643d7501351d65f48338e12d54c83cc9.ppt

- Количество слайдов: 38

Understanding Data and Media Communication Lawrence Yun, Ph. D. Senior Economist, Managing Director of Research National Association of REALTORS® Presentation at NAR Midyear Meetings in Washington, DC May 17, 2007

Understanding Data and Media Communication Lawrence Yun, Ph. D. Senior Economist, Managing Director of Research National Association of REALTORS® Presentation at NAR Midyear Meetings in Washington, DC May 17, 2007

Media Scare • NAR was the lead story for CBS, NBC, ABC evening news in Fall 2006 • AP: Largest Home Sales Decline in 17 years • Prices are already crashing … (2002) • Economy. com … expect worst housing year since early 1990 s (2001)

Media Scare • NAR was the lead story for CBS, NBC, ABC evening news in Fall 2006 • AP: Largest Home Sales Decline in 17 years • Prices are already crashing … (2002) • Economy. com … expect worst housing year since early 1990 s (2001)

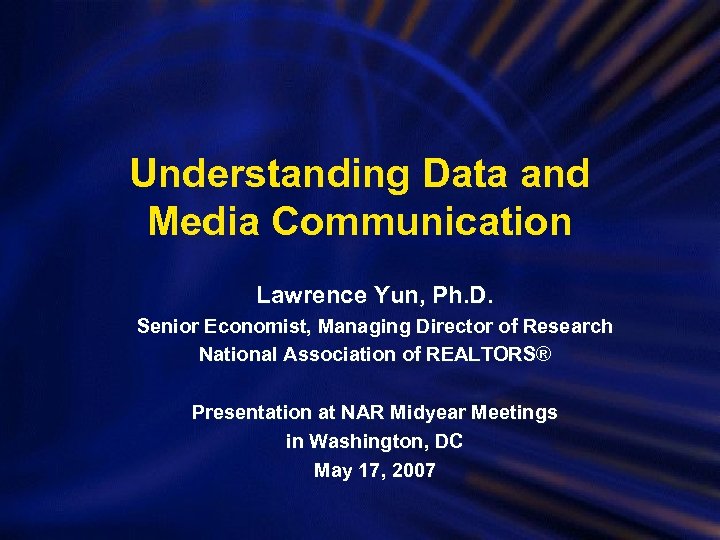

Cooling National Sales: Existing Homes Sales change in % Source: NAR

