38e2f7676f278c8fe6a91c6463fce8e0.ppt

- Количество слайдов: 55

Understanding and using accounts for wealth research Christopher Murphy Ravensbourne Research Limited

Understanding and using accounts for wealth research Christopher Murphy Ravensbourne Research Limited

Topics Business vehicles Types of share Options Valuing businesses Data sources

Topics Business vehicles Types of share Options Valuing businesses Data sources

Business vehicles Company Partnership Sole Trader

Business vehicles Company Partnership Sole Trader

Limited liability many businesses (and nearly all those of much size) have limited liability their owners stand to lose only their investment in the business if things go wrong so their personal assets are safe from creditors

Limited liability many businesses (and nearly all those of much size) have limited liability their owners stand to lose only their investment in the business if things go wrong so their personal assets are safe from creditors

Business vehicles Company Partnership Sole Trader

Business vehicles Company Partnership Sole Trader

Companies Unlimited Limited by Guarantee Limited by Shares

Companies Unlimited Limited by Guarantee Limited by Shares

Limited companies denoted by word ‘Limited’ or ‘Ltd’ in their name warns other parties that the owner’s liability is limited to their investment in the firm potential creditors thus know that the owner’s personal assets cannot be seized if the company doesn’t pay what it owes

Limited companies denoted by word ‘Limited’ or ‘Ltd’ in their name warns other parties that the owner’s liability is limited to their investment in the firm potential creditors thus know that the owner’s personal assets cannot be seized if the company doesn’t pay what it owes

Limited by guarantee • over 90, 000 companies have no share capital • the liability of their owners (‘members’) ‘guarantors' as opposed to ‘shareholders’ -is limited by guarantee • a popular legal form for charities, educational bodies

Limited by guarantee • over 90, 000 companies have no share capital • the liability of their owners (‘members’) ‘guarantors' as opposed to ‘shareholders’ -is limited by guarantee • a popular legal form for charities, educational bodies

Limited by shares • far more common (well over 2 million of them) • liability of the members – ‘shareholders’ – is limited to the nominal value of their shares • nominal (‘face’ or ‘par’) value of shares is very different from their market value • shares with nominal value 10 pence each, currently being traded on stock market at 643 pence

Limited by shares • far more common (well over 2 million of them) • liability of the members – ‘shareholders’ – is limited to the nominal value of their shares • nominal (‘face’ or ‘par’) value of shares is very different from their market value • shares with nominal value 10 pence each, currently being traded on stock market at 643 pence

Partnerships Ordinary Limited Liability

Partnerships Ordinary Limited Liability

Limited Liability Partnership • LLP form available since 2001 • limited liability for non-negligent partners • but not for those judged negligent • has proved very popular (over 40, 000) • treated like companies for filing purposes, thus have to file accounts

Limited Liability Partnership • LLP form available since 2001 • limited liability for non-negligent partners • but not for those judged negligent • has proved very popular (over 40, 000) • treated like companies for filing purposes, thus have to file accounts

LLP ‘Designated Members’ there must be at least two they are responsible for company secretary type duties all members may be designated members

LLP ‘Designated Members’ there must be at least two they are responsible for company secretary type duties all members may be designated members

Limited companies Limited by Shares Public Private

Limited companies Limited by Shares Public Private

Public and private companies • public companies may offer shares to public • ‘Public Limited Company’ or ‘PLC’ • private companies may not • tighter rules apply to PLCs

Public and private companies • public companies may offer shares to public • ‘Public Limited Company’ or ‘PLC’ • private companies may not • tighter rules apply to PLCs

Exemptions from disclosure based on company size • size of PLCs irrelevant - no exemptions • nor for large private companies • medium and small companies get disclosure exemptions - if they choose to claim them

Exemptions from disclosure based on company size • size of PLCs irrelevant - no exemptions • nor for large private companies • medium and small companies get disclosure exemptions - if they choose to claim them

Limited by Shares Public Private Small Medium Large

Limited by Shares Public Private Small Medium Large

Disclosure requirements for small companies must file a balance sheet • need not file • profit and loss account • directors’ report (though these are usually filed voluntarily)

Disclosure requirements for small companies must file a balance sheet • need not file • profit and loss account • directors’ report (though these are usually filed voluntarily)

