 55 Calls @ _____. 246 Profit # of calls (x 100) x 4, 400 Total profit $1, 082. 40 26

Case Study A If stock reaches target (53) with 30 days to expiration Strategy # 1 Buy 14 - 50 Calls @ (2. 141) 3. 639 Now 50 Calls @ _____ 1. 498 Profit # of calls (x 100) x 1, 400 Total profit $2, 097. 20 Strategy # 2 Buy 44 - 55 Calls @ (. 672). 918 Now 55 Calls @ _____. 246 Profit # of calls (x 100) x 4, 400 Total profit $1, 082. 40 26

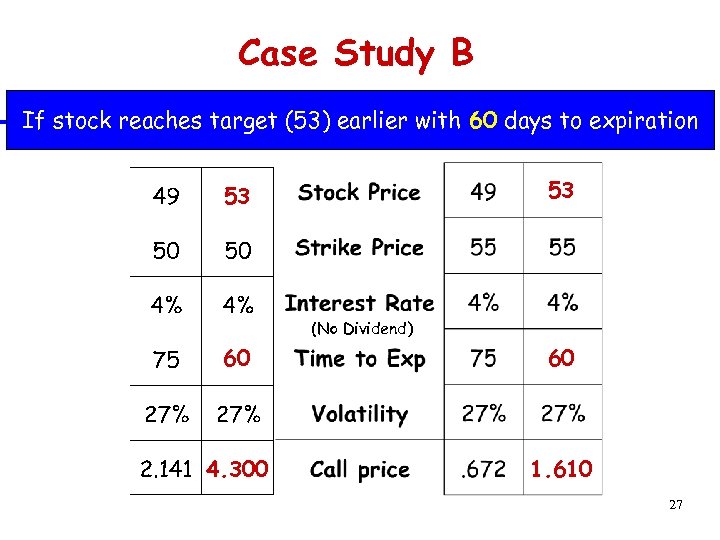

Case Study B If stock reaches target (53) earlier with 60 days to expiration 53 53 (No Dividend) 60 60 4. 300 1. 610 27

Case Study B If stock reaches target (53) earlier with 60 days to expiration 53 53 (No Dividend) 60 60 4. 300 1. 610 27

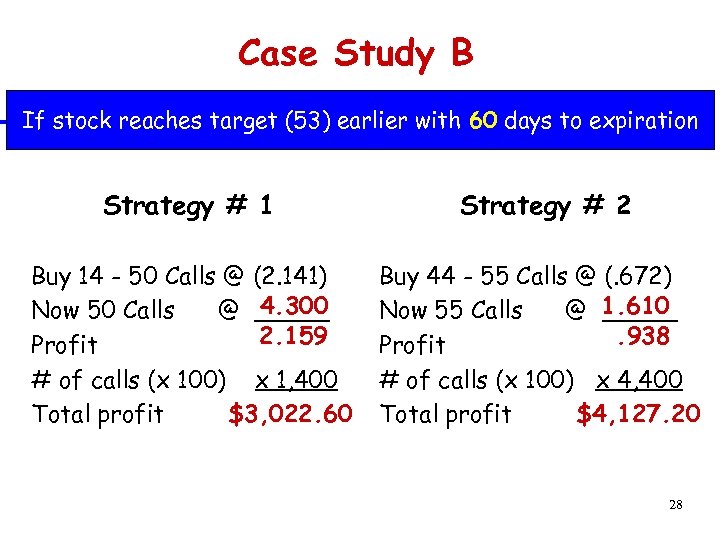

Case Study B If stock reaches target (53) earlier with 60 days to expiration Strategy # 1 Strategy # 2 Buy 14 - 50 Calls @ (2. 141) 4. 300 Now 50 Calls @ _____ 2. 159 Profit # of calls (x 100) x 1, 400 Total profit $3, 022. 60 Buy 44 - 55 Calls @ (. 672) Now 55 Calls @ 1. 610 _____. 938 Profit # of calls (x 100) x 4, 400 Total profit $4, 127. 20 28

Case Study B If stock reaches target (53) earlier with 60 days to expiration Strategy # 1 Strategy # 2 Buy 14 - 50 Calls @ (2. 141) 4. 300 Now 50 Calls @ _____ 2. 159 Profit # of calls (x 100) x 1, 400 Total profit $3, 022. 60 Buy 44 - 55 Calls @ (. 672) Now 55 Calls @ 1. 610 _____. 938 Profit # of calls (x 100) x 4, 400 Total profit $4, 127. 20 28

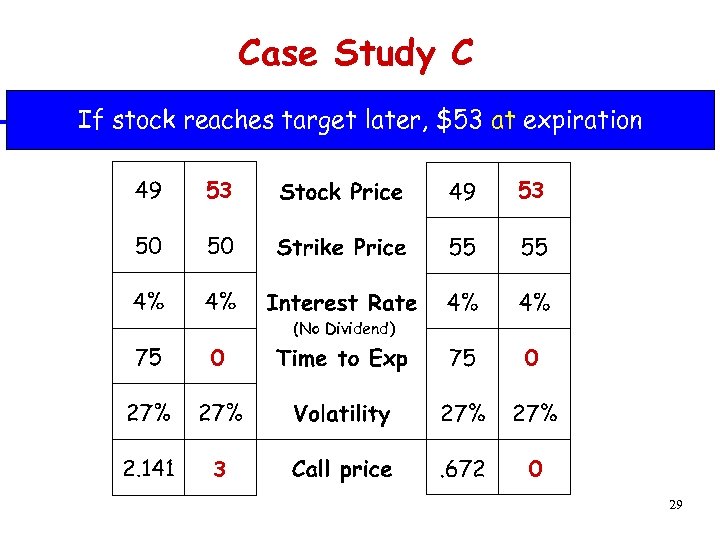

Case Study C If stock reaches target later, $53 at expiration 53 53 (No Dividend) 0 0 3 0 29

Case Study C If stock reaches target later, $53 at expiration 53 53 (No Dividend) 0 0 3 0 29

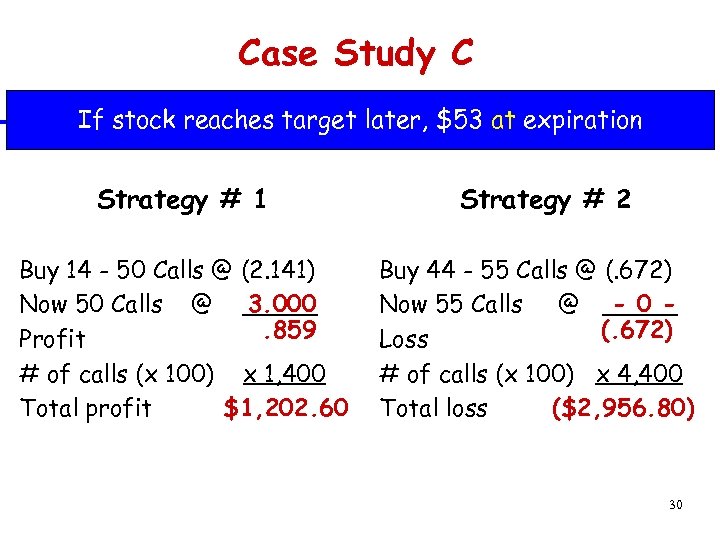

Case Study C If stock reaches target later, $53 at expiration Strategy # 1 Buy 14 - 50 Calls @ (2. 141) 3. 000 Now 50 Calls @ _____. 859 Profit # of calls (x 100) x 1, 400 Total profit $1, 202. 60 Strategy # 2 Buy 44 - 55 Calls @ (. 672) - 0 Now 55 Calls @ _____ (. 672) Loss # of calls (x 100) x 4, 400 Total loss ($2, 956. 80) 30

Case Study C If stock reaches target later, $53 at expiration Strategy # 1 Buy 14 - 50 Calls @ (2. 141) 3. 000 Now 50 Calls @ _____. 859 Profit # of calls (x 100) x 1, 400 Total profit $1, 202. 60 Strategy # 2 Buy 44 - 55 Calls @ (. 672) - 0 Now 55 Calls @ _____ (. 672) Loss # of calls (x 100) x 4, 400 Total loss ($2, 956. 80) 30

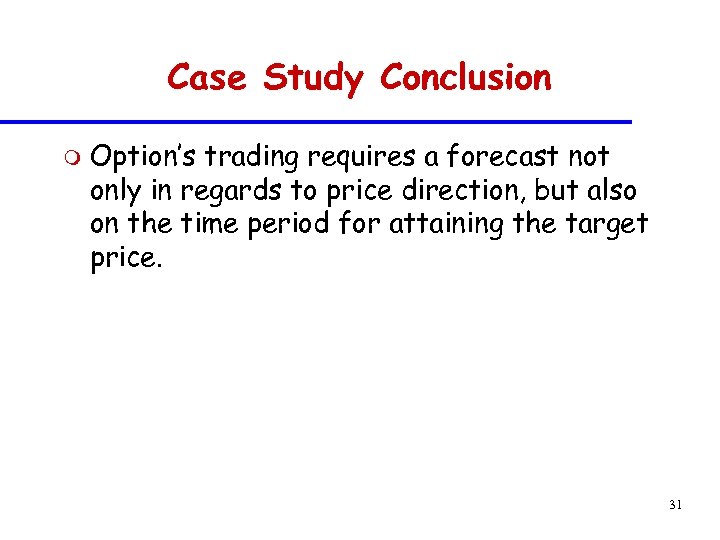

Case Study Conclusion m Option’s trading requires a forecast not only in regards to price direction, but also on the time period for attaining the target price. 31