Cooling National Sales: Existing Homes Sales change in % Source: NAR

Housing Inventory – Raw Count All-time High Source: NAR

Housing Inventory – Raw Count All-time High Source: NAR

Housing Inventory – Months Supply Source: NAR

Housing Inventory – Months Supply Source: NAR

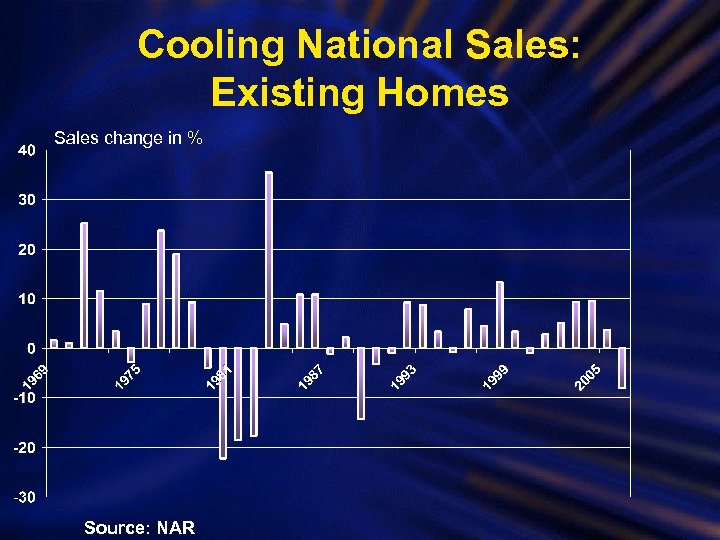

Days on Market – Fuzzy? Source: NAR

Days on Market – Fuzzy? Source: NAR

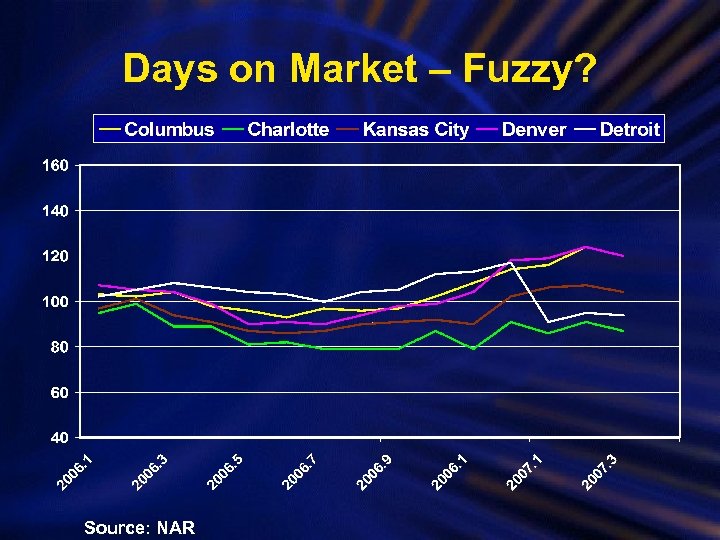

Days on Market – OK? Source: NAR

Days on Market – OK? Source: NAR

Home Price – Seasonal Fluctuations Source: NAR

Home Price – Seasonal Fluctuations Source: NAR

Jobs in Myrtle Beach In thousands Source: NAR

Jobs in Myrtle Beach In thousands Source: NAR

Price Growth (month-to-month) Source: NAR

Price Growth (month-to-month) Source: NAR

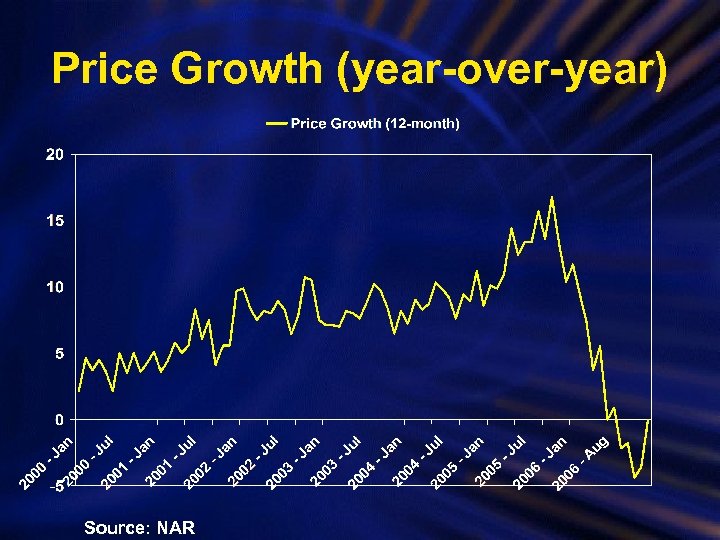

Price Growth (year-over-year) Source: NAR

Price Growth (year-over-year) Source: NAR

Income Not Keeping Pace With Home Prices Income and Price set to Index of 100 in 1990 Source: NAR

Income Not Keeping Pace With Home Prices Income and Price set to Index of 100 in 1990 Source: NAR

