a8940316dd65220ed710c0cc3bb08a59.ppt

- Количество слайдов: 26

Understanding and Embracing The New AECOM Leadership Briefing Sept. 23, 2008 Proprietary and Confidential 1

Objectives 1. Provide update on “State of AECOM. ” 2. Share AECOM organization design vision. 3. Confirm initial implementation priorities. 4. Announce new AECOM leadership appointments in North America. 5. Clarify role of AECOM leaders. 6. Address key questions. Proprietary and Confidential 2

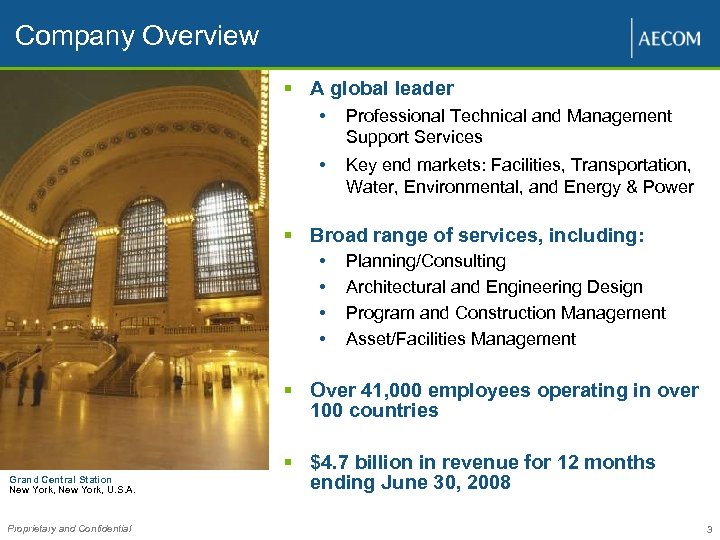

Company Overview § A global leader • Professional Technical and Management Support Services • Key end markets: Facilities, Transportation, Water, Environmental, and Energy & Power § Broad range of services, including: • • Planning/Consulting Architectural and Engineering Design Program and Construction Management Asset/Facilities Management § Over 41, 000 employees operating in over 100 countries Grand Central Station New York, U. S. A. Proprietary and Confidential § $4. 7 billion in revenue for 12 months ending June 30, 2008 3

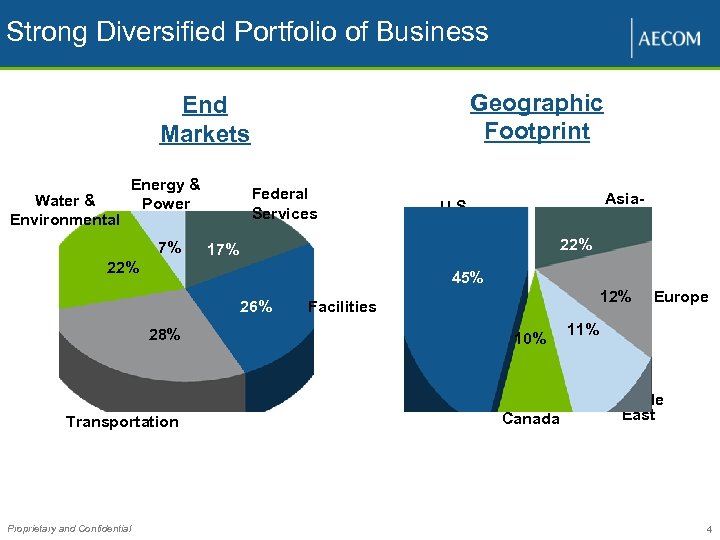

Strong Diversified Portfolio of Business Geographic Footprint End Markets Water & Environmental Energy & Power 7% 22% Federal Services 22% 17% 45% 26% 28% Transportation Proprietary and Confidential Asia. Pacific U. S. 12% Facilities 10% Canada Europe 11% Middle East 4

