764c508d7f7b5eb9c7bc99a861dcce7f.ppt

- Количество слайдов: 27

“Understanding Cost Segregation Studies” Presented by: Cathy A. Harris, CPA Director, Cost Segregation Group

What is a Cost Segregation Study? § A cost segregation study (CSS) is a systematic engineering-based analysis and classification of all capital expenditures associated with a newly constructed, renovated, recently purchased or existing property.

CSS Goal § The goal of a CSS is to identify assets as either real or personal property and to separate the capital expenditures into the most optimum MACRS asset classifications allowed by IRS code, revenue rulings and existing case law.

Why is a Cost Segregation Study a Good Idea? § A properly completed Cost Segregation Study will: § Maximize tax deferrals through accelerated depreciation § Increase cash flow through a decrease in tax exposure – potential for a big “catch-up” § Minimize taxable gains on the sale of property

What Type of Owners Benefit? § Taxpayers with a commercial property having § § § depreciable basis of $750, 000 or greater. Taxpayers who have constructed, purchased, expanded or renovated commercial properties since 1987. Lessees and lessors who have made leasehold improvements of $750, 000 or greater. Owners of properties about to be sold or who have sold property in recent years.

Primary Property Recovery Periods Component Recovery Period § § § § § Building Land Improvements Furn, Fixt. & Equip. FF&E, Retail & Service Information Systems 27. 5 or 39 years 15 years 7 years 5 years

Average Value Misclassified by Property Type § § § § § Manufacturing Hotels Apartments Restaurants Office Buildings Research & Development Hospitals Tenant Improvements Retail Grocery Stores § § § § § 20% - 60% 15% - 40% 20% - 50% 10% - 40% 20% - 50% 15% - 40% 15% - 50%

Examples of Reallocated Personal Property § § § § Carpeting Wallcoverings Cabinetry Specialty lighting Specialty electric and plumbing Built-in shelving Loading dock equipment

Examples of Reallocated Land Improvements § § § Asphalt Concrete Parking lot lighting Curb and gutters Signage Landscaping

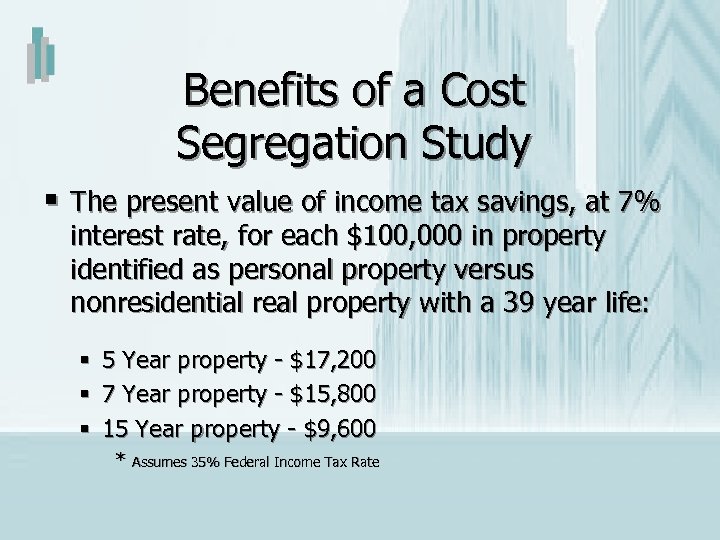

Benefits of a Cost Segregation Study § The present value of income tax savings, at 7% interest rate, for each $100, 000 in property identified as personal property versus nonresidential real property with a 39 year life: § § § 5 Year property - $17, 200 7 Year property - $15, 800 15 Year property - $9, 600 * Assumes 35% Federal Income Tax Rate