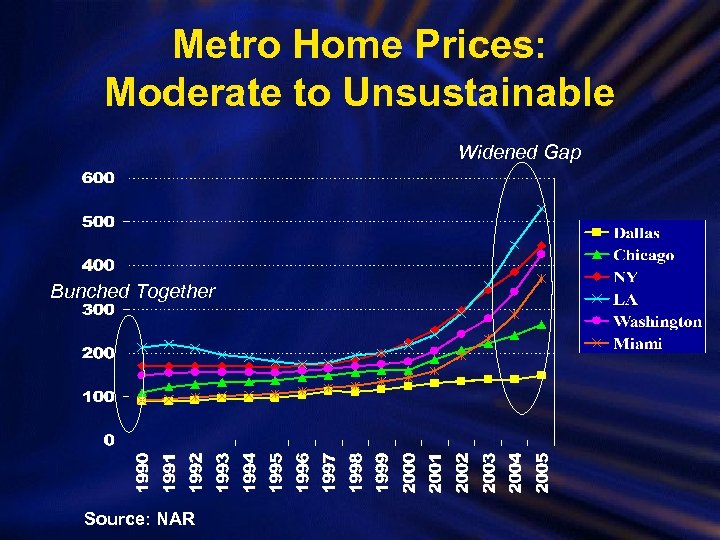

Metro Home Prices: Moderate to Unsustainable Widened Gap Bunched Together Source: NAR

Metro Home Prices: Moderate to Unsustainable Widened Gap Bunched Together Source: NAR

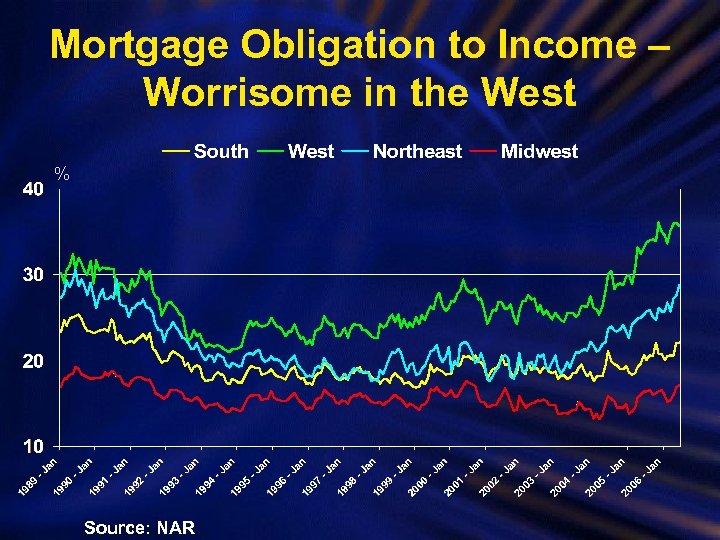

Mortgage Obligation to Income – Worrisome in the West % Source: NAR

Mortgage Obligation to Income – Worrisome in the West % Source: NAR

Mortgage Obligation to Income Very High in Some Markets debt service to buy a median priced home by a middle income family 50% 45% !!! San Diego 40% 30% 20% 1990 Source: NAR 1995 2000 2005

Mortgage Obligation to Income Very High in Some Markets debt service to buy a median priced home by a middle income family 50% 45% !!! San Diego 40% 30% 20% 1990 Source: NAR 1995 2000 2005

Mortgage Obligation to Income Historical High in Some Markets debt service to buy a median priced home by a middle income family 30% Way Above Historical Local Norm Miami 20% 1990 Source: NAR 1995 2000 2005

Mortgage Obligation to Income Historical High in Some Markets debt service to buy a median priced home by a middle income family 30% Way Above Historical Local Norm Miami 20% 1990 Source: NAR 1995 2000 2005