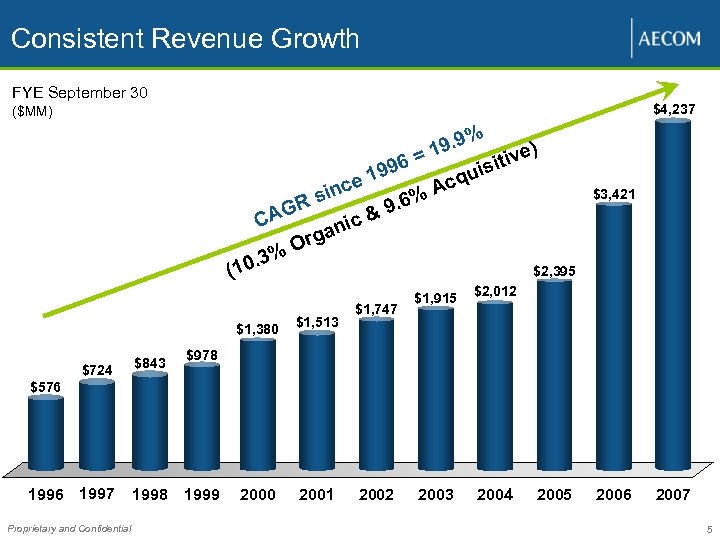

Consistent Revenue Growth FYE September 30 $4, 237 ($MM) 6= (1 $724 1996 1997 1998 $1, 513 $1, 747 ) e itiv s qui c 199 ce A sin 6%. R &9 AG C c ani Org % 0. 3 $1, 380 $843 % 9 19. $3, 421 $2, 395 $1, 915 $2, 012 2003 2004 $978 $576 Proprietary and Confidential 1999 2000 2001 2002 2005 2006 2007 5

FY 08 Year-to-Date Accomplishments Financial Performance § 31% YTD increase in net service revenue § 46% YTD increase in net earnings § 15% YTD increase in backlog Significant Wins § Libya infrastructure § U. S. Customs and Border Protection § Doha, Qatar, port program management § Eisenhower Federal Office Building § Hong Kong International Airport § Abu Dhabi Cultural Center § Manchester Metrolink Northumbria University Newcastle, United Kingdom Proprietary and Confidential 6

AECOM Market Opportunity Continued capital investment across all end markets is driving growth § Market opportunity: • U. S. : Municipal bond issues totaled $145 billion in the second quarter (1) • Emerging Markets: $2. 25 trillion of expected spending (2) § Solid pipeline of large, global award prospects § Emerging markets expected to drive continued growth Wayang Windu Geothermal Project Wayang Windu, Indonesia 1. Thomson Financial (July 2008) 2. Merrill Lynch (June 2008) Proprietary and Confidential AECOM is well positioned § Diversified end markets, geographies, services and funding sources § Leading market positions in transportation, environmental and facilities § Growing exposure to high-growth energy and power end markets § Highly ranked, world-class program management capabilities 7

Our Challenge § How do we leverage our global capabilities to benefit our clients? § How do we continue to recruit & retain top talent? § How do we maintain our position and delivery profitable growth performance? AECOM must evolve to meet demands of an increasingly competitive market Proprietary and Confidential “In the middle of difficulty lies opportunity. ” – Albert Einstein 8

Key Elements of AECOM Vision Our Shared Purpose: “To enhance and sustain the world’s built, natural and social environments” Our Core Values: CN Engineering Services Contract Canada-wide Proprietary and Confidential 9