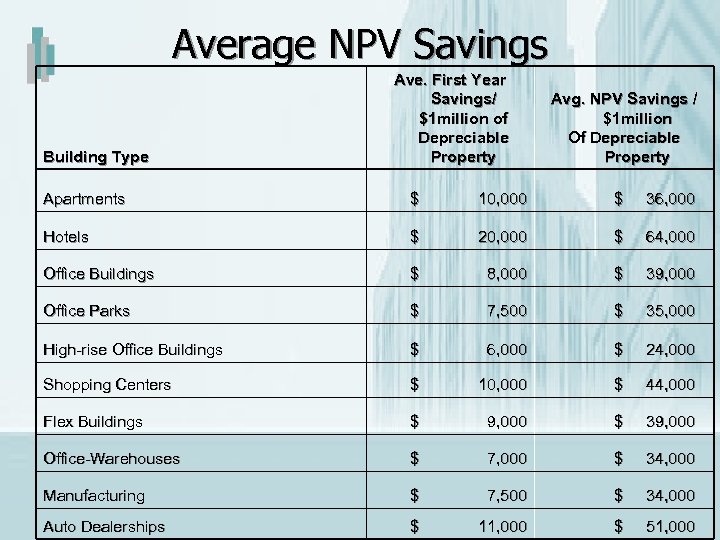

Average NPV Savings Building Type Ave. First Year Savings/ $1 million of Depreciable Property Avg. NPV Savings / $1 million Of Depreciable Property Apartments $ 10, 000 $ 36, 000 Hotels $ 20, 000 $ 64, 000 Office Buildings $ 8, 000 $ 39, 000 Office Parks $ 7, 500 $ 35, 000 High-rise Office Buildings $ 6, 000 $ 24, 000 Shopping Centers $ 10, 000 $ 44, 000 Flex Buildings $ 9, 000 $ 39, 000 Office-Warehouses $ 7, 000 $ 34, 000 Manufacturing $ 7, 500 $ 34, 000 Auto Dealerships $ 11, 000 $ 51, 000

Catch-Up Depreciation § For existing properties that are not optimally § classified, the IRS provides an automatic consent procedure to make changes on a “catch-up” basis. Depreciation differences between current and optimum property classifications are currently allowed to be fully expensed in the year of change.

Year of Sale Study § Catch-up depreciation taken at ordinary tax rates § § (up to 35% federal rate). Additional gain on sale recognized at capital gain rates (15% federal rate). Up to 20% tax savings on additional depreciation taken in the year of sale.

Recent Developments Relating to Depreciable Property § Bonus Depreciation is back for 2008 and 2009!!! § For assets contracted and placed in service between January 1, 2008 and December 31, 2009. § Enhanced Small Business Expensing § Deduct capital expenditures up to $250, 000 phased out after $800, 000 in additions. § Increase extended from 2008 through 2009.

Recent Developments Relating to Depreciable Property § 5 year NOL carryback for small businesses. § Expenditures related to tangible property: Current deduction v. capital expenditure. § Improvements to restore property to former working condition or to keep property in ordinary efficient operating condition may be currently expensed. § Improvements which add to the value or prolong the useful life of the property must be capitalized.

IRS Cost Segregation Audit Technique Guide • This guide was developed to assist IRS agents in the examination of cost segregation studies. Latest update was December 2007. • It identifies cost segregation methodologies that the IRS believes are valid and those which require additional scrutiny. • The guide identifies the attributes of what the Service believes is a quality cost segregation study and report.

The Process 1. Based on preliminary information given, we use our 2. 3. 4. 5. extensive database and estimate the expected tax benefit. A fixed fee proposal is offered. A site visit is made, and the data is processed. Client is under no obligation to pay unless they receive a net benefit from the study. Average turn around is 30 to 60 days.

Steps in a Cost Segregation Study § § § § Perform on-site property tour to collect data. Process detailed information from property tour, site map, blueprints and specifications. Prepare itemized list of all property components. Compute actual or estimated acquisition and installation costs for each identified component. Allocate indirect costs to appropriate property components. Research applicable IRS code, regulations and case law. Determine appropriate depreciable life for each property component. Prepare and present final report.