Case Study Conclusion m Option’s trading requires a forecast not only in regards to price direction, but also on the time period for attaining the target price. 31

Real World Considerations m m Do option prices always behave the way calculated theoretical values illustrate? What could cause options to be valued differently? 32

Real World Considerations m m Do option prices always behave the way calculated theoretical values illustrate? What could cause options to be valued differently? 32

Volatility Annualized standard deviation of stock price movements m why is it important? m how can it be found? 33

Volatility Annualized standard deviation of stock price movements m why is it important? m how can it be found? 33

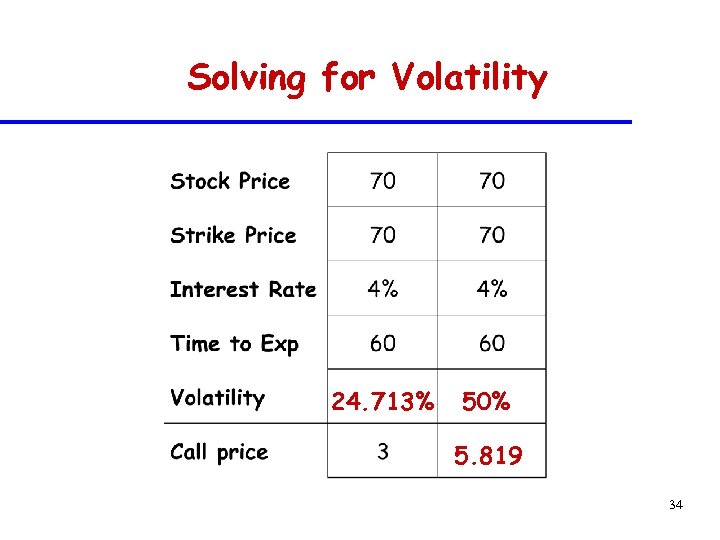

Solving for Volatility 24. 713% 50% 5. 819 34

Solving for Volatility 24. 713% 50% 5. 819 34

Types of Volatility m Historical actual volatility during a specified time period m Future actual volatility from present to option expiration m Implied volatility that justifies an option’s current market price m Forecasted estimate of future volatility used in computer models to calculate theoretical values 35

Types of Volatility m Historical actual volatility during a specified time period m Future actual volatility from present to option expiration m Implied volatility that justifies an option’s current market price m Forecasted estimate of future volatility used in computer models to calculate theoretical values 35

Volatility Reality m Volatility is an important component in the price of an option. – when trading options a forecast of volatility is the finial step before entering the order. 36

Volatility Reality m Volatility is an important component in the price of an option. – when trading options a forecast of volatility is the finial step before entering the order. 36

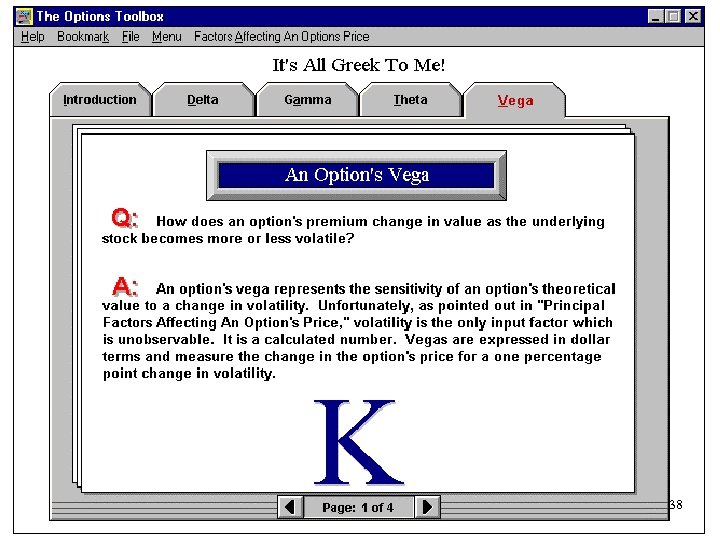

Vega Rate of change in an option’s price for a one-unit change in volatility 37

Vega Rate of change in an option’s price for a one-unit change in volatility 37

38

38

Part II: Summary m m Volatility is an important variable in the price of an option. Option trading requires forecasting - future price of underlying stock - time period for attaining target price - and the implied volatility of the option m Realistic expectations derived from the Equity Option Calculator, the greeks and the Options Toolbox can help you select an appropriate option strategy 39

Part II: Summary m m Volatility is an important variable in the price of an option. Option trading requires forecasting - future price of underlying stock - time period for attaining target price - and the implied volatility of the option m Realistic expectations derived from the Equity Option Calculator, the greeks and the Options Toolbox can help you select an appropriate option strategy 39

INTERMISSION Options Industry Council 888 -OPTIONS Additional Web Sites: www. 888 options. com www. amex. com www. cboe. com www. iseoptions. com www. pacificex. com www. phlx. com PLEASE FILL OUT SURVEY! 40

INTERMISSION Options Industry Council 888 -OPTIONS Additional Web Sites: www. 888 options. com www. amex. com www. cboe. com www. iseoptions. com www. pacificex. com www. phlx. com PLEASE FILL OUT SURVEY! 40

Understanding Stock Options Section III: Selecting Strategies

Understanding Stock Options Section III: Selecting Strategies

Options Give You Choices m m m Bullish, bearish, neutral or volatile market forecasts can be exploited using a variety of options strategies Each strategy has a unique set of risks and rewards Profit/Loss graphs provide snapshots of risk and reward profiles at expiration 42

Options Give You Choices m m m Bullish, bearish, neutral or volatile market forecasts can be exploited using a variety of options strategies Each strategy has a unique set of risks and rewards Profit/Loss graphs provide snapshots of risk and reward profiles at expiration 42