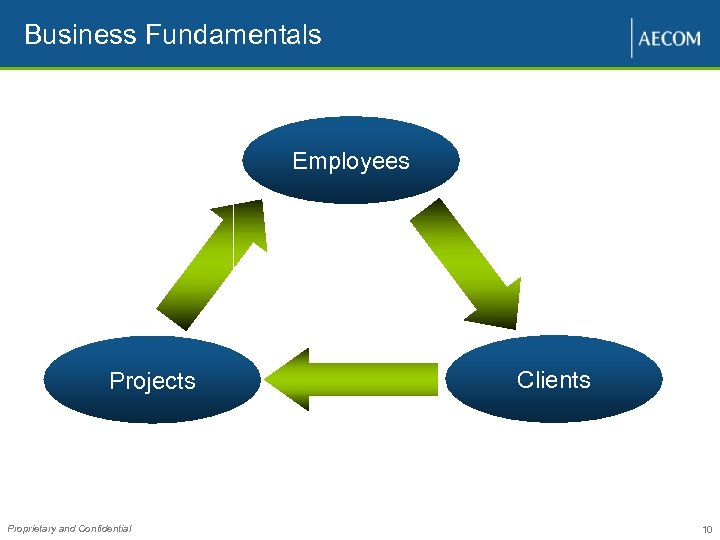

Business Fundamentals Employees Projects Proprietary and Confidential Clients 10

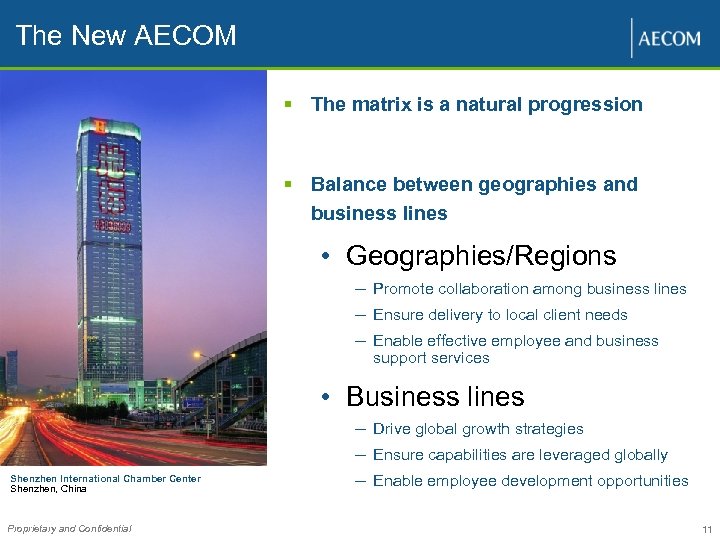

The New AECOM § The matrix is a natural progression § Balance between geographies and business lines • Geographies/Regions – Promote collaboration among business lines – Ensure delivery to local client needs – Enable effective employee and business support services • Business lines Shenzhen International Chamber Center Shenzhen, China Proprietary and Confidential – Drive global growth strategies – Ensure capabilities are leveraged globally – Enable employee development opportunities 11

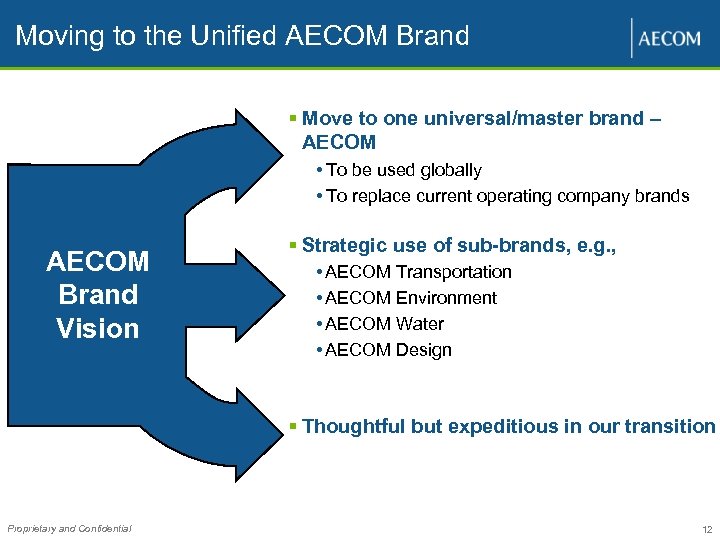

Moving to the Unified AECOM Brand § Move to one universal/master brand – AECOM • To be used globally • To replace current operating company brands AECOM Brand Vision § Strategic use of sub-brands, e. g. , • AECOM Transportation • AECOM Environment • AECOM Water • AECOM Design § Thoughtful but expeditious in our transition Proprietary and Confidential 12