Definition of a small company • meets at least two out of three conditions • turnover (sales) doesn’t exceed £ 5. 6 million • balance sheet total (i. e. either total assets or total liabilities) doesn’t exceed £ 3. 26 million • average number of employees doesn’t exceed 50

Definition of a small company • meets at least two out of three conditions • turnover (sales) doesn’t exceed £ 5. 6 million • balance sheet total (i. e. either total assets or total liabilities) doesn’t exceed £ 3. 26 million • average number of employees doesn’t exceed 50

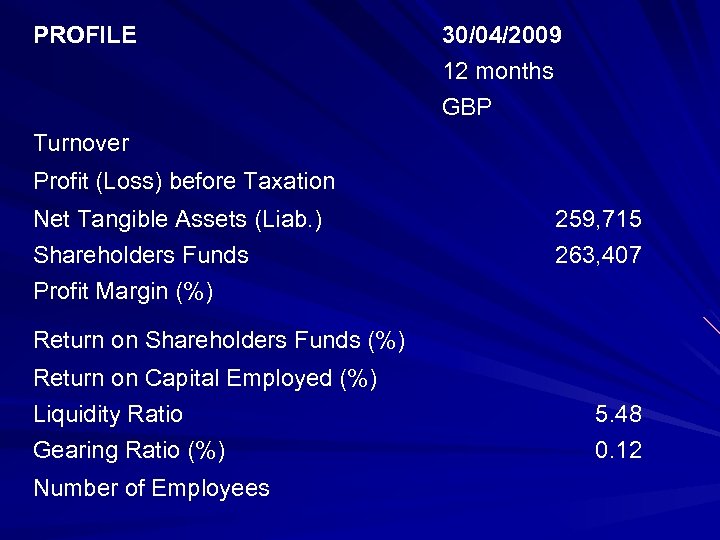

PROFILE 30/04/2009 12 months GBP Turnover Profit (Loss) before Taxation Net Tangible Assets (Liab. ) Shareholders Funds Profit Margin (%) 259, 715 263, 407 Return on Shareholders Funds (%) Return on Capital Employed (%) Liquidity Ratio Gearing Ratio (%) Number of Employees 5. 48 0. 12

PROFILE 30/04/2009 12 months GBP Turnover Profit (Loss) before Taxation Net Tangible Assets (Liab. ) Shareholders Funds Profit Margin (%) 259, 715 263, 407 Return on Shareholders Funds (%) Return on Capital Employed (%) Liquidity Ratio Gearing Ratio (%) Number of Employees 5. 48 0. 12

Bad news for researchers full accounts filed by just 1 in 8 actively trading companies

Bad news for researchers full accounts filed by just 1 in 8 actively trading companies