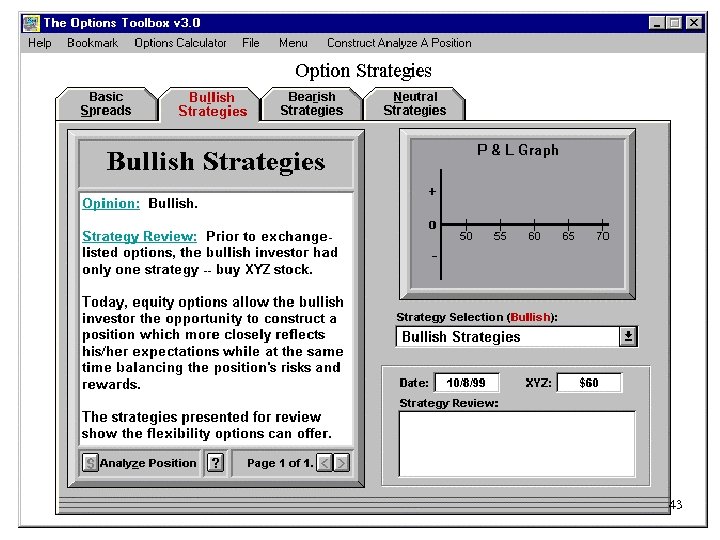

43

43

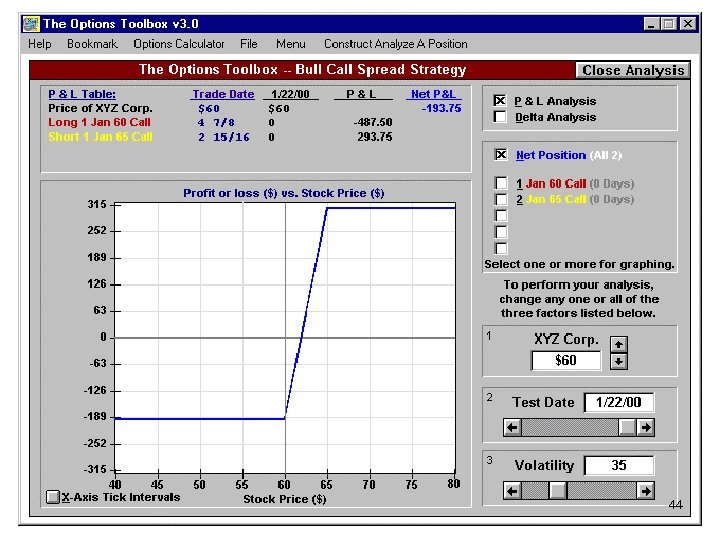

44

44

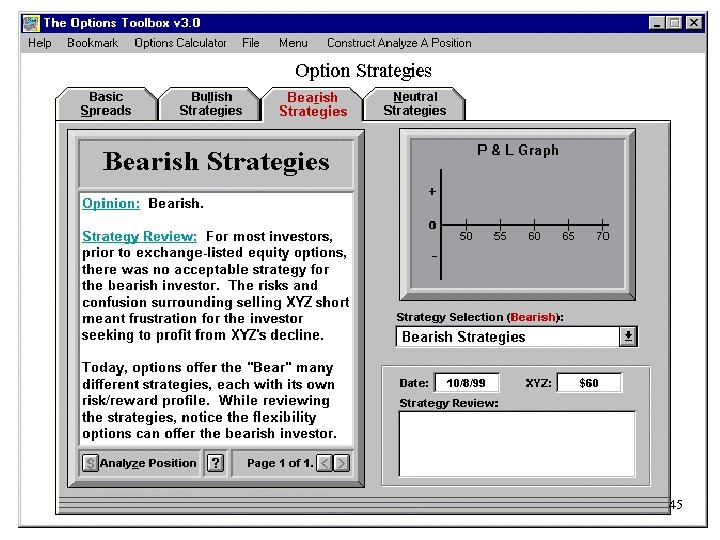

45

45

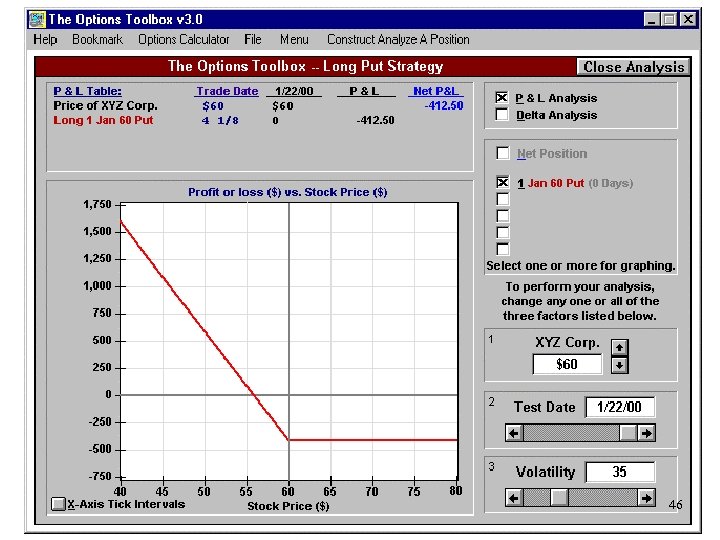

46

46

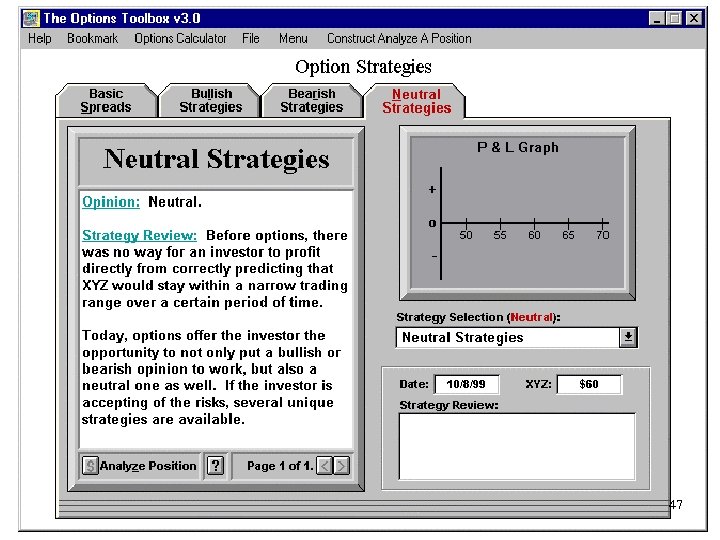

47

47

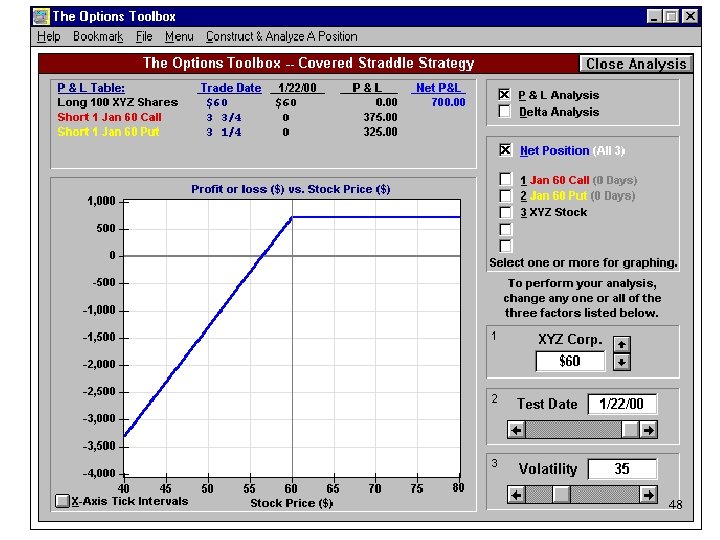

48

48

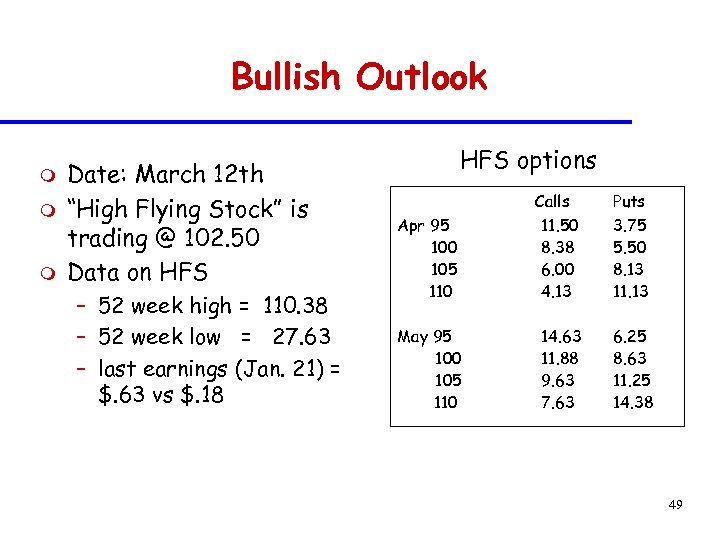

Bullish Outlook m m m Date: March 12 th “High Flying Stock” is trading @ 102. 50 Data on HFS – 52 week high = 110. 38 – 52 week low = 27. 63 – last earnings (Jan. 21) = $. 63 vs $. 18 HFS options Calls Puts Apr 95 100 105 110 11. 50 8. 38 6. 00 4. 13 3. 75 5. 50 8. 13 11. 13 May 95 100 105 110 14. 63 11. 88 9. 63 7. 63 6. 25 8. 63 11. 25 14. 38 49

Bullish Outlook m m m Date: March 12 th “High Flying Stock” is trading @ 102. 50 Data on HFS – 52 week high = 110. 38 – 52 week low = 27. 63 – last earnings (Jan. 21) = $. 63 vs $. 18 HFS options Calls Puts Apr 95 100 105 110 11. 50 8. 38 6. 00 4. 13 3. 75 5. 50 8. 13 11. 13 May 95 100 105 110 14. 63 11. 88 9. 63 7. 63 6. 25 8. 63 11. 25 14. 38 49

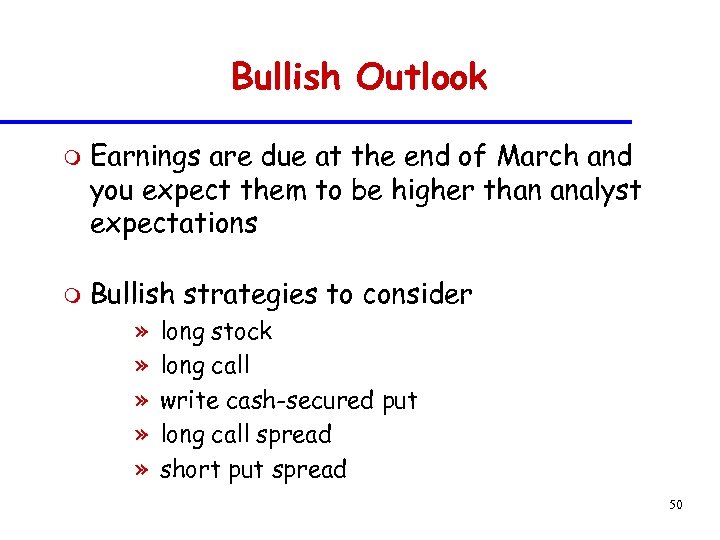

Bullish Outlook m m Earnings are due at the end of March and you expect them to be higher than analyst expectations Bullish strategies to consider » » » long stock long call write cash-secured put long call spread short put spread 50

Bullish Outlook m m Earnings are due at the end of March and you expect them to be higher than analyst expectations Bullish strategies to consider » » » long stock long call write cash-secured put long call spread short put spread 50