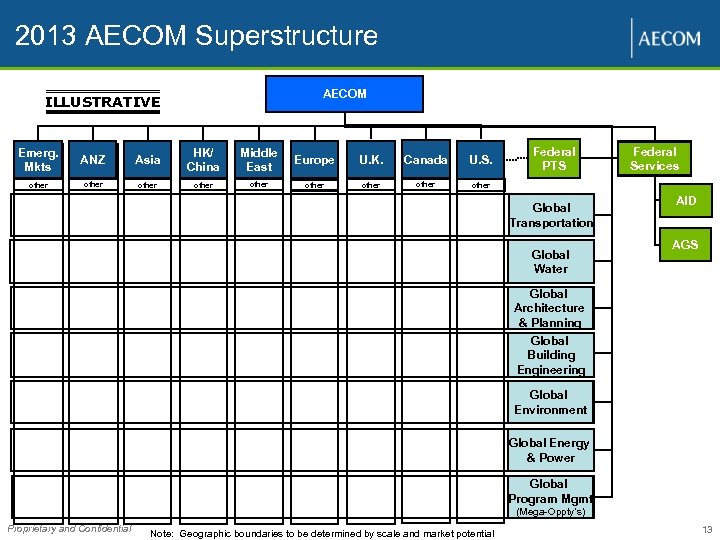

2013 AECOM Superstructure AECOM ILLUSTRATIVE Emerg. Mkts ANZ Asia HK/ China Middle East Europe U. K. Canada U. S. other other Federal PTS Federal Services other Global Transportation Global Water AID AGS Global Architecture & Planning Global Building Engineering Global Environment Global Energy & Power Global Program Mgmt (Mega-Oppty’s) Proprietary and Confidential Note: Geographic boundaries to be determined by scale and market potential 13

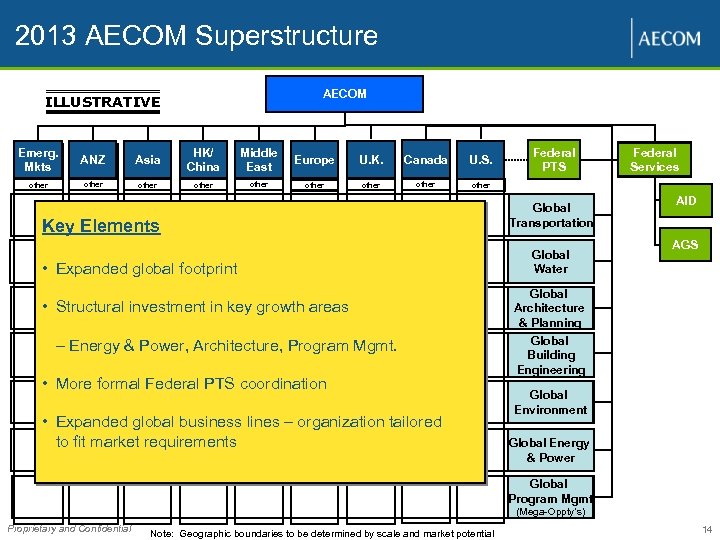

2013 AECOM Superstructure AECOM ILLUSTRATIVE Emerg. Mkts ANZ Asia HK/ China Middle East Europe U. K. Canada U. S. other other other Key Elements • Expanded global footprint • Structural investment in key growth areas – Energy & Power, Architecture, Program Mgmt. • More formal Federal PTS coordination • Expanded global business lines – organization tailored to fit market requirements Federal PTS Global Transportation Global Water Federal Services AID AGS Global Architecture & Planning Global Building Engineering Global Environment Global Energy & Power Global Program Mgmt (Mega-Oppty’s) Proprietary and Confidential Note: Geographic boundaries to be determined by scale and market potential 14

Successful Matrix Operations Requirements § Communicate § Coordinate § Collaborate Proprietary and Confidential 15