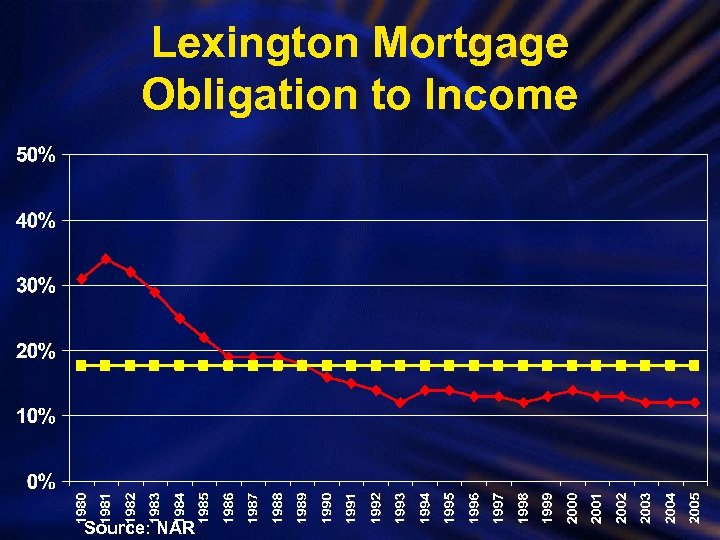

Lexington Mortgage Obligation to Income Source: NAR

Lexington Mortgage Obligation to Income Source: NAR

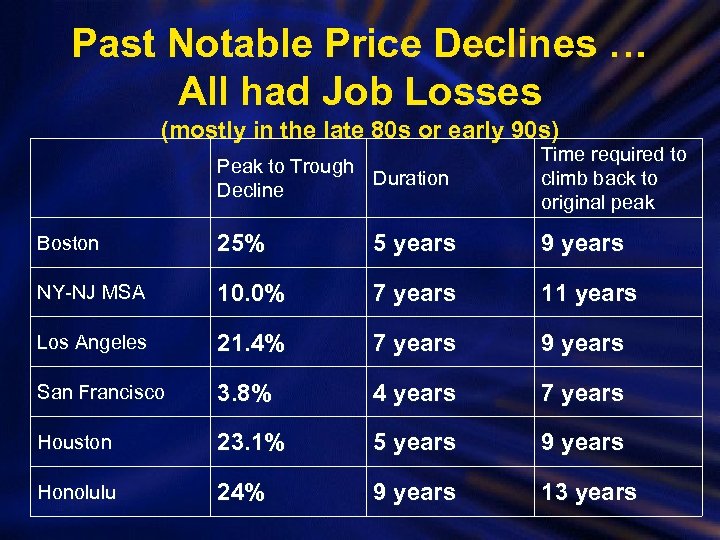

Past Notable Price Declines … All had Job Losses (mostly in the late 80 s or early 90 s) Peak to Trough Duration Decline Time required to climb back to original peak Boston 25% 5 years 9 years NY-NJ MSA 10. 0% 7 years 11 years Los Angeles 21. 4% 7 years 9 years San Francisco 3. 8% 4 years 7 years Houston 23. 1% 5 years 9 years Honolulu 24% 9 years 13 years

Past Notable Price Declines … All had Job Losses (mostly in the late 80 s or early 90 s) Peak to Trough Duration Decline Time required to climb back to original peak Boston 25% 5 years 9 years NY-NJ MSA 10. 0% 7 years 11 years Los Angeles 21. 4% 7 years 9 years San Francisco 3. 8% 4 years 7 years Houston 23. 1% 5 years 9 years Honolulu 24% 9 years 13 years

Emphasize Job Gains: Top Job Creators in 12 months In thousands Source: BLS

Emphasize Job Gains: Top Job Creators in 12 months In thousands Source: BLS

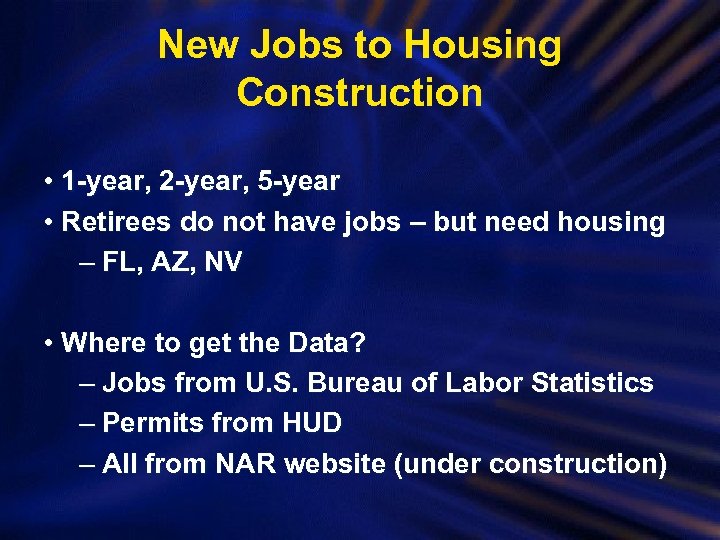

New Jobs to Housing Construction • 1 -year, 2 -year, 5 -year • Retirees do not have jobs – but need housing – FL, AZ, NV • Where to get the Data? – Jobs from U. S. Bureau of Labor Statistics – Permits from HUD – All from NAR website (under construction)