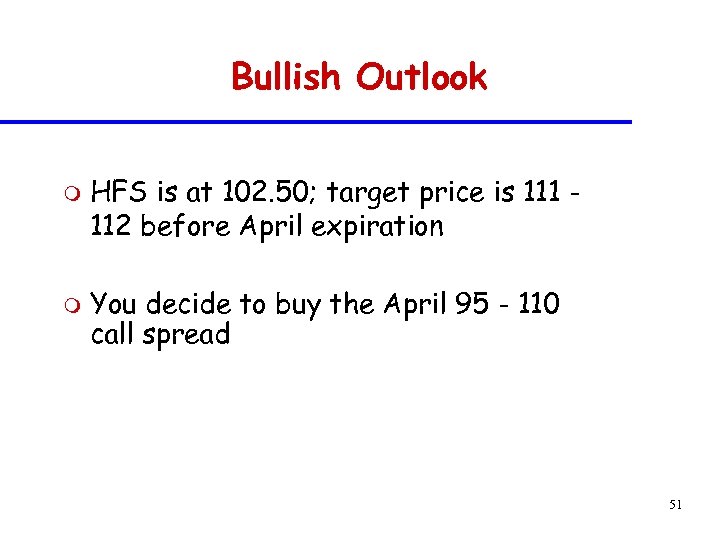

Bullish Outlook m m HFS is at 102. 50; target price is 111 112 before April expiration You decide to buy the April 95 - 110 call spread 51

Bullish Outlook m m HFS is at 102. 50; target price is 111 112 before April expiration You decide to buy the April 95 - 110 call spread 51

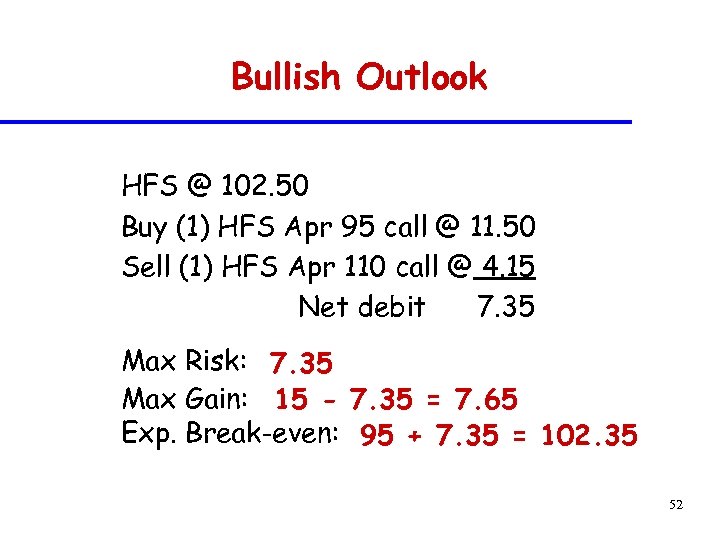

Bullish Outlook HFS @ 102. 50 Buy (1) HFS Apr 95 call @ 11. 50 Sell (1) HFS Apr 110 call @ 4. 15 Net debit 7. 35 Max Risk: 7. 35 Max Gain: 15 - 7. 35 = 7. 65 Exp. Break-even: 95 + 7. 35 = 102. 35 52

Bullish Outlook HFS @ 102. 50 Buy (1) HFS Apr 95 call @ 11. 50 Sell (1) HFS Apr 110 call @ 4. 15 Net debit 7. 35 Max Risk: 7. 35 Max Gain: 15 - 7. 35 = 7. 65 Exp. Break-even: 95 + 7. 35 = 102. 35 52

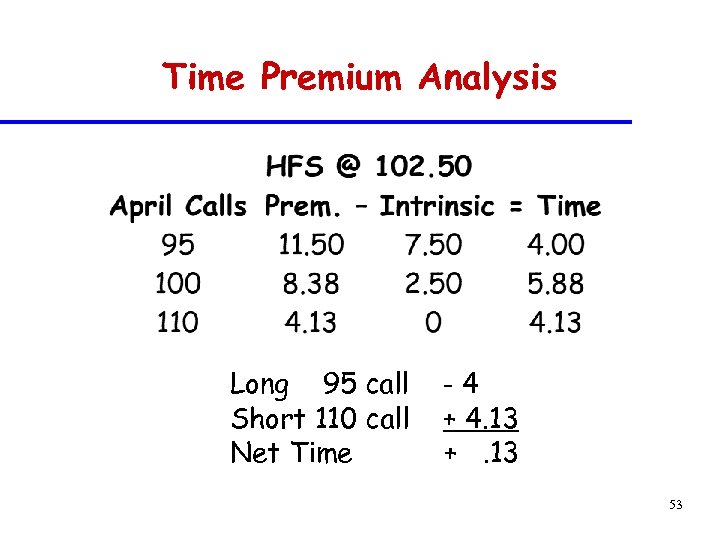

Time Premium Analysis Long 95 call Short 110 call Net Time -4 + 4. 13 +. 13 53

Time Premium Analysis Long 95 call Short 110 call Net Time -4 + 4. 13 +. 13 53

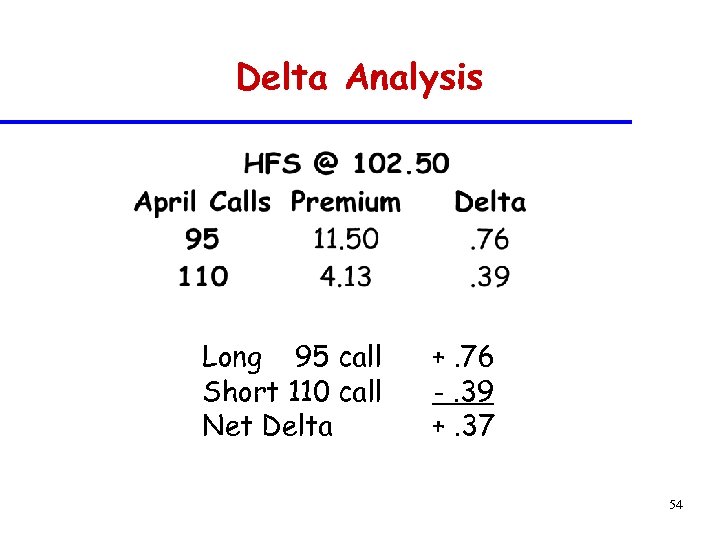

Delta Analysis Long 95 call Short 110 call Net Delta +. 76 -. 39 +. 37 54

Delta Analysis Long 95 call Short 110 call Net Delta +. 76 -. 39 +. 37 54

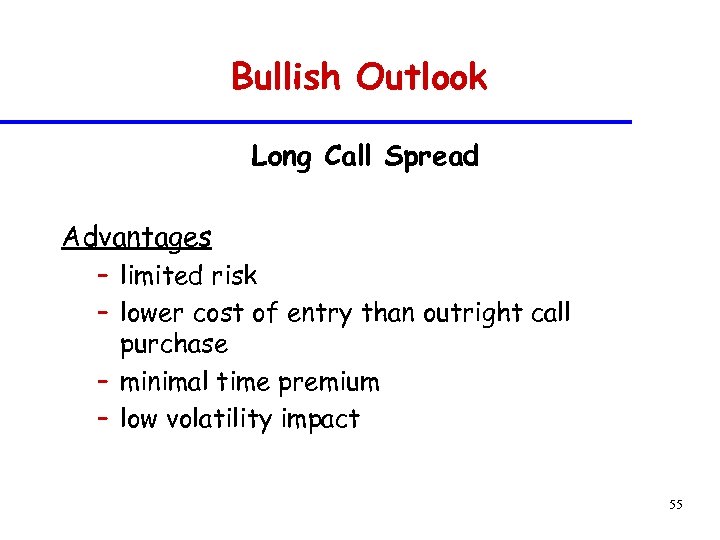

Bullish Outlook Long Call Spread Advantages – limited risk – lower cost of entry than outright call purchase – minimal time premium – low volatility impact 55

Bullish Outlook Long Call Spread Advantages – limited risk – lower cost of entry than outright call purchase – minimal time premium – low volatility impact 55

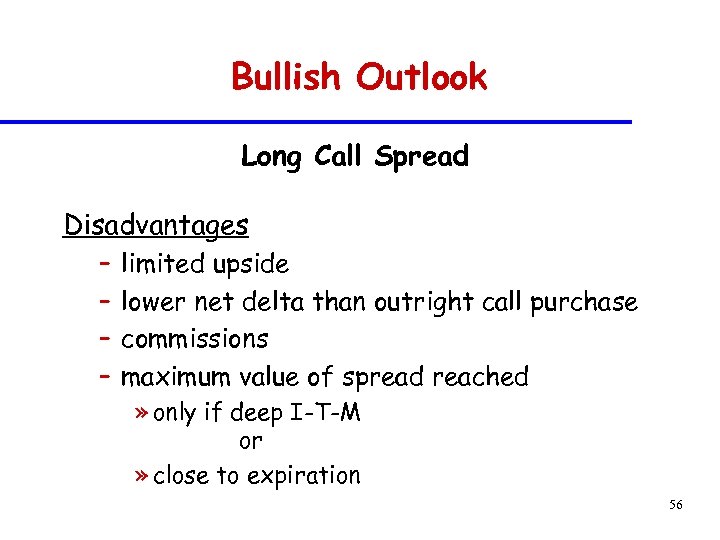

Bullish Outlook Long Call Spread Disadvantages – – limited upside lower net delta than outright call purchase commissions maximum value of spread reached » only if deep I-T-M or » close to expiration 56