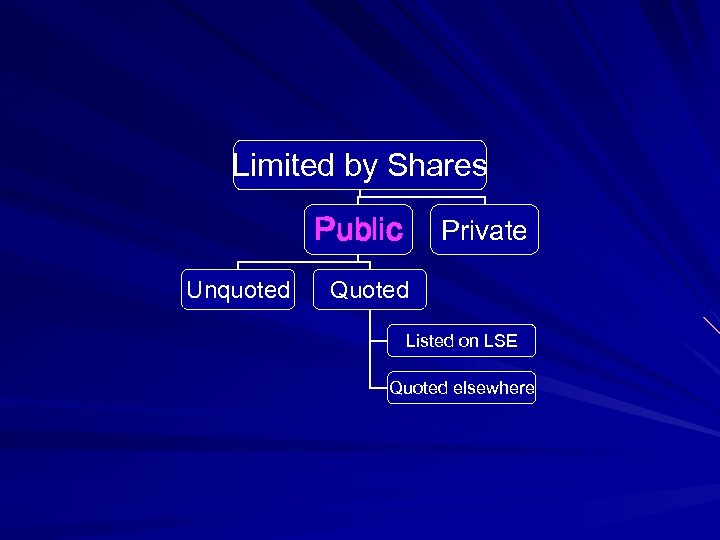

Limited by Shares Public Unquoted Private Quoted Listed on LSE Quoted elsewhere

Limited by Shares Public Unquoted Private Quoted Listed on LSE Quoted elsewhere

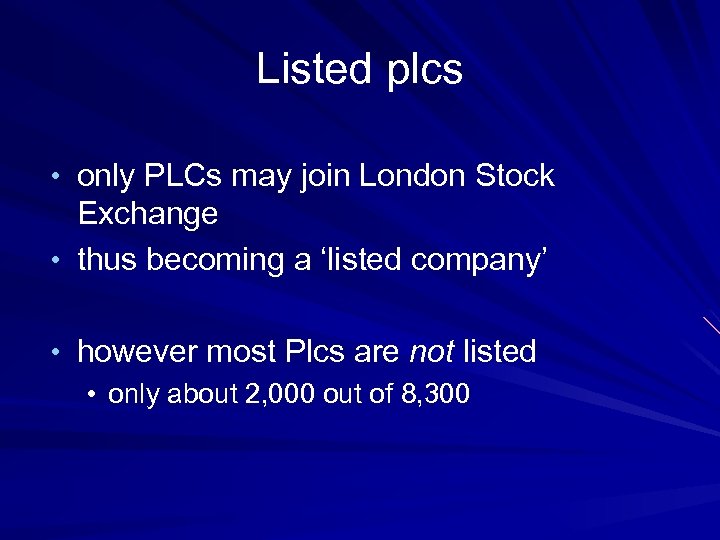

Listed plcs • only PLCs may join London Stock Exchange • thus becoming a ‘listed company’ • however most Plcs are not listed • only about 2, 000 out of 8, 300

Listed plcs • only PLCs may join London Stock Exchange • thus becoming a ‘listed company’ • however most Plcs are not listed • only about 2, 000 out of 8, 300

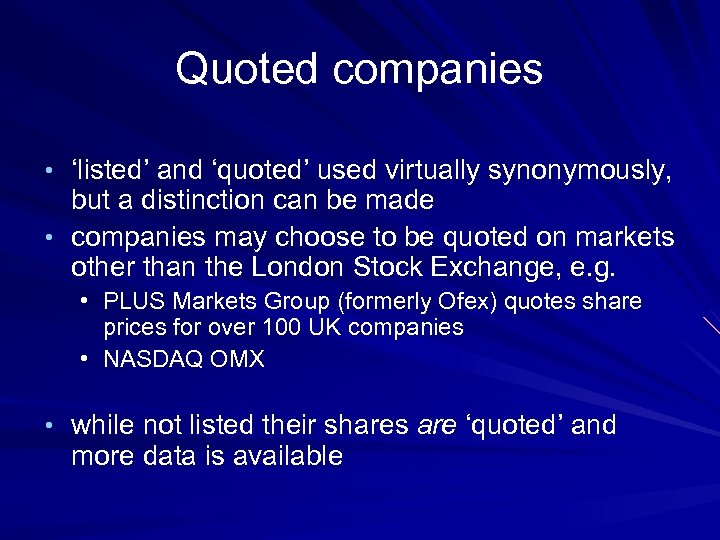

Quoted companies • ‘listed’ and ‘quoted’ used virtually synonymously, but a distinction can be made • companies may choose to be quoted on markets other than the London Stock Exchange, e. g. • PLUS Markets Group (formerly Ofex) quotes share prices for over 100 UK companies • NASDAQ OMX • while not listed their shares are ‘quoted’ and more data is available

Quoted companies • ‘listed’ and ‘quoted’ used virtually synonymously, but a distinction can be made • companies may choose to be quoted on markets other than the London Stock Exchange, e. g. • PLUS Markets Group (formerly Ofex) quotes share prices for over 100 UK companies • NASDAQ OMX • while not listed their shares are ‘quoted’ and more data is available