New Jobs to Housing Construction • 1 -year, 2 -year, 5 -year • Retirees do not have jobs – but need housing – FL, AZ, NV • Where to get the Data? – Jobs from U. S. Bureau of Labor Statistics – Permits from HUD – All from NAR website (under construction)

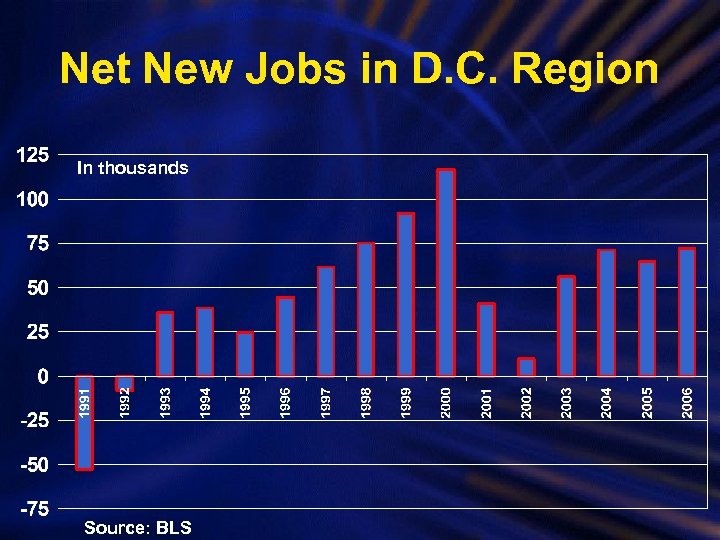

Net New Jobs in D. C. Region In thousands Source: BLS

Net New Jobs in D. C. Region In thousands Source: BLS

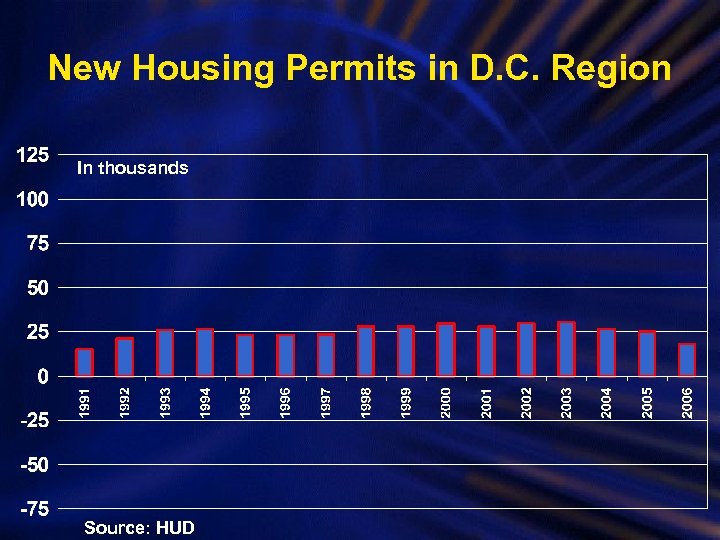

New Housing Permits in D. C. Region In thousands Source: HUD