Bullish Outlook Long Call Spread Disadvantages – – limited upside lower net delta than outright call purchase commissions maximum value of spread reached » only if deep I-T-M or » close to expiration 56

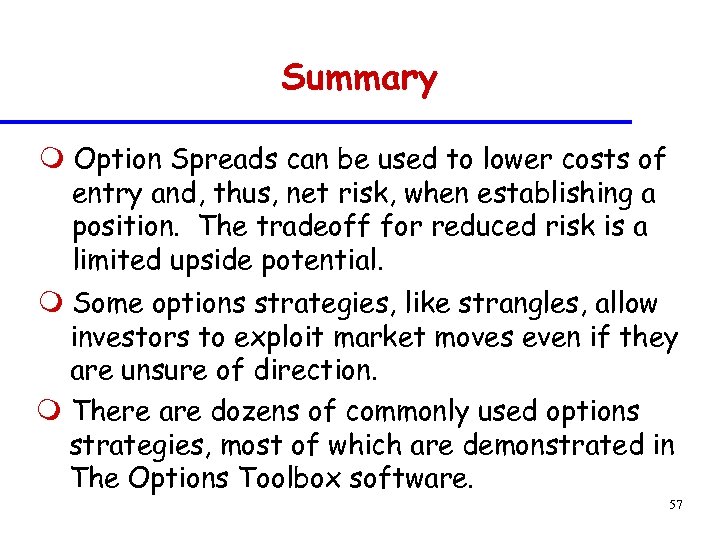

Summary m Option Spreads can be used to lower costs of entry and, thus, net risk, when establishing a position. The tradeoff for reduced risk is a limited upside potential. m Some options strategies, like strangles, allow investors to exploit market moves even if they are unsure of direction. m There are dozens of commonly used options strategies, most of which are demonstrated in The Options Toolbox software. 57

Summary m Option Spreads can be used to lower costs of entry and, thus, net risk, when establishing a position. The tradeoff for reduced risk is a limited upside potential. m Some options strategies, like strangles, allow investors to exploit market moves even if they are unsure of direction. m There are dozens of commonly used options strategies, most of which are demonstrated in The Options Toolbox software. 57

Understanding Stock Options Section IV: Managing Positions

Understanding Stock Options Section IV: Managing Positions

Purchased Stock Decline in Price m A short while back, you established the following long stock position: Bought: 500 XYZ @ 70 Current Market: XYZ @ 56. 50 m Current outlook: – worst is over, short term bullish – would be happy to just break even – unwilling to assume additional risk 59

Purchased Stock Decline in Price m A short while back, you established the following long stock position: Bought: 500 XYZ @ 70 Current Market: XYZ @ 56. 50 m Current outlook: – worst is over, short term bullish – would be happy to just break even – unwilling to assume additional risk 59

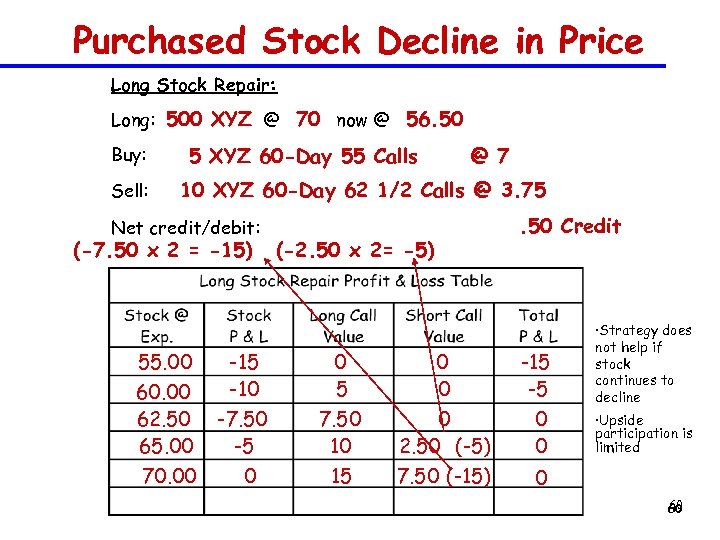

Purchased Stock Decline in Price Long Stock Repair: Long: 500 XYZ @ 70 now @ 56. 50 Buy: Sell: 5 XYZ 60 -Day 55 Calls @ 7 10 XYZ 60 -Day 62 1/2 Calls @ 3. 75 Net credit/debit: (-7. 50 x 2 = -15) 55. 00 60. 00 62. 50 65. 00 70. 00 -15 -10 -7. 50 -5 0 (-2. 50 x 2= -5) 0 5 7. 50 10 15 0 0 0 2. 50 (-5) 7. 50 (-15) . 50 Credit -15 -5 0 0 ·Strategy does not help if stock continues to decline ·Upside participation is limited 0 60 60

Purchased Stock Decline in Price Long Stock Repair: Long: 500 XYZ @ 70 now @ 56. 50 Buy: Sell: 5 XYZ 60 -Day 55 Calls @ 7 10 XYZ 60 -Day 62 1/2 Calls @ 3. 75 Net credit/debit: (-7. 50 x 2 = -15) 55. 00 60. 00 62. 50 65. 00 70. 00 -15 -10 -7. 50 -5 0 (-2. 50 x 2= -5) 0 5 7. 50 10 15 0 0 0 2. 50 (-5) 7. 50 (-15) . 50 Credit -15 -5 0 0 ·Strategy does not help if stock continues to decline ·Upside participation is limited 0 60 60

Covered Write Advance in Price m You established the following covered write: Bought: 100 QRS @ 130 Sold: QRS Feb 135 Call @ 2 Stock is now: 137. 25 with 10 days to expiration Call is now: 4. 75 61

Covered Write Advance in Price m You established the following covered write: Bought: 100 QRS @ 130 Sold: QRS Feb 135 Call @ 2 Stock is now: 137. 25 with 10 days to expiration Call is now: 4. 75 61

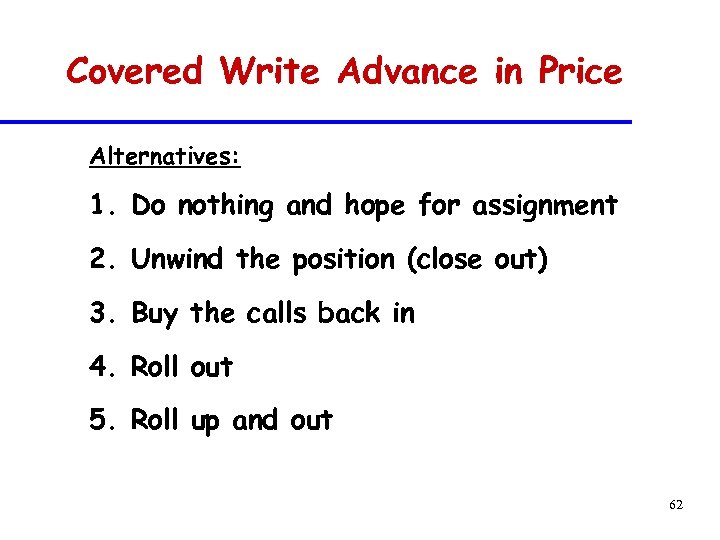

Covered Write Advance in Price Alternatives: 1. Do nothing and hope for assignment 2. Unwind the position (close out) 3. Buy the calls back in 4. Roll out 5. Roll up and out 62

Covered Write Advance in Price Alternatives: 1. Do nothing and hope for assignment 2. Unwind the position (close out) 3. Buy the calls back in 4. Roll out 5. Roll up and out 62

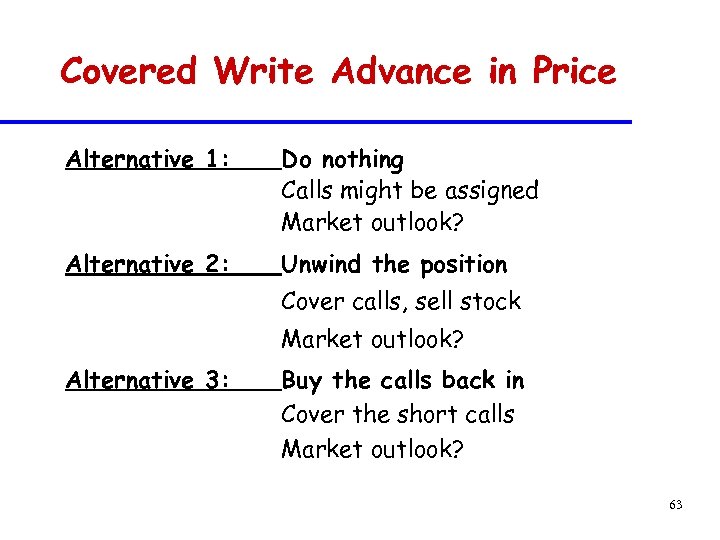

Covered Write Advance in Price Alternative 1: Do nothing Calls might be assigned Market outlook? Alternative 2: Unwind the position Cover calls, sell stock Market outlook? Alternative 3: Buy the calls back in Cover the short calls Market outlook? 63