Business vehicles Types of share Options Valuing businesses Data sources

Business vehicles Types of share Options Valuing businesses Data sources

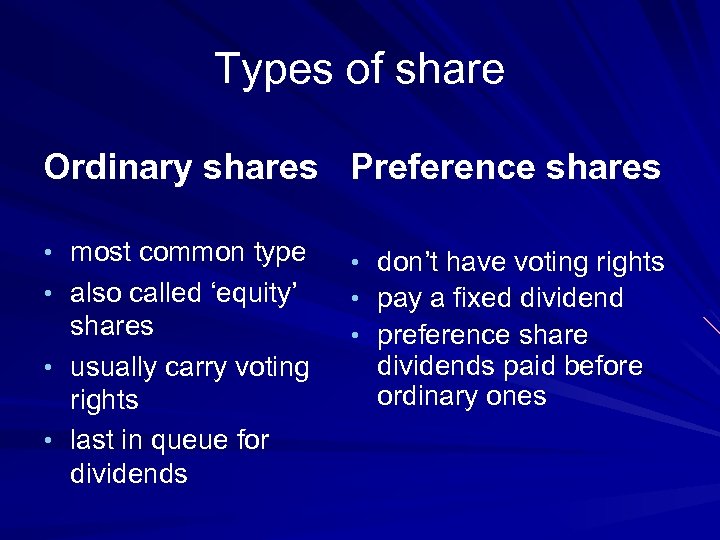

Types of share Ordinary shares Preference shares • most common type • also called ‘equity’ shares • usually carry voting rights • last in queue for dividends • • • don’t have voting rights pay a fixed dividend preference share dividends paid before ordinary ones

Types of share Ordinary shares Preference shares • most common type • also called ‘equity’ shares • usually carry voting rights • last in queue for dividends • • • don’t have voting rights pay a fixed dividend preference share dividends paid before ordinary ones

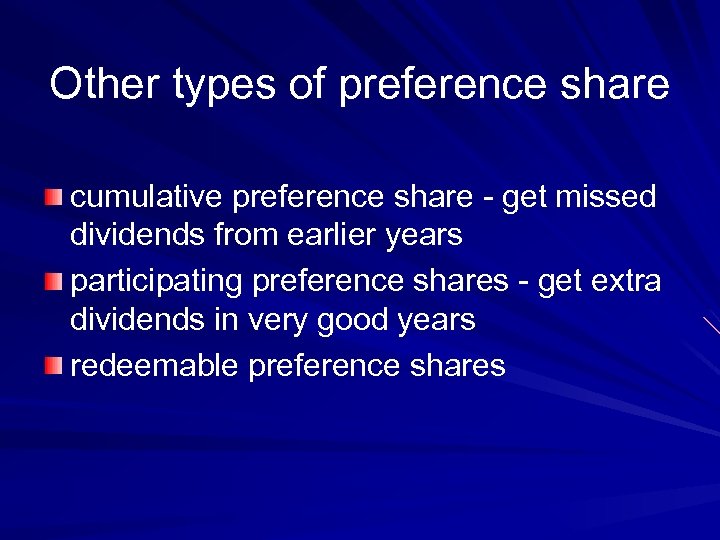

Other types of preference share cumulative preference share - get missed dividends from earlier years participating preference shares - get extra dividends in very good years redeemable preference shares

Other types of preference share cumulative preference share - get missed dividends from earlier years participating preference shares - get extra dividends in very good years redeemable preference shares

Convertible preference shares ‘convertibles’ can be converted into equity shares

Convertible preference shares ‘convertibles’ can be converted into equity shares

Rewards from shareholding shares are safer, but upside probably limited equity shares more risky, potentially more rewarding convertibles offer a two-way bet

Rewards from shareholding shares are safer, but upside probably limited equity shares more risky, potentially more rewarding convertibles offer a two-way bet

Nominal v beneficial owners nominal owners are those listed in public records like Annual Returns – used by large portfolios for administrative convenience – and to conceal real owners’ identity

Nominal v beneficial owners nominal owners are those listed in public records like Annual Returns – used by large portfolios for administrative convenience – and to conceal real owners’ identity

Business vehicles Types of share Options Valuing businesses Data sources

Business vehicles Types of share Options Valuing businesses Data sources

Options rights granted to directors to buy a certain number of shares at a set price within a limited period idea is to align individual performance with company’s fortunes when actual share price exceeds exercise price scope for director making a profit

Options rights granted to directors to buy a certain number of shares at a set price within a limited period idea is to align individual performance with company’s fortunes when actual share price exceeds exercise price scope for director making a profit

But usually conditional ‘forfeited options’ – lost by director leaving or failing to meet performance targets sometimes they lapse before end of exercise period