New Housing Permits in D. C. Region In thousands Source: HUD

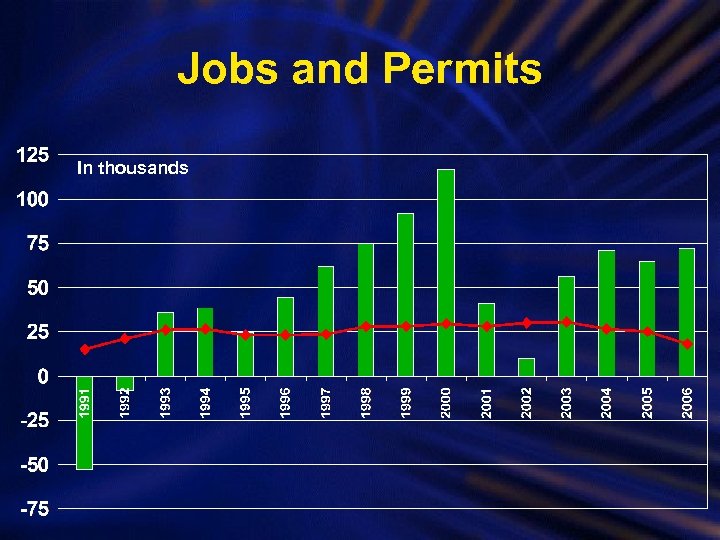

Jobs and Permits In thousands

Jobs and Permits In thousands

Ratio: Jobs to Permits

Ratio: Jobs to Permits

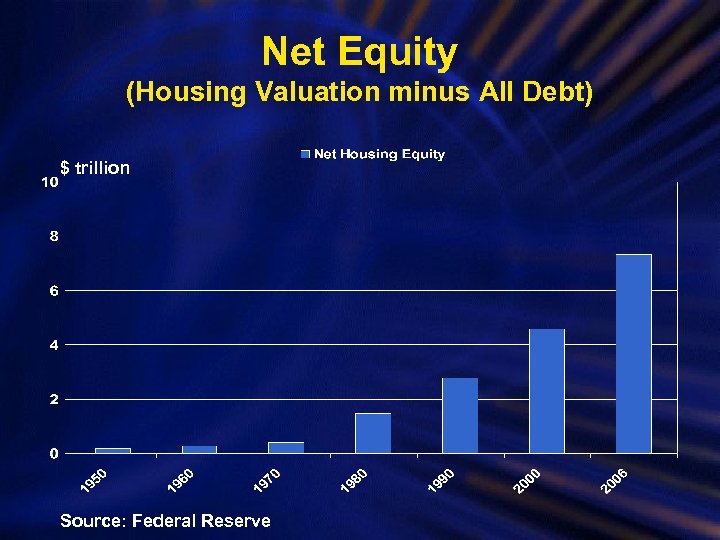

Record High Debt • Yes, Record High Debt • But also, Record High Equity • Record High Net Housing Equity

Record High Debt • Yes, Record High Debt • But also, Record High Equity • Record High Net Housing Equity