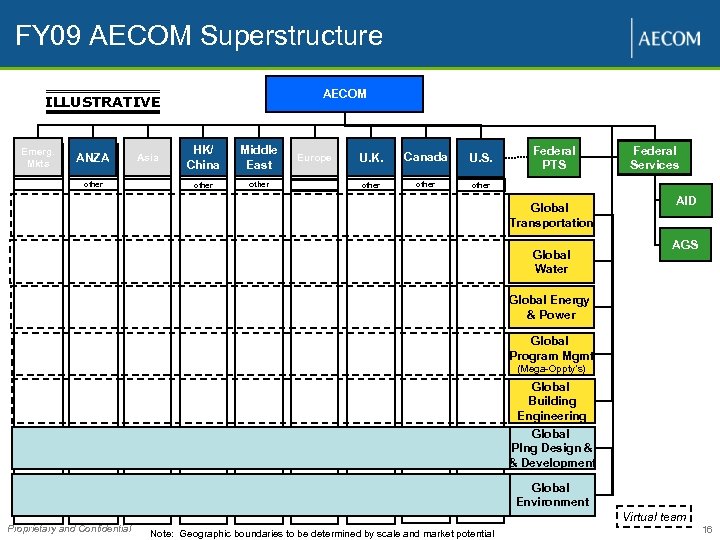

FY 09 AECOM Superstructure AECOM ILLUSTRATIVE Emerg. Mkts ANZA other HK/ China Middle East other Asia other Europe U. K. Canada U. S. other Federal PTS Federal Services other Global Transportation Global Water AID AGS Global Energy & Power Global Program Mgmt (Mega-Oppty’s) Global Building Engineering Global Plng Design & & Development Global Environment Proprietary and Confidential Virtual team Note: Geographic boundaries to be determined by scale and market potential 16

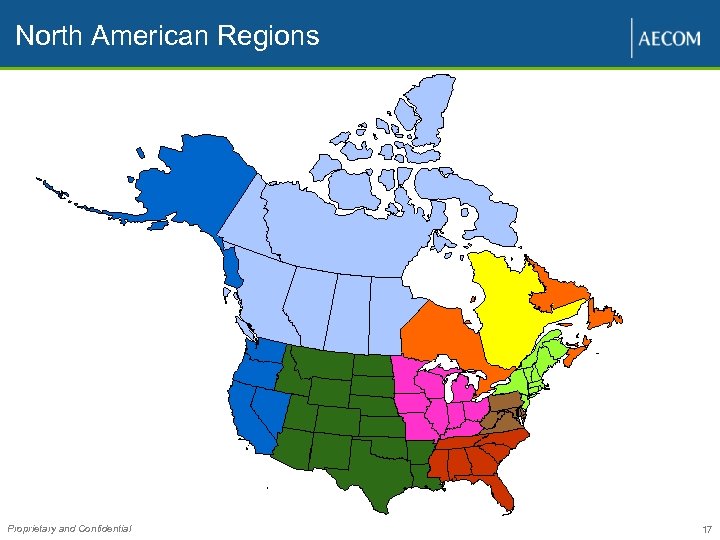

North American Regions Proprietary and Confidential 17

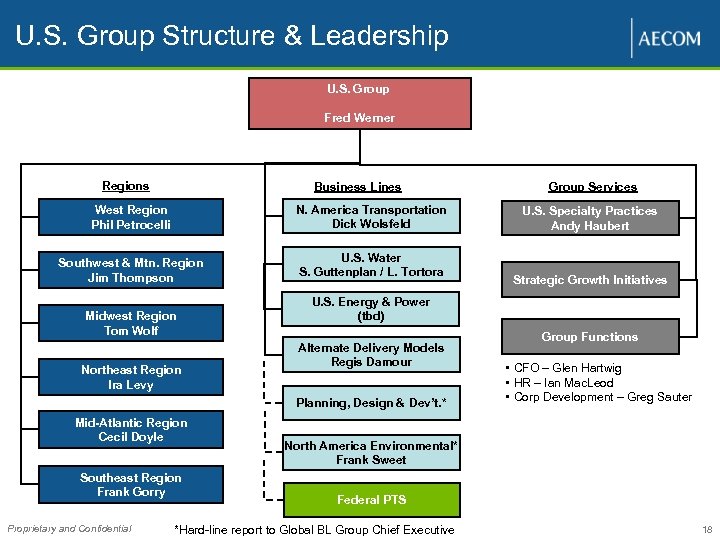

U. S. Group Structure & Leadership U. S. Group Fred Werner Regions Business Lines West Region Phil Petrocelli N. America Transportation Dick Wolsfeld Southwest & Mtn. Region Jim Thompson U. S. Water S. Guttenplan / L. Tortora Midwest Region Tom Wolf Northeast Region Ira Levy Southeast Region Frank Gorry Proprietary and Confidential U. S. Specialty Practices Andy Haubert Strategic Growth Initiatives U. S. Energy & Power (tbd) Alternate Delivery Models Regis Damour Planning, Design & Dev’t. * Mid-Atlantic Region Cecil Doyle Group Services Group Functions • CFO – Glen Hartwig • HR – Ian Mac. Leod • Corp Development – Greg Sauter North America Environmental* Frank Sweet Federal PTS *Hard-line report to Global BL Group Chief Executive 18