But usually conditional ‘forfeited options’ – lost by director leaving or failing to meet performance targets sometimes they lapse before end of exercise period

Option terminology ‘vesting’ – delay between award of option and them being exercisable ‘partial vesting’ – vested in stages ‘cliff’ – no shares vested in first period ‘submerged’ options – exercise price below option price ‘deemed’ – director doesn’t actually own individually (pension scheme)

Option terminology ‘vesting’ – delay between award of option and them being exercisable ‘partial vesting’ – vested in stages ‘cliff’ – no shares vested in first period ‘submerged’ options – exercise price below option price ‘deemed’ – director doesn’t actually own individually (pension scheme)

Business vehicles Types of share Options Valuing businesses Data sources

Business vehicles Types of share Options Valuing businesses Data sources

Many valuation techniques q Market Capitalisation (market cap) Earnings and Dividend payout multiples (PER & DPS) Total Shareholder Returns (TSR) Net Asset Value (NAV) Discounted Cash Flow (DCF) acquisition prices paid for comparable companies (comps) sectoral ‘rules of thumb’ EV/EBITDA

Many valuation techniques q Market Capitalisation (market cap) Earnings and Dividend payout multiples (PER & DPS) Total Shareholder Returns (TSR) Net Asset Value (NAV) Discounted Cash Flow (DCF) acquisition prices paid for comparable companies (comps) sectoral ‘rules of thumb’ EV/EBITDA

Even for quoted companies valuation is a judgement, not a purely objective science

Even for quoted companies valuation is a judgement, not a purely objective science

Price earnings ratio probably most common ratio used relates the earnings (profits) a company delivers to the share price (the price for those earnings)

Price earnings ratio probably most common ratio used relates the earnings (profits) a company delivers to the share price (the price for those earnings)

Definition of PER current share price divided by earnings per share i. e. £ 5/25 pence= PER of 20 jargon –’PE’, ’ 20 times earnings’, ’multiple of 20’

Definition of PER current share price divided by earnings per share i. e. £ 5/25 pence= PER of 20 jargon –’PE’, ’ 20 times earnings’, ’multiple of 20’

Private companies even more difficult – no share price quotations to help us traditional discount of a private company’s value compared with a quoted one

Private companies even more difficult – no share price quotations to help us traditional discount of a private company’s value compared with a quoted one

PER for private companies ‘earnings’ are post-tax profits ‘price’ is what a comparable company is sold for

PER for private companies ‘earnings’ are post-tax profits ‘price’ is what a comparable company is sold for

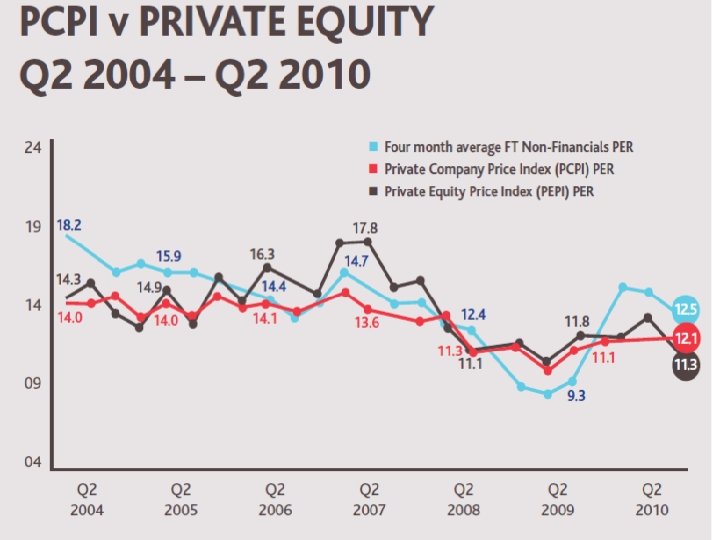

BDO Private Company Price Index (PCPI) measures trends in prices www. bdo. co. uk/library

BDO Private Company Price Index (PCPI) measures trends in prices www. bdo. co. uk/library

But differences in PERs private company discount usually higher for smaller companies PERs vary between sectors best to look at closest comparators

But differences in PERs private company discount usually higher for smaller companies PERs vary between sectors best to look at closest comparators