Deliverable § Cost Segregation Report Preparer Information Project Background Information. Cost Segregation Methodology. Asset Classification Summary. Federal Tax Classifications Support. Project Related Fees and Service. Exhibit 1 - Federal Income Tax - MACRS listing of assets and associated class lives. § Exhibit 2 – Photographs. § § § §

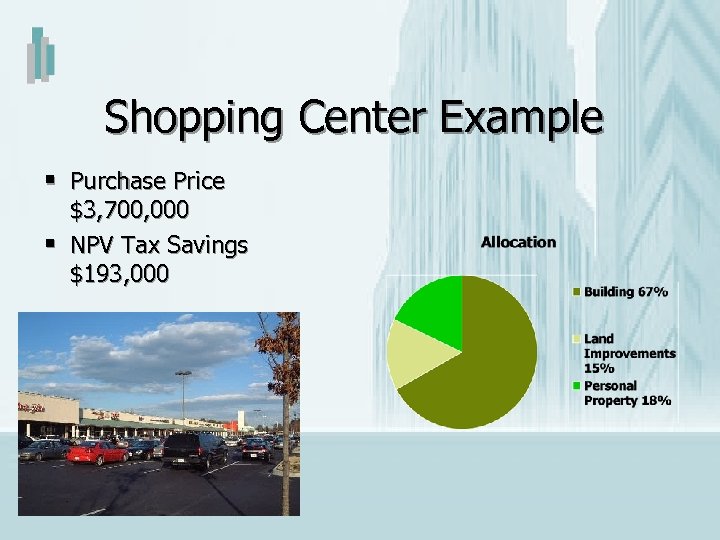

Shopping Center Example § Purchase Price § $3, 700, 000 NPV Tax Savings $193, 000

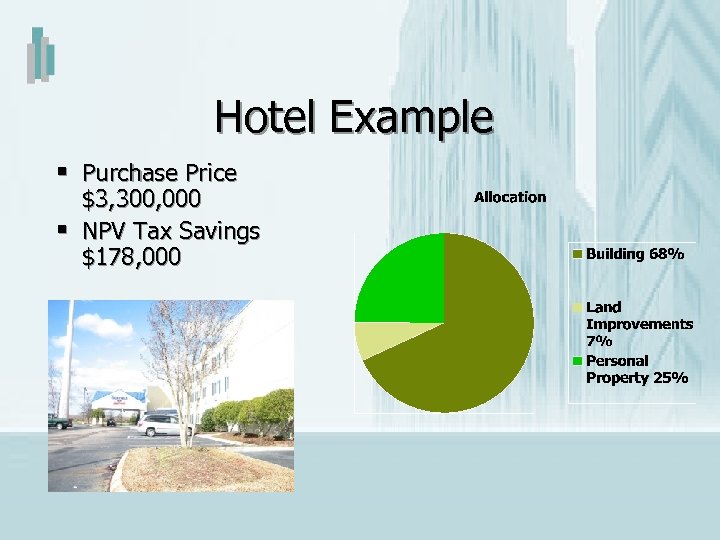

Hotel Example § Purchase Price § $3, 300, 000 NPV Tax Savings $178, 000

Apartments Example § Purchase Price $22, 000 § NPV Tax Savings $969, 000

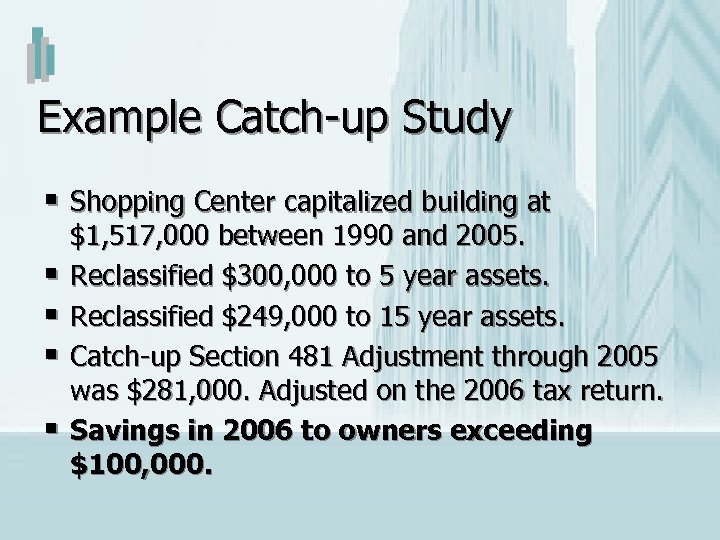

Example Catch-up Study § Shopping Center capitalized building at § § $1, 517, 000 between 1990 and 2005. Reclassified $300, 000 to 5 year assets. Reclassified $249, 000 to 15 year assets. Catch-up Section 481 Adjustment through 2005 was $281, 000. Adjusted on the 2006 tax return. Savings in 2006 to owners exceeding $100, 000.