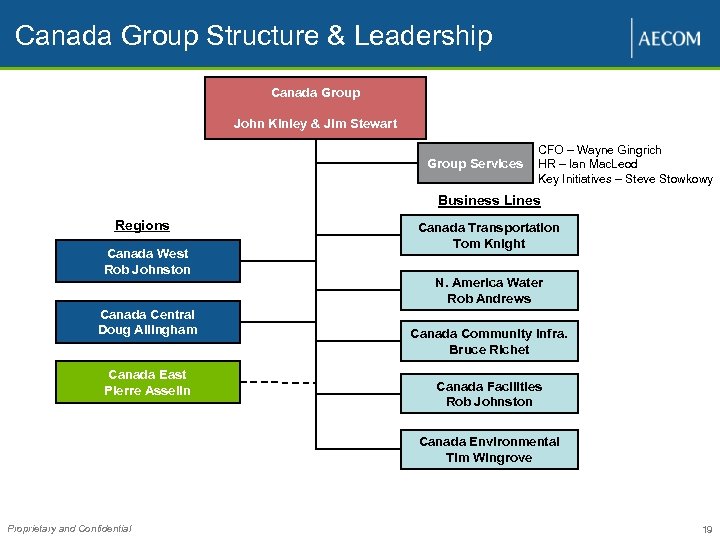

Canada Group Structure & Leadership Canada Group John Kinley & Jim Stewart Group Services CFO – Wayne Gingrich HR – Ian Mac. Leod Key Initiatives – Steve Stowkowy Business Lines Regions Canada West Rob Johnston Canada Central Doug Allingham Canada East Pierre Asselin Canada Transportation Tom Knight N. America Water Rob Andrews Canada Community Infra. Bruce Richet Canada Facilities Rob Johnston Canada Environmental Tim Wingrove Proprietary and Confidential 19

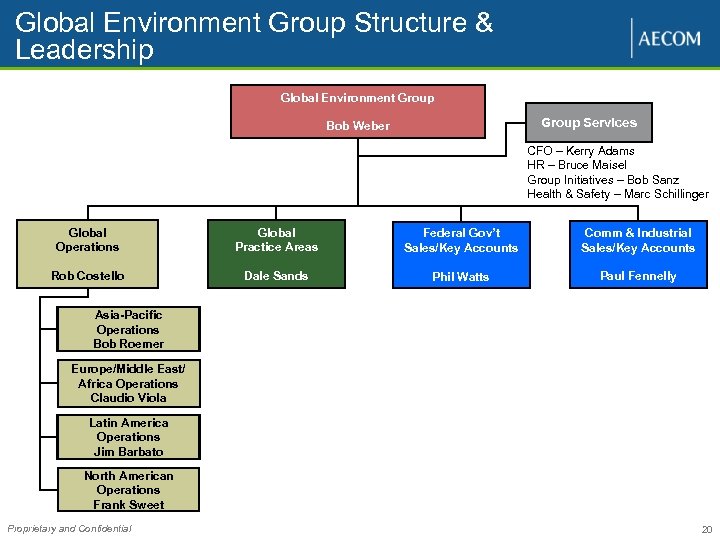

Global Environment Group Structure & Leadership Global Environment Group Services Bob Weber CFO – Kerry Adams HR – Bruce Maisel Group Initiatives – Bob Sanz Health & Safety – Marc Schillinger Global Operations Global Practice Areas Federal Gov’t Sales/Key Accounts Comm & Industrial Sales/Key Accounts Rob Costello Dale Sands Phil Watts Paul Fennelly Asia-Pacific Operations Bob Roemer Europe/Middle East/ Africa Operations Claudio Viola Latin America Operations Jim Barbato North American Operations Frank Sweet Proprietary and Confidential 20