‘Bottom line’ ‘earnings attributable to equity shareholders’ could all be paid out (‘distributed’) to the shareholders as dividends but management often ‘retain’ (reinvest in the business) part or all of the profit

‘Bottom line’ ‘earnings attributable to equity shareholders’ could all be paid out (‘distributed’) to the shareholders as dividends but management often ‘retain’ (reinvest in the business) part or all of the profit

Earnings Per Share (EPS) Earnings attributable to ordinary shareholders – divided by number of issued ordinary shares

Earnings Per Share (EPS) Earnings attributable to ordinary shareholders – divided by number of issued ordinary shares

Dividends depends on size of ‘earnings attributable to ordinary shareholders’ and dividend policy chosen by board measured by ‘Dividends Per Share’ (DPS) individual dividend pay-outs determined by DPS multiplied by number of shares they hold

Dividends depends on size of ‘earnings attributable to ordinary shareholders’ and dividend policy chosen by board measured by ‘Dividends Per Share’ (DPS) individual dividend pay-outs determined by DPS multiplied by number of shares they hold

Business vehicles Types of share Options Valuing Data sources

Business vehicles Types of share Options Valuing Data sources

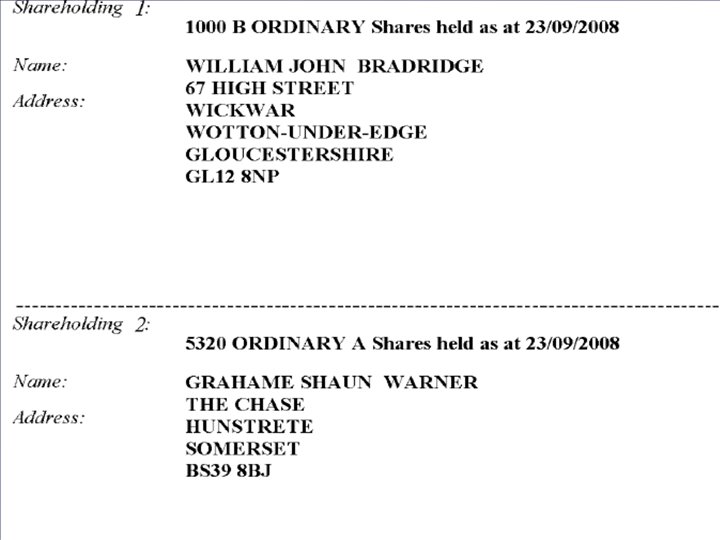

Shareholders individual holdings shown in ‘Annual Return’ but may be hidden behind nominees – no mechanism for identifying beneficial owners in private companies

Shareholders individual holdings shown in ‘Annual Return’ but may be hidden behind nominees – no mechanism for identifying beneficial owners in private companies

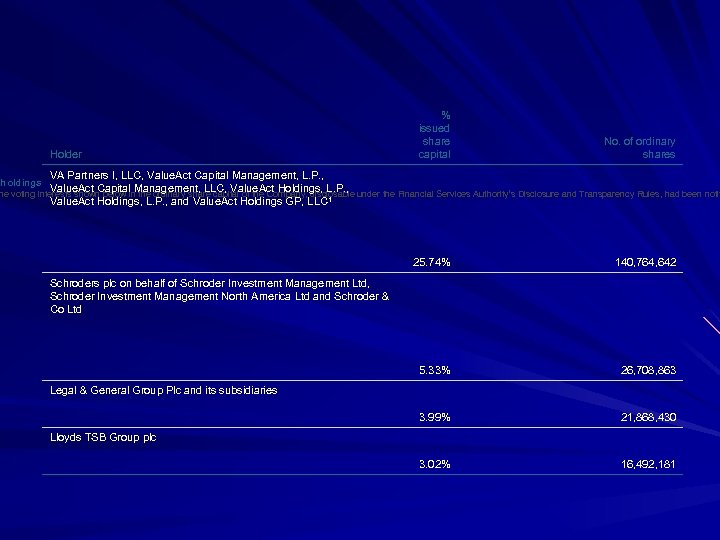

Directors’ report shows holdings by individual directors in quoted companies lists all shareholders holding over 3% of total voting share capital