Covered Write Advance in Price Alternative 1: Do nothing Calls might be assigned Market outlook? Alternative 2: Unwind the position Cover calls, sell stock Market outlook? Alternative 3: Buy the calls back in Cover the short calls Market outlook? 63

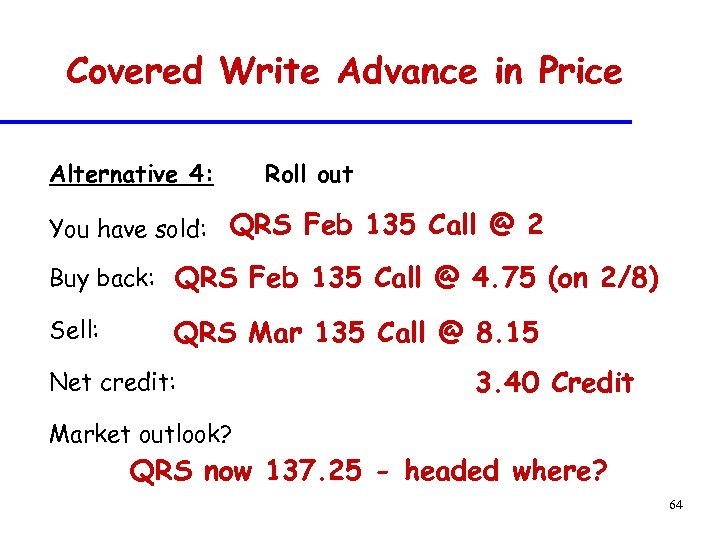

Covered Write Advance in Price Alternative 4: Roll out You have sold: QRS Feb 135 Call @ 2 Buy back: QRS Feb 135 Call @ 4. 75 (on 2/8) Sell: QRS Mar 135 Call @ 8. 15 Net credit: 3. 40 Credit Market outlook? QRS now 137. 25 - headed where? 64

Covered Write Advance in Price Alternative 4: Roll out You have sold: QRS Feb 135 Call @ 2 Buy back: QRS Feb 135 Call @ 4. 75 (on 2/8) Sell: QRS Mar 135 Call @ 8. 15 Net credit: 3. 40 Credit Market outlook? QRS now 137. 25 - headed where? 64

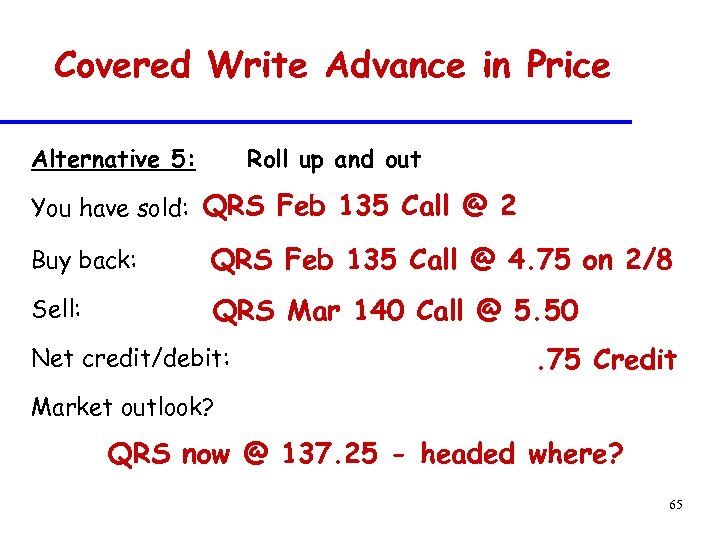

Covered Write Advance in Price Alternative 5: Roll up and out You have sold: QRS Feb 135 Call @ 2 Buy back: QRS Feb 135 Call @ 4. 75 on 2/8 Sell: QRS Mar 140 Call @ 5. 50 Net credit/debit: . 75 Credit Market outlook? QRS now @ 137. 25 - headed where? 65

Covered Write Advance in Price Alternative 5: Roll up and out You have sold: QRS Feb 135 Call @ 2 Buy back: QRS Feb 135 Call @ 4. 75 on 2/8 Sell: QRS Mar 140 Call @ 5. 50 Net credit/debit: . 75 Credit Market outlook? QRS now @ 137. 25 - headed where? 65

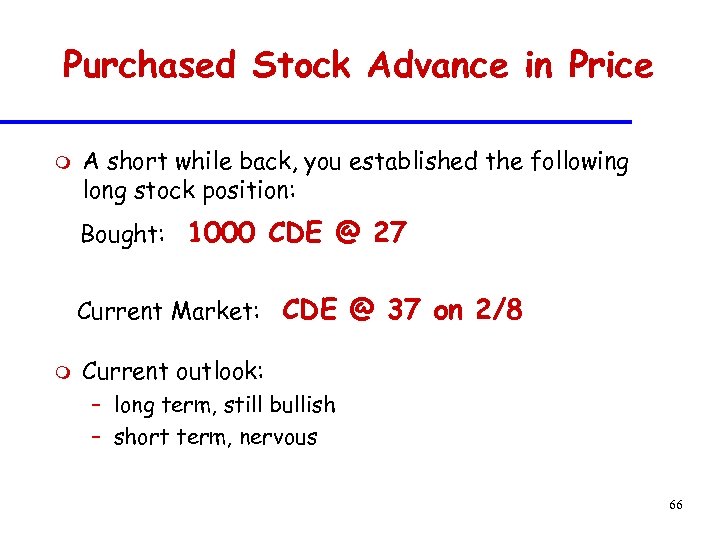

Purchased Stock Advance in Price m A short while back, you established the following long stock position: Bought: 1000 CDE @ 27 Current Market: CDE @ 37 on 2/8 m Current outlook: – long term, still bullish – short term, nervous 66

Purchased Stock Advance in Price m A short while back, you established the following long stock position: Bought: 1000 CDE @ 27 Current Market: CDE @ 37 on 2/8 m Current outlook: – long term, still bullish – short term, nervous 66

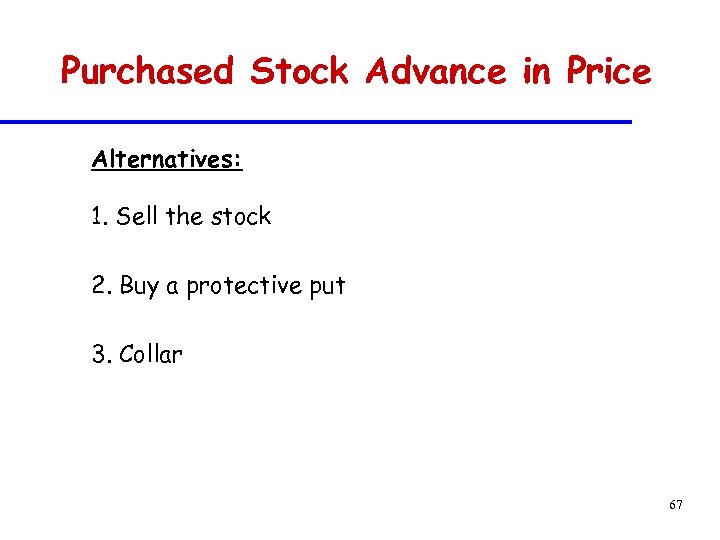

Purchased Stock Advance in Price Alternatives: 1. Sell the stock 2. Buy a protective put 3. Collar 67

Purchased Stock Advance in Price Alternatives: 1. Sell the stock 2. Buy a protective put 3. Collar 67

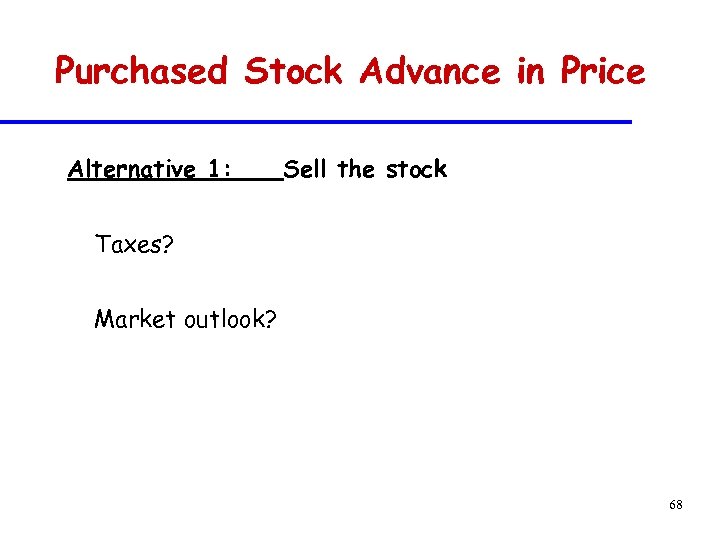

Purchased Stock Advance in Price Alternative 1: Sell the stock Taxes? Market outlook? 68