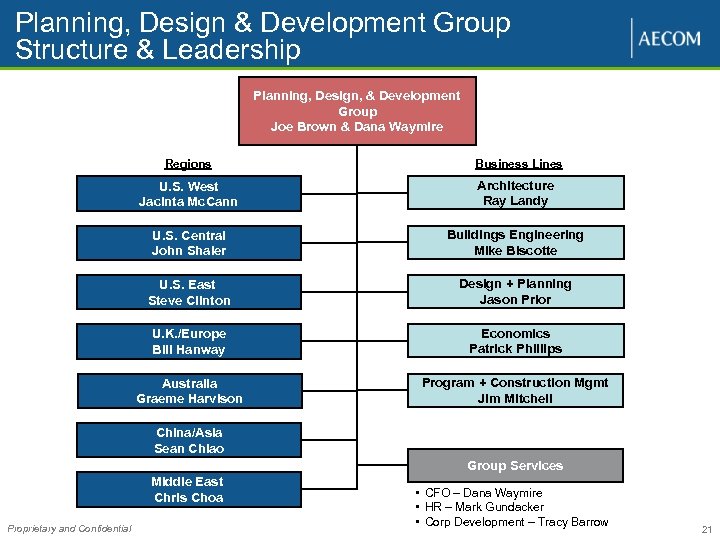

Planning, Design & Development Group Structure & Leadership Planning, Design, & Development Group Joe Brown & Dana Waymire Regions Business Lines U. S. West Jacinta Mc. Cann Architecture Ray Landy U. S. Central John Shaler Buildings Engineering Mike Biscotte U. S. East Steve Clinton Design + Planning Jason Prior U. K. /Europe Bill Hanway Economics Patrick Phillips Australia Graeme Harvison Program + Construction Mgmt Jim Mitchell China/Asia Sean Chiao Group Services Middle East Chris Choa Proprietary and Confidential • CFO – Dana Waymire • HR – Mark Gundacker • Corp Development – Tracy Barrow 21

Organization Transition Plan § North America to start transitioning to new AECOM structure during Q 1 FY 09. § Significant effort underway • Eliminating 6 financial systems • Building management reporting “bridge” between remaining systems • Transitioning 15 legal entities • Aligning support services to new matrix Proprietary and Confidential 22

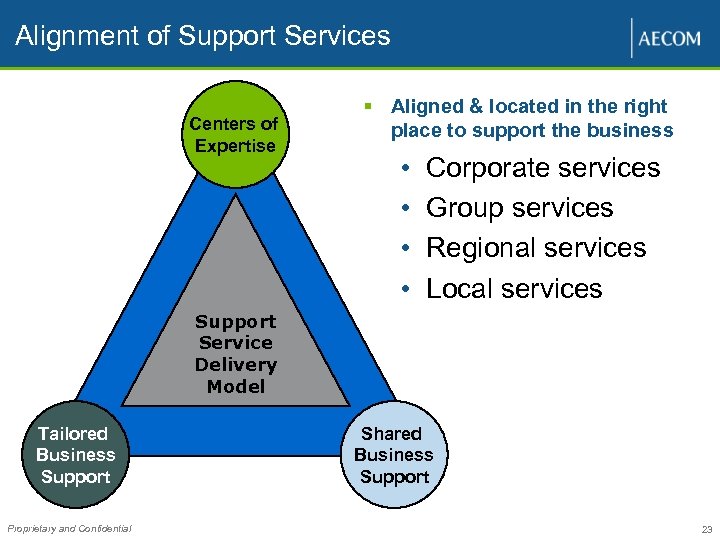

Alignment of Support Services Centers of Expertise § Aligned & located in the right place to support the business • • Corporate services Group services Regional services Local services Support Service Delivery Model Tailored Business Support Proprietary and Confidential Shared Business Support 23

Expectations of You Continued Business Performance Proprietary and Confidential Leadership Employee Communication & Engagement 24

Proprietary and Confidential 25

Understanding and Embracing The New AECOM Questions? Proprietary and Confidential 26

a8940316dd65220ed710c0cc3bb08a59.ppt