Directors’ report shows holdings by individual directors in quoted companies lists all shareholders holding over 3% of total voting share capital

Holder % issued share capital No. of ordinary shares VA Partners I, LLC, Value. Act Capital Management, L. P. , Value. Act Capital Management, LLC, Value. Act Holdings, L. P. , he voting interests shown below in the ordinary share capital of the Company, disclosable under the Financial Services Authority’s Disclosure and Transparency Rules, had been notif Value. Act Holdings, L. P. , and Value. Act Holdings GP, LLC 1 eholdings 25. 74% 140, 764, 642 5. 33% 26, 708, 863 3. 99% 21, 868, 430 3. 02% 16, 492, 181 Schroders plc on behalf of Schroder Investment Management Ltd, Schroder Investment Management North America Ltd and Schroder & Co Ltd Legal & General Group Plc and its subsidiaries Lloyds TSB Group plc

Holder % issued share capital No. of ordinary shares VA Partners I, LLC, Value. Act Capital Management, L. P. , Value. Act Capital Management, LLC, Value. Act Holdings, L. P. , he voting interests shown below in the ordinary share capital of the Company, disclosable under the Financial Services Authority’s Disclosure and Transparency Rules, had been notif Value. Act Holdings, L. P. , and Value. Act Holdings GP, LLC 1 eholdings 25. 74% 140, 764, 642 5. 33% 26, 708, 863 3. 99% 21, 868, 430 3. 02% 16, 492, 181 Schroders plc on behalf of Schroder Investment Management Ltd, Schroder Investment Management North America Ltd and Schroder & Co Ltd Legal & General Group Plc and its subsidiaries Lloyds TSB Group plc

Regulatory News Service London Stock Exchange’s RNS shows purchases or sales of over 3% of voting share capital above this movements of 1% up or down in a holding any acquisitions/disposals by a director

Regulatory News Service London Stock Exchange’s RNS shows purchases or sales of over 3% of voting share capital above this movements of 1% up or down in a holding any acquisitions/disposals by a director

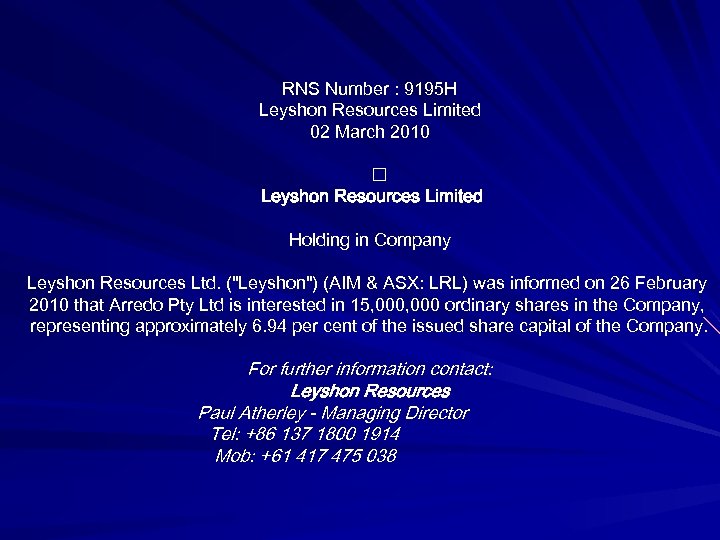

RNS Number : 9195 H Leyshon Resources Limited 02 March 2010 Leyshon Resources Limited Holding in Company Leyshon Resources Ltd. ("Leyshon") (AIM & ASX: LRL) was informed on 26 February 2010 that Arredo Pty Ltd is interested in 15, 000 ordinary shares in the Company, representing approximately 6. 94 per cent of the issued share capital of the Company. For further information contact: Leyshon Resources Paul Atherley - Managing Director Tel: +86 137 1800 1914 Mob: +61 417 475 038

RNS Number : 9195 H Leyshon Resources Limited 02 March 2010 Leyshon Resources Limited Holding in Company Leyshon Resources Ltd. ("Leyshon") (AIM & ASX: LRL) was informed on 26 February 2010 that Arredo Pty Ltd is interested in 15, 000 ordinary shares in the Company, representing approximately 6. 94 per cent of the issued share capital of the Company. For further information contact: Leyshon Resources Paul Atherley - Managing Director Tel: +86 137 1800 1914 Mob: +61 417 475 038