Purchased Stock Advance in Price Alternative 1: Sell the stock Taxes? Market outlook? 68

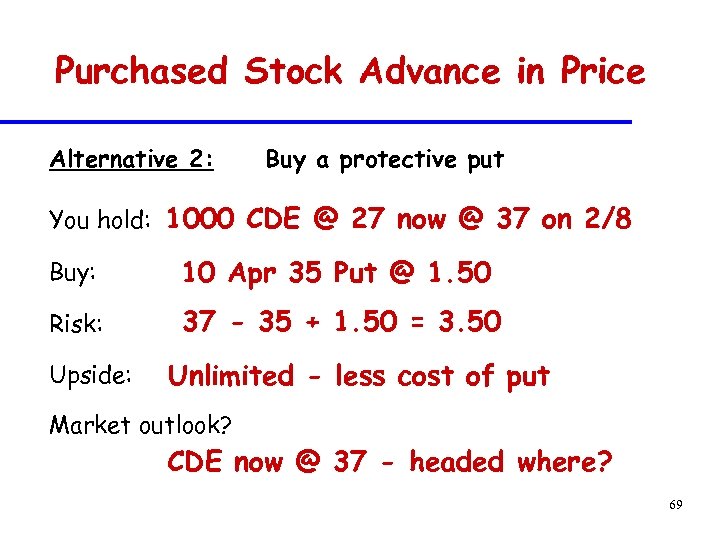

Purchased Stock Advance in Price Alternative 2: Buy a protective put You hold: 1000 CDE @ 27 now @ 37 on 2/8 Buy: 10 Apr 35 Put @ 1. 50 Risk: 37 - 35 + 1. 50 = 3. 50 Upside: Unlimited - less cost of put Market outlook? CDE now @ 37 - headed where? 69

Purchased Stock Advance in Price Alternative 2: Buy a protective put You hold: 1000 CDE @ 27 now @ 37 on 2/8 Buy: 10 Apr 35 Put @ 1. 50 Risk: 37 - 35 + 1. 50 = 3. 50 Upside: Unlimited - less cost of put Market outlook? CDE now @ 37 - headed where? 69

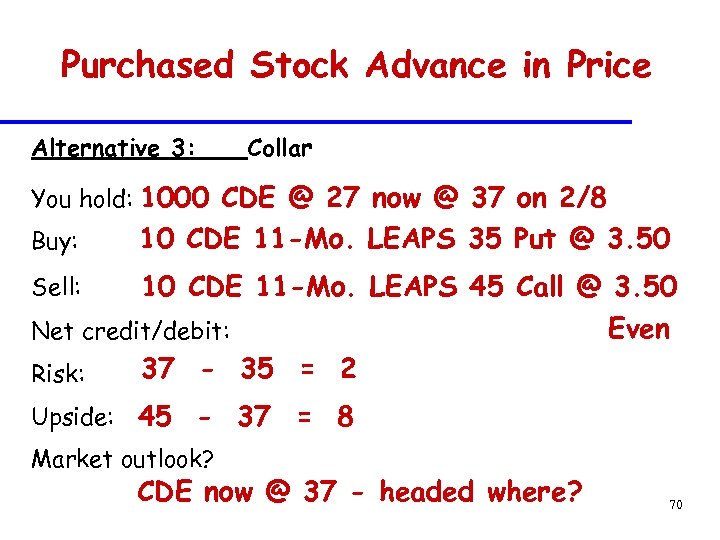

Purchased Stock Advance in Price Alternative 3: Collar You hold: 1000 CDE @ 27 now @ 37 on 2/8 Buy: 10 CDE 11 -Mo. LEAPS 35 Put @ 3. 50 10 CDE 11 -Mo. LEAPS 45 Call @ 3. 50 Even Net credit/debit: 37 - 35 = 2 Risk: Sell: Upside: 45 - 37 = 8 Market outlook? CDE now @ 37 - headed where? 70

Purchased Stock Advance in Price Alternative 3: Collar You hold: 1000 CDE @ 27 now @ 37 on 2/8 Buy: 10 CDE 11 -Mo. LEAPS 35 Put @ 3. 50 10 CDE 11 -Mo. LEAPS 45 Call @ 3. 50 Even Net credit/debit: 37 - 35 = 2 Risk: Sell: Upside: 45 - 37 = 8 Market outlook? CDE now @ 37 - headed where? 70

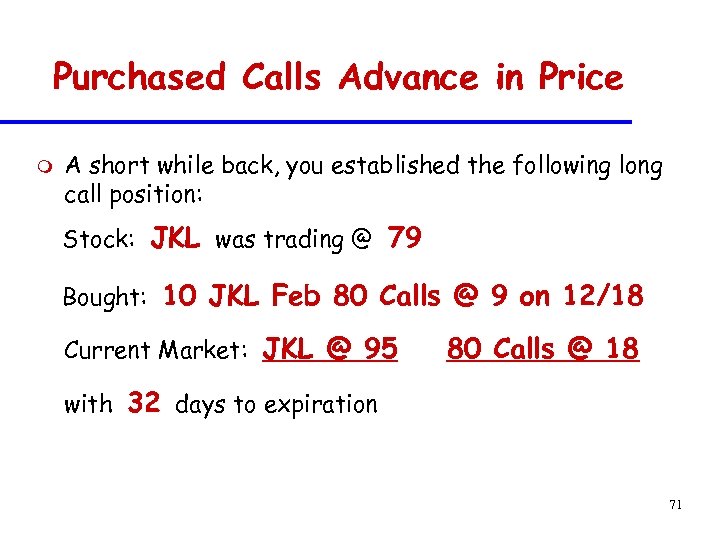

Purchased Calls Advance in Price m A short while back, you established the following long call position: Stock: JKL was trading @ 79 Bought: 10 JKL Feb 80 Calls @ 9 on 12/18 Current Market: JKL @ 95 80 Calls @ 18 with 32 days to expiration 71

Purchased Calls Advance in Price m A short while back, you established the following long call position: Stock: JKL was trading @ 79 Bought: 10 JKL Feb 80 Calls @ 9 on 12/18 Current Market: JKL @ 95 80 Calls @ 18 with 32 days to expiration 71

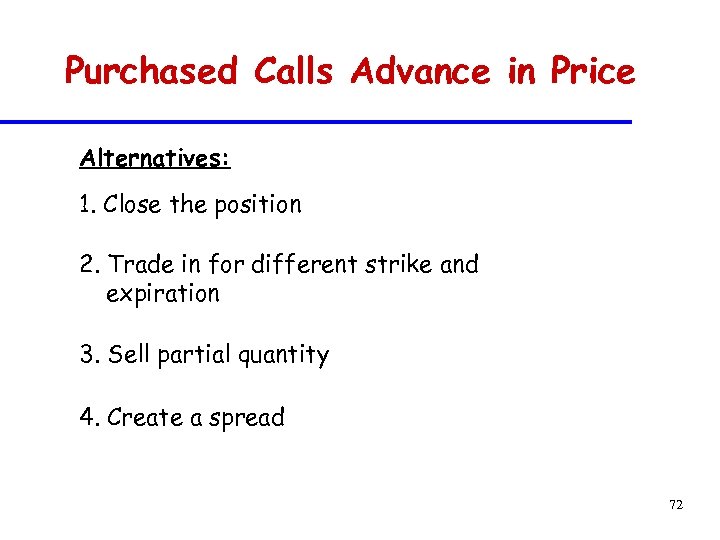

Purchased Calls Advance in Price Alternatives: 1. Close the position 2. Trade in for different strike and expiration 3. Sell partial quantity 4. Create a spread 72

Purchased Calls Advance in Price Alternatives: 1. Close the position 2. Trade in for different strike and expiration 3. Sell partial quantity 4. Create a spread 72

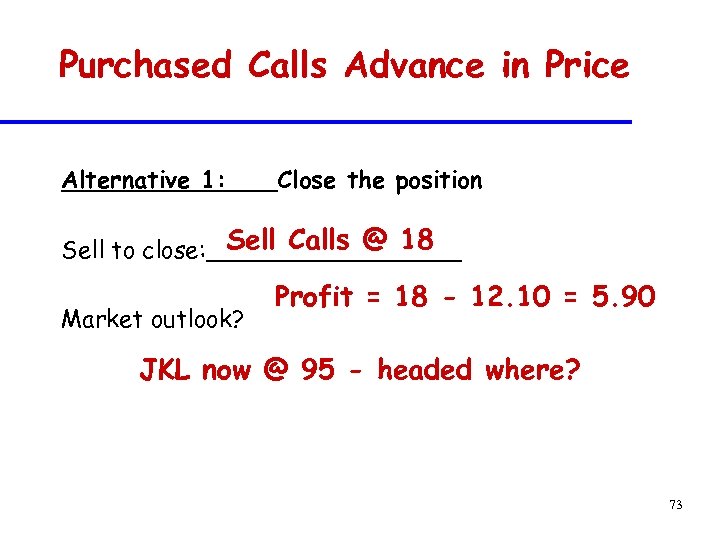

Purchased Calls Advance in Price Alternative 1: Close the position Sell Calls @ 18 Sell to close: _________ Market outlook? Profit = 18 - 12. 10 = 5. 90 JKL now @ 95 - headed where? 73