Housing Valuation and All Debt $ trillion Source: Federal Reserve

Housing Valuation and All Debt $ trillion Source: Federal Reserve

Net Equity (Housing Valuation minus All Debt) $ trillion Source: Federal Reserve

Net Equity (Housing Valuation minus All Debt) $ trillion Source: Federal Reserve

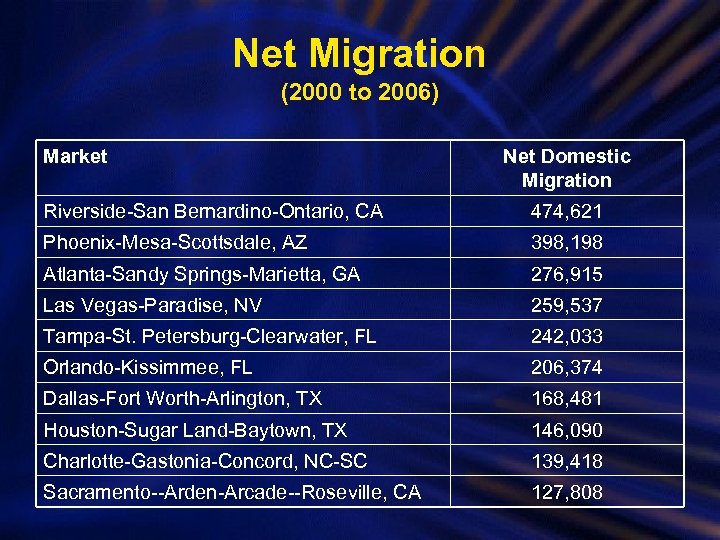

Net Migration (2000 to 2006) Market Net Domestic Migration Riverside-San Bernardino-Ontario, CA 474, 621 Phoenix-Mesa-Scottsdale, AZ 398, 198 Atlanta-Sandy Springs-Marietta, GA 276, 915 Las Vegas-Paradise, NV 259, 537 Tampa-St. Petersburg-Clearwater, FL 242, 033 Orlando-Kissimmee, FL 206, 374 Dallas-Fort Worth-Arlington, TX 168, 481 Houston-Sugar Land-Baytown, TX 146, 090 Charlotte-Gastonia-Concord, NC-SC 139, 418 Sacramento--Arden-Arcade--Roseville, CA 127, 808

Net Migration (2000 to 2006) Market Net Domestic Migration Riverside-San Bernardino-Ontario, CA 474, 621 Phoenix-Mesa-Scottsdale, AZ 398, 198 Atlanta-Sandy Springs-Marietta, GA 276, 915 Las Vegas-Paradise, NV 259, 537 Tampa-St. Petersburg-Clearwater, FL 242, 033 Orlando-Kissimmee, FL 206, 374 Dallas-Fort Worth-Arlington, TX 168, 481 Houston-Sugar Land-Baytown, TX 146, 090 Charlotte-Gastonia-Concord, NC-SC 139, 418 Sacramento--Arden-Arcade--Roseville, CA 127, 808

Total Population Increase (2000 to 2006) Market Natural + International + Domestic Atlanta-Sandy Springs-Marietta, GA 890, 211 Dallas-Fort Worth-Arlington, TX 842, 449 Houston-Sugar Land-Baytown, TX 824, 547 Phoenix-Mesa-Scottsdale, AZ 787, 306 Riverside-San Bernardino-Ontario, CA 771, 314 Los Angeles-Long Beach-Santa Ana, CA 584, 510 New York-Northern New Jersey-Long Island 495, 154 Washington-Arlington-Alexandria, DC-VA-MD-WV 494, 220 Miami-Fort Lauderdale-Miami Beach, FL 455, 869 Chicago-Naperville-Joliet, IL-IN-WI 407, 133

Total Population Increase (2000 to 2006) Market Natural + International + Domestic Atlanta-Sandy Springs-Marietta, GA 890, 211 Dallas-Fort Worth-Arlington, TX 842, 449 Houston-Sugar Land-Baytown, TX 824, 547 Phoenix-Mesa-Scottsdale, AZ 787, 306 Riverside-San Bernardino-Ontario, CA 771, 314 Los Angeles-Long Beach-Santa Ana, CA 584, 510 New York-Northern New Jersey-Long Island 495, 154 Washington-Arlington-Alexandria, DC-VA-MD-WV 494, 220 Miami-Fort Lauderdale-Miami Beach, FL 455, 869 Chicago-Naperville-Joliet, IL-IN-WI 407, 133

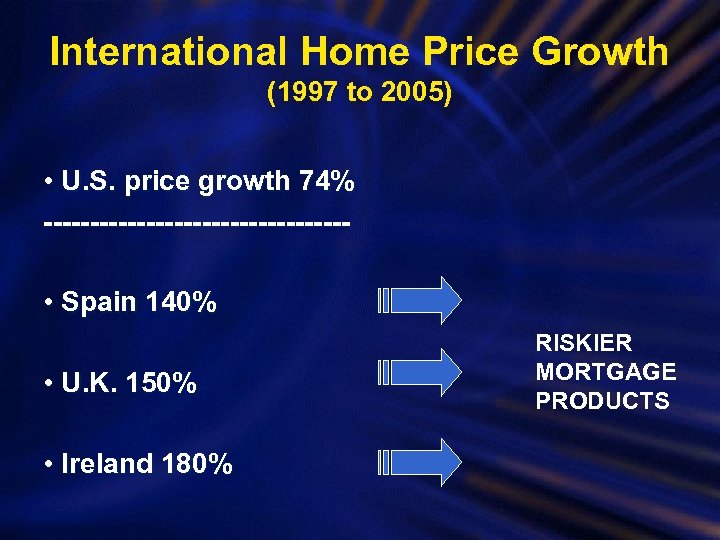

International Home Price Growth (1997 to 2005) • U. S. price growth 74% ---------------- • Spain 140% • U. K. 150% • Ireland 180% RISKIER MORTGAGE PRODUCTS