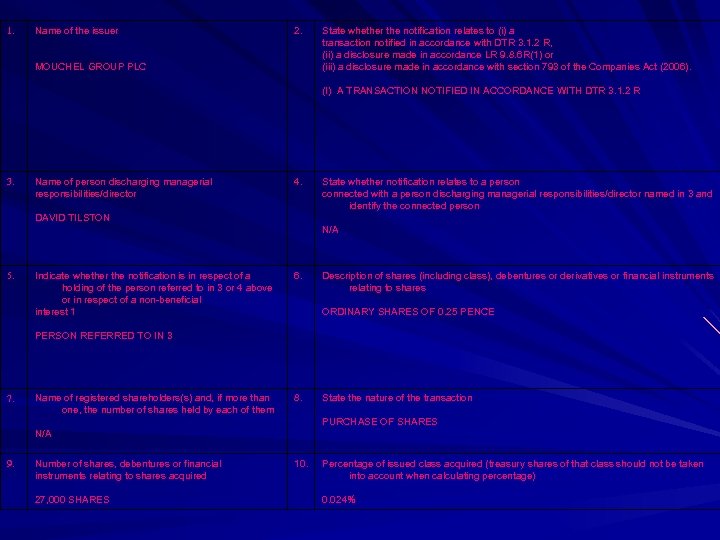

1. Name of the issuer MOUCHEL GROUP PLC 2. State whether the notification relates to (i) a transaction notified in accordance with DTR 3. 1. 2 R, (ii) a disclosure made in accordance LR 9. 8. 6 R(1) or (iii) a disclosure made in accordance with section 793 of the Companies Act (2006). (I) A TRANSACTION NOTIFIED IN ACCORDANCE WITH DTR 3. 1. 2 R 3. Name of person discharging managerial responsibilities/director DAVID TILSTON 4. State whether notification relates to a person connected with a person discharging managerial responsibilities/director named in 3 and identify the connected person N/A 5. Indicate whether the notification is in respect of a holding of the person referred to in 3 or 4 above or in respect of a non-beneficial interest 1 PERSON REFERRED TO IN 3 6. Description of shares (including class), debentures or derivatives or financial instruments relating to shares ORDINARY SHARES OF 0. 25 PENCE 7. Name of registered shareholders(s) and, if more than one, the number of shares held by each of them N/A 8. State the nature of the transaction PURCHASE OF SHARES 9. Number of shares, debentures or financial instruments relating to shares acquired 27, 000 SHARES 10. Percentage of issued class acquired (treasury shares of that class should not be taken into account when calculating percentage) 0. 024%

1. Name of the issuer MOUCHEL GROUP PLC 2. State whether the notification relates to (i) a transaction notified in accordance with DTR 3. 1. 2 R, (ii) a disclosure made in accordance LR 9. 8. 6 R(1) or (iii) a disclosure made in accordance with section 793 of the Companies Act (2006). (I) A TRANSACTION NOTIFIED IN ACCORDANCE WITH DTR 3. 1. 2 R 3. Name of person discharging managerial responsibilities/director DAVID TILSTON 4. State whether notification relates to a person connected with a person discharging managerial responsibilities/director named in 3 and identify the connected person N/A 5. Indicate whether the notification is in respect of a holding of the person referred to in 3 or 4 above or in respect of a non-beneficial interest 1 PERSON REFERRED TO IN 3 6. Description of shares (including class), debentures or derivatives or financial instruments relating to shares ORDINARY SHARES OF 0. 25 PENCE 7. Name of registered shareholders(s) and, if more than one, the number of shares held by each of them N/A 8. State the nature of the transaction PURCHASE OF SHARES 9. Number of shares, debentures or financial instruments relating to shares acquired 27, 000 SHARES 10. Percentage of issued class acquired (treasury shares of that class should not be taken into account when calculating percentage) 0. 024%

chrismurphy 1999@yahoo. co. uk 020 868 0487 07 525 98 44 32

chrismurphy 1999@yahoo. co. uk 020 868 0487 07 525 98 44 32