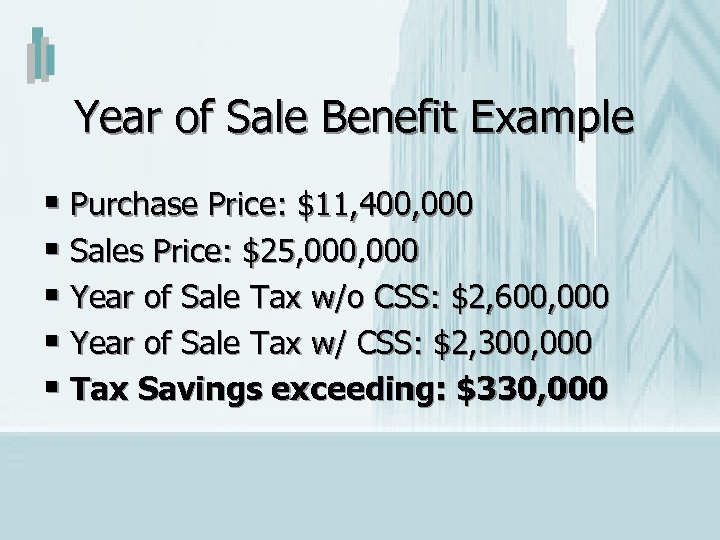

Year of Sale Benefit Example § Purchase Price: $11, 400, 000 § Sales Price: $25, 000 § Year of Sale Tax w/o CSS: $2, 600, 000 § Year of Sale Tax w/ CSS: $2, 300, 000 § Tax Savings exceeding: $330, 000

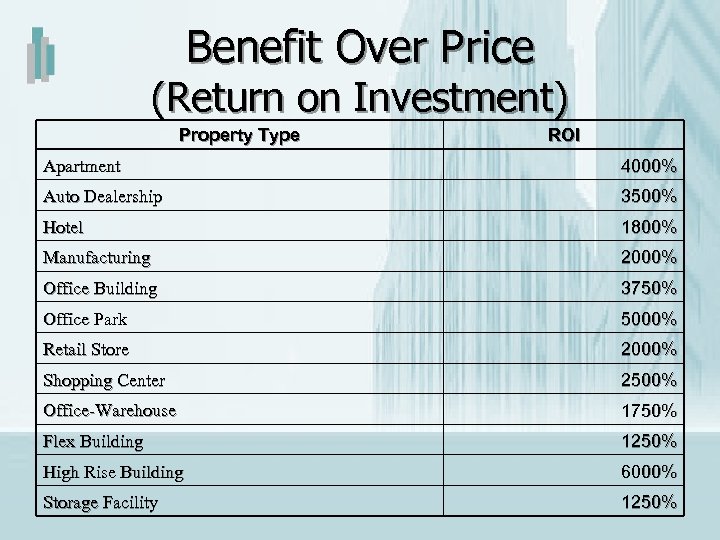

Benefit Over Price (Return on Investment) Property Type ROI Apartment 4000% Auto Dealership 3500% Hotel 1800% Manufacturing 2000% Office Building 3750% Office Park 5000% Retail Store 2000% Shopping Center 2500% Office-Warehouse 1750% Flex Building 1250% High Rise Building 6000% Storage Facility 1250%

Why use The Cost Segregation Group? § Experience providing studies since 1998. § Billions of dollars in real estate segregated. § Engineers and CPAs perform studies. § Senior member of the ASCSP on staff. § 100% IRS audit success. § Authors of CCH’s Practical Guide to Cost Segregation.

Contact Us § Visit our website: www. costsegregationgroup. com The Cost Segregation Group Cathy Harris, Director charris@costsegregationgroup. com (757) 533 -4118

764c508d7f7b5eb9c7bc99a861dcce7f.ppt