International Home Price Growth (1997 to 2005) • U. S. price growth 74% ---------------- • Spain 140% • U. K. 150% • Ireland 180% RISKIER MORTGAGE PRODUCTS

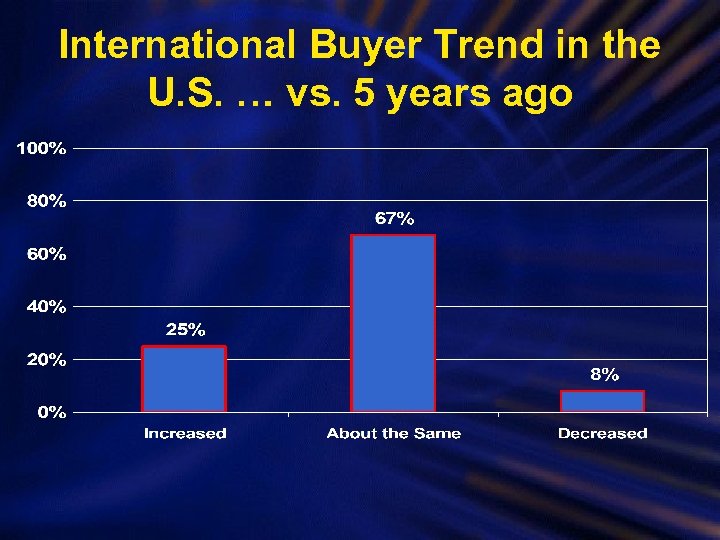

International Buyer Trend in the U. S. … vs. 5 years ago

International Buyer Trend in the U. S. … vs. 5 years ago

Sub-prime Implosion • 100 homes in the neighborhood • 33 homes are owned free and clear • 77 homes have mortgages • 67 homes have prime or gov’t loans • 10 homes have subprime loans • 8 are current on payment • 2 are delinquent • 1 of the 2 delinquent at most would go into foreclosure

Sub-prime Implosion • 100 homes in the neighborhood • 33 homes are owned free and clear • 77 homes have mortgages • 67 homes have prime or gov’t loans • 10 homes have subprime loans • 8 are current on payment • 2 are delinquent • 1 of the 2 delinquent at most would go into foreclosure

We need Your Help! • Feedback on market conditions – Buyer prospects – Open house foot traffic – Listings on the horizon • Customer tracking survey • Leave your business card

We need Your Help! • Feedback on market conditions – Buyer prospects – Open house foot traffic – Listings on the horizon • Customer tracking survey • Leave your business card

What is the NAR Customer Tracking Survey? • Web-based questionnaire sent to clients after final settlement • The 20 questions (mostly yes or no answers) • The timely survey shows you what customers are thinking now and measures changes in customer satisfaction over time. • Identify strengths and weaknesses in attaining full client satisfaction

What is the NAR Customer Tracking Survey? • Web-based questionnaire sent to clients after final settlement • The 20 questions (mostly yes or no answers) • The timely survey shows you what customers are thinking now and measures changes in customer satisfaction over time. • Identify strengths and weaknesses in attaining full client satisfaction

The Goal of the Questions • Identify attributes most strongly associated with customer satisfaction • Several questions to “remind” clients the value of REALTOR service • Helps firm’s training program • Compare aggregate firm performance vs peers

The Goal of the Questions • Identify attributes most strongly associated with customer satisfaction • Several questions to “remind” clients the value of REALTOR service • Helps firm’s training program • Compare aggregate firm performance vs peers