Purchased Calls Advance in Price Alternative 1: Close the position Sell Calls @ 18 Sell to close: _________ Market outlook? Profit = 18 - 12. 10 = 5. 90 JKL now @ 95 - headed where? 73

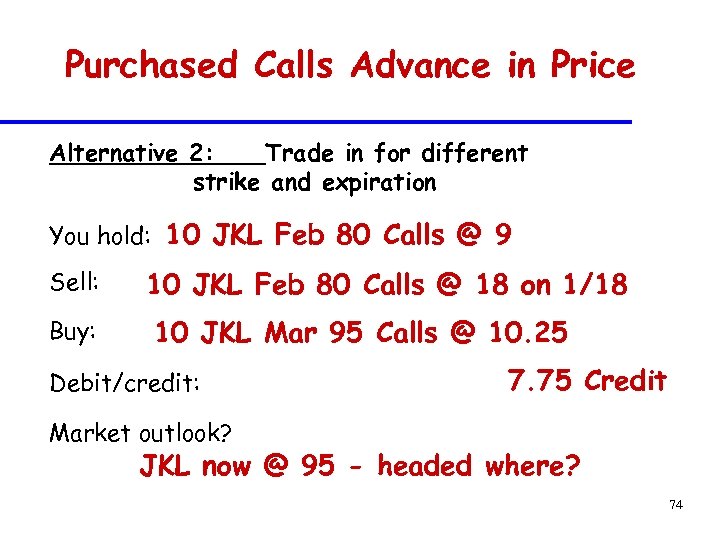

Purchased Calls Advance in Price Alternative 2: Trade in for different strike and expiration You hold: 10 JKL Feb 80 Calls @ 9 Sell: Buy: 10 JKL Feb 80 Calls @ 18 on 1/18 10 JKL Mar 95 Calls @ 10. 25 Debit/credit: 7. 75 Credit Market outlook? JKL now @ 95 - headed where? 74

Purchased Calls Advance in Price Alternative 2: Trade in for different strike and expiration You hold: 10 JKL Feb 80 Calls @ 9 Sell: Buy: 10 JKL Feb 80 Calls @ 18 on 1/18 10 JKL Mar 95 Calls @ 10. 25 Debit/credit: 7. 75 Credit Market outlook? JKL now @ 95 - headed where? 74

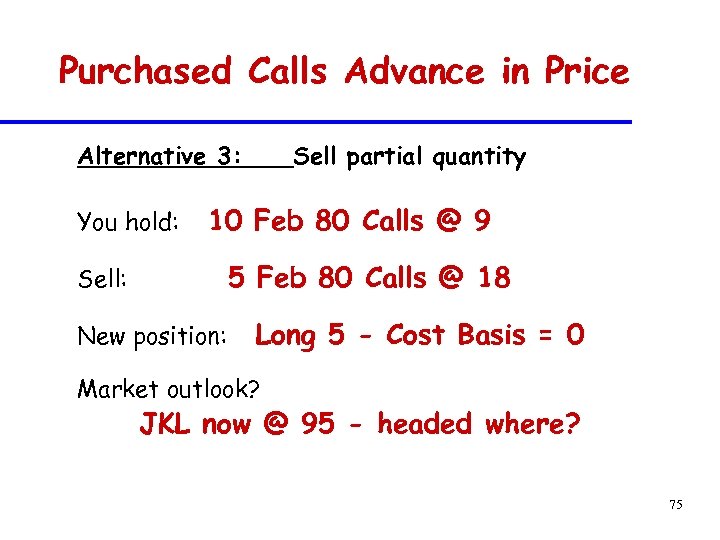

Purchased Calls Advance in Price Alternative 3: You hold: Sell partial quantity 10 Feb 80 Calls @ 9 5 Feb 80 Calls @ 18 Sell: New position: Long 5 - Cost Basis = 0 Market outlook? JKL now @ 95 - headed where? 75

Purchased Calls Advance in Price Alternative 3: You hold: Sell partial quantity 10 Feb 80 Calls @ 9 5 Feb 80 Calls @ 18 Sell: New position: Long 5 - Cost Basis = 0 Market outlook? JKL now @ 95 - headed where? 75

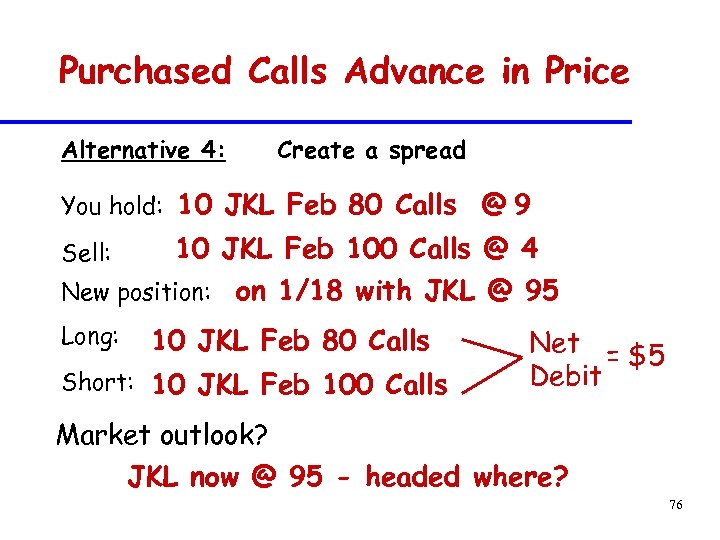

Purchased Calls Advance in Price Alternative 4: Create a spread You hold: 10 JKL Feb 80 Calls Sell: 10 JKL Feb 100 Calls @ 4 New position: Long: @9 on 1/18 with JKL @ 95 10 JKL Feb 80 Calls Short: 10 JKL Feb 100 Calls Net = $5 Debit Market outlook? JKL now @ 95 - headed where? 76

Purchased Calls Advance in Price Alternative 4: Create a spread You hold: 10 JKL Feb 80 Calls Sell: 10 JKL Feb 100 Calls @ 4 New position: Long: @9 on 1/18 with JKL @ 95 10 JKL Feb 80 Calls Short: 10 JKL Feb 100 Calls Net = $5 Debit Market outlook? JKL now @ 95 - headed where? 76

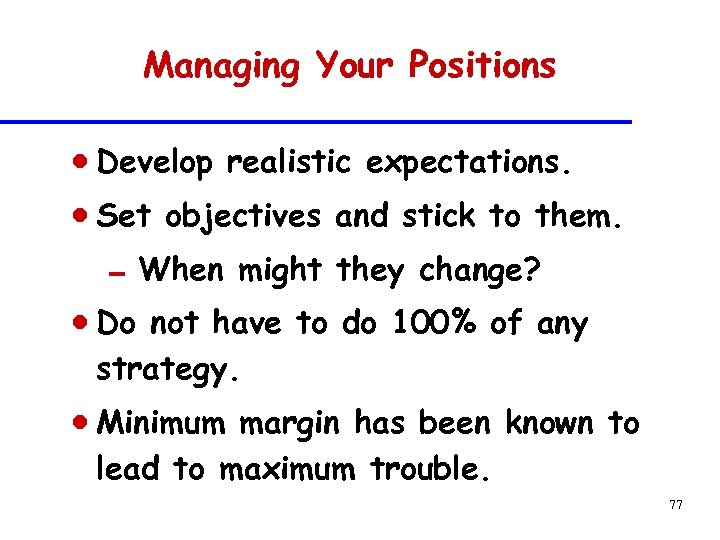

Managing Your Positions n Develop n Set realistic expectations. objectives and stick to them. 0 When might they change? n Do not have to do 100% of any strategy. n Minimum margin has been known to lead to maximum trouble. 77

Managing Your Positions n Develop n Set realistic expectations. objectives and stick to them. 0 When might they change? n Do not have to do 100% of any strategy. n Minimum margin has been known to lead to maximum trouble. 77

Managing Your Positions n n n Know and understand the risks of early assignment. Purchasing puts often present a viable alternative to shorting stock. Stuff happens! 0 If something has a 99% chance of not happening, expect it to occur a few times in your investing career. n Hope is not available on a quote machine. 78

Managing Your Positions n n n Know and understand the risks of early assignment. Purchasing puts often present a viable alternative to shorting stock. Stuff happens! 0 If something has a 99% chance of not happening, expect it to occur a few times in your investing career. n Hope is not available on a quote machine. 78

Options Industry Council 888 -OPTIONS Additional Web Sites: www. 888 options. com www. amex. com www. cboe. com www. iseoptions. com www. pacificex. com www. phlx. com PLEASE FILL OUT SURVEY! 79

Options Industry Council 888 -OPTIONS Additional Web Sites: www. 888 options. com www. amex. com www. cboe. com www. iseoptions. com www. pacificex. com www. phlx. com PLEASE FILL OUT SURVEY! 79